Research Article: 2022 Vol: 28 Issue: 5

Analysis On Current Trends and Challenges that Determine Sustainable Growth of Small and Medium Enterprises (SMEs) During Covid-19 in Ethiopia. A Case of Oromia Regional State, Ambo Town

Abebe Ayalew Balcha, Ambo University

Gemechu Abdisa, Ambo University

Citation Information: Balcha, A.A., & Abdisa, C. (2022). Analysis on current trends and challenges that determine sustainable growth of Small and Medium Enterprises (SMES) during COVID-19 in Ethiopia. A case of Oromia regional state, Ambo Town. Academy of Entrepreneurship Journal, 28(S7), 1-17.

Abstract

Purpose: Small and medium business enterprises had an extensive roles to home-grown employments and inclusive gross of domestic product in developing countries like Ethiopia. This study intends to scrutinize the current determinant factors that affects the growth of small and medium enterprise in Ethiopia where the Case is the Oromia regional state, Ambo Town. Currently, there are crucial factors like coronavirus, and political instability which created room for immense corruption in Ethiopia are concurrently affects the growth of SMEs. These issues have decisive implications on the sustainability of SMEs in Ethiopia.

Research methodology: To this end, the researcher used descriptive and explanatory research designs.

Findings: The results of empirical analysis show that currently, political instability, corruption, and COVID-19 had negatively affected the the grorth of SMEs. Hence, the study strongly supports sequential policy reform in the region and also recommends review of the ongoing policies towards ensuring effective control of corruption in the region and bringing stability of political enviromets.

Research Limitations: The study sample did not represent all the SMEs in the Ethiopian country. It had predominantly focused on the SMEs found in only one region of specific zonal town of the country. Therefore, future research has to consider SMEs found in the all ten regions of the country.

Practical Implications: This outcome has substantial theoretical implications since it advocates that when firm performance is measured corruptions and political instability should be distinguished. Any concrete analysis of this room which does not reflect these two factors, will neglect foremost variables, leading to a partial guesstimate of the performance of firms.

Originality/Value: The originality of the study lies in the presented practical methodology to identifying the current trends and challenges that mostly affect the Sustainable Growth of Small and medium enterprises and modeling the process of responding to this effects

Keywords

Sustainability of SMEs, Political Instability, Corruption, Coronavirus (COVID-19).

Introduction

In the current world, Small and Medium Enterprises (SMEs) is the vital systems for promoting economic growth and development. Small and medium enterprises (SMEs) have become a energetic business organizations of the world economy. Small and Medium Enterprises (SMEs) play a essential role in the economic growth and poverty reduction of various countries. Thus, SMEs are found in a inclusive arrangement of business activities (Igwe et al., 2018). In developing nations like Ethiopia, SMEs make a substantial influence on local employment and overall gross domestic product (GDP). Many times, small business have made boundless effort in a inconsistency of long-term investment activities in developing countries. Small businesses are seen as a significant source of employment generetions in developing countries (Asa & Prasad, 2014; Gregurec, Tomi?i? Furjan, et al., 2021; Hosseininia & Ramezani, 2016). The corona virus pandemic has also affected the African Economy as whole and small businesses of African countries. Thus the Problems of individuals become the problem of the whole society (Cepel & Dvorsky, 2020).

Ethiopia is aslo one of the affected countries for which the first confirmed COVID-19 case was recognized on March 13, 2020, and the number of newly confirmed cases is growing from time to time, at an growing rate. In the Ethiopian context, after the entrance of coronavirus on 13, March 2020 various thoughts are given to how to defend the spread of the virus by the government and other concerned bodies (Olana, 2020; Union, 2020). Hence, the lockdown and a state of emergency in the country had been proclaimed for all organizations and enterprises in the country (Olana, 2020).

Small businesses denote large percentage of employment in Ethiopia Particular, in Ambo town. However, their effort has been fruitless due to political instability in the form of military overthrows, civil war, and various civil unrest that causing poor organizational performance (Bazza & Daneji, 2013; Fenetahun et al., 2021; Gayle Allarda, Candace A. Martinezb, 2012). This political stability formed room for immense corruption in the form of bribe, lobbying, cronyism, and nepotism that directly or indirectly distresses the growth of SMEs (Neudorfer & Theuerkauf, 2014; Shumetie, 2019). Thus, organization require relatively steady working environment for better performance (Bazza & Daneji, 2013). In addition to these factors Global epidemic catastrophes, such as the coronavirus (COVID-19), usually put the lives of small and medium enterprises (SMEs) in danger. Global epidemic crises, such as the coronavirus (COVID-19 usually expose small and medium enterprises (SMEs) to several types of challenges and may put their lives at risk (Adam, 2021; Gregurec, Tomi?i? Furjan, et al., 2021; Sobaih et al., 2021).

The Previous studies shown on SMEs’ in response to the COVID-19 pandemic and business performance have observed the impact of each practice on business performance. For example, (Gerald et al., 2020; Guo et al., 2020; Sobaih et al., 2021; Winarsih et al., 2021). The findings of (Guo et al., 2020) call consideration to the importance of information technology in helping SMEs to cope with the challenges created by the COVID-19 emergency. Similarly, The findings of (Gerald et al., 2020) argued that involved calculated quickness alleviates the negative effects of the COVID-19 crisis on SMEs’ performance. These findings take a managerial tactic to SMEs’ practices for responding to the crisis. Their findings are important since they focused on SMEs’ long-term, rather than short-term, performance. However, the influence of these tactical responses on SMEs’ long-term performance and their prospective for efficiency needs further study.

