Research Article: 2021 Vol: 25 Issue: 4

Annuity Murabaha after Being Regulated in Indonesia, Is It Like Riba (USURY)?

Dodik Siswantoro, Department of Accounting Universitas Indonesia

Abstract

This paper aims to analyze the characteristics of Muslim scholars' preferences on annuity murabaha in Indonesia. Annuity income recognition of Murabaha is permissible from 2013 then it would be regulated in 2019. Annuity recognition has been practiced by conventional banks which are based on the interest rate. The research method applied is based on quantitative and qualitative methods using a survey on member of the public hearing group on revised murabaha accounting standard and discussion during the public hearing. Forty respondents participated in the survey. Data would be analyzed using factor analysis. Results show that most respondents do not agree with annuity recognition in murabaha, but no solution for this issue. No significant affecting factors on margin murabaha similar to riba, this may be caused some people have resigned to this issue. However, the higher the education would state that margin murabaha is similar to interest rate. This is similar to not use murabaha respondents. This is the first paper which responding the revision of annuity income recognition of murabaha accounting standard in Indonesia with specific requirements.

Keywords

Murabaha, Margin, Riba, Income, Recognition, Accounting.

Introduction

Murabaha has becoming a popular financing in Islamic banks in Indonesia since the first Islamic bank established in 1991. Murabaha is flexible, safe and low risk for Islamic banks. Murabaha is only used for selling transaction purpose. So it need some requirements to be fulfilled for this financing scheme. Not all transactions can be covered by murabaha, in fact many unsuitable transactions applied this scheme. Some Muslim scholars do not supports murabaha as proper Islamic finance especially for installment basis. The critic is on different margin along additional time period. The longer the period the bigger margin income. Rosly (1990) criticized this phenomenon on murabaha transaction in Malaysia which also may be applied to other countries like Indonesia. However, the increasing period my realate to risk which Islamic banks has to cover. While this may be similar to interest rate based lending. The longer the period, the bigger income margin bank would get. The difference is Islamic bank only charge fixed profit margin while conventional may refer to the volatility of interest rate.

In Indonesia, income recognition for murabahah is flat. It means profit recognition for each year is similar until complete. While, conventional bank may apply annuity rate basis which recognizes income higher in the beginning. This phenomenon was applied by Islamic banks in Malaysia which then copied in Indonesia. This practice occurred in Indonesia even though no legal accounting standard for this recognition. Then in 2013, this practice has been legalized after FAS No. 102 Murabahah accounting was revised which accommodated annuity recognition for profit.

This objective of the paper is to analyze the characteristics of Muslim scholars preferences on annuity murabaha in Indonesia. This would enrich the analysis how scholars respond the issue. This only occurs in Indonesia which concerned with customers responses on annuity profit recognition. This is the research gap of the paper which may only occur in Indonesia. In addition, respondents of the questionnaire are scholars who concerns with the revision of annuity income recognition of murabaha accounting standard.

The paper starts with the introduction which show how this issue occurred. Then literature review which discuss related theory on murabahah recognition income. Research method discusses identifying factors for preferences. Analysis would map preference factors on annuity murabaha in Indonesia. Lastly, it is the conclusion.

Literature Review

Murabahah is a popular Islamic financing scheme in Islamic banks including in Indonesia. This may be caused by simple, fixed return and easy from customers perspective. However, many critics occurred on this scheme such as possession of good for selling, increasing profit along period, and income recognition. In Islamic perspective, the issue of possession becomes an issue as seller should have items for sale. While, profit is borne to the risk (Al-Fijawi & Yunus, 2019). Difference in murabaha accounting caused by different fiqh interpreting pricing which may be an issue (Al-Fasfus, 2018).

Income recognition in murabaha became an issue when annuity recognition was legalized. Annuity method has been regulated in Islamic bank regulation in 2012 (PBI No. 14/14/PBI/2012 on transparency and publication of Islamic bank report and SEBI No. 15/26/DPbs/2013 on Implementation on Guideline of Islamic Bank Accounting Standard). However, the accounting standard refers to conventional standards. The recognition also has been approved by Islamic scholars, issue of transparency is concerned with (Faisal, 2015). In fact, FAS 102 on murabaha accounting has not accommodated that practiced. In Indonesia, annuity recognition may be applied since 2007.

