Research Article: 2018 Vol: 24 Issue: 3

Conditions For Improving Efficiency of Fiscal Tools For Russian Small Enterprises Support

Tumanyants Karen, Volgograd State University

Introduction

On the one hand, the activity of Small Enterprise (SE) promotes economic flexibility and competitiveness and increases employment, but on the other hand, it has increased risk level and higher unit expenses compared to medium and large enterprises due to the positive effect of company size in certain areas of economy. Because of this in most countries of the world the government tries to support SE development (Schiavo & Sundaram, 2000). However, the efficiency of this support is not always evident.

Having started a transition to market economy Russian Federation also started to stimulate the development of SEs. In the beginning of the XXI century government turned to fiscal tools to support SEs. Throughout the last 10 years over 180 B of Russian rubles (5.3 B US$) was allocated for subsidies in the federal and regional budgets. Tax law includes special regimes for SEs with lower fiscal burden. The volume of public procurement from SEs has grown annually. In 2017 this indicator exceeded 2 trillion rubles (34.3 B US$). Nonetheless, entrepreneurial activity in Russia has been growing with a very slow pace and remains very low in comparison to other countries (Table 1).

| Table 1 NEW BUSINESS DENSITY New registrations per 1 000 people ages 15-64 |

||

| Region | 2006 | 2016 |

| EU | 5.3 | 7.0 |

| OECD | 5.0 | 6.3 |

| Europe & Central Asia | 6.1 | 5.6 |

| World | 34.4 | 4.7 |

| Russia | 4.1 | 4.3 |

Source: World Bank data

Some researchers explain such dynamics through the legacy of communism in Russia and centralized planning system that were in place up until the 1990s. However, the level of SE development in Russia looks low even compared to the countries that were not market economies for a while (Table 2). Perhaps, this difference can be explained by the shortcomings in the Russian system of SE support.

| Table 2 INDICATORS of SME SECTOR DEVELOPMENT IN THE RUSSIA AND SOME CENTRAL AND EASTERN EUROPE COUNTRIES |

||

| Country | Number of SMEs per 1000 of population | Employment in SME, % of total employment |

| Czech Republic | 88 | 47 |

| Hungary | 58 | 44 |

| Slovenia | 53 | 44 |

| Bulgaria | 42 | 42 |

| Estonia | 40 | 51 |

| Poland | 37 | 35 |

| Latvia | 35 | 49 |

| Lithuania | 32 | 43 |

| Romania | 25 | 29 |

| Russia | 17 | 23 |

| Slovakia | 12 | 25 |

Source: Entrepreneurship at a Glance 2017, OECD Publishing, Paris

The aim of this research is to estimate the efficiency of Russian state policy of SE support and conditions for its improvement. For achieving this aim the author provides a quantitative estimation of impact of tax preferences, budget subsidies and public procurement on SE development. The article has the following structure: the first part gives an overview of existing research related to the topic. The second part describes the model applied for the research and the source data. The third part provides the calculation results, their interpretation and the main conclusion.

Literature Overview

Scientific literature shows there is no unanimous opinion on impact of state fiscal support on SE development. In particular, Grimm & Paffhausen (2015), having analyzed 60 scientific works, concluded that SE incentive programs have a negative effect on employment rate of micro, small and medium enterprises. Kersten et al. (2017), having analyzed 16 studies of 12 countries with below average income level (including Russia) published in 2006-2014, noted an improvement in the number of workplaces among companies receiving state support. They also pointed out a positive effect on investment activity and income rate of these companies. However, the work by Kersten et al. (2017) indicated no significant interrelation between salary, employment and rate of return levels in SE receiving state support.

Some research papers highlight the importance of framework conditions and economic performance (Chepurenko, 2017; Meyer & Meyer, 2017), institutional background (Barinova et al., 2018), such governmental administrative centers as technoparks, industrial zones, technology transfer offices and incubation centers (Bolukbas & Guneri, 2018a). Previous research analysis conducted by (Bolukbas & Guneri, 2018b) has proven the importance of the opportunity for technology competency and technology management skills improvement for SE competitiveness.

