Research Article: 2021 Vol: 20 Issue: 2S

Business Recovery Strategies for Adversely Affected Industries in the UAE- Covid-19 Crisis Response

Pranav Kumar, Skyline University College

Usha Seshadri, VIT-AP University

Ch. Paramaiah, Skyline University College

Keywords

Covid-19 Pandemic, Economic Recovery Model, Business Continuity Plan.

Abstract

Covid-19 pandemic struck the world during December 2019, and it has now been over a year that the countries are still struggling to cope up with it. United Arab Emirates (UAE), largely being an oil-driven economy witnessed a contraction in its GDP in 2020. While the UAE is still to assess the total economic and social costs of the pandemic, many businesses seem to have got highly affected and some of them might be on the verge of getting wiped off from the market. Consequently, unemployment might upsurge resulting in increasing number of people falling into the poverty trap. Thus, it is essential for the government and businesses in the UAE to explore possible alternatives to revive the economy. Even though vaccination has started, it is only in the initial stage and another wave of Covid-19 could be anytime possibility. As such, this study attempts to understand the impact of Covid-19 on the UAE’s economic environment along with major sectors that have gained or got distressed in the pandemic. Also, it reviews the existing literature on post-disaster business recovery strategies and identifies the comprehensive framework that could aid the UAE in reviving its economy and businesses. The framework highlighted in this study focuses on the collective action of both government and businesses to fight against the pandemic. It guides the economic recovery via building trust among the people, creating an entrepreneurial and startup ecosystem, learning from small business recovery plans and infusing financial stimulus to create a much needed sustainable and resilient business environment.

Introduction

Covid-19 Scenario in UAE

Covid-19 virus outbreak which is said to be originated from Wuhan, China in December 2019 spread to several countries across the world. The World Health Organization (WHO) declared Covid-19 under the pandemic category leading to over 2.77 million deaths and 126.8 million cases during last one year of the outbreak (WHO, 2021). Seeing such a huge crisis and loss of lives, several countries imposed social distancing norms, restricted domestic and international travel movements, and imposed stringent lockdown in extreme scenarios and so on. For UAE, their entire fight against Covid-19 has been quite erratic with ups and downs in several instances. However, it is a laudable effort of the UAE administration in dealing with the pandemic and keeping the death rate to the lowest possible. The current situation in the UAE reflects that it has started a focused vaccination drive to prevent the pandemic spread and also enhanced its attention on simultaneously treating the active cases with world class facilities.

Impact of Covid-19 on UAE’s Economy

The covid-19 pandemic is predicted to cause a far deeper hole in the economic activities across the globe than the 2008 global crisis (IMF, 2020a). Just before the pandemic originated, UAE was positioning itself to take the maximum benefit of globalization in terms of capital, labour, technologies and foreign investments. However, the dependency on globalization comes with its own costs particularly during situations like pandemic spread. Several business and economics related international studies were conducted post-pandemic that predicted a drop in Foreign Direct Investment (FDI) in 2020-21, international trading activities in 2020, and a remarkable drop in international passenger traffic too (WTO, 2020; UNCTAD, 2020; ICAO, 2020). These factors play a vital role in the UAE’s economy which noticeably depends on international trade and labor migration. Thus, it is quite evident that the pandemic has hit UAE at a much deeper level than it can be imagined. The export of oil substantially fell during the pandemic due to low demand by countries affecting the oil-based UAE’s economy. Using the real GDP values, UAE’s economy though affected, is still expected to perform better than most of the Gulf Cooperation Council (GCC) countries (Alshamsi, 2020).

