Research Article: 2024 Vol: 28 Issue: 5

Consumer Perception and General Insurance Products Advertising: An Examination of IRDAI Guidelines and International Originality Assurance Standards

Tanvi Thakkar, Atharva School of Business, Mumbai

Aparna Ger, Atharva Institute of Management Studies, Mumbai

Citation Information: Thakkar, T., & Ger, A. (2024). “Consumer perception and general insurance products advertising: an examination of irdai guidelines and international originality assurance standards". Academy of Marketing Studies Journal, 28(5), 1-10.

Abstract

Advertising is used as a strategic technique by insurance businesses to attract the attention of prospective clients and urge them to purchase the comprehensive insurance options that the insurance company has to offer. Gaining market share is a common goal for most companies that sell insurance goods, as advertising has become essential to their existence. The most important goal of insurance advertising is to seamlessly include the mission of giving information that is reliable, objective, clear, and relevant regarding risk coverage and insurance products. Concurrently, consumer protection works towards the goal of ensuring that insurance companies give their consumers with relevant and appropriate product details, defend the rights of policyholders, and set up efficient systems for handling complaints. The purpose of this study is to conduct an in-depth analysis of the regulations that are imposed by the Insurance Regulatory and Development Authority of India (IRDA) and compare those regulations to the exemplary procedures that are recommended by regulatory authorities in other parts of the world.

Keywords

Advertising Strategy, General Insurance, Trust, Consumer safety, Insurance Regulatory & Development Authority of India.

Introduction

For all its economic importance, general insurance does not appear to have piqued the interest of academics studying financial services marketing, with most choosing to base their studies on the banking industry. According to a survey of previously published papers in the Journal of Financial Services Marketing (JFSM), the banking industry has the most papers published overall; in contrast, very few papers are published in the other financial services categories, such as general insurance Robson (2015). The promotion of general insurance products is a critical aspect of the insurance industry, serving as a bridge between insurers and consumers. In a world where unforeseen risks and uncertainties are an integral part of daily life, the role of general insurance in safeguarding individuals and businesses cannot be overstated. However, ensuring that these products are marketed and promoted in a manner that prioritizes consumer safeguards is of paramount importance. Personal selling, advertising, and word-of-mouth are the most successful ways to market an insurance company (Bajpai & Mazhar, 2022).

In the context of the Indian insurance landscape, the Insurance Regulatory and Development Authority of India (IRDAI) play a pivotal role in regulating and overseeing the insurance industry. The IRDAI has formulated guidelines and regulations that serve as a comprehensive framework to govern the promotion of general insurance products. These guidelines are not only designed to foster fair competition but also to safeguard the interests of consumers, ensuring that they are well-informed and adequately protected when seeking insurance coverage. Customers are well aware of insurance policies, and they are well-equipped with cutting-edge technology like cell phones, laptops, and various financial websites that give the insured the option and knowledge about the plans, claim Jawaharlal and Sarthak Kumar & Sreeramulu (2022). As the global economy becomes increasingly interconnected, and with the proliferation of multinational insurers operating across borders, it is vital to examine international standards and best practices in promoting general insurance products. The comparison between the guidelines of the IRDAI and international standards is essential to assess the originality and effectiveness of India's approach in ensuring consumer safeguards within the general insurance sector. This paper seeks to undertake a thorough examination of the promotional guidelines laid out by the IRDAI in the context of general insurance products. Additionally, it will compare these regulations with international standards, drawing from the practices and guidelines established by prominent international regulatory bodies, such as the International Association of Insurance Supervisors (IAIS) and the guidelines put forth by leading insurance markets worldwide. By doing so, this research aims to shed light on the strengths, weaknesses, and originality of the Indian regulatory framework concerning the promotion of general insurance products in the context of consumer safeguards. In this era of dynamic technological advancements and ever-evolving consumer preferences, the relevance of consumer safeguards in insurance promotion cannot be overstated. As such, this study is expected to provide valuable insights into how the IRDAI's guidelines measure up to international standards, highlighting opportunities for further enhancement and original contributions that India can bring to the global discourse on insurance regulation and consumer protection. By achieving a comprehensive understanding of these guidelines, we can contribute to the promotion of a safer, more transparent, and customer-centric insurance market in India and beyond. General insurance products are designed to protect individuals and businesses from financial losses arising from unexpected events, such as accidents, theft, and natural disasters. The promotion of these products is essential to ensuring that consumers are aware of their options and can make informed decisions about how to protect themselves and their assets. However, it is important to ensure that the promotion of general insurance products is done in a fair and ethical manner, and that consumers are adequately protected from misleading or deceptive marketing practices. This is where consumer safeguards come into play Dean & Biswas, (2001). Consumer safeguards are regulations and standards that are designed to protect consumers from unfair and deceptive trade practices. They can be found in a variety of sources, including legislation, regulations, and industry codes of conduct. In India, the Insurance Regulatory & Development Authority of India (IRDAI) is the primary regulator of the insurance industry. IRDAI has issued a number of guidelines on the promotion of general insurance products, including the following:

1. Guidelines on the Fair Marketing of Insurance Products (2013): These guidelines provide a framework for the fair and ethical marketing of insurance products in India. They cover a wide range of issues, including the use of advertising, disclosure requirements, and the handling of complaints.

2. Guidelines on the Use of social media for Insurance Marketing (2018): These guidelines provide specific guidance on the use of social media to promote general insurance products in India. They cover issues such as the use of influencers, the disclosure of paid partnerships, and the avoidance of misleading or deceptive advertising.

In addition to IRDAI's guidelines, there are also a number of international standards that can be used to assess the fairness and ethics of the promotion of general insurance products. These standards include:

1. The International Association of Insurance Supervisors (IAIS) Core Principles for Insurance Supervision 2021: These principles provide a framework for the effective supervision of the insurance industry, including the promotion of insurance products.

2. The Organisation for Economic Co-operation and Development (OECD) Principles on Insurance 2013: These principles provide guidance on the development and implementation of sound insurance policies, including the promotion of insurance products.

By comparing the promotion of general insurance products in India with international standards, it is possible to identify areas where consumer safeguards can be strengthened. This can help to ensure that consumers are better protected from misleading or deceptive marketing practices, and that they are able to make informed decisions about the purchase of general insurance products Thornton & White, (2001). The degree to which advertising produces a specific desired impact is known as advertising effectiveness, and assessing this effect is essential to determining the amount of advertising investment required Yiridoe et al. (2005); Sureshchandar et al. (2001); Zeithaml et al. (1990); Mitchell, (1999). Even if it is impossible to measure advertising performance globally, it is even more challenging when it comes to intangible products like insurance Hsu, (2012).

