Research Article: 2019 Vol: 18 Issue: 1

Combining Strategic Management and Transformation Processes in the Environment of International Companies

Dina Tereshchenko, Kharkiv National University of Civil Engineering and Architecture

Olga Nikolaevskaya, South Ural State University

Olha Borysenko, University of Customs and Finance

Kostyantyn Tkach, Odessa National Polytechnic University

Svitlana Filyppova, Odessa National Polytechnic University

Abstract

The article is devoted to the issue of organic combination of strategic management and transformation processes and changes in the current activity of international companies. Level blocks for providing strategic management of corporate transformations have been formed and the determining criteria for strategic effectiveness of international companies activity in the process of organizational changes have been identified. Modeling of conflict-free combination of corporate control and corporate management tools during ownership transformation has been carried out. Corporate transformation should be understood as the process of organizational and economic transformation of IC, in which the composition of legal entities-holders of corporate rights changes (as a rule, the composition and structure of shareholders of a corporation). The main types of corporate transformation should include: corporate integration, spin-off and corporate division. It should be noted that transformations are abrupt changes in IC activity leading to a radical restructuring of the system of production and market activity of the corporation. Authors recommend block based on the scientific concepts of that the development of the ownership structure requires adequate development of the organizational structure of the company, and not only by a method of separation or integration, that is, the use of transformations, but also in the context of providing the most favorable structure for carrying out the set tasks.

Keywords

International Company, Strategic Management, Corporate Management, Corporate Transformation, Organizational Changes, Strategic Effectiveness.

JEL Classifications

M21

Introduction

At the start of the XXI century the world economic system begins to actively change. The level of global competition increases, forcing international companies (IC) to unite in their fight for survival. In these conditions, more and more corporations consider the processes of transformation and organizational changes as a possible way of their further development. Global corporate management practice have underpinned organizational changes in the status of a accelerated mechanism for gaining control over a certain type of shareholder property, which subsequently gives the IC a boost either in the development or in the processes of a forced market reorganization. These arguments are the basis for determining the relevance of research on this type of corporate integration, and considering that transformations become a popular tool in the markets of developing countries this only enhances the scientific and contemporary significance of such research.

Literature Review

The scientific concepts on the use of transformation procedures in corporate management practice are sufficiently qualitatively and reasonably presented in the scientific works of the following well-known scientists, such as (Aguiar, & Reddy, 2017; Blatz et al., 2006; DePamphilis, 2003). At the same time, we identify the significant contribution of such scientists as (Hull, 2012; Thakor, 2003) in forming the theoretical basis for the emergence of the need and prospects for corporate transformations (Drobyazko et al., 2019a & b), which very often lead to different interpretations of the need and procedural assurance of these integration processes in the activities of international companies (Kwilinski, 2018 a & b; 2019).

Methodology

Corporate transformation should be understood as the process of organizational and economic transformation of IC, in which the composition of legal entities-holders of corporate rights changes (as a rule, the composition and structure of shareholders of a corporation). The main types of corporate transformation should include: corporate integration, spin-off and corporate division. It should be noted that transformations are abrupt changes in IC activity leading to a radical restructuring of the system of production and market activity of the corporation. The decisions made in the field of corporate transformation belong to the field of strategic decisions and their importance is extremely great for the corporation, which directly influences the effectiveness of its activity.

Results and Discussion

The purpose of the article is to consider the combination of IC transformation processes and strategic management, which are characteristic of the global laws of such processes, identify their patterns and development trends, as well as issues related to the assessment of the effectiveness and risks of such corporate transformations.