Most oil-based businesses rely on a combination of labour-intensive and capital-intensive techniques. Due to the pandemic, labour market got severely affected and capital became huge cost bearing for the oil companies. Further, the sharp decline in oil prices aggravated the situation thereby increasing the debt of these companies as they depend on working-capital for their normal operations. Hence, the impact of the pandemic is visible both on the lives and livelihoods of people. With all these troubles going around, there was a much deeper area of concern for the UAE as one of its financial hub viz. Dubai was feeling the pinch in the pandemic. Dubai, one of the major cities in terms of economic activities that heavily contribute to UAE’s GDP underwent a significant contraction of 10.8% in the first six months of the pandemic (Dubai Statistics Center, 2020). Several businesses performed poorly and went out of the market. Labour-intensive businesses were the ones who faced the highest brunt of the pandemic. Moreover, a study shows that 75% of the businesses that survive crisis usually fail or go out of the market due to a lack of continuity plan (Cook, 2015). Hence, there is a probability of businesses further suffering in instances when they don’t have appropriate continuity plans in place. A report by HSBC shows that nearly 80% of the businesses in the UAE have been heavily impacted due to Covid-19 (HSBC, 2020). However, also there are visible signs that some sectors flourished during the pandemic such as healthcare, digital technologies and e-commerce. Moreover, as the months are passing and vaccination is out, economies are rolling back to their normal operations though with ‘new world orders’. This broadly requires systematic planning and a roadmap for business recoveries. It would further include building a resilient business environment via risk assessment, risk prevention, preparedness, response, recovery and learning from past similar events. Thus, the current study is based on reviewing the existing literature to find an appropriate framework for business recovery strategies post-crisis such as Covid-19 in the context of the UAE’s economy.

Research Problem & Objectives

Businesses and enterprises are crucial for any economy to have growth and development in overall terms. Covid-19 has temporarily bothered the UAE’s economy affecting the lives and livelihoods of people. With challenging employment conditions, decreasing investments, shrinking demand, and rise in debt to GDP ratio of government, the economy is visibly gearing up for revival. It should be noted that, with all of the aforesaid post-crisis eventualities happening around, private businesses have to join hands with the UAE government to revive and recover the economy. Business continuity plans are required for both small & medium enterprises and large corporations to drive the economy towards growth. Thus, this study is an attempt to apprise the entrepreneurs, businesses and other relevant stakeholders of the potential business recovery strategies using existing literature and learning from the past crises.

The objectives of the study are:

i. To understand the impact of Covid-19 on different sectors in UAE’s economic environment

ii. To review the existing literature on business recovery strategies in crisis and build a framework to be followed for reviving the UAE economy

Material and Methods

The study is based on a rigorous qualitative review of the literature, and quantitative analysis of economic data of the UAE. The research design focuses on analyzing past literature on business recovery strategies in crises. The studies reviewed here were obtained via purposive sampling from peer-reviewed papers. This was done to reduce the size of the dataset to a manageable size (Ames et al., 2019). Along with this, government publications, international organization reports, new articles and other such relevant sources were referred to obtain information on the underlying topic. The research papers were obtained from databases such as Google Scholar, Elsevier, Science Direct, JSTOR, Wiley Online Library, etc using the keywords relevant for the study. Among all of the research results, only relevant studies were selected by skimming through the abstract and some parts of the results and discussions. Further, drill down searches was done to obtain greater insights via visiting cross-references and internal references from the main papers.

Results

Impact of Covid-19 on Different Economic Sectors in the UAE

UAE is a vibrant country with its two largest cities Dubai and Abu Dhabi enjoying popularity as tourist centers for millions of people across the world. A large part of the UAE’s economy is dependent on oil reserves contributing more than a quarter of UAE’s GDP. Apart from this, it has even exceled in the field of trade, manufacturing, tourism, and infrastructure development. Indeed, Dubai’s 95% of economy is non-oil dependent. With Covid-19 striking the world and countries moving towards lockdowns, the oil market got severely impacted causing a huge effect on UAE’s economy. As a whole, different economic sectors saw the varying impact of the pandemic which can be broadly categorized as: Poorly Performing, Moderately Performing and Well Performing. Based on this categorization and understanding gained via secondary sources such as news articles, UAE’s economic websites and other international reports, performance of economic sectors is presented as follows: (Table 1)

| Table 1 Performance of UAE’S Economic Sectors Based on the Impact of the Pandemic (KPMG, 2020; UAE Embassy; Altios, 2020) |

|

|---|---|

| Poorly Performing | Aviation, Textile, Luxury Retail, Chemicals, Personal Services, Construction & Real Estate, Automotive, Travel & Hospitality, Hotel and Food Service Industries |

| Moderately Performing | Logistics, Utilities, Media Entertainment, Pharmaceuticals, IT Services |

| Well Performing | Digital Technology & Services, Digital Payment Systems, Food Industry, E- commerce and Home Delivery Services, Healthcare Services, Education Technologies, Digital Media & OTT Platforms, Telecom Services and Internet Providers |

