Research Article: 2017 Vol: 16 Issue: 2

Building the Probabilistic Model of Quantitative Risk Analysis of Enterprise Development

Kirill Igorevich Lavrenyuk, Vladivostok State University of Economics and Service

Marina Sergeevna Rakhmanova, Vladivostok State University of Economics and Service

Keywords

Quantitative Risk Analysis, Swot Model, Probabilistic Model, Financial Condition of the Enterprise, Deviation from Statutory Values.

Introduction

Management is a process of purposeful processing of business status information into the command information. The choice of action program algorithm, which is based on processed information, is the decision. The decision lays the basis of management. There is a situation, where the same decision may lead to one of many possible outcomes with different probabilities of their implementation. At that, the outcome additionally depends on several factors, which are not known at the time of decision making. In this situation, the decision maker risks to arrive to completely different result, on which he initially did not count.

In turn, the risk category occupies a significant place in economic science and practice and is one of the basic components of the enterprise strategic management. Note that this category is considered both at the stage of strategic analysis (analysis and the impact assessment of the risk of the enterprise development) and at the stage of strategic planning (creation of action plan based on the existing enterprise development risks, i.e., anti-risk action plan). At that, in terms of risks leveling, the existing instrumental component of strategic management does not fully take into account many factors that influence risk emergence and the final result (for example, the influence of the enterprise internal environment factors on minimizing the consequences of the risk occurrence).

At the same time, the question deserves to be asked: Why do similar enterprises differently bear similar risks? This is due to the fact that these companies have different sets of strengths and weaknesses. Thus, consideration of the impact of risks on the company's financial performance, in terms of the corrective impact of the company's internal factors, is an important and understudied aspect.

Methods And Models Of Risk Analysis

Currently, there are many works devoted to the issue of the development of strategic analysis tools. For example, the authors of (Arabzad, Mazaher, Razmi & Shirouyehzad, 2014) propose a two-step model for supplier selection, in which the underlying selection criteria are taken from SWOT analysis. The authors of (Parraga, Gonzalez-Cancelas & Soler-Flores, 2014) propose a SWOT analysis of the port of Manta operation, using expert assessment obtained by employing the Delphi Panel model as quantitative estimates. In (Wang, Zhang & Yang, 2014) the authors propose a hybrid “three-stage” SWOT-model that allows bridging the gap between strategic analysis and the formulation of the strategic development of the enterprise. The article (Morozov, Solodukhin & Chen, 2016) proposes fuzzy-multiple methods for strategic analysis (SWOT and VRIO analyses) of the enterprise.

Particular attention is paid to separate area of strategic analysis, namely, analysis and risk assessment of socio-economic system development. A number of classical tools that allow carrying out qualitative or quantitative analysis of the risks impact on the system development is presented in (Karpova, 2016; Boehm & Lane, 2009). Currently, the instrumental component of risk management continues developing. In (Jahantigh, Malmir & Avilaq, 2017), the authors identify and evaluate financial risks of the projects on engineering structures construction; based on the fuzzy TOPSIS approach. The article (Lai, Zhang, Duffield & Aye, 2014) presents the developed risk analysis tool to assist decision makers, which is based on the cost-benefit analysis model. The article (Rakhmanova, 2015) presents a methodology for financial risk management of small enterprises, which is based on the use of qualitative and quantitative methods of financial risks assessment that allows assessing in detail the economic attractiveness of small business, its performance efficiency, profitability and financial sovereignty.

Besides, a number of studies deserve high attention. They describe the real-world application of the approaches used in this work. For example, the use of the probabilistic approach in solving various economic problems (Datta, 1998, Lalou, Chalikias, Papadopoulos & Fatouros, 2016, Ohlson, 1980, Rosenblat, 1958, Stanley & Sewall, 1976), the use of the economic and mathematical tools technique for modeling socio-economic processes, taking into account existing uncertainties (Chalikias & Skordoulis, 2017, Chalikias, Lolou & Skordoulis, 2016, Chalikias & Skordoulis, 2014), the use of optimization approaches in the formation of an optimal portfolio of activities (Jain, Mahajan & Muller, 1995). However, the situation that the enterprise with its certain strengths and weaknesses is able either mitigating risk or increasing it, is not fully taken into account neither in the framework of these strategic analysis tools nor the most other methods and models. Moreover, existing tools of analysis and risk assessment of enterprise development do not fully take into account the influence of external environment factors on the financial condition of the enterprise. Note that the use of such type of indicators allows unifying the model for its application by any enterprise.

