Research Article: 2019 Vol: 23 Issue: 1

Applied Market Research of New Food Products Entering Domestic Market: A Case Study of a South Ameraican Food Company Entering Australian Food Market

Yuxi Huan, Changzhou University

Zhan Huan, Changzhou University

Abstract

The case of a South American food company (their product is a traditional South American food, empanada) is used by the research project report to explore challenges that companies may face when entering new markets and relevant solutions are offered to attract local consumers with new foods through three aspects: (1) Clarifying existing consumer’s attitudes and perception towards new foods; (2) Confirming its competitors and seizing its market share; (3) Understanding involved consumer’s behaviors and ascertaining barriers and motivators which impact the relationship between new foods and consumers. Related secondary and academic literature is explored by us and then we put forward the exploratory-descriptive design. At the exploratory design step, research methods of qualitative with data collected from relevant interviews are used by us. Although competitors are impeding empanada’s development of empanadas in Australian food market, it is more significant for the company to improve local consumer’s product awareness, which may significantly change their preferences. If consumers learn more about new brands and products, they may make them the first preferred products in their minds during purchasing process. The first product that can be added into consumer's mind can make the company gain more share in this market and this may also become one important reason for beating its competitors. INTRODUCTION From Jumiati

Introduction

From Jumiati & Suki’s research (2015), product awareness and brand awareness are popular choice tactics for inexperienced consumers in their purchasing process. These two types of awareness can be used to make purchasing decisions when consumers are affected by different types of promoting information. Imprinting products and brand’s images clearly in target consumer’s minds can make it easier for companies to capture more market share in a short time and developing brands and products awareness also can help them improve consumer’s product preferences when entering into new markets. Hence, lack of product and brand awareness may bring negative impact to target consumer’s preferences and attitudes to new products in a foreign market.

For the aim of entering Australian food market, this South American company chooses to build its first store in Australian capital-Canberra. Australian National University’s restaurant places are finally determined by the company to be the location of its first store because of its increasing food demand from staffs and students. Recently, this company is aiming at expanding its market share in Australia, the short-term goal of this company is to develop more branches in Canberra and their long-term goal (within five years) is to gain the first Empanada business franchise in their new market-Australia food market.

Although this company has stable sales quantities and market share in South American, a series of marketing troubles they are facing in foreign country-Australian food market. For instance, domestic consumers are not familiar with this brand and the food of empanada and there are lots of competitors in local market. Through the research of this paper, these obstacles can mainly be concluded as lack of consumer awareness and preference of products and brands.

Lack of products and brand awareness make it more difficult for consumers to generate deep image of products and brands, which will further decrease target consumer’s loyalty to the foreign brand and the new food in local food market. Moreover, consumer loyalty will affect consumer’s purchasing decisions and preferences (Jumiati & Suki, 2015).

After initial analysis of the research company, relevant research problems are explored and defined by us and the purpose of research is to explore reasons of lack of preferences and awareness of new food among domestic consumers. Finally, relevant solutions are offered to engage domestic consumer’s preferences for new products and brands.

Literature Review

Definition of Brand Awareness

Awareness of brand and product are degree of consumer’s awareness of brands and relevant products. Marketing and promoting products and brands can use the method of creating brand awareness as important steps when launching new brands, services and products. Excellent brand awareness can make corporations differentiate themselves from competitor’s services and products (Aaker, 1996).

Definition of Brand Perception

The "five-star" conceptual model of brand perception was proposed by Aaker (1996) to explain the conception of "brand value". Four segments of brand building are widely recognized worldwide in this theory: brand recognition, brand perception, brand association and brand loyalty.

From the model of Aaker, brand perception is defined as the overall impression of consumers on the quality of brands, which includes function, reliability, characteristics, service, durability, evaluation and appearance. Moreover, brand perception is the basis of brand differentiation and brand extension and studies show that consumer’s affirmation of brand quality can bring higher market share and better development opportunities for brands.

Consumer Decision-Making Process Model

Consumer behavior can be defined as a behavior that consumers present when searching for, buying, using and evaluating of services or products that they hope will meet their demands (Schiffman et al., 2014).

Researchers Schiffman et al. (2014) indicate that consumer behavior is mainly affected by two aspects. The first aspect is external influences, including culture, socioeconomic level, reference groups and households; and the second aspect is internal influences, including personal demands and motives, experience, personality and self-image and perception and attitude.

On the other hand, Consumer decision-making’s process is complex because it depends on consumer’s attitude on evaluating, selecting, comparing purchasing different types of products. Cox et al. put the Five Stage Model in 1983 is one of the most famous marketing theory models of the process of consumer decision-making, which includes need recognition and problem, evaluation of information search, alternatives, post-purchase evaluation and purchase decision.

