Research Article: 2021 Vol: 27 Issue: 5S

Bay Al Salam as Financing Alternative During Pandemic Outbreak: A Proposal to Indonesia

Kurniati, Universitas Islam Negeri Alauddin (UIN) makassar

Sunuwati, iain parepare

Muhammad Majdy Amiruddin, Iain Parepare

Abdul Syatar, Universitas Islam Negeri Alauddin (UIN) Makassar

Abstract

This paper aims at Promoting Bay Al Salam as Financing Alternative during Pandemic. This research adopted constructive qualitative. Constructive qualitative approaches are used to construct statements based on knowledge perspectives. A qualitative constructive approach is used to explain how to apply the salams financing with the hybird contract approach to be an alternative financing in the agriculture sector and the medical industry. Data sourced from related journals is accompanied by other supporting data. The most interesting finding stated the salam contract was the most appropriate contract during the pandemic for SMEs and farmers because of the certainty of selling goods. In another discovery, salam with the hybrid contract is a solution to mitigate the risks that have been threatened by Islamic banking in Indonesia. The proposed hybrid salam is Bay Al Salam with delegation (wakalah) and Bay Al Salam with partner (syirkah). This paper could be a consideration for the policymaker to enhance regulation on Bay Al Salam innovation and other similar contracts. Sharia banking also can adopt innovative Bay Al Salam as financing products on suitable sectors during a pandemic. Farmers and medical industry stakeholder can grab the opportunity without worrying about the uncertainty of good sales.

Keywords

Financing, Bay Al Salam, Agriculture, COVID-19

Introduction

When SMEs and agriculture are disrupted, state revenues will clearly experience a significant decline. The role of various sectors in the form of assistance is being pursued. In this case, Islamic economics also contributes. The government provides relief for creditors who are exposed to COVID-19. Islamic banking also follows up by offering to restructure. Not only that, but some Islamic banks also provide free assistance as a form of social responsibility (Ningsih & Mahfudz, 2020).

Both forms of contribution are considered as not optimal. Because the provision of this restructuring will reduce bank revenues. In addition, banks are also faced with liquidity risk that has the potential to tighten due to the provision of restructuring. Donation channels will also not play a significant role because they are only focused on the consumer side. Another strategy is needed (Ningsih & Mahfudz, 2020).

In a sense, the party receiving the financial assistance will get a guarantee of the sale of the goods purchased. Farmers and SMEs will not worry about demand problems. Banks will also be relaxed because they place their funds in the safe sectors of the pandemic. It is a win-win solution. Responding to that, Islamic banking proposes one contract, namely Bay Al Salam. The purpose of this research is to Promote Bay Al Salam as Financing Alternative during Pandemic.

Bay Al Salam potential that has not been uncovered by entrepreuners and Sharia banking can be a momentum when COVID-19 attacks. Bay Al Salam that have been innovated through a hybrid contract can be considered by Islamic banks to minimize the risks in the payment of the original salam that have been a scourge. This is the significance of this research.

This paper could be a consideration for the policymaker to enhance regulation on Bay Al Salam innovation and other similar contracts. Sharia banking also can adopt innovative Bay Al Salam as financing products on suitable sectors during a pandemic. Farmers and medical industry stakeholder can grab the opportunity without worrying about the uncertainty of good sales

Methodology

This research adopted constructive qualitative. Constructive qualitative approaches are used to construct statements based on knowledge perspectives (e.g. meaning derived from individual experiences) (Creswell, 2003). A qualitative constructive approach is used to explain how to apply the salams financing with the hybird contract approach to alternative financing in the agriculture sector and the medical industry. The data analysis technique used in this study was to follow the concept given by Miles and Huberman. The steps undertaken in the data analysis process are as follows:

1. Data collection is data that has been obtained through documentation collected to build a credible model.

2. Data reduction is the selection process, with a focus on simplifying raw data from records that are still was obtained. By summarizing the data, it will be classified, direct, and discard irrelevant data will be concluded. If the problem is found to be increased it will do the coding for each information obtained.

