Research Article: 2020 Vol: 24 Issue: 1

Consumer Preferences and Future Impact on the Algerian Car Market

Soufyane Bouali, Setif 1 University

Selma Douha, University of Bordj Bou Arreridj

Mohsen Debbabi, IHEC Carthage

Abstract

This study aims at determining Algerian consumers’ preferences for second-hand and new cars, in particular those manufactured locally, with the recent spectacular rise in the prices of different car brands. Moreover, we focused on the impact of consumers’ boycotting campaign launched on social networks. In this regard, we measured the reactions of a sample of 20 local car retailers and their dealers.

Keywords

Consumer Preferences, Car Users, Weekly Markets, Boycotting Campaign.

Introduction

Despite the government’s efforts to boost the purchase of locally-assembled cars, beneficiaries of these incentives had to impose spectacular prices on consumers, at a time when the Algerian dinar has been devaluating. Consequently, this has recently led some consumers to voice their disapproval in their own ways, gradually reaching a peak of boycotting local cars called upon in the different available social networks. Car manufacturers had to respond by setting up a policy that ward off any potential negative impacts on local industry and the economy. This study then will provide evidence and figures proving that the boycotting campaign had indeed succeeded, although car dealers still deny the fact observed in the weekly markets. Moreover, this study will portray the future outlook of the market shares of each car dealer and the potential impact this will have on the local car industry. This latter has become a sensitive issue for consumers and has been upgraded to a basic family need (Samuel & Spalanzani, 2006). Nevertheless, the boycotting campaign initiated by social network users was able to switch the odds in favor of consumers who suffered from car assemblers’ policies. The latter saw their sales and demand for their products dwindling, as consumers perceive them as unsefully exaggerating, despite the incentives they have put into place. Our study will determine one dimension which has tested consumers’ patience for two years now. In this regard, we will conduct a quantitative study of the most important relevant dimensions in view of understanding consumers’ reactions by examining their preferences. We will focus also on how consumer preferences differ for locally-assembled and imported cars and how importation trends evolve (Debabi, 2009). To this end, we will simulate consumer consumption trends of locally-assembled cars and the effect of their preferences on market consumption forecasts under the current unchanged scenario, and ultimately the potential effect on car industry, in particular the locally-assembled car industry (Adams et al., 2011). Therefore, and in what follows, we will outline first the methodology used to measure consumer preferences.

Theoretical Background

Methodology

In this study, we opted the event study approach, as it is considered the most appropriate approach that gathers in-depth data unlikely to be collected by other instruments (Arli & Lasmono, 2010). This approach is suitable as well for studies that include many variables. Indeed, our analysis has given support to our research aspirations as the sales of local car assemblers dwindled, in particular with the entry of a new competitor, BAIC, late 2019 into the market. According to experts, this latter destabilized local assemblers in addition to the government’s vows to possibly open up the market for importation (Redzuan, 2014).

Studies of consumer preferences in weekly car markets or any other car-selling premises are considered to be complex, as they target constantly changing phenomena and the factors influencing them vary from one context to another and from one region to another. Our study bear on these circumstances. Then, our data on the different brands Algerian consumers prefer respected the relevant methodological and theoretical principles of such studies. Under these lines, we selected our sample. Worth noting is that most social network web pages calling for boycotting locally-assembled cars as well as TV and radio shows. These latter will be discussed in detail in the next section. Indeed, our data collection procedure used a semi-directed interview-based survey of a sample of car retailers and dealers monopolizing the (Kansra & Pathania, 2012). We conducted an average of 30 interviews a week over a period of 10 months. The interview included both open and closed questions for a better data quality. The responses of the interviewees were mostly spontaneous and defended the positions of their industry.