Political instability is another issue that had been considered for this study. According to different previous studies, political instability can be considered as a serious obstacle for the SMEs and the whole economic development of various nations (Gayle et al., 2012; Leydesdorff & Meyer, 2006; Varsakelis, 2006). In politically unstable countries, it can very difficult to attract foreign direct investments, which is the key to SMEs’ sustainable growth (Globerman & Shapiro, 2003). The frequent trendy of political instability convoyed with massive corruption results in deep-rooted underdevelopment and poverty in Africa (Hammed, 2018). Currently, Ethiopia is also one of the affected countries by political instability which causes a budget shortage, weakens collaborations between academicians and practicing enterprises, and lessens government spending on technology (Shumetie, 2019).

Corruption is another key concept considered in this study. Past studies conceptualize corruption as the misuse of public authority for personal gains (Neudorfer & Theuerkauf, 2014; Teixeira & Guimarães, 2015). It is an informal payment that negatively affects enterprises’ sustainability (Nimfa et al., 2021). This study also went further investigations on the factors like poor governance, lack of accountability and transparency, low level of democratic culture, lack of clear regulations and authorizations, and low level of institutional control as major causes of corruption in Ethiopia and how it can affect the sustainability of SMEs (Shumetie, 2019). Hence, in Ethiopia, currently, the sustainability of SMEs is highly affected by the above factors. In fact, as per the knowledge of the researcher, Ethiopia is highly challenged by political instability, and corruption in addition to COVID-19. Especially many micro and business enterprises had lockdown due to war between the Ethiopian government and TPLF in the Tigray region and some parts of Amhara regions. Thus in Ethiopia, political instability and corruptions are the main problematic factor for the growth of SMEs in addition to pandemic (COVID-19).

Although the all above problems are studied by the other few studies, none of them considered coronavirus, and political instability simultaneously as explanatory variables and how they did affect the SMEs in the Ethiopian context particularly addressing in Ambo town. Hence the study is willing to investigate the current factors that affecting SMEs in Ethiopia

Based on the above premises, the study aims to

1 To evaluate how the performance of SMEs are currently affected by corruptions in Ambo town.

2 To assess the extent to which political instability affects the performance of SMEs in Ambo town.

3 To Assess the overall Effects of Covid-19 at the time of instability on sustainability of SMEs in Ethiopia, in Ambo Town.

In line with the above specific objective, the finding of this study contributes a valuable significance for scientific knowledge and the community. For scientific knowledge, the study will aid the government in policy development and implementation. This study will also contribute to academic literature and helps others researchers who wish to conduct their study on a similar issue. Finally, the results of this study will also provide many companies and SMEs with a systematic way of increasing their innovation capabilities, and are a valuable source of ongoing competitive advantage for their sustainability at the time of pandemic and post COVID-19 of their performances in political instability environments.

Related Literature Review and Proposed Hypothesis

Theoretical Literature Review

The theory is very important for emerging disciplines, such as knowledge of sustainable growth for SMEs in strategic management. The essence of the theory and the task it poses to the discipline has been captured by strategic management theory scholars. The theory clearly defines what the phenomenon is or how it functions (Post et al., 2020). Therefore, the study Reviews the following Related Theories of Sustainable Growth of SMEs.

Institutional Theory

Institutional theory refers to advanced components or competencies with the sustainable growth of the small and medium business that inspires the management practices to pursuit sustainable business growth (Srisathan et al., 2020). The overall impression of institutional theory is focused on the rules lay down by the institutes, whereas the novel perspective focused on institutional entrepreneurship, such as the employment of sustainable business representations (Hadjimanolis, 2019) and emphasis on opportunities (Laukkanen, 2013). To meet the needs of stakeholders and society, the business organization seeks rightfulness (Ratten & Usmanij, 2020). The impacts of institutional aspects have led to massive or isomorphic conclusions on sustainability by businesses (Ahmad & Rahman, 2020; Glover et al., 2014). Business sectors encourage innovation within the outline of the institutional structure through cooperation with several stakeholders to boost the sustainable growth of SMEs. The sustainable business enterprise is the improvement for an increasing proportion of SMEs around the world, hopeful productivity, flexibility, and helpful social and environmental results (Jia et al., 2020).

Resource-Based View Theory

The resource-based view theory had mainly focus on opportunities based on the exceptionality of resources that would lead to competitive advantages (Gregurec, Tomi?i? Furjan, et al., 2021). Emphasizing the management lookout, the study enhanced comprehension of the framework of the study and tactics that focus on sustainable franchising improvement (Samsudin et al., 2018). Resource-based view theory, conserving that the dynamic competencies theory has stated that decision-making authors required a basis that is very compulsory to clarify the ways enterprise’s culture of openness and innovation grows into timely, rapidly or qualities flexibility in dynamic marketplaces (Kiiru, 2015). The resource-based view of the firm and the thought of sustained competitive advantage are often not the culture of SMEs that are marked in a distressing endeavor at sustainability and development (Darcy et al., 2014).

Diffusion of Innovation (DOI) Theory

From the perception of innovation and technology alignment, Rogers (1995) projected the Diffusion of Innovations (DOI) theory to describe the concept by which innovation could be shifted between dissimilar people over certain periods by different means. The diffusion of innovation encompasses launching the abilities of innovative cultures that encourage the effectiveness of innovation competitive advantages that support the sustainable growth of SMEs in a new market dynamic. The primary drivers of sustainability, competitive advantage, and efficiency for SMEs are the introduction of new technology and non-technology innovation (Price et al., 2013). As a result, various scientific research, particularly in the field of SMEs, is vibrant due to the novelty display of practices and actions undertaken by enterprises and their innovation responsibilities, which lead to sustainability, achievement in the enterprise, and all-encompassing growth (Anderson & Eshima, 2013; Jia et al., 2020).

