Research Article: 2021 Vol: 20 Issue: 3

Confirmatory Factor Analysis of the Communitys Economic Development through Financial Community Institutes in Chaiyaphum, Thailand

Umawadee Detthamrong, Chaiyaphum Rajabhat University

Wirapong Chansanam, Khon Kaen University

Abstract

The successful operation of financial community institutes is based on joint forces. The spirit of the community and the readiness of many components will impact financial community institutions' operational performance. This research has studied the factors of success in community economic development to community finance is strong. That is an essential mechanism for driving the community economy. So other community financial institutions can bring experience and conclusions to as an example of better management of community financial institutions. In this paper, we hypothesize that key success factors influence the community's economic development in a sample of 396 members of financial community institutes in Chaiyaphum, Thailand. Confirm Factor Analysis (CFA) approach was conducted to examine the factorial validity of the seven factors (Moral, Leadership, Participation, Group Management, Stability, Respect, and Reputation) instrument. The CFA results showed that the community's economic development constructs are considered valid and reliable. The results of the CFA analysis represented CMIN=707.986, df=188, GFI = 0.863, CFI=0.924 and RMSEA=0.084. Furthermore, we find that the core factors affecting the community's economic development success are Leadership and Group Management. There are implications for the utilization of the main success factors as well as a future study.

Keywords

Confirmatory Factor Analysis, Community's Economic Development, Financial Community Institutes, Key Success Factors, Thailand.

Introduction

Community's economic development in a country is highly significant to lead people to a balanced and well-organized life. The outstanding characteristic of the community economy is that it does not focus on the competition but concentrates on people's cooperation in the community brings so many benefits to the local area. Moreover, the community is jointly owned, there will be no monopoly. Therefore, the community economic system does not cause a massive gap between rich and poor. On the contrary, financial community institutes enhance the economic well-being of communities through income generation and job creation. In the long term, this economy will contribute to sustainable community development (Nikkhah & Redzuan, 2010).

Financial community institutes play an important role in providing and promoting people's access to financial services in various communities. Financial community institutes provide reach to credit services that some of these people cannot access in the government financial institutions or commercial banking system. Furthermore, Benjamin, Rubin & Benjamin et al. (2004) present that financial community institutes have a major mission of enhancing economic limitations for low-income individuals and communities. Comprising a wide range of organizational types, these alternative entities furnish a range of financial products and services that are frequently unavailable from more mainstream financiers and lenders. Financial community institutes have been using small-scale and locally developed strategies to develop and stabilize low-income, low-wealth, and financially disadvantaged communities for decades. They provide a range of financial products and services in economically troubled markets that work in market niches (Lowry, 2014).

According to the Opportunity Finance Network (OFN), a network of Community Development Financial Institutions, through its fiscal year 2018, its member CDFIs provided more than $75 billion in lending. This led to the maintenance or creation of 1.56 million occupations, the rehabilitation or development of over 2.1 million housing units and 11,592 community facility projects, and the start or expansion of 419,150 businesses and microenterprises (Thompson, 2021). In Thailand, the encouragement of local-level activity and funding has been obviously linked to the aims of sustainability and well-being to defeat the effects of the economic crisis and achieve sustainable development, reducing the probabilities of future economic uncertainty. The aim is to achieve this through people building strong basements for community development (Schaaf, 2010). The record also confirms that financial institutions play an important role in providing efficient and effective funding to their communities.

Prior studies, such as Kaboski & Townsen (2005), show that financial community institutes, especially those with suitable policies, can support consumption smoothing, asset growth and occupational mobility and can decrease moneylender reliance. Particularly, production credit groups, cash-lending institutions, and especially women's parties successfully furnish intermediation and its benefits to members. However, the question remains why certain types of financial community institutes or financial community institutes with specific strategies are successful and others not. While rural communities have tried to increase their economic base, researchers and practitioners have questioned which factors lead to the community's economic development success (Crowe, 2007). Furthermore, Limsuwan (2018) indicates that community financial institutions are widely recognized as an important tool for positively solving poverty, especially in developing countries. They create the job, create a group for exchanging knowledge, and generate income for members. Most of the community financial institutes in Thailand are successful and have a positive effect on solving poverty. Nevertheless, they still have a significant problem with self-management, some groups that have failed. Therefore, more studies should be done on the key success factors and challenges facing financial community institutes.