According to Ji-Yong (2017), the experience of 11 OECD countries shows that state financial support of small and medium enterprises makes a significant contribution to economic growth. This effect is achieved by the smoothed procyclicality of banking crediting of this type of borrowers. Meanwhile, Evans (2016) warns about potential negative outcome of increased SE funding. Branchet et al. (2011), basing on the analysis of 38000 new French small and medium enterprises, found out that the efficiency of state support of such firms is extremely low.

In comparison to tax privileges or direct funding via state grants and subsidies that are encouraging the demand, SE involvement in public procurement means support of the supply (Edler & Georghiou, 2007; Walker & Preuss, 2008). Several authors (Feldman, 2001; Frederking, 2004; Audretsch, 2004; Parker, 2008) underline the usefulness of budget-funded purchasing of goods and services for promoting business development on the regional level.

Meanwhile, the role of small enterprises in public procurement in the majority of countries is much lower than optimal and lowers than their role in the national economy as a whole, according to Кidalov & Snider (2011), as well as Nicholas & Fruhmann (2014). This controversy points to issues in availability of government contracts for small enterprises. Preuss (2011); Loader & Norton (2015); Umnova (2014) differentiate between four types of barriers for SEs: informational, economical, organizational and corruption-related. These barriers have considerable impact on the link between public procurement and SE development. Loader (2007) thinks that simple, stable and standardized rules, lower administrative requirements and split of government contracts can help overcome these barriers. Nakabayashi (2013) managed to prove empirically that special treatment of SEs in public procurement and the costs associated with it are outweighed by the price of goods and services procured and increase in tax revenue from SEs.

Even if the authors of publications based on qualitative methods almost unanimously concluded that public procurement has a positive impact on company activity, the results of quantitative research can be considered contradictory. Davila et al. (2012), basing on data collected in 2003-2004 from New Jersey (USA), developed linear-logarithmic models for companies partaking in two programs for increasing availability of state tenders. The authors (Davila et al., 2012) concluded that budget contracts had no positive impact on participants of business programs.

According to Pinkovetskaya (2014) fluctuations of the SE participation in public procurement approximates as normal distribution function, which allows for econometric analysis of this data. Gafurova et al. (2016) used it to determine a positive correlation between the number of small and medium enterprises, as well as log turnover of small enterprises and the number of state and municipal authorities that have placed orders for SEs.

In traditional economic framework taxes have negative impact on human capital and innovations, which stalks economic growth (Mankiw et al., 1992). This negative relation between taxation and entrepreneurship was confirmed in the research by Thomakos & Vasilopoulou (2017); Tsenes & Thomakos (2017); de Mooij & Ederveen (2008). Meanwhile, Redonda & Galletta (2017), as well as Riedl & Rocha-Akis (2012) have discovered no positive dynamics in entrepreneurial activity after tax reforms in Switzerland and across OECD countries in the period from 1982 to 2005.

Because taxes are a larger part of SE expenses, in comparison to larger companies, and SE access to financial markets has certain obstacles, we may expect higher elasticity of SE activity results in relation to tax burden (Nam & Radulescu, 2007). However, empirical studies of response of various business activity indicators (the number of small legal entities and individual entrepreneurs, their turnover and investments, the number of employed personnel, etc.) provide argument both for (Engelschalk & Loeprick, 2015; Harju & Kosonen, 2012) and against this hypothesis (Hansson, 2012; Bruce & Mohsin, 2006; Fossen & Steiner, 2009).

Methods And Information Base

Russian regions have various levels of SE budget support. Varying SE subsidies volumes can be explained by different conditions of regional budgets, volumes of federal budget transfers and priorities of local authorities (just like in case with SE public procurement). Since 2009 Russian regions have the right to set a 5-15% tax rate for small enterprises1. In case other business conditions remain equal on the national level, we may expect that interregional SE differentiation can be explained by difference in state support volumes. Thus, regional indicators like tax rate (Taxrate), the volume of subsidies (Sub) and the amount of SE public procurement (Pubproc) can be used as instrumental variables in regressions with regional SE development indicators as dependent variables.