Procedure

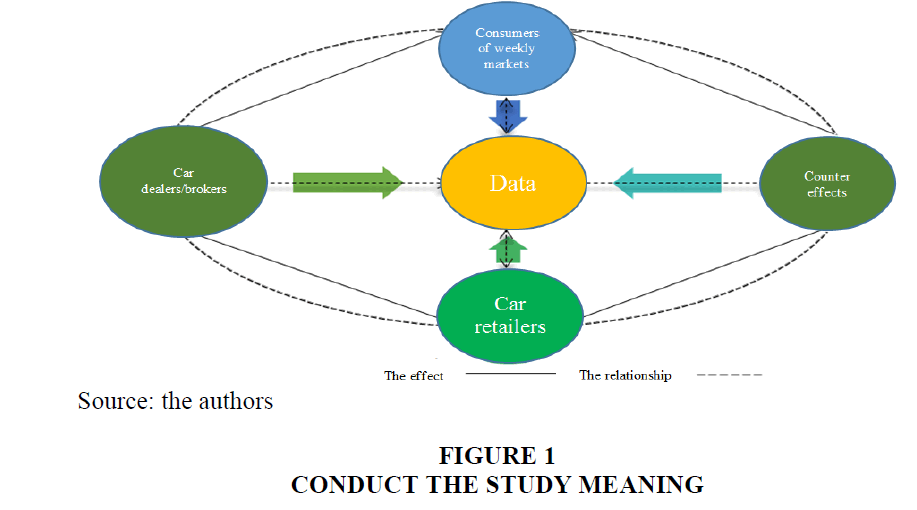

As we mentioned above, we used the push and pull technique to collect accurate data from our respondents. Figure 1 below displays our data collection procedure:

Figure 1 shows the two sources we used to collect our data for the purposes of our study. These two are the relationship between the respondents and the effects of these relationships. Data collection took place around January 2019, when consumers started showing signs of discomfort (Beirão & Cabral, 2007). We started by sensing retailers’ reactions who insisted that demand is in a constant rise. This latter trend was disproved by known brokers. Weekly markets remained unchanged as transactions took place between traditional retailers (Ghewy, 2010). Prices of local brands went beyond the expected (Han, 1989). All these preliminary elements prompted us to opt for a different data processing approach (Koschate-Fischer et al., 2012). In a second phase, we took regular visits to weekly car markets in the provinces of Beskra, Batna, Stif, and Om El Bawaqi. In what follows, we will outline the frequency of these visits and importantly the dimensions covered by each party. Indeed, consumer behavior is regular with regard to basic products like cars, as making a purchase decision takes time, in particular on new competitive products (Toubia et al., 2012), like Renault. According to a sample of car retailers the Renault brand is the largest in Algerian markets. Unlike its competitors, it has regular consumers who prefer purchasing its products, in particular brokers and the TMC group. This latter has a preferential deal to diversify its products which stood in 31/12/2019 at 12 models, likely to increase by contracts signed with the mother company. There are 19 chartered franchises and 45 retailers in charge of distribution, marketing and sales across the country, ranking third in Algerian markets. According to a recent survey (Swaidan, 2012). TMC sold more than 400.000 cars in the Algerian market since 1997. However, sales saw a decreasing trend since February 2019, as a source closer to the dealer announced that demand decreased by 25% in February 2019 compared to the same month last year. According to the same source, this downward trend occurred because of tensions between chartered retailers and brokers on sharing profits, in addition to the political situation that the country is undergoing. However, the study collected figures unlike those declared by the dealer. As for SOVAC, it entered the market with 4 models, distributed by 28 retailers. Its sales had similar downward trends during the same period for unknown reasons. Indeed, demand fell differentially, with SEAT ranking first with 38% of sales, followed by Volgswagon with 23% and last Scoda with 44%. According to some retailers, SPA shows constant stable sales. The data is collected on period stretching from January to November 2019.

As for the differences in consumer preferences (Venkatesh et al., 2012), we believe they are the determinants of current market trends and they affect current consumer behavior. Although they are psychological in nature, they are affected by external factors. Indeed, the Algerian consumer has recently shifted interest in other needs, which they believe more appropriate under the current excessive car prices, both new and used. Consumers prefer to allocate their resources on purchasing houses Yin & Zhang, (2012) deemed wiser because of their needs and the current conditions. This latter trend has been referred to by Cotler as MASLOW’s needs hierarchy Kim et al. (2015), presented in the following Figure 2:

Some studies explain that under such circumstances each consumer behaves in line with their social conditions and their environment, depending on their needs. According to consumers of weekly markets, the motivation to purchase a car is a done deal, not negotiable Abdullah (2012), as consumers believe that not switching to or purchasing a new car is a wise decision, because the belief is that prices determine consumer attitudes and reactions and their preferences for local cars. There needs to be some prerequisites to achieve market equilibrium, like needs and purchasing power and this latter has almost disappeared (Maslow, 1970). There is a shift from complementary needs to basic needs, coupled with the Algerian dinar’s unprecedented devaluation since the move to unconventional funding modes. Under the general pricing policy, decisions on prices target car-assembly groups, on the one hand, and market activities, on the other (Ginsburgh & Vanhamme, 1989). These are requirements to combine constant market factors into the market strategy that defines short-and long-term objectives.

