Research Article: 2025 Vol: 29 Issue: 4

Building Business Bases on Biases: A Systematic Literature Review

Rahul Gupta, Indian Institute of Management (IIM) Sambalpur, Sambalpur

Padmavathy Dhillon, Indian Institute of Management (IIM) Sambalpur, Sambalpur

Citation Information: Gupta, R., & Dhillon, P. (2025). Building business bases on biases: a systematic literature review. Academy of Marketing Studies Journal, 29(4), 1-15.

Abstract

Purpose: In the volatile, uncertain, complex and ambiguous (VUCA) world today, the decision-making process has become increasingly complex and challenging for the organizations. This complexity is further exacerbated when traits, characteristics and biases of the decision makers intermingle with the process. This study aims to highlight the managerial cognitive biases which influence the decisions, leading to suboptimal results for the firm. The study identifies how these biases impact the strategic options available with the firm and explores how the knowledge domain available in the subject. Design / methodology / approach: This research provides an in-depth systematic literature review (SLR) to understand the existing work in this area and guide the future scholars with further areas of research. Findings: This paper finds that overconfidence and discrimination are the key biases which often lead to suboptimal decisions. It is also found that the managers often suffer from regret or hindsight bias which influences their thinking and hence the decision-making process. Often CEOs or the seniormost leaders of the organization suffer from narcissism which tends to bring huge gains or colossal losses for the organizations. Implications: This study has implications for the practitioners and academicians alike. Where it makes the organizations and management cognizant of the cognitive biases which could impact their decision making, it provides guidance to the scholars for future research. This also aids the theorists to review the work done in this area and acknowledge and appreciate the human factors involved in decision-making.

Keywords

Managerial Biases, Cognitive Biases, Decision-Making, Systematic Literature Review, Decision Process.

Introduction

Business is inundated with strategic choices and decisions on a regular basis. The corresponding business managers have a task at hand to review those options and make appropriate decisions for business (Shepherd, 1999; Bhardwaj and Tiwana, 2005). Often these decisions turn to be out of line of expectations (Sherfin, 2001; Baker et al., 2006). This could be because the outcomes of these decisions are not foreseen and they come shrouded in uncertainty and lack of visibility. It leads the decision makers to use ill-structured information (Walsh, 1988; Simon & Houghton, 2003) or have inaccurate data about the subject at hand.

Finance managers are expected to act rationally, and often they use techniques like discounted cash flow (DCF) (Fichman, Keil and Tiwana, 2005), Net Present Value (NPV) (Heaton, 2002) and other financial appraisal tools like Internal Rate of Return (IRR) or payback period to financially evaluate the options and make recommendations. These techniques guide the business to evaluate the business options and help them arrive at an empirical based decision easily. However, in business empirical decisions are few and far between, studies show that managers intuitively recognize such opportunities and have a fair inkling about the forthcoming decision (Fichman et al., 2005). Since these decisions are futuristic in nature and create obligations for next actions, managers tend to build in project buffers risk, while still retaining the upside and optimism of the project intact (Sullivan et al., 1999, Fichman at al., 2005). Inclusions of these buffers and qualitative aspects into the computations are hugely driven by the cognitive biases of the decision makers. The biases emanate from several factors due to the prior experiences and perceptions of environment (Shepherd and Williams, 2015), political grounding (Eisenhardt and Zbracki, 1992), cognitive factors (Wiersema and Bantel, 1992; Amason, 1996) and even demographic factors (Wiersema and Bantel, 1992). Empirical decisions often are anchored to project appraisal technique(s) which may somewhat thwart the impact of biases. Impact of the cognitive biases could be monumental for personal or non-empirical decisions.

