Research Article: 2018 Vol: 22 Issue: 1

Are Changes in Extra-financial Ratings a (Un) Sustainable Source of Abnormal Returns?

Amos Sodjahin, Université de Moncton and GReFA

Claudia Champagne, Université de Sherbrooke and GReFA

Frank Coggins, Université de Sherbrooke, CIRPÉE and GReFA

Keywords

Corporate Social Responsibility, ESG Rating, Abnormal Returns, Conditional Model, Extra-Financial Risk Premium.

JEL Classifications

G14, M14

Introduction

Although the concept of responsible investing (hereafter RI) originated in the US in the 17th century with the Quaker religious movement, it did not take hold institutionally until the late 1920s, when the first “ethical” investment funds were created. The movement started gaining notable popularity during the second half of the 1990s. In Canada, the RI market has experienced rapid growth in recent years. According to the 2015 Canadian Responsible Investment Trends Report published by the Responsible Investment Association, Canadian RI assets account for 31% of total assets under management, while they represent only 18% of assets in the US. The growing awareness of the importance of RI is particularly remarkable among institutional investors, including pension funds.

Simultaneously and in line with an increasing demand, an extra-financial rating market has also developed considerably since the end of the 1990s. Extra-financial ratings can help with the comparison of the corporate social responsibility (CSR) of firms and they are commonly used by investment managers to build RI funds. But how does CSR relate to firm financial performance and risk which, in the end, is the main concern for investors?

Our study seeks to further the understanding of the CSR rating-financial performance relationship by examining whether extra-financial rating upgrades and downgrades affect corporate returns. Our study is motivated by the following considerations. Firstly, given the enhanced awareness of investors to extra-financial risk and the mainstreaming of CSR-related information in capital markets, we expect financial markets to increasingly react to CSR rating upgrades and downgrades like they would for credit rating changes (e.g. Holthausen and Leftwic, 1986)1. And while the literature on the subject is still growing, empirical results are far from conclusive. Renneboog et al. (2008) conclude that whether or not CSR is priced by capital markets remains an open question.

Secondly, our study seeks a better understanding of the fairly controversial issue of how CSR strategies or initiatives affect corporate financial performance and risk. Research is ongoing but produces mixed empirical findings, which reflect the contrasting theoretical views on the subject. Stakeholder theory implies a positive relationship between extra-financial and financial performances (e.g. Edmans, 2011; Hillman and Keim, 2001 and Freeman, 1984). In contrast, theories based on the cost of CSR initiatives or agency problems related to CSR activities imply a negative relationship between CSR and financial performance (e.g. Krüger, 2015; Wright and Ferris, 1997 and Klassen and McLaughlin, 1996). However, we argue that the impact of CSR on stock returns would then be short-lived, as investors anticipate its effect on stock prices. Finally, theories based on the presence of an extra-financial risk premium also imply a negative relationship between CSR initiatives and financial risk, which confers a competitive advantage to the responsible firm compared with the irresponsible firm in terms of cost of capital (Chava, 2014; Hong and Kacperczyk, 2009; Sharfman and Fernando, 2008; Heinkel et al., 2001). However, without an asset model that explicitly integrates an appropriate irresponsible-risk factor, we argue that the impact of CSR initiatives on financial performance would then translate into a sustainable negative alpha. Firms with lower CSR should earn a higher absolute return compared with high-CSR firms because the former are fundamentally riskier.

Unlike prior studies which mainly investigate the impact of extra-financial rating levels on corporate financial performance (e.g. Edmans, 2011; Sharfman and Fernando, 2008; Heinkel et al., 2001), our study extends the existing literature by investigating market reactions to changes or shocks in extra-financial ratings. Specifically, we examine how CSR rating upgrades and downgrades affect firms’ risk-adjusted returns (alpha). Furthermore, we use a conditional asset pricing model approach following recent studies that show that extra-financial ratings and macroeconomic factors can co-vary (Oikonomou, 2012 and Chen et al., 2010). The advantage of the conditional approach is that the respective impacts of the economic context and of the changes in extra-financial ratings on firms’ risk-adjusted returns (alphas) can be distinctly estimated.

