Case Reports: 2020 Vol: 26 Issue: 1

C_Com, Cubacel and Etecsa: Developing The Gsm Mobile Phone Network In Cuba

Luis Demetrio Gómez García, Universidad Federico Henriquez y Carvajal

Abstract

This case seeks to place the student in the position of executive president of one of the three telecommunication companies in Cuba in 2003: Empresa de Telecomunicaciones del Caribe (C_COM), a Cuban-Belgian joint venture, and the only company operating in GSM mobile technology. The president of C_COM had to present a strategic proposal to the country's telecommunication regulatory body, in order to achieve the nationwide extension of the GSM network. The company only operated in Havana, the capital, and in Varadero, one of the most famous tourist areas, both of them with the highest concentration of foreign GSM mobile carriers and with possibilities of connecting them to the network through roaming. However, not only C_COM would present its proposal, but also the other two companies would present their alternatives separately. That put the president in the dilemma of whether to present a competitive proposal that would include only C_COM or a proposal of a strategic alliance that would contemplate the participation of the other two companies. One clear thing was the need to undertake investments for the national expansion of the GSM network, resources that C_COM did not have because it had been operating for only two years. In any case, C_COM needed external sources of financing for the second time in the life of the company.

Case Description

The primary subject matter of this case concerns to corporate-level strategy. Secondary issues examined include business strategy, growth strategy, and foreign direct investment. The case has a difficulty level of four, appropriate for the senior level. The case is designed to be taught in one class hour and is expected to require two hours of outside preparation by students.

Keywords

Corporate Level Strategy, Business Strategy, Growth Strategy, Telecommunications.

Case Synopsis

This case seeks to place the student in the position of executive president of one of the three telecommunication companies in Cuba in 2003: Empresa de Telecomunicaciones del Caribe (C_COM), a Cuban-Belgian joint venture, and the only company operating in GSM mobile technology.

The president of C_COM had to present a strategic proposal to the country's telecommunication regulatory body, in order to achieve the nationwide extension of the GSM network. The company only operated in Havana, the capital, and in Varadero, one of the most famous tourist areas, both of them with the highest concentration of foreign GSM mobile carriers and with possibilities of connecting them to the network through roaming.

However, not only C_COM would present its proposal, but also the other two companies would present their alternatives separately. That put the president in the dilemma of whether to present a competitive proposal that would include only C_COM or a proposal of a strategic alliance that would contemplate the participation of the other two companies.

One clear thing was the need to undertake investments for the national expansion of the GSM network, resources that C_COM did not have because it had been operating for only two years. In any case, C_COM needed external sources of financing for the second time in the life of the company.

Case Body

Waldo Reboredo, the executive president of Empresa de Telecomunicaciones del Caribe (C_COM), was at his desk once again reviewing the projections made for the development of Cuba's GSM network, as a strategic proposal to the request received by the national telecommunications regulatory body.

It was past four o'clock in the afternoon. One of the president's concerns was that, at next Monday's meeting, he would not be the only one to present his proposal. The executive presidents of Empresa de Telecomunicaciones de Cuba, S.A. (ETECSA), and Teléfonos Celulares de Cuba S.A. (CUBACEL) would each present, separately, their strategic alternatives to the development of a nationwide GSM mobile network1.

C_COM

C_COM was created on January 12, 2001, with the Cuban Ministry of Telecommunications holding 50% of the shares and the Belgian company DHL International the other 50% (Powell, 2004).

C_COM represented for Cuba the incorporation of the GSM standard (900 MZH) to mobile telephony -considered as second generation or 2G-, a technology that, at a global level, and especially in the European continent, enjoyed a higher market penetration than the TDMA technology. Being the European market one of the leading emitters of tourists to Cuba, C_COM became the best connectivity option for international travelers through roaming service. For this purpose, C_COM had 80 contracts with GSM operators from 42 countries.