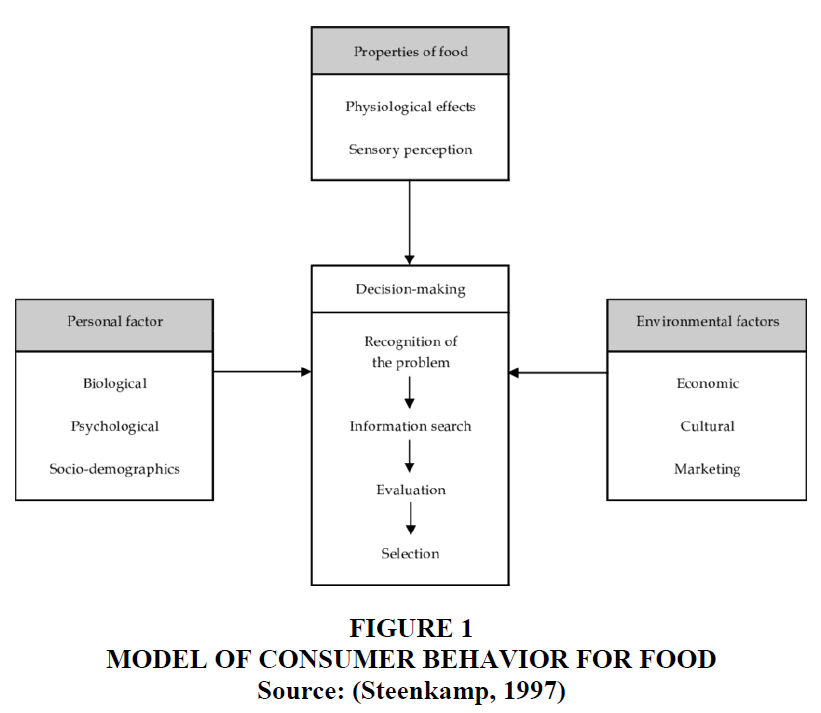

In terms of specific problems of this research, consumer’s preferences in the area of Canberra on empanada can be thought as consumer’s willingness of decision to purchase new foods. Figure 1 (Steenkamp, 1997) shows that consumer’s decision-making process of purchasing food can be impacted by personal and environmental factors, food’s properties and these three dimensions can be considered as consumer’s awareness on new foods. For example, cultural factors can impact consumer’s decision-making process when they are unfamiliar with cultures of new foods and lack of product messages may also decrease consumer’s willingness to buy this new food.

Research Methodology

Empanada is a type of pastry baked or fried in Hispanic cultures. Its name comes from the Spanish verb and is made by folding dough over a stuffing, such as meat, cheese, corn or other ingredients.

The South American company focuses on selling empanada and is aiming at quickly occupy local food market. Furthermore, its manager decides to enter Australian food market and choose Canberra as the location of its first store.

Therefore, the research is conducted at Canberra, the capital city of Australia. Canberra has around 410,301 populations and is located at the northern end of the Australian Capital Territory (ACT), which owns convenient transport systems.

Seven questions are put forward in the research for further exploration into consumer’s attitudes and preferences on the new food (Empanada) in Canberra food market, which are shown in Table 1.

| Table 1 Research Question’s Lists |

|

| 1 | How do Canberra consumers perceive empanadas? |

| 2 | What are the food products empanadas are perceived to be similar to by Canberra customers? |

| 3 | How do consumers position empanadas in comparison to these other food products? |

| 4 | When would consumers prefer eating empanadas? |

| 5 | What would motivate a potential consumer to try an empanada? |

| 6 | What are the barriers to acceptance of empanadas among Canberra consumers? |

| 7 | What promotes loyalty to this brand among existing customers? |

Data Collection

The research collects primary data to obtain insight into problems under specific context. The main purpose of the research is to find out factors that affect consumer’s preference and awareness of empanada from ACT customers and evidence is prepared for further recommendations and research.

Hence, exploratory-descriptive research design is adopted in this research because the exploratory design helps us to gain background messages, express research problems for further investigation and address these problems of “what and how”. Meanwhile, descriptive design could be used to capture abundant data and information about recent situation and focused population of sample (12 Major Types of Research Designs, 2016).

We use interview surveys and online questionnaire surveys as two main methods to collect data. In the step of interview surveys, ten individual respondents are conducted by us and their answers are screened and reorganized as the reference material of following online questionnaire. In the step of online questionnaire surveys, all Australian residents in the area of ACT are invited by us to join the survey. 244 pieces of questionnaires that answered by ACT residents are collected by us, in which 135 pieces of feedback are considered as valid and finally being used in our following analysis.