Research Motivation

Over the past years, several SLRs have explored the domain of managerial decision making and biases involved and influencing the process. Previous studies have highlighted through SLR that overconfidence, anchoring, confirmation bias and escalation of commitment distort decision making (Das and Teng, 1999). Their work also emphasized how these biases adversely impact corporate governance and strategy. A comprehensive review focusing on CEO overconfidence showed its suboptimal impact on mergers and acquisitions (M&A) strategy and management arriving at highly risky decisions leading to volatile outcomes (Malmendier and Tate, 2005). Further, decision making during crises, how risk aversion and confirmation biases shape the firms’ responses in a high-stake environment (Zhang et al., 2019). Despite these incisive reviews on the subject, a comprehensive SLR that incorporates the highly volatile and ambiguous business environment in the last decade – such as digital transformation, advent of artificial intelligence, medical emergencies and pandemic, leadership diversity – is absent. This review attempts to fill in the gaps through exploration how classical and contemporary biases influence managerial decision making in this dynamic yet evolving organizational landscapes.

Theoretical Framework: Biases

Biases are normally considered as an irrational belief which could influence or skew rational thinking or which influences an individual’s ability to take a specified decision based on facts and evidences (Schwenk, 1986; Simon et al., 2000). Economics and Finance disciplines expanded its dimensions since the behavioural scientists came to fore, after the ground-breaking work of Tversky and Kahneman in 1974. These areas of study were revolutionized by identification and evaluation of impact of behaviours of people in various situations (Tversky and Kahneman, 1974). They brought cognitive biases to the forefront of management studies and illustrated how people would take wrong or suboptimal decisions when suffering from biases. Currently, there are more than 200 as listed on Wikipedia (https://en.wikipedia.org/wiki/List_of_cognitive_biases). However, few of the biases are found to have a strong impact on the managerial decision-making. These biases often drive the manager to favour, disfavour a particular strategic choice. Few of them are provided hereinbelow.

a) Uniqueness Bias – this is the tendency when one sees themselves as more singular than they are in reality. For example, one my think of themselves as the most healthy, clever or attractive (Goethals et al., 1991).

b) Overconfidence Bias – People having this bias tend to overestimate the positive results of a proposition and underestimate the negative outcomes, making the organization vulnerable to risks (Moore and Healy, 2008; Proeger and Meub, 2014).

c) Hindsight Bias – this is normally referred to as the people who think “I knew it all along” effect.

d) Availability Bias – Overweighing or prioritizing on the basis of its recency. One values more what’s there in the recency of your memories – the recency effect.

e) Anchoring Bias – In this people have the tendency to rely too heavily on one piece of information, which becomes the key anchor for decision-making (Tversky and Kahneman, 1974).

f) Confirmation Bias – the tendency when the decision-maker concentrates, focuses and values only to those details which confirms his current beliefs and which aren’t contrary to his understanding of the situation.

g) Commitment Bias – tendency to justify increase investment in favour of a decision on the basis of the previous experience into it, despite, the new evidence suggesting that any additional investments will not be offset by the benefits (Thaler, 2015).

h) Human bias – Bias due to the demography and political affinity. It is often determined by the age, experience, geography where he has stayed and also by the political beliefs the person has.

i) Bounded Rationality – These are the limits often experienced by managers about the ability to process, understand and interpret large volumes of data which could be pertinent in making the decision (Simon, 1979).

j) Racial Bias – As the name suggests, it refers to the pre-conceived notions a manager could have for others of different caste, creed, gender, race. Such biases are found to be very costly for the organizations as they forego the opportunities to use the best manpower leading to creation of lesser productive teams (Becker, 1957).

There are many more biases which subconsciously a person may have and which could be impacting his thinking and thereby impacting the decision the person makes. In general, it is believed that cognitive biases (above-mentioned and more) are omnipresent in all strategic decision making (Das and Teng, 1999).

The impact of these biases is multi-fold, especially when organizations face internal or external crises. This brings in the vital impetus of the research motivation: to explore and understand how managerial biases influence decision-making and lead organizations to make suboptimal financial and non-financial decisions.