Stakeholders Theory

The stakeholder theory was promoted by R. E. Freeman which has immersed much emphasis on business ethics (Freeman, 1984). The stakeholder theory specifies concerns about maximizing the value-added of stakeholder wealth that outperforms competitors (Rosyadi et al., 2020). Therefore, sustainable industrial firms needs to practice a culture that incorporates environmental, social, and economic systems into its purposeful corporate practices (Globerman & Shapiro, 2003). In other words, the enterprise is invented to accommodate suppliers, consumers, customers, and the employee being their influential stakeholders concerning the environment, economic and social structures (Ichsan, 2021). In short, small and medium-sized enterprises need reforms that go far beyond basic cultural fitness and work together to foster more adaptable conduct and capacity for culture to cope with rapid change (Post et al., 2020). The sustainability processes would be attained once these principles are fulfilled, with businesses becoming atratictive to make growth, mostly in the long run, to promote the ability of the organizational culture for the sustainable development of SMEs.

Political Instability and its Effects on the Sustainable Growth of Smes

The econometric model result of the study by shumetie reveals that Ethiopian political instability affected enterprises’ innovativeness negatively and significantly. The recurrent political instability does not allow enterprises to introduce new products and/or process in their business process (Shumetie, 2019). Political instability involved the understanding of differences between the power of the national elite that rule the country and that of non-elite (Hammed, 2018). One of the major components of a political system is the institutional environment in which enterprises operate. Political instability has a negative and significant association with the national system of innovation (Gayle et al, 2012).

Conflicts and political instability can indeed be associated with a greater risk of systemic SMEs crisis. The result of our analysis shows that political environment has a significant impact on business performance of multinational companies (Mark John & Nwaiwu, 2015). According to the study conducted in the Nigeria, Nigerian political environment is characterized by frequent changes in government policies and programmes thereby negatively affecting corporate long-term planning. This is attributable to party politics with threats of conflict and wars, growing levels of crime and terrorism, kidnapping, bomb blast, among others thereby hindering business patronage and scaring away foreign investors from the country (Mark John & Nwaiwu, 2015). Hence high rates of corruption in politically unstable countries always create entry barriers for foreign-owned enterprises. This fact may discourage the free flow of ideas and limits the innovativeness of local enterprises as well. Based on these premises, the following hypothesis is constructed.

H1: Political instability is negativevly affects the performances SMEs' performance.

Corruption and its Effects on the Sustainable Growth of SMEs

Although there are numerous studies on the issue of corruption and (poor) institutional quality, the majority of the existing studies used only one single proxy, often in isolation, for corruption and other institutional quality indicators. Moreover, the statistical tests are generally performed on the basis of rather small and very specific samples, most notably focusing on the least developed countries of Africa (Teixeira & Guimarães, 2015).

Awareness of enterprises about recent development and technological issues has significant positive effect on their innovativeness. In connection to this, access to Internet, training, and foreign markets have positive and significant effect on enterprises’ innovativeness in Ethiopia. Moreover, the intensive corruption in the government service delivery would directly aggravate the persistent political instability in Ethiopia. The tough and complex corruption participation of government officials, and enterprise owners and managers significantly aggravate long-lasting political instability in the country. The direct linkage of corruption and political instability implies that corruption has both direct and indir- ect effect on enterprises’ innovativeness (Shumetie, 2019).

Rising corruption and political instability contribute to underdevelopment by adversely affecting government revenue, production, savings, investment, growth, and income distribution in West Africa (Kwon, 1997; Mark John & Nwaiwu, 2015). Identified that corruption reduces enterprises’ innovativeness through increasing distrust and uncertainty in governmental institutions and the entire business environment. On the other hand, (Varsakelis, 2006). mentioned that corruption would rather have a greasing and accelerative effect on enterprises’ innovativeness particularly in countries with poor governance systems. corruption significantly harms innovation activities across countries.

Considering both social and economic inequality based on corruption have a statistically significant positive effect on the risk of ethnic war, holding all other variables constantpointed out that high rates of corruption in politically unstable countries always create entry barriers for foreign-owned enterprises (Neudorfer & Theuerkauf, 2014). This fact may discourage the free flow of ideas and limits the innovativeness of local enterprises as well.

The debate on the corruption, political instability and development nexus is still ongoing. The destabilizing effect of political instability is relatively settled in the empirical literature but the effect of corruption on development have remained polarized. This is because some studies have maintained that corruption stifles development and others have contended that in some circumstances, corruption may be economically desirable simply because it provides a solution to inefficient regulation, bureaucratic delay and bottlenecks which may lead to ineffectiveness in governance. This study investigates empirically the relationship between corruption, political instability and development in the African countries in a System Generalized Methods of Moment (GMM). The study found existence of political instability and ineffective control of corruption in the region. The study also found that simultaneous implementation of policies of ensuring political stability and effective control of corruption are not complementary and has more negative impact on development in the region (Hammed, 2018). Based on these premises, the following hypothesis is constructed.

H2: Corruption in the government system is negativevly affects the performance of SMEs.

Coronavirus (COVID-19) and its Effects on the Sustainable Growth of SMEs

The coronavirus has already left dramatic rippling on the level of economic activity in every region of the world. It is declared as a pandemic by the World Health Organization (WHO) in May 2020, COVID-19 has become a global emergency, given its impact on the entire world population and the economy (Olana, 2020). The world is experiencing the closure of each business activity and stay-at-home principle by quitting different trading directions that can significantly which will eventually impact the world economy (Gerald et al., 2020; Olana, 2020). The consequences of the COVID-19 pandemic have been felt across all economic sectors and institutions, including small and medium enterprises (SMEs) (Sobaih et al., 2021).

SMEs were the ones most exposed to the risks resulting from the pandemic. Many countries intensively worked on adopting various measures of both financial and non-financial support to prevent temporary layoffs, i.e. reducing work time, creating alternative jobs and workplaces, adopting measures to protect self-employed people. Many countries worked intensively on adopting measures aimed at helping SMEs via searching for new work modes and new markets, creating and implementing various mentoring programs, and financial seminars (Cepel & Dvorsky, 2020).

