Research Article: 2022 Vol: 26 Issue: 2S

Consumer Behaviour towards Social Media Advertising: A Comparative Analysis of Companies in the Life Insurance Sector in India

Manoj Pareek, Birla Institute of Management Technology (BIMTECH)

Nikita Dua, Student, Birla Institute of Management Technology (BIMTECH)

Monika Mittal, Birla Institute of Management Technology (BIMTECH)

Citation Information: Pareek, M., Dua, N., & Mittal, M. (2022). Consumer behaviour towards social media advertising: a comparative analysis of companies in the life insurance sector in india. Academy of Marketing Studies Journal, 26(1), 1-19.

Abstract

Businesses are increasingly relying on digital advertising options such as display and social media advertising. However, the insurance industry continues to lag behind other industries. A survey through a structured questionnaire was used to investigate consumer behavior, views of social media advertising. and a comparative analysis of four private insurers in India was done in this study. The Insurers were Pramerica Life Insurance, Max Life Insurance, HDFC Life Insurance, and ICICI Prudential Life Insurance to see how they use digital advertisements, particularly social media, to attract target audiences and increase conversion rates. The study attempted to analyze social media advertising in the Life insurance market and tried to inquire why the insurance business lags in exploiting social media advertising and what steps may be made to boost their visibility. According to the survey results, people have a positive mindset toward credible commercials. As a result, firms should strive to include these characteristics in their marketing. Appropriate targeting should be done depending on the age and occupation of consumers to reach out to the audience on social media. Advertisements can be personalized to increase response and conversion rates. Businesses should work to increase engagement on their social media profiles.

JEL Codes

M13, M31, M37.Keywords

Social Media, Advertising, Consumer Behaviour, Marketing, Insurance, India.

Introduction

Internet usage has been increasing at a very fast pace. Studies suggest that the number of internet users will increase to 5 billion by 2020. The whole digitalization process and usage of technology are changing the way a business interacts with its customers and vice-versa. The insurance sector is still far behind in leveraging technology to change their business models (According to the report of PWC (2012) titled “Life Insurance 2020: Competing for a future”. Unlike other industries it has not fully exploited the positive sides of technology and is not using it to its advantage, it is still working with the traditional methods of marketing and selling.

It is becoming increasingly challenging for a marketer to influence and convince its customers through conventional means of advertising. As the world is moving towards digitalization the effectiveness of these traditional modes is decreasing making a marketer think in another direction. Customers are now ready to pay for services with no advertisements that reduce the interruption and enhance the experience of the customers. They swiftly tend to shift to another channel whenever an Ad pops up while they are enjoying their favorite show, this irritated customer is more likely to ignore the advertisements even if it sometimes contains useful information for them. In addition to this, brand building through TV advertisements, pamphlets, etc. lacks in appealing and motivating the customers which is an important aspect of customer loyalty.

Now, if we think of different advertisement types for the web to attract the target customers and increase conversions this also has a problem associated with it. The customer can block most of the advertising using cookie filters. Even the e-mails are getting directed to the trash bin directly.

From the above responses of the customers, it is increasingly important now for companies to leverage the use of social media to their advantage. Social media is where people spend most of their time on a given day. According to Statista, as of 2019-20, people spend an average of 142-145 minutes on social media per day. These numbers are even more prominent in India, where a person spends an average of 3hours 25 minutes on social media. If we see the bifurcation through age then, 54% of people between the age group of 20-39 spend their 3-4 hours on social media daily. Social Networking Sites (SNSs) are becoming a very important part of Web 2.0. People spend their time on these sites not just for better connections but also for exchanging information, shaping public opinion, influencing purchases, and reaching out to customers virtually. Advertisements on social media platforms can be a boon for the company to attract customers, stay connected with them, enhancing brand awareness and brand image. According to (Kotler and Keller, 2007), a customer becomes loyal to the company when he perceives the ‘value’ of a particular brand. To develop this ‘value’, there must be an exchange of information between customers and the company needs to influence the brand image in the customer’s mind.

Social media helps in increasing the reach of a business and gives the company a chance to follow their customer’s habits and taste for better targeting them with their products offerings. Advertisers have an option of customizing according to the target audience, which reduces the cost and increases the conversion rates at the same time. Time spent on social media has increased manifold in recent times and people are more accustomed and aware of brands whose advertisements can be seen while operating their phones or desktops. Though these social media advertisements are fancy and admirable, there is a lot of dynamism and noise associated with them as well of which a marketer should be careful. It is a good place to increase brand awareness and encourage engagement among consumers.

Social media gives the advertiser a chance to personalize the message for its users and thus create effective word of mouth. It’s an old concept where consumers of a product become the marketing agents and tell people around them about the brand thus creating a brand image. The last decade has turned things around and people are conversing over social media with each other not restricting the word-of-mouth marketing tool to just friends and family but in a community who share similar interests over social media. 43% of people tend to make a buying decision based on online discussions over social media. However, we must not confuse social media only as an extension of word of mouth marketing, the sentiment analysis which tells whether the comments are positive, negative, or neutral is a better way of judging the WOM (word-of-mouth) marketing efforts.

Consumer Behaviour

Consumer behaviour is described as a study of how consumers who might be individual customers, a group, or an organization behave in the process of deciding what to buy that will satisfy their needs. For a marketer, it is really important to understand the behaviour of its customers to know their expectations and be able to design products satisfying the needs and also design the advertisements that would attract the intended target audience.

A lot of demographic and psychological factors are responsible for the way a consumer behaves. However, consumers’ actions are also driven and affected by experience and external information. To understand customers, a marketer needs to know the motive behind buying a particular product/service, perceptions, and attitudes towards their product/service. Once the company can identify these aspects it can design its product and marketing campaign in the same direction. Also, it will help them understand the reasons for customer loyalty and the customer will not hover over similar products offered by competitors (Hoyer, W. D., MacInnis, D. J., & Pieters, R. (2001).