In other country like USA, annuity profit recognition is not a problem by Baktiar et al., (2017) as it may not come in appearance. The interesting issues is on the legality of profit in the Islamic perspective which differs from interest rate (Abdullah, 2016). Yanikkaya et al., (2018) found that non-murabaha financing which based on risk may give better performance to Islamic banks. From this, we can find that murabaha has limitation to the contribution of Islamic bank income. In case of annuity method in murabaha, tt can cause the level of liquidity of Islamic banks but it affects lower profitability of Islamic banks especially in the long run (Kamaliyah, 2018). In addition, margin murabaha profit is affected by macroeconomic factors such as LIBOR rate (Chelhi et al., 2018). This why murabaha may charge higher profit to compensate the risk may occur. Khan (2010) also discusseses this issue but not so detailed.

In case of annuity income recognition in murabaha, based on capital asset ratio (CAR) and Capital Adequacy Pricing Model (CAPM), the annuity model income recognition is like usury. Annuity can increase capital and relate to risk free in CAPM. (Amir et al., 2015). This argument may still debatable, but the main issue in annuity income recognition in murabaha is on transparency of seller (Islamic bank) to customers. Murabaha is different from lending based on interest rate as it is cost and mark up margin which has fixed predertmined income (Kholvadia, 2017).

Financial Accounting Standard (FAS) No. 102 on murabaha accounting first issuance was in 2007. The standard covered for all Islamic financial institutions. Then in 2013, the standard was revised to accommodate annuity income recognition. Some interesting topics in FAS No. 102 are:

1. Annuity income recognition The revised standard No. 102 in 2013 regulated the permission of annuity income recognition in murabaha. Annuity income recognition would recognize bigger income recognition in the early installment period. In fact, this practices has been applied before the standard issued.

2. Seller must own the product

3. Seller must inform the Cost of Goods Sold (COGS)

4. Late installment payment can be fined Then in 2019, the standard is proposed to be revised as annuity method should be regulation with some restrictions. This is interesting issue as annuity method has become debatable issue after its issuance.

Research Method

The research based on quantitative method using questionnaire. Most respondents are meeting member of public hearing of Financial Accounting Standard (FAS) No. 102 on murabaha accounting. The revision in on annuity income recognition which has be regulated in 2013. Statements of questionnaires are based on topics in FAS 102. Total respondents are 40 from 80 people who attended in the meeting. Most respondents did not fill the questionairree as they focus on the discussion of the meeting and miss the questionnaire. Most respondents are practitioners such as bankers, insurance employee, government authority and academics.

Data analysis applies discriminant analysis to map related factors to annuity income recognition preferences. Statements from questionnaire would be grouped using this method. Then we would get main group factors which affect annuity recognition murabaha income preference. Crosstab analysis would be added to enrich the analysis.

Analysis

1. Problem with annuity income recognition in murabaha

Before the revised accounting standard issued, there were a public hearing to inform the exposure draft and the committee, the Indonesian Institute of Accountant receive any comments of the exposure draft. Some issues raised on this case are:

1. Transparency of annuity income recognition

2. Customers should know how much income and debt that they have paid for each installment. This would become an issue when buyer has problem to pay the installment scheme. They may be realized that only income that is recognized, not the debt. This may be different if the income recognition uses the flat rate method. Buyer would pay the installment proportionately along each installment period.

3. Take over issue

4. Similar issue would occur if buyer take over their financing to other financial institution. They would have different income with flat method if they are not informed by the Islamic bank. This may be unjust for buyers as they do not know the portion of income recognition for each installment.

Data Analysis

Statistic descriptive would give detail information about respondent’s preferences on statement in the questionnaire Table 1. The highest is on seller must own the product before they can sell it (4.48). Then, it is followed by seller must inform the profit margin on the product (4.3). The next is rebate can be given if the buyer pay the installment earlier (4.28). Surprisingly, the lowest mean is on margin on installment is similar to interest rate (2.55). The higher mean is on installment margin can refer to interest rate basis (2.75). However, the average mean is still above 2.5 which has ranged from 1-5. While, the main issue on the permissibility of installment income recognition can be used annuity basis has average mean of 3.63. This shows that actually respondents may be in doubt whether annuity income recognition is permisibble or otherwise. But if the parameter is based on the rank of average mean, it has the 11th position among 17 statements. From this, if it is compared to others the statement has lower agreement on the aanuity income recognition. Proportional income recognition has higher rank than annuity income recognition.

