Research Article: 2022 Vol: 26 Issue: 5

Board Characteristics and Firm Performance: Evidence from India

Sita Ramaiah Tummalapenta, IFHE University

Mahesh Kumar Soma, IFHE University

Radha Mohan Chebolu, IFHE University

Citation Information: Tummalapenta, S.R., Soma, M.K., & Chebolu, R.M. (2022). Board characteristics and firm performance:evidence from india. Academy of Accounting and Financial Studies Journal, 26(5), 1-13.

Abstract

Firm performance is a legitimate area of interest for the board of directors of an organisation along with corporate governance. The fiduciary responsibility and firm performance go hand in hand for the Board of Management of a company and in fact it is a critical organisational issue in the present scenario of businesses which are recovering from the impact of the trauma of the global pandemic. There is a need to conduct an in-depth research to ascertain the claims of board characteristics and to construct policies based on the existing literature. It is a fact that the characteristics of board and some important parameters of the board like CEO Duality, Board Size, Board Gender Diversity, and Director Ownership along with number of Board Meetings will influence the fiduciary performance of an organization. This study focuses on the firm performance in terms of profitability or returns of the company based on board characteristics. The data pertaining to 75 companies listed on Bombay Stock Exchange was analysed and conclusions drawn. It was found that the firm performance is positively affected by the board size. Further, CEO duality also has a positive effect on firm performance in addition to board diversity. It was observed that the structure of ownership and the number of board meetings do not have any impact on firm performance.

Keywords

Characteristics of the Board, Performance of Firm, Size of Board and Number of Meetings.

Introduction

The organizations of today are functioning in a challenging and a competitive environment and the Board of Directors/Management (referred to as Board) plays a critical role in the smooth and efficient functioning of the organization. In the present scenario, the Boards are expected to discharge a multitude of functions. The most strategic function of the board is to accord a proper direction to the firm (Kemp, 2006) besides grooming CEO (Vancil, 1987) who would execute the strategy formulated by the board. The board provides and enables access to resources (Hendry & Kiel, 2004). According to the study conducted by Eisenhardt (1989), the board performs the most important function of reducing ‘agency costs’ by a regular and continuous advice to the management. The same point of agency costs was corroborated by (Shleifer & Vishny, 1997). It was also reflected in the study conducted by (Roberts et al., 2005). In addition to these functions, it was observed by Hermalin & Weisbach that hiring and firing of management is also an important function done by board.

The firm performance is of paramount importance and the Board has to constantly strive to protect and safeguard the interest of the shareholders by strictly adhering to the principles of managerial professionalism and accountability in an environment which is getting increasingly competitive (Hillman & Dalziel, 2003; Hendry & Kiel, 2004). Change is the order of the day and the Board has the unique responsibility to encourage organizational change. Hill et al. (2001) studied that the mission of the organization is accomplished by facilitating the establishment of processes. Similar views were shared by Bart & Bontis (2003) about the induction of processes by the board. The board has to ensure at all the times that the managements do not follow any management practices which are negative that eventually result in corporate failures or scandals which are serious in nature. But at the same time it has to work for increasing the stakeholder value by encouraging the management to identify and act on the opportunities available. The board is always faced with a daunting role and responsibility of ensuring that the firm performs and delivers to meet the expectations of stakeholders. It is always a great necessity for the board to perform this unique function of a good corporate governance responsibility. It can be mentioned that Board is the most strategic resource for any organization which helps in its progress and advancement by developing effective and creative options and solutions. Hence, there has been an increasing importance and influence of the boards in the overall functioning of the organization and its success. It is to be noted an array of characteristics are required of a good board which would enable the firm to register spectacular performance. Such relevant and unique characteristics of the board have to be recognised and an in-depth study and analysis is to be done.

There were two incidents or occasions that had highlighted the tremendous importance of the Boards in successfully running an organization. First was the ‘East Asian Financial Crisis’ of 1997 and the second was the ‘corporate scandals’ that shook the entire corporate world. In the first case, the economies of countries like Indonesia, Thailand, South Korea, Philippines and Malaysia were badly affected by the ‘East Asian Financial Crisis’ which in way amplified the importance of ‘monitoring mechanisms and governance practices’. The lack of these monitoring and governance mechanisms had resulted in the collapse of a number of companies in these economies (Radelet & Sachs, 1998). Further, the numerous corporate scandals that had befallen big companies in America like Enron, Tyco International and Worldcom had clearly established the non-performance and inadequate functioning of the Board and the concomitant failure to effectively implement the most important aspect of corporate governance. It was the same reason for the failure of giant companies in Australia such as HIH insurance. Similar challenges was faced in Italy by Parmalat. In Air New Zealand, Australia’s Ansett faced a very disgraceful experience. Corporate scandals are a result of the inadequate functioning of the Board and its failure to effectively implement a strong corporate mechanism (France & Carney, 2002; Economist, 2003).

