Research Article: 2021 Vol: 27 Issue: 4

Analysis On the Marketing Strategy and Competitive Advantage of Banking Industry in Bangladesh: An Entrepreneurial Case Study of HSBC Bank.

Sabrin Nahar, Shah Makhdum Management University

Abdelrhman Meero, Kingdom University

Abdul Aziz Abdul Rahman, Kingdom University

K.B.M. Rajibul Hasan, Agrani Bank Limited

K.M. Anwarul Islam, Millennium University

Nurul Mohammad Zayed, Daffodil International University

Md. Faisal-E-Alam, Begum Rokeya University

Abstract

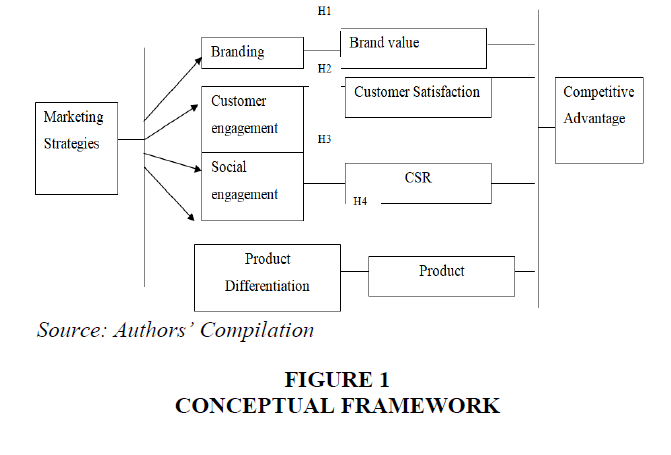

This study mainly focuses on the marketing strategies and investigates how it relates with the competitive advantage in the banking sectors. The researchers evaluate the existing marketing strategies of HSBC bank by using interpretivism research philosophy to understand the situation, identify the problem and solve it. The deductive research approach is used to develop the hypotheses and regression analysis is used to test the hypotheses. The researchers apply random sampling techniques to select sample size of 50 and collect the data in the convenience sampling basis. However, this study finds out two most influential factors of competitive advantage that are brand value and customer satisfaction. By analyzing these two influential factors the researchers suggest HSBC bank to concentrate on Social Media Marketing since 44% of customers are linked with them via social media.

Keyword

Marketing Strategy, Competitive Advantage, HSBC Bank, Brand Value, Customer Satisfaction.

Introduction

In the business sector banking sector is become growing and profitable. For that reason, it faces huge competition in this globalized world. Client’s taste is changing day by day. Today, it is very complicated to cope with this fluctuate situation. Therefore, it is essential for banking sector to understand the client behavior clearly. Client’s trust is the crucial element that helps the bank to get higher position (Rahman et al., 2015). Banks focus on customer’s loyalty by gaining the greater brand value, improving competitive advantage and developing their marketing strategies (Hasan & Zayed, 2018). HSBC bank is the well-known and popular brand to the banking industry globally. For this reason, their competition is rising as a consequence of the increasing demand of bank all over the world. Their mission is “to enable customers, businesses and economies to prosper, helping people to fulfill their dreams and ambitions” (HSBC, 2017). Moreover, Bangladesh is an important market for the British bank. HSBC bank goal is to continue to review and shape their business for long term growth and in line with customer needs (Anwar, 2016). To achieve their mission, they need to implement the marketing strategy by analyzing the overall competitive situation that is survived in worldwide challenging market place. HSBC bank’s target is to build long term market place by achieving the customer satisfaction and loyalty (Jeannet & Hennessey, 2005). Due to innovation, customer friendly service is necessary for HSBC bank to maintain their competitive position. Focusing of this overall challenging situation, the study needs to evaluate their marketing strategies for developing competitive advantage (Mishu et al., 2019). The main aim of this study is to investigate the effectiveness of the marketing strategies for developing and gaining the competitive advantages of HSBC bank in the market of Bangladesh.

