Case Reports: 2023 Vol: 27 Issue: 2S

Analyzing the Effects of Capital Structure and Credit Risk on the Profitability of Iraq's Private Banks

Wisam Fadhil Hanoon, University of Thi-Qar

Mohammed Zaki Ward, University of Thi-Qar

Abbas Hadi Gatea, University of Thi-Qar

Citation Information: Hanoon, W.F., Ward, M.Z., & Gatea, A.H. (2023). Analyzing the effects of capital structure and credit risk on the profitability of Iraq's private banks. Academy of Educational Leadership Journal, 27(S2), 1-15.

Abstract

Iraq's banking sector is one of the most important economic sectors since it plays a significant role in economic growth, support and development. This study aims to motivate bank executives to enhance internal controls and adhere to banking regulations. For banks to succeed and compete effectively, they must ensure that their activities run efficiently and determine the capital structure decisions to enhance their value and profitability. As a result, banks can make more informed capital structure decisions and improve their performance when they implement sound risk management practices. Using path modeling, determine the impact of capital structure and credit risk on the profitability of Iraqi private banks. A total of 405 observations from four Iraqi banks were analyzed between 2015 and 2022 we estimated a PLS-SEM path model. In Iraqi banks, credit risk significantly affected their capital structure and had no significant impact on profitability. However, profitability was negatively affected by credit risk. In conclusion, these findings encourage bank leaders to make profitable capital structure decisions and improve risk management practices. A PLS-SEM model has begun to be used in finance and banking; this study illustrates its applicability and advantages.

Keywords

Credit Risk, Bank Profitability, Capital Structure, Private Banks, PLS Path Model.

Introduction

Different countries have different financial systems. Developed nations have market-based and banking-based system that is relatively mature in both cases. On the other hand, developing countries’ economies are based on public or private banking. In emerging financial sectors prevalent in underdeveloped economies, banks are a unique set of business enterprises because of their regulatory constraints, economic functions, and operations. An efficient private banking sector can protect the financial system from adverse shocks in developing countries.

When private banks provide their services, they must manage multidimensional risks associated with liquidity, capital adequacy, credit volume, interest rates, foreign exchange rates, and operational and sovereign risks. Unfortunately, these aspects have been poorly managed in various economies, resulting in low levels of private credit, high-interest rates, high delinquent loans, low asset quality, and inefficiencies (Ardiny & Alyamoor, 2021).

The banking system acts as an essential element for building the economy, and improving the financial soundness of the banking sector increases the importance of the role of banks operating within it as depository institutions and mediators between deficit and surplus units as capital adequacy. In 2021, the banking sector index decreased to (243%), at a rate of (1.32%), until this decrease is insignificant. The ratio is still higher than the benchmark ratios for Basel and the Central Bank in April, with a rate of 260%, which is higher for the Iraqi liquidity coverage index. During the fourth quarter of 2021, the net stable financing ratio also increased by 240%, which is higher than the Basel ratio.

The profitability and efficiency of the banking sector also contribute to boosting economic transactions and avoiding systemic risk (Martinez, Garca, Montoya, & Gómez, 2017). Accordingly, one of the most critical aspects of this desired condition is the quality of assets and the amount of capital adequacy in the structure of bank accounts. According to the latest Basel III international regulations, banks with more capital and less leverage will be more able to absorb shocks, thus eliminating the deficiencies that lead to financial crises (Brongi & Langone, 2016).

Capital adequacy decisions, however, are more complex. Moreover, it can become a challenge for the banking industry, which warns that banks may be forced to add these costs to loans if its structure is more expensive to finance with equity (Brongi & Langone, 2016). Due to this mechanism, the composition of private banks' liabilities and equity can negatively affect economic growth, as banks prioritize their profitability over economic growth. Contrary to popular belief, there are widespread contradictions. According to Admati, DeMarzo, Hellwig, and Pfleiderer (2013), bank capital is not socially costly, and high leverage is not necessary for banks to serve society. If unaware of this, investors would be discouraged from investing in the banking capital structure.

A total of (62.80) trillion dinars of registered credit were registered in 2021, up from (26.75 trillion dinars in 2020). Cash credit rose to (97.52) trillion dinars in 2021 from (81.49) trillion dinars in 2020, a growth rate of 4.6%. Government, public institutions, and the private sector received 7.65% more cash in 2021, as credit growth rates increased by (0.4%), (3.56%) and (40%).

For companies committed to financial intermediation aiming to maximize their profitability, decision-making regarding capital structure and risk exposure are challenging. Consequently, the bank's sound financial performance should reward shareholders and stimulate additional investment, leading to more significant economic growth. However, Ecuador's economy still needs to review this situation.

During economic recessions and currency crises, banks and their performance play an even more critical role in the economy (Nuhiu et al., 2017). The present study investigates the relationship between capital structure, credit risk levels, and bank profitability. Through this study, we will examine whether the capital structure and credit risk significantly impact the profitability of Ecuadorian private banks.

Theoretical Framework

The profitability of a bank can be influenced both internally and externally. The literature also mentions factors specific to banks and markets. In both cases, the first term refers to variables under the bank's control, and the second refers to variables outside the bank that are influenced by macroeconomic factors. For example, capital structure refers to an internal factor, while credit risk refers to an external factor. A bank's capital levels, operational efficiency, and size are among the internal factors that should be considered. Operating efficiency significantly influences bank profitability (Bucevska & Hadzi Misheva, 2017; Nuhiu, Hoti & Bektashi, 2017). As a result, there needs to be more consistency in the literature regarding the effects of bank capital levels.