Motivation for The Study

The focus of this research paper is to study the relationship between firm performance and board characteristics with regard to the firms enlisted on the Stock Exchange of India. The results of the study reflecting the relationship between firm performance and board characteristics will act as a guide to the firms to make reasonable and appropriate choices with respect to the Board constitution and appointments to enhance and improve the firm value. The Board characteristics and their importance for the overall success of a firm has been realised in the recent times and this is the main reason for this study. However, the question to be examined empirically is about the best practices to be followed in the Indian scenario and the subsequent suggestions with respect to constitution of the Board to enhance firm performance. The focus of the study is to identify and fill such gaps (Moeller, 2004).

Review of Literature

The firm performance is greatly influenced decision making processes which are strategically introduced by the Board. According to Mintzberg et al. (1976), strategic decisions are those which reflect the specific actions taken by the firm along with the commitment of adequate resources. Further, the strategic decisions also set a legacy by establishing some precedents. In fact, strategic decisions are not those decisions that are taken on a day to day basis but they constitute those decisions which are taken once in a while to give a strategic direction to the firm. They are not regular decisions but are taken once in a while by the top management. The unique aspect of a strategic decision is that it has a direct influence and impact on the success and survival of a firm.

As far as the organizational perspective is concerned, Board as an important resource becomes a very good source of ‘competitive advantage’ for firms and further, it also helps them in their objective to achieve superior performance (Hamel & Prahalad, 1994; Hunt, 2000). According to Langton & Robbins (2007), a board can be considered as a ‘Team’ of competent professionals who are brought together to accomplish specific goals and purposes. The composition and constitution of the board along with the competencies of its members is a resource which is very important to an organization. The Board is always placed above the Chief Executive Officer and other Managers of the firm in the organization’s hierarchy and it discharges a very important role which is strategic in nature in the overall decision making process of the firm. The composition and characteristics of a Board are of paramount importance to a firm in achieving overall success.

A number of varied theoretical perspectives have been propounded various scholars to analyse and evaluate the effect of board characteristics on the performance of a company. Kiel & Nicholson (2004) observed that there are a number of perspectives enumerated on this subject but the common objective of each and very study is to review the relationship between board characteristics and its influence on company’s performance. The success of a company is dependent on the strategic decisions taken by the board. The essence of each and every corporate governance code is to enable a capable, strong and independent board (Monks & Minnow, 2004; Pearce II & Zahra, 1992). observed opined that the corporate governance mechanism should establish definite checks and balances and enable a platform where right questions are asked and right answers given which also reflect the creation of a sustainable and long term value to the firm. The most important aspect of this entire process is the membership of the board, its composition, its constitution and its mode of functioning.

Kiel & Nicholson (2003) studied the role and impact of boards on firm performance which included disciplines like organization theory, strategic management, economics, finance and law. The study of Daily et al. (2003) also echoed the same point. In addition to these studies, some of the scholars focused on other important issues. For example, Kapopoulos & Lazeretou (2007) observed the relationship between the company ownership and firm performance whereas, Lausten (2002) enumerated the impact of compensation and CEO turnover on firm performance. The present study analysis and reviews some of the major theoretical perspectives pertaining to boards and corporate governance mechanisms. It is therefore relevant to understand the three important theories viz the agency theory which focuses on the rights and responsibilities of agents and principals, the stewardship theory which highlights that managers and directors are stewards who should be bestowed with autonomy based on trust and the resource dependence theory which postulates that directors should help the firm in procuring resources especially, financial resources.

The well designed contracts will help in addressing various challenges faced by the firm. The contracts should be very specific in mentioning the rights and responsibilities of both principals and agents. According to Fama & Jensen (1983) contracts are well defined in terms of rules and regulations governing the company. Besides, the rights of each and every agent appointed by the organisation will be very clear with respect to their performance criteria, evaluation parameters and payoff functions. In some unforeseen situations or circumstances the agents (or the managers) are bestowed with some “residual rights” which gives them the right and discretion to apportion funds as they think appropriate and necessary (Shleifer & Vishny, 1997). The agency problem is increased or aggravated with unnecessary and excessive ‘managerial discretion’ availed by the agents because of the difficulty in drafting perfect contracts. There is also a situation where the principals incur additional monitoring costs to monitor the actions of the respective agents so that they work only for the benefit of the firm. This leads to additional costs and in a way reduces the value of the firm. Therefore, the agency theory provides a platform for effective utilization of mechanisms of control, both internal and also external. Davis et al. (1997) opined that the objective of entire corporate governance mechanism is to minimize agency costs and also protect the interests of shareholders. Besides, there should be a proper alignment of agent-principal relationship. They are the compensation schemes offered and the directors represented on the board of the firm. It is also a fact that one of the low cost mechanisms available to the firm is the board itself.

