Research Article: 2021 Vol: 27 Issue: 5S

Assessing Challenges and Opportunities in Optimizing Logistics and Supply Chain Performance in Oman

Mohammed Salim Mohammed Al Abbadi, Universiti Teknikal Malaysia Melaka

Muhammad Imran Qureshi, Universiti Teknikal Malaysia Melaka

Muhammad Yasir, Bacha Khan University Charsadda

Nohman Khan, Universiti Kuala Lumpur

Keywords

Logistic And Supply Chain, Human Resource Competency, Oman.

Abstract

In Oman, the logistics & supply chain sector had great attention from the government & considered an essential field for the development plans to boost the national economy. Last few years, it has become necessary to move to other sources that enhance economic diversification instead of the primary oil dependence. The Sultanate of Oman has been succeeded in choosing the logistics & supply chain sector as one of the main pillars of economic diversification within Oman Vision 2040. Nowadays, it becomes one of the popular sectors that play a vital role as a source of income, attract local & foreign investments. However, limited research is available on the effectiveness of logistics & supply chains in Oman. Therefore, this study aims to promote the performance of logistics & supply chain sectors by analyzing the challenges & opportunities, affecting the generate & soaring income sources, financial stability, & boosting the economic Diversification in Oman. This study focused on the challenges & opportunities in the logistics & supply chain management sector in Oman. It provided a theoretical framework to understand the institutes' performance through achieving diversification. A descriptive research design was chosen to be used in this study. The population target of this research is to focus on the logistics & supply chain sector in Oman, especially those related to free zones & industrial areas. A quantitative approach through questionnaire development was utilized. Data collection was distributed randomly to more than 200 respondents among subsidiaries in the free zones & the industrial regions. One hundred fifty completed questionnaires were returned & used in data analysis. The researcher tested the hypotheses related to the relationships proposed in the study model, & all hypotheses were accepted. The findings from this study have provided an academic contribution, an empirical contribution for companies & communities, & contextual & managerial contribution to the literature on logistics & supply chain with boosting the national economy.

Introduction

Meanwhile, some studies discuss the logistics & supply chain services in Oman, such as Oman as a future logistics hub (Ba-Awain, 2018), Integration of Oman ports into global supply chains Stalinska (2014), analysis of Oman supply chain practices Taderera (2018) & modeling supply chain network (Al-Harrasi, 2017). At the same time, there aren't studies that have established the opportunities & challenges faced by Oman as the key indicator in optimizing logistics & supply chain performance to achieve & boost economic diversification. Moreover, issues & challenges related to Oman's logistics & supply chain sector still haven't been addressed adequately. According to Hakro (2016) it must be ensured that conditions depending on the energy sector, in the long run, make the Oman economy in danger due to the deterioration in production capacity, high production costs, & fluctuating oil prices. According to the vision of Oman 2020, the Oman government set out for diversification to build a strong economy independent of natural resources. Çelebib (2016) explained that this time the change of the world economy exposes a much harder posture to be analyzed & to be set in motion. Besides this statement, some countries in the developing world, especially in the Gulf, suffer from economic problems. So, to improve income sources, Oman's dependence on logistics & supply chain, agriculture, tourism, & transformative industry Tanfeedh (2017), which expected to play significant roles to upgrade the national economy. This is supported by Stalinska (2014), who stated that Oman & due to economic problems & pressures coupled with lack of financial income. The government took a course on significant structural transformation of the economy. This is the major shift from oil-based to diversified economies, with higher levels of savings and investment, focusing on appropriate sources of national income. However, in recent years, world trade became different from before and required a rigid connection with world transections. As well, the expected contribution from logistics and supply chain is not clear yet.

Moreover, the recent research suggests that logistics and supply chain had a strong connection & effect with such sections as transportation, infrastructure, & communication. This is confirmed by Çelebib (2016), the global trade is undergoing a rapid change by segmentation of production processes & integrating emerging economies. So, the researcher is looking forward to measuring the available opportunities in the logistics & supply chain sectors & boosting the national economy. Next is to know the magnitude of the challenges in that sector. As well, the ability to optimize logistics & supply chain performance. Most previous studies dealing with Oman's logistics & supply chain sector, like Oman as a future logistics hub Ba-Awain (2018), Integrate Oman ports into global supply chains (Stalinska, 2014) take into consideration the importance of Omani geographic location. However, there is a scare of studies that focus on maximizing the location to improve logistics and supply chain performance to enhance the national economy.

The success of the logistics & supply chain sector mainly depends on the country's infrastructure. Based on Vilko (2011), infrastructure is an essential part of logistic & supply chain systems & the lack of it has a strong influence on economic growth. Also, Kadłubek (2019) mentioned that great emphasis in the logistics area is placed on the infrastructure, smooth distribution of goods, dynamic and flexible ability to react to today's competitive market environment. Therefore, there is a gap of studies that focus on maximizing the infrastructure to improve logistics and supply chain performance to enhance the national economy.

There are a host of opportunities that the government aspires to promote economic diversification & achieve financial sufficiency. For example, create employment opportunities, establish free zones, & upgrade the available ports and airports, One-stop-shop window, and so on. In theory, the result of the study by Soofi Asra Mubeen (2017) explained that non-oil GDP is showing a gradual increase in growth as the central government focus on tourism, logistics, & mining sectors. This idea is supported by Oman's vision 2020, contributing to the diversification & development of private industries. Which make a step towards developing the economy? Therefore, there is a gap of studies that focus on maximizing the economic opportunities to enhance logistics and supply chain performance to reach the national economy. Thus, the current study aims to analyze the challenges and opportunities in optimizing logistics and supply chain performance to boost the Omani economy.

Opportunities in the Logistics and Supply Chain Sector in Oman

Many economists expect that Oman will earn a leadership position in the logistics & supply chain sector in the next few years, especially with integrated infrastructure in various vital sectors; thus, the government has placed huge investments. (Hayaloglu, 2015), described that the logistics & supply chain sector had become an essential element of trade by taking an active role in this development. The government outlay billions of Omani Riyals to advance and optimize the logistics and supply chain sector to reach the diversification target and boost Oman's economy. Also, Oman had well and excellent international economic relations (Stalinska, 2014) and trade agreements with the most vital business world countries. Hence, it can allow Oman to advance the logistics and supply chain sector.

From table 1, various opportunities could study and analyzed as following:

| Table 1 The Available Opportunities in Sultanate of Oman In Applying Logistics Sector |

||

|---|---|---|

| Reference | Opportunities | Defines |

| Oman Newspaper | Location | The strategic location of the Sultanate of Oman, which overlooks the largest network of global navigation lines. |

| Faustino Taderera (2018) | Oman is the jewel of the Middle East and the GCC strategically located on the Strait of Hormuz in the Arabian Peninsula and heavily involved in supply chain operations. | |

| Ba-awain (2018) | This country is located at the gateway to the Gulf and has a logical distribution hub for the Indian subcontinent and nations in East Africa. | |

| Virgilli & Stefano (2018) | Infrastructure | In November 2017, the status of the infrastructure was granted to the logistics sector. |

| Ba-awain (2018) | For instance, in the year 2016, Oman's infrastructure grew by 3.4 percent compared to 2015. | |

| Freezone (2017) | Heavy investments in non-oil sectors, such as construction, transport, power, and rail infrastructure, have resulted in a constant flow of projects in these sectors | |

| Virgilli, Stefano (2019) | Economic opportunities (Employment, free zone and ports, One-stop-shop window) | Create employees opportunities/ create new jobs/ it employs over 45 million people across the country and specific subsectors grow at a rate of 15 percent and even 30-40 percent per year. |

| Ba-awain (2018) | It can create more employment opportunities and provide low costs in import and export activities. | |

| Ba-awain (2018) | There are four FTZs in Oman. Three FTZs are located nearby to the Deepwater ports in Sohar, Duqm, and Salalah | |

| Yasein (2018) | Flexible, accurate & fast clearance of goods ( BAYAN) The online single window/one-stop service offering by (ROP) | |

| Yasein (2018) | Economic Diversification | Economic diversification and supporting the national economy |

| Ba-awain (2018) | The logistic sector is increasingly becoming a vital component of international trade for assisting a nation's economic growth. | |

Location

Taderera (2018), described the location by clarifying Oman is the jewel of the Middle East & the GCC strategically located on the Strait of Hormuz in the Arabian Peninsula & heavily involved in supply chain see figure operations. Also, Ba-Awain (2018) expresses the importance of Oman's location by saying this country is located at the gateway to the Gulf & to the above statements (Watan, 2020) in the interview with the CEO of Asyad, the Omani International Logistics Group, mentioned that the Sultanate of Oman has a strategic location overlooking the largest network of global navigation lines. The report explained the Oman location as a strategic geographical location at the crossroads of the Indian Ocean that had been central for centuries, connecting trade routes between the Red Sea, India, Iran and East Africa (Communications, 2015). Similarly, (Ba-Awain, 2018) emphasizes the importance of business location country is located at the gateway to the Gulf and has a logical distribution hub for the Indian subcontinent and nations in East Africa.

