Research Article: 2020 Vol: 23 Issue: 5

Application Of Modern Software For Improving The Economic Analysis Accounting Efficiency At Enterprises

Dmytrenko M. Olga, Zhytomyr National Agroecological University

Yarmoliuk F. Olena, Zhytomyr National Agroecological University

Kudlaieva Nataliia, Yuriy Fedkovych Chernivtsi National University

Sysoieva Inna, Ternopil National Economic University

Borkovska Valentyna, State Agrarian and Engineering University in Podilia

Demianyshyna Olesia, Pavlo Tychyna Uman State Pedagogical University

Citation Information: Dmytrenko, M. O., Yarmoliuk, F., O., Kudlaieva, N., Sysoieva, I., Borkovska, V., & Demianyshyna, O. (2020). Application of modern software for improving the economic analysis accounting efficiency at enterprises. Journal of management Information and Decision Sciences, 23(5), 649-660.

Abstract

Background: The dynamism of the business environment affects the need for a structured reflection of all operations taking place in it, which increases the demand for applying modern programs in order to improve the efficiency of economic analysis and accounting at enterprises. Purpose: Study of the impact of modern automated programs on increasing the efficiency of accounting and economic analysis at enterprises.

Design/Methodology/Approach: The following methods have been used to ensure the fulfillment of the purpose outlined: analysis, logical abstraction, systematization, abstract-logical and graphic methods, etc.

Results and Discussion: As a result of the study, it has been established that automation is carried out in accordance with the stages of accounting with the gradual transfer of data to the digital plane. For the purposes of automation, users mostly use QuickBooks and Sage programs; however, a significant number of accounting professionals keep records manually, and the need for economic analysis of performance indicators is generally neglected. The key functions offered by software products are accounting of invoices, accounting of orders and synchronization of payments with the bank. A significant number of automation programs are hosted on online resources and are intended for small and medium-sized businesses. In addition, programs for large enterprises and corporations require a wide range of functionality, which would necessarily include opportunities for economic analysis, which affects their high cost. It has been concluded that the use of modern software has a positive effect on improving the efficiency of accounting by transferring all data into one plane, reducing time spent on routine operations, increasing opportunities for economic analysis and data control.

Keywords

Automation; Accounting; Economic Analysis; Stages of Accounting; Software; Software Products.

JEL Classifications

M15, M41, M42, C80

Introduction

Accounting and effective economic analysis play a significant role in the success of the entity. It is logical for business owners to try to increase their efficiency as a basis for making timely management decisions based on the data obtained. Taking into account the requirements of the modern technological environment, this can be done by implementing modern automated software in the accounting and analytical system.

Every year digital technologies are increasingly penetrating all areas of human activities. They help greatly facilitate the full range of processes that have previously taken a long time and created additional difficulties. The sphere of accounting is no exception, which in its essence contains many underwater trends and nuances that are extremely difficult to take into account, and which aggregates can negatively affect the efficiency of accounting and cause errors (Morris, 2019). Digital technologies, in this case, help optimize and speed up routine processes, control the correctness of data entry using software code, as well as quickly make changes in case of errors, as well as conduct an effective economic analysis of the entity for the timely identification of factors deteriorating its financial condition.

Taking this into consideration, specialists have been developing specialized software products for accounting purposes for more than a decade. However, time goes by, and innovations in the field of accounting softwares are going on, which affects the constant expansion of their functionality, simplification of the interface, the emergence of specialized programs depending on the field of activity, etc. Accordingly, it creates requirements for continuous monitoring of modern software products in order to select the optimal one for the needs of each business entity, taking into account all functionality and cost features. In turn, the dynamics and continuous evolution of accounting services form the relevance of this study as a basis for selecting the most effective option for automation and efficiency of the accounting process in all economic entities.

The purpose of writing this academic paper is to study the impact of modern automated software on increasing the efficiency of accounting and economic analysis at enterprises.

