Research Article: 2022 Vol: 25 Issue: 5

Business Practices of Blue Entrepreneus In Rurban Nueva Ecija, Philippines

Gaudencio Gallardo P, Central Luzon State University

Matilde Melicent Santos-Recto, Central Luzon State University

Citation Information: Gallardo, G.P & Santos-Recto, M.M. (2022). Business Practices of Blue Entrepreneus in Rurban Nueva Ecija, Philippines. Journal of Entrepreneurship Education, 25(4), 1-22.

Abstract

Despite the rising significance of agriculture in todays’ world, agricultural activities have continued to decline in different areas in our country. Thus, agricultural activities which include fish production should be encouraged by giving support to various aspects of its production. Benchmarking needs to be undertaken to be able to determine the common practices among blue rurban entrepreneurs and identify problems to provide solutions for the improvement of their business operations. This study determined the practices of blue rurban entrepreneurs in terms of operations, marketing, financial, and sustainability. The respondents for this study were the entrepreneurs engaged in fish production, specifically tilapia growers, which are located in the rurban areas of Nueva Ecija. The list of respondents was requested from the provincial office of Nueva Ecija, Palayan City. A total of 160 respondents were selected through stratified random sampling. A questionnaire was used as guide in interviewing the entrepreneurs to assess their practices in doing their business. It was determined that majority of the sample population comprise adults aged 41-65 years old, married, finished secondary education, and owners of their respective businesses with at most 10 employees. Also, majority of the respondents own at most 2,000 square meters and operating their business for 6 to 10 years. The water used in the production comes primarily from deep wells and majority is purchasing the inputs such as feeds and fingerlings. It was also revealed that majority sells the goods to neighborhood through pick-up in a span of one day and relies on word of mouth in advertising their product. Further, majority obtains their capital through personal investment while those who avail loans acquire them from banking institutions and lending companies. In addition, most of the respondents do not list their cost and manually accounts their expenses when the inputs were used. In terms of the level of their business practices, it was determined that only sustainability aspect is highly practiced by the blue rurban entrepreneurs while operations, marketing, and financial aspects are moderately practiced. It is therefore recommended that the provincial government, LGUs and various organizations should provide strong support such as technical and financial assistance to continuously help the blue rurban entrepreneurs in improving their operations and overall performance.

Keywords

Blue Entrepreneurship, Rurban, Benchmarking, Business Practices, SMEs.

Introduction

In today’s world, agricultural production has a rising significance. In response to nonfarm population growth pressures at the rural-urban, many communities have adopted policies to help preserve farmland. While useful in protecting open space, without parallel efforts to promote the viability of commercial agriculture, the future of agricultural production might still be in doubt. While agriculture is declining in different provinces in our country, agriculture is holding its own and growing and adapting to the challenges and opportunities presented by proximity to urban populations in many areas.

The features of green and blue rural-urban entrepreneurship are at present still indistinguishable. Especially because, industries within communities when taken within the context of a provincial territory is permeable. Reports demonstrate the significant and growing role of fisheries and aquaculture in providing food, nutrition and employment. Most of the losses in the sector are due to improper management of pond conditions, especially water quality (Ajay, 2020). Entrepreneurship for the Blue Economy, hereafter called blue entrepreneurship, has grown in recent years, evidenced by an increase in accelerators, innovation prizes and investment firms supporting startups (Dijkstra et al., 2021).

It is therefore imperative that a study be undertaken to be able to determine the common practices among entrepreneurs and identify issues and problems as well to be able to provide solutions that will be helpful in improving the business operations. This study does not only focus on three of the most important aspects of the business such as operations, marketing, and financial management. It also includes the sustainability aspect as business models have focused on reducing the negative impacts on society, the environment and the efficient use of goods and services, giving rise to entrepreneurship projects within the so-called green economy (Belz & Binder, 2017). For the purpose of this study, the sustainability only focused on the practices which minimize the impact to the environment. It does not include the economic and social dimensions of sustainability.

Review of Related Literature

This chapter presents the relevant foreign and local literature and studies on benchmarking and four aspects of business as the main variables in this study. The studies were obtained various resources such as articles published in academic journals, books, and manuals. Most of these related studies were retrieved from online publication.

Benchmarking

According to benchmarking, in business practice, is used to signify a particular systematic approach in which a business evaluates its own operations and procedures through a detailed comparison with those of another business, in order to establish best practices and improve performance. When using benchmarking in farming and other agricultural activities, it involves gathering data about the best performing farms and comparing them with other farms.

Benchmarking can show how higher levels of performance can be achieved. Many insights can be gained through a benchmarking exercise. It can uncover problems of production, management practices and other factors that affect productivity, cost of production and profitability. These insights and discoveries can be used to improve farm performance. Thus, it can lead to improved efficiency and increased profitability.

The Fishing Industry in the Philippines

Overview: Over 1.6 million Filipinos depend on the fishing industry for their livelihood. Based on the latest available data, the country was ranked among the major fish producing countries in the world with a total production of 3.1 million tons of fish, crustaceans, mollusks and other aquatic animals. Today, we’re still one of the top fishing producers in the world.

In order for the economy to catch up with aquatic consumptions of individuals, the trend should adapt best to the demands through incepting a sustainable activity that would boom the aquatic population needed. Among the three modes of fish production, aquaculture activity best responds to the problems arising from possible insufficient aquatic supply.

The aquaculture industry was said to contribute to food security and employment. It assumes even greater importance when viewed against the micro-economies of specific localities. In the municipality of Lake Sebu, South Cotabato province (Mindanao), the tilapia industry is considered the backbone of the town’s economy. The Lake Sebu town mayor in a 1994 tilapia workshop attested that the fish farming sector contributed more than 50 percent of the annual municipal income and employs ten percent of its total labor force. It is likely that Lake Sebu is not an isolated case.

The bottom line of this research should encourage the activity of freshwater aquaculture in the Philippines particularly small-scale aquaculture integrated with agriculture because in the context of Philippine economy, there is no choice but to provide the poor with water-based livelihood, whether in lakes, in marine waters or man-made self-sufficient aquatic habitation. However, this should be done without leaving the impoverished fishing communities behind.

There is an inherent fallacy in insisting that the poor should only produce for the poor, except if the intention is to keep them poor in perpetuity. Aquaculture should be viewed as a means for the rural poor to be more financially secure so that they can afford to provide themselves with more than just food, clothing and shelter.

Challenges of the industry: On the average, every Filipino consumes daily about 98.6 grams of fish and fish products. However, statistics says that by 2040, the Philippines will have to rely on other countries to supply seafood to its growing population. What happened to the industry? Was the statistics about Philippines being one of the top producers of fish a hoax? Why project dying of fishing industry over 20 years?

Philippine fishery production declined between 2010 and 2017. As a result, since 2010, the contribution of fishery to agriculture growth has been negative. Caught fish retail prices increased faster in Metro Manila: galunggong rose by 30% from 2010 to 2016 versus pork which increased by 22%, dressed chicken by 16%, and bangus and tilapia by 17% through 2017. The decline in fishery production is largely a result of the destruction of coral reefs, which serve as habitat for marine organisms. Coral reefs are suffering despite long-term measures outlawing damaging fishing practices.