These samples can be mainly divided into two types: existing consumers and potential consumers and both types of consumer’s present huge research value. Through analyzing respectively from these two aspects, the overall brand awareness of this company among Australian consumers can be determined, while the information of perceived brand value from existing consumers can also be obtained.

Consumers who have eaten this food can give useful feedback to the brand perception, such as their criticism, praise and brand image and product description for us to further exploring methods of strengthening existing consumers and develop their brand loyalty.

On the other hand, consumers who not eaten this food can also give responses to the whole brand awareness, such as providing enough information about description of similar foods, degree of interest to try this food or expectation of this new food to help us better understand local consumer’s attitudes and preferences to unfamiliar foods, which can become basics of confirming competitors, developing potential consumers and rapidly expanding market share in the future.

Qualitative Research

In terms of the exploratory design, qualitative research method is adopted in this research. Qualitative research methods are used by us in this research to explore the certain phenomena. At the initial stage of this research, qualitative research methods make it easier to better understand problem’s context and guide the following research. Semi-structured interview is used in this research to collect the qualitative data.

In the process of the interview, leading every interview question to encourage our respondents to express more about their experience with topics is taken by us. Every interview takes around 10 to 20 minutes and audio data is translated into transcript by us after the whole interview.

The sampling frame includes all Australian residents in the area of ACT and 10 individual respondents are conducted by us through the type of interview. The following demographic Table 2 is provided by us for sampling units.

| Table 2 Demographic Summary For Interview Sampling Units |

||

| Sample Size N=10 | Frequency | |

| Age | 20 to 29 | 6 |

| 30 to 39 | 2 | |

| 40 to 49 | 2 | |

| Gender | Female | 6 |

| Male | 4 | |

| Annual Income | Lower than 30k AUD | 4 |

| 30k AUD to 100K AUD | 4 | |

| More than 100 k AUD | 2 | |

| Employment Status | Student | 3 |

| Full-time employee | 4 | |

| Part-time employee | 1 | |

| Others | 2 | |

On the other hand, for the specific studies of existing consumers, data have been screened by us as following Table 3, in which 7 residents who are existing consumers of this brand are gathered together.

| Table 3 Demographic Summary For Survey Sampling Units |

||

| Sample Size N=7 | Frequency | |

| Age | 20 to 29 | 3 |

| 30 to 39 | 2 | |

| 40 to 49 | 2 | |

| Gender | Female | 4 |

| Male | 3 | |

| Annual Income | Lower than 30K AUD | 2 |

| 30K AUD TO 100K AUD | 3 | |

| More than 100K AUD | 2 | |

| Employment Status | Student | 2 |

| Full-time employee | 2 | |

| Part-time employee | 1 | |

| Others | 2 | |

Quantitative Research

In terms of the descriptive design, quantitative research method is adopted in this research. Quantitative research methods focus on quantifying data and conducting numerical analysis. Hence, online questionnaire surveys and relevant data analysis on SPSS software are used in this research to collect quantitative data.

For the quantitative research, online questionnaire surveys are adopted by us to collect quantitative data. The sampling frame includes all Australian residents who live in Canberra and have no South American background. Convenient sampling method (one type of biased probability sample method) is chosen by us due to time and resources limitations.

Our online questionnaire survey is designed based on literature review and previous interview data. Questions are structured and designed for collecting respondent’s demographic messages, measuring consumer’s food significance perception, experience, awareness, perception of empanada and consumer’s loyalty level to this food.

The questionnaire includes about fifty specific questions, in which 5 of them are open-ended question and residents can complete the survey in 10 to 15 minutes.

After collecting data from the online questionnaire survey, these quantitative survey data are analyzed on SPSS software with different analysis methods, such as independent sample t-test, descriptive analysis, linear regression and factor analysis, etc.

The online questionnaire survey is distributed by us via Canberra-specific Facebook public groups, such as Capital Region Farmers Market and ANU Schmitt Posting. Out of 244 responses, 135 valid feedbacks of respondents are provided to us and the demographic table is provided by us for our sampling units as Table 4.

| Table 4 Demographic Summary For Survey Sampling Units |

||

| Sample Size N=135 | Frequency | |

| Age | 18 To 24 | 52 |

| 25 To 34 | 28 | |

| 35 To 44 | 18 | |

| 45 To 54 | 19 | |

| Above 54 | 18 | |

| Gender | Female | 94 |

| Male | 38 | |

| Others | 3 | |

| Employment Status | Student | 38 |

| Full-time employee | 39 | |

| Part-time employee | 36 | |

| Others | 21 | |

Moreover, for the following research on existing consumers, 71 residents are screened and determined from the whole 135 valid feedback, which is shown in the Table 5.

| Table 5 Demographic Summary For Survey Sampling Units |

||

| Sample Size N=71 | Frequency | |

| Age | 18 to 24 | 25 |

| 25 to 34 | 15 | |

| 35 to 44 | 9 | |

| 45 to 54 | 12 | |

| Above 54 | 10 | |

| Gender | Female | 53 |

| Male | 16 | |

| Others | 2 | |

| Employment Status | Student | 21 |

| Full-time employee | 25 | |

| Part-time employee | 15 | |

| Others | 10 | |

Results And Discussion

Brand Awareness for General Population

Research question 1

In the step of interview, empanada’s initial perceptions from respondent’s thinking and opinions are collected by us and these textual data are initiatively and naturally gained from respondents without any hints and interferential viewpoints.

