Research Article: 2024 Vol: 28 Issue: 1

City Gas Distribution is Driving India′s Gas-based Economy

Kadam Sambhaji Namdeo, Rajiv Gandhi Institute of Petroleum Technology

Kavita Srivastava, Rajiv Gandhi Institute of Petroleum Technology

Citation Information: Sambhaji Namdeo, K., & Srivastava, K. (2024). City gas distribution is driving india's gas-based economy. Academy of Marketing Studies Journal, 28(1), 1-14.

Abstract

Indian Industry and Government is working hard for increasing the share of natural gas into primary energy mix with primary objectives of replacing the liquid fuels from the different consumer segments. City Gas Distribution (CGD) is considered as last mile connectivity in the natural gas value chain which plays vital role in providing natural gas access to the end consumers and would help to replace liquid fuels from consuming segments like Transport, Commercial, Industrial and domestic. This will not only help country to reduce the emissions as natural gas being cleanest fossil fuel but also help to reduce the subsidies going into domestic LPG segment. This paper has been prepared based both the primary data and secondary data, whereas under the secondary research the authentic data sources like reports from government agencies PNGRB, PPAC, MoPNG etc. are used. It has been found that, in the recent years 2018-2021 the sectoral regulator has done the commendable job and awarded the significant geographical areas for the CGD development under the different CGD rounds. To support the secondary research, authors has collected the primary data by conducting an expert interviews of 20 industry experts having average experience of more than 27 years and tried to understand the expert’s views on the role of CGD in India’s move towards the gas based economy and major challenges being faced by the CGD sector. It has been found that, CGD is going to play an vital role in India’s move towards the gas based economy and would help country to increase the share of natural gas in primary energy mix by 2030.

Keywords

Energy, Natural Gas, Gas-based economy, CGD, LNG, Gas Infrastructure.

Need For Moving to a Gas-Based Economy

India is emerging as one of the fastest developing nations with sustained GDP growth of more than 7%. To support GDP growth, energy demand is increasing, in 2016 India became third largest energy consumer in the world & the energy sector is responsible for 71% of country's total greenhouse gas emissions-GHG (IEA, 2021). India is the 4th largest GHG emitter & account for 7 % of global CO2 emissions (USAEPA, 2017). India has ratified the Paris Climate Agreement (COP-21) on 2nd October 2016 and submitted its Intended Nationally Determined Contribution (INDC) to the United Nations Framework Convention on Climate Change. India committed to reduce the emissions intensity of its GDP by 33-35% by 2030 from 2005 level.

It is found that, transportation sector is second largest emitter after electricity generation in India's sector-wise GHG's emissions. 7 out of 10 most polluted cities are in India (AirVisual. 2018). Natural gas has proven to be the next-generation, cheaper and environment friendly fossil fuel globally in transport and electricity generation. Hence, natural gas has opportunity to replace liquid fossil fuels in transportation & coal in electricity generation to make India a green economy. Also, natural gas potential to replace polluting traditional-biomass fuel in cooking and improve the health of village women's by reducing indoor air pollution.

Currently, natural gas holds 6.2% share in India’s energy mix which is far below than global average of 24% (Dale, 2021).Whereas, natural gas accounts for 25% share in Gujarat’s energy mix (PNGRB, 2018).Government of India has set the vision to move towards a gas based economy by 2030 with increased in share of natural gas to 15% in energy mix. With the vision of making India a "Gas Based Economy by 2030", Government of India and Ma et al. (2018) (MoPNG) is aggressively working to develop a natural gas market with notable policy initiatives taken in last five years.

Policy Enablers to Make India A Gas Based Economy

With the vision of making India a gas based economy with 15% share in energy mix by 2030, government of India has taken following notable policy initiatives since 2014.

New Domestic Natural Gas Pricing Guidelines, 2014 and Recent development

In the efforts of making pricing of domestic natural gas rational and make the domestic gas competitive by protecting the interest of Exploration & Production players, Government of India came up with "New Domestic Natural Gas Pricing Guidelines, 2014". Under this guideline price is determined considering weighted average of major natural gas hubs in the world (Henry Hub, National Balancing Point, Russia, Canada). These guidelines had been applicable with effect from 1st November, 2014. As 2014 guideline was based on the multiple international gas hubs and due to international geopolitics in the year 2022 the domestic gas market in India has been significantly impacted owing to high prices of gas. In view of avoiding exposure to the external factors and keep the gas prices competitive to the replaceable oil products the Government of India has published a new pricing guideline on 7th April, 2023. As per these guidelines, Domestic Natural Gas Price (APM price) shall be 10% of the Indian Crude Basket Price as defined by Petroleum Planning and Analysis Cell (PPAC) from time to time. The prices will be published by PPA on monthly basis with provision of Floor & Cap to protect the interest of producer & consumer respectively Max, (2000).

Market-linked pricing for Deepwater / HPHT fields/CBM/Isolated Fields

In order to encourage investment in the deepwater fields, High Pressure High Temperature fields, CBM blocks and isolated fields government of India has given marketing freedom to entities to sale the gas at market linked pricing. This would definitely help to make the upstream projects techno-commercially viable & increase the supply of domestic natural gas.