The literature has strongly emphasized how managerial biases like bounded rationality, overconfidence, narcissism, regret aversion, ambivalent, confirmation, racial, self-attribution, and anchoring bias have impacted decision-making. It is widely known that overconfident managers tend to underestimate the risks, which leads to suboptimal financial decisions. Similarly, managers who are narcissistic or have a high self-attribution bias are associated with high-risk corporate decisions, which can lead to significant gains or colossal failures. History is resplendent with stories of such narcissistic rulers and dictators whose narcissistic behaviours brought them to power, followed by catastrophic losses leading to destruction. Such decisions are often more complicated when the managers suffer from bounded rationality (Simon, 1975), where managers have restricted cognitive processing capacity, leading to incomplete assessment of options in investment decisions.

This paper explores the following key research questions: -

RQ1: How do behavioural biases impact managerial decision-making in contemporary business contexts?

RQ2: What influence do leadership traits (like CEO narcissism) have on the risk vulnerability of the firm?

RQ3: What are the limitations of the current research on managerial biases, and what future research areas can the researchers explore?

Methodology

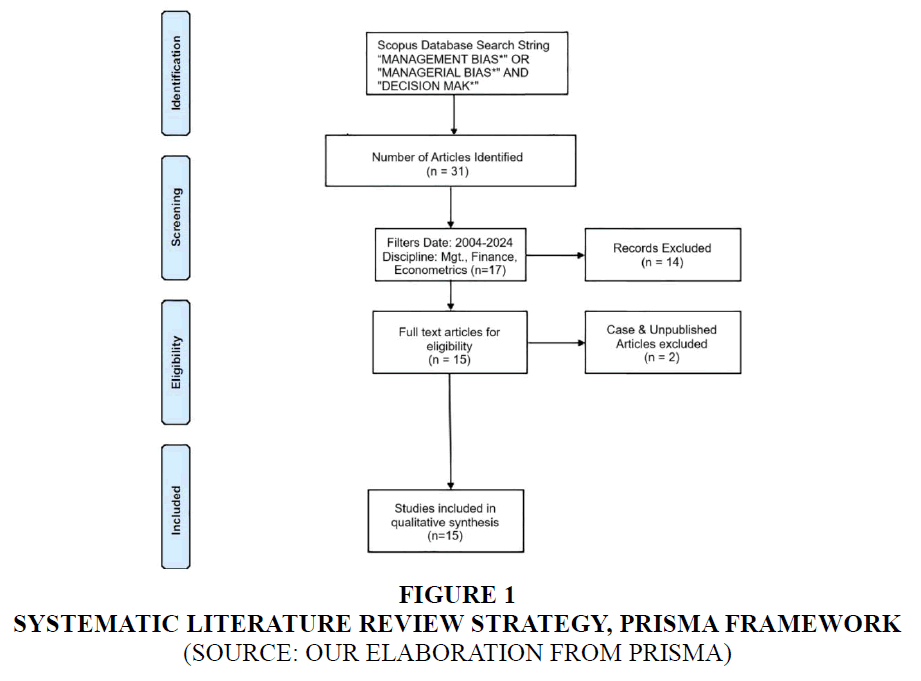

Scopus, being one of the largest and most trusted databases owing to its comprehensive coverage and academic rigour, was used to filter the literature and research conducted on the subject being explored. The procedure used to select the articles for the review is provided in Figure 1.

Figure 1 Systematic Literature Review Strategy, Prisma Framework (Source: Our Elaboration from Prisma)

Using Scopus database, a detailed review of the literature's findings, gaps, methodology, variables, theories, and context is conducted. The database was searched using the string “MANAGEMENT BIAS*" OR "MANAGERIAL BIAS*" AND "DECISION MAK*" to identify key papers and research available on the subject. Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) approach was used to search and filter the research. The initial search yielded 31 results. Thereafter, filters were set on document type as an article from 2004 to 2024, subject restricted to Business Management and Academia, Economics, Finance and Econometrics, and Decision Sciences. The number of documents was reduced to 17. Of the 17 shortlisted articles, of which one was a case study (South Africa's industrial kitchen: the dilemma), and one was a working paper (Classical management biases and behavioural approach comprehension). These two were further removed from the selection. Finally, the relevant list of 15 articles was obtained for review as provided in Figure 1.