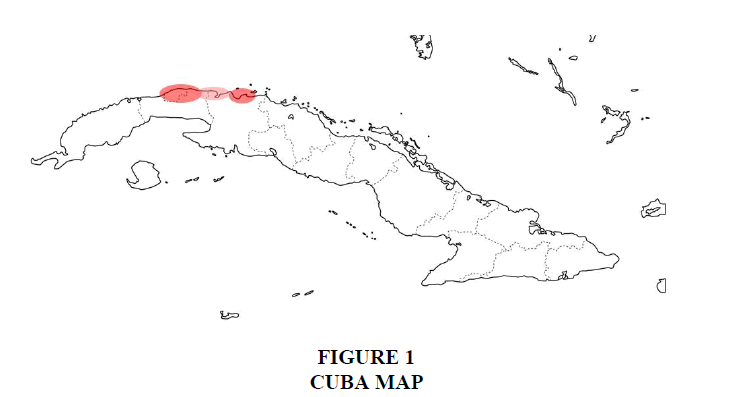

However, C_COM was a small company. In terms of people, the population of Cuba covered by GSM cells amounted to 20% (2,237,916 out of 11,243,358 inhabitants). Geographically, it covered the regions of La Habana, Matanzas, Varadero and the stretch of road that links them by the national highway, covering the 0.75% (858 km2 out of 114,525 km2) of the Cuban territory, as shown in Figure 1, taken from Castiñeiras (2004).

C_COM structured its network based on a Mobile Switching Center (MSC) and its databases Home Location Register (HLR) and Visitors Location Register (VLR) - fundamental elements for the management of communications between its GSM users, and between them and users of other networks. The MSC was licensed for 5,000 subscribers and was located in Havana. The Base Station Controller (BSC) had a capacity for 336 transceiver radio stations (TRX), and 19 base transceiver station (BTS) connected to the MSC (Castiñeiras, 2004).

In addition to the 19 BTSs, the network had four repeaters, nine microwave links, a Pre-paid Light platform (PPL), and a Voice Mail System (VMS), both licensed for 10,000 subscribers. It also had a Short Message Service Center (SMSC) licensed for one message per second; and the Operation and Service Subsystem (OSS) for network control. Besides, it had an intranet to interconnect all the systems: the e-mail server, the Website, the points of sale, and also, administration, technicians, and external access (Castiñeiras, 2004).

In addition, C_COM could provide data transmission services at a speed of 9.6 Kb/s, allowing its foreign clients to have Internet access without the need to install additional applications on the computer. That is, clients only need to configure the telephone access to the network, and use the mobile phone as a modem (Castiñeiras, 2004).

With all this, in 2003, C_COM was serving a market composed of 5,100 permanent subscribers and a total of 35,000 temporary international customers connected by roaming, mostly tourists and foreign technicians coming from international GSM networks (Castiñeiras, 2004).

C_COM used a payment model where customers paid for outgoing and incoming calls. The charge for an incoming call was justified by the interconnection and transport costs that C_COM paid to ETECSA for the use of its national network, and for the international connection, managed by ETECSA through satellite technology. There were also costs generated by the routing and completion of calls made by a CUBACEL customer or received from a fixed telephone of ETECSA's network.

C_COM also monitored the satisfaction of its clients. In a study conducted to its users, C_COM found that the leading cause of complaints was the demand for the extension of the coverage to the whole national territory; and, secondly, the demand for total coverage in La Habana, since 3.2 % of the calls were not completed (Castiñeiras, 2004).

For distribution, C_COM only had three commercial offices: one in each of the three regions with coverage; however, they sold the recharge cards for its only prepaid modality in hotels of La Habana and Varadero.

Cubacel

Mobile phone services were first provided in Cuba on February 24, 1993, with the creation of the company Teléfonos Celulares de Cuba S.A., as a Cuban-Mexican joint venture. In 2003, CUBACEL had the following shareholding composition: 50% held by the Ministry of Communications, 12.5% by Telecomunicaciones Internacionales de México, and 37.5% by the Canadian conglomerate Sherritt International Corporation (Powell, 2004).

In the beginning, CUBACEL deployed a first-generation network, based on AMPS technology to operate in the 800 MHz band. In 1997, a second-generation digital structure of the D-AMPS type (Digital AMPS), also known as TDMA, was added to the network (https://www.ecured.cu/Cubacel).