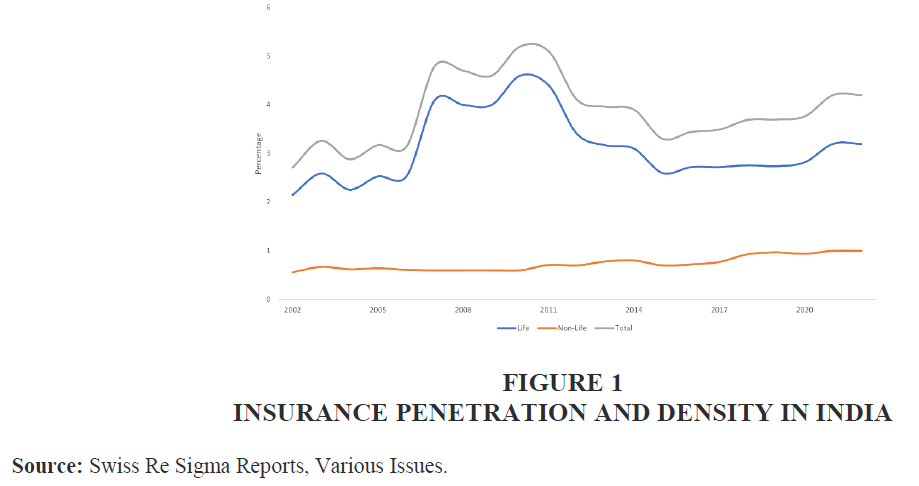

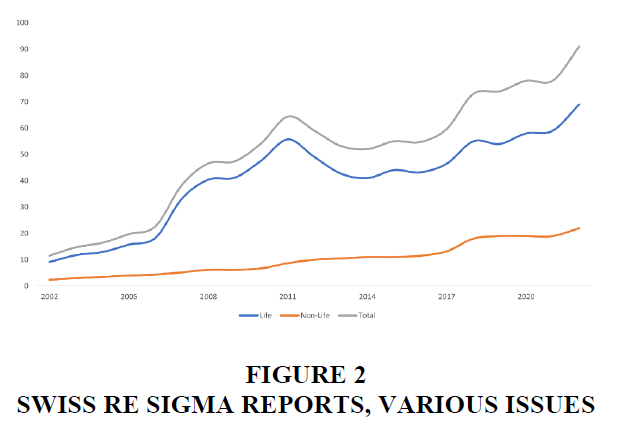

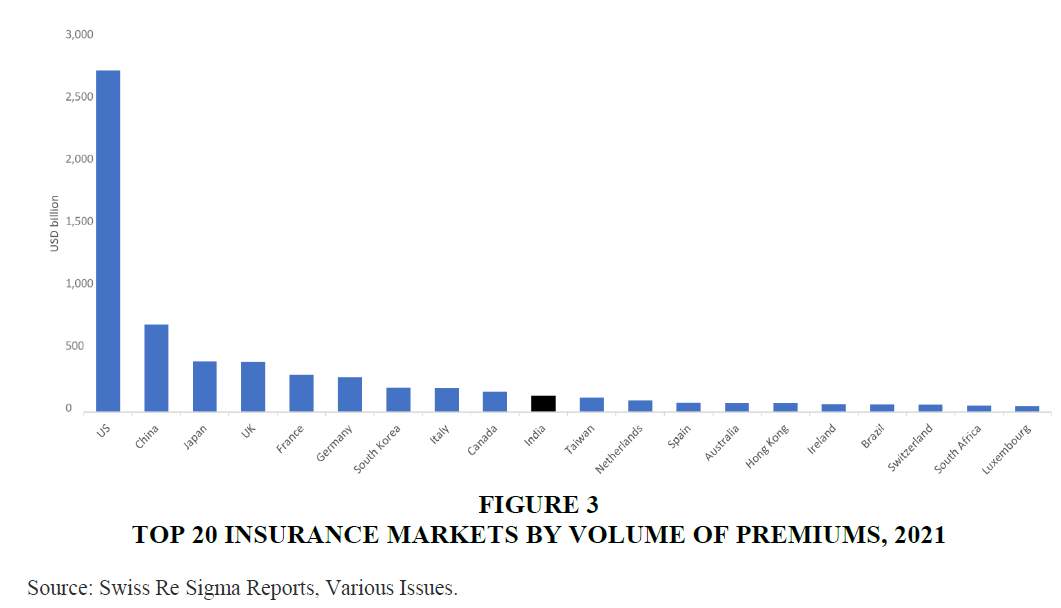

In the following sections, we will examine the promotion of general insurance products in India in more detail, and compare it with international standards. We will also identify some areas where consumer safeguards can be strengthened Figures 1-3.

Figure 3 Top 20 Insurance Markets by Volume of Premiums, 2021

Source: Swiss Re Sigma Reports, Various Issues.

Although things are moving in the right direction, the protection gap in India is still getting wider, which is both a problem and a chance for the sector. By the end of FY 2020, just 18% of the eligible population had signed up for pure retail term plans, and the protection penetration (base sum assured) was at 12% (about). A further 4% annual growth in this protection gap is anticipated. The mortality protection gap was estimated to be USD 40.4 billion (in premium equivalent terms) at the end of 2021 in India alone, according to Swiss Re Institute data. It is anticipated that the protection gap in India will gradually close as a result of the government's overall focus on promoting financial inclusion through extensive insurance programs, the recent wave of market entrants with digital-first operating models, increase in reach and ease of doing business through technology interventions, and recognition of the need for new protection products that will address evolving risks.

