Research Article: 2021 Vol: 25 Issue: 3

Are Firms with Satisfied Customers Admired?

Jaehong Lee, Kyonggi University

Suyon Kim, Jeonbuk National University

Abstract

In this study, we investigate the relationship between customer satisfaction and firms being selected as admired firms. Also, we confirmed the ESG effect on this correlation. Based on 8,126 Korean firms, we use regression analysis to examine the relationship between customer satisfaction and being designated as admired firms, using Korean firms from 2014 to 2018. Our study reports that the firms with satisfied customers are likely to be admired in the market. We also found when the firms are actively engaged in ESG, customer satisfaction plays a role positively, leading to being selected as admired. Among ESG index, the environment index positively impacts on the relationship between customer satisfaction and admired firms. Our findings suggest that customer satisfaction is an intangible asset that affect firm value positively. Our study has contributed that we examine the impact of customer satisfaction on non-financial information, explaining firm value. As we test the effect of firms’ customer satisfaction, we expanded the social contribution including environment, society and governance.

Keywords

Customer Satisfaction, Admired Firms, ESG, Environment, Social, Governance.

Introduction

Customers are one of the company’s most influential stakeholders. Customers have direct information on the value and quality of firms’ products and services. If customers are satisfied with the products and services, they complain less, repeat purchases, and are loyal to the firm, securing a promising financial outcome. Customer satisfaction information can reveal value-relevant information regarding the economic outcome, such as demand and profitability.

Customer satisfaction also implies corporate reputation. A positive corporate reputation helps a firm competitive advantage (Gatzert, 2015), raising capital, building customer relationships, and financial performance. Therefore, it is vital to improving the company's reputation, and the company needs to take action to improve the company's reputation in the long term. In the field of accounting, we view customer satisfaction as one of the intangible assets that help stakeholders reduce uncertainty (Pfarrer et al., 2010), thus affecting firm performances. Achieving a good reputation is vital and enables firms to achieve reliable financing from investors. Thus, we conjecture that customer satisfaction positively affects firm performances.

To test our hypothesis, we manually collected data on customer satisfaction from the Korean Customer Satisfaction Index (KCSI) from Korea Most Admired Companies (KMAC) consulting firm, providing customer satisfaction for publicly traded firms since 1992. The KCSI is widely known to general consumers as a representative customer satisfaction index of the Korean industry, which has the longest history and public credibility in Korea. The methodology adopted by KMAC consulting firm provides companies in 100 industries of the Korean economy with an independent customer-based enterprise-level satisfaction measurement.

While previous studies have focused on the relationship between customer satisfaction and financial outcomes, we investigate whether customer satisfaction is associated with firm’s non-financial information based performance. Non-financial information, though not mandatory to disclose, is useful (Liedtka, 2002). Public Company Accounting Oversight Board (PCAOB) also suggests that non-financial measurement can be a strong tool for assessing data validity and providing an independent benchmark. Gamerschlag (2013) and Bianchi et al. (2014) argue that human resources, regarded as non-financial information, have value relevance, and its public announcement is one of the determinants of a firm’s growth and financial performances. Brazel et al. (2009) also present four factors of manipulating operations based on non-financial information. The number of firms disclosing non-financial information expands gradually as investors’ social and international demands in the capital markets to disclose non-financial information increase. According to the Korea Standards Association, the number of firms publishing sustainable reports increased significantly from 2 firms in 2004 to 133 firms in 2018.

Our study considers being listed as admired firms as an indicator for non-financial information-based performance, using Korea’s Most Admired Company (KMAC) index from KMAC consulting firm. Designated as admired firms implies firm’s continuous and innovative activities that yield outstanding performance. The most admired companies in Korea are respected by all shareholders through increasing shareholder value, social value, and reputation based on excellent competitiveness confirmed through continuous technological innovation activities. Innovation, social and environmental responsibility, which are the criteria for selecting the most admired company, are expected to have a positive impact on corporate value in the long run.

Moreover, we consider the customer satisfaction effect in incorporation with ESG information. ESG is a prolongation of corporate responsible activities that consider in the area of environment, social, and governance. Lichtenstein et al. (2004) assert that corporate responsible activities will attract customer support. For higher customer satisfaction, firms need to identify, apply and communicate corporate responsible activities (Green & Peloza, 2011). Based on the social identity theory (Tajfel & Turner 1985), firms with satisfied customers that are actively involved in good deeds likely report sustainable firm value.