The rest of the study is structured as follows. Section 2 presents the related literature. Section 3 describes the methodology and the data. Section 4 presents and discusses our empirical results and finally, section 5 concludes the paper.

Related Literature And Theoretical Framework

The literature on the impact of CSR on firms’ financial performance is abundant and can be classified into three large streams: i) Studies consistent with or related to stakeholder theory, ii) studies consistent with or related to agency theory and/or cost theory and iii) studies consistent with or related to the presence of an extra-financial risk premium.

In the first stream of the literature, stakeholder theory proponents (e.g. Freeman et al., 2010; Jiao, 2010; Porter and van der Linde, 1995; Freeman, 1984) argue for a positive relationship between extra-financial and financial performances. Specifically, firms that identify and manage their relationships with principal stakeholders are more likely to enjoy a variety of benefits in the long run.

In the second stream, based on Friedman’s (1970) neoclassical school of thought2, CSR investments are expensive and can divert financial resources from more useful areas like advertising or research and development. Some researchers describe the discontinuation of activities or ethically detrimental product lines (e.g. Wright & Ferris, 1997) or project that involve promoting community development plans or investments in environmental protection technology (e.g. Klassen and McLaughlin, 1996), as costly sacrifices for shareholders. Some empirical studies corroborate neoclassical thinking whereby a corporate responsible behaviour increases costs and reduces shareholder wealth. For instance, Makni et al. (2009) examine, in the Canadian context, the causality (Granger) between CSR and financial performance (ROA, ROE and stock returns) and find no significant link between overall CSR performance and financial performance, with the exception of stock returns for which they observe a negative relationship. However, the authors note that, when analysed individually, environmental factors have a significant one-directional negative impact on each of the three financial performance measures examined. These results agree with other studies from the UK (Brammer et al., 2006) and the US (Waddock and Graves, 1997; Klassen and McLaughlin, 1996 and Vance, 1975), suggesting that, under certain conditions, corporate spending on CSR activities can be value destructive for firms (Navarro, 1988).

In the second stream of literature, we also include studies related to the agency theory in which authors such as Krüger (2015), Barnea and Rubin (2010), Cespa and Cestone (2007) or Hemingway and Maclagan (2004) argue that CSR represent private benefits (e.g. respect, job security, public image, etc.) that managers extract at the expense of shareholders. This strategy, if known, can adversely affect firms' market performance possibly because of costs that investors feel are too high or inopportune. For instance, Krüger (2015) examines how stock markets react to positive and negative events regarding a firm's CSR and shows that investors respond negatively to positive CSR news, which is more likely to result from agency problems than negative news.

Finally, in the third stream, authors such as Chava (2014), El Ghoul et al. (2011), Sharfman and Fernando (2008) and Heinkel et al. (2001) argue that ESG ratings might, in fact, affect the risk profile of firms by adding an extra-financial risk component to the market risk, size, book-to-market and other risk documented premiums. As a result, expected returns for firms with low CSR ratings should be higher because they carry a premium for extra-financial risk, For example, theoretical models of the relationship between CSR and expected returns (e.g. Fama and French, 2007; Barnea et al., 2005 and Heinkel et al.,2001) relax the assumption of perfect capital markets by supposing differences in investor preferences (i.e., segmented capital markets based on CSR ratings) and assume the existence of two types of investors in financial markets: Traditional investors and socially responsible investors. Traditional investors consider only financial criteria (risk and return) in their investment decisions, whereas socially responsible investors consider both financial and extra-financial criteria, such as CSR-related ratings. The main prediction of these models is that socially responsible stocks will have an excess demand, which leads to lower risk and expected a return and thus overvalued stock prices based on traditional asset pricing models that do not include an extra-financial risk premium. In contrast, socially irresponsible stocks will have a weaker demand due to the “neglect effect”, which leads to higher risk and expected return because investors require additional premiums as a compensation for the lack of risk-sharing opportunities. Hong and Kacperczyk (2009) provide empirical evidence consistent with the “neglect effect” caused by CSR. The authors show that “sin” stocks (e.g. alcohol, tobacco, gambling, weapons manufacturers and the military, etc.) have higher expected returns because they are neglected by norm-constrained institutional investors such as pension funds.

