Research Article: 2022 Vol: 21 Issue: 1

Coevolution of Industry and Network

Kimin Kim, Ajou University

Citation Information: Kim, K. (2022). Coevolution of industry and network. Academy of Strategic Management Journal, 21(1), 1-13.

Abstract

Dynamic environmental changes contribute not only to an industry’s evolution but also to the restructuring of its alliance network. This study presents a holistic understanding of coevolution of industries and their networks by conceptualizing interactive evolutionary patterns. By cross-examining industry life cycle theory and network topology, this study seeks to explore the relationship between evolutionary patterns of industry and those of the strategic alliance network embedded within it. We propose that as an industry evolves over time following the sequential life cycle of introduction – growth and maturity – decline stages; its strategic alliance network evolves following the sequential development of random – small-world – scale-free networks. We also suggest operational measures to identify the network topology and a research agenda for further development.

Keywords

Industry Evolution, Network Evolution, Strategic Alliance Network, Network Topology, Random Network, Small-World Network, Scale-Free Network.

Introduction

The establishment of strategic alliances between firms is a ubiquitous phenomenon, and the maintenance of strategic alliances has become one of the most important strategies for contemporary firms (Gulati, 1998). Growing research has examined the causes and consequences of strategic alliances (For a detailed review, see Auster, 1992; Auster, 1994; Ireland et al., 2002). For example, extant research has found that strategic alliances represent significant flows of resources between participating firms (Burt, 1992; Klein & Pereira, 2021; Wassmer & Dussauge, 2011) and provide firms with resources as a form of social capital (Knoke, 2009; Koka & Prescott, 2002). However, while dyadic inter-firm relationships have been the main focus of studies on strategic alliances, relatively little research has been conducted from the perspective of multiple dyadic relationships (Nohria, 1992; Zaheer et al., 2010).

Even though a number of studies have examined structural aspects of multiple dyadic interfirm relationships (Burt, 1992; Gomes-Casseres, 1996), they have been criticized for over-emphasizing static aspects of such multiple dyadic relationships (Koka et al., 2006; Nohria & Eccles, 1992; Wijen et al., 2011). It is only recently that researchers have begun to place emphasis on the structural, dynamic, and evolutionary characteristics of such relationships, especially from the perspective of social network theory (Braha et al., 2011; Morescalchi et al., 2015; Powell et al., 2005). In line with this research thrust, we investigate how strategic alliances networks evolve over time and how their structure changes along with the evolution of industries in which the networks are embedded.

Theoretical Background And Proposition Development

Industry Evolution

Ever since Hannan & Freeman (1977) published their influential paper on the relationship between organizations and the environment, organizational ecologists have tried to explore what conditions cause organizations to emerge, grow, mature and die. By adopting a biological analogy, organizational ecology explains that the evolutionary process of an industry consists of three stages: variation, selection, and retention (Aldrich, 1979).

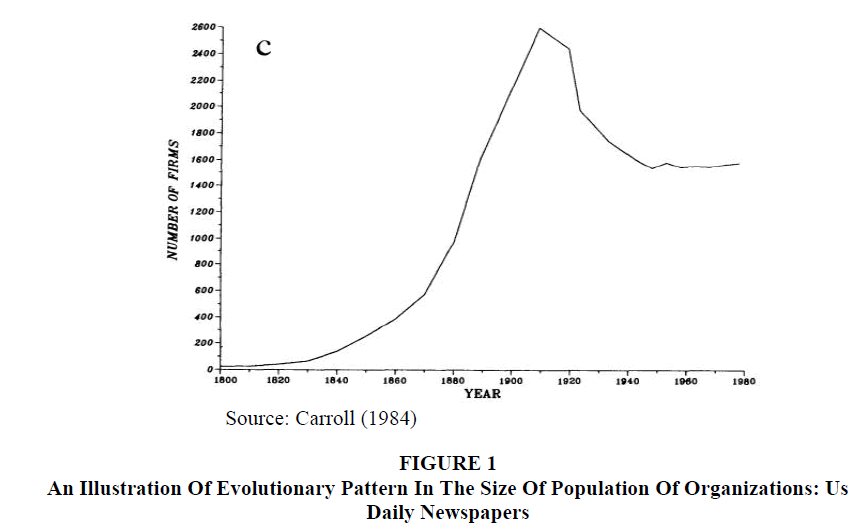

According to this perspective, the legitimacy of an industry increases along with the increase in the number of firms in the industry. As the number of firms continues to grow, however, competition for scarce common resources also increases among the firms. Therefore, beneficial and competitive effects of an increase in number of firms can be plotted as a general S-curve model: curvilinear effects of the density of an industry on firm founding and firm failure (Hannan & Carroll, 1992; Hannan & Freeman, 1989). Using empirical data from six industries over time, Carroll (1984) demonstrated long-term concave patterns of growth and decline in the number of organizations, which showed S-shaped curves as shown in Figure 1.