Banks different debt and capital ratios have positive effects (Siddik, Kabiraj & Joghee, 2017). The level of capital has also been found to be a significant predictor of bank profitability in some cases. In the European Union, Petria, Capraru, and Ihnatov (2015) and Djalilov and Pieces (2016) found that higher capital levels positively and significantly impact bank assets. Similarly, Sufian (2012) found similar results in the South Asian banking sector in Jordan and Saudi Arabia; Bucevska and Hadzi Misheva (2017) found similar results in the Balkan region. Admati et al. (2013) are the authors who emphasize the positive effects of high capital levels on bank profitability.

In contrast, the study by Bitar, Pukthuanthong, and Walker (2017) suggests that higher capital ratios in Organization for Economic Cooperation and Development [OECD] countries may reduce the efficiency and profitability of banks that are highly liquid. Furthermore, regarding liquidity and capital, Kim and Sohn (2017) found that bank capital can positively influence loan placement growth, but only in large banks that maintain sufficient liquid assets. This suggests that the results of capital on profitability differ according to the size and assets of the bank.

Likewise, Knezevic and Dobromirov (2016) found this negative effect of high capital; the authors explain that a higher capital level does not mean greater strength. However, it also means that these additional funds captured are not invested, causing that in the long term, a negative influence on profitability appears. Nuhiu et al. (2017) found this same result for banks in Kosovo and Ayaydin and Karakaya (2014) for a sample of Turkish banks. In other cases, the level of capital has yet to present significant effects on profitability (Mendoza & Rivera, 2017). Based on prior empirical research, Iraqi private banks' profitability is correlated with their level of capital as determined by one of the Basel 3 requirements.

According to studies, capital adequacy and profitability of banks have an inverse relationship, and there is a significant correlation between capital adequacy and profitability for a particular sample. Therefore, a high capital adequacy ratio does not result in a significant relationship between capital adequacy and profitability. Based on its scientific, objective, and reliable results, Basel silent requirements are among the key financial ratios that measure banks' final ability to fulfill their financial and contractual obligations. As a result of the level of importance and the existence of a correlation between capital adequacy and profitability in the Bank of Baghdad, there is no archaeological correlation between capital adequacy and profitability.

Among other internal factors determining bank profitability is the size of the banks, precisely the size of their assets. On this, the studies by Petria et al. (2015) showed that the size of bank assets significantly positively affects bank profitability. Very close to this variable, the concentration of the banking sector and its influence on bank profitability are also analyzed. This aspect is measured in the studies through the Herfindahl-Hirschman index; the investigations show contradictory results. In some cases, competition in the banking industry has not shown significant effects on profitability Bucevska & Hadzi (2017); Djalilov & Piesse (2016), other studies have shown at least a significant indirect effect of said variable Hu & Xie (2016) and others, a significant positive effect (Ayaydin & Karakaya, 2014).

Regarding external factors, the investigations generally include the possible influences that could generate macroeconomic variables and legal regulations on bank profitability. Regarding the macroeconomic environment, it is common to find studies that include inflation, interest rates, and economic growth in their analyses. In some studies, economic growth measured by the country's Gross Domestic Product (GDP) has not shown a significant effect on bank profitability Petrie et al. (2015); Djalilov & Piesse (2016), while other authors found a significant positive effect of this factor (Sufian, 2012).

The financial reports showed a positive effect of inflation on the profitability of a large sample of Iraqi banks. The author explains that these results reveal that managers fully anticipate inflation rates, which causes profits to rise faster than costs, improving net interest margins. Inflation has been a problem in most Middle Eastern economies, especially Iraq. As a result, banks could pressure their customers with higher credit margins.

Bikker and Vervliet (2017) showed, in the context of the United States, that interest rates can significantly affect bank profitability due to lower net interest margins. However, the authors found that banks tend to maintain profitability by reducing provisions, which can jeopardize financial stability. Financial risk emerges directly from market-related factors as one of the most important determinants of bank profitability. Among the investigations, the treatment of credit risk and bank insolvency risk stands out. In both cases, the findings show similar traits: various types of risk have significant effects on bank efficiency. In most studies, evidence has been found that credit risk hurts bank profitability (Bucevska & Hadzi, 2017; Mendoza & Rivera, 2017; Bikker & Vervliet, 2017). However, in other cases, this significant relationship is positive, suggesting that greater risk exposure may mean greater profits for the financial institution and maybe because for this effect to exist, banks with higher provisions for credit losses will require a higher net interest margin to offset the higher risk of default (Haseeb Hasan et al., 2020). Moreover, in institutional environments where the interest of investors is weakly protected, such as in Iraq, it is observed that banks transfer the cost of higher risk to the client who, ultimately, pays higher prices for banking services, managing to suppress the negative effect that credit risk could have on your profit from the capital structure.

The discrepancy between capital structure and profitability gave rise to theories with the most influential studies by Modigliani and Miller (1958) through what they called the theory of Irrelevance, emphasizing that the capital structure does not add value to a company because this value depends on the capacity it has to generate value for the assets it owns and that it is irrelevant if Funds come from internal or external sources.

However, after carrying out a new study, Modigliani and Miller (1963) showed the impact of corporate income taxes on a company's capital structure. They found that companies will increase the use of debt instead of capital. To take advantage of the fact that interest payments are tax deductible, which is called a tax shield.

After that, other theories were born, such as the Trade-Off theory, which maintains that companies seek optimal leverage, that is, the one that minimizes the cost of capital. Belkhir, Maghyereh, and Awartani (2016) refer to this theory in their study, which establishes that the optimal capital structure of bank results from a trade-off between the costs and benefits of debt and equity. Consequently, banks tend to use debt rather than equity to maximize their value. Furthermore, under this theory, companies use debt to benefit from the tax shield provided by interest deductibility.

