Research Article: 2021 Vol: 24 Issue: 2

Bibliometric Analysis of Scientific Production on Tax Evasion in Sciencedirect, Years 2010 to 2019

Irene Buele, Universidad Politécnica Salesiana

Thalía Guerra, Universidad Politécnica Salesiana

Abstract

Tax evasion is an illegal activity that consists of non-payment of taxpayers' obligations towards the state, through fraudulent maneuvers that alter the amount of taxes to be paid. This research analyzes the scientific production related to tax evasion in the ScienceDirect database during the years 2010-2019. With that purpose, a descriptive and relationship analysis was carried out between variables such as, author, continent, determinant of tax evasion, scope, focus, among others. The place of application of this research was established as the scope while the type of tax was the focus. We found that the efficiency of the tax authorities is the most analyzed determining factor regarding tax evasion. 82% of articles are published in European journals, of which 54% belong to case studies carried out on this continent. 51% of authors are economists and 54% of the articles were approached from the perspective of economics. This research shows that tax evasion is a topic of global interest which might be approached from different perspectives and in several areas.

Keywords

Taxpayers, Evasion, Tax Evasion, Taxes, Taxation, Tributes.

Introduction

When talking about tax evasion, we agree with Paredes (2016), who mentions that tax evasion is a fact that worries all the countries of the world because it has produced, such as income decrease, fiscal deficit and in private investment decrease (Patino et al., 2019).

As consultants Gómez & Morán (2016) state in their book Tax Evasion in Latin America, this evasion is one of the main problems of public financing in Latin American countries, where the deficit in tax collection comes not only from the internal part of the country but also from foreign companies that operate in it.

This article analyses the publications related to tax evasion in the ScienceDirect database. According to Gorriz & Casterá (2018), bibliometric studies are carried out with the objective of evaluating the scientific content published in different journals to determine the state and quality of the scientific community in a country or research productive block, as well as the impact of scientific production in society.

ScienceDirect is a database and an open access digital platform that allows consulting the publications of Elsevier, the world's leading academic publisher of scientific content. This platform provides access to both journal articles and monographs in approximately 15 million articles and 37,000 books correspondingly, restricted to the ScienceDirect contracting conditions in each institution (Codina, 2018).

It should be noted that bibliometric studies applied to tax evasion are scarce, which is why it is considered important to carry out this analysis to study the behaviour of production and consumption of scientific literature between the years 2010 - 2019. It is intended to offer a tool that provides them with relevant information that contributes to broadening the perspective of existing studies and will allow establishing a reference line to be used as a precedent for future scientific productions.

Literature Review

Alan Pritchard was the first one to define bibliometrics as a statistical and mathematical process that studies written production, nature, and development of scientific disciplines through the application of verification and evaluation techniques of some aspects of the information generated Davila et al. (2009).

Since bibliometrics is presented as a method for measuring scientific work by evaluating incoming resources, their processing, output and impact of scientific production, it can be concluded that this science is in charge of the evaluating the productivity and the number of documents prepared by researchers belonging to various literary and scientific production units (Cortez, 2007). In this context, references and citations are the main source in bibliometric analysis based on the premise that they represent the impact measure that one or more publications of an author, institution or country have on society (Gorriz & Castera, 2018).

According to Flores & Aguilera (2018), the usefulness of bibliometric studies lies in the fact that from the meticulous study of the quality of scientific production, new lines and research plans are obtained as a result. In addition, the quality of the information contained in the publications of magazines and institutions can be defined, which determines their level of impact on the scientific and consumer society.

Regarding tax evasion, Washco (2015) states that evasion implies any action by which an individual does not pay the taxes that current laws require. In other words, tax evasion represents a fraud consisting of non-compliance with the current tax legislation in a country which results in several legal processes involved with the taxpayer; such processes oversee the protection of tax administration (Guaman, 2013). From the perspective of Montano & Vásquez (2016), tax evasion represents both, the difficulty of collecting inputs for the economic development of a nation, as well as one of the main indicators of the lack of social and collective commitment that tend to grow in the future of society.

Regarding the determining factors of tax evasion, Robles (2016) states that these are attributed to aspects such as tax morale, a complex tax system and the lack of commitment to compliance with tax obligations by taxpayers. According to Cotrina & Castañeda (2017) the determinants of evasion are related to attitude, economic and informative factors where there are aspects such as tax knowledge, the level of acceptance of the taxes to be paid and the tax culture.

Regarding the causes of tax evasion, Almeida (2017) states that the reasons for this problem are caused by aspects such as: the relationship between the benefits that the taxpayer expects to obtain by evading taxes and the detection risks that they are willing to take, the poor control of tax authorities when analysing the indirect relationship between the cost of inspections versus the amounts of taxes they expect to recover as well as ineffective inspections, a poor tax culture and morals, poor transparency, corruption between tax authorities and the high complexity in the tax system, among others. Likewise, Suárez (2017) in its theoretical base mentions that the causes of tax evasion is caused by a high level of tax pressure, excessive formalities, lack of knowledge of the regulations and burdensome processes and lack of formality, which citizens are not prepared to fulfil their role in society; such are values that arise from their own identity. Regarding the consequent effects of tax evasion, we can mention that these are strongly associated to the reduction of resources to strengthen education, health, infrastructure, citizen security, among others (Delgado et al., 2017). This takes place because the state depends directly on taxes to finance the provision of services and the provision of public infrastructures, thus generating negative consequences for society. In other words, sectors such as transportation, health services, education or public infrastructures indirectly suffer the consequences of tax evasion since the state lacks the resources to finance them (Mapfre, 2019).