The fishery is, likewise, a notable sector in the Philippine economy. For the past decades, it contributes increase of annual Gross Domestic Product. However, drastic changes due to political, economic, social, technological, legal and environmental behavior dramatically spin-off the balance and tranquility over aquatic sustainability that had long been established. For the period 1985 to 1998, the average annual contribution of fishery to the country’s Gross Domestic Product (GDP) at current prices amounted to 3.6 percent. In 1998, the gross value added (GVA) at current prices of the industry amounted to P74.1 billion, contributing 2.7% and 2.8% to the country’s GDP and Gross National Product, respectively. Its share to the agriculture, fishery and forestry sector is 17.6%. On the other hand, the fishing industry contributes an estimated 1.8 percent (valued at 196 billion pesos) to the country’s Gross Domestic Product (GDP) at current prices, respectively in 2012.

Sustainability nowadays concerning aquatic supply is at risk. Some experts said that fall down of the Philippine fish production would break an imbalance throughout the world supply of aquatic resources. During the past decades, the people have enjoyed the abundance of the Philippine marine fishery resource. Ask the old fisher folks how they culled their harvests. Many of them would say that fish sized with less than a foot rule will automatically be thrown back to the water. Back then, they even have the luxury to choose the most palatable fish among the wide variety of species thriving in a particular fishing ground.

Through time, technology has improved. More and more municipal fishing boats became motorized. A lot of commercial fishing vessels became bigger and more powerful. Fishing gears have evolved from a simple tool to highly sophisticated fishing gadgets that could sweep the bottom of the fishing grounds of almost everything, including the precious coral reefs. The stress brought by increased in population has done damaged to the ecosystem as a whole. For as population grows, consumption increases. And as they consume, the way they practice catching it has stake a costly price on the habitat of our aquatic resources.

Some activities that destroy and instill stress to the aquatic resources include but not limited to the following: illegal fishing, siltation from deforested upland areas, pollution, destructive fishing activities (muro-ami, cyanide fishing, blastfishing, use of mesh nets), uncontrolled shoreline development, overharvesting of mangroves, damages from anchors, divers, tourist and collectors, lime extraction and land quarrying, proliferation of illegal fish pens, high fish stocking densities, over-feeding fishes, and others that deemed unethical and contrary to moral or legal aspects.

Like many other fishing nations, Philippines has been facing now an overfishing crisis. Of the country’s 13 major fishing grounds, 10 are overfished. Scientists predict that local fisheries will collapse without quick and meaningful fishery reform. The challenges of industry analysis serve as a wake-up call for an urgent, decisive, firm and effective implementation of activities which would lower the risk of undersupplied market for aquatic resources.

To help address the insufficient supply of fish in the country, entrepreneurs have started their own businesses to raise tilapia in various areas of the country. However, these entrepreneurs have faced different challenges in running their business in many aspects of their business operations. The entrepreneurial challenges and motivations associated with starting a new business are experienced by all companies, regardless of the business model chosen. Other relevant drivers include the availability of financing early on in business development, a supportive culture and positive and constructive market response. Challenges include competition from less sustainable businesses that may negatively influence the legitimacy of the industry, as well as slow government responses (Dijkstra et al., 2022).

Opportunities and developments in the industry: While it is alarming to note that import would probably constitute most of our economic expenses in the coming future because of insufficient supply of aquatic resources, this still provides an opportunity for us to cope up with the changes through effective implementation of efficient production of aquatic organisms.

In 2017, the Philippines had a population of about 103 million, and mean per capita consumption of fish and fishery products of 40 kg/year or 109 grams/day with the percent of fish and fishery products intake to the total intake at 12.8%. In 2015, the fishing industry contributed 1.5% and 1.7% at current and constant prices, respectively, to the country’s Gross Domestic Products (GDP) with the fisheries sector providing employment to over 1.6 million people, 85% of whom were from the municipal fisheries and 1% from commercial fisheries, while the aquaculture sector employed 14%.

It is imperative for us to produce aquatic organisms not just to provide food to eat per se but to meet the expected demand of the market. Since the Philippines is archipelagic in nature, establishing fresh water fishponds is quite possible. Utilizing the rich freshwater that enveloped our country would surely provide a bit of assurance towards having in the future to come.

Further, the availability of technology can be utilized to introduce innovation in this industry. In a study conducted by Horiashchenko (2021); Llanto (2017) it was emphasized that environmental friendliness today is a global trend and digitalization is the content and benchmark of entrepreneurship. Being environmental friendly can create competitive advantage as these types of business are supported by the public, the state and the world community. Further, eco-innovation can significantly reduce business costs, create conditions for investment and access to foreign markets.

Micro, Small, and Medium Enterprises (MSMEs) in the Philippines

Since those who are engaged in blue entrepreneurship also forms part of the MSMEs in the Philippines, it is relevant to look at the present condition of MSMEs in the Philippines including their challenges to determine if these are consistent with the findings of the study. MSMEs vary in size and type across countries and industries. Despite these differences, it is globally recognized that MSMEs play a vital role in economic development.

Based on a report presented by Aldaba (2008), “Gearing Up SMEs for Association of South East Asian Nations (ASEAN) Economic Community 2015 (AEC 2015),” ASEAN SMEs account for about 99% of all registered businesses, employ more than 60% of the work force, and contribute 16% to 35% in exports. These statistics explain why SME development is a significant component of AEC 2015, which will officially commence on December 31, 2015. In the Philippines alone, the latest data from the Department of Trade and Industry show that SMEs represent 99.6% of total registered enterprises, contribute 35% to the gross domestic product, and employ about 70% of the total Philippine work force.

SMEs are the lifeblood of our country’s economy. They stimulate economic activity, generate employment, prompt innovation, heighten competition and contribute largely to the country’s progress. However, Philippine SMEs continue to face serious difficulties and challenges in relation to their existence, development and competitiveness. The reality is that most SMEs start small and generally remain small until liquidation or bankruptcy.

Many research studies report that access to financing remains one of the most critical, if not the foremost, constraint facing Philippine SMEs. This is despite the fact that, by law, all lending institutions are required to set aside and lend 6% of their total loan portfolio to small enterprises and 2% to medium enterprises. In addition, Government has also implemented plans and programs to support SME development and growth, such as the National SME Agenda, and the 2011-2016 Micro, Small and Medium Enterprises Development Plans.

Yet, many SMEs still find it very difficult to access funds due to the voluminous and stringent requirements (some of which are unfamiliar to them, including adequate financial statements) from the financial institutions and credit corporations or cooperatives. As a result, SMEs tend to rely heavily on internally generated funds from operations and additional cash infusions from the personal savings of the owners. In a study, “SMEs’ Access to Finance: Philippines” conducted by Aldaba (2012), it was revealed that SMEs, particularly the smaller ones, have been unable to access funds due to their limited track record, limited acceptable collateral and inadequate financial statements.

