Research Article: 2022 Vol: 26 Issue: 1S

Cash Reserve Requirement and Banks Profitability: Evidence from Deposit Money Banks in Nigeria

Gideon Tayo Akinleye, Ekiti State University

Oladimeji Emmanuel Oluwadare, Ekiti State University

Citation Information: Akinleye, G.T., & Oluwadare, O.E. (2022). Cash reserve requirement and banks’ profitability: evidence from deposit money banks in Nigeria. Academy of Accounting and Financial Studies Journal, 26(S1), 1-13.

Abstract

Cash reserve requirement is an important policy instrument in many developing countries. This study examined the effect of cash reserve requirement on banks’ profitability in Nigeria for a period of 10 years, spanning from 2010-2019. The study covered all the listed Deposit Money Banks (DMBs) in Nigeria among which, 8 listed banks designated as Systematically Important Banks (SIBs) by Central Bank of Nigeria (CBN) were purposively selected. Secondary data obtained from the audited annual financial statement, CBN Annual reports and account of DMBs of the selected listed SIBs were used. Panel regression of fixed and random effect estimation was employed and this was carried out after descriptive statistics and Pearson correlation have been done. It was discovered that cash reserve ratio exerts a negative and significant effect on return on assets of Deposit Money Banks (DMBs) in Nigeria to the tune of -0.0025(p=0.036<0.05) and that cash reserve ratio has a negative and significant effect on return on equity to the tune of -0.0039(p0.026<0.05). The study established that the effect of cash reserve requirement on banks’ profitability is statistically significant. Thus, it was recommended that in setting the minimum cash reserve requirement of banks, the objective of the policy makers should not solely center on how to eradicate the possibility of bank failure, they should also focus on how to improve banks’ profitability.

Keywords

Cash Reserve, Profitability, Return on Assets, Return on Equity.

Introduction

Bank is a financial institution licensed to accept deposits from surplus unit and lend such deposits out to the deficit unit. Therefore, one its major roles is financial intermediation which helps to stimulate the growth of economy and enhance financial development of a country. However, Tewodros, (2017)argued that despite the significant impact of banks on the economic activities of a nation, they are prone to failure as any other organization. Because of the major role banks play in financial stability and economy of a country, government exercise a high degree of regulation over them.

In Nigeria, banks are most regulated industry and all their activities are being guided with policies. One of such policies is cash reserve requirement (CRR). According to Ude, (2015), cash reserve requirement is the fraction of total deposit liability which banks are expected to keep as cash with Central Bank of Nigeria (CBN).

Amidst the CRR and other regulations, stockholders expect banks to make profit for sustainability and as reward for their investment. The ability to make maintainable profitability is banks’ performance. Besides, profitability helps banks against unpredicted losses as it fortifies their capital position. Profitability is the net income of banks, where revenue is greater than expenses. Since banks’ profitability determines the functionality of the whole financial system of a nation, studies on financial performance are important since it might reveal the particular regulatory standards, mostly affecting banks and hence help the apex bank (Central Bank of Nigeria) on suitable modifications or restructuring.

It has always been the concern of the Central Banks of Nigeria (CBN) to ensure the sustainability of banks’ performance and macroeconomic stability, since the global economic crisis. Following the internationally financial catastrophe of 2007-2009, domestic financial crises of 2015 and the recent one in 2020, triggered by coronavirus and other macro-economic instabilities like inflation, interest rate, unemployment rate, the instability of capital inflows into developing economies like Nigeria have increased noticeably. Consequently, the macro-economic and financial stability appeared to be engulfed with challenges that are not limited to fluctuating credit growth and exchange rates.

Over the years, the concern of the Nigerian government to increasing capital inflows is to maintain a low level of policy rate to properly regulate domestic currency and avoid extreme appreciation and credit growth. Hence, cash reserve requirement is suspected to be the most common tool among unusual monetary policy instruments. Adriana & Simon, (2017) argued that developing economies are habitually hesitant to upsurge interest rates to respond to credit booms facilitated by capital inflows. It is believed that an increase in interest rates might attract additional capital inflows and escalate the currency. In this regard, cash reserve requirement is considered the best way to tighten the conditions of the domestic credit (Montoro & Moreno, 2011).

In Nigeria, cash reserve requirement is the responsibility of the CBN and not the market forces. Thus, an increase in cash reserve requirement of banks might broaden the gap between the total deposit and lending rates. As the gaps get widened, the domestic sector might find it too expensive to borrow money from banks because of the increase in interest rates and consequently affect the profitability of banks. Also, foreign investors might equally find it unattractive to lend to domestic banks. This infers that an increase in cash reserve requirements may accomplish a contraction in national credit, without any additional increase in capital inflows and local currency. Literature shows that countries like Turkey, Croatia, Columbia, Russia, Peru and Brazil have all adjusted their cash reserve requirement for economic stability.