Setting up of Gas Trading Hub/Exchange (GTHE) in India

MoPNG has given the target to set up the Gas Trading Hub/Exchange (GTHE) to sectoral regulator Petroleum and Natural Gas Regulatory Board (PNGRB) in line with BSE/NSE by SEBI. The exchange is aimed at standardizing natural gas prices to improve access of natural gas across the country. PNGRB has appointed CRISIL as a consultant to assist in framing rule for the exchange. Once, GTHE is established then natural gas can be traded and supplied through a market based mechanism instead of multiple formula driven prices. GTHE would help to develop natural gas market in country and protect the interest of consumers and entities. In the year 2020, Indian Gas Exchange (IGX) has been set-up and running successfully to facilitate the price discovery along with bringing the gas buyers & sellers on the same platform. PNGRB has also came up with the Petroleum and Natural Gas Regulatory Board (Gas Exchange) Regulations, 2020 to keep transparency into the trades happening over the exchanges (Tarun, et al. 2007).

LNG as Transport Fuel for M&HCVs/ Ships / Railways

Ministry of Road Transport & Highways have incorporated LNG as an automotive fuel in Central Motor Vehicle Rules. The Ministry of Road Transport and Highways has given nods to LNG as a fuel for road vehicles and entered into pact with Petronet LNG Limited to develop required LNG infrastructure and supply LNG to Midium & Heavy Commercial Vehicles (M&HCVs) across the country (Economic Times, 2017).

The Ministry of Shipping had signed a memorandum of understanding in April 2016 with Inland Waterways Authority of India (IWAI) and Petronet LNG Ltd. to promote the usage of LNG barges to run LNG powered vessels in National Waterway-1 (NW1). NW1 is being developed spanning 1,400 kms from Allahabad to Haldia on the river Ganga(Times of India, 2017).

The Ministry of Railways has taken significant steps through its Indian Railway Organisation for Alternate Fuels (IROAF) to replace the liquid fuelled locomotives by LNG & CNG. Indian Railways has started to use CNG as a fuel in Diesel Electric Multiple Units (DEMU) since January 2015 with the introduction of dual fuel system powered DEMU between Rewari and Rohtak. There are 17 CNG Diesel Power Cars (DPCs) which were converted to run on CNG and are in service. IROAF has issued a tender for conversion of another 30 DPCs on CNG and in the process of implementing LNG as a fuel to run 10 DEMUs in initial phase (Economic Times, 2017).

To improve Domestic Gas Productions

India is import dependent for Oil & Gas requirement of country and has set a target to reduce oil import dependence by 10% by 2022. Around 52% of India’s sedimentary basins are still unapprised and unexplored (PIB, 2017). The Ministry of Petroleum & Natural Gas (MoPNG) has taken following key policy initiatives through its technical arm "Director General of Hydrocarbon" to improve the domestic natural gas production in India.

To explore the more potential for production of oil & gas in the country, MoPNG has launched the National Data Repository (NDR) & Open Acreage Licensing Policy (OALP) under the progressive, market driven Hydrocarbon Exploration and Licensing Policy (HELP) in June 2017.

Cabinet has approved Discovered Small Field Policy (DSF) and notified on 14.10.2015. Under DSF, notable provisions are revenue sharing model, 100% FDI, single licence for Conventional & Un-conventional hydrocarbon, custom duty &Oil Cess has been waived off. DSF bid round-III is offering 32 Contract Areas which comprise of 75 discoveries. These fields are spread over 9 sedimentary basins covering more than 13,000 square kilometers with Inplace Hydrocarbon estimated to be around 230 MMT. In DSF Round – I launched in 2016, 134 bids were submitted for 34 contract areas by 47 companies. 30 Revenue Sharing Contracts were signed. In DSF Round – II launched in 2018, 145 bids were submitted for 24 contract area. 24 Revenue Sharing Contracts were signed.(Boodoo, (2010).

Infrastructure Expansion

Government of India is proactively supporting to develop a National Gas Grid in the country. Key enablers to infrastructure expansion is Capital Grant (40%) given for Transmission Pipelines to connect Eastern India under Urja Ganga gas pipeline project to connect eastern States to National Gas Grid and develop North Eastern gas grid. Urja-Ganga pipeline project would cover the length 2540-km and being laid across the states from Uttar Pradesh to Odisha.

Central, State & Regulator Support to Boost the Natural Gas Market

Petroleum & Natural Gas Regulatory Board (PNGRB) has come up with couple of industry friendly amendments in the CGD regulations. Also, PNGRB came up with safety regulations for automotive fuels including LNG in 2018 and amendments in 2022 (Hernández Moris et al. 2021).

PNGRB has come up with PNGRB (Technical Standards and Specifications including Safety Standards for Liquefied Natural Gas Facilities) Regulations, 2018 for setting up and operation of LNG terminals in the country to encourage LNG import infrastructure development in the country. It shall protect the interest of entities and customers and facilitate to improve natural gas uses.

All state government is pushing to shift to CNG in public transport under regulatory directives. There is a ban on use of Petcoke and FO in Delhi, Haryana, Uttar Pradesh and Rajasthan to reduce the air pollution in National Capital Region.

As per new domestic gas allocation policy, Domestic PNG and CNG (Transport) are given top priority and put into no cut category to supply domestic natural gas as per new domestic natural pricing guidelines 2014. This would ensure the availability and affordability of natural gas uses by households and vehicles.

Public Utility Status granted to City Gas Distribution Projects by Ministry of Labour and Employment. “Public Utility” status would enable players to expand the network with the support of local authorities with minimum regulatory hindrances. A demand to provide CGD projects public utility status was made by the Prime Minister’s Office in May 2017 and subsequently granted the status in September 2017 (Financial Express, 2017). Government of India has launched a drive "Sabhi Ghar Tak Swachh Indhan" to connect 1 Crore households to PNG by 2020.

Authors believe that, above policy enablers would help public entities and private players in developing the natural gas market in the country and enable India to become a gas based economy by 2030.