From a financial reporting perspective, having timely, accurate and consistent financial statements can help management and stakeholders make timely financial and investment decisions. However, considering the way most SMEs are structured, many do not prioritize their finance and accounting infrastructure, often due to cost considerations. They may also have insufficient finance personnel who are knowledgeable about the latest accounting standards and fast-changing tax regulations.

In a study, “Level of Management Practices of Micro and Small Businesses in Ilocos Norte” conducted by Parilla in 2013, it was determined that majority of the respondents are married (65.27%), college degree holders (59.83%), with 1 to 2 employees (82.43%) and have been in the business for 5 to 10 years (43.75%). Meanwhile, 91.63% of the micro businesses made use of their own money to run their business while 56.25% of small business owners loaned out their capital. Further, majority of micro businesses have annual sales of below P150,000 (82.01%) and 58.33% of small businesses have annual sales of 250,000-350,000.

For microbusinesses, the lowest mean is “Conducts surveys from target market” with descriptive ratings of “Slightly Practiced”. The results indicate that microbusiness owners do not practice some marketing practices which may be crucial to their operations. They do not know the importance of marketing practices in managing their enterprises. Therefore, there is a need to enhance the marketing practices of microbusinesses.

The findings also show that the overall assessment on financial practices is “Moderately Practiced” for owners and “slightly practiced” for employees. This implies that financial practices which include financial planning, financial decision, working capital management and capital budgeting are given moderate importance by microbusiness owners in Ilocos Norte.

Meanwhile, in a report entitled, “Situation Analysis of Small and Medium Enterprises in Laguna” presented by Sugiyama (2008); Simeon (2018), it was found out that there are four main problems faced by SMEs. These are weak financial foundation, weak market positioning, low level of product development, and insufficient support system. These problems are not separate but are interrelated. As a result, it is difficult for SMEs to expand business. The authors recommend that the government should do the following: (1) open seminars to improve managerial and technical skills; (2) provide preferential treatment for the financial needs of SMEs; (3) strengthen relationships and promote networking among SMEs; and (4) improve the information service delivery in terms of quantity, quality, and accessibility.

The researchers emphasized that the national and the local government should lend an ear and extend a helping hand to SMEs. On the other hand, individual SMEs also have to strive by themselves. It is important that every economic agent concerned with SMEs should have a common awareness of the importance of SMEs development. Awareness in turn will serve as an encouragement to do something decisive in order to solve the various problems as discussed in this report. Doing so may represent one of the most effective means by which long-term prosperity can be achieved for the Philippine economy and for the benefit of the Filipino people.

The following discussion presents the various studies about blue entrepreneurs and their practices focusing on the four variables being determined in this study. Results have shown a positive relationship between levels of entrepreneurial activity and economic growth across countries. A similar study found that no countries with high levels of entrepreneurship experienced low levels of economic growth. The promotion of entrepreneurship, its role in society and the opportunities it presents for personal gain, appears to be critical for facilitating economic growth. Polices geared toward enhancing the entrepreneurial capacity of a society will have the greatest impact on the level of entrepreneurial activity.

In a study conducted by it was found out that there are substantial and unique differences between urban and rural environments in relation to not only establishing and enhancing nonagricultural entrepreneurship levels and attitudes, but also maintaining an interest in entrepreneurship in areas historically displaying high levels of enterprise.

Meanwhile, investigated the factors influencing the entrepreneurship in Iran’s agricultural cooperatives. Managers of agricultural cooperatives were surveyed in order to explore their perception about the factors influencing the development of entrepreneurship in agricultural cooperatives in Iran. The total population was 250 managers of agricultural cooperative in six provinces in Iran. Based on the perception of the respondents and ordinal factor analysis, the factors were categorized into eight groups, namely psychological/cognitive, education, economical, organizational, financial, personal characteristics, regulatory, and social, ordered by the magnitude of their impact.

Hailu & Venkateswarlu (2016) studied the financial Management Practices of Micro and Small Enterprises in Addis Ababa, Ethiopia. The results showed that most MSEs (69%) prepared and analyzed their financial statements based on the monthly periods. MSEs lack management knowledge. For example, although they often reviewed inventory levels and prepared inventory budgets, the ability to apply theories of inventory management to inventory budgeting was limited. About 77 percent of MSEs always or often evaluated capital projects before making decisions on investment and reviewed the efficiency of utilizing fixed assets after acquisitions.

Abanis et al. (2013); Yason (2014), determined the extent of financial management practices in Small and Medium Enterprises (SMEs) in selected districts in Western Uganda. The study determined the extent of financial management as to the following dimensions: working capital management (cash management, accounts receivable management, inventory management), investment, financing, financial reporting and analysis and accounting information systems. The findings revealed that the extent of financial management was low among SMEs.

Some authors define sustainable entrepreneurship as a model of economic and social behavior, opening the doors to sustainability in entrepreneurship. It is the study of new ventures and entrepreneurs who are trying to achieve environmental and/or social goals through business. Belz & Binder (2017) discussed in a study that sustainable entrepreneurship represents the link between the business creation process and holistic well-being (social, economic, health or environmental).

Several studies focused on sustainable entrepreneurship. Crecente et al. (2021) reported that SDGs have favored a climate of change in the European economies towards more responsible behavior on the part of society, institutions, and their business fabric, creating new sustainable entrepreneurship. It was also emphasized that the promotion of the SDGs has contributed to increasing the rate of entrepreneurial activity in the period 2013-2017.

In the Philippines, the Micro, Small, and Medium Enterprise Development (MSMED) Plan 2011-2016 aims to promote, support, strengthen, and encourage the growth and development of Micro, Small, and Medium Enterprises (MSMEs). The plan serves as the framework for the convergence of initiatives adopted and implemented by multi-stakeholders towards the growth and development of the MSME sector in the country. Local studies about MSMEs have been relevant to provide insights to MSMED on how they can help these businesses, including those engaged in agriculture and fishery, improve their business operations.

The fusion of fisheries and farming should be introduced in the masses and the idea of agrifishpreneur should be crystallized. In this way, the Filipino people could live the way they want it to be without going hungry in their midst of poverty-line status.

Objectives

Generally, this study aims to determine the benchmark practices of rurban entrepreneurs in Nueva Ecija.

Specifically, this study aims to achieve the following objectives:

1. To provide an overview of the blue rural-urban entrepreneurship in Nueva Ecija.

2. To determine the business practices of the blue rurban entrepreneurs in Nueva Ecija in terms of entrepreneurial operations, marketing, financial and sustainability aspects.

3. To identify the needs of locales considered in terms of entrepreneurial operations, marketing, financial and sustainability aspects.

