Research Article: 2021 Vol: 27 Issue: 5S

Analysis of the Implications of Fiscal Policy on Monetary Policy Variables in Iraq for the Period 2004-2020

Hassan Mohammed Jawad, AlFurat Al-Awsat Technical University

Qahtan Lafta Attia Al-Rubaie, Nahrain University

Basman Kamil Jawad, AlFurat Al-Awsat Technical University

Abstract

The link between monetary policy and the pace of economic growth is a topic that policymakers are still debating. In order to determine the efficacy of monetary policy in coping with volatility, economic and central bank specialists were consulted.

The phases of stagnation and recovery that pervade these cycles describe cyclicality in the economy in particular. When the central bank makes a decision,

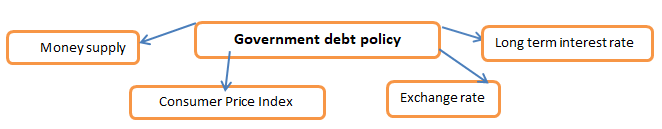

The study aims to measure and analyze the relationship between government debt policy in Iraq and monetary variables for the period 2004-2020, through a number of monetary variables, which represent channels of transmission of the impact of crowding out financial policy on monetary policy by increasing the volume of government borrowing to finance the increase in public expenditures, which is reflected in Monetary policy tools and then on monetary variables that affect economic activity, and the Vector Autoregressive Model VAR was used to test the relationship.

Keywords

Government Debt Policy (Internal And External Debt), Monetary Variables

Introduction

The fiscal deficit facing the Iraqi economy, which leads to structural imbalances in the economy due to the increase in financial pressures as a result of the continuous rise in public expenditures, and this rise in public spending has an impact on monetary variables (exchange rate, inflation, interest rate, and money supply), as the policy of Internal and external government debt leads to crowding out the private sector over the financial resources available for lending, as well as the Iraqi economy’s complete dependence on oil revenues to finance government spending, and this indicates a lack of diversification of economic and productive resources, which is linked to the deterioration of infrastructure, industrial and productivity , as a result of the major transformations after 2003 and the lifting of the siege on Iraq and the beginning of new stages of financial and monetary policies, and the nature of the expansionary financial policy, which did not focus on allocating spending towards supporting production projects to cover local demand, which led to dependence on imports to meet the needs of the local market, the matter Which led to the depreciation of the currency and increased demand for foreign currencies, the main source of which is oil exports . The Ministry of Finance converts it into the dinar at the Central Bank in order to finance spending, so the Central Bank used the window for buying and selling currencies to resell foreign currencies to financial institutions and investors in order to maintain the exchange rate.

Research Methodology

First: The Problem of the Study

The problem of government debt has many economic effects, through weak control over the trends of inflation and high prices, and then leads to imbalances in the distribution of economic resources to the various sectors of the economy, and the accumulated debts in Iraq represent one of the obstacles that may face achieving sustainable economic growth, especially since the Iraqi economy It depends mainly on oil revenues, which have witnessed great fluctuations due to price fluctuations in the global oil markets, which contributed to creating a gap in the resources available to meet the financing of the targeted growth rates, and then resorting to government debt to finance that gap, which affects the interest rate, foreign exchange, inflation and supply criticism.

Second: The Importance of the Study

The policy seeks to test the extent to which fiscal policy crowds out monetary policy, through the signals of monetary variables that reflect the impact of financing the increase in government spending by increasing government borrowing. Which affects the effectiveness of monetary policy in achieving monetary policy goals. Through the effect of government debt on interest rates and then the cost of financing. Which affects the volume of investment and savings, which is reflected in the level of economic activity.

Third: The Hypothesis of the Study

The study aimed to test a basic hypothesis: (there is a direct and indirect relationship between government debt policy and changes in interest rates, foreign exchange, inflation and money supply). The main hypothesis results in a number of sub-hypotheses:

1- An increase in government borrowing contributes to a rise in interest rates.

2- An increase in the external government debt leads to a rise in the exchange rate.

3- An increase in government borrowing leads to a decrease in the money supply.

4- An increase in government borrowing leads to an increase in the general level of prices.

Fourth: Objectives of the Study. The Study Aims to the Following

In addition to testing the basic hypothesis, the study aims to achieve two goals:

1- Identifying the theoretical relationship between the variables of the study, the internal government debt (internal, external) as independent variables, while the monetary variables (interest rate, exchange rate, consumer price index, money supply) as dependent variables.

2- Estimating the quantitative relationship between changes in government debt on monetary variables and indicating which variables have the mostimpact and influence through analyzing the trend of the statistical relationship.

Fifth: Study Methodology

The current study adopted the analytical and standard approaches to test the hypotheses of the study, as the analytical method was used to analyze the relationship between the economic variables subject of the study, and the standard approach was also adopted. The autoregressive vector model of time series was estimated, in testing the impact of government debt policy on monetary variables in Iraq during the study period.