SMEs operating in the service industry were coping with the COVID-19 disruption and to gain insights into drivers and technologies which impacted their response to the COVID-19 pandemic. The literature review showed that the focus of transformational initiatives of SMEs during the COVID-19 disruption slightly shifted from technology to social, customers, and organizationally driven changes (Gregurec, Tomi, et al., 2021). Based on these premises, the following hypothesis is constructed.

H3: Coronavirus (COVID-19) is negatively affects the performances SMEs.

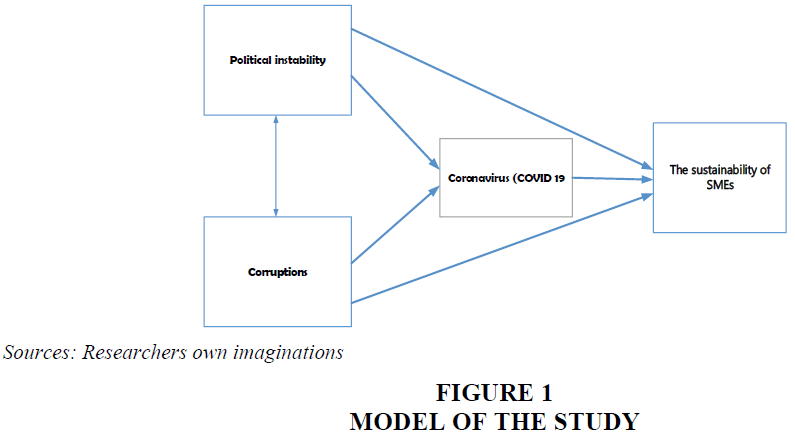

Conceptual Frame Work

This study is guided by the conceptual framework provided under Figure 1. The figure depicts that coronavirus, political instability, corruption, and inflations. On the other hand, the conceptual framework hypothesizes that Small and micro-enterprises could directly or indirectly have affected by the above explanatory variables and it is shown in the following figure.

Methodology

Research Approach

The study was used both Quantitative and Qualitative research approaches. A mixed approach helps to integrating different types of data in the same study, collecting diverse types of data best provides an understanding of a research problem (Creswell, 2009; 2014). These two approaches are commonly used in business and management research, particularly in terms of cause-effect relationships. The research under subject was conducted using a mixed research approach; the rationale for combining both quantitative and qualitative data is to better understand the research problem by combining both numeric values from quantitative research and the detail of qualitative research and to neutralize limitations of applying any of a single approach. According to Creswell (2009), the mixed research approach uses separate quantitative and qualitative methods as a means to offset the weaknesses inherent within one method with the strengths of the other method.

Research Design

This study is a survey study that adopts an explanatory research design. Explanatory designs try to establish cause-and-effect relationships and are undertaken to explain the variance in the dependent variable or to predict organizational outcomes. When the focus is on cause-effect relationships, the study can be explanatory explaining which causes produce which effects. The primary purpose of explanatory research design is to determine how events occur and which ones may influence particular outcomes and helps the researcher to plan and implement the study in a way that would help the researcher to obtain intended results, thus increasing the chances of obtaining information that can be associated with the real situation (Burns & Grove 2001, Kumar, 2014). This is why the study used an explanatory research design.

Target Population

A population is a whole number of elements where a sample is chosen. Therefore, the target population of the study was the current employees of SMEs in Ambo town.

Sample Size and Sampling Methods

As stated above the total population of the study is 448 employees which are large. Thus, the study was used the sample size determination formula, which is developed by Yamane (1967), to determine the sample size for the study. Yamane’s sampling formula with 95% confidence level and the level of precision (e) 5 used to determine sample respondents.

n=N/ (1+N (e) 2)

Where:

n=sample size

N= number of people in the population

e=allowable error (%)

Substitute numbers in the formula

=194

After calculated the sample size by substituting the numbers into the Yamane formula, the study’s sample size of 211 is fair enough to represent the population. To obtain a representative sample, a simple random sampling technique was used and a purposive sampling technique was used for the interview.

Sources of Data and Method of Data Collection

The study was used primarily to achieve the objective of the study. The primary source of information was collected through structured questionnaires (both close-ended and open-ended) and informative interview

Method of Data Analysis

As discussed above, the research is designed to follow a mixed Method. Therefore, both qualitative and quantitative data analysis method was used. For the interview qualitative method was used and for the survey questionnaire, a quantitative analysis method was employed. After the data has been collected, it would be edited, codded, and analyzed by using inferential statistics such as Multiple linear regressions and Pearson Correlation and a significance test of the variables where the tool of data analysis was the Statistical Package for the Social Science (SPSS version 23) software.

Model Specification

The Model is: Y= β +β1X1+β2X2+β3X3+β4X4+e

Where: Y= SMEs Performance

β=Regression coefficient

X1=COVID-19

X2=political insatiably

X3=corruption

X4=inflation

e=Standard error

Reliability and Validity Analysis

The reliability of the scale shows how free the data is from random error. As proclaimed by Bhattacharjee (2012), reliability is the degree to which the measure of a construct is consistent or dependable. They have suggested four cut-off points for reliability, which includes excellent reliability (0.90 and above), high reliability (0.70-0.90), moderate reliability (0.50-0.70), and low reliability (0.50 and below) as cited by. The closer Cronbach’s alpha coefficient to 1.0 is the greater the internal consistency of the items in the scale. Cronbach’s alphas were calculated to examine the reliability of each variable of the study. Since this reliability statistic is found to be above the minimum required threshold of 0.7, therefore it is statistically acceptable. The Cronbach’s alpha value for all items suggested that the data collected through questionnaires are reliable and can be used for further statistical analysis. Based on the findings of the pre-test, the researcher tries to rephrase some questions that are not clear without affecting the basic context of the instrument. Then, it was confirmed that the questionnaires that pass the pre-test become effective to meet the objective of the study before being distributed to the respondents.

