Research Article: 2024 Vol: 28 Issue: 6

Consumer Behavior and Mobile User Economic Optimisation: Insights from India's Cellular Market

Gajavelli Venkateshwara S., Institute of Management Technology, Nagpur

Citation Information: Venkateshwara, G.S. (2024). Consumer behavior and mobile user economic optimisation: insights from india's cellular market. Academy of Marketing Studies Journal, 28(6), 1-13.

Abstract

The Indian Telecom Regulatory Authority (TRAI) has often received many billing-related complaints from mobile customers. It is seen that most of these complaints emerge from likely lapses or flaws in the billing program and a lack of information and clarity about the myriad of tariff schemes. It is imperative to understand whether customers know the various tariff schemes, the effective utilisation of ‘talk time’ available, and how to select service providers. The popular literature mainly focused on cellular telephony products, various related aspects, and some anecdotal commentary about its social propriety. Besides, a few studies on consumer behaviour have explored the pricing practices of cellular service providers. The study looks to understand consumer behaviour regarding the utilisation of talk time. It may also be noted that published empirical research on consumer behaviour concerning cellular telephony practice has been limited and has begun to emerge only in recent times. Hence, this study attempted to understand consumers’ awareness, the effective utilisation of talk time, and how telecom regulations help optimise or sub-optimise the value to cellular telephony users. The results reveal some alarming facts regarding the consumers’ awareness levels of the call rates, tariff schemes and economical utilisation of telephony services. Such startling revelations have far-reaching implications regarding consumer welfare, the Indian cellular telephone market and the welfare implications of telecom regulatory aspects at large.

Keywords

Economic Value, Consumer Behavior, Telecom Authority, Optimization, Service Selection.

Introduction

The global cellular telephony market has witnessed a significant boom in the past decade. “Wireless phones, once a luxury of the high-powered business elite, have invaded every space of our lives. The checker at the grocery store uses one.” This increase in demand, coupled with the deregulation of the telecommunication sector, ushered in enhanced competition in the industry, both in developing countries like India and in developed markets such as the U.S. or Canada. The number of service providers competing for market share has thereby increased manifold. This increased competition has resulted in more choices and better value for the consumers’ competitive plans and equipment pricing. Motivated by a need for mobility and lowered costs of owning a cell phone, an ever-increasing trend among consumers is to use their cell phones as their primary phone. Despite its gaining popularity and a separate watchdog, TRAI, the cellular phone industry appears to have its fair share of issues, such as dropped calls, multiple calling plans, billing errors, etc., which make this service very difficult for consumers, resulting in sub-optimal value creation. In (TRAI, 2013), for instance, has been regularly receiving billing-related complaints; it is seen that most of these complaints emerge from likely lapses or flaws in billing programs, coupled with a lack of information or clarity about tariff schemes.

What is ignored here is the other side of the coin, the ‘consumer’. It is apparent that the consumers are not familiar with the technology, and hence, the main question arises: What is the awareness level of Indian consumers? Regarding technology, competition, and the plans that cellular service providers offer them. Another critical issue is whether the Indian consumers are ready to understand the statistical gimmicks marketed and sales campaigns by the mobile companies.

Literature Review

The popular literature is mainly confined to cellular telephony products and detailed commentary about their social propriety. Published empirical research on consumer behaviour concerning cellular telephony practice has emerged only recently. However, most of these studies, by and large, have emphasised aspects, such as mobile telephony users’ behaviour and practices (Leysia & Youns, 2000), the proximity of users to their mobile phones the effects of location awareness on the established communication patterns (David & Kirstie, 2005), consumers’ purchasing motives in cellular phone markets (Jukka et al. 2006) among others. Some studies have specifically highlighted high switching costs imposed on consumers in this industry (Aneeta, 2002). However, very few studies have focused on user awareness and the economic implications of cellular phone regulatory options (Robert et al. 2005) vis-a-vis their welfare effects on consumers.

Below, we present a review of various studies, along with an assessment of related issues and the relevance of this area of study within the current market, coupled with the encompassing regulatory environment.

In (Leysia & Youngs, 2000) examined instances and features of mobile telephony practice and user behaviour. The results showed that new users rapidly modify their perceptions of social appropriateness around mobile phone use. The actual nature of use frequently differs from what users initially predict. Moreover, it may be noted that understanding service-oriented technologies can be problematic. Further, the authors stated that when in use, mobile phones occupy multiple social spaces simultaneously, spaces with norms that at times conflict; for example, the physical space of the mobile phone user and the virtual space of the conversation. Specifically, by examining issues that new users contend with, the study attempted to understand better how and why mobile telephony is used and how public perception of mobile phones is shaped, depending on the constraints faced in use. Documentation of such user behaviour supports new theoretical insights and helps guide the design and business spaces of cellular communication technologies.

