Commentatory: 2024 Vol: 23 Issue: 5

Central Bank Digital Currency: A note on Global Experience & Exposure

Anil Kumar Pandey, Saveetha College of Liberal Arts & Sciences (SIMATS), Chennai, India

Citation Information: Pandey, A. K. (2024). Central Bank Digital Currency: A Note On Global Experience & Exposure. Journal of International Business Research, 23(5), 1-8.

Keywords

Digital currency, Money, Central Bank Digital Currency (CBDC), Digital finance, Cryptocurrency, Financial inclusion, CBDC design, Blockchain, Distributed ledger technology.

JEL Classifications

G21, G28

The financial sector is experiencing a major shift as digital transactions become increasingly popular. Our traditional money has undergone in significant transformation from cowries and shells, to coins and paper money, and now, to digital representations of currencies. While physical cash has been the foundation of economic activity for generations, its limits become more obvious in today's fast-moving, digital environment (Bordo, 2021). Carrying cash can be inconvenient, security concerns are constant throughout, and international transactions are sometimes delayed and costly.

In 2020, the COVID-19 virus spread all over the world and caused a lot of damage. Recently, during the virtual meeting of the G20 summit, leaders from many countries and global organizations agreed that we are now in a post-pandemic era where we need to learn to live with viruses for a long time. The IMF (2020) named this worldwide crisis 'the Great Lockdown'. This pandemic has changed things globally; it has heavily impacted all aspects of life—politics, economies, and livelihoods (IMF, 2020). Countries with well- developed digital economies seemed to handle this pandemic situation better and bounced back quickly from each wave of infections. The pandemic has threatened people with physical contact, and in that case, they need an alternative way to conduct transactions, which is contactless. During the pandemic, the world is witnessing a cashless revolution. The situation of the pandemic attracted the attention of the central bank towards exploring Central Bank Digital Currency (CBDC).

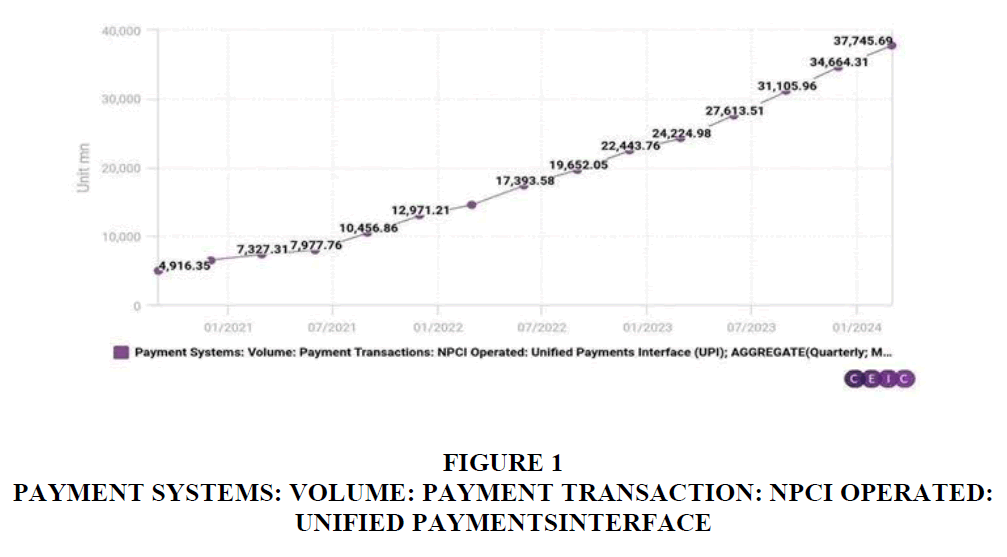

If we take the case of India, from the time of the pandemic people are drastically shifting to online transactions. The Economic Survey 2023 states that in FY22, UPI made up 52% of all digital transactions in India (Figure 1).

According to the CEIC database, in Jan 2024, the transaction of RS. 37,745.69 million has beendone through UPI.

The emergence and quick development of cryptocurrencies present opportunities as well as difficulties for the financial system's and payment system's daily operations. The multiple digital currencies, which include Bitcoin (BTC), Ethereum, Tether, and Facebook's Libra (now called Diem), have significant impacts on and implications for the financial system.