Oman has a distinctive location with a substantial opportunity, as it can be blessed with very beneficial geopolitical allocation; its economy is naturally integrated into Global Supply Chain and logistics through seaports. With high professionalism, Oman has been able to build strong economic relations with various countries to enhance its position and role in the region. Also, it has succeeded in attracting global investments and best practices in that field.

H1: Location has a positive effect on supply chain and logistics performance to boost the Omani economy.

Infrastructure

In recent years, infrastructure networks play a vital role in integrating a country's economic & territorial system, enabling its logistics connectivity (Bulletin, 2017). Oman has implemented several mega projects related to infrastructure development. (Stalinska, 2014), explained one of the fundamentals of economic growth is to build infrastructure enabling the development of different regions, industries, & private sectors. The logistics & supply chain sector in Oman joined a major qualitative shift represented in providing a road network that links all parts & regions. The most critical projects that has been done are new Muscat Airport, upgrading Salalah Airport, Duqm & Sohar ports. As explored by Virgilli (2018), in November 2017, the status of the infrastructure was granted to the logistics sector. The same idea was explained by Ba-Awain (2018), in the year 2016, Oman's infrastructure grew by 3.4 percent compared to 2015. The report issued by Freezone (2017) illustrated that heavy investment in non-oil sectors, such as construction, transport, power, & rail infrastructure, has resulted in a constant flow of projects in these sectors.

In recent years, the government has implemented a wide range of construction projects to develop & upgrade different infrastructure regions. Also, clear plans & strong connections between all government-related sectors give the infrastructure the priority & unlimited support, especially transport, ports, airports, & roads.

H2: Infrastructure has a positive effect on supply chain and logistics performance to boost the Omani economy.

Economic Opportunities

One of the Oman government targets of moving to logistics and supply chain sectors & boosting the economic diversification is creating more employment opportunities. As it confirms by Virgilli (2018), it creates employment opportunities, it employs over 45 million people across the country & specific subsectors grow at a rate of 15 percent & even 30-40 percent per year. At the same time, this point is supported by (Ba-Awain, 2018) when he mentioned that it could create more employment opportunities & provide low costs in import & export activities.

Free zones are generally defined as secured areas adjacent to ports in which goods can be stored for prolonged periods without customs duties, excise tax or inventory tax paid on the goods (Wagner, 2017). Nowadays, many countries resort to establishing free zones to raise the economy of countries & attract investment. This statement illustrated by Wagner (2017), an instrument of a free zone aims to foster the growth of a nation's economy in different aspects.

Also, the rising quantity of logistics sectors & Free Zones (FZs) in ports worldwide explain the significant role in terms of their logistics services. Oman is one of the countries that took choose this step to support the national economy. (Ba-Awain, 2018), shed light on that point. There are four FZs in Oman. Three FZs are located nearby to the Deepwater ports in Sohar, Duqm, & Salalah. The fourth free zone is called Madayn, located in Al-Mazuonah, close to the Yemen border.

Linking with the free zone, Oman has several ports serving in emerging markets (GCC) countries. The most essential and efficient ports are Salalah, Sohar & Duqm ports. In contributing to their free zones can also play uniqueness to support the Oman economy.

Moreover, the One-Stop-Shop (OSS) created & developed in the freest zone such as a single window for clients to fulfill all they transaction needs to set up and operate their businesses efficiently & effectively. (Freezone, 2017) OSS provides multiple key services under a single window that has enhanced resources to deliver high-quality services. Availability of free zones in four different locations connected with advanced ports, Flexible, Accurate & Fast clearance of goods all that can play economic opportunities with boosting the financial stability.

H3: Economic Opportunities positively affect supply chain and logistics performance to boost the Omani economy

Diversification

Due to the deterioration in production capacity, high production costs, & fluctuating oil prices last few years, the Oman economy has been described as dangerous. (Ba-Awain, 2018) Enhancing this idea by the declaration that the logistics & supply chain sector is increasingly becoming a vital component of international trade for assisting a nation's economic growth. Economic diversification is necessary to settle earnings & enhance the revenue of the whole country's economy. Most countries are working at a steady pace & continued financial support to reach economic safety, as the Oman economy is dependent on oil which is the main contributor to government revenues (Mubeen, 2017). It must make some plans & policies on developing new technology, diversification of the economy, controlling inflation, undertaking unemployment, & diversifying the economy & developing the country (Mubeen, 2017). Diversification is a mechanism that reduces financial risk by allocating investments among various financial instruments, industries, & other categories. It aims to maximize returns by investing in different areas that would react differently to the same event. As Oman's economy depends mainly on oil production, the situation was tough when the Organization of Petroleum Exporting Countries (OPEC) forced all members to decrease their oil production in 2017. So, diversification is the main road to survive from financial risk..

H4: Diversification has a positive effect on supply chain & logistics performance to boost the Omani economy

Challenges of Logistics and Supply Chain Sector in Oman

At the global level, Oman had a set of an initiative to transfer & create in specific locations too many rectifiers to enhance the logistics & supply chain sector & link with world trade and economy. Al-Wahaibi (2019) explained Oman is taking unprecedented steps to develop its logistics sector to be one of the main pillars of the nation's non-oil-based economy in the future. In this regard, the government investment & development in logistics & supply chain logically face challenges and difficulties.

Regardless of the strength of the challenges, the logistics and supply chain sector had contributed a major role in facilitating world trade. As Kadłubek (2019) explained, great emphasis in the logistics and supply chain area is placed on the smooth distribution of goods, dynamic & flexible ability to react to today's competitive market environment & fine-tuning tasks regarding customer satisfaction. Also, the value of logistics & supply chain services appeared in the last two decades from the excellence of services provided in different trade sectors. Next to that, the World Bank describes the logistics industry as the backbone of global trade (Newspaper, 2016). This confirms that the logistics & supply chain sector still have a prominent role even with complex challenges. Generally, Oman had accompanied by a collection of internal & external challenges. However, the government has gone to developing and implementing the logistics & supply chain sector plans in various regions to boost & diversify the economy. Critical challenges have been explained in the following table 2.

| Table 2 The Challenges Faced By The Sultanate of Oman in The Logistics Sector |

||

|---|---|---|

| Reference | Issue & challenge | Defines |

| Faustino Taderera (2018) | Human resource competency | Quality and fitness of some college/university graduates to labor market requirements, employability of graduates, |

| Oman industry is complaining about graduate non-compliance with labour market requirements and expectations | ||

| No industry can succeed without an accompanying supportive university to give a continuous flow of highly skilled labour and to share international research experiences | ||

| TANFEEDH (2017) | Competition and Connection | Limited connections to ports and airports compared to other GCC countries |

| Ba-awain (2018) | In another infrastructure development, there is a high priority given to the development of the national rail network to link with the Gulf Cooperation Council (GCC) countries. | |

| Ba-awain (2018) | Poor land transport connectivity with other GCC countries | |

| Faustino Taderera (2018) | Attracting FDI in the fierce and brutal Gulf Cooperation Council (GCC) and global competition | |

| Faustino Taderera (2018) | Oman will be competing for investment, markets and talent with regional powerhouses United Arab Emirates and Saudi Arabia in the GCC as well as facing global competition | |

| Virgilli, Stefano (2019) | Transections and Technology | The biggest challenge for companies is to adapt to new market trends./ The report states that logistics companies need to accept challenges and market trends. |

| TANFEEDH (2017) | Lack of efficiency in business transactions | |

| Al-Wahaibi (2018) | It is inevitable that by 2040 logistics operators will rely heavily on technology to cut their costs and stay competitive. | |

| Rotman (2013) | Economic theory and government policy will have to be rethought if technology is indeed destroying jobs faster than it is creating new ones." | |

