Research Article: 2021 Vol: 25 Issue: 3S

Basel Norms-at a Glance

Deepika Dhawan, Shri Mata Vaishno Devi University

Sushil Kumar Mehta, Shri Mata Vaishno Devi University

Citation Information: Dhawan, D., & Mehta, S.K. (2021). Basel norms at a glance. Academy of Marketing Studies Journal, 25(S3),

Abstract

Keywords

Literature Review, Basel, Financial Stability, Co-word Analysis, Conceptual Maps, Bibliometric Analysis.

Introduction

The growth of the international loan market and financial instability in effect has enhanced the importance of a similar set of norms that could be followed to achieve some harmonious environment to capture the international loan market. Coined in the late 1980s, the term Basel norms aimed to grasp the essence of some harmonious environment to give a fair and level playing field to all the participants in the international loan market. For the said purpose, the need for a better flow of information among the supervisors of different central banks was felt. Basel norms aimed at this parameter along with better approaches to encapsulate credit risk (Barbara et al, 2008; Noor et al, 2018). As the challenges of the international loan market and global environment grew, these norms evolved to reproduce the operational and market risk, systematic risk, and other unforeseen risks that could shake the foundation of different economies (Stefan, 2011). These rules aim for better supervision, mandatory capital restrictions, revision of term "capital" as per the needs of changing times (Rosa Maria, 2004). The financial repercussions of these norms, as and when changed, became the focus of researchers, academicians, and policymakers. To know the impact of these new norms in the different countries’ environment always fascinated them from the research point of view.

With the ever-changing time, a sure hint of uncertainty has always been there. Financial stability is still an illusion. However, a particular set of rules and regulations that help to create a semblance of control to a certain extent while aiding stability in the financial sector of the global economy has always been welcome (Narissa, 2012; Bernadine, 2013 et al). With the aid of existing literature, the present study helps to overcome a gap regarding the evolution of these rules and regulations over time while overseeing various international bank crises’ in the 70s and late 90s; and the global financial crisis of 2007-08. These crises laid the foundation of Basel norms by the Basel Committee on Banking Supervision (BCBS) and evolved with ever-changing challenges in the field of the financial sector.

With the aid of Bibliometrics, the present study takes a step towards fulfilling a research gap by carrying out a quantitative analysis of Basel norms systematically. This study combines the general Bibliometrics method with co-word and co-citation analysis to visualize a bigger picture of the evolution and progress of Basel norms. This study strives to explore the overall theoretical foundation of Basel norms appearing in the ten journals with the highest publications using co-citation analysis, identifying research themes and thematic evolution of Basel norms for 20 years, suggesting future directions to improve Basel norms with the ever-changing time.

In a nutshell, the present study endeavors to perform a review of the literature regarding Basel norms with the aid of bibliometric methods. For this attempt, performance analysis is conducted by calculating the main statistics of the research papers, most productive countries, and most cited source, most productive authors, and most cited manuscripts, most relevant keywords, etc. This is followed by mapping a co-word analysis, where emerging and current themes with the prospects can be analyzed graphically, i.e., through a strategic diagram- present, past, future trends can be seen. Thus, it provides a roadmap for research in this field.

The rest of the paper is structured in the following sections; a brief introduction of the topic is followed by the methodology applied in the research. The next section describes the performance parameters of bibliometrics analysis, followed by the discussion of results for the same. The final section concludes the results along with the limitations of the study and a proposed roadmap for future research.

Brief Overview of Basel Norms

Basel 1

The failure of a major German Bank shifted focus on credit risk internationally, which resulted in creating a better portfolio for banks using minimum capital standards to cover the risks arising from the same. This resulted in first set of regulations named Basel I coming into effect in 1998, focusing on strengthening the soundness and stability of the international banking system (BCBS, 1988). According to the regulations, global banks were required to retain at least 8% capital to total credit risk-weighted assets (BCBS, 1988). Hence, Basel I whole focus was on the credit risk although ignoring market and operational risks. There was no acknowledgment of risks associated with the credit portfolio’s term-structure. The regulation did not recognize effects of credit risk portfolio diversification, the role of collateral, and credit risk mitigation. In reality, it did not differentiate from structure to the size of the organization to the ratings of the organization; following one-size fits all approach. To remove a source of competitive inequality arose from differences in national capital requirements, it proposed a framework to group assets in four categories, depending upon their credit risk, and to calculate CRAR ( Capital to Risk-Weighted Assets Ratio) also known as CAR (Capital Adequacy Ratio). It recognized three types of credit risk, namely on balance sheet risk, off-balance sheet risk, and non- trading off-balance sheet risk. To calculate RWA, following pattern was used, as defined in the BASEL I framework (BCBS, 1988) Table 1.

| Table 1 Risk Weighted Assets Calculation in Basel I |

| RWA= 0*(Bucket1) + 0.2*(Bucket2) + 0.5*(Bucket3) + 1.0*(Bucket4) Whereas RWA= Risk-weighted Assets Bucket1 = Assets with Zero Default Risk as cash/ government bonds/ government securities Bucket2 = Assets with a low rate of default as loans to OECD Banks/ Bucket 3 = Assets containing a medium level of risk as mortgage loans to households Bucket4 = Remaining Assets as loans to non-banks |

Basel I also differentiated the capital into Tier 1 Capital (consisting of Equity Capital and Disclosed reserves) and Tier II capital (consisting of undisclosed reserves, hybrid capital instruments, subordinated debt, and general provisions). To incorporate the market risk, Basel I was amended in 1996 by the BCBS (BCBS, 1996). The amendment clearly stated "as from the end of 1997, or earlier if their supervisory authority so prescribes, banks will be required to measure and apply capital charges in respect of their market risks in addition to their credit risks" (BCBS, 1996, p. 1). This step deemed it necessary to consider market risk with the credit risk, 1997 onwards, while calculating the minimum capital requirements. Operational risks of bank continued to be ignored in the Basel I Accord. In consequence, the concept of capital adequacy was not able to fully explain bank’s financial health. In short, Basel I risk management capacity left a lot to be desired, making it necessary to revise the Basel I Accord.