It is worth mentioning that tax evasion does not only represent a deficit in state revenues that leaves an immediate effect of a scarce or limited coverage power in the provision of services to society, but it also unbalances the principle of equity of taxes, causing that the evader taxpayer enjoys benefits that do not belong to him. This brings disadvantages on final benefits for those who do comply with their tax obligations (Montano & Vásquez, 2016).

Methodology

Our study was a descriptive bibliometric analysis with a qualitative approach to the scientific production on tax evasion in the Science Direct database. The population of our research was made up of all the publications referring to tax evasion corresponding to the years 2010-2019.

To obtain the sample, we delimited our search to the words “tax evasion” in English. Then we selected only open access files, obtaining as a result a universe of 372. A total of 11 articles were excluded because they did not correspond to scientific articles, obtaining finally a total of 361 publications from which a sample was taken.

Once the sample formula was applied, considering a confidence level of 90%, with a sampling error of 10% and a probability of success and failure of 50%, a result of 57 articles was obtained that were classified based on variables such as: name of the journal, author, subject, country, year, company, determinant of evasion, focus, scope, among others.

The variables considered for the data analysis were classified into four groups: In the first group, structural variables were considered, where the number of signing authors in each article, publication language, year, and some relevant data of the first author were analysed, among them the gender, profession, country, and continent of origin. The second group included variables related to the type of tax and the determinants of evasion dealt with in the investigations, which are detailed in Tables 1 and 2. The third group includes variables related to the scope of application (Table 3), the type of company (Table 4) and continent of application. Finally, in the fourth and last group, variables related to the methodology applied in the investigations (Table 5), the instruments used, and the approach to the publications were grouped.

| Table 1 Approach | |

| Tax Type | Description |

| VAT | VAT (Value Added Tax), is an indirect tax that is paid to the state for the added value of a product or service in its production process. |

| SCT | Special consumption tax (SCT), known as the special tax on products and services (IEPS) or special consumption tax (SCT), is levied on goods such as cigarettes, liquor, vehicles, among others, national or imported, and services such as cell phones. |

| IT | The income tax or income tax is a tax that is calculated on the profit of people, companies, or other legal entities that are included in the tax base stipulated in the legislation of each country. |

| Table 2 Evasion Determinant | |

| Determinant | Description |

| Tax morale | It is the set of beliefs, values and rules that determine citizens’ actions towards the tax authorities. Within this classification, the articles that studied tax evasion from the taxpayer’s moral perspective are included. |

| Tax Knowledge | They are articles that analyse tax evasion from the point of view of taxpayers’ knowledge regarding taxes, considering aspects such as current tax laws, payment terms, and the amount of fees to be paid, among others. |

| Perception of the tax authorities | This classification includes aspects such as: taxpayer satisfaction with the tax authorities and the tax perception they have on the tax system. |

| Efficiency of the tax administration | The efficiency of the tax administration is the management capacity of the entities in charge of administering taxes in the different areas of their actions. |

| Table 3 Application Scope | |

| Ambit | Description |

| International | In this category, all studies carried out in more than one country are considered. |

| National | These are the studies that were carried out in a single country. |

| Local | They are studies developed to a province, state or area in a country. |

| Global | Within this category, studies based on a global theme are framed without focusing on any specific area, region, or country. |

| Table 4 Company | |

| Company | Description |

| Public | This classification covers all companies that belong to the public area, public entities where the state has total control over the decisions and activities that are carried out within them. |

| Private | They are companies made up of private capital, whose primary objective of their activities is profit-oriented and are directed by non-government entities. These companies make up the private sector of the economy. |

| Table 5 Methodology | |

| Methodology | Description |

| Empirical analysis | It is a method where the researcher obtains data by observing the behaviour of the phenomena investigated. Therefore, the results are obtained through experiments and trials. |

| Explicative analysis | These investigations describe the event or phenomenon analysed, explaining its causes and consequences. |

| Descriptive analysis | It consists in describing the researched situation, detailing its causes, but without deducing the effects and consequences of the phenomenon being analysed. |

| Comparison | Within this classification are the articles where the situation of the variables considered in their analysis was described and they were compared between two or more similar actors. |

| Verification | It consists in verifying the existence of source documents such as laws, rules and regulations. |

The determining factors of tax evasion were classified as follows (Table 2):

According to the scope of application, the articles were classified based on four variables that are presented below in the Table 3.

Information about companies is also detailed as follows (Table 4):

The description of the obtained variables based on the methodology used in the analyzed research is presented below (Table 5):

Finally, an analysis of the relationship between variables was applied. It was identified the level of dependence between variables such as: author, continent, type of company, focus, determinant of tax evasion, scope, approach, among others.

