Research Article: 2021 Vol: 20 Issue: 2S

Analysis of Motivational Factors that Influence Usage of Computer Assisted Audit Techniques (CAATs) by External Auditors in Jordan

Nour Damer, Princess Sumaya University for Technology

Asma Hussein Al-Znaimat, Princess Sumaya University for Technology

Ala’a Zuhair Ahmad Almansou, University Utara Malaysia

Muzaffar Asad, Princess Sumaya University for Technology

Keywords

Computer Assisted Audit Techniques, External Auditors, Performance, Expectancy, Social Influence, Behavioral Intentions

Abstract

The aim of this study is to analyze the impact of performance expectancy, externalities, facilitating conditions, social influence, and behavioral intentions on using Computer Assisted Audit Techniques by external auditors in Jordan. Moreover, it aims to discover the reasons behind not adopting Computer Assisted Audit Techniques by external auditors in Jordan. For the said purpose, a questionnaire was designed and distributed randomly among a group of external auditors working in the Big Four audit firms in Jordan. A total of 100 valid usable questionnaires were received from respondents showing almost 60% response rate. The findings revealed that performance expectancy, facilitating conditions, and behavioral intentions have a positive impact on using Computer Assisted Audit Techniques by external auditors in Jordan. However, a negative impact of externalities has been observed. Furthermore, social influence showed an insignificant impact over Computer Assisted Audit Techniques used by external auditors in Jordan. The research also revealed some obstacles faced by external auditors when using Computer Assisted Audit Techniques in Jordan.

Introduction

Information Technologies (IT) proved to be a good investment in the modern business world (Shamsuddin, Rajasharen, Maran, Ameer & Muthu, 2015; Teece, 2018; Haseeb, Hussain, ?lusarczyk & Jermsittiparsert, 2019). More and more organizations are switching their traditional business models to e-business (Hall, 2015; Haseeb, Hussain, ?lusarczyk, & Jermsittiparsert, 2019). Thus, the methods and techniques used to handle business processes are changing and auditing has no exception to it (Laudon & Laudon, 2016; Stoel & Havelka, 2020).

The auditing process is of high importance for any business organization. It shows whether the transactions are executed in accordance with the requirements or not (Ramos, Ollero & Suárez-Llorens, 2017). Auditors’ aim is to prove that financial statements represent the real financial status of the organization (Khalil, Asad & Khan, 2018). Thus, they work on detecting and preventing errors and deceit through a set of decisions made at different levels in the organizations (Oni, 2015). In this regard, IT-based techniques are developed to provoke the efficiency of auditing methods (Bierstakera, Janvrin & Lowe, 2014). Auditors can use these techniques to perform a variety of tasks including, selecting the data, and preparing it, defining the internal controls, and checking the compliance.

IT-based auditing techniques have a set of advantages over traditional auditing techniques; however, the success of the IT-based audit is dependent over individual as well as organizational factors (Stoel, Havelka & Merhout, 2012). Firstly, traditional auditing does not guarantee an optimal result because it relies on debriefing a sample of the data set (Stoel, Havelka & Merhout, 2012) whereas, IT-based auditing techniques ensures optimal results (Ahmi & Kent, 2013). Secondly, IT-based auditing is executed quickly, thus, decisions made according to the results are accurate and timely (Mahzan & Lymer, 2014; Pedrosa & Costa, 2014; Oni, 2015).

In the literature, several researchers supported the argument that IT-based techniques promoted auditors to renovate the auditing process and switch their techniques to fulfill the anticipations of stakeholders (Bierstakera, Janvrin & Lowe, 2014; Al-Hiyari, Said & Hattab, 2019). Computer-Assisted Auditing Techniques (CAATs) is among the most noticeable techniques that are developed to assist different procedures of auditing (Mahzan & Lymer, 2014; Pedrosa, Costa & Aparicio, 2019).

Organizational and environmental influences help external auditors in adopting CAATs (Siew, Rosli & Rosli, 2020). To measure the performance, indicators like; timeliness, personal qualities, initiative, dependability, creativeness cooperation, job knowledge, quality of work, and quantity of work show a positive impact for using CAATs on the auditors' performance (Wicaksono, Laurens & Novianti, 2018; Mansour, Ahmi & Popoola, 2020). Auditors are provoked by the new audit criteria to use CAATs to improve the effectiveness and efficiency of auditing (Pedrosa & Costa, 2012; Mahzan & Lymer, 2014; Oni, 2015). This in turn has a significant contribution in monitoring the organizational financial statements. For instance, according to the declaration on the 106th auditing standard, CAATs can be utilized to enhance the competence of auditing by recounting data collected from audit clients (Rosli, Yeow & Siew, 2012). Moreover, CAATs raise the efficiency of auditing since it permits for direct inspection of proofs which are recorded in an e-form (Ciprian-Costel, 2014).