Consequently, the key success factors state the important components required for the financial community institutes to compete in their target position. It is the competencies, resources, and capabilities an institute must possess to complete its profitability and competitive success in a market. In this study, we synthesize key success factors that affect a community's economic development. In this paper, Confirmatory Factor Analysis (CFA) was applied to confirm the theoretical structure.

The rest of the article is organized as follows. Section 2 begins with a brief review of the related literature and research hypotheses. Section 3 describes our data and empirical approach. Section 4 presents and discusses the results of the study. In section 5, we suggest areas for future research and draw implications for practitioners. Finally, section 6 concludes the paper.

Literature Review

Moral

Moral is the principle of good behavior for the benefit of itself, the individual, and society. It is based on religious moral principles that drive conscience, which manifests itself through physical, verbal and mental actions. Morality involves behaving and reasoning according to values that go beyond self-interest (Maccoby, 2005). Moral leadership must be able to identify when a decision has moral consequences, and it must then employ a moral decision-making pattern (Sama & Shoaf, 2002) and select to do the right thing regularly (Sama & Shoaf, 2008). Moral leadership demonstrates good values through their actions and words. Moral leaders are demonstrating appropriate conduct both inside and outside of the workplace. Presenting integrity and doing the right thing is at the core of being a moral and ethical leader. Jansiri (2017) have found that moral affects the likelihood of organizational success in a Nakhon Si Thammarat community financial institute sample. In addition, Kumngam & Pasunon (2017) found that members of Ban Ang Hin Community Financial Institutions have basic moral levels according to the philosophy of sufficiency economy, the honesty at the highest level. For this reason, we argue that financial community institutes that possess a strong moral tend to realize and achieve the accomplishment than do institutes that have a weak moral. We propose a working hypothesis as follows.

H1 Key success factor (Moral) is influence on the community's economic development.

Leadership

Leadership is one of the key success factors affecting the success of financial community institutes. Leadership is the process by which leaders influence group members via convincing them to comply, motivate and unite members to participate in various group activities. According to Hogan & Kaiser (2005), leadership is consequential mainly for the success of institutes or organizations and the well-being of members and employees. Leadership is an adaptive instrument for individual and group survival, and it fundamentally involves building and maintaining effective groups. The encouragement of positive conflict within the leadership context provides a supportive atmosphere, allowing all member an opportunity to indicate the truth of a challenge, listen to a wider array of opinions/ideas, narrowing the space between leaders and followers, and more developed relationships (Grint & Smolovic, 2016). Effective leadership is a key success factor in the management of institutions and has shown that an appropriate leadership manner can lead to better performance (Turner & Müller, 2005). We, therefore, propose the following hypothesis.

H2 Key success factor (Leadership) is an influence on the community's economic development.

Participation

Member participation is the key to making knowledge-sharing activities, and participation is one of the success factors for strategy implementation (Yip et al., 2012). Lau (2014) presents that employee participation reports the practices and processes for achieving a greater degree of employee influence in individual enterprises and workplaces. It is essential when it enables members to have a real influence on decision-making, which relates to matters touching their working lives. Participation leads to better work institutions and change processes (Karltun Erlandsson, 2002). From institutional efficiency perspectives, direct participation, involving excellent members, can play a significant role in ensuring recognition of change and creating the conditions for members to make effective contributions to their institution. Moreover, participation plays an essential role in member development (O'Brien, 2002). When members participate, the institutes are benefitted from the development of a member community, improving communication, and increasing productivity. In line with the literature, we expect the effect of participation on a community's economic development to be positive. Therefore, we propose the following hypothesis.

H3 Key success factor (Participation) is an influence on the community's economic development.