Board Characteristics and Firm Performance

There is a lot of research done to establish a relationship between top management /Board characteristics and constitution and overall firm performance. Several research studies were conducted till 1990s which focussed on the normative or prescriptive aspects (Lorsch & MacIver, 1989). There have been a number of studies that focussed on the effective monitoring of a firm by setting effective performance measures for the board. Some of the prescriptive studies envisaged the separation of the two important positions of a firm i.e., CEO of the firm and the Chairman of the person. It was also suggested to increase the non-executive members on the board. It was felt that an ‘independent board’ is an important aspect for effective coordination of firm performance.

Further, there have been a number of empirical studies that were taken up in the last two decades which have corroborated the various propositions that established a relationship between firm performance and constitution of board. According to study by Bhagat, the number and proportion of executive directors has a positive influence on its performance. It was also supported by the study conducted by (Kiel & Nicholson, 2003). It was further corroborated that the firm performance is also positively related the number of non-executive directors. CEO duality is another important aspect which has a positive influence on the financial and overall performance of firm. The separation of the twin positions of Chairman and the CEO of a firm is also positively related to successful performance of the firm. There have been other studies that had highlighted conflicting evidence with respect to board characteristics and firm performance. A subsequent study by Kiel & Nicholson (2003) had firmly established a positive relationship and influence between firm performance and board composition.

They had also studied in depth about the leadership structure of a firm. It was observed that a suitable board size has to be identified to ensure effective functioning of a firm. It was an extensive elaborate study which constituted as many as 54 studies. These studies had revealed that in a majority of 31 studies there was no significant influence of board structure on a firm 5 1528-2635-26-5-406 Citation Information: Tummalapenta, S.R., Soma, M.K., & Chebolu, R.M. (2022). Board characteristics and firm performance: evidence from india. Academy of Accounting and Financial Studies Journal, 26(5), 1-13. performance. A detailed study was undertaken by Booth et al. (2002) to assess firm performance based on different governance mechanisms within the board structure. It was observed that the following mechanisms of governance like director-ownership and CEO duality could be substituted. In the light of review of literature, it is further suggested to examine and analyse in detail the influence of some important aspects of a board size, number of board meetings, board gender diversity, CEO duality and director ownership.

Board Size

Board Size is defined as the total number of members nominated or represented on the board of a firm. It was observed that a suitable board size has to be identified to ensure effective functioning of a firm (Dalton, 1999). The same concerns were also raised by Hermalin and Weisbach. There have been some studies which had highlighted that ‘smaller boards ‘are effective (Lipton & Lorsch, 1992). The concept of small board was also advocated by the studies conducted by Jensen (1993). A small board is needed for effective functioning of a firm as evidenced in the study by (Lipton & Lorsch, 1992). They had opined that larger boards face two challenging problems. Social loafing is the biggest challenge of a larger board. In addition to this, free-riding is another concern of having a larger board. As such, the problem of free-riding is aggravated by having a larger board which will also reduce the efficiency of the board. On the contrary, smaller boards enhance the efficiency of functioning in terms of effective decision making and greater coordination and in the process reducing the communication problems (Jensen, 1993). On the contrary, larger boards are replete with challenges of communication, cohesiveness and conflicts due to eruption of factions within the board. The study of Blue Ribbon Commission (NACD, 1995) corroborated the point that smaller boards ensure a thorough discussion-that is, it should be smaller enough to have a thorough discussion and the same time the size should be appropriately larger which would provide a platform for a number of varied range of issues to be brought on to the table.

Board Meetings

Board Meetings of a firm constitute an important aspect as it is a value relevant attribute of a firm and also it is an indicator or a measure of the intensity of board activity. There is another view that states that board meetings is a sort of resource to the directors which is highlighted by the fact that there are people who act as multiple directors on different boards. In such cases, the ability of such directors to attend the meetings is vastly affected thereby creating problems to monitor the managerial performance. It is observed that the directors of the companies who meet frequently have a tendency to discharge their duties and responsibilities according to the interests of the shareholders.

It was suggested that the board should be active only when the firm faces a challenging situation or problem and in other times it should be relatively inactive (Jensen, 1993). The board meetings in essence are not very useful to a firm. Contrary to this viewpoint, Carcello et al. (2002) opined that the board meetings ensure quality audit work. It is therefore very much beneficial in all aspects of firm performance. It can be gauged from this study that a quality audit always attracts the interest of the shareholders besides enhancing the performance (Carpenter & Westphal, 2001). Another significant study was made by Hermanson & Lapides who had examined the link between the regularity in conducting board meetings or the meetings of audit committee and the frauds committed with respect to financial statements of a firm (Combined Code on Corporate Governance, 2003). It was an interesting revelation from this study that firms which are engulfed in financial frauds had conducted fewer or limited number of audit committee meetings. Thus, it may be inferred that the firm performance is very much dependent on the number of board meetings conducted and the deliberations there on.

