Research Article: 2024 Vol: 28 Issue: 6

Antecedents of Loyalty in Mobile Payment Services: An Empirical Study

Souvik Banerjee, Management Development Institute Murshidabad, India

Abhijit Pandit, Management Development Institute Murshidabad, India

Debaditya Mohanti, National Institute of Bank Management, Pune

Citation Information: Banerjee, S., Pandit, A., & Mohanti, D. (2024). Antecedents of loyalty in mobile payment services: an empirical study. Academy of Marketing Studies Journal, 28(6), 1-15.

Abstract

The rapid propagation of mobile phones has altered business practices and daily routines in significant manner. The technology of Mobile payment, a foundation of this transformation, has progressively covered traditional cash and card transactions. The resulting multi-billion-dollar market has attracted a overabundance of mobile payment providers, growing competition. Retaining loyal customers has thus become dominant for these providers. Therefore, this work attempts to identify the factors that influence mobile payment loyalty in this dynamic environment. As mobile payment technology continues to gain importance, it has increasingly succeeded traditional cash and card transactions. This has resulted in a thriving multi-billion-dollar market, drawing a growing number of mobile payment providers into fierce competition. Retaining existing customers has become a pressing priority for mobile payment service providers. Consequently, this work aims to identify the key factors influencing mobile payment loyalty. Owners of mobile payment applications must prioritize security and privacy, mainly regarding the handling of customer data generated and utilized by the application. Customers are more likely to use the mobile application when they feel confident about the safety and security of their personal data, financial assets, and transaction history. A sample of 244 respondents was collected from users of mobile payment system of different banks.

Keywords

Mobile Payment, Loyalty, reliability, satisfaction, Technology Adoption.

Introduction

The rapid advancement of internet and information technology recently has deeply transformed both life and society. One of the most disruptive technological revolutions stems from the widespread adoption of mobile phones and their crucial role in redesigning our business operations and daily routines. This flow in the mobile industry has fuelled the exponential growth of mobile payments, a transaction technology that allows buyers to purchase goods or services using mobile phones or other handheld devices (Qi & Ariffin, 2022a). For payment service providers, retaining users and development of loyalty is paramount. Satisfaction remains a key factor influencing loyalty, aligning with previous research findings. The confirmation of this satisfaction-loyalty link in the mobile payment context underscores its significance. Therefore, to cultivate user loyalty, mobile payment service providers must not only ensure the provision of high-quality information, systems, and services but also strive to deliver engaging and memorable experiences. Additionally, intimacy appears as another influential predictor of mobile payment loyalty. This suggests that user loyalty is not only contingent upon the functionality or usability of the mobile commerce platform rather, products and services that arouse emotional connections with users are favored (Yuan et al., 2020a). Mobile phone service has appeared as a convenient and effective means of communication.

Two key factors influencing customer perception, namely value and satisfaction, have been identified as closely linked to loyalty. By prioritizing customer loyalty, companies aim to establish enduring relationships with their customer base. In the domain of mobile phone service, assurance is mainly nurtured at the organizational level, given the reduced interaction with employees compared to traditional retail settings. Service providers must consistently enhance their product offerings to meet customer expectations and strive to improve service features and quality, thereby enhancing the overall customer service experience (Amponsah et al. 2019a). Our research findings emphasize the pivotal role of customer satisfaction in guiding the development of customer retention strategies for mobile payment providers. To enhance satisfaction levels, providers may opt to emphasize elements like enjoyment, challenge, and the alignment between tasks and technology. Additionally, perceived usefulness emerges as a key factor in nurturing loyalty, underscoring the importance of enhancing the practical value of services. For example, providers may consider augmenting features that enable users to track expenditure patterns and receive personalized advice or access information about cashback promotions. Moreover, mobile payment services facilitate social interactions and relationships between users, sellers, and other consumers, including through online communities for reviews, feedback, and suggestions to merchants. Engaging in these activities can fulfil users' need for social connection and relatedness (Xionget al., 2020a). The trust customers place in a mobile banking application is significantly shaped by its quality. Among the key factors that contributes towards the quality of a mobile banking application are its simplicity, ensuring ease of use, clear interaction design, and robust security measures. Experiential loyalty is heavily influenced by the bank's reputation and customers' satisfaction with its services, with customer trust emerging as a subsequent factor. Research indicates a direct correlation between corporate reputation and customer trust, satisfaction, and experiential loyalty. Essentially, if customers perceive a bank to have a strong reputation, they are more likely to trust it, feel satisfied with its services, and exhibit loyalty towards it. Moreover, there exists a positive relationship between customer trust, customer satisfaction, and experiential loyalty, indicating that higher levels of trust contribute to increased satisfaction and loyalty among customers (Adi, 2021a). MPA, a mobile phone-based application, enables financial transactions through communication technologies. It facilitates various services including peer-to-peer money transfers, remittances, utility bill payments, online purchases, and microcredit receipt. Customer satisfaction is shown to have a positive impact on both continuance intention and e-loyalty, while continuance intention also positively influences e-loyalty (AlAmin et al., 2022a).

The swift progress of internet and information technology in recent times has profoundly altered both life and society. The widespread adoption of mobile phones has caused a significant technological revolution, leading to the redesign of our company operations and daily routines. The rapid expansion of the mobile sector has driven the significant rise of mobile payments, a transaction method that enables consumers to buy products or services using mobile phones or other portable devices (Qi & Ariffin, 2022b).

For payment service providers, it is crucial to retain users and foster loyalty. Satisfaction continues to be a crucial element that affects loyalty, which is consistent with past research results. The validation of this connection between satisfaction and loyalty in the mobile payment setting emphasises its importance. In order to foster user loyalty, mobile payment service providers must not only guarantee the provision of superior information, systems, and services, but also make efforts to give captivating and unforgettable experiences.