Basel II

To address the limitations of Basel I, in 2004, the Basel II Accord was developed as the new parameter for the banks. This new parameter was more equipped from a risk management perspective. It consisted of three Pillars (BCBS, 2011). The minimum capital requirement (MCR) was the first pillar. It required focus of banks on all three risks namely, credit, market, and operational to evaluate the MCR. The supervisory review was the second pillar of Basel II. It required identification and assessment of risk, apart from Pillar I, in a broader perspective to calculate additional capital requirement arising from any material risk (residual, reputation, concentration risks, etc.), save for the credit, market, and operational risks. Therefore, the capital required for any material risk was in addition to the MCR in Pillar I. The last Pillar Basel II was market disclosures, which required banks to disclose all the material information, risk exposures , and market outlook to the public, market and all the stakeholders making the financial market more resilient and transparent(BCBS, 2004). Features of Basel II are as follows Table 2.

| Table 2 Features of Basel II Capital Accord | ||

| Pillar 1. | Pillar 2. | Pillar 3. |

| Minimum Capital Requirements | Supervisory Review | Market Discipline |

| Set up of Minimum Capital Standards and Definement of Capital | Assessment of Solvency vs. Risk Profile by Banks | Improved disclosure of |

| Enhanced Approaches for Credit Risk Standardized Internal Ratings Advanced Internal Ratings |

Upholding Minimum Capital Standards | Capital Structure |

| Clear Cut Treatment of Operational Risk with approaches Basic Indicator Standardized Advance Measurement |

If not, early intervention by Regulators in case of a deterioration of Capital Levels | Risk Measurement and Management Practices |

| Preparation of Market Risk Framework with approaches Standarized Internal Model |

Supervisory Review of Bank's Calculations and Strategies for Capital | Profile of Risk |

| Ratios were Unchanged | Adequacy of Capital | |

The principal focus of Basel Committee was on the capital base to safeguard banks against unexpected losses in inescapable circumstances. Three tiers of capital were announced by BCBS in Basel II Table 3.

| Table 3 Types of Capital (BCBS, 2004) | ||

| Tier I (Core Capital) | Tier II (Supplementary Capital) | Tier III (Additional Supplementary Capital) |

| - Paid up Capital - Non- Repayable Share Premium - General Reserves - Statutory Reserves - Retained Earnings - Minority Interest in Subsidiaries - Non- redeemable Preference Shares - Dividend Equalization Account |

- General Provisions - Asset Revaluation Reserves - All other preference shares - Exchange Equalization Account - Revaluation Reserves for securities - Subordinated Debts |

-Short-Term Subordinated Debt (Maturity period less than or equal to 5 years but greater than or equal to two years) |

Tier I was highest quality capital. Tier II capital contributed towards soundness and strengthening of a bank, whereas Tier III capital could be used to cover charges arising out of market risks. Examples could be risks from foreign exchange, interest rate, commodity price, trading book, etc. In ensure a robust and resilient banking system, Tier II capital, Tier III capital was restricted to 100 %, and 250 % of Tier I capital respectively (BCBS, 2004).

Although Basel II was more risk sensitive in comparison to Basel I for assigning diversified risk weights to different exposures, it still was not fully equipped to handle systematic risk as shown by the financial crisis of 2007-08.

Basel III

The serious questions regarding adequacy of Basel II in relation to handling of systematic risk were posed after the financial crisis of 2007-08. It made the regulators to strengthen the capital adequacy norms to handle the unforeseen events better. This is an improved version of Basel II norms and globally, the reforms had been started to be implemented from 2013 (Nadine and Hannah, 2011) Table 4.

| Table 4 Improvements from Basel II to Basel III | ||

| Enhanced Minimum capital and Liquidity Requirements | Enhanced Supervisory review process for firm-wide risk management and capital planning | Enhanced Risk disclosure and Market Discipline |

The main focus is to enhance international banks stability to hold out any unforeseen economic and financial crises, as well as the after-effects of any financial contagions through improving market discipline with enhanced transparency.

The requirements of equity in Tier I capital were increased from 4 to 6% (improving quality capital). The reforms introduced some new measures along with the improved ones of Basel II. Capital Conservation buffer was introduced to hold out the various period of stress, whereas countercyclical buffer was introduced to withhold cyclical requirements of banks related to the macroeconomic conditions of an economy. A minimum level of 3% was to be maintained for the leverage ratio (Ratio of Tier I capital to Total Assets) by 2017. The reforms also introduced better liquidity management for acute liquidity stress scenarios to ensure highly liquid and unencumbered assets to meet obligations with a 30-day time horizon Table 5.

| Table 5 Roadmap for Implementation Of Basel III | |||||||||

| Capital | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Requirement | |||||||||

| (Basel II) | (Basel III) | ||||||||

| Minimum common | 2% | 2% | 3.50% | 4% | 4.50% | 4.50% | 4.50% | 4.50% | 4.50% |

| equity capital ratio | |||||||||

| Capital conservation | 0% | 0% | 0% | 0% | 0% | 0.63% | 1.25% | 1.88% | 2.50% |

| buffer | |||||||||

| Minimum common | |||||||||

| equity plus capital | 2% | 2% | 3.50% | 4% | 4.50% | 5.13% | 5.75% | 6.38% | 7.00% |

| conservation buffer | |||||||||

| Phase-in of | 0% | 0% | 0% | 20% | 40% | 60% | 80% | 100% | 100% |

| deductions | |||||||||

| Minimum Tier 1 | 4% | 4% | 4.50% | 5.50% | 6% | 6% | 6% | 6% | 6% |

| capital ratio | |||||||||

| Minimum total | 8% | 8% | 8% | 8% | 8% | 8% | 8% | 8% | 8% |

| capital ratio | |||||||||

| Minimum total | |||||||||

| capital plus | 8% | 8% | 8% | 8% | 8% | 8.63% | 9.25% | 9.88% | 10.50% |

Novel ideas were introduced in the Basel III reforms. Focus was not only on the quality but also on the quantity of regulatory capital; a more rigid liquidity requirement; a non-risk-based leverage ratio; coverage of risks under stress scenarios; a counter cyclical capital buffer, a capital conservation buffer, and limitations on systematically important banks (SIBs) and financial institutions (Nadine and Hannah, 2011).

Methodology

The research design includes two phases. The first phase covers document source selection, and the second one bibliometrics analysis. The steps taken to execute the phases are explained in the following sections.

Document source selection

Data has been collected from the Scopus database for analyzing research articles for the bibliographic information. The database includes thousands of scholarly publications in the form of review, research books, conference proceedings, etc. It contains bibliographic information regarding the title, keywords, abstract, authors, affiliations, country, quotations, etc. Various databases have not been used for bibliographic purposes as duplication of articles becomes a slightly pressing problem rather than an increase of relevant articles (Anne-Wil & Satu, 2016).

Marta & Maria (2017) proposed to embark on different search steps for the literature review to present a better view of the subject. Accordingly, the documents were retrieved from the database using the relevant terms "Basel I," "Basel II," "Basel III," "Basel IV," "Basel norms," "Basel regulations." Firstly, data were retrieved from abstract, title, and keywords. Secondly, "review" and "article" was specified in the "type of document." Thirdly, the data range was selected "all years." The study obtained 1294 articles using this research criterion. This then formed the basis for bibliometrics analysis. The research articles have been searched for in the database until January 2020. The starting point of the analysis is the oldest article.

Bibliometrics Analysis

In 1969, Alan introduced the term “bibliometrics" as "the application of mathematical and statistical methods to books and other means of communication" (p.349). As a part of scientometrics, the bibliometric analysis uses statistical and mathematical methods to analyze scientific activities in a specific research field (Michel et al., 1991). It studies patterns of publication in a particular field by using quantitative analysis on the published literature to date (Nicola, 2009) and gives a general idea on the significant and recurring themes, if any, to scope out the previous patterns and suggest future roadmap. Thus, in a nutshell, bibliometrics as a method enables a researcher to study a body of literature to classify key themes (Jonathan et al., 2000; Rick & Wolfgang, 2013).

