Original Articles: 2022 Vol: 26 Issue: 1

Analysing Impact of Efficiency, Profitability, and Risk Management on Sustainable Performance of the Pakistani Banks

Muhammad Sadiq Malik, University of Sarawak, Kota Samaharan, Malaysia

Sophee Sulong Bin Balia, University of Sarawak, Kota Samaharan, Malaysia

Rossazana Bt Ab Rahim, Universiti Malaysia Sarawak

Naveed Iqbal Chaudhry, University of the Punjab Gujranwala Campus Gujranwala, Pakistan

Citation Information: Malik, M.S., Balia, S.S.B., Rahim, B.R., & Chaudhry, N.I. (2022). Analysing impact of efficiency, profitability, and risk management on sustainable performance of the Pakistani banks. Academy of Accounting and Financial Studies Journal, 26(1), 1-20.

Abstract

This conceptual paper aims to create a comprehensive framework for the Pakistani banks by analysing the impact of banks’ efficiency, profitability, and risk management capability on sustainable performance by incorporating most suitable determinants of banks specific internal and macroeconomic and external determinants. Internal determinants such as size of bank, capital ratio, loan intensity, credit risk, financial leverage, operating, return on asset (ROA), age of bank, Z-Score, bank ownership (foreign, domestic and government), and listing is studied and impact on efficiency, profitability, and risk management has been measured. Macroeconomic and external determinants such as Gross Domestic Product (GDP), inflation, interest rate, exchange rate, market capital, Global Financial Crisis, corruption control, and financial action task force (FATF) has been discussed and impact on efficiency, profitability, and risk management has been measured. During the process of research, the strands of reviewing literature show that renowned authors conducted independent studies on efficiency, profitability, and risk management and holistic studies analysing all these variables in one unison study are scarce. Whereas this paper has novelty that combines the impact of efficiency, profitability, and risk management capability on sustainable performance of banks and their corresponding banks’ specific internal and macroeconomic external determinants are researched. This conceptual paper has limitations as it is not empirically tested yet and this paper is based on literature review and suggests empirical testing of this framework through another study. This conceptual paper will contribute in assisting management of banking sector to measure sustainable performance of banks and will be helpful to the investors for making investment decisions for different banks.

Keywords

Sustainable Performance, Efficiency, Profitability, Risk Management Capability, Banks’ Internal Determinants, Macroeconomic External Determinants, Banking Sector, Pakistan.

Introduction

This paper aims to formulate a comprehensive framework to measure sustainable performance of banks through banks efficiency; banks profitability; and banks risk management capability by incorporating most suitable determinants of banks specific internal factors and macroeconomic external factors.

The distinguished authors and researchers are not inclined to conduct researches on banking, resulting into very less innovations, inventions, and introduction of new variables and theories in banking sector (Werner, 2016). Since last 300-500 years, scientists and scholars could not suggest new banking theory and even did not agree on the already written theories of banking (Werner, 2016). Banking studies are not looking at the complete picture as a wholesome subject and the researchers are either replicating previous researches or mostly focussing on one odd variable (Alharthi, 2016). Majoritie of studies focussed on developed countries and only some researchers are found replicating the research work of European and American work for the developing countries (Kamarudin et al., 2019; Majed Alharthi, 2016; Yu, 2017). Banks efficiency related researches has wide dispersion in selection of methods and variables (Abreu et al., 2019).

Pakistan is recovering from the fallout of Soviet Union intervention in Afghanistan in 1979 and USA occupation of Afghanistan in 2001 in the wake of 9/11. In the past two decades, besides precious loss of over 70,000 lives, there was a loss of over US $ 150 billion to the economy of Pakistan (Choudhury, 2019).