| Table 1 Statistic Descriptive | |||||

| No | Variable | N | Minimum | Maximum | Mean |

| 1 | Owned | 40 | 2 | 5 | 4.48 |

| 2 | Inform | 40 | 2 | 5 | 4.3 |

| 8 | Payment | 40 | 2 | 6 | 4.28 |

| 3 | Collateral | 40 | 2 | 5 | 4.1 |

| 12 | Prop | 40 | 1 | 5 | 4.05 |

| 5 | Cancel | 40 | 2 | 5 | 3.98 |

| 7 | Aqad | 40 | 1 | 5 | 3.88 |

| 9 | Insurance | 40 | 1 | 5 | 3.73 |

| 6 | Fine | 40 | 1 | 5 | 3.7 |

| 13 | Propbet | 40 | 1 | 5 | 3.68 |

| 10 | Annuity | 40 | 1 | 5 | 3.63 |

| 11 | Inform1 | 40 | 1 | 5 | 3.5 |

| 14 | Annuitybet | 40 | 1 | 5 | 3.25 |

| 15 | Marjin | 40 | 1 | 5 | 3.25 |

| 4 | DP | 40 | 1 | 5 | 2.95 |

| 16 | Interest | 40 | 1 | 5 | 2.75 |

| 17 | Similar | 40 | 1 | 5 | 2.55 |

| Valid N (listwise) | 40 | ||||

The biggest respondents who do not agree about deferred margin income is similar to interest rate is Bachelor degree (not strongly agree = 8 people, not agree = 5 people from 23) (see Table 2). This is similar to Master level graduation with (not strongly agree = 3 people, not agree = 2 people from 10). But not for Phd, 2 out of 4 people are agree that deferred margin income on murabaha is similar to interest rate.

| Table 2 Similar * Education Crosstabulation | ||||||||

| Education | Total | |||||||

| High school | Diploma | Bachelor | Master | Phd | ||||

| Similar | 1 | Count | 0 | 0 | 8 | 3 | 0 | 11 |

| % within Education | 0.0% | 0.0% | 34.8% | 30.0% | 0.0% | 27.5% | ||

| 2 | Count | 0 | 2 | 5 | 2 | 1 | 10 | |

| % within Education | 0.0% | 100.0% | 21.7% | 20.0% | 25.0% | 25.0% | ||

| 3 | Count | 0 | 0 | 5 | 2 | 1 | 8 | |

| % within Education | 0.0% | 0.0% | 21.7% | 20.0% | 25.0% | 20.0% | ||

| 4 | Count | 1 | 0 | 2 | 3 | 2 | 8 | |

| % within Education | 100.0% | 0.0% | 8.7% | 30.0% | 50.0% | 20.0% | ||

| 5 | Count | 0 | 0 | 3 | 0 | 0 | 3 | |

| % within Education | 0.0% | 0.0% | 13.0% | 0.0% | 0.0% | 7.5% | ||

| Total | Count | 1 | 2 | 23 | 10 | 4 | 40 | |

In age classification, most age period is not agree if deferred margin murabaha income is similar to interest rate (see Table 3). Especially for age group of 20-30 years and 31-40 years. This means that they are agree that margin murabaha is not similar to interest age in any ages. This is similar to Baktiar et al., (2017) who found that murabaha margin recognition is not an issue.

| Table 3 Similar * Age Crosstabulation | |||||||||||||||

| Age | Total | ||||||||||||||

| <20yr | 20-30yr | 31-40yr | 41-50yr | >50yr | |||||||||||

| Similar | 1 | Count | 0 | 4 | 5 | 2 | 0 | 11 | |||||||

| % within Age | .0% | 33.3% | 33.3% | 28.6% | .0% | 27.5% | |||||||||

| 2 | Count | 0 | 3 | 4 | 1 | 2 | 10 | ||||||||

| % within Age | .0% | 25.0% | 26.7% | 14.3% | 40.0% | 25.0% | |||||||||

| 3 | Count | 0 | 2 | 3 | 1 | 2 | 8 | ||||||||

| % within Age | .0% | 16.7% | 20.0% | 14.3% | 40.0% | 20.0% | |||||||||

| 4 | Count | 1 | 1 | 3 | 2 | 1 | 8 | ||||||||

| % within Age | 100.0% | 8.3% | 20.0% | 28.6% | 20.0% | 20.0% | |||||||||

| 5 | Count | 0 | 2 | 0 | 1 | 0 | 3 | ||||||||

| % within Age | .0% | 16.7% | .0% | 14.3% | .0% | 7.5% | |||||||||

| Total | Count | 1 | 12 | 15 | 7 | 5 | 40 | ||||||||

We classify respondents based on the application of murabaha scheme. In general, they are agree that deffered murabaha income is not similar to interest rate (see Table 4). But for not using the murabaha scheme, they are agree that deffered murabaha income is similar to interest rate.