India's Insurance Sector - Robust and Future Centric

As a crucial player in re-establishing financial stability in tumultuous times, the insurance sector has gained recognition on a global scale. By March 2022, Indian insurance firms had invested more than USD 700 billion in total. By investing a large amount (more than 50%) of their capital in the debt and equity markets, insurance companies are one of the key players in helping to build capital markets. Given the extent of its investment in the economy, the insurance sector is essential in a crisis for regulating market sentiment.

With growth rates of 16% and 18% in contrast to the prior year, respectively, the general insurance and life insurance markets in FY 2023 have both made headway toward recovery from the COVID-19 pandemic. Over the following ten years, the insurance sector in India is anticipated to expand more quickly. Less stringent regulations, aggressive digitization initiatives by industry players, and improved consumer awareness have all contributed to the near-term improvement in market penetration and growth.

The insurance sector in India had been undergoing significant transformations and was poised for further growth.

1. Growth and Penetration: The Indian insurance sector was experiencing steady growth, with an increasing awareness of the importance of insurance among the population. While life insurance had traditionally dominated the market, general insurance was also gaining momentum. The insurance penetration and density in India, while still relatively low compared to global averages, were on the rise.

2. Regulatory Environment: The Insurance Regulatory and Development Authority of India (IRDAI) continued to play a pivotal role in regulating and supervising the insurance industry. The IRDAI had been working to introduce new regulations and guidelines to promote transparency, customer protection, and innovation within the sector.

3. Digitization: The insurance industry in India had been embracing digital technologies to enhance customer experiences, streamline operations, and expand reach. Online insurance sales, mobile apps, and digital platforms were becoming increasingly popular.

4. Product Diversification: Insurance companies were diversifying their product portfolios to meet the evolving needs of consumers. This included the introduction of customized and niche insurance products in response to changing consumer lifestyles and risks.

5. Bancassurance: Bancassurance, the distribution of insurance products through banks, was gaining prominence. Many banks in India had tied up with insurance companies to offer insurance products alongside their financial services.

6. Health Insurance: The COVID-19 pandemic had highlighted the importance of health insurance. Health insurance products were in high demand, and the pandemic prompted many individuals to consider purchasing or upgrading their health insurance coverage.

7. Insurance Technology Startups: India's insurtech sector had been witnessing rapid growth. Startups were introducing innovative technologies like artificial intelligence, data analytics, and block chain to improve underwriting, claims processing, and customer service.

8. Government Initiatives: The Indian government, through various schemes like Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), had been promoting insurance inclusion among the economically weaker sections of society.

9. Foreign Investment: The government had increased the foreign direct investment (FDI) limit in the insurance sector, allowing more foreign investment in insurance companies. This move was expected to attract additional capital and expertise into the sector.

10. Challenges: Despite the growth and positive developments, the insurance sector in India faced challenges related to trust-building, insurance fraud, and ensuring adequate consumer protection.

The Indian government has taken a number of steps to promote the growth of the insurance sector, including increasing the foreign direct investment (FDI) limit in insurance from 26% to 49%, allowing foreign insurers to set up their own branches in India, and introducing new products and services. The insurance sector in India is facing a number of challenges, including low insurance awareness, low disposable incomes, and regulatory complexities. However, the sector is expected to continue to grow in the coming years, driven by factors such as the growing middle class, increasing urbanization, and rising incomes.

Review of Literature

Manik Jindal 2020, The insurance market in India is booming, with a number of domestic and foreign companies competing and expanding quickly. The many reforms and loosening of policy regulations are to blame for this. One of the most important factors in the success of sales and marketing of services, notably insurance, is effective advertising. Advertising's efficacy is determined by how well it satisfies a particular need. Even if it is impossible to measure advertising performance globally, it is even more challenging when it comes to intangible products like insurance. However, this essay aims to examine and assess the influence of advertising in the insurance industry.

