Research Article: 2025 Vol: 29 Issue: 2

Consumer Behaviour Intentions towards Mobile Payment Applications

Kavitha K, SRM institute of Science and Technology, Kattankulathur, Chennai

Celina A, SRM institute of Science and Technology, Kattankulathur, Chennai

Priya S, Faculty of Management, SRM institute of Science and Technology, Kattankulathur, Chennai

Priyadarsini P, Tagore Engineering College,Vengampaakkam, Chennai

Citation Information: Kavitha, K., Celina, A., Priya, S., & Priyadarsini, P. (2025). Consumer behaviour intentions towards mobile payment applications. Academy of Marketing Studies Journal, 29(2), 1-10.

Abstract

This study Investigated how Behavioural, personal, Social, Technology and environmental factors influence consumers behaviour intention towards the mobile payment platforms.This study seeks to explore the payment behaviour of individual who have previously used mobile payment applications such as Google Pay, PhonePe and Paytm to purchase products and services from a variety of merchants.TAM theory is used to investigate the independent and dependent variable used in this study. A descriptive research design was used to select a sample of 783 mobile payment app users in chennai through purposive sampling.The primary data was collected using the structured questionnaire.The proposed hypothesis were tested using SPSS AMOS.The independent variable included in the proposed model accounted for a substantial portion of the variance in users behavioral intention towards mobile payment apps.

Introduction

A mobile payment application is a type of electronic payment system in which the users complete the process with the assistance of a Mobile device by Initiating and granting the process with passwords, fingerprints, and Face IDs (Pousttchi, 2003). At all times, money will always find a way to locate the current situation of the economy as it is continuously connected to the development of technology (Wong & Mo, 2019). Compared to other mobile payment services, mobile payment applications require more steps; users must link the mobile payment app to their bank account and create a login id and pin to complete the transaction; users use this as an imperative service, despite the fact that it is not the simplest (Liébana-Cabanillas et al., 2020).Mobile payments and its associated services have shown significant growth in the developing countries. The most influential investments have been made through mobile devices, which have changed the lifestyle of people in India and are playing the vital role in the overall financial and social advancement of nations (Madan & Yadav, 2016). When performing a transaction using a mobile payment app, the user must consider two key considerations: security and unauthorized usage of mobile phones; both of the factors will influence consumers' intentions towards using mobile payments (Dahlberg et al., 2008). Mobile Payment applications play an important role in increasing financial inclusion: they enable individuals and businesses to use low-cost goods and services that match their needs. Mobile payments facilitate mobile business transactions and are extremely convenient. From the opposite side of the coin, the factors bring down the prices of commercial services that are provided through mobile devices (Dinh et al., 2018). Mobile Payment Services (MPS) provide several benefits compared to traditional payment methods, with experts forecasting rapid growth in the coming years. Despite these advantages the adoption remains slow.Statement from major providers like PayPAl,Google and Apple could potentially generate more interest and support from vendors.It is unclear if this will be sufficient to drive long-awaited widespread adoption (Johnson et al., 2018).

Evolution of Mobile Payment System

In 1997, the Coca-Cola Company implemented mobile payments for services and goods in Finland. Customers can pay for Coca-Cola via SMS at the vending machine. The payment was made using the account connected with the user's mobile device. This functionality not only benefits modest payments, but also offers up new possibilities in mobile payment technologies. The SMS-based mobile payment system quickly became the biosphere's first mobile financial transaction system, introduced by the Finnish bank Merita in the year 1997. The mobile payment mechanism has steadily developed. In 1999, we began purchasing movie tickets using our mobile handsets.Vodafone introduced one of the largest MPP- mobile payment platforms globally.Built on USSD and SMS technology it facilitated diverse collaborations with local Tanzanian and Kenyan network providers. In 2011, prominent companies like Google and Apple entered the mobile payment industry.Google introduced a novel concept with mobile wallets digitally enabling the users to do transactions, redeem coupons and earn loyalty points via Near field Communication technology.Initially the the Google wallet was limited to a single phone model and was supported by only a few operators.Even though it has limitations it gained popularity among the users by its convenience.The Passbook app introduced by Apple in the year 2012 followed by google focused on managing discounts and boarding passes rather than facilitating mobile payments (Dahlberg et al., 2015).