Based on the type of information provided by the data, different methods are used in Bibliometrics (Anthony, 2005). Sometimes, even a combination of the methods is not enough to give a comprehensive view of what the literature represents so far. So, it is often combined with other visualization methods to give a comprehensive view. It helps to visualize the intellectual structure of a particular field of research (Manuel et al., 2011). A few of the methods used for Bibliometrics are citation-based analysis, keyword co-occurrence analysis, co-word analysis, and co-authorship analysis. The citation-based analysis method can be further classified into the bibliographic coupling, citation analysis, and co-citation analysis (Ludo & Nees Jan 2014). In the aforementioned methods, co-citation analysis is considered most common (Ying et al., 2001). It can be defined as two published materials in any form (research article, working paper, conference proceedings, etc.), which are cited together in a research paper/article (Henry, 1973). This is based on the general belief that if two publications are often cited together, there must be some similarity either in the general idea or content (Pierre & Anita, 2013). In its advance form, the method can be used to identify clusters of co-citation pairs (Mehmet Ali et al., 2015). It can help researchers to gain enhanced insights for the intellectual structure, knowledge base, and the cumulative practices in a particular field (Henry, 1978; Yorgo et al., 1998; Mary, 1986). Co-citation analysis helps to understand the disciplinary structures of a research field (Julie and Edward, 1980). However, in itself, it does not provide a content view of literature as it includes vast topics dealt with in the research. For a reason, the co-word analysis was developed to deal with this type of problem (Michel et al., 1991). This analysis is based on the frequency of two keywords appearing together in research articles, i.e., the rate of recurrence of two keywords together (John, 1989). For this, the strength of the re-occurrence of keywords is measured, to analyze the interactions between keywords (Hsin-Ning & Pei-Chun, 2010). This can help to understand the concept of research topics and patterns in a particular field as keywords represent the core of a research publication (Ying et al., 2010). However, this method has an inherent weakness of stability as core terms representing a topic change over time (Loet, 1997). Due to the inherent weaknesses of different methods, a combination of these methods is used to provide a better picture of a discipline structure (Yu-Wei et al., 2015). Therefore, co-word and co-citation analysis methods are used in combination to get a better view of the situation as the overlapping of these two methods is comparatively small (Fredrick, 2002). It will facilitate a deeper understanding of the intellectual structure of a particular field by creating a comprehensive view of it (Yu-Wei et al., 2015).

Data Analysis and Discussion

Data is collected from the Scopus database. The search criteria included the term terms "Basel I," "Basel II," "Basel III," "Basel IV," "Basel norms," "Basel regulations." The data collected is research articles that are printed in English from 2000-2019. The year 2020 and 2021 is ignored due to extreme circumstances for one reason, and for the other as regulations of Basel III norms were to be imposed by 2019. In order to analyze data, the "R" software has been used, which is open-source software (Massimo & Corrado, 2017). Firstly, research articles were shortlisted on relevance. After removing not related articles from the 1294 documents, 1119 articles remained. The data thus collected is then cleaned through deleting duplicate entries by running "duplicatedMatching" command. After the data cleaning, a total of 1115 documents remained from 430 different sources. Main statistics about the data is as follows Table 6.

| Table 6 Main Bibliometric Indicators of Publications Basel Norms | |

| Documents | 1115 |

| Sources (Journals, Books, etc.) | 430 |

| Keywords Plus (ID) | 1039 |

| Author's Keywords (DE) | 2276 |

| Period verage citations per documents |

2000 - 2019A 7.944 |

| Authors | 1962 |

| Author Appearances | 2379 |

| Authors of single-authored documents | 327 |

| Authors of multi-authored documents | 1635 |

| Single-authored documents | 385 |

| Documents per Author | 0.568 |

| Authors per Document | 1.76 |

| Co-Authors per Documents | 2.13 |

| Collaboration Index | 2.24 |

| Document types | |

| ARTICLE | 936 |

| REVIEW | 50 |

| Note: Researchers’ calculations using Bibliometrix package of R Software | |

Table 6, showcasing main bibliometric indicators of publications on Basel norms, clearly shows that 1115 documents are already published during the period 2000-2019 in 430 sources. Author's keywords are more in number (2276) than keywords plus (1039) as the author's keywords explain more about the article contents in comparison to the latter, which includes words/phrases in the titles of articles’ references appearing frequently (Juan et al., 2016). Average citations (total citations of documents/ total documents) per documents are 7.944 in number. The authors for these documents are 1962 in number representing 327 single-authored documents and 1635 multi-authored documents. Due to more multi-authored documents, authors per documents are 1.76 in number with co-author per documents 2.13 in number with collaboration index at 2.24. Published material includes 936 research articles with 50 reviews along with 129 other materials, e.g., book chapters.

The ten most productive countries in relation to the publications of research articles produce 40.35% of the total relevant published research articles in which the USA alone published 8.24% of total relevant research articles. However, in terms of citations, the USA could not place itself in the top ten places of total citations per country. Among the most productive countries, eight belong to the developed economies group and two to the developing economies group (World Bank, 2019).Table 7 shows the United States of America (USA) as the most productive country as a Single country publication (SCP), followed by Germany, United Kingdom (UK), Italy, South Africa, France, and so on. But in Multiple Country Publications (MCP), it is a different scenario. UK has risen as a country with the highest MCP, followed by the USA, Germany, Spain, Italy, and so on Table 7.

| Table 7 Most Productive Countries in Terms of Publications on Basel Norms | |||||||

| S.No | Country | Articles | Percentage | Freq | SCP | MCP | MCP_Ratio |

| 1 | USA | 92 | 20.44 | 0.1283 | 74 | 18 | 0.1957 |

| 2 | United Kingdom | 74 | 16.44 | 0.1032 | 47 | 27 | 0.3649 |

| 3 | Germany | 72 | 16.00 | 0.1004 | 55 | 17 | 0.2361 |

| 4 | Italy | 42 | 9.33 | 0.0586 | 33 | 9 | 0.2143 |

| 5 | France | 35 | 7.78 | 0.0488 | 28 | 7 | 0.2 |

| 6 | South Africa | 33 | 7.33 | 0.046 | 30 | 3 | 0.0909 |

| 7 | Spain | 32 | 7.11 | 0.0446 | 22 | 10 | 0.3125 |

| 8 | Canada | 24 | 5.33 | 0.0335 | 18 | 6 | 0.25 |

| 9 | Czech Republic | 23 | 5.11 | 0.0321 | 21 | 2 | 0.087 |

| 10 | India | 23 | 5.11 | 0.0321 | 23 | 0 | 0 |

| SCP: Single Country Publications MCP: Multiple Country Publications Freq: Frequency of Publications |

|||||||

Table 8 presents the top ten countries that attained the highest total citations received per country along with average article citations (total citations/total articles) per article published by that country. Again, the UK rose as the country with the most cited publications with 1106 citations with an average of 14.946 per article citations. France (322, 9.2) got second place in terms of citations followed by Netherlands (252), Switzerland (242), and Finland (221), Canada (208), and Greece (175), Australia (172), and Sweden (127), Norway (121 Table 8.

