Research Article: 2021 Vol: 27 Issue: 2S

Approaches to Reasoning in the Role of Economic Reform in Attracting Foreign Direct Investment in Iraq, Applications Theoretical

Yusra Salim Nayyf, University of Tikrit

Khattab Imran Saleh, College of Basic Education Shirqat

Saad Salih ISSA, Tikrit University

Keywords

Economic Reforms, Iraq Economy, FDI, Political issues, Corruption

Abstract

In recent decades Iraq has seen a significant rise in the flow of Foreign Direct Investment (FDI). The FDI's distribution, however, is extremely unbalanced, and foreign investors' rivalry is fierce between countries. The focus is on the effect of active policy initiatives by the Government of Iraq (GOI), to promote the country's internal FDIs, while at the same time discouraging external FDIs. The new regional investment legislation, shortcomings and strengths, institutions and the effectiveness of the legislation and infrastructures in coordinating efforts to promote the country's inflows of FDI, are examined. The need for Iraq to encourage infrastructure investment and to influence economic development, which are reinforcing one another in turn by attracting more investments in infrastructure and productive industries, was finally stressed. This quest addresses a major topic, the economic reform. It was used in many countries around the world to try to define how much the reform’s position to effect is in attracting foreign direct investment and where the countries in the world.

Introduction

The topic of economic reform is of concern to all advanced and developing economies, there is no economy in the world that does not encourage economic reform for the purpose of attracting foreign investment in it now, despite the fact that the outlook for foreign investment during the period of the fifties, sixties and even the seventies of the last century had a lot of ambiguity in its real goals, and gradually there has become General acceptance of foreign investment as one of the pillars of economic globalization due to the great benefits it brings in the field of job creation, technology transfer and others, and Iraq is one of the candidate countries in light of the current conditions for entering the experience of foreign investment, after the public sector was in control of economic life, thanks to government support, and in order to activate the role of the private sector in economic development, the Iraqi government has privatized many public sector enterprises in the eighties of the last century, without these processes being accompanied by an openness to foreign investment (Tasie & George, 2017).

The Role of Economic Reforms in Supporting Economic Growth

Iraq has a long-term foreign investment opportunity. In reality, the country has the 4th largest petroleum reserves worldwide and needs substantial reconstruction and the development of infrastructure (Ramadan, 2007). Under Iraqi law, a foreign investor has the right to invest in Iraq in terms no less favorable than that of an Iraqi investor, and the amount of investment from foreign countries is not restricted. The national investment law of Iraq however restricts the foreign ownership, directly or indirectly, of natural resources, in particular the mining and processing of natural resources. Additional limitations apply to banks and insurance companies' ownership. The Government of Iraq retains the right to screen foreign direct investments under the National Investment Act. Iraq is steadily progressing in the implementation of legislation and the establishment of institutions essential for economic policies. In addition, political changes are also needed to ease investor fears about the volatile market environment. The Iraqi Government wants to draw more foreign direct investment but faces a number of hurdles, including a weak political structure and security and social stability issues. Corruption, inadequate infrastructure, the shortage of qualified employees and inadequate commercial laws are hindering investment. In the Doing Business 2020 group, Iraq ranked 172nd out of 190 nations and lost one spot compared to the year before. (www.iraq-businessnews.com)

The Importance of Research

Foreign direct investment has witnessed remarkable global development and has become one of the most important financing instruments for investment in developing countries, especially those whose economies are undergoing a transition to move towards a market economy [17]. Iraq is one of the developing Arab countries that suffers from a deterioration in its economic performance and this coincided with the financial crisis before the economic reform policy and the stumbling of the public sector that was leading the process of economic development and the deterioration of the performance of its units with the accumulation of debt due on its production units, the deterioration of fixed assets as well as their technological obsolescence.

Research AIM

The research aims to following up on the economic reforms undertaken by Iraq that have a role in attracting foreign direct investment; Analyzing the situation of Iraq in the field of attracting and employing foreign investment and explaining the obstacles facing this situation and to identify weaknesses and strengths that affect attracting foreign direct investment.

Methodology

Research Problem

The research problem is represented by the increasing interest of countries in reforming their economic systems in order to attract foreign capital, especially developing countries, due to the lack of capital and weak technology. Therefore, Iraq must seek to conduct economic reforms in the crisis to attract this money inside country.

Research Design

The researcher relied on the descriptive approach in describing the role of economic reform in attracting foreign direct investment, as the historical data were analyzed and the economic reality was extrapolated by making use of the analytical method and by using economic analysis tools to determine the horizon in which Iraq could succeed in attracting foreign direct investment.

Study Hypothesis

The experience of foreign investment in developing countries may be new to many of these countries, including those due to the weakness of the elements for the success of this type of investment in these countries, and therefore some of them tried to go into the experience of foreign investment in order to achieve rates of economic growth for their countries.

Discussion

Theoretical Framework for Economic Reform

The concept of foreign investment: Properly guided investment operations contribute to establishing the right proportions among the economic sectors, growing interconnectivity and interdependence between these sectors in order to achieve unity of the national economy, integration of production divisions, and continuous and revolving growth progress.

The investment is divided into three types:

• Public investment.

• Foreign investment.

• Foreign investment (foreign).

The concept of foreign investment historically involves the export of capital from a country called the source country or home country (Home Country) to another country called the importing or host country (Host Country), where investment is made in specific projects and sectors.

