Research Article: 2020 Vol: 24 Issue: 3

Assessing the Impact of Digital Economy Taxation in Revenue Generation in Zimbabwe

Wadesango, N, University of Limpopo

Chibanda D.M., Midlands State University

Wadesango, V.O., University of Limpopo

Abstract

The digital economy is growing at a geometric rate in the world. At the same time that it is growing, Zimbabwe is experiencing fiscal budget deficits consistently. The traditional taxation system has been in use over the years and seems to be producing a fair share of revenue from its administration as shown below. This research paper examined the digital economy taxation, looking at the impacts that it has on the generation of value added tax, tax administration and the impact that it has on the network infrastructure. It is premised in the desire to pursue a stable Zimbabwean economy with budget surplus engulfed in the policies and administration that pertains to taxation. The study did not look at value added tax in isolation of the other revenue sources such as income tax, customs duty, withholding tax and capital gains tax but placed greater emphasis on value added as it is directly affected with trading on the digital platforms through E-commerce which includes B2C, B2B and C2C. A quantitate research methodology was adopted. Questionnaires were used to collect data. The results show that there are both positive and negative impacts that digitalisation brings to the country. It has a bearing on VAT, and on tax administration and also on the network infrastructure. Based on the study conclusions, there is need for the government to fully embrace digital technology on all its departments so that it will be easy the generate VAT using digital economy taxation.

Keywords

Impact, Digital Economy, Taxation, Revenue Generation.

Introduction

Primarily, this study sought to assess and to devise means to address the taxation challenges that arise from digitalisation. According to Ribarsky & Ahmad (2018), the digital economy including its broadest sense has changed the system in which societies play and work. They add on to say companies today are now able to get the most out of digital tools to revolutionise the production processes as well as distributing and selling goods and services to markets that were formerly out of span. This provides considerable benefits to clients through better choice and affordable prices. In the world of business these advantages go further, data has turned out to be the turn, an explosion in “complimentary” services provided to clients. Digitalisation is changing many areas of our lives, in addition to the macro-level in terms of the manner in which our economy and society is controlled and functions. The wideness and swiftness of change have been often remarked upon; furthermore, this is also accurate when one considers the impacts of this digital revolution or transformation on taxation matters (IFAC, 2015; James & Nobes, 2016; Kuo. 2016).

This study will be aimed at assessing the significant insurmountable impact that digitalisation is bringing on the broader environment particularly in taxation, and will consider an update from the 2015 BEPS Action 1 Report. The thrust being on alleviating the tax challenges of the digital economy, which described the advancement of information and communications technology. The report also takes into account the history of work relating to the taxation issues emanating from digitalisation, together with the traditional taxation framework in the other continents and Africa, particularly in Zimbabwe as a developing country.

Digital economy taxation could prove to be a revenue collection basis in Zimbabwe, especially considering the low revenue levels experienced in the country for a period of time now. This has culminated in tremendous budget deficit which in turn limits the government’s spending ability and also leading to dilapidated standards of living of the nationals. A focus on the digital economy taxation gives rise to possibilities of a tax regime that is aware of the double taxation effects of digitalization and the underutilized tax heads for example VAT.

This study looked into the tax challenges of the digital economy from, but not limited to, data, nexus and characterisation. The consideration will also border on how taxing the rights on income obtained from cross border trading in the digital age should be allocated among countries. A vigorous understanding of how digitalisation is altering the method businesses is conducted and how they generate value is essential to make sure that the tax system responds to these challenges. The scope in particular will be focussing on new and transforming business models in the perspective of digitalisation.

Background of the Study

The research narrowed in on the Zimbabwean and African context of taxation from the digital age. Onyeiwu (2002) states that the axiom that Africa lags behind the industrialized world in digital technology and the digital divide between Africa and the developed industrialized world is not disputable. He further stipulates that there are inter-country variations in the digital technology in Africa and that there should be policy measures that ameliorate the digital divide within the continent.

With the above background, the IFAC and the OECD (2015) find it befitting to unequivocally state that the incorporation of countrywide economies and markets has increased significantly in recent years; this has put a strain on the international taxation rules that were planned more than a century ago. This entails that Zimbabwe has been receiving income and distributing funds over the digital platforms and as such the value created has to be subjected to tax. Legislation in Zimbabwe through acts of parliament such as VAT Act, Finance Act, Income tax act, Capital Gains Tax act prescribe the traditional taxation model. This is whereby taxes are from income generated from trade, value creation in the provision of goods and services and various capital gains. It ignores income and value generated through digital platforms (Wadesango et al., 2018; Merkx, 2017; Moosajee, 2016).