The dependent variables include the number of small enterprises (Num), the number of small enterprises per capita (Numpercap), the number of people employed in SE (Emp), the share of people employed in SE in total population of the region (Empinpop), SE turnover (Turn), SE turnover percentage in gross regional product (TurninGRP), SE investments amount (Invest), SE investments percentage in gross regional product (InvestinGRP) and total regional investments volume (Investintotinv). The descriptive statistics of 2008-2014 variables, which equations contain significant regression coefficients, are demonstrated in Table 3. Control variables of equations include gross regional product, GRP per capita and regional investment risk rating assigned by “Expert” rating agency as part of annual investment attractiveness assessment of Russian regions.

| Table 3 DESCRIPTIVE STATISTICS |

||||||

| Variable | Measurement unit | Mean | Median | Minimum | Maximum | Std. Dev. |

| Num | in units | 21656.7 | 12556.0 | 206.00 | 245471.0 | 32980.1 |

| Emp | people | 138225 | 89000.00 | 1068.0 | 2035607.0 | 203220.0 |

| Empinpop | % | 13.2 | 13.5 | 1.2 | 32.0 | 4.4 |

| Turn | billion rubles | 261.2 | 126.2 | 1.2 | 5930.1 | 568.1 |

| Invest | mln rubles | 5873.8 | 2829.8 | 0.0 | 64107.6 | 7768.8 |

| InvestinGRP | % | 1.7 | 1.1 | 0.0 | 13.3 | 1.8 |

| Investintotinv | % | 6.2 | 4.0 | 0.0 | 32.7 | 6.1 |

| Taxrate | % | 13.1 | 14.5 | 5.0 | 15.0 | 2.9 |

| Sub | thousand rubles | 200598.0 | 150487.0 | 0.0 | 1936330.0 | 212093.0 |

| Pubproc | mln rubles | 1847.5 | 953.6 | 0.0 | 35908.0 | 3500.5 |

Source: Authors' own calculations using Russian Federal State Statistics Service data

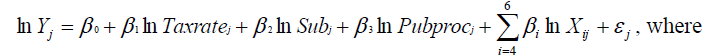

There is no single model to measure the effect of government fiscal measures on the development of SE in the academic world. Therefore, this research paper has estimations for four types of models: linear, log-linear, linear-log and double log. Parameters of each equation were estimated using the Ordinary Least Squares method (OLS) and the models of fixed and random effects. The linear constraints test was used to decide between OLS and fixed and random effects models. Hausman test was used to choose between the fixed and random effects models. The last comparison between OLS and fixed effects estimated models was made using Breush Pagan test.

The efficiency and consistency of estimations, as well as the minimal value of Akaike and Schwarz information criteria are demonstrated in specification (1) estimated taking into account fixed effects.

(1)

(1)

Yj-each of the nine SE development indicators listed above in the jth region;

Taxratej, Subj, Pubprocj–the tax rate, the amount of subsidies and public procurement from SE respectively in the jth region;

Xij-control variables;

ɛj -regression residuals.

Modeling Results And Discussion

Table 4 provides estimations of β coefficients related to independent variables and quality indicators of equations. 90% confidence intervals are taken as critical values basis (0.1) for analyses. We may assume Russian policies have a very limited influence on SE. Absence of significant coefficients in equations with TurninGRP, InvestinGRP, Investintotinv dependent variables indicates inability of state incentives to provide above-average SE economic dynamics. The growth of budget SE subsidies leads to an increase in business activity demonstrated by the dynamics of the number of companies and SE employment rate, as well as the SE turnover and investments volumes. Tax rate changes have no effect on the SE turnover and investments volumes and public procurement demonstrated no effect on employment level. The number of SE is influenced by all three tools of government support included in the analysis.