Data Analysis, Results, and Discussion

Introduction

This chapter deals with the presentation, interpretation, and analysis of the data used for the study. The data were collected through questionnaires and interviews. In order to assess the determinant factors and its effects on SMEs, multiple regression analysis was conducted. A total of 194 questionnaires were distributed and questionnaires were returned. The collected data were presented and analyzed by using SPSS (version 20) statistical software and multiple Regression Analysis was also used to test the hypotheses of the study and the effects of the independent variables on dependent variable.

Validity and Reliability

To measure the reliability of the scores obtained, the study used Cronbach’s alpha (a measure of the internal reliability of the questionnaire items) by using data from all the respondents and Separate reliability tests for each of the variables were computed. Cronbach alpha measures the extent to which item responses obtained at the same time correlate highly with each other and the widely accepted social science cut off is that alpha should be greater than 0.70 for a set of items to be considered a scale (Field, 2009). Accordingly, the Cronbach’s alpha test was carried out by using SPSS and the results are presented as follows:

The above Table 1 shows that, the Cronbach’s alpha reliability statistics value of the scale for all predictors and outcome variables. The calculated coefficients of alpha for this study was found to be 0.984 for all variables, which is greater than the required threshold of 0.70 confirming the variables to be internally reliable. Accordingly, all variables result above a suggested threshold of reliability test is > 0.7, which is statistically significant, and the data were reliable.

| Table 1 Reliability Statistics | ||

| Cronbach's Alpha | Cronbach's Alpha Based on Standardized Items | N of Items |

| 0.979 | 0.984 | 17 |

Descriptive analysis of CE on Performances of SMEs

From the above Table 2, the overall average mean is 4.48. Therefore it can be realized that COVID-19 has more effect on the sustainable performances of SMEs. Poltitical istablity is another issues that challenges the sustianblity of SMEs in Ethiopia. Hence the mean of corruptions is 3.92 with standard devaitions of 0.83, a mean of political istablity in ethiopia is 4.21 with standard devation of 0.84 and the maen of COVID-19 is 4.48 with standard devaitions of 0.56. These results were also supported by the interviews, where participants were asked to elaborate on what they understood by term determinant factors of affecting SMEs. From the repondendents of SMEs in Ambo town, Various responses were verified. Accordingly business venture could be identifying opportunities, solutions to current problems, networking new business ideas, risk taking and innovation. All these ideas came from different respondents those display their thoughtful, however the challenge was on whether it is being executed at Ambo town. There were confusing results where one would indicate agrees, but later disagree with the elements being employed at SMEs sectors of the ambo town.

| Table 2 Descriptive Statistics | |||||||

| N | Mean | Std. Deviation | Skewness | Kurtosis | |||

| Statistic | Statistic | Statistic | Statistic | Std. Error | Statistic | Std. Error | |

| Corruptions | 194 | 3.9299 | 0.83798 | -0.712 | 0.175 | -0.476 | 0.347 |

| Politicalinstablity | 194 | 4.2152 | 0.84045 | -1.132 | 0.175 | 0.081 | 0.347 |

| COVID-19 | 194 | 4.4897 | 0.56783 | -0.849 | 0.175 | -0.059 | 0.347 |

| Valid N (listwise) | 194 | ||||||

Results of Inferential Statistics

According to the above model summery that shown in the above table 3, there is highly significant relationship (p=0.000) between the dependent variable and the linear combination of the predictor variables indicated by R (0.942). The coefficient of determination (R square) is a measure of how good prediction of the criterion variable can be selected by knowing the predictor variables. Accordingly, 88.6% of the variation in the dependent variable was explained by the set of the above independent variables. However R- squared measures the proportion of the variation in the dependent variable explained by independent variables, irrespective of how well they are correlated to the dependent variable. This is not a desirable property of goodness of –fit statistic. Conversely, adjusted R–squared provides an adjustment to the R- squared statistic such as an independent variable that correlates with dependent variable increases adjusted R- squared and any variable without a strong correlation will make adjusted R- squared decrease. Therefore, to see the success of the model in the real world adjusted R- squared more preferable than R- squared (Burns & Burns, 2008). Accordingly, adjusted R- squared, the variation is explained by the regression of the dependent variable on the combined effect of all the predictor variables is 88.3%. Hence, generally speaking, the independent variables (such as COVID-19, Corruptions, Political instablity) can predict the dependent variable (the performances of SMEs) by 85.3%.and 14.7% predicted by extraneous variables.

| Table 3 Model Summaryb | |||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson |

| 1 | 0.942a | 0.886 | 0.885 | 0.30901 | 0.121 |

| a. Predictors: (Constant), COVID-19, Corruptions, Politicalinstablity | |||||

| b. Dependent Variable: performancesofSMEs | |||||

The above table 4 shows, the analysis of variance (ANOVA) table which provides statistics about the overall significance of the model being tested. The significant value which is also P-Value in the model is 0.000 which indicates the independent variables in the model explain the dependent variable. From the ANOVA (Analysis of variance) table shown above, it is possible to describe that, from the total observation value (159.814), the regression model explains the majority of the observation is (141.672).The remaining (18.142) is not explained by the model. Hence, it is possible to deduce that regression explains most of the observations while the other observations are explained by extraneous variables. The mean square of the model (regression) represents the average amount of variation explained by the model is 47.224, and the mean square of the residual is 0.095 which is the average amount of variation explained by extraneous variables (the unsystematic variation). The F ratio (494.567) indicates that a measure of the ratio of the variation explained by the model and the variation explained by extraneous variables. Hence, the value of F is large enough to conclude that the set of independent variables as a whole are contributing to the variance of the sustianable of SMEs and therefore, the model represents an actual practice of the business operators under study.