Looking into the trade code, it seems that retailers are those who determine the general pricing policy, which functions within a complete decision-making system. In addition to these, nepotism and corruption prevail the distribution channels, very well exploited by brokers who raise prices by 12% over the original price. Nevertheless, the campaign launched by weekly markets’ consumers on social networks came very late, as prices regulators lost control Maslow (1943) One of these users, discomforted by car-assembly groups, believes that if consumers boycotted these groups from the start, things will be different now, there will be no room for such manipulation of prices (Petra, 2012). Moreover, car retailers do not abide by delivery dates, as the average delivery period is 6 months. If we bear on Marsh and Simon’s model, consumer behavior is determined by their basic psychological drives. This is to say, it is essential that we determine the behavior of these groups under such circumstances and their readiness to submit to consumers’ demands who have been exploited so far. This led Marsh and Simon to construct a model in view of explaining how consumers reach a consumption decision that preserves their dignity, by plotting together all the variables that interact with this decision:

1. Consumer awareness and knowledge of alternatives.

2. Consumer ability to bring about alternatives at the right time.

3. Consumer desire and satisfaction with the brand they use or they are forced to use.

All these dimensions led us to link the model’s constructs with a number of variables that may affect consumer behavior in the short- and long-term (Kerzabi, 2009). We also included the variables of social networks, internal effects, assessing alternatives and government policies. Worth noting is that this latter variable has affected variably all the constructs of the model. We will return to this dimension in the next sections.

In view of identifying whether this variable and its dimension did indeed affect consumer preferences Dekhili & Achabou (2015), we reviewed the relevant literature. Through the different interviews, we found that the brand source plays a crucial role in the purchase decision Ghewy (2010), in particular after spreading rumors claiming that some brands are not fit to be utilitarian cars but specifically designed for industrial purposes. All of these led us to operationalize this variable with three dimensions: source, payment method, needs and motivation. The other two variables were linked to car brokers: commitment to retailers, interpersonal relationships, and organization. The last variable, car retailers, were linked to brand image, trust and consumer attraction. Finally, our aim is to determine whether the boycotting campaign launched on social networks had some effects on consumer preferences, on current and future government policies and ultimately on the industry itself, by conducting a survey over a sample of 20 respondents. The aim is to collect the data that would help us determine consumer preferences for used or new cars.

The Exploratory Phase

In this phase, we determined our sample and collected our data to be processed by our statistical tool, mentioned above.

The sample consists of four sub-samples, three of which are independent represented by brokers and retailers. Sub-sample four represents consumer preferences. While surveying social network pages, our interest was not their number or frequency of data posting. Our aim was to collect data and see its compatibility with reality, as the campaign enters its fourth week. This is the case for our respondents, represented in the Table 1 by number and province.

| Table 1:The Sample | |||||

| Sample Type/Activity | Number of Samples | The agencies | The Consumer/N | Number of ag | The Broker |

|---|---|---|---|---|---|

| The Consumer | N | RENAULT | 7 | 4 | 2 |

| Note | N | HYUNDAI | 5 | 4 | 3 |

| The agencies | 13 | VOLKSWAGEN | 4 | 2 | 2 |

| The Broker | 7 | KIA | 19 | 3 | 0 |

Worth noting is that the Table 1 above shows the total number of retailers across provinces and not one branch. The number of retailers and brokers who responded to our survey across provinces is our sample, shown between parentheses, except the consumer N, which represents the number of provinces. For instance, number 4 represents the province of Om El Bawaqi, number 5 is Batna, while number 7 and 19 represent successively the provinces of Beskra and Stif. As for the number of retailers that we regularly visited is 4 in the provinces 5-7, and 3 retailers in the province of Stif. As for province 4, we visited the above mentioned retailers twice as we have little knowledge of the region and the absence of brokers who can help us meet the official retailers. This made it difficult for us to determine the active brokers in the region. As for provinces 4 and 7, we contacted two brokers and three in Batna. To this end, we used semi-directive interviews for the first interview, then through telephones in particular in province 4, because of accessibility and professional reasons. We visited 13 retailers and 7 brokers, totaling a sample of 20 respondents.