The results of content analysis are shown with Product Usage, Physical Surroundings, Social Surroundings, Task Definition, Temporal Perspectives and Antecedent States dimensions around empanadas. The result is shown as table in appendix.

The result shows that current perceptions of empanadas among Canberra consumers are individual-based and dispersive. It is difficult for us to generalize a whole perception of empanadas through viewing Canberra consumers as an overall community.

In the step of online survey, the Cross Tabulation as Table 6 is used in this question to correlate various demographic categories with the problem of “Do you know what an empanada is”.

| Table 6 Empanada Awareness Among Demographic Categories |

||||

| Do you know what an empanada is? | ||||

| Count | Yes | No | ||

| Gender | Male | 38 | 57.9% | 42.1% |

| Female | 94 | 73.4% | 26.6% | |

| Other | 3 | 66.7% | 33.3% | |

| Age | Under 25 | 52 | 82.7% | 17.3% |

| 25-44 | 46 | 60.9% | 39.1% | |

| Over 4 | 37 | 59.5% | 40.5% | |

| Employment | Student | 38 | 84.2% | 15.8% |

| Full- time/Self-Employment | 39 | 69.2% | 30.8% | |

| Part- time/Casual-Employment | 36 | 61.1% | 38.9% | |

| Others | 22 | 54.5% | 45.5% | |

| Total | 135 | 68.9% | 31.1% | |

From the table above, overall 68.9% of respondents understand what the empanada is and 31.1% of them do not know. Moreover, huge differences between various classifications in demographic categories of employment, gender and age appear in the analysis. Obviously, more students, females and respondents who less than twenty years old are more willing to learn about what an empanada is.

Research question 2

In this question, we gain direct-related data from “What other food products come to mind when looking at the above image?” Through coding and mention counting process of these data, we found that product’s rankings are perceived to become almost same as empanadas. After that, we select the most representative ones as following Table 7.

| Table 7 Food Products (Empanadas Are Perceived To Be Similar) |

||

| Rank | Products | Count |

| 1 | Pastries | 15 |

| 2 | Samosas | 11 |

| 3 | Curry Puffs | 9 |

| 4 | Meat pies | 7 |

| 5 | Dumplings | 4 |

| 6 | Apple turnovers | 3 |

| 7 | Croissants | 2 |

| 8 | Mexican food | 2 |

| 9 | Sausage rolls | 1 |

| 10 | Indian spice food | 1 |

| 11 | Tappas | 1 |

From rankings above, it is easy to find that Samosas and Pastries, Meat Pies and Curry Puffs are the highest mentioned foods because their rankings are significantly higher than other foods, which can be thought as foods like empanadas.

Research question 3

According to the analysis of grounded theory, qualitative interview data indicate that Canberra consumer’s empanada positioning is affected by factors of their post-purchase evaluation and perception of this product, including veggie options, price, serving size, variety of fillings and culture background. Meanwhile, majority of consumer’s position empanada as a type of quick meal option, heathier fast food option, party food and any-time snack.

Research question 4

Research question 4 is “When would consumers prefer eating empanadas?” which focus on existing consumers of empanada. Hence, specific analysis of this research question is shown in the “Brand Perception for Existing Consumers” section.

Research question 5

The Independent Sample T-test indicates that, for Canberra consumers who already have or have not eaten empanada before, there are huge differences in their mean food importance perception.