Group Management

Management was developed to provide an inclusive and holistic guideline for the governance and management of institutions (Belak & Duh, 2012). As Juneja (2015) has noted, group management refers to the art of getting members together to make them work towards a common core objective, enables the optimum use of resources. Moreover, group management gives a rational direction to the members. The individuals are well sensible of their responsibilities and roles and know what they are supposed to do in the institution. As suggested earlier, one reason to adopt group management is that an institution may be able to improve its achievement, especially the community's economic development (Detburiram & Siripanumas, 2012; Sinthao, 2012). Group management will be beneficial and increase the operation's success if the financial community institutes have planned and set operational goals. A knowledge development plan has been developed for members. Community resources are properly managed for activities. Tasks are assigned that are appropriate to the knowledge and abilities of the individual. In summary, we hypothesize that:

H4 Key success factor (Group management) is an influence on the community's economic development.

Methodology

Sample and Data Collection

The population studied is important to the community's economic development in Chaiyaphum, Thailand. The financial community institutes, which have a key person in the committee's organisation, were used as the sample in the research report, with a total of 396 samples, to point out the key success factors using the purposive sampling process. This figure was calculated using the Cochran method (Cochran, 1977). Table is finished, and the confidence level is set to 95%. The sample size employed was Hair et al. (2010) specify that a ratio of 200 to 1000 cases between the number of samples and the number of parameters is adequate for structural equation modeling. Data collection was accomplished by the use of a questionnaire and convenient sampling techniques using an onsite survey. The data where analyzed using structural equation modeling. The scale used to assess core success indicators was modified from 47 items across seven dimensions.

The questionnaire made use of a five-point Likert Scale (Likert, 1932). Additionally, a Likert five-point interval scale was used, with 1 indicating strong disagreement and 5 indicating strong agreement. Structural equation modeling (SEM) was used due to its superior flexibility and capabilities (Byrne, 2010). The measurement model was examined with confirmatory factor analysis (CFA), and the relationships within the model were examined using path analysis (Kline, 2015). The data were analyzed using SPSS version 19.0 (SPSS Inc., Chicago, IL, USA) and AMOS version 21.0 (SPSS Inc., Chicago, IL, USA). To ascertain sample characteristics, descriptive studies were conducted in the previous research (Detthamrong & Chansanam, 2020). In this investigation a confirmatory factor analysis was used to do preliminary studies on the reliability of measurements and model specification. To test hypotheses, structural equation modeling was used.

Validity and Reliability Measurement

Five business experts were used to verify the content's authenticity. The material validity of this research is established by the recommendations of three distinguished scholars (González & Brea, 2005). The item-objective congruence (IOC) equals between 0.50 - 0.93, which is sufficient (Pérez-Rojo et al., 2019). Cronbach's alpha coefficient was used to determine the questionnaire's reliability. In terms of critical performance indicators, the highest degree of consistency (0.870) was achieved by participation, followed by reputation (0.861), respect (0.854), morale (0.853), leadership (0.851), and group management (0.848). All of these variables have a reliability rating greater than 0.70, which is considered sufficient. At a 95 percent confidence level, there were no statistically significant variations between the two groups in measuring non-response bias (Armstrong & Overton, 1977). Scale verification was based on Fornell et al. (1996). Confirmatory factor analysis was used to determine if each variable in the model had structural validity, based on empirical data for the hypothesis and its principles. Chi-square (χ2), chi-square/degrees of freedom (χ2/df), the goodness of fit index (GFI), and root mean square error of approximation (RMSEA) were used to evaluate statistical accuracy (Byrne, 2010). To validate the final measurement model, the composite reliability (CR) and average extraction discrepancy (AVE) were measured using the construction reliability test (Fornell et al., 1996). According to Table 1, all CR scores were greater than 0.60, while all AVEs were greater than 0.50 (AVE > 0.50). As a result, the precision of the measured convergence was adequate for the measurement model, and all theoretical constructs possessed suitable psychological properties.

Confirmatory Factors Analysis (CFA)

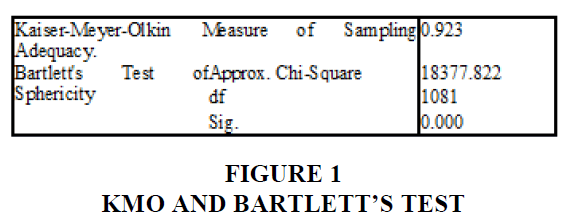

By extracting the process components using the Principle Component Analysis technique, modifying, and then rotating the core components using the Varimax method, and finally testing the sample results to determine the appropriateness of the original data in the component analysis, we were able to obtain the Bartlett's Test value as shown in Figure 1. (Kaiser-Meyer-Olkin; KMO). As can be shown, KMO equals 0.923, which is greater than 0.5 and nearly 1. Furthermore, the Bartlett's Test result has a Chi-square distribution of 18377.822 and a significance value of 0.000, which is less than 0.05, indicating that all seven components have a strong relationship worthy of factor analysis.