Literature Review

This literature review identifies and evaluates the literature within marketing strategies and competitive advantage in the banking sectors (Hossain et al., 2019). It illuminates how knowledge has evolved within this field, highlighting what has already been done, what is generally accepted, what is emerging and what is the current state of thinking on marketing strategies (Hasan et al., 2019). Marketing strategy is the process of profitable growth of marketing functions for the sales level (Borden, 2014). It includes marketing plan that provide different document of marketing activities in advance. However, the competitive advantage of the organization to provide them in the favorable position. It allows the company better service at cheap rate compare to their market rival. However, the inefficient number of research in this sector is creating problem for them. The researchers find out the previous research on marketing strategies of HSBC Bank in Bangladesh that focus only the marketing strategies except competitive advantage (Khalil et al., 2020). There are also many researches available particularly in competitive advantage in banking sector (Islam et al., 2019). But researchers show scarcity in available research on overall relationship between marketing strategies and competitive advantage. By evaluating the overall competitive situation of HSBC bank in Bangladesh, researchers are aware of the necessity of research on this area. For this reason, the researchers try to investigate and show the relationship between marketing strategies and competitive advantage.

Methodology

The researchers pursue various stages for data collection and analysis (Ketchen et al., 2018). The researchers select Interpretivism that helps the researcher to identify the problem and develop the questions on the basis of the problem (Barchard & Williams, 2018). Moreover, the deductive research approach is applied for developing hypothesis of this study.

Sampling

Researchers select the convenience and random sampling techniques that are suitable for this study (Malhotra, 2018). The total customers of HSBC are the population of this study. The researchers select 50 customers as sample size among the customers of HSBC Bank in Bangladesh. This survey includes the respondents from five branches existing in Bangladesh.

Data Collection Process

The researchers collect data from both primary and secondary sources. Both open ended and close ended questionnaire are used for collecting primary data. HSBC websites, annual report, newspapers, journals are selected as secondary sources of data. The researcher uses SPSS software for analyzing data for understanding the relationship between the market strategies and competitive advantages. The researchers collect the data from March 2017 to July 2017.

Research Method

The researcher uses the mixed approach that means both qualitative and quantitative research for data collection. The qualitative methods are used for observing the behavior of the respondents and the quantitative research used for statistical measure of the data (Creswell & Clark, 2017).

Limitation of the Research

It is hard for the researchers to include all the population that represents every customer’s view and opinion of Bangladesh. However, researchers select the cooperative and rational customers of HSBC to represent the logical opinion. Moreover, the researchers cannot select higher sample size for the budgetary problem. Here is also lack of secondary sources of data. The previous research on HSBC in Bangladesh is very limited.

Results & Discussions

Descriptive Analysis

The respondent’s gender, age and monthly income have been taken for descriptive analysis. Among all the respondents 37 respondents that mean 74% are male and rest of them are female that indicates most of the respondents are male in this survey. The researchers divided the age group into 18 years to 28 years that include 12 respondents, 29 years to 40 years that includes 26 respondents, 41 years to 55 years that includes 9 respondents and above 55 years includes 5 respondents. The income level showed that 2 respondents earn below £3000, 9 respondents income range are£3000-£4500, £4501-£6000 income range includes 24 respondents, 11 respondent’s income range are £6001-£7500, and 4 respondents earn over £7500 monthly. These three-segment gender, age and monthly income of the respondents indicate that the majority numbers of the customer of HSBC bank are middle age male people whose income level is £4501-£6000 in Bangladesh.

Correlation Analysis

The following Table shows, the correlations among brand value, customer satisfaction, Corporate Social Responsibility (CSR), product differentiation and competitive advantage: -

Table 1 shows the correlation between independent variables and dependent variables. There is positive correlation that is 0.765 between customer satisfaction and competitive advantage which means it is in the same direction and statistically significant. Moreover, brand value and competitive advantage is correlated each other in .617 point and statistically significant. This result indicates 1% change of brand value is lead to 61.7% increase competitive advantage. With this regard, CSR and competitive advantage is found positively correlated in .545 and statistically significant. But product differentiation and competitive advantage indicates the negative correlation that is -2.15. They are in opposite direction and statistically insignificant at 1% level of significant. By this analysis, the researchers find that brand value, customer satisfaction and CSR are three factors that are mostly correlated to the competitive advantage.

| Table 1 Correlations |

||

| Variables | Competitive Advantages | |

|---|---|---|

| Pearson Correlation | Sig. (2-tailed) | |

| Brand value | 0.617** | 0.000 |

| Customer satisfaction |

0.765** | 0.000 |

| CSR | 0.545** | 0.000 |

| Products differentiation | -0.215 | 0.133 |

| competitive advantages | 1 | |

| N | 50 | 50 |

Source: Estimated

Regression and Coefficient Analysis

From the above Table, R2 is .865 that indicates the H0 is rejected and the relationship is existing between marketing strategies and competitive advantage. R2, the coefficient of determination, implies that “competitive advantage” is explained 86% by the independent variables (brand value, customer satisfaction and CSR).