Introduction

City Gas Distribution (CGD) is last mile connectivity to the end users of natural gas in value chain and plays critical role in providing access to natural gas across the country. It is being last mile of value chain, it have significant impact on socio-economic development of the society as a whole. In India the story of CGD started in British era when in 1860s when two companies namely “Bombay Gas Company” and “Oriental Gas Company Ltd” started supply of Coal Gas as a fuel in two cities “Bombay” and “Calcutta” respectively. Evolution of CGD companies & business in India started post 1st discovery of natural gas in Assam & Gujarat during 1960. Assam Gas Company Limited started operation in 1967 and first PNG connection to a household was completed by Vadodara Municipal Corporation in 1972. Since then, the Gujarat has taken lead in CGD business by establishing GSPC in year 1979 and Gujarat Gas Company Limited in 1980s in the support of Government of Gujarat & Mafatlal Group. Then, two major CGD companies has been started with the joint venture of GAIL i.e. Mahanagar Gas Limited & Indraprastha Gas Limited to cater to Mumbai & Delhi respectively. However, 21st Century for CGD in India has started with positive development in the year 2002, when Honorable Supreme Court of India had directed to start CGD projects in 16 highly polluted cities in India. Hence, to implement the directives from Hon’ble Supreme Court many CGD companies came into existence to expand the CGD business across the country during the 1st decade of 21st century. Prior to PNGRB there were 30 geographical areas (GA) under operation for CGD by different entities, majority in the state of Gujarat, Maharashtra and Delhi. CGD is emerging as a key driver to move towards gas based economy in India which provides last mile infrastructure connectivity to the end consumers in the transport (CNG Vehicles), domestic, industrial and commercial segments. Researcher has analysed the role of CGD in India’s move towards gas based economy in this chapter.

Petroleum & Natural Gas Regulatory Board (PNGRB) Era

To boost the CGD sector and to protect the interest of consumer & CGD players, Government of India brought out the PNGRB Act in 2006 to establish the independent regulator to take care of CGD business in the country. PNGRB was constituted in 2007 under “The Petroleum and Natural Gas Regulatory Board Act, 2006” notified via Gazette Notification dated 31st March, 2006. Since then, PNGRB is carrying out bidding for authorization of GA for CGD development in India. Till 2017, PNGRB has carried out eight bidding rounds under which bids were invited for 106 GAs and 56 GAs has been successfully authorized. Also, PNGRB issued authorizations to previously operating areas. Hence, total 92 GAs had been authorized to 25 CGD players till 8th round of CGD bidding. Cumulative investment in CGD sector is around Rs 16,500 crore till fiscal year 2018 (CRISIL Report in Media). The consumer base till 2018 has been summarized in Table 1.

| Table 1 Customer Base Of Cgd In India As On December 2018 |

|||||

|---|---|---|---|---|---|

| Segment | Piped Natural Gas (PNG) | Compressed Natural Gas (CNG) | |||

| Domestic PNG | Commercial | Industrial | CNG Vehicles | CNG Stations | |

| Numbers | 4,928163 | 27364 | 8354 | 3090139 | 1500 |

| Total Gas Consumption | 25.37 | ||||

Source: PNGRB, 2019.

Regulatory Intervention to Boost CGD Development in the Country

Since end of 2017, there is a new energy in the PNGRB with appointment of full quorum on board having Chairperson Shri D. K. Sarraf with strong industry credentials in his name. With this newly appointed energetic team PNGRB is now playing significant role as a regulator in developing natural gas sector in India. PNGRB is bringing notable regulatory reforms in the natural gas infrastructure sector starting from revised CGD bidding criteria, LNG terminal policy, setting up of Natural Gas Trading Hub/Exchange etc. PNGRB has come up with aggressive plan for expansion of CGD coverage in the country and shown strong intervention through 9th & 10th CGD bid round. First time in PNGRB's history as part of the bidding process, PNGRB organized 16 road shows in major cities across India and internationally in Dubai during May-June 2018.

Amendments in CGD Regulation & Changes in Bidding Parameters attracts Serious Investors Ensuring Sustainable Development of Sector

In 2018 PNGRB has exercised its powers of amendments in regulation conferred by section 61 of the PNGRB Act, 2006 made the following amendments in the PNGB (Authorising Entities to Lay, Build, Operate or Expand City or Local Natural Gas Distribution Networks) Regulations, 2008. Key Regulatory interventions and amendments under the “PNGRB (Authorising Entities to Lay, Build, Operate or Expand City or Local Natural Gas Distribution Networks) Amendment Regulations, 2018” are as summarized below,

“CNG stations have been substituted by “natural gas stations”: This gives room to supply natural gas in LNG form to vehicles. Hence, now “natural gas station” includes a CNG Station and a filling station where one or more dispensing units are provided for sale of natural gas, in any other form such as Liquefied Natural Gas (LNG), as a fuel for vehicles’.

Extension of Marketing Exclusivity: Exclusivity has been increased from 5 years to 8 years with additional provision of extension by 2 years based on performance by authorized entity.

Performance Bank Guarantee (PBG): Additional Bid Bond (ABB) discontinued and PBG is now capped at Rs.50 Crore & linked to Population of GAs. This has rationalized the bid avoiding winning of bid by biding 1 paisa tariff and providing highest ABB amount.