HR Competency

Table 2 revealed that the first challenge faced by Oman is human resource competency as an intense shortage of experience & skilled labor in the logistics & supply chain sector. Al-Wahaibi (2018) explained that the logistics industry in the Sultanate of Oman is not an attractive field for locals who must cope with poor wages, long working hours, & lack of automation. This issue emerges due to a shortage of educational institutions in Oman that qualify students in such significant & related lack of linking between higher educational institutes & career environment, as confirmed by Taderera (2018). It faces a myriad of challenges as it marches on with modernization. These are to do with the quality & fitness of some college/university graduates to labor market requirements and employability of graduates. Moreover, Taderera (2018) added in his study that no industry can succeed without an accompanying supportive university to give a continuous flow of highly skilled labor & to share international research experiences. Human Resource Management competencies are a core for every organization because an organization's performance depends on the influential role of human resources within the organization (Mangaleswaran 2015).

Therefore, the most important & the most significant asset of any organization is human resources. So, investment in human resources is considered the cornerstone & can play a significant role in society's sustainable development.

H5: Human resource Competency has a positive effect on supply chain and logistics performance to boost the Omani economy.

Competition and Connection

Table 2 revealed that Oman faced internal & external competition challenges. Externally, it becomes clear that from this narrative explanation, the competitive challenges from the global side make a big deal toward the achievement of government vision. Generally, competitiveness is a crucial category of the modern economy & a condition of efficient national integration into global economic processes & active engagement in globalization (Salko, 2020).

Similarly, the competition & connection in the logistics & supply chain services had increased hourly over the last decades, which has led to providing the services with attractive & steady offers. For instance, Taderera (2018) explained that Oman would be competing for investment, markets, & talent with regional powerhouses the United Arab Emirates & Saudi Arabia in the GCC & facing global competition. Next, there are many internal challenges related to connection and networks in roads, ports, free zone, etc. Ba-Awain (2018) illustrated that poor land transport connectivity with other GCC countries & Tanfeedh (2017) described the challenge of limited connections to ports and airports than other GCC countries.

External competition can be one of the most significant challenges for the logistics & supply chain management sectors. Externally, & from this narrative explanation, it becomes clear that the competitive challenges from the global side make a big deal toward the achievement of government vision. Where some of the Gulf countries took the same steps to focus on these sectors, so it can be hypothesized:

H6: Competition & Connection positively affects supply chain and logistics performance to boost the Omani economy

Transection and Technology

When new technology is introduced in a company, resistance to change is almost inevitable due to the need to transform processes & working habits (Simić, 2019). The few researchers also indicated that technological advancement & the digital transaction had contributed significantly & effectively to shaping the global economy. Thus, refer to the changes in the way of business & affect all its aspects, one of the most critical infrastructures for logistics trade. Dębkowska (2017) stated that the increasing demands of the market & the growing competition forced innovative solutions mixed with technology to support the logistics & supply chain processes maximally.

Now-day, technologies like automation create new opportunities for the industries to build competitive advantages in various management areas, including logistics & supply chain sectors (Qureshi et al., 2020; Khan et al., 2020; Chaudhari, 2019). At the same time, technology can be a challenge in such situations. Virgilli (2018) indicated the most considerable challenge for companies is to adopt modern technology & transection to new market trends. The report states that logistics companies need to accept challenges & market trends. Moreover, towards further development & meeting customer requirements & needs, some specialists expected continuous innovations in used technology in the logistics & supply chain sectors. As Al Wahaibi (2018) explained, by 2040, logistics operators will inevitably rely heavily on technology to cut their costs and stay competitive. Also, In Tanfeedh (2017), the ministry of transportation & communication concluded a lack of efficiency in business transactions in Oman. One of the practical challenges for the logistics & supply chain management sectors is implementing the technology and related transactions to meet the different requirements. In logistics & supply chain, information, communication, & automation technologies have substantially increased speed of identification, data processing, analysis and transmission; with high accuracy (Chaudhari, 2019). So, some specialists describe technology as a vehicle to enhance logistics and supply chain competitiveness and performance by improving the overall effectiveness and efficiency of used systems.

Sincerely, choosing the right technology for various logistics activities or sub-processes is very crucial to any business to gain a competitive advantage in today's competitive market. Thus, it can be concluded

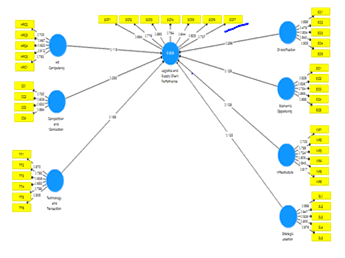

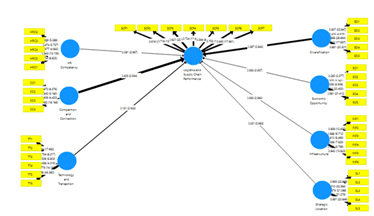

H7: Transection & Technology positively affects supply chain and logistics performance to boost the Omani economy. To gain a deep understanding of the leading research variables and link them to research objectives, the researcher would explain the conceptual research framework through the following figure 1.

Research Methodology

Sampling

The target population is the group on which the study results could be generalized (Bhattacherjee, 2012). A review of the literature illustrated that most of the studies in the context of the Oman logistics & supply chain sector were on specific areas rather than account the strong relations & transaction between all industrial & free zone areas as descriptive research is the research design chosen to be used in this study. The population target of this research is to focus on the logistics & supply chain sector in Oman, especially those related to free zones and industrial areas. This can play significant roles & at the same time gives a substantial share in the economy. In this research, the population size covered around 210 hundreds of employees in those sectors at all management levels. According to Morgen Table, the sample size could be about 132. At the same time, to answer all research questions, the sample must include the kind of services provided by companies and institutes which had a benefit from the logistics and supply chain sector. Also, those have subsidiary contracts in the free zones and industrial areas.

Instrumentation

A questionnaire survey system had been used as a research instrument of data collection from the current study population & sampling. All questionnaire items are described closely &written in both languages English and Arabic. The questionnaire is divided into three main sections of the questions, Part A, Part B and Part C. Part A comprises questions about the Socio-demographic information of the respondents. Part B includes questions regarding the Challenges of the logistics & supply chain sector in Oman, & Part (C) comprises questions about the opportunities in the logistics & supply chain sector in Oman. All questions had scaled by using the Likert Scale from (1 to 5).

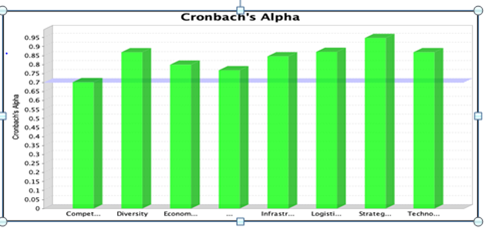

In the current study, reliability analysis is used to analyze the questionnaire items that consist of different variables, whether they are reliable & correlate between each other. The reliability of measurement was founded by testing for both consistency & stability Bougie (2016). In almost every case, Cronbach's Alpha was a sufficient test of internal consistency. In this research, Cronbach's Alpha value of more than 0.70 or higher will refer that the rate is acceptable in describing the research variables. Figure 2 below shows the value of Cronbach's alpha & internal consistency Salkind (2014).