Results and Discussions

The results of this research are presented in two sections. The first section shows the results derived from the descriptive analysis of the variables catalogued in previous paragraphs, such as: year and language publication, methodology and journal. In this section, three figures were obtained; they present the analysis applied in the different variables. The second section shows the results of the analysis of the relationship between the variables referring to: number of authors, gender, journal continent, scope, evasion determinant, company, focus, among others, where there is a total of five figures.

Descriptive Analysis

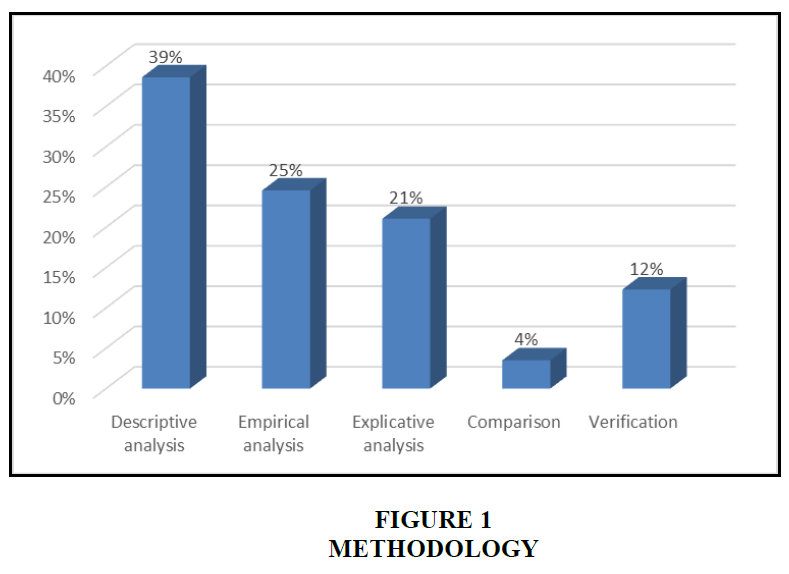

In addition, it was found that 60% of the research used qualitative variables, such as the taxpayers’ behaviour before the tax system, the influence of social norms on the behaviour of the inhabitants of a society, the authorities’ actions, among others. Regarding the instruments used to collect data, it was found that 39% of the articles used documentary analysis, 25% used indirect observation, 16% used the observation sheet, 7% the interview, and in 2% of the articles the data was collected from filing.

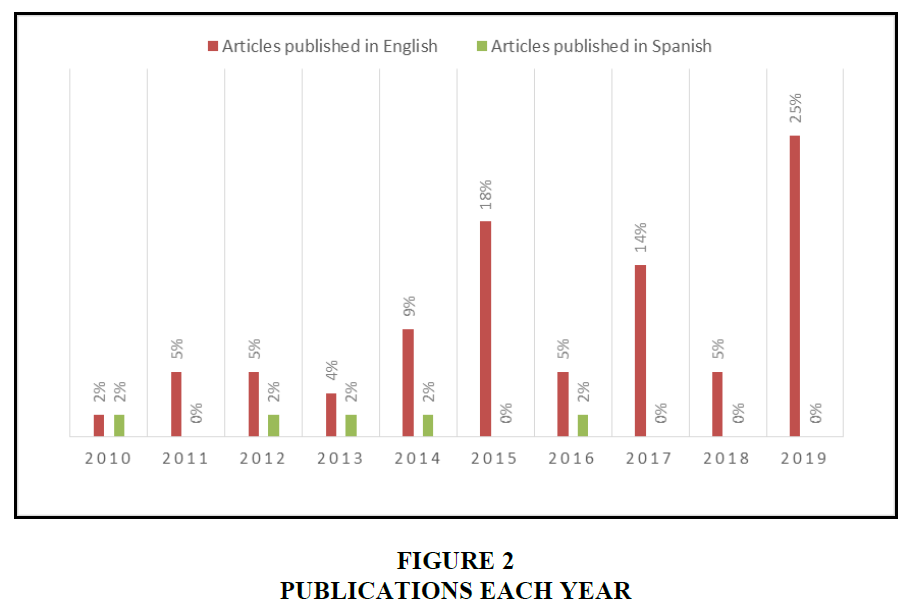

As seen in Figure 2, 91% of the articles were published in English and 9% in Spanish. Additionally, it can be observed that from 2010 to 2012 the level of publications grew slightly, reaching 16% of the total articles published during the analysed decade. Since 2013, a fluctuating behaviour has been observed, that is the analysed publications alternate between periods of growth and decline.

Finally, the rise in publications related to tax evasion during 2019 is notorious. In this year, 25% of publications were made, which shows that the highest number of articles published throughout the decade analysed was found here, with an additional increase of 20% over the number of publications in 2018.