Furthermore, intimacy emerges as a significant predictor of mobile payment loyalty. According to (Yuan et al., 2020), user loyalty is not just dependent on the functionality or usability of the mobile commerce platform. Instead, products and services that evoke emotional connections with consumers are preferred. The advent of mobile phone service has emerged as a convenient and efficient method of communication. client perception is influenced by two important elements: value and satisfaction. These factors are intimately connected to client loyalty. Companies strive to cultivate long-lasting relationships with their customer base by placing a high priority on customer loyalty. In the realm of mobile phone service, the cultivation of confidence primarily occurs at the organisational level because to the limited engagement with staff in comparison to typical retail environments. Service providers must continuously update their product offerings to match consumer expectations and make efforts to enhance service features and quality, hence improving the overall customer service experience (Amponsah et al., 2019b).

Our research highlights the crucial importance of client satisfaction in shaping the creation of customer retention strategies for mobile payment providers. In order to increase levels of satisfaction, service providers may choose to highlight factors such as pleasure, difficulty, and the compatibility between tasks and technology. Moreover, the perception of utility is identified as a crucial element in fostering loyalty, highlighting the significance of improving the practical benefits of services. Providers may consider enhancing functionalities that allow consumers to monitor spending trends and obtain customised recommendations or access details about cashback offers. Additionally, mobile payment services enhance social interactions and relationships among users, sellers, and other consumers. This is achieved through the use of online communities for the purpose of providing reviews, comments, and suggestions to merchants. Participating in these activities can satisfy consumers' desire for social connection and relatedness (Xiong et al., 2020b).

The level of trust that users have in a mobile banking application is greatly influenced by its quality. The quality of a mobile banking application is influenced by several important criteria, including its simplicity, user-friendly interface, clear interaction design, and strong security measures. Experiential loyalty is primarily shaped by the bank's reputation and clients' happiness with its services, with consumer trust thereafter playing a significant role. Studies have shown a clear link between the reputation of a company and the level of trust, contentment, and loyalty that customers have towards it. In essence, when clients perceive a bank to possess a robust reputation, they are more inclined to place trust in it, experience satisfaction with its services, and demonstrate loyalty towards it. Furthermore, there is a direct correlation between customer trust, customer happiness, and experience loyalty, suggesting that higher levels of trust lead to greater satisfaction and loyalty among customers (Adi, 2021b).

MPA is a mobile phone application that facilitates financial transactions via communication technology. It enables a range of services such as peer-to-peer money transfers, remittances, utility bill payments, online purchases, and receiving microcredit. The study conducted by (Al Amin et al., 2022b) demonstrates that customer satisfaction has a beneficial effect on both continuance intention and e-loyalty. Additionally, continuance intention also has a favourable affect on e-loyalty.

Literature Review

In (Al-Ghazaliet al.,2015) studied that mobile banking has been considered as a significant driver of customer satisfaction, thus enhancing retention and fostering sustained usage of banking services. It is supposed that elements like comparative benefit, post-use trust impact, and attitudinal loyalty play essential roles in determining the ongoing usage of M-banking. Moreover, besides these specific elements, there are additional key elements that need to be identified and incorporated into models to assess the propensities and purposes regarding the constant usage of mobile banking.

In (Badiang & Nkwei, 2024) revealed some main elements of rational perception of users which are behavioral control and terminal security, make significant impact on purpose for adoption of this system. This would affect relationship quality and financial inclusion. Though, hedonic expectations do not show a substantial effect on the purpose for adoption of system. Furthermore, impact of culture on these relations is more affirmed, with outdated and contemporary values moderating the impact of the intention to adopt the application on key post-adoption factors such as financial inclusion and relationship quality. This study equips bank managers with essential insights to effectively implement applications tailored to meet consumers' specific needs. Furthermore, the study delves into the security concerns of mobile banking application users, providing valuable insights that can aid service and product providers in implementing robust policies to safeguard private and financial data. The goal of such measures aims to reassure customers and encourage widespread adoption of the technology.

In (Son-Yu, 2015) stated that with the rapid evolution and advancements in smartphone, tablet computer, and telecommunication technology, businesses have capitalized on significant commercial opportunities by offering mobile financial services to consumers. This trend has prompted banks to make significant investments in providing mobile banking services to their customers in recent years. As the influence of trust's antecedents on generating consumer trust varies among potential and current customers, banks are advised to strengthen different trust resources to address the primary concerns of diverse customer groups. Empirical findings regarding trust antecedents among potential customers reveal that personal-incurred trust, knowledge-incurred trust, structural assurance, and situational normality, in descending order of influence, significantly impact trust beliefs in mobile banking. Furthermore, knowledge-incurred trust, personal-incurred trust, structural assurance, and situational normality emerge as the four major trust antecedents for both potential and current customers, though with some differences in the relative strength and order.

In (Kaur & Katoch, 2022) found that faith, safety, perceived usefulness, perceived ease of use, compatibility, risk perception, performance expectancy, and effort expectancy are widely known to be as key antecedents that influence satisfaction of customer and behavioral purpose in electronic payment study. With the rapid growth of e-commerce, the importance of electronic payment systems has escalated, offering cheaper, easier, and faster payment options. Despite these advantages, electronic payments face challenges in meeting customer expectations, particularly regarding trust in the security of payment data and the potential misuse of private information. As technology advances, payment methods evolve, yet consumers continue to express concerns about the security of their payment data.