In their empirical study, (Shwetak et al. 2006) investigated the users’ proximity to their cellular phones. They tested the assumption that a mobile phone is a suitable proxy for its owners’ location. The findings of the study summarised results over sixteen different subjects of a variety of ages and occupations. Further, it established baseline statistics for the proximity relationships in a typical U.S. metropolitan market. Holistically, the study has shown that it is possible to predict the proximity relationship with 86 per cent confidence using simple parameters of the phone, such as current cell ID, current date and time, signal status, charger status, and ring or vibrate mode.

In (David & Kirstie, 2005), in their exploratory field study, examined the behavioural effects of mobile location-aware computing within the social context of frequent social interactions. The study discussed the effect of location awareness on established communication patterns, vis-a-vis the effect of context on user behavior. One of the most compelling observations of this study was how communication patterns differed depending on the devices used. The observations of this study demonstrated that location-aware information benefits social gatherings. Further, the results revealed instances where location awareness information was highly beneficial. It also highlighted other cases in which it was detrimental. For example, location awareness information was helpful because participants could see their partner’s locations and track their progress in a discreet, socially acceptable manner. These results deviate from the study's initial hypothesis that location awareness information would always benefit people attempting to rendezvous.

In (Jukka et al., 2006), in their investigation of consumer behaviour in mobile phone markets in Finland, surveyed 397 Finnish consumers. On the one hand, they looked to understand the consumers’ motives to purchase new mobile phones, and on the other, they aimed to understand the factors that influence mobile phone change on the other. The studies show that while technical problems are the primary reason for changing mobile phones among students, price, brand, interface, and properties are the most influential factors affecting the choice between brands. The study, which has essentially been exploratory in nature, does enhance our understanding of the mobile phone market in general while helping us specifically analyse consumers’ decision-making. The other salient finding of the study relates to ‘cost awareness’, which was found to be an essential variable that affects consumers’ choices. At the same time, audibility was noted to have equal importance. While (Jukka et al., 2006) study sheds light on several aspects, we believe that a more rigorous study on understanding factors that influence the choice of cellular phones and an operator is needed to get a comprehensive picture of consumer motives. Thus, we attempt to contribute to this research gap in this study.

In their study, (Robert et al., 2005) economically evaluated cellular phone regulatory options. The study's primary conclusion was that banning cellular phone usage by vehicle drivers is, in effect, a bad idea. A ban in the United States is estimated to result in annual economic welfare losses of about $20 billion. Less intrusive regulation, such as requiring the use of a hands-free device that would allow a driver to use both hands at the steering wheels, may, on the other hand, not be economically justified. The authors argued that instead of direct regulations, the government could focus on gathering additional information to determine the extent of the problem and also consider providing information to the public on the relative risk of cellular phone use in vehicles. One related inference of this revelation to the present study is that government regulation of tariffs and competition in the cellular marketplace needs to be based on more realistic assumptions and prudent practices of international standards. Further, the regulations must be adequate to ensure maximum returns to users while reasonably eliminating unnecessary costs arising from unfair usage pricing and substandard services of cellular telephony companies.

Yet in another study by (Aneeta, 2005), the reasons for consumer switching behaviour and related aspects were analysed. Some of the reasons identified included dropped calls, billing errors, multiple calling plans, and sheer apathy to users’ needs, which generally result in consumers’ dissatisfaction and possible switching behaviour. Additionally, based on personal experience in the industry, the author identified other reasons specific to the cellular industry, such as technological advancement and complete service providers (wireline, internet, and cellular service). Finally, the author recommended enhancing customer retention while building upon long-term client relationships.

In their study, confirm that the regulatory focus influences consumer behaviour towards smartphone purchase decisions by affecting their perception, motivation, and lifestyle. This study further focuses on external and internal factors which influence a consumer’s decision to purchase a smartphone. The study also focuses on consumer attitudes toward smartphones and brand names' influence on buying decisions.

In their study ‘Customer Satisfaction with Mobile Services in Telecom Companies in JCS Vol. 24 (3), 2016, examined the antecedents of customer satisfaction and loyalty through an empirical investigation of 372 cellular subscribers in Saudi Arabia by adapting the American Customer Satisfaction Index (ACSI). The study found that overall customer satisfaction is comparatively low among customers. Overall, this study offers insights for service providers, regulators and subscribers while forming a foundation for future benchmarking of the performance of wireless network operators in terms of user satisfaction and loyalty.

In (Binil, 2019) analysed the role of cellular phones in the online buying behaviour of employed youth, and the paper examined the factors that influence the buying behaviour of employed youth and also studied the level of smartphone usage among the employed youth of Alappuzha District, Kerala.