Pakistan absorbed one of the world largest migration of over three million Afghan refugees and millions of internally displaced persons (IDPs) bringing a drastic change in the social and cultural pillars of society. Political instability, Global War on Terror (GWOT), and four wars with India due to disputed territory of Kashmir, brought long lasting effects on economy and banking sector performance. Pakistani success against war on terrorism, strategic location of Pakistan, China Pakistan Economic Corridor (CPEC), and prudent economic policies of current government of Pakistan are the positive indicators for economic growth and accelerated financial developments in the country. This will see enhance role of banks, however, in the absence of innovative studied in the banking sector of Pakistan, the targeted economic growth will be very difficult as banks are back bone of economy.

Banks performance related literature independently focused on mostly three topical areas of banks i.e banks efficiency; banks profitability or profitibility; and banks capability to withstand risks, banruptcy etc, wheras stdudies measing sustianible performance of banks encomapassing all important variables in one unison research integrating finance, accounting, and economic disciplines are scarce. Efficiency, profitability, and risk management capability have not been studied in one unison study in Paksitan as overall sustainable performance of Banks. Whereas the relationship between these three topics and the determinants like banks specific internal determinants and macroeconomic as external factors have not been been analyzed in the banking sector literatute of Pakistan. The impact of the internal determinants such as size of bank, capital ratio, loan intensity, credit risk, financial leverage, operating, return on asset (ROA), age of bank, Z-Score, bank ownership (foreign, domestic and government), and listing on efficiency, profitability, and risk management capability has not been researched in Pakistan as most of researchers missed very important determinants. Similarly impact of macroeconomic and external determinants like Gross Domestic Product (GDP), inflation, interest rate, exchange rate, market capital, GFC, corruption control, and financial action task force (FATF) on efficiency, profitability, and risk management capability has not been researched in Pakistan as most of researchers missed very important determinants.

Although Pakistani researchers has followed studies of the developed countries and focus of their studies remained on already identified variable and new contribution in the literary work in Pakistan is rare. This highlights that there is an urgent need to conduct further research studies in the context of the Pakistani banking sector in order to have some new theoretical contributions to the existing literature.

Literature Review

Pakistani Banking Sector

Pakistan owned only one banks i.e. Habib Bank at the time of independence from British in 1947 (Habib Bank, n.d.) State Bank of Pakistan (SBP) is the central bank that was established in 1948 and presently 35 banks are functioning in Pakistan (StateBank, n.d.). Pakistani Banking sectors has witnessed ups and down in the history. The performance of banking sector in Pakistan remained low resulting into less growth and decline in saving and private sector politicization, as 75 % of loans were waved off due to political influence, and overstaffing, more number of branches than required, wastage of resources, and financial crises contributed towards inefficiency, poor profitability (Rehman & Raoof, 2010). However, due to reforms of 1991 and 1997 privatization of banks commenced and banking industry started growing. Due to financial reforms, the ownership structure changed and private banks emerged resulting into decline of public banks share. Fake accounts, money laundering and looming threat of Financial Action Task Force (FATF) has badly affected performance of banks (Mukhtar, 2018). The main reason of decline in the performance of banks in Pakistan includes less innovative research, inefficiency, poor risk management, high tax rates, ownership of assets issues, customer dissatisfaction, and non-diversification (Rehman & Raoof, 2010).

Performance of Banks

The banking sector has pivotal role in the modern economy and the developing countries’ economies are directly linked with performance of banking sector (Ali, 2012). Productivity in banking sector researches is very low as compared to other subjects and a degree of dispersion in the research studies is dominating (Abreu et al., 2019). The banking sector related researches are not gaining attraction in journal of distinction (JOD) and three star rated journals (Brooks & Schopohl, 2018). Replication of studies is in abundance and there are very limited institutions and authors who are devoting their researcher work for banking sector performance with introduction of new variables. Banks performance is not yet a well-defined area of knowledge and banking sector performance has not been area of search in the main journals (Abreu et al., 2019). The prominent researchers believe on conduct of innovative studies on banking sector performance especially for developing countries How a regulatory capital requirement affects banks’ productivity: an application to emerging economies (Duygun et al., 2015; Yu, 2017; Abreu et al., 2019).