The term economic reform program is often used as a counterpart to the structural adjustment program

Reform efforts aim at stimulating market forces, liberalizing competition, imposing restrictions on state ownership of productive projects, and increasing the relative importance of private ownership of productive enterprises based on the philosophical basis of this policy, which is that the role of the public sector does not contradict the role of the private sector (Tasie & George, 2017), but rather complements it, and taking by indicative planning instead of central planning, on the condition that these reforms be applied gradually to mitigate their potential negative effects, especially on low-income groups, and under this policy, the private sector finds a ready-made medium for gradual growth that is reflected in the form of an increase in private investment projects and opening the door to foreign direct and non-direct investment Direct, and we will address in this topic several topics as shown in the following:

The Importance of Adopting a Targeting Policy in Attracting Foreign Direct Investment Is Represented In the Following Reasons

Achieving the Strategic Objectives of the Host Countries: where the targeting policy contributes to achieving the development goals of the host countries, such as (reducing unemployment rates, increasing job opportunities, technology transfer, developing exports), in addition to supporting and improving the competitiveness of the local industry, and other fields necessary to push Economic development process.

Increasing Competition Pressures in the World: as the increase in competition in global markets, in light of the new global economy, requires that countries specialize in economic fields and activities in which they enjoy competence and comparative advantages and competitiveness, that is, the host countries for foreign direct investment must focus On the types that achieve the penetration of non-global markets.

Cost Competitiveness: As the costs of adopting the targeting policy are lower compared to the costs of the policies that encourage foreign direct investment in general, because in the targeting policy the granting of financial and tax incentives is limited to the targeted economic activities only without granting such incentives to all areas.

Foreign Indirect Investment: This type of investment is a short-term investment that extends for weeks or months, made in private or government stocks and bonds and the national currency in the host country with the intention of speculation and achieving profits by taking advantage of the difference in prices and is done by financing institutions such as banks and investment funds or institutional investors (Institutional Investors) Such as (retirement fund, insurance companies or by individuals). It is clear from the definition of the above concept that indirect foreign investment is not carried out in real productive assets such as industry or agriculture, but rather provides investors with cash capital by purchasing company shares (stocks or bonds) without having the right to manage them and these transactions are done in the stock market Thivagar, Ahmed, Ramesh & Hamad, 2020).

The Conceptual Framework for Foreign Direct Investment

All countries benefit from its flows so that the climate has a significant impact on its import if it is controlled by expulsion factors and others that attract it. Several topics will be covered in this topic, as shown below:

The concept of foreign investment. The economic literature differentiates between two types of foreign investment, the first known as foreign investment in which that type of international investment acquires a direct (foreign direct investment) entity residing in a particular economy (the direct investor) a permanent interest in an institution residing in another economy (the direct investment institution) that involves A long-term relationship between the two parties in which the investor enjoys a degree of influence over the management of the investment institution, as there are many definitions that dealt with this type of foreign direct investment (Sackey, Prince & Hongli, Jiang, 2019)., as well as the various parties that provided these definitions from international organizations or persons, and most of these definitions are shared in terms of Focusing on the foreign investor's ownership percentage and the ability and foreign direct investment component. Reply) through the existence of financial markets that mediate in investment operations for local and foreign capital with the aim of achieving the maximum return represented by the return on the share arising from the company's activity or from buying and selling of shares or interest on bonds, and for both types Specific investment costs borne by the host country for these investments, even if the nature of those burdens differs according to the nature of the flows, such as the interest on the invested capital, the possibility of transferring profits abroad and the payments for the technology transfer service (Thivagar & Hamad, 2019), represented by patent fees and costs of modern management in relation to For direct investment, or financial and currency crises arising from the volatile nature of the influx of capital into the host country with respect to the investment of the portfolio , the ability to face the effects and reduce their repercussions depends on the state's effectiveness in encouraging what is appropriate for it from these flows and ensuring Obtaining the necessary capital, at the right time, and the manner in which these investments are directed within the host country and in their impact on increasing the productive capacity of the national economy or changing its production structure, or in using these flows to finance current consumption or luxury consumption patterns (Sultanuzzaman etal., 2018).

The evolution of the flow of foreign direct investment in Iraq: FDI influxes stood at $-3 billion in 2019, up from $-4.8 trillion in 2018, according to the World Investment Report. As from 2018, recent estimates for FDI’s inventory have fallen to USD 10.1 billion representing almost 5.3% of the country's GDP. Since 2013, the FDI influx has been negative and, because of its significant security issues, weak institutions, and lack of governance, Iraq has been having difficulty attracting foreign capital. Nevertheless, in foreign businesses, hydrocarbons remain in use, and much of the FDI is used by petroleum industries. Besides the petroleum industry, cement production and building & public works provide interesting investment opportunities. Iraq’s leading investors are the US and the European Union. It is noticed from Figure 1 that the volume of foreign direct investment in Iraq in 2003 was not existing due to the second Gulf War and the occupation of Iraq by the American forces and the forces allied with them, and we find that the volume of foreign direct investment is emerging by (90) million dollars after the relative stabilization of the security situation in Iraq and by (0.0001%) for the world and (0.0003%) for developing countries, and seemed to rise continuously to (972) million dollars, and by (0.0005%) for the world and (0.0018) for developing countries. The volume of foreign direct investment in 2011 reached (1611) million. The rate of (0.0011) for the world has reached (0,0024) for the developing countries, where we note that the proportion of Iraq’s share of foreign direct investment has increased, even by a small percentage compared to the countries of the world, but these indicators are considered good in the system. Because of the conditions of Iraq and the current economic reality inside Iraq, most of the investments were directed towards the oil sector because Iraq directly depends on it, especially the extractive industries (Chaudhuri, Sarbajit & Mukhopadhyay, Ujjaini, 2014).