In their study of the pricing of mobile telephony services in India, (Ajit & Kishore, 2020), quarterly data on price and demand have been used to regress two types of demand functions- a quadratic polynomial function and an exponential function with pricing as an independent variable. Further, the operators are assumed to follow a revenue maximisation (RM) strategy. The price point leading to revenue maxima for the regressed demand function is predicted as the service price in the following period. It is noted that from March 2008 to Sept 2016, the revenue maximisation assumption yields service prices close to the actuals. However, in subsequent quarters after the entry of Reliance Jio in the market, the prices were not driven by the RM strategy but by the survival needs of operators. As a result, mobile telephone service prices in this period are lower than marginal costs and lower than what is required for revenue maximisation by telephony companies.

In (Ruchita & Karuna, 2020), in their study on the Indian mobile service market, present a framework which is a unique attempt to jointly evaluate the influence of macro and micro factors (i.e., governmental policies and other market and user dynamics) on the diffusion of mobile telephony and its services in India. Developments in the Indian telecommunication sector (1997–2013) are used to develop the framework, and the recent developments (from the latter half of the year 2013–2018) are then used to validate the framework. The study offers fascinating insights into what drives the Indian mobile service market, showing interactions between the two sets of factors through a cause-effect loop.

In (Inayatul et al., 2023), in their study on the impact of 3G and 4G technology on consumer satisfaction in the telecommunication industry. This study investigates the effects of factors such as network coverage, customer service, video calls, and downloading Speed) of 3G and 4G telecommunication services performance on customer satisfaction in the Punjab region of Pakistan. This research indicates how to establish strong relations with customers and what factors in the 3G and 4G networks need to be improved to enhance the revenue of telecom operator companies.

As seen from the literature review thus far, popular literature mainly focused on cellular telephony products, various related aspects, and some anecdotal commentary about its social propriety. It may also be noted that published empirical research on consumer behaviour concerning cellular telephony practice has been limited and has begun to emerge only in recent times (Telecom Regulatory Authority of India, 2019). Moreover, few studies on consumer behaviour have explored price or tariff awareness or pricing practices. Additionally, consumers’ awareness, the level of effective utilisation of talk time available, and the extent to which telecom regulations help optimise or sub-optimise the value to cellular telephony users have also been limited.

Based on these gaps observed from our literature review, we formulate the following objectives for the present study.

Objectives

The main motive of the study is to explore: Whether consumers are aware of the economic importance of utilisation of talk time available to them and the need to use it effectively. Specifically, the study's objectives include i. assessing consumer selection criteria of the cellular operator. ii. Reviewing consumers’ awareness of various schemes and terms used by cellular service providers, and iii. and examining consumers’ economic utilisation of the talk time available to them.

The study was conducted in central India with 200 primary cellular consumers, while secondary data was available through various databases.

Methodology

As mentioned, this study has been based on primary and secondary information sources. We collected the sample from 200 respondents from central India. Further, we identified six cellular operators from the same region, through whom we collated about 35 to 40 bills from each service provider, 200 to 250 mobile bills approximately. Additionally, it may be noted that each bill carried approximately 75 to 100 call details. Hence, the data size was considered sufficiently large for statistical analysis.

We used the following steps:

• Planning the Sample

• Collection of Data

• Analyzing the Data

• Formulation of findings and Conclusion

Sampling Method: the choice of the sample respondents was made based on stratified random sampling; specifically, a cellular phone consumer was considered a sample unit.

Collection of Data: The primary data were collected through a structured, non-disguised questionnaire with a focus on:

• Respondents’ profile

• Decision-making attributes

• Knowing respondent’s views

We collected secondary data from detailed bills provided by various cellular telephony companies to their subscribers. From each respondent, depending on availability, a photocopy of the detailed bill or copies of call history was collected to analyse the call pattern and talk-time utilisation of cellular telephony consumers.

Analysis of data: After the data collection process, we planned a systematic study using appropriate statistical techniques (Verkasalo et al., 2010). Specifically, the analysis focused on two critical aspects: first, related to the consumers’ awareness of various businesses and use-related terms or plans intended by cellular service providers vis-a-vis their implications for calling time utilisation; second, quantifying the amount of call time and value loss to the consumer.

Analysis

The Study Region and the Profile of Respondents

As stated in the methodology, we captured and analysed the following aspects to analyse the awareness and behaviour of cellular telephony consumers.

Income Distribution of Respondents in the Study Region

The respondents comprised four income categories: Rs.3 lakh and above, accounting for 10 percent of the overall sample. The second category was Rs. 2 to 3 lakh, accounting for 15 percent, while the third category was Rs.1 to 2 lakh, accounting for 47 percent. The last category included the income category of less than Rs.1 lakh, accounting for 28 percent of the sample size.