The sectors that required dependency on the labour force, constant interaction with people and gathering or crowding got poorly hit by the pandemic. However, contrary to the above, the sectors where the interaction is minimum, without compromising the service delivery, have indeed witnessed a rise in their market shares.

Healthcare Sector

Since it is a health crisis, the booming of the healthcare sector is natural and by default. Demand for Personal Protective Equipment (PPE) saw a spike causing the health equipment manufacturing sector to take the lead. Also, as the lockdown was imposed and people were staying more at their houses, the cases of anxiety and stress increased. Thus, the need for physical and mental well-being soared up. Many technologies and mobile applications got released to provide online services. Demand for fitness and wellness equipment saw a rise. Additionally, telemedicine and online healthcare services were accessed by the people for diagnostics and medical prescriptions.

Digital Technology Sector

As the pandemic required several businesses to shut down temporarily, the rising need for digital technology was realized. Work from home culture was adopted by IT services industry which used online software and videoconferencing tools to communicate and fulfil the job obligations. The businesses that had rented high-rise buildings and invested heavily in infrastructure realized that this work from home model reduces a substantial cost of operations. The electricity cost, office expenses and many such daily costs got reduced. There is even a possibility that work from home culture would take a new face post-pandemic and would be incorporated into a policy. Similarly, education technology and digital learning applications were launched in the market for children to access education services online. Finally, the media and entertainment industry were smart enough to leverage the increased presence of digital technologies among the population. They started streaming entertainment series and movies on digital and OTT platforms. It was surprising to see a successful response from the population. This caused a spillover effect on the telecom industry and internet service providers who also gained during the pandemic.

E-commerce

Lockdown restricted people’s mobility thereby reducing purchase of consumption goods. As a result, e-commerce platforms saw an increase in their orders for consumption goods. With the ease of lockdown, supply chain and logistics sectors saw a partial opening and started delivering goods and services to customers. Due to intermittent restrictions on and off, the demand for goods over e-commerce platforms hiked enormously. For example, Amazon, online food outlet sites and other delivery platforms received huge orders.

Following is a brief about how the dominant sectors in UAE’s economy map in the current crises situation, and what the prospects are for them.

Food and Beverage Industry (F&B)

The F&B industry was originally forecasted to have a CAGR of 7.40%. However, due to the pandemic, the forecast dropped to a CAGR of 5.12%. The fine-dining sector was impacted heavily, and Expo 2020 is postponed to October 2021. There is still a silver lining that can come to the benefit of the F&B industry. Since 85% of the total food and beverages in the UAE is imported and the pandemic has impacted the imports, the local industry can be encouraged to set-up local production units. Hotel/Restaurant/Café (HORECA) constituting 30% of the total F&B industry demand is facing a significant crunch in its services as hotels; restaurants and tourism are stagnated temporarily. Hotels also play a vital role in organizing meetings, conferences and social activities that are not functioning normally since the pandemic. Lately, such events have started opening though with limited capacity. But the fear of pandemic is leading to demand contraction from customers in city areas. Retail outlets act as a point of sale for most of the F&B products which have not entered into operation in a full-fledged mode. The old business model of customers approaching the retail outlets is no more an acceptable norm. E-commerce and online delivery services have further disrupted retail outlets. This brings in challenges for retail outlets to innovate and create a new business model for their continuity in the market. However, despite these challenges, there are some growth opportunities for F&B industry which are as follows:

? Take-away approach adopted by food outlets reducing their cost of operation

? Phone order and delivery services leading to creation of employment opportunities

? Occurrence of several supply chain and delivery services based start-ups

? Shift towards healthy food is encouraging R&D in this direction

Finally, F&B industry is leveraging the technological innovations promoted by start-ups fostering the new world order for these services.

