Research Article: 2020 Vol: 24 Issue: 3

Capital Market Response to Monetary Policy Shocks: Evidence from Nigeria

Cordelia Onyinyechi Omodero, Clifford University Owerrinta

Abstract

This study appraises the capital market response to monetary policy surprises in Nigeria. Due to the critical role of the capital market in the international economy and finance, it becomes very imperative to determine the effect of monetary policy announcements on its operations. This study uses data that cover a period from 2000 to 2018 to analyze the effect of the monetary policy shocks on the capital market outputs in Nigeria. The data are collected on capital market capitalization, money supply, interest rate and exchange rate while applying the ordinary least squares (OLS) multiple regression technique for data analysis. The multiple regression result provides evidence that money supply has a remarkable positive impact on capital market capitalization while the interest rate exerts a significant negative effect on the capital market output. The study further reveals that the exchange rate has an insignificant positive effect on the capital market performance. Based on these findings, the study suggests initial test running of all monetary policy modifications by the monetary authority in the country before the full adoption of such policy changes. The study also recommends that the CBN should endeavor to encourage credit accessibility and investment in securities by reducing the interest rate and exchange rate fluctuations.

Keywords

Capital Market, Market Capitalization, Money Supply, Interest Rate, Exchange Rate, Monetary Policy.

JEL Classifications

E43, E44, E51, E52, F31

Introduction

Capital market enlargement entails the efficacy of the market in assembling and distributing capital in order to achieve a greater height of economic growth and expansion. Thus, a capital market is obliged to be adequately great and liquid, retaining a robust market capitalization which represents an ample connection to the performance of the real economic sector (Kamal, 2013). As a matter of fact, it is important to note that the capital market plays the vital role of transferring funds from capital borrowers to capital investors which is an indispensable mechanism for economic growth (Rifat, 2015). Hence, both policy makers and investors find it interesting to understand the various ways monetary policy variations affect the economy through the response of the capital market to the modifications that occur from time to time in the monetary policy. In addition, the role of capital markets globally, has become very dynamic in enhancing economic productivity since the beginning of universal industrial uprising, multidimensional economic system and growing financial crunch (Hojat, 2015; Kolozsi, 2013; Chiarella et al., 2013; Dempsey, 2013; Doh & Connolly, 2013; Borys, 2011).

Thus, following the critical response of the capital market to monetary policy surprises, it is expedient that both the monetary powers and investors come to the full realization of the nexus between monetary policy tools and the prices of all securities available in the capital market. According to Onyeke (2016), the capital market reaction to monetary policy is a function of market efficiency and the level of development attained by a nation’s financial institutions and the values of securities in the capital market. The value of some securities changes based on the specific industry information available, while others vary based on the particular company’s accessible insider and general information. This is in line with the three forms of “Efficient Market Hypothesis” conventionally referred to as strong, semi-strong and weak.

Monetary policy refers to a mechanism employed by the monetary authority to determine the quantity and disposal of money and credit accessibility with the aim of realizing an anticipated economic goal. In Nigeria, the Central Bank of Nigeria (CBN) is the monetary authority vested with the power through decrees 24 and 25 1991 to administer monetary policy. All monetary and banking policies in Nigeria originate from the CBN which later conveys the suggestion to the government for adaptation, endorsement or refutation. The selected monetary policy tools that their variations locally and globally affect the capital market especially in Nigeria include the exchange rate, money supply and interest rate among others. The capital market reacts to these financial policy changes negatively or positively which in turn impacts on economic growth.

On the other hand, Capital market in Nigeria is a large security market which gives investors the opportunity to buy and sale securities such as government stocks/securities, debt instrument or bonds, equities and exchange trust fund (ETF) introduced in 2011 (Omodero, 2020). Market capitalization in Nigeria is the share price multiplied by the number of the several classes of listed companies’ shares (Omodero, 2020). According to Anaele & Umuora (2019), market capitalization is simply defined as the share price of securities quoted on the Nigerian Stock Exchange (NSE) multiplied by the outstanding number of shares. Anaele & Umuora (2019) submit that a stable growth in the market capitalization of companies listed in the NSE suggests capital market enlargement. However, expansion or otherwise decrease in the market capitalization depends of the response of the capital market to monetary policy shocks. Moreover, the existing empirical studies and literatures have not sufficiently described the influence of the monetary policy upsets on the capital market productivity (Abdymomunova & Morleyb, 2011; Alves, 2013; Berger, 2011; Febrian & Herwany, 2010; Levy, 2012). The structure of this paper includes general introduction, followed by literature review, methodology, data analysis and interpretation including the discussion on the findings and finally the major proposals made in this study. Thus, this study wishes to determine the reaction of the capital market to several shocks following the interferences in the monetary policy in Nigeria.