The service providers in the study region were Airtel, Idea, Reliance, Vodafone, and BSNL.

Consumer Awareness of Service Providers, Call Rates and User Interest in Service Terms& Conditions.

Call Rates: Most respondents did not know the call rates of the service providers with whom they subscribed to the telephony services. Only 15.5 percent of the respondents possess knowledge of call rates.

Consumer Awareness about Call Rates: The same was the case with the terms and conditions of the service providers. Though 42 percent of the respondents retained service-related brochures, they possessed the slightest interest in maintaining any such service-related documents as a future reference. However, hardly any interest has been shown in using those documents to monitor the billing or change the schemes as per the usage.

Consumers’ Selection Criteria of Service Providers and Awareness of Pulse Rate

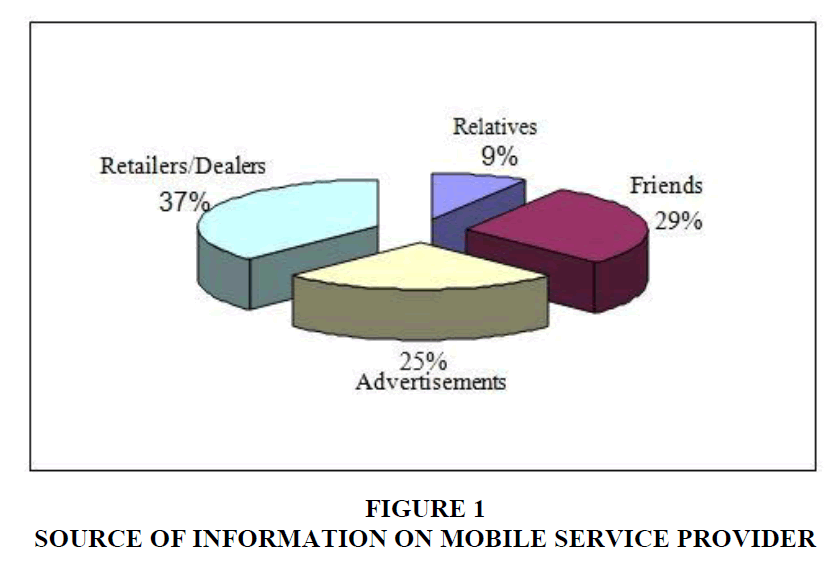

The source of information on service providers has been chiefly from retailers or dealers, friends, advertisements, and relatives and accounted for 37%, 29%, 25% and 9%, respectively, as a choice across the user categories. The same is shown in (Figure 1).

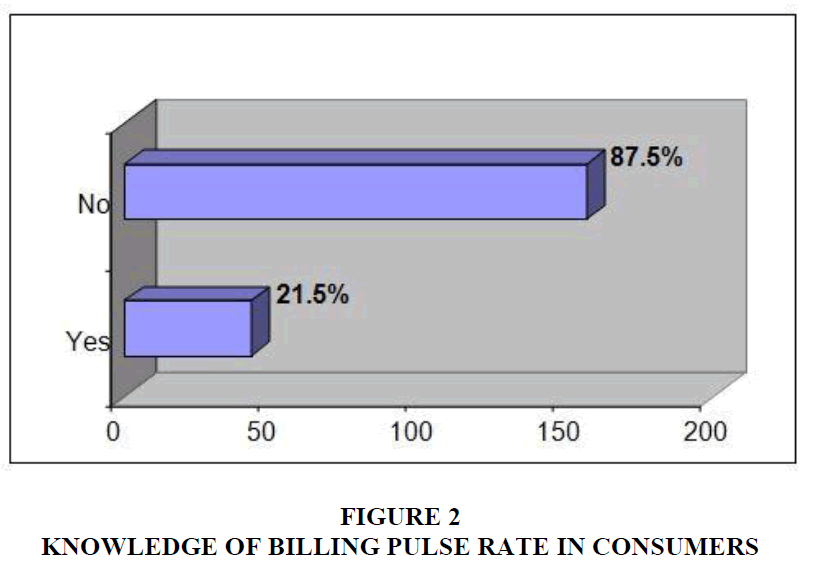

Interestingly, the consumers’ awareness about the billing pulse rate was observed to be very low; only 21.5% expressed awareness about it, and the same is shown in Figure 2.

Selection Criteria of Service Provider and Impact on Talk-Time Utilization

The consumers’ awareness about the billing pulse rate was noted to be very low, only 21.5% expressed awareness about the same, shown in Figure 2.