Advertising informs the public about a company's name, its goods or services, or its concepts. It also aids in attracting new clients, preserves the company's good name in the eyes of the public, and creates favorable perceptions of the brand and its qualities. Regarding the industry's products, customer services, etc., private firms have introduced a number of unique products. They have implemented efficient marketing tactics, advertising campaigns, and advertising effectiveness to increase the appeal of their plans or products to potential customers. Private insurance businesses were permitted by the IRDA to operate during the post-liberalization and WTO era, which resulted in a significant transformation in the insurance industry as more people began to receive coverage. Due to brand building and industry expansion, advertising in the life insurance sector has grown exponentially. Advertising is synonymous with product advertising and is frequently seen in traditional mass media, such as TV, radio, magazines, and newspapers, as shown in the analysis. With insurance now being connected to numerous consumer goods, such as housing and other necessities, a new trend has emerged that has broadened the range of products covered.

Arya Praveen Kumar, Prof. D. Sreeramulu, 2022, the current study examined the impact of insurance marketing tactics on consumers' purchasing preferences in Hyderabad, Telanagna state. 520 buyers and 48 agents from the select public and private sectors responded to a standard questionnaire, which the researcher utilized to collect primary data using a multi-stage random sample procedure. To arrive at the results and conclusions, the research data was analyzed in the SPSS 23.0 version utilizing ANOVAs, correlation, and independent t-tests. The study's findings indicate that marketing strategies have a significant impact on the purchase preferences of Select Public and Private Health Insurance Company; correlation results show that marketing strategies, motivational factors, income, and information source have a strong correlation with purchase preferences; a t-test revealed that income level, motivational factor, marketing strategies, and purchase preferences have a positive correlation with each other. Journal on insurance in India, The Insurance Times ISSN: 0971-4480 Vol. XXII, No. 03, March 2002, pp. 20–23. Over the past ten years, the service sector has experienced tremendous growth and now contributes more than 60% of the GDP in developed nations. Even in India, the service sector now contributes more than even the agriculture sector, accounting for close to 38% of GNP. India has also just turned the corner in this industry, as seen by the rise of Indian banks, hotels, insurance firms, and professional services in the fields of management, accounting, health, and medical. On the other hand, the global economy has become more interconnected, and recent liberalization policies in India likewise seek to harmonize with the world economy. Many nations, including Hong Kong, South Korea, Taiwan, and Singapore, saw robust economic growth because of finance sector innovation and liberalization. Even South Korea, the world's 13th largest economy, became the only developing nation to switch from being an assistance recipient to a contributor of help. The Indian government has learned how to open the financial sectors to competition from newly opened economies like Thailand, Indonesia, and Malaysia. In April 1993, the Indian government accordingly established the committee to regulate the insurance industry. According to the committee's recommendations, the government established the insurance regulatory authority (IRA), a powerful and efficient statutory body that allows foreign insurance companies to operate, opens Indian life and general insurance to international competition, and establishes independent businesses by dissolving the GIC holding company that held the four subsidiaries. As a result, the Indian insurer was forced to review its marketing strategies. This paper's goal is to investigate the marketing operations of the general insurance industry, namely those of N.I.C. Ltd, and to make recommendations for how to reorient marketing techniques considering current events.

Research Objectives

1. The primary objective of this study is to gain insights into the insurance disclosures outlined by the Insurance Regulatory & Development Authority of India (IRDA). This examination encompasses aspects related to financial education, consumer protection prerequisites, and the advertising tactics employed by insurance companies when marketing non-life or general insurance products.

2. Another key focus of this research is to assess the guidelines established by insurance regulatory bodies in various OECD countries concerning the sale of non-life or general insurance products.

3. To investigate how urban customers, perceive the promotional strategies and practices employed by insurance companies.

