Research Article: 2021 Vol: 24 Issue: 1S

Are the Score Ratios Conclusive in Detecting Financial Fraud? The Case of Clinica Las Condes in Chile

Alberto Clavería Navarrete, Sevilla University

Amalia Carrasco Gallego, Sevilla University

Pablo Moreno Padilla, EGEM School of Business Management

Abstract

This research aims to test the effectiveness of certain ratios & financial models frequently used in the literature as tools to detect accounting manipulation, through the case of Clínica Las Condes in Chile. The period of accounting errors 2008 -2019 was analyzed. Situations such as the strong rejection of a forensic audit to determine the real cause of the problem support the interest in using financial analysis tools to know its health. However, the indicators used fail to classify the case as one of financial fraud, but rather as accounting "irregularities". Despite the fact that the company is awaiting a sentence that will allow it to close the case, which has generated economic, legal, social and reputational costs. The study leads to postulate that financial ratios alone are not a sufficient tool to detect manipulation in financial statements. A holistic analysis of the problem is required, using various methodologies, such as the use of data mining models to help prevent and detect financial frauds in time, which have negative consequences for managers, shareholders, investors and other agents of the economy.

Keywords

Financial Fraud, Accounting Manipulation, Fraud Detection, Beneish M - Score, Altman Z - Score, Sloan Ratio

Introduction

In recent years, news related to financial frauds have been increasing (Mehta & Bhavani, 2017), occurring in various types of industries, drawing strong public attention & causing great impact on different economic sectors (Ngai et al., 2010; Hawa et al., 2014). The concern encompassed by these malpractices lies in the harmful impact towards the economy & business: falling share prices, reduced productivity, bankruptcy of companies & loss of money for different agents, leading to poor capital allocation & lack of credibility in the capital market (Kumari Tiwari & Debnath, 2017; Throckmorton et al., 2015; Ngai et al., 2010; Albashrawi, 2016).

Although there are certain differences among authors, the definition of financial statement fraud is understood as "the intentional, deliberate misstatement or omission of material facts or accounting data that are misleading and, when considered with all available information, would cause the reader to change or alter his or her judgment" (ACFE, 1993). More intuitively, it consists of the intentional falsification of financial statements by overstating revenues, assets or earnings (Thornhill & Wells, 1993) or understating liabilities, losses or expenses (Spathis, 2002; Hawa et al., 2014). Being such a detrimental fact for business and capital markets, different agents such as investors, regulators and the financial community have emphasized on preventing and detecting this type of crime (Rezaee, 2005; Nasir et al., 2019; Zhu & Gao, 2011).

Based on the Association of Certified Fraud Examiners (ACFE, 2018), the main types of occupational fraud are corruption, financial statement fraud & asset misappropriation. According to the same study, made up of 2.690 fraud cases in more than 120 countries, financial statement fraud is the least common and the one that produces the highest costs, generating losses on average of USD 800.000. Emblematic cases such as Enron Corporation, Xerox and Parmalat stand out among this type of fraud.

The organization Transparency International has been publishing since 1995 the corruption perception index, which measures on a scale from 0 (very corrupt) to 100 (absence of corruption) the levels of corruption in 180 countries. For 2019, Latin American countries such as Uruguay or Chile have been worsening their index over the last 7 years, placing them far behind countries such as Denmark, New Zealand or Finland (Transparency International, 2019).

In Chile, multiple cases of financial fraud have been uncovered, affecting both private & public sector companies (Leiva & Mellado, 2014). The Penta & SQM cases stand out among the most scandalous cases linked to corruption; the La Polar case, associated with fraud in the financial statements, which negatively affected customers, investors & the stock market (Parisi et al., 2015); the "fraud in Carabineros" case in 2016 -which is currently still under investigation-, where high-ranking officers of the same institution are involved, who were convicted for asset misappropriation crimes (La Tercera, 2019).

In 2017, it was reported that Clínica Las Condes (CLC) was dragging accounting errors since 2008, a fact that was detected exclusively by the transfer of financial accounting information to the new administrative platform of the company, known as SAP system. CLC disclosed an accounting difference of approximately USD 10 million, leading it to hire the consulting firm PwC to conduct an audit of the firm to clarify this accounting problem (Navarrete, 2020). Although the case is still in the hands of the Chilean justice system & it has not yet been determined whether there was fraud in the financial statements, there is a certain probability that this crime has been committed.

Given the above, this research proposes to test the effectiveness of certain financial ratios & models - namely, Altman Z-score, Beneish M-score & Sloan Ratio - frequently used in the literature as a tool to detect manipulation in financial statements, through the case of CLC, trying to answer the following questions: Are the score ratios conclusive, by themselves do they allow radical decisions to be made, and could it be asserted with the application of the selected score ratios that financial fraud has been committed in the case of CLC?

In relation to the above, the research was structured as follows: Section 2 shows the literature review related to ratios and financial models, validated by different authors in the literature as useful tools to detect and prevent fraud in financial statements. Section 3 presents the empirical analysis that includes the research method and information and evidence associated with the CLC case. Section 4 presents the results and their discussion. Finally, Section 5 contains the conclusion of the paper.