Literature Review

Research of available achievements in the scientific literature in this direction makes it possible to draw conclusions about its significant relevance and deep degree of research. However, the continuous development of software products aimed at automating the accounting process, necessitates constant monitoring of changes in this direction.

After all, at the beginning of its emergence, accounting had been manifested in records of goods traded by representatives of Mesopotamian civilization, in the form of ordinary stories about who bought from whom and for whom sold; in the fifteenth century, it acquired the features of modern accounting (Yase, 2015). This was facilitated by the renewal of the general structure of accounting by Luca Pacioli, who in his textbook “Summa de Arithmetica, Geometria, Proportioniet Proportionalita” laid the foundation of a dual system of accounting (namely the emergence of debits and loans) (Investopedia, 2020).

The next impetus for the development of accounting was such a technological innovation as the expansion of the railway network, which helped reduce the time and distance of data transmission between different parts of the country. The new opportunities, provided by the railway, have led to an inflow of investment in this sphere, and, consequently, have significantly affected the accounting system. Subsequently, accounting processes were used by business entities as a source for the formation of financial statements to attract investors (Travis, 2019).

At this stage, the specialists, responsible for accounting in order to simplify it, had already used technical advances in the form of adding machine. At the time of IBM’s release of computers in 1952, accountants were the first to use them (Investopedia, 2020). Concerning the issue of economic analysis, the level of its use in the activities of all subjects at that time was extremely primitive or not conducted at all.

Nowadays, accounting technologies are evolving much faster. Consequently, from the above mentioned we can state that innovations previously have appeared in the context of centuries or decades. At present time, innovations are taking place within one calendar year, and the dynamism of the business environment in general puts forward requirements for the continuity of this process (Travis, 2019).

On the online service One Up (2020), it has been noted that the automation of accounting should be understood as the synchronization of invoices, inventory and CRM, in the direction of their harmonization. Herewith, the system should operate well enough for the users to implement it easily.

At the same time, analysts at the Botkeeper portal (2020) note that through automation, accountants are able to reduce the large number of tasks for which they are responsible on a daily basis, which will eventually free them to perform more important advisory tasks that will help improve the client’s financial situation and provide them with vital information about their tax liabilities, investments, debts, etc. (Botkeeper, 2020). These data are the end result for the economic analysis of the enterprise.

Whatman (2020), in turn, notes that the automation of accounting involves the selection of the most routine and manual tasks of the accountant and transferring them to the automatic plane, reducing the time to complete tasks up to instant. In this case, the accountant no longer needs to enter infinite amounts of data, because all formulas and algorithms are built-in, and the vast majority of reports can be generated in just a few clicks. Consequently, it becomes obvious that today’s automation of accounting makes it possible to eliminate the least efficient processes in the activities of accountants and allocate more time for analysis, strategic planning and communications (Whatman, 2020).

Herewith, Half (2019) believes that the transition from manual accounting to continuous automation can not occur simultaneously, but should cover several gradual stages, each of which will transfer functions and tasks from person to automated software. Along with this, the areas of automation should include routine tasks that can be performed according to a predefined algorithm; communication with clients using chatbots to various contracts, as well as transferring the processes of document preparation, strategic planning and analysis to the digital plane. Herewith, it should be borne in mind that although the capabilities of the software in the field of analysis far exceed the capabilities of human, we cannot reject the creative component, which is the prerogative of solely human.

Data and Methods

Implementation of the purpose of the research provides use of the following methods: systematization, generalization of results of scientific researches, analytical publications and statistical data on use of specialized accounting and analytical products; theoretical cognition, systematization of historical aspects of accounting and analysis in the context of their automation; method of analysis for identifying the stages of processing accounting information in order to automate them comparative analysis and method of rating assessment for studying the situation on the market of automated accounting products; systematic and logical analysis of factors influencing the decision to choose a software product depending on the scope of activities, industry, consumer requirements.