IRDA on Insurance Marketing and Advertising

A Master Circular has been issued by the Insurance Regulatory and Development Authority (IRDA) to protect the interests of policyholders in compliance with applicable legal requirements. The purpose of this circular is to encourage ethical business practices and increase consumer trust in insurance company marketing materials. The Insurance Advertisements and Disclosures Regulations of 2000 (Advertisement Regulations) of the Insurance Regulatory and Development Authority (IRDA) and the Code of Conduct of the Advertising Standards Council of India (ASCI) are among the laws and regulations that must be followed in addition to these guidelines. All promotional materials addressed at policyholders and prospective policyholders, with an emphasis on the solicitation of insurance business, must adhere to existing norms, which are reinforced by IRDA's restrictions. Both public and private insurance businesses can rest easy knowing that they are following IRDA's explicit requirements on marketing and advertising. They stress the importance of being honest, transparent, and ethical in the insurance industry and in the sale of various insurance products to the public. It might be difficult to make sense of insurance policies due to their complexity. Therefore, it is essential that the marketing materials used by insurers be straightforward, honest, and written in plain English so that clients may make educated choices. Rather of focusing on the insurer's bottom line, consumers should prioritize a product's transparency in terms and conditions and their actual need for the coverage. Insurance is becoming increasingly important in people's lives, and IRDA acknowledges this, along with the complexity and variety of insurance products. Recognizing that precise requirements can differ from country to country, it stresses the importance of gauging the level of consumer comprehension and education. While policyholder protection and market integrity and transparency are vital, insurance education must be implemented within a legal framework. The regulatory framework and consumer protection are two separate but related aims that must be kept in mind.

There are certain similarities between the two ideas, but education is more than just giving people access to information. Its goal is to help customers make educated choices about insurance policies. When it comes to safeguarding policyholders' rights and establishing redress procedures, consumer protection emphasizes on regulatory and supervisory factors. Increased consumer awareness, knowledge, and capability in regard to insurance products and industry players is a key goal of these guidelines, which cover aspects of consumer protection and prudential insurance regulation.

Challenges at the Intersection of Marketing Strategies and Ethical Conduct in the Sale of Non-Life/General Insurance Products

Insurance marketing can be done directly to the public or indirectly to the trade channel. Because insurance is an abstract idea that buyers must conceptualize, marketing to consumers is a top priority in the industry. Therefore, rather than only emphasizing the features of insurance products, the emphasis changes to conveying the benefits of insurance. Because of their importance in achieving a sizeable market share and establishing a reputation in the minds of consumers, careful deliberation must be given to the selection of promotional materials and the training of sales employees.

Trust and confidence in insurers are crucial to the success of promotional communications, which are used to sell insurance. Since the insurance industry is highly competitive and includes both public and private entities, it is imperative that all parties involved act in an ethical and transparent manner. The public may have difficulty understanding the nuances of various insurance products, so it is crucial that advertising materials be straightforward, neutral, and presented in simple language free of ambiguity. Customers should be able to make educated judgments about whether to acquire an insurance policy after reading this information. However, policyholders encounter persistent problems that are widespread throughout insurance industry marketing approaches. There is a lack of openness on the part of insurance providers when it comes to notifying customers of premium increases. Insurers owe it to their policyholders to be forthright about the policies' conditions and the processes involved in making claims payments. When insurance firms charge different consumers different amounts for the same coverage, it can give the impression that the company cares more about making a profit than protecting its clients.

Contributions and Constraints

An original approach was taken in this study by contrasting the rules for advertising and consumer protection established by the Insurance Regulatory and Development Authority of India (IRDA) with those of the OECD. The significance lies in the fact that these OECD guidelines are generally accepted as international best practices, regulating insurance firms in 37 countries across regions like Asia, the Pacific, the USA, Latin America, and Australia, where key partners account for a combined 80% of the world's insurance business and investment. The research uses original sources, including IRDA records for India and OECD standards for insurers everywhere. The insurance sector in India has been on a trajectory of evolution and expansion, driven by changing consumer preferences, technological advancements, and regulatory initiatives.

While my knowledge is limited to information available up to September 2021, it is evident that the sector was undergoing several noteworthy developments. The Indian insurance industry was experiencing growth in terms of both life and general insurance. The regulatory environment, spearheaded by the Insurance Regulatory and Development Authority of India (IRDAI), had been instrumental in shaping a more consumer-centric and transparent insurance market. The digitization of insurance services, diversification of insurance products, and the rise of ensures startups were indicative of the industry's commitment to embracing innovation.

Furthermore, the COVID-19 pandemic underscored the significance of health insurance and prompted a surge in demand for related products. The government's efforts to promote financial inclusion through insurance schemes and increasing foreign investment limits had the potential to further expand the sector's reach and capabilities. Nonetheless, challenges remained, including the need to foster greater trust among consumers, combat insurance fraud, and continually enhance consumer protection measures.