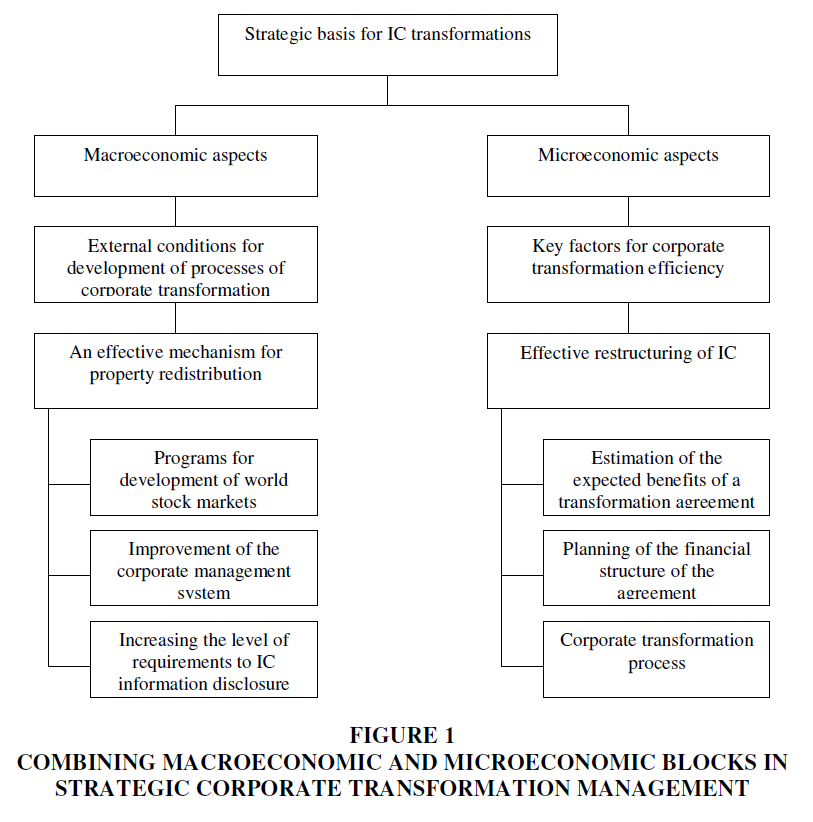

In modern corporate management theory there are several approaches to determining the performance criteria of IC activity. Corporate transformation processes can be considered at both the macroeconomic level as a mechanism for property redistribution and at the micro level as a mechanism for developing an IC strategy (Bakan, 2004). The importance and role of transformation processes in macroeconomic and microeconomic aspects can be presented in the following form (Figure 1).

Figure 1 Combining Macroeconomic and Microeconomic Blocks in Strategic Corporate Transformation Management

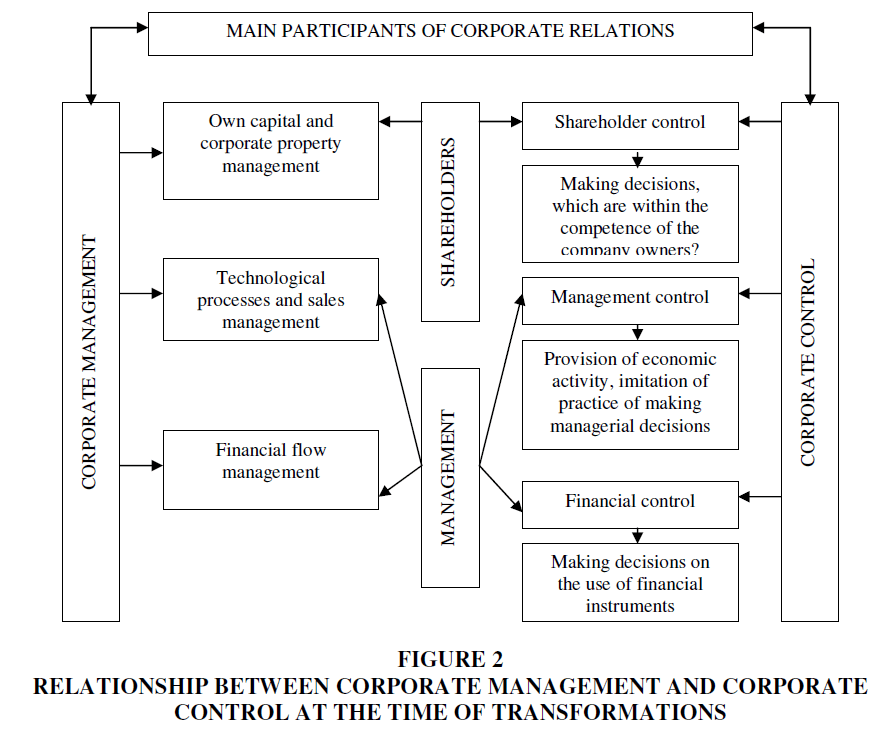

Figure 2 Relationship Between Corporate Management and Corporate Control at the Time of Transformations

The comparative characteristics and the essence of the main approaches to determining the performance criteria of IC activities are shown in Table 1.

| Table 1 Basic Approaches to Definition of the Strategic Efficiency of IC Activity | ||

| Approach name | Approach core | Key performance criteria of IC activities |

| Rational and target approach | Is a mechanistic look at IC? Considering the extent to which the set objectives are implemented | profitability, productivity |

| System approach | IC is viewed as a system with certain input and output variables | The final criterion is the survival of the IC over the long period with changes in the volumes of different types of limited resources |

| Internal processes based approach | IC is viewed as a system of relationships between people | Key performance criteria: undistorted communications, strong corporate culture |

| Shareholder welfare approach | IC is viewed as an organizational community of participants such as: owners, employees, consumers, the public | Increasing shareholder welfare and meeting the expectations of other groups of IC participants |

The most common approach now is to define performance criteria of IC activities based on shareholder welfare. In this regard, issues related to the relationships of the main groups of IC participants, namely the issues of corporate management and corporate relationships of different groups of IC participants are brought to the fore. The development of the corporate form of organization of economic activity raises the question of separation of the direct rights and functions of the owner from the rights and functions of the manager. Corporate management technically comes down to the three most important areas (World Bank, 2018):

1. Own capital and property management;

2. Technological process management, including product sales;

3. Cash flow management.

In foreign practice, the main participants of corporate relations are: 1) company managers; 2) owners (shareholders); 3) other stakeholder groups (creditors, employees, self-government bodies); So, in the process of corporate management the interests of the participants of corporate relations are engaged and a “conflict of interests” arises.