The analysis's findings consider the factor's weight, the number of variables listed, and the variance of each factor in relation to the perceived variables' parameters and the success factors expectation of the community’s economic development which are 1) Moral (MORT), 2) Leadership (EMPT), 3) Participation (COOT), 4) Group Management (MNGT), 5) Stability (STAT), 6) Respect (REST), and 7) Reputation (REPT). In summary, the exploratory factor analysis (EFA) of the perceived variables and the success factors' expectation of financial community institutes given by the committee identified seven factors, and we defined the names of each factor based on the characteristics identified by the variables in accordance with the principles and theories discussed previously.

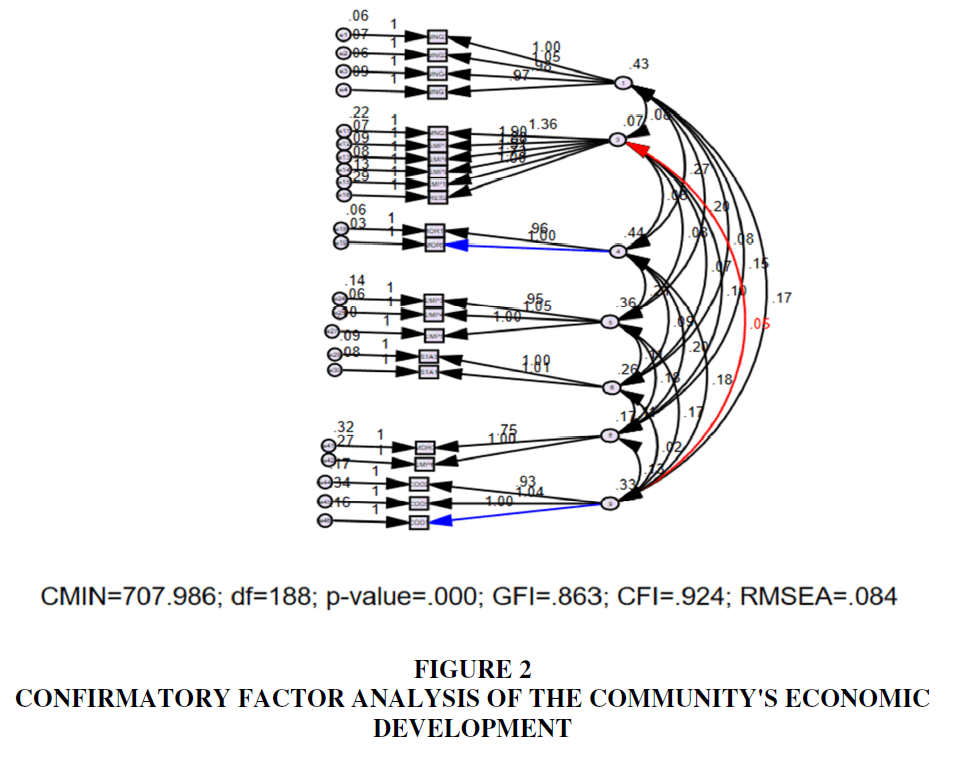

An exploratory factor analysis was conducted to test the dimensionality of the seven variables— 1) Moral (MORT), 2) Leadership (EMPT), 3) Participation (COOT), 4) Group Management (MNGT), 5) Stability (STAT), 6) Respect (REST), and 7) Reputation (REPT). There was just one factor for each variable. Confirmatory factor analysis was used to evaluate the convergent validity of the measures using a two-step modeling technique (Anderson & Gerbing, 1988). Due to the large sample size (n=396), the chi-square statistic was important, 2(155) =707.986, p 0.001, and other fit indices indicated an appropriate fit to the data: Root Mean Square Residual (RMSEA) =0.084, Normal Fit Index (NFI) =0.95, Tucker-Lewis Index (TLI) = 0.98, and Comparative Fit Index (CFI) =0.924. Both composite reliability coefficients (C.R.) for factor loadings were important, and all extracted average variances (AVE) were greater than 0.50, indicating convergent validity (Table 1).