The dynamic nature of the insurance industry dictates that the current scenario is subject to ongoing change. Therefore, it is essential for industry stakeholders, including insurance companies, regulators, and consumers, to remain vigilant and adaptable to new developments and emerging trends in the insurance sector. To gain the most accurate and up-to-date information on the current state of the insurance sector in India, it is advisable to consult recent reports, official announcements, and regulatory updates. By doing so, stakeholders can make informed decisions and contribute to the continued growth and improvement of the insurance sector in India, ensuring that it remains resilient, innovative, and dedicated to safeguarding the financial well-being of the nation's citizens and businesses.

Research Methodology

In the examination of Advertising for General Insurance Products in Comparison to Consumer Protection, this research will draw data from annual reports of Public Sector (PS) insurance companies, the Insurance Regulatory and Development Authority of India (IRDAI), and other reputable secondary sources. Data sources used for analysis and interpretation will be credible and authenticated. The guidelines and best practices will be derived from IRDA documents for the Indian context and OECD documents for international insurer guidelines. The current research aims to gain insights into the perspectives of urban customers by examining their perceptions of the promotional strategies and practices employed by insurance companies to attract them.

Findings and Analysis

Demographic analysis of Urban population:

In this research, only three primary demographic characteristics, namely gender, age, and income, were utilized for analysis. Therefore, only the demographic profiles for these characteristics are provided below Tables 1 & 2.

| Table 1 Demographic Profile | |||||

| Gender | N | Percentage | Above 60 | 45 | 15% |

| Male | 197 | 65.66% | Total | 300 | 100.00% |

| Female | 105 | 35% | Monthly Income | N | Percentage |

| Total | 300 | 100.00% | Less than 10000 | 54 | 18% |

| Age (In Years) | N | Percentage | 10000 – 20000 | 99 | 33% |

| Up to 20 | 20 | 6.66% | 20000 – 30000 | 114 | 38% |

| 21 to 40 | 100 | 33.33% | 30000 and above | 33 | 11% |

| 41 to 60 | 135 | 45% | Total | 300 | 100.00% |

| Table 2 Perception and Elucidation of Advertisement Tools | ||||

| Tools | Perception | Elucidation | ||

| N | % | N | % | |

| Broadcast advertising | 300 | 100 | 300 | 100 |

| Print media promotions | 300 | 100 | 300 | 100 |

| Radio ads | 289 | 96.33 | 154 | 51.33 |

| Direct sales | 256 | 85.33 | 97 | 32.33 |

| Periodical promotions | 245 | 81.67 | 55 | 18.33 |

| Personalized marketing | 259 | 86.33 | 145 | 48.33 |

The table presents a demographic snapshot of a sample of 300 individuals based on their gender, monthly income, and age. In terms of gender, the sample is predominantly composed of males, making up 65.66% of the total, with females accounting for 35%. Regarding monthly income, the majority falls within the income bracket of 10,000 to 30,000, with 33% earning between 10,000 and 20,000, 38% earning between 20,000 and 30,000, and 11% having an income of 30,000 and above. Finally, in the age category, individuals aged 41 to 60 years constitute the largest portion at 45%, followed by those aged 21 to 40 years at 33.33%, and individuals aged up to 20 years at 6.66%. Additionally, a subset of individuals above 60 years comprises 15% of the total sample.

The provided data pertains to the perception and comprehension of different advertising tools among a group of respondents. The table offers insights into the number of individuals (N) and the corresponding percentages (%) who perceive and understand each advertising tool.

Firstly, it is evident that broadcast advertising and print media promotions are universally recognized, with 100% of respondents perceiving and elucidating these advertising methods. For radio ads, nearly 96.33% of respondents are aware of them, but only about 51.33% can fully understand this advertising tool. In the case of direct sales, approximately 85.33% of respondents are aware of it, but understanding lags at 32.33%. Periodical promotions have an 81.67% awareness rate, but only 18.33% of respondents can elucidate them. On the other hand, personalized marketing enjoys a relatively high level of awareness at 86.33%, with 48.33% of respondents having a good understanding of this advertising approach. These findings underscore variations in awareness and comprehension across different advertising tools, which can be valuable information for crafting effective marketing strategies and campaigns.