Selection Criteria of Service Provider and Impact on Talk-Time Utilization

Table 1 below assesses the consumers’ selection criteria for service providers. It is observed from the study that consumers prefer schemes first and then connectivity, followed by transparency, after-sales service, and advertisement by celebrities. But going by an in-depth analysis using advanced statistical methods, the picture that emerges is completely different, as shown by the results in Table 2.

| Table 1 Consumers’ Selection Criteria of Service Providers based on Attributes | |||||

| Attributes | High 1 | 2 | 3 | 4 | 5 Lowest |

| Schemes | 85 | 77 | 15 | 7 | 8 |

| Connectivity | 54 | 75 | 41 | 10 | 4 |

| Transparency | 15 | 50 | 87 | 31 | 11 |

| After-Sales service | 14 | 27 | 64 | 65 | 11 |

| Advertisement by CELEBs | 10 | 20 | 44 | 52 | 61 |

| Table 2 Randomized Block Design for Analysis of Variance of Table 1 | ||||

| Source of Variation | Sum of Squares | Degree of freedom | Mean sum of squares | F ratio |

| SSC | 3393.44 | 4 | 848.36 | 926.46/848.36 = 1.092(16,4) |

| SSR | 23.44 | 4 | 5.86 | 926.46/5.86 = 158.09 (16,4) |

| SSE | 14823.36 | 16 | 926.46 | |

| TSS | 18240.24 | 24 | ||

Note: SSC: Sum of squares column-wise; SSR Sum of squares Row-wise, SSE: sum of squares error-wise; TSS: Total sum of Squares Hypothesis:

H01: There is no difference between attributes that are taken in data analysis

H02: There is a difference between attributes taken in data analysis.

H03: There is no difference between ranks which are given by respondents

H04: There is a difference between the ranks which are given by respondents

Our calculated value was less than the table value at a 1% significance level; thus, we can say that there has been no difference between the various ranks the respondents gave. Further, there was no difference between attributes either. The vital inference herein is that consumers are effectively not aware of the existence of different schemes, connectivity, transparency, etc.

Our calculated value was less than the table value at a 1% significance level; thus, we can say that the difference was indeed significant between attributes.

Consumer Awareness of Mobile Handset Features

Most cellular telephony handsets come with a vital provision to remind the user of sixty-minute talk-time completion; it is commonly known as a ‘minute reminder’. This lets the consumers know about completing a minute during a call (Bhattacharya, 1998). Consumers generally prefer various features while purchasing a handset. Still, it is essential to know and understand their awareness level of this feature of the ‘minute reminder’ because this provision facilitates consumers to effectively utilise the talk time they pay for from their oft-scarce financial resources. As observed by this study, among the few who did know this feature, only 21% activated the same on their handsets.

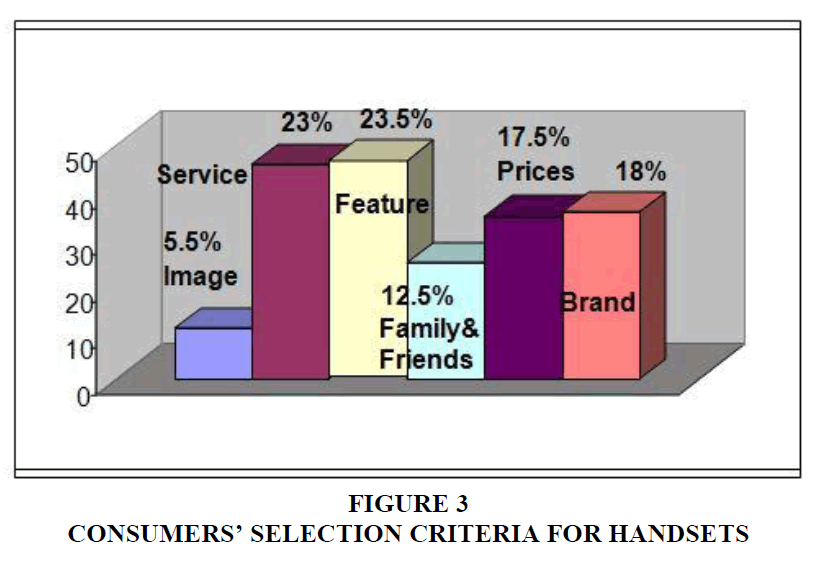

The following issue is about the handset selection criteria. Data, as shown in Figure 3, reveal that many consumers are aware of the importance of various features when buying a handset (Furquan, 2013). Notably, the selection criteria used by our respondents were dominated mainly by features and service, followed by considerations like brand, prices, friends and relatives’ feedback and the product's image. These considerations accounted for 23.5%, 23%, 18%, 17.5%, 12.5% and 5.5%, respectively, as a preference across user categories Figure 3.