| Table 1 Confirmatory Factor Analysis | ||||

| Variable | Unstandardized Factor Loadings | Standardized Factor Loadings | AVE | Composite Reliability |

| Moral (MORT) | 0.799 | 0.831 | 0.540 | 0.615 |

| Leadership (EMPT) | 0.816 | 0.794 | 0.561 | 0.761 |

| Participation (COOT) | 0.712 | 0.838 | 0.540 | 0.614 |

| Group Management (MNGT) | 0.831 | 0.741 | 0.525 | 0.685 |

| Stability (STAT) | 0.664 | 0.707 | 0.570 | 0.601 |

| Respect (REST) | 0.767 | 0.859 | 0.522 | 0.774 |

| Reputation (REPT) | 0.730 | 0.868 | 0.522 | 0.781 |

The composition's efficacy is determined by the loading values of common factors for each item or observed variable in Table 1. Since both questions had large factor loadings (> 0.50) of p<0.01 significance values, they were all strongly correlated with structural theory (Table 1).

The statistical descriptive results consist of the mean (X), standard deviation (S.D.), Minimum (Min), Maximum (Max), Variance (Var), and Meaning as shown in Table 2.

| Table 2 Statistical Information | ||||||

| Item | Mean | S.D. | Min | Max | Var | Meaning |

| MORT | 3.93 | 0.48 | 2.00 | 5.00 | 0.23 | Agree |

| EMPT | 4.22 | 0.46 | 2.00 | 5.00 | 0.21 | Agree |

| COOT | 3.85 | 0.51 | 1.86 | 5.00 | 0.26 | Agree |

| MNGT | 4.19 | 0.48 | 2.00 | 5.00 | 0.23 | Agree |

| STAT | 4.38 | 0.51 | 3.00 | 5.00 | 0.26 | Agree |

| REST | 4.42 | 0.55 | 3.00 | 5.00 | 0.31 | Agree |

| REPT | 4.40 | 0.58 | 2.50 | 5.00 | 0.34 | Agree |

The variables used for estimation were 3.85 while the variation in participation was 0.26, according to the participation data. According to the group management results, the factors used for estimation were 4.19 while the group management deviation was 0.23. When considering the uncertainty of stability at 0.26, the stability findings show that the variables used for estimation is 4.38. When considering the variance of respect at 0.31, the respect results show that the variables used for estimation is 4.42.

The Result of Structural Equation Modelling (SEM)

The Structural Equation Modeling (SEM) defined and measurable 47 items that were evaluated. The model fit findings for 22 measurable items using Structural Equation Modelling (SEM) indicate a good fit to the sample data. Both model fit indices are statistically valid at the 0.001 stage and meet the recommended thresholds for their respective models. Table 3 summarizes the different model fit figures for the measurement model and the threshold (Hair et al., 2010).

| Table 3 Goodness-of-Fit Results for the Structural Equation Model | |||

| Goodness-of-Fit indices | Threshold | Values | Source |

| Chi square(χ2) | p. > 0.05 | 707.986 | Hair et al. (1998); Bollen (1989) and Jöreskog & Sörbom (1996) |

| Normed Chi square (χ2/df) | < 3.0 | 2.490 | Bollen (1989); Diamantopoulos (1994) |

| Goodness of Fit Index (GFI) | ≥ 0.90 | 0.863 | Hair et al. (1998); Browne & Cudeck (1992) |

| Standardized Root Mean Residual (SRMR) | < 0.05 | 0.052 | Diamantopoulos (1994) |

| Comparative Fit Index (CFI) | ≥ 0.90 | 0.924 | Hair et al. (1998); Mueller (1996) |

| Normed Fit Index (NFI) | ≥ 0.90 | 0.923 | Hair et al. (1998); Mueller (1996) |

| Root Mean Square Error of Approximation (RMSEA) | < 0.05 | 0.084 | Hair et al. (1998); Browne & Cudeck (1992) |