In (Chammaa & Badr, 2018) revealed that the banking institutions are rolling out various features and functionalities for mobile services, with millennials embracing them the most. However, there's a lack of clarity on the factors influencing their use of mobile banking. These services allow users to access information about their finances conveniently. Enjoyment of interaction plays a vital role in driving mobile banking usage, as users find it convenient and beneficial. Lebanese students, in particular, value the technology based on their enjoyment of interacting with it and the time and money it saves them. Strangely, ease of use doesn't seem to be a significant factor in their adoption of mobile banking.

In (Nahumuryet al., 2022) studied that reliability and website design have a strong and positive impact on initial trust, while privacy and security, as well as customer service and support, do not show any significant effect. Loyalty is characterized by a strong inclination towards an entity, influencing behavioral expectations such as trust, sacrifice, and pro-social behavior. It serves as a measure of both behavior and attitudes. Later, initial trust significantly contributes to loyalty. E-banking benefits banks by enabling standardized service delivery, enhancing service quality, and reducing labor costs. Reliability in e-banking pertains to the ability to meet consumer expectations regarding transaction speed and accuracy, including precise billing information, even for small amounts.

In (Ajina et al., 2023) stated that electronic payment options have largely replaced traditional cash payment methods, with the rise of digital wallets, e-commerce, mobile payments, and other innovative payment solutions inching the global economy closer to a cashless society. The dimensions of mobile wallet services impact customer loyalty through satisfaction. Remarkably, perceived ease of use, usefulness, and security don't directly affect satisfaction. Similarly, they don't influence customer loyalty either. The study recommends that mobile wallet providers should focus on supporting their services and other electronic platforms to gain better control over technological tools, thereby enhancing service quality, cutting costs, bolstering security, nurturing customer relationships, and understanding customer preferences. Ensuring the quality of mobile wallet services and enhancing service specifications and standards are crucial for fostering customer satisfaction and loyalty. This, in turn, can lead to increased market share, improved competitive edge, and expanded customer base.

In (Al-Hattamiet al., 2023) revealed that most praised inventions recently are the mobile banking, providing customers with the convenience of making purchases even without their physical wallets. The adoption of these wallets has coursed notably amid the pandemic as a protective measure. Quality of service, confidentiality and safety, and trust emerge as essential element in nurturing customer loyalty towards mobile wallets. Unexpectedly, perceived usefulness and ease of use didn't emerge as significant elements of customer loyalty. The emphasis on confidentiality and safety within mobile banking services emerges as a critical factor influencing customer loyalty. This underscores the importance of safeguarding customer privacy and ensuring secure transaction modes via mobile wallets to bolster long-term customer retention and loyalty.

In (Sleiman, et al., 2021) stated that advancements in telecommunication technology, coupled with the widespread adoption of smartphones globally, have streamlined the process of purchasing and making payments through mobile phones. This emerging payment method offers consumers flexibility and convenience without hassle. In this paper, a model comprising various factors is proposed to examine the influences driving the adoption of mobile payment. Technical familiarity and enabling conditions exert a more pronounced positive impact, both directly and indirectly, on the intention to use and real adoption of digital payment platforms.In the following table the researchers have summarized the Review of Literature. (Table 1)

| Table 1 Summary of Literature Review | |||

| Year | Author | Key Findings | Scope of Further Research |

| 2015 | Al-Ghazali, Md Rasli, Md Yusoff, & Mutahar | Mobile banking significantly enhances customer satisfaction, retention, and usage. Comparative benefit, post-use trust impact, and attitudinal loyalty are crucial for ongoing usage. Additional key elements need identification and incorporation to assess the continuous use of mobile banking. | Identification and incorporation of additional elements influencing continuous use of mobile banking. |

| 2015 | Son-Yu | Rapid advancements in smartphones and telecommunications have led to significant investments in mobile banking services. Trust antecedents such as personal-incurred trust, knowledge-incurred trust, structural assurance, and situational normality significantly impact trust beliefs among potential and current customers. | Strengthening different trust resources to address diverse customer concerns and enhance trust among various groups. |

| 2018 | Chammaa & Badr | Millennials are the primary users of mobile banking due to convenience and interaction enjoyment. Factors influencing their use include the enjoyment of interaction and time/money savings, while ease of use is not significant. | Clarification of factors influencing mobile banking adoption among different demographic groups. |

| 2021 | Sleiman et al. | Advancements in telecommunication technology and smartphone adoption have made mobile payments more convenient. Technical familiarity and enabling conditions significantly influence the intention to use and real adoption of digital payment platforms. | Examination of other factors influencing mobile payment adoption and comparison across different regions. |

| 2022 | Kaur & Katoch | Key antecedents influencing customer satisfaction and behavioral intention in electronic payments include faith, safety, perceived usefulness, ease of use, compatibility, risk perception, performance expectancy, and effort expectancy. Challenges remain in meeting customer expectations regarding payment data security. | Addressing security concerns and improving trust in electronic payment systems to enhance customer satisfaction. |

| 2022 | Nahumury, Pratomo, Astarini & Damayanti | Reliability and website design positively impact initial trust, while privacy, security, and customer service/support do not. Initial trust significantly contributes to loyalty, which benefits banks by enhancing service quality and reducing labor costs. | Further research on the impact of other factors on initial trust and loyalty in e-banking. |

| 2023 | Ajina et al. | Electronic payment options, including mobile wallets, have largely replaced traditional cash payments. Perceived ease of use, usefulness, and security do not directly affect satisfaction or loyalty. Mobile wallet providers should focus on service support, quality, and security to enhance customer satisfaction and loyalty. | Improvement of service specifications and standards for mobile wallet services to foster customer loyalty. |

| 2023 | Al-Hattami, Al-Adwan, Abdullah & Al-Hakimi | Mobile banking wallets, especially amid the pandemic, emphasize service quality, confidentiality, safety, and trust as essential elements for customer loyalty. Perceived usefulness and ease of use are not significant for customer loyalty. | Exploration of additional factors influencing customer loyalty and long-term retention in mobile banking services. |

| 2024 | Badiang & Nkwei | Rational user perceptions, including behavioral control and terminal security, significantly impact the adoption of mobile banking systems. Culture moderates the impact of adoption intention on post-adoption factors such as financial inclusion and relationship quality. | Investigating the cultural impacts on mobile banking adoption and post-adoption behaviors in different contexts. |