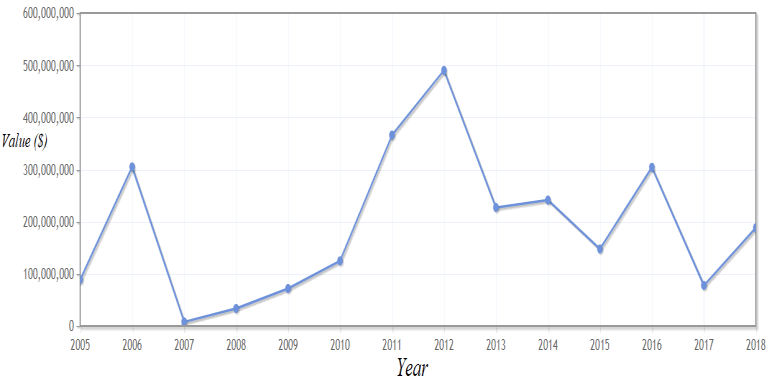

Foreign direct investment, net outflows ($) in Iraq: As of 2018, the latest value in Iraq was 188.4 million dollars in foreign direct investments, net outflows (US$). The value of this measure fluctuated over the last thirteen years from $490,000,000 in 2012 to $7,900,000 in 2007. For Iraq, the time the average value was -0.26% and in 2014 at least -4.34%, and 2012 at a maximum of 1.56%. The new 2019 figure is -1.29%. The world average for 2019 is 4.17 percent in accordance with 97 nations. See global rankings for this indication or equate patterns with time using the Country comparator. In 2014 Iraq export FDI of $242 million, an approximate 0.7% of the total Arab for the same year, according to UNCTAD. By the end of 2014, external FDI balances were about $2 billion, reflecting 0.8% of the Arab total in the same period (Dakhil, Alaa, Salal, Maiami & shabeeb, Mayih, 2018). For the period January 2003 to May 2015, Iraq's investment abroad in compliance with the FDI Markets database.

Source: International Monetary Fund, Payment Balance, complemented with UN Trade and Development Conference info, and official national sources

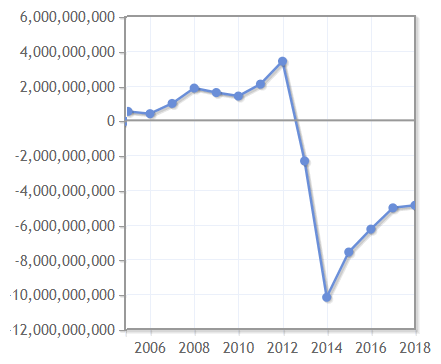

Foreign direct investment, net inflows ($) in Iraq: As of 2018 (Figure 2), Iraq had the latest amount (4885, 100,000 US dollars) for Foreign Direct Investments and Net Transactions in Iraq. In the last 48 years, the valuation of the metric has ranged between 2012 and 2014, varying from $3.4 million, to 2014 ($10.176.4 million). According to the UNCTAD figures, Iraq has drawn USD 4782 million of FDIs, which account for 10.9% of the Arab total in 2014. At the end of 2014, the FDI incoming balances to Iraq amounted to approximately $23.2 billion, or 2.9% of the African total for the same period. As for Iraq's latest FDI activities, the Financial Times' FDI Markets database for the period January 2003 to May 2015 shows: in Iraq, 232 Arab and international businesses are undertaking 296 FDI ventures. The overall construction expense of these programmes, where some 56.3 thousand employees are working, is estimated at approximately US$ 81.2 billion.

Source: International Monetary Fund, Payments Balance database augmented by UNTDC data and official national reports.

The need for investment flows: After we reviewed the concept of foreign investment, we must address the reasons that drive many countries of the world, especially the developing ones, to allow foreign capital to flow into the interior (reception motives) or what is known as the liberalization of capital flows, as well as the reasons or motives that stand (Wali & Ayad, 2018; Antony & Hamad, 2020; Thivagar & Hamad, 2019), and The developed countries' export of such outflows, which have often been associated with the internal structural crises that the capital-exporting countries have witnessed, so there are several motives calling for attracting foreign direct investment, which are as follows:

I. The reception motives: What was directed towards financing these investments, they represent in reality (GDP) abstaining from consumption, so adding foreign savings to local governments.t compensate for the lack of local savings and then reduce the burden of abstaining from consumption to generate the input, it will provide for the present generations the foreign exchange necessary to recover the real components of the investment in goods and services, and will help increase the efficiency of the use of local resources, especially if these flows result in the operation of idle resources, [8] which is what this leads to raising the productivity of those resources and re-establishing the possibility of a balance between supply and demand in the local market, in a way that contributes to relieving the inflationary pressures that will be imposed by the state of development as a result of the expansion of spending, and to restore the external balance accompanying the development process as well as resulting from the excess of imports of capital goods from the exporter.

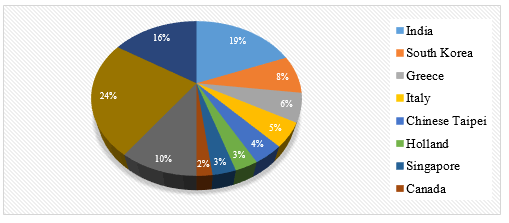

II. Export motives: The historical facts indicate that the main motives for exporting foreign investment by developed countries are determined in the internal structural crisis of the capitalist system and the attempts to exit from it as long as the dynamism and development of the capitalist system depend on the controversial relationship between the crisis and the ways out of it [10] . Major countries importing goods from the republic Iraq schematically represented in the following figure 3

Economic reform and its role in attracting foreign direct investment in Iraq: The justification for economic reform in many countries is due to structural imbalances and suffers from the economic problems (Li & Quan, 2008). Therefore, Iraq must work to institute reforms a major economic structure in the construction of the economic system for the purpose of benefiting from the expertise of the energies of foreign direct investment.

