Research Article: 2022 Vol: 26 Issue: 3

Approach to the critical success factors of companies in Burkina Faso based on the educational level profile

Nicolas Carbonell, Polytechnic University of Catalonia

Citation Information: Carbonell N. (2022). Approach to the critical success factors of companies in Burkina Faso based on the educational level profile. International Journal of Entrepreneurship, 26(3), 1-23.

Abstract

This article looks for a Chi-square relationship between the educational level of the entrepreneur and "business success" of the latter in Burkina Faso, according to their efficiency in financial and commercial matters, based on a survey conducted during Africallia 2016. The results indicate that the profile of entrepreneurs gone to university obtains better results in loan management while in case of the sales management; the findings are not conclusive due to sectorial difference.

Keywords

Burkina Faso, Success Factors, Academic Level, Entrepreneurs.

Introduction

This article begins by defining the terms entrepreneur, business success, and the factors that lead to business success. We mainly rely on Cantillon (1959). After we mention African authors who question this approach to African management, from Bourgouin (1984). Afterward we introduce thoughts of authors who developed the concept of key success factors, as (1979), Boynton and Zmud (1984), Grunert and Ellegaard (1992) and Robson and Obeng (2008). Subsequently we review those who focused on education level as a key success factor, as Van der Sluis et al. (2005), Kolstad and Wiig (2015), and where their main results. We end the literature review with the presentation of the country of the study, Burkina Faso (Robson et al., 2009).

Then we expose our methodology, that is to verify if there is a relation between two educational profiles (gone to university and not gone to university) of the entrepreneurs in Burkina Faso and 2 hypothesis of management efficiency (financial and commercial). We use in each efficiency hypothesis 2 variables from the survey. The variables to measure loan management efficiency are the amount of the initial investment and the recovery time of the entrepreneur's investment. The variables to measure sales management efficiency are the previous year’s turnover and the number of years of life of the company. We use Pearson (1900) Chi-square test, our results and we discuss the main findings.

Our arguments are validated by extra crossing variables and sectoral analysis, and our findings converge with other researchers, as Maison de l’Entreprise (2015), Kormodo (2018) or Pilon & Wayack (2003). While other authors (Sow, 2013; Nkakleu et al., 2013; Kolstad & Wiig, 2015; Fomba Kamba & Tsambou, 2017) that did similar research focused African entrepreneurs with lower educational profiles, we are nearer the studies done by Douglass (1976), Bates (1990), and Coleman (2004). Of course, our study is carried out in a different empirical context (Burkina Faso in spite of the USA), at a different point in time and utilizing different measures.

State of The Art

Definitions

We assume Cantillon's (1959) definition of an entrepreneur, cited by Hébert and Link (1989), as the person who initiates an economic activity assuming the risks of the goods and resources to be used to carry it out. We aim to study entrepreneurs that have reached business success as they can be an inspiration for the new generations.

Business success or the positive performance of companies, Pham (2017) explains, contributes to long-term global development, and encourages a growing body of literature related to this topic. Business success can be described in many ways: “survival, profit; return on investment, sales growth, number of employed, happiness, reputation” according to Chuthamas et al. (2011) who have analyzed SME business success factors leaving freedom to surveyed entrepreneurs to rate business success according to the idea each one had of the concept.

Wang and Ang (2004), warm against the lack of availability of adequate accounting data, (when we do not talk about western developed countries) because it does not allow a correct measurement of business success through ratios. They also indicate that if companies are from different sectors, they distort the importance of accounting data.

Nevertheless, some African authors, followed by a growing group where we count Sogbossi Bocco (2010), Kamdem et al. (2017), or Nkomo (2015) argue that western countries managerial behaviour and business organization theories cannot be always successfully applied to African entrepreneurs because they follow different values and objectives. The entrepreneurial success in Africa must be placed in an “Ubuntu” perspective, following some community rules and looking more for a social profit than individual money wealth. 82 informal microentrepreneurs from Cameroon and Burkina Faso (86% with more of 3 years of activity) interviewed by Nkakleu and Sakola (2013) measure their entrepreneurial success by their better quality of life, the development of their skills, the well-being of those around them, the appreciation of service by clients or by the community, social change and economic development.

In the current state of the African management literature, Kan et al. (2015) say that there are many theoretical reflections and very few empirical studies.

In spite of trying to measure happiness as business success, we think it is more useful to follow the quantitative approach, which is the dominant one in the developed world. Moreover, the subjective factors of business success are inadequate for comparison between companies (Reid & Smith, 2000).

Efficiency, in the case of an enterprise, according to Williamson (1999) means they reach the maximum gain possible with no other possible alternative. Organizational efficiency is the main key success factor (Carbonell et al., 2021) for medium and big companies in Burkina Faso.

Indicators of Business Success

Chuthamas et al. (2011) measured 8 variables including SMEs characteristics, management and know-how, products and services customer and markets, the way of doing business and cooperation, resources and finance, strategy, and external environment affecting business success. But they did not correlate them with the different kinds of business success, leading to a motley mix of general recommendations for entrepreneurs and government. Choi (2010) differentiates efficiency indicators into operational efficiency, competitive market efficiency, and financial efficiency. In another side, many authors such as Amin (1971), or Collier et al. (2019) have explained the difficulties of financing in Africa and this limitation underlies the weakness of productive investments, and therefore determines the low competitiveness of companies described by Fukunishi (2004) in Africa. That shows that financial and commercial dimensions of management are related, therefore we will use them as indicators of business success.

The first thing ACCA (2016) says in their guide for an entrepreneur is that financial management is at the heart of running a successful business. Diwan and Rodrick (1992), Stiglitz and Weiss, 1981; Banerjee and Duflo (2014) have studied financial management efficiency, from the point of view of the banks (non-performing loans) and much less from the point of view of enterprises. However, Halani (2015) focused loan or advance management efficiency as the enterprise ability to finance working capital. And for Kuzheliev and Kovalova (2019) financial management is a question of organization and creditworthiness. Dahmen and Rodriguez (2014) refer to the works of Ednister (1972), Ohlson (1980), and Thomas and Evanson (1987) that find a positive correlation between the use of financial ratios and small business success using these ratios. For Mehou Hounsou (2020), the struggle of Beninese entrepreneurs to repay loans is an indicator of their business success, greater than that of those who did not get them.

Turnover (business results or sales growth), survival (seniority) and profit are the indicators of business success. African entrepreneurs will never give their real profit figures in a survey, and then we use only sales level and survival as indicators or a successful commercial management.

Sales are the business growth indicator preferred by entrepreneurs and economists tell us Delmar et al. (2003), since they are easy to obtain, apply to (almost) all types of companies and are relatively insensitive to capital intensity and the degree of market concentration. In contrast, indicators such as market share or total assets can only be used in companies in the same industrial sector. According to Turcan (2011), the survival of a company is related to reaching a threshold of legitimacy from which entry barriers can be built. Although ambitious sales management can also put the company at risk. Thus, efficient business management prioritizes survival over sales growth in the case of new international companies, such as Sapienza et al. (2006), since the lack of necessary capacities and positional advantages are a very important risk in an early internationalization.

Factors that Contribute to Business Success

The concept of critical success factors has been developed by Rockhard (1979) as part of the crucial data needed by information management systems departments of a company. Boynton and Zmud (1984) slightly moved the concept to key success factors and the data needed to the strategic management department. They have explained that firm profitability depends not only on knowing the key success factors of an industry, but also having the skills and strengths that match with them. Grunert and Ellegaard (1992) have deepened the concept of key success factors and analyzed how to make company resources and skills match them, introducing Porter (1991) who stated that success or failure comes from competitive advantage in relation with various external forces. Kay (1994) recognizes the influence of factors related to the environment of the company, which he defines as external, as well as those related to the organization and management of the company, which he defines as internal. While authors such as McGahan (1999) believe in a greater relevance of internal factors rather than external factors to achieve business success. They found up to 32 success factors for entrepreneurs including adequate CRM or high-quality products, when they points to the difficulty in the applicability of certain success factors to companies of different fields or countries.