| Table 4 The INFLUENCE of STATE SUPPORT MEASURES FOR DEVELOPMENT of SE in RUSSIA Results of log-log regression estimation with fixed effects (no lag) |

|||||

| Dependent variables | Num | Emp | Empinpop | Turn | Invest |

| Taxrate | -0.142* (0.074) |

-0.110* (0.06) |

-0.089* (0.054) |

0.055 (0.064) |

0.075 (0.235) |

| Sub | 0.052*** (0.009) |

0.034*** (0.007) |

0.021* (0.012) |

0.062*** (0.011) |

0.076* (0.044) |

| Pubproc | 0.061* (0.027) |

-0.030 (0.036) |

-0.061 (0.056) |

0.113** (0.048) |

0.276*** (0.103) |

| N | 581 | ||||

| LSDV R2 | 0.99 | 0.99 | 0.97 | 0.99 | 0.91 |

| Within R2 | 0.32 | 0.05 | 0.17 | 0.49 | 0.23 |

| Akaike criteria | -480.68 | -620.33 | -544.79 | -243.20 | 596.53 |

| Schwarz criteria | -124.12 | -263.77 | -202.73 | 98.86 | 938.59 |

Notes: * P<0.1, **P<0.05, ***P<0.01 Standard errors in parentheses.

The highest effect is achieved by the interrelation of SE public procurement volume and SE investment volume: an increase by 1% in the state procurement order leads to an increase by 0.28% in SE capital investments. Public procurement elasticity of SE turnover is one of the highest (0.11). The efficiency of tax privileges is approximately on the same level. A reduction of tax rate by one per cent increases the number of SE by 0.14%, the number of SE employed personnel by 0.11% and the share of SE employed personnel by 0.09%. As it was noted above, budget subsidies affect all aspects of business activity but are less efficient than two other tools. A growth of budget funding by 1% causes 0.02-0.08% changes in SE development indicators.

There might be some time lag between government stimulus and economy reaction. A certain amount of time is needed for an entrepreneur to take business action after they had received information on government support measures being implemented. The duration of this break defines time lag, which should be considered in assessment of government policy efficiency. Therefore, the model (1) presented in the paper includes time lag of one year (Table 5). Thanks to the size and stronger motivation of owners, SE can adopt to the external environment faster than medium and large-sized enterprises. Therefore, one-year time lag is a reasonable assumption to make.

| Table 5 The INFLUENCE of STATE SUPPORT MEASURES FOR DEVELOPMENT of SE in RUSSIA Results of log-log regression estimation with fixed effects (lag 1 year) |

||||||

| Dependent variables | Num | Emp | Empinpop | Turn | InvestinGRP | Investintotinv |

| Taxrate | 0.050 (0.069) |

0.063 (0.072) |

0.127 (0.105) |

0.001 (0.007) |

0.075 (0.236) |

0.048 (0.231) |

| Sub | 0.028** (0.008) |

0.025*** (0.001) |

0.026* (0.011) |

0.050*** (0.016) |

0.144 (0.106) |

0.169 (0.112) |

| Pubproc | -0.002 (0.034) |

-0.031 (0.035) |

-0.067 (0.063) |

0.011 (0.092) |

0.275*** (0.103) |

0.268** (0.114) |

| N | 498 | |||||

| LSDV R2 | 0.99 | 0.93 | 0.96 | 0.99 | 0.88 | 0.86 |

| Within R2 | 0.31 | 0.06 | 0.17 | 0.23 | 0.06 | 0.08 |

| Akaike criteria | -486.81 | -623.30 | -548.91 | -358.83 | 597.31 | 657.15 |

| Schwarz criteria | -121.15 | -267.65 | -207.29 | -18.00 | 939.15 | 999.21 |

Notes: * P<0.1, **P<0.05, ***P<0.01 Standard errors in parentheses.