Objectives of the Study

1. To identify the advantages and challenges that impact mobile payment applications.

2. To examine and assess the structural connections between the different constructs of the conceptual model.

Literature Review

Tam and Utaut Model

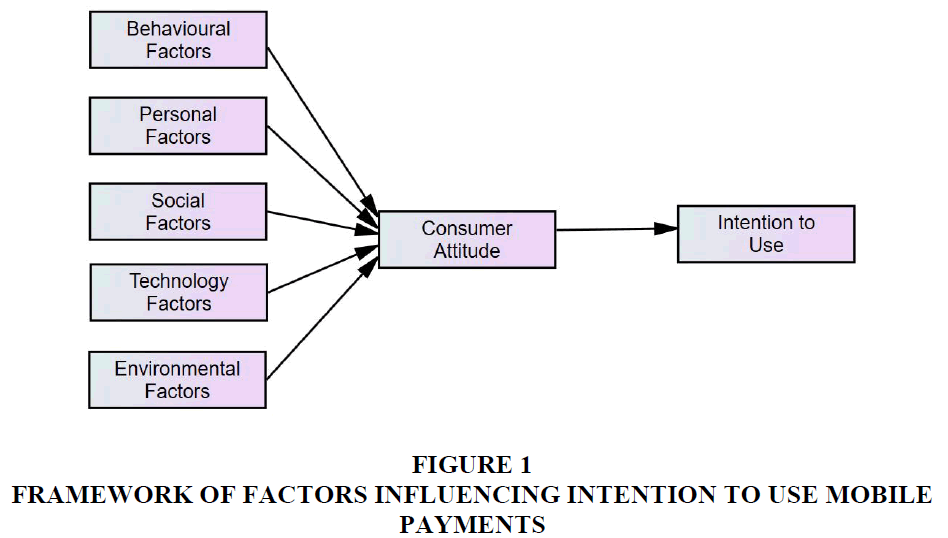

Technology Acceptance Model (TAM) is regarded as one of the most trustworthy and vital behavioural model for innovation that deals with how consumers accept and use digital tools (Davis et al., 1989; Pavlou, 2003). The TAM model was derived from the Theory of TRA to elucidate aspects that influence the overall acceptability of computers. It aims to explain consumer behaviors pertaining to various economically viable end-user computing technologies and user groups. In addition, the authors Davis et al. (1989) provide theoretical explanation. Nevertheless, TAM does not incorporate a component within the subjective norm of TRA. By the late 20th century, many competing theories had emerged to report the limitations of Technology Acceptance Model, DOI, IDT, and Personal Computer Utilization Theory. Numerous contexts and theories have presented new challenges for researchers in the field of information security. The popularity and various variations of TAM led to the development of the Unified Theory of Technology Acceptance and Utilization (UTAUT) (Venkatesh, et al. 2003). This Theory incorporates the Theory of reasoned action, The Technology Acceptance Model, Theory of Planned Behavior, Decomposed Theory of Planned Behavior, Diffusion of Innovation Theory, Social Cognitive Theory, The motivation model, Personal Computer Utilization, and combined TAM and TPB models. UTAUT incorporates variables that depend on the receptive area of the technology. This Theory provides a new niche to the original constructs of perceived usefulness and user-friendliness at newer Expected Performance, Effort Expectancy, social influence and facilitating conditions in current technology stated by (Thakur 2013). These constructs are considered to be direct precursors of behavioral Intention. It may also be moderated based on gender, age, experience. Since the original UTAUT model was designed to calculate the adoption and use of know-how in an organizational context, this model did not include elements related to the consumer acceptance process stated by (Patil et al., 2020). As discussed by (Williams et al., 2015), The consistent appearance of some terms such as Intention, adoption, end-user, banking, mobile wallets, mobile payments, Structural equation Modelling in the studies conveys that much of UTAUT’s research focuses on the Intention, adoption, implementation, and the use of technology in numerous types of information also in security research, and suggests using commonly used analytical methods such as SEM and PLC. Bhatiasevi V. (2016) discusses that The UTAUT model applies to a wide range of technologies and different genders, skill levels, and IT cultures to indicate credibility Table 1. Thus, the UTAUT model provides a valuable tool for understanding the viability of new technologies. It also helps to understand the drivers of adoption, especially among consumers who are less likely to adopt and use new technologies Figure 1.