In 2003, both types of networks coexisted in CUBACEL in an AMPS / D-AMPS structure. The technological infrastructure consisted of three mobile switching stations located in the western part of the country (La Habana), one in the central part (Cienfuegos), and another in the eastern part (Santiago de Cuba), with 34 radio bases and 12 repeaters that provided national coverage (Castiñeiras, 2004).

For that year, CUBACEL had 6797 permanent subscribers and a monthly average of 785 temporary customers, mainly tourists, and businessmen (Castiñeiras, 2004). CUBACEL had a market of tourists from TDMA networks and foreign residents in Cuba, as well as companies and entities that operated in hard currency, such as foreign commercial firms, corporations, international press, tourism, international organizations, tour operators, embassies and diplomats.

CUBACEL customers also paid for outgoing and incoming calls, for the same reasons already mentioned for C_COM.

For distribution, CUBACEL had 14 commercial offices distributed in each of the provinces of the country. CUBACEL offered its services in the postpaid modality. The company required the presence of the customer at the moment of signing the contract, as well as for the monthly payment of the services.

Etecsa

The first telephone service in Cuba was inaugurated in La Habana on March 6, 1882. A fully automatic Central Office existed in the country as early as 1909. By 1921 the first international telephone conversation was established between La Habana and Catalina Island in northern California through a circuit consisting of underwater copper telephone cables, land-based telephone lines, and a radio link (https://www.ecured.cu/Telefonía_en_Cuba).

Until 1959, US investment played an essential role in the telephone industry in Cuba, with the presence of the International Telephone and Telegraph Company; and the signing of a tripartite agreement between American Telephone and Telegraph Company, Cuban Telephone Company and Cuban American Telephone and Telegraph. In 1960, after the triumph of the Cuban Revolution, the American companies and the Cuban Telephone Company were nationalized, and telecommunications in Cuba became state-owned (https://www.ecured.cu/Telefonía_en_Cuba).

In 1977, EMTELCUBA was created, with 14 local companies, one for each of the 14 provinces. The objective was to bring companies closer to their regional markets. The 1990s led to the restructuring of the sector and the search for foreign investors due to the economic-financial crisis that hit the country, together with the effects of technological obsolescence experienced throughout the nation, as well as the effects of EMTELCUBA's decentralization (https://www.ecured.cu/Telefonía_en_Cuba).

Thus, on 29 December 1993, Empresa de Telecomunicaciones de Cuba, S.A., was created as a joint venture and stock company with Cuban and Mexican capital, according to agreement number 2728 of the Executive Committee of the Council of Ministers of the Republic of Cuba. After several restructuring processes and changes in ownership, in 2003, the Ministry of Communications held 49% of the shares, Telecom Italia held 30%, and a coalition of banks owned the rest (Cereijo, 2009).

As a result, ETECSA led a qualitative leap in Cuba's telecommunications, expressed in 721,400 fixed telephone lines in service, for a population of 11,243,358 inhabitants, which represented 6.42% telephone density or penetration, and a considerable increase from the 3.25% existing in 1995 (Castiñeiras, 2004).

On the other hand, ETECSA provided the country with a transport network consisting of two essential networks: the national digital microwave network and the national fiber-optic network. Similarly, the company had achieved the digitalization of the main telephone stations in La Habana and almost all of them in the rest of the country's provinces (Castiñeiras, 2004).

Towards the end of 2003, ETECSA covered fixed telephony services, public telephony, and most Internet connectivity services, as well as incoming and outgoing international calls. ETECSA also had the backbone of the country's entire telecommunications network, initially in copper wire, but after the investments, gradually replaced by fiber-optic. This backbone worked as a transport network for C_COM and CUBACEL for national interconnection and incoming and outgoing international calls.

To cover the Cuban island, ETECSA had deployed a distribution network consisting of 116 commercial offices, 27 multiservice centers, 14 tele points, 14 after-sales service workshops, and 68 mini points2.

Dynamics of the Sector

Fiber-optic networks burst into telecommunications in the 1970s and cell phone networks in the 1980s. Considering the chronology helps to understand how the telecommunication sector has been structured and how the relationships between the different actors in the mobile telephone industry have been shaped.