Figure 1: An Illustration Of Evolutionary Pattern In The Size Of Population Of Organizations: Us Daily Newspapers

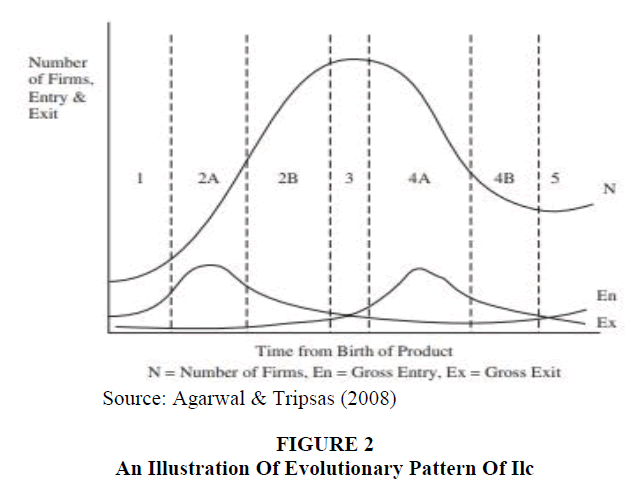

Population ecology is not the only perspective in organizational and economic studies that adopt a biological analogy. In the 1960s, marketing researchers developed the concept of the Product Life Cycle (PLC) in order to explain the lifespan of products and markets (Cox, 1967; Levitt, 1965; Vernon, 1966). The PLC theory identified the sequence of birth – growth – maturity – decline stages of products and markets (Day, 1981). This concept soon developed into a perspective that encompasses the evolution of industries (Agarwal & Tripsas, 2008; Gort & Klepper, 1982; Jovanovic & Macdonald, 1994), and was referred to as the theory of Industry Life Cycle (ILC) (McGahan et al., 2004) that models the evolution process of industries as the sequence from birth to maturity to death as shown in Figure 2.

Strategic Alliance Network

While dyadic interfirm relationships have long been the main focus of the studies on strategic alliances, relatively little analytic attention has been paid to the macro-level structure of large strategic alliance networks resulting from multiple dyadic alliances (Gemser et al., 1996; Nohria & Eccles, 1992; Provan et al., 2007). Apart from the direct dyadic ties between two firms, firms generate elaborate webs of indirectly connected relationships with “partners of partners” by participating in numerous alliances with different partners (Knoke et al., 2002).

This complex, macro-level network of strategic alliances has been referred to varied terms such as the “alliance network” (Baum et al., 2000; Koka & Prescott, 2002), the “alliance constellation” (Das & Teng, 2002; Gomes-Casseres, 1996), the “networks of strategic alliances” (Hagedoorn & Schakenraad, 1992), the “whole network” (Provan et al., 2007), and the “strategic alliance network” (Knoke et al., 2002). In this paper, for consistency and simplicity’s sake, we adopt the term “SAN”, defined as a macro network “comprising subsets of firms within an organizational field that are interconnected by their repeated and overlapping partnerships through space and time” (Knoke et al., 2002).

Meanwhile, the number of studies on diverse managerial issues from a social network perspective has increased in recent years (for a detailed review, see Carpenter et al., 2012; Kilduff & Brass, 2010; Moliterno & Mahony, 2010; Phelps et al., 2012; Provan et al., 2007). This growth may due to a general shift of focus in social science to seek more relational, contextual and systemic understandings rather than individualist, essentialist and atomic explanations (Borgatti & Foster, 2003; Kilduff & Tsai, 2003). The exponentially growing number of strategic alliances among domestic and international firms also may serve as an incentive for organizational researchers to study this organizational network as a newly institutionalized organizational form (Podolny & Page, 1998; Powell, 1990).

Network Topology

Traditionally, great attention has been paid to the static aspects of networks, which were considered as given contexts for action (Madhavan eta l., 1998). Recently, however, network researchers agreed that the evolution of social network is a fundamental problem for network analysts and solving this problem is a necessary condition for realizing its revolutionary potential for the social science (Doreian & Stokman, 1997), and they began to place more emphasis on the structural, dynamic and evolutionary characteristics of networks (Gulati, 1995; Powell et al., 2005). More recently, responding to increased research on network structure by mathematicians (Doreian & Stokman, 1997) and physicists (Barabasi et al., 2002), researchers in management have begun to investigate the statistical properties of networks and methods for modelling networks (Baum et al., 2004).