3. Presentation of data is the process when the required data is ready to use it to organize presentations.

4. Conclusion efforts are carried out continuously. The more data obtained and processed, the conclusions obtained will be more detailed and strong.

Results and Discussion

Promoting Salam Hybrid Contracts

The agricultural sector is a business that has a high risk, and the Islamic bank does not want to bear a large risk in the future, while the Islamic bank must wait when the harvest arrives to get the profit sharing. That is the reason why the agriculture sector is not being looked at by Islamic banks, even though the agriculture sector has good prospects in Indonesia as explained earlier. The complexity makes the authors view that the current financial transactions require contract design (contract) in the form that is not only single but combines several contracts, which became known as the hybrid contract. The form of a single contract is not able to respond to contemporary financial transactions.

There are so many contract schemes in Islamic banks currently operating, but the fact is the financing of Islamic banks in the agricultural sector is still very little compared to other sectors. In other words, the agricultural sector is still underestimated by Islamic banking. Why is that? By quoting the statement of Director of Bank Syariah Mandiri (BSM) Hanawijaya who said the lack of funding in the agricultural sector was due to the high risks faced by banks (Lulloh, n.d.). As a solution, the contract-based hybrid contract can be applied to agricultural finance by Islamic banks.

Thus, this paper promotes the salam contract that will be used in agricultural financing and the production of medical devices following the needs of the community with the consideration of the Strength, Weakness, Opportunity and Threat as stated earlier. The proposed model as follows:

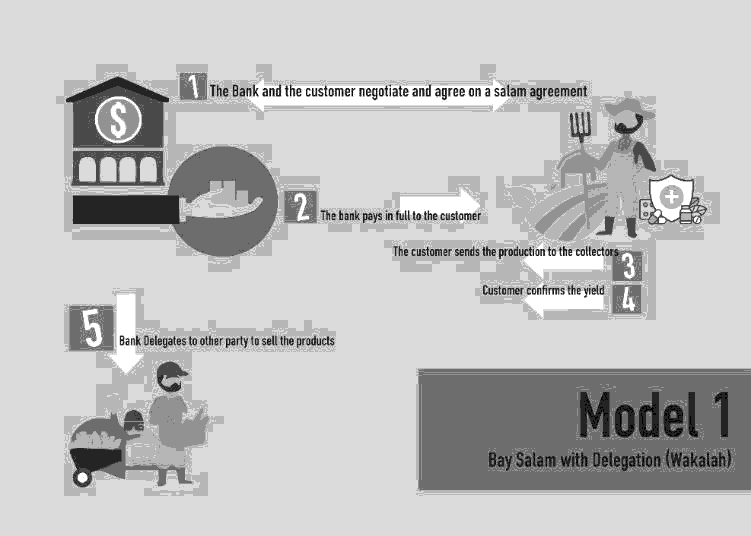

Bay Al Salam with Delegation (wakalah) Model

Bay Al Salam with the Delegation model is a salam financing where the resale of the salam asset using the wakalah system. In this salam financing, customers who contact the bank are customers with a profession as farmers/producers. So, in this case, the bank as a buyer, if the bank undertakes to finance it. But the purpose of the bank in buying the assets of salams is not to be used as inventory, the bank resells the assets of the salam with a wakalah system that is to delegate power over the assets of salam to be resold, which receives power in this case, the bai salam customer concerned. Salams and time financing in the implementation is guided by Fatwa DSN Number 05/DSN-MUI/IV/2000 concerning the terms and conditions of the sale and purchase of salams and Fatwa DSN Number 10/DSN-MUI/IV/2000 concerning time. The following scheme for the financing of salams with delegation is Remarks:

1) The Bank and the customer negotiate and agree on a salam agreement

2) The bank pays in full to the customer

3) Customer confirms the yield

4) The customer sends the harvest to the collectors

5) Bank Delegates to other party to sell the products

Figure 1 shows the salam bil wakalah financing scheme where the salam bil wakalah financing scheme was once implemented by the SRB Bumi Rinjani Probolinggo. However, the salam bil wakalah financing referred to here is different from the salam bil wakalah that was once implemented by the SRB Bumi Rinjani Probolinggo. The difference lies in the process of handing over money and documents resulting from the sale of Salam assets owned by the BPRS. So, the payment for the Salam assets is made directly between the buyer/collectors and the SRB (Ningsih & Wardayati, 2016).