From the 1970s onwards, the use of fiber-optics encouraged the replacement of the copper networks deployed by the telephone companies -national operators with a monopolist position in many countries- mainly for the backbone. The replacement increased data transmission capacities and improved the quality of digital communications, not only at the national level but also in international connections, traditionally carried out by inter-oceanic copper cables or via satellite.

Mobile telephone networks arrived in the 1980s, but these networks should not be seen as an independent technology, but rather as interconnected: to a large extent, mobile networks operate over the terrestrial transmission networks deployed by national telephone companies.

Mobile telecommunication is not a satellite technology. Services are based on a set of cells with a territorial range limited to a hexagonal radius of action. The use of terrestrial fiber-optic transmission networks is superior to microwave links, as they guarantee greater bandwidth and higher quality of communications. Thus, the deployment of a nationwide mobile telephone network is greatly facilitated when, for the interconnection of its various components, it has a terrestrial fiber-optic transmission network.

In countries that liberalized telecommunications, mobile phone companies choose not to develop their fiber-optic backbone, which would mean a high investment. On the other hand, they prefer to operate in technological interconnection with a large national telephone company. Commercial relationships mediate this business model between both types of companies.

Telecommunications companies are articulated through different interconnected and related technologies, which often make it difficult to define where industries such as fixed telephony, mobile telephony, television, and data end. In products such as voice over IP, high-definition video calls, and HD television, the boundaries between industries are often blurred. There may be companies wholly specialized in mobile services that include both phone services, data, and high-definition television, but also telecommunications companies that provide all the above services and include the traditional services associated with fixed telephony.

GSM Network Development Proposal

Reboredo was clear that achieving the strategic objective of developing the GSM mobile telephone network in Cuba under the GSM standard required establishing short, medium, and long term goals. For this purpose, the engineer structured the investment process in phases.

The first phase of the development of the GSM network envisaged would last an estimated one year, during which the following results and qualitative leaps were to be achieved:

1. Coverage of all provincial capitals and the most famous tourist poles in Cuba.

2. The increase of lines in service by 100 %, that is to say, doubles the existing combined lines between C_COM and CUBACEL in 2003.

In this sense, the engineer contemplated the acquisition and commissioning of 37 BTS and one BSC, connected mainly through ETECSA’s transmission network. The works would be executed through turnkey projects, and the technology to be acquired would be chosen based on criteria such as compatibility with current technology and the existence of commercial relations with the suppliers’ countries (Castiñeiras, 2004).

The projected capacity increase for this phase totaled 56,140 lines in service, of which 15,875 were estimated to be for international roaming. Table 1 shows the required investment of 6,116,895 USD for the first phase. The estimated cost per line would amount to 108.953 USD3.

Thus, the population of Cuba covered by GSM cells would amount to 44.7 % (5,024,144 inhabitants out of 11,243,358), and 15.4 % of the island would be covered (17,669 km2 out of 114,525 km2). Similarly, the country's telephone density would rise to 6.91 telephones per 100 inhabitants (Castiñeiras, 2004).

The second phase of development of the projected GSM network would last an estimated one year and would be implemented based on the results obtained in the first phase, therefore in the second year. The second phase of investment would lead to the following results:

1. The national expansion and full coverage of the GSM network.

2. The increase of lines in service by 225 % compared to the combined lines between C_COM and CUBACEL existing in 2003. That means a total increase at the end of the two phases of development and investment of 325 %.

The investment projection for this stage contemplated the installation of 40 new BTS. That would make it possible to meet the unsatisfied demands for services: if one assumes that the lack of coverage caused that a significant percentage of calls in C_COM's network cannot be completed, the planning of where to locate these new BTS required acute precision.

For that purpose, CUBACEL used the coverage prediction software Plan 2000, for which it paid an annual license (Castiñeiras, 2004). Besides, CUBACEL, being a nationwide company, had valuable information: the current coverage of its TDMA network, as well as the reports of complaints from its customers about specific areas where the geography became an impediment for the transit of mobile signals. Having this information would greatly assist in the accurate planning of the location of the remaining BTS in the nationwide GSM network.