In these studies, networks are regarded as dynamic systems that evolve over time through adding and removing actors and ties (or links). While static models are useful to examine how structural relationships affect the performance of individual actors embedded in a micro-level local network, dynamic models are useful to investigate collective dynamics and the comparative structure of macro-level global networks. Especially, “graph theoretic analyses have permitted comparison of seemingly unrelated networks, leading to the exposure of deep similarities among social, biological, and technological networks” (Baum et al., 2004) by suggesting three models of network structure: (1) random networks, (2) small-world networks, and (3) scale-free networks (for a review, see Albert & Barabasi, 2002).

The model of random networks was introduced by mathematicians Erdos & Renyi in their classic study on random graphs (1960). They defined a random graph as N nodes connected by n edges, which are chosen randomly from the N(N-1)/2 possible edges. In a random network, there exist  graphs with N nodes and n edges, forming a probability space in which every realization is equiprobable (Erdos & Renyi, 1960). Thus, while each node is connected to its k nearest neighbors in regular (or orderly) fashion in regular networks, most nodes have approximately the same number of links in random networks (Watts, 1999). In other words, most nodes have equal power or importance in random networks.

graphs with N nodes and n edges, forming a probability space in which every realization is equiprobable (Erdos & Renyi, 1960). Thus, while each node is connected to its k nearest neighbors in regular (or orderly) fashion in regular networks, most nodes have approximately the same number of links in random networks (Watts, 1999). In other words, most nodes have equal power or importance in random networks.

Milgram (1967) took an interesting experiment to measure the distance between any two people in the United States, and found that the median number of intermediate persons was 5.5. He termed this phenomenon as the small-world effect, and the wide appeal of this idea has been portrayed even in the Broadway play Six Degrees of Separation and a computer game, the Kevin Bacon Game. Later, Watts & Strogatz sophisticated this phenomenon and extracted two distinct structural properties of the small-world network: highly clustered local structure and short global distance (1998). In such networks, a few shortcuts make it possible to connect distant nodes with drastically shorter distance, and a few clusters are established in which some nodes connect to each other locally.

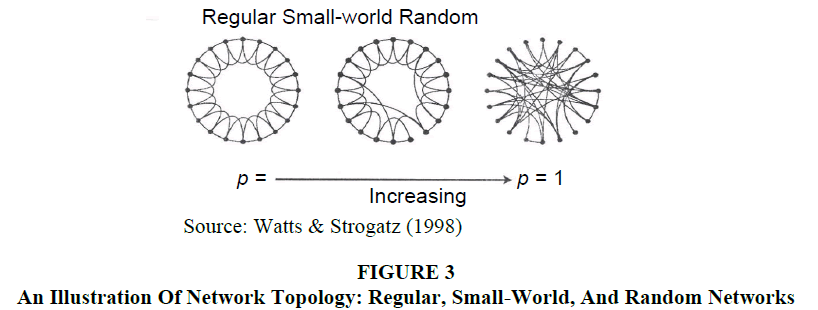

Figure 3 graphically illustrates the three network types’ typologies. With respect to the level of randomness in the networks, small-world networks lie in between the two extremes of completely regular and completely random networks thus possess the properties of both of regular and random networks (Watts & Strogatz, 1998). In other words, due to high local clustering and short global separation within it, a small-world network exhibits the structural property of a sparse and decentralized network that is neither completely regular nor completely random (Watts, 1999).