On the other hand, the theory of Financial Hierarchy authored by Myers and Majluf (1984) arises., which emphasizes a pre-definition of bank financing options, according to the authors. In this case, banks prioritize retained earnings as the best source of funds. Debt or bonds will be used if internal financing is unavailable; therefore, the need for leverage is expected to be less for highly profitable firms and banks. Likewise, the Market-Timming theory proposes the issuance of shares in periods in which market conditions are favorable; during which the company's shares have high market value relative to their book value and past market value; reducing the company's cost of capital and benefiting shareholders (Caselli & Negir, 2018).

Based on these theories, several determinants exert influence when determining capital structure (M'ng, Rahman & Sannacy, 2017). The size of the bank exerts influence because large banks have less volatile earnings, better access to capital markets, and can increase debt at a lower cost (Bitar et al., 2017); That is why the trade-off theory predicts a positive effect of the size of the bank in terms of the capital structure.

On the other hand, liquidity is part of the determinants of capital structure, given that financial entities with more liquid assets face lower bankruptcy costs and are more capable of increasing debt; therefore, according to trade-off theory, more liquid assets will result in more leverage (Belkhir, Maghyereh & Awartani, 2016). In contrast, pecking order theory suggests that having more liquid assets implies less information asymmetry and, therefore, a better ability to increase wealth; this implies that greater asset liquidity is conducive to less leverage.

Likewise, the availability of fixed assets means that companies and banks can obtain more debt since said assets back it; that is, banks with more tangible assets are expected to have lower bankruptcy costs and higher leverage ratios (Sha'ban, Girardone & Sarkisyan, 2016). However, under the pecking order theory, companies and banks with more tangible assets available are less sensitive to information asymmetry. Consequently, the cost of issuing shares will be less than the cost of debt. Therefore, it is presumed that fixed assets are positively associated with capital ratios.

Among other findings, when interest is tax deductible, the higher the tax rates a company faces and, therefore, the greater the benefits derived from using debt because interest payments result in more tax savings. Trade-off theory, therefore, predicts that firms facing higher income tax rates will use more leverage. As a measure of this, the relationship between current income tax and income before taxes is used; In addition, a positive correlation between taxes and leverage is expected (Belkhir, Maghyereh & Awartani, 2016). The development of the economy exerts an influence on capital structure decisions.

In this case, a fundamental macroeconomic determinant is the GDP growth rate because wealth increases are more favorable during the economic boom and expansion periods. Typically, stock prices and taxable income are higher in these periods, and expected bankruptcy costs are lower. Consequently, the banks' profits will increase and are considered with retained earnings in their capital reserves (Bitar et al., 2017).

On the other hand, different studies argued that, due to the unique nature of banking units, the capital structure could have its theoretical bases specific to this sector. Among them, Diamond and Rajan (2000) establish a framework for bank capital structure, pointing out important features, such as the fact that banks can create liquidity. However, this capacity is reduced when bank capital is increased to reduce the probability of financial instability. Consequently, the optimal structure of bank capital must be balanced between the effects of the creation of liquidity, the costs of banking difficulties, and the ability to maintain a loan portfolio without high default rates. Specifically, the most relevant difference in the bank's capital structure is its high percentage of debt reflected in public deposits and the extent to which said deposits are allocated to credit in search of profitability of banking risk.

In general terms, credit risk represents the probability of loss that the company incurs in the event of a business partner failure. Klieštik and Cúg (2015) explain that non-compliance with obligations under contract terms can be considered a credit risk, which represents a loss for the business, in which obligations arising from the credit, trade, or investment activities can be included. , payment and liquidation; for example, defaults on loans to customers, unpaid invoices, overdue obligations arising from the issuance of debt securities or shares or obligations derived from trading in financial and capital markets, and the like.

In particular, financial institutions are particularly vulnerable to credit risk. However, it is essential to expose various approaches to credit risk that have subsequently been applied and improved for risk assessment, specifically in the banking industry. Klieštik and Cúg (2015) classify the progress of credit risk models in five stages: (1) First generation of models in a structural way, credit valuation models; (2) Second generation of models of structural form; (3) Reduced form models; (4) Contributions from the relationship between the probability of default and recovery rate; and (5) VaR models.

Among the main determinants of bank credit risk, market risk has been one of the most studied. As a result, the latest contributions from Basel were modified by adding the market risk component to its credit risk controls. However, the two types of risk tend to be generated by the same economic factors, so their separation or identification can be difficult. On this, Kim (2017) explains that, for example, the prices of corporate bonds reflect the expectations of credit losses; therefore, in these cases, it is not clear if this volatility should be classified as a risk of market or credit risk.

On the other hand, liquidity risk is also closely related to credit risk. Although some studies have failed to prove a significant association between the two types of risk (Adeniran et al., 2020), several authors suggest their simultaneous control (Fenjan & Salman, 2021).

In Iraq, prior literature determines that delinquency, a measure of credit risk, is especially negatively sensitive to liquidity in a sample of banks from Iraq. In particular, oil prices, the volume of credit, and economic activity are the most critical factors in Iraq.

Prior literature found that a higher share of loans is associated with higher interest margins, suggesting that risk-averse shareholders seek higher profits to offset the higher credit risk. For this reason, banks that make relatively high-risk loans will allocate more funds to the loan loss reserve than a bank that assumes lower risks.

In this sense, many researchers have focused on studying the relationship between bank capital and its impact on risk, mainly when credit crises occur, thus emphasizing the need to better understand the determinants of bank risk in an environment of less capital. Therefore, it is not surprising that the relationship between bank capital and risk has recently become a matter of concern, especially since the level of capital can have both beneficial and adverse effects on bank profitability.