| Table 8 Country-Wise Total Citations in Terms of Publications on Basel Norms | |||

| S. No | Country | Total Citations | Average Article Citations |

| 1 | United Kingdom | 1106 | 14.946 |

| 2 | France | 322 | 9.2 |

| 3 | Netherlands | 252 | 14 |

| 4 | Switzerland | 242 | 15.125 |

| 5 | Finland | 221 | 27.625 |

| 6 | Canada | 208 | 8.667 |

| 7 | Greece | 175 | 10.294 |

| 8 | Australia | 172 | 8.19 |

| 9 | Sweden | 127 | 12.7 |

| 10 | Norway | 121 | 20.167 |

| Source: Researchers’ calculations using Bibliometrix package of R Software | |||

Table 9 portrays the journals that published research articles relevant to Basel norms and regulations with its practical application. The top ten journals that published the articles are arranged in decreasing order in terms of the number of the article published by them. All of these journals are a part of the ABDC category published in December 2019 by the Australian Business Deans Council as a Journal Quality List. This shows qualitative publications in the relevant journals. Journal of Banking and Finance published 67 articles related to the Basel norms and publications, followed by Journal of Financial Regulation and Compliance (39), Journal of Banking Regulation (31), Bank and Bank Systems (24), and so on. Journal of Banking and Finance published almost more than five times Economic Modelling, which ranks 10th in the most relevant sources of publications on Basel norms, showcasing the major contribution of the former in the field of Banking and its prevailing norms Table 9.

| Table 9 Most Relevant Sources of Publications on Basel Norms | ||

| Sources (I) | Category (II) | Articles (III) |

| Journal of Banking And Finance | A* | 67 |

| Journal of Financial Regulation and Compliance | C | 39 |

| Journal of Banking Regulation | C | 31 |

| Banks and Bank Systems | C | 24 |

| Journal of Financial Stability | A | 23 |

| Journal of Financial Services Research | A | 18 |

| International Review of Financial Analysis | A | 17 |

| Journal of Risk Finance | B | 15 |

| Journal of Risk Model Validation | C | 15 |

| Economic Modelling | A | 12 |

| Source: (I) and (III) Researchers’ calculations using Bibliometrix package of R Software; (II) ABDC Journal Quality List 2019 | ||

In terms of publications, topmost research articles explore the features of Basel norms, their practicality, and different approaches to attain maximum benefits of precautionary features of Basel norms (Table 10). The table depicts citation-wise manuscripts on Basel norms Table 10.

| Table 10 Citations-Wise Manuscripts on Basel Norms | ||||||

| S.No | Title | Year | Journal Title | Category | Total Citations | Total Citations per year |

| 1 | Modelling credit risk for SMEs: Evidence from the U.S. Market | 2007 | Abacus | A | 204 | 14.57 |

| 2 | A neutral network approach for credit risk evaluation | 2008 | Quarterly Review of Economics and Finance | B | 123 | 9.46 |

| 3 | International evidence on the impact of regulations and supervision on banks' technical efficiency: An application of two-stage data envelopment analysis | 2008 | Review of Quantitative Finance and Accounting | B | 123 | 9.46 |

| 4 | Setting the rules: Private power, political underpinnings, and legitimacy in global monetary and financial governance | 2008 | International Affairs | A | 118 | 9.08 |

| 5 | Procyclicality in Basel II: Can we treat the disease without killing the patient? | 2006 | Journal of Financial Intermediation | A* | 118 | 7.87 |

| 6 | The impact of banking regulations on banks' cost and profit efficiency: Cross-country evidence | 2009 | International Review of Financial Analysis | A | 114 | 9.5 |

| 7 | The cyclical behaviour of European bank capital buffers | 2008 | Journal of Banking and Finance | A* | 111 | 8.54 |

| 8 | Does macro-prudential regulation leak? Evidence from a UK policy experiment | 2014 | Journal of Money, Credit and Banking | A* | 102 | 14.57 |

| 9 | Capital regulation and monetary policy with fragile banks | 2013 | Journal of Monetary Economics | A* | 102 | 12.75 |

| 10 | The bank lending channel : Lessons from the crisis | 2011 | Economic Policy | A | 100 | 10 |

Table 11 describes the most relevant author keywords that represent articles content (Juan et al., 2016) and keywords-plus in decreasing order of their frequency of appearance in research articles. Author keywords include the name of the regulations, i.e., Basel III and Basel II, their features, namely, credit risk, risk management, value at risk, regulation, capital requirements, the operational risk that applies to Banks for facing the financial crisis. Keywords-plus are more broadly descriptive in nature (Juan et al., 2016). Therefore, keywords-plus focus more on broader parameters, namely, risk assessment, risk management, risk perception in the banking adhering regulatory framework, credit provision, capital in the financial crisis while following Basel II norms Table 11.

| Table 11 Most Relevant Keywords of Publications on Basel Norms | ||||

| S.No. | Author Keywords (De) | Articles | Keywords-Plus (Id) | Articles |

| 1 | Basel III | 201 | Banking | 67 |

| 2 | Basel II | 197 | Risk Assessment | 57 |

| 3 | Credit Risk | 77 | Risk Management | 26 |

| 4 | Risk Management | 63 | Basel II | 24 |

| 5 | Banks | 57 | Regulatory Framework | 23 |

| 6 | Value At Risk | 57 | Financial System | 22 |

| 7 | Regulation | 54 | Credit Provision | 20 |

| 8 | Capital Requirements | 47 | Financial Crisis | 20 |

| 9 | Financial Crisis | 40 | Capital | 18 |

| 10 | Operational Risk | 40 | Risk Perception | 18 |

| Source: Authors Calculations using Bibliometrix package of R Software | ||||

Basel norms brought many changes in the ways of managing and mitigating risk while maintaining growth and financial stability. Various researchers tried to find different ways of the application of these norms towards financial growth and stability. However, more productive authors focussed on different facets of these norms in either different economies or different financial sectors. Michael Mcaleer, Teodosio PEREZ- Amaral, and Juan-Angel Jiminez- Martin collectively worked on the management of risk under the basel regime and to forecast value-at-risk of VIX futures; VaR using stochastic dominance, and ten commandments to optimize daily capital charges and value-at-risk. Janine Mukuddem-Petersen and Mark A Petersen collectively worked on the liquidity measures, asset securitization of Basel III, capital adequacy ratio of banks, and exacerbation of sub-prime crisis by capital regulation with the optimal auditing for the banking industry. Gerda Van Vuuren focussed on the impact of Basel II norms on the South African economy. With the changes brought by the basel III norms, the researchers’ focus shifted to the features of Basel III norms, i.e., countercyclical capital buffer, counterparty valuation adjustments, regulatory treatment for liquidity risk, and economic capital for credit risk, whereas Kolade Sunday Adesina focussed on the Net stable funding ratio and liquidity capital requirements’ impact on the bank lending growth, the regulatory capital buffer on the business cycle fluctuations. Petr Teply focussed on the implications of Basel norms on the banking sector of the European economy, i.e., profitability and risk management, operational risk mitigation, level of capital, key challenges of new regulations.