According to (Lin et al., 2006), “conflict of interests” is the management of a company in which the hierarchy of corporate interests is violated when the observance or non-observance of the corporate interests of a single joint-stock company depends on the priorities of the choice of internal corporate management decisions. “Conflict of interests” is a situation of choice between the interests of the corporation as a whole and the interests of a particular group of entities involved in joint-stock relations. When avoiding such conflict, the task of corporate management is to prevent changing the hierarchy of interests and target functions of participants of the corporation activities with management, technological and organizational methods (Riany et al., 2012).

The primary form of control is shareholder control, which reflects the interests of the company. Management control is a form of corporate control derived from shareholder control. Management control is formed by giving the direct managers of the corporation the necessary set of rights and responsibilities. Financial control is formed in the process of choosing between own and external sources of financing (Makedon et al., 2018). Services of financial institutions, which are understood worldwide as intermediaries, are aimed at productive use of monetary funds in the corporate investment process.

Recommendations

We will form the recommendation block based on the scientific concepts of that the development of the ownership structure requires adequate development of the organizational structure of the company, and not only by a method of separation or integration, that is, the use of transformations, but also in the context of providing the most favorable structure for carrying out the set tasks. For international companies, the range of problems extends to address the problems of intensifying competition in the capital market in the areas of: placement and refinancing, the fight for leadership, the use of behavioral differences in national and international markets. In this case, corporate transformations enable strategic development and consolidation of one's position in the markets.

Conclusion

In practice, there is, on the one hand, a constant tendency to integrate all forms of control, and on the other hand, the process of concentration of certain controls in different entities of corporate management. The global practice of corporate management has formed clear principles of corporate behavior, such as: limited liability principle, disclosure principle, centralized management, free transfer of shares. It has been proven that these principles are the universal basis for the development and implementation of a corporate transformation strategy, especially when using system transformations; adherence to these principles guarantees to both parties of the corporate relations the preservation of the corporate rights and obligations in the future regardless of the consequences of the completion of the corporate changes.

References

- Aguiar, E., & Reddy, Y.V. (2017). Corporate diversification on firm's financial performance: An empirical analysis of select FMCG companies in India.

- Bakan, J. (2004). The corporation: The pathological pursuit of power and pro?t.

- Blatz, M., Kraus, K.J., & Haghani, S. (2006). Corporate restructuring: Finance in times of crisis. Springer Science & Business Media.

- DePamphilis, D. (2003). Acquisitions and Other Restructuring Activities: An Integrated Approach to Process, Tools, Cases, and Solutions. International Economic Review, 5, 11-21.

- Drobyazko, S., Barwi?ska-Ma?ajowicz, A., ?lusarczyk, B., Zavidna, L., & Danylovych-Kropyvnytska, M. (2019a). Innovative entrepreneurship models in the management system of enterprise competitiveness. Journal of Entrepreneurship Education.

- Drobyazko, S., Okulich-Kazarin, V., Rogovyi, A., & Marova, S. (2019b). Factors of influence on the sustainable development in the strategy management of corporations. Academy of Strategic Management Journal.

- Hull, J. (2012). Risk management and financial institutions,+ Web Site (Vol. 733). John Wiley & Sons.

- Kwilinski, A. (2018a). Mechanism of formation of industrial enterprise development strategy in the information economy. Virtual Economics, 1(1), 7-25.

- Kwilinski, A. (2018b). Mechanism of modernization of industrial sphere of industrial enterprise in accordance with requirements of the information economy.

- Kwilinski, A. (2019). Mechanism for assessing the competitiveness of an industrial enterprise in the information economy. Research Papers in Economics and Finance, 3(1), 7-16.

- Lin, B., Lee, Z.H., & Peterson, R. (2006). An analytical approach for making management decisions concerning corporate restructuring. Managerial and Decision Economics, 27(8), 655-666.

- Riany, C.O., Musa, G.H., Odera, O., & Okaka, O. (2012). Effects of restructuring on organization performance of mobile phone service providers. International Review of social sciences and Humanities, 4(1), 198-204.

- Thakor, A.V. (2003). Corporate investment and finance. Financial Management, 22(2), 135-144.

- World Bank (2018). Corporate governance: A framework for implementation, Washington