Overall, the above three streams or theories imply different results regarding the relationship between CSR shocks and financial performance. According to the first theory, inefficient markets, extra-financial rating upgrades (downgrades) should be related to an anticipated value creation (destruction), higher (lower) stock prices and thus short-term positive (negative) abnormal returns. In contrast, following the second set of theories, namely agency theory and/or cost theory, extra-financial rating upgrades (downgrades) should lead to lower (higher) stock prices and thus to short-term negative (positive) alphas as investors anticipate inefficient (more efficient) expenses. Finally, the third theory, based on a systematic risk premium adjustment, suggests that extra-financial upgrades (downgrades) should lead to sustainable negative (positive) alphas since long-term expected returns (cost of capital) should be lower for responsible firms compared with irresponsible firms.

Our results will help shed light on the relationship between CSR shocks and financial performance and help with identifying which theory seems better at explaining empirical results.

Methodology and Data

Model Specification

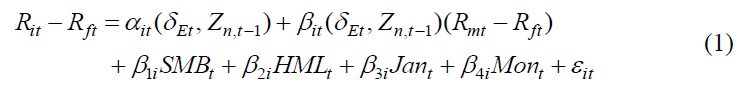

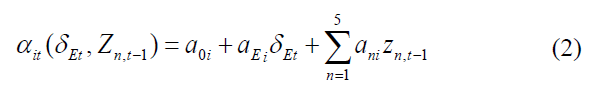

To test the impacts of CSR rating upgrades and downgrades on financial performance, we follow the methodology introduced by Sodjahin et al. (2017), which is based on Fama- French’s (1993) model and on the conditional approach proposed by Ferson and Schadt (1996). This approach allows us to condition the impact on return and risk on the macroeconomic and financial context. The return diffusion process for firm i is defined as follows:

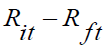

where  is the excess daily return of firm i on day t and

is the excess daily return of firm i on day t and  respectively designate the return for firm i and the risk-free rate (i.e., the daily yield on a 90-day maturity government bond). Market portfolio return

respectively designate the return for firm i and the risk-free rate (i.e., the daily yield on a 90-day maturity government bond). Market portfolio return is the value-weighted stock return of the S&PTSX index. Risk factors

is the value-weighted stock return of the S&PTSX index. Risk factors respectively represent the book-to-market ratio effect and the size effect (Fama and French, 1993).

respectively represent the book-to-market ratio effect and the size effect (Fama and French, 1993).  binary variables control for the January and Monday effects respectively and equal 1 for the control period and 0 otherwise.

binary variables control for the January and Monday effects respectively and equal 1 for the control period and 0 otherwise.  is a dummy variable that equals 1 if day t is included in the event window (i.e., when we observe a change in firm ESG rating) and 0 otherwise. Vectors include the five, macroeconomic information variables that condition the alpha

is a dummy variable that equals 1 if day t is included in the event window (i.e., when we observe a change in firm ESG rating) and 0 otherwise. Vectors include the five, macroeconomic information variables that condition the alpha is the error term for firm i and

is the error term for firm i and

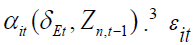

Conditional alpha for firm i is then defined as follows:

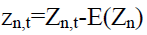

Where  s a vector of the deviations of Zn,t from the unconditional means.

s a vector of the deviations of Zn,t from the unconditional means. measures the average conditional alpha unrelated to rating changes and macroeconomic information variables;

measures the average conditional alpha unrelated to rating changes and macroeconomic information variables;  is the average daily abnormal return attributable to the ESG rating change (upgrade or downgrade) and

is the average daily abnormal return attributable to the ESG rating change (upgrade or downgrade) and  measures the sensibility of the conditional alpha to the nth conditioning variable,

measures the sensibility of the conditional alpha to the nth conditioning variable,