All of these are pushing central banks to research revolutionary methods of payment and currency issuance techniques, particularly about CBDC. Globally, a large number of central banks are investigating whether or not to implement CBDCs. A trustworthy and inexpensive value exchange method is required globally as the usage of cash and checks is decreasing. There has been speculation that CBDC will guarantee progress and efficiency in the payments system in the absence of strong enforcement authority. Some countries have made remarkable breakthroughs. Economies, including China and Sweden, as well as major emerging markets and developing economies (EMDEs) have started testing digital versions of their national currencies (Kumhof & Noone, 2018). The Bahamas introduced the "Sand Dollar," a digital currency issued by the central bank, for retail use in October 2020, making it the first nation in the world to do so. A digital version of the Eastern Caribbean Dollar based on blockchain technology, called DCash, was introduced by the Eastern Caribbean Currency Union in April of this year, making it the first currency union central bank to do so.

Objective

In this paper, we analyze the possibility of introducing a CBDC. We begin by examining howto conceive about CBDCs, specifically the various definitions and possible institutional frameworks. The next subsection focuses on the current global land space of CBDCs'.

Finally, we examine the advantages and drawbacks of implementing CBDCs and conclude.

What are CBDCs?

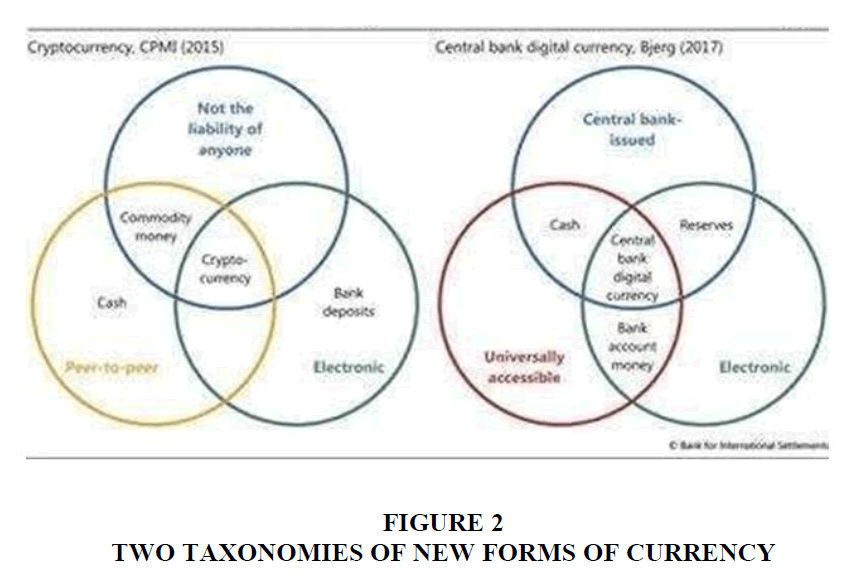

A central bank digital currency (CBDC) is a digitalized form of currency that can be used in a similar way as the bills and coins currently being used. CBDCs might sound like a cryptocurrency and yes, they do share some characteristics as they both are digital forms of money but they are created and controlled in very different ways. In simple terms, CBDCs are digital representations of a country's present physical currency that are issued and controlledby the central bank, much like actual cash. Since CBDCs are usually based on the face value of the traditional currency, this provides stability. Cryptocurrencies, on the other hand, are decentralized and used to conduct secure transactions and use distributed database technologies, such as blockchain, to record them (Lee, et al., 2021). Due to their decentralized nature, they can see huge price fluctuations, but Central Bank Digital Currencies (CBDCs), which are supported by the government, provide better protection against severe fluctuations, and probable cyber threats. In simple words, CBDCs function more like digital currency issued by a reliable authority, whereas cryptocurrencies are similar to tradable alternative assets on a public market without any regulatory oversight (Figure 2).

Because of the various stages of financial development as well as the various goals and requirements of nations, there are currently multiple definitions from a variety of different points of view. Common definitions of CBDC based on publications or reports of a few well- known organizations or institutions are presented in (Table 1).

| Table 1 Definitions of Central Bank Digital Currency (CBDC) by Various Institutions | ||

| Author | Year | Definitions |

| Copenhagen Business School (Bjerg 2017) | 2017 | Universally accepted electronic money which is issued by the central bank |

| The Bank for International Settlements (BIS) (CPMI-MC) |

2018 | CBDC is a digital form of central bank money that is different from balances in traditional reserve or settlement accounts. |

| Bank of England (Kumhof and Noone 2018; Meaning et al. 2018) | 2018 | A Central Bank Digital Currency (CBDC) would be an electronic form of central bank money that could be used by households and businesses to make payments |

| IMF (Kiff et al. 2020) | 2020 | A digital representation of a sovereign currency issued by and as a liability of a jurisdiction’s centralbank or the monetary authority. |

Around the world, the central banks of various countries are exploring different designs of CBDC based on various factors such as privacy, accessibility, and distribution methods. Based on the access mechanism, there are mainly two common designs of CBDCs: token-based and account-based. Both have different technical approaches or infrastructures and also have different levels of privacy and accessibility.