As any other IT-based technique, the user acceptance to use the tool is important. Mansour (2016) has extended the Unified Theory of Acceptance and Use of Technology model (UTAUT), and previously, Venkatesh, Morris, Davis & Davis (2003) included another two main motivations for external auditors to apply CAATs; facilitating conditions and performance expectancy. Chang, Tsai, Shih & Hwang (2008); Mansour (2016); Siew, Rosli & Rosli, (2020) supported the argument that applying CAATs is driven by firm influence and performance expectancy. Performance expectancy is important in this case because when CAATs was uncommon, auditors felt uncomfortable while giving an audit opinion on the financial statements based on audit evidence created by CAATs (Janvrin, Bierstaker & Lowe, 2009).

However, with the passage of time, auditors tend to use IT-based auditing techniques such as CAATs more than before (Oladele & Agochukwu, 2016; Lowe, Bierstaker, Janvrin & Jenkins, 2018). Thus, it is obvious that there are challenges that should be considered before adopting these techniques to ensure governance and transparency (Vogel, Zhao, Zhu, Guo & Chen, 2017; Asad, Tabash, Sheikh, Al-Muhanadi & Ahmad, 2021). Researchers who are dedicated to study the behavioral sides of using IT-based auditing tools in Jordan are very limited (Mansour, 2016; Al-Hiyari, Said & Hattab, 2019) despite the importance and significance. Therefore, the in the current research the researchers have attempted to empirically develop and tested a framework which affect utilizing CAATs by external auditors in Jordan. The study is significant for the practitioners as they will become capable on catering the most influencing factors to get best results from implementation of CAATs

Methods

Literature Review

Using CAATs as an IT-based auditing tool is affected by many factors (Daoud, Marei, Al-Jabaly & Aldaas, 2021). In this study the focus is over the usage of CAATs by the external auditors as Al-Hiyari, Said & Hattab (2019) studied the impact of using CAATs by internal auditors in Jordan, where the importance of external auditors in the light of stakeholders is very high. Dias & Marques (2018) conducted a study in Portuguese over the manufacturing firms to study the impact of some factors on using CAATs. The authors considered existence of a certified internal auditor in the workplace, experience in auditing and size of the workplace as the key factor and found a positive impact of size of the audit department and the size of the workplace on using CAATs. Furthermore, the findings of the study revealed that using CAATs is affected by the existence of a certified internal auditor in the workplace and the experience in auditing.

Bierstakera, Janvrin & Lowe (2014) investigated the usage level of CAATs by the auditors in the Netherlands using the UTAUT model and used facilitating conditions, technical infrastructure support, organizational pressures, and outcome expectations as influencer. The findings of the study revealed that probability of using CAATs is affected by technical infrastructure support, the extent of organizational pressures, and outcome expectations.

Likewise, Shamsuddin, Rajasharen, Maran, Ameer & Muthu (2015) conducted a study in Malaysia for understanding that factors that impact usage level of CAATs. The authors found that the usage level of CAATs by internal auditors in Malaysia is affected significantly by effort expectancy. Whereas, the remaining factors facilitating conditions, social Influence, and performance expectancy have a minor impact. Internal auditors prefer adopting CAATs because they cover all the functions needed by auditors and that they are easy to use and understand. Meanwhile Mansour (2016) investigated the reasons behind the lack of CAATs' usage by external auditors in Jordan based on the UTAUT model.

The authors analyzed facilitating conditions, social influence, effort expectancy, and performance expectancy. The findings of the study revealed that facilitating conditions and the performance expectancy of auditors have a significant impact on the intention to adopt CAATs by external auditors in Jordan, whereas, social influence and effort expectancy have shown an insignificant impact. Similarly, (Al_Khasawneh, Syahida & Idris, 2017) conducted a study in Jordan and identified that social influence, effort and performance expectancy significantly influence CAATs whereas, facilitating conditions have an insignificant impact.

Zainol, et al. (2017) investigated the impact of a set of factors on using CAATs by internal auditors in Malaysia. The author’s studies behavioural intention towards CAATs adoption, facilitating condition, and social influence, and performance expectancy and identified that behavioral intention towards CAATs adoption is affected significantly by facilitating condition, performance expectancy, and social influence. On the contrary, there is a weak relationship between behavioral intention towards CAATs adoption and effort expectancy.

Ojaide & Agochukwu (2017) studied the impact of performance expectancy of external auditors on the usage level of CAATs in Nigeria and found that there is no impact for effort expectancy of using CAATs by external auditors in Nigerian audit companies, therefore, it should not be used. Likewise, Dias & Marques (2018) conducted a study in Portugal and claimed a significant impact of size of the audit department and the size of the workplace over the adoption of CAATs, whereas, the authors claimed that existences of a certified internal auditor in the workplace and the experience in auditing has an insignificant impact.