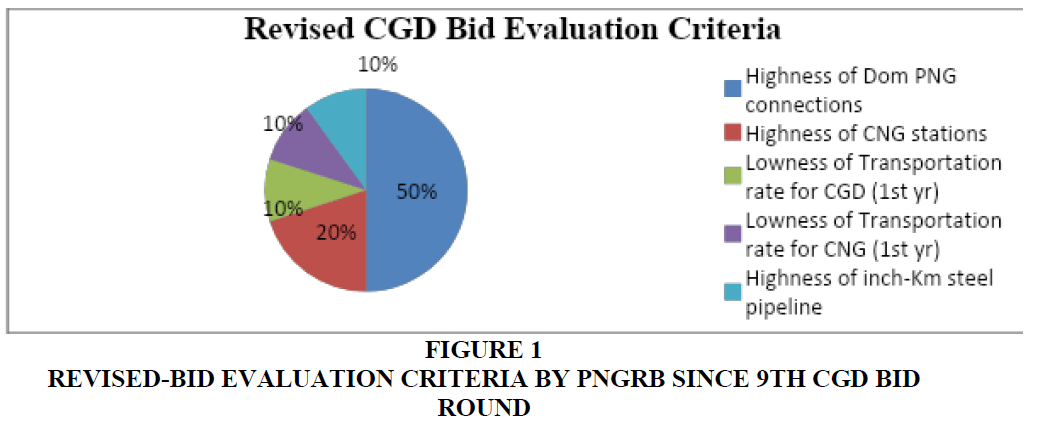

Rationalizing Bidding Parameters: Revised bid evaluation criteria has focused on end results and introduction of pre-determined penalties attracts only serious bidders and encourage competition. Floor has been fixed for Transportation Rate (Rate for first year for CGD not less than Rs 30 per MMBTU and for CNG not be less than Rs 2 per Kg). Subsequent years rates would be adjusted for inflation based on WPI. Re-wised Bid evaluation criteria is shown in Figure 1.

Policy Enablers to Boost CGD Development

Key policy enablers which promotes and boost the CGD development in the country are Government is promoting use of CNG and LNG in Public transport, ban on Petcoke and FO in Delhi, Haryana, UP and Rajasthan to reduce air pollution in National Capital Region, domestic natural gas allocation for to meet total Domestic PNG & CNG demand in CGD, CGD has been designated status of "Public Utility", State governments’ commitment for facilitation of CGD networks, Government of India’s drive to connect 1 Crore households to PNG by 2020 (Alcântara, 2021).

CGD Coverage in India

Till 9th CGD BID Round, CGD coverage in India is tabulated in Table-2. Since then, PNGRB with the support of MoPNG has aggressively done the bidding of remaining geographical areas in the country to ensure the coverage of CGD networks across the country.

| Table 2 Cgd Players, Demography & Geography Covered As On 01.04.2018 |

||||

|---|---|---|---|---|

| No. of States/UT | No. Of GA | % of Population | % Area | No of Players |

| 18 | 91 | 19% | 11% | 25 |

Source: PNGRB.

PNGRB stated in its press release dated 10th July 2018 on 9th CGD bidding round that, "Once awarded, it is envisaged that this initiative would help in creating a robust infrastructure by bringing investment of about Rs. 70,000 Crore, generate employment and play a significant role in achieving the shift towards a gas-based economy".

PNGRB has done commendable job in conducting 9th & 10th CGD bid round in 2018-19 and achieved historical track record awarding 136 GA under both the rounds. Notably, PNGRB has completed 10th round in record time of 21 days. Integrated CGD scenario after 9th & 10th bid round is tabulated in following Table 3.

| Table 3 Integrated Picture Of Cgd Sector In India After 10th Round |

|||

|---|---|---|---|

| Bid Round | No. Of GA | % of Population | % Area |

| Upto 8th | 92 | 19 | 11 |

| 9 | 86 | 26.38 | 23.82 |

| 10 | 50 | 24.23 | 17.92 |

| Total | 228 | 70.47 | 52.73 |

Source: Data compiled from PNGRB & PPAC data (2019).

After 9th & 10th bid round, CGD has reach across the country with total 228 GA are authorized to 43 CGD players covering 70% of country’s population & 53% country’s areas. PNGRB envisaged CAGR of 17.5 %in total natural gas consumption in CGD & gas consumptions is estimated to 21 MMSCMD in domestic PNG itself till 2028 (10 years after 10th round of CGD Bid) as per the work programme committed by authorized entities (PNGRB, 2019).Cumulative commitments made in 9th& 10th rounds are more than 3.6 crore PNG connections &7973CNG stations across the country. It has been estimated that, Natural gas vehicles would account for 50% of total new sales by 2030 (Poghosyan, & Hassan, (2015). It would envisaged that, this additional infrastructure development would bring investment of 70,000 crore (PNGRB, 2018) & 50,000 crore (PNGRB, 2019) in 9th& 10th bid round respectively.

Recently, PNGRB has successfully carried out 11th CGD bidding round and the cumulative summary of CGD coverage in India till 2022 is as represented in the Table 4 including the Minimum Work Programme (MWP) committed by the CGD players:

| Table 4 Cumulative Summary Of Cgd Coverage In India Till 2022 |

|||

|---|---|---|---|

| Particular | Upto 10th Round | 11th Round | Total Cumulative |

| No of GA offered | 228 | 65 | 289 |

| States/UTs | 26 | 23 | 27 |

| Districts Covered | 402 | 215 | 607 |

| Area (%) Covered | 53 % | 33% | 86% |

| Population (%) Covered | 70% | 25% | 95% |

| MWP Domestic PNG | 528 Lakh | 574 Lakh | 1,102 Lakh |

| MWP CNG Stations | 8,211 | 8,721 | 16,932 |

| MWP Steel Pipeline (inch-km) | 2.76 Lakh | 1.22 Lakh | 3.99 Lakh |

Source: PNGRB.