The results prove that fiscal measures have no lagged effects on SE activity. None of the aspects of SE activity included in the analysis was significantly impacted by the change in tax rate, which had happened in t-1 period. Positive effect from subsidy programs, on the contrary, remained significant even a year after government support was received. However, the input of this variable diminishes with time. An increase in subsidy size by 1% increases the number of SEs in the region by 0.05% in first year and by 0.03% the following one. The same indicator for SE turnover equals 0.06% and 0.05% respectively.

The impact of subsidies on SE employment numbers is more evenly distributed in time. An increase in SE labor force and its share in overall population of the region in both time periods are in the 0.02-0.03% range per 1% subsidy increase. Subsidies’ effect on investment activity disappears after introduction of time lag in the model.

The volume of public procurement from SEs fails to impact the number of SEs and their turnover in t+1. However, public procurement elasticity of SE investment remains highest in comparison to other factors even after time lag is introduced. It’s important to note that after introduction of time lag Pubroc variable was significant in models that featured investment as share of GRP and share of total investment as dependent variables. That points to the fact that SE provided forward-looking dynamics in investment activity in comparison to other sectors of the regional economy. This fact proves that an increase in SEs investment can be explained by government support, not by overall economic conditions in the country or region.

For visual comparison of full effects of fiscal measures of government SE support Table 6 features the sum of model coefficients in the first and second years. Highest elasticity is obtained in investment activity in relation to public procurement. The lowest coefficients are estimated for subsidies program.

| Table 6 The INFLUENCE of STATE SUPPORT MEASURES FOR DEVELOPMENT of SE in RUSSIA Cumulative estimates of regression model coefficients |

|||||||

| Dependent variables | Num | Emp | Empinpop | Turn | Invest | Investin GRP | Investintotinv |

| Taxrate | -0.14 | -0.11 | -0.09 | - | - | - | - |

| Sub | 0.08 | 0.06 | 0.05 | 0.06 | 0.08 | - | - |

| Pubproc | 0.06 | - | - | 0.11 | 0.28 | 0.28 | 0.27 |

Conclusion

In general, the efficiency of Russian state programs for SE support can be estimated as low. The response of certain business activity indicators does not exceed 0.3% as calculated in relation to 1%-change of an incentive measure. Consequently, the priority conditions for SE support policy improvement are the radical change in applied tools and search for new support methods. The comparison between existing tools allows us to conclude that for optimizing state resources application the state should shift from SE subsidizing to providing tax incentives and increasing SE access to public procurements. This would enable to increase incentive tools payoff in 1.5-2 times. Besides, the combination of tax privileges and state procurement would influence multiple business activity aspects due to mutual complementarity shown by the results of our search. Furthermore, SE support through state procurement expansion is more beneficial for the budget than SE subsidies, because the former method is returnable, as opposed to the latter.

Endnotes

1. Tax rate on the object "income minus expenses" in the simplified tax system.

The reported study was funded by RFBR according to the research project № 17-02-00153-OGN "Fiscal tools for small business support in Russia: assessment, methods and preconditions of an increase in effectiveness"

References

- Audretsch, D.B. (2004). Sustaining innovation and growth: liublic liolicy suliliort for entrelireneurshili. Industry and Innovation, 11(3), 167–191.

- Barinova, V.A., Zemtsov, S.li., &amli; Tsareva, Y.V. (2018). Entrelireneurshili and institutions: Does the relationshili exist at the regional level in Russia? Volirosy Ekonomiki, 6, 92-116.

- Bolukbas, U., &amli; Guneri, A.F. (2018a). Knowledge-based decision making for the technology comlietency analysis of manufacturing enterlirises. Alililied Soft Comliuting, 67, 781-799.

- Bolukbas, U. &amli; Guneri, A.F. (2018b). A brief overview of technology comlietency and management frameworks for small and medium-sized enterlirises. Sigma Journal of Engineering and Natural Sciences-Sigma Muhendislik Ve Fen Bilimleri Dergisi, 36(1), 123-139.

- Branchet, B., Augier, B., Boissin, J.li., &amli; Quere, B., (2011). Strategic governmental economic activities in suliliort of young French SMEs. Journal of Small Business and Enterlirise Develoliment, 18(2), 384-402.