Previously, the authors have developed a quantitative method of risk analysis of socio-economic system (Lavrenyuk, Mazelis & Solodukhin, 2016; Mazelis & Morozov, 2014). However, the proposed method belongs to the class of the expert methods. Often, the expert makes the assessment taking into account the subjective beliefs and feelings. In this regard, there is a need to use methods that would take into account this fuzziness of information. In this article we propose to use a probabilistic approach. It is also worth noting that the proposed method is more suitable for meso and macroeconomic systems. This leads to the need for its modification for the micro level.

Thus, the elaboration of analysis and risk assessment methods and models for enterprise development that take into account the impact of risks on the financial condition of the enterprise, as well as formulating a set of analysis-based anti-risk measures is a current topic of research. In this regard, the aim of this work is to modify the risk assessment method of socioeconomic system, proposed in (Lavrenyuk, Mazelis & Solodukhin, 2016), using a probabilistic approach, as well as its unification for the use at micro level.

Probabilistic Model For Quantitative Risk Analysis Of Enterprise Development

To analyse and assess the impact of risks on the financial condition of the enterprise we propose a model, based on a qualitative SWOT analysis, where factors in the external environment are considered as the system development risks. At the same time, the need to use the SWOT model is conditioned by the need to take into account the ability of factors of the internal environment of the socio-economic system to influence the irrigation of external factors. The risk analysis and assessment method of enterprise development are based on the algorithm described below.

At the first step, we carry out analysis of the internal environment of the enterprise, emphasizing and assessing quantitatively its strengths and weaknesses. The quantitative assessment is done using an indicator of expressiveness of the ith factor i N , measured on an integer scale from “0” to “5”. The larger the indicator, the more pronounced is given strength (weakness) relative to competitors.

At the second step, we carry out analysis of the external environment of the enterprise. We select and assess quantitatively the opportunities and threats. The quantitative assessment is based on the probability of occurrence of the jth factor Pj , measured on a scale from “0” to “1”.

At the third step we compare factors of internal and external environment. The quantitative assessment is based on the indicator showing the enterprise’s capability to use the ith strength in order to take advantage of the jth opportunity or confront the jth risk at the rth scenario (the capability of the ith weakness to hamper the implementation of the jth opportunity or increase the negative effects of the jth threat at the rth scenario). This indicator is measured on a scale from “0” to “1”. At that, three possible scenarios are considered: Pessimistic (r=1), realistic (r=2) and optimistic (r=3) ones.

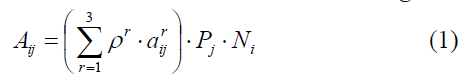

Further we transform the assessments into the index according to the formula:

Where  is the probability of occurrence of the rth scenario.

is the probability of occurrence of the rth scenario.

Then we assess the implementation of the internal environment factors of the enterprise as the difference between the sum of modified assessments of strengths and the sum of modified assessments of weaknesses:

At the fourth step we compare factors of the external environment and the financial condition indicators of the enterprise. At that, we suggest to use the following indicators reflecting the financial condition of the enterprise: The absolute liquidity ratio, coverage ratio, intermediate coverage ratio, Altman’s integrated indicator, equity ratio, debt to equity ratio, current assets to equity ratio, coefficient of long-term investments structure of the enterprise, financial sustainability ratio, actual cost rate of the enterprise assets and assessment of the financial soundness of the enterprise. Note that we assess the influence not on the indicators of the enterprise financial condition, but their components, which are used to calculate these indicators. The information basis for assessing the financial condition of the enterprise consists of the enterprise performance indicators, as reflected in form 1 “The balance sheet” and form 2 “The profit and loss standard report” of the enterprise. Statutory values of the indicators will be used as the target values of financial condition of the enterprise.