4. To provide specific policy recommendations to improve benchmark situations of the locales under the study.

Methodology

Conceptual Framework

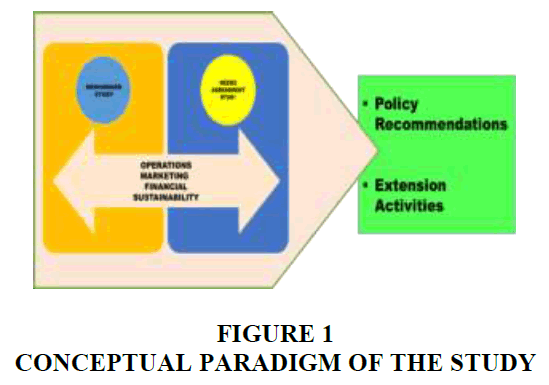

The conceptual framework of the study is depicted by a continuous independent study list that is interconnected by the determinants of the benchmark and needs studies. The benchmark was determined based on the 4 constructs used in this study namely; operations, marketing, financial, and sustainability.

In the end, the outputs of the interrelated studies are the policy recommendations which are based on the benchmark and needs of the respondents and the needed extension activities that will fill the gap between what is the status quo and the need requirements Figure 1.

Scope and Limitations of the Study

This study is about ascertaining the benchmark practices of blue entrepreneurs in Nueva Ecija. The respondents for this study are those entrepreneurs and cooperatives located in the province of Nueva Ecija who are engaged in fishery business specifically tilapia growers. Questions provided in the questionnaire are limited on ascertaining the demographic characteristics of the respondents as well their operations, marketing, financial, and sustainability practices. The results and interpretation are based solely on the answers in the questionnaires as provided by the owners/managers, officers, or employees in their absence.

Locale and Respondents

The locale of the study is the selected rurban communities in Nueva Ecija. Nueva Ecija is considered the “Rice Granary of the Philippines” for being the leading rice producer in the country. Most of the researches conducted in the province have focused on green entrepreneurship or agriculture while only few researches have focused on blue entrepreneurship. This is why the researcher focused on the respondents from this area.

The respondents of the study were the key players in tilapia growing industry which include fisherfolk-entrepreneurs, cooperatives, and industry partners. In case of cooperatives, they were represented by one of their officers or employees in their absence. The list of respondents was requested from the Provincial Office of Nueva Ecija.

Research Instrumentation and Data Collection

This study made use of a guide questionnaire and recorder for the interview. The guide questionnaire is made up of two parts. Part I entails questions profiling the respondents’ sociodemographic characteristics and Part II is about the rurban benchmarking variables. The major variables to be considered in asking about the status of the rurban entrepreneurship focus on operations, marketing, financial and sustainability aspects. The questionnaire is composed of questions answerable by Yes or No, in multiple choice, and in Likert scale format in the case of practices. Some of the questions included using Likert scale were adopted from the business planning resource framework of Manitoba Agriculture, Food and Rural Initiatives (MAFRI) entitled Gaining Ground. The rest of the questions were included based on what the researcher considered necessary and applicable in the given setting.

The researcher used stratified random sampling in selecting the respondents. The respondents were chosen randomly from each town or municipality which were identified as rurban. As the questionnaire contains some terminologies which may not be understood by the respondent, the researcher will explain it to the respondent.

Data Analysis

This study made use of frequency distribution tables to present and analyze qualitative data. It also utilized the mean scores to analyze the quantitative data. Descriptive statistics was used in particular to meet the objective of describing the organizational profile of the respondents and the level of their practices in four aspects of business. To assign quantitative description on the four variables using Likert scale, the following scale was used. However, the statistical range may vary depending on the actual responses of the respondents.

| Statistical range | Descriptive rating |

| 4.21-5.00 | Very highly practiced |

| 3.41-4.20 | Highly practiced |

| 2.61-3.40 | Moderately practiced |

| 1.81-2.60 | Slightly practiced |

| 1.00-1.80 | not practiced |

Operational Definition of Terms

Benchmarking-comparing one’s business processes and performance metrics to industry bests and best practices from other companies.

Blue entrepreneur-refers to an entrepreneur who is engaged in fish production.

Financial management-the process of planning, organizing, directing, and controlling financial resources with a view to achieve organizational goals and objectives.

Marketing-the business of promoting and selling products or services, including market research and advertising.

Operations-the process of transforming resources or inputs into desired goods or services.

Rurban-refers to area which is chiefly residential but where some farming is carried on.

Sustainability-one of the aspects of managing business which focuses on meeting the needs of the present without compromising the ability of future generations to meet their needs.

Results and Discussion

This chapter presents the results of the study which provide an overview of the blue rurban entrepreneurship in terms of operations, marketing, financial and sustainability aspects.

Demographic Characteristics

Table 1 shows the summary of the demographic characteristics of the respondents based on age, civil status, and educational attainment, and position, number of employees, farm area, and years in business.

| Table 1 Demographic Characteristics of Blue Rurban Entrepreneurs | ||

| Characteristics | Frequency | Percent (%) |

| Age | ||

| Young Adult (18-40) | 34 | 21.25 |

| Adult (41-65) | 108 | 67.50 |

| Elderly (65 and above) | 18 | 11.25 |

| Civil Status | ||

| Single | 9 | 5.62 |

| Married | 140 | 87.50 |

| Widow | 9 | 5.62 |

| Separated | 2 | 1.26 |

| Educational Attainment | ||

| Primary | 37 | 23.12 |

| Secondary | 69 | 43.13 |

| Tertiary | 54 | 33.75 |

| Position | ||

| Owner | 106 | 66.25 |

| Manager | 12 | 7.50 |

| Others | 6 | 3.75 |

| No Response | 36 | 22.50 |

| No. of Employees | ||

| 1 – 10 | 26 | 16.25 |

| 11 – 20 | 5 | 3.13 |

| No Response | 129 | 80.62 |

| Farm Area (sq. m) | ||

| 2,000 or Less | 113 | 70.62 |

| 2,001 – 4,000 | 20 | 12.50 |

| 4,001 – 6,000 | 7 | 4.38 |

| 6,001 – 8,000 | 3 | 1.88 |

| More than 8,000 | 17 | 10.62 |

| Years in Business | ||

| 5 Years or Less | 47 | 29.37 |

| 6 – 10 Years | 49 | 30.63 |

| 11 – 15 Years | 27 | 16.88 |

| 16 – 20 Years | 19 | 11.87 |

| More than 20 Years | 18 | 11.25 |

The majority, which made up 67.50% of the sample population comprise adults aged 41- 65 years old. It is important to note that the combined number of those belonging to adult and elderly comprises 78.75% of the total respondents. This means that most of the respondents are aging already which indicates the urge to promote the blue entrepreneurship among the residents of the province especially the young generation.

In terms of marital status, 87.5% of the respondents are married while the remaining 12.5% are made up of single, widowed and separated individuals. It only shows that married individuals engage in blue entrepreneurship to augment income to sustain the needs of their family. As to the educational attainment of the respondents, 43.13% finished secondary education, 33.75% reached tertiary level, and the remaining 23.12% accomplished primary education.

Although the majority covers those who achieved secondary education, still, those who accomplished primary or tertiary level share more than half of the population. Because the results show diverse concentration on the educational status of the respondents, it indicates that high educational attainment does not directly influence blue entrepreneurship in Nueva Ecija.