| Table 1 Definition of the Study Variables Used in the Study | |||

| S.NO | Variable | Study Variable Definition | |

| 1 | Behavioural Factors | Perceived usefulness (PU) | The extent to which a user believes that using a system will enhance its effectiveness. Davis (1989) |

| 2 | Perceived ease of use (PEOU) | The user believes that employing a specific system necessitates no additional effort" Davis (1989). | |

| 3 | Perceived Trust(PT) | According to Reichelt etal. (2000), perceived trust plays a crucial factor in the acceptance and adoption of technology and assists suppliers in establishing a strong relationship with their customers. | |

| 4 | Perceived risk(PR) | The extent to that consumers are able to identify potential waste that may result from uncertainty in the use of MPP. Yang et al. (2015) | |

| 5 | Perceived Security(PS) | Shin (2009) defines "the extent to which customers believe it is safe to use a specific mobile payment procedure." | |

| 6 | Personal Factors | Mobile Payment Education(EDU) | The intended use of MPS (mobile payment services) can be closely correlated with the users' knowledge of how and where to use them, as there is a risk of pointing out the fraud or the loss of financial assets due to unauthorised use or transaction errors of mobile payment services. |

| 7 | Income(IN) | According to Ahmed and Khan (2016), income is defined as the currency that is consistently earned from a job or investment. This encompasses wages and salaries, revenues, payments, rent, and other forms of income. | |

| 8 | Personal Innovativeness(PI) | Consequently, the extent to which an user is able to experiment with or attempt new indicates a desire for novelty or innovation. | |

| 9 | Digital Lifestyle(DL) | In order to facilitate and expedite tasks, consumers depend on a digital lifestyle, which encompasses the use of computers, mobile devices, and cyberspace to connect and create. | |

| 10 | Self-efficacy(SE) | Self-efficacy in mobile payments is linked to the belief that people know how to use mobile payment tools and have experience doing so.Chiu and Wang, (2008) | |

| 11 | Social Factors | Subjective Norms(SN) | When talking about mobile payments, subjective standards are how acceptable people think mobile payments are in a social setting. |

| 12 | E-word of Mouth(EWOM) | According to Williams et al. (2015), electronic word of mouth refers to any bad or good statement made by a potential or past consumer about a company or product that many people and organisations can access via the internet. | |

| 13 | Social influence(SI) | The degree to which the sentiments and feelings of friends, family, and well-wishers affect a consumer's perspective on embracing a specific technology is known as social influence. | |

| 14 | Technology Factors | Compatibility(CY) | The consistency and operational effectiveness of a new service in comparison to the current worth of an old service is known as compatibility. |

| 15 | Transaction Speed(TS) | The time it takes to finish a transaction on a mobile device is known as perceived transaction speed. | |

| 16 | Environmental Factors | Promotion and offers(PO) | Discounts and coupons come with a host of advantages, such loyalty points, cash rewards for downloading apps, referral points, and discounts. Promo codes aid in raising the standard of customer care, bringing in new business, and keeping hold of current clients.(Khong and Teng, 2021) |

| 17 | Demonetization(DN) | To put it simply, demonetization is the process of taking a certain currency or form of cash out of circulation and substituting it similar a new one. It also refers to a number of other goals, such as eliminating black money, managing inflation, ending the funding of illicit activities, and creating an economy free from corruption. | |

| 18 | Consumer Attitude(AT) | Encompasses users beliefs, intention and sentiments regarding a produConsumer attitude encompasses a consumer's beliefs, emotions, and intentions regarding a product or service. | |

| 19 | Behaviour Intention(ITU) | The ability to execute a specific activity, indicating a person's enthusiasm for carrying out a specific behaviour | |

Study Variable Definition

Research Design

Reliability Analysis

Cronbach's alpha values were computed for each measurement to assess the reliability of the scale items. The results indicated that all values were greater than or equal to 0.758 to 0.964. Composite reliability is employed to assess the table's internal consistency; the composite reliability value falls within the range of 0.75 to 0.86. Both the composite reliability and Cronbach’s alpha value exceeds 0.7, as recommended by the literature (Nunally, 1978; Fornell and Larcker 1981). The values are between 0 and 1. The outer loading value should exceed 0.70 (Hair et al., 2010). The outer loading conditions were also satisfied in the current study, as the value ranges from 0.769 to 0.995.