Hypotheses Development

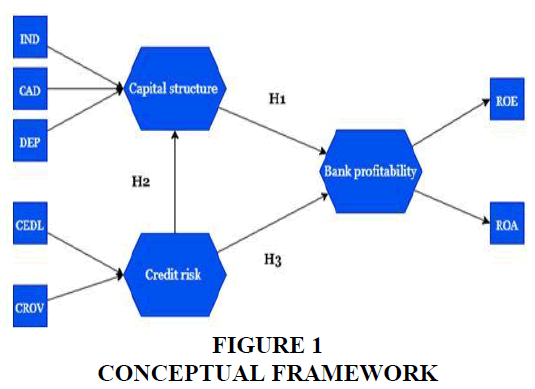

The capital structure measured by different debt and capital ratios has shown positive effects in the banking context (Siddik, Kabiraj & Joghee, 2017); specifically, some studies found that higher levels of capital have a positive and significant effect on the performance of banks assets (Petria, Capraru & Ihnatov, 2015; Djalilov & Piesse, 2016; Sufian, 2012; Bucevska & Hadzi Misheva, 2017; Aboalriha & Fakhruldeen, 2022; Psillaki, & Mamatzakis, 2017; Akter, Majumder, & Uddin, 2018) and in other cases, this positive effect appears only in banks with sufficient liquid assets(Kim & Son, 2017). On the contrary, other findings suggest a negative influence of capital on profitability (Bitar, Pukthuanthong, & Walker, 2017; Knezevic & Dobromirov, 2016; Nuhiu et al., 2017; Ayaydin & Karakaya, 2014; Chavali & Rosario, 2018; Cruz -García & Fernández, 2019) and in other studies, capital adequacy is a non-significant predictor of profitability (Mendoza & Rivera, 2017). Consequently, the first research hypothesis corresponds to the following:

H1: Bank profitability is positively affected by capital structure.

Likewise, previous studies focusing on the relationship between capital and risk have mixed results. Some studies find a positive relationship between capital and risk. This reveals that regulatory entities encourage banks to increase their capital proportionally to the risk assumed (Ayaydin & Karakaya, 2014). To determine this relationship between capital structure and credit risk, various investigations have been applied to banks in the United States, Europe, and the middle east, thus finding a positive relationship between capital and total risk (Iannotta, Nocera & Sironi, 2007). Despite this, some authors find opposite results; the capital structure is negatively related to risk levels (Majumder & Li, 2018). Therefore, the second research hypothesis is:

H2: Bank capital structures are positively affected by credit risk.

A risk emerges as one of the most important determinants of bank profitability from market-related factors. In most studies, evidence has been found that credit risk harms bank profitability (Bucevska & Hadzi, 2017; Mendoza & Rivera, 2017; Bikker & Vervliet, 2017); in other cases, although scarcer. , this significant relationship is positive, suggesting that greater exposure to risk can mean greater profits for the financial institution; this effect occurs in weak institutional environments such as in Iraq, .where the interest of investors is weakly protected. Banks transfer the cost of higher risk to the customer who pays higher prices for banking services. A non-significant relationship between these variables has also been shown (Tan, 2016). Finally, the third hypothesis is:

H3: Bank profitability is negatively affected by credit risk.

Methodology

A study collected information from the four largest Iraqi banks (Baghdad, Commercial Bank, Iraqi Middle East Investment Bank, Investment Bank of Iraq) with assets of over USD 685,251,700.00 (central bank of Iraq, 2023). Therefore, their participation is relevant and significant.

Additionally, 67 out of 74 banks in Iraq are owned by the private sector, representing 90.5% of the total. Private Banks own 75.4% of the banking sector's capital because they are large and adhere to the Central Bank's directives to hold at least 250 billion Iraqi dinars. Although these banks account for only 13% of total deposits, 16% of cash credit, and 21.4% of banking sector assets, they are significantly overshadowed by state banks (central bank of Iraq, 2022). Monthly data was collected from 2015 to 2022 (Ibrahim, 2017; Jabbouri & Zahari, 2014; Khatab et al., 2019). A panel of 405 financial indicators was used to construct the database.

For the PLS-SEM gniledom, profitability, capital structure, and credit risk variables were constructed as latent or unobservable variables. For constructing these variables, the most relevant financial ratios were used as observed variables. we present the variables with their nomenclature and descriptions and the authors using them to measure credit risk, profitability, and capital structure Appendix Table 5.

A path model based on Partial Least Squares (PLS) was considered. Since it can evaluate the measurement of latent variables as well as the relationship between them, this technique is gaining acceptance in many business and social disciplines (Hair, Sarstedt, Hopkins & Kuppelwieser, 2014); it is considered a viable methodology. When a latent variable is not directly observable with a single indicator, it is usually measured or explained using a block of highly correlated indicators (Avkiran & Ringle, 2018). Profitability, for example, can be viewed as the return on capital and assets. The latent variable of both indicators can thus be construed as profitability.

As with multiple regression analysis, PLS-SEM works similarly. Specifically, this method can be described as a multivariate, non-parametric approach that estimates latent variables and their direct relationships using iterative regressions. The PLS-SEM has recently received considerable attention in various disciplines, including banking and finance (Nitzl, 2016; Ayadurai & Eskandari, 2018; Avkiran & Ringle, 2018).

Based on the construction of the internal and external models, the PLS-SEM model specification is divided into stages. Relationships between the evaluated constructs are shown in the internal or structural model. Comparatively, external models assess the relationships between indicator variables and their corresponding constructs (Hair et al., 2014). After the theoretical foundation has been reviewed, the specification of the PLS-SEM model implies constructing a model of routes connecting the variables and constructs; therefore, it is crucial to differentiate the location and relationships between the constructs when considering this model. Accordingly, we specified the model based on the above hypotheses Figure 1.

As illustrated in Table 1, the measurement model connects observed variables, such as financial ratios, with their respective latent variables: capital structure, credit risk, and bank profitability. Latent variables and manifested variables can be grouped into blocks. There can be a formative or reflective relationship between a block and its latent variable. Formative indicators form exogenous latent constructs. Exogenous latent constructs become the dependent variable in this scenario. Conversely, reflective indicators are manifestations of the latent construct (i.e., path relations from the construct to the indicators). Endogenous latent constructs are, therefore, independent variables.