Most of the respondents are the owners of their respective businesses (66.25%). Also, 26 respondents (16.25%) employ at most 10 employees.

However, a notable number of respondents (80.62%) did not disclose the number of their employees. In terms of farm area, majority (70.62%) owns at most 2,000 square meters. Seventeen respondents (10.62%) own more than 8,000 square meters which are mostly cooperatives.

Moreover, 30.63% represents the majority of the respondents who are operating their business for 6 to 10 years during the study. It can also be noted that more than half of the respondents (60%) have been in the business for at most 10 years which implies that most of them are still in the early years of their operation.

Operations

The first of the business aspects ascertained by the researcher is the operations aspect. Operations aspect undertaken includes good governance practices and includes the type of operation, facility usage, pond ownership, and water source.

It is about how the core operations of the organization is designed and implemented. Proper governance as part of entrepreneurial undertakings is essential in the enhancement of the performance of the business and optimum utilization of resources which results to avenue for better access to capital and achievement of long term prosperity.

The Table 2 results of the survey of the operations aspect show that majority of the respondents (78.75%) employs a combination of manual and mechanized operation. This implies that most of the respondents utilize the technology specifically in mechanizing their operation.

| Table 2 Characteristics of Blue Rurban Entrepreneurs in Terms of Operations | ||

| Characteristics | Frequency | Percent (%) |

| Type of Operation | ||

| Mechanized | 2 | 1.25 |

| Manual | 32 | 20.00 |

| Combination | 126 | 78.75 |

| Storage Facility | ||

| Raw Materials | 135 | 84.37 |

| Machine/Equipment | 113 | 70.63 |

| Harvest | 7 | 4.38 |

| Pond Ownership | ||

| Owned | 158 | 98.75 |

| Rented | 2 | 1.25 |

| Water Source | ||

| Natural | 57 | 35.62 |

| Deep Well | 69 | 43.50 |

| Irrigation | 62 | 38.75 |

| Others | 3 | 18.75 |

However, it should be noted that 20% represents those who employ pure manual operation. Meanwhile, the use of storage facility is mainly for the raw materials or inputs (84.37%) and equipment and machines (70.63%).

Only 7 of them (4.38%) use storage facility for harvest as most of the respondents delivered their harvest within one day which does not necessitate storage.

Among the respondents, only 1.25% is renting the pond used for the rurban entrepreneurship. The 98.75% entrepreneurs own the ponds they are farming. In addition, 43.50% source the water needed from deep wells. Irrigation and natural water systems are secondarily used as water source.

Table 3 shows how the different inputs on the business are garnered. The inputs include feeds, fingerlings, fertilizers, and lime.

| Table 3 Source of Inputs of Blue Rurban Entrepreneurs | ||

| Characteristics | Frequency | Percent (%) |

| Feeds | ||

| Produced | 3 | 1.88 |

| Purchased | 147 | 91.87 |

| Fingerlings | ||

| Produced | 8 | 5.00 |

| Purchased | 126 | 78.75 |

| Others | 8 | 5.00 |

| Fertilizer | ||

| Produced | 2 | 1.25 |

| Purchased | 81 | 50.63 |

| Lime | ||

| Produced | 0 | 0.00 |

| Purchased | 2 | 1.25 |

The findings reveal that 91.87% of the respondents are purchasing the feeds. Further, 78.75% of the respondents are buying fingerlings while 5% are producing their own fingerlings. It can also be noted that 8 respondents (5%) receive fingerlings from the Department of Agrarian Reform (DAR).

Meanwhile, 50.63% answered that they purchase the fertilizer they use in their business. Lastly, the two respondents who use lime also purchase the same; none produces such.

Table 4 shows that the operations aspect of the business is moderately practiced (X=3.32) by the blue rurban entrepreneurs. The results show that in implementing the operations of the entity, the respondents are keener in the execution of the production process. Of the 17 activities provided by the researcher, the top three employed most include monitoring the production quality (X=4.33), keeping an eye on the machine/equipment effective operation (X=4.20), and monitoring the production yield (X=4.03).

| Table 4 Practices of Blue Rurban Entrepreneurs in Terms Of Operations | ||

| Item | Mean | Verbal Description |

| Monitors the production quality. | 4.33 | Very highly practiced |

| Machines/equipment are operating effectively. | 4.20 | Highly practiced |

| Monitors the production yield. | 4.03 | Highly practiced |

| Develops and follows preventive maintenance schedules for facilities and equipment. | 3.97 | Highly practiced |

| Inputs are always available when needed. | 3.58 | Highly practiced |

| Considers the accessibility of the supplier. | 3.57 | Highly practiced |

| Monitors the operation costs. | 3.53 | Highly practiced |

| Considers the price of inputs. | 3.44 | Highly practiced |

| Screens the suppliers. | 3.33 | Moderately practiced |

| Does not encounter problems in price of inputs. | 3.16 | Moderately practiced |

| Buys inputs/raw materials in big quantities. | 3.03 | Moderately practiced |

| Considers the brand of inputs. | 2.79 | Moderately practiced |

| Conducts research and training on new production technology to improve the operations. | 2.77 | Moderately practiced |

| Monitors the production/operations plan. | 2.76 | Moderately practiced |

| Develops a production/operations plan. | 2.76 | Moderately practiced |

| There are choices on brands of inputs. | 2.67 | Moderately practiced |

| Revises the production/operations plan when needed. | 2.65 | Moderately practiced |

| Average | 3.32 | Moderately Practiced |

It can be observed that monitoring the operation costs (X=3.53) and considering the price of inputs (X=3.44) garnered lower scores than monitoring the production quality. This implies that respondents give importance to the quality of their production even if it is associated with higher costs because quality production is expected to yield quality products/harvest.

It is observed that the respondents treat the need for developing and revising production/operations plan, and choosing brand inputs at minimum. This means that the respondents have not considered the importance of planning in running a business. These areas of operation should be improved through proper training to the entrepreneurs.

Marketing

Another business aspect tackled is the marketing aspect. Marketing includes identifying, understanding, and satisfying customer needs and wants through the goods and services of the company. The study identified the delivery mode, the average length of delivery, the usual customers, and the advertisement techniques of the enterprise.