Sampling Method

The participants were chosen using a non-probability sampling method. Responses were obtained using Purposive sampling method.Because this study focuses on users' subjective opinions, attitudes, and motivations towards mobile payment applications, non-probability sampling can provide rich and thorough insights. Responses were obtained using purposive sample approaches from informants who had used the mobile payment application at least three months prior to the survey and had lived in Chennai for more than a year. To eliminate researcher bias, data was collected in categories such as gender, professional and non-professional, joint family, and nuclear subdivisions. The study necessitates a specific target population: consumers who are already engaged or interested in mobile payment applications. With purposive sampling, the researcher can strategically target a specific group, guaranteeing that the chosen participants will offer valuable and pertinent data for research objectives.

Structural Equation Model for Users' Perception of Adoption and Use of M-Payment Applications in Chennai City

Structural Equation Modeling (SEM) approach is utilized in the current research to determine to what extent the users' attitude towards the adoption and use of Mobile payment applications in Chennai city. SEM can examine the relationship between independent variables (i.e. behavioural factors, personal factors, social factors, technology factors, environmental factors, and dependent variable (i.e. intention to use and adoption of mobile payment apps)

The research hypothesis has been developed based on the conceptual model of the research which aimed to examine Behavioural Intention of users on adoption and use of m-payment applications. In regard to the below given model, the consequent hypothesis is proposed:

H1: Behavioural factors have a significant positive effect on users’ attitudes towards the adoption of m-payment apps.

H2: Personal factors have a significant positive effect on users’ attitudes towards the adoption of m-payment apps.

H3: Social factors have a significant positive effect on users’ attitudes towards the adoption of m-payment apps.

H4: Technological factors has a significant positive effect on users’ attitude towards adoption of m-payment apps.

H5: Environmental factors have a significant positive effect on users’ attitudes towards the adoption of m-payment apps.

H6: Users’ attitude has a significant positive effect on the intention to use and adoption of m-payment apps in Chennai city.