Typically, reflective indicators are a representative set of all elements within a construct's conceptual domain; therefore, they should be highly correlated and can be omitted without changing the meaning. A formative construct's fundamental nature can change if an important observed variable is omitted (Hair et al., 2014). It is important to evaluate the reliability and validity of the external reflective and formative models. Although both criteria were considered, they were not the same. Reflective models are unique in their reliability.

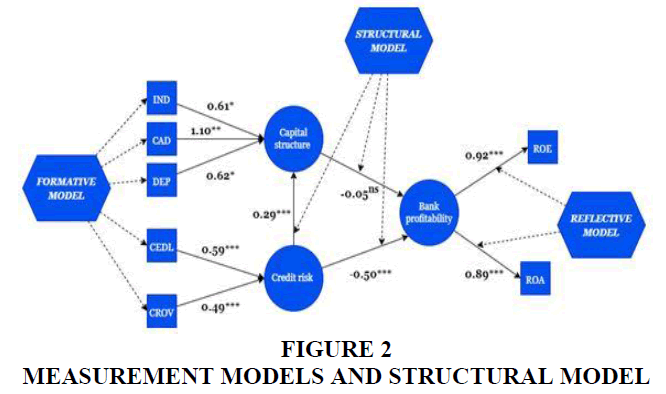

The validity, however, is analysed differently in both cases. Formative measurement differs fundamentally from reflective measurement, as previously stated (Hair et al., 2014). In Figure 2, reflective and formative indicators are used to construct the model.

For reliability evaluation, Cronbach's alpha coefficient and composite reliability were used. Hair et al. (2017) suggest that the Rho index should be between .70 and .90. Values greater than .90 suggest that several indicators measure the same thing and are potentially redundant. Generally, convergent validity is considered when items with external loadings exceeding .70 and AVEs greater than .50 in reflective models (Hair et al., 2014). A Variance Inflationary Factor (VIF) or tolerance index was used to examine collinearity in the formative indicators. Moreover, collinearity was also verified in the internal structural model (Hair et al., 2017). Cross-loadings, better known as cross-loadings, were used to evaluate discriminant validity. It is necessary for an indicators charge in its construct to be greater than any of its cross charges in other constructs (Hair et al., 2014). Coefficient of determination, f2 effect size, and mean square residual (SRMR) are used to determine the goodness of fit of a structural model.

Descriptive Statistics

For each bank in the sample, table 2 shows the mean and standard deviation of the financial ratio. The entity banks of Baghdad obtained a return on equity ROE was 0.10 as the highest average value in profitability. The median ROA return on assets for all financial institutions in the sample is 0.02.

The average return on equity in the total sample is 1.16, which could vary by 0.03, either positively or negatively.

Generally, the assets of large private sector banks are financed between 0.79 and 0.80 by debt primarily derived from public deposits. The highest average debt ratio recorded was 0.80, corresponding to the bank of Baghdad and Commercial Bank. As a result of shareholder contribution ratios, the equity contribution to private bank assets ranges, on average, between 0.08 and 0.11. Lastly, regarding the debt/equity ratio, it was found that the proportion between debt financing and own resources is high in large private banks, with an average value of 32.1.

Commercial Banks and Investment Banks of Iraq had the lowest average delinquency rates according to credit risk indices. Nevertheless, these two institutions achieved the highest profitability indices. According to the average of the Austro financial entity, the highest delinquency rate was reported, followed by the Iraqi Middle East. Finally, the average delinquency rate in the entire sample was 0.12.

The Iraqi Middle East had the highest provision percentage, followed by the Investment Bank of Iraq. Bank of Baghdad reported the lowest provision levels. Furthermore, in terms of standard deviation, banks with lower delinquency rates and lower provision percentages had relatively low values, indicating less variability in these indicators. Investment Bank of Iraq and the Iraqi Middle East had the highest variability in the ratios evaluated.

Measurement Models

To construct the model, we evaluated the validity and reliability criteria of the formative and reflective measurement models. Using Table 2, we can assess the convergent validity of external or measurement models for capital structure, credit risk, and profitability. We constructed formative models for capital structure, credit risk, and reflective models for profitability Figure 2.

Using bootstrapping to determine the significance level of each indicator's weight, the convergent validity of the formative constructs was evaluated (Hair et al., 2014). The upper and lower limits for each observed variable did not contain zero, indicating that the chosen financial indicators were significant. As a result, the capital structure was defined by IND (β = 0.61; t = 2.01; p < 0.05), CAD (β = 1.10; t = 3.52; p < 0.01), and DEP (β = 0.620; t = 2.75; p < .05). CEDL measures credit risk (β= 0.59; t = 6.37; p < .001) and CROV (β = 0.49; t = 5.95; p < .001).

Additionally, the Variance Inflationary Factor (VIF) is used to evaluate collinearity in the formative constructs. Hair et al. (2014) found no redundant variables in the formative constructions of credit risk and capital structure. A similar convergent validity criterion was used for the reflective profitability model, which showed significantly lower bound intervals when ROE and ROA were significant, with lower bound intervals that did not contain zero. We evaluated the standard reliability criteria for the reflective profitability model in particular. In order to evaluate this criterion, Cronbach's alpha coefficient (a = 0.80) and the Rho index or composite reliability (r = 0.90) were used, both with fair values between 0.70 and 0.90 (Hair et al., 2017). The reflective model supports convergent validity when the average variance extracted (AVE = 0.81) is .50 or higher (Hair et al., 2014).