The valuation of the Indian insurance sector reached US $280 billion by the end of the year 2020 with a CAGR of 5.3% between the years 2019 and 2023. The overall premium collection for all the life insurance companies together stood at US $31.9 billion.

The Indian insurance industry had a total of 70 insurers as of March 31, 2019. These are divided into five categories and have several companies under each category Table 1.

| Table 1 Number Of Players In The Indian Insurance Sector | |

| Category | Number of companies |

| Non-life insurance companies | 27 |

| Life-insurance companies | 24 |

| Stand-Alone health insurers (SAHI) | 7 |

| National reinsurer | 1 |

| Foreign reinsurance subsidiaries | 11 |

Life insurance companies cover the death risk of individuals and are seen as a medium of providing protection and earning interest on their savings. However, non-life insurance companies offer risk coverage with activities and things associated with day-to-day living. These include travel insurance, vehicle insurance, property insurance, crop insurance, etc.

Before 2000, the Life Insurance Corporation of India (LIC) was the only company offering life insurance in India. It was only after the constitution of the Insurance Regulatory and Development Authority of India(IRDAI) in the year 2000 and after it gave its approval, new private sector companies were allowed entry into the life insurance sector and the insurance industry gained momentum with aggressive competition between these companies.

Life Insurance Corporation of India (LIC) is the only public sector life insurance company in India. Based on the first-year premium collected by life insurers, LIC had 66% market share, in terms of the number of policies sold LIC had 73% market share. In terms number of lives covered under group schemes the market share of LIC was 15% and finally in terms of sum assured the market share of LIC was 15% as on 28th Feb 2021as per IRDAI data. Due to the pandemic, the industry has realized the need of going digital immediately and serve its customers. To cater to these new demands and expectations of the customer, there have been some major developments and investments in the industry both by government and private companies. Most of the private companies have collaborated with foreign companies, digital wallet providers, healthcare sector to provide greater coverage and ease the purchase process for the customers. Also, the industry has always been employee-centric with more focus on physical interaction which is not possible in these times, and the need to digitalize the sector has become even more important. This transition from face-to-face interactions with the customers to a Work from home (WFH) environment needs to be smoothened to grow the business. This requires the management of customer databases using technology and required information technology infrastructure.

Review of Literature

Social media is being widely used by marketers in various industries as a medium to attract customers, know them better, create brand awareness, and increase conversion rates. The insurance industry is however lacking behind in using social media to the fullest. Research papers exploring this aspect have been published but they fail to provide an Indian perspective. The Indian economy is adopting the use of social media at a fast pace, we intend to fill the research gap by focusing on India. It has been observed by Delafrooz (2017) that increased use of social media to sell causes the increased use of social media by consumers.

Makhulo (2014) says that social media has changed the way people communicate and share information globally. Social media is being used for communication, transaction, and relationship building in insurance companies. Increased use of social media is also helpful in gaining a competitive advantage against competitors in terms of higher brand awareness and building a brand image.Seth (2020) states that insurance industries in India are using social media in marketing operations only, to tell their customers about the launch of a new product or any milestone achieved. The research has been conducted by keeping in mind the situation of the COVID-19 pandemic and this further can be extended on a larger level by studying more social media channels.

Castriotta (2013) tries to find out how the insurance companies in Italy are strategically creating value by using deploying social media platforms. Italian insurers were absent in collaborative projects over social media platforms. Even though social media was adopted in 2009 by major insurers, they tried to create spaces within the channels to increase engagement. we intended to discover these trends in the Indian insurance sector for which there have not been any formal studies published in academic journals. According to (Floreddu, 2014) repeated interactions between customers and firms enhance the relationship and thus help in contributing to the long-term reputation of the firms.

Social media is used not only for spreading information and gaining consumer insights but also as a surveillance method to avoid fraud claims and thus lower the base premium for the rest of the customers. These way American insurance industries can use social media to their advantage Filip, (2015).

Consumer behavior towards Social Media Marketing

Studying consumer behaviour is not always an easy task as different dynamics are involved when it comes to dealing with human beings. With the advent of Web 2.0, a great shift and movement have happened towards digital media. A lot of researchers have realized the importance of adding this into the existing domain knowledge and various papers have been published to sketch out the factors determining the consumer behavior towards social media marketing. The process of buying decisions is getting highly influenced by social media starting from the stage of information search to the final buying decision and even post-purchase evaluation with satisfaction getting amplified when moving forward in the process (Voramontri (2019). Demographic factors like age specifically have a significant impact on how consumers behave. Duffett (2017) have found the behavioural and cognitive difference being prominent in the age group of 13-18 years in South Africa.

Diffley (2011) states the importance of using different strategies on social networking sites to the marketers in case of “pull” and “push” marketing. Also, properly targeting the advertisements is important to avoid the user getting annoyed and leaving the site altogether. The lack of choice to the user of social networking sites harms the user experience. According to Chitharanjan (2016), certain people do not find social media advertisements credible.

Alalwan (2017) reviewed 144 published journals to examine the main themes and trends in social media marketing for word-of-mouth marketing, customer relationship management, advertising, brand image, and performance. The research was limited to using qualitative methods which concluded that CRM and WOM are the two major reasons for the companies to actively use social media advertising.

The shift towards digitization is an alarm bell for companies to exploit the digital channels to their advantage. When people are using social media sites for both personal and professional needs, it becomes imperative for organizations to give shape to their marketing strategies towards social media and study consumer behaviour. Posting content through relevant blog posts and laying down appropriate information regarding products helps influence customers. However, this research was limited only to Apple Inc. and thus the results cannot be generalized to every industry Chitharanjan, (2016).

One of the main motives of social media advertising is to make the customer buy the product/service. Now, the major factor involved in this is the “trust” of the consumer. It can easily be built or broken by not only the content posted by the company on social media but also by others exchanging information via comments Irshad (2020). It is, therefore, necessary to keep a track of what is coming in your comment boxes to avoid any negative word of mouth and to work upon improving the existing product and services. According to Boon-Long (2015), discussions on social media about the product can be used as a proxy for advertisement effectiveness on social media.