The Table 5 study reveals that 48.75% of the respondents sell their goods to their customers through pick-up usually in a span of a day (57.50%). Also, according to the survey, 58.75% of the usual customers are from the neighborhood and 28.12% are from the neighboring towns and cities. Since majority of the customers are neighbors of the respondents, the products are simply picked by the customers which does not necessitate the incurrence of delivery costs on the part of the business owners. If the harvest needs to be delivered in the neighboring towns, majority of the respondents deliver the harvest within one day to preserve the freshness of the fish. This is supported by the findings that the owners give importance to quality of their products.

| Table 5 Characteristics of Blue Rurban Entrepreneurs in Terms of Marketing | ||

| Characteristics | Frequency | Percent (%) |

| Delivery | ||

| Picked-up | 78 | 48.75 |

| Delivered | 47 | 29.38 |

| Others | 31 | 19.37 |

| Length of Delivery | ||

| Within 1 day | 92 | 57.50 |

| 2 – 3 days | 23 | 14.38 |

| 4 – 7 days | 11 | 6.87 |

| No response | 34 | 21.25 |

| Customers | ||

| Neighbors | 94 | 58.75 |

| Other Cooperatives | 1 | 0.63 |

| Traders | 24 | 15.00 |

| Neighboring towns/cities | 45 | 28.12 |

| Others | 7 | 4.38 |

| Advertisement | ||

| Word of Mouth | 47 | 29.37 |

| Social Media | 1 | 0.63 |

| No advertisement | 112 | 70.00 |

As to the method of advertising, 70% of the respondents acknowledged that they do not use any specific advertising technique. Only 47 respondents (29.37%) use advertising but only through word of mouth which means that they do not allocate fund in advertising. It is surprising to find out that despite the rampant use of social media, the blue entrepreneurs do not utilize the available technology to advertise their product. It can be attributed to the fact that majority of the fisher folks are adult and elderly. The marketing aspect focuses on obtaining, retaining, and building long-term relationship with the customers by providing their wants and keeping them to need the services provided to them by improving the services of the entity. Different activities are needed to be implemented in order to achieve the goal of the marketing.

Generally, the marketing activities are moderately practiced by the respondents (X=2.80). The study tells that the respondents focus greatly on improving the product and services in order to meet customer demands (X=3.84). It is consistent with the results of operation aspect that blue entrepreneurs give importance to the quality of the production.

It also shows Table 6 that the respondents exert time in understanding the external factors affecting the market (X=3.67) and exploring and evaluating new market opportunities (X=3.24) as means to preserving and improving their market share. These practices are helpful in determining the extent and timing of production to be able maximize the financial performance of the business.

| Table 6 Marketing Practices of Blue Rurban Entrepreneurs | ||

| Item | Mean | Verbal Description |

| Improves the products and services to meet consumer demand. | 3.84 | Highly practiced |

| Understands the external factors affecting the market. | 3.67 | Highly practiced |

| Explore and evaluate new market opportunities. | 3.24 | Moderately practiced |

| Asks for feedback from customers and other stakeholders. | 3.13 | Moderately practiced |

| Develops a marketing plan. | 3.11 | Moderately practiced |

| Monitors the marketing plan. | 3.10 | Moderately practiced |

| Conducts research to determine the needs and wants of customers. | 3.09 | Moderately practiced |

| Revises the marketing plan when needed. | 2.94 | Moderately practiced |

| Sets the price based on what is prevailing in the market. | 2.90 | Moderately practiced |

| Sets the price based on cost. | 2.32 | Slightly practiced |

| Seeks help of middlemen. | 1.27 | Not practiced |

| Designs packaging for customers convenience. | 1.03 | Not practiced |

| Average | 2.80 | Moderately Practiced |

Moreover, the survey conducted reveals that the nature of the blue entrepreneurship makes the business concentrate less in the designing of the packaging to be used for customer convenience (X=1.03). This is due to the fact that most of the entrepreneurs do not deliver their products but instead, the products are being picked up by their customers. Also, seeking the help of middlemen (X=1.27) is not that necessary in conducting the business as most of the customers come from the neighborhood. It also shows that the prices are not typically based on cost (X=2.32) which means that they do not have a strong bargaining power in terms of prices of the commodities within this line of business.

Financial

Financial aspect is the facet of the business wherein the concerns with regards to the finances of the enterprise are dealt with. The study focused on the financial information which include the level of income, sources of capital, sources of loans, terms of credit, listing of costs, expenses occurred, and timing of cost recognition.

Based on the study, 50% of the respondents earns the bracket P50,000 and below as their gross income Table 7. In terms of financing, 92.5% obtain their capital through personal funding; 9.38% acquire loans from different sources. This result is consistent with the study of Parilla (2013); Muñoz et al. (2018) that most of the micro businesses invested their own money in administering the business. Only 15 which constitute 9.38% of the total respondents obtain loans to finance their operations. The microbusiness owners have difficulty in obtaining loans due to limited track record, limited acceptable collateral and inadequate financial statements as reported by Aldaba (2012).

| Table 7 Characteristics of Blue Rurban Entrepreneurs in Financial Aspect | ||

| Characteristics | Frequency | Percent (%) |

| Gross Income Per Year | ||

| P50,000 and Below | 80 | 50.00 |

| P50,001 – P100,000 | 14 | 8.75 |

| P100,001 – P150,000 | 9 | 5.62 |

| P150,001 – P200,000 | 4 | 2.50 |

| P200,001 – P250,000 | 4 | 2.50 |

| P250,001 and above | 11 | 6.87 |

| No answer | 40 | 25.00 |

| Source of Capital | ||

| Personal Investment | 148 | 92.50 |

| Proceeds from Loan | 15 | 9.38 |

| Government Grants | 1 | 0.63 |

| Others | 1 | 0.63 |

| Source of Loans | ||

| Individual Lenders | 37 | 23.12 |

| Banks | 69 | 43.13 |

| Lending Companies | 54 | 33.75 |

| Others | 9 | 5.63 |

| Terms of Credit | ||

| Short-term | 15 | 9.38 |

| Medium-term | 5 | 3.12 |

| Listing of Costs | ||

| Yes | 65 | 40.63 |

| No | 95 | 59.37 |

| Timing of Cost Recognition | ||

| When Paid | 65 | 40.63 |

| When Used | 78 | 48.75 |

| Costs/Expenses Incurred | ||

| Materials/Inputs | 153 | 95.62 |

| Labor | 68 | 42.50 |

| Advertising | 1 | 0.63 |

| Utilities | 107 | 66.87 |

| Legal Fees | 5 | 3.12 |

| Rent | 2 | 1.25 |

| Interest | 7 | 4.38 |

| Table 8 Financial Practices of Blue Rurban Entrepreneurs | ||

| Item | Mean | Verbal Description |

| Prepares cash budget. | 4.08 | Highly practiced |

| Monitors cash budget. | 3.96 | Highly practiced |

| Maintains sufficient cash to meet the needs of operations. | 3.89 | Highly practiced |

| Implements internal control to minimize costs. | 3.78 | Highly practiced |

| Evaluates investment projects before making investment decisions. | 3.77 | Highly practiced |

| Revises the cash budget when needed. | 3.61 | Highly practiced |

| Implements internal control on cash. | 3.40 | Moderately practiced |

| Invests in other profitable activities. | 3.37 | Moderately practiced |

| Sets aside cash for future investment. | 3.21 | Moderately practiced |

| Performs financial analysis. | 3.19 | Moderately practiced |

| Conducts periodic inventory count. | 2.69 | Moderately practiced |

| There is proper authorization for purchase. | 2.65 | Moderately practiced |

| Prepares financial statements at least annually. | 2.24 | Slightly practiced |

| Deposits money in the bank. | 1.98 | Slightly practiced |

| Maintains a separate account for your business. | 1.71 | Not practiced |

| Adopts strict credit policy. | 1.42 | Not practiced |

| Average | 3.06 | Moderately Practiced |

Moreover, the loans are primarily acquired from banking institutions and lending companies which made up 43.13% and 33.75% of the population, respectively. In addition to that, 15 out of 20 prefer short-term credit term over long-term credit term. The study also reveals that most of the respondents do not list their cost and only 40.63% manually account their expenses. While listing of costs is considered as basic step in accounting business operations, this is not widely used by the blue entrepreneurs. Thus, it can be inferred that they do not determine the financial condition and performance of their respective businesses which are essential in making economic decisions.