In samples of 8,126 firm-year observations, this study documents that customer satisfaction information plays a significant role in increasing firm value selected as one of the most admired firms. These results indicate that satisfied customers play a vital role in the admired firm designation. Also, the additional analysis finds that a positive relationship between customer satisfaction with ESG and admired company. As firms engage in ESG, the firms’ customer satisfaction signals firms’ favorable evaluations, and in turn, lead to be listed as admired firm.

Our study has a distinct contribution. Prior studies on the effect of customer satisfaction on financial performances. However, we attempt to analyze the relationship between customer satisfaction and non-financial information based performance, being selected as admired firms.

Recently, capital markets and government have emphasized responsible investment, highlighting the importance of corporate sustainability and corporate responsibility. We are not limiting corporate responsibility to social contribution activities but are focusing on the results of overall corporate activities that include environment, society and governance (ESG). For this reason, it has been argued that regulations must be introduced or strengthened to expand non-financial information disclosure. In this study, we analyze the impact of non-financial information on corporate performance and sought to improve our understanding of the companies’ reality and capital markets regarding non-financial information. By using internationally used metrics and examining the impact of each disclosure type, we complemented the previous studies on ESG.

However, this study has a limitation. We conducted our analysis based on Korean data. If the number of non-financial information is expanded and the index of companies not included in the public announcement is released, it will be possible to analyze more sample firms.

Literature Review

Customer Satisfaction

Customer satisfaction is considered as a firm’s intangible asset that influences consumer behavior, leading to favorable outcome (Anderson et al., 2004; Luo & Homburg, 2007). Satisfied customers purchase repeatedly, are less subject to price, and build loyalty behavior, leading to competiveness in the market. Being loyal to the firm is the most representative ways of expressing customers’ satisfaction. At the same time, by satisfying customers, the firm can strengthen the relationship with customers, establishing a stable customer base.

There are previous research that examine the effect of customer satisfaction on financial outcome. Anderson & Mazvancheryl (2004), Gruca & Rego (2005), and Aksoy et al. (2008) asserted that customer satisfaction influences shareholder value by increasing future cash flow growth. Tuli & Bharadwaj (2009) found that customer satisfaction can be used as a financial market measurement and reduces idiosyncratic risk and systematic risk. Due to this reason, when firms are exposed to a market, firms can increase customer satisfaction when controlling the risk of a stock. Fornell et al. (2006) suggested that customer satisfaction improves repetitive usage level, future revenue, productivity, and long-term growth affecting stock prices and corporate value. Jung and Im (2010) found the positive impact of customer satisfaction on the return on assets and net sales growth rates, used as a proxy for a firm’s financial performance. Williams & Naumann (2011) found a positive relationship between customer satisfaction and changes in earnings per share, revenue, Tobin Q ratio, and stock price. Cho et al. (2014) confirm the positive effect of customer satisfaction on ROA and ROE as a measurement for corporate financial performances. Antunovich & Laster (2003) analyzed the firms' rates selected as respected firms. The result indicates that the size of the portfolio made up of the most respected firms showed significantly higher rates of return, the book value to market value, momentums, and rates after controlled industrial effects. The stock prices of respected firms are not overvalued, and they have high rates of return in the long run. To sum up, customer satisfaction's positive effects on the firm performance are reduced dissatisfaction, repeated purchases, and increased customer interest gained from customer loyalty.

However, prior research shows a negative correlation between customer satisfaction and financial performance. Yi & Lee (2006) found the effect of customer satisfaction in the manufacturing or service industry on each economic value and financial performance. They found customer satisfaction is more robust on economic value, but no result is found on the firm performance. Lee & Kang (2007) examined customer satisfaction and corporate performance, using sales growth rate. They found there is no significant impact of customer satisfaction on sales growth.

Admired Firms

When evaluating corporate value, it is evaluated by only 30 % of financial assets, while the rest of corporate value is assessed by non-financial assets (Caparo & Srivastava, 1997). Firm’s reputation is considered as an intangible element of non-financial assets, but in order to gain reputation, firms must realize continuous technological ability, shareholder value, employee value, customer value, and social value. Non-financial information provides additional value besides the information presented by financial results. Brazel et al. (2009) assert that non-financial information is superior in providing highly trustworthy information based on independent sources, less subject to fraudulent accounting and profitability, while a financial measurement is at discretion by management. Also, manipulating non-financial measurement complicates the act itself, requiring further manipulation of other non-financial measurements. Taken together, non-financial measurement manipulation is not common in fraudulent business. Also, Gamerschlag (2013) and Bianchi et al. (2014) argue that non-financial information is value relevant and its disclosure is one of the determinants of a firm’s growth and financial performance. To sum up, non-financial information provides markets and shareholders with additional information effects besides financial performance, leading to corporate sustainability in the long run.