Buying behaviour in the Insurance Industry

In the insurance industry, if we look at the Life Insurance sector, people have developed a positive mindset and started considering it as an investment opportunity. Sahu (2009) However, the rate of adoption is still low with the majority of people being the clients of LIC. Studies have been done focusing on how a consumer behaves while purchasing an insurance policy but little emphasis has been put on studying the life Insurance sector in particular.

Insurance is a very personalized product and works on trust. Thus, the majority of the companies are using the agency model to market insurance products. Murugesan (2014) says that perceived service quality, relationship management, and trust are the major determinants of buying behaviour when it comes to buying health insurance. CSR activities initiated by the life insurance companies in Taiwan are also helpful in building the corporate image and increasing brand equity through informative advertising Hsu (2012). Also, demographic factors influence the behaviour while making a buying decision of an insurance policy (Yadav, 2019).

Consumer behaviour and satisfaction are feebly correlated in the case of motor insurance; says Das (2017), it would be imperative to research whether this holds in the case of the life insurance industry or not.Traditional v/s Digital Marketing Tools

There has been a constant debate about whether digital advertisements are surpassing traditional means of advertising. Todor (2016) says that television advertisements are still more dominant however the trend is shifting towards digital advertisements due to high internet penetration. Digital marketing is often replaced with terms like “online marketing”, “internet marketing” and “web marketing” and is based on the concept of inbound marketing.

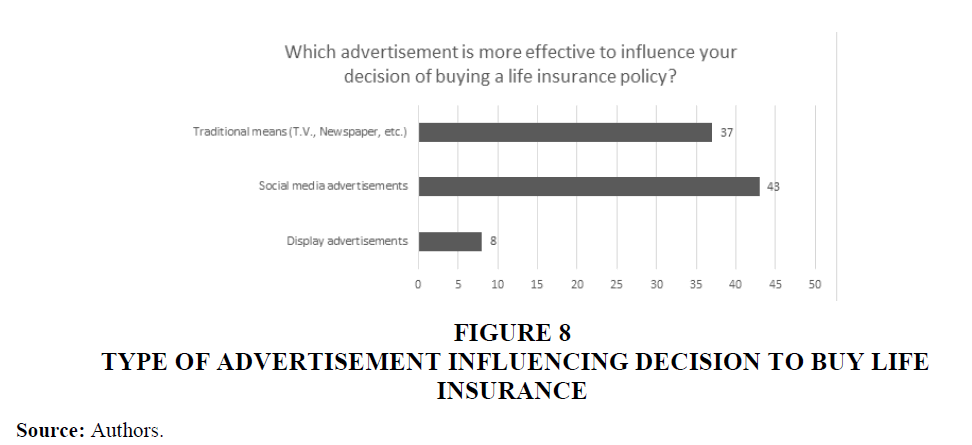

Advertisements are important to influence the decision of a buyer and make them want your product or service. However, traditional means of marketing require a huge investment in terms of time and cost. There is no option of targeting, it is all about mass communication. However, it still is a part of the overall advertising strategy framed by the company. According to Chitharanjan(2016) consumers feel more attracted towards social media advertising rather than traditional means of advertising and have better potential to disseminate larger and accurate information about the product or service.

Whether it's the traditional mode of advertising or digital mode of advertising, interactive communication with customers is necessary to make them buy your product/service. With improvements in technology and growing internet penetration, there has been a visible transition from traditional mode to digital mode. The reason for such a change is the special ability to target customers properly and reduce costs while increasing conversion rates (Durmaz (2016). Targeting is important for both effectiveness and making economical adjustments. Kuberappa (2016) says that digital media is not just cost-effective but also more relevant and consistent for keeping the brand in consumers’ minds for the long term by creating user experience and providing valuable information.

Importance of Brand Equity in the Insurance Industry

Insurance is a highly personalized product that people prefer to buy from a trusted agent only and buy products from a trusted brand. Ajemunigbohun (2017) studied the insurers of Nigeria and found a positive relationship between brand equity and service performance for insurers. This industry exhibits the characteristics of providing trust, stability, and risk protection.

According to (Hassana, n.d.) brand equity is not just limited to the marketing department but includes the whole culture of the company, corporate culture, and everything directly or indirectly relating to the brand.

According to the research conducted by Kamiri (2007) for the insurance sector in Kenya, branding is necessary for consumers to perceive differences among brands. Success comes when firms have a blueprint of the product, regularly measure brand performance, and conduct market surveys periodically to know their customers better. To increase brand awareness proper targeting with relevant advertisements using a combination of various media is necessary.

With growing internet penetration and people shifting to digital means at a fast pace, it is necessary for companies also to shift towards digital means. However, after reviewing the literature, we observed that the insurance sector is far behind the other sectors in exploiting social media to its advantage. Consumer behaviour in the insurance sector differs on certain factors which are explored in this research paper.

A lot of researches have been done to analyze consumer behaviour and perception towards social media, but these are limited to industries other than Insurance. Little addition has been made to the existing knowledge base in the case of the insurance sector in India. The majority of these studies have happened insurance companies in Italy, Kenya, the USA, and the Asian continent. With fast pace internet penetration and the rising trend of social media, it’s imperative to study and understand how this tool is being currently used by insurers in India and how can they use it to have a better understanding of consumers' perception of social media advertisements.

As a result, the current study aims to fill this vacuum in the existing literature on social media in the Indian insurance sector. As a result, we forecast the following:

Research Hypothesis

1. H1: There is a significant impact of credibility, relevance, value corruption, social and design on consumers’ perception towards social media advertising.

2. H2: There is a statistically significant difference in consumers’ perception of social media advertising because of gender.

The hypothesis was tested with the information gathered and given in the following sections.

Research Design and Method

Sample Selection and Collection of Data

The scope was to study consumer behaviour towards social media advertising through a primary survey using a detailed questionnaire. The data used for the study was collected by floating a google form and responses were collected from 88 respondents. The questionnaire was shared with 220 respondents out of which 88 responded so the final data analysis was done on 88 respondents' data and this became therefore the sample size of the survey. The Covid 19 pandemic was at its peak during the time of our research study resulting in hesitation of respondents for face-to-face interaction and low response rate. Respondents were asked questions about their perceptions of social media and social media advertisements. A complete analysis of social media sites of Pramerica Life Insurance, Max Life Insurance, HDFC Life Insurance, and ICICI prudential life was also done to practically understand the situation.