The model fit statistics show that the key success factors of the community's economic development have been validated as a useful model for studying the acceptance of financial community institute by various academic stakeholders of Thailand's higher education. Table 4 shows the hypotheses' results and summarizes the direct causal effects on each endogenous variable in the SEM.

| Table 4 Standardized Causal Effects of the Structural Equation Model and Hypotheses Assessments | |||||

| Determinants | Outcomes | Standardized Coefficients Paths (ß) |

Hypotheses | Assessments | |

| Direct Causal Paths | Critical Ratios |

||||

| EMPT | STAT (R2 = 0.35) | 0.309 | 5.543*** | H:2 | Supported |

| EMPT | REST (R2 = 0.31) | 0.218 | 3.470*** | H:2 | Supported |

| EMPT | REPT (R2 = 0.33) | 0.265 | 4.368*** | H:2 | Supported |

| MNGT | REST (R2 = 0.32) | 0.263 | 4.878*** | H:4 | Supported |

| MNGT | REPT (R2 = 0.41) | 0.326 | 6.032*** | H:4 | Supported |

Leadership, an exogenous variable, contributes approximately 35% of the variation in the endogenous variable, stability. Leadership has a statistically meaningful, total, and causal impact of 0.309 on stability. Leadership, an exogenous variable, explains 31% of the variation in respect, which is an endogenous variable. Leadership has a statistically meaningful, total, and causal impact of 0.218 on respect. Leadership, an exogenous variable, explains 33% of the variation in reputation, an endogenous variable. Leadership has a statistically relevant, total, and causal impact of 0.265 on reputation. Group Management, an exogenous variable, explains 32% of the variation in respect, an endogenous variable. Group Management has a statistically meaningful, total, and causal effect of 0.263 on respect. Finally, group management, an exogenous variable, contributes approximately 41% of the variation in the endogenous variable, reputation. Group Management has a statistically important, total, and causal impact of 0.326 on reputation. SEM is used to evaluate the model and the significance of the relationship between the constructs. The basic model of key success factors is evaluated using the four constructs defined for which scales are developed. The model is shown in Figure 2.

Discussion

The findings satisfy the study's aims and fully support the hypotheses, according to the researchers. From the study of the key success factors of the community’s economic development model, it was found that the committee should have good leadership and group management to succeed in terms of the key success factors model. It can be seen from the study's results on the model of key success factors expectations. From the survey and analysis of the strategic leadership on performance of community financial institutions in North-eastern Thailand proposed by Toopoj & Chansanam (2018), it was found that the community financial institutions have a high quality of leader and committee. Suppose the committee of the financial community institute wants to change the administration to make it more effective. In that case, they will do so by working on the leadership and committee's qualifications, such as improving the verification or definition of all members’ qualifications of the financial community institute. The research results have answered two dimensions as follows:

Theoretical Aspects

The validation equation to relation model structural model refers to theoretical concepts. The analytical findings of this analysis contribute to management philosophy by providing a better interpretation of the core success drivers of the Chaiyaphum Financial Community Institute. The community's economic development model's overall primary success drivers, such as leadership, have a significant and immediate impact on stability, respect, and reputation. Moreover, group management of the key success factors has a direct influence on the community’s economic development through respect and reputation. Stability, respect, and reputation are the driving forces for increasing the community’s economic development model.

Practical Aspects

Firstly, the results provide relations that exist among the concepts of leadership, participation, group management, moral to community’s economic development for the financial community institute in Thailand. Leadership and group management are both important drivers of a community’s economic development. Stability, respect, and reputation are crucial for the financial community institute to survive in a competitive environment. Secondly, the financial community institute leaders who aim to satisfy their members need to focus on providing favourable key success factors as follows: leadership, participation, group management, and moral. This is achieved through gaining a better awareness of their members' needs and desires. Thirdly, the financial community institute leaders need to recognize the importance of self-development in leadership and administrative skill as a key driver of an organization’s success, as well as its significance in holding members over a longer period of time.