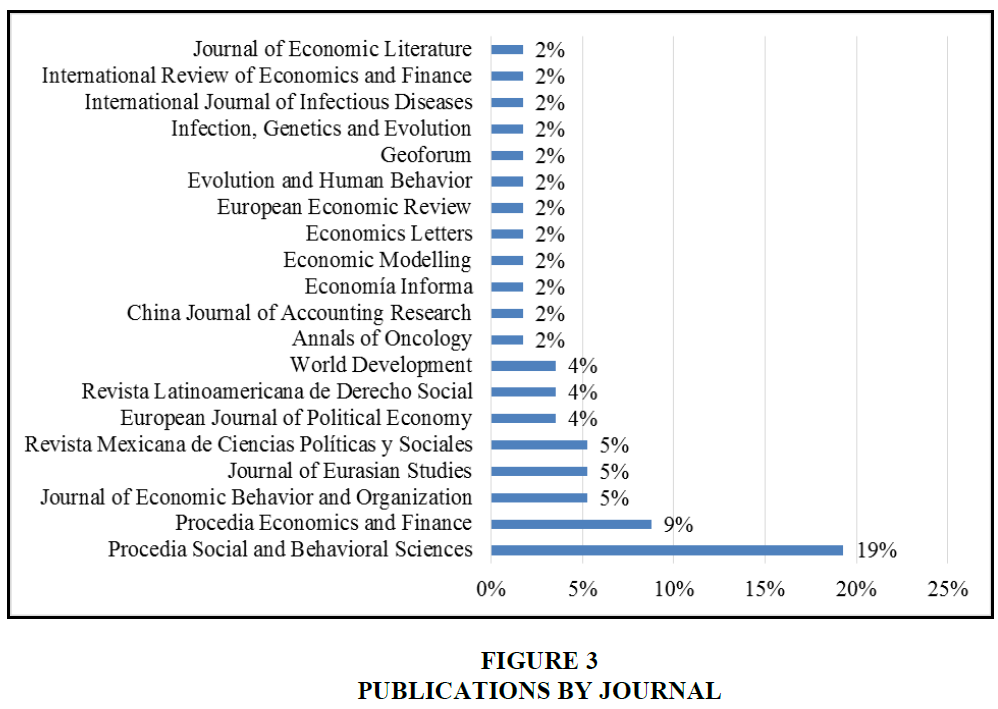

Figure 3 reflects the results concerning the 20 journals with the highest concentration of analysed articles. The results indicate that 86% of the journals are published by the European Publisher Elsevier. This company is the most recognized and profitable publisher worldwide; it shows net benefits of up to 40% in its activities, where both open and closed scientific content is published which comes from leading countries in scientific production that have obtained a subscription with the publishing house (Hartley & Alvial, 2018). Furthermore, the results show that 33% of the articles were published in the collection of open access conference proceedings “Procedia”, which belongs to the Elsevier editorial.

The remaining 24% are journals that belong to the Autónoma de Mexico University UNAM, considered one of the two best Ibero-American universities, and positioned among the 100 best universities worldwide according to the QS World University Rankings 2021. This is a ranking that assesses, among other aspects, quality, and the level of transfer of scientific knowledge to the world (Radio Imagen, 2020).

In summary, figure 3 indicates that within the 34 journals found in the Science Direct database that publish about topics related to tax evasion, there are 20 outstanding journals, from which the most relevant journal is Procedia Social and Behavioural Sciences with 19% of the publications.

Relationships Analysis between Variables

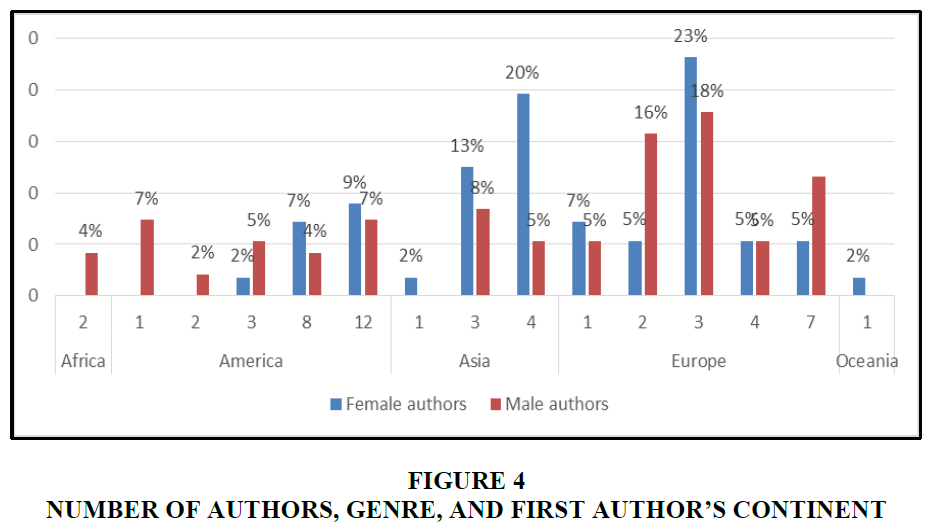

Figure 4 indicates an average of 3 authors per article. It is observed that 68% of the articles were signed by more than one author and 32% of them were signed by a single author. The articles are published with co-authorship of up to twelve authors.

Additionally, it is observed that the highest percentage of both male and female authors is found in Europe with 56% and 46% respectively. In addition, it is evident that Asia and Oceania are the only continents where women with 34% and 2% are the ones who predominate in authorship.