Sustainable Performance in Banking Sector

Sustainability is defined as the economic developmental activity by meeting the needs of generations of today with the caveat of not compromising future generation’s abilities and opportunities (Brundtland, 1987). All the stake holders expects a sustainable banks and that’s why they participate in the evaluation reports (Young & Tilley, 2006). Annual reports on sustainability are the main source that are communicated to shareholders and provide them opportunity to asses sustainability of bank (Stauropoulou & Sardianou, 2019). A new banking strategy can be achieved by integrating sustainability into strategy, product, process, and services, and this sustainability becomes public mission, value driver, and the requirement of customers (Weber, 2005).

Banking Theory

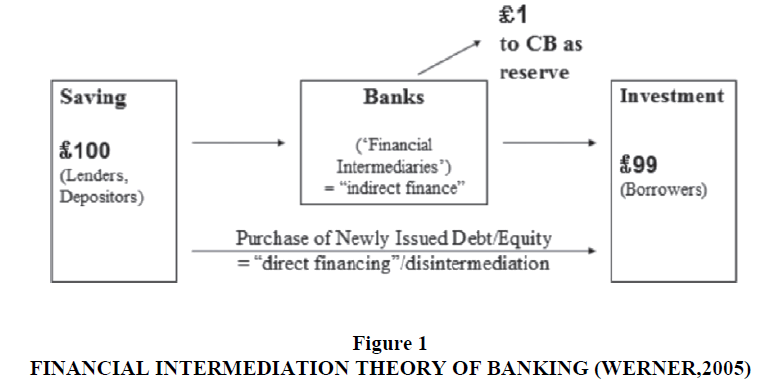

A bank functions on two theoretical concepts; first concept is an intermediation approach, where banks extends loans to the borrower by generating money that is deposited by the depositor (Abdul-Majid et al., 2011). Second concept is the banks performs through production approach and generates loan and deposits by utilizing capital and labour (Abdul-Majid et al., 2011). According to Werner (2016) in the past one century, three banking theories remained dominant during different times: (1) The currently prevalent financial intermediation theory of banking says that banks collect deposits and then lend these out, just like other non-bank financial intermediaries. (2) The older fractional reserve theory of banking says that each individual bank is a financial intermediary without the power to create money, but the banking system collectively is able to create money through the process of ‘multiple deposit expansion’ (the ‘money multiplier’). (3) The credit creation theory of banking, predominant a century ago, does not consider banks as financial intermediaries that gather deposits to lend out, but instead argues that each individual bank creates credit and money newly when granting a bank loan.” “The present financial intermediation theory holds that banks are merely financial intermediaries, not different from other non-bank financial institutions: they gather deposits and lend these out” as illustrated in Figure 1 (Werner, 2005).

Contingency Theory

Contingency theory of performance indicates that with one common measurement process an organization cannot measure sustainable performance rather contextual and specific organizational characteristics influence characteristics and efficiency of organization (Ong et al., 2019). Hence, variables relating to ownership structure the external environment, size, strategy, and organizational structure, affect the performance of an organization (Ong et al., 2019). According to the theory of contingency, the performance of an organization is a result of certain external factors and an organization achieves high performance by adopting variety of contingent factors (Saiful, 2017). The contingency theory plays important role in deciding the factors that plays main role in performance of an organization. Contingency theory is like a science because Science is ether a body of knowledge or an inquiry process, whereas the contingency theory encompasses both (Betts, 2011).