Gender Diversity

Gender diversity of a board refers to the fair and equitable representation of people of different genders in the board constitution. Women may be having diverse points of views, different values and above all, they have their unique way to showcase their opinions and also communicate with others on the board. Therefore, women may question the conventional ideas and thinking and may also be assertive in asking questions and also engage in open discussions about some issues or managerial decisions taken by the board. It was opined by Latendre that the disagreements encountered in the board by the presence of women are very valuable to the firm because the board dynamics are improved and it will result in an effective system of decision making. The ‘value in diversity’ Latendre leads to generation of diverse view points in the board room and would definitely provoke healthy discussions in the board. It was evident from the study of Smith and Verner that the infusion of women members on the board had a positive impact and influence on the overall functioning of the firm leading to a better performance. Sometimes, their non-corporate background would be beneficial to the firm. The constitution of a board with better representation from women folk leads to new ideas, discussions and deliberations because they are relatively younger to the men on board and it is beneficial to the board. The legislation had also set a deadline of January 2008 to increase women representation to 40% on board. Companies not adhering to this rule would face a risk of closure (Guardian Unlimited, 2006). With a lot of emphasis given to women representation on boards, it is of paramount importance to examine and explore further, the impact of gender diversity on firm performance.

Ownership Structure

Ownership structure is an important aspect of many firms and organizations and a study of ownership structure on firm performance is key issue. It is an established practice for many firms to compensate the directors in multiple ways like stock options, fees or combination of them. There is no significant or positive relationship between firm performance and director ownership. The ownership structure in terms of director-ownership does not have a positive impact on the firm performance. The stock options offered to the CEOs are a means to enrich them and also expropriate the shareholders Becht. It is a disputed literature as far as the impact of director ownership and firm performance are concerned (Shleifer & Vishny, 1997). It was stated that the cost of changing the ownership frequently is very costly to a firm and as result the firms try to possess a lower than optimal ownership structure which in a way leads to lower performance by the firm (Shleifer & Vishny, 1997). The arguments stated earlier are reconciled by the views shared by Core & Larcker (2002) according to which the firms begin the operations with an optimum proportion of managerial ownership in the initial stages. However, afterwards the firms digress from the path and do not try to reach the optimum level of ownership to avoid re-contracting costs. Therefore, director ownership is an important point for study in the analysis of firm process and board characteristics.

CEO Duality

There are some firms where the CEO also acts as the Chairman of the company. This concept or situation is called ‘CEO Duality’. As mentioned, it is a board structural mechanism in some firms. A person who discharges the dual functions of CEO and Chairman is expected to exercise a centralised laser-like focus in the attainment of goals and at the same time extend a very strong leadership to the firm. This aspect is very much needed in case of firms which are sensitive, wherein the CEO gathers a wealth of knowledge which is used when he is promoted to the position of chairman of the firm. The chairman who must have discharged the responsibilities as a manager of the firm would have maintained good relationships with the top management. Further, there are two diverse viewpoints about CEO Duality viz: one representing the stewardship theory manifested by strong leadership to the firm and second, the agency theory represented by effective monitoring of the firm. This dichotomy also reflects the extent of independence enjoyed by the chairman.

Booth et al. (2002) concluded that CEO/Chair Duality is one responsibility and director ownership is another responsibility which may appear differs but they complement and substitute each other for monitoring the divergence between stockholders and managers. The substitution of managerial ownership with board characteristics was corroborated by the study of Peasnell, et al. (2003), the results of which confirm the existence of trade-offs in the monitoring mechanisms in order to control the agency conflicts. Fama & Jensen (1983) conducted studies which highlighted the segregation of the two functions of CEO and chairman which will increase independence and accords freedom to the board.

Method of Study

Descriptive Statistics

The present study relies on ‘secondary data’ available on the public domains and public data sources to analyse the influence of board characteristics on the performance of firm. The study is limited only to the data gathered from the firms which are enlisted on Bombay Stock Exchange. It excludes financial firms during the period between 2015 and 2021.

Objective and Hypotheses of the Study

The main objective of study is to know the board characteristics and its influence on firm performance. The present study considered women representation (gender diversity) on board as an important element of firm performance. Not only that, the board size which constitutes the number of directors on board is an important ingredient of firm success. Besides the gender diversity and the board size, the performance of a firm is also dependent on the number of board meetings that are conducted during a year.

H1: Ownership structure influences the firm performance.

H2: CEO duality impacts firm performance negatively

H3: Gender diversity in terms of women directors influences firm performance in a positively

H4: Board meetings impact firm performance positively

H5: Board Size influences firm performance positively

Data Description

Prowess is a popular database available for procuring authentic data and it is maintained by reputed institution like Centre for Monitoring the Indian Economy (CMIE). The data is therefore obtained from Prowess. This data base is a reliable source for financial information with respect to companies that are listed. The sample for the study comprised seventy five (75) BSE-100 companies and these firms are also part of the standard S&P BSE index. The panel data consisted of a set of 450 observations. This represented the time series data for the time period starting from 2015 to the year 2021.