Literature Review

Theoretical Review

This study is anchored on the quantity theory of money and the liquidity hypothesis. The quantity theory of money validates the nexus connecting money supply and stock prices. When money supply increases, the resultant effect is that the quantity of money becomes excess and so the investing public will be willing to buy more shares which also increases the share prices (Raksha et al., 2016). As considered by Keynes, the diminution in interest rates usually exert some level of influence on collective demand. Following the expansionary monetary policy adoption, there could be a decrease in the interest rates within a period of time. When interest rates are lesser than the marginal efficiency of capital, the marginal productivity of capital enlarges the investment demand until it is equal to the interest rate (Yoshino et al., 2014). The growth in investments produces a multiplier effect, thereby resulting to a total demand expansion and it impacts on the stock market. Growing demand for stocks creates pressure on prices. Consequently, low interest rates decrease borrowing costs causing stock demand and prices to increase (Yoshino et al., 2014).

The liquidity hypothesis also advocates an affirmative association between the monetary policy tools and the capital market. The monetary policy expectation assumption is that excess money in circulation could be controlled through tightening of accessibility to credits by increasing the interest rates which eventually leads to a decrease in stock prices (Raksha et al., 2016). For the purpose of general price stability in an economy, interest rate manipulation has the most beneficial economic result and stands as the best monetary policy tool to achieve price stability (Nguyen, 2019). Based on this premise, it is believed that interest rate and exchange rates adjustments are the monetary policy tools that invariably influence the behavior of the capital market (Lawal et al., 2018). On the contrary, Nguyen (2019) affirms that “one-percentage-point increase in the interest rate is associated with a fall in output in emerging and developing countries”. Nguyen (2019) believes that monetary policy tightening reduces economic productivity especially in unindustrialized nations. This is because it makes credit obtainability difficult, as a result the capital market will lack patronage from the investing public who due to the rise in the finance cost may not be able to invest in stocks and other securities.

Empirical Review

Okpara (2010) studied the effect of monetary policy on the stock market returns in Nigeria using two stage least squares method and vector error correction model. The study found that monetary policy affected stock market returns in the long run. The Treasury bill decreased the stock market returns while the interest rate had a significant positive impact on the stock market returns. Osamwonyi and Evbayiro-Osagie (2012) employed vector error correction model and data covering a period from 1975 to 2005 to investigate the impact of macroeconomic variables on the capital market in Nigeria. The independent variables applied in the study included the interest rate, inflation rate, exchange rate, fiscal deficit, GDP and money supply. The study made use of All Share Index as the dependent variable which is the proxy for the capital market in Nigeria. However, the most important discovery was that all the predictor variables used in the study impacted on the All Share Index. That is, the macroeconomic variables including interest rate, exchange rate and money supply among others, had significant effects on the capital market in Nigeria during the period covered by the study.

Mala, (2012) used structural vector auto-regression model to analyze the Malaysian monetary policy during the pre and post 1997 Asian Crisis periods. The results showed that the crunch and the resultant most important variation in the exchange rate substantially affected the Malaysian ‘Black Box’. The study found evidence that the indigenous factors were more susceptible to foreign monetary shocks in the pre-crisis period. It was observed that the exchange rate helped significantly in diffusing the interest rate shocks, whereas credit and asset prices facilitated the spread of the money shock. However, during the post-crisis period, the asset prices were more dominant in escalating the effects of both interest rate and money shocks on productivity, and the economy was isolated from foreign shocks.

Zare et al. (2013) observed the uneven reaction of stock market to monetary policy over bull and bear market periods in ASEAN5 countries (Malaysia, Indonesia, Singapore, the Philippines and Thailand) by applying pooled mean group (PMG) method. The study used Markov-switching models and rule based non-parametric approach to identify the bull and bear markets. Monthly data from January1991to December 2011 were used for model estimation, thus the results showed that a rise in the interest rate led to a more robust long-term consequence on stock market instability in the bear markets than it was noticed in the bull’s market. Chen and Wu (2013) employed a threshold regression model to determine the effect of monetary policy on capital markets. Contrary to the traditional economic theory that stock prices have inverse relationship with interest rates, this study revealed that interest rates inversely affect stock indexes only when interest rate exceeded a particular threshold. However, the major findings of this study were that when interest rates decreased or increased, the stock prices were significantly affected. Thus, a significant co-integration relationship occurred both prior to and after the reduction of the interest rates by the Central Banks of nations studied.