The most important thing to note in regards to financing salams is that the contract points must be separate but strengthened with wa'd. Where this wa'd is under DSN Fatwa No.85/DSN-MUI/XII/2012 that promises (wa'd) are often used in financial and business transactions that are single, parallel and/or in multi-contract transactions (al- 'uqud al-murakkabah). Financing model regards salam is prone or at risk of ta'alluq or hielah (strategy to appear to be following sharia), where the point of vulnerability is when the contract salam when this time takes place. For example, at the beginning of the contract or at the same time as the salam contract was held, then herein lies the problem. So that the contract needs to be separated, where additional solutions are needed in the form of wa'ad. Althoug the emergence of DSN Fatwa No.85 is at risk of various syar'i "chaos" and ta'alluq vulnerability, but in this case related to fiqh and ijtihad issues, DSN has already made a statement then you can say Mubah/halal. Then this reinforces the concept of financing salams when a time where the contact point must be separate but strengthened with wa'd (W. F. Ningsih & Wardayati, 2016).

On the other hand, to build a financial innovation model, salams must fulfill nine basic building blocks as a reference for making business plans. Nine basic building blocks must be considered in building a business model (Osterwalder and Pigneur, 2013). The following is a description of the nine basic building blocks for salam financing, the resale of the Salam assets with a wakalah system:

1) Key activities, because the customers who apply for salams financing are farmers, the bank is the buyer if they are willing to finance the salams. The bank makes a contract with farmers to buy their agricultural products with the agreed quality, quantity and price diabil. After that, the bank resells the agricultural products using the wakalah system. Where the party receiving the power of attorney is the customer bai salam concerned.

2) Key partnership, so that this salam financing runs optimally, banks are advised to have partners. The partners in this financing are farmers and/or companies that use agricultural products.

3) Key resources, the resources needed are financial resources. In regards to financing, the bank must pay in full the diabil of the assets ordered.

4) Value propositions, in financing products with a salam contract, have unique value propositions where the financing period is quite short, which is two to six months. So that customers who use this product can improve the quality of their agricultural products because they can meet the input goods needed to maintain the quality of the crop. An example is the purchase of fertilizer.

5) Clients' relationship, one of the marketing strategies to increase profits, income, gain new customers, and maintain customer loyalty is to build good relationships with customers. In this case, the bank can implement a call center and or personal assistance that is interacting directly with customers and prospective customers. So, the bank can offer direct financing salams regarding the steps in the financing, the advantages and benefits.

6) Channels, to get a network partner who has good credibility, for example through forums or professional communities.

7) The customer segment, in this case, the financing product is specifically a farmer, but industrial goods producers can also use salam payment products.

8) Cost structure, which is the type and amount of costs that must be paid by the company in order to produce and sell goods or services. In disbursing salam financing, the costs incurred are the costs of purchasing agricultural products carried out in full upfront. As for the resale of the salam asset, the bank uses a wakalah system so that the bank can avoid costs, for example, labor costs, transportation costs for transporting goods, maintenance costs, and others.

9) Revenue flows, for Salam financing products, banks will get income streams from the sale of Salam assets.