| Table 4 Similar * Using Crosstabulation | |||||

| Using | Total | ||||

| Yes | No | ||||

| Similar | 1 | Count | 5 | 6 | 11 |

| % within Using | 35.7% | 23.1% | 27.5% | ||

| 2 | Count | 5 | 5 | 10 | |

| % within Using | 35.7% | 19.2% | 25.0% | ||

| 3 | Count | 2 | 6 | 8 | |

| % within Using | 14.3% | 23.1% | 20.0% | ||

| 4 | Count | 1 | 7 | 8 | |

| % within Using | 7.1% | 26.9% | 20.0% | ||

| 5 | Count | 1 | 2 | 3 | |

| % within Using | 7.1% | 7.7% | 7.5% | ||

| Total | Count | 14 | 26 | 40 | |

We also classify respondents based on the application of murabaha scheme with the statement of proportional income recognition of murabaha is better than annuity income recognition. In general, they are agree that proportional income recognition in murabaha is better than annuity income recognition (see Table 5). The most preference occurs on not using the murabaha scheme.

| Table 5 Proportional * Using Crosstabulation | |||||

| Using | Total | ||||

| Yes | No | ||||

| Propbet | 1 | Count | 1 | 1 | 2 |

| % within Using | 7.1% | 3.8% | 5.0% | ||

| 2 | Count | 1 | 5 | 6 | |

| % within Using | 7.1% | 19.2% | 15.0% | ||

| 3 | Count | 5 | 3 | 8 | |

| % within Using | 35.7% | 11.5% | 20.0% | ||

| 4 | Count | 5 | 6 | 11 | |

| % within Using | 35.7% | 23.1% | 27.5% | ||

| 5 | Count | 2 | 11 | 13 | |

| % within Using | 14.3% | 42.3% | 32.5% | ||

| Total | Count | 14 | 26 | 40 | |

Compare to the annuity income recognition is better in murabaha scheme, it has lesser support preference compared to the proportional statement (see Table 6). This shows that proportional income recognition has some preference compared to the annuity one.

| Table 6 Proportional * Using Crosstabulation | |||||

| Using | Total | ||||

| Yes | No | ||||

| Annuitybet | 1 | Count | 2 | 1 | 3 |

| % within Using | 14.3% | 3.8% | 7.5% | ||

| 2 | Count | 1 | 8 | 9 | |

| % within Using | 7.1% | 30.8% | 22.5% | ||

| 3 | Count | 6 | 5 | 11 | |

| % within Using | 42.9% | 19.2% | 27.5% | ||

| 4 | Count | 2 | 7 | 9 | |

| % within Using | 14.3% | 26.9% | 22.5% | ||

| 5 | Count | 3 | 5 | 8 | |

| % within Using | 21.4% | 19.2% | 20.0% | ||

| Total | Count | 14 | 26 | 40 | |

From Table 7 and Table 8, we can see that the correlation of similarity interest issue with other variables is not significant. The highest correlation is with proportional income recognition issues (0.211). This shows that the higher the preference of deffered income is similar to interest rate, the higher preference for proportional income recognition is better in murabaha. However, this correlation cannot be concluded.

| Table 7 Correlation Variables with Similar Issues | ||

| Similar | ||

| Owned | Pearson Correlation | .153 |

| Sig. (2-tailed) | .347 | |

| Inform | Pearson Correlation | -.163 |

| Sig. (2-tailed) | .316 | |

| Collateral | Pearson Correlation | .061 |

| Sig. (2-tailed) | .707 | |

| DP | Pearson Correlation | .032 |

| Sig. (2-tailed) | .843 | |

| Cancel | Pearson Correlation | -.009 |

| Sig. (2-tailed) | .958 | |

| Fine | Pearson Correlation | -.040 |

| Sig. (2-tailed) | .806 | |

| Aqad | Pearson Correlation | -.099 |

| Sig. (2-tailed) | .543 | |

| Payment | Pearson Correlation | -.094 |

| Sig. (2-tailed) | .563 | |

| Insurance | Pearson Correlation | -.112 |

| Sig. (2-tailed) | .490 | |

| Annuity | Pearson Correlation | -.011 |

| Sig. (2-tailed) | .944 | |

| Inform1 | Pearson Correlation | .067 |

| Sig. (2-tailed) | .681 | |

| Prop | Pearson Correlation | -.105 |

| Sig. (2-tailed) | .520 | |

| Propbet | Pearson Correlation | .211 |

| Sig. (2-tailed) | .191 | |

| Annuitybet | Pearson Correlation | -.120 |

| Sig. (2-tailed) | .462 | |

| Marjin | Pearson Correlation | -.040 |

| Sig. (2-tailed) | .807 | |

| Interest | Pearson Correlation | .184 |

| Sig. (2-tailed) | .257 | |

| Table 8 KMO and Bartlett's Test | ||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | .700 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 186.670 |

| df | 45 | |

| Sig. | .000 | |

Next analysis is on factor analysis for affected variables to similarity issue. Table 9 shows that the related variables can be used as it is significant and above 0.5 for the test (0.7). This also occurs with anti image matrices correlation which all above 0.5, this means that all variables are qualified for factor analysis. Six variables omitted as the score is below 0.5 (see appendix 2). They are owned, cost, collateral, disclose, prop and propbet. These variables can not be interpreted for further analysis.