Consumer Awareness and Estimation of Talk-Time Utilization and Value Loss

Apart from the primary data and other information, we also made an effort to collect itemised bills from all 200 sample respondents and thereby analysed their call patterns. The findings of the secondary data analysis are given below.

To quantify the talk-time and value loss to the consumers, it was decided that all the itemised bills are summarised in terms of pulse rates of various cellular telephony service providers, total call time of consumers (both local and STD usage), and loss of talk-time along with associated value loss as measured in monetary terms.

Use of Talk Time and Loss of Value to Consumers

It is pertinent to mention that cellular telephony providers charge users on a 1-minute basis, irrespective of whether the user used one minute entirely or not (it is ironic that in most countries, the regulations are such that the user is charged based on a second as a unit). In this context, this study makes an effort to understand the consumers’ awareness level of the effective use of talk time and value loss to users.

From the sample respondents and the data tabulation and processing, the value loss as measured in monetary form due to lack of awareness was noted to be about 24% concerning local calls; it is 15% with respect to STD call usage. This is mainly because consumers are more conscious when using long-distance STD calls and less cautious when it comes to local calls. It is reinforced from the informal qualitative information gathered from the sample respondents that it is more on account of cost-related psychological restraints than any genuine awareness about the actual usage charges of local call usage vis-à-vis STD calls usage. Further, the same cost-related restraints dampened their propensity to consume more of STD call usage Table 3.

| Table 3 Summary of Time and Money Loss in Local Call Usage | |||

| LOCAL calls | LP | TML | TMC |

| Total loss | 60 | 2890.48 | 12003.79 |

| The TML/TMC ratio: | 0.24 or 24 percent | ||

Note: Here, LP stands for Pulse rate for local calls, TML stands for Total Money Loss in all local calls for all sample bills, and TMC stands for Total Money Charged by the service provider as per 60-second billing Table 4.

| Table 4 Summary of Time and Money Loss in Long-Distance STD Call Usage | |||

| STD calls | STDP | TML | TMC |

| Total loss | 60 | 818.95 | 5396.72 |

| The TML/TMC ratio: | 0.15 or 15 percent | ||

Note: Apart from the above abbreviations, STDP is the pulse rate for STD calls followed by the service provider Table 5.

| Table 5 Call Rates, Total Talk-Time, and Value Loss to the Consumers | ||||||

| Call Rates in Rs. | Total Money Loss | Total Time Loss | Ratio | Money Loss in % | No. of Calls | Avg. Money Loss |

| 0.2 | 55.36 | 317.75 | 0.174225 | 17.42 | 1498 | 24 |

| 0.3 | 188.68 | 923.85 | 0.204232 | 20.42 | 3080 | 24 |

| 0.49 | 391.81 | 1469.42 | 0.266643 | 26.66 | 2998 | 24 |

| 0.5 | 166 | 652.5 | 0.254406 | 25.44 | 1305 | 24 |

| 0.75 | 205.26 | 1001.5 | 0.204953 | 20.5 | 1024 | 24 |

| 1 | 875.2 | 3678.2 | 0.237942 | 23.79 | 3636 | 24 |

| 1.5 | 341.41 | 1078.75 | 0.316487 | 31.65 | 691 | 24 |

| > 2.00 | 666.74 | 2881.82 | 0.231361 | 23.14 | 1425 | 24 |

By making clusters of different call rates, the data is as follows:

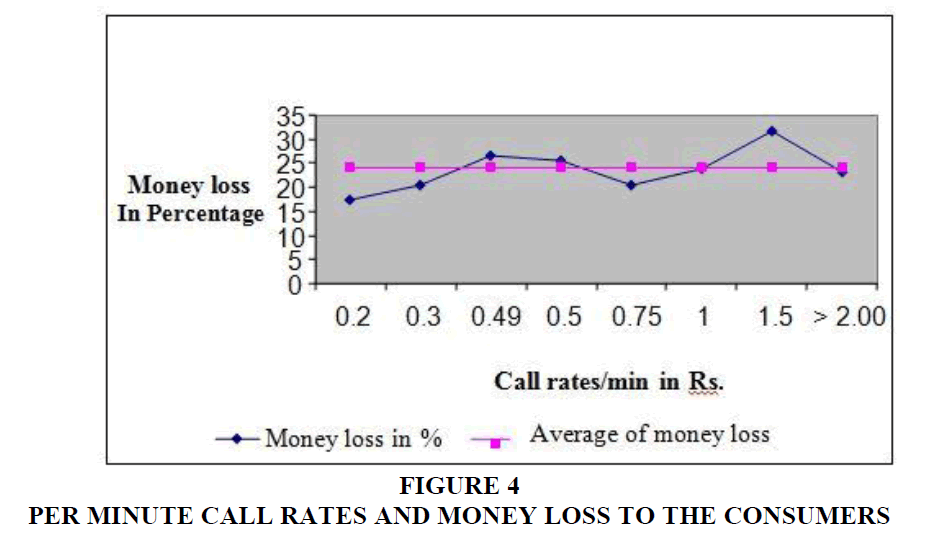

To further understand the trend between the call rates and value loss in the data provided in Table 5 above, we analyse the data in Figure 4.

