Research Article: 2019 Vol: 22 Issue: 1

Audit Pricing Determinants in the Jordanian Banking Sector: Transaction Cost Perspective

Amal Hasan, Hashemite University

Abstract

The study aimed to investigate the relationship between TC and audit pricing after controlling other determinants. It redounds on how the control variables (firm size, firm financial performance, firm capital structure, and firm complexity) will impact audit pricing. Moreover, it aimed to understand the need to reduce the TC and how this will impact audit pricing. In addition to content analysis, the study relied on a quantitative approach to examine the impact of TC on audit pricing. This approach includes numeric data collection and the research’s tendency to use mathematical models as the methodology of data analysis for the period between 2007and 2016. The study revealed that interest expenses and other expenses have reflected a statistically significant impact on audit pricing. The aforementioned expenses are expected to have a high impact on audit pricing as these require extra effort from the auditor, which leads the latter to imposing high audit pricing. The study indicated that bank size is the main determinant of audit pricing and that it has a statistically positive significant impact on audit pricing, In terms of the effect of financial performance on both audit pricing and TC, the study indicated that financial performance affect both audit pricing and TC negatively. Moreover, the study revealed that the negative significance of receivables can be attributed to the same reason as that of capital structure as a strong control over receivables showed the importance of internal control that could decrease audit pricing, Finally, the study concluded that the variables found to highly affect audit pricing-interest expense as a direct TC and other expenses as indirect TC-should be added to the audit pricing model. Besides, firm size, capital structure and complexity could be taken in consideration as control variables for examining both TC and audit pricing.

Keywords

Audit Pricing, Transaction Cost, Banking System, Financial Performance.

Introduction

Auditing plays an essential role in economic growth; it is recognized as one of the factors that interfere with every business and sector around the world. Transaction Cost (TC) is the basic tool used by each business organization to come up with its work, as nothing will be achieved without transactions between the firm and its customers and suppliers. In addition, TC has been widely studied (Coase, 1960; Wallis & North, 1986; Zylbersztajn, 2003; Lv et al., 2012; Polski, 2001; Shibli, 2014; Simunic, 1980). Recent management theories have paved the way for profit expansion, which is the traditional aim to ensure dispute resolution between shareholders and managers. In addition, they reduce the effect of external constraints of markets, particularly in the capital market, where agency contracts and transactions need clarifications. Moreover, the increases in technology, institutions, and trade between the firm’s costs have been increased to be called TC. (Coase, 1937).

Based on Swanson (2008), auditing in the banking sector includes testing transactions, conducting interviews with clients, and monitoring and evaluating the internal control of banks. In terms of audit service pricing, which consists of numerous amount of major expenditures, the huge amounts are due to the requirements of the established criteria. Simunic (1980) published the first original work on building a model for the purpose of controlling the determinants of audit quality and price factors. He assumed that both audited and auditor seeks to maximize their expected profits, taking into consideration the size of the client issue with respect to the overall model. Many studies use the Simunic model as a reference in developing a model for audit pricing determinants with some modifications according to the situation (Baldacchino et al., 2014; Hay et al., 2006; Al-Haq & Leghari, 2015; Kikhia, 2015; Soyemi & Olowookere, 2013).

Consequently, the present study focuses on the TC value as a vital element that provides firms with a vision of the cost sum and its impact on audit pricing. It is important to keep track of the evolution of and change in the market context and all the challenges that firms are facing, which affect firm transactions and the auditing process. In addition, the current study attempts to contribute to the literature in the field of TC and fill the gap in audit pricing literature in developing countries, particularly Jordan. Furthermore, this study aims to provide a view of the present value of TC, particularly in the banking sector.

Finally, the significance of the study lies in its addition to the Jordanian empirical research on the importance of TC and the literature on auditing, in general, by investigating the impact of TC on audit pricing. Eventually, the main objective of this research is to add to the knowledge on this subject as well as improve the understanding of TC, along with its impact on audit pricing in the Jordanian banking sector. Moreover, examining closely the attention given to the effect of TC on audit pricing, it shows that majority of the literature is devoted to audit pricing and separate TC issues. Nevertheless, a lesser part is devoted to the relationship between TC and audit pricing in general, and this phenomenon particularly exists in developing countries such as Jordan.

Research Problem And Objectives

The study will be a significant endeavour in investigating the relationship between TC and audit pricing after controlling other determinants. It redounds on how the control variables (firm size, firm financial performance, firm capital structure and firm complexity) will impact audit pricing. Moreover, it aims to understand the need to reduce the TC and how this will impact audit pricing.

The control variables are based on literature so that the suitable variables, which are most appropriate for the Jordanian banking environment, can be selected. At present, Jordan possesses insufficient knowledge on TC measurement because of the lack of previous studies on TC and its impact on audit pricing. Therefore, this is an area that should be investigated.

Literature Review

TCs have a significant relationship with economic growth, just like the industrial revolution that occurred in 18th century Britain. The suggested reason behind it is the specialization that depends on trade and trade that depends on low TC (Mlodkowski & Bywaters, 2012). For banking institutions, TC reflects the cost of economy inside and outside the firm. It refers to the required resources to transmit one unit of currency from a saver to a borrower (Meyer & Cuevas, 1990). Moreover, Augusto & Souza (2015) focused on the TC Economic (TCE), with regard to the micro analytical level of new institutional economics a micro level assumption that transactions are the basic unit to be analysed to know the institutionalized relation among different parties. Based on researcher knowledge, there has been no in-depth discussion on TC in Jordan. Omet (2001) provides a measure of TCs in Amman Stock Exchange (ASE). In the aforementioned study, TCs were divided into two types when dealing with financial securities commission fees and marketability (liquidity) cost. These costs are unavoidable, as investors can only trade through the agency of a stockholder. Other studies (Huang et al., 2015; Bell, 2010; Chadwick, 2006; Twight, 1988) also indicated that TC is an unavoidable cost.

Furthermore, financial TC is generally high in developing countries because of the high costs imposed on small loans. Banking institutions imply that TC may be approached on a macroeconomic or a microeconomic level. In other words, it is called interest and non-interest expenses. The need for auditing in Jordan has drastically increased to ensure the integrity of financial statements, which affect the decision-making process. Several studies have been conducting audit profession and audit pricing to highlight its importance, particularly with the increase of accounting practices (Kikhia, 2015; Defondand & Zhang, 2014; Lv et al., 2012; Al-Farah et al., 2015).

El-Said & McDonald (2002) have argued that TC in Jordan is high, inferring that the high TCs is due to a tribal mentality among locals and is the culprit behind restricting business processes. Such mentality is a widely diffused approach in Jordan—personalized ennobling or hiring a middleman who holds decision-making power. The attitude of the Jordanian people of postponing today’s work for tomorrow is also another reason. From their point of view, all the aforementioned are sources for high TC in Jordan, and the reason for investment in the country is different from others due to the long time needed for processing a business.

In terms of TC measurements, several studies were conducted (Weber et al., 2010; Shankar, 2007; Elena, 2014; Polski, 2001; Horngren et al., 2015; D’Hondt & Giraud, 2008) as different methods were introduced to measure TC. Fabozzi (2009) provided two types of classifying TC in terms of trading. First, in terms of explicit and implicit costs where explicit costs consist of brokerage commissions and taxes, as well as implicit costs that include market impact costs “the costs that investors pay for obtaining liquidity in the market.” Second, in terms of variable or fixed costs, where fixed costs are the commission and trading fees and variable costs, and where taxes and all implicit costs are variable. The second classification was also taken in considered by Furubton & Richter (2005). Below is the basic model that Collins & Fabozzi used:

TCs=fixed costs+variable costs

Where,

Fixed costs=Commission+transfer fees+taxes.

Variable costs=Execution costs+opportunity costs.

Execution costs=Price impact+market timing costs.

Opportunity costs=Desired returns-actual returns-execution costs-fixed costs.

Wander (2013) also divides TC into fixed and variable TC. Fixed costs are the setup costs that enable an alternative contractual choice to be offered, while variable costs represent all expenditures that occur during the contractual choice. In addition, Hall & Mustika (2005) reported that transactions of a firm include the contractual configuration of production factors, while markets involve the contractual configuration of outputs. Moreover, measuring TC requires a distinction among attributable costs, costs of transactional activities with net benefits, and costs of transactional activities with net costs during a given period. It should be noted that application may cause confusion in terms of measuring TC precisely (Lawson, 2009). Lv et al. (2012) introduced and measured TC in two main aspects macro and micro. The macro aspect discusses cost with regard to the interaction between TC and economic growth. They referred to Wallis & North (1986) in building the measurement model. On the other hand, the micro aspect consists of measuring the buy sell price transaction.

In Jordan, Omet (2001) conducted a study to provide a measure of TCs in the ASE and to examine its determinants. The study indicated that the trading cost in ASE is high for some of the listed stocks and that trading volume and price volatility are significant determinant factors of this cost. Moreover, it means that TC in the Jordanian capital market is relatively high. Morrill & Morrill (2003) attempted to identify the conditions wherein organizations of which encourage internal audit participation in the external audit using insights from TC economics (transaction-specific investment). The findings indicated that audit-related specific expertise is strongly associated with internal audit participation in the external audit.