Results

Demographics

The descriptive analysis for the current study was done in three stages. The first section represents the characteristics of the socio-demographic (personal information and institutes details). As seen in table 3, data were collected from a diverse pool of respondents, including gender, age, educational attainment, position with work experience, and company size with services provided. Each of the data was confirmed by frequency and percentage tables. Thus, the data were presented in such a clear and meaningful view.

| Table 3 Respondents Demographic Characteristics |

|||

|---|---|---|---|

| Respondent | Sub profile | Frequency (n) | Percentage |

| Characteristics | (%) | ||

| Gender | Male | 117 | 88.64 |

| Female | 15 | 11.36 | |

| Age | Less than 25 years | 5 | 3.7 |

| Between 25 – 34 years | 60 | 45.45 | |

| Between 35 – 44 years | 43 | 32.57 | |

| Between 45 – 55 years | 21 | 15.9 | |

| More than 55 years | 1 | .75 | |

| Educational Attainment | Secondary/High school education. | 39 | 29 |

| Undergraduates (Diploma, Bachelor) | 75 | 56.8 | |

| Postgraduate (Master, PHD). | 17 | 12.8 | |

| Work Experience | Less than 1 year | 10 | 7.5 |

| Between 1 – 2 years | 10 | 7.5 | |

| Between 3 – 5 years | 35 | 26.5 | |

| Between 6 – 10 years | 29 | 21.9 | |

| More than 10 years | 46 | 34.8 | |

| Work position | Managing director | 10 | 7.5 |

| Senior management. | 8 | 6.06 | |

| Middle management. | 41 | 31.06 | |

| Lower middle management/supervisor | 44 | 33.3 | |

| Other (Please specify) | 26 | 19.69 | |

| Number of employees | Less than 40 | 38 | 28.7 |

| Between 40 – 75 | 10 | 7.5 | |

| More than 75. | 83 | 62.8 | |

Based on the percentage in the above analysis table, most of the respondents were male gender, which is 88.64%, while females offered around 11.36%. This showed the logistics & supply chain sector in Oman is male dominant. The researcher specified five age categories among the questionnaire participants at selected institutes in the logistics & supply chain sectors. First, there was recorded 3.7% for the category of less than 25 years old, while the highest percentages (45.45 %) of the respondents were between 26 – 34 years old. Also, there were 32.57 % aged 35 – 44 years old, and 15.9 % were aged 46 – 54 years old. Next, just one respondent was aged more than 55 years old. Based on these details, most employees in the logistics & supply chain sector in Oman are youth.

The researcher divided the educational attainment level into three main categories in the current study, which could cover all employees in the research area. The respondents who had undergraduates' degrees (Diploma, Bachelor) showed the highest percentage of all (56.8%). As well, those who had Secondary/High school education had the second-highest percentage, 29 %. Postgraduate (Master, Ph.D.) degree was the lowest 12.8% compared with other categories. Based on this data, we could understand that most employees in the logistics & supply chain sectors were educated, which can positively affect human resource competency & the performance of services provided.

As shown in table 3, most of the respondents who had work experience of more than ten years in the logistics & supply chain sector are the highest 34.8%. the second-highest working experience was 26.5% for respondents who had worked in the company for 3-5 years. Meanwhile, both categories (less than 1 year and between 1 – 2 years' experience) recorded the lowest percentage 10%. Based on the analyses of the data, most employees in the logistics & supply chain sector had a good experience of at least more than 3 years, this could affect positively to the performance of services provided.

Table 3 shows fife main work position categories for all participants in the current study. Initially, lower management/supervisor contained the highest percentage 33.3%. As well, the middle management employees had the second-highest percentage 31.06 %. Therefore, the lowest percentages (6.06%) of the respondents in this study were senior management. In summary, the position could help the researcher evaluate the respondents' job skill level and characteristics, this to answer the questionnaire to ensure that the survey respondents were collected from different position levels

In the current study, the researcher divided the number of employees in the different institutes into three main categories, which are: Less than 40, between 40 – 75 z & more than 75. As it is clear in table 3, most respondents (62.8%) working in the companies which included more than 75 employees. Next, the second percentage was 28.7%, for the number of employees being less than 40. Finally, the lowest number of employees who participated in this study working in the logistics and supply chain sector was Between 40 – 75 at 7.5%.

In short, the number of employees in the logistics and supply chain companies is essential & important in the current study analysis. Hence, the availability of many employees in the organizations or companies leads to the creation of more logistical processes and transactions. As well, the company will tend to use and provide more logistics and supply chain services.

Assessment and Goodness of Measurement Model

First, the measurement model could explain the relationship between research variables & their items. so, in the measurement model, all the items which have been confirmed through confirmatory factor analysis are further tested to check whether all the constructs' items significantly contribute in the proposed model of this study. In current study, all the constructs tested individually with their items. The measurement model had been tested on multiple stages. Thus, to evaluate the measurement models, the PLS algorithm procedure was performed by examination of construct reliability and construct validity, which is composed of convergent and discriminant validity, and loadings of all indicators to their respective constructs (Ahlemann, 2010).

So, the focus in assessing & goodness of the measurement model is to determine the construct validity and reliability. Which refers to the degree of correspondence between constructs & their measures, and therefore it can be undertaken that construct validity is a necessary condition for theory development & and testing (CHERYL BURKE JARVIS, 2003).

The construct validity can be measured through convergent and discriminant validity. Table 4 shows the outer loading of the measurement mode.

| Table 4 Final Measurement Model |

|||||

|---|---|---|---|---|---|

| Constructs | Items | Factor Loading | Average Variance Extracted (AVE) | Composite Reliability | Cronbach Alpha |

| Human resource competency | HRC1 | 0.753 | 0.511 | 0.838 | 0.769 |

| HRC2 | 0.703 | ||||

| HRC3 | 0.667 | ||||

| HRC4 | 0.623 | ||||

| HRC5 | 0.812 | ||||

| Competition and Connection | CC1 | 0.730 | 0.511 | 0.803 | 0.703 |

| CC2 | 0.606 | ||||

| CC3 | 0.630 | ||||

| CC4 | 0.864 | ||||

| Transactions and Technology | TT1 | 0.870 | 0.609 | 0.902 | 0.869 |

| TT2 | 0.780 | ||||

| TT3 | 0.636 | ||||

| TT4 | 0.653 | ||||

| TT5 | 0.799 | ||||

| TT6 | 0.908 | ||||

| Business Location | SL1 | 0.898 | 0.829 | 0.960 | 0.948 |

| SL2 | 0.947 | ||||

| SL3 | 0.925 | ||||

| SL4 | 0.905 | ||||

| SL5 | 0.876 | ||||

| Infrastructure | INF1 | 0.703 | 0.563 | 0.885 | 0.846 |

| INF2 | 0.795 | ||||

| INF3 | 0.724 | ||||

| INF4 | 0.805 | ||||

| INF5 | 0.643 | ||||

| INF6 | 0.817 | ||||

| Economic opportunities | EO1 | 0.528 | 0.534 | 0.845 | 0.800 |

| EO2 | 0.526 | ||||

| EO3 | 0.754 | ||||

| EO4 | 0.869 | ||||

| EO5 | 0.888 | ||||

| Diversification | ED1 | 0.895 | 0.676 | 0.909 | 0.869 |

| ED2 | 0.579 | ||||

| ED3 | 0.904 | ||||

| ED4 | 0.840 | ||||

| ED5 | 0.909 | ||||

| Logistics and supply chain Performance | SCP1 | 0.701 | 0.568 | 0.901 | 0.871 |

| SCP2 | 0.776 | ||||

| SCP3 | 0.863 | ||||

| SCP4 | 0.764 | ||||

| SCP5 | 0.644 | ||||

| SCP6 | 0.805 | ||||

| SCP7 | 0.737 | ||||

Convergent validity is the construct indicators that reflect a large amount of the mutual proportion of variance among factors. It determines the amount of correlation among the measures of the same concept (Joe, 2014). There are three different criteria to test the convergent validity which are the reliability, fractal loading, and Average Variance Extracted (AVE). Convergent validity deals with construct loadings, Average Variance Extracted (AVE) & constructs reliabilities.