The estimated correlation co-efficient between number of calls and money loss is -0.16094, across various call rates, as given in Table 6.

| Table 6 The Relationship between Call Rates and Money Loss | ||

| Call Rates in Rs. | Money Loss in % | No. of Calls |

| 0.2 | 17.42 | 1498 |

| 0.3 | 20.42 | 3080 |

| 0.49 | 26.66 | 2998 |

| 0.5 | 25.44 | 1305 |

| 0.75 | 20.5 | 1024 |

| 1 | 23.79 | 3636 |

| 1.5 | 31.65 | 691 |

| > 2.00 | 23.14 | 1425 |

| Correlation is = | -0.16094 | |

Notably, there seems to be a low correlation (- 0.16094) between money loss and the number of calls. The data show that money loss is not dependent on the number of calls. Hence, we conclude that money loss is more dependent on the consumers’ awareness level vis-a-vis their knowledge about cellular telephony services and their effective use in optimising the scarce budget that is generally allocated to these services (Choudhury, 2014). Furthermore, it is crucial to note that against the general perception that consumers are rational and conscious of the cost-effectiveness of usage of goods or services, the reality, as per the results of this study, seems to be completely different. In India, consumer negligence is a common feature and the value loss, as measured in monetary form, is due to a lack of awareness among cellular telephony consumers.

Discussion

Call and billing pulse rates are the most crucial parameters of talk-time calculation and usage. The results of this study yield some exciting findings about consumers’ awareness of call rates; it is hardly 15%. Given that India is an emerging market, and the demand for cellular phones is still emerging, the concerned regulatory bodies must take the initiative on a larger scale to educate consumers through various awareness programs.

A similar picture emerges, even concerning the user's awareness of pulse rates. Consumers who were aware of the pulse rate accounted for only 22%. Hence, going by the most important indicator, such as talk time having a direct bearing on the effective utilisation of the consumer monthly budget, almost 80% of the respondents did not seem to be aware of the pulse rates and their significance. Moreover, nearly 80% of consumers seemed to prefer schemes and their benefits on a high-priority basis, but only at the time of connection or at the time of the service provider selection. Once the users received the connection, they did not bother knowing about various changes in schemes. This highlights that consumers have not been using schemes that service providers often come out with, and there has been no effort on their part to optimise their usage following their changing use preferences. From the service companies’ perspective, they insist on users keeping a close eye on various schemes and changing them accordingly, matching their personal use patterns. This is essential from the point of view of optimising the consumers’ scarce financial resources. It is thus very significant, especially when the users feel the necessity for communication to maintain their livelihood in an economy predominantly services-driven but with feeble financial resources to fall back upon (Rust, 1998).

From the findings, one understands that the level of consumers’ awareness expected towards priorities of various schemes is virtually negated. Notably, the difference is significant between the attributes – such as schemes, connectivity, transparency, after-sales service, and celebrity advertisements – as suggested by the user. This, in turn, implies that the user is aware of schemes, connectivity, etc., but not concerned about the priority of schemes, connectivity, and transparency on mobile usage.

Further, to understand the selection criteria, we asked the respondents a cell phone feature-related question (i.e. the ‘minute reminder’). This feature is available on most handsets to optimise call time usage. It ‘beeps’ at the 50th second of every minute of a call so that if anyone wants to end the conversation, the user can end it. If every caller utilises this feature, the talk time may be used most cost-effectively.

Unfortunately, most consumers prefer features on their handsets only for fancy and multimedia, which is not practical and effective usage. This is because the number of consumers who know about the ‘minute reminder’ feature, for instance, comprised hardly 21% of the sample size. Even among those who know it, only 3% prefer it when buying a phone. We also tried to determine the number of respondents who activated the feature on their mobile phones, but it was negligible. This outcome is also because of the abysmally low levels of consumers' knowledge of pulse rate. Herein, it may be noted that the pulse rate is 60 seconds across all service providers and uses only a part of 60 seconds; even a single second is equivalent to 1 minute or a full pulse. Hence, the consumer is charged for the talk time, which is not consumed. This is like you are availing of a service but don’t use it and still pay for it.

The following explanation explores the above issue further with a detailed analysis of the monthly bills collected from the respondents:

With the help of the data collected from the sample respondents, the money lost due to lack of awareness is about 24% of the talk time available to the user concerning local calls and 15% regarding STD calls. This means that INR 24 out of every INR 100 is unutilised and still paid for by consumers. On the other hand, billions of rupees are earned by mobile companies for services that users do not even consume.