An increase in the cash reserve requirement of banks serves as a tax burden on the total deposit and might consequently, affects their transactions and the profitability level. In the Nigerian context, cash reserve ratio of Deposit Money Banks is fixed at 27.5% (billion) in November 2020. Though, Cash Reserve Requirement (CRR) is set at a different percentage between the private and public sector fund from 2013 -2014 and was harmonized in 2015 (Central Bank of Nigeria press release through Communiqué No. 98 & 101). This was done to stimulate banks to be more proactive in performing their obligation of financial intermediation rather than depending on government funds as their main source of deposit.

The impact of monetary policies and banks’ profitability has generated a lot of studies globally. For example, studies like Prada, (2008); Montoro & Moreno, 2011; Khrawish, (2011); Akanbi & Ajagbe, (2012); Ajayi & Atanda, (2014); Udeh, (2015); Punita & Somaiya, (2016); Onoh, (2017); Adesina et al. (2018) examined how banks’ profitability is affected by monetary policies, among which is cash reserve requirement. In other developing and developed countries, studies like Fatima & Samreen, (2015); Abeysinghe & Basnayake, (2016); Adriana & Simon, (2017); Dakito, (2017); John, (2018); Oganda & Mogwambo, (2018) specifically examined cash reserve requirement and financial performance of banks. However, studies on cash reserve ratio and profitability of banks, measured with return on asset and return on equity are relatively few in Nigeria. It is therefore the interest of the researchers to examine cash reserve requirement and profitability of Deposit Money Banks (DMBs) in Nigeria.

Over the years in Nigeria, the CBN has intermittently revised the cash reserve ratio of Deposit Money Banks (DMBs), with the intention to curb inflation and maintain the financial stability of the economy. However, the influence of the changes on Banks’ profitability (DMBs) appeared to be inadequate because of the lack of studies in this context. Based on the available literature in Nigeria, studies on monetary policies and financial performance of banks did not give considerable prominence to the reserve requirement of banks. This gives the impetus for this current study on cash reserve requirement and profitability of Deposit Money Banks (DMBs) in Nigeria.

This paper provides empirical evidence on how the profitability of banks is affected by bank regulation in terms of cash reserve requirements. It might equally help banks on how to regulate their lending capacity and still achieve the stated objectives. Additionally, it will serve as a reference point for scholars interested in a similar study. The remaining part of this paper was divided into four sections. Section two covered the conceptual review, theoretical review and empirical review. Section three detailed out the description of the methodology employed by the scholars, section four covered results and discussion of findings and section five detailed the conclusion and recommendations.

Literature Review

In most economies of the universe, the apex bank has the basic responsibility of modifying the banking activities and uses different monitory policies to ensure a vibrant stable economy. The apex bank serves as a moderator of banking activities through its regulations. John, (2018) asserted that the central bank builds regulatory standards for banks' entry into the industry, as well as bank management. This is to ensure that the economic interests of banks, their customers and the economy at large are not jeopardized by the banking activities and customer behaviour. Embedded in the framework of the Central Bank's regulatory policies is the cash reserve.

Conceptual Review

Bawa et al. (2018) defined cash reserve as the funds that Deposit Money Banks set aside with the apex bank for use in emergencies. Cash reserve is the stipulated minimum rate of the total deposits that deposit money banks have to reserve for economic stability. The funds are saved to ensure that banks do not become penniless to meet the demands of their customers. Cash reserve determines the capital level maintained by banks in proportion to their assets (Mitku, 2018). Cash reserve, also called reserve requirement, is the central bank standard employed by most of the world's apex banks. Hence, the required cash reserves are typically in form of cash stored in the bank vault or deposited with the apex bank. Reserve requirement ratio is a monetary tool that affects the volume of banks transaction in terms of loans and advances and financial performance.

Bank profitability like other business is the excess of income over expense. The major portion of bank’s income comes from fees and charges for the service rendered while the major expense is from interest paid on liabilities. According to Althanasoglou, (2006), bank’s profitability is generally measured by return on assets (ROA) and or return on equity (ROE).which often expressed as a function of internal and external determinants .Evaluating banks’ financial performance allows the financial report users, both internal and external, to judge the result of the business strategy and activity in objective monetary terms. Adesina, et al., (2018) identified two broad categories of financial performance measures as accounting and investor returns. The basic idea of investor returns is that the return is measured from the perspective of shareholders. Whereas accounting returns measure of financial performance focus on how bank's earnings respond to different managerial policies (John, (2018)). Bank’s performance is the ability to generate sustainable profitability. Profitability is essential for a bank to maintain ongoing activity and for its investors to obtain fair returns. In the context of this study, banks’ performance in terms of profitability was captured with return on assets and return on equity.