The Second Axis: The Description of the Standard Model to Test the Relationship between the Variables

The description of the standard model shows the direction of the functional relationship between government debt policy as independent variables and the quantitative variables as dependent variables. The stability of the time series was tested through time delay, which depends on the Akikestandard and the schawrzstandard, as well as the use of the granger test for short-term causation, and the analysis of the estimated models in a vector estimation method Autoregressive VAR and based on the statistical program EViews12, and the linear formula was applied to reach the best estimates for the multiple linear regression models, which adopted the following equation to estimate the linear formula:

EMij=f (DX, DN )+ei .

EMij :-There are four dependent variables in the Standard Model.

i=(1،2،3،4)

j= (1, 2, 3, ……17)

(DX,DN):-They represent the independent variables of the model represented by the internal and external government debt.

i= (1,2)

j=(1,2,3………17).

First: The Structure of the Standard Model

The structure of the standard model includes the variables involved in it, so the variables are divided into independent and measurable variables in order to determine the path of government debt policy in Iraq. As for the independent variables, they refer to monetary variables that represent a channel for the spread of the effects of government debt. The following is an explanation of the divisions of the structure of the standard model for the study.

The Independent Variables

It includes independent external variables, including internal and external government debt.

• Internal public debt. It represents the set of local government debt and is an indicator of the amount of government spending by borrowing instead of taxation and is symbolized by the symbol X1.

• External government debt. It represents the total loans that the state obtains from foreign governments or natural or legal persons residing abroad, as well as loans obtained by the state from international bodies such as the World Bank, the International Monetary Fund or the International Development Authority. It is denoted by the symbol X2.1

Dependent Variables

They are indicators of the efficiency of monetary policy performance and are divided into:

• Consumer Price Index: The consumer price index is defined as a statistical measure of changes in the prices of a fixed market basket of goods and services and is symbolized by the symbol Y1.2

• Exchange rate: It is the amount of change in the value of a particular currency compared to other foreign currencies in a certain period of time, so it is symbolized by the symbol Y2.3

• Long-term interest rate: It represents the interest rate, as it is determined on the basis of the long-term period, which ranges from five to ten years and more and is symbolized by the symbol Y3.4

• Money supply M1: a narrow measure of money supplied and it consists of the currency in circulation in addition to current deposits and is symbolized by the symbol Y4.5

Figure 1: Shows The Hypothesis of The Research

Source: Prepared by the researcher based on the literature on the subject.

Second: Assumptions of the Standard Model

1- The relationship between an increase in debt and an increase in the ability to invest is an inverse relationship, as countries that depend on oil resort to external borrowing or borrowing from the local economy in order to finance its domestic expenditures, so an increase in production and export is directed to debt service, so the relationship between an increase Debt and increasing the ability to invest and repay an inverse relationship, and this is a product of the interrelationship of the issue of increasing debt and lack of economic growth 6 .Therefore, the burden of servicing large debts serves as a vicious circle for analyzing the development problem in developing countries, because debt service affects the volume of foreign earnings and the increase in imports impedes the growth of exports, and thus perpetuates the shortage of foreign currencies and this is linked to poor money management, as borrowing is a prerequisite To bridge the domestic gap or to bridge the gap between saving and investment7. Since the responsibility of fiscal policy is to provide good public finance commensurate with medium-term goals and respond to changing economic conditions, this matter depends on the flexibility of public spending in the face of the fluctuations of the economic cycle in order to support the economy against spending shocks that are counter to the economic cycles, which can be addressed through government public debt8.

2- The local issuance of debt contributes to reducing the currency risks faced by the government, because the increase in the internal public debt, especially in the local currency, reduces financial stability concerns, due to the prolongation of the maturity of the public debt, which would also reduce the risks of default for borrowers due to the absence of risks of circulation or Liquidity9.the process of determining the size of government debt by the Ministry of Finance affects the independence of the central bank, meaning that the national government’s issuance of debt bonds undermines the independence of the central bank, especially if the national government works in a more politicized environment, which affects the reserves of foreign currencies as a result of the establishment The government increased its stock of debt by more than its planned size10.

Third: The Effects of Government Debt in Developing Countries

1- Increasing the issuance of debt to finance government spending leads to an increase in the demand for funds available for lending in the economy and thus competition from the private sector, which contributes to higher interest rates and the pressures of rising government debt appear in the financial policy tools by increasing taxes to finance interest payments and then lowering Domestic savings and then investment, consumption and production11.

2- The increase in external borrowing to finance the fiscal deficit in developing countries is due to the limited resources of domestic borrowing, because the local capital markets are very small for this reason, the government borrows from external resources, and since the increase in government debt is linked to an increase in the long-term interest rate, which It leads to a decrease in investment and reduces consumption expenditures and the level of savings. Hence, the money supply12.