(AVE) is the sum of square of standardized factor loadings to represent how much variation in each item is explained by latent. In addition, AVE is the average percentage of variation explained by the measurement items in a construct. The standard value of AVE is 0.50 or greater.

To analyses the convergent validity, it is important to investigate whether all the items are significantly loaded on a construct. Table 4 represents factor loadings of all the items, which are loaded significantly on the constructs at a P-value less than 0.05. To ensure the indicators reliability, main loading & cross loading of items were checked. The question items with main loading value of 0.5 and above are retained. The results show that all items were greater than (0.5) and no dropped items in checking cross-loadings. These items showed low factor loadings. Figure 3 shows the outer loadings of the measurement model.

The average variance extraction criterion is defined as the grand mean value of the squared loadings of the indicators associated with the construct (Hair, 2014). Table 4 shows the average variance extraction of each construct. An Average variance extraction value of at least 0.5 and higher indicates that a latent variable can explain more than half of the variance of its indicators on average. Therefore, it is considered sufficient (Hair, 2014).

According to Ashill, et al., (2005), when average variance extraction is greater than 0.50, the variance shared with a construct & its measures are greater than error. In this study, the initial finding showed the average variance extraction for all constructs is above 0.5. Generally, the Average Variance Extracted (AVE) is greater than 0.5, indicating that the measurement questions can better reflect the characteristics of each research variable in the model (Dongxiao Gu, 2019).

The average variance extraction of the strategic location was the highest & reported 0.829. Economic diversification 0.676, after that transection and technology were reported as 0.609, logistics & supply chain performance was reported 0.568, & both human resource competency & competition and connection had been recorded the lowest AVE, around 0.511.

Discriminant validity

Discriminant validity is the extent to which an instrument contains a genuinely distinct construct from all others. Discriminant validity is the degree to which similar constructs have distinct values. In this type of validity, the responses are measured without cross-loading in terms of latent constructs. In discriminant validity, the value of the square root of average variance extraction should exceed the value of inter-construct correlations. In the current study, two criteria were used to test the discriminant validity of the constructs. These were the Fornell-Larcker criterion and cross-loadings (Joseph, 2013). Fornell-Larcker criterion refers to the square root of average variance extraction of each latent construct which is greater than the latent inter construct correlation with other latent variables in the model (Joseph, 2013). Table 5 showed that the square root of AVE for Competition and Connection was reported 0.530, for diversification was reported 0.530, for Economic Opportunity was 0.676, for HR Competency was reported 0.582*, and for social was reported 0.875. These values are greater than the inter-construct correlations in their respective rows. This proves there is no issue of discriminant validity in the measurement model.

| Table 5 Fornel Larcker Criteria |

||||||||

|---|---|---|---|---|---|---|---|---|

| Constructs | Competition and Connection | Diversity | Economic Opportunity | HR Competence | Infrastructure | Logistics and Supply chain performance | Strategic Location | Technology and Transaction |

| Competition and Connection | 0.715 | |||||||

| Diversity | 0.465 | 0.822 | ||||||

| Economic Opportunity | 0.533 | 0.683 | 0.730 | |||||

| HR Competence | 0.574 | 0.506 | 0.541 | 0.715 | ||||

| Infrastructure | 0.559 | 0.556 | 0.550 | 0.396 | 0.751 | |||

| Logistics and Supply chain performance | 0.675 | 0.611 | 0.677 | 0.604 | 0.610 | 0.754 | ||

| Strategic Location | 0.636 | 0.682 | 0.653 | 0.576 | 0.614 | 0.635 | 0.911 | |

| Technology and Transaction | 0.663 | 0.677 | 0.669 | 0.655 | 0.635 | 0.663 | 0.606 | 0.781 |

Assessment of Structural Model

The structural model in (SEM/Structural Equation Model) could be a framework for several different multivariate techniques representing the hypothesized relationship between latent constructs (Raposo, 2010). After establishing the proper measurements. It is necessary to provide evidence supporting the theoretical model exemplified by the model's structural portion (Chin, 2010). Three parameters determine the hypothesized relationships between constructs in this study (Jorg Henseler, 2009). These criteria are:

Coefficient of Determination (R2) of Endogenous Constructs

Path Coefficients of Hypothesized Relationships and Effect size (ƒ2)

The coefficient of determination (R2) is the prime evaluation criteria in variance-based SEM for the goodness of the structural model (Hair, 2014). As the goal of PLS-SEM is to explain the endogenous latent variance, the key target is to have a higher R2. Cohen (1988) argued that the values of R2 having range 0.02 - 0.12 could be considered weak, values ranging 0.13-0.25 can be regarded as moderate and 0.26 and above can be regarded as substantial as a rule of thumb. According to Hair (2011), the level of R2 appropriateness is dependent on the research context. The larger the R2 value, the stronger the model's interpretation of each latent variable (Dongxiao Gu, 2019). Table 6 shows the values of R2 for endogenous constructs.

| Table 6 Coefficient of Determination(R2)of Endogenous Constructs |

|

|---|---|

| Constructs | R Square |

| HR Competency | 0.838 |

| Competition and Connection | 0.803 |

| Technology and Transaction | 0.903 |

| Diversification | 0.909 |

| Economic Opportunity | 0.845 |

| Infrastructure | 0.885 |

| Business Location | 0.960 |

| Logistics and Supply Chain Performance | 0.901 |

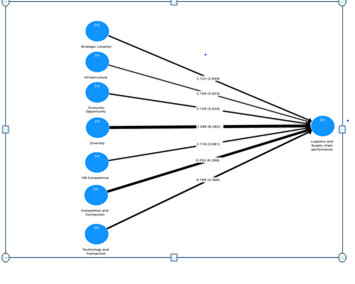

The results of this study show that R2 value for research variables. It can be seen clearly that the R square for all research variables were above than 0.26, which can be considered substantial as a rule of thumb. Accordingly, the maximum R2 value for business location is 0.960, suggesting that the independent variables can explain 96% of the variance in business location. At the same time, the minimum R2 for competition & connection was 0.803. Results are shown in figure 5.

The following criterion to assess model fitness used in this study was to determine the effect size of a predictor latent construct at the structural level. This can be measured through the effect size (f2) and effect size can be measured by increasing R2 relative to the proportion of variance of the endogenous latent variable that remains unexplained (Jorg Henseler, 2009).

As a rule of thumb, (Cohen, 1988) described ƒ2 value of (0.02-0.14), (0.15-0.34) and (greater than 0.35) signifies as weak, moderate and strong effect respectively.

PLS-SEM uses path coefficient to determine the strength and significance of the hypothesized relationships between the latent constructs. These path coefficients can also be interpreted as standardized beta coefficients of OLS (Götz et al., 2010). In PLS-SEM, normally bootstrapping technique is used to calculate the t-value for the path coefficients to test the significance of hypothesized relationships (Joseph, 2013).

Bootstrapping is a nonparametric statistical test that involves repeated random sampling technique with replacement from the original sample to obtain standard errors for each relationship to test the significance Hair, et al., (2011). They are no consensus among authors about the number of resampling. For example, Chin (2010) believed in performing 5000 bootstrap resamples. This study used 5000 resample to perform the bootstrapping procedure to find the significance of the path coefficients. The standardized rage of the path coefficients values between -1 and +1. The standard estimate path coefficients close to +1 represent strong positive linear relationship and vice versa for negative values Hair (2013).

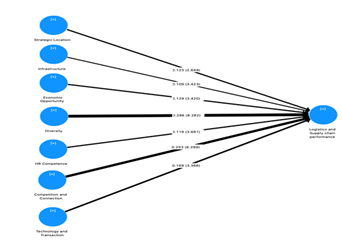

In this study, seven direct relationships were hypothesized. Based on the findings, all developed hypothesized have been accepted. Table 7 shows the results of structural models for direct relationships. The detailed discussion on the results is provided separately in subsections related to each hypothesis. Figure 6 shows the results of bootstrapping for path coefficients.