The rationale for this review builds upon previous SLRs and intends to extend the scope to examine more recent biases including review of recent literature on the subject and their effects across diverse industries and decision-making contexts.

Findings and Discussions

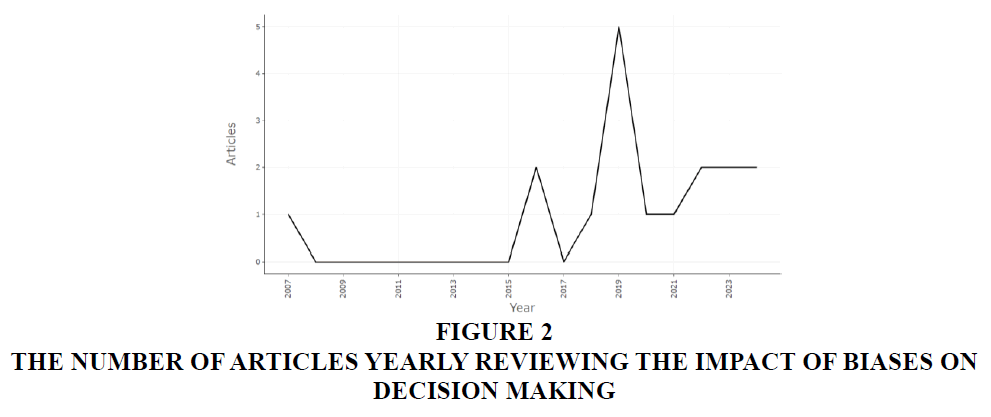

Based on the document shortlisting criterion, 17 (including the case study and non-classified documents) were selected. These researches pertained to the period between 2007 to 2024, covering 80 keywords. The annual growth rate of the study has been 4.16%. Six of the 17 articles were single-author research, and the average number of authors per document was estimated to be 2.35.

Looking at the temporal review of the articles, the interest in assessing managerial biases started in 2015. This isn’t surprising, though, as one of the pioneering works on human biases by Daniel Kahneman, “Thinking Fast and Slow,” was published in 2011. This was when the understanding of biases came to the common fore. This was further cemented through the work of Kahneman and Tversky, “The Undoing Project,” in 2016. The increase in interest in this area began in 2015-16, following which the number of research studies on the subject grew at a rate of 4.16%. From the graph (Figure 2), it seems that the research peaked in 2019, following which, every year, some aspect of the relationship between biases and decision-making is explored.

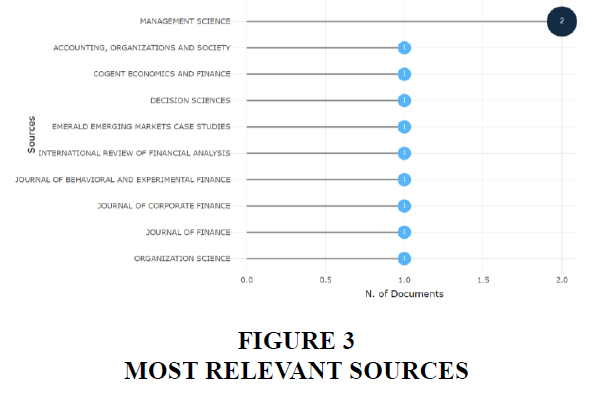

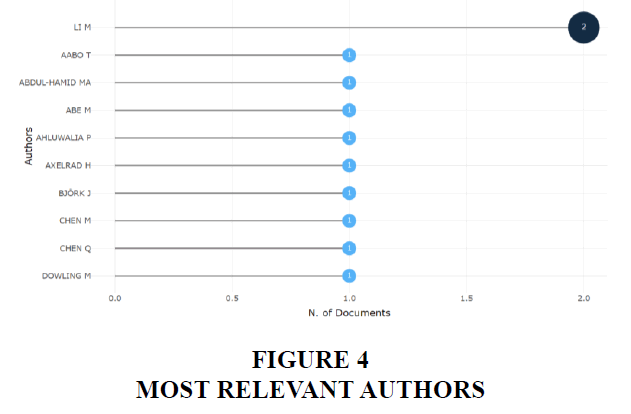

Key contribution has been made by Li M and various management and financial journals have explored this topic.