The investment projection also included a second MSC in the central-eastern region of the country. The new MSC would guarantee a decrease in the network's vulnerabilities, as well as savings in transmission costs and use of the backhaul network by traffic generated in the eastern region, not having to bring back-traffic to La Habana. The investment also contemplated a GPRS for roaming services, which would facilitate the connectivity of foreign customers in the country.

The completion of the second phase would increase the capacity of 127,425 additional lines, of which 19,952 were estimated to be occupied by roaming users. The estimated investment for this second phase totaled USD 30,040,558, as shown in Table 1, which would generate a cost per line of USD 235.43 for those incorporated in this phase. As a weighted average, the cost per line at the end of the development process would amount to USD 196.66 (Castiñeiras, 2004).

From this, the national population covered by GSM cells would amount to 58.8% (6,612,799 inhabitants out of 11,243,358), and 32% of the island would be covered (36,725 km2 out of 114,525 km2). Similarly, the country's telephone density would rise to 8.04 telephones per 100 inhabitants (Castiñeiras, 2004).

Need for a Strategic Proposal

Waldo Reboredo knew that he had to present a proposal that offered a comprehensive look at the situation of the telecommunication sector in Cuba, with its three well-differentiated operators: C_COM, CUBACEL, and ETECSA. International voices were recommending the development of telecommunications in the country structured in a provider company with a regulated monopoly character -to protect the consumer-, and several operating companies competing with each other and providing international long distance and Internet services (Cereijo, 2009).

However, the situation in the international telecommunications sector was quite different in several countries, and to some extent, contradictory. Nations such as Costa Rica, with an open market economy, had only one company, which was monopolistic and state-owned. In other countries such as the United States, antitrust law had led to the split of the Bell Telephone Company into several companies in the 1980s.

On the other hand, the concept of technological convergence, as applied to the telecommunications sector, raised questions about what made more sense: generalist companies in the sector or highly specialized companies in the fixed, mobile, television, and data industries. He was aware that the technological convergence required re-examining the existing basis for regulation in the country. What kind of regulatory framework will be needed to facilitate the growth of the sector and balance social, political, and cultural objectives? (Blackman, 1998). In 2003, no such regulation existed in Cuba.

Waldo Reboredo also knew that the national regulatory framework limited the funding mechanisms for Cuban companies. In 2003 the Cuban Foreign Investment Law contemplated the following modalities: foreign direct investment and investment in shares or other securities of public or private value. The possible forms included: joint ventures, international economic association contracts, and whole foreign capital companies (Ley No 77, 1995).

A joint venture is constituted as an independent legal entity, in the form of a corporation by registered shares. It has to join the Chamber of Commerce of the Republic of Cuba. An international economic association contract does not constitute a legal entity distinct from the contracting parts, but rather each part makes different contributions without constituting a share capital, but rather a common fund. This contract requires a notarial deed and to join the Chamber of Commerce of the Republic of Cuba (Ley No 77, 1995).

The owner of a whole foreign capital company can act as a natural person, joining the Chamber of Commerce and acting on his or her behalf. Another way is acting as a legal person in the country, creating a Cuban subsidiary of the foreign company he or she owns, or in the form of a corporation with registered shares and joining the Chamber of Commerce (Ley No 77, 1995).

In addition, in his analysis, he had not visualized the possible strategic projections for the industry that would be presented by the executive presidents of CUBACEL and ETECSA. In that sense, he wondered if analyzing the position that these competitors might assume could bring new perspectives to his analysis.

Although his projection contemplated all the technical aspects necessary for the development of Cuba's GSM network, he had not considered what the sources of financing might be for undertaking such investments, nor the deployment of a commercial network throughout the country. Furthermore, bringing the company to that level would require an increase in the workforce and management coordination throughout the island, which would undoubtedly generate an additional expense burden for the company.

After only two years of operation, C_COM did not have financial resources for these investments, so the only option would be to resort to external financing sources. In that order, several questions arise. Which would be the best alternative? Financing by the Cuban Government, or the search for new foreign investment? Indebtedness or increase in the company's capital stock?