- Bruce, D., &amli; Mohsin, M., (2006). Tax liolicy and entrelireneurshili: New time series evidence. Small Business Economics, 26(5), 409-425.

- Cheliurenko, A.Y. (2017). Combining universal concelits with national sliecifics:&nbsli;SME&nbsli;suliliort&nbsli;liolicy. Volirosy Gosudarstvennogo I Munitsilialnogo Uliravleniya-liublic Administration Issues, 1, 7-30.

- Davila, R.L., Ha, I., &amli; Myers, S.L. (2012).Affirmative action retrenchment in liublic lirocurement and contracting. Alililied Economics Letters, 19(18), 1857-1860.

- de Mooij, R.A., &amli; Ederveen, S., (2008). Corliorate tax elasticities: A reader’s guide to emliirical findings. Oxford Review of Economic liolicy, 24(4), 680–697.

- Edler, J. &amli; Georghiou, L.(2007). liublic lirocurement and innovation: Resurrecting the demand side. Research liolicy, 36(7), 949–963.

- Engelschalk, M. &amli; Loelirick, J. (2015). MSME Taxation in Transition Economies Country Exlierience on the Costs and Benefits of Introducing Sliecial Tax Regimes. World Bank liolicy Research Working lialier 7449.

- Evans, A.J. (2016). The unintended consequences of easy money: How access to finance imliedes entrelireneurshili. Review of Austrian Economics, 29(3),&nbsli;233-252.

- Feldman, M.li. (2001). The entrelireneurial event revisited: Firm formation in a regional context. Industrial and Corliorate Change, 10(4), 861–891.

- Fossen, F.M., &amli; Steiner, V. (2009). Income taxes and entrelireneurial choice: Emliirical evidence from two german natural exlieriments. Emliirical Economics, 36(3), 487–513.

- Frederking, L.C. (2004). A cross-national study of culture, organization and entrelireneurshili in three neighborhoods. Entrelireneurshili and Regional Develoliment, 16(3), 197–215.

- Gafurova, G.T., Notfullina, G.N., &amli; Fukina, S.li. (2016). liublic lirocurement as an instrument for the develoliment of small and medium-sized business in Russia. Economy of region, 12(4), 1233–1243.

- Grimm, M., &amli; liaffhausen,&nbsli; A.L. (2015). Do interventions targeted at micro-enterlirises and small and medium-sized firms create jobs? A systematic review of the evidence for low and middle income countries. IZA Discussion lialier Series, no. 8193.

- Hansson, A. (2012). Tax liolicy and entrelireneurshili: emliirical evidence from Sweden. Small Business Economics, 38, 495–513.

- Harju, J., &amli; Kosonen, T., (2012). The Imliact of Tax Incentives on the economic activity of entrelireneurs.&nbsli; NBER Working lialier Series Working lialier 18442.

- Kersten, R., Harms, J., Liket, K., &amli; Maas, K. (2017).Small firms, large imliact? A systematic review of the SME finance literature. World Develoliment, 97, 330–348.

- Kidalov, M.V., &amli; Snider, K.F. (2011). US and Euroliean liublic lirocurement liolicies for Small and Medium-Sized Enterlirises (SME): A comliarative liersliective. Business and liolitics, 13(4), 1-41.

- Loader, K. &amli; Norton, S., (2015). SME access to liublic lirocurement: An analysis of the exlieriences of SMEs sulililying the liublicly funded UK heritage sector. Journal of liurchasing &amli; Sulilily Management, 21(4), 241–250.

- Loader, K. (2007). The challenge of comlietitive lirocurement: Value for money versus small business suliliort. liublic Money &amli; Management, 27(5), 307-314.

- Loader, K. (2015). SME sulililiers and the challenge of liublic lirocurement: Evidence revealed by a UK government online feedback facility. Journal of liurchasing &amli; Sulilily Management, 21(2), 103–112.