Banks Efficiency

Numerous banks efficiency studies in the banks sectors have been focusing as banks efficiency being measurement of banks performance. The banks efficiency helps the managers of banks to protect performance of their banks (Neves et al., 2020). This study only discussed only few macroeconomic variable and did not incorporate main macroeconomic variables that would have made this study could be more conclusive. Hassan (2006) conducted study on banking sector of 21 Muslim countries encompassing 43 banks from 1995 to 2001. This study missed ownership that is important bank specific variable. This study used return on equity (ROE) and return on asset (ROA) to measure effect on banks efficiency but missed net interest margin (NIM). Sufian (2007) used DEA method for 17 Islamic banks to measure the efficiency of banks in Malaysia. The researcher did not use external factors and macroeconomic factors that impact the banks efficiency. Garza-Garcia (2012) measured the Mexican banks efficiency from 2001 to 2009 using DEA. The study used Technical efficiency (TE), pure technical efficiency (PTE), and Scale efficiency (SE). This study concluded that ROA, foreign ownership and loans contributed towards better efficiency, whereas inflation and no performing loans badly affected the efficiency. Main macroeconomic variables were studied in this study.

Sufian (2011) conducted study on Korean banks from 1992 to 2003 and examined technical efficiency. No statistical analysis has been conducted in this study that incorporate the details to measure overall efficiency of banks. Yeh (2011) measured efficiency of 44 Taiwan banks for period from 1995 to 2008 and finds that the banks with large size has more efficiency than the banks with small size. This study did not analyses global financial crisis, and inflation. Feng & Serletis (2010) conducted study on 292 USA banks for a period from 2000 to 2005 and impact of various factors has not been highlighted in this study.

Ataullah et al. (2004) compared efficiency of Indian and Pakistani Banks for a period of 1988 to 1998 and this study could be more useful by using banks specific internal and external factors. Casu & Molyneux (2003) utilizes DEA method to calculate efficiency of 750 banks of France, Germany, UK, Italy, and Spain. The limitation of study is that this researcher only focused on variable return to scale and constant return to scale. This study missed important variables of banks specific and macroeconomic variables. Hasan & Marton (2003) researched banks of European country during the years from 1993 to 1998 using SFA approach. This study efficiently used banks specific variables, however missed impact of macroeconomic variables.

Banks Profitability

Short (1979) is historically considered as pioneer of investigating the determinants of banking sector performance. Short (1979) studied relationship between banking concentration and banking profitability utilizing the data of 12 countries for years from 1972 to 1974. The outcome of this study advocates that higher concentration results to more profit. Thereafter, Bourke (1989) researched to discover external and internal determinants of profitability in Europe, Australia and North America for the years from1972 to1981. The profit is increased due to higher degree of market power (Bourke, 1989).

Smaoui & Salah (2011) studied 44 Islamic banks of GCC region from the years 1995 to 2009 and analyzed the determinants of profitability. This study finds that NIM, ROE and ROA as main indicators of profitability, and profits are resulted due to size, capital and better asset quality. Whereas inflation and GDP taken as macroeconomic variables have significant and positive correlation with the profitability. However, this study did not incorporate the effects of global financial crisis. Westman (2011) conducted a study of 37 European countries commercial and investment banks for the period of 2003-2006. This study focused on ROE and ROA as main determinants of profitability and results show that as compared to diversified and traditional banks, the non-traditional banks earned more profit. Similarly, the small banks earned less profit as compared with large banks (Westman, 2011). During study of Macedonian banks, the researcher finds that capital ratio, operating expense of management, and credit risk influence ROA negatively and significantly (Curak et al., 2012). Whereas, GDP growth, concentration, and liquidity have positive and significant correlation with ROA in Macedonian banks (Alharthi, 2016).