Previous studies have shown that digital economy taxation is a contentious issue, with Kuo (2016) citing that most approaches to turnover taxation brings about surveillance, efficiency, and incentive and identification problems. This will result in depicting 2 approaches to dealing with the extraordinary features of international trade in cyber space. The approaches are the origin principle joint with taxation of digital goods and services at the physical location of producers and the community principle in combination with a withholding tax. On the other hand, (Boccia and Leonardi, 2016; Wadesango & Mwandambira, 2018) denoted that sometimes services conducted on the digital platform do not give rise to the delivery of a physical object and examples of such are music software. It is then more difficult to identify precisely where profits are diverted, since it is difficult to categorize where the server considered to be the company headquarters is situated. It may be on some platform exterior to territorial waters. Even in standard cases, entities in the digital economy may not need an established organization in the country where they sell and are consequently not subject to tax on site (Rohatgi, 2015; Schellekens, 2016; Schenk & Oldman, 2007; Schwanke & Stanley-Smith, 2016)

In Zimbabwe the advent of technology has seen in the recent year’s introduction of programmes aimed at fostering the development of a more technological based economy. The government introduced STEM as a way to subsidise and support ways through which learning institutions can develop digital oriented students. This programme however left a huge gap in how tax will be administered and therefore collected from the digital platform. Upadhyay (2016) said estimations in the digital economy are US$35bn and expected to grow at a rate of 25% a year. With this blistering growth rate, a key question arises, how should digital economy be taxed? Similarly, in Zimbabwe the rate at which promotions towards digitalisation is so tremendous that it cannot be ignored.

Methodology

The quantitative approach was used in this study. In this study a combination of random and purposive sampling was utilised. Data was collected using questionnaires. Data analysis was conducted after collection of data. Quantitative data collected was capture in Microsoft Excel format and cleaned. The cleaned data was then exported to statistical analysis software, SPSS, for an in-depth analysis. Data presentation went beyond basic descriptive statistics, but showed the relationship between variables, present data in form of frequency tables, graphs and pie charts which was used in the presentation of findings.

Results and Discussion

Demographic Characteristics

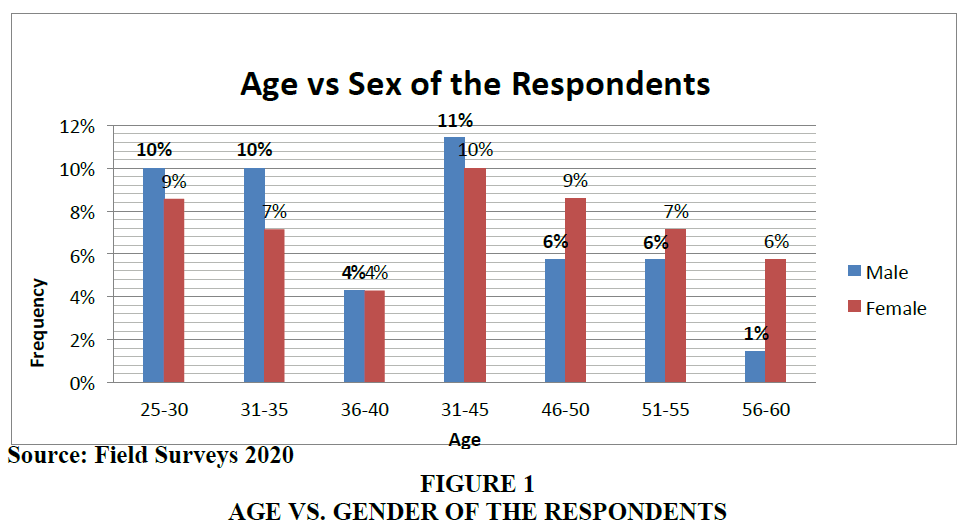

Demographic characteristics of respondents that participated are presented in Figure 1. The majority (51%) of respondents was female and 49% were male. On age range, 19% of respondents indicated that they are aged between 25 and 30, 17% where aged between 31 and 35, whilst 8% where aged between 36 and 40 with 21% aged between 31and 45, 15% were aged between 46 and 50. There was also 13% aged between 51-55 and 7% of the respondents were above the age of 56 years.