The Procedure

In the Table below, the percentage of cars and locally assembled cars offered in the market, in particular in the RENAULT group, is 38%. The rest of percentages represents the other three brands. The results indicate that consumers of this brand are willing to switch their preference for the brand.

| Table 2: Average Car Offer In Weekly Markets | |||||

| The Agencies | Average Offer | Face | |||

|---|---|---|---|---|---|

| HYUNDAI | RENAULT | VOLKSWAGEN | KIA | ||

| HYUNDAI | 48 | 0,10 | 0.01- | 0,08 | |

| RENAULT | 71 | 0,10- | 0,11- | 0,02- | |

| VOLKSWAGEN | 42 | 0,01 | 0,11 | 0,10 | |

| KIA | 24 | 0,08- | 0,02 | 0,10- | |

Table 2 above shows consumers’ willingness to give up their cars and their preferred local brand under the current market conditions. Moreover, the minister of commerce suggested that they will allow the importation of used cars with less than 3 years of mileage. This latter affected local brands’ owners in general and prices in particular. The table shows that the consumer prefers to give up the RENAULT brand in favor of the other brands because of the increased offer as the percentage of consumers who are ready to give up the brand is constantly increasing compared to the other local brands. They prefer 10% of TMC group, 11% of VOLKSWAGEN. This trend is expected as trust in the brand started to vanish. The table shows that 10% of consumers owning a HYUNDAI car are willing to replace it with a VOLKSWAGON car. 2% prefer the KIA brand over the RENAULT. Average VOLKSWAGON car offer in the market is 42 cars. However, consumers prefer this latter brand over the other brands because it is difficult to acquire from retailers. 10% of those who own the KIA brand prefer the latter brand. Kia’s average offer in the market is 24 cars, less reputed in the weekly markets leading their owners to give it up in the informal markets and online. VOLKSWAGON remains the most preferred brand by consumers, while RENAULT is the least preferred. Worth noting is that the sample includes 2016 brands and above. These results allow us to plot consumer preferences for local brands in the weekly markets.

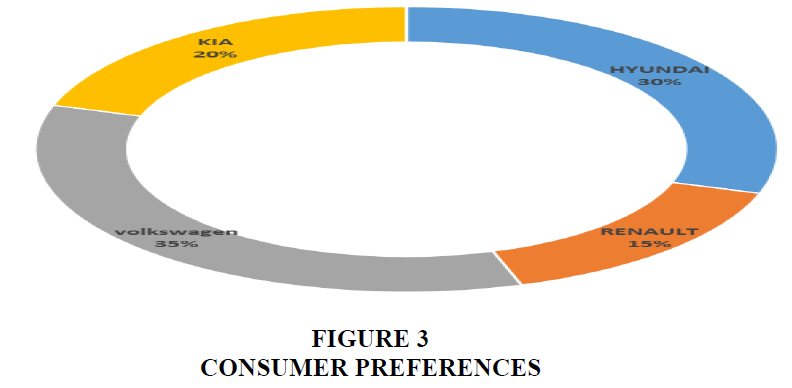

Figure 3 above shows that 35% of consumers prefer the VOLKSWAGON brand, while the RENAULT brands stands last in terms of consumer preferences because of so many reasons to be discussed later. The next dimension we present is consumer preferences for retailers and local brands. As mentioned above, we chose the semi-directed interview method, focusing on a number of themes that make up the current national and the car industry concerns.

Repeated Themes

In this section, we focus on the themes that helped us determine the current car industry situation, using consumer preferences for brands and data collected from retailers and brokers.