Resorting to external financing sources was always a complicated option for a Cuban company, due to the inexistence of a financial market per se.

The Havana Stock Exchange operated from 1859 until The Bay of Pigs invasion in 1961 with different ups and downs, but its formal liquidation occurred in 1970 (Moreno, 2013). The different Systems of Management and Planning of the Cuban Economy did not conceive the monetary-mercantile relations as the primary mechanism for the functioning of the economy in the socialist era under the umbrella of socialist countries of Eastern Europe and the USSR, so finances were not valued as necessary.

Since the restructuring of the economy in the 1990s, the existence of financial markets in Cuba was limited to the purchase and sale of shares through direct negotiation between the shareholders (De la Oliva de Con, 2001). However, the change of shareholders and the purchase or sale of shares of one of the parts could not take place without the agreement of the current shareholders and the approval of the Executive Committee of the Council of Ministers of the Republic of Cuba or a Government Commission (Ley No 77, 1995).

All that means that there was no primary market or stock exchange in the country where the value of the shares was recognized, nor the existence of a secondary market for negotiating the shares by supply and demand market mechanisms. Public offerings were not mechanisms available to companies to raise money.

In theory, Cuban companies could finance their investments just like any others in the world: by using internal and external resources; however, the practice was quite different (López & García, 2012).

Cuban banks performed poorly, and their banking institutions were uncompetitive, mainly due to the centralization imposed by the political-economic system. The financial institutions that operated did not perform all the authorized functions. Specifically, they had restrictions on lending to companies with foreign participation (López & García, 2012).

Besides, the weak functioning of the Cuban financial system was exacerbated by problems of information asymmetries such as the lack of regular publication of financial statements, the use of financial statement presentation formats did not correspond to internationally accepted standards, the lack of certification of accounting and the lack of clarity on the status of state-owned enterprise. All of that significantly limited access to international sources of debt financing (López & García, 2012).

On the other hand, C_COM could consider some kind of strategic alliance with ETECSA and CUBACEL. But what kind of alliance and with which one? Or both? What could be more convenient for C_COM?

Barely an hour after leaving his office, the president realized that there were still loose pieces to fit in this puzzle.

Instructors' Notes

Position in the Course

The case is designed for a general course in Strategic Management for undergraduate MBA and Master in Management students. It should be applied later to the topics of Strategic Diagnosis, Business Strategy, and Corporate Strategy.

Learning Objectives

1. To identify the information necessary for strategic decision making on the growth of joint ventures with foreign shareholdings, in contexts of restricted economic and political-legal environments.

2. To evaluate the viability of different strategic growth options for a company.

3. To assess the role of mergers as a strategic growth option, and their implications in the transition from a competitive strategy to a corporate level strategy.

Suggested Reading

Porter, M.E. (1987). From Competitive Advantage to Corporate Strategy. Harvard Business Review, 65(3), 43–43.

Prahalad, C.K., & Hamel, G. (1990). The Core Competence of the Corporation. Harvard Business Review, 68(3), 79–91.

Thompson, A.A., Gamble, J.E., & Peteraf, M. A. (2015). Administración estratégica: Teoría y casos. (19a. ed.). México DF: McGRAW-HILL

Questions for the Student

1. Evaluate the pros and cons of different financing options for the national expansion of the GSM network by C_COM:

a. Financing by the Cuban government.

b. Financing by the current foreign partner.

c. Financing through new foreign direct investment.

d. A combination of the above.

2. Evaluate the pros and cons of the merger between:

e. C_COM and CUBACEL.

f. C_COM and ETECSA.

g. C_COM, CUBACEL and ETECSA.

3. Compare both strategies: growth through seeking funding and growth through a merger, and make a decision for C_COM.

Recommendations for Teaching Approaches

The session can begin by asking students to describe the context and moment of telecommunications in the world and Cuba. This activity can be a reading check.

Next, the teacher will proceed to the joint construction of the evaluation of the pros and cons of each of the strategic options requested.