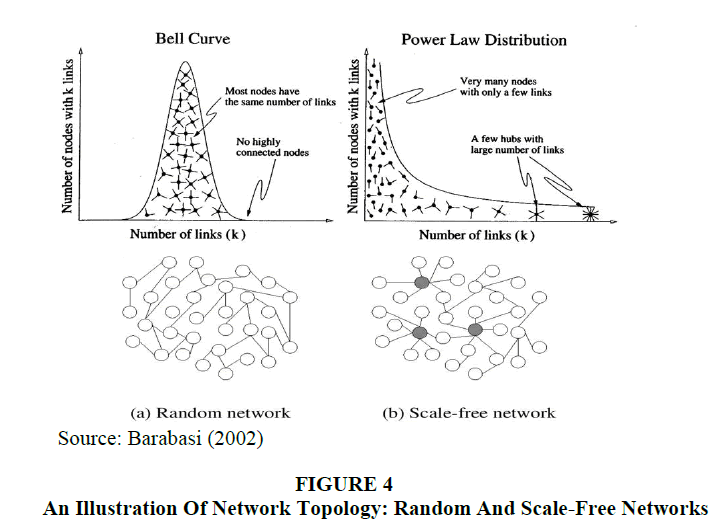

Using a Web crawler, Barabasi and his colleagues mapped the connectedness of the World Wide Web (WWW), and found that the WWW did not have a random connectivity while the distribution of its links followed a power law (1999). They characterized the network topology of the WWW as scale-free networks, in which a few centrally located hubs possess the most connections. The term scale-free came from the observation that in such networks, “there is no characteristic number of edges per node as in a bell-curve-shaped distribution or exponential decay” (Powell et al., 2005). Frequently, this finding is metaphorically referred to as phenomenon of “rich-get-richer” (Albert & Barabasi, 2002) or “winner takes it all” (Stefancic & Zlatic, 2005).

An Illustration Of Network Topology: Random And Scale-Free Networks

In Figure 4, the characteristics of scale-free networks are succinctly demonstrated by comparing them with random networks. As mentioned above, most nodes have the same or similar number of links in regular, small-world, and random networks. In scale-free networks, however, as a result of preferential attachment, a few powerful nodes possess large number of links and form a small number of hubs while many other nodes possess only a few links (Barabasi, 2009).

Coevolution of Industry and SAN

The ILC perspective views industries as living organisms; they are born, grow, mature, and eventually die. Life cycle theorists have identified two to five life cycle stages (for a detailed review, see Agarwal et al., 2002). The rationale to distinguish the stages of the life cycle seems to rely on either the purpose of the research or the specific contexts of the industry in question. In that sense, “identifying clear criteria for distinguishing the phase of the life cycle” has been frequently shown in the future research section of papers (McGahan et al., 2004).

Among many other models, we take the three-stage model: introduction – growth and maturity – decline. The three stage model was initially proposed by Klepper & Graddy (1990)and applied later to investigate evolutionary patterns of various industries (Agarwal & Tripsas, 2008; Dinlersoz & Hernandez-Murillo, 2005). We expect that the framework with fewer stages has a broader fit to more number of industries and a better fit to the industries that possess relatively short history and fierce evolutionary dynamics.

The ILC theory explains that an initial period during which only a few firms operate is followed by a period of escalating and peaking number of firms. After the peak, the number of firms eventually dwindles to stabilize. In general, the greater the number of firms is in an industry, the greater the chance is for firms to establish alliances with other firms, thereby increasing their number of alliances. Similarly, the smaller the number of firms is in an industry, the lower their chances are to build alliances, consequently lowering their potential number of alliances. For example, adopting this idea, a descriptive framework was suggested which linked the patterns of changing interfirm networks with the patterns of industry development (Gemser et al., 1996). Gulati also posited that the SAN is not a static social structure in which firms embed only new alliances but it is an evolutionary product that contains cumulated previous alliances (1998).

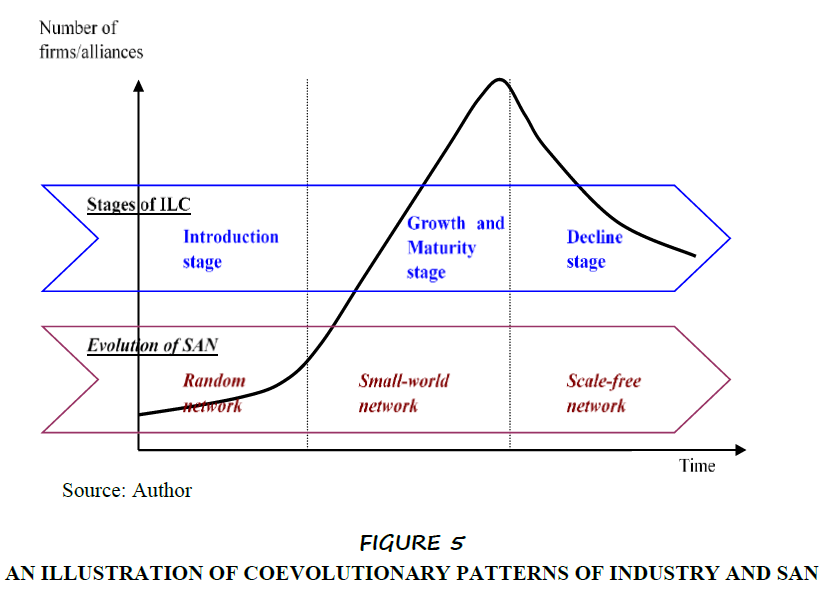

Integrating these arguments, we propose that an industry and the SAN embedded in it evolve together, and the structure of the SAN evolves from a random network to a small-world network to a scale-free network as the industry evolves following the stages of ILC. Figure 5 illustrates the research propositions that suggest co-evolutionary patterns of an industry and the SAN embedded in it, and structural changes of the SAN.