Literature Review

To cope with the large number of fraud cases that occur today, the detection of fraud in financial statements has become a key fact to avoid the negative consequences that it can generate (Ngai et al., 2010), motivating to investigate effective methodologies that allow detection at an early stage (Hawa et al., 2014). In this line, the area of data mining has contributed with important techniques and methods that facilitate the detection of financial fraud (see West & Bhattacharya, 2016; Phua et al., 2005; Kotsiantis et al., 2006; Fanning & Cogger, 1998). In turn, financial researchers and practitioners recommend the simultaneous use of certain ratios and models as effective tools to detect fraud in financial statements (Mehta & Bhavani, 2017; Bai et al., 2008). Based on the above, the study proposes 3 models that are used to detect manipulation in financial statements. These are the Beneish M - score and Altman Z - score models, which are widely used in the literature, and the Sloan ratio, which takes into consideration the company's cash flow.

Altman Model Z - score

Altman (1968) implemented a multiple discriminant analysis model, which allows predicting whether the analyzed company will default or not. According to Altman (1968), the model consists of five variables that are constructed based on financial statements and stock market information (Altman et al., 2019). It correctly predicts the financial failure of 95% of companies one year before their bankruptcy and decreases to 72% accuracy when measured two years before bankruptcy (Mehta & Bavani, 2017; Altman, 1968). For these reasons, the Altman Z - score model is pioneering and among the most widely used in the literature to detect the possibility of corporate insolvency.

Although the Altman Z-score model is used to detect the possibility of bankruptcy, but not fraud, there is literature that supports a fairly close relationship between both situations. Cressey (1953) establishes the Fraud Triangle, a model that contemplates three common characteristics. First, there is an opportunity or incentive to commit fraud. Next, there is a financial pressure or need perceived by the fraudster. Finally, whoever commits the fraud rationalizes that their personal ethical codes are consistent with their fraudulent act (Kamal et al., 2016). Along these lines, Deloitte Forensic Center (2008) posits that there is a relationship between bankrupt companies and financial fraud, and that bankrupt companies are three times more likely to be involved in financial statement fraud than non-bankrupt companies.

Several authors have used the Altman Z-score model to test its usefulness in particular cases. Mehta & Bavani (2017) analyze the effectiveness of the model for the Toshiba case, concluding that it is useful for detecting corporate fraud. MacCarthy (2017); ofori (2016) analyze the model for the case of Enron Corporation, detecting high probability of default for the year 1997. Parisi, et al., (2015) analyze the case of the Chilean company La Polar, where the Altman model shows that the company is on the verge of financial collapse in the year 2011. reaching a CCC+ risk rating. Alareeni & Branson (2013) test the model for a sample of 142 companies in Jordan, determining that the Z - score works correctly to determine companies that fall into default. Yi (2012) analyzed the efficiency of the model for 40 companies listed in China, concluding that the model is appropriate for early warning of financial failure detection, reaching an accuracy close to 90%.

Although the Altman Z - score model is among the most widely used in the literature due to its ease of application, it has been criticized for not including company cash flow information and not including more financial ratios in its formulation (Mehta & Bavani, 2017). Under this concept, the test allows to know whether this Score ratio is conclusive and whether it delivers indications of fraud in the case of CLC.

Beneish Model M – score

Beneish (1997, 1999) developed a model that allows the detection of companies that manipulate their earnings in financial statements, through a score that is obtained from the elaboration of variables that can be constructed using the information reported in their own financial statements. By using an unweighted probit, the Beneish M - score model allows detecting approximately half of the companies that engage in manipulation prior to public discovery. Thus, the model can be a useful tool to classify and detect manipulative companies (Price et al., 2011; Beneish, 1997). The model classifies manipulative firms with 58% to 76% efficiency, while the percentage of non-manipulative firms incorrectly classified ranges from 7.6% to 17.5% (Beneish, 1999).

Several authors have tested the efficiency of this indicator. MacCarthy (2017); Muntari (2015) use the model for the case of Enron Corporation, detecting manipulation in its earnings for the year 1997. Omar, et al., (2014) applied the model for the company MMHB, finding that it had recorded fictitious revenues, thus validating the effectiveness of the model to detect fraud. Ramirez, et al., (2017) analyze the case of Pescanova (Spanish business family), finding that Pescanova had engaged in fraud and in aggressive accounting practices prior to disclosing its financial problems. Talab, et al., (2018) apply the model for a list of 23 banks listed on the Iraqi stock exchange, finding that 62% of the sample present accounting manipulation in their earnings. Adu-Gyamfi (2020) establishes that the Beneish M - score model is useful in predicting the incidence of earnings manipulation in Ghanaian listed companies.

However, not all evidence points to the Beneish M - score being effective in all situations. ofori (2016) analyzes the Enron case, finding that the model presented flaws in its prediction, which can lead to erroneous conclusions. Karikari (2014) used the model to detect fraud in AngloGold Ashanti, which did not show signs of fraud while the Altman Z - score model did warn of financial problems in the years studied. With this information, the test allowed to know if this score ratio is conclusive and if it provides indications that fraud has been committed in the case of CLC.

