Case Reports: 2017 Vol: 23 Issue: 4

Business Opportunities and Challenges in Lesser Developed Member Countries of ASEAN: a Case Study From the Seafood Processing Industry in Thailand

Instructors’ Note

Case Description

This case deals the situation in which a company from a more developed country exploring opportunities in lesser developed members of ASEAN regional integration. The management faces many challenges including nontariff barriers, border trade, gray products and smuggling. Being unfamiliar with the local political system, the management starts to wonder if being first in the market could be too risky. However, the opportunities in these markets are too appealing to forego.

Case Synopsis

Lucky Union Food (LUF), Co. Ltd. has been a Thai processor and exporter of ground fish (surimi) products for more than twenty years. Vantanee Seang-U-Tai, Managing Director, is revising LUF’s 2016 business strategy for venturing into the Lao PDR. Its first outlet operation in the Laos market in 2014 is running into obstacles because the Lao government ordered the land right owner to develop the property where LUF’s outlet is located into a distribution centre. Its joint venture partner is facing financial hardship causing it to be unable to assist LUF any longer. Moreover, the market is underdeveloped and somewhat different from LUF’s domestic one.

Expanding into Laos’ traditional segment is running into the conflict with wholesalers at the border who are keeping an eye on LUF’s movements in the Laotian market. These wholesalers have to date been LUF’s product distributors for the Laotian market. In addition to these complexities, the promise of a freer market from the ASEAN regional agreement has not fully materialized. Being unable to use similar exporting methods as these wholesalers, LUF’s prices are higher in this market relative to those of the wholesalers. Given these obstacles, Vantanee now wonders if LUF has entered into this market too soon or employed a too risky method.

Teaching and Learning Objectives

This case is used to analyse the situation in which a company from a more developed country explores opportunities in a lesser developed member country of ASEAN’s regional integration thrust, i.e., the ASEAN Economic Community. Students will become acquainted with a company’s decisions of the complicated international environment–e.g., regional agreements, free trade zones, nontariff barriers and border trade. Specially, they will analyse management tasks in assessing opportunities and threats and making recommendations on the appropriate forms and speed of market entry. They will learn how competitive advantages are developed and how far these advantages can be transferred in another market.

Potential Courses and Target Audiences

This case is designed to illustrate the conceptual foundations of international business expansion in order to allow the analysts to develop an understanding on how to utilize relevant international business frameworks to make appropriate decisions in an unfamiliar business environment. It is primarily intended for graduate-level students who are studying international business or taking other strategic decision making courses.

Conceptual Analysis

The subsequent case analysis is based on the two below-listed and discussed conceptual models that explain firm performance and strategic directions.

Strategy Tripod

Peng (2008) identifies three perspectives that form a strategy tripod in influencing firm strategy and subsequently, its performance. The industry-based competition view suggests that the growth or contraction of a firm depends on opportunities and threats in the environment. The resource-based view stresses the importance of the internal strengths and weaknesses in determining a firm’s strategy. The availability of firm-specific capacities distinguishes successful firms from failing unsuccessful ones. Finally, the institutional conditions and transitions view emphasizes that successful companies are those which can come up with an appropriate strategy in response to formal and informal rules in foreign markets.

Firm-specific Advantages

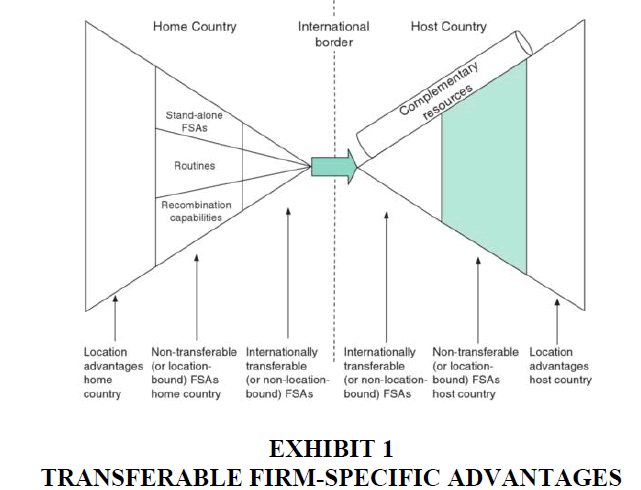

Verbeke (2013) models how a firm forms its advantages and the extent to which these advantages can be used in forming its international strategy (TN Exhibit 1). On the home country side, location advantages motivate a firm to conduct economic activity in a specific location. These advantages are, for example, cheaper labour force, large market size and attractive tax incentives. A successful firm operating in this location is a result of firm-specific advantages (FSAs). There are three sets of FSAs: Stand-alone FSAs (such as a well-known brand name, patented R&D knowledge and good reputation), routines (i.e., a routine in developing resources inside the firm such as a mass production system or a quality control process) and recombination capabilities (i.e., the recombination of a firm’s resources in novel ways, e.g., entrepreneurial managers using new methods to deploy the firm’s resources in response to business opportunities). FSAs can also be classified into location-bound (or non-transferable) and non-location-bound (or internationally transferable) FSAs.