Raksha et al. (2016) employed a panel data of five emerging countries to consider the influence of monetary policies on stock markets for a period covering 2004 to 2014. The study used random effect model and panel vector error correction model to examine the short run and long run correlation between the monetary policy tools and the stock market’s performance. The results disclosed the existence of a negative relationship between interest rate and stock returns and a direct connection between money supply and stock returns. The study established evidence that monetary policy could be responsible for variations in the stock returns both in the short and long terms. Onyeke (2016) applied six variable standard VAR model and a secondary form of data that spanned from 2003 to 2014 to analyze the response of stock market returns to monetary policy variations in Nigeria. The six variables used in the study included consumer price index, interbank rate, open buy-back, Treasury bill rate, exchange rate and all share index. The study appraisal outcome showed that monetary policy had an immaterial influence on the stock prices and the conclusion was that stock market reaction to monetary policy changes during the period covered by the study was insignificant.

Atgur & Yigit (2017) used the Johansen Co-integration and Granger Causality test techniques to examine the impacts of monetary policy tools on the BIST stock market in Turkey from 2006 to 2016. The results revealed that monetary policy tools (M2 and deposit interest rate) had a significant effect on the BIST stock market prices and returns. Echekoba et al. (2018) examined the impact of monetary policy on capital market performance in Nigeria using ordinary least squares method and data spanning from 1986 to 2016. The monetary policy tools employed as the independent variables included monetary policy rate and cash reserve ratio while the capital market performance was represented by the all share index. The study discovered that monetary policy instruments used and within the period covered by the study did not have favorable influence on the capital market performance. The monetary policy rate exerted an undesirable material correlation with the performance of the capital market while the cash reserve ratio had a slight positive relationship with the capital market performance.

Franco & Galloppo (2018) analyzed the reaction of stock price to the monetary and fiscal policy variations following the pronouncements in 12 universal stock exchanges from June 1, 2007 and June 30, 2012. The study estimated the unusual stock responses and found that stock industry indices’ response to the policy interferences was different from how the broad stock index reacted. Secondly, the stock returns responded negatively to the restraint processes for the broad and nonbanking sector indices. The findings further revealed that stock response to expansionary methods became sturdier at the commencement of the monetary crunch. Hu et al. (2018) investigated the impact of monetary and fiscal policy shocks on Chinese stock markets. The findings revealed that fiscal policy had a noteworthy adverse concurrent association with the stock market performance while the effect of the monetary policy on the stock market varied in accordance with the fiscal policy. Following the output of the lagged variables, both policies had a direct substantial positive impact on the stock market performance.

Kontonikas & Zekaite (2018) scrutinized the connection between the US monetary policy and stock estimation by employing an operational VAR basis that permitted the concurrent interface between the federal funds rate and stock market expansions which depended on the postulation of long-run financial objectivity. The study found a robust, harmful and momentous monetary policy constriction influence on real stock prices. In addition, the study comparatively established that small stocks deferred reaction to monetary policy shocks more than the large stocks. Megaravalli & Sampagnaro (2018) used co-integration test, granger causality test and pooled mean group estimator to determine the short- and long-term relationship between China, Japanese and India (ASIAN 3 countries) stock markets and the macroeconomic forces such as inflation and the exchange rates. The study employed a monthly time series data covering a period from January 2008 to November 2016. From the results of the pooled estimation, the exchange rate had a significant positive long-term influence on the stock markets of the ASIAN 3 countries while inflation had an inconsequential negative long run impact on them.

Val et al. (2018) examined the reaction of the stock market to the monetary policy in Brazil. The study analyzed the effects of both the expected and unexpected elements of monetary policy on the 53 stocks and IBOVESPA returns index. The study found that monetary policy impacted substantially on the stock market as a result of the unexpected deviations in the rate of unemployment, industrial production index, over-all market price index and the general consumer price index. Yang, (2018) used structural vector auto-regression model to examine the special effects of macroeconomic shocks on key macro variables which comprised stock market returns in Korea. The study found backing for a negative (positive) relation of demand (supply) shocks to stock returns. The finding revealed that demand shocks had more substantial impact on stock market adjustment than the supply shocks. The result of the sub-period examination showed that international market oscillations during the worldwide economic crunch comparatively had slight influence on the performance of the Korean stock market.