| Table 4 Anovaa | ||||||

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

| 1 | Regression | 141.672 | 3 | 47.224 | 494.567 | .000b |

| Residual | 18.142 | 190 | .095 | |||

| Total | 159.814 | 193 | ||||

| a. Dependent Variable: performancesofSMEs | ||||||

| b. Predictors: (Constant), COVID-19, Corruptions, Politicalinstablity | ||||||

The above Table 5 shows that, an unstandardized coefficient of an independent variable (also called B or slope) measures the strength of its relationship with the dependent variable (sustainablity of SMEs); this means, the variation in the growth of SMEs corresponds to the variation in the independent variables (such as Corruptions, Political instablity and COVID-19). A coefficient of 0 means that, the dependent variable does not consistently vary as the independent variables vary. In this research model, the coefficient for the Corruptions is -0.07; and the coefficient for the Political instablity is 0.678 and the COVID-19 is 0.540. So, for a certain variation in each independent variable as stated above, there was a consistent variation in the growth of SMEs. That is, the Corruptions predicts that, the growth of SMEs declined by 7%, the Political instablity predicts the growth of SMEs by 67.8% and the COVID-19 predict the growth of SMEs by 54%,

| Table 5 Coefficientsa | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | (Constant) | -0.979 | 0.231 | -4.235 | 0.000 | |

| Corruptions | -0.007 | 0.097 | -0.006 | -0.070 | 0.944 | |

| Politicalinstablity | 0.678 | 0.104 | 0.627 | 6.532 | 0.000 | |

| COVID-19 | 0.540 | 0.107 | 0.337 | 5.044 | 0.000 | |

| a. Dependent Variable: performances of SMEs | ||||||

The standardized beta (β) coefficient column also showed that the contribution that an individual variable makes to the model. The beta weight is the average variation the dependent variable (the growth of SMEs) increases when the independent variables (such as Corruptions, Political instablity and COVID-19) increases or decreases by one standard deviation (all other independent variables are held constant). Thus, the largest influence on the growth of SMEs is from the Political instablity (0.627), and the next is from COVID-19 (0.337). The table which is illustrated above further shows that all the explanatory (independent) variables included in this study can significantly explain the variation on the dependent variable at a 95% confidence level except corruptions.

In the above table 6, the first entry is the value of the t-statistic, next is the degrees of freedom (df), followed by the corresponding p value for 2-tailed test given as Sig. (2-tailed).

| Table 6 One-Sample Test | ||||||

| Test Value = 0 | ||||||

| T | Df | Sig. (2-tailed) | Mean Difference | 95% Confidence Interval of the Difference | ||

| Lower | Upper | |||||

| Corruptions | 65.320 | 193 | 0.000 | 3.92990 | 3.8112 | 4.0486 |

| Politicalinstablity | 69.856 | 193 | 0.000 | 4.21521 | 4.0962 | 4.3342 |

| COVID-19 | 110.128 | 193 | 0.000 | 4.48969 | 4.4093 | 4.5701 |

| PerformancesofSMEs | 65.525 | 193 | 0.000 | 4.28093 | 4.1521 | 4.4098 |

t-statistic of 65.320 with 193 degrees of freedom. The corresponding two-tailed p value is 0.000. If we take the significance level of 5%, we can see that the p value obtained is less than 0.05. Therefore, we can reject the null hypothesis at p = 0.05, which means that the sample mean is significantly different from the hypothesized value and the average corruptions in the small business enterprise is not the same in all small business sectors at the 5% level of significance.

t-statistic of 69.856 with 193 degrees of freedom. The corresponding two-tailed p value is 0.000. If we take the significance level of 5%, we can see that the p value obtained is less than 0.05. Therefore, we can reject the null hypothesis at p = 0.05, which means that the sample mean is significantly different from the hypothesized value and the average political instablity in the small business enterprise is not the same in all small business sectors at the 5% level of significance.

t-statistic of 110.128 with 193 degrees of freedom. The corresponding two-tailed p value is 0.000. If we take the significance level of 5%, we can see that the p value obtained is less than 0.05. Therefore, we can reject the null hypothesis at p=0.05, which means that the sample mean is significantly different from the hypothesized value and the average COVID-19 in the small business enterprise is not the same in all small business sectors at the 5% level of significance.

Discussion of Hypotheses

The finding of the study reveals that there is a positive and significant relationship between independent variables (Corruptions, Political instability, and COVID-19) and SMEs performance (Table 7). hence, it can be concluded all variables under this study have a positive and significant role in the SMEs' performance except corruptions. Therefore, all the hypotheses are analyzed below:

| Table 7 Discussion of Hypotheses | |||

| Hypothesis | Beta Value | Sig | Result |

| Hypothesis 1 (H1): Corruptions has a positive and significant effect on SMEs performance. | -0.006 | 0.944 | Negative, Not Significant Rejected |

| Hypothesis 2 (H2): Political instablity has a positive and significant effect on SMEs' performance. | 0.627 | 0.000 | Positive, Significant Accepted |

| Hypothesis 3 (H3): COVID-19 has a positive and significant effect on SMEs' performance. | 0.337 | 0.000 | Positive, Significant Accepted |

Hypothesis 1(H1): Corrutpions has negative correlation with sustianablity of SMEs, but has no stastistically significant effects. Result: P=0.944 and beta has negative coefficient, hence, null hypothesis is accepted and the alternative hypothesis is safely rejected, thus corruptions is negatively affect the sustainablity of SMEs but it is not stastistically significant. (Shumetie, 2019).

Hypothesis 2(H2): There are effects and positive correlation (p<0.05) between the Political istablity and SMEs performance. Result: P=0.020 and Beta is positive, hypothesis 2 is accepted and the null hypothesis is safely rejected, thus the Political istablity has significantly affects the SMEs performance and its sustianbaliy. The results of this study is similar with the finding that revaels, political instability, defined in the context of governmental duration, is likely to have a negative effect on economic growth. (Hammed, 2018; Mark John & Nwaiwu, 2015).