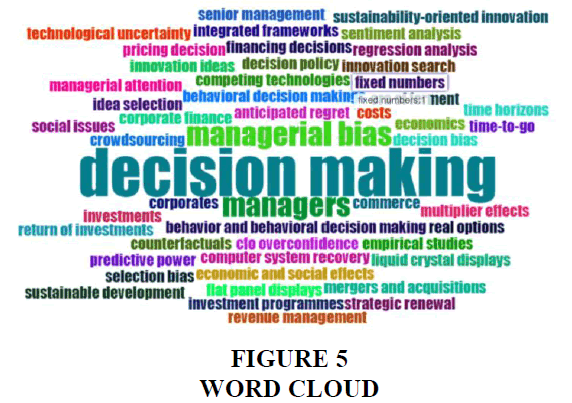

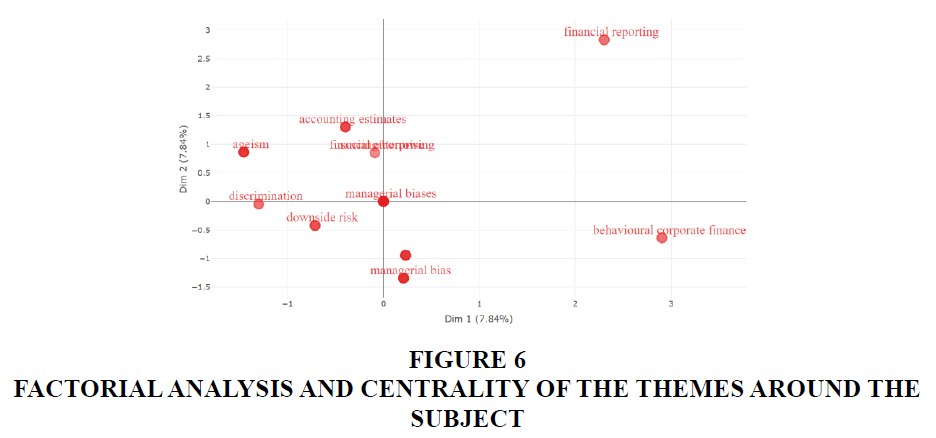

Reviewing the words and their co-occurrences reveals that decision-making and management biases or managerial biases are the most commonly used words. Other frequently used words are decision bias, overconfidence, and predictive power. Further, the centrality score of co-occurring words like financial reporting, discrimination, managerial bias(es), downside risk, and behavioural corporate finance was high and core to the subject.

Figures 3-7 reflect the word cloud and factorial analysis of word occurrences, indicating the themes and topics researchers are exploring on the impact of managerial biases.

Other aspects of the bibliometric analysis are provided in Exhibit 2.

TCCM Framework

Theories – Context – Characteristics – Methodology (TCCM) Framework provides a comprehensive approach to literature reviews in management research (Paul & Rosado-Serrano, 2019). This section explores the subject on these four key dimensions viz. theory – identifying and the theoretical approaches used, context – defining the environmental and situational factors affecting the relationship between managerial biases and decision making; characteristics – review of the population, sample size, and attributes of the research undertaken; and finally, methodology – assess the research methodologies and evaluation of the robustness of the methods.

Overconfidence theory emerged as a dominant theoretical framework across several studies. The papers have been verbose about how this bias exposes the firms to additional risk, leads to suboptimal financial decisions, and poor and ineffective allocation of resources. Another recurring theme that frequently warranted attention was the Prospect theory. This was highly advocated by studies focusing on decision-making under uncertainty. The theory evaluates decision-makers' perceptions of gains and losses, clouding their judgment. It was often associated with underlying biases like risk aversion and anchoring effect.