The information reflected in figure 4 indicates that men are the ones who publish the most articles with reference to tax evasion worldwide with 63% of publications, compared to women who have 37% of authorship.

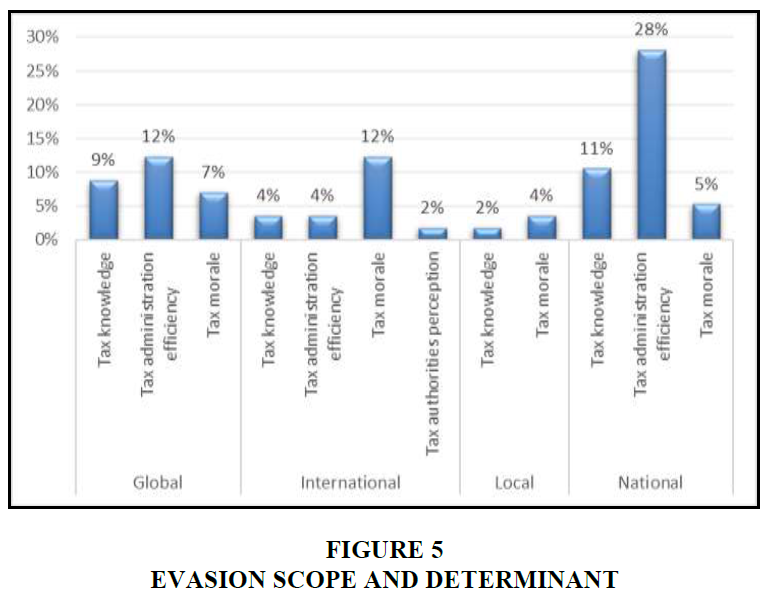

Figure 5 reveals that 44% of the articles delimited their research to the national scope, mainly in countries like Mexico, where 11% of the research focused on taxes such as VAT and IR were applied. In Romania, with 7% of publications, it was discussed about evasion without specifying any type of tax. A similar situation occurred in Colombia, the United States, Malaysia, China, and Russia.

Additionally, it was found that 28% of the articles were developed at a global level; 21% of them were carried out in more than one country. 5% performed their study at a local level, in a specific province, state or locality of a country.

Furthermore, Figure 5 shows that, from the perspective of the tax authorities, the efficiency of the tax administration, that is, the management capacity of the entities and authorities in charge of administering taxes in different countries was the most relevant aspect referring to evasion, representing 44% of the articles analysed. The majority of these correspond to the national level with 28%, and to a lesser extent to international and global levels with 4% and 12% respectively.

It is also shown that 57% of the articles focused on the position of the taxpayer and the variables analyzed such as tax knowledge, tax morale and the perception of the tax authorities. Tax morale and tax knowledge were the most addressed in this classification with 30% and 25% of articles, respectively. Tax morale, with 12%, had a greater participation in research carried out in an international sphere, and knowledge of taxation, with 11% was more discussed in the national sphere.

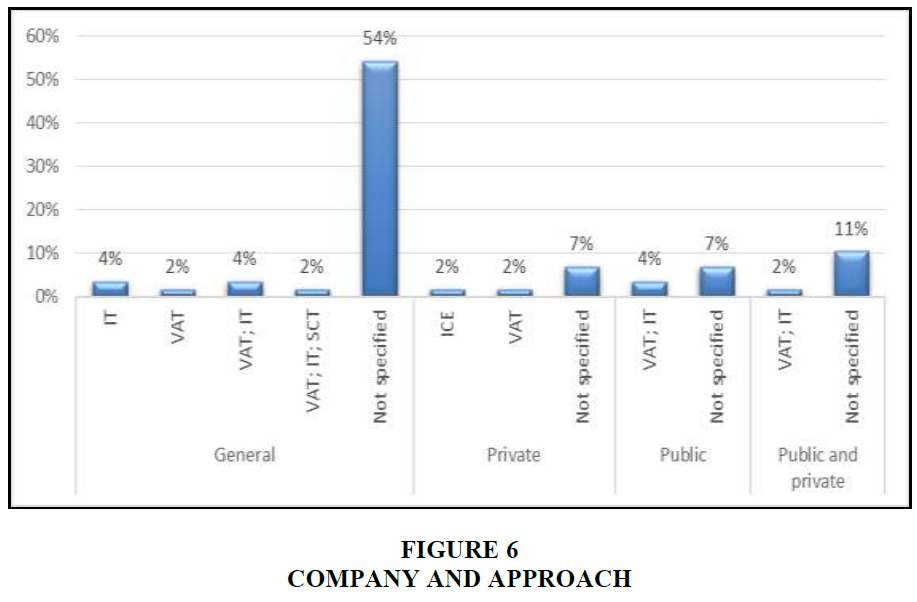

Figure 6 shows that in 65% of the publications it was not possible to determine the business section related to tax evasion, but instead it was referred to evasion from a general point of view, encompassing companies from all areas of the economy. 12% of articles were applied to public sector companies, 11% to private sector companies and the remaining 12% belongs to research made to companies belonging to both sectors.

Furthermore, 81% of the analysed articles studied tax evasion without focusing on a specific tax, with the greatest percentage of 54% in the articles that did not specify the business area.