Hypothesis 3(H3): There are effects and positive correlation (p<0.05) between the COVID-19 and SMEs performance. Result: P=0.005 and Beta is positive,hence hypothesis 3 is accepted and the null hypothesis is safely rejected, thus the COVID-19 has significant effects on SMEs performance.(Gregurec, Tomi, et al., 2021; Ichsan, 2021).

Conclusion and Recommendations

Based on the analysis, the undermentioned conclusions are put forth.

The findings from this study are believed to give an insight into the current trends and challenges that Determine Sustainable Growth of Small and medium enterprises (SMEs) during COVID-19 in Ethiopia. The result of this analysis shows that political environment has a significant impact on business performance of SMEs. This is attributable to party politics with threats of conflict and wars, growing levels of crime and terrorism, kidnapping, bomb blast, among others thereby hindering business patronage and scaring away foreign investors from the country. The result of the study reveals that Ethiopian political instability is negatively and significantly affects the sustainblity of SMEs. Hence, The recurrent political instability does not allow enterprises to introduce new products and/or process in their business process.

The analysis also shows that corruption has significant effect on Ethiopian Small and medium enterprises. Within this study, it is recognized that most of the respondents stated that government officials illegitimately take money from them. This seems to confirm the results of a study who found that SMEs owner/managers regularly encountered harassment from the government officials that extorted monies from them..Moreover, the intensive corruption in the government service delivery would directly aggravate the persistent political instability in Ethiopia. Hence, The direct linkage of corruption and political instability implies that corruption has both direct and indirect effect on SMEs. In aditions, the COVID-19 pandemic has wrought disastrous consequences on the Ethiopian economy, jeopardizing the existence of small medium enterprises (SMEs) across the the regions of the countries. Hence, There is need for new strategy especially by providing financial support for existing business transaction and loans for new businesses in order to make mvjost of SMEs survive after the plague of COVID-19.

Implication

This outcome has substantial theoretical implications since it advocates that when firm performance is measured corruptions and political instability should be distinguished. Any concrete analysis of this room which does not reflect these two factors, will neglect foremost variables, leading to a partial guesstimate of the performance of firms.

Limitations and Future Research Directions

The study sample did not represent all the SMEs in the Ethiopian country. It had predominantly focused on the SMEs found in only one region of specific zonal town of the country. Therefore, future research has to consider SMEs found in the all ten regions of the country. Future studies should emphasis on other industry level elements affecting SME performance alongside corruptions and political instability, and also comprise other macroeconomic pointers such as unemployment ratio, recession and boom impacts.

Authors Contribution: Conceptualization: A.A; Design: A.A; Data Acquisition: A.A.; Analyzing and interpreting the Data: A.A.; Writing the original draft: A.A. All authors have read and agreed to the published version of the manuscript.

Funding: There is no external funding source for this study.

Acknowledgements: I would like to provide a heartfelt gratitude to all whom contributed in one way another to bring this article up to this level. My respondents, business owners, managers of SMEs of Ambo town and government officials earn special thanks from me.

Conflict of Interest: I declare that there is no conflict of interest on this study.

References

Adam, N.A. (2021). Innovation practices for survival of small and medium enterprises (SMEs ) in the COVID-19 times : the role of external support. 6.

Ahmad, N.H., & Rahman, S.A. (2020). Sustainable entrepreneurship practices in Malaysian manufacturing SMEs : the role of individual , organisational and institutional factors Sustainable entrepreneurship practices in Malaysian manufacturing SMEs : The role of individual, organisational and.

Indexed at, Google Schalor, Cross Ref

Anderson, B.S., & Eshima, Y. (2013). The influence of firm age and intangible resources on the relationship between entrepreneurial orientation and fi rm growth among Japanese SMEs. Journal of Business Venturing, 28(3), 413–429.

Asa, A.R., & Prasad, N.S. (2014). Analysis on the Factors that Determine Sustainable Growth of Small Firms in Namibia. International Journal of Management Science and Business Administration, 1(1), 5–11.

Bazza, M.I., & Daneji, B.A. (2013). Political instability and organizational performance : A case study of afribank PLC ( Mainstreet Bank ) Maiduguri Branch. Asian Journal of Business and Management, 1(5).

Cepel, M., & Dvorsky, J. (2020). The impact of the COVID-19 crisis on the perception of business risk in the SME segment. Journal of International Studies, 13, 248–263.

Indexed at, Google Schalor, Cross Ref

Darcy, C., Hill, J., Mccabe, T.J., & Mcgovern, P. (2014). A consideration of organisational sustainability in the SME context A resource-based view and composite model.

Indexed at, Google Schalor, Cross Ref

Fenetahun, Y., You, Y., Xu, X., & Nzabarinda, V. (2021). The impact of political instability on sustainable rangeland management : A Study of Borana Rangeland , Southern Ethiopia.

Gayle Allarda, Candace A. Martinezb, C. W. (2012). Political instability, pro-business market reforms and their impacts on national systems of innovation. Research Policy, 41(3), 638–651.

Indexed at, Google Schalor, Cross Ref

Gerald, E., Obianuju, A., & Chukwunonso, N. (2020). Strategic agility and performance of small and medium enterprises in the phase of Covid-19 pandemic. International Journal of Financial, Accounting, and Management, 2(1), 41–50.

Indexed at, Google Schalor, Cross Ref

Globerman, S., & Shapiro, D. (2003). Governance infrastructure and US foreign direct investment. Journal of International Business Studies, 34(1), 19–39.

Indexed at, Google Schalor, Cross Ref

Glover, J.L., Champion, D., Daniels, K.J., & Dainty, A.J.D. (2014). An Institutional Theory perspective on sustainable practices across the dairy supply chain. International. Journal of Production Economics, 152, 102–111.

Indexed at, Google Schalor, Cross Ref

Gregurec, I., Tomi, M., & Tomi, K. (2021). The Impact of COVID‐19 on Sustainable Business Models in SMEs. 13(1098).