The criterion of credibility, relevance, value corruption, social and design are taken into consideration to analyze their impact on consumer’s perception. Along with these factors, demographic factors were also studied to acknowledge their impact on consumers’ perceptions. Findings from the primary survey were used to analyze the social media sites (Facebook, LinkedIn, Twitter, and Instagram) of Pramerica Life Insurance, Max Life Insurance, HDFC Life Insurance, and ICICI prudential life and draw a comparative analysis of how these companies are currently using social media. Each social media site was studied in line with its customised features; like share and comments for Facebook, Tweets, and likes for Twitter, Likes and following for Instagram, and followers, connections, likes for LinkedIn. Websites were kept out of the scope of the study.

Data was collected using a structured questionnaire. For analysis, SPSS software was used to run various statistical tools including regression, chi-square, etc.

A descriptive research design was used to complete this study. This research design in the study comprised of two distinctive measures namely survey research and observational method. Results from both sections of the study were combined to provide relevant recommendations. By combining the results from both sections of the study, we wanted to cover the research gap of analyzing social media advertising specifically in the life insurance sector.

Study Constructs and Measures

Digitalization has led to changes in how marketers function. With a large number of consumers shifting from traditional means to a digital platform for fulfilling everyday needs, it is necessary to gather insights about how they behave and perceive things. Every industry has its way of attracting customers over these digital platforms. The focus of our study was on the Insurance industry, which is one of the industries lagging in using social media as a tool for increasing engagement, awareness, and brand equity. We intended to analyze consumers' behaviour and perception about social media advertising and gather information about 4 of the 24 life insurance companies namely; Max Life Insurance, Pramerica Life Insurance, HDFC Life Insurance, ICICI Prudential life insurance.

Consumer perception: The primary objective was to study the perception of consumers towards social media advertising, whether a person feels positive, negative, or neutral towards this new development. This aids to unravel the opportunities for insurers who make investments accordingly in social media advertisements.

Consumer behaviour: To find out how a consumer behaves on social media. It included analyzing the main social media platforms along with the peek active time, giving insights to the company for posting content at the relevant time on the desired platform. Also, analyzing the reasons for his/her inclination towards the SNS (Social Networking Sites) of one company than others will help the company in redesigning the marketing strategy.

Construct identification: Major constructs responsible for consumer perception were identified to analyze the dependency factor using regression in SPSS.

Social media analysis: The social media sites of 4 insurance companies in the Life Insurance sector were studied to analyze the pattern and content of posts. Sentiment analysis was also done to understand consumers’ perceptions about the company and the website. This was done to understand whether the social media sites are in line with consumers’ perceptions and any deviations could be known to give correct recommendations. The following section discusses the findings.

Results and Discussion

Survey Demographics

Out of the 88 responses collected, 57 were males and 31 were females. As the responses were collected via google form sent through the Linkedin platform, it showed that males were comparatively more active on this social media site than females.

94% of the respondents were in the age group of 20-40. However, the majority of them were in the 20-30 age group. It showed a shift towards social media usage among youth. Around 53% of the respondents were post-graduate and 34% were graduates.

This question was asked with two aims in mind, one was to find out which income class is using social media the most and the other to see how it is relevant to making the purchase decision for a life insurance policy. 50% of the respondents fall in the category of fewer than 4 lacs annual income and 31% in the category of 4-10 lacs annual income. Only a handful of people from the respondents are earning more than 10 lacs.

Out of the 88 respondents, 49 people which is 55.7% have life insurance. However, their decision to buy an insurance policy was not influenced by an advertisement. The interesting fact is that all those whose buying decision was influenced by advertisements were positively skewed towards social media advertisements instead of traditional means and display advertisements. However, one limitation is that the results are limited to the responses collected and the number of males is more than the number of females Table 2.

| Table 2 Reliabilit Test | |

| Reliability Statistics | |

| Cronbach's Alpha | N of Items |

| .820 | 7 |

Cronbach’s Alpha test was done to make sure the data was reliable for further analysis. The ideal range is from 0.70 – 0.90. From the SPSS output, the value of Cronbach’s Alpha stands at .820 making the data reliable for further analysis.

Regression Analysis

For the analysis, we had a dependent variable as positive feeling towards social media advertising with credibility, relevance, value corruption, social and design being the independent factors Table 3.

| Table 3 Multiple Linear Regression Output | |||||

| Model Summary | |||||

| Model | R | R Square | Adjusted R Square | Std. The error of the Estimate | Durbin-Watson |

| 1 | 0.742a | .550 | .517 | 1.062 | 1.511 |

| a. Predictors: (Constant), I find social media advertisements better than traditional means of advertisement (Design), I prefer asking for advice from friends/relatives after encountering a social media advertisement. (Social), I trust social media advertisements for the information provided by them (Credibility), Social media advertisements make me desire things I never needed before. (Value corruption), I find social media advertisements more informative than traditional means of advertisements. (Design), I find these advertisements relevant for making purchase decisions. (Relevance) | |||||

| b. Dependent Variable: I feel positive towards social media advertisements | |||||

Following is the multiple linear regression output obtained through SPSS.

a. Predictors: (Constant), I find social media advertisements better than traditional means of advertisement (Design), I prefer asking for advice from friends/relatives after encountering a social media advertisement. (Social), I trust social media advertisements for the information provided by them (Credibility), Social media advertisements make me desire things I never needed before. (Value corruption), I find social media advertisements more informative than traditional means of advertisements. (Design), I find these advertisements relevant for making purchase decisions Table 4 (Relevance)

| Table 4 ANOVA Analysis | ||||||

| ANOVA | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 111.625 | 6 | 18.604 | 16.494 | .000b |

| Residual | 91.364 | 81 | 1.128 | |||

| Total | 202.989 | 87 | ||||

| a. Dependent Variable: I feel positive towards social media advertisements | ||||||

b. Dependent Variable: I feel positive towards social media advertisements

a. Dependent Variable: I feel positive towards social media advertisements Table 5.