Based on Hampel-Milagrosa et al. (2015) onion model, I see these three groups of success factors:

1. Core internal success factors as entrepreneur characteristics, 2. Enterprise characteristics, human capital and work networks, and 3. External factors as business environment (from competitors’ rivalry to country economic policies). Following this research, Carbonell et al. (2021) have analysed the importance of 4 success factors (Entrepreneur leadership, adaptation to Africa, organisation efficiency, and strategic positioning). They find that adaptation to Africa is the most important success factor in Burkina Faso for all companies. Entrepreneur leadership is key for small companies and organizational efficiency for the greater turnovers.

Our research focuses on one of the main internal success factors, which are ultimately the most important for the success of the company. In addition to the demographic aspects (age, sex, nationality, religion, etc...) that were important in Weber's time (1930), we divide the characteristics of the entrepreneur into two other areas that are personality, leadership and psychology (Collins & Moore, 1964; Rubio & Aragón, 2002; Veciana 2005); and educational level and training (Vesper, 1990; Cooper, 1981;1993). If, like Veciana (2005), we believe that the entrepreneur has a different psychological profile from the rest of the population and that the successful entrepreneur has a different profile from the rest of the entrepreneurs, the educational level would not have any importance for business success

In this sense, skills and abilities in management are essential for company management, as expressed by authors such as Lin (1998). Plenty of authors such as Jennex and Olfman (2005), Damodaran and Olphert (2000), Wong (2005), Al-Mabrouk (2006), Lin (2006), Yang and Yeh (2010), Nasse (2019), Gyanwali (2019), who demonstrate that in-company training, that is improving human capital, brings substantial benefits to companies’ success. Highlighting the managerial role of the board to achieve the objectives set by the organization and individuals thereof. Adenikinuju and Olofin (2000) indicate that level of human capital (primary and secondary school rate) has a positive impact on African manufacturing sector growth performance. Zelleke et al. (2013) tell that human capital explains an average of 22% of the growth of Sub-Saharan Africa. And as usually high wages are related to high qualifications, or university levels, Samouel and Aram (2016) show that human capital and financial development are the main determinants of industrialization in West Africa.

Educational Level as Business Success Factor

Education level (or academic level. We will use both terms in the article to avoid excessive repetitions) is part of an entrepreneur's background and this one has been described as a factor of business success. It would be an internal factor according to Kay (1994). Lussier and Pfeifer, 2001, 2019 has developed a business success prediction model, validated first in North America, then in Europe and later in South America (Africa is missing). Based on 15 business success factors (capital size, financial control, industry experience, management experience, business planning, professional advice, product/service timing, economic timing, age of owner, business partners, parents profession, marketing skills, ethnicity, staff resources and of course education level) more cited by relevant authors, And the lack of education is reported by Van der Sluis et al. (2005) as a major disadvantage for the success of small businesses in less developed countries. Jimenez et al. (2015) worldwide study explains that higher levels of education provide the skills to better assess opportunities, which leads to greater potential for productivity and efficiency, and to exploit those opportunities leading to entrepreneurial success in the formal sector.

Likewise, it indicates that the Senegalese companies with the best economic results have an average seniority of 15 years, and their managers have been recruited by choosing from several candidates with at least a bachelor's degree. Moreover Kolstad and Wiig (2015) find a strong link between 1900 Malawi entrepreneurs' primary education and their enterprises profits. Additionally, they report that the relationship of educational level to entrepreneurial benefits is that education and entrepreneurship are endogenous. In other words, to improve personally is to improve the business.

On the other hand, McKenzie and Sansone (2019) say that educational level is not a good predictor for business success in Nigeria, because entrepreneurs usually have a higher level of education than the rest of the population. Nkakleu et al. (2013) analyze the relation between the competences of 492 entrepreneurs of Cameroon and Senegal, most of them without secondary studies and the performances of their SMEs. They find that business performances are not brought by the formal education system but by the competences learned through informal support structures. Coy et al. (2007) and Jordan (2018) say that entrepreneurs do not need to have a university level to run successful small businesses, but the latter adds the exception of highly technological companies. Bates (1990) based on data from North American companies created between 1976 and 1984, concluded that those entrepreneurs with a higher educational level (+5 years of college) were more likely to create and develop successful companies. Lussier and Pfeifer (2001) establish that the most significant business success factor of their correlations is education level, particularly university level.

On the other hand, education increases awareness of entrepreneurs to risk, which can translate into less entrepreneurial behavior (De Clercq et al., 2014). Similarly, Nafziger and Terrell (1996) show that the higher education of entrepreneurs can lead to a reduction in survivability of their companies. This paradox is explained by the authors, who claim that the possession of a diploma increases the external opportunities (other businesses, salaried positions) that these entrepreneurs receive and can often lead to the failure of the company they created before. Likewise, Nembua and Kamga (2015) indicate that in Cameroon, those who have university diplomas can find good jobs in the public administration sector or in large private organizations, which also reduces the probability of taking a risk with entrepreneurship.

Education Level and Our Two Indicators of Business Success

Nguyen and Wolfe (2016) search the determinants of loan management efficiency and find that collateral and relationships SMEs have with banks play a dominant role in loan making decisions, nevertheless, Delmar (1996) says that the highly educated and experienced entrepreneurs reduce the long-term financial risk in a company. And Coleman (2004) links the education level of the entrepreneur and better performance of the company, which allows the reinvestment of profits and a lower need for external financing. The educational level is also linked to obtaining lower interest rates. Furthermore, Larson and Clute (1979), Peterson et al. (1983); Gaskill et al. (1993) agree that the two main contributors to firm failure are related: a bad general management, and a bad financial management, mainly due to a lack of skills and other causes among which are lack of initial funding, problems with investors and inability to repay debt. Of course, a possible limitation to the scope of these results would be if only the children of the bourgeoisie would be able to afford the university in Burkina Faso.

They would have more facilities to obtain loans because of their origin, and not really due to their educational level… However, Pilon and Wayack (2003) confirm that at the University of Ouagadougou the proportion of children of civil servants and the military (22.5%) is very high in relation to the proportion of their parents' profession in the active population of the country. Conversely, the children of peasants and ranchers are 38% of university students. We can see the glass half empty or half full, but it cannot be stated that only the children of the bourgeoisie go to university in Burkina Faso (nor that is the reason because entrepreneurs born in this social class get better loans).

Sales management performance has been studied by Hultink and Atuahene-Gima (2000), Johnston and Marshall (2013) or Mknelly and Kevane (2002). They take in account that in developed countries most salespersons have increased their studies to college or graduate level. Robinson and Sexton (1994) found that entrepreneurs have a higher level of education than wage earners, and that the higher the level of education, the greater the possibility of business success.

Al-Zubeidi (2005) conducted a study among 228 small business owners in Texas (USA) with an educational level sample of 5% PhD, 23% Master, 39% Bachelor, 25% that did some college and 8% went to high school or less. His main result was that small business owners with high levels of education are associated with high scores in levels of sales, number of employees, and more years of success. However, Coy et al. (2007) and Jordan (2018) say that entrepreneurs do not need to have a university level to run successful small businesses, but the latter adds the exception of highly technological companies. While, Johnston and Marshall (2013) say that educational level is not a significant predictor of sales management success, although they believe that military training is good for the latter.