Agency theory and Upper echelons theory were also frequently referred to by studies dealing with narcissism. Often, senior leaders, like CEOs or CROs, are associated with being aggressive and have a very high opinion about themselves, leading to narcissism. Decisions under this bias often expose organizations to grave risks and impact their financial performance. Such managers introduce a high degree of volatility and risk to the firm. Several pieces of literature have also explored the real options theory and bounded rationality to analyse the decisions made by managers or senior leaders under uncertain conditions. Though less explored, other studies have researched stereotypes and social identity theory.

The literature has explored various industrial contexts. While corporate finance is the most researched area, much of the literature caters to small and mid-sized enterprises (SMEs). These organizations have studied how they adapt themselves during difficult times like external shocks (COVID-19) or fiscal downturns in the market. In addition, a lot of studies have been concentrated around multinational companies. These have been reviewed from the context of leadership and how overconfidence and narcissism impact the critical decisions of these large-sized firms.

Characteristics in the literature have circumvented cognitive and behavioural biases. Overconfidence and regret have been widely studied biases. Several types of research have been published about how these biases lead to distorted judgments that adversely impact the organization. Several leadership traits, especially narcissism, have been examined through their impact on corporate strategies and risk-taking behaviours. Narcissistic CEOs have often been found to formulate aggressive strategies, which could lead to windfall gains for the organization or bring colossal losses. It is observed that the journey to gain or loss is volatile. Studies have found that cognitive biases like overconfidence (Malmendier and Tate, 2005), anchoring, and self-attribution lead to a firm's reluctance to shift strategies even when failure is inevitable.

This area was found to have a fair mix of quantitative and qualitative studies, while several of them employed mixed methods, both quantitative and qualitative. Quantitative analyses have deployed regression models examining the relationship between the traits and the firm performance. On the other hand, qualitative studies have focused on leadership traits and organizational outcomes. Qualitative researches have conducted qualitative interviews and thematic analysis of the financial and organizational performance data. Some studies used mixed methods approaches, combining both techniques to provide a more incisive understanding of the phenomena. A summary of all the articles on the TCCM framework is provided in Exhibit 3.

The key findings of this SLR reveal that overconfidence and other cognitive biases highly influence the shaping of managerial decisions. Exhibit 4 provides a tabular review of the articles on different parameters. The impact of these biases is magnified when stakes are very high, especially in corporate finance and strategic planning. Narcissism was found to largely influence risk-taking and performance, both financial and non-financial (Chatterjee and Hambrick, 2007). The research highlights the importance of understanding these biases to develop more effective decision-making frameworks, particularly in uncertain and rapidly changing environments. Considering our limited literature and selected biases being explored, this area holds potential for future research. It implores the researchers to assess the impact of other biases in decision-making.

Conclusions and Implication

The current review investigated into the relationship between the managerial biases and strategic decision making by using the systematic literature review methodology. A total of 31 articles were collected from Scopus database which reviewed the said relationship. Necessary filters were applied to the obtained articles maintain a steadfast concentration on the subject. Detailed review of the shortlisted 15 articles explores what all biases influence the decision-making and how.

This paper systematically examined and reviewed the research progress of managerial biases and their impact on corporate decision-making. The conclusions are provided below. The critical theoretical underpinnings governing the research are overconfidence theory, prospect theory (Kahneman and Tversky, 1979), agency theory, and upper echelon theory. Reviewing the co-occurrence map this subject is closely aligned to financial reporting, downside risk and behavioural corporate finance. The word cloud of frequently used words strongly focuses on biases, decision-making, managers, and managerial bias, which are also studied with behaviours, CEO overconfidence and narcissism.

The current study addresses the identified research questions by presenting the work and research currently undertaken in the domain. It identifies that cognitive biases like overconfidence and regret impact the decision-making involving corporate strategy and organization performance by arriving at suboptimal results. Several leadership traits have shown how personality and characteristics traits drive riskier behaviours and lead to unexpectedly volatile results for the firm. The presence of biases about race or age challenges the diversity and inclusion efforts of the organizations.