Indexed at, Google Schalor, Cross Ref

Gregurec, I., Tomičić Furjan, M., & Tomičić‐pupek, K. (2021). The impact of covid‐19 on sustainable business models in SMEs [El impacto de covid-19 en modelos de negocio sontenibles en PYMES]. Sustainability (Switzerland), 13(3), 1–24.

Guo, H., Yang, Z., Huang, R., & Guo, A. (2020). The digitalization and public crisis responses of small and medium enterprises: Implications from a COVID-19 survey. Frontiers of Business Research in China, 14(1), 1–25.

Indexed at, Google Schalor, Cross Ref

Hammed, A. (2018). Corruption , political instability and development nexus in Africa: A Call for sequential policies reforms. Munich Personal RePEc Archive, 85277.

Hosseininia, G., & Ramezani, A. (2016). Factors Influencing Sustainable Entrepreneurship in Small and Medium-Sized Enterprises in Iran : A Case Study of Food Industry.

Ichsan, H. (2021). Business sustainability in the times of crisis : Propositions and framework.

Indexed at, Google Schalor, Cross Ref

Igwe, P.A., Amaugo, A.N., Ogundana, O.M., Egere, M., & Anigbo, J.A. (2018). Factors Affecting the Investment Climate , SMEs Productivity and Entrepreneurship in Nigeria. 7(1), 182–200.

Indexed at, Google Schalor, Cross Ref

Jia, C., Tang, X., & Kan, Z. (2020). Does the Nation Innovation System in China Support the Sustainability of Small and Medium Enterprises ( SMEs ) Innovation?

Kiiru, G.W. (2015). Dynamic capabilities , strategic orientation and competitive advantage of small and medium-retail enterprises in Kenya. Grace Wangari Kiiru A thesis submitted in partial fulfillment for the degree of Doctor of Philosophy in Business Administration.

Kwon, U. (1997). ScholarWorks at WMU The Impact of Political Instability on Economic Growth : Evidence from Developing Countries.

Laukkanen, T. (2013). The effect of strategic orientations on business performance in SMEs A multigroup analysis comparing. 510–535.

Indexed at, Google Schalor, Cross Ref

Leydesdorff, L., & Meyer, M. (2006). Triple Helix indicators of knowledge-based innovation systems. Introduction to the special issue. Research Policy, 35(10), 1441–1449.

Indexed at, Google Schalor, Cross Ref

Mark John & Nwaiwu, J. N. (2015). Impact of political environment on business performance of multinational companies in Nigeria. African Research Review, 9(3), 1-10.

Neudorfer, N.S., & Theuerkauf, U.G. (2014). Buying war not peace: The influence of corruption on the risk of ethnic war. Comparative Political Studies, 47(13), 1856–1886.

Indexed at, Google Schalor, Cross Ref

Nimfa, D.T., Latiff, A., & Wahab, P.A. (2021). Theories underlying sustainable growth of Small and Medium. Africaln Journal of Emerging Issues, 3(2), 43–66.

Olana, D.R. (2020). The effect of covid-19 on smes and entrepreneurial resilience in Ethiopia. A case of nekemte town. Research on Humanities and Social Sciences, 10(11), 1–5.

Indexed at, Google Schalor, Cross Ref

Post, C., Sarala, R., Gatrell, C., & Prescott, J.E. (2020). Advancing theory with review articles 3117(3).

Price, D.P., Stoica, M., & Boncella, R.J. (2013). The relationship between innovation , knowledge, and performance in family and non-family firms : An analysis of SMEs. Journal of Innovation Entrepreneurship, 2(14), 1–20.

Rosyadi, S., Kusuma, A.S., Fitrah, E., Haryanto, A., & Adawiyah, W. (2020). The Multi-Stakeholder ’ s Role in an Integrated Mentoring Model for SMEs in the Creative Economy Sector.

Shumetie, M.D. (2019). Effect of corruption and political instability on enterprises’ innovativeness in Ethiopia: Pooled data based. Journal of Innovation and Entrepreneurship, 8(1), 1–19.

Indexed at, Google Schalor, Cross Ref

Sobaih, A.E.E., Elshaer, I., Hasanein, A.M., & Abdelaziz, A.S. (2021). Responses to COVID-19: The role of performance in the relationship between small hospitality enterprises’ resilience and sustainable tourism development. International Journal of Hospitality Management, 94(6), 102824.

Indexed at, Google Schalor, Cross Ref

Srisathan, W.A., Ketkaew, C., & Naruetharadhol, P. (2020). Cogent Business & Management The intervention of organizational sustainability in the effect of organizational culture on open innovation performance : A case of thai and chinese SMEs The intervention of organizational sustainability in the effect of orga. Cogent Business & Management, 7(1).

Teixeira, A.A.C., & Guimarães, L. (2015). Corruption and FDI: Does the Use of Distinct Proxies for Corruption Matter? Journal of African Business, 16(1–2), 159–179.

Indexed at, Google Schalor, Cross Ref

Union, A. (2020). Country Case Studies of the Impact of COVID-19. II.

Varsakelis, N. C. (2006). Education, political institutions and innovative activity: A cross-country empirical investigation. Research Policy, 35(7), 1083–1090.

Indexed at, Google Schalor, Cross Ref

Winarsih, Indriastuti, M., & Fuad, K. (2021). Impacto de Covid-19 en la transformación digital y la sostenibilidad en pequeñas y medianas empresas Empresas (PYMES): un marco conceptual. In Advances in Intelligent Systems and Computing: 1194 AISC. Springer International Publishing. https://doi.org/10.1007/978-3-030-50454-0.

Received: 03-May-2022, Manuscript No. AEJ-22-11502; Editor assigned: 06-May-2022, PreQC No. AEJ-22-11502(PQ); Reviewed: 18- May-2022, QC No. AEJ-22-11502; Revised: 20-May-2022, Manuscript No. AEJ-22-11502(R); Published: 23-May-2022