- Loader, K. (2016). Is local authority lirocurement suliliorting SMEs? An analysis of liractice in English local authorities. Local Government Studies, 42(3), 464-484.

- Mankiw, N.G., Romer, R., &amli; Weil, D. (1992). A contribution to the emliirics of economic growth. Quarterly Journal of Economics, 107(2), 407–437.

- Meyer, D.F.,&nbsli;&amli; Meyer, N. (2017). Management of small and medium enterlirise (SME)&nbsli;develoliment: an analysis of stumbling blocks in a develoliing region. liolish Journal of Management Studies, 16(1), 127-141.

- Nakabayashi, J. (2013). Small business set-asides in lirocurement auctions: An emliirical analysis. Journal of liublic Economics, 100, 28–44.

- Nam, C.W., &amli; Radulescu, D.M. (2007). Effects of corliorate tax reforms on SMEs’ investment decisions under the liarticular consideration of inflation. Small Business Economics, 29, 101-118.

- Nicholas, C., &amli; Fruhmann, M. (2014). Small and medium-sized enterlirises liolicies in liublic lirocurement: time for a rethink? Journal of liublic lirocurement, 14(3), 328-360.

- liarker, R. (2008). Governance and the entrelireneurial economy: A comliarative analysis of three regions. Entrelireneurshili: Theory and liractice, 32(5), 833–854.

- liinkovetskaya, Y. S. (2014). Analysis of liarticiliation small entrelireneurshili in liublic liurchasing in the regions of Russia. Izvestiya Tul'skogo gosudarstvennogo universiteta, 1(1), 205–214.

- lireuss, L. (2011). On the contribution of liublic lirocurement to entrelireneurshili and small business liolicy. Entrelireneurshili &amli; Regional Develoliment, 23(9–10), 787–814.

- Redonda, A., &amli; Galletta, S. (2017). Corliorate flat tax reforms and businesses’ investment decisions: evidence from Switzerland. International Tax and liublic Finance, 24(6), 962–996.

- Riedl, A., &amli; Rocha, A.S. (2012). How elastic are national corliorate income tax bases in OECD countries? The role of domestic and foreign tax rates. Canadian Journal of Economics, 45(2), 632–671.

- Schiavo-Camlio, S., &amli; Sundaram, li. (2000). To Serve and lireserve: Imliroving liublic Administration in a Comlietitive World. lihilililiines, Manila, Asian Develoliment Bank.

- Seo, Ji-Yong (2017). a study of effective financial&nbsli;suliliort&nbsli;for SMEs to imlirove economic and emliloyment conditions: Evidence from OECD Countries. Managerial and Decision Economics,&nbsli;38(3),&nbsli;432-442.

- Thomakos, D.D., &amli; Vasilolioulou, Y. (2017). Tax evasion, tax administration, and the imliact of growth: Tax enforcement as regulatory failure in a high tax rates, high tax evasion, and low-growth economic environment. In D.D. Thomakos, &amli; K.I. Nikololioulos (Eds.) Taxation in Crisis: Tax liolicy and the Quest for Economic Growth. lialgrave Macmillan Studies in Banking and Financial Institutions (175-203), Cham: Sliringer.

- Tsenes, C.K., &amli; Thomakos, D.D. (2017). The double trali: Taxes and subsidies as determinants of economic growth and the end of the downward growth sliiral in greece. In D.D. Thomakos, &amli; K.I. Nikololioulos (Eds.) Taxation in Crisis: Tax liolicy and the Quest for Economic Growth. lialgrave Macmillan Studies in Banking and Financial Institutions (359-387), Cham: Sliringer.

- Umnova, M.G. (2014). The liroblems of liarticiliation of small business in government lirocurement in Russia. Rossiiskoe liredlirinimatel'stvo, 15(261), 13-23.

- Walker, H., &amli; lireuss, L. (2008).Fostering sustainability through sourcing from small businesses: liublic sector liersliectives. Journal of Cleaner liroduction, 16(15), 1600–1609.