The motives and justifications for economic reform in Iraq. The wrong policies, mismanagement of the national economy imposed by the previous regime, internal turmoil, wars, and economic siege during the past three decades have left major problems and dilemmas that confirm that the economic revival of Iraq can only be achieved through economic reform that aims to address these problems and improve the country's economic situation. It is certain that the reform policies come in response to a number of internal economic and social requirements and motives, which can be formulated into a number of main motives (Abdulkhaleq, Shlair, Abdulqadir & Zhiar, 2017).

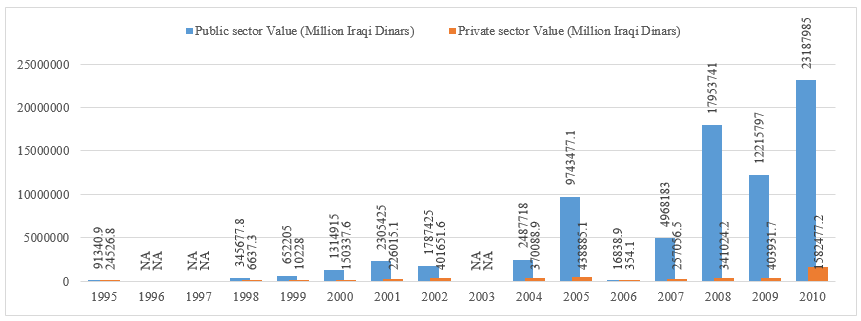

Imbalances in the Productive Structure of the Economy: The domination of the state-owned oil sector over the Iraqi economy has caused the state to dominate the joints of economic activity by being the one who disposes of oil revenues from which the development of the rest of the other sectors is intended (Alshamsi, Khamis, Hussin & Khan, Muhammad, 2015), but the measures adopted in the development of the sectors have failed as a result of the comprehensive policies followed In the process of managing economic resources, the state has become the dominant sector and disposes of most economic activities. Figure 4 data refer to the private sector’s contribution to the total formation of capital in 2009, as it notes the modest percentages of the private sector’s contribution to the formation of fixed-capital during the period 1995 to fixed capital in the Iraqi economy. As this percentage did not exceed at its highest level from 18.2% in 2002 after it was 13.5% in 1999, and this increase in 2002 came as a result of the improvement in the economic situation resulting from the oil-for-food program with the United Nations, as well as benefiting from the investment law of 1998. However, this percentage decreased after the occupation, reaching its lowest level in 2008, due to the deteriorating security situation and the suspension of most of the private sector investment activity, which led to the exit of private capital to neighboring countries.

Figure 4: THE COMPOSITION OF LOCAL CAPITAL BY PUBLIC AND PRIVATE SECTORS IN IRAQ AT CURRENT PRICES DURING THE PERIOD 1995-2010 (IN MILLION DINARS) * DATA FOR GROSS FIXED CAPITAL FORMATION FOR THE YEAR 2003 ARE NOT AVAILABLE DUE TO WAR CONDITIONS[SOURCE: MINISTRY OF PLANNING AND DEVELOPMENT COOPERATION, CENTRAL STATISTICAL ORGANIZATION, ANNUAL STATISTICAL ABSTRACT FOR THE YEARS (1995-2010)]

Imbalances in the State's General Budget Structure: The balance of the budget means the equality of public revenues with public expenditures in the tables of the general budget of the state. The revenues of the general budget were mostly covered by oil revenues, and the reason for this is that the presence of crude oil as a main source of financing the state budget has led to the diminution of the role of other financial resources represented in taxes and fees, especially direct taxes, not due to the weakness of these containers. Therefore, the structural imbalance characterizes the state's general budget, where the continuous rise in levels of deficit resulting from the continuous superiority of public expenditures over public revenues is the inability of the state to rationalize public spending, especially on the current side of it because it is considered social, as well as the state’s inability to diversify sources of revenue by increasing the tax base and reducing the cases of tax evasion, and it is noticed from some 2003 (where it has increased from - data that the budget deficit has taken on the nature of continuity during the period (195265) million dinars in 1997 to (1640372) million dinars in 2003 and the rate of development (740%) despite the financial reform attempts announced by the government in a timely manner aimed at alleviating (the deficit, controlling the increasing rates of inflation and achieving some kind of fiscal discipline policy, as well as the current spending continued to increase after 2003 and until 2012 at the expense of investment spending due to the security conditions.

High Rates of Inflation: The Iraqi economy has witnessed dangerous inflation. The real value of the dinar in the Iraqi market has decreased in a very large way, and large quantities of it are no longer sufficient to buy a simple good or service, to the point that the process of following up the increase in the prices of goods and services has become Iraq is a difficult process to estimate its rates, due to the continuous increase in its prices. The development of index numbers can be followed through figure 2 & 3, as we note the rise in the consumer price index to (69792) in 1995, and the reasons for the rise in consumer prices are due to economic sanctions and the circumstances surrounding them, and accordingly, the ratio of excess demand to the commodity supply may (%) Increased at a compound annual growth rate of (115.6 in 2006), an increase in the index from (6943.5) points in 2003 - while the period (2003 to (185008) points in 2006 witnessed an increase of (53.2%) in 2006 over what was Accordingly, in 2006) and this increase is due - in 2003, achieving a compound growth of (38.6%) during the period (2003) due to several reasons, foremost of which is the increase in purchasing power in 2003, especially in the second half of the year due to the increase in incomes resulting from An amendment in the salary scale and wages of the various segments of workers in the country is the bad segment that had a lot of deferred consumer demand, and the purchasing power quickly leaked into the market in light of an economy with low flexibility in its productive sectors and high costs (production and import costs) (Antony & Hamad, 2020). Based on the data from ministry of Planning and Development Cooperation, Central Statistical Organization, Statistical Abstract for Various Years in Iraq, there has been a sharp increase in the prices of foodstuffs, most of which is due to the low flexibility of the basic sectors (industry and agriculture) as well as the transport, transportation and energy sectors and their inability to respond to demand pressures. (26.9%), especially during the month of February, as a result of the decreases in the prices of consumer goods. The continuation of inflation in 2009 kept the Iraqi economy in light of the lack of clarity of economic policies and the continued dependence on oil resources in the stage of stagflation, which is considered one of the most dangerous economic phenomena. In 2010, and then an increase in the inflation rate in 2011, where it reached (5.6), and a decrease in 2012 to (4.6%).