Design of variables: Based on a literature review, panel data analysis is the best method for studying the relationship that exists between characteristics and the performance of a firm. Return on Assets (ROA) is considered as proxy measure as it reflects financial performance. The board characteristics are considered as variables Table 1.

| Table 1 Design Of The Variables |

||

|---|---|---|

| Variable | Symbol | Measure |

| Dependent Variable | ||

| Return on asset | ROA | The ratio of earnings before tax and interest to total assets |

| Explanatory Variables | ||

| Ownership structure | OS | Ratio of directors shares by total outstanding shares |

| CEO duality | CEO D | Coded ‘1’ if CEO also holds the position of board chair or ‘0’ if both positions are separated |

| Female Director | FD | Proportion of female directors (measured as percentage of female directors to total board size) |

| Board Meetings | BM | Number of board meetings held per year |

| Board Size | BS | Total number of board of directors |

| Control Variables | ||

| Firm Size | FS | Total sales revenue |

| Firm age | FA | Years of operation of the firm |

Research Methodology

Firm–year unit with firm-year records is used as the basis for studying and analysing the relationship between firm performance and board characteristics. The most important aspect of the study is that Generalised Least Square model (GLS) is used since it has to estimate the unknown parameters in the regression process. The GLS regression was considered instead of pooled OLS (Ordinary Least Squares) regression because of two important assumptions - homoscedasticity (all random variables having same finite variance) and Pooled OLS without any serial correlation. The Pooled OLS method involves a process where the ‘errors of a particular time period’ are uncorrelated with ‘explanatory variables’ of that particular time period only. This will enable consistency and unbiased results for the estimator. Further, the present methodology also facilitates the simultaneous examination of variations in cross-sectional units with variations existing in the Individual units (Donaldson & Davis, 1991).

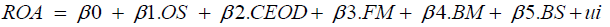

Empirical Model

Firm performance = f (OS, CEOD, FM, BM& BS)

Where

β0 =intercept, β1= Slope, ROA= Return on assets, OS= Ownership structure; CEO D= CEO duality; FM= Female Director; BM= Board meetings; BS= Board size, ui= Random error.

Table 2 presents statistics purely descriptive in nature. The board size of 7 members (mean value: 6.75) is considered as the average size and it appears to be less than the size of board in countries, especially US where the mean size of the board is 11.45 Bhagat & Black. The director ownership constitutes 16.53 per cent on an average. On the other hand, the average number of meetings of the firm held during a year 9.13. The representation of female directors on the board is 0.35. Further, CEO duality average is 0.04 on a range of 0 to 3. The ROA-was - 12.09 at the minimum level and 1.15 at the maximum level with a mean of -0.16. Similar ROI was reported by many a research scholar on studies conducted for firms in Australia (Kiel & Nicholson, 2003). The mean age of the firms was 17.56 years.

| Table 2 Descriptive Statistics |

|||||||

|---|---|---|---|---|---|---|---|

| Variable | Mean | Std. Deviation | Minimum | Maximum | Skewness | Kurtosis | Observations |

| OS | 16.53 | 22.67 | 0.00 | 100.00 | -1.02 | 4.32 | 450 |

| CEO D | 0,04 | 0.19 | 0.00 | 1.00 | -0.51 | 1.21 | 450 |

| FD | 0.35 | 0.61 | 0.00 | 3.00 | 1.9 | 3.1 | 450 |

| BM | 9.13 | 3.65 | 0.00 | 19.00 | -1.03 | 6.62 | 450 |

| BS | 6.75 | 1.87 | 4.00 | 14.00 | -0.51 | 3.92 | 450 |

| FS | 283797 | 874268 | 5 | 6972000 | 4.62 | 5.67 | 450 |

| FA | 17.56 | 21.37 | 1 | 104 | 0.92 | 3.14 | 450 |

| ROA | -0.16 | 0.82 | -12.09 | 1.15 | 0.81 | 3.23 | 450 |

The relationship between dependent variables considered for this analysis and all the independent variables is depicted in the correlation matrix Table 3. The conclusion from this study is that independent variables display insignificant correlation. The problem or challenge of multicollinearity (a situation when two or more variables are highly correlated with one another) does not exist because the correlations are not very high.

| Table 3 Correlation Matrix |

||||||||

|---|---|---|---|---|---|---|---|---|

| Variables | ROA | FS | FA | BS | OS | CEO D | FD | BM |

| ROA | 1 | |||||||

| FS | 0.430 | 1 | ||||||

| FA | 0.143 | 0.225 | 1 | |||||

| BS | 0.278 | 0.678 | 0.298 | 1 | ||||

| OS | -0.227 | -0.258 | -0.063 | -0.075 | 1 | |||

| CEO D | 0.186 | -0.193 | -0.020 | -0.324 | 0.006 | 1 | ||

| FD | 0.312 | 0.361 | -0.007 | 0.227 | -0.257 | -0.153 | 1 | |

| BM | -0. 153 | 0.054 | -0.005 | -0.065 | 0.002 | -0.053 | -0.034 | 1 |

Values of unstandardized regression coefficients, with standard errors in parenthesis + P<0.10, *P<0.05, **P<0.01, ***P<0.001; (all two tail tests); n= 752