Most productive authors can be ascertained by the total number of articles published by them. The other method could be the fractional counting method. In this method, the author's contribution is calculated by the fraction allotted to the co-author, with the overall weight being one for the publication (Perianes-Rodriguez, 2016). Table 12 reports the top authors by the number of publications and, according to the article fractionalized too to ascertain the most productive authors Table 12.

| Table 12 Most Productive Authors of Publications on Basel Norms | ||||

| S.No. | Authors | Articles | Authors | Articles Fractionalized |

| 1 | Mukuddem- Petersen J | 10 | Tepl P | 4.17 |

| 2 | Petersen MA | 10 | Van Vuuren G | 4.03 |

| 3 | Mcaleer M | 9 | Herring RJ | 4.00 |

| 4 | Van Vuuren G | 9 | Kanas A | 4.00 |

| 5 | Prez- Amaral T | 8 | Kiefer NM | 4.00 |

| 6 | Tepl P | 8 | Mcaleer M | 3.23 |

| 7 | Jimenez- Martin JA | 5 | Handorf WC | 3.00 |

| 8 | Tarazi A | 5 | Sais FF | 3.00 |

| 9 | Adesina KS | 4 | Swamy V | 3.00 |

| Source: Bibliometrix package of R Software | ||||

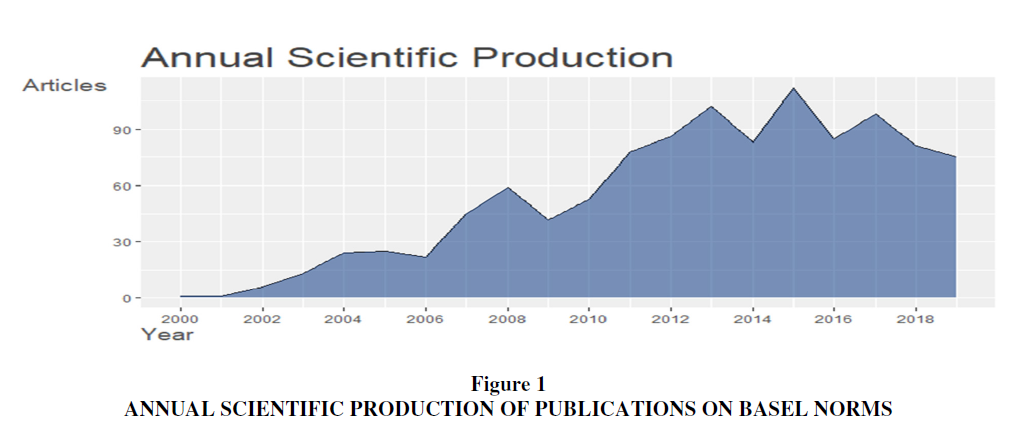

Figure 1 show clearly that the annual production of Basel related articles increased after the global financial crisis and in between drafting Basel III guidelines. The reasons could be explained by the more stringent rules and regulations regarding Basel III, which garnered the interest of authorities and researchers for the various implications, practicalities, and loopholes of the new revolutionary system Figure 1.

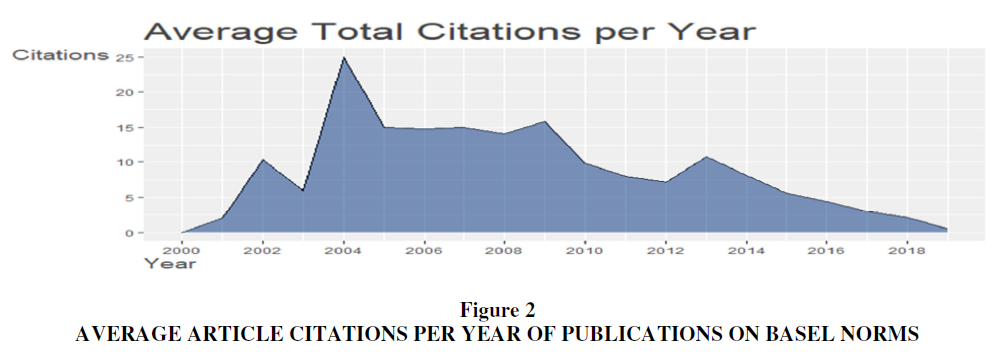

Figure 2 portrays three peaks in 2004, 2009, and 2013. The underlying reasons could be explained through the happening of events- Basel II applicability, global financial crises, and Basel III implications, respectively Figure 2.

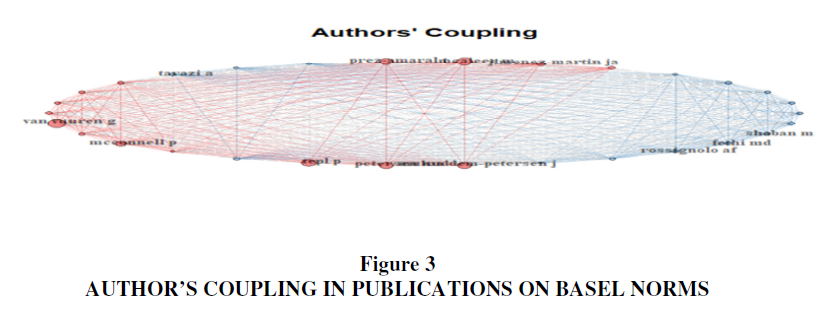

Authors’ Coupling

Authors' coupling can be defined as two authors being cited in a third author's work together, showing a common link between the works of these authors. In the following diagram, the coupling of authors is shown for 30 authors with ten vertices to plot for the author's coupling. Generally, research articles with fewer references tend to be coupled weakly in terms of bibliography, if the coupling strength is measured through a number of references only. To overcome this hindrance, a relative measure of coupling is used. In this, association strength is measured through normalizeSimilarity function, which uses either Jaccard or Salton similarity to see the association among the vertices of a network Figure 3.

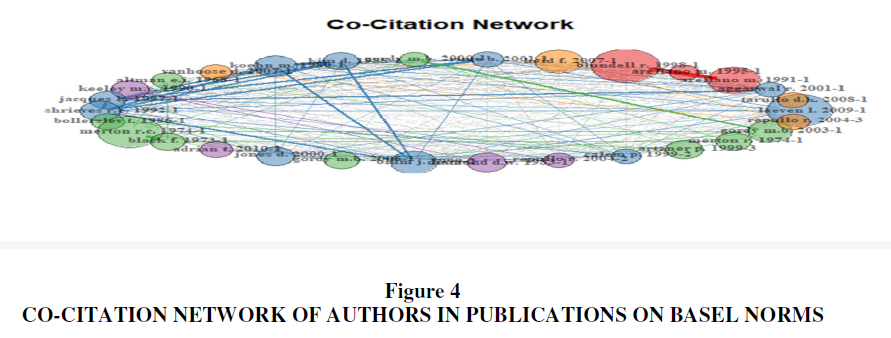

Figure 4 explains how authors co-cited each other's work on the basis of some common elements Figure 4.