Next, we calculate correction factor, which allows estimating the influence of internal environment factors of the enterprise on its external environment factors. The formula for calculation of the correction factor is presented in (Parraga, Gonzalez-Cancelas & Soler-Flores, 2014).

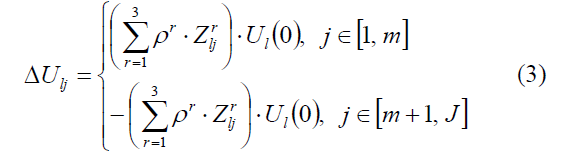

To determine changes in values of the financial condition indicators of the enterprise due to the occurrence of one or another external environment factor we use the following formula:

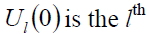

where  is the effect of the

is the effect of the factor of the external environment on the

factor of the external environment on the  indicator of the financial condition of the enterprise at the rth scenario, measured on a scale from “0” to “2”;

indicator of the financial condition of the enterprise at the rth scenario, measured on a scale from “0” to “2”;  indicator of the financial condition of the enterprise at the initial instant.

indicator of the financial condition of the enterprise at the initial instant.

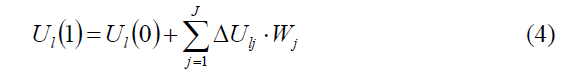

Further, we calculate indicators taking into account the correction factor at time instant t=1:

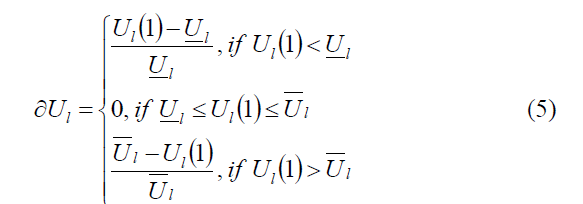

Then we calculate the deviations of the indicators at time instant t=1 from their target values:

Where  he lower is limit of the statutory value of lth indicator of the financial condition of the enterprise;

he lower is limit of the statutory value of lth indicator of the financial condition of the enterprise;  is the upper limit of the statutory value of lth indicator of the financial condition of the enterprise.

is the upper limit of the statutory value of lth indicator of the financial condition of the enterprise.

Note that in case if the development of the enterprise necessitates decreasing lth indicator, then the deviations should be taken with the opposite sign, i.e.,

At the fifth step we assess the risk of the enterprise development. The enterprise development indicator is determined by the formula:

Where L is the number of considered indicators of the financial condition of the enterprise.

If  , this means that the emerged situation is characterized by low enterprise development risk (favorable), while

, this means that the emerged situation is characterized by low enterprise development risk (favorable), while  means that the emerged situation is characterized by high risk (unfavourable).

means that the emerged situation is characterized by high risk (unfavourable).

The decision concerning formulating a possible set of anti-risk measures should be taken by the enterprise CEO (or other responsible person) in the framework of the further strategic planning. At that, the set of anti-risk measures is formed taking into account the need for the development of the enterprise's strengths and elimination of the weaknesses, which, in turn, contribute to the most effective use of existing opportunities and reducing threats.

Risk Assessment Of Enterprise Development In The Primorye Territory

As an example, consider the use of the proposed method with regard to a trading company involved in sales of jewellery in the Primorye Territory (Russia).

In consequence of the calculation we have obtained the following values of the financial condition indicators of the enterprise under study: Absolute liquidity ratio  ; intermediate coverage ratio

; intermediate coverage ratio  ; coverage ratio

; coverage ratio  Altman integrated indicator

Altman integrated indicator  equity ratio

equity ratio  debt to equity ratio

debt to equity ratio  current assets to equity ratio

current assets to equity ratio  coefficient of long-term investments structure

coefficient of long-term investments structure  and financial sustainability ratio

and financial sustainability ratio  Since

Since  and

and  then we can talk about the prospective liquidity of the company's assets. Note that the company under study has a high creditworthiness. The absolute liquidity, coverage and debt to equity ratios of the company are all within the statutory values, other indicators are beyond the statutory values, therefore, the company is solvent but financially unstable.

then we can talk about the prospective liquidity of the company's assets. Note that the company under study has a high creditworthiness. The absolute liquidity, coverage and debt to equity ratios of the company are all within the statutory values, other indicators are beyond the statutory values, therefore, the company is solvent but financially unstable.