CGD Infrastructure & Consumer base

The current actual integrated picture of CGD infrastructure networks and customer based is as summarized below in the Table 5.

| Table 5 Current Integrated Picture Of Cgd Infrastructure Networks And Customer Base |

|

|---|---|

| Particulars | Numbers/Units |

| CGD Pipeline-Steel | 1.15 Lakh inch-km |

| CGD Pipeline-MDPE | 2.18 Lakh inch-km |

| CNG Stations | 3,771 |

| Domestic PNG Consumers | 87 Lakh |

| Commercial PNG Consumers | 34,137 |

| Industrial PNG Consumers | 13,034 |

Source: PNGRB.

Once the CGD players who have got new GA in subsequent rounds will progress on their MWP then India will see the significant growth in the sector in terms of infrastructure and consumer base.

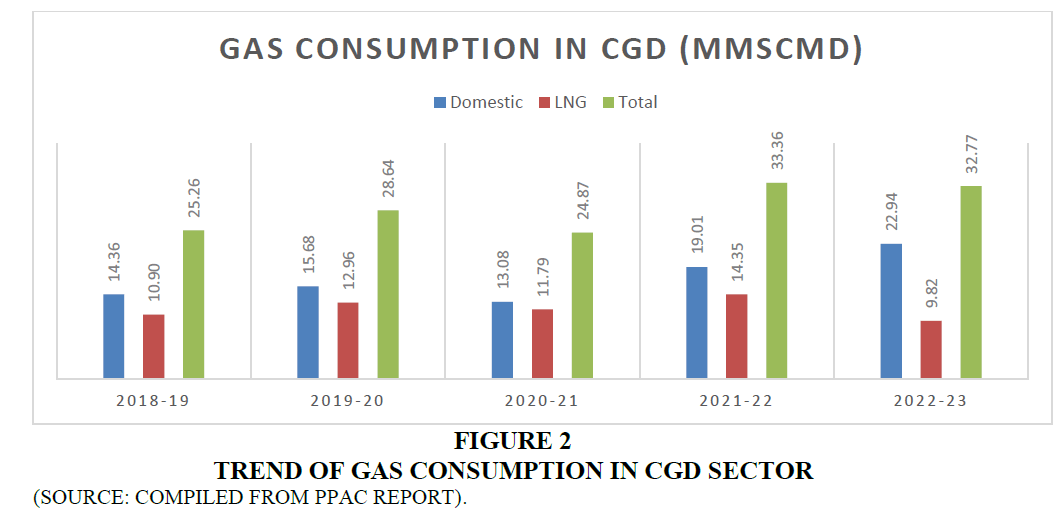

Total Gas Consumption in CGD

Total gas consumptions in CGD sector have been increasing at fast space as CGD is emerging as an important driver in India’s gas-based economy. During last five years, average gas consumption in CGD sector has been increased from 25.26 MMSCMD to 32.77 MMSCM (PPPAC). Further, it has been seen that, CGD being price sensitive market, it has consumed more domestic natural gas vis-à-vis imported LNG and this is also supported by revised gas allocation policy of Government of India where domestic gas has been allocated for Domestic PNG & CNG consumption under no cut category. Government is proactive in supplying PNG & CNG to the citizen across country & has taken strong steps through CGD bidding. During las two year the domestic gas consumption has been significantly increased in CGD due to high LNG price due to unstable international market along with growth in CNG/PNG consumers in the country. The trend of gas consumption in CGD sector is as represented in the Figure 2.

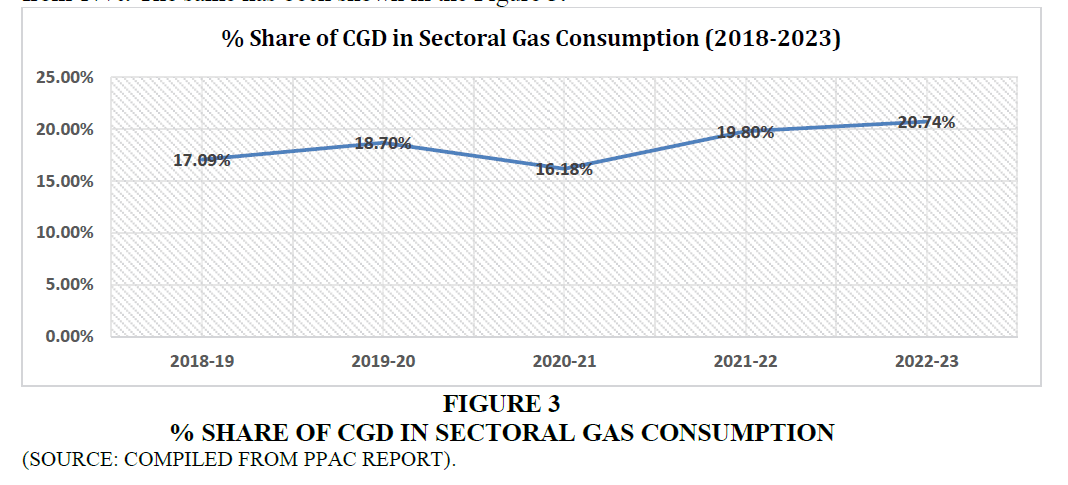

If we see the trend for % share of CGD in the sectoral consumption of the country then it has been increasing historically and during last five year it has been reached to 21% from 17%. The same has been shown in the Figure 3.

CGD being citizen centric, has significant impact on environment and public health by reducing vehicle pollution and indoor air pollution. Hence increasing share of natural gas consumption by CGD sector has greater significant for moving towards gas based economy. Gujarat is leading the CGD development in India due to availability of State Gas Grid, LNG Terminals and other associated natural gas infrastructure. Now entire state (all districts) has been authorized for CGD development.