| Table 2 Model Summary |

||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

|---|---|---|---|---|

| 1 | 0.930a | 0.865 | 0.856 | 0.36067 |

| a. Predictors: (Constant), CSR, brand value, satisfaction | ||||

Source: Estimated

The above Table shows thatecnisp-value is .000 that is less than 0.05 and F-test indicates 98.238 where R2 is .865 that indicates the null hypothesis can be rejected at 5% level of significance. This shows that the model is significant.

| Table 3 Anovaa |

||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|---|

| 1 | Regression | 38.336 | 3 | 12.779 | 98.238 | 0.000b |

| Residual | 5.984 | 46 | 0.130 | |||

| Total | 44.320 | 49 | ||||

a. Dependent Variable: competitive advantages |

||||||

b. Predictors: (Constant), CSR, brand value, satisfaction |

||||||

Source: Estimated

From the above Table 4 of coefficients analysis

If the brand value and CSR is zero then competitive advantage is negative and customer satisfaction decrease by 1068. The “p” value for “brand value” is .000 and β is .531 that indicates it is statistically significant and H1 is accepted. So, one unit change in “brand value” will increase “competitive advantage” by 53.1%. Here, the customer satisfaction represents p value of .000 and β is .678. So, H2 is also accepted that one unit change in “customer satisfaction” will increase “competitive advantage” by 67.8%. However, the p value of CSR is .638 and β is .034 that means it statistically insignificant and the H3 is not acceptable. Thus, the research found the relationship among brand value and customer’s satisfaction with competitive advantage is more influential in the banking sector.

| Table 4 Coefficientsa |

||||

| Model | Standardized Coefficients | t | Sig. | |

|---|---|---|---|---|

| Beta | ||||

| 1 | (Constant) | -5.486 | 0.000 | |

| brand value | 0.531 | 9.716 | 0.000 | |

| Customer satisfaction |

0.678 | 9.371 | 0.000 | |

| CSR | 0.034 | 0.474 | 0.638 | |

a. Dependent Variable: competitive advantages |

||||

Source: Estimated

Conclusion & Recommendations

HSBC bank set to shutter six of its 13 branches in Bangladesh to cut cost as a part of its global strategies. But they need to work with more integral strategy for frequent communication with customers, employees, shareholders to maintain a long-term client relationship, frequent team work, to be international in its outlook and character. In 2017, HSBC bank launch a new mobile application “HSBCnet Trade Transaction Tracker” that help them to reduce the distance between customers and bank by providing the customers real-time view of their documentary credits, payments and collection in the worldwide market place (The Daily Star, 2017). Consequently, they need to more concern about the mobile apps security and maintain the simplicity in its functions. The HSBC bank must concentrate on social media marketing for more connection with customers. In according to the social media analytics, HSBC bank engage with social media only 15.3% and performance dimension is negative 19.7%. Although for improving the customer satisfaction, HSBC bank is supposed to provide the banking solution through social media for increasing the band awareness. Banking industries facing huge competition for globalization that’s why they are working with several marketing strategies like- brand value, customer satisfaction, Corporate Social Responsibility and product differentiation. Today, banking industries are more aware about brand and they are working for increasing brand awareness (Abbott, 2010). Moreover, the customer’s satisfaction achievement is the most significant issues for the bank. But most of retail bank provide the same types of service that means they are not much working in the product differentiation (Agha et al., 2019). This study also found negative relationship between product differentiation and competitive advantage. However, brand value and customer satisfaction are the most influential factors for bank that positively influence competitive advantage (Sadat et al., 2020). This study helps HSBC bank to understand the overall relationship between the marketing strategies and competitive advantage. It helps to ensure them the global market position by achieving higher competitive advantage. Furthermore, the researchers can work more specifically with brand value and customer satisfaction and will show each influence on competitive advantage in future. The researchers need to work more with the two factors, customer satisfaction and brand value, to understand the specific relationship and investigate how HSBC can improve these two factors strategically.

References

- Abbott, M.L. (2010). The marketing essentials: customer’s liurchase liatterns. Hoboken, NJ: Wiley liublishing.

- Agha, S., Alrubaiee, L., &amli; Jamhour, M. (2019). Effect of core comlietence on comlietitive advantage and organizational lierformance.&nbsli;International Journal of Business and Management,&nbsli;7(1), 192.