Qureshi et al. (2019) studied the interconnection between bond fund flows, stock market returns and monetary policies prevalent in advanced and emerging markets. The discoveries indicated a bi-directional adverse connection between bond flows and stock market returns in the advanced nations due to the existence of fiscal and monetary policies. For the emerging nations, expansionary financial position exerted a negative influence on bond flows while an expansionary fiscal policy had a positive impact on the stock market returns and bond flows. Further findings showed that bond flows thrived in the periods of diminutive economic activity, both in the industrialized and unindustrialized nations. Zhang, (2019) assessed the influences of company share on stock liquidity and the causal inducing instrument. The study found evidence that the investment of A-share listed companies considerably condensed the market risk level of the company shares and improved the stock liquidity. The findings also showed that corporate market risk had incomplete arbitrating consequence on the connection between company share and stock liquidity. However, during the period of monetary policy tightening especially companies that had extraordinary monetary restraints, company share had more positive effect on stock liquidity while the umpiring influence of company market risk became more noticeable.

Material and Methods

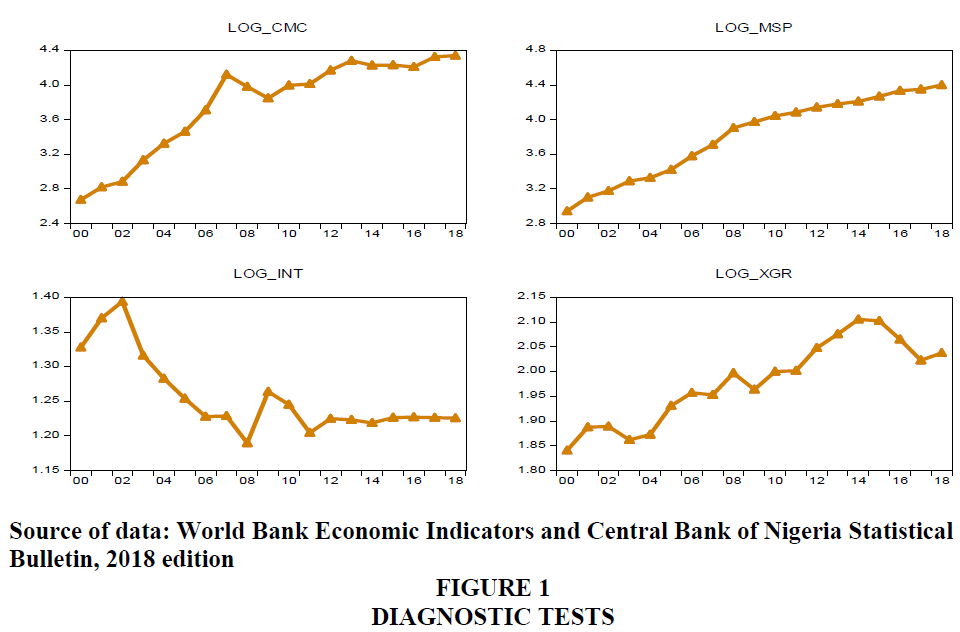

This study considers the capital market response to monetary policy shocks in Nigeria. The research design adopted is the ex-post facto which does not permit manipulation of data, while the secondary form of data employed cover a period from 2000 to 2018. This method of investigation is necessitated by the fact that all the data required for the assessment are historical. They are gathered from events that have already occurred and are necessary for future forecast or prediction. This method will guide the study to be able to produce empirical evidence that can effectively influence monetary policy changes. The appropriate diagnostic tests are done to establish data normality, stability and absence of serial correlation and multicollinearity. The analysis of data is done with the ordinary least squares (OLS) multiple regression technique in order to prevent intricacy and ambiguity in interpretation and in specifying the actual statistical evidence the study wishes to validate. All the data collected for this study are sourced from the Central Bank of Nigeria Statistical Bulletin, 2018 edition, and the World Bank Economic Indicators. For the purpose of uniformity and to avoid misuse of numbers, all data are expressed in logarithm form due to the disparity in their form.