Token-based CBDCs

Token-based CBDCs operate by using digital tokens for settlement through centralized or decentralized mechanisms for transactions between digital wallets. For access and claim token- based CBDCs, users require knowledge of the token (a public-private key pair). This approach has a significant level of anonymity. To validate payment transactions and confirm the ownership chain of each token, token transfers depend on the sender's capacity to confirm the legitimacy of the payment object (Kiff, et al., 2020). For this reason, some sort of distributed ledger technology is needed. Moreover, there is a greater chance for end users to misplace tokens or keys kept in noncustodial wallets.

For now-your-customer (KYC) and anti-money laundering/combating the funding of terrorism (AML/CFT) compliance, commercial banks would have to be the first line of defense in a token-based strategy. While this approach can make CBDCs accessible to anyone, compared to other designs, it also makes law enforcement more difficult.

Account-based CBDCs

For accessing and claiming account-based CBDCs, users need a bank account that is tied to the identity of the account holder in the central bank or a commercial bank. Account- based CBDCs work as physical cash or traditional cash. To execute each payment or transfer fund, banks debit the sender's CBDC account and credit the beneficiary's CBDC account. Because user identities must be used to verify transactions, strong identity management systems are necessary to maintain each individual's unique identity across payment systems.

To use an account-based strategy, the central bank is in charge of adhering to KYC and AML/CFT regulations. In an account-based system, the verification of transfers is based upon the implementation of suitable measures to prevent fraudulent activities, identity theft, and unauthorized withdrawals from valid accounts. Now based on target user, CBDCs have two broad types i.e.

Retail CBDC and Wholesale CBDC

A Retail CBDC is designed for everyday transactions by general people whereas a Wholesale CBDC is used by banks and other financial institutions for interbank settlement and large-value transactions.

Current Global Landspace of CBDCs

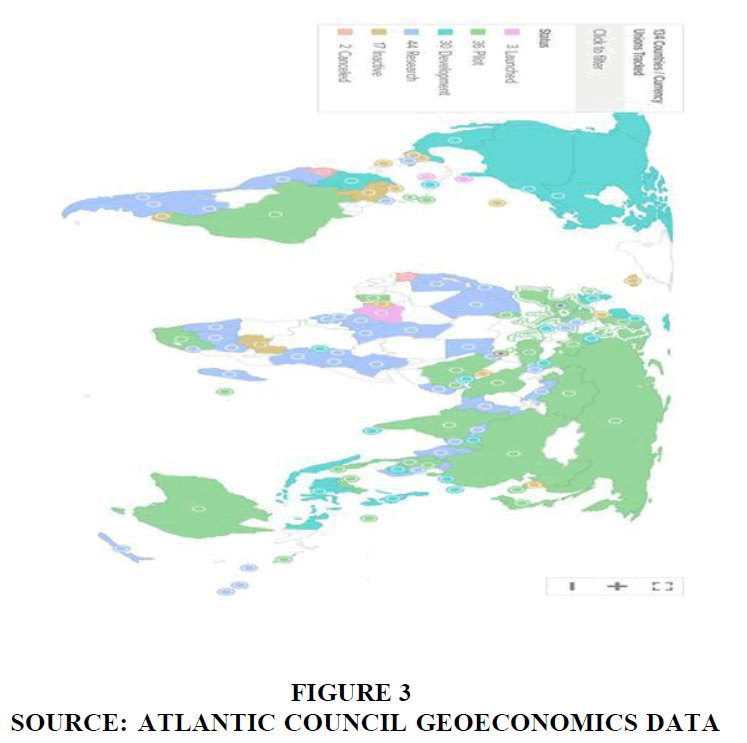

According to Atlantic Council Geoeconomics Center data, till March 2024, around the world 134 countries are exploring CBDCs. Of these 36 countries are doing pilot projects, 30 countries have development status of CBDCs, 44 countries are still researching CBDCs and 3 countries are already CBDCs in the country.

Some key Findings:

• 134 currency unions and countries, approximately 98% of the world's GDP, are investigating a CBDC. They were just 35 in May 2020. At the moment, 68 nations are engaged in advanced exploration, which includes development, piloting, or launch.

In a token-based strategy. While this approach can make CBDCs accessible to anyone, compared to other designs, it also makes law enforcement more difficult.