Sloan Ratio

Sloan (1996) proposed a financial indicator that allows calculating the percentage of accruals with respect to a company's total assets. By analyzing stock performance, Sloan (1996) shows that companies with high accruals ratios have significantly lower returns than companies with low accruals ratios. The reason for this is that investors pay too much attention to reported earnings that drive short-term stock returns. This puts pressure on management, which is driven to generate earnings results that are not sustainable over the long term. In this way, positive stock returns can be generated in the short term, however, when future earnings are lower than expected, the stock price will correct for negative performance in the long term.

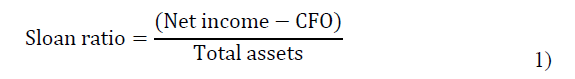

The ratio proposed by Amat (2017), based on Sloan (1996), is as follows:

What emerges is that, when the ratio has a value higher than 10%, it delivers a warning regarding possible accounting manipulations. The reason is that it reflects a high amount of differences between what has been accrued and what has affected the cash (Amat, 2017).

Although empirically the use of this indicator has not been generalized, Amat (2017) proposes its use, since it employs information that the other 2 ratios do not consider, in this case, the company's cash flow. This is the reason to check whether this Score ratio is conclusive and whether it provides evidence that fraud has been committed in the case of CLC.

Empirical Analysis

Research Methodology

This work is based on the case study, allowing contrasting data with a theoretical framework according to the problem, to analyze and interpret the information collected (Hernández Sampieri et al., 2014; Yin, 1994). It contains a line of research of mixed order and a documentary design supported by information from secondary sources. The case studied will be CLC, where the period where errors are presented in the financial statements was analyzed, that is, from 2008 to 2019. The information used to analyze the case was: (a) Income Statement, (b) Statement of Financial Position and (c) Cash Flow Statement, which was extracted from CLC's annual reports and consolidated financial statements, obtained from its website (dated October 13, 2020) and from Thompson Reuters, duly audited by different companies (Deloitte, EY & PwC).

Case Background: CLC

CLC was founded in 1978, bringing together renowned physicians-academics in their specialties, to form a hospital of excellence, with a strong vocation for vanguard and innovation (CLC, 2011). In June 1979, Clínica Las Condes S.A. was established. At present, CLC has 5 sites, offering different specialties in each clinical center.

The health industry in Chile is composed of a mixed system, financed mainly by public and private contributions. The public component has 78% coverage, while the private sector accounts for 20% (CLC, 2019). Service delivery is carried out by public and private providers, and CLC competes in the latter sector.

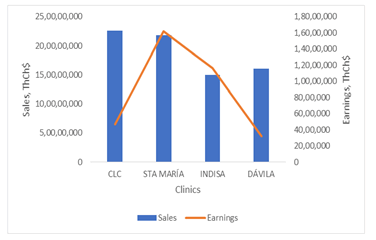

CLC is one of the most prestigious and excellent private healthcare facilities in Chile. Among the clinics that show their balance sheets, CLC is the one that has the highest revenues from sales, with amounts of around $226,000 million, surpassing other major competitors in the sector, such as Clínica Santa María and Clínica Dávila (La Tercera, 2020). However, it has one of the lowest profits among its competitors, reaching an approximate amount of ThCh$ 4,500.000. being widely surpassed by Clínica Santa María (ThCh$ 16,232.911) and Clínica Indisa (ThCh$ 11.629,751).

Source: Own elaboration based on financial statements of clinics.

However, certain accounting errors that have dragged on for many years resulted in lawsuits and legal problems that are still under discussion, which will be described below.

In January 2017, the general manager of CLC sends an essential fact to the Superintendency of Securities and Insurance (SVS), notifying that since November 2015 the firm has implemented a new administrative platform, which supports the essential processes of the company, including the financial accounting process known as SAP system. Due to the migration of financial information to this enterprise resource planning software, it was possible to detect carry-forward differences in the company's accounting, which came from 2008, for an amount close to $10.000 million (Poder Judicial, 2018). In response to these facts, the company's board of directors decided to hire the audit firm PwC to accurately determine the differences, origin and impact on the company's financial statements (Poder Judicial, 2018).

During the course of 2018, strong discrepancies arose between directors and majority shareholders of the company. In April 2018, the new board of directors takes office, where the possibility of conducting a forensic audit to determine the problematic aspects that had been generated in the company's accounting was raised (Poder Judicial, 2018). Immediately, this possibility is rejected by the directors and general manager of CLC.

On August 1. 2018, a shareholders' meeting is requested to discuss, again, the performance of a forensic audit. Within days, the director and president of the company rejected this request. On August 30. 2018, a second request for a shareholders' meeting is made, where it is proposed to discuss the performance of a forensic audit and the total revocation of the board of directors (Poder Judicial, 2018). With 5 votes in favor and 4 against, the request was again rejected, which meant a reprimand from the Financial Market Commission.