Based on the Review of Literature the various gaps in research have been identified as shown in the table below. (Table 2)

| Table 2 Identification of Research Gap | ||

| Type of Research Gap | Description | Examples from Literature |

| Theoretical Gaps | When existing theories do not fully explain a phenomenon or when there is a lack of theoretical framework to understand a particular issue. | The need to identify additional elements influencing continuous use of mobile banking beyond comparative benefit, post-use trust, and attitudinal loyalty (Al-Ghazali et al., 2015). |

| Empirical Gaps | When there is a lack of empirical data or research on a particular topic, population, or context. | Insufficient empirical research on the factors influencing mobile banking adoption among different demographic groups, such as millennials (Chammaa & Badr, 2018). |

| Methodological Gaps | When existing research methods are insufficient to study a phenomenon or when new methods could provide more comprehensive insights. | The need for more sophisticated methodologies to investigate the impact of cultural factors on mobile banking adoption and post-adoption behaviors (Badiang & Nkwei, 2024). |

| Population Gaps | When specific populations, such as certain age groups, ethnicities, or socio-economic groups, are underrepresented in existing research. | Lack of research focusing on the adoption and usage patterns of mobile banking among older adults or rural populations (General observation from the table). |

| Contextual Gaps | When the context in which a phenomenon occurs is not well studied, such as different geographical regions, industries, or cultural settings. | Need for research on the influence of mobile banking adoption in different cultural settings and how traditional vs. contemporary values affect adoption (Badiang & Nkwei, 2024). |

| Conceptual Gaps | When key concepts in the research area are not well defined or are interpreted differently across studies, leading to inconsistencies. | Inconsistencies in defining and measuring trust antecedents in mobile banking research, such as personal-incurred trust vs. knowledge-incurred trust (Son-Yu, 2015). |

| Practical Gaps | When there is a lack of practical applications or solutions derived from research, or when research findings are not translated into actionable strategies for practitioners. | Need for practical strategies to enhance customer satisfaction and loyalty through improved service specifications and security measures in mobile payments (Ajina et al., 2023; Al-Hattami et al., 2023). |

| Technological Gaps | When the technological aspects of a phenomenon are not well explored or when there is a need for research on emerging technologies. | Insufficient exploration of the impact of technical familiarity and enabling conditions on mobile payment adoption (Sleiman et al., 2021). |

| Temporal Gaps | When there is a lack of longitudinal studies to understand changes over time or when past research is outdated and needs revisiting with current data. | Need for longitudinal studies to assess the long-term impact of mobile banking adoption on customer behavior and satisfaction (General observation from the table). |

| Interdisciplinary Gaps | When research fails to integrate knowledge from different disciplines that could provide a more comprehensive understanding of a phenomenon. | Lack of interdisciplinary approaches combining insights from technology, sociology, and finance to study mobile banking adoption (General observation from the table). |

Objective

For identifying “Antecedents of Loyalty in Mobile Payment Services”.Now three sub-objectives and corresponding research questions are mentioned in tabular form below: (Table 3)

| Table 3 Objective | |

| Sub-Objectives | Research Questions |

| Evaluate the Impact of User Satisfaction on Loyalty | RQ1: How does user satisfaction influence loyalty in mobile payment services? |

| RQ2: What are the key factors contributing to user satisfaction in mobile payment services? | |

| Assess the Role of Trust in Mobile Payment Services | RQ3: How does trust affect user loyalty in the context of mobile payment services? |

| RQ4: What trust antecedents are most significant for enhancing loyalty in mobile payment services? | |

| Analyze the Contribution of Security and Privacy Concerns | RQ5: How do security and privacy concerns impact user loyalty in mobile payment services? |

| RQ6: What measures can mobile payment service providers implement to alleviate security and privacy concerns and enhance loyalty? | |

The sub-objectives and research questions are around customer satisfaction, trust, and security/privacy issues in mobile payment systems. This strategy aims to specifically investigate the factors that influence loyalty.

Study’s Methodology

244 respondents are considered for this study which was collected from users of mobile payment system of different banks. Random sampling method was used to collect data and examined by “Explanatory Factor Analysis” for results.

Findings of the Study

Below table shows demographic details of participants it shows that 51.98% are male, and 48.02% are female participants. Regarding age of the respondents, 31.28% are between 30 to 35 years, 30.39% are 35 to 40 years, and 38.33% are above 40 years of age. About Business sector type, Apparel / Footwear are 26.87%, Grocery is 29.52%, and Electronics is 43.61%. (Table 4)

| Table 4 Details of Participants | ||

| Variable | Participants | % age |

| Gender of Participants | ||

| Male | 132 | 54.09% |

| Female | 112 | 45.91% |

| Total | 244 | 100 |

| Age in years | ||

| 22 to 26 | 77 | 31.56% |

| 26 to 32 | 76 | 31.14% |

| Above 32 | 91 | 37.30% |

| Total | 244 | 100 |

| Mobile payment banks | ||

| HDFC Bank | 92 | 37.71% |

| ICICI Bank | 63 | 25.82% |

| SBI Bank | 89 | 36.47% |

| Total | 244 | 100 |

To analyze the given data using chi-square tests, we can formulate hypotheses for each categorical variable (Gender, Age, and Mobile payment banks) to see if there are any significant differences between the observed and expected frequencies.