Renewable Energy Sector

UAE’s economy is substantially dependent on oil and natural gas production. However, looking at the effects on environment due to heavy usage of such products, several countries across the globe have started adopting renewable energy practices slowly and steadily. This might pose challenges to the UAE economy in long run. Thus, the government’s strategic plan adequately covers issue like diversification in non-oil activities to boost the economy addressing post-oil era circumstances. Moreover, International Renewable Energy Agency (IRENA) is headquartered in Abu Dhabi that promotes future energy practices globally. Major renewable energy sources in the UAE are solar energy, waste-to-energy, wind energy and water-based energy generation. Additionally, the pandemic has acted as an eye-opener for the UAE to diversify its energy domain from oil to renewable energy sources. Considering the current scenario, the construction and transportation industry appears to be the foremost sectors for energy transition toward renewable sources. In the renewable energy sector, UAE is performing better than other countries in GCC region (IRENA, 2018), however, there is a long way ahead for it to become sustainable in this sector. As a whole, the UAE can tackle the existing challenges in this sector by taking up following measures: Local manufacturing of equipment and devices needs to be encouraged to overcome supply-chain related issues; Digital technologies and automation needs to be incorporated in production of renewable energy to reduce dependency on labour and for reducing the gestation period; Policy regulations need to be eased out to promote renewable energy generation.

Real Estate & Construction Sector

The real estate and construction sector is labour-intensive and employs a large number of people. The experts might predict that the real estate sector would see contraction which would basically be for short-term. Investors might take advantage of the pandemic situation to purchase property and sell it once the market is up. Furthermore, the government has pushed the interest rates lower to increase the investment in this sector. The primary reason for doing so is the multiplier effect that it has on the economy and employment generation. However, a fear of pandemic spread among the human resources, supply-chain issues and investment delays are some of the primary challenges that are in front of the government to deal with. Digitization, standardized regulations and stimulus packages could come to the rescue in such situations.

Business Recovery Strategies in Crisis

Crises and disasters have occurred in the past and they have always impacted economies in varying ways. Some of the crises were manageable due to their less uncertain nature whereas some were highly uncertain increasing the difficulty in managing. Thus, it becomes pertinent to categorize crises and identify their characteristics in terms of shocks caused by them.(Table 2)

| Table 2 Types of Crisis and Related Shocks (Loayza et al., 2020) |

||||||||

|---|---|---|---|---|---|---|---|---|

| Characteristics of shocks | ||||||||

| Mechanism | Scope | Duration | Certainty | |||||

| Types of Crises | Supply | Demand | Domestic/Regional | Global | Short | Long | Uncertain | Very Uncertain |