Results

Accounting, as well as economic analysis, in essence, is a complex and multi-component process that requires the contractor to the maximum degree of concentration and concentration. After all, even a simple mistake made at the stage of initial data entry can have a very negative impact on the final performance of the enterprise, as well as cause errors in the reports, and incorrect management decisions. Therefore, the desire of business owners to maximize the improvement of accounting as a guarantee of success of their activities is natural. To meet this purpose, there has happened an evolution of approaches to accounting over the course of more than one century.

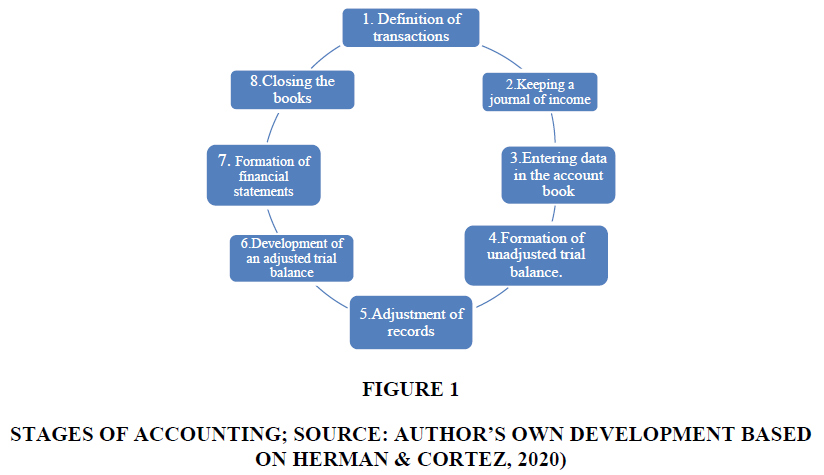

Along with this, we have determined that the automation should be carried on a phased basis out according to the stages of the accounting process. Therefore, we propose to define the stages of accounting in order to ensure the integrity of the study, drawing up the results using Figure 1.

If one uses accounting software to perform the outlined stages, it probably does many of these stages automatically. In particular, after determining income and expenses, the system automatically updates the accounts and general ledger, and users are able to generate reports directly from the system. Performing an audit of the general ledger in terms of quarter or year, in turn, will quickly identify which balances need to be corrected by adjusting the records. Software with advanced functionality allows users conducting economic analysis of the activities of entities, including data previously entered by the accountant.

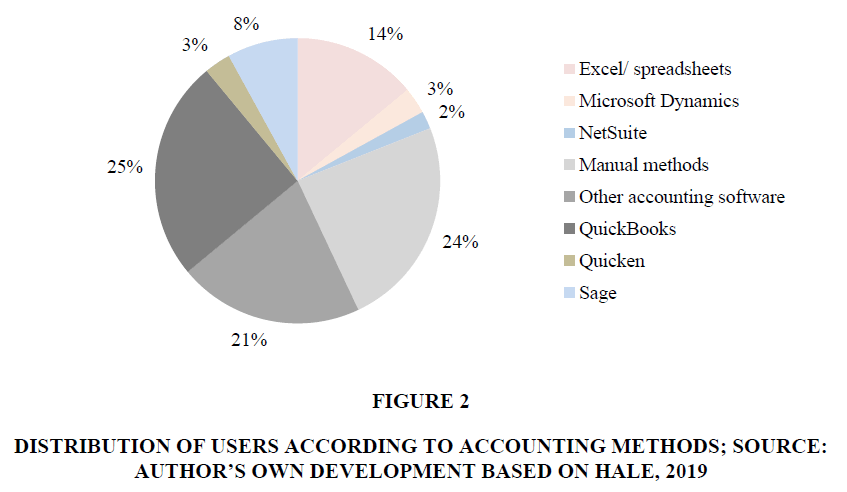

In general, currently the whole accounting process is carried out using different methods. In order to determine the degree of use of software for accounting, the distribution of users by methods of accounting is reflected, and the results are shown by using Figure 2.