On the host country side, the host location advantages attract foreign firms to venture into this market. These advantages are such as a cheap labour force, a large consumer market and available natural resources. When a firm ventures into a host country market, it utilizes its internationally transferable FSAs to compete or develop new FSAs. If these advantages are insufficient, it needs complementary resources of local partners in the host country.

Discussion Questions

1. What challenges did LUF face when targeting its domestic market? How did it overcome them?

Initially, LUF’s operation was set up to satisfy market conditions in developed countries. It would have been relatively simply if it could cater the same segment that it catered in Thailand. However, it did not have the option to sell to the modern trade because of its prior agreement with a local entrepreneur who had an exclusive distribution agreement in this channel. Thus, it had to venture into low-end segments and catering services operated by small SME owners. The challenges that LUF faces and its subsequent adjustments when dealing with the traditional sector were as follows.

Channels of Distribution: When selling in the modern sector in the EU and the US, LUF is part of a supply chain controlled by retail stores. The channel of distribution is short, involving few trade members who are buying in large volume. On the other hand, buyers in the traditional sector in Thailand are more fragmented and have diverse needs. The channel of distribution also longer contains wholesalers who specialize by region and trade among themselves.

Product and Promotion: When selling in the developed countries, LUF produces under a retail-owned brand and has to follow international standards. When selling locally, it has to follow local product standards and observe customary industry practices such as product size, colour and pricing methods. Since it has to manage its own brands, it has to deal with promotional activities and evaluate the effectiveness of these programs.

Competition: In developed countries, LUF is part of the supply chain of supermarket chains. These chains control their suppliers’ products to fit specific market segments. On the other hand, when dealing with the traditional sector in Thailand, LUF has to understand the strategy of each competitor and find ways to compete effectively since each competitor controls a specific market niche.

Ethical Behavior: Typical product quality standards in Thailand turn out to be ethical decisions for LUF. For example, adding chemical preservatives to prevent surimi-based products from forming bacteria turned out to be an ethical issue because while using natural preservatives is safer for consumers, it is also very expensive in a market that is highly price sensitive. (The fundamental problem is that street vendors do not refrigerate the products properly, causing the product to turn slimy from the growth of bacteria.)

Overall, LUF has been successful in penetrating the Thai domestic market by adjusting its production and business practices to meet the challenges in the local market. These turn out to be its internationally transferable FSAs because

• Consumers in Laos prefer Thai brands and LUF is viewed as one of the Thai familiar brands.

• The traditional sector is more prevalent in Laos. Its experience in selling in Thailand enables LUF to understand this sector prior to entering this market.

• The modern trade sector in Laos is expanding and LUF is also familiar with doing business with buyers in this sector.

• LUF is likely to confront the same competitors as in Thailand. Competing with them is not too difficult since LUF is already familiar with their strengths and weaknesses.

2. Should LUF enter into Laos, even before the complete implementation of tariff reduction?

The official schedule for the CLMV, including Laos to lower their tariff is at the end of 2015, but the effectiveness of implementation is still unknown. The decision to continue LUF’s venture into Laos will rely on its assessment of the pros and cons of both internal and external factors, as well as how well LUF may be able to handle the negative aspects.

Pros

a. Compared to other Thai producers, LUF does not face a shortage of surimi block because it has a reliable supplier in Vietnam.

b. There is no leader in the Laos market, even though some preferences towards specific Thai brands exist. This gives LUF a chance to build brand and expand to sell other products beyond surimi-based products.

c. The opportunity in this market is expanding rapidly. In addition, this market can be used as a platform to send products to South China.

d. Products exported from Laos will benefit from the GSP. On the other hand, Thailand is losing this privilege because it has moved up to become an upper middle income country which does not qualify for the GSP. LUF can establish a packing site in one of SEZs of Laos for this purpose.

e. The protection of intellectual property rights is weak. Brands could be copied or imitated. By venturing into this market, LUF can protect its own brand and assure buyers of its product authenticity.