| Pandemic | ? | ? | ? | ? | ? | ? | ||

| Wars | ? | ? | ? | ? | ? | |||

| Macroeconomic Crisis |

? | ? | ? | ? | ||||

| International Financial Crises | ? | ? | ? | ? | ||||

| Natural Hazards | ? | ? | ? | ? | ||||

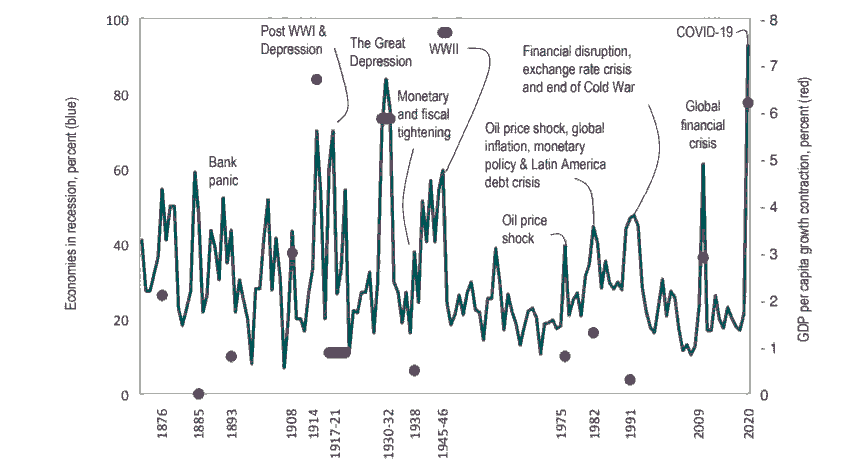

The crises types are ranked in the order of severity and uncertainty showing pandemic to be highly disastrous compared to wars followed by the macroeconomic crisis and so on. As such, by looking at history and comparing all the crises to date in terms of severity and economic contractions, it is Covid-19 that has shown the largest impact. The following graph reveals the same (World Bank 2020a; Kose et al., 2020; Loayza et al., 2020; Kose et al., 2019; Bolt et al., 2018).

Figure 1 represents how different crises caused a varying level of growth contraction in the GDP of countries across the world. It is Covid-19 that has caused a decline of around 8% in the GDP per capita growth across the globe. This is three times worse than the global financial crisis of 2008-09. Thus, Covid-19, being a pandemic, is the most severe form of crises that needs a different strategy than what would be required for other crises. Seemingly, many governments across the world including UAE are focusing on preparation and contingency approaches rather than stressing more on recovery strategies (Miles & Shipway, 2020; Hall et al., 2020; Kuo et al., 2009; Ritchie, 2004). In that regard, following are some of the existing models in the literature that can enable businesses in the UAE to prepare for their future roadmap and continue operations.

Entrepreneurship and Start-up based Model

The businesses have got their operations affected both in domestic as well as in international markets. Thus, the primary approach in preparing a business continuity plan should be to revive the domestic demand and strengthen their operations to keep pace with the new world ecosystem post-pandemic (Pforr & Hosie, 2008). Another approach would be encouraging entrepreneurship and start-ups for innovative solutions. However, this requires ease of doing business with low administrative and bureaucratic hindrances. Finally, leveraging the existing network and forming new networks with similar objectives is again important in pandemic-like crises. The market is down, therefore competitiveness is not the objective in such a scenario. Although some competition is required for fostering innovation. It would be efficient to build market systems back in such a dynamic environment via networks and cooperation mechanisms (McKercher & Chon, 2004). Thus, a model based on innovation and entrepreneurship qualifies as a priority in the pandemic.

Models of recovery based on L,W,V and U shapes

The pandemic has created an external shock which is further exacerbated with multiple internal shocks due to limitations in economy’s response capacities. Based on learning from previous crises situations, various kinds of recession recovery scenarios can be seen as follows:

L-shaped recovery

This kind of recovery model doesn’t reflect positive growth in the near future. Countries observing this model spend all of their financial resources in fighting the pandemic and fail to generate the result. Thus, there are other internal shocks such as unemployment hike, macroeconomic instability and loss of trust in government among the investors. Also, debt to GDP ratio increases the burden on the country thereby increasing their dependency on grants and aids (Sheiner & Yilla, 2020).

W-Shaped Recovery

This recovery model features double recession in a short period if not managed efficiently. Countries usually spend most of their resources in the healthcare sector to address the issues but fail to deal with them resulting in multiple lockdowns, openings and new waves of the pandemic. This occurs due to the dependency on external environment for the successful operation of the economy which is highly volatile and dynamic. However, such a recovery pathway is rare but can be plausible considering the pandemic which doesn’t have vaccination available for preventing it’s spread (Reinhart & Rogoff, 2014).

V-Shaped Recovery

Most of the countries in the world might prefer to follow this recovery shape wherein initially there is a contraction in the economy due to stringent restrictions and lockdown. However, as and when the situation eases out, the economy slowly starts gaining pace. Also, it requires government support in form of stimulus and packages to boost the economy. Further, it should be noted that if the stimulus is pumped in by the government without addressing the health crisis appropriately, there might be a scenario of a further dip in the economy leading to counterproductive activities (World Bank, 2020b; IMF, 2020b).