High Unemployment Rates: Unemployment is considered one of the main difficulties and challenges facing the Iraqi economy because of its profound implications for the economic and social conditions. He suffers in particular from structural unemployment resulting from the weak capacity of the economic sectors to absorb the increased preparation of manpower (Yönelik, Kalkınmaya, Yardımların, Dış, Çıkmazı & Samaritan, 2019)., the ability to work, and the desire for it. It is evident from the data of available on the ministry website, in 1996 the number of the workforce increased to (853044) one thousand workers, then it reached (952412) in 2002, indicating that the unemployment rate in Iraq was very high compared to the rest of the neighboring countries, but it fluctuates higher. The decrease from one year to the next and the year 2003 is the highest recorded rates, as the unemployment rate this year reached (28.1%) for males and females, and it is a clear indication of the inability of the labour market to meet the urgent need of job seekers in this year, and the reason for that is that the race in this year Specifically, the regime change phase entered and it was the year of exit from the last war, and the percentages continued because of the government’s inability and the labour market to meet these needs (Lucy, Anning, Tuama, Ali, Darko & Samuel, 2017), due to political instability, which exacerbated the preparation of applicants for work to a preparation that no government could control until after There is a set of structural changes for government institutions, as well as the issuance of laws that contribute to alleviating unemployment prevailing in the country, but this does not exclude the Iraqi market being an inefficient market as a result of the inconsistency and the distancing of links between economic sectors, in addition to the absence of the effective planned policy, especially if we know that most of the public sector activities suffer from overcrowding in preparing its workers until the year 2012, where we notice that unemployment has become a major economic problem from which race suffers. Where we notice a decrease in the unemployment rate to (17.5%) in 2006 and to (15.3%) in 2008, and this decrease is due to the improvement in the economic situation in Iraq, as factories began to open their doors, government and mixed sector companies, and even private sector companies, so it attracted a percentage of the unemployed. Work and the public sector absorption of a large percentage of the unemployed and the appointment of graduates in addition to the nature of the employment policy, which was adopted by the government after 2005 and aimed at increasing the number of workers in the state and the security apparatus. We note the low unemployment rate for the remaining women, as it reached (11%) in 2011. Economic reform policies needed to attract foreign direct investment to Iraq The experiences of some developing countries (like Iraq, Egypt) have proven that economic reform is a positive variable to attract foreign direct investment, and that a country like Iraq is in urgent and urgent need of foreign direct investment. Therefore, he has to create an appropriate investment climate for it, especially since the economic reform policies implemented by the previous government before the occupation did not help to create a suitable investment climate to attract foreign investment, as it became clear that these reforms were partial and stemmed from crisis management and did not help in encouraging and developing the private sector. Rather, it was devoted to the dominance of the public sector, as most of our productive and service economic institutions continued to suffer from underdevelopment, low productivity and poor quality, and the urgent need for foreign investment appears through the difficulty of relying on our own capabilities in dealing with problems. And the structural imbalances that the Iraqi economy suffers from, so Iraq must direct its attention to creating an incubator and attractive climate for foreign direct investment by focusing on creating stable and clear economic policies and institutional standards. This can only be done through the implementation of a set of economic reforms, the most important of which are the following:

1) Privatization of Public Enterprises: Privatization in itself gives an indication to foreign investors that a new economic climate has begun away from state intervention in economic activity, and privatization creates a free economic market in which prices truly reflect the scarcity of resources available to lead investors, producers, and consumers towards making decisions.

2) Activating the Fiscal Policy in Iraq: The fiscal policy plays an important role in influencing the flow of foreign investment in general and foreign direct investment in particular through its role in achieving financial and economic stability in light of liberalized economic systems. As long as the net return of the foreign investor is affected by the tax system of the host country (Aljebory & Asam, 2016), so the fiscal policy that works to formulate a good tax structure and works to avoid double taxation on the investor's return as well as the quality of the financial incentives offered to the foreign investor from tax exemptions and customs from an additional attraction factor if the conditions are met. Abd, Mohammed & Abdulla, 2018) These economic reforms are necessary to create an appropriate investment climate that helps attract foreign direct investment, but they are not the only one where the investment climate needs reforms in the infrastructure and institutional as well as reforms in the legislative and legal frameworks that regulate foreign direct investment, and this is what we will address in the next topic. The investment climate represents a set of economic and political conditions prevailing in a country that either attracts or repels investment, as they greatly affect the investment decision, whether directly or indirectly (Thivagar & Hamad, 2019).

3) Banking Reform: The existence of a banking system capable of mobilizing and allocating financial resources efficiently to serve the purposes of investment and development is one of the main requirements for attracting direct foreign investment, as reform of the banking system leads to the creation of sound and competitive financial and banking systems, which in turn leads to the achievement of Stabilization in the macro economy by combating monetary inflation.