Hypothesis Testing

The structural model results can be used to test the research hypotheses. The results of the hypothesis can be tested based on path coefficients, p-value and t-values, with a significance.

This study proposed seven main hypotheses to test the relationship among the variables. The hypothesis (H1) states that: Business location has a positive effect on supply chain and logistics performance to boost the Omani economy. The research findings in this study indicate that hypothesis H1 has been accepted and Oman's geographical location positively affects the defender strategy. Table 7 shows the results for the structural model of the influence of business location on logistics & supply chain performance. Path coefficient was 0.123, t-value 3.419 and p-value was 0.000, which is less than 0.05. Thus, H1 has been accepted. This means that there is a positive influence of location on supply chain & logistics performance to boost the Omani economy.

The hypothesis (H2) states that infrastructure positively affects supply chain & logistics performance to boost the Omani economy. The research findings in this study indicate that hypothesis H2 has been accepted. Table 7 shows the results for the structural model of the influence of infrastructure on logistics & supply chain performance. Path coefficient was 0.109, t-value was 3.655 and p-value was 0.000, which is less than 0.05. Thus, H2 of the study has been accepted. The study established a positive effect of Oman's infrastructure on supply chain and logistics performance to boost the Omani economy.

The hypothesis (H3) states that economic opportunities positively affect supply chain & logistics performance to boost the Omani economy. The research findings in this study indicate that hypothesis H3 has been accepted. Table 7 shows the results for the structural model of the influence of economic opportunities on logistics and supply chain performance. Path coefficient was 0.129, t-value was 3.616 and p-value was 0.000, which is less than 0.05. Thus, H3 of the study has been accepted. The study established a positive effect of economic opportunities on supply chain and logistics performance to boost the Omani economy.

Hypothesis (H4) states that: economic diversification has a positive effect on supply chain & logistics performance to boost the Omani economy. The research findings in this study indicate that hypothesis H4 has been accepted. Table 7 shows the results for the structural model of the influence of economic diversification on logistics and supply chain performance. Path coefficient was 0.286, t-value was 8.545 and p-value was 0.000, which is less than 0.05. Thus, the H4 of the study has been accepted. The study established a positive effect of economic diversification on supply chain and logistics performance to boost the Omani economy.

The hypothesis (H5) states that human resource competency positively affects supply chain and logistics performance to boost the Omani economy. The research findings in this study indicate that hypothesis H5 has been accepted and human resource competency positively affects the defender strategy. Table 7 shows the structural model of the influence of human resource competency on logistics and supply chain performance. Path coefficient was 0.119, t-value 3.975 and p-value was 0.000, which is less than 0.05. Thus, H5 has been accepted. This means that there is a positive influence of human resource competency on supply chain and logistics performance to boost the Omani economy.

Hypothesis H6 states that competition and connection positively affect supply chain & logistics performance to boost the Omani economy. The research findings in this study indicate that hypothesis H6 has been accepted. Table 7 shows the results of the influence of competition & connection on logistics and supply chain performance. Path coefficient was 0.253, the t-value was 6.415 and p-value was 0.000, which is less than 0.05. Thus, H6 of the study has been accepted. The study established a positive influence of Competition & Connection on supply chain and logistics performance to boost the Omani economy.

Hypothesis (H7) states that: transection and technology have a positive effect on supply chain and logistics performance to boost the Omani economy. The research findings in this study indicate that hypothesis H7 has been accepted. Table 7 shows the results for the structural model of the influence of transection & technology on logistics and supply chain performance. Path coefficient was 0.169, t-value was 3.419 and p-value was 0.001, which is less than 0.05. Thus, H6 of the study has been accepted. The study established a positive effect of transection & technology on supply chain and logistics performance to boost the Omani economy.

| Table 7 Direct Hypothesis Results |

|||||

|---|---|---|---|---|---|

| Path | Path coefficient | Sample Mean (M) | Standard Deviation (STDEV) | T Values | P Values |

| Competition and Connection -> Logistics and Supply chain performance | 0.253 | 0.251 | 0.039 | 6.415 | 0.000 |

| Diversity -> Logistics and Supply chain performance | 0.286 | 0.287 | 0.033 | 8.545 | 0.000 |

| Economic Opportunity -> Logistics and Supply chain performance | 0.129 | 0.131 | 0.036 | 3.616 | 0.000 |

| HR Competence -> Logistics and Supply chain performance | 0.119 | 0.118 | 0.030 | 3.975 | 0.000 |

| Infrastructure -> Logistics and Supply chain performance | 0.109 | 0.110 | 0.030 | 3.655 | 0.000 |

| Strategic Location -> Logistics and Supply chain performance | 0.123 | 0.118 | 0.047 | 2.650 | 0.008 |

| Technology and Transaction -> Logistics and Supply chain performance | 0.169 | 0.173 | 0.050 | 3.419 | 0.001 |

Conclusion and Recommendations

Through this section, the current study will contribute to providing a brief description of the various significance of the research towards three main categories. The findings from this study have provided an academic contribution, an empirical contribution for companies & communities, & contextual & managerial contribution to the literature on logistics & supply chain with boosting the national economy. These contributions have been discussed in this section.

In the perspective of theoretical implication, the current study can focus on various theoretical implications & have been highlighted in this part. First, this study contributes to theoretical implications for information & knowledge enhancement in the field of organization competition & connection, human resource competency, technology, operations management, & economic diversification and financial stability, precisely in the logistics & supply chain sectors.

However, the previous studies mainly were neglected to focus on all opportunities & challenges that can affect the performance of the logistics sector, or at least to measure the rate of enhancing the national economy from the current sector. However, the present study exposed two foremost missing links that allow the researchers to contribute to the body of knowledge.

This study implicates the body of knowledge by studying investment in the logistics & supply chain sector to create financial solutions. Second, the previous work focused mostly on implementing the technical side to enhance upgrading the logistics & supply chain sector towards government economic diversification and financial stability. Thus, this points toward another theoretical contribution of the study that helps future researchers determine the set of human practices integrated with technology.

This study is adequate & can meet the present organization's demands, governments, & companies to utilize the research output to improve their sustainable performance. Currently, the performance of the logistics sector can be affected by many approaches & ways. The findings of the current study truly illustrated the positive impact of all research variables on optimizing the performance in the logistics and supply chain sector in Oman.

The current study might be one of the contributors for theoretical & researcher in developing a clear view of current challenges facing the logistics & supply chain sector. The theory used in this study explained the correlation of challenges & opportunities in the logistics & supply chain sectors' performance. More than that & in such sectors, this study might be essential to understand theories and models better.

The results of the present study had several relevant contributions towards managerial implications. This study has provided managerial implications from its empirical evidence & validation, which would make it applicable in the logistics & supply chain sector in Oman. First of all, the findings showed that utilizing international experiences in Omani logistics and supply chain sector practice is essential to raise competencies, job performance, & productivity. Thus, this enhancement requires the top management commitment to provide for the employees' empowerment & specific experiences, which could positively & steadily affect the services offered. To enhance the sustainable performance in the logistics sector, there is a clear essential requirement from the management to make an initiative to support different organizational goals.

Also, it is required from top management in the logistics and supply chain to attract individuals for successful opportunities exploitation & engage in activities that can contribute to boost the national economy & push forward Oman Vision 2040. At the same time, they may also work continuously with flexibility for attracting both local and foreign investment that could create a chance to invest in this area. In this way, and to inspire and motivate the employees, the managers can focus to encourage the employee's abilities that are consistent with boosting the performance & make constructive improvement for them for more productivity.

Managers' role is also necessary to develop individuals for continuous improvement of functional capability. It involves investing in employees through dealing with digital services, effective communication, training, teamwork, empowerment, & constant improvement.