U-Shaped Recovery

This kind of recovery is considered a gradual approach to crises recovery. It is based on the principle of resilience wherein in years that follow post-crisis situation, the public health system is strengthened, the vulnerable population is prioritised and minimum disruption is caused to the businesses by formulating friendly regulations along with smooth vaccination drive (Furman, 2020).

Ecosystem-centric Business Continuity Plan

Any business or organization depends on four major factors: people, process, profits and partnerships. Whenever a crisis occurs, all four of these factors get affected and if not reacted in time, it can lead to a long-term scar on the business. The covid-19 pandemic has undeniably affected all four factors and still leaves several uncertainties for future. Now, the ecosystem-centric business continuity plan attempts to recover the economic activities by combining Sustainable Development Goals (SDGs) and Sendai Framework for Disaster Risk Reduction (SFDRR). It focuses on reducing Greenhouse Gas (GHG) emission, up-skilling labour forces, creating green jobs, reducing waste, moving towards renewable energy, encouraging sustainable innovations and ecosystem for business activities, etc. However, adopting such a model requires significant resources and time. Additionally, if some elements of certainty and clarity is gained regarding the current crisis, the resources could be diverted judiciously for sustainable development without getting stuck with another crisis in the near future (Mukherjee et al., 2020).

Small Business Disaster Recovery Framework (SBDRF)

Many a time, businesses post-crisis are in a dilemma whether to resume operation, not to operate, survive for a while, close completely, work on recovery or create a resilient business. Thus, there is a need to have a standardized operating procedure for businesses post-disaster and SBDRF is something similar to it. The SBDRF model is more of a self-learning model wherein it doesn’t provide any framework for business continuity. Instead, it focuses on performing research about the different status of the businesses post-pandemic and guides the recovery pathway. It provides an opportunity for a business owner or a researcher working on the recovery pathway in understanding the factors that interplay during the evolution of recovery process over time. Subsequently, this acts as a model or standard for other businesses to create their path of recovery. Also, the government develops an understanding of the policy interventions that are required (Stevenson et al., 2017).

Trust Radar

In a crisis, businesses usually end up planning for and fighting the crisis with little or no focus on building trust with the stakeholders. Top management is consumed due to dealing with the crisis and creating a business continuity plan to reduce the cost of the crisis on the company. However, many a time it is observed that businesses are successful in overcoming the crisis but fail to gain the market and trust of the customers. This probably happens because of getting too much absorbed in resolving the crisis wherein external stakeholders are ignored eventually. Thus, to overcome such a scenario, “Trust Radar” can be used. It has four components, namely, empathy, commitment, transparency and expertise (Lowe, 2014). Organizations should focus on operating on these four components during and post-crisis for ensuring acceptance among the customers once the crisis ends. Transparency is the process of providing information to the public. However, it should not be misunderstood that all information including critical ones should be disclosed. Only relevant ones should be provided. Next, expertise is required for overcoming the crisis consequences. Thus, businesses should hire experts to deal with a crisis. The third is commitment wherein businesses should take the responsibility of responding to the problems at the earliest possible moment. Finally, empathy is showing feeling or apology for any mishap caused due to the organization’s activities. This is not equivalent to saying sorry, instead, it is understanding people’s concern and apologizing for the losses caused. Such interaction should be done by the top management because that increases the credibility and overall trust in the business (Diermeier, 2011).

As such, five of the prominent models/scenarios from the literature have been highlighted above. Although the list is not exhaustive and several other models could be used in a crisis to revive the businesses, the rationale behind prioritizing the above models is the involvement of the government who plays a vital role in handling the crisis. The businesses alone cannot recover without government interventions. These models provide an opportunity for both businesses and government to collaborate and work towards a recovery path.