Account-based CBDCs

For accessing and claiming account-based CBDCs, users need a bank account that is tied to the identity of the account holder in the central bank or a commercial bank. Account- based CBDCs work as physical cash or traditional cash. To execute each payment or transfer fund, banks debit the sender's CBDC account and credit the beneficiary's CBDC account. Because user identities must be used to verify transactions, strong identity management systems are necessary to maintain each individual's unique identity across payment systems.

To use an account-based strategy, the central bank is in charge of adhering to KYC and AML/CFT regulations. In an account-based system, the verification of transfers is based upon the implementation of suitable measures to prevent fraudulent activities, identity theft, and unauthorized withdrawals from valid accounts.

Now based on target user, CBDCs have two broad types i.e.

Retail CBDC and Wholesale CBDC

A Retail CBDC is designed for everyday transactions by general people whereas a Wholesale CBDC is used by banks and other financial institutions for interbank settlement and large-value transactions.

Current Global Landspace of CBDCs

According to Atlantic Council Geoeconomics Center data, till March 2024, around the world 134 countries are exploring CBDCs. Of these 36 countries are doing pilot projects, 30 countries have development status of CBDCs, 44 countries are still researching CBDCs and 3 countries are already CBDCs in the country.

Some key Findings:

• 134 currency unions and countries, approximately 98% of the world's GDP, are investigating a CBDC. They were just 35 in May 2020. At the moment, 68 nations are engaged in advanced exploration, which includes

• As of now,19 of the Group of 20 (G20) nations have advanced in their CBDC development. Eleven of those nations have already completed the experimental program. Turkey, Russia, South Korea, South Africa, Australia, Japan, and India are included in this.

• Three nations, Nigeria, Jamaica, and the Bahamas, have fully implemented CBDCs. Due to technological difficulties, the Eastern Caribbean Currency Union, which consists of eight nations, discontinued offering DCash and is now working on a new pilot.

• 36 CBDC pilots are currently in operation, a record high that includes the digital euro. Currently in the preparatory stage, the European Central Bank (ECB) is carrying out real-world trials and settling some transactions in a regulated setting. After two years of preparation, the digital euro is set to launch in 2025.

• The US has reached a dead end with retail CBDC development. The gap between the US and G7 banks—which includes the Bank of England and the Bank of Japan— is growing.

• CBDCs are intermediated, or delivered through banks, financial institutions, and payment service providers, in any nation with an advanced retail CBDC scheme.A direct CBDC is another alternative available in China, and it may be accessed via a central bank application.

• The original members of BRICS—Brazil, Russia, India, China, and South Africa—are currently in the pilot stage of CBDC investigation. Saudi Arabia, Iran, and the United Arab Emirates are among the new members that are investigating cross- border wholesale CBDCs. The development of an alternative payment system to the dollar has been vigorously supported by BRICS since last year.

• Wholesale CBDC developments have increased since Russia's invasion of Ukraine d the G7 sanctions response that followed. There are presently thirteen cross-border wholesale an CBDC projects. One of them, called mBridge, connects China, Thailand, the United Arab Emirates, and Hong Kong. This year, it will extend to eleven more countries as part of a new phase.

• China's digital yuan (e-CNY) hits 260 million wallets across 25 cities, making itthe largest CBDC experiment globally. It has been utilized since 2022 in a variety of contexts, including purchasing crude oil and transportation. The pilot's 2024 goal are to maximize foreign visitor utilization and increase e-CNY's cross-borderapplications (Figure 3).

The purpose of CBDC: Advantages

Adopting CBDC has several benefits, including boosting transaction security and efficiency,promoting financial integration, and lowering the cost of cross-border payments.

CBDCs have various advantages

• CBDCs boost financial inclusion

Financial inclusion may be enhanced by allowing digital wallets to be accessible by mobile phones or other digital devices, through which electronically issued legal cashis directly credited into the user's account. For people and businesses, specifically those who live in underserved or distant locations, this could make it easier for them to obtain financial services as long as they have access to a mobile phone and are connected to the internet. This could facilitate citizens' access to financial services and economic participation.

Before 2021, in Nigeria, almost one-third of the population did not have a bank account.So to improve financial inclusion in 2021, Nigeria will launch sCBDC, i.e., eNaire.

According to master card analysis based on figures from the World Bank global Findex database, due to direct mobile applications, CBDCs have the potential to transform financial inclusion. They could provide advantages to the over 600 million individuals globally who possess a mobile device but lack a bank account.

• CBDCs can counter criminal activity

Another benefit that CBDC may bring about is a decrease in crime, particularly financial fraud. Because all transactions would be traceable and so subject to higher AML and KYC standards than current currency, financial fraud might be significantly decreased if it were mandated that digital wallets be linked to an individual's national identification, allowing for easy identity verification. Also, real money, particularly notes, is subject to fraud. Since it is digital and issued directly by the central CBDC, it is unaffected by traditional counterfeiting techniques.