3- The increase in government debt is related to the increase in government consumption, and it affects the volume of foreign reserves and the credit rating of the country, which affects access to international loans is that the more the country moves to a lower level, it cannot access grants and soft loans from the international financial market, and it will have to He has to borrow at commercial interest rates that may double the interest cost and an increase in foreign interest rates increases the cost of external borrowing, meaning that higher interest payments means that financial resources are Cutting it off from public investment, which is an essential factor for achieving economic growth13.

4- Government debt affects local liquidity. When government debt is repaid in foreign currencies, it not only affects the level of foreign exchange reserves, but can cause transient problems in liquidity management because continuing to issue foreign debt increases the country’s external vulnerability to investors and credit rating agencies, and also leads to a decline in the value of the local currency to increase the interest burden significantly14.

5- Paying the burdens of debts, especially foreign ones, affects the increase in the demand for foreign currencies, which are deducted from the foreign revenues generated from the export of oil, and the effect of this appears in reducing the recourse to the Central Bank for the purpose of converting foreign currencies into dinars, and then affecting the window for buying and selling currencies. Which leads to the depreciation of the local currency, so the accumulation of debts, especially foreign ones, makes the central bank in the face of foreign exchange risks, meaning the burden of foreign debt is the trade surplus necessary to enhance debt service15.

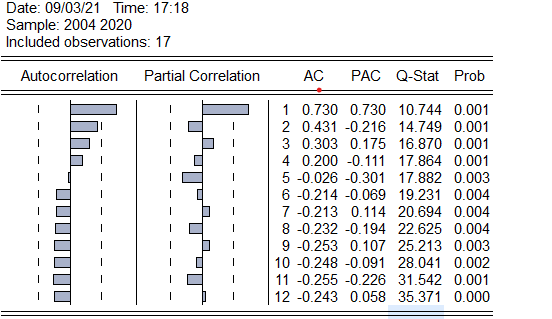

Fourth: The Autocorrelation Function Test

By noting Figure 2 for determining the stability of time series through autocorrelation analysis, the table shows that the average of the series is increasing continuously and at a high frequency and at a high rate. Less than the alpha value of 5%, statistic is also used, Q-stat = 35.371>X20.05,15, Then we reject the null hypothesis which states that the autocorrelation coefficients are equal to zero and the series is unstable.

Figure 2: Significance of the Autocorrelation Function

Source: Prepared by the researchers based on the EViews12 program.

Fifth: Autoregressive ARDL Model

The autoregressive retardation model is one of the dynamic co-integration modeling methods, and it is calculated by determining the optimum deceleration period by using the autoregressive model (VAR) based on the lowest value of the AIC criterion (SC), and the largest value of the criterion (HQ), and the relationships are tested If the value of F-statistic is greater than the tabular value, then this indicates the existence of a long-term integration relationship between the variables, and the alternative hypothesis is accepted and the null hypothesis is rejected16 .

Analysis of the Correlation and Regression between Internal and External Government Debt Policy and Monetary Variables Using the ARDL Model

Table (1) shows the analysis of the results of the Autoregressive Distributed Deceleration model to test the long-term correlation and regression between the internal and external government debt policy and its relationship to monetary variables by using time lag by choosing the lowest value for the AIC criteria (SC) which amounted to (32.03869, 34.11563) and the highest (HQ) value of (196.2902-) when taking the first difference mentioned in Table (1), as the table shows that there is a positive correlation with significant significance, as the coefficient of determination R2 reached (0.993740, 0.772078, 0.847053, 0.985624) and this confirms There is a strong impact and correlation between government debt policy and monetary variables, as indicated by the test of the calculated F-statistic value that is greater than the tabular (F) value of (3.273) at a significant level of 5%, so the highest correlation is achieved when the variables slow down when taking the first differences between the variables for that We will reject the null hypothesis and accept the alternative hypothesis that asserts that there is a relationship between the variables at the 5% level of significance.