Global interests in sustainability have increased significantly. The selection of admired firms is a global management trend and expands to developed and emerging countries. For example, Fortune in U.S. selects and announces ‘America’s Most Admired Companies (AMAC)’ and ‘The world’s Most Admired Companies’ since 1983 and 1994, respectively. Similarly, ‘The World’s Largest Companies’ of Financial Times in England since 1982, ‘Australia’s Most Respected Companies’ in Australia, and ‘Japan’s Most Admired Companies’ in Japan select and announce the most admired firms.

In Korea, Korea Management Association (KMAC) consulting announces Korea’s Most Admired Companies. It is a survey-based score that comprehensively evaluate the firms with six core values such as continuous technological innovation ability, customer value, shareholder value, employee value, and image value and proceed with integrated research. The firms selected as the most admired company are expected to operate a business with excellence in the market. At the same time, an admired company fulfills the social responsibilities in good faith and well-evaluated by all stakeholders (Cho et al., 2010) KMAC officials assert that change for survival and correct technological innovation will lead to firms’ sustainable growth. According to KMAC consulting, being selected as an admired company means more than just generating profits, it creates excellent business results through constant technological innovation and sustainable competitiveness.

Hypothesis Development

With the rising importance of customer satisfaction, customer satisfaction is considered a key factor in achieving success and competitiveness. Customer satisfaction can also be used strategically and is a driving force of long-term profitability and market value (Fornell et al., 2006). Customers satisfied with the product and services will have an overall good image and will bring benefits to the firm, such as brand loyalty, stable price, reputation, less in cost of transaction and failure costs, and shielding customers from competitors (Anderson et al., 1994). Nowadays, a non-financial measurement like intangible assets, customer satisfaction is one of the vital elements in deciding firm performance (Aaker & Jacobson, 2001).

Most studies have focused on financial information-based measurement when measuring firm performance. However, with rising demand for disclosure on non-financial information, we attempt to examine the association between customer satisfaction and firm’s non-financial information. Non-financial information reflects the willingness of companies to provide evidence of how they do business, and integrate sustainability in the strategic and decision-making process that are critical in achieving sustainable goals (Jackson et al., 2020; Hess, 2019; Rezaee & Tuo, 2017). Non-financial information can be used to predict firm’s financial performances (Serafeim & Grewel, 2017).

We focus on the non-financial information-based performance using an index of Korea’s Most Admired Company (KMAC index). KMAC index in firms’ non-financial information disclosed by KMAC in Korea. KMAC index assesses the firms in the aspects of innovative technology continuum, shareholder value, employee value, customer value, and social value. The firms listed in the KMAC index are admired companies and are good at integrating different financial and non-financial objectives as they are generating profits. Therefore, if there is high degree of satisfaction, this will further shape the consumers’ estimation of product quality or attitude towards the product, and even a positive evaluation on the company. In this study, we attempt to analyze whether the firms with the customer satisfaction are likely to be admired.

H1: The firms with good customer satisfaction are likely to be admired.

People are nowadays well aware of the actions or policies that the firms are into or onto in their community, and it is called corporate social responsibility (CSR). CSR is the firms’ actions and policies, considering stakeholders’ expectations and the triple bottom line of economic, social, and environmental performances. We consider ESG in our study. ESG is an acronym of Environment, Social, and Governance, and it is a prolongation of CSR. ESG is not limited to simple social contribution activities such as donation and establishing a public interest foundation. It has expanded the CSR area into a sustainable existence. ESG is a major factor that UN PRI (Principle of Responsible Investment) suggests considering when making an investment. Korea Corporate Governance Service (KCGS) has developed the ESG model, based on international standards, including ISO 26000, promoting transparent corporate governance and providing useful information that they are socially and environmentally responsible.

The effect of ESG can be explained by social identity theory. According to the theory, people are affected by the surrounding environment that they are involved. In other words, it categorizes people according to social attributes, which develops a sense of belonging (Paruzel et al., 2020). Purchasing products or receiving services from socially responsible company creates the feelings that customers are actually participating in the virtuous act (Luo & Bhattacharaya, 2006) and enhances the sense of connection. A growing number of customers appraise firms’ commitment to the environment and society when purchasing (Galbreath & Shum, 2012). For example, customers regard the firms with the social, environmental, and ethical problem as ‘bad’, and if badness gets serious, the firm may face boycotts. However, the firms with actively engaged in social, environmental, and ethical activities are considered as ‘good or nice’, acquiring consumers’ preferences, resulting in increased sales. Another example is that the survey from Embrain Trend Monitor showed the result that 68.9% of response that they would purchase the product with ethical management. Customers highly evaluate firms with actively involved in ESG and are apt to purchase products with good reputation. Firms investing in ESG offer an advantage in positively increasing consumer appreciation and attitude towards the firm. Thus, firms involving ESG are secured among competitors through improved image or reputation (Porter & Kramer, 2006). In our study, we attempt to analyze whether firms with satisfied customers involved in ESG are likely to be listed as admired firms and the hypothesis is as follows.