Model Specification

The functional and econometric relationship between the response variable and the explanatory variables can be noticed in the equations below:

CMC = f (MSP, INT, XGR) ……………………………………………………………. (1)

LOGCMC = β0 + β1LOGMSP + β2LOGINT + β3LOGXGR + μ…………...................... (2)

Where:

CMC = Capital market capitalization

MSP = Money supply;

INT = Interest rate;

XGR = Exchange rate

β0 = Constant;

β1–β3 = Regression coefficients;

μ = Error term.

A priori, we expect: β1 > 0, β2> 0, β3 > 0.

Data Analysis and Interpretations

Trend Analysis

Table 1 and 2 above indicate the absence of serial correlation and heteroskedasticity respectively. The absence of heteroskedasticity proves that the model coefficients estimated using ordinary least squares are not biased (Figure 1). Table 3 confirms there is a linear relationship in the regression model while Table 4 shows that the data set are normally distributed based on the Jarque-Bera probability outcomes that are above 5 percent level of significance. The standard deviations are far below the mean values, this implies that there is a lower spread of the data and that they are all clustered around the mean.

| Table 1 Breusch-Godfrey Serial Correlation LM Test | |||

| F-statistic | 0.495650 | Prob. F (2,13) | 0.6202 |

| Obs*R-squared | 1.346173 | Prob. Chi-Square (2) | 0.5101 |

| Table 2 Heteroskedasticity Test: Breusch-Pagan-Godfrey | |||

| F-statistic | 0.716777 | Prob. F (3,15) | 0.5572 |

| Obs*R-squared | 2.382245 | Prob. Chi-Square (3) | 0.4969 |

| Table 3 Ramsey Reset Test | |||

| Specification: LOG_CMC LOG_MSP LOG_INT LOG_XGR C | |||

| Value | Df | Probability | |

| F-statistic | 3.975598 | (1, 14) | 0.0660 |

| Table 4 Descriptive Statistics for Normality Test | ||||

| LOG_CMC | LOG_MSP | LOG_INT | LOG_XGR | |

| Mean | 3.776200 | 3.812949 | 1.256741 | 1.979626 |

| Median | 3.996433 | 3.973641 | 1.227887 | 1.996949 |

| Maximum | 4.340524 | 4.399323 | 1.393926 | 2.105510 |

| Minimum | 2.674218 | 2.943721 | 1.189771 | 1.840733 |

| Std. Dev. | 0.554706 | 0.475048 | 0.056334 | 0.082843 |

| Skewness | -0.814267 | -0.437498 | 1.243747 | -0.121951 |

| Kurtosis | 2.220174 | 1.756112 | 3.454982 | 1.857254 |

| Jarque-Bera | 2.581034 | 1.831024 | 5.062419 | 1.080907 |

| Probability | 0.275128 | 0.400312 | 0.079563 | 0.582484 |

| Sum | 71.74780 | 72.44604 | 23.87808 | 37.61289 |

| Sum Sq. Dev. | 5.538568 | 4.062076 | 0.057123 | 0.123533 |

| Observations | 19 | 19 | 19 | 19 |

A test of multicollinearity is a test to confirm if there is a strong interrelationship among the predictor variables used in a study. The application and analysis of a multiple regression model hinge on the hypothesis that the independent variables are not interrelated (Australian Property Institute, 2015). Table 5 above provides test for multicollinearity which supervenes when two or more autonomous variables intensely interconnect in describing the same element. It simply denotes that there is an overlay among them in assessing the same value. In order to recognize any such situation, the Variance Inflatory Factor (VIF) is employed. The VIF is used to measure the degree at which the variance of a variable is growing. VIF specifies how the variance of a variable increases due to the presence of multicollinearity. The level of collinearity upsurges as the variance of a variable intensifies (Gujarati & Porter, 2009). The rule is that if the value of VIF of a variable goes beyond 10, then there is a high collinearity between that variable and other independent variables (Gujarati & Porter, 2009). So, in order to synchronize the distribution, the affected autonomous variable has to be removed. However, in this study the VIF values of all the independent variables are less than 10, thus, there is no presence of multicollinearity in this study.