Similarly, another study conducted by Mohamed, Muhayyidin & Rozzani (2019) identified those factors which influence the adoption of CAATs by the auditors using UTAUT. By collecting the data through questionnaires the researchers found that behavioural intentions of auditors for adopting CAATs in Malaysian companies are driven by performance expectancy, effort expectancy, and facilitating conditions. Moreover, (Al-Hiyari, Saidb & Hattab, 2019) conducted their study in Jordan and identified that effort expectancy and performance expectancy have a significant impact but behavioral intention, social influence, and facilitating conditions have an insignificant impact. Recently, (Khan, Asad, Fatima, Anjum & Akhtar, 2020) conducted a meta-analysis over outsourcing internal audit and claimed that use of technology is important for the internal as well as external auditors.

Thus, considering the various literature streams and after ensuring the three are significant controversies over the existing literature, there is a need to further conduct research over use of CAATs. Majority of the studies have been conducted in the European countries and very few researchers have conducted research over developing countries and especially there is a significant gap in the body of knowledge in the Arab world. Thus, considering the available literature, this study is being conducted in Jordan especially over the external auditors, as there is only one study over the CAATs and that is also over internal auditors.

Research Design and Methodology

The aim of this study is to test factors which affect the use of CAATs by external auditors in Jordan through utilizing the quantitative approach. The survey is designed taking into consideration the measurements and scales presented in the recent literature. The 5-Likert scale was utilized to seize the items with a range of five points as follows: 5=strongly agree, 4- agree, 3=neutral, 2=disagree & 1=strongly disagree. The respondents were the external auditors working in different audit firms. The unit of analysis for the study was individual as the study deals with behaviors. The research structure presented in contains six variables in addition to the obstacles in applying CAATs. The instrument has been compiled from the previous studies. The description of the questionnaire as well as the sources is mentioned in the Table 1 below:

| Table 1 Instrument Description |

||

|---|---|---|

| Factor | # of questions | Studies in the literature |

| Performance Expectancy | 6 | Al-Hiyari, et al., (2019); Shamsuddin, et al., (2015) |

| Externalities | 2 | Oni, (2015) |

| Facilitating Conditions | 3 | Al-Hiyari, et al., (2019); Mahzan & Lymer, (2014) |

| Social Influence | 4 | Bedard, et al., 2016; Aidi & Kent 2013; Gonzalez, et al., 2012 |

| Behavioral Intention | 3 | Al-Hiyari, et al., (2019); Shamsuddin, et al., (2015); Venkatesh, et al., (2003) |

| Applying (CAATs) | 8 | Al-Hiyari, et al., (2019); Shamsuddin, et al., (2015); Gonzalez, et al., (2012) |

| Obstacles in applying CAATs | 3 | Al Khasawneh, et al., (2017); Pedrosa & Costa (2014); Bierstaker, et al., (2014) |

The survey is distributed to (100) participants, all of them are external auditors in the big4 in Jordan. (72) Out of the (100) are valid for this study. Initially the demographics have been mentioned in the analysis, afterwards descriptive analysis of the variables have been conducted to check the normality which is essential for regression analysis. After ensuring the normality along with multicollinearity, when it was sure that the assumptions of OLS have been met later on regression analysis has been conducted using SPSS 22 for testing the model developed in the study through hypothesis testing.

Analysis

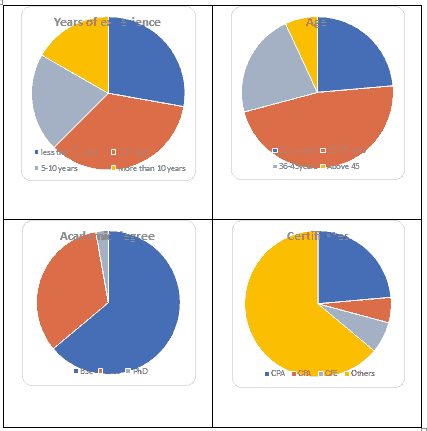

Initially the demographics have been measured. The survey asked respondents to indicate their gender, age, degree, certificates, and experience. As it is shown in table (1) the gender section which resulted in having a higher male response rate (75%) higher than female response rate (25%). In the age section people between age people from (25-35) years old are (47.2%) which are the highest between all the ages. In the highest qualification of education section people who have bachelor’s degree filled this survey the most. In the certificates section that has another certificate filled this survey the most. The results of the study showed that most of the people they have experience (2 years-5 years) participated in this survey. For further acknowledgments refer to chart 1.