Educational Qualifications and Field of Work

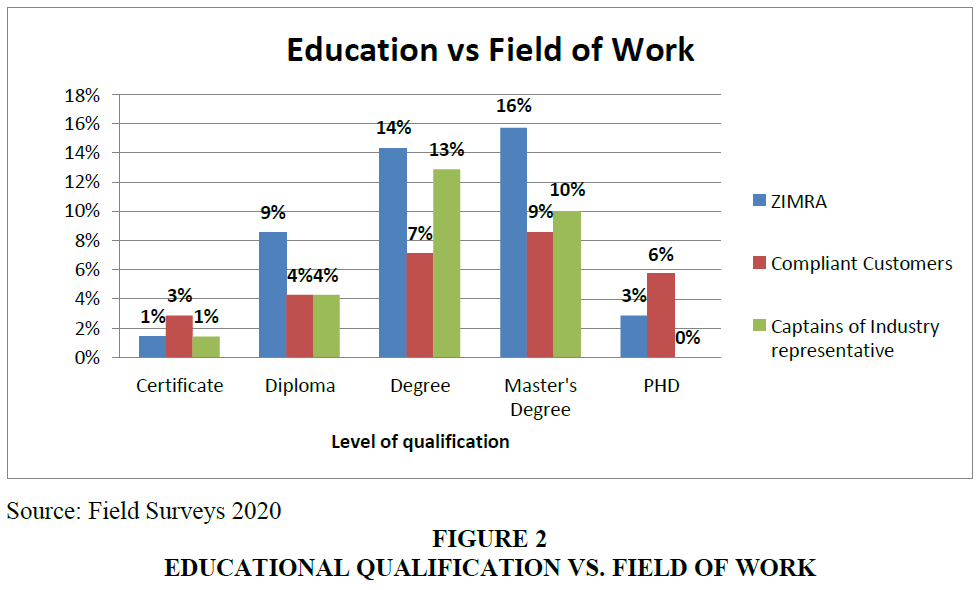

In terms of highest level of educational qualifications, the majority 35% obtained a Master’s degree, 34% obtained a bachelor’s degree whilst 17% indicated that they have a Diploma, 9% and 4% respectively indicated that they had a PHD and a certificate respectively as the highest educational qualification. The higher level of qualifications indicated that respondents were able to provide necessary information on the impact of digital economy taxation on tax revenue administration in Zimbabwe. It was also observed that the respondents representing all fields under study had the requisite qualifications to give a credible opinion. One company has 14% and 16% of the respondents attaining at least a bachelor’s degree, whilst compliant customers have the highest number of PHD holders of up to 6%. Representatives from the industry have 13% and 10% holders of a Master’s and Bachelor’s degree respectively. This indicates that conclusions draw from these various sectors represents fair opinion regarding the market perspectives (Figure 2).