| Table 5 Multicollinearity Test | |||

| Variance Inflation Factors | |||

| Date: 12/29/19 Time: 08:47 | |||

| Sample: 2000 2018 | |||

| Included observations: 19 | |||

| Coefficient | Uncentered | Centered | |

| Variable | Variance | VIF | VIF |

| LOG_MSP | 0.029116 | 621.0153 | 8.999840 |

| LOG_INT | 0.640002 | 1464.236 | 2.781981 |

| LOG_XGR | 0.789683 | 4481.781 | 7.423230 |

| C | 3.281623 | 4744.612 | NA |

From Table 6 above, the regression result shows the existence of a very strong relationship between the CMC and the explanatory variable (MSP, INT and XGR). The correlation value is 98.2% which the square root of the R-squared. The R-squared value is 96.4% which shows the extent to which MSP, INT and XGR explain the changes in CMC. This result validates the fact that monetary policy amendments determine the capital market productivity to a very large extent. Thus, it follows that the remaining 3.6% is not incorporated in the model specified for this study. The Durbin-Watson is 2 which indicates absence of autocorrelation in the study sample (Gujarati & Porter, 2009). The F-Statistic is 135.4865 while the p-value is 0.000 < 0.05. This result indicates that the model is statistically significant and appropriate for the study. It is also implying that the monetary policy instruments used in this study mutually influence CMC.

| Table 6 Regression Result | ||||

| Dependent Variable: LOG_CMC | ||||

| Method: Least Squares | ||||

| Date: 12/29/19 Time: 08:46 | ||||

| Sample: 2000 2018 | ||||

| Included observations: 19 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| LOG_MSP | 0.754928 | 0.170633 | 4.424267 | 0.0005 |

| LOG_INT | -3.318082 | 0.800001 | -4.147594 | 0.0009 |

| LOG_XGR | 0.321083 | 0.888641 | 0.361319 | 0.7229 |

| C | 4.432044 | 1.811525 | 2.446582 | 0.0272 |

| R-squared | 0.964409 | Mean dependent var | 3.776200 | |

| Adjusted R-squared | 0.957291 | S.D. dependent var | 0.554706 | |

| S.E. of regression | 0.114636 | Akaike info criterion | -1.309447 | |

| Sum squared resid | 0.197121 | Schwarz criterion | -1.110617 | |

| Log likelihood | 16.43974 | Hannan-Quinn criter. | -1.275797 | |

| F-statistic | 135.4865 | Durbin-Watson stat | 2.116092 | |

| Prob(F-statistic) | 0.000000 | |||

The impact of the specific variables is verified with the t-statistics. From Table 6 above, MSP t-statistic is 4.424267 with a p-value of 0.000 < 0.05. This result implies that money supply has a significant positive impact on CMC. This evidence is in harmony with the findings of (Raksha et al., 2016; Atgur & Yigit, 2017) but the outcome of the (Onyeke, 2016; Echekoba et al., 2018) studies contradict this result. The result implies that money supply has a significant positive impact on CMC. INT t-statistic is -4.147594 while the p-value is 0.000 < 0.05. This result indicates that interest rate has a substantial destructive consequence on CMC. XGR t-statistic is 0.361319 with the p-value of 0.72 > 0.05 level of significance. The result provides evidence that exchange rate has an insignificant positive influence on CMC. Thus, this result agrees with (Megaravalli & Sampagnaro, 2018).

Conclusion and proposals

Conclusion and Implication of Findings

This study specifically measures the effect of monetary policy shocks on the capital market in Nigeria using capital market capitalization as a function of money supply, interest rate and exchange rate. The regression result provides evidence that money supply has a significant favorable influence on the capital market while the interest is substantially harmful to the capital market performance. The exchange rate exerts a positive immaterial influence on the capital market. The hurtful influence of interest rate variations on the capital market has been substantiated in the previous studies (Chen & Wu, 2013; Raksha et al., 2016; Atgur & Yigit, 2017), as such this study provides further evidence to this claim. Sufficient and well-regulated money supply helps to boost the capital market performance (Raksha et al., 2016; Atgur & Yigit, 2017), this is also established in this study. However, the exchange is not substantial in this investigation as seen in an earlier examination (Megaravalli & Sampagnaro, 2018). The findings of this study have some social transformation consequences which will enable institutional and individual investors to make an informed investment decision and rationally allocate resources especially when there are financial constraints. Furthermore, the result of this study could serve as a backing for the monetary powers in their assessment of the reaction of the capital market towards the modifications in the monetary policy tools and therefore avert a sudden collapse in the Nigerian capital market. Generally, this study corroborates the quantity theory of money and the liquidity hypothesis which state that increase in the interest rate discourages investment in shares while the increase in the amount of money in circulation promotes investment in the capital market, its profitability and vice versa.