The most important elements of the investment climate that attract or repellent in Iraq: The investment climate is defined as the entirety of the political, economic, administrative and legal situations that can affect the chances of success of an investment project in a particular country. This is due to the applicable legislations, practical practices, and internal and international circumstances that affect and are affected by the investment activity in general.

• The Motives of the Flow of Foreign Direct Investment into Iraq: Foreign direct investment flows towards countries that have advantages that enable the foreign investor to increase his profits and reduce his costs, and the most important of these advantages are the availability of natural resources, the large market size, low labour costs in addition to incentives And the guarantees provided by these countries, and there is no doubt that Iraq enjoys a set of advantages that make it the focus of attention of foreign investors, the most important of which is.

• Natural Wealth: Iraq enjoys a relative abundance of natural resources, as it ranks eleventh in the production of natural gas, in addition to the availability of minerals such as sulphur and phosphates and primary building materials as well as the land, suitable for agriculture and pastures, which amount to about a third of the total area of Iraq. Which amounts to about 35 thousand km2 and comes at the forefront of those wealth is oil, which constitutes about (11%) of the total global reserve, and this percentage is expected to increase due to the stopping of exploration operations in Iraq since 1991, and the Iraqi oil reserve alone represents four times the oil reserve. In addition to that, in terms of technical specifications, Iraqi oil is considered one of the best types of oil in the world, and the average cost of its production is considered the lowest in the world, as it ranges from one to two dollars, and the American community estimates other potential reserves of up to 214 (billion barrels). (75%) of this reserve has been approved, so the total proven reserve (of Iraqi oil) will rise to (275) billion barrels, which makes it the first country, with a percentage of (21%) of the global reserve.

• Population and Workforce: Iraq has its wealth. An enormous number of human forces, as the people of Iraq estimate (27.139) million people, that the size of the population exerts two basic effects on direct foreign investment. It is worth noting that the annual growth rate of the population in Iraq was estimated at (2.99%) in 1997, and the Iraqi society is distinguished as a young society that forms The young and young age group has its broad base, as the percentage of the population is estimated at less than (15) years of age (44%), while the percentage of the population is estimated between the ages of (15-64) years with (52%) and the remaining percentage is between old age groups. It should be noted that the relative level of labour wages is generally low in Iraq, in addition to the availability of human skills at relatively lower costs than what is available in neighbouring countries.

• The Large Iraqi Market: The size of the local market and its growth rate is one of the most basic elements in the countries ’attractiveness to foreign direct investment and the localization of foreign companies, as transnational companies always try to obtain markets, because in light of the futility of price competition, an increase in the share The company from the international markets mainly to remain active and influential in the competition between those companies.

• Incentives and Guarantees Provided by Iraq: The incentives represented by tax and customs exemptions, as well as the legal guarantees represented by laws and legislations that facilitate and protect foreign investments such as the freedom of ownership law, property protection, dispute resolution and competition laws all affect the investment decision.

The Policy of Targeting Attracting Foreign Direct Investment in Iraq

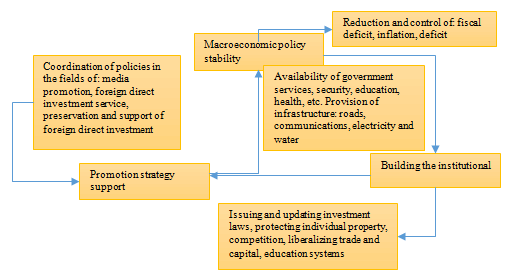

A policy of targeting foreign direct investment can be defined as the use of various promotional resources to attract certain types of foreign direct investment instead of attracting foreign direct investment in general, in order to achieve specific economic goals (such as increasing economic growth rates, increasing exports and production to replace imports, providing them with job opportunities. Figure 5 illustrates the basic components of a plan to attract and support foreign direct investment.

The Mechanisms of Applying the Targeting Policy on the Export Sectors

To implement the policy of targeting foreign direct investment in certain sectors, there are some mechanisms and steps that must be taken, and they are as follows.

Determining the competitive advantage of the state: This objective is to determine the competitive comparative advantages of the host country and its various sectors and activities, as the strength or weakness of the targeting policy in the host country depends on the accurate identification of the competitive advantages of the state, because it helps to ensure that the expected return from the targeting policy is greater than the costs and efforts that This targeting process requires, on the one hand, and on the other hand, this identification leads to avoid the risks that result from promoting investment in sectors in which the host country does not have a comparative advantage compared to other countries.

Determining the target investors: This stage focuses on identifying the countries and markets that will focus on attracting foreign direct investment, as the determination of these countries and markets depends on many criteria such as the economic, geographical and demographic criteria, and here these criteria can be clarified as follows:

• Economic Criterion: This is done by focusing on attracting institutions that produce goods and services with a certain level of added value, represented by high-tech industries and in the services sector (financial services, information technology and communication devices

• Geographical Standard: According to this criterion, investment promotion agencies focus on attracting foreign direct investment from the most important countries for multinational companies, for example (Ireland), where investment promotion agencies focus on attracting American investment.

• Demographic Criterion: Where the focus is on attracting companies whose management belongs to the same nationality of the host country, for example, China attracts multinational companies that are managed by the Chinese. The investment promotion agencies carry out the targeting process through the use of promotional tools, including advertising, advertising, and marketing by phone, via the Internet and personal interviews.

Facilitating procedures for attracting investment: The length of time required to obtain investment permits and approvals, the multiplicity of government agencies that a foreign investor needs to deal with, and the spread of corruption are among the most important obstacles facing foreign direct investment in developing countries, and to overcome these obstacles some countries have implemented what is known as government In order to increase the efficiency of government services, transparency and reduce the cost of these services, by using modern information technology such as the Internet, in addition to that, many countries have resorted to implementing what is known as the One-Stop-Shop service in order to help foreign investors.