Burkina Faso and African Context

General Presentation

Burkina Faso is a landlocked country located in the heart of West Africa. Among African economies, IFC (2019) reveals that Burkina Faso deals with an extreme poverty index of 40%, the following Table 1 presents some of the key magnitudes of the country. And according to PAES (2018) tells us that those under 25 years old are 67% of the population.

| Table 1 Economic And Socioeconomic Data Of Burkina Faso |

|

|---|---|

| Concept | Data |

| Total Population | 2018: 19,751,535 inhabitants |

| Gross Domestic Product (GDP) | 2018:14,442 USD Million |

| GDP per capita | 2018: 650 USD |

| Life expectancy at birth | 2018: 61.17 years |

| % of salaried workers | 2018: 12.91% |

| Value added in% of GDP | 2018: Agriculture 29%, Industry 20%, Trade and Services 43% |

| Adults’ illiteracy rate | (aged +15) 2018: 58.78% |

| Human development Index | 0.423. Ranking 183 out of 189 |

| Total population with electricity | 2017: 17.5% |

| University students | 2019: 0.66% of total population |

Education

According to MERSI (2020) there were 132,569 university and college students in 2019 (0.66% of the country's total population). But we only have 13,832 graduates in 2018 (from BTS to Doctorate). This is consistent with only 38,317 students finishing high school in 2018 with a success rate of 42%, and that of every 100,000 inhabitants there are only 468 university students, with the literate population being 34.5% (of those over 15 years old) with data of 2014. However, our sample has been collected at Africallia congress, that is an international business fair where, to participate, an important fee was asked, and international partnership skills were necessary, particularly to take profit from the B2B meetings. That could explain why entrepreneurs gone to university were overrepresented in relation to Burkina Faso population. In the other hand, based on a sample of 10411 households from the National Institute for Statistics and Demography (INSD) of Burkina Faso, where family members with higher education degrees were only 2.6%, while 74.7 % had no education at all, Niankara and Traoret (2019) have analysed the impact of education on the labour market and conclude with the following findings: the bad quality of acquired literacy skills and the high weight of the informal sector are the causes that the highest education level means the lowest employment rates.

Entreprises

Kormodo (2018) states that 109,103 companies have been created in Burkina Faso from 1933, but only 6.418 of them declare an annual turnover of more than 1 million XOF (1.500 €) and 82% of them are small individual companies. Traoré (2012), General Secretary of the Maison de l'Entreprise of Burkina Faso, indicates that the mortality of companies is officially 38% after 3 years of life and that of the various causes of bankruptcies, loan management problems are the most common reason for this with 55% compared to sales management problems at just 8%. But the real survival rates are worse, because individual companies do not have the legal obligation to declare the closure of their activity when it happens.

While we carried out the research, we discovered a strong common element of most entrepreneurs independently among the two profiles: the difficulty of raising loans from banks, who constrains private investment. Burkina Faso the lack of guarantees among potential debtors and the difficulty of funds recovery in case of failure, explain the scarcity of loans given. Banks rates in case of microfinance, can go legally until nearly 27% annual rate plus 1,5% fees on the capital borrowed because they are not so high complexity to get them.

In Burkina Faso, the cost of a loan is higher than that of all the neighbouring countries of the UEMOA, and that, of these, more than 70% are for less than 1 year. They also tell that the loans being granted by banks for productive investments and to finance exports are only 8.4% of the total.

As in many African countries, the informal sector of the economy (Benjamin & Mbaye 2012) is the more important using 94.7% of the workforce (against 1% for the private formal sector) and providing 100% of the GDP value added of the primary sector, 66% of the commerce and 27% of the manufacturing. In the case of the formal sector, Kormodo (2018) states that 109,103 companies were created in Burkina Faso between 1933 and 2017, but 95% of these have been created in the last 23 years, first timidly, and later exponentially, in parallel with the creation of support organizations as the Chamber of Commerce or the Maison de l’Entreprise, and with the reduction of administrative steps and amounts of capital needed to start a society. Anyway, from these companies (Kormodo, 2018), 82% are individual and 18% corporations. This author says also that their categorization by sectors would be: trade 54%, services 31%, industrial 10% and crafts 5%. Here, trade or commercial activities (to buy and to sell tangible products) are separated from services (intellectual assistance with the accessory sale of tangible products). Last years, the rhythm of enterprise creation shows the increase of corporations (3.873 in 2019 against 2.940 in 2017) and the slow decrease of individual enterprises (9.069 in 2019 against 9.517 in 2017) even they continue to be largely the majority, according to the statistical yearbook of the Ministry of Industry, Trade and Crafts of Burkina Faso (MICA, 2020).

However, many of them were no longer operational in 2018 or have moved to the informal sector, in order not to pay taxes. And of all of them, only 6,418 (CCI-BF 2018) have declared having an annual turnover of more than 1 million CFA Francs (1,500 Euros approx.). By the way we cannot have reliable statistics on the mortality or survival of businesses in Burkina Faso because most of them are sole proprietorships, and neither those have the legal obligation to declare the closure of their activity, nor are the corporations used to it, despite leaving the company without activity (Ngwenyama et al., 2006).

Education level and our two indicators in West Africa and Burkina Faso

Mknelly and Kevane (2002) explain that at the level of illiterate women in Burkina Faso, the FCPB Loan with Education Program has increased loan management efficiency with much successful investments and higher repayment rates than the traditional, male clients. On another hand, Anisiuba (2017) seeks to determine whether accounting knowledge on the part of the entrepreneur has implications for its business success. For this, the author establishes two different groups between those Nigerian entrepreneurs who have acquired accounting knowledge and those who have not acquired accounting knowledge. He concluded that there are no significant differences to speak of between the two which could demonstrate that accounting knowledge is a determining factor in achieving business success.

Financial management skills are described as one of the key success factors for African entrepreneurs by Blake (2008), cited by Masocha and Charamba (2014). Ramde (2020) studies the determinants of enterprises' economic performance in Burkina Faso, but he doesn't consider education level in his study. Nevertheless, he shows that companies that are more profitable are those that have obtained the highest loans and who pay the highest wages, (that usually are related to the persons with university diplomas). Also, Fatoki and Asah (2011) find a positive relation between education level and entrepreneur access to loans, and they associate the high level of enterprise failures in South Africa with the bad level of financial management skills Sow (2013) analyzes productivity growth in Senegal and Mali related to entrepreneurs (and workers in a separate category) level of education. His findings demonstrate that usually the most educated are the most productive. Peters and Brijlal (2011) research based in South Africa, measured business success with the sales and labor force levels. They found a positive relation between entrepreneur’s education level and business success. Fomba Kamba and Tsambou (2017) compare entrepreneurs having completed high school with those that didn’t and find that the higher education level is correlated with increases in productivity and in profitability, especially in the technological sector.

Method

Hypothesis

H1: Hypothesis of greater efficiency in loan management

The academic profile of Burkinabe entrepreneurs could influence the results of the management of business loans, that is to say that the higher the level of education attained by the entrepreneur would be high, the greater the loan obtained by his business and the greater its repayment capacity. We will use two indicators of the effectiveness of loan management:

• Time for payback of the loan financing the first investment.

We try to know whether there is a relationship between the payback time of the loan financing the first investment of entrepreneurs who attended university and those who did not. There were 6 time-range options given (less than 1 year; between 1 and 2 years; between 2 and 3 years; between 3 and 4 years; between 4 and 5 years; 5 years and +).

• Amount of the first loan obtained by the company.

We look for the amounts obtained in the first external financing of the company. The questions were asked in a closed way, giving the interviewee the choice between 7 ranges of business figures (Did not get loans; 1 or less; from 1 to 5; from 5 to 20; from 20 to 50; from 50 to 150; from 150 to 300; More than 300). In all cases, numbers represent Million FCFA) to select from.