Subsequent to the shareholders' meeting held in October 2018, the chairman of the board of directors expressed his lack of interest in "digging into the past", justifying and referring to the non-performance of a forensic audit to discover the real causes of the company's accounting problems. This generated that, in November 2018, a part of shareholders made a request for the appointment of an arbitrator to the 12th Civil Court of Santiago, to resolve the differences between directors, board of directors, managers and shareholders (Poder Judicial, 2018).

Days later, the opposing party filed an appeal to the decision taken by the Court, which implied that in the event that the decision was maintained, the case would go to the Court of Appeals of Santiago. In February 2019, the Court ordered the appointment of an arbitrator to settle the conflict, making effective the appeal of the opposing party, so the case was elevated to the Court of Appeals of Santiago. Currently, the case is still being studied and analyzed by the Chilean judicial system, without having a resolution regarding the accounting errors presented by CLC from 2008 onwards.

Table 1 presents the chronological order of the events highlighted in the case, with a brief description of the case.

| Table 1 Chronological Order of the CLC Case |

|

|---|---|

| Date | Descripción of The Event |

| 2008 | Beginning of the accounting errors of the company, which will be detected in 2017. |

| November 2015 | Transfer of financial accounting information to the new administrative platform: SAP system. |

| January 2017 | General Manager sends document to the SVS notifying accounting errors since 2008, for $10.000 million. PwC audit firm is hired to determine accounting differences in the financial statements. |

| April 2018 | New board of directors takes office. A forensic audit is proposed, which is immediately rejected. Strong disagreements between directors and majority investors, accusing few actions to resolve and clarify the accounting errors. |

| August 1. 2018 | A shareholders' meeting is requested to discuss the possible performance of a forensic audit. The president and director of the company reject this request. |

| August 30. 2018 | A shareholders' meeting is again requested to address the issue of a forensic audit and the total revocation of the board of directors. This request is again rejected by the board of directors. |

| October 2018 | Holding of a shareholders' meeting. The president of the company indicates his lack of interest in investigating the situations that caused the accounting disorder of the company. |

| November 2018 | Appointment of an arbitrator judge by the 12th Civil Court of Santiago to settle the conflict. Counterparty files an appeal to this designation, requesting that the case be elevated to the Santiago Court of Appeals. |

| February 2019 | The case is elevated to second instance, taken by the Court of Appeals of Santiago. |

Source: Own elaboration based on Poder Judicial (2018).

Based on the information gathered, it can be noted that the CLC case has led the company to be in the spotlight of investors, shareholders, directors and regulatory institutions, awaiting a ruling that will allow closing the case, which has generated economic, legal and reputational costs. When these possible irregularities were detected, CLC's management showed a willingness to clarify the origin of the situation; a willingness that, as the months went by, diminished to the point of generating legal conflicts between administrators that still persist in court.

Situations such as the strong rejection of a forensic audit to determine the real cause of the problems, and statements by the company's president expressing his disinterest in investigating the past, support the interest in using data analysis tools in the financial statements to gain additional insight into the financial health of the company, without forgetting that the case is in the hands of the Chilean justice system and that, at present, no sentence has been handed down.

Situations such as the strong rejection of a forensic audit to determine the real cause of the problems, and statements by the company's president expressing his disinterest in investigating the past, support the interest in using data analysis tools in the financial statements to gain additional insight into the financial health of the company, without forgetting that the case is in the hands of the Chilean justice system and that, at present, no sentence has been handed down.

Results

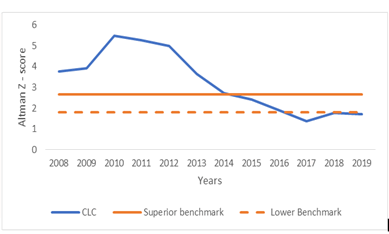

The analysis performed on CLC - through the information presented in its financial statements - with the Altman Z-score model provides an overview of the company's financial performance. In particular, to determine CLC's risk of bankruptcy during the period analyzed, taking into consideration that companies at risk of bankruptcy are more likely to commit fraud in their financial statements (Cressey, 1953; Deloitte Forensic Center, 2008). The results are presented in Table 2. while Figure 2 shows the evolution of the indicator in the period studied.

| Table 2 Altman Z Model - CLC Score |

||||||

|---|---|---|---|---|---|---|

| 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | |

| X1 | 0.198 | 0.176 | 0.042 | 0.139 | 0.136 | 0.140 |

| X2 | 0.142 | 0.133 | 0.156 | 0.195 | 0.257 | 0.264 |

| X3 | 0.043 | 0.048 | -0.015 | 0.027 | 0.058 | 0.062 |

| X4 | 0.983 | 1.145 | 1.146 | 1.382 | 1.951 | 2.288 |

| X5 | 0.539 | 0.522 | 0.484 | 0.522 | 0.541 | 0.505 |

| Z - score | 1.705 | 1.765 | 1.390 | 1.881 | 2.425 | 2.619 |

| 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | |

| X1 | 0.229 | 0.211 | 0.226 | 0.244 | 0.207 | 0.225 |

| X2 | 0.294 | 0.319 | 0.304 | 0.284 | 0.256 | 0.242 |

| X3 | 0.092 | 0.108 | 0.110 | 0.107 | 0.087 | 0.081 |

| X4 | 3.532 | 5.576 | 6.434 | 6.410 | 4.086 | 3.907 |

| X5 | 0.531 | 0.602 | 0.598 | 0.596 | 0.584 | 0.552 |

| Z - score | 3.639 | 5.007 | 5.517 | 5.486 | 3.931 | 3.771 |

Source: Prepared by the Company based on CLC's financial statements.