| Table 9 Anti-image Matrices | |||||||||||

| DP | Cancel | Fine | Aqad | Payment | Insurance | Annuity | Annuitybet | Marjin | Interest | ||

| Anti-image Covariance | DP | .680 | .044 | -.102 | .026 | -.016 | .120 | -.105 | -.073 | .017 | .077 |

| Cancel | .044 | .695 | .063 | -.037 | -.227 | -.091 | .018 | .034 | .039 | -.136 | |

| Fine | -.102 | .063 | .258 | -.154 | -.006 | .051 | .061 | -.098 | .033 | -.076 | |

| Aqad | .026 | -.037 | -.154 | .162 | -.040 | -.112 | -.084 | .110 | -.042 | .046 | |

| Payment | -.016 | -.227 | -.006 | -.040 | .665 | -.026 | .030 | -.152 | .144 | .019 | |

| Insurance | .120 | -.091 | .051 | -.112 | -.026 | .381 | -.053 | -.074 | .006 | .030 | |

| Annuity | -.105 | .018 | .061 | -.084 | .030 | -.053 | .269 | -.121 | -.042 | -.106 | |

| Annuitybet | -.073 | .034 | -.098 | .110 | -.152 | -.074 | -.121 | .337 | -.154 | .047 | |

| Marjin | .017 | .039 | .033 | -.042 | .144 | .006 | -.042 | -.154 | .362 | -.174 | |

| Interest | .077 | -.136 | -.076 | .046 | .019 | .030 | -.106 | .047 | -.174 | .548 | |

| Anti-image Correlation | DP | .695a | .063 | -.244 | .077 | -.024 | .236 | -.245 | -.152 | .034 | .127 |

| Cancel | .063 | .627a | .149 | -.111 | -.334 | -.177 | .042 | .071 | .078 | -.221 | |

| Fine | -.244 | .149 | .658a | -.751 | -.013 | .161 | .233 | -.333 | .108 | -.201 | |

| Aqad | .077 | -.111 | -.751 | .614a | -.121 | -.450 | -.404 | .472 | -.172 | .153 | |

| Payment | -.024 | -.334 | -.013 | -.121 | .580a | -.052 | .071 | -.321 | .294 | .032 | |

| Insurance | .236 | -.177 | .161 | -.450 | -.052 | .801a | -.164 | -.207 | .015 | .065 | |

| Annuity | -.245 | .042 | .233 | -.404 | .071 | -.164 | .800a | -.403 | -.133 | -.277 | |

| Annuitybet | -.152 | .071 | -.333 | .472 | -.321 | -.207 | -.403 | .626a | -.440 | .109 | |

| Marjin | .034 | .078 | .108 | -.172 | .294 | .015 | -.133 | -.440 | .767a | -.391 | |

| Interest | .127 | -.221 | -.201 | .153 | .032 | .065 | -.277 | .109 | -.391 | .746a | |

| a. Measures of Sampling Adequacy(MSA) | |||||||||||

Next analysis is on communalities requirement. The biggest percentage would give the clearer explanation of variable. The highest percentage is marjin and annuity (see Table 10).

| Table 10 Communalities | ||

| Initial | Extraction | |

| Marjin | 1 | 0.809 |

| Annuity | 1 | 0.791 |

| DP | 1 | 0.751 |

| Aqad | 1 | 0.747 |

| Insurance | 1 | 0.699 |

| Fine | 1 | 0.679 |

| Interest | 1 | 0.668 |

| Annuitybet | 1 | 0.62 |

| Cancel | 1 | 0.616 |

| Payment | 1 | 0.605 |

| Extraction Method: Principal Component Analysis. | ||

In Table 11, we can see that from ten variables can be grouped into three factors as the four component has only 0.929 which is below 1.

| Table 11 Total Variance Explained | |||||||||

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | Rotation Sums of Squared Loadings | ||||||