Co-Word Analysis

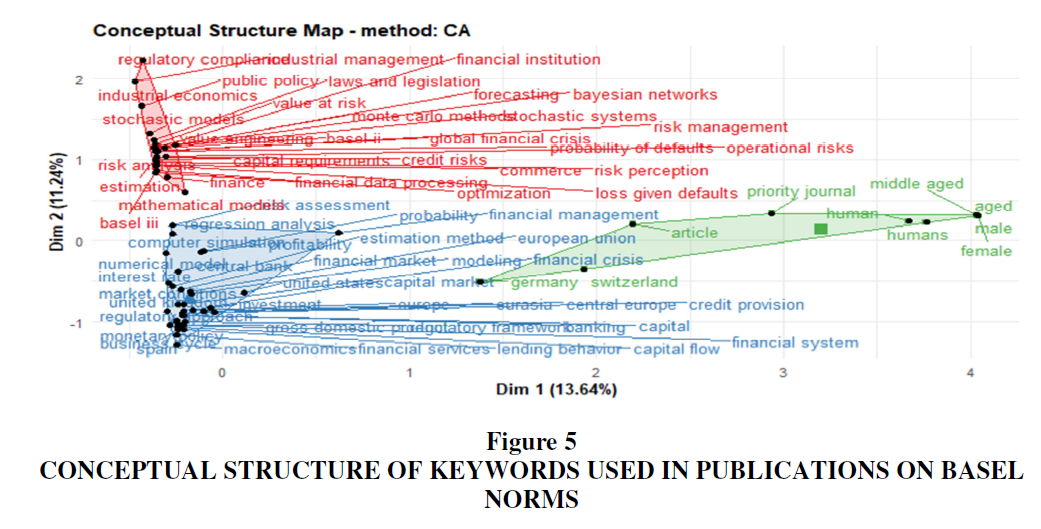

The conceptual structure of Basel

In the study, the co-word analysis aims to find a conceptual structure of Basel norms using the co-occurrences of keywords in the available literature. The dimension reduction techniques are used for the analysis. It could range from multidimensional scaling (MDS) to multiple correspondence analysis (MCA) to correspondence analysis (CA). In the present study, CA is used to create a conceptual structure map. It involves carrying out correspondence analysis of a scientific field to structure a conceptual map. It makes clusters using a bipartite network for terms extracted from title, abstract, or keywords. For this, the standard field is chosen. In this sample, the researchers chose "ID," i.e., Keywords Plus, associated with Scopus. Clusters selected are three in number, which identifies documents expressing common concepts and place them according to a cluster. Stemming is chosen to be false so as to not apply Porter's Stemming algorithm to all extracted terms. In this study, results are plotted on a two-dimensional map Figure 5.

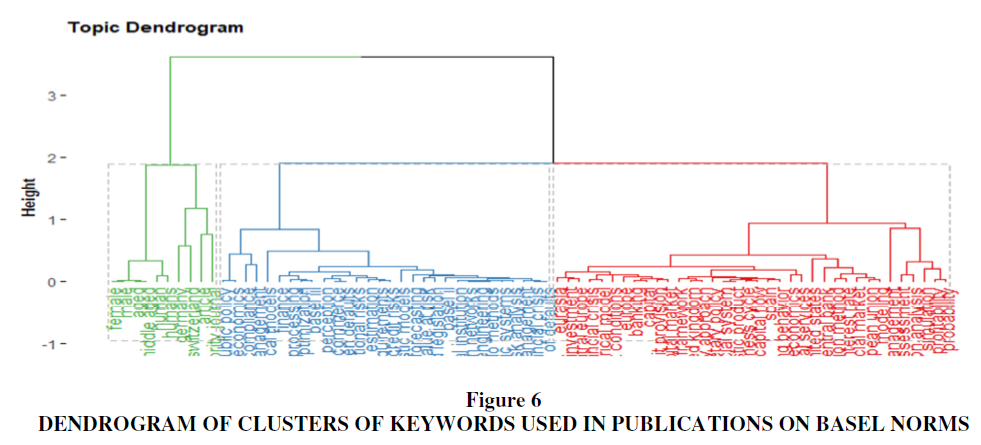

The clusters can be better understood through the dendrogram, which is represented in the form of tree diagram showing clades (branches) and leaves (single, double, and triple). The more similar keywords are placed close in height to each other. The following dendrogram is shown to represent three clusters of keywords showing similarity among them Figure 6.

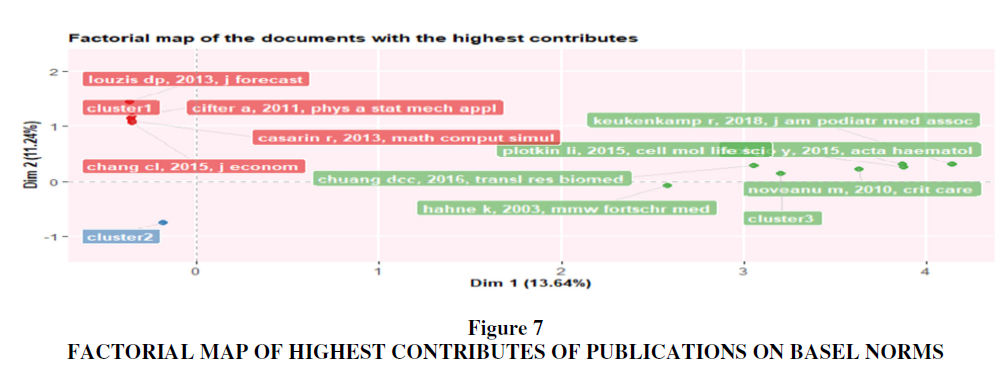

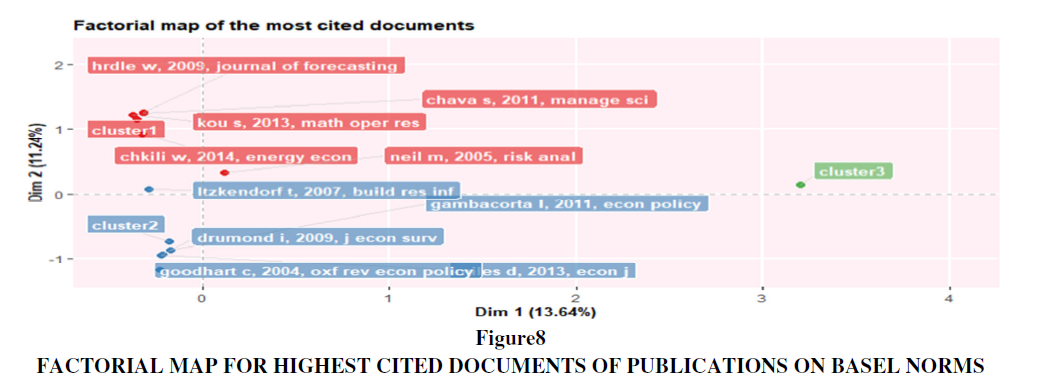

The documents of the highest contribute are shown in Figure 7 whereas the highest cited documents in the above-mentioned clusters are shown in Figure 8.