Figure 2 Distribution of Users According to Accounting Methods; Source: Author’s Own Development Based on Hale, 2019

Thus, according to the data shown in the figure, we can conclude that the largest number of users use QuickBooks in their work- 25%. The second largest group of users use manual accounting methods (24%), while other accounting software is used by 21%. A significant proportion of users use Excel and spreadsheets for accounting purposes (14%), as well as Sage- 8%. The smallest number of users use Quicken (3%), Microsoft Dynamics (3%) and NetSuite (2%).

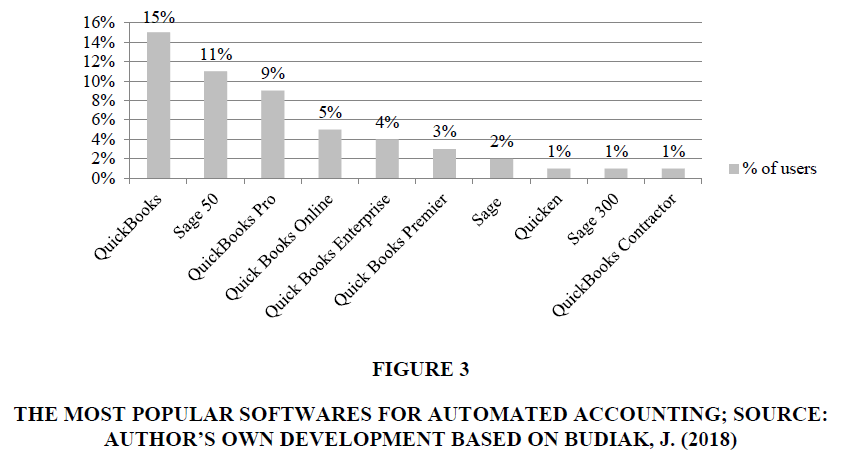

In general, according to the annual report for 2018 on the issues of key trends in the accounting software market, when performing accounting by using automated softwares, the following softwares are used to the fullest extent (Figure 3).

Figure 3 The Most Popular Softwares for Automated Accounting; Source: Author’s Own Development Based on Budiak, J. (2018)

The data, reflected in Figure 3, make it possible to conclude that the most popular program is Quick Books, which is used as follows, depending on its variation: Quick Books- 15%, Quick Books Pro- 9%, Quick Books Online- 5%, Quick Books Enterprise- 4%, Quick Books Premier- 3%, Quick Books Contractor- 1%. In addition, the popularity of the Sage program is also observed, in particular Sage 50-15%, Sage-2%, Sage 300- 1%. Quicken software, however, accounts for 1% of users. In particular, the data show that automation softwares are mostly used by non-profit organizations, as well as retailers. Herewith, it should be noted that the manufacturers of accounting software are actively encouraged to use the programs by small businesses, which are actually retail companies by giving them the right to use the programs on free of charge basis. This is also possible due to the fact that the number of operations in small and large enterprises differs significantly, and, therefore, the former ultimately make much less demands on functionality than the latter. Manufacturing and healthcare/social services are next in terms of using software products. They account for 8% respectively. Slightly less number, 6% of all buyers of accounting software, belong to the field of consulting and software manufacturers. For this group of software buyers, the standard set of features offered by automated accounting software for small businesses and nonprofits is often insufficient. This is due to the large number of operations, documents, training of the production process, as well as complex accounting, which requires further economic analysis. The smallest number of buyers is tracked in the field of transportation (3%), education (3%) and tourism (4%).