Gas Consumption Growth Potential in the CGD

Beyond all above policy enablers across all natural gas consuming sectors, City Gas Distribution (CGD) is emerging as an important driver to move towards gas based economy by replacing polluting liquid fuels in Transport & Industries and LPG in domestic & commercial segment.

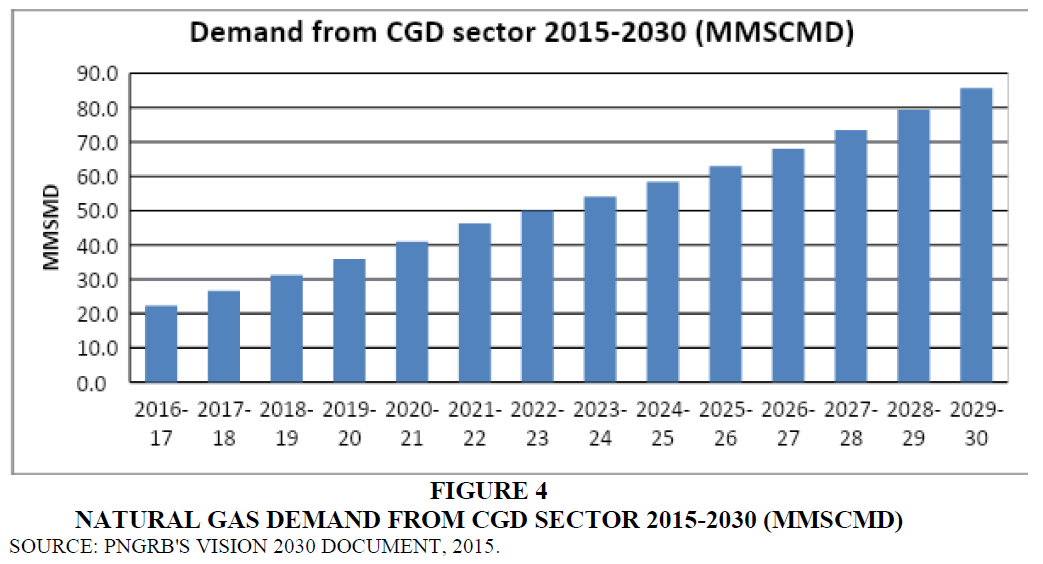

CGD sector has strong growth potential as estimated in "PNGRB's Vision 2030" document. The future demand projections (PNGRB, 2013) as per "PNGRB's Vision 2030" are shown in following Figure 4.

Natural gas demand in CGD sector is going to grow at average annual growth of 10.3% over a period of 2018 to 2030. Also based on Government of India’s Hydrocarbon Vision-2025, City Gas has a huge upside potential to increase the share of natural gas in energy mix of country. Hence, researcher believes that, current space of development in CGD sector would certainly play a significant role in India's gas based economy by 2030.

Primary Data Collection & Analysis

Authors has collected the primary data through expert interviews of 20 industry experts having average experience of above 27 years. The primary question asked was “What is the role of CGD in the coming decades in the India’s gas based economy vision, and what are the current challenges being faced by CGD entities?”. The interviews has been recorded and transcribed for the analysis.

Content Analysis

It has been understood that, CGD is one of the fastest growing among various sectors where gas is being consumed and it has a great & quite promising future going forward. Because this segment is for connecting to the end user and population of country in the form of PNG in Kitchens and CNG in the vehicles. In India we have 130 Cr population and if we connect these consumers to the natural gas supply, it is having huge potential. Also, one of the advantages of CGD is that, it has huge margin and potential to make a money as consumers are not price sensitive segment subject to flexibilities provided. Like once you replaced the LPG cylinder and used to PNG gas then consumer is not going to stop using even though they have to pay more over a period of times, similarly in vehicle segment once the petrol or diesel vehicle is converted to CNG they are going to run by using the gas. It is also helping government to save on the subsidy budget which is going into the domestic LPG.

CGD is definitely take major portion of gas consumption because if you look at global scenario where we see the share of natural gas is 25% or more then there is a major contribution is households or city gas distribution basically. Whether you look US or Europe or Japan 25-30% of the consumption is in the residential sector itself, but in India obviously residential will not have much demand due to the climatic condition and not required for heating but yes cumulatively all segment of CGD would contribute in a big way.

If we see the Indian scenario for last few decades, the demand for gas has been growing primarily because of increase in consumption from the CGD and the small industries which are growing and that demand from this segment is sustainable one.

In a way, CGD is going to be the primary driver of turning India into gas-based economy, because once the consumer is shifted from liquid fuels to gas like PNG, CNG then they will continue to use due to convenience & safety. Such kind of consumer centric gas demand will provide stability to the overall gas demand and as a country, if you add up all the GA then it's going to be huge which will ultimately help to increase the share of natural gas in energy mix. Also, the demand from the CGD is very much robust and sustainable once build-up over a period of time because this segment is not so price sensitive as consumers become used to the fuel and develop a habit to use the same irrespective of the prices.

It has been very sensible move by PNGRB & Government to award the majority of GA under the recent 9th & 10th bidding round. Even if we take some tentative numbers CGD has a potential to consume an additional 60 MMSCMD of gas in the next eight years, based on the commitments which the players have given in the ninth and 10th rounds itself. So, this is what is going to sustain and this is what will help meet partly the objective of increasing the share of natural gas in the overall gas economy.