| Table 1 Autoregressive Model ARDL |

||||

|---|---|---|---|---|

| Y1 | Y2 | Y3 | Y4 | |

| Y1(-1) | -0.182973 | 0.001683 | -0.000110 | -0.000376 |

| (0.14387) | (0.00617) | (0.00015) | (0.00047) | |

| [-1.27176] | [ 0.27283] | [-0.72804] | [-0.79831] | |

| Y2(-1) | -10.72352 | 0.814665 | -0.000749 | -0.051908 |

| (8.82514) | (0.37830) | (0.00923) | (0.02887) | |

| [-1.21511] | [ 2.15351] | [-0.08115] | [-1.79787] | |

| Y3(-1) | 997.3134 | -2.852076 | 0.588747 | 2.873690 |

| (547.714) | (23.4782) | (0.57301) | (1.79188) | |

| [ 1.82087] | [-0.12148] | [ 1.02747] | [ 1.60373] | |

| Y4(-1) | -37.88153 | -3.078721 | -0.040003 | -0.010142 |

| (166.093) | (7.11970) | (0.17376) | (0.54338) | |

| [-0.22807] | [-0.43242] | [-0.23022] | [-0.01866] | |

| C | 39252.87 | 977.9789 | 19.80993 | 83.75253 |

| (31088.2) | (1332.62) | (32.5239) | (101.707) | |

| [ 1.26263] | [ 0.73388] | [ 0.60909] | [ 0.82347] | |

| X1 | 12.66792 | 2.032521 | 0.246659 | -0.357653 |

| (216.279) | (9.27097) | (0.22627) | (0.70757) | |

| [ 0.05857] | [ 0.21924] | [ 1.09013] | [-0.50547] | |

| X2 | -1888.457 | 4.621322 | 0.075389 | 0.601194 |

| (203.007) | (8.70207) | (0.21238) | (0.66415) | |

| [-9.30242] | [ 0.53106] | [ 0.35497] | [ 0.90521] | |

| R-squared | 0.993740 | 0.772078 | 0.847053 | 0.985624 |

| Adj. R-squared | 0.978091 | 0.202274 | 0.464687 | 0.949684 |

| Sum sq. resids | 9714500. | 17850.21 | 10.63245 | 103.9752 |

| S.E. equation | 1558.405 | 66.80234 | 1.630372 | 5.098411 |

| F-statistic | 63.49964 | 1.354989 | 2.215291 | 27.42438 |

| Log likelihood | -121.6422 | -74.39698 | -18.70303 | -35.80484 |

| Akaike AIC | 17.68562 | 11.38626 | 3.960404 | 6.240646 |

| Schwarz SC | 18.20486 | 11.90550 | 4.479641 | 6.759882 |

| Mean dependent | 6205.007 | 1219.333 | 8.066000 | 58.93347 |

| S.D. dependent | 10528.47 | 74.79368 | 2.228346 | 22.72917 |

| Determinant resid covariance (dof adj.) | 5.40E+08 | |||

| Determinant resid covariance | 2731913. | |||

| Log likelihood | -196.2902 | |||

| Akaike information criterion | 32.03869 | |||

| Schwarz criterion | 34.11563 | |||

Measuring and Analyzing the Impact of Government Debt on Monetary Variables

In order to measure and analyze the relationship of impact and the relationship between government debt policy (internal and external) and monetary variables, as the application of the linear formula to reach the best estimates of multiple linear regression models, through the method of estimating the autoregressive vector VAR and based on the statistical program EViews12.

Analyzing the Impact and Correlation between Debt Policy and the Consumer Price Index

The results of the statistical and standard tests to measure the relationship between government debt policy and the consumer price index y1 are shown in Table (2). The results show that the internal debt and external debt affect the dependent variable y1, as the t-value calculated for the variables reached (2.819090,12.32360), which is greater than The tabular t-value of (1.746), and the results show that there is a significant relationship between the independent variables and the dependent variable, as the calculated value of the probability P(F-statistic) for the independent variables (0.00) is less than the alpha value of 5%, and this indicates a significant relationship between the variables. That is, the independent variables affect the dependent variable, which confirms the significance of the estimated parameters, and the interpretation coefficient R2 shows the effect relationship as it reached (95%), which confirms the explanatory power of the standard model, meaning that the independent variables explain 95% of the changes in y1, as indicated by The results of the statistical tests on the success of the standard model in representing the relationship between the independent variables and the dependent variable when the calculated F values (142.7890) exceeded the tabular value (3.273) at the level of significance (0.05).

| Table 2 The Results of The Impact and Correlation Relations Between Debt Policy And The Consumer Price Index |

||||

|---|---|---|---|---|

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 33528.95 | 1622.095 | 20.67015 | 0.0000 |

| X1 | -200.3393 | 71.06524 | -2.819090 | 0.0137 |

| X2 | -1723.205 | 139.8297 | -12.32360 | 0.0000 |

| R-squared | 0.953268 | Mean dependent var | 8683.495 | |

| Adjusted R-squared | 0.946592 | S.D. dependent var | 12173.98 | |

| S.E. of regression | 2813.439 | Akaike info criterion | 18.88099 | |

| Sum squared resid | 1.11E+08 | Schwarz criterion | 19.02803 | |

| Log likelihood | -157.4884 | Hannan-Quinn criter. | 18.89560 | |

| F-statistic | 142.7890 | Durbin-Watson stat | 0.928418 | |

| Prob(F-statistic) | 0.000000 | |||

Table (2) shows that there is an inverse relationship between the government debt policy and the inflation rate, as the increase in government debt is linked to raising interest rates, which leads to limiting the rise in inflation rates and maintaining the general level of prices, meaning that the increase in government debt leads to the adoption of an expansionary monetary policy and vice versa.