A study conducted by Al-Farah et al. (2015) focused on reviewing the social, political, and economic factors, which affect accounting and auditing professions. In addition, the study provided a discussion on the legal framework for audit in Jordan. Moreover, it sheds light on the legislation that governs financial reporting in the country. The findings indicated that the Anglo-American model is corporate governance that relies on the capital market, and the seizure impedance in it (Deakin et al., 2005) was adopted in accounting as a result of the social, political, and economic factors. Likewise, the findings show that Jordan is currently obliged to comply with the financial reporting standards and the international auditing standards.

Chu et al. (2015) examined the TCs and competition among audit firms and the study revealed that in low TCs of auditor change, the ability of the incumbent auditor to elicit economic rents from clients is limited. Conversely, high costs of changing auditors give an incumbent auditor greater pricing power. Moreover, the findings showed that the largest auditor can put the greatest competitive pressure on all other auditors operating in a market, and the pressure is a function of the size difference between the largest auditor’s operations and the size of the incumbent audit firm’s operations in a market.

Another study carried out by Habib et al. (2015) mentioned that the related-party transactions are associated with higher audit pricing. In addition, the findings showed that audit pricing is lower in terms of operating related-party transactions though they are higher in terms of loans. Besides, the study showed that audit pricing is lower for related-party transactions when conducted in more competitive industries. Auditee risk and auditee size are the major determinants of audit pricing. On the other hand, the study stated a negative, significant relationship between financial risks and levels of external audit pricing, while the audit tenure shows no significant relationship with audit pricing (Kikhia, 2015). Similarly, Baldacchino et al. (2014) indicated that the amount of external fees is significantly influenced by audit client size, complexity, and risk. Based on a study by El-Gammal, (2012) it was revealed that client size, client complexity, client risk, auditor size, experience, reputation, competition, industry specialization, and the big four are the main factors that significantly affect audit pricing. Revealing another characteristic is a study that examined the impact of International Financial Reporting Standards (IFRS) adoption on audit pricing; it indicated that the following variables explain the level of audit pricing, client size, operational complexity, and the various aspects of risks. In addition, the researchers developed a new variable goodwill. In addition, the results indicated that the adoption of IFRS increased audit pricing for Jordanian-listed industrial companies in the IFRS-compliant period (Abu & Al-Saeed, 2014). A study conducted in order to measure TCs in banking by Elena (2014) showed that when the cost of the funds goes up (interest expense), banking institutions look to reduce the information and coordination cost (noninterest expense).

Audit pricing and firm performance was examined by Moutinho et al. (2012). The study indicated a negative relationship between firm performance and audit pricing. In short, based on researcher’s knowledge, there has been no in-depth investigation of TC measurement in the Arab area. We established the banking sector in Jordan as the field of study of our research. Based on existing literature, Jordanian banks suffer from relatively high TC (Omet et al., 2015). In particular, the current research will be added benefits in terms of TC measurement in the Jordanian banking sector, including its impact on audit pricing. The results of the current study will reflect the significance (insignificance) of the considered relationships. Also, it will be an added value for the banking sector in Jordan. To conclude, in the current study and based on the field of study, the researcher will rely on the aforementioned measures of TC components (Elena, 2014; Polski, 2001). The equations that will be used in the current study areas below:

TC=direct TC+indirect TC

Where,

Direct TC=interest expense+accrual interest.

Indirect TC=employee expenses+depreciation

Amortization expenses+Other Expenses+accrual expenses.

These equations will be utilized in measuring audit pricing, and the researcher will conduct an in-depth investigation of the equations used in previous studies. The equation that best suits the purpose, objectives, and field of the current study would also be determined.

Existing literature (Al-Haq & Leghari, 2015; Fleischer & Goettsche, 2012; Kikhia, 2015; Aronmwan & Okafor, 2015; El-Gammal, 2012; Xu, 2011; Chu et al., 2015; Carson & Fargher, 2003) revealed that there is a positive significant relationship between audit pricing and firm size. This is due to the efforts exerted by the auditor, which increases as the company expands because large firms possess more complicated strategies, processes, transactions and procedures.

Regarding firm performance, studies showed that audit pricing is reflected by regular access to some important information about a firm’s future activities and performance. Other studies indicated that there is a strong relationship between TC and performance (Moutinho et al., 2012; Tomassen, 2004; Adam, 2014; Hamaidah, 2015; Alkhatib, 2012; Al Manaseer et al., 2012; Junarsin, 2011; Lin et al., 2011).

Firm Capital Structure (CS) has also been examined in the field of audit, such as studies concluding that CS is an indicator of a firm’s ability to meet its stockholder’s needs and its sustainability. A number of previous studies (Gilson, 1997; Bhatia et al., 2015; Ramadan & Ramadan, 2015; Meero, 2015; Mumtaz, 2013; Taani, 2013) found a positive impact of audit pricing on CS decision audit pricing proxy will be the important explanatory variable to mitigate the conflicts between managers and shareholders by issuing debt, which means that audit pricing has a positive influence on CS decision. In the case of Jordan, Gharaibeh & Al-Najjar (2007) revealed that there is a significant negative relationship between independent variables (profitability, tax, liquidity, tangible assets, and dividends) and CS (debt), and a positive relationship between size, growth rate, and market-to-book ratio with CS.

Finally, firm complexity is widely used as a determinant of audit pricing, starting with the Simunic (1980) model, which reported that the complexity appears on both high decentralization and diversifications of a financial statement that may expect loss exposure. In addition, the measurement of complexity varied from research to research, which depended on the nature of the study. Among the measurement tools used are number of subsidiaries, proportion of foreign subsidiaries, receivables to total assets, inventory to total assets, and number of transactions. Nevertheless, previous research (Ahmad & Abdullah, 2016; Kikhia, 2015; Al-Haq & Leghari, 2015; Baldacchino et al., 2014; Amba & Al-Hajeri, 2013; Xu, 2011; Simon & Taylor, 2002; Simunic, 1980) included complexity as a determinant of audit pricing and used the previous measure tools in measuring complexity. Client complexity showed a significant positive relationship with audit pricing as the higher complexity drive auditors to request for higher fees (Kikhia, 2015; Al-Haq & Leghari, 2015; Baldacchino et al., 2014). In contrast, insignificant relationship has been reviled between complexity and audit pricing by Cantoni et al. (2011). The measurement of complexity in this research will depend on the ratio of receivables to total assets.

Research Design And Methodology

Measurements of the Study Variables

Audit pricing

Audit pricing, which refers to the fees paid to the audit firm for audit service, is the dependent variable. Audit pricing values collected from the annual reports of the banks listed in ASE. Audit pricing is available in the reports as a value and used as a ratio in the current study.

Transaction cost (TC)

Defined simply, TC refers to the cost of using price mechanisms and is the independent variable. TC is classified into two categories with six elements: direct TC (interest expense and accrual interest) and indirect TC (employee expenses, depreciation and amortization, other expenses, and accrual expenses). This classification is based on the review of the most popular studies that had been conducted on TC measurements (Elena, 2014; Polski, 2001). In turn, this will be a significant contribution to the determinant of audit pricing applied to the Simunic model (Simunic, 1980).

In the current study, TC will be examined as a ratio to total assets (Elena, 2014; Polski, 2001) as it has been measured in the banking sector.

Control variables

Based on existing literature, the control variables (size, financial performance, capital structure and complexity) were examined as determinants of audit pricing, particularly in the banking sector (Ahmad & Abdullah, 2016; Castro et al., 2015; Kikhia, 2015; Amba & Al-Hajeri, 2013; El-Gammal, 2012; Simunic, 1980).

In terms of measuring the impact of the control variables on the relation between TC and audit pricing, the current study measured these variables using previous literature as the basis:

1. Bank size: Measured using the natural logarithm of total assets (Kikhia, 2015; Dogan, 2013).

2. Financial performance: The firm’s aggregate financial health through a given period (Bhunia et al., 2011) measured by Adam (2014), Dogan (2013) and Alkhatib (2012).

Return on assets (ROA)=Net income/Total assets (1)

3. Capital structure: A combination of different types of securities (long-term debt, common stock, and preferred stock) issued by a company to finance its assets as measured by Song (2005).

Debt ratio=Total liabilities/Total assets (2)

4. Complexity of the auditee operations as measured by Xu (2011) and Simon & Taylor (2002). Receivables/Total assets (3)

Research Methodology

In addition to content analysis, the current study also relied on a quantitative approach to examine the impact of TC on audit pricing. This approach includes numeric data collection and the research’s tendency to use mathematical models as the methodology of data analysis for the period between 2007and 2016.

Research Sample and Population

Until the year 2015, the number of licensed banks that operate properly in Jordan has reached 25, with 9 foreign banks and 16 local ones (Association of Banks in Jordan, 2016).