Further, we carry out comprehensive analysis of the company activities. The results of conducted analysis were used to identify and assess the factors of external and internal environment. Strengths and weaknesses of the company are presented in Table 1.

| Table 1: Enterprise Internal Environment Factors | |

| Name of the internal environment factor | |

|---|---|

| Strengths | |

| The widespread representation in the Primorye Territory | 4 |

| Wide assortment of jewellery products made of gold | 2 |

| Flexible system of interaction with customers | 4 |

| The developed system of interaction with business partners | 4 |

| Low sales cost of jewellery products | 3 |

| High renewal rate of jewellery collections | 3 |

| High level of service and maintenance | 2 |

| Attractive company visualization design in the market | 5 |

| Weaknesses | |

| The lack of jewellery made of other precious metals | 5 |

| The low level of brand awareness | 4 |

| The lack of effective methods of marketing promotion of the company | 3 |

| Problems with the shelf stocks | 3 |

In consequence of the conducted analysis we have highlighted company’s opportunities and threats presented in Table 2.

| Table 2: Enterprise External Environment Factors | |

| Name of the external environment factor | |

|---|---|

| Opportunities | |

| Successful functioning of the maritime terminal of Vladivostok in the Primorye Territory | 0.5 |

| The creation of priority social and economic development areas in the Primorye Territory | 0.6 |

| The development of the gambling zone | 0.9 |

| Interest of investors in key development projects of the city | 0.7 |

| The depreciation of the rouble relative to other currencies | 0.3 |

| The development of good neighbourly relations and economic cooperation with neighbouring countries | 0.7 |

| Threats | |

| Negative migration mobility of the population | 0.7 |

| Growing income inequality of the population | 0.9 |

| The mismatch of reality with the expectations with regard to the free maritime terminal of Vladivostok and priority development areas | 0.5 |

| New political and economic sanctions and counter-sanctions | 0.3 |

| Unstable public finance and credit policy | 0.6 |

At the third step we compare external and internal environment factors of the enterprise. Each expert gives three scores for each of the correlations between the strength (weakness) and the opportunity (threat). This is because in the present study we consider three scenarios. Note that comparative matrix is omitted in the article because of its awkwardness.

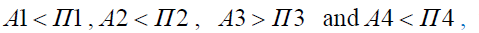

Then we transform the obtained expert assessments into the indicators  according to the formula (1) and assess implementation of opportunities and threats

according to the formula (1) and assess implementation of opportunities and threats  according to the formula (2). At that, we use the following probability of scenarios:

according to the formula (2). At that, we use the following probability of scenarios:  for pessimistic,

for pessimistic, - for realistic and

- for realistic and  –for optimistic scenario.

–for optimistic scenario.

The calculated correction factors are presented in Table 3.

| Table 3: Correction Factors | |

| Correction factor | Correction factor value |

|---|---|

| W1 | 1.01 |

| W2 | 1.01 |

| W3 | 1.05 |

| W4 | 0.99 |

| W5 | 0.98 |

| W6 | 0.99 |

| W7 | 0.98 |

| W8 | 1.04 |

| W9 | 0.99 |

| W10 | 1.02 |

| W11 | 1.10 |

Further, we determined the influence of the particular factor of the external environment on the components, which are used to calculate the financial condition indicators of the company under consideration for each scenario. Note that comparative matrix of the external environment as well as the financial condition indicators are omitted in the article due to their awkwardness.