Reliability and Descriptive Analysis

Results show that the Cronbach alpha for the model generated in the study is (77.8%). Table 2 shows the results of the descriptive analysis for the factors. Results indicate that: 1) the total average of answers (performance expectancy) is (4.304) which is closer to "strongly agree", 2) the total average of answers (externalities) is (4.153) which is closer to "agree", 3) the total average of answers (facilitating conditions) is (4.258) which is closer to "strongly agree", 4) the total average of answers (social influence) is (3.624) which is closer to "agree", 5) the total average of answers (behavioral intention) is (4.206) which is closer to "strongly agree", 6) the total average of answers (applying (CAATs)) is (3.592) which is closer to "agree", and finally 7) the total average of answers (obstacles in applying (CAATs)) is (3.351) which is closer to "neutral".

| Table 2 Reliability and Descriptive Analysis |

|||||

|---|---|---|---|---|---|

| Variables | (α) | Standard deviation | Average | Skewness | Kurtosis |

| Performance Expectancy | 0.731 | 0.427 | 4.304 | 1.35 | 0.75 |

| Externalities | 0.736 | 0.68 | 4.153 | 1.65 | 0.68 |

| Facilitating Conditions | 0.812 | 0.617 | 4.258 | 1.38 | 0.19 |

| Social Influence | 0.793 | 0.761 | 3.624 | 1.67 | 0.25 |

| Behavioral Intention | 0.867 | 0.618 | 4.206 | 1.51 | 0.36 |

| Applying (CAATs) | 0.924 | 0.265 | 3.592 | 1.44 | 0.41 |

| Obstacles in Applying CAATs | 0.702 | 0.931 | 3.351 | 1.55 | 0.82 |

| All Questions | 0.778 | ||||

After ensuring that the data is normally distributed as shown in the calculated values of skewness and Kurtosis the next step was to ensure that the data is free from multicollinearity. For checking multicollinearity tolerance and variable inflation factors have been measured. The results on multicollinearity are mentioned in Table 3

| Table 3 Multicollinearity Diagnostic |

||

|---|---|---|

| Variables | Tolerance | VIF |

| Performance Expectancy | 0.872 | 1.645 |

| Externalities | 0.835 | 1.852 |

| Facilitating Conditions | 0.725 | 1.723 |

| Social Influence | 0.635 | 1.951 |

| Behavioral Intention | 0.729 | 1.347 |

| Applying (CAATs) | 0.719 | 1.169 |

After ensuring that the data is correct for OLS regression analysis has been conducted to test the hypothesis in order to check the significance of the model and to identify that in Jordan which are the most important variables that need to be addressed by the audit firms to ensure the adoption of CAATs in audit firms.

Hypothesis Testing

To know whether the hypotheses of this study are accepted or not, the study was based on multiple linear regressions. Significance levels have been analyzed to check if the hypotheses are accepted or not with a percentage not exceeding 0.05 in order to approve the alternate hypotheses. Furthermore, the coefficient of determination i.e., R² is also seen to illustrate the preciseness in explaining the dependent variable responding to each independent variable. A principle states that if the Significance’s value (p<0.05) is not exceeding 0.05, the hypothesis “Ho” is rejecting and therefore, alternative hypothesis has to be accepted. The results of multiple linear regressions were used to verify the hypothesis of the current study (Table 4) as follows.

| Table 4 Hypothesis Testing |

||||

|---|---|---|---|---|

| Hypotheses | Coefficient (β) | T-value | Sig. Level (P) | Decision |

| Performance expectancy -> CAATs | 0.262 | 2.318 | 0.024<0.05 | Rejected |

| Externalities -> CAATs | -0.235 | 2.123 | 0.038<0.05 | Rejected |

| Facilitating conditions -> CAATs | 0.238 | 2.117 | 0.048<0.05 | Rejected |

| Social influence -> CAATs | 0.133 | 1.188 | 0.239<0.05 | Accepted |

| Behavioral intention -> CAATs | 0.288 | 2.597 | 0.012<0.05 | Rejected |

Table 4 shows the outcomes of regressions analysis and the way independent Variables can impact use of CAATs by external auditors in Jordan. The detailed discussion over each variable is mentioned below:

Ho1: "There is no impact with statistical significance at (α ≤ 0.05) of performance expectancy on uses of CAATs by external auditors in Jordan". The findings provided that first null hypothesis is rejected and alternative hypothesis is accepted (β=0.262; Sig. T=p<0.05, => 0.024). This means there is a positive impact of performance expectancy on uses of CAATs by external auditors in Jordan.

Ho2: "There is no impact with statistical significance at (α ≤ 0.05) of externalities on uses of CAATs by external auditors in Jordan". The findings provided that second null hypothesis is rejected and alternative hypothesis is accepted (β=-0.235; Sig. T=p<0.05,=0.038). This means there is a negative impact of externalities on uses of CAATs by external auditors in Jordan.

Ho3: "There is no impact with statistical significance at (α ≤ 0.05) of facilitating conditions on uses of CAATs by external auditors in Jordan". The findings provided that third null hypothesis is rejected and alternative hypothesis is accepted (β=0.238; Sig. T=p<0.05,=0.038). This means there is a positive impact of facilitating conditions on uses of CAATs by external auditors in Jordan.

Ho4: "There is no impact with statistical significance at (α ≤ 0.05) of social influence on uses of computer assisted audit techniques (CAATs) by External auditors in Jordan". The findings provided that fourth null hypothesis is rejected and alternative hypothesis is accepted (β=0.133; Sig. T=p<0.05,=0.239). This means there is a positive impact of social influence on uses of CAATs by external auditors in Jordan.