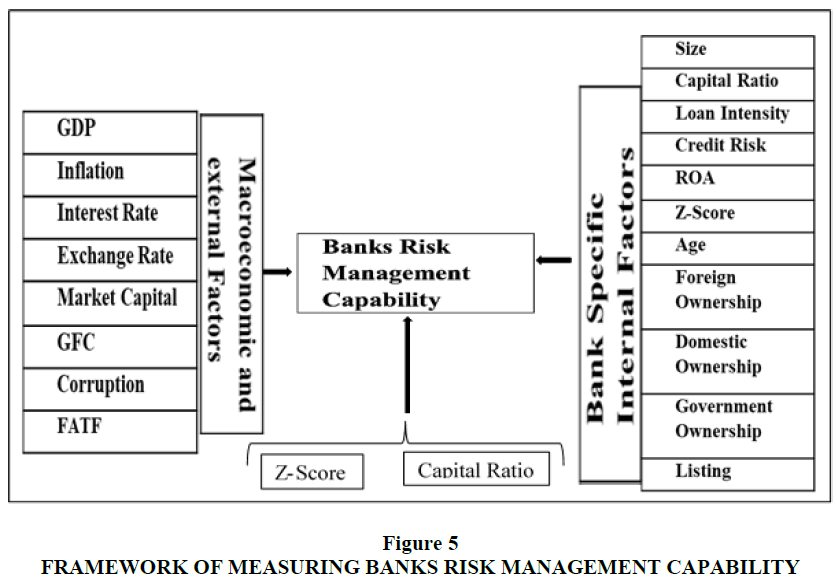

Banks Risks Management Capability

After global financial crisis of 2008 the research related to risk management capability gained importance in the literature of banking sector. Majority of studies have been conducted on conventional banks (Fu et al., 2014; Williams, 2014). Whereas very limited studies have analyzed Islamic banks or drawn an comparison between conventional and Islamic banks risk management capability (Ghosh, 2014). Majorities of studies concentrates on z-scores that indicates percentage of banks bankruptcy. Numerous studies also take capital ratio as indicator of stability (Horváth et al., 2014). Many studies found determinants of risk management capability through OLS as statistical regressions model and fixed effect regression, and random effects (Srairi, 2013; Fu et al., 2014).

The stability factors of four South Asian banks were concentrated (Bangladesh, Pakistan, India, and Sri Lanka) by Nguyen et al. (2012) who evaluated the reasons of stability by utilizing z-score as dependent variable for a period from 1998 to 2008. The author used generalized method of moments (GMM). The results suggest that the banks operating under big market powers have shown more stability while diversifying in the non-traditional activity. Furthermore, size, non-interest income, financial development, capital ratio, and GDP growth rate increase the z-score (resulting in decreases insolvency risk); on contrary, concentration and ex-post credit loss decrease the z-score (causing in increased insolvency risk). Generally, government owned banks remained less risky in contrast to foreign banks. However, this study found no influence of Asian financial crisis (AFC) and global financial crisis (GFC) on stability of banks.

Cubillas & González (2014) conducted international study on banks stability of 83 (developing and developed) countries for a period of 1991 to 2007. Thy used methodology of random effects model that included bank market power and z-score as dependent variables. The result suggests that financial liberalization raise risk taking that also increase competition within the banks. Furthermore, on the financial stability side, the capital requirement minimizes negative influence of financial liberalization. Moreover, in developing countries financial transparency and official supervision are only workable. Market power of banks impacted positively on the z-score, whereas, GDP growth, deposit insurance coverage to deposits per capita, inflation, and GDP has negative impact on z-score. The developing countries banks remained more stable as compared to banks of developed countries. Also, small banks were found riskier having low z-score.

Schaeck & Cih (2014) conducted study on 10 European countries for a period from 1995 to 2005 and focused on capital ratio. The results illustrate that the smaller banks maximized their capital more as compared with large banks. Moreover, new banks were less capitalized as compared to older banks. Lastly, banks of countries with higher GDP managed to increase their capitalization. The logical reason may that a country with high GDP per capita offer a benefit to its banks to attract additional deposits and invest these deposits by lending interests.

Horváth et al. (2014) conducted a stability study of commercial banks of Czech Republic using data of 31 commercial banks for a period from 2000 to 2010. The conclusions projected that z-score showed a positive and significant association with capital which mean that the banks were not risky and stable when these banks were involved more in operations. In addition, unexpectedly the capital was increased due to higher inflation rates. On the other hand, negative determinants of capitalization include as credit risk, non-performing loans, volatility, earnings, unemployment, and size. The explanatory factors such as deposits and loans have been ignored in this study.