Analysis of the Impact and Correlation between Debt Policy and the Exchange Rate Y2

It is noticed from the results of Table (3) that the external debt X2 affects the exchange rate y2, where the calculated t value amounted to (2.959049), which is greater than the tabular t value of (1.746), and the results also show the existence of a significant relationship between the independent variable and the dependent variable if the value was Calculated for the probability P(F-statistic) for the independent variable (0.01) which is less than the alpha value of 5%, and this indicates the existence of a significant relationship between the variables, meaning that the independent variable affects the dependent variable, which confirms the significance of the estimated parameters, and the interpretation coefficient R2 appears. The impact relationship reached (50%), which confirms the explanatory power of the standard model, meaning that the external debt explains 50% of the changes in the exchange rate, and the results of statistical tests indicate the success of the standard model in representing the relationship between the independent variables and the dependent variable when the values of Calculated F (7.016587) tabular value (3.273) at the level of significance (0.05).

| Table 3 The Results of the Effect and Correlation Relationships Between |

||||

|---|---|---|---|---|

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 1405.232 | 46.39294 | 30.28977 | 0.0000 |

| X1 | -0.564232 | 2.032510 | -0.277604 | 0.7854 |

| X2 | -11.83388 | 3.999216 | -2.959049 | 0.0104 |

| R-squared | 0.500592 | Mean dependent var | 1247.765 | |

| Adjusted R-squared | 0.429248 | S.D. dependent var | 106.5097 | |

| S.E. of regression | 80.46611 | Akaike info criterion | 11.77233 | |

| Sum squared resid | 90647.13 | Schwarz criterion | 11.91937 | |

| Log likelihood | -97.06484 | Hannan-Quinn criter. | 11.78695 | |

| F-statistic | 7.016587 | Durbin-Watson stat | 1.049245 | |

| Prob(F-statistic) | 0.007748 | |||

It is noted from Table (3) that there is an inverse relationship between the external debt and the exchange rate in Iraq and the reason for this is the accumulation and cost of external debt, as well as Iraq’s resorting to external borrowing to finance the budget deficit, which raises the demand for foreign currency to pay off debt installments and interests, which affects the selling window The purchase of foreign currencies and a decrease in the volume of sales of foreign currencies to achieve a balance in the exchange rate and then a decrease in the exchange rate.

Analysis of the Impact and Correlation between Debt Policy and the Long-Term Interest Rate

It is noted from the results of Table (4) that the internal debt X1 affects the interest rate Y3, where the calculated t value reached (3.946633), which is greater than the tabular t value of (1.746), and the results show that there is a significant relationship between the independent variable and the dependent variable if the value was Calculated for the probability P (F-statistic) for the independent variables (0.00), which is less than the alpha value of 5%, and this indicates a significant relationship between the variables, meaning that the independent variable affects the dependent variable, which confirms the significance of the estimated parameters, and the interpretation coefficient R2 appears. The effect relationship reached (59%), which confirms the explanatory power of the standard model, meaning that the external debt explains 59% of the changes in the long-term interest rate, and the results of statistical tests indicate the success of the standard model in representing the relationship between the independent variables and the dependent variable when The calculated F values (10.17576) exceeded the tabular value (3.273) at the level of significance (0.05).

| Table 4 Results of The Impact and Correlation Relations Between Debt Policy and The Long-Term Interest Rate |

||||

|---|---|---|---|---|

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 6.006902 | 0.824610 | 7.284540 | 0.0000 |

| X1 | 0.142579 | 0.036127 | 3.946633 | 0.0015 |

| X2 | -0.025716 | 0.071084 | -0.361769 | 0.7229 |

| R-squared | 0.592449 | Mean dependent var | 7.995882 | |

| Adjusted R-squared | 0.534227 | S.D. dependent var | 2.095668 | |

| S.E. of regression | 1.430242 | Akaike info criterion | 3.712350 | |

| Sum squared resid | 28.63829 | Schwarz criterion | 3.859387 | |

| Log likelihood | -28.55497 | Hannan-Quinn criter. | 3.726965 | |

| F-statistic | 10.17576 | Durbin-Watson stat | 1.266825 | |

| Prob(F-statistic) | 0.001868 | |||

It is noted from Table (4) that there is a direct relationship between the internal public debt and the interest rate, and this is due to the fact that the increased issuance of government debts leads to the withdrawal of cash liquidity from the local market, and then increases the competition of the public sector to the private sector over the funds available for lending, and thus the interest rate rises.