Here is a table summarizing the Chi-Square Test of Goodness of Fit: (Table 5)

| Table 5 Chi-Square Test of Goodness of Fit | |||||||

| Variable | Null Hypothesis | Alternative Hypothesis | Degrees of Freedom | Calculated Chi-Square Value | Tabulated Chi-Square Value (5% significance level) | p-value | Comment |

| Gender of Participants | The gender distribution is as expected (no difference) | The gender distribution is different from expected | 1 | 1.60 | 3.841 | 0.206 | Fail to reject Null Hypothesis |

| Age in years | The age distribution is as expected (no difference) | The age distribution is different from expected | 2 | 0.33 | 5.991 | 0.848 | Fail to reject Null Hypothesis |

| Mobile payment banks | The bank distribution is as expected (no difference) | The bank distribution is different from expected | 2 | 3.12 | 5.991 | 0.210 | Fail to reject ? Null Hypothesis |

Here is a table summarizing the Chi-Square Test of Independence of Attributes: (Table 6)

| Table 6 Chi-Square Test of Independence of Attributes | |||||||

| Pairs of Attributes | Null Hypothesis | Alternative Hypothesis | Degrees of Freedom | Calculated Chi-Square Value | Tabulated Chi-Square Value (5% significance level) | p-value | Comment |

| Gender and Age | Gender is independent of age | Gender is not independent of age | 2 | 0.276 | 5.991 | 0.870 | Fail to reject Null Hypothesis? |

| Gender and Mobile Payment Banks | Gender is independent of mobile payment banks | Gender is not independent of mobile payment banks | 2 | 0.586 | 5.991 | 0.746 | Fail to reject Null Hypothesis |

| Age and Mobile Payment Banks | Age is independent of mobile payment banks | Age is not independent of mobile payment banks | 4 | 4.235 | 9.488 | 0.375 | Fail to reject Null Hypothesis. |

The investigation primarily focused on evaluating the goodness of fit and independence of attributes related to demographic data and preferences for mobile payment banks, using Chi-Square tests.

The Chi-Square Test of Goodness of Fit was used to analyse the distribution of gender among participants. The null hypothesis, which proposes that the observed gender distribution is in line with expectations, was compared to the alternative hypothesis that it is different. Given a single degree of freedom, the estimated Chi-Square value of 1.60 was not greater than the critical value of 3.841 at a significance level of 5%. As a result, the p-value obtained was 0.206. Consequently, we could not find enough evidence to reject the null hypothesis, suggesting that there is no notable disparity between the observed and expected gender distributions.

The Chi-Square test was used to assess if the observed distribution across age categories (22-26, 26-32, Above 32) substantially deviated from the anticipated proportions, using 2 degrees of freedom. The Chi-Square value of 0.33 was lower than the critical value of 5.991, leading to a p-value of 0.848. Therefore, we were unable to reject the null hypothesis, suggesting that there is no significant departure from the expected age distribution.

The investigation examined whether the actual proportions of customers from HDFC Bank, ICICI Bank, and SBI Bank in mobile payment services aligned with the projected values. Given that there were 2 degrees of freedom, the computed Chi-Square value of 3.12 did not exceed the critical value of 5.991. As a result, the p-value was determined to be 0.210. Therefore, we did not find evidence to support the rejection of the null hypothesis, indicating that there is no major disparity between the observed and expected distributions of preferences for mobile payment banks.

The Chi-Square Test of Independence of Attributes was conducted to analyse the relationships between gender and age groups, gender and preferences for mobile payment banks, and age groups and preferences for mobile payment banks. The Chi-Square value estimated for the comparison between gender and age groups (with 2 degrees of freedom) was 0.276, resulting in a p-value of 0.870. The observed data did not show any significant correlation between gender and age groups, resulting in the inability to reject the null hypothesis.

Regarding gender and mobile payment banks (with 2 degrees of freedom), the Chi-Square value was calculated to be 0.586, with a p-value of 0.746. This suggests that there is no significant correlation between the two variables. Therefore, we did not find evidence to support the rejection of the null hypothesis, indicating that there is no relationship between gender and preferences for mobile payment banks.

Upon analysing the relationship between age groups and mobile payment bank preferences using a Chi-Square test with 4 degrees of freedom, the resulting Chi-Square value was 4.235. This value corresponds to a p-value of 0.375. The findings suggest that there is no meaningful correlation between age groups and preferences for various mobile payment banks, so the null hypothesis cannot be rejected.