Table 13 encapsulates concepts of the conceptual map found through correspondence analysis succinctly to make it easier to understand (Jackendoff, 1992) Table 13.

| Table 13 Conceptual Structure of Keywords Used in Publications on Basel Norms | ||

| Cluster I | Cluster II | Cluster III |

| Regulatory Compliance | Article | Risk Assessment |

| Industrial Management | Priority Journal | Financial Management |

| Industrial Economics | Middle Aged | Regression Analysis |

| Public Policy | Male | Probability |

| Stochastic Models | Female | Computer Simulation |

| Value-at-Risk | Aged | Profitability |

| Risk Analysis | Human | Central Bank |

| Estimation | Humans | Interest Rate |

| Credit Risks | Switzerland | Estimation Method |

| Risk Perception | Germany | Financial Market |

| Optimization | European Union | |

| Mathematical Models | Financial Crisis | |

| Laws and Legislations | United States | |

| Forecasting | Modeling | |

| Financial Institution | Numerical Model | |

| Monte Carlo Methods | Capital Market | |

| Value Engineering | Market Conditions | |

| Basel II | Credit Provision | |

| Stochastic Systems | Monetary Policy | |

| Global Financial Crisis | United Kingdom | |

| Risk Management | Business Cycle | |

| Operational Risks | Investent | |

| Probability of Defaults | Europe | |

| Commerce | Eurasia | |

| Capital Requirements | Central Europe | |

| Financial Data Processing | Banking | |

| Loss Given Defaults | Capital | |

| Basel III | Regulatory Approach | |

| Finance | Gross Domestic Approach | |

| Regulatory Framework | ||

| Financial System | ||

| Lending Behavior | ||

| Spain | ||

| Financial Services | ||

| Macro economics | ||

The shift of focus of keywords is explained in Table 14, showing a shift of focus due to the changing regulations. As the regulations change over time, the shift of focus can be felt through changed keywords. After the financial crisis, requirements change from the capital requirements and credit risk to include features of Basel III norms as and when they were being applied to the banking sector of different economies due to their timeline. The shift of focus can be seen from the Net stable funding ratio (NSFR), liquidity coverage ratio (LCR) from 2014 to 2016, as the timeline of implementation of these features of Basel III for the banking sector came closer. Therefore, researchers' focus shifted from risk and capital regulation to implementation and implications of NSFR and LCR on their respective economies Table 14.

| Table 14 Shift of Focus of Keywords Used in Publications on Basel Norms Over the Years | |||

| 2010 | 2012 | 2014 | 2016 |

| Basel II | Banks | Bank Capital | Basel III |

| Capital Requirements | Risk Management | Bank Regulation | Basel |

| Credit Risk | Capital Adequacy | Capital | Financial Stability |

| Regulatory Capital | Economic Capital | Capital Regulation | Financial Crisis |

| Financial Regulation | Risk | Net Stable Funding Ratio | |

| Banking | Bank | Liquidity Coverage Ratio | |

| Bank Capital | Liquidity Risk | ||

| Procyclicality | Value-at-Risk | ||

| Basel Accord | Regulation | ||

| Market Risk | |||

| Banking Regulation | |||

| Source: Researchers’ calculations via VOS Viewer | |||

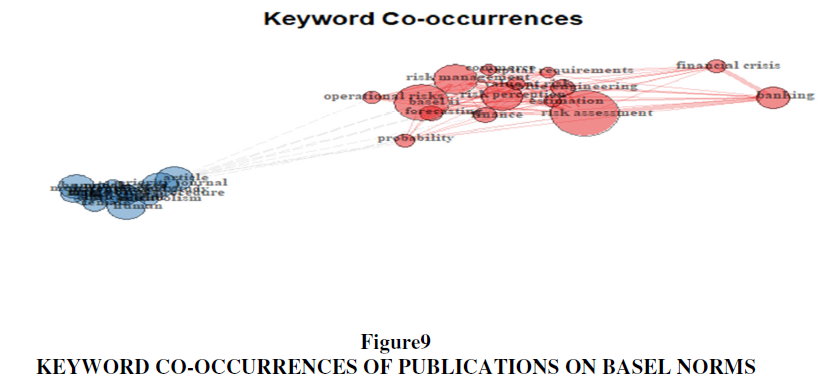

The keyword co-occurrences regarding the terms used in Basel are explained through the figure 9. Figure 9 explains how risk management, risk assessment along with risk perception, banking, financial crisis occur with operational risks, value at risk, value engineering with the probability and estimation in the field of finance and commerce to understand basel Figure 9.

Ethics

Due to the secondary nature of the data, i.e., available published research, none of the authors was contacted for ethics approval. No clarification or further information for the data was obtained from the authors in Table 15.

| Table 15 Abbreviations | |

| Abbreviations | |

| ABDC | Australian Business Deans Council |

| BCBS | Basel Committee on Banking Supervision |

| CA | Correspondence Analysis |

| De | Author Keywords |

| Id | Keywords-Plus |

| LCR | Liquidity Coverage Ratio |

| NSFR | Net Stable Funding Ratio |

| MCA | Multiple Correspondence Analysis |

| MCP | Multiple Country Publications |

| MDS | Multidimensional Scaling |

| SCP | Single Country Publications |

| UK | United Kingdom |

| USA | United States of America |

Conclusion

Publications related to Basel norms have increased steadily after the global financial crisis and reaching peaks in 2013 and 2015. The USA rose as the highest contributor to relevant articles published. The United Kingdom rose as the highest contributor to multiple-authored documents and citations. The top ten journals that published relevant articles are listed in ABDC rankings giving an aura of credibility to them. The top ten cited documents are also published in journals listed in ABDC journals. The shift of focus of keywords during the period reflects changes in the basel norms showing a pattern. This will help researchers to know about the shift of focus and give them a future direction on testing the waters for the new and evolved regulations for Abbreviations.s

References

- Aria, M. & Cuccurullo, C., (2017). bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics, 11(4), pp.959-975.

- Åström, F., (2002). Visualizing library and information science concept spaces through keyword and citation based maps and clusters. In Emerging frameworks and methods: Proceedings of the fourth international conference on conceptions of Library and Information Science (CoLIS4) (pp. 185-197). Greenwood Village: Libraries Unlimited.

- Australian Business Deans Council (2019), 2019 ABDC Journal Quality List, Australian Business Deans Council, viewed on 03 March 2020, < https://abdc.edu.au/research/abdc-journal-list/>

- Bank, B., (2010). Guidelines on Risk Based Capital Adequacy: Revised Regulatory Capital Framework for Banks in line with Basel II. Bangladesh Bank.