Conclusion

It is essential to note that when services sectors, such as telecommunications mainly drive the overall value-added in economic activity, there is no reason why consumers should not get the full financial benefit when charged for those services that are effectively not consumed. Besides, this is a very pertinent issue from the point of view of current talk-time billing and the need to overhaul it. Making talk-time billing more consumer-oriented on a second basis, as opposed to the current one-minute billing, directly affects consumer welfare. Consumers are, therefore, required to raise their awareness levels and voice their concerns about changes in billing patterns. Consumers must raise a collective voice for these changes and, in the process, help regulatory authorities by giving them constructive input. It may also be noted that mobile companies offer far too many packages for a consumer to study and make an informed judgment. This is another area where the regulations play an important role by effectively implementing TRAI proposals to limit the number of schemes each company can offer. Indeed, with consumers being better equipped to compare prices and services, such limits may even facilitate a more rapid market expansion. These policy responses, coupled with heightened consumer awareness, would go a long way in enhancing the relevance of industry regulations while making the industry more responsive to consumer interests.

References

Ajit S and Kishore K Morya(2020). Pricing of Mobile Telephony Services in India, International Journal on Emerging Technologies 11(2): 120-134.

Aneeta S(2005), ‘Canadian Cellular Industry: Consumer Switching Behaviour’. Simon Fraser University. Burnaby, BC, Canada.

Bhattacharya, C. B. (1998). When customers are members: Customer retention in paid membership contexts. Journal of the academy of marketing science, 26(1), 31-44.

Indexed at, Google Scholar, Cross ref

Binil V. Rajan(2019), An Analysis on the Role of Smartphones in Online Buying Behaviour of Customers in Kerala. Journal of Management, 6(3), 2019, pp. 96-105.

Choudhury, D., Mishra, S., & Savitskie, K. (2014). Study on cell phone feature perception and usage behavior among students. Parikalpana: KIIT Journal of Management, 10(2), 1-12.

David D and Kirstie H. (2005), ‘Exploring the Behavioral Effects of Location Awareness within the Social Context of Rendezvousing’. In First Annual Workshop on the Social Implications of Ubiquitous Computing, CHI.

Furquan Ameen Siddiqui (2013). Indian smartphone cos challenging big players like Apple, Samsung. Hindustan Times.

Jukka, P., Marjukka, P., Rauli, S. and Heikki, K. (2006). An Investigation of Consumer Behaviour in Mobile Phone Markets in Finland. 32nd European Marketing Academy Conference, Glasgow, 20-23 May 2003.

Leysia, Marilyn and Ed Youngs (2000). ‘Going wireless: Behavior & Practice of New Mobile Phone Users’. In Proceedings of the 2000 ACM conference on Computer supported cooperative work (pp. 201-210).

Robert W. H., Paul C. T. and Jason K. B., (2005), ‘Regulating cellular phone use: Too little benefit for too much cost’. Harvard University.

Ruchita G and Karuna J(2020). What drives the Indian mobile service market: Policies or users?. Telematics and Informatics, 50, 101383.

Indexed at, Google Scholar, Cross ref

Rust, R. T., & Zahorik, A. J. (1993). Customer satisfaction, customer retention, and market share. Journal of retailing, 69(2), 193-215.

Indexed at, Google Scholar, Cross ref

Shwetak, Julie, Gillian and Suraj (2006), ‘Farther than you may think: An empirical investigation of the proximity of users to their mobile phones’. In UbiComp 2006: Ubiquitous Computing: 8th International Conference, UbiComp 2006 Orange County, CA, USA, September 17-21, 2006 Proceedings 8 (pp. 123-140). Springer Berlin Heidelberg.

Indexed at, Google Scholar, Cross ref

Telecom Regulatory Authority of India (2019), New Delhi, 20th Feb, 2019. (Press Release No.13/2019).

TRAI (2013). The Indian Telecom Services Performance Indicators, April-June 2013, TRAI, December.

Verkasalo, H., López-Nicolás, C., Molina-Castillo, F. J., & Bouwman, H. (2010). Analysis of users and non-users of smartphone applications. Telematics and Informatics, 27(3), 242-255.

Indexed at, Google Scholar, Cross ref

Received: 20-Mar-2024, Manuscript No. AMSJ-24-14954; Editor assigned: 21-Mar-2024, PreQC No. AMSJ-24-14954(PQ); Reviewed: 10-May-2024, QC No. AMSJ-24-14954; Revised: 24-May-2024, Manuscript No. AMSJ-24-14954(R); Published: 15-Jun-2024