Further, we calculate the values of all the indicators of the financial condition of the company according to the formula (4) given the correction factor at time instant t=1. The values obtained are given in Table 4.

| Table 4: Values Of The Company Financial Condition Indicators |

|

| Indicator | Value |

|---|---|

| Absolute liquidity ratio | 0.41 |

| Intermediate coverage ratio | 0.42 |

| Coverage ratio | 2.81 |

| Altman integrated indicator | 4.42 |

| Equity ratio | 0.79 |

| Debt to equity ratio | 0.18 |

| Current assets to equity ratio | 0.98 |

| Coefficient of long-term investments structure | 0.11 |

| Financial sustainability ratio | 0.81 |

Since  the company will retain the status, which is characterized by the prospective liquidity of assets.

the company will retain the status, which is characterized by the prospective liquidity of assets.

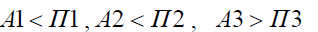

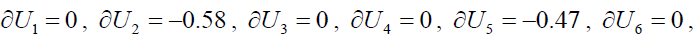

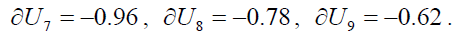

Finally, using the formula (5) we define the deviations of the indicators at time instant t=1 from their target values:

Using the formula (6) we calculate integrated risk index. It amounted to 0.38.

Using the formula (6) we calculate integrated risk index. It amounted to 0.38.

Discussion

The most “critical” indicators of the financial condition of the considered company are the current assets to equity ratio, coefficient of long-term investments structure and financial sustainability ratio of the company, i.e., the indicators related to financial soundness of the company. Therefore, we can say that the company is in a condition, in which the solvency is a time variable, while debt to equity ratio is not capable of providing this solvency.

At that, according to the determined integrated risk index, the company is characterized by an average risk situation with regard to further development and consequently there is a need to develop anti-risk measures. Note that anti-risk strategy of the company should be based on the elimination of existing weaknesses. In particular, it is necessary to develop an effective marketing strategy, which will precisely define market promotion mechanisms of the concerned brand in the Primorye Territory. This will contribute to brand awareness and therefore increase stockholder equity.

Thus, the practical effect of this model is that it allows to identify the most dangerous (in terms of impact on financial indicators) risks for the enterprise. Taking into account the correction factors that are formed due to existing strengths and weaknesses of the enterprise, it is possible to identify those internal factors of the enterprise, the development or elimination of which will minimize the existing risks. It is planned to develop an economic-mathematical model in future years for the formation of an optimal anti-risk toolbox based on the method described in this paper.

Conclusion

In this study we have developed a probabilistic model for the risk analysis of the enterprise development, where the indicators of financial condition of the enterprise are in fact the company development indicators. Enterprise development risks are understood as its external environment factors (both threats and opportunities), the impact of which is adjusted depending on the existing internal environment factors. The need for using probabilistic approach is caused by the subjective nature of expert opinions concerning a particular issue. The developed model has been tested on the example of a company engaged in the jewellery sale in the Primorye Territory. The data obtained allowed concluding that at present current risks will not significantly affect the company development (i.e., will not lead to negative consequences).

Nevertheless, the current situation is considered to be of average-risk situation, suggesting the need for construction of an optimum portfolio of anti-risk measures. Given the existing totality of strengths and weaknesses, it is recommended to develop a marketing strategy to increase brand awareness of the company that in turn will significantly reduce “imminent peril” of many risks for the company and lead to positive growth in its financial performance.

References

- Arabzad, S.M., Mazaher, G., Razmi, J. & Shirouyehzad, H. (2014). Employing fuzzy TOPSIS and SWOT for supplier selection and order allocation problem. International Journal of Advanced Manufacturing Technology. Retrieved August 31, 2017, from https://www.researchgate.net/publication/264793061

- Boehm, B. & Lane, A. (2009). Better management of development risks: Early feasibility evidence. Proceedings of the Annual Conference on Systems Engineering Research. Retrieved August 31, 2017, from https://www.researchgate.net

- Chalikias, M. & Skordoulis, M. (2017). Implementation of F.W. Lanchester's combat model in a supply chain in duopoly: The case of Coca-Cola and Pepsi in Greece. Operational Research: An International Journal, 17 (3), 735-745.

- Chalikias, M., Lalou, P. & Skordoulis, M. (2016). Modelling advertising expenditures using differential equations: The case of an oligopoly data set. International Journal of Applied Mathematics and Statistics, 55(2), 23-31.