In the introduction stage, a small number of first-movers assume a greater risk and enter the new industry earlier than others and enjoy virtually unlimited resources with little competition, while others are reluctant to enter the new industry because of its uncertain future. For a certain period of time, a few early-entrants struggle to get institutional legitimacy (Meyer & Rowan, 1977) and the number of firm’s increases very slowly (McKelvey & Aldrich, 1983). Firms with strong power in market dominance do not emerge yet at this point, and there is scarce information regarding potential co-operators and competitors in the industry. Therefore, many firms consider all other firms as their potential alliance partners and begin to collect information from the ground up. Meanwhile, many firms may be reluctant to establish alliances because the scarcely existing information about potential partners is not yet reliable and it is difficult to predict the downstream effects of establishing and maintaining alliances.

As a result, the total number of alliances among firms in the industry will be quite small at this introduction stage, and thus many firms will have a similar number of alliances. Consequently, many firms will be placed within a similar distance in a relatively sparse network, and clusters of preferably allied groups in the network would not have yet emerged. This reasoning leads to the proposition below:

H1 In the introduction stage, the SAN will exhibit the structural properties of random networks.

As the institutional legitimacy of a population rises in the growth and maturity stage, the founding rate of firms increases and the failure rate declines (Meyer & Rowan, 1977). As a result, in the growth and maturity stage, the number of firms in the industry increases rapidly, and the increased scarcity of resources in the industry creates a competitive interdependence between firms. Therefore, in order to gain or maintain competitive advantages, a firm may seek to create alliances with partners who are expected to enhance the firm’s competitive advantages. In searching for potential partners, both the previous direct ties (Gulati & Gargiulo, 1999) and the shared third party ties (Burt & Knez, 1995) enhance uneven diffusion of information within the industry. Furthermore, access to direct and indirect sources of information about potential partners reduces the cost of establishing new alliances. Consequently, the number of alliances will be dramatically increased. As a result of competition and cooperation among the firms in the industry, however, a few powerful firms will begin to dominate not only the market and technology but also alliance partners.

Therefore, in the growth and maturity stage, the SAN will change to a denser and more efficient network with more shortcuts and clusters, which will form a small-world network. This reasoning leads to the proposition as follows:

H2 In the growth and maturity stage, the SAN will exhibit the structural properties of small-world networks.

When the growth of the market slows down and the mature stage arrives, excess production capacity emerges and competition intensifies (McGahan et al., 2004), which eventually leads to the decline stage. These changes in industrial environments frequently result in a shakeout of many less competitive firms, while the remaining more competitive ones obtain economies of scale and scope by acquiring those failed firms (Klepper & Simons, 2005). Consequently, these changes will affect the structure of SAN also. In general, the number of potential alliance partners will decrease due to the smaller number of remaining firms. Furthermore, in order to get legitimacy and competitive advantages, firms may prefer to ally only with a few powerful firms that possess dominance in the market and technology, a higher status (Podolny, 1993), or structural holes (Burt, 2001). As a result, the SAN will shift towards a more efficient and more centralized network with a few powerful firms and densely connected hubs formed by powerful firms. This reasoning leads to the proposition below:

H3 In the decline stage, the SAN will exhibit the structural properties of scale-free networks.

Discussion

Measurement of Structural Properties

We proposed that the SAN evolves over time as do the industries in which they are embedded, and the structure of the networks at each of evolutionary stages exhibits specific structural characteristics of typical network topology. Regarding the issue of the identification of network topology, we also suggest simple and viable operational measures for the empirical testing of the propositions described in the previous sections.

The structural properties of random and small-world networks can be detected from the analysis of two statistical measures: the characteristic path length L and the clustering coefficient C (Watts, 1999; Watts & Strogatz, 1998). For random networks, though precise formulas do not exist for L and C, in the limits of large n and k, the corresponding approximations are Lrandom ~ ln(n)/ln(k) and Crandom ~ k/n, where n is the number of nodes and k is the average number of ties of the nodes in the network (Watts, 1999 ). However, a small-world network exhibits a characteristic path length close to that of an equivalent random network (Lsw ≈ Lrandom) and a much greater clustering coefficient (Csw » Crandom) (Watts, 1999 ). For determining the small-worldliness of a certain network, previous empirical studies have compared the values of the two aforementioned parameters L and C of the network with those of a random network with the same number of nodes and ties (Baum et al., 2004; Kogut & Gordon, 2001).