Using cross-loadings between each latent variable, discriminant validity was evaluated Table 3. This criterion can determine a one-dimensional indicator or observed variable if it does not belong to any other construct. Essentially, it was sought that the ROE or ROA indicator, intended to measure profitability, not be associated with a capital structure or credit risk. An indicator's charge in a construct must be greater than its cross charge in another (Hair et al., 2014). Therefore, the ROA load or correlation with profitability must be greater than any estimated load related to credit risk or capital structure. Reporting on cross-loading is best done in a table with columns for the latent variable and rows for the indicators.

Structural Model

Latent variable estimators are presented in Table 3. The capital structure construct (β = -0.05; t = -0.09; N-S) was not associated with bank profitability. Meanwhile, credit risk (β = -0.50; t = 15.98; p < 0.001) predicted profitability significantly. It was found that credit risk and capital structure are significantly correlated (β=0.29; t=6.95; p < 0.001).

R-squared values were determined to determine the goodness of fit; a value greater than 0.25 was considered moderate (Cohen, 1988). A particular endogenous construct's omitted construct effect size can be determined from f two by calculating 0.02, 0.15, and 0.35 (Cohen, 1988) for small, medium, and significant effects based on the value of f 2. In the case of credit risk, the effect size was large (f 2=0.47). At the same time, the capital structure did not achieve an acceptable value (f 2=0.01). As a final measure of the model's fit criterion (Hair et al., 2017), the normalized root means square residual (SRMR) allows one to assess the average magnitude of differences between observed and expected correlations. SRMR indicates that a fit is acceptable when it produces a value smaller than 0.10 and a good fit when it produces a value less than 0.05 (Kline, 2011); in this case, a good fit for profitability was detected Table 4.

Results and Discussion

This study examined the relationships between capital structure, credit risk, and profitability of Iraqi private banks. The applied technique, unlike other investigations, allowed latent variables to be constructed based on the most relevant financial ratios. By applying the PLS-SEM technique to bank performance, we contribute to research on its validity (Ayadurai & Eskandari, 2018).

First, hypothesis 1 was rejected; capital structure and bank profitability did not appear to be significantly related; this result contradicts the theory that banks with greater ability to cover credit defaults are more profitable (Mendoza & Rivera, 2014). Thus, rejecting this hypothesis may suggest no relationship between profitability and the stock market or retained earnings financing sources (Llorens & Martin-Oliver, 2017; Hashim, 2022). There is no relationship between capital structure and profitability because financing options are limited to debt or retained earnings in an underdeveloped bond and share market like Iraq, reducing diversification opportunities and profitability chances (Siddik et al., 2017).

Moreover, the conclusions in hypothesis 1 are different from those of other authors who maintain that higher capital ratios are significant positive predictors of bank profitability (Petrie et al., 2015; Djalilov & Piesse, 2016; Bucevska & Hadzi, 2017; Sufian, 2012; Psillaki, & Mamatzakis, 2017; Akter, Majumder, & Uddin, 2018). Furthermore, by rejecting this hypothesis, we cannot conclude that changes in the capital structure negatively and significantly affect bank profitability, a conclusion confirmed by other studies (Chavali & Rosario, 2018; Bitar et al., 2017; Knezevic & Dobromirov, 2016; Nuhiu et al., 2017; Ayaydin & Karakaya, 2014). This study confirms the findings of Mendoza & Rivera (2017); Ayadurai & Eskandari (2018) that increased capital levels are not a significant determinant of bank profitability.

Financial institutions will always need help to choose optimal capital levels. According to some authors Knezevic & Dobromirov (2016), when banks report high capital levels, these funds should be reduced to invest in profitable opportunities. It also serves as an insurance policy for depositors in financial crises (Mendoza & Rivera, 2014).

A good combination of capital structures can increase profitability for banks and, by reducing debt dependency, reduce bankruptcy chances Velnampy & Niresh (2012), highlighting the need to review strategies. Implementing an optimal capital structure would improve the debt/equity ratio for the banks studied.

Partially accepting hypothesis 2 reveals exciting points. According to Iannotta et al. (2007), higher risk exposure positively correlates with capital structure indicators.

According to Bai & Elyasiani (2013), a bank that grants high-risk loans will allocate more funds to the reserve for loan losses; and in studies by Sha'ban, Girardone, & Sarkisyan, this positive association can be explained by the effect described by Bai & Elyasiani (2013). Banks with a higher risk exposure are generally better capitalized than those with lower risks. Banks most likely to fall below the regulatory minimum maintain a proper capital structure. Additionally, Ayaydin & Karakaya (2014) state that regulations in the sector may also explain this finding. A higher increase proportional to the risk assumed by banks can be encouraged or forced by regulatory entities in different contexts.

However, it is necessary to analyze the causes of these modifications in the banking capital structure motivated by credit risk in greater depth to determine whether institutional pressures are primarily responsible or whether shareholders or managers are responsible for the same analysis and behaviour. However, it is essential to highlight the positive of this finding, which is that the better risk management practices, the better the banks choose their capital structure decisions; In other words, the positive relationship between these two variables indicates that Iraq banks strengthen their capital structure according to their risk assessments. Laws and regulations are in place to ensure banking stability and prudence in Iraq.

Hypothesis 3 was valid because credit risk negatively affected profitability. The results of this study are consistent with those of many previous studies (Bucevska & Hadzi, 2017; Mendoza & Rivera, 2017; Bikker & Vervliet, 2017). As a result of this negative effect, not only do the entities with higher provisions lose money due to delinquent loans, but they also lose profits since they subtract income from the income they originally recorded on the Profit and Loss Statement.

Limitation

A prudent bank can earn higher profits in the sector and have a competitive advantage. A wise decision can only be made if banks recognize how debt policy influences their profitability (Velnampy & Niresh, 2012). Our sample of banks did not show this effect. The directors/executives of each bank must review their prudent financing decisions in order to remain stable, profitable, and competitive.