- Chalikias, M. & Skordoulis, M. (2014). Implementation of Richardson's arms race model in advertising expenditure of two competitive firms. Applied Mathematical Sciences, 8(81), 4013-4023.

- Datta, A. (1998). Automating the discovery of as-is business process models: Probabilistic and algorithmic approaches. Information Systems Research, 9(3), 275-301.

- Jahantigh, F.F., Malmir, B. & Avilaq, B.A. (2017). Economic risk assessment of EPC projects using fuzzy TOPSIS approach. Int. J. Industrial and Systems Engineering, X(Y), 1-19.

- Jain, D., Mahajan, V. & Muller, E. (1995). An approach for determining optimal product sampling for the diffusion of a new product. Journal of Product Innovation Management, 12(2), 124-135.

- Karpova, I.F. (2016). Analiz risk-orientirovannyh metodov ocenki ehffektivnosti sistemy vnutrennego kontrolya zatrat v aspekte povysheniya ehkonomicheskoj bezopasnosti hozyajstvuyushchih sub"ektov [Analysis of risk-oriented methods for evaluating the effectiveness of the internal control system of costs in terms of increasing the economic security of business entities]. Economy and Management: Problems and Solutions, 2(12), 94-102.

- Lai, J., Zhang, L., Duffield, C. & Aye, L. (2014). Economic risk analysis for sustainable urban development: Validation of framework and decision support technique. Desalination and Water Treatment, 52, 1109-1121.

- Lavrenyuk, K.I., Mazelis, L.S. & Solodukhin, K.S. (2016). Kolichestvennyj analiz riskov social'no-ehkonomicheskogo razvitiya municipal'nogo obrazovaniya na osnove stejkholderskogo podhoda [Quantitative analysis of socio-economic development risks of the municipal entity based on the stakeholder approach]. Azimuth of Scientific Research: Economy and Management, 5-4(17), 262-265.

- Mazelis, L.S. & Morozov, O.V. (2014). Metodika SWOT-analiza riskov regiona v razreze makroehkonomicheskih pokazatelej social'no-ehkonomicheskogo razvitiya (na primere Kamchatskogo kraya) [Methodology of SWOT-analysis of the risks of the region in terms of macroeconomic indicators of socio-economic development (in the context of the Kamchatka Territory). Contemporary problems of science and education, 6. Retrieved August 31, 2017, from https://science-education.ru/ru/article/view?id=16329

- Morozov, V.A., Solodukhin, K.S. & Chen, A.Y. (2016). Nechetko-mnozhestvennye metody strategicheskogo analiza stejkholder-kompanii [Fuzzy-multiple methods for strategic analysis of stakeholder company]. Fundamental Research, 2, 179-183.

- Lalou, P., Chalikias, M., Skordoulis, M., Papadopoulos, P. & Fatouros, S. (2016). A probabilistic evaluation of sales expansion. Proceedings of 5th International Symposium and 27th National Conference of HEL.O.R.S on Operation Research. Piraeus: Piraeus University of Applied Sciences, 109-112.

- Ohlson, J.A. (1980). Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research, 109-131.

- Parraga, M.M., Gonzalez-Cancelas, N. & Soler-Flores, F. (2014). DELPHI-SWOT tools used in strategic planning of the port of Manta. Procedia-Social and Behavioral Sciences, 162, 129-138.

- Rakhmanova, M.S. (2015). Metodika upravleniya finansovymi riskami malyh predpriyatij [Methods of financial risk management of small enterprises]. Fundamental Research, 12(3), 638-642.

- Rosenblatt, F. (1958). The perceptron: A probabilistic model for information storage and organization in the brain. Psychological review, 65(6), 386.

- Stanley, T.J. & Sewall, M.A. (1976). Image inputs to a probabilistic model: Predicting retail potential. Journal of Marketing, 40(3), 48-53.

- Wang, X., Zhang, J. & Yang, T. (2014). Improved SWOT approach for strategic constructing in China worldwide express mail service. Journal of Applied Research and Technology, 12, 230-238.