Olokoyo, (2019) defined return on assets (ROA) as a financial ratio that reveals the rate of profit an organization earns in relation to its overall resources. ROA is an indicator of how lucrative a business entity is, in relation to its total assets. It is the main ratio that reveals the profitability level of banks. In the view of Oganda & Mogwambo, (2018), return on assets is the ratio of total income to the total asset. It measures the efficiency of banks' management strategy to generate income by utilizing the bank's assets at their disposal. Also, it shows how efficiently the bank's resources are used to generate enough income. Udeh, (2015) added that return on asset exposes the efficiency of the bank's management in generating net income from all available resources. A high Return on Asset (ROA) indicates that the business entity is becoming more efficient in using its available resources. Mathematically, return on assets (ROA) is calculated by dividing a corporation's net income by its total assets.

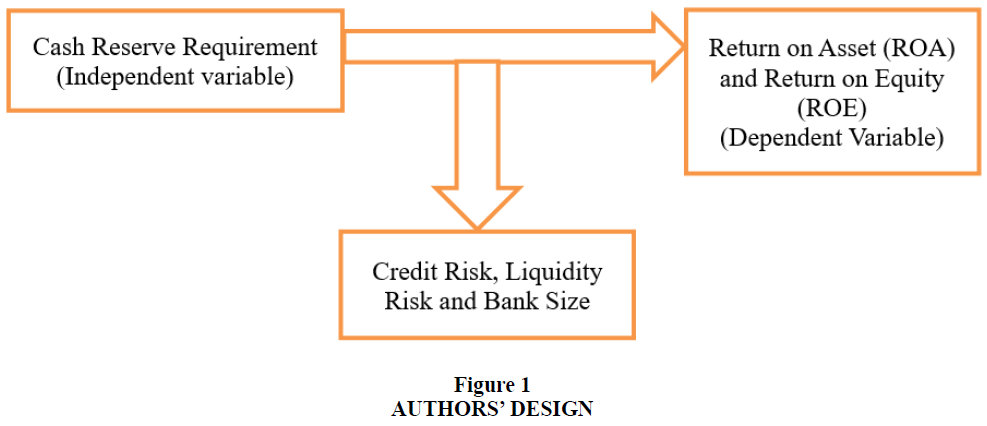

According to Abeysinghe & Basnayake, (2016), return on equity (ROE) is defined as a financial ratio that shows how much profit a company earned compared to the total number of shareholder equity invested or recorded on the balance sheet. A business entity with high ROE is likely to generate cash internally. Thus, the higher the ROE the better the company is in terms of profit generation. ROE represents the rate of return earned on the funds invested in the bank by its stockholders. According to John, (2018), ROE is very crucial to the shareholders because it indicates the rate of return that has been earned on the capital provided by stockholders after deducting payment to other capital suppliers. ROE indicates how effectively the management of commercial banks used shareholders' funds. The conceptual framework is depicted in figure 1:

Theoretical Review

This study was theoretically underpinned by trade-off theory and commercial loan theory. The trade-off theory of capital structure states that banks’ objective is to attain an optimum degree of liquidity to balance the advantage and disadvantages of holding cash. It is believed to have been established by (Kraus & Litzenberger, 1973). The cost or disadvantage of holding cash revolves around a low rate of return because of tax burden and liquidity premium. The immediate survival of a firm is heavily dependent on its liquidity, while its long-term survival and growth is heavily dependent on its profitability. Hence, liquidity ensures short term survival and profitability ensures long term survival. Both are therefore important for any firm to survive.

This theory according to Hanaffie, (2017) accentuates that companies keep an optimal degree of their liquidity level by trying to retain equilibrium between their profits and the price of keeping cash. He stressed that the primary point in trade-off theory is the proposition that corporate firms regulate the optimum level of their cash by defining the extent of their final cost significance and final profits from keeping cash. The highlight of the theory is that there must always be a trade-off between profitability and liquidity.

The biggest criticism of the trade-off theory is that it predicts a positive relationship between earnings and leverage, contradictory to well-established empirical evidence (Moses et al., 2015). Another critic is that the foundation of the theory was based on the assumption of perfect knowledge in a perfect market. Also, it failed to integrate the influence of taxes, agency cost, cost of issuing new securities, apex bank regulation and financial ache of investment opportunities (Nguyen & Le, 2017). The relevance of this theory to the current study is that it explains the fact that corporations are usually financed with debt and partly with equity.