The existing literature also recognizes the paradoxical nature of nature of narcissistic personality in which the self-esteem is high along with the combination of self-admiration and a constant positive self-view of themselves. It has a humpback (an inverted U curve) impact on the corporate performance where the performance of the firm improves as narcissism increases but only up to a point after which any increase in narcissism leads to negative performance of the firm (Aabo and Eriksen, 2017). In addition to narcissism, regret bias also impacts the corporate performance significantly. The research has established that regretful sellers tend to underprice the products, a more biased seller is destined to receive a smaller revenue (Li and Liu, 2020).

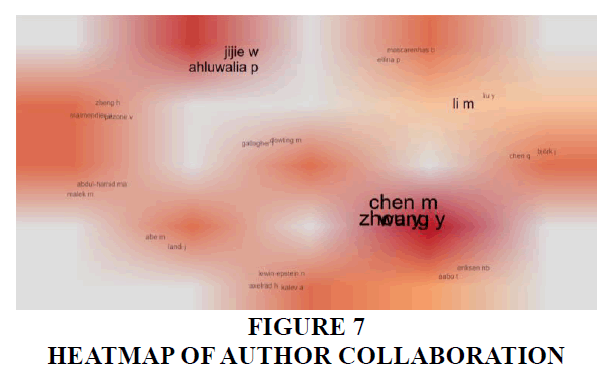

Relooking at the bibliometric analysis, the research trends reflect an increased vigour and rigour among researchers between 2016 to 2022. Post 2022, the vigour has dampened. This could be due to a multiplicity of factors, like the landscape between the dependent and independent variables that have already been largely explored, and new findings are yet to be explored. The heatmap of the authors' collaboration network shows dispersed and scattered research approaches to the problem at hand. It represents an open call for the authors to have a more collaborative and integrated approach. Collaborative efforts by authors could bring to the fore the global intricacies of the relationship.

This systematic literature review indicates that the study of managerial biases on decision-making, though the research seems to be saturated, is still an area with huge potential. Currently, the research has concentrated only on a few biases; however, we know that many more biases influence a person's personality, influence the decisions the person takes, and ultimately impact the organization's overall decision-making process. This also highlights the influence of

Exploring the RQ3, we see deduce that future research should drive the means to develop efforts and interventions that could remove the biases or could productively use the biases for the welfare of the organization and shareholders. More studies are needed to explore the long-term impact of biases and how these biases could impair and hamper the progress made in the strategic decisions taken by the firm. Further research should examine how the biases manifest across various geographies, cultures, religions, and industrial contexts. Integrating quantitative and qualitative methods would be essential to provide a holistic understanding of the complex relationship between managerial biases and decision-making Tables 1-4.

Co-author Network Analysis

1. Mark Keil and Amrit Tiwana as key influencers in IT and project management, frequently collaborating with other researchers.

2. Collaboration Clusters between management and psychology fields in diversity-related papers.

References

Aabo, T., & Eriksen, L. B. (2017). The impact of CEO narcissism on corporate performance. Strategic Management Journal, 38(3), 495-508.

Amason, A. C. (1996). Distinguishing the effects of functional and dysfunctional conflict on strategic decision-making: Resolving a paradox for top management teams. Academy of Management Journal, 39(1), 123-148.

Baker, M., Ruback, R. S., & Wurgler, J. (2006). Behavioral corporate finance: A survey. Handbook of Corporate Finance: Empirical Corporate Finance, 1, 145-186.

Becker, G. S. (1957). The economics of discrimination. University of Chicago Press.

Bhardwaj, G., & Tiwana, A. (2005). Managerial biases and decision-making: The role of overconfidence and hindsight bias. Journal of Business Research, 58(12), 1530-1541.

Chatterjee, A., & Hambrick, D. C. (2007). It's all about me: Narcissistic CEOs and their effects on company strategy and performance. Administrative Science Quarterly, 52(3), 351-386.