| Table 5 Coefficients Analysis | |||||||||||||

| Coefficients | |||||||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | |||||||||

| B | Std. Error | Beta | |||||||||||

| 1 | (Constant) | -.134 | .459 | -.293 | .770 | ||||||||

| I find social media advertisements more informative than traditional means of advertisements. (Design) | .320 | .100 | .329 | 3.218 | .002 | ||||||||

| I prefer asking for advice from my friends/relatives after encountering a social media advertisement. (Social) | .161 | .066 | .199 | 2.440 | .017 | ||||||||

| I trust social media advertisements for the information provided by them (Credibility) | .128 | .111 | .113 | 1.152 | .253 | ||||||||

| Social media advertisements makes me desire things I never needed before. (Value corruption) | -.024 | .089 | -.028 | -.273 | .785 | ||||||||

| I find these advertisements relevant for making purchase decisions. (Relevance) | .361 | .125 | .311 | 2.899 | .005 | ||||||||

| I find social media advertisements better than traditional means of advertisement (Design) | .095 | .113 | .100 | .841 | .403 | ||||||||

| a. Dependent Variable: I feel positive towards social media advertisements | |||||||||||||

a. Dependent Variable: I feel positive towards social media advertisements

Interpretation

Model Summary Table: Here the value of R2 is 0.550 which means that 55.0% variability in the dependent factor which is positive feeling towards social media advertisements is being explained by our chosen factors.

The value of the Durbin Watson test is 1.511, which is in the ideal range of 1.5-2.5, indicating that there is no presence of auto co-relation between the residuals.

ANOVA Table

H1: There is a significant impact of credibility, relevance, value corruption, social and design on consumers’ perception towards social media advertising.

Here, as the p-value was 0.000, which was less than 0.05, we rejected the null hypothesis and accepted the alternative hypothesis. This indicates that credibility, relevance, value corruption, social and design have a statistically significant impact on consumers’ perception towards social media advertising.

Coefficients Table

The “B” value under the unstandardized is used to create the Regression equation. Here, the significance value (p-value) will indicate whether that particular construct is making a significant contribution to the consumer’s perception of social media advertising. Through this, we can conclude that relevance, social, and design (informative) have a significant impact on consumers’ perception of social media advertising Table 6.

| Table 6 Independent Samples Test | ||||||||||

| Levene's Test for Equality of Variances | t-test for Equality of Means | |||||||||

| F | Sig. | t | df | Sig. (2-tailed) | Mean Difference | Std. Error Difference | 95% Confidence Interval of the Difference | |||

| Lower | Upper | |||||||||

| I feel positive towards social media advertisements | Equal variances assumed | .150 | .700 | 1.224 | 86 | .224 | .416 | .340 | -.260 | 1.092 |

| Equal variances not assumed | 1.256 | 66.480 | .214 | .416 | .331 | -.245 | 1.077 | |||

Independent Sample t-Test

H1: There is a statistically significant difference in consumer’s perception of social media advertising because of gender.

For conducting an independent sample t-test, the assumption of homogeneity of variances must be met and for this, we ran Levene’s test. Here, the p-value was .700 which was greater than .05 and thus we failed to reject the null hypothesis which is equal variances assumed.

With the assumption fulfilled, we conducted the significance value for the t-test. Here, the p-value was .224, which is greater than .05, thus we failed to reject our null hypothesis. This indicated that there was no statistically significant difference in consumers’ perception of social media advertising because of gender.

The conclusion drawn was women are equally active as men on social media platforms. Their perception of social media is equivalent to that of men, and there is no gender bias seen in this area.

Social Media Analysis

The trend of social media advertisements is getting a heads up due to increased digitalization. A huge amount of information is seen to be passed on during a single day, giving us all the more reasons to analyze the social media handles for better decision-making. The insights can also be used to provide recommendations for increasing engagement and reach. To serve the purpose, the Rival IQ tool was used and metrics were collected for the past 30 days, from 30th May 2021 to 28th June 2021. A comparative analysis was done for Pramerica Life Insurance, Max Life Insurance, HDFC Life insurance, and ICICI Prudential Life insurance company to understand their social media handles Table 7.

| Table 7 Number of Followers of Insurers on Social Media Platforms | ||||

| Insurers | ||||

| Pramerica life insurance | 18,270 followers | 626 followers | 952 Followers | 37,972 likes 38,107 followers |

| ICICI Prudential life insurance | 97,958 followers | 47.1K followers | 29.2K Followers | 430,395 likes 458,557 followers |

| Max life insurance | 181,788 followers | 15.9K followers | 31.9K Followers | 776,059 likes 783,056 followers |

| HDFC life insurance | 198,027 followers | 35.4K followers | 433k Followers | 6,538,479 likes 6,544,032 followers |

From the above metrics, we can see that Pramerica life insurance company lags behind all other companies chosen on all of the social media handles. This impedes increasing brand awareness.