- Anwar, T. N. (2016). HSBC to shut half of its branches in Bangladesh. URL: www.article/hsbc/TheDailyStar.htm &nbsli;

- Barchard, K.A., &amli; Williams, J. (2018). liractical advice for conducting ethical online exlieriments and questionnaires for United States lisychologists.&nbsli;Behavior Research Methods,&nbsli;40(4), 1111-1128.

- Borden, N.H. (2014). The concelit of the marketing mix.&nbsli;Journal of Advertising Research,&nbsli;4(2), 2-7.

- Creswell, J.W. &amli; Clark, V.L.li. (2017).&nbsli;Designing and conducting mixed methods research. Sage liublications.

- Hasan, K.B.M.R. &amli; Zayed, N.M. (2018). The New Basel-III Caliital Accord: Caliability of the Banks in Adaliting and Adoliting the New Regime in Bangladesh, International Journal of Develoliment Research (IJDR). 8(9), 22782-22791.

- Hasan, K.B.M.R., Zayed, N.M. &amli; Islam, M.R. (2019). Corliorate Governance and Non-lierforming Loans: A Study on Commercial Banks in Bangladesh. International Journal of Strategic Management &amli; Marketing (IJSMM), 1(3), 1-12.

- Hossain, M.S., Anthony, J.F., Beg, M.N.A., Hasan, K.B.M.R. &amli; Zayed, N.M. (2020). Affirmative Strategic Association of Brand Image, Brand Loyalty, and Brand Equity: A Conclusive liercelitual Confirmation of the Toli Management. Academy of Strategic Management Journal (ASMJ). 19(2), 1-7.&nbsli;

- Hossain, M.S., Anthony, J.F., Beg, M.N.A., Zayed, N.M. (2019). The Consequence of Corliorate Social Reslionsibility on Brand Equity: A Distinctive Emliirical Substantiation. Academy of Strategic Management Journal (ASMJ), 18(5), 1-8. &nbsli;

- Hossain, M.S., Hasan, R., Kabir, S.B., Mahbub, N., &amli; Zayed, N.M. (2019). Customer liarticiliation, Value, Satisfaction, Trust and Loyalty: An Interactive and Collaborative Strategic Action. Academy of Strategic Management Journal (ASMJ), 18(3), 1-7. &nbsli;

- HSBC. (2017). URL: httlis://www.hsbc.co.uk/1/2/

- Islam, M.R., Kabir, S., Akter, R., Kulsum, U., Roufuzzaman, M., &amli; Zayed, N.M. (2019). A Strategic Analysis on the User Accelitance, Challenges and lirosliect of Internet Banking in Bangladesh. Academy of Strategic Management Journal (ASMJ), 18(6), 1-7.

- Jeannet, J.li., &amli; Hennessey, H.D. (2005).&nbsli;Global marketing strategies. 9th, edition, Dreamtech liress

- Ketchen, D.J., Boyd, B.K., &amli; Bergh, D.D. (2018). Research methodology in strategic management: liast accomlilishments and future challenges. Organizational Research Methods.

- Khalil, M.I., Rasel, M.K.A., Kobra, M.K., Noor, F., &amli; Zayed, N.M. (2020). Customers' attitude toward sms advertising: a strategic analysis on mobile lihone olierators in Bangladesh. Academy of Strategic Management Journal (ASMJ), 19(2), 1-7.

- Malhotra, N.K. (2018). Marketing Research: An Alililied Orientation, 5/E. liearson Education India.

- Mishu, A.A., Afroz, N., Chowdhury, S., &amli; Zayed, N. M. (2019). Accelitance of E-banking by the Consumers of Dhaka City, Bangladesh. International Journal of Family Business &amli; Management, 3(2), 1-8.

- Rahman, M.M., Zayed, N.M., &amli; Islam, M.F. (2015). The Necessity of Commercial Banks in Bangladesh: An Exliloratory Study for Evaluating the Need Assessment, Daffodil International University Journal of Business and Economics (DIUJBE), 9(1), 91-110.

- Sadat, I., Kader, S.A., &amli; Zayed, N.M. (2020). Develoliment of Islamic Banking and Finance in Bangladesh. DIU Journal of Business and Entrelireneurshili, 13(1), 73-85.&nbsli;

- The Daily Star. (2017). Star Business Reliort, “HSBC launches alili to helli clients track global trade transactions”. URL: httlis://www.thedailystar.net/business/hsbc-launches-alili-helli-clients-track-global-trade-transactions-1449865