Proposals

Capital market in Nigeria is a pivot connecting all aspects of the economy in one place through buying and selling of securities. Following the result of this study, the monetary powers in Nigeria has the obligation to standardize the policies determining the supply of money and control the interest rate excesses. Therefore, it is recommended that the cost of obtaining credit by investors should be minimized to boost the capital market efficiency. The money supply should be stable and match with the prevailing economic realities. This implies that money supply should correspond with the investment needs of the economy. The Central Bank of Nigeria should endeavor to come up with strategies to improve the value of the local currency. The study is also suggesting a pilot test running of all monetary policy adjustments before adoption by the monetary authority in the country.

The major constraint of this study is the dearth of data to quantify and measure the effect of other potential monetary policy tools on the capital market in Nigeria. These unquantifiable tools include the open market operation and moral suasion used by the Central Bank of Nigeria. Therefore, this is a potential research area for future researchers who may wish to explore the response of the capital market to the variations in all the monetary policy tools, both the quantifiable and the qualitative instruments the CBN employs in stabilizing the economy.

References

- Abdymomunov, A., & Morley, J. (2011). Time variation of CAPM betas across market volatility regimes. Applied Financial Economics, 21, 1463–1478.

- Alves, P. (2013). The Fama-French model or the capital asset pricing model: International evidence. International Journal of Business and Finance Research, 7(2), 79-89.

- Anaele, S.C., & Umeora, C.E. (2019). Monetary policy and the performance of the Nigerian capital market (1986-2017). International Journal of Research in Engineering Science and Management, 2(7), 59-72.

- Atgur, M., & Yigit, F. (2017). Causality analysis of the impact of monetary policy on stock Markets: The case of Turkey. Journal of Knowledge Management, Economics and Information Technology, 7(4), 1-20.

- Australian Property Institute (2015). The valuation of real estate. 2nd edition. Canberra, Australia: Appraisal Institute.

- Berger, D. (2011). Testing the CAPM across observed and fundamental returns. Applied Financial Economics, 21, 625–636.

- Borys, M.M. (2011). Testing multi-factor asset pricing models in the visegrad countries. Journal of Economics and Finance, 61(2), 118-137.

- Chen, G., & Wu, M. (2013). How does monetary policy influence capital markets? Using a threshold regression model. Asia-Pacific Financial Markets , 20, 31–47 (2013).

- Chiarella, C., Dieci, R., He, X., & Li, K. (2013). An evolutionary CAPM under heterogeneous Beliefs. Annals of Finance, 9, 185–215.

- Dempsey, M. (2013). The CAPM: A case of elegance is for tailors? ABACUS, 49, 82-87.

- Doh, T., & Connolly, M. (2013). Has the effect of monetary policy announcements on asset prices Changed? Federal Reserve Bank of Kansas City. Available online at: http://www.KansasCityFed.org.

- Echekoba, F.N., Okaro, C.S., Ananwude, A.C., & Akuesodo, O.E. (2018). Monetary policy and capital market performance: An empirical evidence from Nigerian data. Research Journal of Economics, 2(1), 1-6.

- Febrian, E., & Herwany, A. (2010). The performance of asset pricing models before, during and After an emerging market financial crisis: Evidence from Indonesia. The International Journal of Business and Finance Research, 4(1), 85-97.

- Franco, F., & Galloppo, G. (2018). Stock market reaction to policy interventions. The European Journal of Finance, 24(18), 1817-1834.

- Gabaix, X. (2011). Disasterization: A simple way to fix the asset pricing properties of Macroeconomic models. American Economic Review, 101(3), 406–409.

- Gujarati, D.N., & Porter, D.C. (2009). Basic Econometrics (5th Ed.). Boston:McGraw-Hill Irwin. ISBN 978-0-07-337577-9.

- Gwilym, R.A., (2013). The monetary policy implications of behavioral asset bubbles. Southern Economic Journal, 80(1), 252-270.

- Hojat, S. (2015). The impact of monetary policy on the stock market. A Ph.D Dissertation Submitted to Walden University. Available online at: https://scholarworks.waldenu.edu/cgi/viewcontent.cgi?article=2602& context=dissertations.