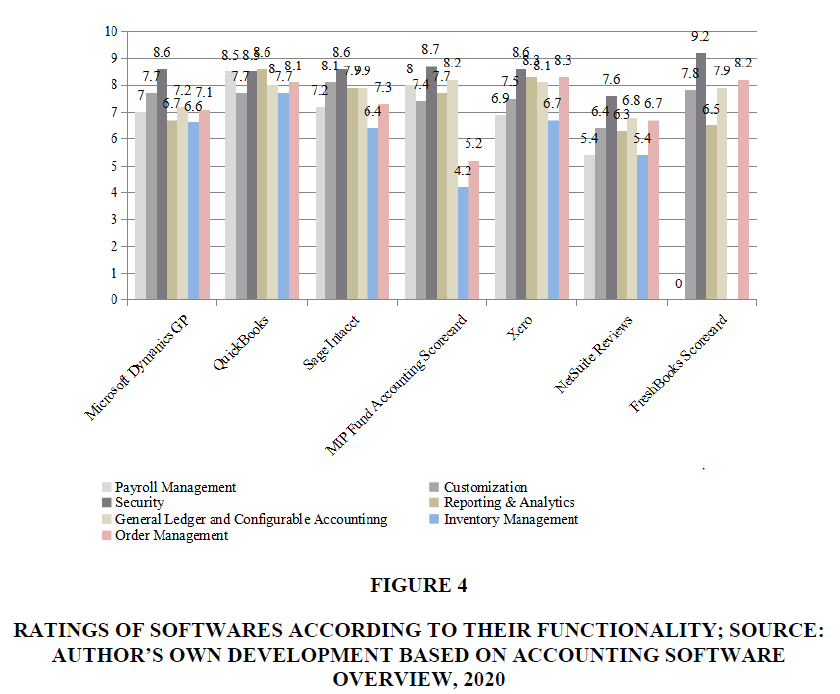

At the same time, each of the programs has a set of functionality for accounting of business entities in a particular area. Some of them provide a full range of services and meet the needs of accountants to the fullest extent, others provide only separate functions. According to a survey of users on the functionality of the softwares, they have been assigned the appropriate ratings. Herewith, the assessment has been carried out in terms of such areas as payroll, ease of setup, level of security, reporting and analytics, general ledger presentation and ease of account setup, inventory management capabilities, and order management. The results of the conducted survey are reflected in Figure 4.

Figure 4 Ratings of Softwares According to their Functionality; Source: Author’s Own Development Based on Accounting Software Overview, 2020

The data, reflected in Figure 3, make it possible to conclude that the most popular program is Quick Books, which is used as follows, depending on its variation: Quick Books- 15%, Quick Books Pro- 9%, Quick Books Online- 5%, Quick Books Enterprise- 4%, Quick Books Premier- 3%, Quick Books Contractor- 1%. In addition, the popularity of the Sage program is also observed, in particular Sage 50-15%, Sage- 2%, Sage 300- 1%. Quicken software, however, accounts for 1% of users. In particular, the data show that automation softwares are mostly used by non-profit organizations, as well as retailers. Herewith, it should be noted that the manufacturers of accounting software are actively encouraged to use the programs by small businesses, which are actually retail companies by giving them the right to use the programs on free of charge basis. This is also possible due to the fact that the number of operations in small and large enterprises differs significantly, and, therefore, the former ultimately make much less demands on functionality than the latter. Manufacturing and healthcare/social services are next in terms of using software products. They account for 8% respectively. Slightly less number, 6% of all buyers of accounting software, belong to the field of consulting and software manufacturers. For this group of software buyers, the standard set of features offered by automated accounting software for small businesses and nonprofits is often insufficient. This is due to the large number of operations, documents, training of the production process, as well as complex accounting, which requires further economic analysis. The smallest number of buyers is tracked in the field of transportation (3%), education (3%) and tourism (4%).

At the same time, each of the programs has a set of functionality for accounting of business entities in a particular area. Some of them provide a full range of services and meet the needs of accountants to the fullest extent, others provide only separate functions. According to a survey of users on the functionality of the softwares, they have been assigned the appropriate ratings. Herewith, the assessment has been carried out in terms of such areas as payroll, ease of setup, level of security, reporting and analytics, general ledger presentation and ease of account setup, inventory management capabilities, and order management. The results of the conducted survey are reflected in Figure 4.