Future Direction

Data were treated as a transversal block for analyzing internal factors derived from decisions made by administrators of the institution Saona (2016) that affect bank profitability. The PLS technique does not account for the evolution of the indicators over time, which means that macroeconomic variables whose trends require analysis cannot be included in this study. For explaining a bank's profitability, several studies have focused solely on internal factors (Avkiran & Ringle, 2018; Malik et al., 2019; Mendoza & Rivera, 2017). The authors encourage future researchers to consider incorporating this effect through latent growth models when treating unobservable variables with their indicators or regression techniques when treating observable variables with their data. When dealing with observable indicators, the panel is involved. Moreover, other variables of interest include macroeconomic variables such as inflation, concentration, GDP growth rate Bucevska & Hadzi Misheva (2017), interest rates Bikker & Vervliet (2017), fiscal freedom and monetary freedom Djalilov & Piesse (2016), as well as operating expenses and regulations (Ozili, 2017).

Conclusion

Bank leaders are encouraged to improve risk management practices and comply with banking regulations in light of the study's findings. In order for banks to continue to operate and grow competitively, they must not only ensure that the bank's operations run smoothly but also determine the capital structure decisions that will increase the bank's value and profitability. Therefore, sound risk management practices will help banks make better capital structure decisions and improve their performance.

References

Aboalriha, A.M.J., & Fakhruldeen, W.M.K. (2022). Suggested model to measure the governance of banks in accordance with the corporate governance guide for banks issued by the Central Bank of Iraq and employ them in fulfilling social responsibility: An applied study in a sample of private banks listed in the Iraq Stock Exchange. Journal of STEPS for Humanities and Social Sciences, 1(3), 40.

Indexed at, Google Scholar, Cross Ref

Adeniran, A.O., Jadah, H.M., & Mohammed, N.H. (2020). Impact of information technology on strategic management in the banking sector of Iraq. Insights into Regional Development, 2(2), 592-601.

Indexed at, Google Scholar, Cross Ref

Admati, A.R., DeMarzo, P.M., Hellwig, M.F., & Pfleiderer, P.C. (2013). Fallacies, irrelevant facts, and myths in the discussion of capital regulation: Why bank equity is not socially expensive. Max Planck Institute for Research on Collective Goods, 23, 13-7.

Indexed at, Google Scholar, Cross Ref

Akter, A., Majumder, M.T.H., & Uddin, M.J. (2018). Do capital regulations and risk-taking behavior affect bank performance? Evidence from Bangladesh. Asian Economic and Financial Review, 8(8), 1042.

Indexed at, Google Scholar, Cross Ref

Ardiny, T.A.H., & Alyamoor, A.H. (2021). The Extent of Commitment of Iraqi Commercial Banks to The Disclosure and Transparency Requirements of Corporate Governance Principles Issued by The Central Bank of Iraq. Review of International Geographical Education Online, 11(4).

Avkiran, N.K. (2018). Rise of the partial least squares structural equation modeling: An application in banking. Partial least squares structural equation modeling: Recent advances in banking and finance, 1-29.

Indexed at, Google Scholar, Cross Ref

Ayadurai, C., & Eskandari, R. (2018). Bank soundness: a PLS-SEM approach. Partial least squares structural equation modeling: Recent advances in banking and finance, 31-52.

Indexed at, Google Scholar, Cross Ref

Ayaydin, H., & Karakaya, A. (2014). The effect of bank capital on profitability and risk in Turkish banking. International Journal of Business and Social Science, 5(1).

Bai, G., & Elyasiani, E. (2013). Bank stability and managerial compensation. Journal of Banking & Finance, 37(3), 799-813.

Indexed at, Google Scholar, Cross Ref

Belkhir, M., Maghyereh, A., & Awartani, B. (2016). Institutions and corporate capital structure in the MENA region. Emerging Markets Review, 26, 99-129.

Indexed at, Google Scholar, Cross Ref

Bikker, J.A., & Vervliet, T.M. (2018). Bank profitability and risk‐taking under low interest rates. International Journal of Finance & Economics, 23(1), 3-18.

Indexed at, Google Scholar, Cross Ref

Bitar, M., Pukthuanthong, K., & Walker, T. (2017). The effect of capital ratios on the risk, efficiency and profitability of banks: Evidence from OECD countries. Journal of international financial Markets, Institutions and Money, 53, 227-262.

Indexed at, Google Scholar, Cross Ref

Bucevska, V., & Hadzi Misheva, B. (2017). The determinants of profitability in the banking industry: Empirical research on selected Balkan countries. Eastern European Economics, 55(2), 146-167.

Indexed at, Google Scholar, Cross Ref

Chavali, K., & Rosario, S. (2018). Relationship between capital structure and profitability: A study of Non Banking Finance Companies in India. Academy of Accounting and Financial Studies Journal, 22(1), 1-8.

Cohen, J. (1988). edition 2. Statistical power analysis for the behavioral sciences.

Diamond, D.W., & Rajan, R.G. (2000). A theory of bank capital. The Journal of Finance, 55(6), 2431-2465.

Djalilov, K., & Piesse, J. (2016). Determinants of bank profitability in transition countries: What matters most?. Research in International Business and Finance, 38, 69-82.

Indexed at, Google Scholar, Cross Ref

Fenjan, K.M., & Salman, M.S. (2021). The Effectiveness of Indicators of Financial Discipline in Strengthening the Exchange Rate, with a Special Reference to Iraq. Journal of Economics and Administrative Sciences, 27(130), 118-141.

Indexed at, Google Scholar, Cross Ref

Hair Jr, J.F., Sarstedt, M., Hopkins, L., & Kuppelwieser, V.G. (2014). Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. European business review, 26(2), 106-121.