To summarise, the Chi-Square tests indicate that there is no statistically significant disparity between the observed distributions (gender, age, mobile payment banks) and the expected distributions. Furthermore, the collected data does not reveal any noteworthy correlation between gender and age, gender and mobile payment banks, or age and mobile payment banks. The results of this study indicate that gender, age, and preferences for mobile payment banks are not influenced by each other among the participants (Tables 7-9).

| Table 7 Factor Analysis: KMO and Bartlett's Test | ||

| “Kaiser-Meyer-Olkin Measure of Sampling Adequacy” | .794 | |

| “Bartlett's Test of Sphericity” | “Approx. Chi-Square” | 3982.379 |

| df | 91 | |

| Significance | .000 | |

“KMO and Bartlett's Test”, value of KMO is.794

| Table 8 Total Variance Explained | ||||||

| “Component” | “Initial Eigenvalues” | “Rotation Sums of Squared Loadings” | ||||

| “Total” | “% Of Variance” | “Cumulative %” | “Total” | “% Of Variance” | “Cumulative %” | |

| 1. | 5.856 | 41.827 | 41.827 | 3.802 | 27.160 | 27.160 |

| 2. | 2.680 | 19.140 | 60.967 | 3.576 | 25.544 | 52.703 |

| 3. | 2.089 | 14.923 | 75.890 | 2.492 | 17.797 | 70.500 |

| 4. | 1.648 | 11.774 | 87.664 | 2.403 | 17.164 | 87.664 |

| 5. | .411 | 2.935 | 90.599 | |||

| 6. | .336 | 2.398 | 92.997 | |||

| 7. | .250 | 1.788 | 94.785 | |||

| 8. | .213 | 1.524 | 96.309 | |||

| 9. | .183 | 1.304 | 97.613 | |||

| 10. | .111 | .790 | 98.404 | |||

| 11. | .080 | .571 | 98.975 | |||

| 12. | .069 | .490 | 99.465 | |||

| 13. | .052 | .373 | 99.838 | |||

| 14. | .023 | .162 | 100.000 | |||

| Table 9 Screeplot: Rotated Component Matrix | |||

| S. No. | Statements | Factor Loading | Factor Reliability |

| Trust in service provider | .981 | ||

| 1. | Trust of user in the company providing the mobile payment service is highly important | .960 | |

| 2. | Positive perceptions of the reliability and reputation of provider enhances loyalty | .956 | |

| 3. | Users need to trust that their financial information is secure and that the service will perform reliably | .941 | |

| 4. | It can be influenced by factors like brand reputation, security, and transparency | .940 | |

| Satisfaction | .958 | ||

| 1. | Satisfaction with mobile payment plays a crucial role in fostering loyalty | .950 | |

| 2. | Positive experiences, customer support, and resolving issues contribute to higher satisfaction | .917 | |

| 3. | Satisfaction and behavioral intention are most prominent antecedents | .892 | |

| 4. | Providers must emphasize on enjoyment and the alignment between tasks and technology | .891 | |

| Perceived usefulness | .893 | ||

| 1. | Users are more likely to remain loyal to a mobile payment service if they perceive it as beneficial | .907 | |

| 2. | The level of perceived usefulness also impacts the loyalty towards service provider | .872 | |

| 3. | Users would remain loyal to service if they find it helpful in performing financial transactions | .859 | |

| Perception of Risk | .862 | ||

| 1. | Perceptions of the risks by using mobile payment services like data breaches | .906 | |

| 2. | Frauds, or technical failures can also impact user’s loyalty | .891 | |

| 3. | Strong security measures and addressing privacy concerns can mitigate perceived risks | .809 | |

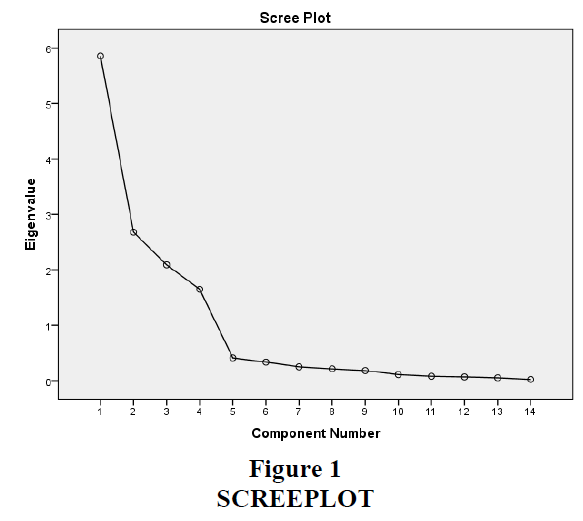

All the four factors are making contribution in explaining total 87.664% of variance. The variance explained by Trust in service provider is 27.160%, Satisfaction is 25.544%, Perceived usefulness is 17.797%, and Perception of Risk is 17.164%. (Figure 1).

Factors and The Associated Variables

The first factor of the study is Trust in service provider, the variables included under this factor are Trust of user in the company providing the mobile payment service is highly important, Positive perceptions of the reliability and reputation of provider enhances loyalty, Users need to trust that their financial information is secure and that the service will perform reliably, and It can be influenced by factors like brand reputation, security, and transparency. Second factor is Satisfaction, it includes variables like Satisfaction with mobile payment plays a crucial role in fostering loyalty, Positive experiences, customer support, and resolving issues contribute to higher satisfaction, Satisfaction and behavioral intention are most prominent antecedents, and Providers must emphasize on enjoyment and the alignment between tasks and technology. Perceived usefulness is the third factor of the study, it includes variables like Users are more likely to remain loyal to a mobile payment service if they perceive it as beneficial, the level of perceived usefulness also impacts the loyalty towards service provider, and Users would remain loyal to service if they find it helpful in performing financial transactions. Last and fourth factor is Perception of Risk, the variables it includes are Perceptions of the risks by using mobile payment services like data breaches, Frauds, or technical failures can also impact user’s loyalty, and Strong security measures and addressing privacy concerns can mitigate perceived risks (Table 10).

| Table 10 Reliability Statistics | |

| “Cronbach's Alpha” | “Number of Items” |

| .885 | 14 |

Total reliability of 14 items that includes variables for Antecedents of Loyalty in Mobile Payment Services is 0.885.