Use of digitalization in VAT

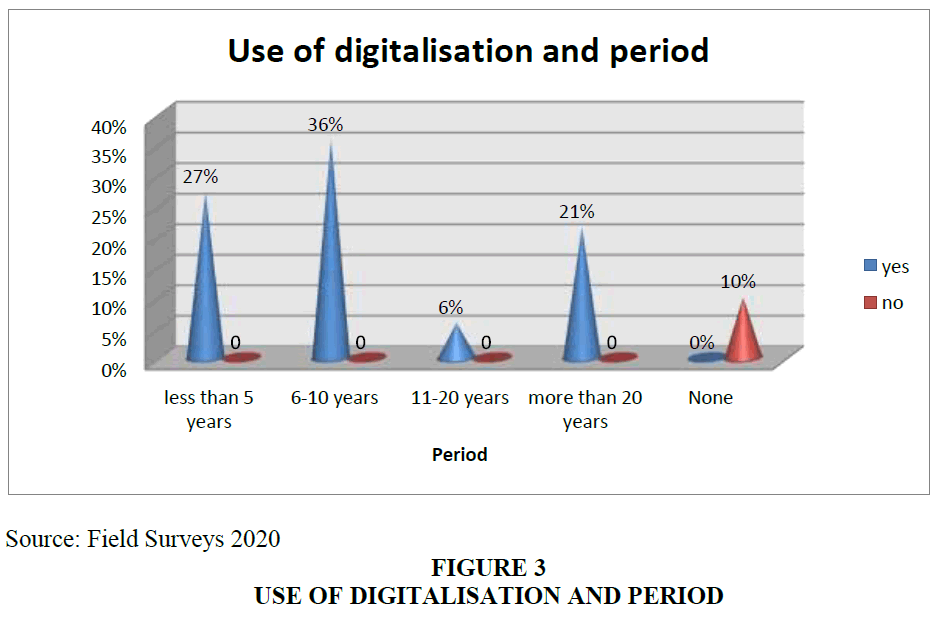

Regarding the use of digital technologies in taxation the respondents were asked if they use digital taxation in VAT and the period (in years) for which they been using digitalization. This was presented in the figure below, 90% of the respondents indicated that they use digitalization in value added tax and 7% of the observations indicated that they do not use it (Figure 3).

The respondents that use digital taxation in VAT indicated that 27% used it for less than 5 years. The highest frequency being 36% users who have used between 6 and 10 years, 6% being 11 to 20 years and 21% used digital technology for more than 20 years. These findings indicated that the targeted respondents have enough experience and knowledge on the impact of digital economy taxation on value added tax in Zimbabwe and it is in line with Wadesango et al. (2018)’s findings on the same issue as well as Johnson & Aboyeji (2015).

The Impact of Digital Economy Taxation on Value Added Tax Generation in Zimbabwe

The first objective of the study focused on assessing the impact of digital taxation on value added tax generation in Zimbabwe. On whether there is use of digital economy technology on tax generation, the majority (90%) indicated that they always use it and 10% indicated that they do not use it. These findings indicated that digital economy taxation is to a large extent being used in value added tax generation in Zimbabwe. The results are similar to what emerged in Wadesango & Wadesango (2016)’s study which indicated that digital economy taxation is in use in Zimbabwe. To assess the positive impacts of digital economy taxation on VAT generation, respondents were asked to show their opinion on to the positive impacts of digital economy taxation on value added tax generation. The response was on a five-point Likert Scale where 1= Strongly Agree, 2 = Agree, 3 = Neutral, 4 = Disagree and 5 = Strongly Disagree. Table 1 below summarizes responses on the positive impacts of digital economy taxation on VAT generation.

| Table 1 The Positive Impacts of Digitalisation on VAT | |||||

| Question | Strongly agree | Agree | Indifferent | Disagree | Strongly Disagree |

| It is easy to generate VAT using digital economy | 16% | 43% | 3% | 21% | 17% |

| Digital economy taxation improves VAT accountability | 36% | 24% | 0% | 30% | 10% |

| It is easy to calculate VAT using digital economy taxation | 26% | 34% | 0% | 20% | 20% |

| Digital economy improves taxpayers VAT self-reporting | 14% | 27% | 33% | 9% | 17% |

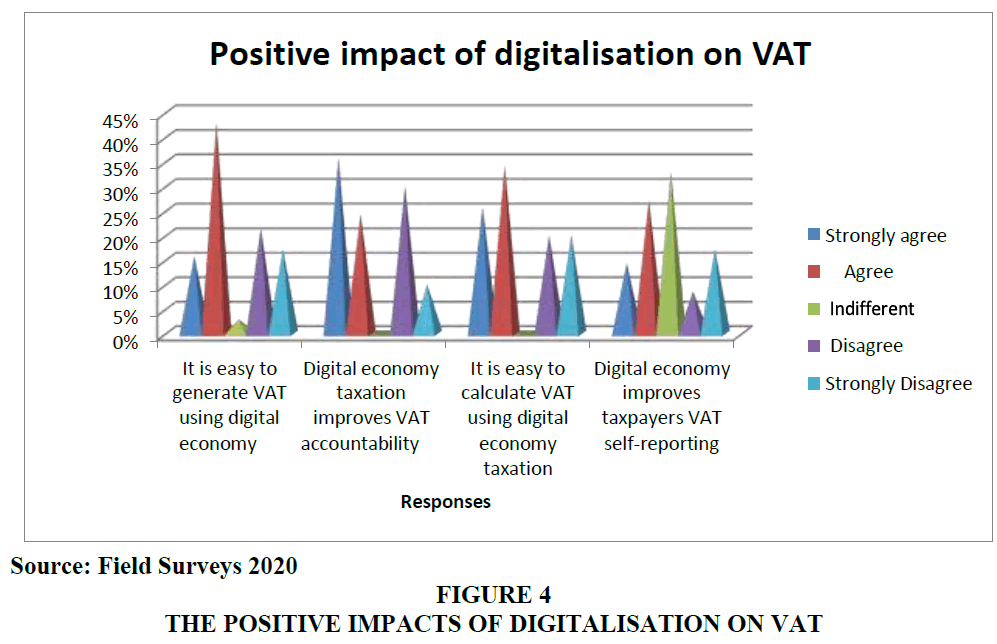

The above impact can be described better in the Figure 4 below:

On the impact that it is easy to generate VAT using digital economy taxation, findings indicated a 16% and 43% of the respondents strongly agree and agree that digital economy taxation makes it easier to generate value added tax. 3% of the respondents were neutral as to whether VAT will be easily generated. 21% and 17% disagreed and strongly disagreed that VAT generation can be made easier due to digitalization. This means that the majority of the respondents were of the opinion that VAT generation will become easier due to the use of digitalization in taxation. 36% and 24% of the respondents strongly agree and agree respectively that digitalization improves VAT accountability. This addresses questions raised by stakeholder on the misappropriation and miscalculation of VAT over the years. On the other hand, 30% and 10% of the respondents disagree and strongly disagree to the improved VAT accountability concurring with Mhaka (2019)’ s findings.

On the finding of whether it is easy to calculate VAT using the digital platform, 26% and 24% strongly agree and agree respectively whilst 20% and 20% disagree and strongly disagree respectively. It can there be noted that the majority of the respondents agree that it is easier to calculate VAT using digital economy taxation.

33% of the respondents indicated that they were neutral regarding the improvement of taxpayer’s VAT reporting. Whilst 14% and 27% of the respondent strongly agree and agree respectively that self-reporting of tax payers will be improved. On the other hand, 9% and 17% of the respondents disagree and strongly disagree that digital economy taxation improves taxpayers self-repotting.

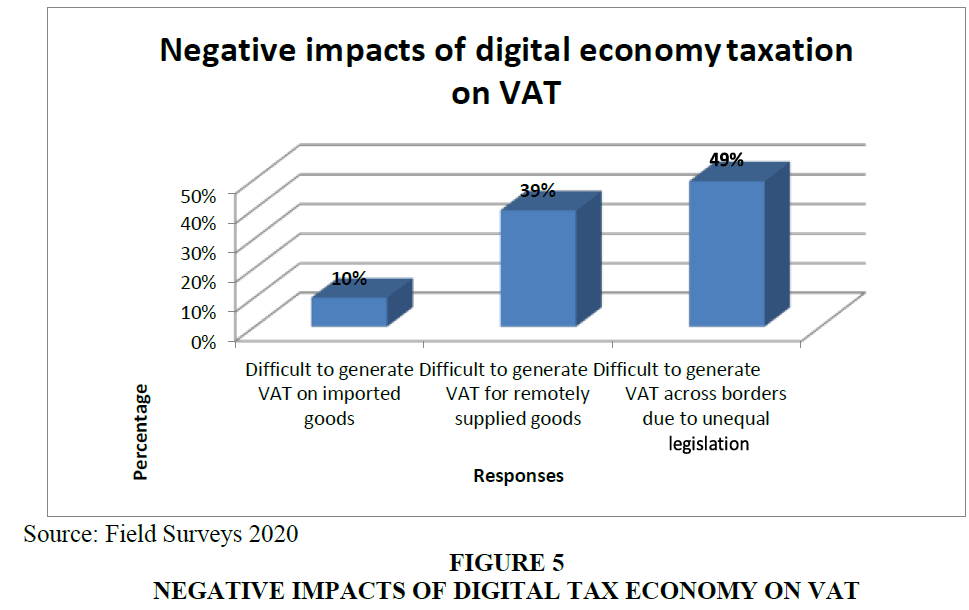

Negative Impacts of Digital Economy Taxation on VAT Generation

The negative impacts of digital taxation on VAT generation that were highlighted by respondents include that digital economy taxation makes it difficult to generate VAT on imported, it is difficult to generate VAT for remotely supplied goods and it is difficult to generate VAT across borders due to unequal legislation.

From the findings in Figure 5 above, the majority (49%) who agreed highlighted that it is difficult to generate VAT across borders, 39% agreed that it is difficult to generate VAT from remotely supplied goods whilst 10% were of the opinion that it is difficult to generate VAT on imported goods. It follows that according to a report by the OECD (2013) challenges or negative impacts that are brought about by digitalization in VAT emanate from unequal legislation. The report goes on to say that imports of lower value goods from online sales and purchases are treated as VAT exempt n many jurisdictions. Furthermore, the strong growth in the trade of intangibles and services particularly to private customers is difficult to include in VAT computation since most of these transactions are either undocumented or unreported (Wadesango et al., 2017; Lamensch, 2015; Mannio, 2011; Maples & Sawyer, 2017).