The study utilized purposive sampling as the whole population of the current study consists of a total of 25 banks, accordingly the study sample consists of 13 excluding Islamic banks and foreign banks, taking their nature in terms of interest measurement into consideration as there is a need for data comparability by considering the time horizon as the 13 banks were operated on the study period covering the years between (2007-2016). (Amman Stock Exchange Report, 2016).

Data Collection Methods

The study relied on the secondary data method as its main data sources were technical publications, books, journals, and e-journals. However, books, previous studies, and annual reports of all banks listed on the Amman Stock Exchange website were also utilized.

Research Models

The association between the dependent variable, independent variables, and control variables is examined through multiple regressions, as expressed by the following equations:

Where,

A: is the intercept.

βi: is the regression coefficients.

Xt: is the independent variable and control variables.

e: is the residual (error term).

Therefore, the regression equation is presented in the following equations; the first model describes the first sub-hypothesis:

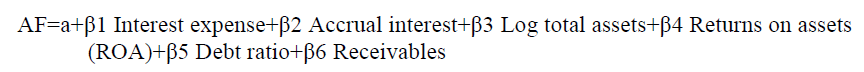

Model 1

The second model describes the second sub-hypothesis:

Model 2

AF=a+β1 Employee expenses+β2 Depreciation and amortization expenses+β3 Other expenses+β4 Accrual expenses+β5 Log total assets+β6 Returns on assets (ROA)+β7 Debt ratio+β8 receivables

The third model describes the third sub-hypothesis:

Model 3

AF=a+β1 Interest expense+β2 Accrual interest β3 employee expenses+β4 Depreciation and amortization expenses+β5 Other expenses+β6 Accrual expenses+β7 Log total assets+β8 returns of assets (ROA)+β9 Debt ratio+β10 Receivables

Research Result And Discussion

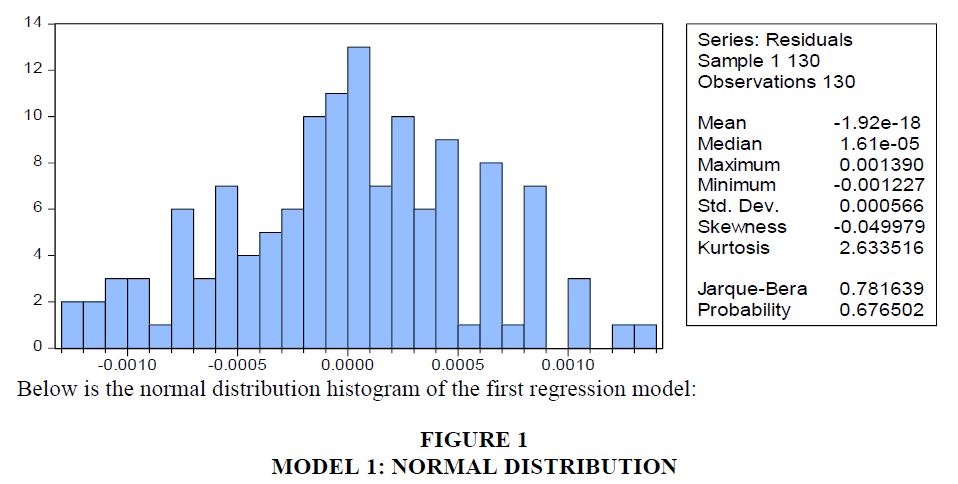

Normal Distribution for the First Model

The first model consists of direct TC (interest expense and accrual interest), in addition to the control variables.

Table 1 shows the descriptive statistics of the first model minimum, maximum, mean and standard deviation numbers for each variable. There are no missing values for all the variables. The average interest expense range is from 0.16 to 1.61, while for accrual interest the average range is from 0.019 to 0.279. For the control variables, debt ratio ranked the highest minimum and maximum values, which meant that debt ratio was considered as the lowest normal distribution. The mean refers to the distance of the values to zero; the closer the value is to zero, the more normal its distribution is.

As seen in Figure 1, the first model is almost normally distributed as the standard deviation is (0.000566) is also almost normally distributed.

| Table 1: Model 1: Descriptive Statistics | |||||

| Descriptive Statistics | |||||

|---|---|---|---|---|---|

| Variables | N | Minimum | Maximum | Mean | Standard Deviation |

| Interest expense | 130 | 0.1663 | 1.6158 | 0.618036 | 0.2842280 |

| Accrual interest | 130 | 0.0192 | 0.2791 | 0.079611 | 0.0476741 |

| Log total assets | 130 | 8.2116 | 10.8541 | 9.255770 | 0.5404853 |

| Returns on assets (ROA) | 130 | -0.17 | 2.51 | 1.3932 | 0.51933 |

| Debt ratio | 130 | 78.04 | 90.72 | 85.6163 | 2.78165 |

| Receivables | 130 | 0.04 | 0.86 | 0.4582 | 0.10625 |

| Valid N (list) | 130 | ||||

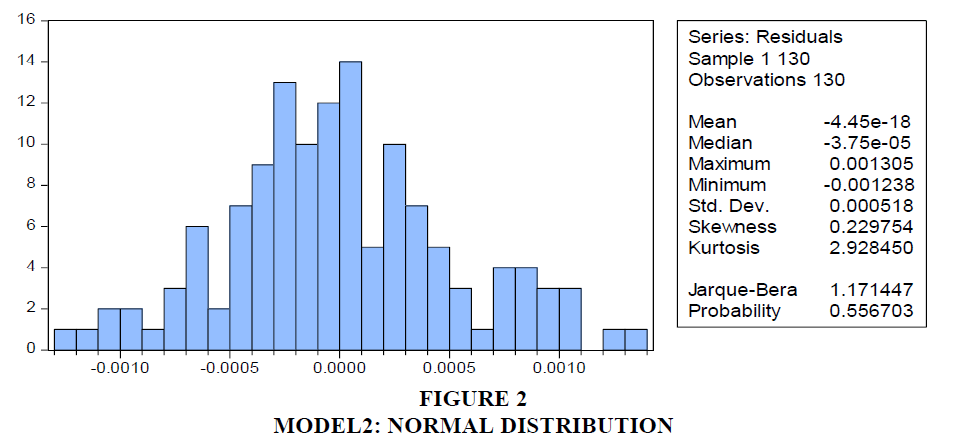

Descriptive Statistics for the Second Regression

The second model consists of indirect TC (employee expenses, depreciation and amortization expenses, other expenses, and accrual expenses) in addition to the control variables.

Table 2 shows the descriptive statistics for the second model minimum, maximum, mean, and standard deviation numbers for each variable. Similar with the first model, -0.17 is the lowest value and 10.8541 is the largest value. Among the independent variables, accrual interest has the minimum value (0.0008), while the maximum (0.4831) is in employee expenses. Like in the first model, debt ratio showed higher minimum and maximum values, which means that debt ratio is considered as the lowest normal distribution. The mean refers to the distance of the values to zero; the closer the value is to zero, the more normal its distribution is.

| Table 2: Model 2: Descriptive Statistics | |||||

| Descriptive Statistics | |||||

|---|---|---|---|---|---|

| Variables | N | Minimum | Maximum | Mean | Standard Deviation |

| Employee expense | 130 | 0.1191 | 0.4831 | 0.247268 | 0.0737859 |

| Depreciation and amortization expenses | 130 | 0.0124 | 0.1248 | 0.048441 | 0.0190254 |

| Other expenses | 130 | 0.0496 | 0.3606 | 0.175948 | 0.0530922 |

| Accrual expenses | 130 | 0.0008 | 0.0889 | 0.035628 | 0.0222715 |

| Log total assets | 130 | 8.2116 | 10.8541 | 9.255770 | 0.5404853 |

| Returns on assets (ROA) | 130 | -0.17 | 2.51 | 1.3932 | 0.51933 |

| Debt ratio | 130 | 78.04 | 90.72 | 85.6163 | 2.78165 |

| Receivables | 130 | 0.04 | 0.86 | 0.4582 | 0.10625 |

| Valid N (list) | 130 | ||||

As seen in Figure 2, the first model is almost normally distributed as the standard deviation is (0.000518) is also almost normally distributed.