Commercial loan theory states that a commercial bank should advance only short-term self-liquidating loans to business firms. Implicitly, the theory upholds that banks should lend only on short-term, self-liquidating commercial documents. This is because a bank has liabilities or commitments payable on demand, and it would be unable to satisfy these responsibilities if its assets are inadequate or tied up for a lengthy period. Self-liquidating loans are those loans that are meant to fund the manufacturing and movement of commodities through the continuous levels of production, storage, transportation and distribution. Commercial loan theory is recognized to be the oldest theory on cash reserves and liquidity management. Commercial loan is a short-term, negotiable and self-liquidating instrument with little risk. It facilitates the capability of the borrower to make installments on a definite date when commodities are bought on credit. There are three notable benefits to short-term self-liquidating productive loans (Vincent & Gemechu, 2013). They achieve liquidity; therefore, they automatically liquidate themselves. Also, since they become mature in the short-run, and are for productive ambitions, there is no fear of them transferring to bad debts. Lastly, such loans are high on productivity and provide revenues for the banks.

This theory holds weight in its doctrines and suppositions. However, it has some weaknesses and shortcomings. The weakness of this theory comes out from the failure to realize that the loans are made, based on the worth of the commodity, and not the commodity itself. Also, the worth of the commodity is subject to diverse variations, based on the state of the economy (Obim et al., 2020). This theory has shortcomings such as inconsistency with the demand for economic development, exclusion of long-term loans, exclusion of stability of demand deposit which helps banks to undertake long term lending among others and much emphasis on the maturity of bank assets instead of marketability (Yusuf et al., 2019).

The relevance of this theory to the research is based on the fact that it points to the reservation of cash through issuing of short-term loans to firms and also obtaining cash from the central bank through the security of short-term loans. It brings to limelight the fact that having adequate cash reservations protect the liquidity of the bank, and also increases profitability, which ultimately improves the economy. The theory makes an adequate comparison between liquidity and profitability of banks, stating that the liquidity of a bank is directly related to both the profitability and performance of the banks, as they have financial obligations and commitment to fulfill

Empirical Review

A good number of studies focused on monetary policies and banks' profitability. For example, Ajayi & Atanda, (2014) investigated the effect of monetary policy instruments on banks' performance to determine the existence of long-run relation for the period 1980-2008. The Engle-granger two-step cointegration approaches were adopted. The empirical estimates indicated that bank rate, inflation rate and interest rate are credit enhancing, while liquidity ratio and cash reserves ratio exerted a negative effect on banks total credit. Although, it was only cash reserve system and interest rate that were found to be significant at 5% critical value.

Fatima & Samreen, (2015) examined the relationship between Reserve Requirement Ratio and Banks Profitability in Pakistan. It emphasizes the effect of changes in cash reserve ratio on commercial banking profitability and how it affects the return on equity and return on assets. The data collected for the research was secondary and quantitative time series data for the ten years 2005-2014. Using correlation analysis followed by Linear Regression carries the empirical analysis of the study. The finding of the study revealed that cash reserve ratio, taken as a measure for Reserve Requirement has a significant inverse relationship on banks' financial performance, which is measured by ROA and ROE.

In, Udeh, (2015)investigated the impact of monetary policy instruments on profitability of commercial banks in Nigeria: a case of zenith bank Plc experience using a descriptive research design. The study utilized time series data collected from published financial statements of Zenith Bank Plc as well as the Central Bank of Nigeria Bulletin from 2005 to 2012. Pearson Product moment correlation technique was used to analyze the data collected while t-test statistic was used in testing the hypotheses. The study revealed a very low positive relationship exists between Profit Before Tax of Zenith Bank plc and the cash reserve rate implying that cash reserve ratio does not have any significant effect on profitability of Zenith Bank Plc.

In yet another study, Malede, (2017) examined the role of cash reserve ratio in his study on determinants of commercial banks' lending in Ethiopia. The study used panel data of eight commercial banks in the period from 2005 to 2011. He tested the relationship between commercial bank lending and its determinants using OLS. The results showed that there is a significant relationship between commercial bank lending and its size, credit risk, gross domestic product and liquidity ratio.

Nguyen & Le, 2017 investigated the impact of monetary policy on commercial banks' profit in Vietnam. Data were collected from 20 commercial banks doing business in Vietnam's banking market for the period 2007 to 2014, panel data was used for the regression. Monetary Base (MB), discount rate (DIS) and required reserve ratio (RRR) were used as proxies for monetary policy. Profit before tax was used to represent commercial banks' performance. The results showed that there is a positive relationship between banks' profits and monetary policies.

Also Bawa et al. (2018)examined the effect of cash reserve ratio and money supply on the profitability of DMBs in Nigeria. Data for the study were extracted from the annual reports and accounts of the DMBs for the study period (2002-2012). Descriptive statistics and regression analysis technique were used to analyze the data. The results revealed that cash reserve ratio has negative and insignificant impact on the earnings of DMBs in Nigeria. Money supply has a positive significant effect deposit money banks volume of loans and advances, interest rate and interest income.