- BCBS (2019), Sixteen progress report on adoption of the Basel regulatory framework, BIS, viewed on 31 May, 2019 , < https://www.bis.org/bcbs/publ/d464.htm >

- BCBS (1988), International Convergence of Capital Measurement and Capital Standards, BIS, viewed on 29 December 2019, < https://www.bis.org/publ/bcbs04a.pdf>

- BCBS (1996), Amendment to The Capital Accord to Incorporate Market, BIS, viewed on 25 December 2019, < https://www.bis.org/publ/bcbs24.pdf>

- BCBS 2004, Internal Convergence of Capital Measurement and Capital Standards: A Revised Framework, BIS, viewed on 29 December 2019, < www.bis.org/publ/bcbs107a.pdf>

- BCBS (2011), Basel III: A global regulatory framework for more resilient banks and banking systems, BIS, viewed on 24 December 2019, < https://www.bis.org/publ/bcbs189.pdf>

- Benckendorff, P. & Zehrer, A., (2013). A network analysis of tourism research. Annals of Tourism Research, 43, pp.121-149.

- Bichteler, J.& Eaton III, E.A., (1980). The combined use of bibliographic coupling and cocitation for document retrieval. Journal of the American Society for Information Science, 31(4), pp.278-282.

- Callon, M., Courtial, J.P. and Laville, F., 1991. Co-word analysis as a tool for describing the network of interactions between basic and technological research: The case of polymer chemsitry. Scientometrics, 22(1), pp.155-205.

- Chang, Y.W., Huang, M.H. & Lin, C.W., (2015). Evolution of research subjects in library and information science based on keyword, bibliographical coupling, and co-citation analyses. Scientometrics, 105(3), pp.2071-2087.

- Cobo, M.J., López-Herrera, A.G., Herrera-Viedma, E. and Herrera, F., 2011. An approach for detecting, quantifying, and visualizing the evolution of a research field: A practical application to the fuzzy sets theory field. Journal of informetrics, 5(1), pp.146-166.

- Culnan, M.J., (1986). The intellectual development of management information systems, 1972–1982: A co-citation analysis. Management science, 32(2), pp.156-172.

- De Bellis, N., (2009). Bibliometrics and citation analysis: from the science citation index to cybermetrics. scarecrow press.

- De Waal, B., Petersen, M.A., Hlatshwayo, L.N. and Mukuddem-Petersen, J., (2013). A note on Basel III and liquidity. Applied Economics Letters, 20(8), pp.777-780.

- Ding, Y., Chowdhury, G.G. and Foo, S., (2001). Bibliometric cartography of information retrieval research by using co-word analysis. Information processing & management, 37(6), pp.817-842.

- Gatzert, N. and Wesker, H., 2011. Managing longevity risk under adverse selection: the influence of policyholder age and contract duration. Zeitschrift für die gesamte Versicherungswissenschaft, 100(5), pp.695-706.

- Grant, J., Cottrell, R., Cluzeau, F. and Fawcett, G., (2000). Evaluating “payback” on biomedical research from papers cited in clinical guidelines: applied bibliometric study. Bmj, 320(7242), pp.1107-1111.

- Harzing, A.W. and Alakangas, S., (2016). Google Scholar, Scopus and the Web of Science: a longitudinal and cross-disciplinary comparison. Scientometrics, 106(2), pp.787-804

- He, Q., 1999. Knowledge discovery through co-word analysis.

- Jones, E. and Knaack, P., (2019). Global financial regulation: Shortcomings and reform options. Global Policy, 10(2), pp.193-206.

- Köseoglu, M.A., Sehitoglu, Y. and Craft, J., (2015). Academic foundations of hospitality management research with an emerging country focus: A citation and co-citation analysis. International Journal of Hospitality Management, 45, pp.130-144.

- Jackendoff, R., 1992. Semantic structures (Vol. 18). MIT press.

- Lastra, R.M., 2004. Risk-based capital requirements and their impact upon the banking industry: Basel II and CAD III. Journal of Financial Regulation and Compliance, 12(3), pp.225-239.

- Leydesdorff, L., (1997). Why words and co‐words cannot map the development of the sciences. Journal of the American society for information science, 48(5), pp.418-427.

- Luppi, B., Marzo, M. & Scorcu, A.E., (2008). Credit risk and Basel II: are nonprofit firms financially different?. Applied Financial Economics Letters, 4(3), pp.199-203.

- Lyngen, N., (2012). Basel III: dynamics of state implementation. Harv. Int'l LJ, 53, p.519.

- Pasadeos, Y., Phelps, J. and Kim, B.H., (1998). Disciplinary impact of advertising scholars: Temporal comparisons of influential authors, works and research networks. Journal of Advertising, 27(4), pp.53-70.

- Perianes-Rodriguez, A., Waltman, L. & Van Eck, N.J., 2016. Constructing bibliometric networks: A comparison between full and fractional counting. Journal of Informetrics, 10(4), pp.1178-1195.

- Pritchard, A., 1969. Statistical bibliography or bibliometrics. J. Doc. 25 (4), 348–349.

- Riera, M. and Iborra, M., (2017). Corporate social irresponsibility: Review and conceptual boundaries. European Journal of Management and Business Economics.

- Rizvi, N.U., Kashiramka, S. and Singh, S., (2018). Basel I to Basel III: Impact of credit risk and interest rate risk of banks in India. Journal of Emerging Market Finance, 17(1_suppl), pp.S83-S111.

- Schwerter, S., (2011). Basel III's ability to mitigate systemic risk. Journal of financial regulation and compliance.

- Sheng, A., (2013). Basel III and Asia.

- Small, H., (1973). Co‐citation in the scientific literature: A new measure of the relationship between two documents. Journal of the American Society for information Science, 24(4), pp.265-269.

- Small, H.G., (1978). Cited documents as concept symbols. Social studies of science, 8(3), pp.327-340.

- Su, H.N. and Lee, P.C., (2010). Mapping knowledge structure by keyword co-occurrence: a first look at journal papers in Technology Foresight. Scientometrics, 85(1), pp.65-79.

- Uprety, C.P., (2013). Basel III implementation: challenges and opportunities in Nepal. Basel III Implementation: Challenges and Opportunities, pp.237-275.

- van Raan, A.F., (2005). For your citations only? Hot topics in bibliometric analysis. Measurement: interdisciplinary research and perspectives, 3(1), pp.50-62

- Vogel, R. and Güttel, W.H., (2013). The dynamic capability view in strategic management: A bibliometric review. International Journal of Management Reviews, 15(4), pp.426-446.

- Waltman, L. and Van Eck, N.J., (2013). A smart local moving algorithm for large-scale modularity-based community detection. The European physical journal B, 86(11), p.471.

- Whittaker, J., (1989). Creativity and conformity in science: Titles, keywords and co-word analysis. Social Studies of Science, 19(3), pp.473-496.

- World Bank (2019), World Bank Country and Lending Groups, World Bank, viewed on 09 April 2020, <https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups>

- Yuksel, M., (2018). A Decade of Post-crisis G20 Financial Sector Reforms. RBA Bulletin, June, viewed, 30.

- Zhang, J., Yu, Q., Zheng, F., Long, C., Lu, Z. and Duan, Z., (2016). Comparing keywords plus of WOS and author keywords: A case study of patient adherence research. Journal of the Association for Information Science and Technology, 67(4), pp.967-972.