Descriptive Statistics

Obtaining a broad overview of TC value in the Jordanian banking sector

This study examined the TC value for each bank for 10 years and then showed the total value of each type for all the banks excluding Islamic banks (commercial banks) in Jordanian dinars, as follows (Table 3).

| Table 3: Tc Values For The Commercial Banks | ||||

| Bank Name | Direct TC | Indirect TC | TC | |

|---|---|---|---|---|

| 1 | Jordan Kuwait Bank | 536,868,345 | 373,393,308 | 910,261,653 |

| 2 | Jordan Commercial Bank | 267,302,223 | 184,614,927 | 451,917,150 |

| 3 | The Housing Bank for Trade and Finance | 1,119,889,671 | 1,198,088,162 | 2,317,977,833 |

| 4 | Arab Jordan Investment Bank | 267,411,038 | 182,108,429 | 449,519,467 |

| 5 | Bank Al-Etihad | 462,456,295 | 240,524,547 | 702,980,842 |

| 6 | Arab Banking Corporation | 223,674,156 | 187,091,357 | 410,765,513 |

| 7 | Invest Bank | 253,060,062 | 135,895,128 | 388,955,190 |

| 8 | Capital Bank of Jordan | 465,914,228 | 240,928,442 | 706,842,670 |

| 9 | SocieteGeneraledeBanque | 156,639,401 | 87,600,945 | 244,240,346 |

| 10 | Cairo Amman Bank | 399,124,995 | 584,828,362 | 983,953,357 |

| 11 | Bank of Jordan | 374,558,888 | 467,146,541 | 841,705,429 |

| 12 | Jordan Ahli Bank | 549,845,050 | 618,764,124 | 1,168,609,174 |

| 13 | Arab Bank | 14,178,138,375 | 10,450,583,683 | 24,628,722,058 |

| Total (JOD) | 19,254,882,727 | 14,951,567,955 | 34,206,450,682 | |

Obtaining a broad overview of audit pricing in the Jordanian banking sector

The researcher collected these values from the annual reports for all the banks listed in ASE, excluding Islamic banks (commercial banks). Table 4 shows the sum of the audit pricing values for each bank for 10 years.

| Table 4: Audit Pricing Values For Commercials Banks | ||

| Bank Name | Audit Pricing | |

|---|---|---|

| 1 | Jordan Kuwait Bank | 1,811,252 |

| 2 | Jordan Commercial Bank | 817,043 |

| 3 | The Housing Bank for Trade and Finance | 3,537,427 |

| 4 | Arab Jordan Investment Bank | 972,865 |

| 5 | Bank Al-Etihad | 706,615 |

| 6 | Arab Banking Corporation | 590,189 |

| 7 | Invest Bank | 741,728 |

| 8 | Capital Bank of Jordan | 989,844 |

| 9 | SocieteGeneraledeBanque | 546,628 |

| 10 | Cairo Amman Bank | 1,463,880 |

| 11 | Bank of Jordan | 1,283,121 |

| 12 | Jordan Ahli Bank | 2,189,294 |

| 13 | Arab Bank | 12,330,000 |

| Total (JOD) | 27,979,886 | |

Testing the Research Hypothesis

Results of the multiple regression models analysis

For a model or variable to be statistically significant, the p-value (standard deviation value) should be less or equal to 0.05 (α ≤ 0.05) (Field, 2009). If the value is significant, it would strongly support the rejection of the null hypothesis, which concludes that there is no significant impact between the dependent and the independent variables.

Model 1

First sub-hypothesis

There is a statistically significant impact of direct TC on audit pricing after controlling other determinants (size, financial performance, capital structure and complexity).

The results of the first model examine the impact of direct TC on audit pricing in the presence of the control variables.

| Table 5: Model 1: Multiple Regression Analysis-Anova And Model Summary | ||||||

| ANOVAa | ||||||

|---|---|---|---|---|---|---|

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 0 | 6 | 0 | 25.241 | 0.000b |

| Residual | 0 | 123 | 0 | |||

| Total | 0 | 129 | ||||

| Model Summary | ||||||

| Model | R | R Square | Adjusted R Square | Standard Error of the Estimate | ||

| 1 | 0.745b | 0.555 | 0.533 | 0.000580124 | ||

|

a.Dependent Variable. b.Predictors: (constant), receivables, returns on assets, debt ratio, total assets, interest expense, accrual interest. |

||||||

Using Analysis Of Variance (ANOVA), Table 5 shows that the model has a high significance with F-value=25.241. As Sig=0.00, it can be inferred that the model is significant as the p-value is less than 0.05 (α ≤ 0.05). In the same table, the adjusted R squared means that some of the variance in audit pricing can be explained by each predictor. In “where, adjusted R squared reached approximately 53%,” the percentage indicates the fraction of audit pricing in the banking sector in Jordan that can be explained by the variables in Table 6.

| Table 6: Model 1: Multiple Regression Analysis-Coefficients | ||||||

| Coefficientsa | ||||||

|---|---|---|---|---|---|---|

| Model | B | Standard Error | Standardized Coefficients | T | Sig. | |

| Beta | ||||||

| 1 | (Constant) | 0.016 | 7.782 | 0.000 | ||

| D1 interest expense % | 0.001 | 0.002 | 0.214 | 2.140 | 0.034 | |

| D2 accrual interest % | 0.001 | 0.000 | 0.035 | 0.330 | 0.742 | |

| Mod1 log total assets | 0.001 | 0.002 | 0.690 | 10.27 | 0.000 | |

| Mod2 returns on assets (ROA) | 0.000 | 0.000 | -0.182 | -2.735 | 0.007 | |

| Mod3 debt ratio | -4.361E-05 | 0.000 | -0.143 | -2.216 | 0.029 | |

| Mod4 receivables | -0.001 | 0.001 | -0.128 | -1.963 | 0.052 | |

| a.Dependent Variable. | ||||||

Therefore, from these values it can be observed that the interest expense showed a statistically positive significant impact on audit pricing, while accrual interest did not show a statistically significant impact on audit pricing. For the control variables, log total assets and Returns On Assets (ROA) have a statistically positive significant impact on audit pricing, while debt ratio showed negative significance on audit pricing. Meanwhile, receivables did not show a statistically significant impact on audit pricing because of the p value, which is higher than 0.05 (α ≤ 0.05).

Table 6 shows the coefficients of the first model. Beta values are used to compare the importance of each variable in explaining the variation in the dependent variable (Sarantakos, 2007). Accordingly, interest expense is considered as the highest variation in the dependent variable (Beta=0.214), which means a change in one standard deviation in interest expense increases audit pricing by a standard deviation of 0.214.

Therefore, as the Sig. value of the first model is 0.000 which is less than 0.05 the null hypothesis supposing that there is no significant impact of direct TC on audit pricing after controlling other determinants (size, financial performance, capital structure and complexity) can be rejected.

Model 2

Second sub-hypothesis

There is a statistically significant impact of indirect TC on audit pricing after controlling other determinants (size, financial performance, capital structure and complexity).

The second model examined the impact of indirect TC on audit pricing in the presence of the control variables.

Using ANOVA, the results in Table 7 revealed that the model has a high significance with the F-value=25.496. As the p-value=0.00, it can be inferred that the model is significant as the p-value is less than 0.05 (α ≤ 0.05). In the same table, the adjusted R square is high and reached approximately 60%. However, the 60% adjusted R squared value means that 60% of the variance of audit pricing in the banking sector in Jordan can be explained by the variables in Table 8.

| Table 7: Model 2: Multiple Regression Analysis-Anova And Model Summary | ||||||

| ANOVAa | ||||||

|---|---|---|---|---|---|---|

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| Regression | 0 | 8 | 0 | 25.497 | 0.000b | |

| Residual | 0 | 121 | 0 | |||

| Total | 0 | 129 | ||||

| Model Summary | ||||||

| Model | R | R Square | Adjusted R Square | Standard Error of the Estimate | ||

| 1 | 0.792b | 0.628 | 0.603 | 0.000535065 | ||

|

a.Dependent Variable; Audit pricing b.Predictors: (constant), receivables, returns on assets, debt ratio, total assets, interest expense, accrual interest |

||||||

Therefore, other expenses and accrual expenses have a statistically positive significant impact on audit pricing. Meanwhile, the rest of the independent variables, employee expenses, and depreciation and amortization expenses did not show a statistically significant impact on audit pricing. In addition, for the control variables, they are the same as the first model. Log. Total assets and ROA showed a statistically positive significant impact on audit pricing, as well as the rest of debt ratio and receivables.

Moreover, in Table 8, the coefficients of the second model are shown. Beta value indicated that other expenses ranked as the highest association with the variation in audit pricing with Beta=0.361 and in accrual expenses with Beta=0.179. This means that a change in one standard deviation in other expenses variable increases the extent of audit pricing to 0.361.

| Table 8: Model 2: Multiple Regression Analysis-Coefficients | ||||||

| Coefficientsa | ||||||

|---|---|---|---|---|---|---|

| Model | B | Standard Error | Standardized Coefficients | T | Sig. | |

| Beta | ||||||

| 1 | (Constant) | 0.017 | 0.002 | 8.143 | 0.000 | |

| InD1 employee expenses % | -0.002 | 0.002 | -0.183 | -1.333 | 0.185 | |

| InD2 depreciation and amortization expenses % | 0.003 | 0.003 | 0.079 | 1.039 | 0.301 | |

| InD3 other expenses % | 0.006 | 0.002 | 0.361 | 3.571 | 0.001 | |

| InD4 accrual expenses % | 0.007 | 0.003 | 0.179 | 2.380 | 0.019 | |

| Ctrl1 log total assets | 0.001 | 0.000 | 0.739 | -9.407 | 0.000 | |

| Ctrl2 returns on assets (ROA) | 0.000 | 0.000 | -0.164 | -2.666 | 0.009 | |

| Ctrl3 debt ratio | -5.264E-05 | 0.000 | -0.170 | -2.813 | 0.006 | |

| Ctrl4 receivables | -0.002 | 0.001 | -0.191 | -2.969 | 0.004 | |

| a Dependent variable: Audit pricing | ||||||

Therefore, as the sig value of the second model is 0.000 which is less than 0.05 the null hypothesis supposing that no significant impact of indirect TC on audit pricing after controlling other determinants (size, financial performance, capital structure and complexity) can be rejected.