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 4.135 | 41.352 | 41.352 | 4.135 | 41.352 | 41.352 | 2.914 | 29.139 | 29.139 |

| 2 | 1.730 | 17.300 | 58.652 | 1.730 | 17.300 | 58.652 | 2.480 | 24.799 | 53.938 |

| 3 | 1.120 | 11.196 | 69.849 | 1.120 | 11.196 | 69.849 | 1.591 | 15.911 | 69.849 |

| 4 | .929 | 9.290 | 79.139 | ||||||

| 5 | .643 | 6.434 | 85.573 | ||||||

| 6 | .509 | 5.093 | 90.666 | ||||||

| 7 | .342 | 3.421 | 94.087 | ||||||

| 8 | .261 | 2.609 | 96.696 | ||||||

| 9 | .241 | 2.405 | 99.101 | ||||||

| 10 | .090 | .899 | 100.000 | ||||||

| Extraction Method: Principal Component Analysis. | |||||||||

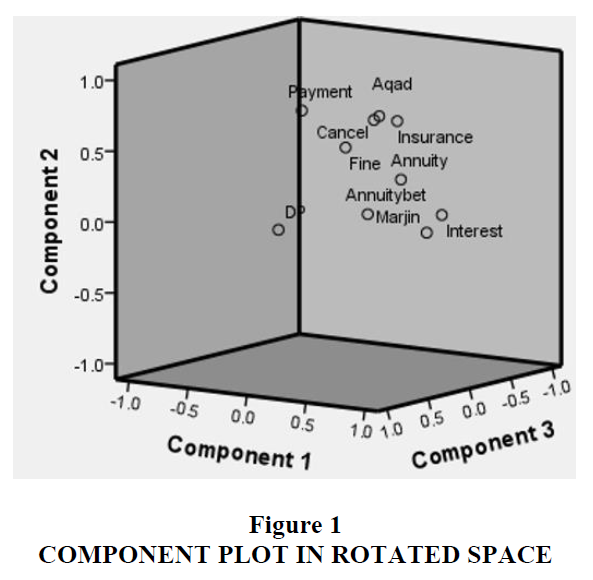

To categorize which variables can be grouped into component 1, 2, and 3, we can see Table 12 and 13. Table 14 shows that all components are above 0.5, so it can be concluded that it is right and have high correlation. 3 dimension can be seen in figure 1.

| Table 12 Component Matrixa | |||

| Component | |||

| 1 | 2 | 3 | |

| DP | .374 | -.422 | .658 |

| Cancel | .226 | .712 | -.242 |

| Fine | .761 | .100 | .299 |

| Aqad | .790 | .341 | .083 |

| Payment | .294 | .606 | .389 |

| Insurance | .717 | .409 | -.134 |

| Annuity | .876 | -.144 | -.061 |

| Annuitybet | .691 | -.358 | .118 |

| Marjin | .719 | -.437 | -.317 |

| Interest | .616 | -.214 | -.493 |

| Extraction Method: Principal Component Analysis. | |||

| a. 3 components extracted. | |||

| Table 13 Rotated Component Matrixa | |||

| Component | |||

| 1 | 2 | 3 | |

| DP | .093 | .031 | .861 |

| Cancel | .023 | .635 | -.461 |

| Fine | .374 | .581 | .449 |

| Aqad | .417 | .738 | .168 |

| Payment | -.222 | .735 | .126 |

| Insurance | .451 | .701 | -.066 |

| Annuity | .746 | .372 | .310 |

| Annuitybet | .595 | .139 | .496 |

| Marjin | .879 | -.007 | .189 |

| Interest | .809 | .070 | -.095 |

| Extraction Method: Principal Component Analysis. Rotation Method: Varimax with Kaiser Normalization. |

|||

| a. Rotation converged in 5 iterations. | |||

| Table 14 Component Transformation Matrix | ||||

| Component | 1 | 2 | 3 | |

| dimension0 | 1 | .751 | .570 | .332 |

| 2 | -.388 | .789 | -.476 | |

| 3 | -.534 | .229 | .814 | |

| Extraction Method: Principal Component Analysis. Rotation Method: Varimax with Kaiser Normalization. |

||||

DP can be called as risk component. While, cancel, fine, aqad, payment, insurance can be called as scheme component. Annuity, annuitybet, marjin, interest as commitment component.

From Table 15, the correlation commitement variable is positive to similar component, others is negative, but all are insignificant. The bigger response for commitment variable would increase the similarity response of annuity record treatment is similar to usury (riba). The result is also similar to regression method (see Table 16, 17, 18). This is similar to Al-Fasfus (2018) who states that different fiqh interpreting also cause this.