DeYoung & Torna (2013) used capital ratio while analyzing stability of American banking sector and incorporated data of banks for a period of 2007-2010. The statistical results suggest that capitalization of American banks was affected positively and significantly by liquidity, stakeholder, non-performing loans, brokered deposits, equity, and goodwill.

The literature review on risk management capability assists the researcher to analyses empirically the association between risk management capability and dominant. The bank-specific determinants can be loan intensity, capital ratio, bank size, ROA, credit risk, age, operating leverage, listing, and ownerships (public, domestic, and foreign). The external macroeconomic variables can be inflation, GDP, market capitalization, control of corruption, global financial crisis, Financial Action Task Force (FATF), interest rates, and exchange rates.

Determinants of Efficiency, Profitability, and Risk management capability

This research uses the impact of external factors and internal on banks efficiency, banks profitability, and banks risk management capability. As per past literature, the most suitable internal variables are bank capital ratio; size; loan intensity; financial leverage; return on assets (ROA); credit risk; ownerships; listing bank; and age. External variables are inflation; market capitalization; gross domestic production (GDP); control of corruption; global financial crisis; Interest rates; exchange rates; Financial Action Task Force.

Banks Specific Internal Factors That Impact Efficiency, Profitability, And Risk Management Capability

Bank size: Majority of studies suggest bank size as main variable of efficiency, profitability, and risk management capability. The researcher found a prominent positive impact on efficiency, profitability, and risk management capability, which means; large sized banks are efficient, financially performing well and are less averse to risk. Whereas some studies suggests that small banh achieved better efficiency (Moussawi & Obeid, 2010; Ariff & Can, 2008). Majority of studies suggest that the bank size impacted the efficiency negatively and positively (Noor & Ahmad, 2011; Tan & Floros, 2013). Whereas certain studies concluded that the relationship between efficiency and size is insignificant (Garza-Garcia, 2012; Wanke & Barros, 2014).

Capital ratio: The capital ratio shows importance of equity of shareholders. Higher capital ratio may enhance the efficiency, profitability; and banks risk management capability in the banking sector (Rosman et al., 2014; Mamatzakis et al., 2016). Few researcher suggest that banks are performing well with low capital ratios (Zhang et al., 2012; Vu & Nahm, 2013).

Loan intensity: Banks main role is to provide loans as main function of banks. Majority of studies suggests that banks performance increased on provision of more loans (Sufian & Habibullah, 2009; Garza-Garcia, 2012; Johnes et al., 2014). Few researcher states that more loan makes a bank more prone to risks (Sufian, 2009; Ahmad & Noor, 2010).

Credit risk (Liquidity): The study of efficiency of small and large banks of China for years from 2004 to2011 suggest that credit risk affects the profit negatively and significantly in small banks (Lee & Chih, 2013). Therefore, to enhance efficiency the banks are required to increase loans. A significant relation exists between efficiency and credit risk (Hou et al., 2014). More lending activity pave way for less efficiency (Ariff & Can, 2008). The impact of credit risk on profitability remained significantly negative (Chitan, 2012). Similarly another study related to Korean banks indicates that the banks which provided more loans achieved less stability (Jeon & Lim, 2013).

Financial leverage: There is a significant and positive relation between financial leverage and efficiency (Alharthi, 2016). The financial leverage is a determinants of efficiency and a significant and negative relation exists between financial leverage and DEA scores (Abu-Alkheil et al., 2012).

Return on Assets (ROA): Numerous studies used ROA being an explanatory variable for efficiency. Majority of studies verified that efficiency is increased by the profitability ratios (Sufian, 2009; Rosman et al., 2014). Whereas, few studies suggest that there is a negative and significant association between profitability ratios and the efficiency (Hou et al., 2014). Moreover, El-Moussawi & Obeid (2010) conclusions suggested that ROA impacted efficiency negatively and positively for the GCC banks during years from 2005 to 2008 (Moussawi & Obeid, 2010). Another study suggest that there is no effect of ROA on efficiency of Korean commercial banks (Sufian & Habibullah, 2009).