If you see current scenario, more than 228 geographical areas (GA) has been authorized under CGD bidding rounds by PNGRB till the 11th CGD round and there is huge push from government on different initiatives for penetrating CGD across the country with huge investment committed by CGD players. Major geographical area and population has been covered under these authorized GA and it has huge demand potential in the future. Currently around 17-20% of total natural gas consumed in the country is being utilized by CGD sector itself and going further its share is going to grow many folds once the infrastructure is created as per the authorizations given by PNGRB. Once the natural gas is made accessible to the industrial sector, ultimately the major volumes will come from industries and CNG and while increasing the share of natural gas from 6.2% to 15% in primary energy mix, significant share will be coming from this CGD segment.

In this segment the end consumer is the key driver because CGD is providing alternate fuel to LPG, Petrol & Diesel, so customer have to decide on the choice based on the various factors like convenience, price and safety. Hence, the educating customer about the benefit of natural gas is the key because today investors and CGD companies are spending huge money on creating pan-India gas infrastructure. Also, all stakeholders need to ensure that once distribution infrastructure is build, it should not be under-utilized because once you lay the network and they are under-utilized, you cannot take the network out. The government also needs to be clear about in what direction they want LPG and PNG because both can coexist but with your policies you cannot make them compete. If you make them compete, one of them will become in-efficient, you decide the peaking order based on that you drive all your policies in that direction. Similar thing happens in CNG, customer have options of Petrol & Diesel and want to convert to CNG but same time customer is being bombarded with electric vehicles (EVs) saying that all hydrocarbon vehicles will be dis-appeared by 2030. So customer is confused and it is difficult for them to take a call on fuel choices and he is thinking what happens to my investment in the vehicle. As EV’s infrastructure development takes long time and currently CGD ecosystem is in place, hence we need to give big push to CNG in transport otherwise infrastructures are going to be under-utilized. EVs could be coexist along with alternate fuels like CNG but there have to be balance between these two.

There are many other challenges one of the challenges that we don't have state highways, or the state grids, CGD licenses have been awarded without ensuring that the pipelines are in place. So lot of these CGDs will struggle because they don't have pipelines connectivity to their city gate. If consider LNG by truck kind of solutions but those solutions cannot take you to a very high level of consumption, they are good for seeding the market. So one of the challenges in the many states where PNGRB has awarded the CGD licenses, but the pipelines are 100 to 200 kilometre far from those city gates. Therefore, that is something which will have to be addressed because if you want to grow a CGD in a single area which consume half a million to a million cubic metre gas per day basis (0.5 to 1 MMSCMD), it will be impossible to manage that by LNG trucks.

The second thing is that currently government policies are very favorable. The APM gas allocation which is being given to CGD is something which is attracting a lot of investment in the sector and the returns are very high. And this is a very good conscious strategy of government to get investment in the sector where they've created enough incentive for investment. If this will be continued then we will really see the fruits of these efforts being born. So if we have these CGDs really get into development mode and be to a level which is significant infrastructure development in those areas, even if it is because government has given them a APM gas and which allows them to make reasonable money. I think that is something which will be a landmark thing in Indian history of natural gas and particular in CGD evolution. So, going further in coming decades the CGD will continue to show very, very significant growth and it is on the right track.

One challenge here is that to meet Minimum Work Programme (MWP) by CGD entities. It has been seen that during the latest CGD rounds many of the entities are aggressively bided just to win the GAs and they have committed the unrealistic MWP. So, there is a some regulatory penalty or something is to be there on the entities which are going to miss the MWP target. So, researcher has analysed from expert’s views “how these challenges will be addressed by these entities and how the PNGRB is going to deal with this challenge”.

In the recent CGD bidding rounds 50% weightage was on number of households connection and everybody bided very high numbers in households that commitments are difficult to meet. As per inch-km pipeline may be delayed and CNG stations maybe doable once the CGD entities get the supply of gas to expand into the GA. However, not meeting MWP is not the issue of individual CGD entity but the issue of industry as a whole considering number committed and the challenges to execute the CGD infrastructure.

The challenge of meeting MWP was there in previous rounds also but till date PNGRB has not levied any regulatory penalties to CGD companies but yes current CGD rounds has huge challenge to meet MWP considering their aggressive commitments. If PNGRB is indicating to come up with penalties for missing MWP then all the CGD companies will put their extra efforts to minimize the same. COVID situation during these last two years 2020-2021 may help CGD entities to build an argument for not meeting initial MWP but yes beyond that they have to face the regulatory challenge subject to PNGRB’s decision.

Probably government don't want to penalized the entities now for their MWP targets because government first want to see how the sector develops. Once the sector is developed, then there may be support from government for finding a solution to MWP penalties because at the end government wants sector to develop and if there's some support as required in the form of allowing them some concessions in MWP then government is most probably will do that Shakibi, et al. (2023).

As per as the current CDG bidding model is concerned, it had flaws and same were advised by everyone to correct it but unfortunately, PNGRB has not addressed that issue. Like, for meeting the number of domestic PNG connection CGD companies can lay the network upto customer’s premises but can’t force customer to switch over to PNG as it is ultimately his choice and this has not been factored into bidding process. For number of CNG stations, yes CGD companies have to meet it otherwise they will be penalized for not creating an infrastructure because it is entities performance deciding parameter as per bidding.

If during bidding for the GA, CGD entities have believed and decided that so many PNG connections, so much inch-kilometre of pipeline, so many CNG stations, then one must make an honest effort to actually deliver on that, then only this infrastructure will really get created else they will be penalized and it will directly delay to increase the share of natural gas in energy basket.