Ho5: "There is no impact with statistical significance at (α ≤ 0.05) of behavioral intention on uses of computer assisted audit techniques (CAATs) by External auditors in Jordan". The findings provided that fifth null hypothesis is rejected and alternative hypothesis is accepted (β=0.288; Sig. T=p<0.05,=0.012). This means there is a positive impact of behavioral intention on uses of CAATs by External auditors in Jordan.

The calculated value of r2 is 0.355 which shows significant acceptable impact of independent variables over the dependent variable. The r2 value (determinant of coefficient) is 0.355 which indicate that the change in the use of CAATs by external auditors is accounted for 35.5% of the variations in uses of CAATs by external auditors in Jordan. This value indicates support for the research objectives, since it indicates that the uses of CAATs by external auditors in Big4 audit firms in Jordan become clear and justified according to the selected factors in this study.

To prove or reject the hypothesis regarding hinderance in the use of CAATs by the external auditors in Jordan, the researchers have used One Sample T-test method by depending on (P- value and Ho: μ ≥ 3) to accept or reject hypotheses; where P-value should be less than 0.05, and μ ≥3, to reject the null hypothesis and accept the alternative one.

The calculated value of r2 is 0.355 which shows significant acceptable impact of independent variables over the dependent variable. The r2 value (determinant of coefficient) is 0.355 which indicate that the change in the use of CAATs by external auditors is accounted for 35.5% of the variations in uses of CAATs by external auditors in Jordan. This value indicates support for the research objectives, since it indicates that the uses of CAATs by external auditors in Big4 audit firms in Jordan become clear and justified according to the selected factors in this study.

To prove or reject the hypothesis regarding hinderance in the use of CAATs by the external auditors in Jordan, the researchers have used One Sample T-test method by depending on (P-value and Ho: μ ≥ 3) to accept or reject hypotheses; where P-value should be less than 0.05, and μ ≥3, to reject the null hypothesis and accept the alternative one.

Table 5 shows One Sample T-test results for the variable (obstacles that hinder the application of CAATs). Results in the table show that mean value is 3.351, which indicates the existence of neutral by the members of the study. Study findings have shown that P-value<5% has reached 0.002 and Ho: μ ≥ 3, has reached 3.351. Based on the rule which states the rejection of the null hypothesis "Ho" If the value of P is less than 0.05, and Ho: μ ≥ 3, showing that there are obstacles that hinder the use of CAATs; therefore, rejecting the null hypothesis and accepting the alternative one which says "External auditors in Jordan face obstacles in use of CAATs".

| Table 5 Obstacles That Hinder The Applying Use of Computer Assisted Audit Techniques |

||||

|---|---|---|---|---|

| P- Value | T- Value | Df | Mean | S-Deviation |

| 0.002 | 3.201 | 71 | 3.351 | 0.931 |

Discussion

This section discusses the outcomes related to the study. This study aims to identify the influence of factors on uses of CAATs by External auditors in Jordan. Also, discover the reasons for not adopting CAATs by external auditors in Jordan. In order to estimate how a use of CAATs is affected by the factors, the researchers managed a questionnaire and distributed it to external auditors who work in the Big 4 audit firms in Jordan. As a result, the researchers improved a paradigm which considered the factors represented by (performance expectancy, externalities, facilitating conditions, social influence, and behavioral intention) as independent variables and try to find the significance of the identified factors over uses of CAATs as a dependent variable. The debate on the study is presented in the discussion section to examine the study aims and characterize the impact of every variable on the uses of CAATs as shown in conclusions section. The last section covers the limitations of the study that were faced while conducting the study. Finally, the suggestions for probable future studies have been discussed.

The results of the study identified that factors represented by performance expectancy, externalities, facilitating conditions, social influence, and behavioral intention have a significant positive impact over use of CAATs by external auditors in Jordan. Analyzing the data in the analysis section represented that there’s a positive impact of factors chosen in this study over the use of CAATs, also, r² value of 0.355 shows that dependence of uses of CAATs over performance expectancy, externalities, facilitating conditions, social influence, and behavioral intention. As a rule of thumb when the r2 value is above 0.51 it shows a strong relationship; if it is above 0.33 it shows a moderate relationship, and if it is 0.20 it shows a weak relationship. The calculated value is moderate and reliable in the process of interpretation and prediction. This means that if applied factors represented by performance expectancy, externalities, facilitating conditions, social influence, and behavioral intention, then uses of CAATs will increase. This is harmonious with several studies like Bierstakera, Janvrin & Lowe (2014); Al_Khasawneh, Syahida & N. Idris (2017); Dias & Marques (2018); Wicaksono, Laurens & Novianti (2018); Al- Hiyari, Said & Hattab (2019) who claimed a significant positive impact of a combination of factors on uses of CAATs by External auditors.