Age of banks: Researchers have different views about age of banks. A study conventional and in Islamic banks suggest that new banks are less efficient as compared to older banks (Abu-Alkheil et al., 2012). In contrast another study shows that old banks achieved less efficiency as compared with new commercial banks of China (Lee & Chih, 2013). However, another study suggest age had no impact on efficiency of Hungarian conventional banks (Hasan & Marton, 2003). According to Beck et al. (2005) the new banks earned more profit than older banks in Nigeria for period of ten years from 1990 to 2001. Older banks has shown more stability than new banks (Lee & Chih, 2013).

Ownership: There are three types of ownerships: government (public or state-owned banks), foreign, and private (domestic) banks (Alharthi, 2016). Researchers are divided regarding ownership impact on efficiency, profitability and risk management capability of banks and studies have shown different results, in some studies foreign banks performed well, in some domestic, whereas in some studies governments banks remained dominating (Alharthi, 2016). The relationship between foreign ownership and efficiency is significant and positive (Garza-Garcia, 2012). There is as significant and negative relationship between profitability and foreign ownership (Dedu & Chitan, 2013).

Listing: These determinants examine whether stock listed banks is performing better or an unlisted bank. According to a study on Islamic banks, the unlisted banks performed better than unlisted banks (Yudistira, 2004). The banks listed on stock market are more profitable than the unlisted banks due to good control from the central bank (Alharthi, 2016). The banks that are listed have shown more stability against risks as compared with unlisted banks (Wang et al., 2015). In contrast, another study shows that unlisted banks more financially stable than listed banks (Saghi-Zedek & Tarazi, 2015).

Z-score: Boyd et al. (1993) proposed Z-score to determine the bankruptcy probability, higher Z-score means a stable banks and has less potential of bankruptcy. Researchers used Z-Score as determinant in banking sector studies. There is a negative correlation between ROA and Z-score because more profit resulted into less stability in a study of US banks for the period from 2000 to 2013 (Apergis, 2014). Another study suggests that risks reduces the level of efficiency in banks (Sufian & Habibullah, 2009).

Operating Leverages: Operating leverage can be calculated by dividing fixed assets with total assets of a bank (Srairi, 2013). A very few studies examined effect of fixed assets intensity on stability. A study was conducted by Srairi (2013) on the indicators of stability for 10 MENA countries that encompass 175 (conventional and Islamic) banks for a time from 2005 to 2009. The findings suggest that conventional and Islamic banks were suggested to invest more fixed assets as operating leverage and the z-score remined significant and positive. Whereas another study of 23 countries brought opposite findings suggesting that fixed assets had negative correlation with the z-score resulting into worse financial stability (Berger et al., 2009). Since the depreciation may be due to high cost to fixed assets therefore, these results allow the policy makers to go for selling of more fixed assets.

Banks Specific External Macroeconomic Determinants That Impact Efficiency, Profitability, And Risk Management Capability

Gross domestic production (GDP): GDP has been used by different researchers as main determinant is banks performance studies as GDP is GDP is the main indicators of an economy; the country with more GDP results into better economy (Majed Alharthi, 2016). The countries with growth in the GDP paved way for enhancing efficiency in banking sector (Hermes & Nhung, 2010). The results of this study has been supported by (Garza-Garcia, 2012; Tan & Floros, 2013; Hou et al., 2014). Whereas in other study of Korean banks GDP impacted negatively on banks efficiency (Sufian & Habibullah, 2009). In contrast, a study shows that GDP is not significant for efficiency of banks (Moussawi & Obeid, 2010).