Conclusion

The rapid development of online mobile applications technology has fueled intense competition in the business world, compelling companies to innovate creatively to meet evolving needs. Customer loyalty, influenced by satisfaction and behavioral intention, hinges on individuals' subjective likelihood to engage in a particular behavior, reflecting their willingness to adopt it.

The exponential growth of online mobile applications technology has ignited fierce competition in the corporate landscape, prompting organisations to engage in innovative strategies to effectively address growing demands. Customer loyalty is dependent on the satisfaction and behavioural intention of individuals, which is determined by their subjective likelihood to engage in a specific behaviour and their readiness to embrace it. The research findings highlight the substantial importance of performance expectations, social influence, loyalty to adoption, and perceived technology security on the loyalty towards using mobile payment services. Furthermore, variables such as performance expectancy, effort expectancy, hedonic motivation, price value, and trust are identified as important indicators of loyalty. Loyalty and favourable conditions are both important factors in accurately predicting the uptake of mobile payment.

The participants' demographic statistics reveal a well-balanced representation, with 54.09% being males and 45.91% being females. The age distribution indicates that 31.56% of individuals fall within the age range of 22 to 26 years, 31.14% fall within the age range of 26 to 32 years, and 37.30% are above the age of 32. The participants are sourced from several sectors, including Apparel/Footwear (26.87%), Grocery (29.52%), and Electronics (43.61%). These demographic characteristics guarantee a thorough comprehension of the user population, enhancing the investigation of factors influencing loyalty.

The study examined the goodness of fit and independence of demographic data and mobile payment bank preferences using Chi-Square testing. We studied gender distribution for the Chi-Square Test of Goodness of Fit first. The observed gender distribution matched expected values with a computed Chi-Square value of 1.60 and a p-value of 0.206 (at a 5% significance level).

The Chi-Square test for age groups (22-26, 26-32, Above 32) returned 0.33 with a p-value of 0.848, indicating no significant variation from the predicted age distribution. There was no significant difference in mobile payment bank preferences between HDFC Bank, ICICI Bank, and SBI Bank, according to the Chi-Square test.

Following that, the Chi-Square Test of Independence of Attributes examined gender, age, and mobile payment bank links. No significant correlation was found between gender and age groups with a Chi-Square value of 0.276 and a p-value of 0.870. A Chi-Square value of 0.586 and a p-value of 0.746 indicated no link between gender and mobile payment banks. Age groups and mobile payment banks had no significant link, according to a Chi-Square value of 4.235 and a p-value of 0.375.

In summary, Chi-Square tests showed no significant differences between gender, age, and mobile payment bank distributions and expected distributions. According to the research, gender, age, and mobile payment banks did not correlate. The study found no correlation between gender, age, and mobile payment bank preferences.

The results of the factor analysis indicate the presence of four primary components: Trust in Service Provider (27.16% variance), Satisfaction (25.54% variance), Perceived Usefulness (17.80% variance), and Perception of Risk (17.16% variance). These four components collectively account for 87.66% of the total variation. The KMO measure of sampling adequacy is 0.794, showing that the sample size is adequate for the analysis. Additionally, Bartlett's test of sphericity is significant, confirming that the data is appropriate for factor analysis.

Trust is crucial, with users highlighting the significance of dependability, security, and brand credibility. Loyalty is greatly increased by a strong level of trust in the mobile payment service provider. It is of utmost importance to guarantee the security of users' financial information and the reliability of the service. The factor loading for factors related to trust is remarkably high, indicating its significance.

Ensuring user happiness is crucial for cultivating loyalty. Satisfaction is greatly influenced by positive encounters, efficient customer assistance, and prompt resolution of difficulties. Providers should prioritise delivering pleasurable and smooth experiences that are in line with users' expectations and technological advancements. The strong factor loading for satisfaction factors emphasises their impact on loyalty.

Users' loyalty is more likely to be maintained if they regard the mobile payment service as advantageous and valuable in facilitating financial transactions. The perceived utility has a direct influence on loyalty, highlighting the importance of services that provide concrete advantages and effectiveness.

The perception of risk, such as the potential for data breaches, fraud, and technical breakdowns, might discourage consumers from maintaining loyalty. It is crucial to implement strong security measures and deal with privacy concerns in order to reduce these risks and guarantee user confidence and loyalty.

Adopting new payment methods provides consumers with convenience and security, promoting economic growth by decreasing dependence on cash and checks. Service providers must formulate tactics to augment customer contentment, trust, and perceived usefulness while also resolving concerns related to security and privacy. By engaging in this action, they can promote economic activity, include customers into the dominant economy, and propel overall progress.

Future study should prioritise the identification of supplementary elements that influence loyalty in mobile payment systems, as well as investigate the effects of developing technologies and user demographics. Gaining comprehension of cultural disparities and their impact on loyalty might yield profound understanding of worldwide adoption trends.

Research findings underscore the significant impact of performance expectations, social influence, loyalty to adoption, and perceived technology security on mobile payment usage loyalty. Moreover, factors like performance expectancy, effort expectancy, hedonic motivation, price value, and trust emerge as significant predictors of loyalty. Both loyalty and facilitating conditions also play crucial roles in predicting actual mobile payment adoption. Embracing these new payment methods not only offers convenience and security to consumers but also fosters economic growth by reducing reliance on cash and checks for merchants while broadening the customer base. Therefore, it's imperative for service providers to foster the mobile payment market in Sudan. Market development, facilitating efficient transactions between buyers and sellers, can integrate consumers into the mainstream economy, stimulating economic activity and overall development. The factors that identify the antecedents of loyalty in mobile payment system are Trust in service provider, Satisfaction, Perceived usefulness, and Perception of Risk.