| Table 15 Correlations | |||||

| Similar | Commitment | Scheme | Risk | ||

| Pearson Correlation | Similar | 1.000 | .044 | -.115 | -.059 |

| Commitment | .044 | 1.000 | .000 | .000 | |

| Scheme | -.115 | .000 | 1.000 | .000 | |

| Risk | -.059 | .000 | .000 | 1.000 | |

| Sig. (1-tailed) | Similar | 0.00 | .393 | .240 | .358 |

| Commitment | .393 | 0.00 | .500 | .500 | |

| Scheme | .240 | .500 | 0.00 | .500 | |

| Risk | .358 | .500 | .500 | 0.00 | |

| N | Similar | 40 | 40 | 40 | 40 |

| Commitment | 40 | 40 | 40 | 40 | |

| Scheme | 40 | 40 | 40 | 40 | |

| Risk | 40 | 40 | 40 | 40 | |

| Table 16 Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | .137a | .019 | -.063 | 1.34026 |

| a. Predictors: (Constant), Commitment, Scheme, Risk | ||||

| Table 17 ANOVAb | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 1.233 | 3 | .411 | .229 | .876a |

| Residual | 64.667 | 36 | 1.796 | |||

| Total | 65.900 | 39 | ||||

| a. Predictors: (Constant), Risk, Scheme, Commitment | ||||||

| b. Dependent Variable: Similar | ||||||

| Table 18 Coefficientsa | ||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | |||

| B | Std. Error | Beta | Tolerance | VIF | ||||

| 1 | (Constant) | 2.550 | .212 | 12.033 | .000 | |||

| Commitment | .057 | .215 | .044 | .268 | .790 | 1.000 | 1.000 | |

| Scheme | -.150 | .215 | -.115 | -.697 | .490 | 1.000 | 1.000 | |

| Risk | -.077 | .215 | -.059 | -.359 | .722 | 1.000 | 1.000 | |

| a. Dependent Variable: Similar | ||||||||

Conclusion

The research is interesting as annuity method recognition murabaha standard was revised in Indonesia. Discussion on this case could be important input for other country which still adopt similar method. Annuity method recognition is permissible since 2013 until 2020, then it has restriction.

The result shows that bachelor degree and above stated that deferred margin murabaha is similar to interest rate, this is similar to respondents who do not use murabaha scheme. While, respondents who use murabaha would prefer proportional method for murabaha scheme compared to annuity method.

For loading factor analysis, three main variable can be grouped (a) annuity permisiblity, preference of annuity method, bigger margin at the early payment, interest reference (b) issue of cancel, fine for late payment, fine information, discount on early settlement and insurance (c) down payment. All variables are insignificant, only first variable is posisitve, others are negarive correlation to the similar variable. Further research can be done with respondents who use murabaha contract so the impact of annuity method can be elaborate in detail. In addition, other issues such as take over or early settlement could be interesting topic.

Appendix

| Appendix 1 List of Statement Questionnaire | ||

| No | Statement | Code |

| 1 | Seller must own goods when murabaha contract conducted | Owned |

| 2 | Seller must inform cost of good sold (COGS) to buyer | Inform |

| 3 | Buyer must provide collateral untuk installments purchase | Collateral |

| 4 | Down payment can be owned by seller if buyer cancel the transaction | DP |

| 5 | In murabaha purchase order, buyer can cancel the order and pay the real cost incurred | Cancel |

| 6 | If buyer pay late the installment so it can charge fine | Fine |

| 7 | The amount of fine charged because of late payment must be stated in the transaction | Aqad |

| 8 | Discount can be given for early settlement | Payment |

| 9 | Each murabaha must be covered by Islamic insurance | Insurance |

| 10 | Murabaha income recognition can be treated by annuity method | Annuity |

| 11 | Murabaha income recognition can be conducted if buyer informed the amount of income recognition | Inform1 |

| 12 | Murabaha income recognition can be by proportional method | Prop |

| 13 | Proportional income method is better than annuity method | Propbet |

| 14 | Annuity income recognition method is better than proportional method | Annuitybet |

| 15 | Murabaha margin can be big at the beginning of the contract | Marjin |

| 16 | Murabaha margin can refer to interest rate | Interest |

| 17 | Murabaha margin is similar to interest rate | Similar |

| Appendix 2 Anti-Image Matrices | |||||||||||

| DP | Cancel | Fine | Aqad | Payment | Insurance | Annuity | Annuitybet | Marjin | Interest | ||

| Anti-image Covariance | DP | .680 | .044 | -.102 | .026 | -.016 | .120 | -.105 | -.073 | .017 | .077 |

| Cancel | .044 | .695 | .063 | -.037 | -.227 | -.091 | .018 | .034 | .039 | -.136 | |

| Fine | -.102 | .063 | .258 | -.154 | -.006 | .051 | .061 | -.098 | .033 | -.076 | |

| Aqad | .026 | -.037 | -.154 | .162 | -.040 | -.112 | -.084 | .110 | -.042 | .046 | |

| Payment | -.016 | -.227 | -.006 | -.040 | .665 | -.026 | .030 | -.152 | .144 | .019 | |