We estimate model (2) for estimation windows that begin 500 days preceding changes in ESG ratings and ending 250 days following the changes. Based on parameters  we then analyse the impact of ESG rating upgrades and downgrades on abnormal returns for six different analysis periods around ESG rating changes: [-250; 0], [-120; 0], [-60; 0], [0; +60], [0; +120] and [0; +250].

we then analyse the impact of ESG rating upgrades and downgrades on abnormal returns for six different analysis periods around ESG rating changes: [-250; 0], [-120; 0], [-60; 0], [0; +60], [0; +120] and [0; +250].

Data

Our sample comprises 266 Canadian firms included in the 2007-2012 Sustainalytics’s extra-financial rating database. Unlike MSCI ESG STATS, which evaluates CSR based on seven qualitative criteria (e.g. strengths and concerns), Sustainalytics4 scores firms on over 100 proprietary indicators for the three ESG dimensions. Aggregate ESG ratings are weighted to reflect the importance of each dimension for a particular industry. For example, the environmental dimension is weighted more heavily for energy companies than it is for companies in the banking industry. Sustainalytics' ESG ratings range from 0 (worse) to 10 (best). We complement data on CSR with financial and macroeconomic data for the 2007-2012 period extracted from the Canadian Financial Markets Research Centre (CFMRC) and Bloomberg databases.

This Table 1 presents descriptive statistics for the CSR ratings for a sample of 266 Canadian firms between 2007 and 2012. Statistics are presented for the aggregate rating and for each ESG rating dimension: Environment, Social and Governance. N is the number of observations.

| Table I: Descriptive Statistics For Extra-Financial Ratings | ||||||||||||

| ESG rating (Rating/10) | Rating upgrades | Rating downgrades | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Std | Min | Max | Observations | Mean | Std | Min | Max | Observations | |||

| N | # of Firms | N | # of Firms | |||||||||

| Panel A: ESG rating levels | ||||||||||||

| Aggregate | 5.514 | 0.851 | 2.800 | 7.954 | 1312 | 236 | 5.398 | 0.812 | 2.700 | 7.926 | 901 | 244 |

| Environment | 5.624 | 0.975 | 3.039 | 8.900 | 1104 | 254 | 5.048 | 0.937 | 2.929 | 8.446 | 772 | 235 |

| Social | 5.602 | 1.514 | 1.900 | 9.586 | 930 | 252 | 5.200 | 1.380 | 1.000 | 9.186 | 521 | 221 |

| Governance | 6.876 | 0.986 | 4.282 | 9.686 | 867 | 232 | 6.148 | 1.018 | 3.500 | 9.586 | 860 | 254 |

| Panel B: ESG rating changes | ||||||||||||

| Aggregate | 0.206 | 0.210 | 0.002 | 2.074 | 1312 | 236 | -0.141 | 0.159 | -2.400 | -0.002 | 901 | 244 |

| Environment | 0.565 | 0.598 | 0.002 | 3.547 | 1104 | 254 | -0.457 | 0.573 | -5.031 | -0.014 | 772 | 235 |

| Social | 0.713 | 0.680 | 0.000 | 5.172 | 930 | 252 | -0.498 | 0.493 | -3.093 | -0.004 | 521 | 221 |

| Governance | 0.572 | 0.552 | 0.004 | 4.360 | 867 | 232 | -0.693 | 0.667 | -4.360 | -0.088 | 860 | 254 |

For the period studied (January 2007 to December 2012), there are 2,213 extra-financial rating changes, consisting of 1,312 upgrades and 901 downgrades. Table I presents descriptive statistics on rating levels (Panel A) and changes (Panel B) for firms in the sample, by rating dimension (environmental, social and governance). From Panel A, we see that average rating is higher for firms that experience an upgrade in their extra-financial rating, both on the aggregate level and for each ESG dimension. From Panel B, we observe that, for the aggregate rating as well as for the environment and the social dimensions, upgrades are more common than downgrades. Also, extra-financial rating upgrades (in absolute value) are, on average, larger than rating downgrades, for each rating dimension, with the exception of the governance dimension.