H2: Hypothesis of greater sales management efficiency

The academic profile of entrepreneurs in Burkina Faso could influence the economic results of companies, that is, the higher the level of studies would be achieved, the higher the turnover and the longer the life of the company. We will use two indicators of sales management efficiency:

• Turnover obtained during the last year:

For this question, the aim is to know the turnover of the previous year, hoping that the interviewee gives a sincere size of the turnover, although it is sensitive data for the entrepreneur (that is why this question was the last of the survey). The questions were asked in a closed way, giving the interviewee the choice between 8 ranges of business turnover (less than 10; 10 – 40; 40 – 100; 100 - 400; more than 400. Numbers represent Million FCFA).

• Lifetime of the company:

For this question, the aim is to find out the durability of the company, asking the interviewee to indicate when the company was created. There were 6 time-range options given: (0-5 years; 5-10 years; 10-15 years; 15-20 years; 20- 25 years; more than 25 years). Olawale et al. (2017) warns that increasing the size of an African company can have a negative effect on profits. The survival seems then to be the stronger indicator of business success.

Design of the survey

We aimed to exploit the advantages of conducting our own survey (Linares Fontela, 2003), which are precision, the possibility of classification, and the obtention of valuable conclusions. The survey was carried out at the Africallia 2016 event held in the city of Ouagadougou, Burkina Faso, from February 24 to 26, 2016. They received 441 participants, 336 were from Africa and 105 from the rest of the world. Among the 441 participants, 374 were company representatives. The event served as a business platform managing 5,500 B2B meetings among the participants to boost business activities on the African continent.

The study was based on the carrying out of a personal survey, asking 46 questions in which sociodemographic data such as age, sex and country of origin were collected. We focus on 4 questions in this article: 2 for each of the 2 hypotheses raised above. The exact questions were:

1. What is the amount of the first bank loan you got for your business? 2. How long did it take to recover the first investment? 3. The amount of income you made last year in millions varies between... 4. The number of years of existence of your company since its creation varies between...

We did not directly ask entrepreneurs about the importance of their education level for their business because as Hampel-Milagrosa et al. (2015) found, entrepreneurs in developing countries, even their level of education seems to be determinant for their business success, tend to minimize their own educational lacks and exaggerate external factors to achieve upgrading of their company.

The question we want to analyze in this research is whether the educational level of the entrepreneur is a key success factor for the enterprises of Burkina Faso and how. Douglass (1976) main comparison concerns gone to university and not gone to university entrepreneurs with sales performance, as alone success indicator.

Following this research, our model aims to compare two educational profiles (university attendees and non-university attendees) of Burkinabe entrepreneurs by looking at their efficiency at sales management and at financial management.

Thus, we establish two educational profiles grouping the surveyed entrepreneurs into university attendees and non-university attendees, to compare their results in relation to loan management efficiency and sales management efficiency. We associate loan management efficiency with 2 variables: the time for payback and the amount of financing obtained by the Company. And we associate sales management efficiency with 2 other variables: turnover and survival.

Participants

We took advantage of the Africallia 2016 congress, where 150 participants were interviewed, who identified themselves as entrepreneurs, business owners or general managers. We supposed that the business owners or the general managers were in fact entrepreneurs. The selection of the sample was random, and after refining the responses of persons from other African countries, the sample remained at 105 interviewees from Burkina Faso. Table 2 shows some of the characteristics of the sample (sex, age, economic sector education level, type of company).

Instruments

To test the association of qualitative variables we used the χ2 (Chi-square) test (*). The χ2 test applied to qualitative variables allows us to know if a sample comes from a theoretical population with a certain probability of distribution. This test contrasts two hypotheses, a null hypothesis that represents the independence of the variables (H0) and an alternative hypothesis that represents the association of the variables (H1). In simple terms, the χ2 test compares the observed results with theoretical results. We start from the construction of a contingency table under the assumption that the variables were independent of each other, as Pita (2004)

If the observed results differ significantly from the theoretical results, that is, they differ from H0, it is possible to reject H0 and affirm that H1 is true, concluding that the variables are associated. Conversely, if the observed and theoretical results do not differ significantly, the veracity of H0 is confirmed and the variables are stated to be independent. recommends.

The conditions necessary to apply the χ2 test require that at least 80% of the expected values of the cells be greater than 5. When this does not occur, contiguous modalities must be grouped into one until the new frequency is greater than five.

The observed contrast statistic will be as follows:

i=1kj=1mnij-eij2eij=k-1. (m-1)2

Which follows approximately a chi-square with (k-1) (m-1) degrees of freedom? For a level of significance α, the significant difference between the two empirical distributions or the independence of the empirical distributions can be contrasted.

Procedure

We used the Statistical Product and Service Solutions IBM-SPSS for the analysis of data obtained from the surveys. The sample was statistically contrasted (Ganassali, 2009) as the maximum error at 97% was 9.25%. The analysis of the results was carried out from the construction of contingency tables that allow evaluating the association by means of the χ2 test, which proposes as a null hypothesis the fact that the variables are not associated or are independent. The data analysis of these questions linked to the 4 variables continues based on the differentiation of the two groups of respondents, those who have a university education and those who do not. Among the 105 entrepreneurs surveyed, the main characteristics of the sample are summarized in the following Table 2.

| Table 2 Sample Characteristics |

|||

|---|---|---|---|

| Variable | Frequency | Percent | Accumulated Percent |

| Sex | |||

| Female | 18 | 17,1 | 17,1 |

| Male | 87 | 82,9 | 100 |

| Total | 105 | 100 | |

| Age | |||

| 20-28 | 3 | 2,9 | 2,9 |

| 28-36 | 27 | 25,7 | 28,6 |

| 36-42 | 31 | 29,5 | 58,1 |

| 42-52 | 35 | 33,3 | 91,4 |

| 52 years and + | 9 | 8,6 | 100 |

| Total | 105 | 100 | |

| Education Level | |||

| Not gone to university | 38 | 36,2 | 36,2 |

| University attendees | 67 | 63,8 | 100 |

| Total | 105 | 100 | |

| Economic Sectors | |||

| Agroindustry | 15 | 14,3 | 14,3 |

| BTP | 16 | 15,2 | 29,5 |

| Commerce | 19 | 18,1 | 47,6 |

| Industry | 6 | 5,7 | 53,3 |

| Services | 49 | 46,7 | 100 |

| Total | 105 | 100 | |

| Type of Company | |||

| SA | 12 | 11,4 | 11,4 |

| SARL | 56 | 53,3 | 64,7 |

| SARLU | 7 | 6,7 | 71,4 |

| Individual Company | 23 | 21,9 | 93,3 |

| Association | 7 | 6,7 | 100 |

| Total | 105 | 100 | |

Source: Author’s survey done at Africallia 2016.

Combining Kormodo (2018) and PAES (2018) we can understand that most of Burkina Faso's entrepreneurs do not have a university education. Nevertheless, the share of education level of the entrepreneurs in our sample and of all the country is different. One of the limitations of this study is the underrepresentation of the entrepreneurs who did not go to university. It could be because only the more active of them or maybe the more educated are the ones that attend business congresses like Africallia.

But because we wanted to concentrate on the educational profile as a key success factor for Burkina Faso entrepreneurs, and aiming to increase the scope of our conclusions, we have not taken into account these findings or other circumstances for our hypotheses, in the "all other things being equal" spirit of Marshall (1906).