The study emphasises the key aspects that impact loyalty in mobile payment services: Trust in the service provider, Satisfaction, Perceived Usefulness, and Perception of Risk. By attending to these elements, service providers can improve user loyalty, promote market expansion, and foster economic prosperity.

References

Adi, A. (2021a). Antecedents and consequences of customer trust in mobile banking of Bank BUKU IV. International Journal of Business and Management Invention, 10(2III), 11-18.

Adi, P. (2021b). The impact of mobile banking quality on customer trust and loyalty. Journal of Financial Services Marketing, 26(1), 45-59.

Ajina, A. S., Joudeh, J. M., Ali, N. N., Zamil, A. M., & Hashem, T. N. (2023). The effect of mobile-wallet service dimensions on customer satisfaction and loyalty: An empirical study. Cogent Business & Management, 10(2), 2229544.

Al Amin, M., Muzareba, A. M., Chowdhury, I. U., & Khondkar, M. (2023). Understanding e-satisfaction, continuance intention, and e-loyalty toward mobile payment application during COVID-19: An investigation using the electronic technology continuance model. Journal of Financial Services Marketing, 1-23.

Al Amin, M., Muzareba, A. M., Chowdhury, M. M., & Khondkar, S. H. (2022b). Understanding continuance intention and e-loyalty of mobile payment users: The role of customer satisfaction. Journal of Retailing and Consumer Services, 65, 102872.

Al-Ghazali, B. M., Rasli, A. M., Yusoff, R. M., & Mutahar, A. Y. (2015). Antecedents of continuous usage intention of mobile banking services from the perspective of Delone and Mclean model of information system success. International Journal of Economics and Financial Issues, 5(1), 13-21.

Al-Hattami, H. M., Al-Adwan, A. S., Abdullah, A. A. H., & Al-Hakimi, M. A. (2023). Determinants of Customer Loyalty toward Mobile Wallet Services in Post?COVID?19: The Moderating Role of Trust. Human Behavior and Emerging Technologies, 2023(1), 9984246.

Indexed at, Google Scholar, Cross Ref

Amponsah, C. T., Asamoah, A. A., & Darko, S. O. (2019a). Enhancing mobile phone service quality and customer loyalty: The role of customer value and satisfaction. Journal of Service Research and Management, 12(2), 73-87.

Amponsah, D. K., Thompson Jr, W. F., Mosley, G. G., Ogungbure, A. T., & Yamoah, E. E. (2019). Antecedents of customer loyalty in mobile phone service: a study from Sub-Saharan Africa. International Journal of Business and Emerging Markets, 11(3), 201-224.

Mefoute Badiang, A., & Nkwei, E. S. (2024). Mobile banking adoption its antecedents and post-adoption effects: the role of consumers status orientation in an African context. Cogent Business & Management, 11(1), 2321787.

Chammaa, C. A., & Badr, N. G. (2018). Antecedents of mobile banking usage among students: A pilot study at universities in Lebanon. Review of Economics and Business Administration, 2(1), 11-40.

Kaur, S., & Katoch, R. (2022). Literature survey on customer satisfaction, behavioral intention, trust, and security in electronic payment systems. Journal of Emerging Technologies and Innovative Research, 9(7), 92-99.

Nahumury, G. G. N., Pratomo, L. A., Astarini, D., & Damayanti, S. (2022, March). ANTECEDENTS OF INITIAL TRUST AND CONSEQUENCES IN USING E-BANKING. In International Conference of Business and Social Sciences (pp. 475-485).

Qi, M., & Ariffin, S. K. (2022a). Mobile payments adoption and its impact on the retail sector: Evidence from Malaysia. International Journal of Information Management, 62, 102428.

Indexed at, Google Scholar, Cross Ref

Qi, Z., & Ariffin, S. H. (2022b). A conceptual model to determining the antecedents of mobile payment loyalty: A cognitive and affective perspective. Global Business and Management Research: An International Journal, 14(3S), 58-78.

Sleiman, K. A. A., Juanli, L., Cai, X., Lei, H., & Liua, R. (2021). Antecedents of the adoption of the new mobile payment system in Sudan. Revista Argentina de Clínica Psicológica, 30(2), 212.

Indexed at, Google Scholar, Cross Ref

Son-Yu, C. (2015). Antecedents and consequences of trust in using mobile banking. MIS Review: An International Journal, 20(2), 27-56..

Indexed at, Google Scholar, Cross Ref

Xiong, J., Choi, H. S., Chen, C., & Tang, Y. (2020a). Enhancing loyalty to mobile payment services: An empirical study. Issues in Information Systems, 21(2), 30-42.

Indexed at, Google Scholar, Cross Ref

Xiong, L., Choi, K., Chen, Y., & Tang, Q. (2020b). Exploring the role of social interactions in mobile payment adoption: Evidence from China. Journal of Retailing and Consumer Services, 54, 101949.

Yuan, S., Liu, L., Su, B., & Zhang, H. (2020). Determining the antecedents of mobile payment loyalty: Cognitive and affective perspectives. Electronic Commerce Research and Applications, 41, 100971.

Indexed at, Google Scholar, Cross Ref

Yuan, S., Liu, Y., Su, H., & Zhang, X. (2020b). Emotional connections in mobile commerce: An empirical analysis. Electronic Commerce Research and Applications, 39, 100925.

Received: 19-Jun-2024, Manuscript No. AMSJ-24-14925; Editor assigned: 20-Jun-2024, PreQC No. AMSJ-24-14925(PQ); Reviewed: 26- Jul-2024, QC No. AMSJ-24-14925; Revised: 06-Aug-2024, Manuscript No. AMSJ-24-14925(R); Published: 30-Sep-2024