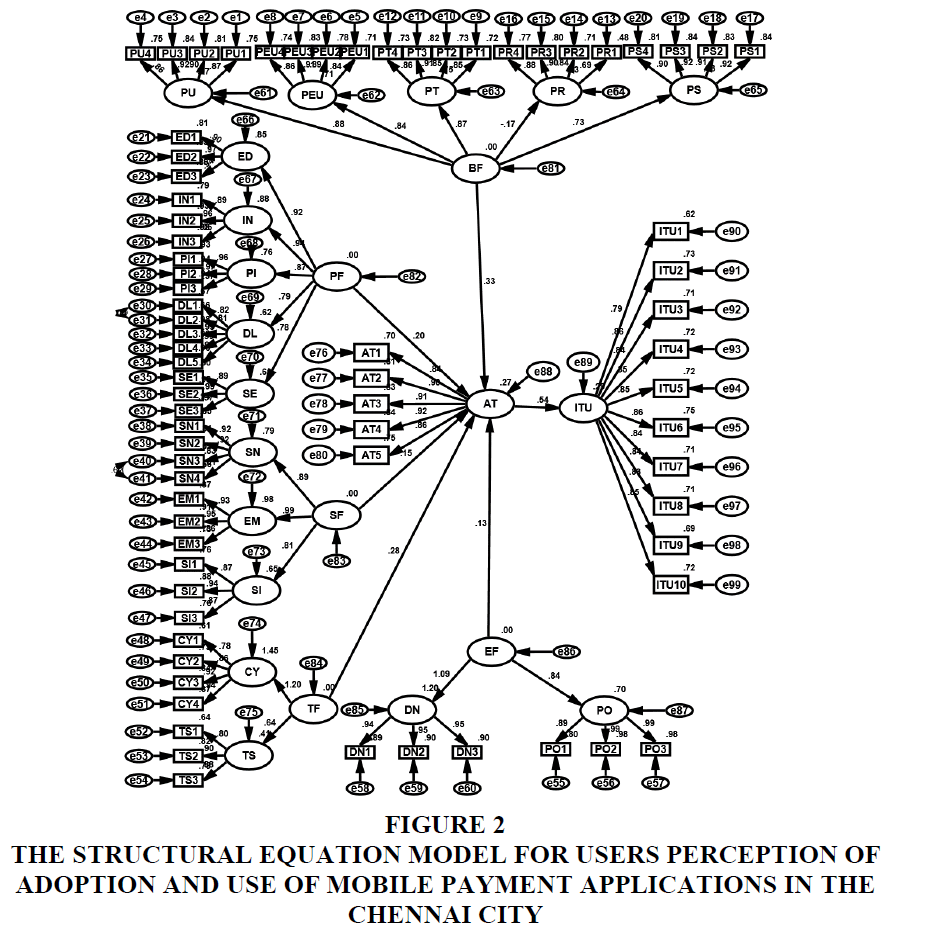

Table 2 demonstrates a perfect fit, as indicated by the model fit summary, where the P-value is 0.105, indicating a perfect match and greater than 0.05 as stated by (Hair et al. 1998). The above table also suggests that the Goodness of Fit Index (GFI) value is 0.955 (Hair et al., 2006), the Adjusted Goodness of Fit Index (AGFI) value is 0.947 (Daire et al., 2008), and the Comparative Fit Index value is 0.932 (Hu et al.,1999). All three of these values are greater than 0.9, indicating a good fit. The analysis also reveals that the RMSEA (Root Mean Square Error of Approximation) value is 0.021 (Hair et al. 2006), which is less than 0.08 and indicates a satisfactory fit, while the RMR (Root Mean Square Residuals) value is 0.037 (Hair et al. 2006). Similarly, the summary also indicates that the Tucker-Lewis index (TLI) value is 0.983 and the Normalised Fit Index (NFI) value is 0.978. Consequently, it is determined that the conceptual model created in this study fits the data gathered in the study well based on the model fitness indices Figure 2.

| Table 2 Regression Weights for Users’ Attitude on Adoption and use of M-Payment Applications in Chennai City | ||||||

| Path | Unstd.Estimate | Std.Estimate | S.E. | C.R. | P | Hypothesis Result |

| Behavioural Factors -> Users’ Attitude | 0.311 | 0.327 | 0.034 | 9.161 | <0.001** | H1 Significant |

| Personal Factors -> Users’ Attitude | 0.182 | 0.204 | 0.030 | 6.131 | <0.001** | H2 Significant |

| Social Factors Users’-> Attitude | 0.127 | 0.148 | 0.028 | 4.521 | <0.001** | H3 Significant |

| Technology Factors -> Users’ Attitude | 0.203 | 0.277 | 0.039 | 5.227 | <0.001** | H4 Significant |

| EnvironmentalFactors -> Users’Attitude | 0.100 | 0.134 | 0.028 | 3.518 | <0.001** | H5 Significant |

| Users’Attitude ->Intention to use and Adoption | 0.517 | 0.538 | 0.036 | 14.217 | <0.001** | H6 Significant |

Figure 2 The Structural Equation Model for Users Perception of Adoption and use of Mobile Payment Applications in the Chennai City

From the above SEM analysis, it is clear that behavioural factors, personal factors, social factors, technology factors, and environmental factors are having a significant positive effect on the users’ attitude towards m-payment apps in Chennai city at 1% level, whereas it is also found that the users’ attitude towards m-payment apps has a significant positive effect on their intention to use and adoption of m-payment apps in Chennai city. Users' attitudes towards m-payment applications are significantly positively impacted by five elements that influence behaviour, with a coefficient of 0.31. These factors are followed by technological factors (0.20), personal factors (0.18), social factors (0.12), and environmental factors (0.100).

Discussion

Frequency and percent are used to analyse the demographic features of the respondents. Consequently, it can be observed that out of the 763 users of mobile payment applications, men constitute the majority (57.9%) of the sample users. This is because men make up the majority of the family's breadwinners. Out of the mobile payment app users questioned, a substantial proportion (60.2%) are married, while one-third (33.0%) are unmarried. Only a small percentage of users (6.8%) fall into other categories. Statistical investigation indicates that age is the primary demographic factor that may accurately forecast the behaviour and patterns of mobile payment applications. There is a strong desire among young people for smartphones that provide mobile payment possibilities. Concurrent advancements in mobile phone technology, alluring offers from mobile phone operators, and the expansion of the m-commerce industry are driving mobile commerce.Based on the percentage study, a substantial proportion (41.7%) of users are employed in the private sector. Approximately 47.3% of customers utilise the Mobile payment app for a duration ranging from six months to one year. Approximately 65.0% of users of Mobile payment apps are identified as belonging to nuclear families and have a monthly income ranging from Rs. 25001 to Rs. 50000.