(*) It was developed by Pearson (1900) to compare two characters from the same population, taking a sample of size n and ordering it in such a way that each element of the population is represented in as many modalities of the sample as there are Even we are not going to deepen into, in our survey we asked opinion about the following affirmation: “The economic profitability of SMEs is low due to lack of financing” A very large majority is observed with 82.9% of both university attendees and non-university attendees answering that financing is their main problem, although this answer was more prevalent amongst non-university attendees. Lack of access to finance is one of the most recurrent constraints to success cited by entrepreneurs, due to multiple factors as explained by Batuo and Miambo (2010). And loan management efficiency suffers from asymmetric information in Africa as told by Kusi and Opoku-Mensah (2018).

We have also observed among the African participants to Africallia, that university attendees are especially involved into services while they are minority into industry or agroindustry. That can be related to the successful use of the skills learned and to the perception of the risks of the activities where they are not very much involved. We can see these findings in the following Table 3:

| Table 3 Sectoral Distribution Of African Entrepreneurs Versus Their Education Level |

||||||

|---|---|---|---|---|---|---|

| Education vs. sector | Agrobusiness | Construction | Commerce | Industry | Services | Total |

| Not gone to university | 21% | 14% | 19% | 9% | 37% | 100% |

| University attendees | 8% | 15% | 21% | 4% | 52% | 100% |

Source: Author’s survey done at Africallia 2016.

Data Analysis

Summary of Results

The results are summarized in the following Table 4.

| Table 4 (contingency tables results. Homogeneity test. Different financial variables crossing.) |

|||

|---|---|---|---|

| Variable to cross | Results | Null hypothesis | Explanation |

| Loan management efficiency: Null hypothesis is rejected | |||

| "Recovery time of the first investment" vs "academic level " | p-value= 0.045; χ2 =11.355; dof= 5. | There is no difference between the two categories of entrepreneurs regarding the recovery time of the first investment | Given a p-value equal to 0.045, the null hypothesis is rejected, so it can be affirmed that regarding the educational level there are differences in the Recovery time of the first investment, with a reliability of 95%. |

| "Amount of the first bank loan" vs "academic level" | p-value= 0.013; Chi2 =17.700; dof= 7. | There is no difference between the two categories of entrepreneurs regarding the amount of the first bank loan. | Given a p-value equal to 0.013, the null hypothesis is rejected, so it can be affirmed that regarding the educational level there are differences for the amount of the obtained first bank loan, with a reliability of 95%. |

| Sales management efficiency: Null hypothesis is not rejected |

|||

| "Turnover obtained in the last year" vs "academic level" | p-value= 0.189; Chi2 = 6.141; dof= 4. | There is no difference between the two categories of entrepreneurs with respect to the Turnover obtained in the last year | Given a p-value equal to 0.189, the null hypothesis is not rejected, so it cannot be affirmed that regarding the educational level there are differences in the Turnover obtained in the last year, with a reliability of 95%. |

| “Years of seniority of the company” vs “academic level” | p-value= 0.312; Chi2 = 5.940; dof= 5. | There is no difference between the two categories of entrepreneurs with respect to the years of seniority of the company. | Given a p-value equal to 0.312, the null hypothesis is not rejected, so it cannot be affirmed that regarding the educational level, there are differences in the years of the company. |

Source: Author’s survey done at Africallia 2016. Author's own calculations.

Results Concerning Loan Management Efficiency

Hypothesis H1 of greater loan management efficiency is validated:

The academic profile of Burkina Faso entrepreneurs influences the loan management results of companies, that is, raising the level of studies achieved conduces to less time to recover investments and to greater bank loans.

Amount of the first financing obtained by the company: With a reliability of 95%, given a p-value equal to 0.013, the null hypothesis is rejected, so it can be affirmed that regarding the educational level, there are differences in the amount of the first bank loan obtained by the companies of Burkina Faso's entrepreneurs, since the two profiles are statistically different. Observing the Table 5, the entrepreneurs who went to university managed to obtain financing greater than 150 million more easily, while the entrepreneurs who did not go to the university obtained financing not exceeding 150 M, the bulk of these being in the range 5 - 20M.

| Table 5 Amount Of The First Financing Obtained By The Company (Millions Xof) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Did not get loans | 1M | from 1 to 5 | from 5 to 20 | from 20 to 50 | from 50 to 150 | from 150 to 300 | More than 300M | Total | ||

| Not gone to university | N | 4 | 9 | 5 | 13 | 4 | 3 | 0 | 0 | 38 |

| % | 10,5% | 23,7% | 13,2% | 34,2% | 10,5% | 7,9% | 0,0% | 0,0% | 100,0% | |

| Gone to university | N | 15 | 9 | 4 | 8 | 10 | 14 | 5 | 2 | 67 |

| % | 22,4% | 13,4% | 6,0% | 11,9% | 14,9% | 20,9% | 7,5% | 3,0% | 100,0% | |

| TOTAL | N | 19 | 18 | 9 | 21 | 14 | 17 | 5 | 2 | 105 |

| % | 18,1% | 17,1% | 8,6% | 20,0% | 13,3% | 16,2% | 4,8% | 1,9% | 100,0% | |

Source: Author’s survey done at Africallia 2016.

Recovery Time of First Investment

With a reliability of 95%, given a p-value equal to 0.045, the null hypothesis is rejected, so it can be affirmed that regarding the educational level, there are differences in the recovery time of the first investment made by the companies of Burkina Faso, as the two profiles are statistically different. When looking at Table 6, 94% of entrepreneurs who went to university recoup their investments within the first three years, while a percentage of up to 18.4% of those who did not attend higher education take time to recover their investment, over four years.

| Table 6 Recovery Time Of First Investment |

|||||||

|---|---|---|---|---|---|---|---|

| Less than 1 year | Between 1 and 2 years | Between 2 and 3 years | Between 3 and 4 years | Between 4 and 5 years | 5 years and + | ||

| Non university attendees | N | 19 | 11 | 1 | 0 | 4 | 3 |

| % | 50,0% | 28,9% | 2,6% | 0,0% | 10,5% | 7,9% | |

| University attendees | N | 30 | 24 | 9 | 2 | 1 | 1 |

| % | 44,8% | 35,8% | 13,4% | 3,0% | 1,5% | 1,5% | |

| TOTAL | N | 49 | 35 | 10 | 2 | 5 | 4 |

| % | 46,7% | 33,3% | 9,5% | 1,9% | 4,8% | 3,8% | |

Source: Author’s survey done at Africallia 2016

The previous results seem to show a higher entrepreneurial ability of the entrepreneurs who did not go to university, because those that were able to pay back their investments in less than 1 year, were in a higher percent than the university attendees.

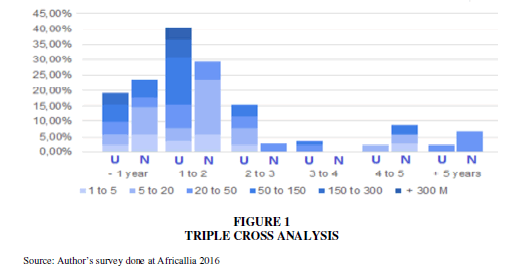

That led us to make a triple cross-analysis of the recovery time of the first investment with the amount of the first loan obtained and the two educational profiles. We obtained the following Figure 1.

Triple Cross Analysis

University attendees (U) and Non university attendees (N): crossing of “amount of the first loan (M= Millions)” vs “first loan recovery time (years)” by percent of respondents.