Financing by the Cuban Government

Elements in favor: being the Cuban government the majority partner of C_COM, additional financing would not imply a change of vision about the company by this shareholder. As the regulatory body is requesting the proposal, its acceptance implies an automatic recommendation to the Ministry of Telecommunications. The elements against this option are: the acceptance or not of the foreign shareholder, who may perceive that an increase in shares may mean a stock's dilution. On the other hand, if the financing is credit and not stock, the amortization of the debt would mean financial expenses that would reduce the company's profits and the consequent return on the shares. Besides, it is necessary to evaluate why these companies have been created through foreign investment. That is because of the impossibility of the Cuban government to undertake these investments alone.

Financing by the Current Foreign Partner

The advantage of this option is that the current partner already knows the market behavior and financial performance of the company, so it may be easier to convince him/her of an additional investment than a new partner. However, the element against this option is that the Cuban partner, as a majority shareholder, would also have to agree. That would also imply the need for the latter to make capital contributions so that there is no dilution of capital, and he loses his majority position.

Financing through New Foreign Direct Investment

The advantage of this option is that there may be foreign investors interested in participating in such a promising business as telecommunications, in a country with one of the lowest mobile telephone penetration rates, and with growth possibilities. The elements against this option are the capital dilution of the current partners and the fact that the new foreign investor(s) do not comply with other strategic and political requirements that the Cuban government may have. That will make the process of linking the parts very slow, and competitors could achieve faster development and, therefore, matching better with the requirements of the telecommunications regulatory body.

a. A combination of the above.

This option requires the analysis of all the pros and cons of the previous options.

b. Merger between C_COM and CUBACEL.

Elements in favor: C_COM would provide its actual network: the MSC, the HLR, and VLR databases; the PPL, the SMSC, and the OSS, as well as its intranet, the email server and the website. In the merger, CUBACEL could participate in the current utilities generated by C_COM clients and the latter in those generated by CUBACEL clients. C_COM would contribute with qualified labor and with the know-how that CUBACEL does not have for the operation of the GSM networks, which in turn could serve to CUBACEL if it was considering converting its network to the GSM standard. CUBACEL can provide knowledge of the geographical areas of weak signal coverage in the country, where the GSM network should be enhanced and reinforced. CUBACEL could provide infrastructure elements such as physical spaces and current antennas, for the location of the new network devices, as well as their commercial distribution present in the 14 provinces of the country. The elements against the merger would be the decisions regarding the companies’ trademarks and the estimates of the capital contributions of each of the parts in the newly merged company, mainly referring to the foreign shareholders and possible risks of capital dilution.

Merger between C_COM and ETECSA

Elements in favor: C_COM would contribute with the elements of its GSM network, its operation, and management, as well as the qualified labor and know-how, which ETECSA does not have. ETECSA could provide infrastructure elements such as current physical spaces for the location of the new network devices, as well as their intensive commercial distribution in the country, superior to the other two companies. Another element in favor of this merger is that, in the newly merged company, prices could be lowered for the client by eliminating the transaction costs associated with the use of ETECSA's networks. Elements against the merger would be decisions regarding the companies’ trademarks and estimates of the capital contributions of each of the parts to the newly merged one, particularly concerning foreign shareholders and possible risks of capital dilution.

Merger between C_COM, CUBACEL and ETECSA

This option requires the analysis of all the pros and cons of the three previous options. However, it is necessary to assess the suitability of the monopolistic role that the merged company would acquire, dominating all the markets in each of the telecommunications industries. The professor should take advantage of the contradiction that currently exists in the international telecommunications sector, using the examples of Costa Rica and the United States that appear in the case. This analysis should take into account and discuss aspects such as the current state of the international telecommunications sector (2003), Cuba's economic and political system, the size of the market and demand, limitations on access to the national market for mobile telephone services, the lack of an independent consumer protection agency in the country, possible losses in market efficiency due to the lack of competitors, the possibility of lowering service prices due to economies of scale and the elimination of transaction costs and, increased coordination costs in a more significant proportion for the merged company, among others.

Comparison and Decision Making for C_COM from the Analysis of Strategic Options

At this point, it is suggested that the teacher conduct a student vote for the different options. Next, he/she could ask for arguments on each of the preferred decisions.