Research Limitations

First, there were drawbacks to the cross-sectional study that was gathered from members of the financial community institute in Thailand who had prior experience with the institution. This could restrict the opportunity to apply the findings to other industries' financial institute management. Second, there are limits to the constructs that have been studied. There are structures that are often thought to influence a community's economic development. These structures could have a significant impact on the relationships between core success factors and economic development in a community.

Future Research

To begin, future researchers might use the methods utilized in this study to construct and assess the essential success factors of financial community institutes in other places around the globe. Second, future research might build on the current study by examining the direct effects of important success factors and gaining a better knowledge of the economic growth of the community.

Conclusion and Recommendations

The core factors affecting the success of the community’s economic development are Leadership and Group Management. Therefore, the committees of each community financial institutions should focus on building leadership and administration skills. Not just at the executive level or board only; instead, it includes all members of the community financial institutions. As it is a vital force in bringing community financial institutions to survive in political, social, and economic changes, the committee should adhere to the principles of operation and in the performance of their duties by established regulations. It will result in members being accepted and cooperative. Furthermore, willing to take part in the management of the financial institution community. It will make the financial institution a vital driver community’s economy and achieve the objectives defined.

Acknowledgement

This research project was financially supported by Chaiyaphum Rajabhat University and Khon Kaen University

References

- Anderson, J.C., & Gerbing, D.W. (1988). Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin, 103(3), 411-123.

- Armstrong, J.S., & Overton, T.S. (1977). Estimating nonresponse bias in mail surveys. Journal of Marketing Research, 14(3), 396-402.

- Belak, J., & Duh, M. (2012). Integral management: Key success factors in the MER model. Acta Polytechnica Hungarica, 9(3), 5-26.

- Benjamin, L.M., Rubin, L., & Zielenbach, S. (2004). Community development financial institutions: Current issues and future prospects. Journal of Urban Affairs, 26, 177-195.

- Bollen, K.A. (1989). Structural equation models with observed variables. Structural Equations with Latent Variables, 80-150.

- Browne, M.W., & Cudeck, R. (1992). Alternative ways of assessing model fit. Sociological Methods & Research, 21(2), 230-258.

- Byrne, B.M. (2010). Structural equation modeling with AMOS: basic concepts, applications, and programming (multivariate applications series). New York: Taylor & Francis Group, 396, 7384.

- Cochran, W.G. (1977). Sampling technique (3rd edition). New York: John Wiley.

- Crowe, J.A. (2007). In search of a happy medium: How the structure of interorganizational networks influence community economic development strategies. Social Networks, 29(4), 469-488.

- Detburiram, P., & Siripanumas, P. (2012). Guidelines for elderly wickerwork group’s management in Nongkham community Nonpluang subdistrict, Prathai district, Nakhonratchasima province. Journal of Research and Development Buriram Rajabhat University, 7(2), 89-96.

- Detthamrong, U., & Chansanam, W. (2020). Key success factors of community’s economy development: a case study of the financial community institute, Chaiyaphum. Journal of the Association of Researchers, 25(1), 72-89.

- Diamantopoulos, A. (1994). Modelling with LISREL: A guide for the uninitiated. Journal of Marketing Management, 10(1-3), 105-136.

- Fornell, C., Johnson, M.D., Anderson, E.W., Cha, J., & Bryant, B.E. (1996). The American customer satisfaction index: nature, purpose, and findings. Journal of Marketing, 60(4), 7-18.

- González, M.E.A., & Brea, J.A.F. (2005). An investigation of the relationship among service quality, customer satisfaction and behavioural intentions in Spanish health spas. Journal of Hospitality & Leisure Marketing, 13(2), 67-90.

- Grint, K., & Smolovic, O. (2016). What is leadership: Person, result, position or process, or all or none of these?. In The Routledge companion to leadership (pp. 25-42). Routledge.

- Hair, J.F., Anderson, R.E., Babin, B.J., & Black, W.C. (2010). Multivariate data analysis: A global perspective. Pearson Upper Saddle River.

- Hair, J.F.J., Anderson, R.E., Tatham, R.L., & Black, W.C. (1998). Multivariate data analysis, 5th edn. Prentice Hall, Upper Saddle River, New Jersey.