Empirical Results

We estimate model (1) and analyse results for the evaluation of alpha (model 2) to assess the impact of extra-financial rating changes on financial performance. Table II presents the mean values for coefficients aEi that measure abnormal return (alpha) around changes in extra-financial ratings.

| Table 2: Abnormal Returns Around Changes In Extra-Financial Ratings | ||||||||

| Analysis window | Rating upgrades | Rating downgrades | ||||||

|---|---|---|---|---|---|---|---|---|

| Agg. | Envir. | Social | Gov. | Agg. | Envir. | Social | Gov. | |

| [-250; 0] | 0.0001 | -0.0001 | -0.0000 | -0.0002 | 0.0001 | 0.0002 | 0.0001 | 0.0000 |

| (0.14 | (-0.51) | (-0.16) | (-1.29) | (0.14) | (1.04) | (0.15) | (0.09) | |

| [-120; 0] | 0.0000 | -0.0000 | -0.0001 | -0.0000 | 0.0000 | 0.0000 | 0.0001 | 0.0001 |

| (0.00) | (-0.08) | (-0.23) | (-0.02) | (1.12) | (0.00) | (1.08) | (0.17) | |

| [-60; 0] | -0.0001 | 0.0000 | -0.0001 | -0.0003 | 0.0001 | 0.0000 | 0.0002 | 0.0001 |

| (-1.11) | (-0.14) | (-1.05) | (-1.51) | (0.03) | (1.01) | (1.03) | (1.56) | |

| [0; +60] | -0.0001 | 0.0000 | -0.0002 | -0.0001 | 0.0002 | 0.0002 | 0.0002 | 0.0002 |

| (-1.84) | (0.03) | (-2.87) | (-1.01) | (1.99) | (2.13) | (2.19) | (2.87) | |

| [0; +120] | -0.0001 | -0.0001 | -0.0001 | -0.0001 | 0.0002 | 0.0002 | 0.0002 | 0.0002 |

| (-2.33) | (-0.83) | (-2.79) | (-2.14) | (1.96) | (3.01) | (2.73) | (3.13) | |

| [0; +250] | -0.0001 | -0.0002 | -0.0001 | -0.0001 | 0.0002 | 0.0003 | 0.0001 | 0.0002 |

| (-1.81) | (-2.89) | (-1.97) | (-1.79) | (3.02) | (3.85) | (2.59) | (3.27) | |

| Obs. | 1312 | 1104 | 930 | 867 | 901 | 772 | 521 | 860 |

This Table 2 presents the results for the estimation of the model (2). Mean values for aEi are shown, with t-statistics in parentheses. Other coefficients in the model (2) are estimated but not shown to save valuable space. Model (2) is estimated on a sub-sample of rating upgrades and a sub-sample of rating downgrades and, in each case, for the four types of rating dimensions (aggregate (agg.), environment (envir.), social and governance (gov.)). Six analysis periods are considered ([-250; 0] [-120; 0], [-60; 0], [0; +60], [0; +120] and [0; +250]), for which the estimation period [-500; +250]. The overall sample includes 266 Canadian firms from January 2007 to December 2012. Numbers in bold indicate significance at the 10% level.

Our results show that extra-financial rating upgrades (downgrades) are associated with negative (positive) abnormal returns. For example, aggregate rating upgrades are followed by decreases in the alpha of -0.0001 for the three periods following rating changes. Similar results are obtained for upgrades in the environmental, social and governance dimensions. Firms that improve (worsen) their CSR therefore appear to be penalized (rewarded) by financial markets in terms of their risk-adjusted returns. Results also provide some evidence that changes in extra-financial ratings are associated with significant sustainable abnormal returns. Specifically, significant abnormal returns are observed for the three post-changes periods, [0, 60], [0; 120] and [0; 250], indicating that the impact of extra-financial rating changes on alpha lasts for at least one year after the rating changes.