It also shows that 48.75% of the population recognizes cost when it is used while 40.63% of the respondents employ cash basis of accounting which means that costs are recognized only when paid. Majority of the cost are incurred for the purchase of raw materials and payment of utilities, 95.62% and 66.87% respectively. Rent expense is incurred by those who rent the land for the operation of their business while interest expense is incurred by those who have availed loans to finance the operation of their businesses. It can be noted also that only 1 respondent spends on advertising as those who practice advertising rely only on word of mouth.

The activities within the financial aspect use numbers and tools to objectively identify the standing of the business and the necessary decisions needed by the entity in effectively running the business. The study tells that financial practices are moderately practiced by blue rurban entrepreneurs (X=3.06) b. Most of the rurban entrepreneurs focus on cash management techniques in managing their finances, more specifically the working capital. The respondents by and large prepare and monitor cash budgets and maintain cash needed for operations. This means that business owners give high importance to liquidity of the business. This is quite different from the result of the study conducted by Parilla (2013) which revealed that microbusiness owners give moderate importance to working capital management which includes cash.

However, adopting strict credit policy (X=42) is a strategy least used by the respondents as most of them employs cash on delivery policy in selling their products. Also, due to the results, it is discernible that the entity concept is not typically observed as maintaining separate accounts of the business and the owner are not often employed. Additionally, depositing money in the bank is treated as somehow burdensome to most of the respondents seeing that the activity belongs to the least employed by the respondents.

Sustainability

Sustainability pertains to the fulfillment of the entity of their long-term goals by employing activities concerning the financial, social, and environmental risks, obligations, and opportunities affecting entity.

The Table 9 indicates that sustainability aspect is highly practiced by the respondents (X=4.00). Majority of the respondents give high importance to compliance with environmental regulations (X=4.57). The survey also shows that analyzing environmental benefits (X=4.18) as well as analyzing environmental costs (X=4.16) when making business decisions are highly practiced by blue rurban entrepreneurs in Nueva Ecija. This indicates that business owners nowadays consider the implications of their decision to the environment.

| Table 9 Sustainability Practices of Blue Rurban Entrepreneurs | ||

| Item | Mean | Verbal Description |

| Complies with environmental regulations. | 4.57 | Very highly practiced |

| Analyzes environmental benefits when making business decisions. | 4.18 | Highly practiced |

| Analyzes environmental costs when making business decisions. | 4.16 | Highly practiced |

| Seek information on preservation of environment. | 4.14 | Highly practiced |

| Adopts practices that minimize the impact of operation in the environment. | 4.08 | Highly practiced |

| Adopts new environmentally-friendly techniques, technology and business practices. | 3.96 | Highly practiced |

| Minimizes the impact of the operations on neighbors (example: noise, vibration, smoke) | 3.83 | Highly practiced |

| Conducts research about new environmentally-friendly techniques, technology and business practices. | 3.80 | Highly practiced |

| Attends seminar about environment preservation. | 3.29 | Moderately practiced |

| Average | 4.00 | Highly practiced |

However, attending seminar about environment preservation (X=3.29) and conducting research about new environmentally-friendly techniques, technology and business practices (X=3.80) are carried out least. This may be due to budget and time constraints that forbid most to do so. Lastly, minimizing the impact on neighbors due to noise, vibration, and smoke is also one of the activities which are bit grueling for most of the respondents to employ.

Table 10 shows the summary of descriptive results about the extent of practices among blue entrepreneurs in Nueva Ecija in terms of operations, marketing, financial, and sustainability. It is shown that only sustainability aspect is highly practiced while operations, marketing, and financial aspects are moderately practiced by blue rurban entrepreneurs.

| Table 10 Summary of The Business Practices of Blue Rurban Entrepreneurs | ||

| Business Aspect | Mean | Verbal Description |

| Operations | 3.32 | Moderately Practiced |

| Marketing | 2.80 | Moderately Practiced |

| Financial | 3.06 | Moderately Practiced |

| Sustainability | 4.00 | Highly Practiced |

This study aimed to determine the business practices of blue entrepreneurs in rurban Nueva Ecija who are engaged in fishery business specifically the tilapia growers. The study is limited on ascertaining the business practices of the respondents focusing on operations, marketing, financial, and sustainability. The results and interpretation are based solely on the answers in the questionnaires as provided by the owners/managers, officers, or employees in their absence.

Based on the data collected, it was determined that majority of the sample population comprise adults aged 41-65 years old, married, finished secondary education, and owners of their respective businesses with at most 10 employees. Also, majority of the respondents own at most 2,000 square meters and have been operating their respective businesses for 6 to 10 years.

In terms of operations, majority of the respondents employ a combination of manual and mechanized operation while the usage of storage facility is mainly for the raw materials or inputs and equipment and machines. Only 2 are renting the land and the rest own the ponds they are farming. The water comes primarily from deep wells while irrigation and natural water systems are secondarily used as water source. Also, majority of the respondents are purchasing the feeds, fingerlings, and fertilizer as the primary inputs of their business.

Moreover, the findings reveal that the operations aspect of the business is moderately practiced by the blue rurban entrepreneurs. The results show that in implementing the operations of the entity, the respondents are keener in the execution of the production process. They give importance to production quality, machine/equipment effective operation and monitoring the production yield. However, respondents treat the need for developing and revising production/operations plan, and choosing brand inputs at minimum.

For marketing aspect, the study reveals that majority sells the goods to customers through pick-up in a span of one day. Majority does not use any specific advertising technique which can be attributed to the fact that the usual customers are from the neighborhood. Those who advertise use word of mouth which means that they do not spend in advertising.

Generally, the marketing activities are moderately practiced by the respondents. The study tells that the respondents focus greatly on improving the product and services in order to meet customer demands. It also shows that the respondents exert effort in understanding the external factors affecting the market and exploring and evaluating new market opportunities as means to preserving and improving their market share. In addition, the survey conducted reveals that blue entrepreneurs concentrate less in designing the packaging to be used for customer convenience. Also, seeking the help of middlemen is one of the least practiced as most of the customers come from the neighborhood. It is also shown that the prices are not typically based on cost but on the prevailing market price.