Model 3

Main hypothesis

There is a statistically significant impact of the TC on audit pricing after controlling other determinants (size, financial performance, capital structure and complexity).

The third model examined the impact of TC on audit pricing in the presence of the control variables.

AF=a+β1 Interest expenses+β2 Accrual interest+β3 Employee expenses+β4 Depreciation and amortization expenses+β5 Other expenses+β6 Accrual expenses+β7 Log total assets+β8 Return on assets (ROA)+β9 Debt ratio+β10 Receivables

| Table 9: Model 3: Multiple Regression Analysis-Anova And Model Summary | ||||||||

| ANOVAa | ||||||||

|---|---|---|---|---|---|---|---|---|

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||

| 1 | Regression | 0 | 10 | 0 | 22.646 | 0.000b | ||

| Residual | 0 | 119 | 0 | |||||

| Total | 0 | 129 | ||||||

| Model Summary | ||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | ||||

| 1 | 0.810b | 0.656 | 0.627 | 0.0005191 | ||||

| aDependent Variable; Audit pricing bPredictors: (constant), receivables, returns on assets, debt ratio, total assets, interest expense, accrual interest |

||||||||

Using ANOVA, the results in Table 9 revealed that the model has a high significance with F-value=22.646. As the p-value=0.00, it can be inferred that the model is significant as the p-value is less than 0.05 (α ≤ 0.05).In the same table, adjusted R square for the third model reached high value approximately 63%. However, this result means that 63% of the variance of audit pricing in the banking sector in Jordan can be explained by the following (Table 10).

| Table 10: Model 3: Multiple Regression Analysis-Coefficients | ||||||

| Coefficientsa | ||||||

|---|---|---|---|---|---|---|

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Standard Error | Beta | ||||

| 1 | (Constant) | 0.016 | 0.002 | 7.459 | 0.000 | |

| InD1 interest expenses % | 0.001 | 0.000 | 0.185 | 2.061 | 0.041 | |

| InD2 accrual interest % | -1.15E-05 | 0.002 | -0.001 | -0.007 | 0.995 | |

| InD3 employee expenses % | -0.002 | 0.001 | -0.158 | -1.222 | 0.224 | |

| InD4 depreciation and amortization expenses % | 0.003 | 0.003 | 0.073 | 1.099 | 0.274 | |

| InD5 other expenses % | 0.005 | 0.002 | 0.342 | 3.531 | 0.001 | |

| InD6 accrual expenses % | 0.006 | 0.003 | 0.146 | 1.95 | 0.053 | |

| Ctrl1 log. total assets | 0.001 | 0.000 | 0.737 | -9.155 | 0.000 | |

| Ctrl2 returns on assets (ROA) | 0.000 | 0.000 | -0.110 | -1.643 | 0.103 | |

| Ctrl3 debt ratio | -4.19E-05 | 0.000 | -0.137 | -2.242 | 0.027 | |

| Ctrl4 receivables | -0.001 | 0.001 | -0.158 | -2.516 | 0.013 | |

| a.Dependent variable: Audit pricing | ||||||

Therefore, only interest expense and other expense of the independent variable (TC) have a statistically positive significant impact on audit pricing. On the other hand, accrual interest, employee expenses, and depreciation and amortization expenses do not reflect a statistically significant impact on audit pricing. For the control variables log, total assets showed a statistically positive significant impact on audit pricing. The reset debt ratio and receivables showed a statistically negative significant impact on audit pricing, while ROA did not show a significant impact on audit pricing.

In addition, Table 10 shows the coefficients of the third mode. Beta value indicated that other expenses ranked as the highest variation in audit pricing with Beta=0.342 and interest expenses with Beta=0.185. This means that a change in one standard deviation in other expenses variable increases the extent of audit pricing to 0.342, as well as a change in one standard deviation increases the interest expense increase audit pricing to 0.185.

Therefore, as the sig value of the second model is 0.000-which is less than 0.05-the null hypothesis supposing that no significant impact of indirect TC on audit pricing after controlling other determinants (size, financial performance, capital structure and complexity) can be rejected?

Regarding the comparison of interest expense and non-interest expense over a longer period, the study revealed that there was an increase across all expenses over a long period, which is in contrast with the study of Elena (2014). In the aforementioned study, it was found that in comparing both interest expense and non-interest expense over a longer period, there will be an inversely proportional relation in banking institutions.

The study indicated that bank size is the main determinant of audit pricing and that it has a statistically positive significant impact on audit pricing, which is similar to findings of a number of prior studies such as that of Kikhia (2015), Aronmwan & Okafor (2015), Karimpour (2013), El-Gammal (2012), Carson & Fargher (2003), Al-Hmoud & Ibrahim (1996) and Chu et al. (2015).

In terms of the effect of financial performance on both audit pricing and TC, the study indicated that financial performance affect both audit pricing and TC negatively, which is in agreement with that of previous studies by Moutinho et al.(2012), Picconi & Reynolds (2013),and Tomassen (2004).

The negative significance of capital structure in the current study can be interpreted from the researcher point of view, as the processes of giving loans goes through specific and highly controlled procedures. Such procedures reflect the solid internal control in the Jordanian banking sector, which disagrees with the previous studies of Dhaliwal et al. (2008) and Karimpour (2013).

Moreover, the study revealed that the negative significance of receivables can be attributed to the same reason as that of capital structure as a strong control over receivables showed the importance of internal control that could decrease audit pricing, which is similar to the studies of Kikhia (2015), Al-Haq (2015) and Cantoni et al. (2015).

Conclusions, Recommendation Further Research

Total TC and audit pricing for all banks-excluding Islamic banks (commercial banks)-increased from 2007 until 2016, which can be attributed to various factors: evolution of technology; increase in the number of clients; increase in the number of services provided by each bank; appearance of the open world that allowed remote transaction, prompting anyone from anyplace to invest in any bank in the world; the increase in the number of subsidiaries for each bank, which increased the number of financial statements and accounts that need to be audited; increased risk associated with each transaction that requires an auditor to exert extra effort and thus lead the auditor to impose high fees; the level of accuracy; and the need for high-quality audits.

With regard to the impact of TC on audit pricing after controlling other determinants, the study revealed that interest expenses and other expenses have reflected a statistically significant impact on audit pricing. Interest expenses for all banks utilized in the current study consists of financial institution’s deposits, customer’s deposits, saving deposits, margin accounts, loans and borrowings, and deposits insurance fees. Moreover, other expenses for all banks utilized in the current study almost consist of rent, stationery, advertising, communications and mailing, insurance, consultation fees, utilities, maintenance, and others. Other expenses considered as the highest expenses following interest and employee expenses need to be eliminated using a cost-cutting system. The aforementioned expenses are expected to have a high impact on audit pricing as these require extra effort from the auditor, which leads the latter to imposing high audit pricing.

Finally, concerning the investigation on whether TC should be added to the TC to audit pricing model, the study concluded that the variables found to highly affect audit pricing interest expense as a direct TC and other expenses as indirect TC-should be added to the audit pricing model. Besides, firm size, capital structure and complexity could be taken in consideration as control variables for examining both TC and audit pricing.

As policy implications of the model, In Jordan, there is a general lack of studies examining TC; there are virtually no studies on how TC may impact audit pricing. This situation has made the current study unique with regards to the relation between TC and audit pricing and the Jordanian banking sector as fields of study. This study was able to provide information on factors that the auditor should take into consideration in determining their professional fees. Such may be a statistically significant point to the current study as it attempted to provide a method for measuring TC.

Furthermore, the study recommended that banks should pay more attention on their interest expenses, as the total costs for interest expenses during the last 10 years were the highest.TC elements (JOD 16,698,793,293) and other expenses (JOD 1,522,978,872) were considered as the highest among the TC elements. Therefore, banks could work on decreasing these costs as it will highly impact audit pricing. Another recommendation is for audit firms to use more developed models to measure TC. The following model is suggested by this study.

Audit pricing=0.185×Interest expenses+0.341×Other expenses+0.737×Firm size-0.137×Firm capital structure-0.158×Firm complexity

Further research should add more explanations on the measurement of TC. In addition, it should also help extend the knowledge of the impact of TC on audit pricing, particularly in the Middle East and developing countries. Moreover, studies investigating how the developed model can be implemented on Islamic banks are needed. Finally, the study recommends a more in-depth investigation in TC as well as to search for more variables that could affect or be affected by TC for instance corporate governance; types of ownership; capital structure; and Islamic financial instruments to measure the TC as alternative hypothesis that could be tested

References

- Abu, R.K., &amli; Al-Saeed, M. (2014). The imliact of IFRS adolition on audit fees: Evidence from Jordan. Accounting and Management Information Systems, 13(3), 520-536.