Conclusion

In conclusion, the examination of guidelines from the Insurance Regulatory & Development Authority of India (IRDA) in comparison with international standards, particularly those outlined by organizations like the International Association of Insurance Supervisors (IAIS) and the Organization for Economic Cooperation and Development (OECD), has shed light on the critical need for promoting general insurance products with a strong emphasis on consumer safeguards. This analysis has demonstrated the importance of aligning India's insurance regulatory framework with global best practices to ensure consumer protection, market stability, and the growth of the insurance sector. By fostering an environment that encourages transparency, fair practices, and enhanced consumer awareness, India can strengthen its position in the global insurance market and provide its citizens with reliable and secure insurance options.

However, as India strives to bridge the gap between its regulatory framework and international standards, several challenges must be addressed. Firstly, achieving uniformity and consistency in the implementation of consumer protection measures across the diverse landscape of India is a formidable task. Regional disparities, varying levels of financial literacy, and differing consumer needs require tailored approaches that can be challenging to develop and enforce uniformly. Additionally, fostering a culture of consumer awareness and financial literacy poses a significant challenge, as it requires extensive efforts in education and outreach to ensure that individuals are equipped to make informed decisions about insurance products. Moreover, ensuring the compliance of a multitude of insurance providers, including both established and emerging entities, with the evolving regulatory framework is an ongoing challenge that demands rigorous monitoring and enforcement mechanisms. Despite these challenges, the alignment of India's insurance sector with international standards remains a crucial endeavour to safeguard consumers and promote the healthy growth of the general insurance industry.

References

Bajpai, S., & Mazhar, S. S. (2022). Marketing Strategies of Life Insurance Companies. Book Rivers.

Dean, D. H., & Biswas, A. (2001). Third-party organization endorsement of products: An advertising cue affecting consumer prepurchase evaluation of goods and services. Journal of advertising, 30(4), 41-57.

Indexed at, Google Scholar, Cross Ref

Hsu, K. T. (2012). The advertising effects of corporate social responsibility on corporate reputation and brand equity: Evidence from the life insurance industry in Taiwan. Journal of business ethics, 109, 189-201.

Kumar, A. P., & Sreeramulu, D. (2022). Insurance company marketing strategies: a comparative study of public and private company. EPRA International Journal of Economics, Business and Management Studies (EBMS), 9(3), 20-25.

Mitchell, V. W. (1999). Consumer perceived risk: conceptualisations and models. European Journal of marketing, 33(1/2), 163-195.

Indexed at, Google Scholar, Cross Ref

Robson, J. (2015). General insurance marketing: A review and future research agenda. Journal of Financial Services Marketing, 20, 282-291.

Indexed at, Google Scholar, Cross Ref

Sureshchandar, G. S., Rajendran, C., & Kamalanabhan, T. J. (2001). Customer perceptions of service quality: A critique. Total quality management, 12(1), 111-124.

Indexed at, Google Scholar, Cross Ref

Thornton, J., & White, L. (2001). Customer orientations and usage of financial distribution channels. Journal of services Marketing, 15(3), 168-185.

Indexed at, Google Scholar, Cross Ref

Yiridoe, E. K., Bonti-Ankomah, S., & Martin, R. C. (2005). Comparison of consumer perceptions and preference toward organic versus conventionally produced foods: A review and update of the literature. Renewable agriculture and food systems, 20(4), 193-205.

Zeithaml, V. A., Parasuraman, A., & Berry, L. L. (1990). Delivering quality service: Balancing customer perceptions and expectations. Simon and Schuster.

Received: 19-Feb-2024, Manuscript No. AMSJ-24-14520; Editor assigned: 20-Feb-2024, PreQC No. AMSJ-24-14520(PQ); Reviewed: 30-Mar-2024, QC No. AMSJ-24-14520; Revised: 29-Jun-2024, Manuscript No. AMSJ-24-14520(R); Published: 14-Jul-2024