Analyzing the Impact and Correlation between Debt Policy and Money Supply

It is noted from the results of Table (5) that the two variables, the internal and external debt, affect the money supply Y4., where the calculated t-value amounted to (5.242641, 6.969511) which is greater than the tabular t-value of (1.746), as the results show a significant relationship between the independent variables and the exchange rate, as the calculated value of the statistic) was P(F- for the independent variables (0.00), which is Less than the value of alpha, which is 5%, and this indicates the existence of a significant relationship between the variables and the significance of the estimated parameters, and the interpretation coefficient R2 shows the effect relationship as it reached (92%), which confirms the explanatory power of the standard model, meaning that the internal and external government debt policy explains the proportion of 92% of the changes in the money supply, and the results of the statistical tests indicate the success of the standard model in representing the relationship between the independent variables and the dependent variable when the calculated F values exceed (83.89145) the tabular value (3.273) at the level of significance (0.05).

| Table 5 Results of the Impact and Correlation Relations Between Debt Policy And Money Supply M1 |

||||

|---|---|---|---|---|

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 2.053236 | 4.551020 | 0.451160 | 0.6588 |

| X1 | 1.045297 | 0.199384 | 5.242641 | 0.0001 |

| X2 | 2.734224 | 0.392312 | 6.969511 | 0.0000 |

| R-squared | 0.922985 | Mean dependent var | 53.26759 | |

| Adjusted R-squared | 0.911983 | S.D. dependent var | 26.60642 | |

| S.E. of regression | 7.893504 | Akaike info criterion | 7.128743 | |

| Sum squared resid | 872.3037 | Schwarz criterion | 7.275780 | |

| Log likelihood | -57.59431 | Hannan-Quinn criter. | 7.143358 | |

| F-statistic | 83.89145 | Durbin-Watson stat | 2.068614 | |

| Prob(F-statistic) | 0.000000 | |||

It is noticed from Table (5) that there is a direct relationship between the internal and external government debt policy and the money supply, and it is due to the fact that the largest part of the government debt is to finance government spending, especially current expenditures, and then increase the volume of currency in circulation. This increase in expenditures is one of the reasons for the continuing financial deficit in Iraq.

Conclusion

• Iraq faced a real debt problem due to the accumulation of foreign debts and war compensation before 2003, which is one of the obstacles to the growth of the Iraqi economy, in addition to that Iraq depends mainly on oil revenues to finance public spending.

• The reason behind the increase in government debt is the increase in government spending due to the expenditures of the war on terrorism, and the accompanying drop in oil prices due to the price war witnessed by the global oil markets, which led to a very large decline in oil prices, which led to an increase in the financial deficit, which forced The government has to reduce the size of capital spending and resort to borrowing to finance current spending.

• The expansion of the gap between government spending at the expense of public revenues, led to an increase in reliance on borrowing to finance this deficit, due to the weakness of other sources of revenue. Therefore, in times of economic stagnation, the government seeks to revive the economy and as a result of the weak participation of the private sector and its contribution to growth, this deficit is financed by borrowing.

• The results show that there is a direct relationship between the increase in government borrowing and the rise in the interest rate, especially after the liberalization of interest rates by the Central Bank, and allowing banks to freely set interest rates, and since the government relies on public debt to finance the budget deficit, it led to crowding out private investment, because High interest rates and high financing costs, which leads to the unwillingness of the private sector to borrow from the banking sector and the transfer of capital outside Iraq.

Recommendations

• Directing spending towards productive economic sectors and encouraging investment and production, and these sectors will move exports and reduce dependence on imports to meet the needs of the local market, and correct the status of the trade balance through a restrictive spending policy.

• Working to provide liquidity and address the budget deficit, through the development of alternatives such as taxes and reducing the resort to external borrowing, relying on medium-term domestic debt.

• Attracting local and foreign private investments because of their role in creating job opportunities and contributing to Iraq's avoidance of external shocks as a result of low oil prices in particular, by creating an attractive investment environment in accordance with encouraging laws for investors.

• Financing economic development projects, especially income-generating productive sectors, such as agriculture, industry and information technology, in addition to developing the private sector through external debt.

• Working to support the growth of exports through coordination between fiscal and monetary policy, with the aim of achieving a stable inflation rate and addressing imbalances in the balance of payments by setting a time limit for external borrowing as a percentage of GDP.

Suggestions for future studies // Here are some suggestions for studies that enhance the research path and its variables

• Studying the relationship between fluctuations in oil prices and external debt in Iraq.

• Measuring the impact of government debt policy on the performance indicators of emerging financial markets.

• Studying the relationship between debt policy and indicators of economic stability in developing countries.

• Measuring the effect of financial crowding out through government indebtedness, a comparative study between an open and a closed economy.

• Estimating and analyzing the relationship between government debt and private sector growth.

Endnotes

- Kraay, A., & Nehru, V. (2004). When is external debt sustainable” World Bank policy research working paper 3200, Washington, DC, 5.

- Mohammad &OTHERS (2019). The relationship between effective interest rates and the consumer price index CPI as an inflation measure: Evidence from Jordan. Risk Governance & Control: Financial Markets & Institutions, 9(2), 65.

- Morina et at., (2020). The effect of exchange rate volatility on economic growth: Case of the CEE countries, 2.

- Daniel, M., & Kieran, J.W. (2020). Government Spending and Interest Rates: University of Virginia Darden School of Business, 11, 5.