H2: The relationship between good customer satisfaction and admired firms is more assertive in firms with ESG.

Methodology

Customer Satisfaction Measurement

In this study, we use Korean Customer Satisfaction Index (KCSI) by KMAC consulting to assess the aggregate level of satisfaction in each industry and service. KCSI reflects the overall satisfaction of 30%, the element satisfaction of 50%, considering the characteristics of each industry, and the repurchase intention rate of 20%. It is survey-based scores, collected by telephone interviews annually or by one-on-one interviews on the characteristics of the industry. KCSI started the survey in 1992, and in the 2000s, the number of industries surveyed was expanded and grew significantly. A survey is conducted across all industries in Korea. KCSI guides the qualitative growth of the Korean industry and supports each firm every year to be used as a foundation to ensure competitiveness.

The KCSI survey is superior for the following reasons, according to KMAC consulting. First, it establishes a culture of customer satisfaction in Korean firms in every industries and drives the rise in customer satisfaction. KCSI’s annual survey was announced since the early 1990s, when there was even no concept of customer satisfaction. Based on this, Korean firms gradually became interested in customer satisfaction management since then. The culture of customer satisfaction has now spread to the public sector, and we are in an era where all public institutions are valued by customer satisfaction. The KCSI index showed an increase of 89% compared to 1992. Firms that have promoted sustainable and true customer satisfaction management and prioritized customer value have demonstrated that they can achieve growth and development even in a recession.

Second, it contributes to improving the quality of life of the people at the forefront of protecting interests of customers. The results of the KCSI survey are being used in the government’s economic policy to set the overall direction of the Korean industrial economy. By utilizing this, it will be utilized for policy formulation of the management team of each firm, but it will also contribute to the protection of consumer interests, and ultimately, an industrial culture that will improve the people’s quality of life.

Third, it extends to the public sector, public enterprises, quasi-government agencies, and other public institutions. The culture of customer satisfaction that began with KCSI has spread to the public sector, and recently it has become an era in which all public institutions are evaluated as customer satisfaction. More than 300 public institutions in Korea receive customer satisfaction evaluations from the public every year.

Research Model

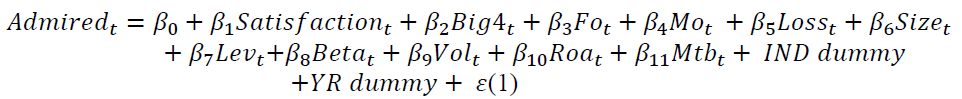

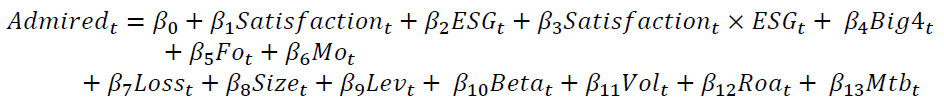

The following regression models are used to test customer satisfaction's effect on firms’ being admired. Model (1) is to test the first hypothesis of the impact of customer satisfaction on selected as admired firms. Model (2) examines the second hypothesis of testing the impact of customer satisfaction incorporated with ESG on selected as admired firms. The following models are used to test the hypotheses.

Where, Admired = score of admired firms; Satisfaction = Scores of customer satisfaction; Big4= if firm is audited by Big4 and 0 otherwise; Fo = percentage of shares held by foreign investors; Mo = percentage of shares held by largest shareholder; Loss = 1 if a company with loss, and 0 otherwise; Size = natural logarithm of total assets; Lev = total debt divided by total assets; Beta = estimated value of beta, the number of months for five years before the relevant year to control the systematic risk; Vol = volatility of stock; Roa = net income/total assets; Mtb = market value of equity / book value of equity; IND dummy = industry dummies; YR dummy = year dummies.

Based on the prior research, to minimize the possible bias, firm size and financial leverage are included. Size, as a proxy for firm size, is measured as the natural log of total assets. For measuring firm performance and risk, Roa and Loss are included, respectively. For controlling volatility within a particular year arise from a specific economic situation, year dummies are included in the model. To control effect of a specific industry, industry dummies are included in the model.