Source: Prepared by the Company based on CLC's financial statements.

| Table 3 Comparison Between Manipulator and Non-Manipulator Firm Variables With the Average CLC |

|||

|---|---|---|---|

| Variable | Manipulators | Non-manipulative | Average CLC |

| DSRI | 1.465 | 1.031 | 1.019 |

| GMI | 1.193 | 1.014 | 1.029 |

| AQI | 1.254 | 1.039 | 1.028 |

| SGI | 1.607 | 1.134 | 1.107 |

| DEPI | 1.077 | 1.001 | 1.017 |

| SGAI | 1.041 | 1.054 | 1.033 |

| LVGI | 1.111 | 1.037 | 1.106 |

| Accruals 1 | 0.031 | 0.018 | 0.049 |

Source: Own elaboration based on Beneish (1999) results and CLC financial statements.

Source: Prepared by the Company based on CLC's financial statements.

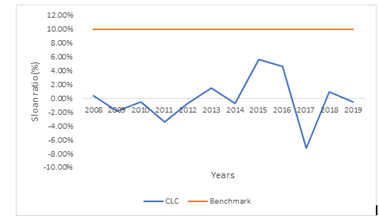

Table 4 presents the results obtained using the Sloan ratio for the CLC time period under study. Its behavior can be seen graphically in Figure 4.

| Table 4 Sloan Ratio of CLC |

||||||

|---|---|---|---|---|---|---|

| 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | |

| Net income | $17.863 | $20.177 | -$6.214 | $10.199 | $19.113 | $19.191 |

| CFO | $20.066 | $16.241 | $22.660 | -$7.191 | $428 | $22.725 |

| Total Assets | $419.431 | $419.936 | $402.608 | $376.283 | $332.006 | $309.946 |

| Sloan ratio | -0.53% | 0.94% | -7,17% | 4,62% | 5,63% | -1.14% |

| 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | |

| Net income | $24.005 | $22.936 | $21.236 | $19.220 | $14.698 | $16.546 |

| CFO | $20.125 | $24.439 | $27.925 | $20.235 | $17.766 | $11.987 |

| Total Assets | $261.476 | $211.413 | $193.858 | $179.356 | $168.322 | $159.064 |

| Sloan ratio | 1.48% | -0.71% | -3,45% | -0.57% | -1.82% | 2.87% |

Source: Prepared by the Company based on CLC's financial statements.

Source: Prepared by the Company based on CLC's financial statements

Discussion of Results

Results Z – Score

Graphically, Figure 2 shows the evolution of the Z - score indicator over time. These results reveal that CLC went through the 3 zones: from 2008 to 2013 in the safe zone (Z - score above 2.67), 2014 to 2016 through the gray zone (Z - score between 2.67 and 1.81) and ending in the danger zone, from 2017 to 2019.

Table 5 shows the value of the variables and Z - score from the data collected from the financial statements, from 2008 to 2019. Specifically, in 2017 CLC presents deterioration of the Z - score. This situation is due to the worsening of the variables of the model, highlighting 2 of these. CLC's Z-score, which decreased by 69.6% compared to 2016, alerting about liquidity problems; and , which decreased by 156.9% with respect to the same year, indicating a very low productivity of the company's assets. It follows that CLC's financial health worsened between 2017 and 2019, with values of 1.390. 1.765 and 1.705, which could draw attention and alert managers, to reverse the poor performance that the company has presented.

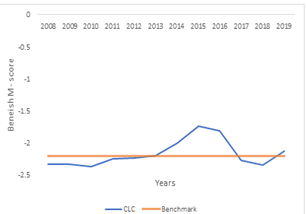

Results M – score

Figure 3 shows that CLC's M - score has had variations, passing through different zones during the period. From 2008 to 2012. and from 2017 to 2018, the M - score was below the benchmark (-2.2), which means that there is no indication of accounting manipulation. However, from 2013 to 2016, and also for 2019, the M - score exceeded the benchmark, which according to the indicators proposed by Beneish, could be a sign of possible manipulation in the financial statements.

Table 4 shows the details of each variable and the value of the M-score. It is important to note that, for the year 2008, since the accounting errors are carried forward, the score obtained is -2.334, which is below the benchmark and would classify as free of accounting manipulation. In the following 4 years, the score remains stable and almost unchanged: -2.334, -2.370. -2.242 y -2.234. In 2013, the first warning signs are obtained, given that the M - score reaches the value of -2.194, remaining in this same zone until 2016

Table 5 presents the averaged values for each index of the model, of CLC and of the firms used in the original study by Beneish (1999). It can be seen that the CLC indices that present similar values to the manipulator firms are SGAI, LVGI and Accruals, with values of 1.031. 1.106 and 0.051. respectively. Although these indexes need to be introduced to the model in order to deliver more robust information, they are useful indicators to examine financial statements of companies (Golden et al., 2016). Based on the information extracted specifically from these indexes, managers and analysts should pay special attention to the behavior of short and long-term debts, the different types of expenses and accruals, the main accounts that make up the indexes involved.