| Insurance | .120 | -.091 | .051 | -.112 | -.026 | .381 | -.053 | -.074 | .006 | .030 | |

| Annuity | -.105 | .018 | .061 | -.084 | .030 | -.053 | .269 | -.121 | -.042 | -.106 | |

| Annuitybet | -.073 | .034 | -.098 | .110 | -.152 | -.074 | -.121 | .337 | -.154 | .047 | |

| Marjin | .017 | .039 | .033 | -.042 | .144 | .006 | -.042 | -.154 | .362 | -.174 | |

| Interest | .077 | -.136 | -.076 | .046 | .019 | .030 | -.106 | .047 | -.174 | .548 | |

| Anti-image Correlation | DP | .695a | .063 | -.244 | .077 | -.024 | .236 | -.245 | -.152 | .034 | .127 |

| Cancel | .063 | .627a | .149 | -.111 | -.334 | -.177 | .042 | .071 | .078 | -.221 | |

| Fine | -.244 | .149 | .658a | -.751 | -.013 | .161 | .233 | -.333 | .108 | -.201 | |

| Aqad | .077 | -.111 | -.751 | .614a | -.121 | -.450 | -.404 | .472 | -.172 | .153 | |

| Payment | -.024 | -.334 | -.013 | -.121 | .580a | -.052 | .071 | -.321 | .294 | .032 | |

| Insurance | .236 | -.177 | .161 | -.450 | -.052 | .801a | -.164 | -.207 | .015 | .065 | |

| Annuity | -.245 | .042 | .233 | -.404 | .071 | -.164 | .800a | -.403 | -.133 | -.277 | |

| Annuitybet | -.152 | .071 | -.333 | .472 | -.321 | -.207 | -.403 | .626a | -.440 | .109 | |

| Marjin | .034 | .078 | .108 | -.172 | .294 | .015 | -.133 | -.440 | .767a | -.391 | |

| Interest | .127 | -.221 | -.201 | .153 | .032 | .065 | -.277 | .109 | -.391 | .746a | |

| a. Measures of Sampling Adequacy(MSA) | |||||||||||

References

- Abdullah, A. (2016). Examining US approvals of Islamic financing products and the Islamic theory of lawful profit. International Journal of Islamic and Middle Eastern Finance and Management, 9(4), 532–550. https://doi.org/10.1108/IMEFM-09-2015-0107

- Al-Fasfus, F. (2018). Reasons of the Difference of Murabaha Accounting Standards in Islamic Banks. International Journal of Economics and Finance, 11(1), 28–36. https://doi.org/10.5539/ijef.v11n1p28

- Al-Fijawi, M.F.A., & Yunus, S.M. (2019). Modern applications of profit-sale (Bay? mur?ba?ah) from a maq??id shar??ah perspective. Al-Shajarah, 24(1), 49–66.

- Amir, V., Hatimah, H., Khalisah, N., & Purboyanti, R.T. (2015). A criticism of anuities in murabahah transaction: allowing riba throught fatwa? (a case study of sharia banking in Indonesia). Proceeding - Kuala Lumpur International Business, Economics, and Law Conference 6, 1, 19–27.

- Baktiar, A., Ode, L., & Adam, B. (2017). Murabahah Implementation in Islamic Bank ( Study at Bank Muamalat Kendari Branch ) Samdin Hasan Aedy. IOSR Journal of Economics and Finance, 8(5), 13–27. https://doi.org/10.9790/5933-0805011327

- Chelhi, K., Hachloufi, M.E., Elfar, M., Eddaoui, A., & Marzak. (2018). Data Mining Approach for Modeling Murabaha Return Risk Taking into Account Economic Factors. Colloquium in Information Science and Technology, CIST, 167–171. https://doi.org/10.1109/CIST.2018.8596596

- Faisal, M. (2015). Metode anuitas dan proporsional murabahah sebagai bentuk transparansi dan publikasi laporan bank. Mimbar Hukum, 26(3), 382–394. https://doi.org/10.22146/jmh.16032

- Kamaliyah, F. (2018). The influence of margin murabaha recognition method on Islamic banking sustainability. Economics and Accounting Journal, 1(3), 206–214. https://doi.org/10.32493/eaj.v1i3.y2018.p206-214

- Kholvadia, F. (2017). Islamic banking in South Africa form over substance? Meditari Accountancy Research, 25(1), 68–81. https://doi.org/10.1108/MEDAR-02-2016-0030

- Yanikkaya, H., Gümü?, N., & Pabuçcu, Y.U. (2018). How profitability differs between conventional and Islamic banks: A dynamic panel data approach. Pacific Basin Finance Journal, 48, 99–111. https://doi.org/10.1016/j.pacfin.2018.01.006