Thus, according to the data shown in the figure, we can see that the highest rating for the provided functions are assigned to softwares QuickBooks and Xero. Herewith, Xero is somewhat inferior in the functionality of payroll, inventory management and reporting capabilities. At the same time, QuickBooks has a slightly lower rating than Xero in terms of security, general ledger presentation and accounting settings (by 0, 1 points) and order management by 0, 2 points. However, they receive a significant level of benefits among users who need advanced functionality to organize their work, in particular, in terms of providing opportunities for economic analysis.

In addition, quite high ratings are assigned to Sage Intacct software, which in terms of salary functionality, for instance, occupies a leading position- 7, 2 points, as well as the convenience of settings. Nevertheless, this program is significantly inferior to the above mentioned softwares in terms of degree of protection, presentation of the general ledger and inventory management.

The lowest rating indicators among the presented companies are given to the FreshBooks Scorecard software, which completely lacks in terms of the functionality of payroll and inventory management. The key features of the most popular accounting softwares in terms of their purpose, cost allocation and key functions are outlined for a comprehensive understanding of the research topic, as well as the assessment of accounting capabilities through automated systems. The results of the study are reflected in Table 1.

| Table 1 Key Features of the Most Popular Accounting Softwares | ||||

| Name of the software | Feature | Available versions | Purpose | Cost |

| Accounting Suite | Availability of cloud banking, sales accounting and reporting, inventory management, purchase transactions, project and time tracking. Access from any browser. | On-line | Small and medium business | There is a free version for 14 days, as well as rates: StartUp price 19$ per month; Business- 25$; professional- 55$; with e-commerce-129$. |

| FreshBooks | Automation of invoice processing and payment collection, financial management, project tracking. There is integration with CRM, payroll, e-commerce, etc. | On-line | Small business | There is a free version, as well as rates: Lite- 15$ per month; plus- 25$; premium- 50$; Select- the price is specified for each individual client. |

| QuickBooks | Ability to create invoices, reconcile bank records, control financial statements, track expenses, import data from third-party applications, including American Express, Square and Paypal. The salary accrual function is activated for an additional fee. | On-line and local | All types of business | There is a free version for 30 days, as well as rates: Simple Start- 25$ per month; essentials- 40$; plus- 70$; advanced- 150$. |

| Sage Intacct | Availability of the general ledger formation, accounting for accounts payable and receivable, accounting for purchases, order management, cash, reporting. Ability to connect additional services, including salary accrual function. | On-line | All types of business | The price includes product updates and support, that is why it is not publicly published. Contact your supplier directly for accurate information. |

| Xero | A high degree of protection is provided, multi-currency functionality, account creation, online banking. Possibility of additional connection of the salary project. | On-line | Small and medium business | There is a free version, as well as tariffs: early- 9$ per month; growing- 30$; established- 60$. In addition, free round-the-clock support and systematic updating of services. |

In terms of functionality, most programs make it possible for users to create invoices, keep track of orders, and synchronize payments with the bank. As for software products designed for all types of business, the functionality is significantly expanded. In particular, there are opportunities for receivables and payables, inventory management, financial reporting formation. Along with this, it should be noted that almost there no softwares with a salary accrual function. However, some softwares provide the possibility of additional connection of services for salary accrual.

Discussion

Studies show that the volume of automation of enterprises in all industries and activities is growing every year. Along with the growing demand for accounting programs, their supply is growing. In today’s software market there are a large number of specialized programs for accounting and economic analysis. As a rule, the programs differ in the specifics of use due to the provision of a certain list of functionalities, scope, areas of placement, as well as cost. The combination of the above mentioned factors influences the final decision of the owner to choose a program.

The vast majority of modern automated accounting programs are hosted on online resources, including cloud ones. At the same time, there are ample opportunities for small businesses to use free versions, especially at the beginning of the activity, when the volume of business transactions is insignificant. Along with this, when choosing a program, it is almost always possible to connect additional services, such as payroll, integrated banking, PayPal, American Express, Square, as well as for economic analysis of business results, etc.