Sample Selection

Table 1 describes the procedures to get the final sample to test the hypotheses. We manually collected firm data of customer satisfaction and admired firms from KMAC consulting. We acquired ESG data from Korea Corporate Governance Service (KCGS). We use the FnGuide database for financial data as control variables.

| Table 1 The Data Description | |

| Panel A. Sample selecting process | |

| Firm year observations from 2014 to 2018 with December closing fiscal year | 12,943 |

| Less: | |

| No data for control variables | 1,183 |

| Customer Satisfaction, ESG missing data | 3,634 |

| Final observation | 8,126 |

We include all the firms listed in the Korea Stock Exchange with December year-end from 2014 to 2018. We eliminated the firms in the financial industry. Firms without or incomplete financial data are removed. The top and bottom 1% of dependent and independent variables are winsorized to minimize the outlier effect. After the selection process, we get the final 8,126 firm-year observations.

Results and Discussion

Descriptive Statistics and Correlation Matrix

Table 2 displays the description statistics for the main variables. The mean of admired and satisfaction are 0.092 and 0.072, respectively. The average value of ESG is 3.309 and median value is 3.296.

| Table 2 Descriptive Statistics | |||||

| Variables | Mean | STD | Q1 | Median | Q3 |

| Admired | 0.092 | 0.289 | 0.000 | 0.000 | 0.000 |

| Satisfaction | 0.072 | 0.259 | 0.000 | 0.000 | 0.000 |

| ESG | 3.309 | 0.443 | 3.045 | 3.296 | 3.584 |

Table 3 shows the Pearson correlation matrix for this study's main variables. We can confirm that satisfied customers and being selected as admired firms are positively related. The result indicates that customer satisfaction and ESG are useful in explaining admired firms.

| Table 3 A Correlation Matrix | |||

| (1) | (2) | (3) | |

| (1) Admired | 1.000 | 0.573 | 0.423 |

| <.0001 | <.0001 | ||

| (2) Satisfaction | 1.000 | 0.395 | |

| <.0001 | |||

| (3) ESG | 1.000 | ||

Regression Analysis

Table 4 shows the result of regression analysis on the relationship between customer satisfaction and admired firms. It is our first hypothesis using equation (1). The coefficient of customer satisfaction 9.809, positively significant at 1% level. This finding suggests that the firms with satisfied customers are likely to be admired.

| Table 4 The Regression Result on the Relationship between Customer Satisfaction and Admired Firms | ||

| Variables | Coeff. | t-stat. |

| Intercept | -5.045 | -39.080*** |

| Satisfaction | 9.809 | 8.290*** |

| Big4 | -0.008 | -0.650 |

| Fo | 0.760 | 12.810*** |

| Mo | -0.046 | -1.340 |

| Loss | 0.023 | 1.490 |

| Size | 0.201 | 38.780*** |

| Lev | 0.398 | 14.450*** |

| Beta | -0.023 | -2.720*** |

| Vol | -0.941 | -2.990*** |

| Roa | -0.296 | -4.470*** |

| Mtb | -0.046 | -13.640*** |

| Control Variables | Included | |

| IND Dummy | Included | |

| YEAR Dummy | Included | |

| F-value | 246.73*** | |

| Adj. R2 | 0.388 | |

| Observations | 8,126 | |

| 1) *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively. 2) See Table 2 for definitions of other variables. |

||

We interpret this result that customer satisfaction as overall satisfaction that is integrated customers’ experiences. If the level of positive customer satisfaction increases, the firms are likely to be selected as the most admired firms. Namely, the firms with customers’ satisfaction mean the firms’ having overall good image and reputation. Those firms are expected to perform better and can be measured as inclusion in the admired firms' list. Through this result, we can find that corporate sustainability is formed by corporate trust of customers. Reichheld (2001) confirmed that customer satisfaction is a vital assessment of long-term firm performance. As a result, firms make many efforts to increase their profitability by investing in customer satisfaction (Yi & La 2002). The general manager at KMAC consulting emphasizes that admired firms are not the current choice but an obligation. Today’s businesses must strive to be admired firms through maximizing customer satisfaction.