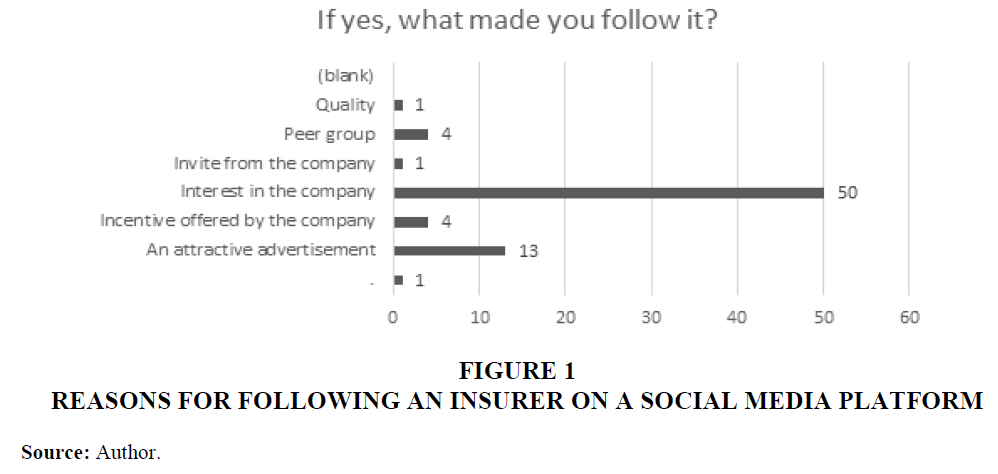

The survey conducted also tried to find out the reason people follow a particular company on social media. 67% of respondents said that their interest in a particular company made them follow the social media of that company. The second highest contribution is of attractive advertisements by the company making people follow their social media handles. The number of followers can be increased by posting advertisements that would generate interest in the company thereby increasing the reach and making social media posts and advertisements more productive Figure 1.

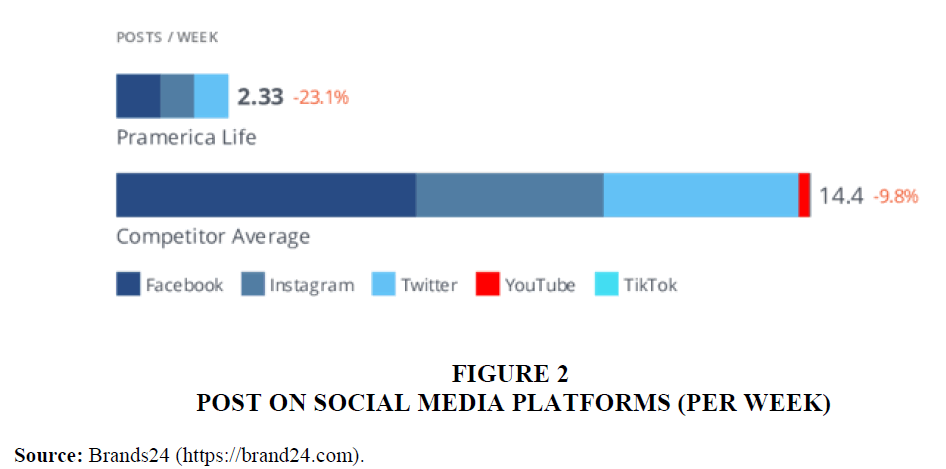

Here also for Pramerica Life, the number of posts per week was much lower than the competitor’s average. There was a need to improve this number so that more people can keep the brand in their minds. Along with the number of posts, the type of post also matters. Carousel posts generate the most engagement for our company, yet there are the majority of photo posts posted. This can be altered for increasing engagement. One reason for this as discovered from the survey findings is that people prefer using social media from mobile phones rather than desktops which makes carousal posts more engaging than photo posts Figure 2.