Sloan Ratio Results

Table 8 shows that the value of the ratio has been in the safe zone during the period studied. In particular, it shows a value of 2.87% for 2008, the same year that accounting irregularities began to be recorded in CLC. Between 2008 and 2014 the value of the ratio shows some stability around 0%, having variations of less than 4 percentage points. The most pronounced change in the indicator is obtained between 2016 and 2017, going from 4.26% to -7.17%, translating into a difference of almost 12 percentage points.

Figure 4 complements the previous analysis, showing that, for all the years studied, CLC presents a Sloan ratio that does not exceed the benchmark, which indicates that the company does not present problems with its accruals, inferring that there may not be any accounting mismatches.

Table 5 consolidates the results of each model used in the time period covered by this study

| Table 5 Summary of Results Obtained |

|||||||

|---|---|---|---|---|---|---|---|

| 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | ||

| Altman Z - score | 1.705 | 1.765 | 1.390 | 1.881 | 2.425 | 2.619 | |

| Beneish M - score | -2.130 | -2.347 | -2.434 | -1.728 | -1.692 | -2.085 | |

| Sloan ratio | -0.53% | 0.94% | -7,17% | 4,62% | 5,63% | -1.14% | |

| 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | ||

| Altman Z - score | 3,639 | 5,007 | 5,517 | 5,486 | 3,931 | 3,771 | |

| Beneish M - score | -2.184 | -2.182 | -2.293 | -2.370 | -2.334 | -2.334 | |

| Sloan ratio | 1.48% | -0.71% | -3,45% | -0.57% | -1.82% | 2.87% | |

The results provided by the Beneish M - score model show that the company does not show signs of manipulation during the first 4 years of the study; in subsequent years, the indicator shows certain variations that, contrary to previous studies on cases such as those of MacCarthy (2017); Muntari (2015); Omar, et al., (2014); Ramirez, et al., (2017); Talab, et al., (2018), do not allow to conclude that there was manipulation of the financial statements. In this same line, the Sloan ratio proposed by Altman (2017) shows that there are no alerts about a possible accounting makeup in the analyzed period. For its part, the Altman Z - score model highlights a financial robustness for the first 7 years; subsequently, the indicator remains in the warning zone, however, contrary to Mehta & Bavani (2017); MacCarthy (2017); ofori (2016); Parisi, et al., (2015), it does not provide sufficient evidence to classify CLC as a company on the verge of bankruptcy, and even more, to conclude that it has incurred in accounting manipulation of its financial statements.

It is important to note that the models used are not always able to classify manipulative and non-manipulative companies with complete efficiency. According to the results obtained in various researches, Altman's model correctly predicts the financial failure of 95% of the companies one year before their bankruptcy and decreases to 72% accuracy when measured two years before bankruptcy (Mehta & Bavani, 2017; Altman, 1968). For its part, the Beneish model classifies manipulative firms with 58% to 76% effectiveness, while the percentage of non-manipulative firms incorrectly classified ranges from 7.6% to 17.5% (Beneish, 1999). With this in mind, there is a likelihood that the CLC case could be incorrectly classified as a company that has committed financial statement fraud.

Conclusion

Financial statement fraud is the result of manipulation of the company's earnings, directed by its managers, breaching accounting regulations to deceive stakeholders with a false positive performance (Kamal et al., 2016). Since 1960, several studies have used financial models as a tool to detect the risk of bankruptcy and accounting manipulation of a company. Although studies have been conducted on four continents, the focus has been mostly on European or U.S. companies. This study allows to focus on a Latin American country such as Chile through the CLC case study, where certain accounting errors dragged on for many years resulted in lawsuits and legal problems that are still under discussion.

In the study, three indicators used in the literature were used to detect the possibility of fraud in CLC's financial statements, which allows for more information to analyze and different points of view when evaluating the case. It is important to note that the models used are not always able to classify manipulative and non-manipulative companies with total effectiveness.

In fact, contrary to other studies, none of the models provide sufficient evidence to classify CLC as a company on the verge of bankruptcy, and furthermore, to conclude that it has incurred in accounting manipulation of its financial statements. In short, the proposed indicators fail to classify CLC's case as one of financial fraud, but rather as accounting "irregularities" that were analyzed at the appropriate time. This is in line with the development of this case, which is still under evaluation by the Chilean justice and regulatory entities, without ruling the case as financial fraud. However, the company is under the scrutiny of investors, shareholders, directors and regulatory institutions, awaiting a ruling that will allow closing the case, which has generated great economic, legal and reputational costs.