Among users, 26.1% perceive Google Pay to be the most popular mobile payment app, while 20.1% choose PhonePe, and 17.6% of respondents utilize BHIM Axis Pay. States their preference for the m-Payment app. Similarly, in frequency analysis, 17.2% of users utilized PayTM as their mobile payment application, while 14.2% exclusively relied on Dhani as their preferred mobile payment app. Only 5.0% of users opted for alternative mobile payment apps.Approximately one-third of users prefer sending money to other accounts as their primary transaction in the mobile payment app, while around one-fifth frequently use payments for making transactions. A significant portion of users, 22.0% to be exact, prefer using the mobile payment app for various transactions such as electricity bills, internet connections, post-paid mobile communications, DTH services, and more. A significant portion of users, approximately 10.5%, reported that the transactions made through the mobile payment app were primarily for prepaid mobile phone charges. Additionally, around 7.3% of users mentioned using the app specifically for ordering meals. A small percentage of users, around 4.8%, mentioned that they use m-payment apps for various purposes such as paying for parking tickets or buying movie tickets.The majority of users (95.9%, 732) expressed their overall satisfaction with m-payment apps, while a small percentage (4.1%) reported being unhappy with them.This study offers novel insights into the factors of consumer attitude, intention to use, and mobile payment application from a theoretical perspective. The extension of the combined TAM model to analyse mobile payment application services has been the subject of this research. The model's expansion encompasses factors such as demonetization, digital lifestyle, eWOM, promotion and offers. Consequently, by assessing and validating, this study makes a substantial contribution to the literature of these four novel factors of mobile payment applications. The factors of mobile payment applications are identified in this study, along with the usage patterns of mobile wallets, the relationship between these factors and consumer attitudes, mobile wallet usage, and the intention to use and adopt the mobile payment application.The presence of risk has a detrimental impact on the amount of confidence exhibited by both male and female respondents. If individuals perceive mobile service as a high-risk endeavour, their degree of confidence in engaging in such transactions will be diminished. By using multi-level authentication techniques like fingerprint, iris, and facial recognition, businesses can reduce risk in lieu of password protection. It will enhance the utility. An augmentation in utility will result in a corresponding rise in the quantity of mobile payment customers.The study discovered that multiple factors have a significant and positive impact on users' views regarding the use and acceptance of mobile payment applications. The coefficients for behavioural (0.321), personal (0.199), social (0.148), technical (0.281), and environmental variables (0.103) suggest that an increase of one unit in these categories leads to a corresponding improvement in users' attitudes, as determined by statistical significance at the 1% level. Additionally, the coefficient of 0.420 shows that users' sentiments and their desire to use and accept mobile payment applications are directly related. In particular, the desire to use and adopt these apps increases by 0.420 for every unit increase in attitude. The findings confirm that, at the 1% significance level, every theoretical link in the conceptual framework shows good and statistically significant relationships.

Conclusion

Although mobile payments can be made using a credit or debit card or bank account, customers still prefer to physically enter or swipe their card instead of simply waving their phone at the terminal. This research is intended to serve as a foundation for future studies to further develop the model of consumer attitude and behaviour intention. Mobile wallets are expected to supplant conventional payment methods soon. Online banking is experiencing a strong surge in popularity due to the rise of digital payments and the existence of a well-established ecosystem. Consumers can assess the advantages and disadvantages of different digital payment products, thereby recognizing a highly developed consumer ecosystem. Implementing high-quality motivation strategies to encourage users to improve their skills and knowledge, rather than solely focusing on the general benefits of product features or digital payments, along with providing specific "how to use" guidance, helplines for learning and problem solving, and robust security features to ensure user safety, will contribute to making India a society with reduced reliance on cash transactions. Mobile payment app users must comprehend the terms and restrictions. Prior to using premium applications, business owners must thoroughly review and comprehend the accompanying terms and conditions, similar to other business agreements. If the user fails to read the fine print carefully, they may be in for an unpleasant surprise when they receive their statement at the end of the month, particularly about processing costs.Today, the digital movement has progressed beyond the early adoption stage, and it is noteworthy that even the low-income group is actively participating in it.