Table 5 shows the result of examining the second hypothesis using equation (2). It displays the result of the ESG effect on the relationship between customer satisfaction and admired firms. The coefficient of customer satisfaction 4.144, showing positive and significance at 1% level. Also, the interaction coefficient of customer satisfaction and ESG is 0.193 and positively significant at 1 % level.

| Table 5 The Effect of ESG on the Relationship between Customer Satisfaction and Admired Firms | ||

| Variables | Coeff. | t-stat. |

| Intercept | -3.199 | -22.710*** |

| Satisfaction | 4.144 | 3.690*** |

| ESG | 0.100 | 6.230*** |

| SatisfactionESG | 0.193 | 31.530*** |

| Big4 | -0.006 | -0.500 |

| Fo | 0.323 | 5.660*** |

| Mo | -0.007 | -0.210 |

| Loss | 0.013 | 0.870 |

| Size | 0.128 | 22.590*** |

| Lev | 0.252 | 9.500*** |

| Beta | -0.010 | -1.330 |

| Vol | -0.347 | -1.170 |

| Roa | -0.199 | -3.210*** |

| Mtb | -0.031 | -9.500*** |

| Control Variables | Included | |

| IND Dummy | Included | |

| YEAR Dummy | Included | |

| F-value | 306.38*** | |

| Adj. R2 | 0.463 | |

| Observations | 8,126 | |

| 1) *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively. 2) See Table 2 for definitions of other variables. |

||

Firms engaged in ESG imply that the firms are concerned in the environment, trying to communicate with society. Also, customers’ purchasing product or experiencing services is what customers support and represent. Customers also assess the firms’ involvement in the environment and society (Galbreath & Shum 2012). Corporate responsible activities attract customers’ support (Lichtenstein et al., 2004), creates product differentiation (McWilliams & Siegel 2001), leading to willingness to buy the product. As shown in table 4, if firms participate in ESG with satisfied customers, the effect of satisfaction would be doubled up. Thus, high satisfaction incorporated with ESG leads firms to be admired. This result is in line with Fatemi et al. (2018) that customer satisfaction with ESG increases firm value, because ESG plays a crucial role in mitigating negative news of the firms. Thus, ESG disclosure, which improves transparency, accountability, and stakeholder trust, helps customers satisfied, and it will lead to be listed in the admired firms’ list.

Additional Analysis

Table 6 shows the additional analysis effect of each ESG index on the relationship between customer satisfaction and admired firms. First, panel A shows the effect of the Environment index on the relationship between customer satisfaction and admired firms. The interaction coefficient of Satisfaction×E is 17.938 and shows a significant positive coefficient at 1 % level. The result is consistent with the previous research that firms with high customer satisfaction and involved in environmental activities are likely to be admired. The firms with satisfied customers benefit from greater customer loyalty, improved reputation, and secured competitiveness. The result indicates that if the firms are highly involved in environmental activities, such as environmental strategy, management, performance, and stakeholders, customer satisfaction leads to firm’s admiration, meaning elevated firm value. Among ESG, the significance of environment (E) is the largest. This supports the evidence that customer satisfaction incorporated highly with environmental issue, such as climate change, environmental-friendly services or product, compliance with environmental laws, leads to be listed as the most admired firms in Korea.

| Table 6 Effect of Each E, S, G on the Association between Customer Satisfaction and Admired Firms | ||

| Panel A. E - Environment | ||

| Variables | Coeff. | t-stat. |

| Intercept | -4.661 | -32.980*** |

| Satisfaction | 6.634 | 5.120*** |

| E | 0.088 | 5.750*** |

| Satisfaction E | 17.938 | 5.930*** |

| Control Variables | Included | |

| IND Dummy | Included | |

| YEAR Dummy | Included | |

| F-value | 231.15*** | |

| Adj. R2 | 0.396 | |

| Observations | 8,126 | |

| Panel B. S - Social | ||

| Variables | Coeff. | t-stat. |

| Intercept | -4.541 | -31.180*** |

| Satisfaction | 2.643 | 1.750* |

| S | 0.120 | 6.930*** |

| Satisfaction S | 15.745 | 6.680*** |

| Control Variables | Included | |

| IND Dummy | Included | |

| YEAR Dummy | Included | |

| F-value | 234.83*** | |

| Adj. R2 | 0.398 | |

| Observations | 8,126 | |

| Panel C. G- Governance | ||

| Variables | Coeff. | t-stat. |

| Intercept | -4.387 | -30.080*** |

| Satisfaction | 3.613 | 2.330** |

| G | 0.158 | 9.230*** |

| Satisfaction G | 11.997 | 5.140*** |

| Control Variables | Included | |

| IND Dummy | Included | |

| YEAR Dummy | Included | |

| F-value | 233.34*** | |

| Adj. R2 | 0.396 | |

| Observations | 8,126 | |

| 1) *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively. 2) See Table 2 for definitions of other variables. |

||

Panel B shows the effect of Social index on the correlation between customer satisfaction and admired firms. The interaction coefficient of Satisfaction×S is 15.745, positively significant at 1 % level. The criteria of S include employee turnover, partner and competitor companies, consumers and the local community. The evaluation includes whether firms share an interest with their stakeholders in their management. Thus, the customers satisfied in the firm related to the social sector are likely to be admired. This result is in line with the study of Min et al. (2014) that financial performance increases when the social sector is strong.