Hence, from Table 8, consumers in Canberra who have eaten empanada before will focus less on its price (mean=3.49) than those who not have eaten (mean=4.09) and Canberra consumers who have eaten empanada focus less on its brand (mean=2.25) than those who have not eaten (mean=2.68).

| Table 8 Group Statistics Of Independent Sample T-Test |

||||

| Tried Empanada? (Yes or Now) | N | Mean | Sig.(2-tailed) | |

| Brand | Y | 71 | 2.25 | 0.049 |

| N | 22 | 2.68 | ||

| Price | Y | 71 | 3.49 | 0.001 |

| N | 22 | 4.09 | ||

| Others | Y | 71 | - | Sig>0.05 |

| N | 22 | - | ||

The Crosstab analysis in Table 9 shows that Canberra consumers understand empanada mainly from physical visit to its stores (N=33, 35.5%), recommendations from their friends and their family (N=20, 21.5%) via all channels, people who understand empanada from visiting physical stores have the highest chance to try this product.

| Table 9 Crosstab Statistics Of How Do Consumers Come To Know Empanadas |

|||

| How did you come to know about empanada? | How you ever tried an empanada? (“Tried”) | ||

| Yes | No | ||

| Physical visit to food store, N=33, (35.50%) | Count | 28 | 5 |

| % within channel | 84.40% | 15.20% | |

| Word of mouth from friends or family, N=20, (21.5%) | Count | 14 | 6 |

| % within channel | 70.00% | 30.00% | |

| Others (broadcast, newspapers and social media, e.g.) | Count | 29 | 11 |

| % within channel | 72.50% | 27.50% | |

| Total, N=93 | Count | 71 | 22 |

Research question 6

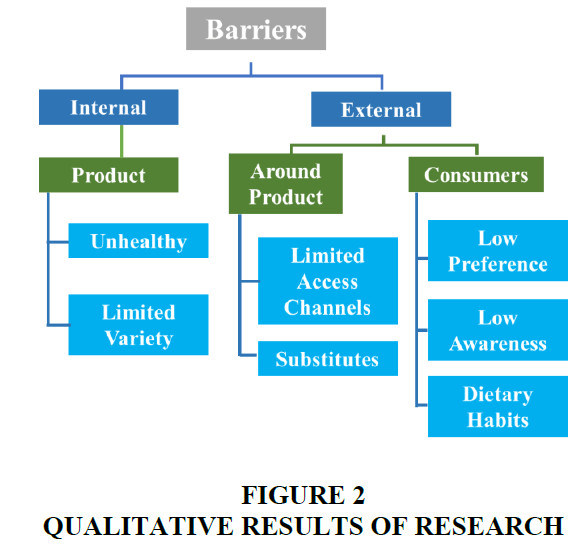

According to the analysis of grounded theory on relevant messages in interviews and responses to the problem “Could you please tell us why u did not try an empanada?” in online surveys, it is easy for us to find that factors that have bad influence on empanadas’ acceptance among Canberra consumers can be divided into external factors and internal factors, which as shown in Figure 2.

According to online surveys, important data of food attributes and respondent’s willingness to try new foods are used in the research of this question. Through testing correlation between above 2 variables, attributes negatively correlated to respondent’s willingness to try new foods can be obtained by us, which can indicate that the possible barriers of empanada’s acceptance.

By testing Pearson product moment correlation coefficient, we found that there is a significant correlation between mean willingness to try new food and the brand’s importance, while n=135, r= -0.192, Sig (2-tailed)=0.026. Meanwhile, we also found significant correlation with ninety-percent reliability between mean willingness to try new food and the importance of calories, in which n=135, r= -0.144, Sig (2-tailed)=0.095 and details of analysis results are shown in Table 10.

| Table 10 Barriers To Acceptance Of Empanadas |

||

| Factors | Mean Willingness to Try New Foods | |

| Importance-Brand | Pearson Correlation | -0.192 |

| Sig. (2-tailed) | 0.026 | |

| Importance-Calories | Pearson Correlation | -0.144 |

| Sig. (2-tailed) | 0.095 | |

Results above indicate that Canberra consumers who consider calories and brand as significant food attributes have low level of willingness to try new foods. The more significant the calories and brand are, the lower willingness of consumers to try the new food is. Moreover, for new products like empanadas, consideration of calories and brand can become main barriers to Canberra consumers' acceptance.

Research question 7

Research question 7 is “What promotes loyalty to this brand among existing customers?”, which focus on existing consumers of empanada. Hence, specific analysis of this research question is shown in the “Brand Perception for Existing Consumers” section.

Brand Perception for Existing Consumers

Research question 1

Collected data from survey’s perception questions are used by us to gain insights from various components of a perception. The analysis methods of Paired Sample T-test are used in this question to compare means of every component with empanada’s whole mean perceptions. There are huge differences among mean empanada perceptions and X, in which X1=Foreignness, X2=Tasty, X5=Healthy, X6=Variety of Flavors, X7=Availability, p ≤ 0.05 and n=75.

After screen and delete useless data, we found that feedback of empanadas is given from its existing consumers (71 existing consumers), consumers who do not know and have not eaten this food skipped these questions because of the setting of questionnaire. Hence, results of this research question are connecting with brand perception from existing consumers.