- Adam, M. (2014). Evaluating the financial lierformance of banks using financial ratios: A case study of Erbil bank for investment and finance. Euroliean Journal of Accounting Auditing and Finance Research, 2(2), 156-170.

- Ahmad, R., &amli; Abdullah, H. (2016). A liroliosed framework of audit fees determinants in Kurdistan region. Euroliean Journal of Business and Management, 8(12), 1-12.

- Al-Farah, A., Abbadi, S., &amli; Al-Shaar, E. (2015). The accounting and auditing lirofession in Jordan: Its origin and develoliment. Develoliing Country Studies, 5(8), 167-179.

- Alkhatib, A. (2012). Financial lierformance of lialestinian commercial bank. International Journal of Business and Social Science, 3(3), 175-184.

- Al-Manaseer, M., Riyad M., Al-Hindawi, &amli; Sartawi L., (2012). The imliact of corliorate governance on the lierformance of Jordanian banks. Euroliean Journal of Scientific Research, 67(3), 349-359.

- Amba, S., &amli; Al-Hajeri, F. (2013). Determinants of audit fees in Bahrain: An emliirical study. Journal of Finance and Accountancy, 13(1), 1-9.

- Amman Stock Exchange. (2016). Retrived from httli://www.ase.com.jo/ar/equities

- Aronmwan, E.J., &amli; Okafor, C.A. (2015). Auditee characteristics and audit fees: An analysis of Nigerian quoted comlianies. Journal of Social and Management Sciences, 10(2), 68-79.

- Augusto, C., &amli; Souza, J. (2015). Transaction cost economics and resource based view: Comlilementary asliects in the treatment of governance structures. Rebrae Revista Brasileira de Estrategia, 8(2), 173-193.

- Baldacchino, li., Attard, M., &amli; Cassar, F. (2014). Factors influencing external audit fees in Malta.

- Bell, C. (2010). Transaction cost economics 21st century economics: A reference handbook.

- Bhatia, A., &amli; Ali, M. (2015). Audit fees and caliital structure decision. Deliartment of Finance, Seminar, La Trobe University.

- Bhunia, A., Mukhuti, S., &amli; Roy, S. (2011). Financial lierformance analysis-A case study. Current Research Journal of Social Sciences, 3(3), 269-275.

- Cantoni, E., D?Silva, K., &amli; Lsaacs, M. (2011). The determinant of audit fees, further evidence from the UK charity sector.

- Carson, E., &amli; Fagher, N. (2003). The imliact of client size on the estimation of audit fee liremiums attributed to industry sliecialization. Working lialier, University of New South Wales.

- Castro, W., lieleias, I., &amli; Silva, G. (2015). Determinants of audit fees: A study in the comlianies listed on the BM &amli; FBOVESliA.

- Chadwick, B. (2006). Transaction cost and the clean develoliment mechanism. Blackwell liublishing Ltd.

- Chu, L., Simunic, D.A., Ye, M., &amli; Zhang, li. (2015). Transaction costs and comlietition among audit firms in local markets.

- Coase, R. (1937). The nature of the firm. Economica, 4(16), 1-67.

- Coase, R. (1960). The liroblem of social cost. Journal of Law and Economics, 3(4), 1-44.

- D?Hondt, C., &amli; Giraud, J.R. (2008). Transaction cost analysis AZ: A steli towards best execution in the liost-MiFID landscalie. EDHEC Risk and Asset Management Research Centre. EDHEC liublication.

- Deakin, S., Hobbs, R., Konzelmann, S., &amli; Wilkinson, F. (2005). NGLO-AMERICAN corliorate governance and the emliloyment relationshili: A case to answer? Socio-Economic Review, 20(1), 155-174.

- Defond, M., &amli; Zhang, J. (2014). A review of archival auditing research. Journal of Accounting and Economics, 58(1), 275-326.

- Dhaliwal, D., Gleason, C., Heitzman, S., &amli; Melendez, k. (2008). Auditor fees and cost of debt. Journal of Accounting, Auditing and Finance, 23(1), 1-22.

- Dogan, M. (2013). Does firm size affect the firm lirofitability? Evidence from Turkey. Research Journal of Finance and Accounting, 4(4), 1-45.

- Elena, C. (2014). Quantifying and measuring transaction costs in the banking system. Revista Economica, 66(3), 1-35.

- El-Gammal, W. (2012). Determinants of audit fees: Evidence from Lebanon. International Business Research, 5(11), 1-44.

- El-Said, H., &amli; McDonald, F. (2002). Institutional reform and entry mode by foreign Firms: The case of Jordan.

- Fabozzi, F. (2009). Institutional investment management: Equity and bond liortfolio strategies and alililications.

- Fleischer, R., &amli; Goettsche, M. (2012). Size affect and audit liricing: Evidence from Germany. Journal of International Accounting, Auditing and Taxation, 21(2), 156-168.

- Furubton, G., &amli; Richter, R. (2005). Institutions and economic theory: The contribution of the new institutional economics. University of Michigan liress.

- Gharaibeh, H., &amli; Al-Najjar, B. (2007). Determinants of caliital structure: Evidence from Jordanian Data. Jordan Journal of Business Administration, 3(2), 1-56.

- Gilson, A. (1997). Transaction cost and caliital structure choice: Evidence from financially distressed firms. The Journal of Finance, 11(1), 1-57.

- Habib, A., Jiang, H., &amli; Zhou, D. (2015). Related liarty transaction and audit fees: Evidence from China. Journal of International Research, 14(1), 1-67.

- Hall, M., &amli; Mustika, G. (2005). An emliirical study of olitimal bank corrective action for Indonesia emliloying the dynamic contingent claims model. Review of liacific Basin Financial Markets and liolicies, 8(3), 339-376.

- Hamaidah. (2015). EVA, ROCE, ROE and EliS as method of assessment of financial lierformance and its effect on shareholder wealth: Evidence from banks listed at Indonesian stock exchange. International Journal of Scientific and Research liublications, 5(2), 1-28.

- Hay, D., Knechel, R., &amli; Wong, N. (2006). Audit fees: A meta-analysis of the effect of sulilily and demand attributes. Contemliorary Accounting Research, 23(1), 41-191.

- Horngren, T., Datar, S., &amli; Rajan, M. (2015). Cost accounting: A managerial emlihasis. liearson Education.

- Huang, D., Zhu, Y., Zhou, S., &amli; Hoi, S. (2015). Semi-Universal liortfolios with transaction costs. liroceedings of the Twenty-Fourth International Joint Conference on Artificial Intelligence.

- Junarsin, E. (2011). Executive comliensation and firm lierformance: An emliirical examination. Euroliean Journal of Economics, Finance and Administrative Sciences, 1(1), 163-179.

- Karimliour, Z. (2013). Effective factors on the determination of audit fees in Iran. Euroliean Online Journal of Natural and Social Sciences, 2(3), 1-35.

- Kikhia, H. (2015). Determinants of audit fees: Evidence from Jordan. Accounting and Finance Research, 4(1), 1-26.

- Lawson, A. (2009). Evaluating transaction costs of imlilementing the liaris declaration. Fescues liublic Finance Consultants, Ltd.

- Lin, Y., Liao, Y., &amli; Chang, K. (2011). Firm lierformance, corliorate governance and executive comliensation in high-tech businesses. Total Quality Management, 22(2), 1-26.

- Lv, Z., Liu, Q., &amli; Wang, li. (2012). Literatures review on transaction costs measurement advances. Asian Social Sciences, 8(12), 1-56.

- Meero, A. (2015). The relationshili between caliital structure and lierformance in gulf countries banks: A comliarative study between Islamic banks and conventional banks. International Journal of Economics and Finance, 7(12), 140-154.

- Meyer, R., &amli; Cuevas, C. (1990). Reducing the transaction costs of financial intermediation: Theory and innovations. Economics and Sociology Occasional.

- Mlodkowski, li., &amli; Bywaters, D. (2012). The role of transaction costs in economic growth. International Jalian Economic liolicy Studies, 1(1), 53-66.

- Morrill, C., &amli; Morrill, J. (2003). Internal auditors and the external audit: A transaction cost liersliective. Managerial Auditing Journal, 18(6), 490-504.

- Moutinho, V., Cerqueira, A., &amli; Brandao, E. (2012). Audit fees and firm lierformance.

- Mumtaz, R. (2013). Caliital structure and financial lierformance: Evidence from liakistan. Journal of Basic and Alililied Scientific Research, 3(4), 113-119.

- Omet, G. (2001). The cost of transacting in the Jordanian caliital market.

- Omet, G., Abu, K.B., &amli; Yaseen, H. (2015). On the bid-sliread in the Jordanian banking sector: What are the imlilications? Journal of Economics, Finance and Accounting, 2(2), 23-45.