- Hu, L., Han, J., & Zhang, Q. (2018). The impact of monetary and fiscal policy shocks on stock Markets: Evidence from China. Emerging Markets Finance and Trade, 54(8), 1856-1871.

- Kamal A.E (2013). The development of stock markets: In search of a theory. International Journal of Economics and Financial Issues, 3(3), 606-624

- Kolozsi, P.P. (2013). Monetary policy, interest groups, financial crisis. Journal of Financial Economics, 5(2), 35-55.

- Kontonikas, A., & Zekaite, Z. (2018). Monetary policy and stock valuation: structural VAR Identification and size effects. Journal of Quantitative Finance, 18(5), 837-848.

- Lawal, A.I., Somoye, R.O., Babajide, A.A., & Nwanji, T.I. (2018). The effect of fiscal and monetary policies interaction on stock market performance: Evidence from Nigeria. Future Business Journal, 4, 16-33.

- Levy, H. (2012). Two paradigms and Nobel prizes in economics: A contradiction or coexistence? European Financial Management, 18(2), 163-182.

- Mala, R., Paramsothy, S. & George, A. (2012). Structural VAR models for Malaysian monetary Policy analysis during the pre- and post-1997 Asian crisis periods. Applied Economics, 44(29), 3841-3856.

- Megaravalli, A.V., & Sampagnaro, G. (2018). Macroeconomic indicators and their impact on stock markets In ASIAN 3: A pooled mean group approach. Cogent Economics & Finance, 6, 1-14.

- Nguyen, T.M.L. (2019). Output effects of monetary policy in emerging and developing countries: Evidence from a Meta-Analysis. Emerging Markets Finance and Trade, 2019, 1-18.

- Nguyen, T.M.L., Papyrakis, E., & Bergeijk, P.A.G.V. (2019). Assessing the price and output effects of monetary policy in Vietnam: Evidence from a VAR analysis. Applied Economics, 51(44), 4800-4819.

- Okpara, G.C. (2010). Monetary policy and stock market returns: Evidence from Nigeria. Journal of Economics, 1(1), 13-21.

- Omodero, C.O. (2020). Capital market determinants and market capitalization in Nigeria. International Journal of Financial Research, 11(1), 462-473.

- Onyeke, C.E. (2016). Impact of monetary policy on stock returns in Nigeria. Middle-East Journal of Scientific Research, 24(5), 1778-1787.

- Osamwonyi, I.O., & Evbayiro-Osagie, E.I. (2012). The relationship between macroeconomic variables and stock market index in Nigeria. Journal of Economics, 3(1), 55-63.

- Qureshi, F., Khan, H.H., Rehman, I., Qureshi, S., & Ghafoor, A. (2019). The effect of monetary and fiscal policy on bond mutual funds and stock market: An international comparison. Emerging Markets Finance and Trade, 55(13), 3112-3130.

- Raksha, B., Boopen, S., Reena, B., Narvada, G., & Keshav, S. (2016). Monetary policy impact on Stock Return: Evidence from growing stock markets. Scientific Research, 6(5), 20-30.

- Rifat, A. (2015). Impact of monetary policy on stock price: Evidence from Bangladesh. Journal of Investment and Management, 4(5), 273-284.

- Val, F.F., Klotzle, M.C., Pinto, A.C.F. & Barbedo, C.H.S. (2018). Stock market reaction to monetary policy: An event study analysis of the Brazilian case. Emerging Markets Finance and Trade, 54(11), 2577-2595.

- Yang, E., Kim, S.H., Kim, M.H., & Ryu, D. (2018). Macroeconomic shocks and stock market returns: The case of Korea. Applied Economics, 50(7), 757-773.

- Yoshino, N., Hesary, F.T., Hassanzadeh, A., & Prasetyo, A.D. (2014). Response of stock Markets to monetary policy: An Asian stock market perspective. Asian Development Bank Institute 2014.

- Zare, R., Azali, M., & Habibullah, M.S. (2013). Monetary policy and stock market volatility in the ASEAN5: Asymmetries over Bull and Bear Markets. Procedia Economics and Finance, 7, 18-27.

- Zhang, H., Ye, J., Wei, F., Kashif, R., & Cao, C. (2019) Monetary policy adjustment, corporate investment, and stock liquidity: Empirical evidence from Chinese stock market. Emerging Markets Finance and Trade, 55(13),3023-3038.