Discussion

UAE’s economy has faced the brunt of the pandemic and would require a series of interventions to revive itself. Primarily, the government has to intervene to provide stimulus to the severely affected businesses. However, the kind of stimulus provided would drive the economy due to its multiplier effect. For instance, if there is government expenditure on public goods, the impact would be different than its investment in infrastructure goods. The multiplier effect would be higher in the case of infrastructure goods than public goods. But then this would not be sufficient unless businesses join hands with the UAE’s government. Thus, a distinctive and comprehensive framework must be followed to revive the UAE’s economy including businesses which are as follows:

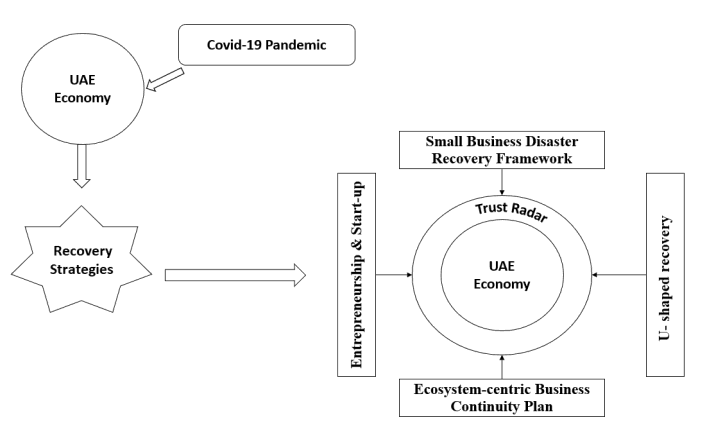

As shown in Figure 2, it is evident that the UAE’s economy is hit by the Covid-19 pandemic causing challenging economic and business conditions necessitating strong recovery strategies. In such a case, the foremost step of businesses and government should be to adopt the trust radar model. As a result of this, there would arise enough confidence among the people which would be of further help in future while rebuilding the economy. Advisably, the rebuilding of the economy might follow U-shaped recovery which is gradual and resilient to adapt as per the crisis, and prevents future loss. Additionally, the following must be ensured:

? Entrepreneurship and start-up ecosystem should be developed for promoting businesses that are aligned with the new world order

? Small businesses’ recovery pathway must be observed in response to crisis to create a working model for other such businesses

? All of the recovery plans must incorporate sustainability factor in them

However, all of this would require state’s sufficient capacity to perform. Hence, regular training and capacity building efforts must be in place to increase the intended outcome of this framework.

Conclusion

UAE has done well in fighting Covid-19, and with the ongoing vaccination, the economy is slowly gaining pace towards growth and development. However, to ensure continuity in a positive direction, collaborative efforts would be required. Businesses and government should join hands to fight the post-crisis impact on the economy. There are different frameworks available for post-crisis recovery in literature, and there is a high probability that each stakeholder would adopt a framework suitable to its own respective capacity and need. But in that case, the intended outcomes would not be sustainable and a new wave of virus could push the economy further into deep trouble. Thus, there is a need to adopt a comprehensive model wherein there is sufficient interaction with the citizens of the economy who are indeed a contributor to the GDP. Also, each stakeholder should follow a collective action approach in reviving the businesses and in turn, the economy. This is possible only when the different models of post-crisis recovery are merged to obtain an efficient framework resulting in sustainable revival. Accordingly, the recovery framework suggested in this study is a combination of multiple individual frameworks from the literature. These individual frameworks have their pros and cons which are incorporated with an assumption that all the pros would nullify the negatives associated with them. However, this suggested framework is time-consuming and requires employment of significant resources. Hence, there is a possibility that some components of the suggested model could be moulded or modified in a way that seeks to reduce resource requirements. This could be one of the future research agendas. Also, though the current framework is designed considering UAE’s economic environment, it conceptually can be applicable to other countries too which can further be taken as an area for future research.

References

- Alshamsi, R. (2020). A Blessing in Disguise: UAE’s Possible Scenarios for a Post-COVID-19 World. E-International Relations ISSN 2053-8626.

- Altios. (2020). Understanding the impact of covid-19 in the UAE and GCC region.

- Ames, H., Glenton, C., & Lewin, S. (2019). Purposive sampling in a qualitative evidence synthesis: A worked example from a synthesis on parental perceptions of vaccination communication. BMC Medical Research Methodology, 19(1).

- Bolt, J., Inklaar, R., de Jong, H., & Luiten van Zanden, J. (2018). “Rebasing ‘Maddison’: New income comparisons and the shape of long-run economic development.” GGDC Research Memorandum 174, Groningen Growth and Development Center, University of Groningen, Netherlands.