John, (2018) examined the effect of cash reserve ratio (CRR) on the financial performance of commercial Banks and their engagement in CSR in Ghana. Data on banks’ cash reserve ratios from Bank of Ghana and data on corporate social responsibility engagement and return on investment from the 2013 annual reports of 20 commercial banks in Ghana are used. Data are analyzed quantitatively using SPSS. The first and second research hypotheses are tested using Pearson's Product Moment Correlation. The second hypothesis is tested using ordinary least squares (OLS) regression. It is found that cash reserve ratio positively relates to the financial performance of commercial banks, but it negatively relates to banks' level of engagement in corporate social responsibility. Also, cash reserve ratio significantly and strongly predicts the financial performance of commercial banks in terms of return on investment.

A related study by Olusanya et al., (2018) researched the determinants of lending behaviour of commercial banks in Nigeria and included the cash reserve ratio among the independent variables. The study adopted Pearson Correlation and multiple regression analysis model. The results of the study showed that there is a direct or positive relationship between commercial bank loans and advances and the cash reserve requirement ratio.

Using an Autoregressive Lag analysis Model (ADL), Adesina et al., (2018) carried out a study to ascertain the monetary policy instruments of the Central Bank of Nigeria (CBN) during and after the bank consolidation exercise (2000 – 2016) and determine the effects of these policies on the financial performance of deposit money banks (DMBs) in Nigeria. The result revealed that monetary policies of the CBN had a significant effect on the performance of DMBs in the short-run but an insignificant effect in the long-run.

Also, Mitku, 2018 examined the effect of cash required reserve on commercial bank lending in Ethiopia using panel data of eight purposively chosen commercial banks over eleven years (2005 to 2015). The investigation tested the relationship between commercial bank lending and cash required reserve. Eleven years of financial data of eight purposively chosen commercial banks were used for analysis purposes. Ordinary least square model was applied to test the impact of the predictor variable on commercial bank lending. The result revealed that there is no significant relationship between commercial bank lending and cash required reserve in Ethiopian commercial.

Oganda et al., (2018) carried a study titled, “Effect of Cash Reserves on Performance of Commercial Banks in Kenya: A Comparative Study between National Bank and Equity Bank Kenya Limited.” The study adopted correlation and regression analysis model to analyze the gathered data. The study found that cash reserves had a strong negative correlation with return on equity giving a significant negative relationship with performance of Equity bank.

Over the years in Nigeria, the CBN has intermittently revised the cash reserve ratio of Deposit Money Banks (DMBs), with the intention to curb inflation and maintain financial stability of the economy. However, the influence of the changes in cash reserve requirements by the CBN on the performance of Deposit Money Banks (DMBs) appeared to be inadequate because of lack of studies in this context. Based on the available literature in Nigeria, studies on monetary policies and financial performance of banks did not give considerable prominence on the reserve requirement of banks. This gives the impetus for this current study on cash reserve requirement and profitability of Deposit Money Banks (DMBs) in Nigeria.

Methodology

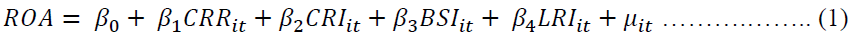

Ex-post facto research design was adopted for this study and the population covered all the listed Deposit Money Banks in Nigeria among which, 8 listed banks designated as Systematically Important Banks (SIBs) by Central Bank of Nigeria (CBN) were purposively selected because of their significant role in the Nigeria financial system and their size and capacity to avert the complete breakdown of the whole economy. These were First Bank of Nigeria Limited, Guaranty Trust Bank Plc, Zenith Bank Plc, United Bank for Africa Plc, Access Bank Plc, Eco Bank, Stanbic IBTC and Fidelity Bank. Secondary data obtained from the audited annual financial statement, CBN Annual reports and account of DMBs of the selected listed SIBs, covering the period of 10 years, from 2010 -2019, were used. The period covered comprised of the global financial and economic crises and the period of domestic economic recession that affected every sector of the economy, part of which is the banking industry. The independent variable was cash reserve ratio while the dependent variable was Return on Assets (ROA) and Return on Equity (ROE). The model used by Fatima & Samreen, (2015) to unravel the impact of changes in cash reserve requirement on banks’ profitability was used. However, the model was modified to include other related variables that could affect the performance of banks, as used by Tewodros, (2017). These include bank size, credit risk and liquidity risk. The functional and linear representation of the models are given in equation one and two.