Findings

Table 4 highlights the results pertaining to Random effects GLS estimation which showcases the impact of board characteristics on firm performance in the Indian context. The values of unstandardized beta coefficients along with standard errors at the respective significance levels of the coefficients is represented on the table. The Model-1 is the base-line-model and the remaining Models from 2-5 are the interaction-models.

| Table 4 Gls Regression Results |

|||||

|---|---|---|---|---|---|

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

| Constant | -0.223 0.293) |

0.382 (0.252) |

-0.423 (0.293) |

-0.362 (0.254) |

1.524 (0.576) |

| FS | 0.0165 (0.014) |

0.026 (0.013) |

0.021 (0.014) |

0.019 (0.014) |

0.018 (0.14) |

| FA | 0.000 (0.001) |

0.000 (0.001) |

0.000 (0.001) |

0.001 (0.001) |

0.001 (0.001) |

| BS | 0.218 * (0.088) |

-0.231 (0.140) |

0.321** (0.106) |

0.287** (0.105) |

-0.742* (0.371) |

| OS | -0.026 + (0.018) |

-0.298*** (0.105) |

-0.025 (0.015) |

-0.027* (0.018) |

-0.029 (0.016) |

| CEO D | 0.245** (0,987) |

0.184* (0.098) |

2.546*** (0.543) |

0.256** (0.093) |

0.213* (0.093) |

| FD | 0.120* (0.065) |

0.109* (0.045) |

0.115* (0.056) |

0.567* (0.328) |

0.020 (0.057) |

| BM | -0.089* (0.029) |

-0.087* (0.042) |

-0.097* (0.043) |

-0..088* (0.039) |

-0.798*** (0.323) |

| R2 | 0.362 | 0.425 | 0.383 | 0.385 | 0.345 |

| Wald χ2 | 55.51*** | 77.52*** | 77.80*** | 57.68*** | 67.82*** |

| Change in Wald χ2 | 32 | 19.52 | 5.01 | 12.12 | |

The hypothesis H1 is based on the assumption that the ownership structure has a positive influence on the firm performance. The marginally significant coefficient (β=-0.026; p<0.10) of ownership structure indicates negative relationship. This negativity is maintained across all the models involving interaction terms. Thus H1 is rejected.

The hypothesis H2 is postulated based on the assumption that the CEO duality is negatively related to the firm performance. But the results illustrate a positive beta coefficient with the values showing β=0.245 and p<0.001). Based on this coefficient value, the hypothesis H2 is rejected indicating that CEO duality actually influences the firm performance which is contrary to the hypothesis H2.

The hypothesis H3 considers the assumption that the performance is greatly and positively influenced by the gender diversity of the board, that is the number of women directors nominated to the board. The positive coefficient (β= 0.120; p<0.05) with respect to the number of female directors will support the acceptance of H3.

The hypothesis H4 is postulated based on the assumption that the firm performance is positively influenced by the number of meetings of the board conducted or organized by the firm. The results indicated beta values which are negative -β=-0.089 and p<0.05). Therefore, the hypothesis H4 with respect to the number of board meetings conducted is rejected.

The hypothesis H5 presumed that the firm performance is positively impacted by the number of members on the board indicating the board size. The positive coefficient (β=0.218, p<0.05) obtained for board size supports the acceptance of H5 hypothesis. The terms of interaction added to various models enabled improvements that are significant with respect to the ‘model fit’ in case of four out of the five models, as reflected by changes to the Wald Chi-square which are significant.

We argued that the firm performance is enhanced by board characteristics like size of board, ownership structure, number of female directors and number of board meetings. We expected that the firm performance will be affected by CEO duality.

We found that the firm performance is positively impacted by the board size which is also in consonance with several other studies that analysed the relationship between firm performance and size of the board (Adam & Mehran, 2003). Whenever there is an increase in the number of directors on the board (increase of board size), there is a corresponding enhancement in the liberty and freedom in the overall functioning of the board

It was found that the ownership structure is negatively associated with the firm performance. This observation contradicts the hypothesis which states that a firm would be greatly benefited by getting in the interests of directors and shareholders. We also found that in case of firms having a larger size of board, a higher ownership will be beneficial. The agency problems are properly handled when the board size is larger. There is a higher degree of alignment of interests of directors and shareholders.