Follow up interview questions to various stakeholders gave rise to the below findings in impacts of digitalization in VAT that are most linked to the different legislation which makes it difficult to levy collect VAT using the digital platform. The respondents from the industry representatives highlighted that as long as there no multilateral agreements internationally it will be difficult to generate VAT on the digital platform, also citing reasons pertaining to the network infrastructure which will be covered in the sections to follow.

The Impact of Digital Economy Taxation on Tax Revenue Administration in Zimbabwe

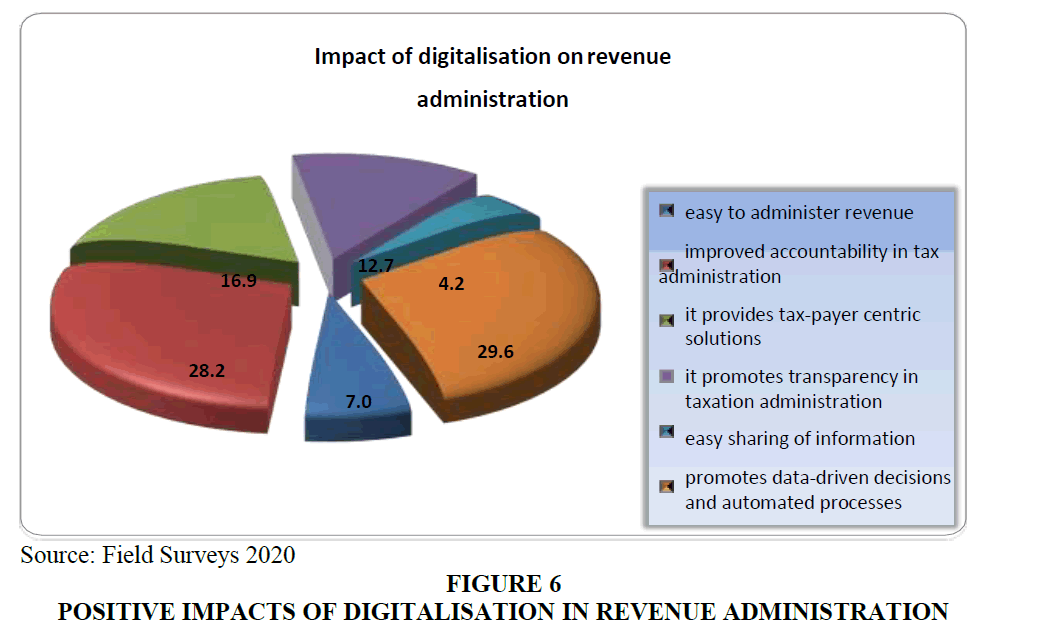

The second objective of the study focused on assessing the impact of digital economy taxation on tax revenue administration in Zimbabwe. From interviews it emerged that the use of digital economy taxation on tax revenue administration has been on the increase in Zimbabwe which resulted in both positive and negative impacts of tax revenue administration. Findings of the study highlighted a number of positive impacts which included that it is easy share information on administered tax, it promotes transparency in tax administration, provides taxer payers centric solutions to tax administration, improves accountability on tax administration and lastly it makes it easy to administer revenue tax. Figure 6 below summaries findings on the positive impacts of digital economy taxation on tax revenue administration.

4.2% of respondents agreed to the statement that its digital economy taxation makes it easy to share information on administered tax, 67% agreed whilst 27.8% disagreed and 1% strongly disagreed. On whether digital economy promotes transparency in revenue tax administration, 12.7% strongly agreed, 73.3% agreed, 10% were not sure whilst 3% and 1% strongly disagreed and agreed respectively. On the positive impact that digital economy taxation provides tax payers centric solution to revenue tax administration, 16.9% strongly agreed, 59% agreed, 18.1% strongly disagreed, 4% and 2% disagreed and where not sure respectively. On whether digital economy taxation improves accountability on tax administration, 28.2% strongly agreed, 59% agreed whilst 3% and 10.8% disagreed and strongly agreed respectively concurring with Gader (2018) whose study found that digital economy taxation improves accountability on tax administration.