Panel C displays the effect of the Governance index on the correlation between customer satisfaction and admired firms. The coefficient of Satisfaction×G is 11.997, positively significant at 1% level. The criteria of G includes the protection of shareholder’s right, board of directors, public announcements, auditing institutions, and profit-sharing. Customer satisfied with well-established corporate governance is likely to be admired. This result is in line with the study of Lee & Kim (2013) that corporate governance of CSR contributes to increased firm value. This result is also similar to studies of Kook & Kang (2011) and Fetami et al. (2018), that superb corporate governance has effect on positive firm value.

Conclusion

No firms can survive without customers. That is, firms need to focus on customers’ feedback and continue to real improvements, thus acquiring competitiveness in the market. Without customers, the innovative technology, ability to raise capital are in vain. This study analyzes the customer satisfaction leads to be on the list of admired firms using 8,126 firm- year observation in Korea. Our study indicates that satisfied customer is vital in the admired firm designation. We conducted additional analysis of the ESG effect on the relationship between customer satisfaction and being admired. We also conducted each index of ESG. As firms engage in ESG, the firms’ customer satisfaction signals firms’ favorable evaluations, leads to be listed as admired firm. We found the result that the environment has the most impact on the relationship between customer satisfaction and admired firms. We interpret this result that the rising importance of environment, in the firms actively involved in environment area, customer are more satisfied, thus being admired.

Our study has a distinct contribution. First, our study is distinct in that we measure the outcome of firm performance using non-financial information based performance. We use non-financial information as the accumulation of customer trust. Second, capital markets and government have emphasized responsible investment, highlighting the importance of corporate sustainability and corporate responsibility. We are not limiting corporate responsibility to social contribution activities but are focusing on the results of overall corporate activities that include environment, society, and governance (ESG). For this reason, it has been argued that regulations must be introduced or strengthened to expand non-financial information disclosure. In this study, we analyze the impact of non-financial information on corporate performance and sought to improve our understanding of the reality of the companies and capital markets regarding non-financial information. By using internationally used metrics and examining the impact of each disclosure type, we complemented the previous studies on ESG.

However, this study has a limitation. We conducted our analysis based on Korean data. If the number of non-financial information is expanded and the index of companies not included in the public announcement is released, it will be possible to analyze more sample firms.

References

- Aaker, D.A., & Jacobson, R. (2001). The value relevance of brand attitude in high-technology markets. Journal of Marketing Research, 38, 485-93.

- Anderson, C.F., & Mazvancheryl, S.K. (2004). Customer satisfaction and shareholder Value. Journal of Marketing 68, 172-185.

- Anderson, E.W., Fornell, C., & Lehmann, D.R. (1994). Customer satisfaction, market share, and profitability: Finding from Sweden. Journal of Marketing, 58(3), 53-66.

- Antunovich, P., & Laster, D. (2003). Are good companies bad investments? Journal of Investing, 12(1), 53-65.

- Aksoy, L., Cooil, C., Keiningham, G.T., & Yalç?n, A. (2008). The long-term stock market valuation of customer satisfaction. Journal of Marketing, 72(4), 105-122.

- Bianchi, M.S., Corvino, A., Doni, F., & Rigolini, A. (2014). Human capital disclosure: a determinant of firm growth and financial performance. Empirical evidence from European listed companies. European Journal of Management, 14(2), 153-175.

- Brazel, J.F., Jones. K.L., & Zimbelman, M.F. (2009). Using Non-financial measures to assess fraud risk. Journal of Accounting Research, 47, 1135-1166.

- Capraro, A., & Srivastava, R. (1997). Has the influence of financial performance on reputation measures been overstated? Corporate Reputation Review, 1(1), 86-93.

- Cho, K.S., Kim, D.S., & Ahn, S.P. (2010). Performance of the investment in the most admired company in Korea. Korean Journal of Business Administration, 12, 3321-3337.

- Cho, H., Son, H., & Youn, G. (2014). The effect of customer satisfaction on firm’s long-term financial performance. Korea International Accounting Review, 56, 208- 227.

- Fatemi, A., Glaumb, M., & Kaiserc, S. (2018). ESG performance and firm value: The moderating role of disclosure. Global Finance Journal, 38, 45-64.

- Fornell, C., Mithas S., Morgeson, F., & Krishnan, M. (2006). Customer satisfaction and stock prices: High prices, low risk. Journal of Marketing, 70(1), 3-14.

- Galbreath, J., & Shum, P. (2012). Do customer satisfaction and reputation mediate the CSR–FP link? Evidence from Australia. Australian Journal of Management, 37(2), 211-229.