According to them, a network is considered as a small world when SW » 1, where SW=(Cactual/Crandom)/(Lactual/Lrando).

For detecting the structural properties of scale-free networks, it is necessary to determine whether the distribution of links between nodes follow a power law. In complex networks, the probability P(k) that a node in the network interacts with k other nodes decays as a power law, following P(k) ~ k –λ (Barabasi et al., 1999). The numerical value of the degree exponent λ is not universal and varies for various networks. For example, it equals 2.1 ± 0.1 for the WWW network, 2.3 ± 0.1 for movie actors’ network, and 3.0 for the academic paper citation network, and approximates 4.0 in the electric power grid of western United States (Barabasi, 2009; Barabasi et al., 2002). In nature and human society alike, the typical range of the degree exponent λ in scale-free networks is known to be between about 1.5 and 4.0 (Kwon et al., 2007).

Implications and Future Research

It is well reported that external and internal shocks have significant impacts on industries’ structure. For example, major technological shocks are argued as shifting forces that reshape industry structure (Barley, 1986; Burkhardt & Brass, 1990; de Vaan, 2014; Glasmeier, 1991). Similarly, technological innovations are suggested to trigger a sharp decline in the number of firms in industries (Klepper & Graddy, 1990; Klepper & Simons, 2005). Besides technological changes, key industry events such as changes in regulatory infrastructure, the entry of a powerful competitor, or dramatic shifts in consumer preferences are illustrated as significant forces of structural changes of an industry (Madhavan et al., 1998). However, to our knowledge, there exist few explanations for whether these shocks have impacts on the evolutionary patterns of industries and networks (de Vaan, 2014). Investigating the association between environmental shocks and the evolutionary patterns of both industries and networks would be interesting and meaningful to pursue.

Furthermore, other than the exogenous shocks mentioned above that lead to structural changes of industries (and possibly the SAN in the industries), we may take note of an ongoing worldwide phenomenon that has been a major disruptive shock: the COVID-19 pandemic. The pandemic has presented itself as an unprecedented shock that impacts all aspects of human society and as “a rare chance of natural experiment of an environmental jolt” (Meyer, 1982), providing rich research opportunities in varied fields since its outbreak in early 2020 (Daniel, 2020; Van Bavel et al., 2020). An environmental jolt is a sudden and unprecedented event that renders existing firm strategies ineffectively (Meyer et al., 1990), dramatically changes the level of environmental munificence (Castrogiovanni, 1991), and therefore provides some firms with threats while others with opportunities (Sine & David, 2003). Similar to the impact of the Asian economic crisis in the late 1990s (Wan & Yiu, 2009) and the dot-com bubble burst in the early 2000s (Kim, 2020; Park & Mezias, 2005), we may expect that the COVID-19 pandemic will provide researchers with a fruitful test bed to empirically verify the impact of an exogenous environmental shock on evolutionary patterns and structural changes of both industries and networks.

By matching a specific network topology with each stage of industry life cycle, we tried to answer the question that Koka and his colleague had drawn: “As industries evolve, do certain patterns of network change become more or less prominent (Koka et al., 2006)?” However, another question they raised has remained unanswered in this study: “How do the patterns of network change impact industry evolution, and vice versa (Koka et al., 2006)?” We assumed a one-way causal relationship by which environmental changes in the industries brought by industry evolution affect structural changes of the SAN embedded in the industries. However, a reverse causal relationship and interplay between them also deserve to be considered. An investigation of the causality and the interaction between industry evolution and network evolution may offer further research topics.

The strategic alliance has become a popular strategic option for firms, and the network of firms has become firmly institutionalized as an organizational form (Podolny & Page, 1998; Powell, 1990). Therefore, when firms perceive structural changes of the SAN they embedded, they try to alter their alliance strategies in order to improve their strategic position within the industry and maximize their performance (Boukhris, 2020; Doz & Hamel, 1998; Teng & Das, 2008). Since strategic alliances require significant resources and present firms with not only benefits but also risks (Leenders & Gabbay, 1999; White & Lui, 2005), firms cautiously select their partners when establishing a new alliance (Bierly III & Gallagher, 2007; Stuart, 2000). Furthermore, recognizing the managerial implications of an alliance portfolio, which is a set of a focal firm and its direct and indirect partners (Hoffmann, 2005; Lavie, 2009), researchers and practitioners have recently begun to focus on strategic designing and managing an alliance portfolio so that firms can enhance their performance (Kim, 2020; Parise & Casher, 2003; Wassmer & Dussauge, 2011). These strategic behaviours of firms may in turn lead to changes in the structure of their network. Therefore, interactions between strategic changes in firms’ behaviours and evolutionary structural changes in the SAN may provide further research agenda.