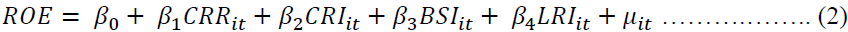

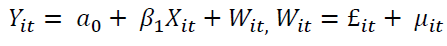

Where ROA is Return on Assets, ROE is Return on Equity, CRR is Cash Reserve Ratio, CRI is Credit Risk, BSI is Bank Size and LIR is Liquidity Risk, β0 is the intercept, β1 - - - - - β4 are the slop parameters, subscript "it" represents the combination of time and individuality, μit means error term. The study comparatively adopts fixed effect model and random effect model of panel data analysis. Before then, descriptive and correlation analysis were carried out. The fixed effect follows the form presented below:

i is a time varying intercept that captures all the variables that affect Yit that very over time but are constant across firms. The random effect model follows the forms presented below:

Where measures the random deviation from the global intercept a, subscript “it” represents the combination of time and individuality. Uit means error term. The selection of the best suited model from the two is done following the Hausman test in Table 1.

| Table 1 Definitions of Variables | |||

| Dependent variables | Definitions | Measurements | A-priori Expectation |

| Return on Assets | It measures the efficiency of banks’ management strategy to generate income by utilizing the assets at their disposal. | Net income/ total assets. | |

| Return on Equity | This measures how effectively the managements of commercial banks are using shareholders’ funds | Net income/ Shareholders’ equity | |

| Independent Variable | |||

| Cash Reserve Requirement | This is the stipulated minimum rate of the total deposits which deposit money banks have to reserve either as deposit or in-cash with the central bank | Prescribed cash reserve ratio in the previous year | + |

| Control Variables | |||

| Credit Risk | This means the risk banks face in providing loans | Loan loss provision/ total loan | _ |

| Bank Size | This refers to the total asset of banks through which they transact business | Logarithm of the total assets. | + |

| Liquidity Risk | This measures the liquidity of banks’ asset | liquid asset/total asset | + |

Results and Discussion of Findings

Findings of the study are presented in this section. The first two tables, Table 2 and 3 captured the descriptive and Pearson correlation analysis.

| Table 2 Descriptive Statistics | |||||

| Variable | Obs | Mean | Std. Dev. | Min | Max |

| ROA | 80 | 0.0351 | 0.1671 | -0.008 | 1.5041 |

| ROE | 80 | 0.1381 | 0.2284 | -0.9776 | 1.6104 |

| CRR | 80 | 26.5764 | 21.6900 | 0.0103 | 90.5335 |

| CRI | 80 | 12.6809 | 14.7448 | 0.2685 | 97.5484 |

| BSI | 80 | 18.4080 | 3.2900 | 11.7205 | 22.6495 |

| LRI | 80 | 0.0589 | 0.0600 | 0.0001 | 0.2749 |

| Table 3 Pearson Correlation Analysis | ||||||

| Variable | ROA | ROE | CRR | CRI | BSI | LRI |

| ROA | 1 | |||||

| ROE | 0.7095 | 1 | ||||

| CRR | -0.1489 | -0.2380 | 1 | |||

| CRI | -0.0550 | -0.0417 | -0.0690 | 1 | ||

| BSI | -0.1535 | -0.0127 | 0.1172 | 0.0977 | 1 | |

| LRI | 0.0266 | -0.1154 | 0.6630 | -0.2526 | 0.0371 | 1 |

Descriptive and Correlation Analysis

Table 1 gives the summary of the descriptive analysis of the variables. It shows that the average and standard deviation values of return on assets and return on equity are 0.0351(0.1671) and 0.1381(0.2284) respectively. The mean and standard deviation values of cash reserve ratio, credit risk, bank size and liquidity ratio are 26.5764, 12.6809, 18.4080, 0.0589 respectively. In the same vein, the minimum and maximum values of return on assets, return on equity, cash reserve ratio, credit risk, bank size and liquidity ratio are -0.008(1.5041), -0.9776(1.6104), 0.0103(90.5335), 0.2685(97.5484), 11.7205(22.6495) and 0.0001(0.2749).

Table 3 gives the results of the Pearson correlation analysis. It shows that return on assets has a negative correlation with cash reserve ratio, credit risk and bank size with the correlation coefficient of -0.1489, -0.0550 and -0.1535 respectively. This is an indication that return on assets alongside cash reserve ratio, credit risk and bank size move in opposite directions, reflecting that increase in cash reserve ratio, credit risk and bank size would lead to a decrease in return on assets. Also, the relationship between return on assets and liquidity ratio was positive with a correlation coefficient of 0.0266. In the same vein, the result shows that return on equity has a negative correlation with cash reserve ratio, credit risk, bank size and liquidity with the correlation coefficient of -0.2380, -0.0417, -0.-127 and -0.1154 respectively. This reflects that both the explained and the explanatory variables move in different directions, indicating that an increase in the explanatory variable would engender a decrease in the explained variable.

Regression Analysis

For the first and second model, panel regression model was carried out and this was followed by Hausman test, Wald test of heterogeneity, Pesaran test of cross-sectional dependence and Wooldridge test.