Indexed at, Google Scholar, Cross Ref

Haseeb Hasan, S., Dhiaa AbdulKareem, A., & Ritha Daghr, A.A. (2020). An econometric study of the impact of monetary policy on foreign direct investment in Iraq for the period (2004-2017).

Indexed at, Google Scholar, Cross Ref

Hashim, H.T. (2022). The Reliability and Relevancy of Accounting Information Systems Impact Auditing Profession. American Journal of Economics and Business Management, 5(10), 215-224.

Hu, T., & Xie, C. (2016). Competition, innovation, risk-taking, and profitability in the chinese banking sector: An empirical analysis based on structural equation modeling. Discrete Dynamics in Nature and Society, 2016.

Indexed at, Google Scholar, Cross Ref

Iannotta, G., Nocera, G., & Sironi, A. (2007). Ownership structure, risk and performance in the European banking industry. Journal of banking & finance, 31(7), 2127-2149.

Indexed at, Google Scholar, Cross Ref

Ibrahim, S.S. (2017). The impacts of liquidity on profitability in banking sectors of Iraq: A Case of Iraqi Commercial Banks. International Journal of Finance & Banking Studies (2147-4486), 6(1), 113-121.

Indexed at, Google Scholar, Cross Ref

Jabbouri, N.I., & Zahari, I. (2014). The role of core competencies on organizational performance: an empirical Study in the Iraqi Private Banking Sector. European Scientific Journal, 1(4), 130-139.

Indexed at, Google Scholar, Cross Ref

Kim, D., & Sohn, W. (2017). The effect of bank capital on lending: Does liquidity matter?. Journal of Banking & Finance, 77, 95-107.

Indexed at, Google Scholar, Cross Ref

Klieštik, T., & Cúg, J. (2015). Comparison of selected models of credit risk. Procedia Economics and Finance, 23, 356-361.

Indexed at, Google Scholar, Cross Ref

Knezevic, A., & Dobromirov, D. (2016). The determinants of Serbian banking industry profitability. Economic research-Ekonomska istraživanja, 29(1), 459-474.

Indexed at, Google Scholar, Cross Ref

Llorens, V., & Martin-Oliver, A. (2017). Determinants of bank’s financing choices under capital regulation. SERIEs, 8, 287-309.

Indexed at, Google Scholar, Cross Ref

Majumder, M.T.H., & Li, X. (2018). Bank risk and performance in an emerging market setting: the case of Bangladesh. Journal of Economics, Finance and Administrative Science, 23(46), 199-229.

Indexed at, Google Scholar, Cross Ref

Malik, G.H., Al Jasimee, K.H., & Alhasan, G.A.K. (2019). Investigating the Effect of Using Activity Based Costing (ABC) on Captive Product Pricing System in Internet Supply Chain Services. Int. J Sup. Chain. Mgt Vol, 8(1), 400.

Mendoza, R., & Rivera, J.P.R. (2017). The effect of credit risk and capital adequacy on the profitability of rural banks in the Philippines. Scientific Annals of Economics and Business, 64(1), 83-96.

Indexed at, Google Scholar, Cross Ref

Modigliani, F., & Miller, M.H. (1958). The cost of capital, corporation finance and the theory of investment. The American economic review, 48(3), 261-297.

Myers, S.C. (1984). Capital structure puzzle.

Nitzl, C. (2016). The use of partial least squares structural equation modelling (PLS-SEM) in management accounting research: Directions for future theory development. Journal of Accounting Literature, 37(1), 19-35.

Nuhiu, A., Hoti, A., & Bektashi, M. (2017). Determinants of commercial banks profitability through analysis of financial performance indicators: evidence from Kosovo. Business: Theory and Practice, 18, 160-170.

Indexed at, Google Scholar, Cross Ref

Omukaga, K.O. (2017). Effect of capital structure on financial performance of firms in the commercial and service sector in the Nairobi Securities Exchange for the Period 2012-2016.

Ozili, P.K. (2017). Bank profitability and capital regulation: Evidence from listed and non-listed banks in Africa. Journal of African Business, 18(2), 143-168.

Indexed at, Google Scholar, Cross Ref

Petria, N., Capraru, B., & Ihnatov, I. (2015). Determinants of banks’ profitability: evidence from EU 27 banking systems. Procedia economics and finance, 20, 518-524.

Indexed at, Google Scholar, Cross Ref

Psillaki, M., & Mamatzakis, E. (2017). What drives bank performance in transitions economies? The impact of reforms and regulations. Research in International Business and Finance, 39, 578-594.

Indexed at, Google Scholar, Cross Ref

Saona, P. (2016). Intra-and extra-bank determinants of Latin American Banks' profitability. International Review of Economics & Finance, 45, 197-214.

Indexed at, Google Scholar, Cross Ref

Sha’ban, M., Girardone, C., & Sarkisyan, A. (2016). The determinants of bank capital structure: A European study. Essex Business School.

Siddik, M.N.A., Kabiraj, S., & Joghee, S. (2017). Impacts of capital structure on performance of banks in a developing economy: Evidence from Bangladesh. International Journal of Financial Studies, 5(2), 13.

Indexed at, Google Scholar, Cross Ref

Sufian, F. (2012). Determinants of bank profitability in developing economies: empirical evidence from the South Asian banking sectors. Contemporary South Asia, 20(3), 375-399.

Indexed at, Google Scholar, Cross Ref

Velnampy, T.D., & Niresh, J.A. (2012). The relationship between capital structure and profitability.

Received: 04-Jul-2023, Manuscript No. aelj-23-13761; Editor assigned: 06-Jul-2023, PreQC No. aelj-23-13761(PQ); Reviewed: 20- Jul-2023, QC No. aelj-23-13761; Revised: 01-Dec-2023, Manuscript No. aelj-23-13761(R); Published: 08-Dec-2023