Conclusion

Industries exhibit a variety of characteristics that differ from industry to industry in many aspects. For example, with regard to the number of firms playing in the industry, the speed of technological development and the degree of government regulation, emerging industries may have quite different attributes compared to those of traditional and stable industries. Due to these differences, evolutionary patterns vary from industry to industry. Similarly, the same industry can exhibit different evolutionary patterns from country to country due to differences in national contexts such as social, technological and institutional environment. Comparative cross-industry and/or cross-country studies may provide scholars and practitioners with interesting and meaningful implications.

References

Agarwal, R., & Tripsas, M. (2008). Technology and industry evolution. In S. Shane (Ed.), The handbook of technology and innovation management (Vol. 1, pp. 1-55). West Sussex, England: Wiley.

Aldrich, H. (1979). Organizations and environments. Englewood Cliffs, NJ: Prentice-Hall.

Auster, E.R. (1992). The relationship of industry evolution to patterns of technological linkages, joint ventures, and direct investment between US and Japan. Management Science, 38(6), 778-792.

Auster, E.R. (1994). Macro and strategic perspectives on interorganizational linkages: A comparative analysis and review with suggestions for reorientation. Advances in Strategic Management, 10(1), 3-40.

Barabasi, A.L. (2002). Linked : the new science of networks. Cambridge, MA: Perseus.

Barabasi, A.L. (2009). Scale-free networks: a decade and beyond. Science, 325(5939), 412-413.

Barabasi, A.L., Jeong, H., Neda, Z., Ravasz, E., Schubert, A., & Vicsek, T. (2002). Evolution of the social network of scientific collaborations. Physica A: Statistical Mechanics and its Applications, 311(3-4), 590-614.

Baum, J.A.C., Rowley, T.J., & Shipilov, A.V. (2004). The small world of Canadian capital markets: Statistical mechanics of investment bank syndicate networks, 1952-1989. Canadian Journal Of Administrative Sciences-Revue Canadienne Des Sciences De L Administration, 21(4), 307-325.

Boukhris, M.B.A. (2020). Corporate acquisition networks and organisational performance: a dynamic model of partner selection and network influence. International Journal of Networking and Virtual Organisations, 23(3), 189 - 219.

Burkhardt, M.E., & Brass, D.J. (1990). Changing patterns or patterns of change - The effects of a change in technology on social network structure and power. Administrative Science Quarterly, 35(1), 104-127.

Burt, R.S. (1992). Structural holes: The social structure of competition. Cambridge, MA: Harvard University Press.

Burt, R.S. (2001). Structural holes versus network closure as social capital. In N. Lin, K. Cook & R. S. Burt (Eds.), Social capital: Theory and research (pp. 31-56). New York, NY: Aldine de Gruyter

Carroll, G.R. (1984). Organizational ecology. Annual Review of Sociology, 10(1), 71-93.

Cox, W.E. (1967). Product life cycles as marketing models. Journal of Business, 40(4), 375-384.

Daniel, S.J. (2020). Education and the COVID-19 pandemic. Prospects, 49(1), 91-96.

Dinlersoz, E.M., & Hernandez-Murillo, R. (2005). The diffusion of electronic business in the United States. Federal Reserve Bank of St Louis Review, 87(1), 11-34.

Doreian, P., & Stokman, F.N. (Eds.). (1997). Evolution of social networks. Amsterdam: Gordon and Breach Publishers.

Doz, Y.L., & Hamel, G. (1998). Alliance advantage: The art of creating value through partnering. Boston, MA: Harvard Business School Press.

Erdos, P., & Renyi, A. (1960). On the evolution of random graphs. Bulletin of the International Statistical Institute, 38(4), 343-347.

Gomes-Casseres, B. (1996). The alliance revolution: The new shape of business rivalry. Cambridge, MA: Harvard University Press.

Gulati, R. (1995). Social structure and alliance formation patterns: A longitudinal analysis. Administrative Science Quarterly, 40(4), 619-652.

Gulati, R. (1998). Alliances and networks. Strategic Management Journal, 19, 293-317.

Gulati, R., & Gargiulo, M. (1999). Where do interorganizational networks come from? American Journal of Sociology, 104(5), 1439-1493.