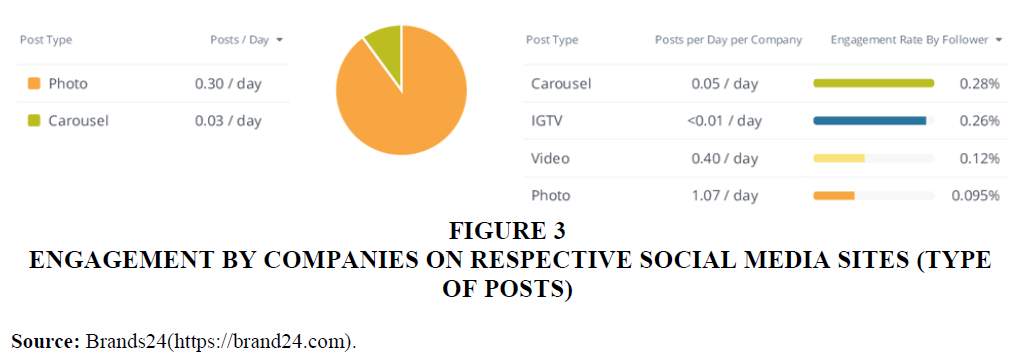

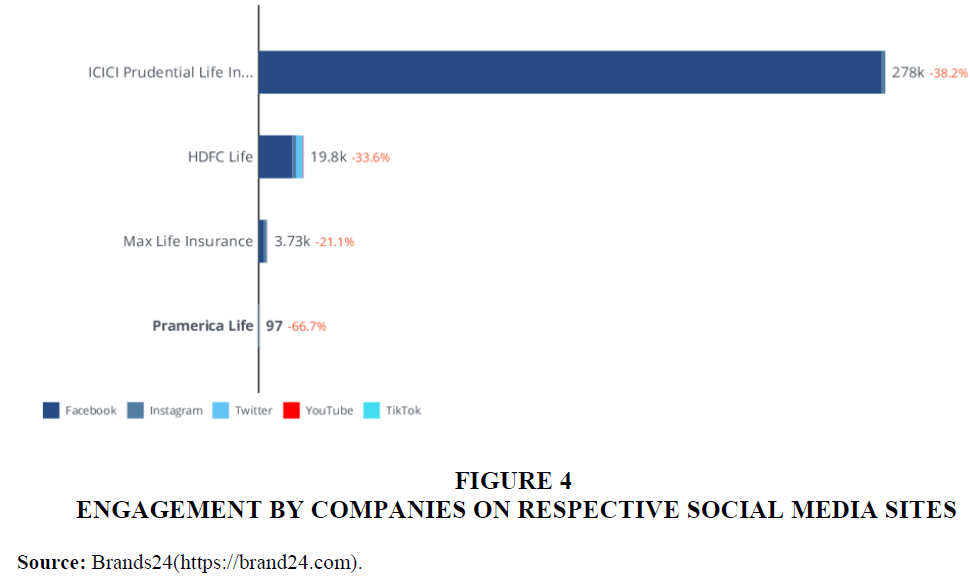

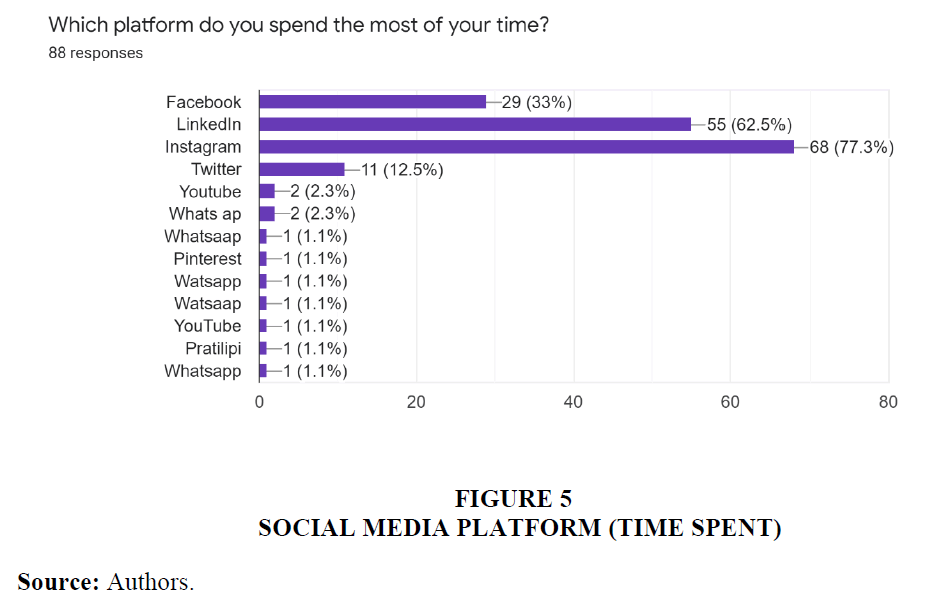

Now, looking at the chart below for total engagement by companies on respective social media sites, here again, Pramerica life insurance is at the bottom of the pyramid. With increased posts and proper targeting, engagement can be increased. Using hashtags is particularly useful in reaching out to several potential customers. The data from the last 30 days showed that Pramerica life insurance company used 5 out of the 8 trending hashtags but was not using #Retirement which has the highest engagement Figure 3. However, the most active channel according to the metrics is Facebook, still, engagement is highest on Instagram. This shows that people are shifting from Facebook to Instagram. The results are in line with the survey conducted. The graph below shows that 77% of people spend most of their time on Instagram.

Figure 3 Engagement by Companies on Respective Social Media Sites (Type of Posts)

Source: Brands24(https://brand24.com).

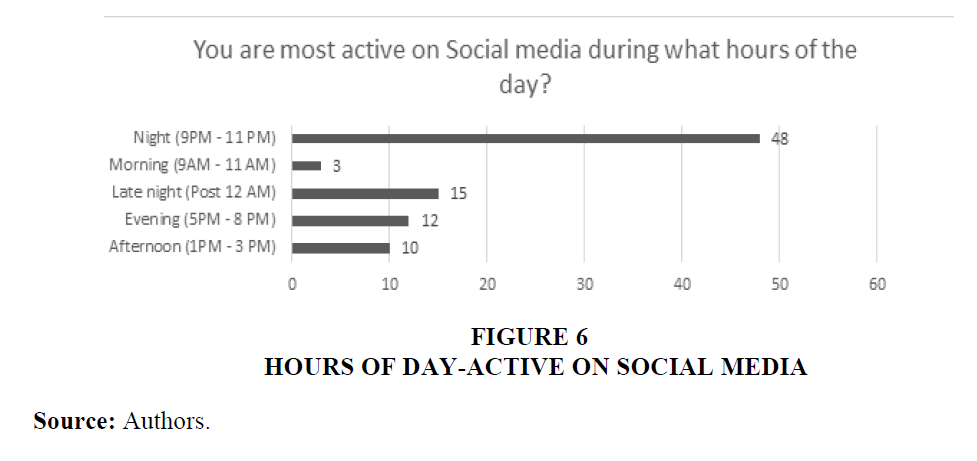

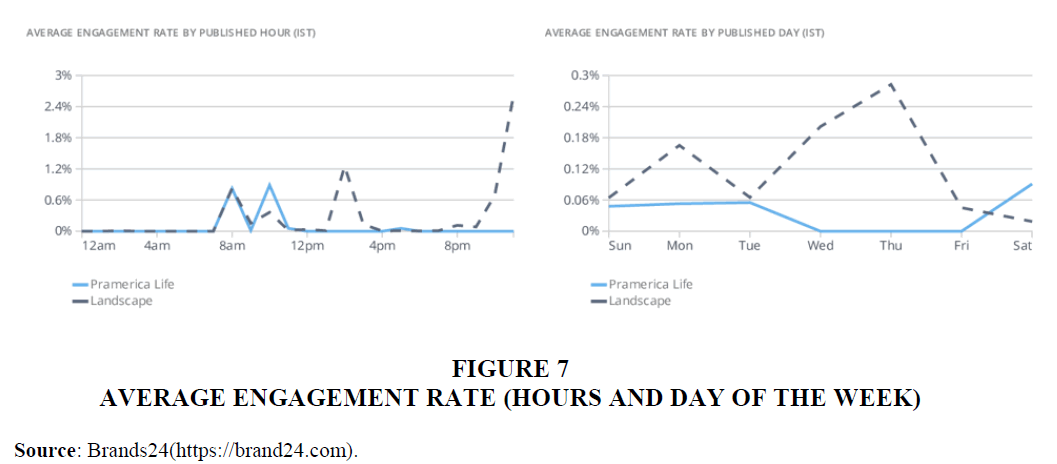

Along with the content, the day and time of posting also matter for increasing engagement and brand awareness. The metrics results from Rival IQ also show that the peak engagement time for Pramerica's post is 10:00 AM, however, the industry average is 11:00 PM. 54% of the people are active from 9:00 PM – 11:00 PM. The least active time on social media is during the morning, which is the time Pramerica company was posting its content. This could be a reason for people missing onto the content posted and not being much aware of the brand name Figures 4 & 5.