In Table 4, the probability value of the Hausman test given to be 0.0291 shows that fixed effect estimation is the best estimate. It reveals that cash reserve ratio, credit risk and bank size have a negative effect on return on assets with their respective coefficient of -0.0025, 0.0010 and -0.0036. however, the negative effect is significant for cash reserve ration with the probability value of 0.036<0.05, as against the negative effect of credit risk and bank size with their respective probability values of 0.464>0.05 and 0.563>0.05. Also, liquidity risk has a positive effect on return on assets to the tune of 0.2860(p=0.009<0.05). The R-square statistics reported in table 4 shows that about 35.5% of the systematic variation in return on assets can be jointly explained by the explanatory variables. The F-statistics along with the probability value given to be 10.93 and 0.0061 respectively shows that the model is fit. Wald test reveals that there is no heteroskedascity problem in the model given the probability value of 0.4903. Similarly, there is no serial correction problem as shown in the result of the Wooldridge test with the probability value of 0.6115, which is insignificant and aligned with the null hypothesis which states that no serial auto correlation. Also, the Pesaran test shows that there is no evidence to reject the null hypothesis of no cross-sectional dependence with the probability value of 0.8848, confirming the acceptance of the null hypothesis.

| Table 4 Effect of Cash Reserve Requirement on Return on Assets (MODEL I) | ||||

| Variable | Coefficient | Std Error | T-Test | Probability |

| C | 0.1281 | 0.1204 | 1.06 | 0.291 |

| CRR | -0.0025 | 0.0011 | 2.18 | 0.036 |

| CRI | -0.0010 | 0.0014 | 0.74 | 0.464 |

| BSI | -0.0036 | 0.0062 | 0.58 | 0.563 |

| LRI | 0.2860 | 0.0522 | 3.63 | 0.009 |

| Hausman Test | Stat = 11.97, Prob = 0.0291 | |||

| Wald test | Stat = 3.07, Prob = 0.4903 | |||

| Pesaran test | Stat = 0.15, Prob = 0.8848 | |||

| Wooldridge test | Stat = 618.97, Prob = 0.6115 | |||

| Adjusted R-Square | 0.3559 | |||

| F-Stat | 10.93 | |||

| Prob (F-Stat) | 0.0061 | |||

In Table 5, the probability value of the Hausman test given to be 0.3702 shows that random effect estimation is the best estimate and it reveals that cash reserve ratio has a negative and significant effect on return on equity to the tune of -0.0039(p0.026<0.05). likewise, both credit risk captured with non-performing loans and bank size captured with total asset have a negative and significant effect on return on equity to the tune of -0.0008(p=0.679>0.05) for credit risk and -0.0016(0.839>0.05) for bank size. Also, liquidity risk has a positive effect on return on equity to the tune of 0.2260(p=0.041<0.05). The R-square statistics reported in table 5 shows that about 39.5% of the systematic variation in return on equity can be jointly explained by the explanatory variables. The F-statistics along with the probability value given to be 13.67 and 0.0088 respectively sho that the model is fit. Wald test reveals that there is no heteroskedascity problem in the model given the probability value of 0.2206. Similarly, there is no serial correction problem as shown in the result of the Wooldridge test with the probability value of 0.5518, which is insignificant and aligned with the null hypothesis which states that no serial auto correlation. Also, the Pesaran test shows that there is no evidence to reject the null hypothesis of no cross-sectional dependence with the probability value of 0.4884, confirming the acceptance of the null hypothesis.

| Table 5 Effect of Cash Reserve Requirement on Return on Equity (MODEL II) | ||||

| Variable | Coefficient | Std Error | T-Test | Probability |

| C | ||||

| CRR | -0.0039 | 0.0016 | 2.27 | 0.026 |

| CRI | -0.0008 | 0.0019 | 0.41 | 0.679 |

| BSI | -0.0016 | 0.0079 | 0.20 | 0.839 |

| LRI | 0.2260 | 0.1054 | 2.05 | 0.041 |

| Hausman Test | Stat = 4.01, Prob =0.3702 | |||

| Wald test | Stat = 3.308, Prob = 0.2206 | |||

| Pesaran test | Stat = 2.663, Prob = 0.4884 | |||

| Wooldridge test | Stat = 0.593, Prob = 0.5518 | |||

| R-Square | 0.3935 | |||

| Wald Chi | 13.67 | |||

| Prob (F-Stat) | 0.0088 | |||

Discussion of Findings

Based on the best estimate for model I, it was discovered that cash reserve ratio exerts a negative and significant effect on return on assets of Deposit Money Banks (DMBs) in Nigeria to the tune of -0.0025(p=0.036<0.05). This shows that there enough evidence to reject the null hypothesis and accept the alternative one, reflecting that a 1% increase in cash reserve requirement of DMBs in Nigeria would cause return on asset to decrease by 0.0025. The same discovery was made for model II, where cash reserve ratio has a negative and significant effect on return on equity to the tune of -0.0039 (p0.026<0.05), indicating that a 1% increase in cash reserve requirement of DMBs in Nigeria would cause return on equity to decrease by 0.0039. The corollary of these findings is that all other things being equal, cash reserve ratio has the capacity to negatively influence the profitability of DMBs in Nigeria.