Our results show that there is a negative relationship between CSR shocks and financial performance, consistent with either the agency/cost theory or the risk-premium theory discussed previously. However, the fact that we observe a long-lasting impact of CRS shocks on alpha indicates that the extra-financial risk premium theory seems more plausible, specifically in light of recent research which shows that firms’ social irresponsibility (responsibility) increases (decreases) their financial risk (Sodjahin et al., 2017 and Bouslah et al., 2013). Investors are therefore tempted to increase (reduce) the risk premium related to the social irresponsibility (responsibility) of firms, which will increase (decrease) the return required by investors for firms less (more) responsible.

Conclusion

This study investigates whether and how stock markets react to extra-financial rating changes (upgrades and downgrades) for a sample of 266 Canadian firms between 2007 and 2012 and provide important empirical findings. Our results show that extra-financial rating upgrades (downgrades) lead to sustainable negative (positive) abnormal returns. Further, we find that the impact of rating changes on alpha is long lasting. There is therefore a negative and sustainable relationship between CSR shocks and financial performance which is consistent with the notion that expected stock returns (or cost of capital) must be lower (higher) for socially responsible (irresponsible) firms because they are associated with lower (higher) risk. In sum, our general results imply that it may be appropriate to include a social-irresponsibility-related extra-financial risk factor in a general asset-pricing model. We leave this question and tests to future research. At the very least, our results confirm that, as for financial and macroeconomic information, extra-financial ratings play important roles for investors.

Acknowledgement

The authors thank the Caisse de Dépôt et Placement du Québec (CDPQ), the Desjardins Chair in Responsible Finance and the CIBC Research Chair in Financial Integrity for their financial support. Special thanks also go out to Stephen Kibsey, Joanne Pichette and Ginette Depelteau of the CDPQ for their invaluable comments and contributions.

Endnote

1. The fact that major financial players, such as Bloomberg and Morgan Stanley, now provide CSR-related information is an indication of its mainstreaming.

2. According to the economic “Friedman-esque” view, “shareholders entrust managers with their investment solely to maximize long-term returns, not so that managers can use the proceeds to underwrite their urge to better the world” (Luo and Bhattacharya, 2009).

3. Based on the literature (e.g. Ferson and Qian, 2004) and following Sodjahin et al.’s (2017) methodology, we identify five information variables: i) The short-term interest rates, ii) the term structure of interest rates, iii) the stock market performance, iv) stock market (implied) volatility and v) the credit spread.

4. Sustainalytics’ analysis is primarily based on publicly available information reported by the companies as well as information produced by NGOs, governmental organisations or trade unions.

References

- Barnea, A., Heinkel, R. & Kraus, A. (2005). Green investors and corporate investment. Structural Change and Economic Dynamics, 16(3), 332-346.

- Barnea, A. & Rubin, A. (2010). Corporate social responsibility as a conflict between shareholders. Journal of Business Ethics, 97(1), 71-86.

- Bouslah, K., Kryzanowski, L. & M’Zali, B. (2013). The impact of the dimensions of social performance on firm risk. Journal of Banking & Finance, 37(4), 1258-1273.

- Brammer, S., Brooks, C. & Pavelin, S. (2006). Corporate social performance and stock returns: UK evidence from disaggregate measures. Financial Management, 35(3), 97-116.

- Cespa, G. & Cestone, G. (2007). Corporate social responsibility and managerial entrenchment. Journal of Economic Management and Strategy, 16(3), 741-771.

- Chava, S. (2014). Environmental externalities and cost of capital. Management Science, 60(9), 2223-2247.

- Chen, C., Guo, W. & Tay, N. (2010). Are member firms of corporate groups less risky? Financial Management, 39(1), 59-82.

- Edmans, A. (2011). Does the stock market fully value intangibles? Employee satisfaction and equity prices. Journal of Financial Economics, 101(3), 621-640.

- El Ghoul, S., Guedhami, C., Kwok, C.Y. &. Mishra, D.R. (2011). Does corporate social responsibility affect the cost of capital? Journal of Banking & Finance, 35(9), 2388-2406.