The results of the first hypothesis, where Performance expectancy was theorized to have a positive impact on uses of CAATs by External auditors in Jordan as supposed in the literature, analysis of the data provide justification to reject null hypothesis and accept alternative (β=0.262; Sig. T=p<0.05, =0.024), thus, presented that there’s a positive impact of performance expectancy on uses of CAATs. This means that if performance expectancy is increased, then uses of CAATs will increase. The reason for this according to researchers is that performance expectancy will lead external auditors to customize its services and to personalize more the relationships with their customers, which reflects positively on uses of CAATs. It is also clear that this variable comes at the second time in terms of influence on the uses of CAATs, among the variables that were chosen in this study. This is harmonious with the findings of several prior studies (Shamsuddin, Rajasharen, Maran, Ameer & Muthu, 2015; Janvrin, Bierstaker & Lowe, 2009; Mansour, 2016) which marked a positive impact of performance expectancy on uses of CAATs.

The result of the second hypothesis where Externalities were theorized to have a significant impact on uses of computer assisted audit techniques by External auditors in Jordan, as supposed in the literature, analysis of the data provide justification to reject null hypothesis and accept alternative (β=-0.235; Sig. T=p<0.05,=0.038), thus, presented that there’s a significant impact of externalities on uses of CAATs. This means that if externalities are increased then uses of CAATs will decrease. The reason for this according to researchers is that the external factors and their continuous development may be the reason for failure to adopt such systems, due to the high costs, which reflects negatively on uses of CAATs. It is also clear that this variable appears at the final time in terms of influence on the uses of CAATS, among the variables that were chosen in this study. This is harmonious with the findings of several prior studies (Janvrin, Bierstaker & Lowe, 2009; Mahzan & Lymer, 2014; Oni, 2015) which marked a negatively impact of externalities on uses of CAATs.

The result of third hypothesis where Facilitating conditions were theorized to have a positive impact on uses of computer assisted audit techniques by External auditors in Jordan as supposed in the literature, analysis of the data rejects the null hypothesis and accept alternative hypothesis (β=0.238; Sig. T=p<0.05, =0.038), thus presented that there is a positive impact of facilitating conditions on uses of CAATs by external auditors. This means that if facilitating conditions are improved or increased, then uses of CAATs will increase. This is because increasing the accuracy of work and reducing the time and effort spent while maintaining the quality of service provided to customers, and reducing the level of errors, will be reflected positively on uses of CAATs by external auditors. It is also clear that this variable is placed at third level in terms of influencing the uses of CAATs, among the variables that were chosen in the study. These findings are in-line with the findings of several prior studies where a positive impact of facilitating conditions was claimed over use of CAATs (Al-Hiyari, Said, & Hattab, 2019; Shamsuddin, Rajasharen, Maran, Ameer, & Muthu, 2015; Bierstakera, Janvrin, & Lowe, 2014; Al_Khasawneh, Syahida, & N. Idris, 2017).

The results of fourth hypothesis where Social influence was theorized to have a positive impact on use of CAATs by External auditors in Jordan as claimed on the basis of literature, analysis of the data suggest to accept null hypothesis and reject alternative (β=0.133; Sig. T=p<0.05,=0.239), thus, presented that there is an insignificant impact of social influence on uses of CAATs by external auditors. This is because the external auditor's process does not depend on the social influence and habits, and serves as the separation between interests of the administrations and owners, which cause lack of effect on use of CAATs. These findings are exception to the prior literature and directly contradicts several prior studies where it is claim to have a significant impact of social influence over use of CAATs (Zainol et al., 2017; Mansour, 2016; Shamsuddin, Rajasharen, Maran, Ameer & Muthu, 2015).

Results of fifth hypothesis where the Behavioral intention were theorized to have a positive impact on uses of CAATs by External auditors in Jordan as identified the reviewed literature, analysis of the collected data rejects null hypothesis and accept alternative (β=0.288; Sig. T=p<0.05, =0.012), thus, presented that there is a positive impact of behavioral intention on uses of CAATs. This means that if behavioral intentions are enhanced, then uses of CAATs will also increase. This phenomenon took place because behavioral intention will lead external auditors to customize its services and to personalize more the relationships with their customers, which reflects positively on uses of CAATs. It is also clear that this variable has been incorporated at the first time in terms of influence on the uses of CAATs, among the variables that were chosen in this study. The findings of the study are harmonious with several prior studies where as positive impact of behavioral intentions has been analyzed for in general (Zainol et al., 2017; Al-Hiyari, Said & Hattab, 2019), however, the current study identified particularly for the external auditors.

The last objective for which the hypothesis was raised that external auditors in Jordan do not face any obstacle has also been rejected and alternative hypothesis has been accepted (μ ≥ 3=3.351; p<0.05, =0.002). This means that external auditors face obstacles in using CAATs, which was another important finding that the current study has unveiled.