This study answers the questions formulated and allows to postulate that financial ratios, which have traditionally been used in the literature to detect accounting fraud, are not by themselves a sufficient tool to detect manipulation in financial statements. A holistic analysis of the problem is required, using various methodologies. Strengthening internal auditing, analysis of the company's cash flow (Warshavsky, 2012), exemplary labor and monetary sanctions subsequently imposed on managers (Beneish, 2001), implementation of programs to encourage workers to expose irregular situations without fear of reprisals (Cohan, 2002), more frequent forensic audits and the use of data mining models are possible alternatives to help prevent and detect fraud in financial statements in time, which have negative consequences for managers, shareholders, investors and other agents of the economy.

For all the above, future research may consider the use of different methodologies to detect financial fraud, especially the use of data mining models.

Notes

Variable that changes in its preparation according to Beneish (1999). It allows the use of the information in the cash flow statements instead of the statement of financial position. Beneish et al. (2013) argue that, although it is calculated in a slightly different way, the results are very similar. On the other hand, this update of the variable was made to be consistent with the accruals literature.

References

- ACFE (1993). Cooking the books: what every accountant should know about fraud. No. 92-5401. Self-study Workbook: 12. Austin, TX.

- ACFE (2018): Report to the Nations. Global Study on Occupational Fraud & Abuse. Association of Certified Fraud Examiners. Disponible en Adu-Gyamfi,

- M. (2020). “Investigating Financial Statement Fraud in Ghana using Beneish M-Score: A Case of Listed Companies on the Ghana Stock Exchange (GSE)”.

- Alareeni, B., & Branson, J. (2013). “Predicting listed companies' failure in Jordan using Altman models: A case study”.International Journal of Business and Management,8(1), 113.

- Altman, E.I. (1968). “Financial ratios, discriminant analysis and the prediction of corporate bankruptcy”.The journal of finance,23(4), 589-609.

- Altman, E.I., & Hotchkiss, E. (1993). Corporate financial distress & bankruptcy. John Wiley & Sons Inc, New York.

- Altman, E.I., Hotchkiss, E., & Wang, W. (2019).Corporate financial distress, restructuring, & bankruptcy: Analyze leveraged finance, distressed debt, & bankruptcy. John Wiley & Sons Inc.

- Amat, O. (2017). Companies that lie. How they make up the accounts and how to detect them in time. Editorial Profit.

- Bai, B., Yen, J., & Yang, X. (2008). “False financial statements: characteristics of China's listed companies and CART detecting approach”.International journal of information technology & decision making,7(02), 339-359.

- Beneish, M.D. (2001). “Earnings management: A perspective”. 1–16.

- Beneish, M.D., Lee, C.M., & Nichols, D.C. (2013). “Earnings manipulation and expected returns”.Financial Analysts Journal,69(2), 57-82.

- Cîrciumaru, D. (2011). “The score models for analyzing the bankruptcy risk. Some specific features for the case of Romania”.The magazine of young economists, (16), 153-160.

- Cohan, J.A. (2002). “I didn?t know” and “I was only doing my job”: Has corporate governance careened out of control? A case study of Enron?s Information Myopia”. Journal of Business Ethics, 40(3), 275–299.

- Cressey, D.R. (1953). Other people's money: A study of the social psychology of embezzlement. Glencoe, III., Free Press.

- Dalnial, H., Kamaluddin, A., Sanusi, Z.M., & Khairuddin, K.S. (2014). “Detecting fraudulent financial reporting through financial statement análisis”.Journal of Advanced Management Science,2(1), 17-22.

- Deloitte Forensic Center (2008). Ten things about bankruptcy and fraud. Disponible en (Consultado el 04 de diciembre).

- Golden, T.W., Skalak, S.L., Clayton, M.M., & Pill, J.S. (2006). A guide to forensic accounting investigation. Hoboken, John Wiley & Sons Inc, New Jersey.

- Hernández, R., Fernández, C., & Baptista, P. (2014). Investigation methodology. Mc Graw Hill Education.

- Kamal, M.E.M., Salleh, M.F.M., & Ahmad, A. (2016). “Detecting financial statement fraud by Malaysian public listed companies: The reliability of the Beneish M-Score model”.Jurnal Pengurusan (UKM Journal of Management),46.

- Karikari Amoa-Gyarteng (2014). “Analysing a listed firm in ghana for early warning signs of bankruptcy and financial statement fraud: An empirical investigation of AngloGold Ashanti”. European Journal of Business and Management.6.5.

- Koornhof, C.,&du Plessis, D.(2000). "Red flagging as an indicator of financial statement fraud: The perspective of investors and lenders".Meditari Accountancy Research, 8, 1.

- Kumar, M., & Anand, M. (2013). “Assessing financial health of a firm using Altman’s original & revised Z-score models: A case of Kingfisher Airlines Ltd (India)”.Journal of Applied Management and Investments,2(1), 36-48.

- Kumari Tiwari, R.,&Debnath, J.(2017). "Forensic accounting: A blend of knowledge".Journal of Financial Regulation and Compliance, 25(1), 73-85. .

- La Tercera (2019). “Las Condes Clinic: what is behind the conflict with its doctors ", October 24.