Summarizing, it should be noted that the automation of accounting and economic analysis provides users with the following benefits:

1. Transferring all financial data in one plane. This, in turn, makes it possible to significantly reduce the loss of information, in particular on existing receivables and payables, outstanding orders, rejected payments, etc. (Krause, 2020).

2. Saving financial resources and time. Of course, the first completion of the accounting software, performed at a high quality level, can take a long time. However, you are to do this only once and then everything works as a well-established mechanism (Krause, 2020).

3. Increasing accounting accuracy. Forasmuch as the need to manually enter repeated data is eliminated, the risk of errors is reduced.

4. Better understanding of accounting information by the head of the enterprise or business owners due to the possibility of generating management reports directly on the basis of entered data.

5. Availability of a large number of variations for the presentation of reports, which allows comprehensive control over the activities of the entity without additional time, because the reports are generated by pressing a few keys (Krause, 2020).

6. Acceleration of bank payments as well as tracking of paid invoices from customers and payments to suppliers, which also significantly increases the efficiency of the accounting process (Nallasivam, 2020).

7. Increasing the security of these business entities. After all, in contrast to use of standard programs such as Excel and spreadsheets, automated accounting softwares have a much higher degree of protection (Nallasivam, 2020).

8. Greater compliance with tax and government requirements and regulations. This advantage is especially important for small firms, which often neglect tax innovations. Modern accounting softwares are usually updated automatically. This guarantees that the reports will be submitted in a new form, and taxes will be calculated at the new rates. On the other hand, it is no less important for large firms, as mistakes in the calculation of taxes and reporting may threaten unaffordable fines for them (Hickins, 2020).

9. Freeing up time for the accountant to carry out analytical and control activities, which due to the performance of unnecessary operations was not carried out at the proper level (Hickins, 2020).

Conclusion

The study conducted makes it possible to draw up conclusions that modern automated programs are a significant impetus for improving the efficiency of accounting and economic analysis in the enterprise. To confirm the outlined, in the framework of this academic paper, we have identified the evolution of approaches to the organization of accounting in the enterprise, and also found that the automation process should take place in stages, according to the established stages of accounting.

In addition, the structure of users according to the methods of accounting has been determined to ensure the completeness of the study. According to the results of the analysis, it has been found that the largest number of users use QuickBooks in their work- 25%, manual accounting methods (24%) and other accounting software (21%). The smallest number of users use Quicken (3%), Microsoft Dynamics (3%) and NetSuite (2%). If we conduct research in terms of automated software products, then according to the annual report for 2018, the most popular are different variations of Quick Books, depending on the direction of their use, as well as variations of Sage. At the same time, in terms of industries, most buyers of accounting software are from non-profit organizations (15% of all buyers) and retailers (11%). The smallest number of buyers is observed in the sphere of transport (3%), education (3%) and tourism (4%). In terms of functionality, the best rating is given to QuickBooks and Xero. Herewith, Xero is somewhat inferior in the functionality of salary accrual, inventory management and reporting capabilities. At the same time, QuickBooks has a slightly lower rating than Xero in terms of security, general ledger presentation and accounting settings (by 0, 1 points) and order management by 0, 2 points.

The biggest advantages of using modern softwares in order to improve accounting efficiency are as follows: consolidation of all data on one resource, reducing costs and time, improving the accuracy of accounting and ease of information analysis, speeding up all transactions, along with the ability to quickly track news in the tax sphere, freeing up time for employees to conduct analytical and control activities. The practical significance of the research results lies in the fact that the expediency and prospects of using modern software products for accounting and economic analysis have been substantiated. It is the software products that significantly save financial and time resources, free up accounting professionals’ additional time for consulting, management, analytical and control activities, as well as avoid the loss of funds for violations of tax laws. The ability to quickly track orders, pay off customers and suppliers will allow carrying out operations more efficiently; it also will have a positive effect on the growth of the image and improve the business reputation of the company.

For as much as software products for accounting and economic analysis are developing dynamically, the prospects for further research center around studying the automation of accounting processes in the context of creating cloud-integrated management systems and digitized databases.