- Cook, J. (2015). A six-stage business continuity and disaster recovery planning cycle. SAM Advanced Management Journal, 80(3), 22-33.

- Diermeier, D. (2011). Reputation rules: Strategies for building your company's most valuable asset.

- Dubai Statistics Center. (2020).

- Furman, J. (2020). "Protecting people now, helping the economy rebound later." In mitigating the COVID economic crisis: Act fast and do whatever it takes. Edited by R. Baldwin and B. Weder di Mauro, 191–96. CEPR Press.

- Hall, C.M. (2010). Crisis events in tourism: Subjects of crisis in tourism. Current Issues in Tourism, 13(5): 401–417.

- HSBC. (2020). Resilience: Building back better.

- ICAO. (2020). Economic impact estimates due to COVID-19travel bans.

- IMF. (2020a). World economic outlook, June 2020.

- IMF. (2020b). World economic outlook update, June 2020.

- IRENA. (2018). Renewable capacity statistics 2018.

- Kose, M.A., Sugawara, N., & Terrones, M.E. (2019). “What happens during global recessions?” In a decade after the global recession: Lessons and challenges for emerging and developing economies. Edited by M. A. Kose and F. Ohnsorge, 55–114. Washington, DC

- Kose, M.A., Sugawara, N., & Terrones, M.E. (2020). “Global recessions.” Policy Research Working Paper 9172, World Bank, Washington, DC.

- Kuo, H.I., Chang, C.L., Huang, B.W., Chen, C.H., & McAleer, M. (2009). Estimating the impact of avian flu on international tourism demand using panel data. Tourism Economics, 15(3): 501–511.

- Loayza, N., Sanghi, A., Shaharuddin, N., & Wuester, L. (2020). Recovery from the pandemic crisis: Balancing short-term and long-term concerns. World Bank, 38.

- Lowe, Z. (2014). Strategies for building trust before, during, and after a crisis. Kellogg School of Management.

- McKercher, B., & Chon, K. (2004). The over-reaction to SARS and the collapse of Asian tourism. Annals of Tourism Research, 31(3): 716–719.

- Miles, L., & Shipway, R. (2020). Exploring the COVID-19 pandemic as a catalyst for stimulating future research agendas for managing crises and disasters at international sport events. Event Management, 24(4), 537–552.

- Mukherjee, M., Chatterjee, R., Khanna, B.K., Dhillon, P.P.S., Kumar, A., Bajwa, S., … & Shaw, R. (2020). Ecosystem-centric business continuity planning (eco-centric BCP): A post COVID19 new normal. Progress in Disaster Science, 100117.

- Pforr, C., & Hosie, P.J. (2008) Crisis management in tourism: Preparing for recovery. Journal of Travel & Tourism Marketing 23(2–4): 249–264.

- Reinhart, C.M., & Rogoff., K.S. (2014). “Recovery from Financial Crises.

- Ritchie, B.W., Dorrell, H., Miller, D., & Miller, G.A. (2004). Crisis communication and recovery for the tourism industry: Lessons from the 2001 foot and mouth disease outbreak in the United Kingdom. Journal of Travel & Tourism Marketing 15(2–3): 199–216.

- Sheiner, L., & Yilla, K. (2020). “The ABCs of the Post-COVID economic recovery.

- Stevenson, J.R., Brown, C., Seville, E., & Vargo, J. (2017). Business recovery: An assessment framework. Disasters, 42(3), 519–540.

- UAE Embassy. (n.d.).

- KPMG. (2020). Navigating the pandemic.

- UNCTAD. (2020). Global foreign direct investment projected to plunge 40% in 2020.

- World Bank. (2020a). Global Economic Prospects, June 2020. Washington, DC.

- World Bank. (2020b). Global Monthly July 2020. Global Economic Prospects Group, World Bank.

- World Health Organisation (2021). Coronavirus disease (Covid-2019) situation reports.

- WTO. (2020). Trade set to plunge as COVID-19 pandemic upends global economy.