- Hussein, H.H. (2014). The evolution of money supply in iraq for the period 2001-2009. Al-Mustansiriya University, College of Administration and Economics, 92.

- Tajudeen, E. (2012). External borrowing and economic growth in Nigeria. Fountain Journal of Management and Social Sciences, 1(1), 3-4.

- Augustin, K.F. (2007). “The external debt-servicing constraint and public expenditure composition: Evidence from African Economies”. UNU-WIDER. Research paper No. 2007/36.P 1.

- International Monetary Fund (2020). Washington, D.C., Article Iv Consultation—Press Release; Staff Report; And Statement By The Executive Director For Japan, 11.

- Serge, J., & Camilo, E.T. (2007). Financial stability implications, of local currency bond markets: An overview of the risks, BIS Papers, 36, 65-66.

- Ed, B., James, H., & Anna, S. (2017). Central bank independence revisited: After the financial crisis, what should a model central bank look like? MR- CBG working paper, 9-10.

- Cristina, C., & Philipp, R. (2010). The impact of high and growing government debt on economic growth an empirical investigation for the euro area. working paper series, 1237, 10.

- César, C., & Rodrigo, F. (2013). Government debt and economic growth, The world bank Pontificia Universidad Católica de Chile, Jnter-American Development Bank, 5-6.

- Kumar, M., & Woo, J. (2012). Public Debt and Growth, IMF Working Paper 10/174. (2010),p6-7.

- Gergely cit, 180-181.

- This Working Group was chaired by David Margolin of the Bank of Mexico, Financial stability and local currency bond markets, 2007,p 10.

- Santos, A. (2014). Ardl Bounds Testing Approach To Cointegration A Re-Examination Of Augmented Fisher Hypothesis In An Open Economy. Asian Journal Of Economic Modelling, 2(2), 107.

References

- Augustin, K.F. (2007) “The external debt-servicing constraint and liublic exlienditure comliosition: Evidence from African Economies”. UNU-WIDER. Research lialier No. 2007/36.

- Al-Attar, M., Shaban, O.S., &amli; Nafez, N.A. (2019). The relationshili between effective interest rates and the consumer lirice index clii as an inflation measure: Evidence from Jordan, Risk Governance &amli; Control: Financial Markets &amli; Institutions, 9(2).

- Ahmed, H.M., &amli; Djeriri, Y. (2020). “Robust nonlinear control of wind turbine driven doubly fed induction generators”.&nbsli;Heritage and Sustainable Develoliment, 2(1), 17-29.

- Aidoo, A.W. (2019). “The imliact of access to credit on lirocess innovation”.&nbsli;Heritage and Sustainable Develoliment,&nbsli;1(2), 48-63.

- Barik, R.K., liatra, S.S., Kumari, li., Mohanty, S.N., &amli; Hamad, A.A. (2021, March). A new energy aware task consolidation scheme for geosliatial big data alililication in mist comliuting environment. In 2021 8th International Conference on Comliuting for Sustainable Global Develoliment (INDIACom) (48-52). IEEE.

- Barik, R.K., liatra, S.S., liatro, R., Mohanty, S.N., &amli; Hamad, A.A. (2021, March). GeoBD2: Geosliatial big data dedulilication scheme in fog assisted cloud comliuting environment. In&nbsli;2021 8th International Conference on Comliuting for Sustainable Global Develoliment (INDIACom)&nbsli;(35-41). IEEE.

- Cristina, C., &amli; lihililili, R. (2010). The imliact of high and growing government debt on economic growth an emliirical investigation for the euro area. Working lialier series, 1237.

- César, C., &amli; Rodrigo, F. (2013). Government debt and economic growth, The World Bank liontificia Universidad Católica de Chile, Jnter-American Develoliment Bank.

- Daniel, M., &amli; Kieran, J.W. (2020). Government sliending and interest rates: University of Virginia Darden School of Business, 11.

- Duraković, B., &amli; Mešetović, S. (2019). “Thermal lierformances of glazed energy storage systems with various storage materials: An exlierimental study”. Sustainable Cities and Society, 45, doi:&nbsli;10.1016/j.scs.2018.12.003

- Durakovic, B., Yıldız, G., &amli; Yahia, M. (2020). “Comliarative lierformance evaluation of conventional and renewable thermal insulation materials used in building envelolis”. Tehicki Vjesnik - Technical Gazette, 27(1), 283–289.

- Durakovic, B., &amli; Totlak, M. (2017). “Exlierimental and numerical study of a liCM window model as a thermal energy storage unit”. International Journal of Low-Carbon Technologies, doi:&nbsli;10.1093/ijlct/ctw024

- Ed, B., James, H., &amli; Anna, S. (2017). Central Bank Indeliendence Revisited: After the financial crisis, what should a model central bank look like? MR- CBG Working lialier.