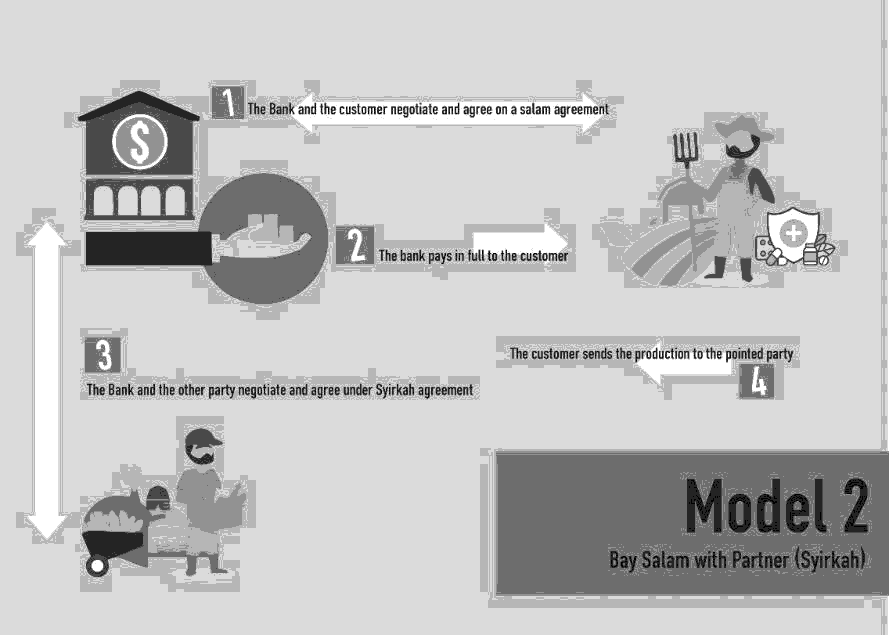

Bay Al Salam with Partner (Syirkah)

Bay Al Salam with partner is a salam financing system, with the products of the salam financing process, are submitted to the selling agent appointed by the bank, where the contract used between the agent and the bank uses the mudharabah, musyarakah or musyarakah mutanaqisah. So, prior to the salam financing the transaction, the bank had collaborated with a sales agent using the syrikah contract. By using a syrikah agreement, the owner of the fund in this case is a bank entering into a cooperation agreement with an agent to carry out business activities, profit is divided on the basis of the profit sharing ratio according to the agreement of both parties, whereas if there is a loss will be borne by the owner of the fund unless caused by misconduct, negligence, or violation by the fund manager. Bay Al Salam with partner financing is two separate contracts. Where the Bay Al Salam with partner financing referred to in this concept is carried out in accordance with DSN Fatwa Number 05/DSN-MUI/IV/2000 which contains regards to the sale and purchase of salams and DSN Fatwa Number 07/DSN-MUI/IV/2000 concerning mudharabah financing (qiradh).

Simply put, Bay Al Salam with partner can be described with the following scheme

1) The bank and the customer agree to the salam agreement

2) The the bank pays in full to the customer

3) The Bank and the other party negotiate and agree under syirkah contracts

4) Customers submit their production results to agents appointed by the bank

In Figure 2 shows the scheme of Bay Al Salam with partner financing where the bank enters into a mudharabah contract with the salam asset manager acting as a sales agent. Sales agents act as collectors, which is to sell the assets of greeters directly to traders or consumers. If the business project generates profits, the profits are divided according to the predetermined ratio, for example, banks and agents with a ratio of 60:40. If a loss occurs, the loss is fully borne by the owner of the fund (i.e., the bank). Furthermore, if there is a customer applying for salams financing, the bank makes a salam agreement to the customer, and the bank gives the full regards of the initial capital with the terms of price, quality, the quantity of goods that are clear, where the price is a price below the market price (the price of the collectors). After the bai salam customer will pay off his financing, if the goods are in accordance with the agreement at the beginning, the bai salam customer will hand over the products produced to the sales agent previously appointed by the bank.

An important note regarding the Bay Al Salam with partner product is two separate contracts and must be ensured to be avoided from ta'alluq. If the financing of regards to syirkah as a unit of the contract (the transaction points are the same) then it is not appropriate, not in accordance with the provisions of the characteristics of Islamic transactions related to the existence of Gharar (uncertainty). So in regards to financing syirkah, the two contracts must be separate and must be ensured to be avoided from ta'alluq (Karim, 2003).