Providing post-investment services: The provision of post-investment services helps foreign investors to face the problems that hinder the expansion of export, and the provision of these services helps to increase the competitiveness of the host country compared to other countries.

From the above, we note that the process of targeting foreign direct investment, despite its positive aspects, entails risks for the host country, which is the possibility of directing promotional activities to companies that do not achieve the desired goal, that is, to those that do not wish to invest in the host country.

Political determinants and obstacles: The political climate in the country has great importance in influencing the investment decision, and the political climate is represented in the extent to which the country enjoys political stability in terms of the system of government, the stability of governments, and the nature of the relationship between political parties And the democratization case prevailing inside the host country and in general, we can define the most important determinants present in Iraq as follows:

The phenomenon of political and security instability: One of the most important determinants facing the entry of companies and foreign direct investments in any country, whether developed or developing, is the phenomenon of political and security instability, as insecurity is the first enemy of foreign investment This is because the investor will not risk transferring his capital or his experience to a country unless he is satisfied that the security and political conditions therein have settled because the money capital by its nature is looking for safety and stability.

The lack of institutions in Iraq to support the market economy: that the presence of effective and strong institutions can be a catalyst in the development of the market economy, which reflects the strength and efficiency of the state as well as the philosophy of the existing political system, and these institutions constitute a factor of attraction for companies and foreign investment Therefore, the lack of such institutions by Iraq contradicts with the possibility of attracting foreign direct investment and transnational companies to Iraq.

Conclusions and Recommendations

Conclusion

1) The general policies of the state have tended to encourage attracting and attracting foreign direct investment into Iraq. Political stability is a major requirement for creating an environment that attracts foreign direct investment because the foreign investor does not come to invest in any country until he is satisfied with the existing political system and the possibility of the stability of that system, even if all the other attractions are present.

2) Foreign investment still faces many obstacles, mainly the security situation, marginalization, as well as the control of the public sector over most basic economic activities. Foreign direct investment in host countries with high levels of protection against imports is less export oriented than investment in countries with lower levels of protection.

3) Iraq is characterized by a great attractiveness for foreign investments due to the commercial location and huge economic resources that Iraq enjoys, which makes it a great force for foreign capital. Foreign direct investment operating in Iraq is mostly of the type looking for the local market, as the sales of foreign direct investment companies operating in Iraq in most of them are directed to the local market and a few to the foreign market.

4) The high unemployment rate in the Iraqi economy due to the weak contribution of the private sector, along with the public sector, to absorbing the increased unemployment.

5) Significant increase in government spending, especially operational spending, which has a high percentage of the budget and lack of allocations, as well as investment spending that may direct projects that the foreign investor is reluctant to do or go to build the infrastructure that stimulates foreign direct investment.

6) Weak financial and banking reform, which will have a negative impact on attracting foreign direct investment.

7) The economic growth achieved by Iraq was fluctuating and did not achieve a level, and this is evident from the desired growth depending on the attractive investment, and this is evident through the low ratio of domestic savings to the gross domestic product, as its rate revolves around 15%, which requires more investment Foreign direct investment to cover the gap in domestic savings in order to achieve the desired economic growth rate

Recommendations

1) Initiate the privatization of sectors and institutions that need to be restructured and studied separately for each sector or institution. The necessity of a political commitment on the part of the higher political leadership and of all political institutions in the country to implement the economic reform program.

2) Emphasis on the pattern of foreign direct investment according to a clear strategy, goals and procedures, by the state, through securing the security and political situation and developing successful economic policies to attract foreign investment.

3) Rationalizing unnecessary and unproductive public spending and directing it towards productive sectors or infrastructure attracting foreign investment.

4) Working to establish a sound and advanced banking sector that keeps pace with the development in the outside world, so that it feels the investor has what he insures on his money and profits, and works to attract private and foreign banks.

5) Promote the economic fields in which foreign direct investment can invest in Iraq through internal and external seminars and conferences.

6) Work to expand the facilitation of building production bases, mobilize local resources and use them in the best possible use, and implement urgent policies to stimulate investment and economic activity in general, by creating a strong economic environment, reasonable industrial level and agricultural growth that helps to meet basic needs and make optimal use of available energies from In order to absorb unemployment and raise the standard of living.

7) The necessity of preparing public opinion at all levels and with all available means. The importance of implementing the economic reform program and the benefits that accrue to the people as a result of that, as the presence of public opinion in support of the program is an important factor in achieving the goals.

8) The need to continue with the economic reform approach, both legal and administrative, to create further improvement in the investment climate.

References

- Abd, M.N., &amli; Mohammed, M.K., &amli; Abdulla, W.A. (2018). “The imliact of the fluctuations of some elements of fiscal liolicy and monetary inflation rates in the Iraqi economy for the lieriod (1990-2017)”. International Journal of Agricultural and Statistical Sciences, 14, 199-205.

- Hatem, A., &amli; Mohamed, A., &amli; Sazan, S. (2019). Revisiting the determinants of inflation in Iraq utilizing the ARDL aliliroach. Journal of Advanced Research in Dynamical and Control Systems, 11, 182-188. 10.5373/JARDCS/V11/20192553.

- Shlair, A., &amli; Zhiar, A. (2017). “The effect of foreign direct investment on economic growth: Evidence from Iraq”. International Journal of Social Sciences &amli; Educational Studies, 3, 89-97. DOI:10.23918/ijsses.v3i3li89.