- Leiva, S., & Mellado, A. (2014). “Financial and accounting fraud in Chile in the last ten years”.

- MacCarthy, J. (2017). Using Altman Z-score & Beneish M-score models to detect financial fraud and corporate failure: A case study of Enron Corporation”.International Journal of Finance and Accounting,6(6), 159-166.

- Mahama, M. (2015). “Detecting corporate fraud & financial distress using the Altman and Beneish models”.International Journal of Economics, Commerce and Management,3(1), 1-18.

- Mehta, A., & Bhavani, G. (2017). “Application of forensic tools to detect raud: The case of Toshiba”.Journal of Forensic and Investigative Accounting,9(1), 692-710.

- Memoria, C.L.C. (2011). Report 2011 Las Condes Clinic.

- Mohd Nor, J.,Ahmad, N.,&Mohd Saleh, N.(2010), Fraudulent financial reporting and company characteristics: Tax audit evidence".Journal of Financial Reporting and Accounting, 8(2), 128-142.

- Nasir, N.A.B.M.,Ali, M.J.,&Ahmed, K.(2019). Corporate governance, board ethnicity & financial statement fraud: evidence from Malaysia".Accounting Research Journal, 32(3), 514-531.

- Ngai, E.W., Hu, Y., Wong, Y.H., Chen, Y., & Sun, X. (2011). “The application of data mining techniques in financial fraud detection: A classification framework and an academic review of literature”.Decision support systems,50(3), 559-569.

- ofori, E. (2016). “Detecting corporate financial fraud using Modified Altman Z-score & Beneish M-score. The case of Enron Corp”.Research Journal of Finance and Accounting,7(4), 59-65.

- Omar, N., Koya, R.K., Sanusi, Z.M., & Shafie, N.A. (2014). “Financial statement fraud: A case examination using Beneish Model and ratio analysis”.International Journal of Trade, Economics and Finance,5(2), 184-186.

- Parisi, F., Cornejo, E., & Castro, G. (2015). "La Polar: Manipulation of Financial Statements, Fraud and Impact".

- Price III, R.A., Sharp, N.Y., & Wood, D.A. (2011). “Detecting & predicting accounting irregularities: A comparison of commercial and academic risk measures”.Accounting Horizons,25(4), 755-780.

- Poder Judicial de Chile, 12º Juzgado Civil de Santiago. Causa Rol C-37500-2018,DemandaInversiones Santa Filomena Ltda/Navarro a Clínica Las Condes.

- Ramírez, A., Martínez, M., & Mariño, T. (2017). “Measuring fraud & earnings management by a case of study: Evidence from an international family business”. European Journal of Family Business, 7, 41-53.

- Rezaee, Z. (2002).Financial statement fraud: prevention & detection. John Wiley & Sons.

- Rezaee, Z. (2005). “Causes, consequences, & deterence of financial statement fraud”.Critical Perspectives on Accounting,16(3), 277-298.

- Spathis, C.T.(2002). "Detecting false financial statements using published data: Some evidence from Greece".Managerial Auditing Journal, 17(4), 179-191.

- Talab, H.R., Flayyih, H.H., & Ali, S.I. (2018). “Role of Beneish M-score model in detecting of earnings management practices: Empirical study in listed banks of Iraqi stock exchange”.International Journal of Applied Business and Economic Research,16.

- Throckmorton, C.S., & Mayew, W.J. (2015). “Financial fraud detection using vocal, linguistic and financial cues”.Decision Support Systems,74, 78-87.

- Thornhill, W.T., & Wells, J.T. (1993). Fraud terminology reference guide. Association of Certified Fraud Examiners, Austin, TX.

- Transparency International (2019). Corruption perception index. Available (Consulted on December 03, 2020)

- Tanui, D.P.J., Katana, H., Alosi, G., Khahenda, L., & Adhiambo, V.E. (2021). Ownership structure & financial performance of listed firms in Kenya: Mediation role of corporate diversification. Journal of Advanced Research in Economics and Administrative Sciences, 2(2), 16-34.

- Warshavsky, M. (2012). “Analyzing earnings quality as a financial forensic tool”. Financial Valuation and Litigation Expert Journal, (39), 16–20.

- Yi, W. (2012). “Z-score Model on Financial Crisis Early-Warning of Listed Real Estate Companies in China: a Financial Engineering Perspective”. Systems Engineering Procedia,.3, 153–157.

- Hariyanto, D. (2021). Effect of trading volume, market capitalization, firm size in explaining return on vultures. Journal of Advanced Research in Economics & Administrative Sciences, 2(2), 50-64.

- Yin, R.K. (1994). Case study research. Design & Methods, Applied Social Research Methos Series, 5, Second Edition, Sage Publications, London.

- Zhu, J., & Gao, S.S.(2011), "Fraudulent financial reporting: Corporate behavior of Chinese Listed Companies",Susela Devi, S.&Hooper, K.(Edition.)Accounting in Asia Research in Accounting in Emerging Economies, 11. Emerald Group Publishing Limited, Bingley, 61-82.