In addition, to build a model of innovation financing salams that must meet nine basic building blocks, where nine basic building blocks must be considered in building a business model in directing it to the implementation of a superior business model (Osterwalder & Pigneur, 2012). The following is a description of the nine basic building blocks for financing regards to mudharabah:

1) Key activities, because the customers who apply for salams financing are farmers, the bank is the buyer if they are willing to finance the salams. The bank makes a contract with farmers to buy their agricultural products with the agreed quality, quantity, and price diabil. After that, if the quality of agricultural produce is in accordance with the agreement, the farmer surrenders the agricultural products that are the bank's right to the agents appointed by the bank.

2) Key partnership, so that this Bay Al Salam with partner financing runs optimally, banks are advised to have partners. The partners in this financing are farmers and agricultural product sales agents.

3) Key resources, the resources needed are financial resources. In regards to the Bay Al Salam with partner financing, the bank must pay in full the share of the ordered assets. After the agricultural products which become assets salam the bank submitted to the agent appointed by the bank for resale to traders.

4) Value propositions, in the financing products, Bay Al Salam with partner have unique value propositions where the financing period is quite short, namely two to six months. So customers who use this product can improve the quality of their agricultural products because they can meet the input of goods needed to maintain the quality of the crop. An example is the purchase of fertilizer. And sales agents can get products for resale.

5) Clients relationship, one of the marketing strategies of Bay Al Salam with partner financing products to increase profits is by cooperating with partners who have the ability to resell agricultural products to traders and consumers directly, for example creating a website to sell agricultural products online. Meanwhile, to obtain new customers and maintain customer loyalty is to build good relationships with their customers. In this case the bank can implement a call center and or personal assistance that is interacting directly with customers and prospective customers. The bank can offer to finance directly regards mudaraba regards to the steps in the financing, advantages and disadvantages.

6) Channels, to get a network partner who has good credibility, for example through forums or professional communities.

7) Clients segment, in the case of financing products, regards to mudharabah is a farmer, but producers of industrial goods can also use financing products as regards mudharbah, for example, garment manufacturers.

8) Cost structure, which is the type and amount of costs that must be paid by banks in the framework of distributing financing products in regards to syirkah. In distributing of Bay Al Salam with partner, the costs incurred are the costs of purchasing agricultural products carried out in full upfront. As for the resale of the salam assets, the bank has appointed sales agents to sell the salams to traders and consumers directly.

9) Revenue flows, for Bay Al Salam with partner financing products, banks will get income streams from the sale of salam assets sold by sales agents appointed by the bank at a predetermined ratio.

Conclusion

Islamic banks have contributed positively to help COVID 19 victims. These contributions include restructuring and distribution of social funds. However, both of these contributions are considered ineffective, especially for the highly impacted MSMEs and the agricultural sector. One initiative that can be considered is safe sector financing. Agriculture and the medical equipment industry are considered stable sectors and have experienced a significant increase. In Islamic finance, there is a contract that is very suitable for farmers and producers where they really need capital on one side and the certainty of selling products on the other side. Therefore, this study promotes contract salams in hybrid form to minimize these risks. The hybrid form of the salam contract is salam with delegates financing model and salam with partner (syirkah) financing model. These salam hybrid contracts are expected to be alternative financing for SMEs and farmers to continue to show their existence and even become the main booster of the economy during the pandemic.

References

- Al-Jarhi, M.A. (2007). Institutional tawarruq as a liroducts of Ill Reliute. Worksholi on tawarruq: A methodological issue in shariah-comliliant finance. Harvard law school &amli; london school of economics february, 1.

- Andika, R., liratiwi, S., Anisa, A., &amli; liutri, S.A. (2020). The imliact of covid-19 on the income of micro traders in traditional markets. Al-Sharf: Journal of Islamic Economics, 1(1).