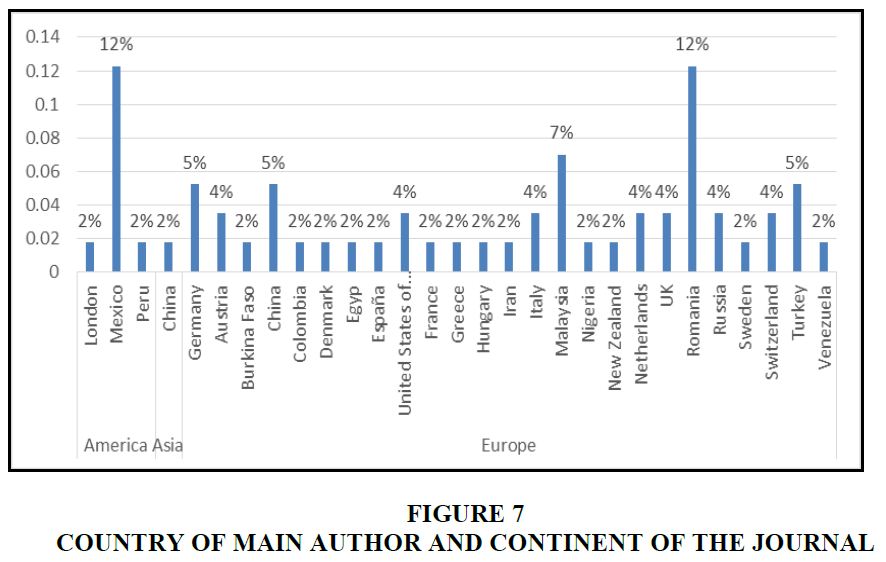

Figure 7 shows that the highest numbers of publications on tax evasion according to the origin of the first author are in Romania and Mexico; these countries represent 24% of the publications on evasion worldwide.

In addition, it is evident that the origin of the first author is identified in European countries, where 56% of the scientific production related to tax evasion is focused on Romania, Germany, Italy and Turkey as the most representative countries. Regarding the origin of the magazines continent where they were written, it was found that 82% of them were published in magazines coming from the European continent, 16% of publications were registered in magazines coming from America and the remaining percentage of 2% of articles were published in magazines coming from Asian countries.

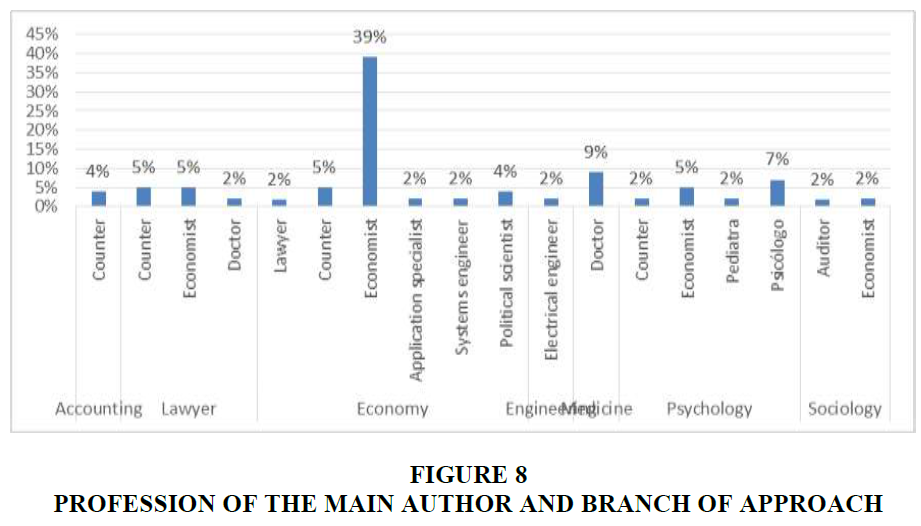

The results found in Figure 8 suggest that the professionals with the highest rate of published articles on tax evasion were economists and accountants, with a participation of 51% and 16% correspondingly. The professions that stood out less in the scientific production of the topic were the lawyer, electrical engineer, systems engineer and paediatrician, with 2% of publications.

In addition, among the most relevant professions, 16% of articles were accountants; only 4% of them were carried out from an accounting point of view and 12% from economics, law, and psychology point of view. 12% of articles signed by economists were carried out from the law perspective, psychology, and sociology with 5% and 2% each. Finally, psychology is the only branch of approach in which all the articles are located where psychologists are shown as first signing authors.

With results illustrated in Figure 8, it was found that, regardless the profession of the first author, most of the research on tax evasion is carried out from the economics point of view, since this approach represents 54% of the articles published between 2010 and 2019. Likewise, psychology has proven to be an important reference framework to analyse tax evasion, since it is in second place with 16% of publications on the subject. On the other hand, accounting, with less than 5% of articles published in the decade analysed, is the reference point least considered when assessing tax evasion.