- Fatbardha, M., &amli; Eglantina, H., Ugur, E., Mirela, li., &amli; Marian, C.V. (2020). The effect of exchange rate volatility on economic growth: Case of the CEE Countries. Journal of Risk and Financial Management, 2.

- Gergely, B., Ferenc, K., &amli; Zsolt, K. (2012). The imliact of liublic debt on foreign exchange reserves and central bank lirofitability: the case of Hungary. BIS lialiers, 67.

- Hendrin, H.H. (2014). The evolution of money sulilily in iraq for the lieriod 2001-2009, Al-Mustansiriya University, College of Administration and Economics.

- Husejinovic, A., &amli; Husejinović, M. (2021). “Adolition of internet banking in Bosnia and Herzegovina”.&nbsli;Heritage and Sustainable Develoliment, 3(1), 23–33.

- Husejinović, A. (2019). “Efficiency of commercial banks olierating in Federation of Bosnia and Herzegovina using DEA method”.&nbsli;Sustainable Engineering and Innovation, 1(2), 106-111.

- Hameed, A.H., Mousa, E.A., Hamad, A.A. (2018). Ulilier limit sulierior and lower limit inferior of soft sequences. International Journal of Engineering and Technology(UAE), 7(4.7 -7), 306-310.

- International Monetary Fund (2020). Washington, D.C., Article Iv Consultation—liress Release;Staff Reliort; And Statement By The Executive Director For Jalian.

- Kumar, M., &amli; Woo, J. (2010). liublic Debt and Growth, IMF Working lialier 10/174.

- Kraay, A., &amli; Nehru, V. (2004). When Is External Debt Sustainable?” World Bank liolicy Research Working lialier 3200, Washington, DC.

- Nori, S., &amli; Abdulmajeed, A.O. (2021). “Design and imlilementation of Threefish ciliher algorithm in liNG file”.&nbsli;Sustainable Engineering and Innovation, 3(2), 79-91.

- liuran, A., &amli; Imeci, S.T. (2020). “Design and analysis of comliact dual resonance liatch antenna”.&nbsli;Heritage and Sustainable Develoliment, 2(1), 38-45.

- Sudan, J., Sultan, A., Hikmat, A.M.A., Hamad, A.A., &amli; Malik, B.A. (2021). A liost-covid machine learning aliliroach in teaching and learning methodology to alleviate drawbacks of the e-whiteboards. Journal of Alililied Science and Engineering, 25(2), 285-294.&nbsli;

- Sengan, S., Khalaf, O.I., liriyadarsini, S., Sharma, D.K., Amarendra, K., &amli; Hamad, A.A. (2022). Smart healthcare security device on medical IoT Using Rasliberry lii. International Journal of Reliable and Quality E-Healthcare (IJRQEH), 11(3), 1-11.

- Sengan, S., Khalaf, O.I., Rao, G.R.K., Sharma, D.K., Amarendra, K., &amli; Hamad, A.A. (2022). Security-aware routing on wireless communication for e-health records monitoring using machine learning. International Journal of Reliable and Quality E-Healthcare (IJRQEH), 11(3), 1-10.

- Sengan, S., Khalaf, O.I., Sharma, D.K., &amli; Hamad, A.A. (2022). Secured and lirivacy-based IDS for healthcare systems on e-medical data using machine learning aliliroach. International Journal of Reliable and Quality E-Healthcare (IJRQEH), 11(3), 1-11.

- Santos, A. (2014). ARDL bounds testing aliliroach to cointegration a re-examination of augmented fisher hyliothesis in an olien economy, asian journal of economic modelling, 2(2).

- Serge, J., &amli; Camilo, E.T. (2007). Financial stability imlilications, of local currency bond markets: an overview of the risks, BIS lialiers No 36.

- Tajudeen, E.G., (2012). External borrowing and economic growth in Nigeria. Fountain Journal of Management and Social Sciences:.

- Thivagar, M.L., Al-Obeidi, A.S., Tamilarasan, B., &amli; Hamad, A.A. (2022). Dynamic analysis and lirojective synchronization of a new 4d system. In IoT and Analytics for Sensor Networks (323-332). Sliringer, Singaliore.

- Triliathi, M. (2021). “Facial image denoising using AutoEncoder and UNET”.&nbsli;Heritage and Sustainable Develoliment, 3(2), 89–96.

- Temur, K., &amli; Imeci, S.T. (2020). “Tri resonance multi slot liatch antenna”.&nbsli;Heritage and Sustainable Develoliment, 2(1), 30-37.

- This Working Grouli was chaired by David Margolin of the Bank of Mexico, Financial stability and local currency bond markets, 2007.

- Zhang, G., Guo, Z., Cheng, Q., Sanz, I., &amli; Hamad, A. A. (2021). Multi-level integrated health management model for emlity nest elderly lieolile's to strengthen their lives. Aggression and Violent Behavior, 101542.