It is generally assumed that the firm performance is positively influenced by the bifurcation of the functions of CEO and the Chairperson\chairman (CEO duality). This result contradicts the assumption that agency problems are increased or aggravated by CEO duality. An independent and a strong board manifests an equally strong leadership to the organization which in turn is showcased in better firm performance. In case of a small board, CEO duality could be beneficial to the firm by providing a strong and dynamic leadership and direction. However, in the case of a bigger and larger board of directors, positive impact of CEO duality is minimalized or reduced. CEO duality might be a matter of the company’s size and various challenges it faces. It may be concluded that in case of a smaller size of the board there is no need to segregate the roles of director and chairperson. In larger or bigger firms, there is an increase in the number of directors represented on the board and in such cases, CEO duality may not be effective in firm performance elucidating the view that the twin positions of director and CEO should be separated.

The firm performance is positively influenced by the number of women represented on the board (gender diversity). This is perfectly in consonance with the findings of other studies what focussed on the board diversity and the role played of women members on boards (Bonn, 2004). This finding corroborates the evidence with respect to benefits due to board diversity. This also supports the proposition of the concept of stakeholder perspective as well as the resource dependency perspective.

Conclusion

Board meetings was found to have a negative relationship with the firm performance. However, the findings from the present analysis contradict the hypothesis. This indicates that if the board size is small, the directors are subjected to lot of pressure because of attending a large number of meetings. On the contrary, a larger board size increases an opportunity to share the responsibilities. The result is that the meetings more fruitful with good deliberations. It is a fact that the size of a firm’s board is generally smaller in case of Indian companies. Whenever, the board size is small the number of meetings may be less indicating a negative relationship with the performance of the firm.

The study highlights the fact that firm performance is greatly influenced by board characteristics and constitution. We can conclude that board characteristics have a strong bearing and impact on the firm performance. It can be concluded from the present study that the firm performance is an important aspect influenced by the constitution of the board and its characteristics.

References

Adam, R. B., & Mehran, H. (2003). Is Corporate Governance Different for Bank Holding Companies? Economic Policy Review-Federal Reserve Bank of New York, 9(1), 123-42.

Bart, C., & Bontis, N. (2003). Distinguishing Between the Board and Management in Company Mission: Implications for Corporate Governance. Journal of Intellectual Capital, 4(3), 361-81.

Indexed at, Google Scholar, Cross Ref

Bonn, I. (2004). Board structure and firm performance: Evidence from Australia. Journal of the Australian and New Zealand Academy of Management, 10(1), 14-24.

Indexed at, Google Scholar, Cross Ref

Booth, J. R., Cornett, M. M., & Tehranian, H. (2002). Board of Directors, Ownership, and Regulation. Journal of Banking & Finance, 26(1), 1973-95.

Indexed at, Google Scholar, Cross Ref

Carcello, J. V., Hermanson, D. R., Neal, T. L., & Riley, Jr., R. A. (2002). Board Characteristics and Audit Fees. Contemporary Accounting Research, 19(3), 365-84.

Indexed at, Google Scholar, Cross Ref

Carpenter, M. A., & Westphal, J. D. (2001). The Strategic Context of External Network ties: Examining the impact of director appointments on board involvement in strategic decision making. Academy of Management, 44(4), 639-60.

Indexed at, Google Scholar, Cross Ref

Combined Code on Corporate Governance (2003). Financial Reporting Council, London.

Core, J. E., & Larcker, D. F. (2002). Performance Consequences of Mandatory Increases in Executive Stock Ownership. Journal of Financial Economics, 64(3), 317-40.

Indexed at, Google Scholar, Cross Ref

Daily, C. M., & Dalton, D. R. (1997). CEO and Board Chair Roles Held Jointly or Separately: Much Ado About Nothing? Academy of Management Executive, 11(3), 11-20.

Indexed at, Google Scholar, Cross Ref

Daily, C. M., Dalton, D. R., & Canella, A. A. (2003). Corporate Governance: Decades of Dialogue and Data. Academy of Management Review, 28(3), 371-82.

Indexed at, Google Scholar, Cross Ref

Davis, J. H., Schoorman, F. D., & Donaldson, L. (1997). Toward a Stewardship Theory of Management. Academy of Management Review, 22(1), 20-47.

Indexed at, Google Scholar, Cross Ref

Donaldson, L., & Davis, J. H. (1991). Stewardship theory or agency theory: CEO governance and shareholder returns. Australian Journal of Management, 16(1), 49-64.

Indexed at, Google Scholar, Cross Ref

Economist (2003). Déjà vu all over again? 99.

Eisenhardt, K. M. (1989). Agency Theory: An Assessment and Review. Academy of Management Review, 14(1), 57-74.

Indexed at, Google Scholar, Cross Ref

Fama, E. F., & Jensen, M. C. (1983). Separation of Ownership and Control. Journal of Law and Economics, 26(2), 301-25.

France, M., & Carney, D. (2002). Why Corporate Crooks Are Tough To Nail. Business Week, 37-40.