The negative coefficient confirmed the a-priori expectation, as it was expected that an increase in the cash reserve requirement of banks will affect the transaction volume and consequently affect their performance. It is significant because banks solely depend on deposits for operational activities, and a reduction in the deposit level limits their transaction capacity and thus, the performance level. An increase in cash reserve requirement of banks might broaden the gap between the total deposit and lending rates. As the gaps get widened, the domestic sector might find it too expensive to borrow money from banks because of the increase in interest rates and consequently affect the profitability of banks. Also, foreign investors might equally find it unattractive to lend to domestic banks. Large capital is expected to be costly for banks in terms of profitability. However, trade-off theory posits that higher capital might limit banks’ risk and hence the premium needed to pay investors for the costs of liquidation. This outcome corroborates the findings of Fatima & Samreen, (2015); Oganda et al. (2018); Bawa et al. (2018) that cash reserve has a negative effect on the performance level of banks. However, this finding was contrary to the discoveries (Akanbi & Ajagbe, (2012); Onoh, (2017)). They reported a positive effect of cash reserve requirement on banks’ profitability.

Conclusion and Recommendations

This paper was an attempt to reveal the effect of cash reserve requirement and Banks profitability in Nigeria. It covered all the 8 DMBs, designated as banks that are too big to fail for a period of 10 years, spanning from 2010-2019. Panel regression of fixed and random effect estimation was employed and this was carried out after descriptive statistics and Pearson correlation. It was established that the effect of cash reserve requirement on banks’ profitability is statistically significant. Particularly, it was discovered that cash reserve requirement has a negative and significant effect on banks’ profitability captured with return on assets and return on equity. Thus, it was recommended that the Central Bank of Nigeria (CBN) should revise the requirement of cash reserve of DMBs in a way that the operational activities of banks and the entire financial system of the nation will not be negatively affected. Also, in setting the minimum cash reserve requirement of banks, the objective of the policy-makers should not solely center on how to eradicate the possibility of bank failure, they should also focus on how to improve banks’ profitability. Scholars interested in a similar topic can include non-bank specific explanatory variables in the model.

References

Adriana, G., & Simon, C. (2017). Reserve Requirement Ratio and Financial Performance Relationship: A Review of Measurement Approaches. Economic Research Ekonomska, 30(1), 676-693.

Ajayi, F.O., & Atanda, A. (2014): Monetary Policy and Bank Performance in Nigeria: A Two-Step cointegration Approach, African Journal of Scientific Research, 9(1), 463-468.

Akanbi, T.A., & Ajagbe, F.A (2012), Analysis of monetary policy on commercial banks in Nigeria, African Journal of Business Management, 51(6).

Bawa, A.B., Akinniyi, K.O., & Njarendy P.I. (2018). Cash Reserve Ratio, Money Supply and the Profitability of Deposit Money Banks in Nigeria. International Journal of Financial Management (IJFM), 7(4), 9-18.

Dakito, A.K. (2017). The Impact of Cash Reserve Requirement on Financial Performance of Banking Sector in Ethiopia. Global Journal of Management and Business Research, 17(1), 78-95.

Hanaffie, B.M.Y. (2017). The Effect of Liquidity and Solvency on Profitability: The Case of Public-Listed Consumer Product Companies in Malaysia. Published Thesis, Malaysia University.

Khrawish, H.A. (2011). Determinants of Commercial Banks Profitability: Evidence from Jordan. International Research Journal of Finance and Economics, 5(5), 19-45.

Mitku M.Y. (2018). Lending and Cash Required Reserve: Empirical Evidence from Ethiopian Commercial Bank. European Scientific Journal, 14(13), 179-189.

Moses, M., Harjit, S., & Sadananda, P. (2015). Liquidity-Profitability Trade-off in Commercial Banks: Evidence from Tanzania. Research Journal of Finance and Accounting, 6(7), 93-100.

Olokoyo, F.O. (2019). Determinants of Commercial Banks’ Lending Behavior in Nigeria, International Journal of Financial Research, 2(2), 16-25.

Prada, J. (2008). Financial Intermediation and Monetary Policy in a Small Open Economy. Borradores de Economía, 531. Bogotá, Colombia: Banco de la República de Colombia.

Udeh, S.N. (2015). Impact of Monetary Policy Instruments on Profitability of Commercial banks in Nigeria: Zenith Bank experience. Research Journal of Finance and Accounting, 10(6), 190-205.