Cons

a. Even though the implementation of the free trade agreement is approaching at the end of 2015, it still lagged behind. Other non-tariff barriers still exist.

b. Political risk is high. For instance, as a communist country, all land in Laos belongs to the state. The government can announce its land use policy and implement it swiftly.

c. Knowledgeable and politically well-connected partners are hard to find.

d. The border wholesalers dislike the idea of LUF venturing directly into Laos. They are threatening to drop LUF’s products if their sales revenues decline.

e. Behaving as an ethical company in developing countries with pervasive underground economies is difficult.

3. LUF uses the Laos market to gain more experience before investing in other CLMV countries. How should LUF adapt its marketing activities to meet the needs in this new environment?

By marketing its products in the traditional market as well as convenience stores in Thailand, LUF should be able to adjust its operation systems to deal with the Laotian market. In addition, its experience working with modern trade retailers should allow the company to understand their needs. This flexibility will turn out to be core competencies that should facilitate LUF’s entrance into Lao markets since this market contains both modern and traditional sectors. The traditional market is more prevalent currently but is expected to diminish in significance after the country’s economic development has progressed.

However, it has to adapt its marketing activities in Thailand to suit this new context. Some of potential adaptive activities are as follows.

Product: Laotian consumers pay attention to the picture on the package to interpret product quality. As seen in the case of Squid fish sauce, these consumers believe that this brand uses squids as raw material, while, in fact, all fish sauce brands use small fish as their main ingredient. Because of this mistaken belief, they prefer Squid brand fish sauce over Tipparos, the leading brand in Thailand. LUF has to observe preferred packages in the market in order to avoid being disadvantaged due to consumers’ misunderstanding of what the packaging does and does not, convey.

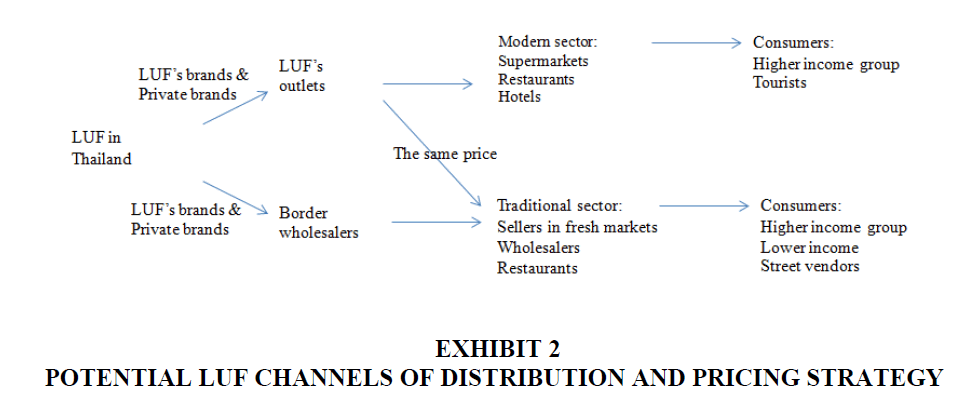

Distribution, Price and Promotion: LUF should set up two distribution systems, as shown in TN Exhibit 2 below. The first system will be for the modern trade sector where the management system has to be adjusted to deal with the foreign owners of modern trade outlets. The needs and behavior of local and foreign consumers must be studied to adapt its products to fit these requirements. Brand building should be its major thrust in increasing its bargaining power over other channel members. Moreover, since their competitors from Thailand have not yet formally entered into this market, this is an opportunity for LUF to establish itself as the market leader. If requested, LUF should stand ready to produce for private brands in order to prevent competitors from establishing relationships with these trade members, as well as increase its economy of scale.

The second trading system will aim at the traditional sector. Here LUF should produce under the wholesalers’ brands in addition to its own brands. In order to address the concern of wholesalers that LUF would undercut their price, LUF should fix its price at its outlet in Laos to be equal to that of wholesalers at the border. This should allow the wholesaler to retain their existing customers and to continue their normal business. If LUF promotes their brand in the modern sector, its brand goodwill will have a halo effect on the traditional sector. Consequently, LUF brands are expected preferred over private brands and competitors’ brands.

Research Methodology

This case study was developed by Professor Nittaya Wongtada, with two primary sources of data: Semi-structured interviews and a consulting project at NIDA Business School, Thailand. Apart from these primary data, this case study relied on various secondary data sources on the Internet.

I would like to acknowledge Professor Clifford E. Darden’s generous assistance throughout the process of writing this case. His meticulous comments made possible the case and its accompanying teaching note. I also would like to thank NIDA Business School, National Institute of Development Administration (NIDA), Thailand, for the enabling case research grant.