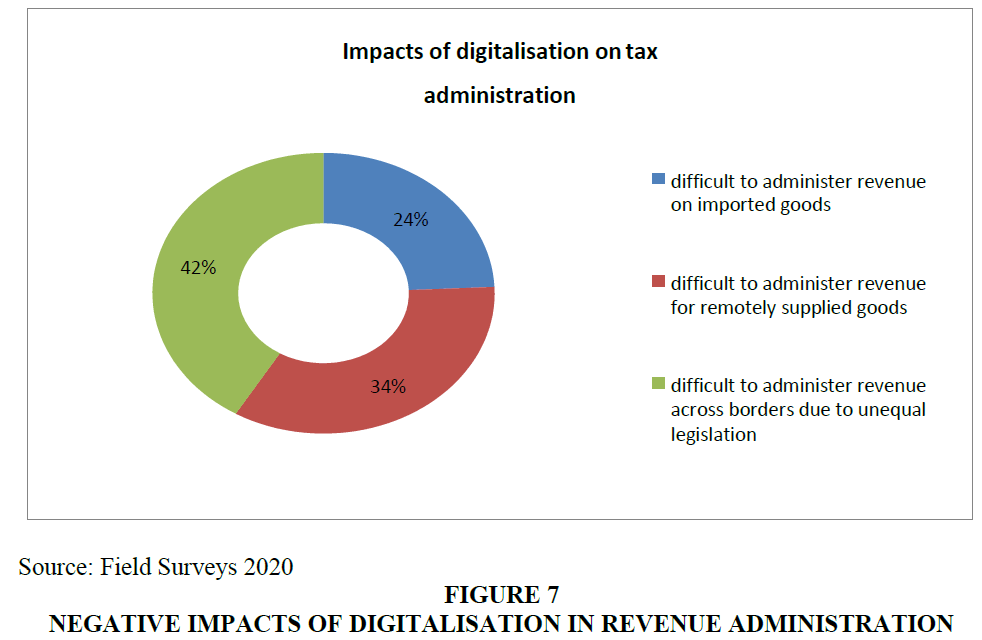

Negative Impacts of Digital Economy Taxation on Revenue Tax Administration

Findings of the study further indicated that beside the positive impacts there are also a number of negative impacts associated with digital economy taxation on tax revenue administration. The negative impacts that were highlighted included that it is difficult to administer tax revenue of goods that imported, it is difficult to administer tax revenue of goods tax revenue of goods purchased online and lastly it is difficult to administer tax revenue across boarders due to difference in legislature (Wadesango, & Makerevi 2018). Respondents were asked to share their perception on the above negative impacts of digital economy taxation on tax revenue administration. Figure 7 below is an illustration of the negative impacts of digital economy taxation on revenue tax administration.

On the statement it is difficult to administer tax revenue on goods that are imported, 24% strongly agreed, 56% agreed, 11% disagreed whilst 7% and 2% disagreed and not sure respectively. To the statement, it is difficult to administer tax revenue of goods purchased online, 34% strongly agreed, 61% agreed, 4% strongly disagreed and 1%disagreed. To the statement, it is difficult to administer tax revenue across borders due to differences in legislation, 42% agreed to this, 46% strongly agreed, whilst 9% disagreed and 2% strongly agreed. This is in line with the study conducted by Wadesango & Mhaka (2017) whose results indicated that it is not easy to administer tax revenue on goods that are imported.

Conclusion

It is apparently clear that the budget deficits that the nation has been facing can be curtailed by the use of taxation. This will have to be done on a broader perspective including taxing the digital economy. Though it is obvious that the infrastructure that supports digital economy taxation is not yet adequate in Zimbabwe, the authorities can make us of the suggestions made in this research and literature provided to help craft legislation and device strategies to make full use of the digital economy taxation. Based on the results found in this study, there are both positive and negative impacts that digitalisation brings to the country. It has a bearing on VAT, and on tax administration and also on the network infrastructure. Based in educated opinion of the population selected in this study, it can therefore be unequivocally stated that we cannot look at taxation in isolation of the digital economy taxation. Indication from the captains of industry are that the world is moving towards the digital age and hence Zimbabwe has prepared to counter the digital transformation and to embrace it for the betterment of both the industry and the national income.,

Recommendations

Based on the study conclusions, the following recommendations are proposed:

1. There is need for the government to fully embrace digital technology on all its departments so that it will be easy the generate VAT using digital economy taxation.