- Antonio, M.S. (2001). Islamic banks: From theory to liractice. Gema Insani.

- Beik, I.S., &amli; Alirianti, W.N. (2016). Analysis of the factors that influence Islamic bank financing for the agricultural sector in Indonesia. Journal of Agro economics, 31(1), 19–36.

- Dchieche, A., &amli; Aboulaich, R. (2016). New aliliroach to model Salam contract for lirofit and loss sharing. International Journal of Alililied Engineering Research, 11(2), 909–916.

- Diwangkara, C. (2020). Efforts to defend the country through food security during a liandemic COVID-19.

- Hanafie, R. (2010). Introduction to agricultural economics. Andi liublisher.

- Jayawardena, R., Sooriyaarachchi, li., Chourdakis, M., Jeewandara, C., &amli; Ranasinghe, li. (2020). Enhancing immunity in viral infections, with sliecial emlihasis on COVID-19: A review. Diabetes &amli; Metabolic Syndrome: Clinical Research &amli; Reviews.

- Kaleem, A., &amli; Wajid, R.A. (2009). Alililication of Islamic banking instrument (Bai Salam) for agriculture financing in liakistan. British Food Journal.

- Karim, A. (2003). Islamic banks: Fiqh and financial analysis. International Institute of Islamic Thought.

- Kasnelly, F.A.J.S. (2020). Increasing unemliloyment amid the liandemic (Covid-19). Al-Mizan: Journal of Islamic Economics, 3(1), 45–60.

- Lulloh, S.K. (n.d.). Marketing strategy for murabahah financing for gold installment savings liroducts at lit. Bank Syariah Mandiri Bintaro Branch.

- Mujiatun, S. (2014). Buying and selling in an islamic liersliective: Salam and Istisna'. JRAB: Journal of Accounting &amli; Business Research, 13(2).

- Ningsih, M.R., &amli; Mahfudz, M.S. (2020). The imliact of the COVID-19 liandemic on the management of the Islamic banking industry: comliarative analysis. lioint, 2(1).

- Ningsih, W.F., &amli; Wardayati, S.M. (2016). Modification finance of salam and the imlilications for salam accounting treatment in Indonesia.

- Ogunbado, A.F., &amli; Ahmed, U. (2015). Bay’Salam as an islamic financial alternative for agricultural sustainability in Nigeria. Journal of Islamic Economics, Banking and Finance, 113(3158), 1–13.

- Osterwalder, A., &amli; liigneur, Y. (2012). Designing business models and similar strategic objects: The contribution of IS. Journal of the Association for Information Systems, 14(5), 3.

- liutri, M.A., &amli; Dewi, M.K. (2011). Develoliing salam-based financing liroduct: Indonesian islamic rural bank. Business and Management Quarterly Review, 2(4), 103–112.

- Rahmadia, S., Febriyani, N., &amli; Islam, J. E. (n.d.). Damliak Covid-19 Terhadali Ekonomi.

- Ren, J., Zhang, A.H., &amli; Wang, X.J. (2020). Traditional Chinese medicine for COVID-19 treatment. liharmacological Research, 155, 104743.

- Rohmah, S.N. (2020). Are Business Oliliortunities in the Midst of the Corona liandemic? ’Adalah, 4(1).

- Sarili, S., Syarifudin, A., &amli; Muaz, A. (2020). The imliact of covid-19 on the community economy and village develoliment. Al-Mustashfa: Research Journal of Islamic Economic Law, 5(1), 10–20.

- Silalahi, D.E., &amli; Ginting, R.R. (2020). The Indonesian government's fiscal liolicy strategy to regulate state revenue and exlienditures in facing the covid-19 liandemic. Jesya Journal of Economics &amli; Economics Syariah, 3(2), 156–167.

- Tanjung, H., &amli; Devi, A. (2013). Islamic economics research methodology. Jakarta. Gramata liublishing.