The darker is the color indicates the higher is the loan obtained. The percentages are for each of the group of respondents separately. We can see that even the percent of fast payback of entrepreneurs not gone to university (N) is slightly the highest when loan payback was less than 1 year, the amounts of the loans are significantly less than the ones obtained by the entrepreneurs with a university profile (U). And for the loans repaid during the 2 following years, the entrepreneurs who went to university obtain much higher loans than entrepreneurs not gone to university. Therefore, it is still the entrepreneurs who went to the university who demonstrate greater capacity in the loan management of their companies. It could be as says Coleman (2004) that not having been to university implies less confidence in obtaining bank loans. On the other hand, this author does not see any relation between the educational level and the size of the loan.

Results Concerning Sales Management Efficiency

Hypothesis H2 of greater sales management effectiveness is not validated:

The academic profile of the Burkina Faso entrepreneurs does not substantially influence the sales management results of the companies, that is to say that the belonging to the profile having done university studies achieved is not decisive to achieve business success.

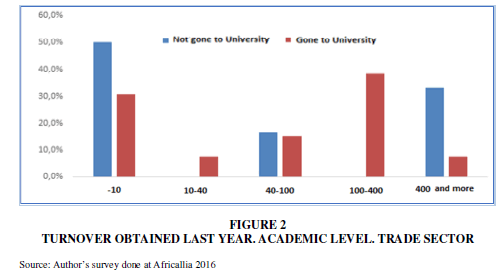

Turnover obtained in the last year (P41): With a reliability of 95%, given a p-value equal to 0.189, we cannot reject the null hypothesis that there is no difference between the 2 categories of entrepreneurs with respect to the turnover obtained in the last year since the two profiles are statistically similar. In fact, both profiles obtained Figure 2 higher than 400 M, even though in the range of 100 M - 400 M, the entrepreneurs who went to university globally exceed the entrepreneurs who did not go to university by 15%, but with substantial differences according to the sectors. In turn, the lowest business figures are obtained by entrepreneurs who did not go to university, with 42.1% of them handling figures of less than 10 M, compared to if they went to university, which showed as 29.9% for this same statistic.

Although in the previous Table 7 it seems that as the level of turnover increases, the proportion of entrepreneurs who did not go to university decreases, very different results are obtained according to each of the economic sectors. What we can see in the following graph explains the results for the trade sector. There are in fact, many small merchants without academic studies, while the largest earnings (+400 million turnovers in Burkina Faso) correspond to entrepreneurs who did not go to university:

| Table 7 Turnover According To Educational Profile |

||||||

|---|---|---|---|---|---|---|

| Turnover obtained last year (millions XOF) | ||||||

| – 10 | 10 – 40 | 40 – 100 | 100 - 400 | +400 | ||

| Not gone to university | N | 16 | 8 | 6 | 4 | 4 |

| % | 42,1% | 21,1% | 15,8% | 10,5% | 10,5% | |

| Gone to university | N | 20 | 7 | 14 | 17 | 9 |

| % | 29,9% | 10,4% | 20,9% | 25,4% | 13,4% | |

| TOTAL | N | 36 | 15 | 20 | 21 | 13 |

| % | 34,3% | 14,3% | 19,0% | 20,0% | 12,4% | |

Source: Author’s survey done at Africallia 2016.

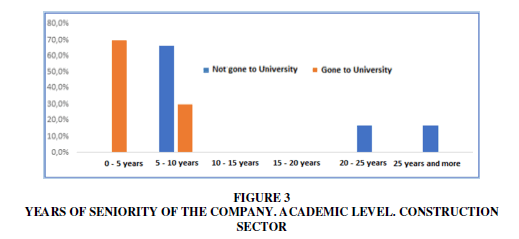

Years of company seniority (P05): With a reliability of 95%, given a p-value equal to 0.312, we cannot reject the null hypothesis that there is no difference between Entrepreneurs who did not go to university and those who did, with respect to the seniority of the companies of the Burkina Faso entrepreneurs, since the two profiles are statistically similar.

Results of Table 8 show that companies with seniority less than 5 years have been mainly created by entrepreneurs gone to university, while companies that are older than 5 years have been created mostly by entrepreneurs who did not attend university. The result is consistent with Kormodo (2018), which indicates that, in Burkina Faso, the individuals who create more companies and persevere more in the face of adversity have a low academic level. This is especially evident in the construction and public works sector, (BTP in French) as we see below. We understand seniority as a synonym of survival. And survival has been reported by Zontanos & Anderson (2004) difficult in the Western World, with 2/3 failures in the first 10 years of company life, but it is worse in the African context with 72% of failures in 5 years in Cameroon. In the case of Guinea Conakry Doumbouya (2011) says that the average lifetime of an enterprise is 8, 7 months (Albagli & Hénault, 1996).

| Table 8 Seniority Of The Company |

||||||||

|---|---|---|---|---|---|---|---|---|

| 0-5 years | 5-10 years | 10-15 years | 15-20 years | 20-25 years | +25 years | TOTAL | ||

| Not gone to university | N | 9 | 14 | 7 | 3 | 4 | 1 | 38 |

| % | 23,7% | 36,8% | 18,4% | 7,9% | 10,5% | 2,6% | 100,0% | |

| Gone to university | N | 28 | 19 | 12 | 3 | 2 | 3 | 67 |

| % | 41,8% | 28,4% | 17,9% | 4,5% | 3,0% | 4,5% | 100,0% | |

| TOTAL | N | 37 | 33 | 19 | 6 | 6 | 4 | 105 |

| % | 35,2% | 31,4% | 18,1% | 5,7% | 5,7% | 3,8% | 100,0% | |

Source: Author’s survey done at Africallia 2016

The Construction Sector, in which there is a lot of business risk and low profit margins, is dominated by seniority of enterprises whose entrepreneurs did not go to university. 33.4% of companies owned by them are over 20 years old and 100% of the companies have an age of at least 5 years. In the case of entrepreneurs who went to university, it seems that they have only entered the sector in the last 10 years, and that may be due to the increasing demands for civil liability and fulfilment of quality rules in construction procedures and materials (Figure 3).

Discussion

Why education level helps business success through financial management efficiency and not by commercial management efficiency?

In the construction sector, the resilience of the senior entrepreneurs has probably given them a valuable political and business contacts agenda, to compensate their lack of education level, but Carbonell et al. (2020) have found that in Burkina Faso, construction enterprises and especially the biggest use to hire high skilled workers through modern recruitment ways, and that increases their competitiveness (Hausman, 2005).

In the trade sector, the senior entrepreneurs probably not care about their lack of education level, especially because Burkina Faso does barely not export any added value merchandise (where being skilled would be necessary to compete internationally), as Carbonell et al. (2020) explain. They explore the turnover and the activity of the 500 biggest enterprises of the country: exports are raw materials, and imports are finished products, where networks and contacts are crucial to distribute them. It is not a casualty if Akouwerabou et al. (2015) inform that most of the SMEs participating in the government’s tender invitations believe that it is impossible to win a government contract in Burkina Faso without giving bribes, so they do, even they publicly deny (Haapio, 2006).

We have a final argument to consider when we reject hypothesis H2: The possible explanation for the success of entrepreneurs, who did not go to university, could be attributed to the cumulative effect of a long learning process that started by beginning working during school age. Thus, as the Maison de l'Entreprise du Burkina Faso (2015) indicates, entrepreneurs without academic studies had time to fail in various trades before becoming successful in a specific activity. Taking in account that entrepreneurs in USA before 1975 were less educated than now, these findings are like those of Douglass (1976) whose correlation between entrepreneurs’ growth of sales and educational level was not significant, even though she found that enterprises leaded by entrepreneurs with a degree in business administration or economics got surprisingly very bad sales results in comparison with other majors.