- Gamerschlag, R. (2013) Value relevance of human capital information. Journal of Intellectual Capital, 14(2), 325-345.

- Gatzert, N. (2015). The impact of corporate reputation and reputation damaging events on financial performance: empirical evidence from the literature. European Management Journal, 33(6), 485-499.

- Green, T., & Peloza, J. (2011). How does corporate social responsibility create value for consumers? Journal of Consumer Marketing, 28(1), 48-56.

- Gruca, T., & Rego, L.L. (2005) Customer satisfaction, cash flow, and shareholder value. Journal of Marketing, 69(3), 115-130.

- Hess, D. (2019). The Transparency Trap: Non-financial disclosure and the responsibility of business to respect human rights. American Business Law Journal, 56(1), 5-53

- Jackson, G., Bartosch, J., Avetisyan, E., Kinderman, D., & Knudsen, J.S. (2020). Mandatory non-financial disclosure and its influence on CSR: An international comparison. J. Bus. Ethics, 162, 323-342.

- Jung, H., & Im, D. (2010). The impact of continuity of customer satisfaction on future financial pderformance and market value of a company. Accounting Research, 35(4), 163-192.

- Kook, C., & Kang Y. (2011). Corporate social responsibility, corporate governance and firm value. Korean Journal of Financial Studies, 40(5), 713-748.

- Lee, J., & Kang, S. (2007). An Empirical study on the relation between customer satisfaction and corporate performance. Korean Academic Society of Accounting, 12(1), 23-45

- Lee, J., & Kim, Y.A. (2013). Study on relationship between corporate values and corporate governance, social and environmental Evaluation Index. Korean Academic Society of Accounting, 18(4), 81-99.

- Lichtenstein, D.R., Drumwright, M.E., & Braig, B.M. (2004). The effect of corporate social responsibility on customer donations to corporate-supported nonprofits. Journal of Marketing, 689, 16-32.

- Liedtka, S. (2002). The Information Content of Nonfinancial Measures in the Airline Industry. Journal of Business Finance and Accounting, 29, 1105-1121.

- Luo, C., & Bhattacharya, C.B. (2006). Corporate social responsibility, customer satisfaction and market value. Journal of Marketing, 70(4), 1-18.

- McWilliams, A., & Siegel, D. (2001). Corporate social responsibility and financial performance: Correlation or misspecification? Strategic Management Journal, 21, 603-609.

- Min, J., Kim, B., & Ha, S. (2014). The impact of firms’ environmental, social, and governancial factors for sustainability on their stock returns and values. Journal of the Korean Operations Research and Management Science Society, 39(4), 33-49.

- Parunzel, A., Danel, M., & Maier, G.W. (2010). Scrutinizing social identity theory in corporate social responsibility: An experimental investigation. Frontiers in Psychology, 11, 1-12.

- Pfarrer, M.D., Pollock, T.G., & Rindova, V.P. (2010). A tale of two assets: The effects of firm reputation and celebrity on earnings surprises and investors’ reactions. Academy of Management Journal, 53, 5, 1131- 1152.

- Porter, M.E., & Kramer, M.R. (2006). Strategy and society: the link between competitive advantage and corporate social responsibility. Harvard Business Review, 84(12), 78-92.

- Reicheld, F.F. (2001). The loyalty rules. Harvard Business School Press. Boston, MA

- Rezaee, Z., & Tuo, L. (2017). Voluntary disclosure of non-financial information and its association with sustainability performance. Adv. Account., 39, 47-59.

- Serafeim, G., & Grewal, J. (2017). The value relevance of corporate sustainability disclosures: An analysis of a dataset from one large asset owner. SSRN Electronic Journal, 1-55

- Tajfel, H., & Turner, J.C. (1985). The social identity theory of intergroup behavior. In S. Worchel & L. W. Austin, Psychology of intergroup relations. Chicago: Nelson-Hall. 1985.

- Tuli, K.R., & Bharadwaj, S.G. (2009). Customer satisfaction and stock returns risk. Journal of Marketing, 73(6), 184-197.

- Williams, P., & Naumann, E. (2011). Customer satisfaction and business performance: a firm-level analysis. Journal of Services Marketing, 25(1), 20-32

- Yi, Y., & Lee, C. (2006). The effects of customer satisfaction on firm’s profitability and value. Marketing Research, 21(2), 85-113.

- Yi, Y., & Suna, L. (2002). The relationship of customer satisfaction, adjusted expectation and repurchase intention: The moderating role of customer loyalty. Journal of Consumer Studies, 13(3), 51-78.