In terms of financial aspect, majority of the respondents earn the bracket P50,000 and below as their gross income. Most of them obtain their capital through personal investment. Further, the loans which are mostly short-term in nature are primarily acquired from banking institutions and lending companies. The study also reveals that most of the respondents do not list their cost and manually account their expenses. It also shows that most of the blue entrepreneurs recognize cost when used. In addition, the study shows that financial practices are moderately practiced by blue rurban entrepreneurs. Most of the rurban entrepreneurs focus on cash management techniques in managing their finances, more specifically the working capital. On the other hand, adopting strict credit policy is a strategy least used by the respondents as most of them employs cash on delivery policy in selling their products. Maintaining separate accounts of the business and the owner and depositing money in the bank are not often employed.

Conclusion

Lastly, sustainability aspect is highly practiced by the respondents. Majority of the respondents give high importance to compliance with environmental regulations. The survey also shows that analyzing environmental benefits as well as analyzing environmental costs when making business decisions are highly practiced by blue rurban entrepreneurs in Nueva Ecija. However, attending seminar about environment preservation, conducting research about new environmentally-friendly techniques, technology and business practices, and minimizing the impact on neighbors due to noise, vibration, and smoke are carried out least.

It can be concluded that blue rurban entrepreneurs in Nueva Ecija are already ageing who need strong support to enhance their skills in managing their microbusinesses. They consider doing business primarily to earn additional income by selling their produce to their neighbors and to provide food for family’s consumption. They need to be equipped with operations and marketing tools to further their knowledge and skills. Most importantly, they need support in terms of financial aspect to acquire additional funds to expand their operations and improve their financial performance.

Future researches should be undertaken to determine the business practices of blue entrepreneurs in other areas of the country. Further studies should be conducted that will not only focus on tilapia growers but also in other fishery businesses. Other variables such as innovation and use of technology should be taken into consideration that could help in identifying the best practices as well as the needs of the blue entrepreneurs. If these needs will be addressed, our blue rurban entrepreneurs will not just provide food for their family and neighbors but also to other residents within and outside the province thereby addressing the shortage in the fish production due to increasing demand for fish.

Recommendations

After the data had been analyzed and conclusion had been formulated, the following are hereby recommended:

The blue entrepreneurs should enhance their exposure and skill in managing their business through attending to various trainings and development programs focusing on how to effectively manage their business specifically in the aspects of operations, marketing, financial, and sustainability. But if they do not have sufficient financial resources, it is recommended that they adopt business practices that fit their ability and context. They should also consider visiting the various government offices to avail the programs and services being provided to support and improve their operations.

The Department of Agriculture should continue to sponsor free training to enhance the knowledge and skills of blue entrepreneurs in the province on how they could improve the operations of their business. The training should focus on aspects with low scores such as operations, marketing, and financial. Focusing on these aspects of business management will help the blue entrepreneurs to further improve their operation which may result to better financial performance.

The local government of Nueva Ecija as well as the various local government units in the province should implement programs to help the blue entrepreneurs in the province especially on how they can source out funds for possible expansion of their business. It is also recommended that there should be a continuous monitoring and assessment to evaluate the impact of the programs implemented.

Central Luzon State University, as an academic institution, should help in the improvement of the blue entrepreneurs’ operations through conducting extension services. The university, particularly the College of Business Administration and Accountancy, should educate the entrepreneurs through conducting seminars focusing on operations, marketing, and financial aspects of the business. The CBAA through its extension office should consider visiting the entrepreneurs in the province and provide technical assistance to them based on the needs of their business as determined by this study such as preparation of their financial records.

Business support organizations and industry partners should help educate the blue entrepreneurs by sharing the best practices in the industry that can be adopted without spending that much as lack of financial resources was identified to be one of their concerns. Banks and other financial institutions should help increase the capitalization of entrepreneurs through short-term and long-term financing and provide technical support on how to manage their financial resources effectively.

A similar research should be undertaken to determine the business practices of blue entrepreneurs in other areas of the country. Additional variables that could help determine the benchmarks and needs of the respondents should be taken into consideration.

References

Abanis, T., Sunday, A., Burani, A., & Eliabu, B. (2013). Financial Management Practices In Small and Medium Enterprises in Selected Districts In Western Uganda. Research Journal of Finance and Accounting, 4(2), 29-42.

Ajay, V. (2020). FISHCO TECH: A Mobile Interface for Aqua Farmers to Acquire Knowledge on Hurdles, Remedies, Guidelines, and Entrepreneurship to Promote the Blue Economy. Agri Mirror: Future India, 1(8), 4-16.

Aldaba, R.M. (2008). SMEs in the Philippine manufacturing industry and globalization: meeting the development challenges.

Aldaba, R.M. (2012). Small and medium enterprises'(SMEs) access to finance: Philippines (No. 2012-05). PIDS Discussion Paper Series.

Belz, F.M., & Binder, J.K. (2017). Sustainable entrepreneurship: A convergent process model. Business Strategy and the Environment, 26(1), 1-17.

Indexed at, Google Scholar, Cross Ref

Crecente, F., Sarabia, M., & del Val, M.T. (2021). Sustainable entrepreneurship in the 2030 horizon. Sustainability, 13(2), 909.

Indexed at, Google Scholar, Cross Ref

Dijkstra, H., van Beukering, P., & Brouwer, R. (2021). In the business of dirty oceans: Overview of startups and entrepreneurs managing marine plastic. Marine Pollution Bulletin, 162, 111880.

Indexed at, Google Scholar, Cross Ref

Dijkstra, H., van Beukering, P., & Brouwer, R. (2022). Marine plastic entrepreneurship; Exploring drivers, barriers and value creation in the blue economy. Sustainable Technology and Entrepreneurship, 100018.

Indexed at, Google Scholar, Cross Ref

Hailu, A.Y., & Venkateswarlu, P. (2016). Financial Management Practices of Micro and Small Enterprises in Addis Ababa, Ethiopia. Financial Management, 2(3), 50-64.

Horiashchenko, Y. (2021). Innovative Approaches To Greening Entrepreneurship. Green, Blue & Digital Economy Journal, 2(2), 24-28.

Indexed at, Google Scholar, Cross Ref

Llanto, G. (2017). 2nd National Aquaculture Summit: Improving Governance in Aquaculture Value Chains. SMX Convention Center.

Munoz, P., Cacciotti, G., & Cohen, B. (2018). The double-edged sword of purpose-driven behavior in sustainable venturing. Journal of Business Venturing, 33(2), 149-178.

Indexed at, Google Scholar, Cross Ref

Parilla, E.S. (2013). Level of management practices of micro and small businesses in Ilocos Norte. International Journal of Academic Research in Business and Social Sciences, 3(7), 439.

Simeon, L. (2018). Fisheries Production Improve in Second Quarter of 2018. The Philippine Star.

Sugiyama, E. (2008). Situation Analysis of Small and Medium Enterprises in Laguna

Yason, S. (2014). Financial Reporting: A Challenge to SMEs.

Received: 28-Jun-2022, Manuscript No. AJEE-22-12266; Editor assigned: 30-Jun -2022, PreQC No. AJEE-22-12266(PQ); Reviewed: 14- Jul-2022, QC No. AJEE-22-12266; Revised: 18-Jul-2022, Manuscript No. AJEE-22-12266(R); Published: 25-Jul -2022