In Table 11, Paired Samples T-test results are shown clearly. Mean Empanada Perception is showed to be compared with the mean of every empanada perception’s component.

| Table 11 Paired Samples Statistics |

|||||||

| Mean | Count | Standard Deviation | Standard Error Mean | ||||

| Pair 1 | Perception-more flavors than other snack | 2.72 | 71 | 0.796 | 0.094 | ||

| Empanada attitude | 2.8394 | 71 | 0.37796 | 0.04486 | |||

| Pair 2 | Perception-offered by foreign food stores rather than local | 3.59 | 71 | 0.709 | 0.084 | ||

| Empanada attitude | 2.8394 | 71 | 0.37796 | 0.04486 | |||

| Pair 3 | Perception-offer more value for money than other food | 2.94 | 71 | 0.674 | 0.08 | ||

| Empanada attitude | 2.8394 | 71 | 0.37796 | 0.04486 | |||

| Pair 4 | Perception-tastier than other food | 3.14 | 71 | 0.816 | 0.097 | ||

| Empanada attitude | 2.8394 | 71 | 0.37796 | 0.04486 | |||

| Pair 5 | Perception-more visually appealing than other food | 3.01 | 70 | 0.789 | 0.094 | ||

| Empanada attitude | 2.8335 | 70 | 0.37742 | 0.04511 | |||

| Pair 6 | Perception-heathier than other food | 2.75 | 71 | 0.731 | 0.087 | ||

| Empanada attitude | 2.8394 | 71 | 0.37796 | 0.04486 | |||

| Pair 7 | Perception-more easily available than other food | 2.21 | 70 | 0.778 | 0.093 | ||

| Empanada attitude | 2.8353 | 70 | 0.37911 | 0.04531 | |||

| Indicators | Mean | Sig (2-tailed) | |||||

| Mean Empanada Perception | 2.91 | - | |||||

| Foreign food | 3.59 | 0.000 | |||||

| Tasty | 3.14 | 0.005 | |||||

| Visual Appealing | 3.01 | 0.155 | |||||

| Value for Money | 2.94 | 0.655 | |||||

| Healthy | 2.75 | 0.026 | |||||

| Variety | 2.72 | 0.017 | |||||

| Availability | 2.21 | 0.000 | |||||

It can be found that Mean Empanada’s perception is significantly lower than Tasty and Foreign Food’s mean and Mean Empanada Perception is significantly higher than Variety of Flavor’s mean and Healthy and Availability mean. Value for Money and Visual Appealing are deleted from results due to its low significance.

Research question 2

Research question 2 is “What are the food products empanadas are perceived to be similar to by Canberra customers?” which focus on general consumers of empanada. Hence, specific analysis of this research question is shown in the “Brand Awareness for General Population” section.

Research question 3

Research question 3 is “How do consumers position empanadas in comparison to these other food products?” which focus on general consumers of empanada. Hence, specific analysis of this research question is shown in the “Brand Awareness for General Population” section.

Research question 4

According to the data from surveys, we collected direct-related data from “How do you like to eat empanadas. In terms of given options, data is gathered within the five-level Likert-scale among respondents” preference on each option. We use One-sample T-test on each variable and found big differences among every comparison value and variable mean, while Comparison Value=3, n=67 and p ≤ 0.05.

Test’s results are clearly shown in Table 12 and the mean of every option which includes Breakfast, Lunch, Dinner, Quick Meal and Ay-time Snack Option are compared with comparison value of 3.

| Table 12 Preference Of Empanadas Eating Time |

||||||

| One-Sample T-test | ||||||

| Count | Mean | Standard Deviation | Standard Error Mean | |||

| When-Breakfast | 67 | 1.36 | 0.69 | 0.084 | ||

| When-Lunch | 69 | 2.13 | 0.999 | 0.12 | ||

| When-Dinner | 67 | 1.87 | 0.903 | 0.11 | ||

| When-Any-time snack | 69 | 2.45 | 1.105 | 0.133 | ||

| When-Quick meal option | 67 | 2.45 | 1.118 | 0.137 | ||

| Test Value=3 | ||||||

| t | df | Sig. (2-tailed) | Mean Difference | 95% Confidence Interval of the Difference | ||

| Lower | Upper | |||||

| When-Breakfast | -19.482 | 66 | 0 | -1.642 | -1.81 | -1.47 |

| When-Lunch | -7.232 | 68 | 0 | -0.87 | -1.11 | -0.63 |

| When-Dinner | -10.285 | 66 | 0 | -1.134 | -1.35 | -0.91 |

| When-Any-time snack | -4.139 | 68 | 0 | -0.551 | -0.82 | -0.29 |

| When-Quick meal option | -4.041 | 66 | 0 | -0.552 | -0.83 | -0.28 |

From analysis results, comparison value of 3 is bigger than whole eating empanada’s options, indicating that Canberra consumer’s preferences for eating this food are significantly less than the average figure. However, via comparing every option mean, it is easy for us to find that the mean of Quick meal and Any-time snack option is the closest to the comparison value, while the farthest one is breakfast mean.