Das, T. K., & Teng, B. S. (1999). Cognitive biases and strategic decision processes: An integrative perspective. Journal of Management Studies, 36(6), 757-778.

Eisenhardt, K. M., & Zbaracki, M. J. (1992). Strategic decision-making. Strategic Management Journal, 13(S2), 17-37.

Fichman, R. G., Keil, M., & Tiwana, A. (2005). Beyond valuation: "Options thinking" in IT project management. California Management Review, 47(2), 74-96.

Goethals, G. R., Messick, D. M., & Allison, S. T. (1991). The uniqueness bias: Studies of construct accessibility in self?perception. Journal of Experimental Social Psychology, 27(1), 92-111.

Heaton, J. B. (2002). Managerial optimism and corporate finance. Financial Management, 31(1), 33-45.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263-291.

Indexed at, Google Scholar, Cross Ref

Kahneman, D., & Tversky, A. (2016). The undoing project: A friendship that changed our minds. W. W. Norton & Company.

Li, M., & Liu, J. (2020). Managerial regret and its impact on pricing and performance. Journal of Behavioral Decision Making, 33(2), 224-237.

Malmendier, U., & Tate, G. (2005). CEO overconfidence and corporate investment. Journal of Finance, 60(6), 2661-2700.

Moore, D. A., & Healy, P. J. (2008). The trouble with overconfidence. Psychological Review, 115(2), 502-517.

Paul, J., & Rosado-Serrano, A. (2019). Gradual internationalization vs born-global/international new venture models: A review and research agenda. International Marketing Review, 36(6), 830-858.

Indexed at, Google Scholar, Cross Ref

Proeger, T., & Meub, L. (2014). Overconfidence as a cause of premature market entry. Journal of Economic Psychology, 45, 205-218.

Schwenk, C. R. (1986). Information, cognitive biases, and commitment to a course of action. Academy of Management Review, 11(2), 298-310.

Shepherd, D. A. (1999). Venture capitalists' assessment of new venture survival. Management Science, 45(5), 621-632.

Shepherd, D. A., & Williams, T. A. (2015). Moral awareness, ethical decision making, and the use of information. Journal of Business Ethics, 131(3), 527-548.

Sherfin, H. M. (2001). Beyond greed and fear: Understanding behavioral finance and the psychology of investing. Harvard Business Review Press.

Simon, H. A. (1975). The functional equivalence of problem-solving skills. Cognitive Psychology, 7(3), 268-288.

Simon, H. A. (1979). Rational decision making in business organizations. The American Economic Review, 69(4), 493-513.

Simon, M., & Houghton, S. M. (2003). The relationship between overconfidence and the introduction of risky products: Evidence from a field study. Academy of Management Journal, 46(2), 139-149.

Sullivan, M., Vanderwielen, B. A., & Wiggins, R. A. (1999). Estimating the effect of new product introductions on the firm's value. Strategic Management Journal, 20(7), 689-705.

Thaler, R. H. (2015). Misbehaving: The making of behavioral economics. W. W. Norton & Company.

Tversky, A., & Kahneman, D. (1974). Judgment under uncertainty: Heuristics and biases. Science, 185(4157), 1124-1131.

Indexed at, Google Scholar, Cross Ref

Walsh, J. P. (1988). Selectivity and selective perception: An investigation of managers' belief structures and information processing. Academy of Management Journal, 31(4), 873-896.

Wiersema, M. F., & Bantel, K. A. (1992). Top management team demography and corporate strategic change. Academy of Management Journal, 35(1), 91-121.

Indexed at, Google Scholar, Cross Ref

Received: 21-Mar-2025, Manuscript No. AMSJ-25-15780; Editor assigned: 22-Mar-2025, PreQC No. AMSJ-25-15780(PQ); Reviewed: 20-Apr-2025, QC No. AMSJ-25-15780; Revised: 29-Apr-2025, Manuscript No. AMSJ-25-15780(R); Published: 11-May-2025