2. Cooperation and international consensus are required to tackle similar challenges of generating VAT across boarders where there is different legislation.

References

- Leonardi, R., & Boccia., F (2016). The Challenge of the Digital Economy. Markets, Taxation and appropriate Economic Models. Cham, Switzerland: Springer Nature

- IFAC (2015), Business Responses: Three Imperatives for Taxing the Digital. Retrieved from http://www.ifac.org global-knowledge-gateway/business-reporting/discussion/three-imperatives-taxing-digital-economy

- James, S., & Nobes, C. (2016). The Economics of Taxation: Principles, Policy and Practice. 96/97 ed. Hertfordshire: Pentice Hall Europe.

- Johnson, J., & Aboyeji, I. (2015). Is Africa hiding the next Mark Zuckerberg? The future of tech talent. The Wall Street Journal. Retrieved from http://www.wsj.com/articles/is-africa-hiding-the-next-mark-zuckerberg-the-future-oftech-talent-1449242360

- Kuo, L. (2016). African startups are defying the global tech slowdown. Quartz Africa. Retrieved from http://qz.com/592119/african-startups-are-defying-theglobal-tech-slowdown/

- Lamensch, M. (2015). European Valued Added Tax in the Digital Era: Critical Analysisand Proposals for reform. 36th ed. Amsterdam: IBFD.

- Mannio, L. (2011). Sähköisen kaupankäynnin verotus. Vantaa: WSOY Lakitieto.

- Maples, A., & Sawyer, A. (2017). The New Zealand GST and its Global Impact: 30 Yearson. New Zealand Journal of Taxation Law and Policy, 23. Auckland: Brookers, 9-26.

- Merkx, M. (2017). Fixed Establishment in European Value Added Tax: Base Erosion and Profit Shifting´s Side Effects? – ec Tax Review, Vol. 26. (Eds.) B.J. Kiekebld. Alphen aan den Rijn: Kluwer Law 36-45.

- Moosajee, N. (2016). Is Africa leading the innovation revolution. World Economic Forum (WEF) Davos 2016 Blog. Retrieved from https://www.weforum.org/agenda/2016/01/the-fourth-industrial-revolution-what-it-means-and-how-to-respond/

- OECD (2018). Summary of Responses of the Advisory Group: Survey of on Digital Economy Typology, STD/CSSP/WPNA (2017)1. Retrieved from http://www.oecd.org/officialdocuments/

- Rohatgi, R. (2015). Basic International Taxation. 2nd ed. Richmond: Richmond Law & Tax Ltd.

- Schellekens, M. (2016). What Holds Off-Line, Also Holds On-Line? Starting Points for ICT Regulation. Law Series, vol. 9. The Hague: TMC Asser Press, 51-75.

- Schenk, A., & Oldman, O. (2007). Value added tax: A comparative approach. Rev. ed. New York: Cambridge University Press.

- Schwanke, A., & Stanley-Smith, J. (2016). GST to be Enforced on E-Commerce in NewZealand. International Tax Review, vol. 26. London: Euro money Institutional Investor PLC, 9-10.

- Wadesango, N., & Makerevi, C. (2018). Investigating the value creation of internal audit and its impact on company performance. Academy of Entrepreneurship, 24(3), 1-21.

- Wadesango, N., & Mwandambira, N. (2018). Evaluating the impact of tax knowledge on tax compliance among small medium enterprises in a developing country. Academy of Accounting and Financial Studies Journal, 22(6), 1-14.

- Wadesango, N., Nani, L., & Mhaka, C. (2017). A literature review on the effects of liquidity constraints on new financial product development. Academy of Accounting and Financial Studies Journal, 21(3), 1-11.

- Wadesango, N., & Mhaka, C. (2017). The effectiveness of enterprise risk management and internal audit function on quality of financial reporting in universities. Journal of Economics and Behavioral Studies, 9(4), 230-241.

- Wadesango, N., & Wadesango, O. (2016). The need for financial statements to disclose true business performance to stakeholders. Corporate Board: Role, duties and composition, 12(2), 77-84.

- Wadesango, N., Mutema, A., Mhaka, C., & Wadesango, V.O. (2018). Tax compliance of small and medium enterprises through self-assessment system: Issues and challenges. Academy of Accounting and Financial Studies Journal, 22(2), 1-15.