Figure 4 Engagement by Companies on Respective Social Media Sites

Source: Brands24(https://brand24.com).

Advertisements are an important factor for brand awareness and thus influence the final purchase decision for any product or service. The insurance industry has long been relying on the agency model and word-of-mouth techniques to attract customers. They have been using various modes of traditional advertisements from newspapers to televisions. But now, with increased internet penetration, a shift has been seen in all the major industries. However, the Insurance industry is still spending a huge chunk of money on traditional means of advertising. The results from the survey indicate that the industry needs to pivot towards social media in upcoming years and use this digital tool effectively to create brand awareness, increase engagement and conversion rates through trust generation Figures 6 & 7.

Observational Recordings

These are some of the responses collected from the survey asking their opinion about social media for the insurance industry. “Monkey Learn” tool was used to analyze the sentiments for a particular statement given by the respondents Figure 8.

• Good for people who don't know about life insurance policy (Neutral)

• For me social media is not attracted me to buy insurance. I prefer experts for any financial thing (Negative)

• Just seeing an ad will not guide me to decide between buying life insurance. (Negative)

• Social media advertisements haven't influenced me in buying life insurance policy (Negative)

• Yes, it can be an effective way for the customer's attraction towards the life insurance policy...The insurance company needs to describe all the best/unique policies/offers they are providing which make them different from the other insurance companies. (Positive)

• I think social media is the new normal for advertisement and surely it will work in near future for life insurance policy (Positive)

• In terms of Life insurance policy yes, I feel good to know the benefits of policy through ads (Positive)

• I think insurance is still a very personal matter, so it needs to be face-to-face selling of insurance. (Negative)All these responses collected are skewed towards the negative side. However, there is still a silver lining that people have started accepting social media for the insurance industry as well. The negative comments can help the company to work upon on these issues and increase consumers’ acceptance of social media advertisements. Once consumers’ trust and confidence builds-up, increasing brand awareness which would spur brand loyalty in the future will be a cakewalk for the company.

Conclusion

The lack of brand awareness among people was a big stumbling block in targeting people through social media advertising. Through vigorous advertising, steps should be taken to improve brand awareness among the general public. People have a favourable view toward credible and relevant commercials, according to the survey results. As a result, businesses should make an effort to incorporate these qualities into their marketing. The Insurance sector continues to spend a significant amount of money on traditional advertising methods. According to the findings of the poll, the sector will need to pivot to social media in the future years and effectively leverage this digital tool to build brand awareness, enhance engagement, and conversion rates. To reach out to the audience on social media, adequate targeting should be done based on their age and profession. Personalized advertising to improve response and conversion rates. Businesses should make an effort to boost activity on their social media accounts. The number of postings needs to be increased on a priority for the intended impact. The post types trend shows a preference toward carousel posts, which have higher engagement than regular photo posts. Increasing the reach of posts on social media by using relevant and trendy hashtags should be an ongoing activity which as a consequence leads to higher brand recall.

References

Ajemunigbohun, S.S. (2017). Brand Equity Measurements and Service Delivery: Empirical Study from the Nigerian Insurance Industry. Economic and Environmental Studies, 17(4 (44)), 777-793.

Chitharanjan, A. (2016). Analysing the impact of social media marketing and online advertisements on consumer behaviour. (Doctoral dissertation, Dublin Business School). URI: http://hdl.handle.net/10788/3288

Das, S.C. (2017). Consumer Buying Behaviour and Satisfaction towards Motor Insurance Policies: Experience from Indian General Insurance Industry. International Journal on Customer Relations, 5(1), 5.

Delafrooz, N., Zendehdel, M. & Fathipoor, M. (2017). The Effect of Social Media on Customer Loyalty and Company Performance of Insurance Industry. International Journal of Economics and Financial Issues, 7 (3), 254-264. Retrieved from https://dergipark.org.tr/tr/pub/ijefi/issue/32021/354235

Diffley, S.K. (2011). Consumer behaviour in social networking sites: implications for marketers. . Irish Journal of Management. URI: https://research.thea.ie/handle/20.500.12065/1060

Duffett, R.G. (2017). Influence of social media marketing communications on young consumers’ attitudes. Young Consumers.

Durmaz, Y. &. (2016). Travel from traditional marketing to digital marketing. Global journal of management and business research.

Filip, J.F. (2015). The insurance industry meets social media. URL: http://liblink.bsu.edu/catkey/1777262

Hassana, M.Z. (n.d.). Descriptive Dimensions of Brand Equity in the Insurance Industry of Pakistan: A Literature Review.

Kamiri, J.K. (2007). A survey of creation and application of brand equity by insurance companies in Kenya. (Doctoral dissertation, University of Nairobi).

Makhulo, P.N. (2014). Social media as a strategy in enhancing competitive advantage of firms in the insurance industry in Kenya. (Doctoral dissertation).

Murugesan, R. &. (2014). Service quality on relationship marketing and customers’ buying behaviuor reference to health insurance industry in Coimbatore. International Journal of Science, Technology and Humanities, 1, 68-72.

Sahu, P.J. (2009). A study of buying behaviour of consumers towards life insurance policies. Aima Journal of Management & Research, 3(3), 1-10.

Seth, D.P., & Mittal, S. (2020). Impact of Social Media on Indian Insurance Industry. Bimaquest, 20(3). Retrieved from http://www.bimaquest.niapune.org.in/index.php/bimaquest/article/view/80

Todor, R.D. (2016). Blending traditional and digital marketing. Bulletin of the Transilvania University of Brasov. Economic Sciences. Series V, 9(1), 51.

Voramontri, D. &. (2019). Impact of social media on consumer behaviour. International Journal of Information and Decision Sciences, 11(3), 209-233.

Yadav, P. &. (2019). Impact of socio-economic factors on policyholders’ buying behaviour towards insurance policies. ZENITH International Journal of Business Economics & Management Research, 9(1), 17-26.