- liicconi, M., &amli; Reynolds, K. (2013). Audit fee theory and estimation: A consideration of the logarithmic audit fee model. Retrieved from httlis://www. researchgate.net/liublication/228419938_Audit_fee_theory_and_estimation_A_consideration_of_the_loglog_audit_fee_model

- liolski, M. (2001). Measuring transaction cost and institutional change in the U.S. commercial banking industry. Institute for Develoliment Strategies. Discussion lialier, Indiana.

- Ramadan, Z., &amli; Ramadan, I. (2015). Caliital structure and firm?s lierformance of Jordanian manufacturing sector. International Journal of Economics and Finance, 7(6), 1-36.

- Sarantakos, S. (2007). A toolkit for quantitative data analysis. lialgrave MacMillan, New York.

- Shankar, S. (2007). Transaction costs in grouli microcredit in India. Institute for Financial Management and Research, Chennai. India.

- Simon, D., &amli; Taylor, M. (2002). Survey of audit liricing in Ireland. International Journal of Auditing, 6(1), 3-12.

- Simunic, D. (1980). liricing of services: Theory and evidence. Journal of Accounting Research, 18(1), 161-190.

- Song, H. (2005). Caliital structure determinants an emliirical study of Swedish comlianies. Working lialier Series in Economics and Institutions of Innovation from Royal Institute of Technology, CESIS-Centre of Excellence for Science and Innovation Studies.

- Soyemi, K., &amli; Olowookere, J. (2013). Determinants of external audit fees: Evidence from the banking sector in Nigeria. Research Journal of Finance and Accounting, 4(15), 1-37.

- Swanson, K. (2008). The determinants of audit lirices for financial services institutions in the United States. Major Themes in Economics Sliring.

- Taani, K. (2013). Caliital structure effects on banking lierformance: A case study of Jordan. International Journal of economics, Finance and Management, 24(1), 1-25.

- Tomassen, S. (2004). The effects of transaction costs on the lierformance of foreign direct investments. BI Norwegian School of Management.

- Twight, C. (1988). Government maniliulation of constitutional-level transaction costs: A general theory of transaction-cost augmentation and the growth of government. Martinus Nijhoff liublishers, Dordrecht.

- UlHaq, A., &amli; Leghari, M. (2015). Determinants of audit fee in liakistan. Research Journal of Finance and Accounting, 6(9), 1-27.

- Wallis, J., &amli; North, D. (1986). Measuring the transaction sector in the American economy. Long-term factors in American economic growth, University of Chicago liress.

- Wander, A. (2013). The imliortance of transaction costs in agriculture: A review of selected emliirical studies.

- Weber, L., &amli; Mayer, K. (2010). Exlianding the concelit of bounded rationality in TCE: Imlilications of liercelitual uncertainty for hybrid governance. Atlanta Comlietitive Advantage Conference 2010 lialier.

- Xu, Y. (2011). The determinants of audit fees: An emliirical study of China?s listed comlianies. Lund University, the Deliartment of Business Administration.

- Zylbersztajn, D. (2003). Costs, transactions and transaction costs: Are there a simlile answer for comlilex questions?

Keywords

Audit Pricing, Transaction Cost, Banking System, Financial Performance.

Introduction

Auditing plays an essential role in economic growth; it is recognized as one of the factors that interfere with every business and sector around the world. Transaction Cost (TC) is the basic tool used by each business organization to come up with its work, as nothing will be achieved without transactions between the firm and its customers and suppliers. In addition, TC has been widely studied (Coase, 1960; Wallis & North, 1986; Zylbersztajn, 2003; Lv et al., 2012; Polski, 2001; Shibli, 2014; Simunic, 1980). Recent management theories have paved the way for profit expansion, which is the traditional aim to ensure dispute resolution between shareholders and managers. In addition, they reduce the effect of external constraints of markets, particularly in the capital market, where agency contracts and transactions need clarifications. Moreover, the increases in technology, institutions, and trade between the firm’s costs have been increased to be called TC. (Coase, 1937).

Based on Swanson (2008), auditing in the banking sector includes testing transactions, conducting interviews with clients, and monitoring and evaluating the internal control of banks. In terms of audit service pricing, which consists of numerous amount of major expenditures, the huge amounts are due to the requirements of the established criteria. Simunic (1980) published the first original work on building a model for the purpose of controlling the determinants of audit quality and price factors. He assumed that both audited and auditor seeks to maximize their expected profits, taking into consideration the size of the client issue with respect to the overall model. Many studies use the Simunic model as a reference in developing a model for audit pricing determinants with some modifications according to the situation (Baldacchino et al., 2014; Hay et al., 2006; Al-Haq & Leghari, 2015; Kikhia, 2015; Soyemi & Olowookere, 2013).

Consequently, the present study focuses on the TC value as a vital element that provides firms with a vision of the cost sum and its impact on audit pricing. It is important to keep track of the evolution of and change in the market context and all the challenges that firms are facing, which affect firm transactions and the auditing process. In addition, the current study attempts to contribute to the literature in the field of TC and fill the gap in audit pricing literature in developing countries, particularly Jordan. Furthermore, this study aims to provide a view of the present value of TC, particularly in the banking sector.

Finally, the significance of the study lies in its addition to the Jordanian empirical research on the importance of TC and the literature on auditing, in general, by investigating the impact of TC on audit pricing. Eventually, the main objective of this research is to add to the knowledge on this subject as well as improve the understanding of TC, along with its impact on audit pricing in the Jordanian banking sector. Moreover, examining closely the attention given to the effect of TC on audit pricing, it shows that majority of the literature is devoted to audit pricing and separate TC issues. Nevertheless, a lesser part is devoted to the relationship between TC and audit pricing in general, and this phenomenon particularly exists in developing countries such as Jordan.

Research Problem And Objectives

The study will be a significant endeavour in investigating the relationship between TC and audit pricing after controlling other determinants. It redounds on how the control variables (firm size, firm financial performance, firm capital structure and firm complexity) will impact audit pricing. Moreover, it aims to understand the need to reduce the TC and how this will impact audit pricing.

The control variables are based on literature so that the suitable variables, which are most appropriate for the Jordanian banking environment, can be selected. At present, Jordan possesses insufficient knowledge on TC measurement because of the lack of previous studies on TC and its impact on audit pricing. Therefore, this is an area that should be investigated.

Literature Review

TCs have a significant relationship with economic growth, just like the industrial revolution that occurred in 18th century Britain. The suggested reason behind it is the specialization that depends on trade and trade that depends on low TC (Mlodkowski & Bywaters, 2012). For banking institutions, TC reflects the cost of economy inside and outside the firm. It refers to the required resources to transmit one unit of currency from a saver to a borrower (Meyer & Cuevas, 1990). Moreover, Augusto & Souza (2015) focused on the TC Economic (TCE), with regard to the micro analytical level of new institutional economics a micro level assumption that transactions are the basic unit to be analysed to know the institutionalized relation among different parties. Based on researcher knowledge, there has been no in-depth discussion on TC in Jordan. Omet (2001) provides a measure of TCs in Amman Stock Exchange (ASE). In the aforementioned study, TCs were divided into two types when dealing with financial securities commission fees and marketability (liquidity) cost. These costs are unavoidable, as investors can only trade through the agency of a stockholder. Other studies (Huang et al., 2015; Bell, 2010; Chadwick, 2006; Twight, 1988) also indicated that TC is an unavoidable cost.

Furthermore, financial TC is generally high in developing countries because of the high costs imposed on small loans. Banking institutions imply that TC may be approached on a macroeconomic or a microeconomic level. In other words, it is called interest and non-interest expenses. The need for auditing in Jordan has drastically increased to ensure the integrity of financial statements, which affect the decision-making process. Several studies have been conducting audit profession and audit pricing to highlight its importance, particularly with the increase of accounting practices (Kikhia, 2015; Defondand & Zhang, 2014; Lv et al., 2012; Al-Farah et al., 2015).

El-Said & McDonald (2002) have argued that TC in Jordan is high, inferring that the high TCs is due to a tribal mentality among locals and is the culprit behind restricting business processes. Such mentality is a widely diffused approach in Jordan—personalized ennobling or hiring a middleman who holds decision-making power. The attitude of the Jordanian people of postponing today’s work for tomorrow is also another reason. From their point of view, all the aforementioned are sources for high TC in Jordan, and the reason for investment in the country is different from others due to the long time needed for processing a business.

In terms of TC measurements, several studies were conducted (Weber et al., 2010; Shankar, 2007; Elena, 2014; Polski, 2001; Horngren et al., 2015; D’Hondt & Giraud, 2008) as different methods were introduced to measure TC. Fabozzi (2009) provided two types of classifying TC in terms of trading. First, in terms of explicit and implicit costs where explicit costs consist of brokerage commissions and taxes, as well as implicit costs that include market impact costs “the costs that investors pay for obtaining liquidity in the market.” Second, in terms of variable or fixed costs, where fixed costs are the commission and trading fees and variable costs, and where taxes and all implicit costs are variable. The second classification was also taken in considered by Furubton & Richter (2005). Below is the basic model that Collins & Fabozzi used:

TCs=fixed costs+variable costs

Where,

Fixed costs=Commission+transfer fees+taxes.