- Fama, E. & French, K. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33(1), 3-56.

- Fama, E. & French, K. (2007). Disagreement, tastes and asset prices. Journal of Financial Economics, 83(3), 667-689.

- Ferson, W. & Qian, M. (2004). Conditional performance evaluation revisited. Research Foundation Monograph of the CFA Institute, ISBN 0-943205-69-7

- Ferson, W. & Schadt, R. (1996). Measuring fund strategy and performance in changing economic conditions. Journal of Finance, 51(2), 425-462.

- Friedman, M. (1970). The social responsibility of business is to increase its profits. The New York Times Magazine, 32, 122-126.

- Freeman, R.E. (1984). Strategic management: A stakeholder approach. Pitman (Boston).

- Freeman, R.E., Harrison, J.S., Wicks, A.C. Parmar, B.L. & Colle, S (2010). Stakeholder theory: The state of the art. Cambridge: Cambridge University Press.

- Heinkel, R., Kraus, A. & Zechner, J. (2001). The effect of green investment on corporate behaviour. Journal of Financial and Quantitative Analysis, 36(4), 431-449.

- Hemingway, C.A. & Maclagan, P.W. (2004). Managers' personal values as drivers of corporate social responsibility. Journal of Business Ethics, 50(1), 33-44.

- Hillman, A.J. & Keim, G.D. (2001). Shareholder value, stakeholder management and social issues: What's the bottom line? Strategic Management Journal, 22(2), 125-139.

- Holthausen R.W. & Leftwic R.W. (1986). The effect of bond rating changes on common stock prices. Journal of Financial Economics, 17(1), 57-89.

- Hong, H. & Kacperczyk, M. (2009). The price of sin: The effects of social norms on markets. Journal of Financial Economics, 93(1), 15-23.

- Jiao, Y. (2010). Stakeholder welfare and firm value. Journal of Banking and Finance, 34(10), 2549-2561.

- Klassen, R.D. & McLaughlin, C.P. (1996). The impact of environmental management on firm performance. Management Science, 42(8), 1199-1214.

- Krüger, P. (2015). Corporate goodness and shareholder wealth. Journal of Financial Economics, 115(2), 304-329.

- Luo, X. & Bhattacharya, C.B. (2009). The debate over doing good: Corporate social performance, strategic marketing levers and firm-idiosyncratic risk. Journal of Marketing, 73(6), 198-213.

- Makni, R., Francoeur, C. & Bellavance, F. (2009). Causality between corporate social performance and financial performance: Evidence from Canadian firms. Journal of Business Ethics, 89(3), 409-422.

- Navarro, P. (1988). Why do corporations give to charity? Journal of Business, 61(1), 65-93.

- Oikonomou, I., Brooks, C. & Pavelin, S. (2012). The impact of corporate social performance on financial risk and utility: A longitudinal analysis. Financial Management, 41(2), 483-515.

- Porter, M.E. & Kramer, M.R. (2006). Strategy and society: The link between competitive advantage and corporate social responsibility. Harvard Business Review, 12, 78-92.

- Renneboog, L., Ter Horst, J. & Zhang, C. (2008). The price of ethics and stakeholder governance: The performance of socially responsible mutual funds. Journal of Corporate Finance, 14(3), 302-322.

- Sharfman, M.P. & Fernando, C.S. (2008). Environmental risk management and the cost of capital. Strategic Management Journal, 29(6), 569-592.

- Sodjahin, A., Champagne, C., Coggins, F. & Gillet, R. (2017). Leading or lagging indicators of risk? The informational content of extra-financial performance scores. Journal of Asset Management, 18(5), 347-370.

- Vance, S.C. (1975). Are socially responsible corporation’s good investment risks? Management Review, 64(8), 19-24.

- Waddock, S.A. & Graves, S.B. (1997). The corporate social performance-financial performance link. Strategic Management Journal, 18(4), 303-319.

- Wright, P. & Ferris, S. (1997). Agency conflict and corporate strategy: The effect of divestment on corporate value. Strategic Management Journal, 18(1), 77-83.