Conclusion

This study aims to examine the impact of performance expectancy, externalities, facilitating conditions, social influence, and behavioral intention over the use of CAATs by external auditors in Jordan. The findings of the research also revealed the reasons for not adopting CAATs by external auditors in Jordan. The study sample included Big Four audit firms working in Jordan. This survey instrument was distributed to external auditors who were working in the Big4 in Jordan, the sample included (100) respondents, and (72) questionnaires were received in the usable form. The study’s conclusions are harmonious with the conclusions of previous studies in the field.

Based on literature review, the researchers confirm that a positive impact of factors on uses of computer assisted audit techniques by external auditors in Jordan. Secondly, it was found that uses of CAATs, is considered to improves efficiency and contribute to organizational performance and the sustainability of auditing works, which reflects positively on brand images by client firms.

Finally, "Big4 audit firms in Jordan can enhance the overall strategy from customer perspective, by determining customer’s needs and preferences, which create an obvious picture for audit firms to plan and implement powerful activities carried out via these uses of CAATs, in addition, results showed there are obstacles in the use of CAATs, the researchers believe that application of such systems requires huge investment which is supposed to be a major impediment to the application of this system.

Limitations

Although the study fulfilled its goal, yet it faced certain limitations which should be marked. The first one is the that this is highly unexplored area and researchers in the field have hardly tested the factors that may affect use of CAATs by External auditors mainly in Jordan. The second one is that the method of gathering information was survey which is a traditional approach. Publishing the outcomes of these techniques may be useful but its generalizability may cause problems. The third limitation is measurement errors which are the limitations of any survey research, as this study used quantitative method and a survey-based technique. Despite this limitation, maximum efforts were done to reduce errors and publish guaranteed results as mentioned in the analysis section that the validity of the study and reliability of outcomes have been calculated. The fourth one is time limitation and the inherited limitations of cross-sectional study are there. The study was conducted in almost three months and this is a very short time to analyze the gathered information.

Despite the limitations yet study is very important for the practitioners as it highlighted several important aspects which the practitioners should cater to implement a better system for conducting external audit. Likewise, the study acts as a foundation stone and calls for further research in the field of CAATs.

References

- Ahmi, A., & Kent, S. (2013). The utilisation of Generalized Audit Software (GAS) by external auditors. Managerial Auditing Journal, 28(2).

- Al_Khasawneh, M., Syahida, K., & N. Idris. (2017). Factors influencing adoption of Computer Assisted Audit techniques (CAATS) by external auditors in Jordan. International Journal of Engineering Sciences & Management Research, 4(2), 23-27.

- Al-Hiyari, A., Said, N.A., & Hattab, E. (2019). Factors that influence the use of Computer Assisted Audit Techniques (CAATs) by internal auditors in Jordan. Academy of Accounting and Financial Studies Journal, 26, 1-15.

- Asad, M., Tabash, M.I., Sheikh, U.A., Al-Muhanadi, M.M., & Ahmad, Z. (2021). Gold-oil-exchange rate volatility, Bombay stockexchange and global financial contagion 2008: Application of NARDL model with dynamic multipliers for evidences beyond symmetry. Cogent Business & Management, 7, 1-30.

- Bierstakera, J., Janvrin, D., & Lowe, D.J. (2014). What factors influence auditors' use of computer-assisted audit techniques? Advances in Accounting, 30(1), 67-74. doi:https://doi.org/10.1016/j.adiac.2013.12.005

- Chang, S.-I., Tsai, C.-F., Shih, D.-H., & Hwang, C.-L. (2008). The development of audit detection risk assessment system: Using the fuzzy theory and audit risk model. Expert Systems with Applications, 35(3), 1053-1067.

- Ciprian-Costel, M. (2014). Arguments on using Computer-Assisted Audit Techniques (CAAT) and business intelligence to improve the work of the financial auditor. Management Strategies Journal, 26(4), 212-220.

- Daoud, L., Marei, A., Al-Jabaly, S.M., & Aldaas, A.A. (2021). Moderating the role of top management commitment in usage of computer-assisted auditing techniques. Accounting, 7(2), 457-468.

- Dias, C., & Marques, R.P. (2018). The use of computer-assisted audit tools and techniques by Portuguese internal auditors. 13th Iberian Conference on Information Systems and Technologies (CISTI), 1-7. Caceres, Spain: IEEE.

- Hall, J.A. (2015). Information technology auditing. Cengage Learning.

- Haseeb, M., Hussain, H.I., ?lusarczyk, B., & Jermsittiparsert, K. (2019). Industry 4.0: A solution towards technology challenges of sustainable business performance. Social Sciences, 8(5).

- Janvrin, D., Bierstaker, J., & Lowe, D.J. (2009). An investigation of factors influencing the use of computer?related audit procedures. Journal of Information Systems, 23(1), 97-118.

- Khalil, R., Asad, M., & Khan, S.N. (2018). Management motives behind the revaluation of fixed assets for sustainability of entrepreneurial companies. International Journal of Entrepreneurship, 22(Special), 1-9.

- Khan, S.N., Asad, M., Fatima, A., Anjum, K., & Akhtar, K. (2020). Outsourcing internal audit services; A review.