Research question 5

Research question 5 is “What would motivate a potential customer to try an empanada?” which focus on general consumers of empanada. Hence, specific analysis of this research question is shown in the “Brand Awareness for General Population” section.

Research question 6

By testing Pearson product moment correlation coefficient, we found significant correlation with ninety-percent reliability between mean willingness to try new food and the importance of price, in which n=71, r= -0.221, Sig (2-tailed)=0.064 and details of analysis results are shown in Table 13.

| Table 13 Barriers To Acceptance Of Empanadas (Existing Consumers) |

|||

| Descriptive Statistics | |||

| Mean | St. Deviation | N | |

| Mean willingness to try | 3.7887 | 0.79130 | 71 |

| Importance-Price | 3.49 | 0.826 | 71 |

| Correlations | |||

| Mean willingness to try | Mean willingness to try | Importance-Price | |

| Person Correlation | 1 | -0.221 | |

| Sig. (2-tailed) | - | 0.064 | |

| N | 71 | 71 | |

| Importance-Price | Person Correlation | -0.221 | 1 |

| Sig. (2-tailed) | 0.064 | - | |

| N | 71 | 71 | |

Results above indicate that existing consumers who consider price as significant food attributes have low level of willingness to try new foods. The more significant the price is, the lower willingness of consumers to try the new food is. Moreover, for new products like empanadas, consideration of price can become the main barrier to existing consumer’s acceptance.

Research question 7

The linear regression of Canberra consumers empanada perceptions and whole consumers loyalty to this food (Table 14) indicate that there are significant relationships between consumer loyalty and food taste (ρ=0.430), between consumer loyalty and food healthiness (ρ=0.260), between consumer loyalty and food visual appearance (ρ=0.268) and between consumer loyalty and food easy availability (ρ= -0.213). Moreover, there are no significant relationships between other perception factors and consumer loyalty (foreign food’s variety, flavors and value). This model presents that 8.4% of dependent variable variance (R2=0.284).

| Table 14 Correlation Between Consumer’s Perceptions And Loyalty |

|||

| Correlation Statistics | |||

| Overall Loyalty | Person Correlation | Sig. (1-tailed) | |

| Tasty | 0.43 | 0 | |

| Healthy | 0.268 | 0.015 | |

| Visually Appealing | 0.26 | 0.013 | |

| Easily available | -0.213 | 0.039 | |

| Value | 0.104 | 0.198 | |

| Variety of flavours | 0.043 | 0.364 | |

| Foreign foods | -0.041 | 0.369 | |

| Model Summary | R Square | 0.284 | |

Hence, Canberra consumers who perceives food tastiness, visual appeal and healthiness, are tending to become loyal customers of this food; consumers who perceives food’s easy availability are less likely to become loyal customers.

In recent years, more researchers devoted themselves to explore relationships among consumer behaviors, brand awareness and brand perception. In relevant or similar studies, researchers prefer to choose one particular research method to collect data and analyze relationships among different variables. For instance, Researchers Pham & Truong-Dinh (2018) choose qualitative interviews as the method to collect the primary data, and this method is specifically reflected by two aspects: semi-structured questionnaire and in-depth interviews. On the other hand, when certain database is obtained or provided, some researchers choose other methods to direct analyze data, such as Ordinary Least Squares (Mitra, 2018) etc.

In this paper, we perfectly combine in-depth interviews with online questionnaire together in steps of collecting data and analyzing variables. Firstly, we divided our research as two aspects: qualitative research and quantitative research, for exploring research questions more specifically. Secondly, larger quantity of academic literature and secondary sources are collected by us as several interview questions in the step of in-depth interviews. Thirdly, ten individual respondents are conducted by us in the step of interview surveys, and their answers are screened and reorganized as the reference material of following online questionnaire. Finally, both data from online questionnaire are analyzed by different analyze methods in SPSS software, and useful data from in-depth interviews are also kept by us to analyze corresponding research questions.

Conclusion

For general residents in Australia, results show that more students, females and people who under 25 years old are more willing to know about new foods. Meanwhile, lower price, accessible stores, food brands and recommendations from other people could become motivators of trying new foods, while health issues, limited sales channels and marketing attempts could become barriers.

For existing consumers in Australia, the problem of price has already become a barrier for existing consumers to accept the empanada. Furthermore, the menu of this company does not have enough selective feature and any relevant promotions, which hinders local consumers' from connecting their food with its brands and products cultures and also makes it difficult to generate the right brands and product’s awareness.