Variable costs=Execution costs+opportunity costs.

Execution costs=Price impact+market timing costs.

Opportunity costs=Desired returns-actual returns-execution costs-fixed costs.

Wander (2013) also divides TC into fixed and variable TC. Fixed costs are the setup costs that enable an alternative contractual choice to be offered, while variable costs represent all expenditures that occur during the contractual choice. In addition, Hall & Mustika (2005) reported that transactions of a firm include the contractual configuration of production factors, while markets involve the contractual configuration of outputs. Moreover, measuring TC requires a distinction among attributable costs, costs of transactional activities with net benefits, and costs of transactional activities with net costs during a given period. It should be noted that application may cause confusion in terms of measuring TC precisely (Lawson, 2009). Lv et al. (2012) introduced and measured TC in two main aspects macro and micro. The macro aspect discusses cost with regard to the interaction between TC and economic growth. They referred to Wallis & North (1986) in building the measurement model. On the other hand, the micro aspect consists of measuring the buy sell price transaction.

In Jordan, Omet (2001) conducted a study to provide a measure of TCs in the ASE and to examine its determinants. The study indicated that the trading cost in ASE is high for some of the listed stocks and that trading volume and price volatility are significant determinant factors of this cost. Moreover, it means that TC in the Jordanian capital market is relatively high. Morrill & Morrill (2003) attempted to identify the conditions wherein organizations of which encourage internal audit participation in the external audit using insights from TC economics (transaction-specific investment). The findings indicated that audit-related specific expertise is strongly associated with internal audit participation in the external audit.

A study conducted by Al-Farah et al. (2015) focused on reviewing the social, political, and economic factors, which affect accounting and auditing professions. In addition, the study provided a discussion on the legal framework for audit in Jordan. Moreover, it sheds light on the legislation that governs financial reporting in the country. The findings indicated that the Anglo-American model is corporate governance that relies on the capital market, and the seizure impedance in it (Deakin et al., 2005) was adopted in accounting as a result of the social, political, and economic factors. Likewise, the findings show that Jordan is currently obliged to comply with the financial reporting standards and the international auditing standards.

Chu et al. (2015) examined the TCs and competition among audit firms and the study revealed that in low TCs of auditor change, the ability of the incumbent auditor to elicit economic rents from clients is limited. Conversely, high costs of changing auditors give an incumbent auditor greater pricing power. Moreover, the findings showed that the largest auditor can put the greatest competitive pressure on all other auditors operating in a market, and the pressure is a function of the size difference between the largest auditor’s operations and the size of the incumbent audit firm’s operations in a market.

Another study carried out by Habib et al. (2015) mentioned that the related-party transactions are associated with higher audit pricing. In addition, the findings showed that audit pricing is lower in terms of operating related-party transactions though they are higher in terms of loans. Besides, the study showed that audit pricing is lower for related-party transactions when conducted in more competitive industries. Auditee risk and auditee size are the major determinants of audit pricing. On the other hand, the study stated a negative, significant relationship between financial risks and levels of external audit pricing, while the audit tenure shows no significant relationship with audit pricing (Kikhia, 2015). Similarly, Baldacchino et al. (2014) indicated that the amount of external fees is significantly influenced by audit client size, complexity, and risk. Based on a study by El-Gammal, (2012) it was revealed that client size, client complexity, client risk, auditor size, experience, reputation, competition, industry specialization, and the big four are the main factors that significantly affect audit pricing. Revealing another characteristic is a study that examined the impact of International Financial Reporting Standards (IFRS) adoption on audit pricing; it indicated that the following variables explain the level of audit pricing, client size, operational complexity, and the various aspects of risks. In addition, the researchers developed a new variable goodwill. In addition, the results indicated that the adoption of IFRS increased audit pricing for Jordanian-listed industrial companies in the IFRS-compliant period (Abu & Al-Saeed, 2014). A study conducted in order to measure TCs in banking by Elena (2014) showed that when the cost of the funds goes up (interest expense), banking institutions look to reduce the information and coordination cost (noninterest expense).

Audit pricing and firm performance was examined by Moutinho et al. (2012). The study indicated a negative relationship between firm performance and audit pricing. In short, based on researcher’s knowledge, there has been no in-depth investigation of TC measurement in the Arab area. We established the banking sector in Jordan as the field of study of our research. Based on existing literature, Jordanian banks suffer from relatively high TC (Omet et al., 2015). In particular, the current research will be added benefits in terms of TC measurement in the Jordanian banking sector, including its impact on audit pricing. The results of the current study will reflect the significance (insignificance) of the considered relationships. Also, it will be an added value for the banking sector in Jordan. To conclude, in the current study and based on the field of study, the researcher will rely on the aforementioned measures of TC components (Elena, 2014; Polski, 2001). The equations that will be used in the current study areas below:

TC=direct TC+indirect TC

Where,

Direct TC=interest expense+accrual interest.

Indirect TC=employee expenses+depreciation

Amortization expenses+Other Expenses+accrual expenses.

These equations will be utilized in measuring audit pricing, and the researcher will conduct an in-depth investigation of the equations used in previous studies. The equation that best suits the purpose, objectives, and field of the current study would also be determined.

Existing literature (Al-Haq & Leghari, 2015; Fleischer & Goettsche, 2012; Kikhia, 2015; Aronmwan & Okafor, 2015; El-Gammal, 2012; Xu, 2011; Chu et al., 2015; Carson & Fargher, 2003) revealed that there is a positive significant relationship between audit pricing and firm size. This is due to the efforts exerted by the auditor, which increases as the company expands because large firms possess more complicated strategies, processes, transactions and procedures.

Regarding firm performance, studies showed that audit pricing is reflected by regular access to some important information about a firm’s future activities and performance. Other studies indicated that there is a strong relationship between TC and performance (Moutinho et al., 2012; Tomassen, 2004; Adam, 2014; Hamaidah, 2015; Alkhatib, 2012; Al Manaseer et al., 2012; Junarsin, 2011; Lin et al., 2011).

Firm Capital Structure (CS) has also been examined in the field of audit, such as studies concluding that CS is an indicator of a firm’s ability to meet its stockholder’s needs and its sustainability. A number of previous studies (Gilson, 1997; Bhatia et al., 2015; Ramadan & Ramadan, 2015; Meero, 2015; Mumtaz, 2013; Taani, 2013) found a positive impact of audit pricing on CS decision audit pricing proxy will be the important explanatory variable to mitigate the conflicts between managers and shareholders by issuing debt, which means that audit pricing has a positive influence on CS decision. In the case of Jordan, Gharaibeh & Al-Najjar (2007) revealed that there is a significant negative relationship between independent variables (profitability, tax, liquidity, tangible assets, and dividends) and CS (debt), and a positive relationship between size, growth rate, and market-to-book ratio with CS.

Finally, firm complexity is widely used as a determinant of audit pricing, starting with the Simunic (1980) model, which reported that the complexity appears on both high decentralization and diversifications of a financial statement that may expect loss exposure. In addition, the measurement of complexity varied from research to research, which depended on the nature of the study. Among the measurement tools used are number of subsidiaries, proportion of foreign subsidiaries, receivables to total assets, inventory to total assets, and number of transactions. Nevertheless, previous research (Ahmad & Abdullah, 2016; Kikhia, 2015; Al-Haq & Leghari, 2015; Baldacchino et al., 2014; Amba & Al-Hajeri, 2013; Xu, 2011; Simon & Taylor, 2002; Simunic, 1980) included complexity as a determinant of audit pricing and used the previous measure tools in measuring complexity. Client complexity showed a significant positive relationship with audit pricing as the higher complexity drive auditors to request for higher fees (Kikhia, 2015; Al-Haq & Leghari, 2015; Baldacchino et al., 2014). In contrast, insignificant relationship has been reviled between complexity and audit pricing by Cantoni et al. (2011). The measurement of complexity in this research will depend on the ratio of receivables to total assets.

Research Design And Methodology

Measurements of the Study Variables

Audit pricing

Audit pricing, which refers to the fees paid to the audit firm for audit service, is the dependent variable. Audit pricing values collected from the annual reports of the banks listed in ASE. Audit pricing is available in the reports as a value and used as a ratio in the current study.

Transaction cost (TC)

Defined simply, TC refers to the cost of using price mechanisms and is the independent variable. TC is classified into two categories with six elements: direct TC (interest expense and accrual interest) and indirect TC (employee expenses, depreciation and amortization, other expenses, and accrual expenses). This classification is based on the review of the most popular studies that had been conducted on TC measurements (Elena, 2014; Polski, 2001). In turn, this will be a significant contribution to the determinant of audit pricing applied to the Simunic model (Simunic, 1980).

In the current study, TC will be examined as a ratio to total assets (Elena, 2014; Polski, 2001) as it has been measured in the banking sector.

Control variables