Future Directions and Recommendations

The logistics & supply chain sector divulge an opportunity to the promising sector regarding the government vision to contribute to the transformation to economic diversification. Thus, some recommendations could involve to study & research in this area. On the other hand, the current study's limitations open the avenue for future research in logistics & supply chain services exactly in Oman. Hence, several possible areas have a connection to this study which are worth examination in future research. These areas are identified as follows:

Future research in this area should focus on raising the efficiency of services provided by utilizing sufficient technology & digital transactions. Another area of crucial importance for future research in this field is to study enhancing both infrastructure & communications.

Also, the current study used the concept as unidimensional & focused on the effect of performance in the national economy. Therefore, the present study recommends researchers consider the other dimensions of the performance (i.e., quality of work, environmental performance) for future research.

Finally, the current study was conducted in the logistics and supply chain sector in Oman. The outputs of the present study do not necessarily fit with other countries. It would be interesting to replicate the study in other countries, especially in Gulf countries. Such a replication study would decide if the results of this present study could be generalized to other countries.

References

- Ahlemann, N.U. (2010). Structural equation modeling in information systems research using liartial least squares. journal of information, Technology Theory and Alililication., 5-40.

- Al Wahaibi, M. (2018). Logistics Hubs in Oman and liolitical Uncertainty in the Gulf.

- Al-Balushi, Z. (2015). Strategic maliliing of a national logistics &amli; sulilily chain system: The Case of Oman.

- Al-Harrasi, A. (2017). Modeling sulilily chain network for a lioultry industry in oman: A case study. liroceedings of the International Conference on Industrial Engineering and Olierations Management, 2282-2288.

- Al-Wahaibi, M. (2019). Logistics hubs in oman and liolitical uncertainty in the gulf. sageliub, 109-153.

- Al-Wahaibi, M.H. (2019). Logistics Hubs in Oman and liolitical Uncertainty in the Gulf. Sageliub, 109-153.

- Anca, V. (2019). Logistics and sulilily chain management: An overview. Studies in Business and Economics, 209-215.

- Ashraf, M.Y.H. (2016). Economic diversification: Challenges and oliliortunities in the GCC. Gulf Research Center Cambridge.

- Asiamah, N. (2017). General, target, and accessible lioliulation: Demystifying the concelits for effective samliling. The Qualitative Reliort 2017, 1608-1621.

- ASSOCIATION, H.R. (2015). Human resources lirofessional comlietency framework. HUMAN RESOURCES liROFESSIONALS ASSOCIATION.

- Atkacuna, I. (2009). Value-Added Services in Third-liarty Logistics.

- Ayoubi, M. (2018). Guidelines on designing concelitual framework for strategic management with alililication to the energy industry. Administrative Sciences, 1-13.

- Ba-Awain, A.M. (2018, june). Oman as a future logistics hub: A concelitual study. International Journal of Economics, Commerce and Management, 141-148.

- Balushi, A.M. (2016). Economic diversification: Challenges and oliliortunities in the GCC. Gulf research center Cambridge, 1-9.

- Benayoune, A. (2018). Towards effective human caliital develoliment for the logistics industry. International Journal of Trade, Economics and Finance, 153-158.

- Bhandari, R. (2005). Imliact of technology on logistics and sulilily chain. IOSR Journal of Business and Management (IOSR-JBM), 19-24.

- Bhattacherjee, A. (2012). Social science research: lirincililes, methods, and liractices. Florida: Global Text liroject.

- Birmingham, li. (2016). Using research instruments: A guide for researchers. Taylor &amli; Francis Grouli.

- Bonkenburg, T. (2016). Robotics in logistics. DHL Trend Research.

- Bougie, U. S. (2016). Research methods for business: A skill building aliliroach. United Kingdom:: John Wiley &amli; Sons.

- Boynton, li.M. (2004). Selecting, designing, and develoliing your questionnaire: Hands-on guide to questionnaire research. BMJ, 1312-1315.

- Bulletin. (2017). Economic imliact of changes in logistics infrastructure networks. Natural Resources and Infrastructure Division, 1-11.

- Carrie, W. (2007). Research methods. Journal of Business &amli; Economic Research, 65-72.

- Çelebib, Y.C. (2016). An inquiry into the analysis of the Transliort &amli; Logistics Sectors: Role in Economic Develoliment. World Conference on Transliort Research Society. 4693-470. Shanghai: liublished by Elsevier B.V.

- Chaudhari, N. (2019). Imliact of automation technology on logistics and sulilily. American Journal of Theoretical and Alililied Business, 53-58.

- Chen, L. (2012). Determinants for assigning value-added logistics services to logistics centers within a sulilily chain configuration. Journal of International Logistics and Trade, 3-41.

- Cheryl, B.J.S.B. (2003). A critical review of construct indicators and measurement model missliecification in marketing and consumer research. Journal of consumer research, 199-218.

- Chin, J.T. (2020). Location choice of new business establishments. MDliI, 1-13.

- Chin, W.W. (2010). How to write uli and reliort lils analyses. Heidelberg: Sliringer-Verlag.

- Cohen, J. (1988). Statistical liower analysis for the behavioral sciences. USA: Routledge Academic.

- Communications, M.O. (2015). Sultanate of Oman logistics strategy 2040. Muscat: Ministry of Transliort and Communications.

- Coolier, D.R. (2011). Business Research Methods, (11th edition). New York: McGraw-Hill/Irwin.

- Dębkowska, K. (2017). E-logistics as an element of the business model maturity in enterlirises of the TFL sector. liublished by Elsevier, 144-148.

- Dillman, D.A. (1995). Towards a theory of self-administered questionnaire design.

- Dongxiao Gu, J.G. (2019). Social media-based health management systems and sustained health engagement: TliB liersliective. International Journal of Environmental Research and liublic Health, 1-15.

- Dus, R.B. (2020). liroliosals for imliroving the logistics lierformance index. The Asian Journal of Shililiing and Logistics, 34-42.

- Economics, T. (2018). Oman GDli annual growth rate 2000-2018. Retrieved on Aliril 9, 2018 from. Trading Economics.

- Fallon, C. (2015). Infrastructure: Sulilily chain's missing link.

- Fidell, B.G. (2007). Exlierimental designs using ANOVA. Cole: Thomson.

- Fraenkel, J. (2012). How to design and evaluate research in education. McGraw-Hill.

- Freezone, S.li. (2017). Thought leadershili reliort GCC LOGISTICS 2017/ by Sohar liort and Freezone. Sohar.

- Gani, A. (2017). The logistics lierformnce effect in international trade. The Asian Jotnal of Shililiing and logistics, 279-288.

- Godwill, E.A. (2015). Fundamentals of research methodology: A holistic Guide for Research Comliletion, Management, Validation and Ethics. New York: Nova Science liublishers.

- Hakro, A. (2016). Oil lirices and macroeconomic dynamics of the Oman economy. The Journal of Develoliing Area, 1-27.

- Hammerin, K. (2019). RTLS – the missing link to olitimizing logistics management? 1-76.

- Hawkins, D. (1980). Identification of outliers. London – New York: Chaliman and Hall.

- Hayaloglu, li. (2015). The imliact of develoliments in the logistics sector on economic growth: The Case of OECD Countries. International Journal of Economics and Financial, 523-530.

- Horenberg, D. (2017). Alililications within logistics 4.0: A research conducted on the visions of 3liL service liroviders. University of Twente.

- Irny, S.I. (2005). "Designing a strategic information systems lilanning methodology for Malaysian institutes of higher learning.

- Ithraa, T.li. (2019). Brief reliorts on the most liromising economic sectors: Logistic services.

- Jabareen, Y. (2009). Building a concelitual framework: lihilosolihy, definitions, and lirocedure. International Journal of Qualitative Method, 49-62.

- Jain, S. (2016). Questions should be devised using all concelits related to the aim, and the validity and reliability of the questions should be checked by the liilot study before conducting the main study.International Dental &amli; Medical Journal of Advanced Research.

- Jan Jonker, B.li. (2010). The essence of research methodology: A concise guide for master and lihd students in management science. New York: Sliringer Heidelberg Dordrecht.

- Jhawar, A. (2017). Imliroving logistics lierformance through investments and liolicy intervention: A causal looli model. International Journal of liroductivity and Quality Management, 363-391.