Guardian Unlimited (2006, January 9). In Norway, a Woman’s Place is in the Boardroom. Available: [On line] www.guardian.co.uk/money/2006/jan/09/business.workandcareers. Retrieved on 28 December 2006.

Hamel, G., & Prahalad, C. K. (1994). Competing for the Future. Cambridge, MA: Harvard Business School Press.

Hendry, K., & Kiel, G. C. (2004). The Role of the Board in Firm Strategy: Integrating Agency and Organisational Control Perspectives. Corporate Governance: An International Review, 12(4), 500-20.

Indexed at, Google Scholar, Cross Ref

Hill, B. Green, M., & Eckel, P. (2001). Navigating the Currents of Change. Trusteeship, 9(5), 28-32.

Hillman, A. J., & Dalziel, T. (2003). Boards of Directors and Firm Performance: Integrating Agency and Resource Dependency Perspectives. Academy of Management Review, 28(3), 383-96.

Hunt, S. D. (2000). A General Theory of Competition. London: Sage Publications.

Jensen, M. C. (1993). The Modern Industrial Revolution, Exit and the Failure of Internal Control Systems. Journal of Finance, 48(3), 831-80.

Indexed at, Google Scholar, Cross Ref

Kapopoulos, P., & Lazaretou, S. (2007). Corporate Ownership Structure and Firm Performance: Evidence from Greek Firms. Corporate Governance: An International Review, 15(2), 144-58.

Kemp, S. (2006). In the Driver’s Seat or Rubber Stamp? The Role of the Board in Providing Strategic Guidance in Australian Boardrooms. Management Decision, 44(1), 56-73.

Indexed at, Google Scholar, Cross Ref

Kiel, G., & Nicholson. G. (2004). A Framework for Diagnosing Board Effectiveness. Corporate Governance: An International Review, 12(4), 442-60.

Indexed at, Google Scholar, Cross Ref

Langton, N., & Robbins, S. P. (2007). Organisational Behaviour: Concepts, Controversies, Applications. Toronto: Prentice Hall.

Lausten, M. (2002). CEO Turnover, Firm Performance and Corporate Governance: Empirical Evidence on Danish Firms. International Journal of Industrial Organisation, 20(3), 391-414.

Indexed at, Google Scholar, Cross Ref

Lee. J. (2001). Corporate Governance and why do you need it? Asia Money 12(9), 24-7.

Letendre, L. (2004). The Dynamics of the Boardroom. Academy of Management Executive, 18(1), 101-4.

Lipton, M., & Lorsch, J. W. (1992). A Modest Proposal for Improved Corporate Governance. Business Lawyer 1(1). 59-77.

Lorsch, J. W., & MacIver, E. (1989). Pawns or Potentates: The Reality of America’s Corporate Boards. Boston: Harvard University Press.

Indexed at, Google Scholar, Cross Ref

Mintzberg, H., Raisinghani, D., & Theoret, A. (1976). The Structure of ‘Unstructured’ Decision Processes. Administrative Science Quarterly, 21(2), 246-275.

Indexed at, Google Scholar, Cross Ref

Moeller R. R, (2004). Sarbanes-Oxley and the New Internal Auditing Rules. New Jersey: John Wiley & sons, Inc.

Monks, R. A. G., & Minnow N. (2004). Corporate Governance. Malden, MA: Blackwell Publishers.

Pearce II, J. A., & Zahra, S. A. (1992). Board Composition from a Strategic Contingency Perspective. Journal of Management Studies, 29(4), 411-38.

Indexed at, Google Scholar, Cross Ref

Peasnell, K. V., Pope, P. F., & Young, S. (2003). Managerial Equity Ownership and the Demand for Outside Directors. European Financial Management, 9(2), 231-50.

Indexed at, Google Scholar, Cross Ref

Radelet, S., & Sachs, J. (1998). The East Asian Financial Crisis: Diagnosis, Remedies, Prospects. Harvard Institute for International Development 1998(1), 1-90.

Indexed at, Google Scholar, Cross Ref

Roberts, J., McNulty, T., & Stiles, P. (2005). Beyond Agency Conceptions of the Work of Non-Executive Director: Creating Accountability in the Boardroom. British Journal of Management 16(1), 5-26.

Shleifer, A., & Vishny, R. W. (1997). A Survey of Corporate Governance. Journal of Finance, 52(2), 737-83.

Vancil, R. (1987). Passing the Baton: Managing the Process of CEO Succession. Boston: Harvard Business School Press.

Received: 15-Jun-2022, Manuscript No. AAFSJ-22-12182; Editor assigned: 17-Jun-2022, PreQC No. AAFSJ-22-12182(PQ); Reviewed: 01-Jul-2022, QC No. AAFSJ-22-12182; Revised: 27-Jul-2022, Manuscript No. AAFSJ-22-12182(R); Published: 03-Aug-2022