References

Ahmed, M. E., and Khan, M.M. (2016). Income, Social Class And Consumer Behaviour : A Focus on Developing Nations. 14(10), 6679–6702.

Bhatiasevi, V. (2016). An extended UTAUT model to explain the adoption of mobile banking. Information Development, 32(4), 799–814.

Indexed at, Google Scholar, Cross Ref

Chiu, C.-M., Wang, E. T. (2008). Understanding web-based learning continuance intention: The role of subjective task value. Information and Management, 45, 194-201.

Indexed at, Google Scholar, Cross Ref

Dahlberg, T., Guo, J., and Ondrus, J. (2015). A critical review of mobile payment research. Electronic Commerce Research and Applications, 14(5), 265–284.

Indexed at, Google Scholar, Cross Ref

Dahlberg, T., Mallat, N., Ondrus, J., and Zmijewska, A. (2008). Mobile Payment Market and Research - Past, Present, and Future

Davis, F.D. (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly, 13(3), 319.

Indexed at, Google Scholar, Cross Ref

Dinh, V. S., Nguyen, H. V., and Nguyen, T. N. (2018). Cash or cashless?: Promoting consumers’ adoption of mobile payments in an emerging economy. Strategic Direction, 34(1), 1–4.

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18, 39–50.

Indexed at, Google Scholar, Cross Ref

Johnson, V. L., Kiser, A., Washington, R., and Torres, R. (2018). Limitations to the rapid adoption of M-payment services: Understanding the impact of privacy risk on M-Payment services. Computers in Human Behavior, 79, 111–122.

Indexed at, Google Scholar, Cross Ref

Madan & Yadav Liu, Y. (2021). The effects of mobile payment on consumer behavior. Journal of Consumer Behaviour(3), 512-520.

Indexed at, Google Scholar, Cross Ref

Patil, P., Tamilmani, K., Rana, N. P., and Raghavan, V. (2020). Understanding consumer adoption of mobile payment in India: Extending Meta-UTAUT model with personal innovativeness, anxiety, trust, and grievance redressal. International Journal of Information Management, 54(February), 102144.

Indexed at, Google Scholar, Cross Ref

Shin, D. H. (2009). Towards an understanding of the consumer acceptance of mobile wallet. Computers in Human Behavior, 25(6), 1343–1354.

Indexed at, Google Scholar, Cross Ref

Teng, S., & Khong, K. W. (2021). Examining actual consumer usage of E-wallet: A case study of big data analytics. Computers in Human Behavior, 121, 106778.

Indexed at, Google Scholar, Cross Ref

Thakur, R. (2013). Customer Adoption of Mobile Payment Services by Professionals across two Cities in India: An Empirical Study Using Modified Technology Acceptance Model. Business Perspectives and Research, 1(2), 17–30.

Indexed at, Google Scholar, Cross Ref

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User Acceptance of Information technology: toward a Unified View. MIS Quarterly, 27(3), 425–478. JStor.

Indexed at, Google Scholar, Cross Ref

Williams, M.D., Rana, N.P., & Dwivedi, Y.K. (2015). The unified theory of acceptance and use of technology (UTAUT): a literature review. Journal of Enterprise Information Management, 28(3), 443–488.

Indexed at, Google Scholar, Cross Ref

Yang, Y., Liu, Y., Li, H., and Yu, B. (2015). Understanding perceived risks in mobile payment acceptance. Industrial Management and Data Systems, 115(2), 253–269.

Indexed at, Google Scholar, Cross Ref

Received: 18-Jan-2025, Manuscript No. AMSJ-25-15637; Editor assigned: 19-Jan-2025, PreQC No. AMSJ-25-15637(PQ); Reviewed: 20-Jan-2025, QC No. AMSJ-25-15637; Revised: 22-Jan-2025, Manuscript No. AMSJ-24-15637(R); Published: 23-Jan-2025