Conclusion

Based on the results of the descriptive analysis applied in this research, it can be deduced that the publications on tax evasion in the ScienceDirect database have a growing trend with a prevalence of (91%) in English language. In addition, based on the methodology set forth in the articles, the analysis of information from secondary sources is the most convenient instrument to describe and characterize tax evasion, given that the descriptive analysis (39%), which has a focus on qualitative variables, is the most used method to discuss tax evasion. In other words, when talking about tax evasion, most of the work is based on the observation of characteristics of the topic studied to know its behaviour and the features that characterize it in different environments and settings (Patino et al., 2019).

On the other hand, through the relationship between variables, this research allowed to answer the following questions:

Does the Most Addressed Factor of Tax Evasion Depend on the Area Where the Research is Being Applied?

The results found in Figure 5 allow us to determine that the efficiency of the tax administration, with 44%, is the most important factor referring to tax evasion, especially when it is done in a specific country. This can be explained due to the importance given to this indicator in the control of tax revenue collection in a nation, as well as to reduce tax fraud.

Paredes (2016) states that a poor tax system will result in equally poor tax control and collection, but it is not the unique tax control viable mechanism to prevent evasion, since it also takes care of tax collection. The tax administration is the one in charge of raising awareness and educating taxpayers on tax matters, using technically less complex and more accessible mechanisms to achieve voluntary commitment and. compliance. So, it is inferred that the efficiency of tax administration is the key as a determinant factor of tax evasion in all countries of the world (Zamora, 2018).

Do Studies on Tax Evasion Focus on Public or Private Companies and What is the Most Influential Type of Tax?

To answer this question, we will refer to the results shown in Figure 6, where a high tendency was identified to study evasion from generalized perspectives by encompassing companies from all areas of the economy and without focusing on a specific type of tax, since 65% of articles did not classify their study as public or private companies and 81% did not specify the type of tax they were dealing with. This proves that tax evasion is a problem that concerns countries around the world in all areas, regardless of whether they are developing countries such as Mexico, Colombia, Venezuela or major developed countries such as the United States, China, Russia and Germany (Justo, 2015).

Does the Prevailing Genre in Research Depend on the First Author of the Origin Country?

Regarding the predominant gender in publications, Figure 4 helps us to verify that, regardless the origin country, 63% of articles published and with a significant prevalence in three of the five continents, men are the ones who are predominant in the scientific production on topics related to tax evasion in the ScienceDirect databases. Although no evidence could be found from existing studies related to our research, the results are in line with Olmeida’s findings and others (2017), where men have a participation that even duplicates the collaboration of women in the authorships, composition of writers, and in the direction of doctoral theses found in the Theseus database period from 1976 to 2015.

Does the Country of the First Author Influence the Country of Articles’ Publication?

As an answer to this question, the findings in Figure 7 shows that the origin country of the first author does not determine the country where the articles are published since most of the articles (82%) were published in European journals of which 54% come from countries in that continent and the remaining publications belong to other continents. It can be said that ScienceDirect is a database that includes 100% of journals published by the European publisher Elsevier and additionally a low percentage of journals belongs to associated publishers (Codina, 2018). In addition, it must be stated that Elsevier is a company that works in collaboration with academic institutions in 180 countries worldwide, including Mexico, Spain, the United States and Romania, among others (Elsevier, 2020)

Is the Research Carried Out from the First Author's Profession Point of View or from Different Branches?

The results illustrated in Figure 8 show that the profession of the first author is not an influential factor in the branch of science from where they are approached in the research on evasion, since out of 11 professions found, 54% developed their study from the economics. This proves once again that tax evasion is a social interest issue that is being addressed from different perspectives and professions, as it is a global problem that has affected nations since the creation of the state and, consequently, the tax system (Sarduy, 2017). In addition, having a trained tax culture does not depend only on tax advisors or those who perform their daily tax-related tasks such as accountants, business advisors, tax lawyers, among others. Tax knowledge is essential for decision making in general society regardless of whether or not one has direct obligations to the tax system (Fernandez, 2016).

In summary, once the results have been discussed and the findings identified, conclusions can be given in the following points:

1. The efficiency of tax authorities is the most relevant factor which determines tax evasion when studying this topic; in the same way the studies applied at national level seem to be the most viable ones to characterize evasion.

2. Regarding the type of tax and company, most of the authors do not limit their research to specific taxes and companies, but rather to talk about tax evasion from universal perspectives that encompass all possible aspects in the two variables.

3. The male gender is the leader in publications related to tax evasion. Likewise, it was identified that the origin country and the profession of the first author do not influence the place of publication of the articles or their approach, thus evidencing that tax evasion is a global research topic that can be studied from several branches of science.

Due to this bibliometric analysis, it was possible to determine the scientific production related to tax evasion at a global level, where it was possible to confirm an absence of content related to the subject in our country. For this reason, we consider that this study is a reference instrument for future research in different careers of higher education institutions at a national and local level, considering the socioeconomic context of Ecuador.

Considering that the bibliometric analysis applied in this article has its limitations, we conclude that this study is a useful source of information and reference for future research in the areas of economics and finance regarding evasion matters, especially for further studies on the subject.