- Hogan, R., & Kaiser, R.B. (2005). What we know about leadership. Review of General Psychology, 9(2), 169-180.

- Jansiri, N. (2017). Successful factors of the administration of community organizations: A case of community financial organizations in Nakhon Si Thammarat province. Journal of Humanities and Social Sciences Suratthani Rajabhat University, 9(2), 265-294.

- Jöreskog, K.G., & Sörbom, D. (1996). LISREL 8: User's reference guide. Scientific Software International.

- Juneja, P. (2015). Organization management- Meaning, need and its features. Retrieved June 2021, from https://www.managementstudyguide.com/organization-management.htm

- Kaboski, J.P. & Townsend, R.M. (2005). Policies and impact: An analysis of village-level microfinance institutions. Journal of the European Association, 3(1), 1-50.

- Karltun Erlandsson, A. (2002). Perceived participation: a key factor for Successful Implementation of a New Working Concept. In Proceedings of the 34th annual congress of the Nordic ergonomics society, 229-234.

- Kline, R.B. (2015). Principles and practice of structural equation modeling. Guilford publications.

- Kumngam, P., & Pasunon, P. (2017). The moral basis of principles of sufficiency economy affecting sustainability of financial community. A case study of Ban Ang Hin, Sam Phra Ya, Phetchaburi Province. Veridian E-Journal, Silpakorn University (Humanities, Social Sciences and arts), 10(1), 388-400.

- Lau, W.K. (2014). Employee’s participation: A critical success factor for justice perception under different leadership styles. Journal of Management Policies and Practices, 2(4), 53-76.

- Likert, R. (1932). A technique for the measurement of attitudes. Archives of Psychology, 140, 1-55.

- Limsuwan, W. (2018). The role of microfinance on poverty reduction. Journal of Humanities and Social Sciences, 6(1), 59-75.

- Lowry, S. (2014). Community development financial institutions (CDFI) fund: Programs and policy issues. Congressional Research Service.

- Maccoby, M. (2005). Creating moral organizations. Research Technology Management, 48(1), 59-60.

- Mueller R.O. (1996). Confirmatory Factor Analysis. In: Basic Principles of Structural Equation Modeling. Springer Texts in Statistics. Springer, New York, NY.

- Nikkhah, H.A., & Redzuan, M.R.B. (2010). The role of NGOs in promoting empowerment for sustainable community development. Journal of Human Ecology, 30(2), 85-92.

- O’Brien, G. (2002), Participation as the key to successful change-a public sector case study. Leadership & Organization Development Journal, 23(8), 442-455.

- Pérez-Rojo, G., Noriega, C., Velasco, C., & López, J. (2019). Development and assessment of the content validity of the professional good practices scale in nursing homes. International Psychogeriatrics, 31(10), 1517-1521.

- Sama, L.M., & Shoaf, V. (2002). Ethics on the web: Applying moral decision-making to the new media. Journal of Business Ethics, 36(1), 93-103.

- Sama, L.M., & Shoaf, V. (2008). Ethical leadership for the professions: Fostering a moral community. Journal of Business Ethics, 78(1), 39-46.

- Schaaf, R. (2010). Financial efficiency or relational harmony? microfinance through community groups in northeast Thailand. Progress in Development Studies, 10(2), 115-129.

- Sinthao, S. (2012). The critical success factors of a community financial institution in Ketoon village, Tambon Tha Chalung, Chokchai district, Nakhon Ratchasima province. Unpublished doctoral dissertation, , Khon Kaen University.

- Thompson, B. (2021). Impact investing through community development financial institutions (CDFIs). Retrieved June 2021, from https://moph.cc/uY2X3EhI2

- Toopoj, S., & Chansanam, W. (2018). Effects of strategic leadership on performance of community financial institutions in Northeastern of Thailand. Modern Management Journal, 16(1), 37-46.

- Turner, J.R., & Müller, R. (2005). The project manager's leadership style as a success factor on projects: A literature review. Project Management Journal, 36(2), 49-61.

- Yip, M.W., Ng, A.H.H. & Lau, D.H.C. (2012). Employee participation: Success factor of knowledge management. International Journal of Information and Education Technology, 2(3), 262-264.