Epilogue

As a closing of the case, the professor could mention that on December 16, 2003, the Council of Ministers, authorized the merger of ETECSA, CUBACEL, and C_COM, through the incorporation of the latter two to ETECSA, creating a unified operator with a new concession and a new development plan for fixed, cellular and data telephony. The network technology to be developed was GSM, and the prevailing brands were ETECSA and CUBACEL, with the disappearance of the brand C_COM.

Endnotes

1. This case deals with a real situation and has been built on secondary information obtained from public sources. Waldo Reboredo was the Executive President of C_COM since its foundation. However, the author of the case has not interviewed the protagonist. The author constructs a fictitious initial situation to put the student in the context of the decision making about the strategy to be followed by C_COM. The case recreates a situation with the only purpose of serving as class discussion material. The case does not intend to illustrate good or bad administrative practices. The author wants to give thanks to María Fernanda Miguel, Executive Director, Latin America Research Center at Harvard Business School for her valuable supervision and advice in the development of this business case.

2. Data estimated by the author for 2003 based on information from the "Commercial Network" available at http://www.etecsa.cu/contacto/red_comercial/

3. Table 1 is the result of the aggregation of the different investment concepts that appear in Castiñeiras (2004), pp. 55-56, and in Annexes 6, 7, and 8. The author would like to thank Javier Ferreira Herrera, M.Sc., a former manager of ETECSA, for the preparation of table 1

| Table 1: Investments To Be Made For The Expansion Of The Gsm Network In Cuba | ||||

| No. | Investment concept | Phase I Investment (USD) | Phase II Investment (USD) | Total Investment (USD) |

|---|---|---|---|---|

| 1 | Operations Support Systems | 1,623,494 | 20,933,738 | 22,557,232 |

| 2 | Antennas and Transmitters | 2,543,365 | 7,594,220 | 10,137,585 |

| 3 | Construction and Assembly | 552,629 | --- | 552,629 |

| 4 | Engineering and Training Services | 559,053 | 787,098 | 1,346,151 |

| 5 | Logistics and Services | 838,354 | 725,502 | 1,563,856 |

| Total | 6,116,895 | 30,040,558 | 36,157,453 | |

References

- Blackman, C.R. (1998). Convergence between telecommunications and other media: How should regulation adapt? Telecommunications policy, 22(3), 163-170. doi:10.1016/S0308-5961(98)00003-2

- Castiñeiras, A. (2004). El estándar GSM y su empleo en Cuba. [Master?s thesis, Facultad de Ingeniería Eléctrica, Universidad Central " Marta Abreu" de Las Villas]. Universidad Central "Marta Abreu" de Las Villas Archive. http://dspace.uclv.edu.cu/bitstream/handle/123456789/6989/Alfredo%20Casti%C3%B1eiras%20Arencibia.pdf.

- Cereijo, M. (2009). Republic of Cuba Telecommunications Infrastructure Assessment. University of Miami. https://docplayer.net/2371038-Republic-of-cuba-telecommunications-infrastructure-assessment.html.

- De la Oliva de Con, F. (2001). Selección y evaluación de carteras. La Habana: Editorial Félix Varela.

- Ley No 77. Ley de la inversión extranjera. Gaceta Oficial de la República de Cuba. La Habana, Cuba, 6 de septiembre de 1995.

- López, L.V., & García, V.R. (2012). El proceso inversionista y la financiación de inversiones en Cuba: deficiencias, limitaciones y retos. Economía y Desarrollo, 148(2), 124-138.

- Moreno, J. (2013). La Bolsa De La Habana, El Mercado Mundial De Azúcar Y Las Fluctuaciones De La Economía Cubana, 1910-1959*: The Havana Stock Exchange, global sugar market and fluctuations of the Cuban economy, 1910-1959. Revista de Historia Economica-Journal of Iberian and Latin American Economic History, 31(1), 111-143. doi:10.1017/S0212610913000049

- Powell, C.L. (2004). Commission for Assistance to a Free Cuba. U.S Department of State. https://2001-2009. state.gov/p/wha/rt/cuba/commission/2004/c12237.html.