- International Journal of Management, 11(8), 503-517.

- Laudon, K.C., & Laudon, J.P. (2016). Management information systems. Upper Saddle River: Pearson, 143.

- Lowe, D.J., Bierstaker, J.L., Janvrin, D.J., & Jenkins, J.G. (2018). Information technology in an audit context: Have the big 4 lost their advantage? Journal of Information Systems, 32(1), 87-107.

- Mahzan, N., & Lymer, A. (2014). Examining the adoption of computer-assisted audit tools and techniques: Cases of generalized audit software use by internal auditors. Managerial Auditing Journal, 29(4), 327-349.

- Mansour, A.Z., Ahmi, A., & Popoola, O.M.J. (2020). The personality factor of conscientiousness on skills requirement and fraud risk assessment performance. International Journal of Financial Research, 11(2), 405.

- Mansour, E.M. (2016). Factors affecting the adoption of computer assisted audit techniques in audit process: Findings from Jordan. Business and Economic Research, 6(1), 248-271.

- Mohamed, I.S., Muhayyidin, N.H., & Rozzani, N. (2019). Auditing and data analytics via computer assisted audit techniques (CAATS): Determinants of adoption intention among auditors in Malaysia. 3rd International Conference on Big Data and Internet of Things (pp. 35-40). Melbourne, Australia: Association for Computing Machinery.

- Ojaide, F., & Agochukwu, B.O. (2017). The effect of effort expectancy on computer-assisted audit techniques usage by external auditors in Nigeria. International Journal of Management Science Research, 3(1), 204.

- Oladele, K.O., & Agochukwu, B.O. (2016). An empirical study of the effect of task technology fit, audit firms and clients innovations on CAATS usage in Nigeria. International Journal of Management Science Research, 1(1), 90.

- Oni, A.A. (2015). Computer assisted audit techniques and audit quality in developing countries: Evidence from Nigeria. Journal of Internet Banking and Commerce, 20(3), 1-17.

- Pedrosa, I., & Costa, C.J. (2014). Statutory auditor's profile and computer assisted audit tools and techniques' acceptance: Indicators on firms and peers' influence. International Conference on Information Systems and Design of Communication, 20-26. Lisbon, Portugal: Electronic Data Processing.

- Pedrosa, I., Costa, C.J., & Aparicio, M. (2019). Determinants adoption of computer-assisted auditing tools (CAATs). Cognition, Technology & Work, 22, 565-583.

- Ramos, H.M., Ollero, J., & Suárez-Llorens, A. (2017). A new explanatory index for evaluating the binary logistic regression based on the sensitivity of the estimated model. Statistics & Probability Letters, 120, 135-140.

- Rosli, K., Yeow, P.H., & Siew, E.-G. (2012). Computer-Assisted auditing tools acceptance using I-Toe: A new paradigm. Computer 7, 15-2012.

- Shamsuddin, A., Rajasharen, L. A., Maran, D. A., Ameer, M. F., & Muthu, P. A. (2015). Factors influencing usage level of computer assisted audit techniques (CAATs) by internal auditors in Malaysia. Proceeding-Kuala Lumpur International Business, Economics and Law Conference 6, 1, 123-131.

- Siew, E.-G., Rosli, K., & Rosli, K. (2020). Organizational and environmental influences in the adoption of Computer-Assisted Audit Tools and Techniques (CAATTs) by audit firms in Malaysia. International Journal of Accounting Information Systems, 36.

- Stoel, D., Havelka, D., & Merhout, J.W. (2012). An analysis of attributes that impact information technology audit quality: A study of IT and financial audit practitioners. International Journal of Accounting Information Systems, 13(1), 60-79.

- Stoel, M.D., & Havelka, D. (2020). Information technology audit quality: An investigation of the impact of individual and organizational factors. Journal of Information Systems.

- Teece, D.J. (2018). Profiting from innovation in the digital economy: Enabling technologies, standards, and licensing models in the wireless world. Research Policy, 47(8), 1367-1387.

- Venkatesh, V., Morris, M.G., Davis, G.B., & Davis, F.D. (2003). User acceptance of information technology: Toward a unified view. MIS quarterly, 27(3), 425-478.

- Vogel, D., Zhao, J., Zhu, Z., Guo, X., & Chen, J. (2017). Introduction to the special issue on service-oriented E- business development. Electronic Markets, 27, 197-198.

- Wicaksono, A., Laurens, S., & Novianti, E. (2018). Impact analysis of computer assisted audit techniques utilization on internal auditor performance. 2018 International Conference on Information Management and Technology (ICIMTech) (pp. 267-271). Jakarta, Indonesia: IEEE.

- Zainol, S.S., Samsuri, A.S., Arifin, T.R., Hussin, S., Othman, M.S., & Jie, S.J. (2017). Determinants of Computer Assisted Audit Techniques (CAATS) adoption. A study in small and medium practices in Malaysia. European Journal of Business and Social Sciences, 135-150.