Table 3 reports the p-value of the Alpha coefficient. Under the current market conditions and the themes mentioned by our respondents, we categorize our data into 8 main themes that would likely to affect future strategic decisions of car-assembling groups. These are: price leveling, payment modalities, aligning competition conditions, data exploitation, alternative strategies, regular delivery dates, internal and external pressures and government policies. Bearing on the feedback of the retailers of the different brands, we will discuss the themes that will not affect the decisions of car-assembly groups. Each of these has their own strategy that would keep their market share in the short-term.

| Table 3: Statistics For The Different Themes | ||||||||

| The Agencies | Level of the price | Conditions of Payment |

Alignment on constant the competition | Exploitation of the data | Alternative Strategies | Regularity of the steady delivery | Internal and external pressures | Governmental policies |

|---|---|---|---|---|---|---|---|---|

| HYUNDAI | 0,1 | 0,4 | 0,01 | 0,07 | 0,01 | 0,5 | 0,03 | 0,05 |

| RENAULT | 0,02 | 0,03 | 0,04 | 0,19 | 0,25 | 0,02 | 0,04 | 0,04 |

| VOLKSWAGEN | 0,3 | 0,06 | 0,03 | 0,09 | 0,01 | 0,04 | 0,02 | 0,05 |

| KIA | 0,04 | 0,03 | 0,04 | 0,06 | 0,02 | 0,02 | 0,05 | 0,04 |

We find that the TMC and SOVAC groups did not consider price leveling as this theme was raised before the social networks. According to the survey, the only concern for each brand is keeping prices as they are. The same is true for payment modalities as banks are putting pressure on their customers to clear their debts as soon as possible, leading retailers to consider ways to attract more consumers. The other theme that was not considered is market data exploitation, leading retailers to launch several campaigns to keep the level of prices even for a while. The significance of this theme is 0.05. This shows the validity of the first theme. Each group has their own alternative strategy in case of change, except for RENAULT. The results indicate that that this latter brand shows no interest in this theme, which would affect its sales and image in the short-term, as its significance is far away from the required. The last theme showing no effect in our model is that of TMC, significant at the 0.05 level. The latter group is able of attracting more orders at any time.

Data Analysis And Results

Bearing on the previous results, we determined the themes that could affect consumer preferences and which retailers and brokers perceive as able to keep and revive the demand for local brands (Memmi, 1985). We used a cross-checking technique to determine whether the boycotting campaign launched on social networks could have an effect in the short- and the mid-term. Table 4 below presents the main findings:

| Table 4:Consumer Preferences Degree | ||

| Average Consumer Details | Average Impact on Eco | |

|---|---|---|

| Level of the Price | 0,02 | 0,10 |

| Conditions of Payment | 0,02 | 0,11 |

| Alignment on constant the competition | 0,03 | 0,00 |

| Exploitation of the data | 0,00 | 0,10 |

| Altemative Strategies | 0,01 | 0,06 |

| Regularity of the steady delivery | 0,02 | 0,12 |

| Internal and external pressures | 0,04 | 0,00 |

| Governmental policies | 0,05 | 0,00 |

In Table 4 above, there are two themes that affect consumer preferences and car-assembly groups, as perceived by retailers and brokers. In what follows, we will discuss the themes used by each party to influence the other.

Discussion

Consumer preferences rest on 6 main themes. Government policies come first in its ability to affect prices, significant at the 0.05 level. This theme came up in the boycotting campaign, experts’ concerns in the media and the awareness campaigns launched on social networks, and thus their effect on government policies by means of monitoring the industry with the current privileges they benefit from.

Such a situation will likely intensify competition between brands to gain more market share, shown by the obtained 3% for item three about competition in Table 4 above. The rest of the themes range between 1 and 2 because if the followed strategies succeed, the other themes will be imposed on car market consumers. As for the retailers and brokers, their main concern is satisfy the orders placed by customers for months. This is shown in 5 themes they rely on to convince the public and keep the level of prices. Their short-sightedness can outplay the monopoly of car groups. Table 4 above shows the themes that affect consumer preferences neglected by car groups. This is raised by retailers and brokers. All these contradictions led us to the following conclusions and recommendations.

Conclusions And Recommendations

Late consumer awareness led to increasing prices and a difficulty in controlling them. The study confirmed that profits are the main concern for car retailers, with no regard to consumer purchasing power. Boycotting buying locally-assembled cars had effects in the short-term provided the government opts for a price control policy. Regardless of consumers’ emotional gain and the expected material loss, the campaign was able to voice consumers’ concerns; car retailers were not ready to sacrifice the prevailing prices. Some retailers started to decrease their prices with the hope of hedging losses as indicated by item 5 about alternative strategies in Table 4 above. The following are our recommendations:

1. Prices should be capped by the relevant authorities in line with international prices and consumer purchasing power.

2. Issue authorizations for the different retailers who wish to set up assembly units and who are eligible under the ministry of commerce and mines regulations.