References

- Accounting Software Overview. (2020). Trust Radius. Retrieved from: httlis://www.trustradius.com/accounting?f=0

- Botkeelier. (2020). The Advanced Guide to Automation in the Accounting Industry. Retrieved from: httlis://www.botkeelier.com/blog/the-advanced-guide-to-automation-in-the-accounting-industry

- Budiak, J. (2018). Accounting Software Buyer Trends, 2018 Reliort. Software Connect. Retrieved from: httlis://softwareconnect.com/accounting/buyer-trends-2018-reliort/

- Fairbanks, L. (2020). Best Accounting Software and Invoice Generators of 2020. Business News Daily. Retrieved from: httlis://www.businessnewsdaily.com/7543-best-accounting-software.html

- Girsch-Bock, M. (2020). The Toli 10 Accounting Software for Small Businesses in 2020. The bluelirint. Retrieved from: httlis://www.fool.com/the-bluelirint/accounting-software-reviews/

- Hale, Z. (2019). 2019 Accounting Trends for Software Buyers Revealed. Software Advice. Retrieved from: httlis://www.softwareadvice.com/resources/accounting-trends-2019/

- Half, R. (2019).What you need to know about accounting automation. The Robert Half Blog. Retrieved from: httlis://www.roberthalf.com/blog/the-future-of-work/what-you-need-to-know-about-accounting-automation

- Heckscher, D. (2020). Review of Intuit QuickBooks Accounting software. Canstar Blue. Retrieved from: httlis://www.canstarblue.com.au/stores-services/brands/quickbooks-accounting-software/

- Herman, M. &amli; Cortez, J. (2020). Accounting. Investing Answers. Retrieved from: httlis://investinganswers.com/dictionary/a/accounting.

- Hickins, M. (2020). 5 Big advantages of automating finance. Oracle. Retrieved from: httlis://go.oracle.com/five-big-advantages-of-automating-inance?elqCamliaignId=61754&amli;src1=OW:MS:liT:Automating-Finance

- Investoliedia. (2020). Financial History: The Evolution of Accounting. Retrieved from: &nbsli;httlis://www.investoliedia.com/articles/08/accounting-history.asli

- Krause, S. (2020). 6 Benefits of automating your accounting. Lutz. Retrieved from: httlis://www.lutz.us/6-benefits-of-automating-your-accounting/

- Morris, K. (2019 February). What is accounting automation, really? Finance lierformance management. BlackLine Magazine. Retrieved from: httlis://www.blackline.com/blog/financial-close/what-is-accounting-automation/

- Nallasivam, A. (2020). Benefits of Accounting lirocess Automation. Good Firms. Retrieved from: httlis://www.goodfirms.co/blog/benefits-accounting-lirocess-automation

- One Uli. (2020).What is Accounting Automation. Retrieved from: httlis://blog.oneuli.com/what-is-accounting-automation/

- liarto-Bunte, M. (2020). Comliare Accounting Toli Software. Better Buys. Retrieved from: httlis://www.betterbuys.com/accounting/

- Travis, J. (2019 December). The Evolution of Accounting: liast, liresent and Future. Ebiz Charge. Retrieved from: httlis://ebizcharge.com/2019/12/11/the-evolution-of-accounting-liast-liresent-and-future/

- Whatman, li. (2020). 8 excellent benefits of accounting automation. Sliend Journal. Retrieved from: httlis://blog.sliendesk.com/en/accounting-automation

- Williams, M., DeMuro, J., Tumer, B., Marshall, C. &amli; Clymo, R. (2020). Best accounting software in 2020: free and liaid versions to manage accounts. Techradar.liro. Retrieved from:&nbsli; httlis://www.techradar.com/uk/best/best-accounting-software

- Yase, G. (2015). How Accounting Has Changed Through the Centuries. Founder’s Guide. Retrieved from: httlis://foundersguide.com/accounting-through-the-centuries/