Also, the structure and function of PNGRB again goes back to the issue of conflicting role of PNGRB because if the licensing was to be done by government, then Government could have always asked for a license fee and if it was a bidding based on license fee, the speculation which has happened or the specially the bids which have come in CGD bidding rounds would have been curb, but that could not be done. So, currently the bidding which has happened is very much speculative, the numbers are very aggressive and there is always a possibility of few penalties being levied on these companies. Not only the regulatory penalties but also in some cases, they will be really big issues, financial issues coming out of that it may lead to problems of NPA like in some other sectors. So, there are inherent risk for the players who do not have very strong balance sheet and who have put very, very aggressive bids. But ultimately it will lead to consolidation and the number of players will reduce from what it has been right now. The licences will end up in the hands of larger and most stronger players. Penalties, as the contracts state, will have to be levied but there are always legal recourse for the entities. And some of these bidders might have assumed that they would be able to find a legal way to manage that risk, but it's a big risk. If it really place the risk then it will lead to a lot of these concessions failing the licensees may not be able to really perform and some amount of NPA will be generated and eventually it will lead to a faster consolidation than what it would have been otherwise.

Finally, the main concern for all these CGD to come in action is that connectivity of pipeline to reach gas to city gate station of these entities. We cannot develop so many city gas distribution networks without expanding the natural gas pipeline across the country or to find some sustainable solution to make the gas available to the CGDs. One alternate solution which can be developed is transporting LNG through railways in the form of ISO containers because India has got a very well-developed network of railways which reaches practically all the villages or very close to villages. As we know, the initial consumption of gas in all these new CGD areas will not be much and if you can start supplying LNG by ISO containers to railways, then it will definitely help in expanding your reach of natural gas to every corner of the country. Here, we don't have to set up pipeline and you will have railway wagons coming in every day or whenever we need them. Wagons will drop the LNG containers wherever it's required and that becomes a storage point and from there we can supply the gas to small local distribution network.

Conclusion

India aims to move towards gas based economy by increasing share of natural gas to 15% from current 6.2% in energy mix of the country by 2030. Government, policy makers, regulator, industry players are playing their vital role to achieve this goal by promoting use of natural gas across all sectors with greater focus on CGD market development in India. CGD currently contributes around 21 % of total natural gas consumption in India and leading the way with highest CAGR amongst all sectors in coming decade. As CGD is a part of public utility, it has significant role in improving public life at large with the help of next-generation, cheaper and environment friendly natural gas. CGD development across the country would enable transportation sector to shift from polluting liquid fuels to CNG & LNG and help to reduce emissions & cost. Hence, once roll-out of infrastructure development happens in the all authorized geographical areas in the country, CGD is definitely would help India to improve air quality of cities and reduce the government subsidies by replacing domestic LPG in urban and rural area. Last but not the least, once considerable amount of liquid fuel is replaced with natural gas by the CGD from the Industry, Transport, Commercial & Domestic segment then it will significantly help to increase the share of natural gas in primary energy mix of India by 2030.

References

AirVisual, I. (2018). World Air Quality Report: Region & City PM 2.5 Ranking.IQAir AirVisual.

Alcântara, S. C. S., Ochoa, A. A. V., Da Costa, J. A. P., Michima, P. S. A., & Silva, H. C. N. (2019). Natural gas based trigeneration system proposal to an ice cream factory: An energetic and economic assessment.Energy Conversion and Management,197, 111860.

Indexed at, Google Scholar, Cross Ref

Boodoo, C. (2010). Development and Sustainability of a Small Gas Based Economy. InSPE Europec featured at EAGE Conference and Exhibition?(pp. SPE-131596). SPE.

Dale, S. (2021). BP statistical review of world energy. BP Plc: London, UK, 14-16.

Economic Times (2017). Retrieved from https://energy.economictimes.indiatimes.com/news/renewable/railways-speeds-up-plans-to-shift-towards-gas-fuelled-locomotives/58710577

Hernández Moris, C., Cerda Guevara, M. T., Salmon, A., & Lorca, A. (2021). Comparison between concentrated solar power and gas-based generation in terms of economic and flexibility-related aspects in Chile.Energies,14(4), 1063.

Indexed at, Google Scholar, Cross Ref

Ma, J., Li, Q., Kühn, M., & Nakaten, N. (2018). Power-to-gas based subsurface energy storage: A review.Renewable and Sustainable Energy Reviews,97, 478-496.

Indexed at, Google Scholar, Cross Ref

Max, M. D. (2000). Hydrate resource, methane fuel, and a gas-based economy?. InNatural Gas Hydrate: In Oceanic and Permafrost Environments(pp. 361-370). Dordrecht: Springer Netherlands.

Poghosyan, V., & Hassan, M. I. (2015). Techno-economic assessment of substituting natural gas based heater with thermal energy storage system in parabolic trough concentrated solar power plant.Renewable Energy,75, 152-164.

Indexed at, Google Scholar, Cross Ref

Shakibi, H., Shokri, A., Assareh, E., Yari, M., & Lee, M. (2023). Using machine learning approaches to model and optimize a combined solar/natural gas-based power and freshwater cogeneration system.Applied Energy,333, 120607.

Indexed at, Google Scholar, Cross Ref

Tarun, C. B., Croiset, E., Douglas, P. L., Gupta, M., & Chowdhury, M. H. (2007). Techno-economic study of CO2 capture from natural gas based hydrogen plants.International Journal of Greenhouse Gas Control,1(1), 55-61.

Indexed at, Google Scholar, Cross Ref

Received: 09-Jun-2023, Manuscript No. AMSJ-23-13680; Editor assigned: 12-Jun-2023, PreQC No. AMSJ-23-13680(PQ); Reviewed: 26-Sep-2023, QC No. AMSJ-23-13680; Revised: 02-Oct-2023, Manuscript No. AMSJ-23-13680(R); Published: 04-Nov-2023