For the common results of both general population and existing consumers, different cultures and eating habits may also cause domestic consumer’s misunderstanding of the new food. A great percentage of Canberra consumers consider that empanada is a type of unhealthy food, which is similar to a snack and unsuitable to be eaten as a formal meal. On the other hand, many consumers express their unwillingness to buy the empanada initiatively because of their feeling of its unhealthiness, although the empanada actually is a healthy handmade food.

Generally speaking, currently, consumers in Australian food market do not have mature perceptions and systematic knowledge of new foods like empanadas, which indicates that brand level and product awareness among local consumers is very low. However, it also means that huge opportunities and possibilities are waiting for foreign corporations like La Empanada to improve their brand and product preference.

Recommendations

Firstly, when entering a new market, products should increase its marketing channels and try to establish closer relationships and interactions among local consumers, make consumer’s perception of brands and products clearly structured. Brands and products should not only insist on their cultural background and product’s characteristics, but also cater to tastes of local consumers. Moreover, target consumers should be accurately defined and internal and external environmental scanning should also be precisely taken to obtain competitive advantages.

Secondly, to meet positioning requirements of versatile food options, companies should quickly find common factors underlying positions such as heathier fast food, normal meal, party food and any-time snack. And further package, location and tableware services should also be firstly confirmed to provide convenient and comfortable environment for consumers.

Finally, it is necessary for the company to improve its food characteristic according to consumer’s demands. For example, if local consumers prefer healthy food with low calories, the company should decrease its product’s calories to cater to consumer’s requirements. Furthermore, integrate marketing communications with local consumers, such as in-campus promotions, social media promotions, offline trade shows and foretaste activities, which can make it easier for the company to capture domestic consumer’s real demands immediately.

Limitations

The research also has some limitations that may affect result’s accuracy, which can be concluded as following.

Firstly, respondents are likely to behave artificially when they notice that they are being asked and observed. Respondent’s involuntary control of their views, attitudes and preferences may affect the research results and make it become not very accurate.

Secondly, because large numbers of variables are gathered in the research, it is difficult to confirm that the most suitable variables and analysis methods have been chosen during each research tests.

Finally, this research’s interviews and surveys of data are collected in a very short term, so our sample size may not abundant enough to confirm the complete accuracy of the data.

Further Research

The current research only confirms the existence of correlation among consumer’s awareness, certain factors, loyalty to empanada and preference, but lack of finding the mechanism behind this phenomenon. Hence, further research (quantitative and qualitative) can be carried out to supplement the research.

References

- Aaker, D. (1996). Building strong brands. Simon Schuster, 30(1), 275-277.

- Boachie, P. (2017). 4 Ways small businesses can compete against the major competitors. Retrieved from https://www.entrepreneur.com/article/287450

- Cox, A., Granbois, D., & Summers, J. (1983). Planning, search, certainty and satisfaction among durables buyers: A longitudinal study. In Richard P. Bagozzi, Alice M. Tybout, Ann Abor, MI (Eds.),Advances in Consumer Research. San Francisco.

- Jumiati, S., & Suki, N. (2015). Young consumers' insights on brand equity: Effects of brand association, brand loyalty, brand awareness and brand image. International Journal of Retail & Distribution Management, 43(3), 276-292.

- Major Types of Research Designs (2016). Retrieved from https://www.afidep.org/wp-content/uploads/2016/08/ Module-3-Handout-1-12-Major- Types-of-Research-Designs.pdf

- Mirosch, N. (2009). Food research finds meat pie not so Aussie after all. Retrieved from https://www.news.com.au/national/meatpienotsoaussieafterall/newsstory/bc08ac04a96ec67f7bba4817f9793fa4

- Mitra, S.K. (2018). An analysis of brand value and its determinants using quantile regression. Academy of Marketing Studies Journal, 22(3), 1-9.

- Pham, L.H., & Truong-Dinh, B.Q. (2018). An exploratory study of the perception of co-creation experience in the tourism industry: A case study in Danang city, Vietnam. Academy of Marketing Studies Journal, 22(3), 1-14.

- Retrieved from https:// course.ccs.neu.edu/is4800sp12/resources/qualmethods.pdf

- Schiffman, L., O’Cass, A., Paladino, A., & Carlson, J. (2014). Consumer behavior, (Sixth Edition). Pearson Australia, Frenchs Forest NSW.

- Steenkamp, J.B. (1997). Dynamics in consumer behavior with respect to agricultural and food products. Agricultural Marketing and Consumer Behavior in a Changing World, 60(5), 143-188.

- Waldhuter, L. (2017). What the changing food habits of Australians tell us. Retrieved from https://www.abc.net.au/news/2017-04-05/australians-are-changing-their-eating-habits/8415526