References

- Almeida, P. (2017). Control of tax evasion in a developing country: The visibility of the economy. Retrieved from https://www.udl.cat/ca/cerca/?searchaction=search&searchPage=1&buscadorfield-1=+La+visibilidad+de+la+econom%C3%ADa+oculta+y+su+evasi%C3%B3n&submit=submit

- Codina, L. (2018). ScienceDirect-Elsevier digital platform and database. Retrieved from https://www.lluiscodina.com/science-direct-elsevier/

- Cortez, D. (2007). Measuring the scientific production of university researchers: Bibliometry and its limits. Higher Education Magazine, 32(152), 43-65.

- Cotrina, H.E., & Castañeda, M.E. (2017). Determinant factors of tax evasion in micro and small companies in the construction sector, in the Cajamarca district, 2016. Retrieved from https://repositorio.upn.edu.pe/ handle/11537/11297

- Davila, M., Guzmán, R., Macareno, H., Piñeres, D., Barranco, R.D., & Caballero, C.V. (2009). Bibliometrics: Concepts and utilities for medical study and professional training. Salud Uninorte, 25(2), 319-330.

- Delgado, R.M., Abambari, M.J., & Moreira, C.A. (2017). Effects of evasion on income tax, originated by the smuggling of merchandise on the southern border. Science Mastery, 3(4), 275-284.

- Elsevier. (2020). About Elsevier. Retrieved form https://tienda.elsevierhealth.com/

- Fernandez, C.J.R. (2016). Knowledge of the tax system is not just for advisers. Retrieved from https://www.fiscal-impuestos.com/conocimiento-sistema-tributario-no-es-solo-para-asesores-fiscales.html

- Flores, C., & Aguilera, R. (2018). Regarding the bibliometric analysis performed, what is it and what would be its. Journal of the Spanish Pain Society, 25(5), 307-308.

- Gómez, J.C., & Morán, D. (2016). Tax evasion in Latin America. Santiago: United Nations. Retrieved from https://www.cepal.org/es/publicaciones/39902-evasion-tributaria-america-latina-nuevos-antiguos-desafios-la-cuantificacion

- Gorriz, V.T., & Castera, V.T. (2018). Bibliometrics in the evaluation of scientific activity. Hospital a Domicilio, 2(4), 1-19.

- Guaman, J.D. (2013). Tax avoidance in Ecuadorian legislation. Retrieved from http://www.dspace.uce.edu.ec/handle/25000/3133

- Hartley, A., & Alvial, C. (2018). Elsevier, the publisher against the dissemination of scientific knowledge. Retrieved from https://www.eldesconcierto.cl/2018/08/21/elsevier-la-editorial-contra-la-difusion-del-conocimiento-cientifico/

- Justo, M. (2015). The champions of tax evasion in the world. Retrieved from https://www.bbc.com/mundo/noticias/2015/04/150406_economia_evasion_fiscal_america_latina_mj#:~:text=Derechos%20de%20autor%20de%20la,niveles%20de%20impuestos%20como%20Alemania

- Mapfre. (2019). The consequences of evading taxes. Retrieved from https://www.jubilacionypension.com/derechos-obligaciones/impuestos/evasion-de-impuestos-consecuencias/

- Montano, J.J., & Vásquez, F. (2016). Causes of tax evasion and its effect on the Peruvian economy 2014-services item. Crescendo, 7(1), 39-49.

- Olmeida, A., Abenza, L., Serrano, A., Muñoz, A.M., García Angulo, F., & Ortega, E. (2017). Bibliometric study of doctoral theses on sports psychology. Sports Psychology Notebooks, 17(2), 126.

- Paredes, P.R. (2016). Tax evasion vs. control mechanisms implemented by the public administration. Retos, 6(12), 180-198.

- Patino, R.A., Mendoza, S.T., Quintanilla, D.A., & Diaz, J. (2019). Tax evasion: A review. Revista Activos, 17(1), 167-194.

- Radio Imagen. (2020). Among the 100 best universities in the world is UNAM. Retrieved from https://www.imagenradio.com.mx/entre-las-100-mejores-universidades-del-mundo-se-encuentra-la-unam#:~:text=Entre%20las%20100%20mejores%20universidades%20del%20mundo%20se%20encuentra%20la%20UNAM&text=La%20Universidad%20Nacional%20Aut%C3%B3noma%20de,est%C3%A

- Robles, D. (2016). The determining factors of tax evasion in micro-enterprises of the commerce sector in the city of Chimbote. Retrieved from http://dspace.unitru.edu.pe/handle/UNITRU/4602

- Sarduy, M. (2017). Analysis approaches of tax evasion. Conceptual framework. Cofín Habana, 12(2), 367-386.

- Suárez, E.D. (2017). Reasons and consequences of tax evasion in MYPES in the commercial emporium Gamarra, La Victoria, Lima. Retrieved from http://repositorio.ucv.edu.pe/handle/UCV/4595

- Washco, T.L. (2015). Analysis of tax reforms and their impact on the collection of the main taxes in Ecuador. Retrieved from https://dspace.ucuenca.edu.ec/bitstream/123456789/21566/1/tesis.pdf

- Zamora, Y. (2018). Tax evasion and its impact on the Ecuadorian economy, 2010-2014. Quipukamayoc, 26(50), 21-29.