• The Bank for International Settlements (BIS) believes that CBDCs could not only cut thecosts of cross-border transactions by eliminating the need for money transfer providers but it could also reduce the time taken for such transactions. International payments can take up anywhere from one to five days to two days, whereas CBDCs allow for instantdigital payments at any time of day.

• Improved data privacy: Under a conventional method of payment, a bank can extract a lot of details about the transaction such as its amount, partes involved in that transaction,and from where it’s been made, etc. When gathered at a large scale, this information becomes extremely valuable and at times sold on to interested parties without the user profiting the sales of his or her data. Nobody can keep an eye on how this sold data will be further used, it culd be used to track one’s expenses or it could be used to track one’s location as well. This also comes with the possibility that transactors’ account details might get exposed which bring plethora of other phishing risks and scams. CBDC wouldput an end to this rent generation as central banks would not engage in such data gathering and sales thereof. The end-user would no longer have to give away valuable information to private entities for free and run the risk that they are traded on.

Disadvantages of CBDCs

Financial Stability

If CBDCs are widely used, it would make it harder for banks to sustain their traditional business models. If the general public can access CBDCs easily, it could reduce bank deposits, and reduce banks’ lending capacity and financial stability. In extreme cases, an increase in CBDC withdrawal during times of economic hardship could trigger bankruns and financial instability.

Technological Challenges

Many CBDC designs are based on new technologies such as blockchain. These technologies offer a lot of potential, but they are still in their early stages of development. As a result, there is a risk of technical issues, scalability problems, and differences in standards between different systems. All of these teething issues can hurt the operations of CBDC and raise security issues. Therefore, it is important to carefully considerand continuously invest in technological improvements.

Legal uncertainties

As a new financial instrument, the legal and regulatory landscape for CBDCs may not be fully defined. As a result, a regulatory grey area exists. This creates challenges for policymakers and regulators when it comes to regulating and supervising the issuance, use, and circulation of CBDCs. The absence of a clear legal framework could lead to loopholes in the management of CBDCs, which could increase risks and impede innovation (Priyadarshini & Kar, 2021).

Conclusion

Imagine a digital dollar or euro! That's basically what Central Bank Digital Currencies, or CBDCs, are. They're being talked about a lot these days and for good reason. They could change the way money works around the world. This whole report dives into what CBDCs are, how different countries are approaching them, and the good and bad that could come with them. We're talking easier online payments, maybe even helping people who don't have bank accounts to get in the game. But there are also things to watch out for, like banks maybe needing to adjust and keep our digital money safe from cyber threats. The thing is, a lot of countries are already looking into CBDCs. This could change the way money moves across borders, how central banks operate, and even the very idea of money itself! It's still early days, but if we would be able to work together and figure out the technical and legal stuff, CBDCs could prove to be a positive for everyone which entails a smooth, safe, and more inclusive financial system on a global scale.

References

Bordo, M. D. (2021). Central bank digital currency in historical perspective: Another crossroad in monetary history (No. w29171). NBER.

Indexed at, Google Scholar, Cross Ref

IMF. 2020. World Economic Outlook, April 2020. Great Lockdown: International MonetaryFund (IMF). Kiff, J., J. Alwazir, S. Davidovic, A. Farias, A. Khan, T. Khiaonarong.

Kiff, M. J., Alwazir, J., Davidovic, S., Farias, A., Khan, M. A., Khiaonarong, M. T., & Zhou, P. (2020). A survey of research on retail central bank digital currency.

Indexed at, Google Scholar, Cross Ref

Kumhof, M., & Noone, C. (2018). Central bank digital currencies-design principles and balance sheet implications.

Indexed at, Google Scholar, Cross Ref

Lee, D. K. C., Yan, L., & Wang, Y. (2021). A global perspective on central bank digital currency. China Economic Journal, 14(1), 52-66.

Indexed at, Google Scholar, Cross Ref

Priyadarshini, D., & Kar, S. (2021). Central bank digital currency (CBDC): critical issues and the Indian perspective. Institute of Economic Growth Working Paper, 444.

Received: 03-Sept-2024, Manuscript No. jibr-24-15201; Editor assigned: 04-Sept-2024, Pre QC No. jibr-24-15201(PQ); Reviewed: 18-Sept-2024, QC No. jibr-24-15201; Revised: 23-Sept-2024, Manuscript No. jibr-24-15201(R); Published: 30-Sept-2024