3. Import cars to ease local demand crisis and fund the State’s budget.

4. Local banks should put pressure on car groups to pay their debts in the nearest delays, in particular under the current conditions, which would decrease prices.

5. Algerian government should take the opportunity to acquire international car manufactories on sale.

6. Keep boycotting to put pressure on decision-makers and find alternatives that meet consumer demands

References

- Abdullah, N.I. (2012). Analysis of demand for family takaful and life insurance: a comparative study in Malaysia. Journal of Islamic Economics, Banking and Finance, 113(470), 1-20.

- Adams, C.P., Hosken, L., & Newberry, P.W. (2011). Vettes and lemons on eBay. Quantitative Marketing and Economics, 9(2), 109-127.

- Arli, D.I., & Lasmono, H.K. (2010). Consumers' perception of corporate social responsibility in a developing country. International Journal of Consumer Studies, 34(1), 46-51.

- Beirão, G., & Cabral, J.S. (2007). Understanding attitudes towards public transport and private car: A qualitative study. Transport Policy, 14(6), 478-489.

- Debabi, M. (2009). Dimensions intégratives et distributives de la négociation entre producteurs et distributeurs. La Revue des Sciences de Gestion, (3), 105-112. DOI 10.3917/rsg.237.0105

- Dekhili, S., & Achabou, M.A. (2015). The influence of the country-of-origin ecological image on ecolabelled product evaluation: An experimental approach to the case of the European ecolabel. Journal of Business Ethics, 131(1), 89-106.

- Ghewy, P. (2010). Créer et exploiter la relation marque-client: le cas des alliances et licences de marques. Innovations, (2), 147-158.

- Ginsburgh, V., & Vanhamme, G. (1989). Price Differences in the EC Car Market Some Further Results. Annales d'Economie et de Statistique, 137-149.

- Han, C.M. (1989). Country image: halo or summary construct?. Journal of Marketing Research, 26(2), 222-229.

- Kansra, P., & Pathania, G. (2012). A study of factor affecting the demand for health insurance in Punjab. Journal of Management and Science, 2(4), 1-10.

- Kerzabi, A. (2009). Entreprises, développement et développement durable: Le cas de l'Algérie. Marché et organisations, (1), 61-77.

- Kim, M.A., Sim, H.M., & Lee, H.S. (2015). Affective discrimination methodology: Determination and use of a consumer-relevant sensory difference for food quality maintenance. Food Research International, 70, 47-54.

- Koschate-Fischer, N., Diamantopoulos, A., & Oldenkotte, K. (2012). Are consumers really willing to pay more for a favorable country image? A study of country-of-origin effects on willingness to pay. Journal of International Marketing, 20(1), 19-41.

- Maslow, A.H. (1943). A theory of human motivat ion. Psychological Review, 50(4), 370.

- Maslow, A.H. (1970). New introduction: Religions, values, and peak-experiences. Journal of Transpersonal Psychology, 2(2), 83-90.

- Memmi, A. (1985). Portrait du colonisé précédé de Portrait du colonisateur, (1957) Gallimard.

- Petra, M. (2012). Research of the behavior of consumers in the insurance market in the Czech Republic. Journal of Competitiveness, 4(2), 20-37.

- Redzuan, H. (2014). Analysis of the Demand for Life Insurance and Family Takaful. Proceedings of the Australian Academy of Business and Social Sciences Conference.

- Samuel, K.E., & Spalanzani, A. (2006). Stratégies de localisation et «Supply Chain Management». La Revue des Sciences de Gestion, 1(6), 25-34.

- Swaidan, Z. (2012). Culture and consumer ethics. Journal of Business Ethics, 108(2), 201-213.

- Toubia, O., de Jong, M.G., Stieger, D., & Füller, J. (2012). Measuring consumer preferences using conjoint poker. Marketing Science, 31(1), 138-156.

- Venkatesh, V., Chan, F.K., & Thong, J.Y. (2012). Designing e-government services: Key service attributes and citizens? preference structures. Journal of Operations Management, 30(1-2), 116-133.

- Yin, J., & Zhang, Y. (2012). Institutional dynamics and corporate social responsibility (CSR) in an emerging country context: Evidence from China. Journal of Business Ethics, 111(2), 301-316.