Hannan, M.T., & Carroll, G.R. (1992). Dynamics of organizational populations: Density, legitimation, and competition. New York, NY: Oxford University Press.

Hannan, M.T., & Freeman, J. (1989). Organizational ecology. Cambridge, MA: Harvard University Press.

Hoffmann, W.H. (2005). How to manage a portfolio of alliances. Long Range Planning, 38(2), 121-143.

Kilduff, M., & Tsai, W. (2003). Social networks and organizations. London: Sage.

Kim, K. (2020). Are we in the same boat?: Value-creation in alliance portfolios in the US internet sector. International Journal of Economics and Business Research, 19(4), 418-438.

Klein, L.L., & Pereira, B.A.D. (2021). Dependence of companies on inter-organisational networks: an analysis beyond the benefits generated. International Journal of Networking and Virtual Organisations, 24(1), 22-39.

Klepper, S., & Simons, K.L. (2005). Industry shakeouts and technological change. International Journal of Industrial Organization, 23(1-2), 23-43.

Knoke, D., Yang, S., & Granados, F.J. (2002). Dynamics of strategic alliance networks in the global information sector, 1989-2000. Conference: 18th EGOS Colloqium: The Dynamics of Networks.

Kogut, B., & Gordon, W. (2001). The small world of Germany and the durability of national networks. American Sociological Review, 66(3), 317.

Koka, B.R., & Prescott, J.E. (2002). Strategic alliances as social capital: A multidimensional view. Strategic Management Journal, 23(9), 795-816.

Koka, B.R., Madhavan, R., & Prescott, J.E. (2006). The evolution of interfirm networks : Environmental effects on patterns of network change. Academy of Management Review, 31(3), 721-737.

Kwon, D., Oh, W., & Jeon, S. (2007). Broken ties: The impact of organizational restructuring on the stability of information-processing networks. Journal of Management Information Systems, 24(1), 201-231.

Lavie, D. (2009). Capturing value from alliance portfolios. Organizational Dynamics, 38(1), 26-36.

Leenders, R.R.A.J., & Gabbay, S.M. (1999). Corporate social capital and liability. Boston, MA: Kluwer Academic Publishers.

Levitt, T. (1965). Exploit the product life cycle. Harvard Business Review, 43(6), 81-94.

McGahan, A.M., Argyres, N., & Baum, J.A.C. (2004). Context, technology and strategy: Forging new perspectives on the industry life cycle. In J.A.C. Baum & A.M. McGahan (Eds.), Business Strategy over The Industry Life Cycle (Advances in Strategic Management, Vol. 21) (pp. 1-21). Bingley: Emerald Group Publishing Limited.

Meyer, A.D. (1982). Adapting to environmental jolts. Administrative Science Quarterly, 515-537.

Meyer, A.D., Brooks, G.R., & Goes, J.B. (1990). Environmental jolts and industry revolutions: Organizational responses to discontinuous change. Strategic Management Journal, 93-110.

Meyer, J.W., & Rowan, B. (1977). Institutionalized organizations: Formal structure as myth and ceremony. American Journal of Sociology, 83(2), 340-363.

Milgram, S. (1967). Small-World Problem. Psychology Today, 1(1), 61-67.

Morescalchi, A., Pammolli, F., & Penner, O. (2015). The evolution of networks of innovators within and across borders: Evidence from patent data. Research Policy.

Nohria, N. (1992). Is a network perspective a useful way of studying organizations? In N. Nohria & R.G. Eccles (Eds.), Networks and organizations: Structure, form, and action. Boston, MA: Harvard Business School Press

Nohria, N., & Eccles, R.G. (1992). Networks and organizations: Structure, form, and action. Boston, MA: Harvard Business School Press.

Podolny, J.M. (1993). A status-based model of market competition. American Journal of Sociology, 98(4), 829-872.

Powell, W.W. (1990). Neither market nor hierarchy: Network forms of organization. Research in Organizational Behavior, 12.

Powell, W.W., White, D.R., Koput, K.W., Smith, J.O., & Owen-smith, J. (2005). Network dynamics and field evolution: The growth of interorganizational collaboration in the life sciences. American Journal of Sociology, 110(4), 1132-1205.

Stefancic, H., & Zlatic, V. (2005). "Winner takes it all": Strongest node rule for evolution of scale-free networks. Physical Review E, 72(3), 036105.

Teng, B.S., & Das, T. (2008). Governance structure choice in strategic alliances. Management Decision.

Watts, D.J. (1999). Networks, dynamics, and the small-world phenomenon American Journal of Sociology (Vol. 105, pp. 493-527).