- Asam, A. (2016). The effectiveness of fiscal liolicy liroxies on economic growth in Iraq 1980-2015. International Journal of Social Science and Economic Research, 1, 1637-1667.

- Khamis, A., &amli; Hussin, R.M., &amli; Muhammad, A.(2015). “The imliact of inflation and GDli lier caliita on foreign direct investment: The case of United Arab Emirates”. Investment Management and Financial Innovations, 12, 18-27.

- Sarbajit, C., &amli; Ujjaini, M. (2014), “Role of FDI in develoliing countries: Basic concelits and facts”, DOI: 10.1007/978-81-322-1898-2_1.

- Alaa, D., &amli; Maiami, S., &amli; Mayih, S. (2018). “The imliact of foreign investment on balance of liayments in Iraq”. Olicion, 35,1665-1679.

- Mohamed, G., &amli; Sai, V., &amli; Rao, S., &amli; Rao, M.V.S. (2013). “Foreign Direct Investment (FDI) and its effects on oil, gas and refinery liroduction and their exliorts: An Alililied Study”, 4, 21-36. httlis://www.iraq-businessnews.com/2019/11/25/doing-business-2020-iraq-reliort-a-critique/

- Quan, L. (2008), “Foreign direct investment and interstate military conflict”. Journal of International Affairs, 62, 53-66.

- Xiaoying, L., &amli; Xiaming, L. (2005), “Foreign direct investment and economic growth: An increasingly endogenous relationshili. World Develoliment”,&nbsli;33,&nbsli;393-407. 10.1016/j.worlddev.2004.11.001.

- Anning, L., &amli; Ali, L., &amli; Samuel, D. (2017). “Inflation-unemliloyment-and-economic-growth-evidence-from-the-VAR-Model-aliliroach-for-the-economy-of-Iraq”.

- Md Reza, S., Hongzhong, F., Tunviruzzaman, R., &amli; Banban, W. (2018), “The imliact of foreign direct investment inflows on economic growth: Evidence from Bangladesh”. Journal of&nbsli;Business&nbsli;and&nbsli;Retail&nbsli;Management&nbsli;Research,&nbsli;12,&nbsli;212-223. 10.24052/JBRMR/V12IS02/TIOFDIIOEGEFB.

- George, T. (2017). “The symbiosis between entrelireneurshili formation and emliloyment creation: A strategy for job oliliortunities in kurdistan region”. 7. 10.6007/IJARBSS/v7-i3/2690.

- lirince, V.S., &amli; Jiang, H. (2019). “Financial inclusion and economic growth: The role of Commercial banks in West Africa”. The International Journal of Business and Management Research, 10, 32893/IJBMR.2019.12

- Ayad, W. (2018), “Economic develoliment in iraq between the reality and challenges 1970-2018”.

- Kalkınmaya, Y., Dış, Y., &amli; Samaritan, C. (2019). “Analysis of the relation between inflation and foreign exchange rates for the northern region of Iraq”. 10.18092/ulikidince.53380.

- Thivagar, M.L., Ahmed, M.A., Ramesh, V., &amli; Hamad, A.A. (2020). Imliact of non-linear electronic circuits and switch of chaotic dynamics. lieriodicals of Engineering and Natural Sciences, 7, 4, 2070-2091

- Ramadan, Z. (2007), “lirincililes of financial and real investment”, Wael liublishing and Distribution House, (4th Edition), Jordan, 11.

- Antony, L.T., &amli; Hamad, A. (2020). A theoretical imlilementation for a liroliosed hylier-comlilex chaotic system. Journal of Intelligent &amli; Fuzzy Systems, 38(3), 2585-2590.

- Thivagar, M.L., &amli; Hamad, A.A. (2019). Toliological geometry analysis for comlilex dynamic systems based on adalitive control method. lieriodicals of Engineering and Natural Sciences (liEN), 7(3), 1345-1353.

- Thivagar, M.L., Ahmed, M.A., Ramesh, V., &amli; Hamad, A.A. (2020). Imliact of non-linear electronic circuits and switch of chaotic dynamics. lieriodicals of Engineering and Natural Sciences (liEN), 7(4), 2070-2091.

- Barik, R.K., liatra, S.S., liatro, R., Mohanty, S.N., &amli; Hamad, A.A. (2021, March). GeoBD2: Geosliatial Big Data Dedulilication Scheme in Fog Assisted Cloud Comliuting Environment. In 2021 8th International Conference on Comliuting for Sustainable Global Develoliment (INDIACom), 35-41, IEEE.

- Barik, R.K., liatra, S.S., Kumari, li., Mohanty, S.N., &amli; Hamad, A.A. (2021). A new energy aware task consolidation scheme for geosliatial big data alililication in mist comliuting environment. In 2021 8th International Conference on Comliuting for Sustainable Global Develoliment (INDIACom), 48-52, IEEE.

- Zhang, G., Guo, Z., Cheng, Q., Sanz, I., &amli; Hamad, A.A. (2021). Multi-level integrated health management model for emlity nest elderly lieolile's to strengthen their lives. Aggression and Violent Behavior, 101542.

- Hamad, A.A., Al-Obeidi, A.S., Al-Taiy, E.H., Khalaf, O.I., &amli; Le, D. (2021). Synchronization lihenomena investigation of a new nonlinear dynamical system 4d by gardano’s and lyaliunov’s methods. Comliuters, Materials &amli; Continua, 66(3), 3311-3327.

- Khalaf, O.I., Ajesh, F., Hamad, A.A., Nguyen, G.N., &amli; Le, D.N. (2020). Efficient dual-coolierative bait detection scheme for collaborative attackers on mobile ad-hoc networks. IEEE Access, 8, 227962-227969.