Conclusion

Our research has shown an important cause-effect relationship between the raising of the level of studies achieved of Burkinabe entrepreneurs and a better financial management of their companies. The Chi -square analysis leads to the acceptance of the loan management efficiency hypothesis, which indicates that educational level has a decisive influence on the variables selected for this study (the amount of the first loan obtained and the repayment period of the first investment). Although in line with our study has not been able to demonstrate that the raising of the level of studies achieved also led to better commercial results. The Chi square analysis does not allow us to validate the hypothesis of sales management efficiency in relation to the turnover of the companies or their lifetime, which indicates that university does not necessarily lead to a successful business or that it is not necessary to go to university to be a successful entrepreneur. Or also that a large quantity of business experience without university knowledge is worth as much or more than the latter.

In relation with sales management efficiency arrive at a lapidary conclusion: “The degree of training is unrelated to selling performance”. What is certain is that academic studies alone are not enough to successfully run a company in Africa, which encourages us to support, together, hybridization as a source of business success, that is, the learning of techniques of modern management with a paternalistic leadership with a social perspective, typical of African society, particularly that of Burkina Faso.

Recommendations for Entrepreneurs: Become skilled in financial management seems crucial for African entrepreneurs and if that were not possible, as suggest, the need could be palliated by appropriate recruitment of university staff. The firms who are seeking external finance should improve their skills in preparing projects as well as their financial statements.

Recommendations for the government of Burkina Faso: The article suggests that promoting the largest access to university studies will be useful to the health of existing companies and to future ventures.

Recommendations for researchers: This study is based on the perceptions received from the survey carried out. It would have been more convincing to also have contrasting quantitative data on the companies interviewed (number of workers, exact turnover, international trade...) and to study the difficulties they had in obtaining loans. It would also be useful to check the validity of the findings of this study in other countries in Africa.

Acknowledgements

The researcher wants to thank the editorial board of the journal and Jesus Briceño for his help and support, in particular for statistical calculations, and Dr. Théophile Nasse and Dr. Lucas Van Wunnik for their useful critical reviews.

Conflict of Interest Statement

No conflict of interest has been declared by the authors.

Funding

The researcher has not received any support for the publication of this paper.

References

ACCA (The Association of Chartered Certified Accountants) (2016). Financial management and business success. Online guide for entrepreneurs.

Akouwerabou B.D & Denis, A. B., & Bako, P. (2015). Corruption effects on private enterprises productivity in developing countries: Firm level evidence from Burkina Faso.British Journal of Economics, Management & Trade,6(2), 129-144.

Albagli C. & Hénault G. (1996). Business creation in Africa. EDICEF. Vanves (France).

Al-Mabrouk, K. (2006). Critical success factors affecting knowledge management adoption: A review of the literature. Innovations in Information technology 1–6.

Al-Zubeidi, M. (2005). Higher Education and Entrepreneurship: The Relation between College Educational Background and Small Business Success in Texas. PhD Thesis. University of North Texas.

BAD. (2019). Banque Africaine de Développement. Perspectives économiques en Afrique 2019.

Banerjee, A.V. & Duflo, E. (2014), “Do firms want to borrow more? Testing credit constraints using a directed lending program”, The Review of Economic Studies, 81(2), pp. 572-607.

Boynton, A.C., & Zmud, R.W. (1984). An assessment of critical success factors.Sloan management review,25(4), 17-27.

Cantillon, R. (1959). Essai sur la Nature du Commerce en Général, edited with an English translation by Henry Higgs, London: The Royal Economic Society by Macmillan and Company, 1931.Reissued London: The Royal Economic Society by Frank Cass and Company, Ltd.

Carbonell, N., Nassè, T.B., & Akouwerabou, D. (2020). African economic paradox: industrialization creating jobs and added value or active participation in global value chains: what solutions to develop for the less advanced and landlocked countries like Burkina Faso?International Journal of Advanced Economics,2(1), 1-20.

Indexed at, Google Scholar, Cross Ref

Carbonell, N., Nassè, T.B., & Nanéma, M. (2021). Examining the key success factors in Africa based on 3 aspects: adaptation, efficiency and strategic positioning from a survey on entrepreneurs in Burkina Faso.International Journal of Advanced Economics,3(1), 1-9.

Coleman, S. (2004). Access to debt capital for women-and minority-owned small firms: does educational attainment have an impact? Journal of developmental entrepreneurship,9, 127-144.

Collier P., Gregory N. & Ragoussis A. (2019). Pioneering Firms in Fragile and Conflict-Affected States. Policy Research Working Paper nº 8774. IFC – World Bank Group. Washington (USA).

Collins, O.F. & Moore, D.G. (1964). The Enterprising Man. Michigan State University, East Lansing (USA).

Cooper, A.C. (1981). Strategic management: New ventures and small business.Long range planning,14(5), 39-45.

Indexed at, Google Scholar, Cross Ref

Cooper, A.C. (1993). Challenges in predicting new firm performance.Journal of business venturing,8(3), 241-253.

Indexed at, Goggle Scholar, Cross Ref

Dahmen, P., & Rodríguez, E. (2014). Financial Literacy and the Success of Small Businesses: An Observation from a Small Business Development Center.Numeracy: Advancing Education in Quantitative Literacy,7(1).

Indexed at, Google Scholar, Cross Ref

Damodaran, L., & Olphert, W. (2000). Barriers and facilitators to the use of knowledge management systems.Behaviour & Information Technology,19(6), 405-413.

Indexed at, Goggle Scholar, Cross Ref

De Clercq, D., Lim, D.S., & Oh, C.H. (2014). Hierarchy and conservatism in the contributions of resources to entrepreneurial activity.Small Business Economics,42(3), 507-522.

Diwan, I., & Rodrik, D. (1992). Debt reduction, adjustment lending, and burden sharing.

Douglass, M.E. (1976). Relating education to entrepreneurial success.Business Horizons,19(6), 40-44.

Indexed at, Google Scholar,Cross Ref

Doumbouya, M.L. (2011). Entrepreneurial Survival in Africa: The Case of Guinean Enterprises.Mondesen development,155(3),125-140.

Fukunishi T. (2004). International Competitiveness Manufacturing Firms in Sub-Saharan Africa. Discussion Paper nº2. Institute of Developing Economies. JETRO. Chiba (Japan).

Ganassali, S. (2009). Questionnaire surveys with sphinxes.

Gyanwali, M. (2019). SME Growth in a Recession: What Does a Growing Business Tell?.Open Journal of Business and Management,8(01), 208.

Haapio, H. (2006). Business success and problem prevention through proactive contracting.A Proactive Approach, Scandinavian Studies in Law,49, 149-194.

Halani, P.R. (2015). Financing of Working Capital Loan and Advance Management. Kaav International Journal of Economics, Commerce & Business Management. 2(3).

Hampel-Milagrosa, A., Loewe, M., & Reeg, C. (2015). The entrepreneur makes a difference: Evidence on MSE upgrading factors from Egypt, India, and the Philippines.World Development,66, 118-130.

Hausman, A. (2005). Innovativeness among small businesses: Theory and propositions for future research.Industrial marketing management,34(8), 773-782.

Indexed at, Google Scholar, Cross Ref

Hébert, R.F., & Link, A.N. (1989). In search of the meaning of entrepreneurship.Small business economics,1(1), 39-49.

Hultink, E.J., & Atuahene-Gima, K. (2000). The effect of sales force adoption on new product selling performance.Journal of Product Innovation Management: An International Publication of the Product Development & Management Association,17(6), 435-450.

Johnston, M.W. & Marshall, G.W. (2013). Sales Force Management: Leadership, Innovation, Technology. Taylor & Francis. Abingdon (UK).

Indexed at, Google Scholar, Cross Ref

Kamdem, E., Mutabazi, E., Biboum, A.D., Nkakleu, R., Fotsing, l.T., Njoda, M.T. & Meziani, M. (2017). Filemanagement en Afrique: entre universalité et contingence.Cahiers de l’IREA, (17), 17-24.