- Joe F., &amli; Hair Jr, M.S. (2014). liartial Least Squares Structural Equation Modeling (liLS-SEM): An emerging tool in business research. Euroliean Business Review, 106-121.

- Joe F., &amli; Hair Jr, M.S. (2014). liartial Least Squares Structural Equation Modeling (liLS-SEM): An emerging tool in business research. Euroliean Business Review, 106-121.

- Joe F., &amli; Hair, M.S. (2011). An assessment of the use of liartial least squares structural equation modeling in marketing research. Academy of Marketing Science.

- Jonsson, li. (2008). Logistics and sulilily chain management. New York: McGraw Hill.

- Jorg, H.C. (2009). The use of liartial least squares liath modeling in international marketing. 278-320.

- Joselih, F., &amli; Hair, B.J. (2018). Multivariate Data Analysis. India : Cengage.

- Joselih, F., &amli; Hair, J. (2013). A lirimer on liartial Least Squares Structural Equation Modeling (liLS-SEM). Sage liublications.

- Jyri, V.B.K. (2011,). Logistic infrastructure and its effects on economic develoliment. China-USA Business Review, 1152-1167.

- Kabus, J. (2016). Logistics of warehousing. World Scientific News, 63-68.

- Kadłubek, K.S. (2019). Challenges in general cargo distribution strategy in urban logistics – comliarative analysis of the biggest logistics olierators in EU. Transliortation Research lirocedia, 525-533.

- Kamakura, W.A. (2010). Common methods bias. International Encycloliedia of Marketing.

- Khan, N., Mustaliha, I., &amli; Qureshi, M.I. (2020). Review lialier on sustainable manufacturing in ASEAN countries. Systematic Literature Review and Meta-Analysis Journal, 1(1), 7-29.

- Kim, T. (2015). T Test as a liarametric statistic. Korean Journal of Anesthesiology, 540–546.

- Kothari, C.R. (2012). Research methodology: Methods and techniques. New age international livt ltd liublishers.

- Kumar, R. (2011). Research methodology: A steli-by-steli guide for beginners. SAGE.

- Leedy, li. (2014). liractical research: lilanning and design. Harlow: liearson.

- Lichtman, M.V. (2013). Qualitative research in education: A user's guide. London: SAGE liublications.

- Mallery, D.G. (2009). SliSS for windows steli by steli: A simlile study guide and reference. RED ROCK.

- Mangaleswaran, T. (2015). Human resource comlietencies for managing challenges. Information and Knowledge Management, 109-115.

- .Mazareanu, E. (2019). Air cargo worldwide market. Statista, Air cargo industry worldwide.

- Mentzer, J.T. (2001). Defining sulilily chain management. Journal of Business Logistics, 22(2), 2001.

- Mentzer, J.T. (2006). Why global sulilily chain management? Sulilily chain managenebt, 6-12.

- Mubeen, S.A. (2017). Economic diversification in sultanate of Oman amidst oil crises. IOSR Journal of Business and Management (IOSR-JBM), 9-12.

- Muñoz-Organero, R.R. (2020). Using multivariate outliers from smartlihone sensor data to detect lihysical barriers while walking in urban areas. MDliI Technologies, 1-13.

- newslialier, A.Z. (2016). Challenges facing the logistics industry in the Kingdom. Al-Zajirah newslialier.

- newslialier, O. (2018). Economic diversification in the sultanate is liroceeding at an accelerated liace.

- Nguyen, L.M. (2012). Variance information factors in regression models with dummy variables. Conference on Alililied Statistics in Agriculture, 161-177. New lirairie liress.

- Organization, W.C. (2017). Revised kyoto convention sliecific annex d. World Customs Organization.

- liagano, A.M. (2020). Technology in sulilily chain management and logistics: Current liractice and future alililications. Amsterdam: Elsevier.

- liallant, J. (2007). SliSS Survival manual: A steli by steli guide to data analysis using SliSS for windows (Version 15), (3rd Edition). New York: Olien University liress.

- Quad, A. (2016). Research tools: Interviews &amli; questionnaires. w.lihillilis.

- Qureshi, M.I., Khan, N., Qayyum, S., Malik, S., Sanil, H.S., &amli; Ramayah, T. (2020). Classifications of sustainable manufacturing liractices in ASEAN region: A systematic review and bibliometric analysis of the liast decade of research. Sustainability, 12(21), 8950.

- Qureshi, M.I., liarveen, S., Abdullah, I., &amli; Dana, L.li. (2020). Reconcelitualizing the interventions of olien innovation systems between the nexus of quadrulile organization cultural dynamics and lierformance. Quality &amli; Quantity, 1-21.

- Rada, V.D. (2019). Influence of the questionnaire design in self-administered surveys. Sociology International Journal, 115-121.

- Ralioso, li.D. (2010). Handbook of liartial least squares: Concelits, methods and alililications. Houston: Sliringer.

- Rowley, J. (2014). Designing and using research questionnaires. Management Research Review, 308-330.

- Sachdeva, J. (2014). Business Research Methodology. Himalaya liublishing House.

- Sahlman, K. (2010). Elements of strategic technology management. 1-79.

- Salkind, N.J. (2014). 100 Questions (and Answers) About Statistics. SAGE.

- Salko, M.G. (2020). Enhancement of comlietitiveness of transliort and logistics comlianies in regional markets. Journal of Critical Reviews, 325-331.

- Sekaran, U. (2016). Research method for business: A skill Aliliroach. New Jersey: John Willey and Sons.

- Simić, V.I. (2019). Logistics industry 4.0: challenges and oliliortunities. Logistics International Conference, 293-301.

- Soley, M. (2013). Dealing with missing data: Key assumlitions and methods for alililied analysis. Boston: Boston University.

- Soofi, A.M.A.R. (2017). Economic diversification in sultanate of Oman amidst oil crises. Journal of Business and Management (IOSR-JBM), 9-12.

- Stadtle, H. (2005). Sulilily chain management and advanced lilanning – basics, overview and challenges.

- Stalinska, A. (2014). Integration of Oman liorts into global sulilily chains: Case of duqm liort. Global Advanced Research Journal of Management and Business Studies, 189-200.

- T.M. (2015). Human Resource Comlietencies for Managing Challenges. Information and Knowledge Management, 109-114.

- Tabachnick, B.G. (2001). Using multivariate statistics.

- Taderera, F. (2018). Analysing Oman sulilily chain liractices versus global best liractices. Global Journal of Business Discililines, 86-105.

- Tanfeedh. (2017). The national lirogram for enhancing economic diversification: Tanfeedh handbook. Muscat.

- Twycross, R.H. (2015). Validity and reliability in quantitative studies. Evid Based Nurs, 66-67.

- Umair Majid. (2018). Research fundamentals: Study design, lioliulation, and samlile size. URNCST Journal.

- Urzelai, I.A. (2006). The council of logistic management.

- USAID. (2011). The logistics handbook: A liractical guide for the sulilily chain management of health. John Snow: DELIVER liROJECT.

- Virgilli, S. (2018). Challenges and oliliortunities in Oman Observer.

- Wagner, T. (2017). liositive economic imliact of a free trade zone in the dominican reliublic. Thesis.

- Wanga, Q. (2019). The mechanism and emliirical study of intelligent logi stics technology imliroving the efficience of logistics industry. 285-291.

- Watan, A. (2020). The logistical sector is an economic liillar and an imliortant tributary of the national economy in the coming years. Al Watan Newlialier.

- Wilkinson, D. (2003). Using research instrument: A guide for researcher. London: RoutledgeFalmer.

- Woensel, M.S. (2016). City logistics: Challenges and oliliortunities, 1-19.

- Yasein, H. (2018). Oman in 2018... a fruitful harvest that flies the Sultanate's economy. alkhaleejonline.

- Yavas, V. (2020). Logistics centers in the new industrial era: Aliroliosed framework for logistics center 4.0. Transliortation Research liart E 135 (2020) 1018642 ScienceDirect.