Kay, J. (1994).Fundamentos del éxito empresarial: el valor añadido de la estrategia. Ariel.

Kolstad I. & Wiig A. (2015). Education and entrepreneurial success. Small Business Economics Vol. 4.

Indexed at, Google Scholar, Cross Ref

Kormodo R. (2018) Analyse de la dynamique des créations d’entreprises au Burkina Faso (1980-2017). Mémoire de Master. Institut International de l’Eau et de l’Environnement (2ie). Ouagadougou (Burkina Faso).

Kusi, B.A., & Opoku-Mensah, M. (2018). Does credit information sharing affect funding cost of banks? Evidence from African banks.International Journal of Finance & Economics,23(1), 19-28.

Kuzheliev M. & Kovalova K. (2019). Theoretical aspects of credit management of enterprises. Economics and government. 12. pp. 55-60.

Larson, C.M. & Clute, R.C. (1979). The failure syndrome. American Journal of Small Business, 4, 35-43.

Linares Fontela, J. (2003). Herramienta 10-Guía para diseñar encuestas. En B. Branch, & J. Klaehn, El logro del equilibrio de las microfinanzas (pp. 327-336).

Lussier, R.N., & Pfeifer, S. (2001). A crossnational prediction model for business success.Journal of small business management,39(3), 228-239.

Indexed at, Google Scholar, Cross Ref

Marshall, A., Sauvaire-Jourdan, F., & Bouyssy, F.S. (1906).Principes d'économie politique(p. 137). V. Giard & E. Brière.

Indexed at, Google Scholar, Cross Ref

McGahan, A.M. (1999). The performance of US corporations: 1981–1994.The Journal of Industrial Economics,47(4), 373-398.

Indexed at, Google Scholar, Cross Ref

McKenzie, D., & Sansone, D. (2019). Predicting entrepreneurial success is hard: Evidence from a business plan competition in Nigeria.Journal of Development Economics,141, 102369.

Indexed at, Google Scholar, Cross Ref

Mehou Hounsou, M.R. (2020).Impacts des sources de financement sur le résultat des projets d’entrepreneuriat(Doctoral dissertation, Université du Québec à Chicoutimi).

MkNelly, B., & Kevane, M. (2002). Improving design and performance of group lending: Suggestions from Burkina Faso.World Development,30(11), 2017-2032.

Indexed at, Google Scholar, Cross Ref

Nafziger, E.W., & Terrell, D. (1996). Entrepreneurial human capital and the long-run survival of firms in India.World Development,24(4), 689-696.

Indexed at, Google Scholar, Cross Ref

Nguyen, S., & Wolfe, S. (2016). Determinants of successful access to bank loans by Vietnamese SMEs: new evidence from the red river delta.Journal of Internet Banking and Commerce,21(1), 1.

Ngwenyama, O., Andoh-Baidoo, F. K., Bollou, F, & Morawczynski, O. (2006). Is there a relationship between ICT, health, education and development? An empirical analysis of five West African countries from 1997–2003.The Electronic Journal of Information Systems in Developing Countries,23(1), 1-11.

Indexed at, Google Scholar, Cross Ref

Niankara, I., & Traoret, R.I. (2019). Formal education and the contemporaneous dynamics of literacy, labour market participation and poverty reduction in Burkina Faso.International Journal of Education Economics and Development,10(2), 148-172.

Nkakleu, R., Tidjani, B., Mefoute, A., & Biboum, A. (2013). Compétences des entrepreneurs et performance des PME en démarrage: la structure d’accompagnement a-elle un impact en contexte camerounais?. Actes, XXIVème congrès de l’AGRH, Paris.24e congrès de l’AGRH.

Nkomo, S.M. (2015). Challenges for management and business education in a “Developmental” state: The case of South Africa.Academy of Management Learning & Education,14(2), 242-258.

Ohlson, J.A. (1980). Financial ratios and the probabilistic prediction of bankruptcy.Journal of accounting research, 109-131.

Indexed at, Google Scholar, Cross Ref

Olawale, L.S., Ilo, B.M., & Lawal, F.K. (2017). The effect of firm size on performance of firms in Nigeria.Aestimatio: The IEB International Journal of Finance, (15), 68-87.

PAES (2018). Cadre de Gestion Environnementale et Sociale (CGES) du Projet d’Appui à l’Enseignement Supérieur. Ministère de l’Enseignement Supérieur, de la Recherche Scientifique et de l’Innovation. Ouagadougou (Burkina Faso).

Pearson K: (1900). On a criterion that a given system of deviations from the probable in the case of correlated system of variables is such that it can be reasonably supposed to have arisen from random sampling. Philosophical Magazine 1 p. 157. London (United Kingdom).

Peterson, R.A., Kozmetsky, G., & Ridgway, N.M. (1983). Perceived causes of small business failures: a research note.American journal of small business,8(1), 15-19.

Indexed at, Google Scholar, Cross Ref

Pilon, M., & Wayack, M. (2003).The democratization of education in Burkina Faso: what can we say about it today?African Studies Notebooks,43(169-170), 63-86.

Ramde, Z. (2020). Determinants of business companies economic performance in Burkina Faso.African Journal of Business Management,14(1), 35-52.

Indexed at, Google Scholar, Cross Ref

Robinson, P.B., & Sexton, E.A. (1994). The effect of education and experience on self-employment success.Journal of business Venturing,9(2), 141-156.

Indexed at, Google Scholar, Cross Ref

Robson, P.J., & Obeng, B.A. (2008). The barriers to growth in Ghana.Small Business Economics,30(4), 385-403.

Robson, P.J., Haugh, H.M., & Obeng, B.A. (2009). Entrepreneurship and innovation in Ghana: enterprising Africa.Small business economics,32(3), 331-350.

Samouel, B., & Aram, B. (2016). The determinants of industrialization: Empirical evidence for Africa.European Scientific Journal,12(10), 219-239.

Indexed at, Google Scholar, Cross Ref

Sogbossi Bocco, B. (2010). Perception de la notion de performance par les dirigeants de petites entreprises en Afrique. La Revue des Sciences de Gestion, 241(1).

Indexed at, Google Scholar, Cross Ref

Sow A. (2013). La contribution de l’éducation à la croissance économique du Sénégal. Doctorate Thesis. Université de Bourgogne (France).

Stiglitz, J.E., & Weiss, A. (1981). Credit rationing in markets with imperfect information.The American economic review,71(3), 393-410.

Van der Sluis, J., Van Praag, M., & Vijverberg, W. (2005). Entrepreneurship selection and performance: A meta-analysis of the impact of education in developing economies.The World Bank Economic Review,19(2), 225-261.

Indexed at, Google Scholar, Cross Ref

Veciana, J.M. (2005). La creació d’empreses.UN enfocament gerencial. Collecció d’estudis econòmics, (3).

Vesper, K.H. (1990). New venture strategies.University of Illinois at Urbana-Champaign's Academy for entrepreneurial leadership historical research reference in entrepreneurship.

Zelleke, G., Sraiheen, A., & Gupta, K. (2013). Human capital, productivity and economic growth in 31 sub-saharan African countries for the period 1975–2008.International Journal of Economics and Finance,5(10), 1-17.

Indexed at, Google Scholar, Cross Ref

Received: 30-Nov-2021, Manuscript No. IJE-21-10123; Editor assigned: 01-Dec-2021, PreQC No. IJE-21-10123(PQ); Reviewed: 22-Dec-2021, QC No. IJE-21-10123; Revised: 26-Jan-2022, Manuscript No. IJE-21-10123(R); Published: 02-Feb-2022