Market Capitalization: The market capitalization increases efficiency of banks (Johnes et al., 2014). This argument is supported by another study (Vu & Nahm, 2013). Whereas few studies suggest that stock market correlation with efficiency is positive and negative (Garza-Garcia, 2012). In contrast another study suggest that the stock market has no impact on the efficiency of banks. The expansion in the stock market contributes towards profitability, and profitability and market capitalization are highly correlated (Pasiouras & Kosmidou, 2007).

Global Financial Crisis (GFC): GFC has significant and negative influence on the efficiency of banks (Sufian & Habibullah, 2009). GFC had negative impact on profitability of American commercial, cooperative banks and savings (De Haan & Poghosyan, 2012). During the period of GFC, Asian commercial banks faced bankruptcy risks (Williams, 2014).

Inflation: The relationship between efficiency and the inflation remained positive and significant during study of Islamic banks (Moussawi & Obeid, 2010). On the contrary, majority of studies validated that inflation affects efficiency negatively and significantly (Sufian & Habibullah, 2009; Vu & Nahm, 2013). Whereas, some studies suggest that inflation has no impact on efficiency (Grigorian & Manole, 2002). Generally, high inflation barred banks from gaining high profits as purchasing power of individuals declined resulting into reduced bank deposits. Therefore, less loans are offered by the banks due to reduced profits and that reflects negatively on overall operations of banks. Some studies suggest that during higher inflation banks profitability of banks increased and remained significant and positive (Sufian & Habibullah, 2009; Tan & Floros, 2012). Inflation also curtailed the banks risk taking (Tan & Floros, 2013).

Interest Rates: Interest rate is the amount paid on principal amount by the barrower to the bank or lender. The interest rate is lending interest rate that a bank gets. Both positive and negative evidence have been shown during previous studies regarding impact of interest rate on performance of banks. A study reported negative impact of interest rate on performance on bank (Rashid & Jabeen, 2016), whereas another study found positive effect (Yahya et al., 2017).

Financial Action Task Force (FATF): According to Mukhtar (2018), Financial Action Task Force (FATF) placed Pakistan in the grey list on the pretext of lack of effective internal controls to prevent terror financing and money laundering. Pakistan has taken numerous steps to regarding counter terror financing, and anti-money laundering, however, still the stakeholder are facing challenges in the absence of efficient strategic management and effective internal control of banking sector. The neighboring states of India, Afghanistan, and Iran are also hub of such activities due to trafficking and growth of opium (Mukhtar, 2018). International rating agency Moody states that the banking system of Pakistan faces credit risk due to inclusion the country in the grey list of FATF (M. Ali, 2020). There is a positive and strong relationship between anti money laundering polices and performance of banks (Idowu & Obasan, 2012). Due to placing of Pakistan in grey list by FATF, performance of Pakistan banks is impacted as they are barred to conduct business outside country in case placed in the black list.

Exchange Rates: A foreign exchange rate is the price to convert one currency into another. The exchange rate is important for balance of payments, international trade, and economic performance of a country. Exchange rate is usually used as determinant for performance of banks in the future studies. Bergen (2010) studied factors that affect the exchange rates and suggest that inflation, interest rates, and exchange rates are all correlated. To create impact on currency value and inflation, the central bank can influence exchange rates and inflation by manipulating exchange rates (Bergen, 2010). A higher return is offered through high interest rates in an economy, therefore, high interest rates results in raising of exchange rates thereby attracting foreign capital. A positive relationship exists between loan loss and exchange rates resulting into a tendency of banks in accumulating bad loans due to fluctuation in the exchange rates (Adesola, 2013).

Methodology

This is conceptual paper based the results and findings of literature of the past. Since last 300-500 years, scientists and scholars could not suggest new banking theory and even did not agree on the already written theories of banking (Werner, 2016). Very few studies used macroeconomic variables but missed many important variables of macroeconomics like interest rate and exchange rate, and other external factors like corruption, global finical crises, and financial action task force (FATF) related to money laundering and terror financing. Similarly many researchers missed most of important banks specific factors like ownerships, and listing on stock exchange baring (Alharthi, 2016). Majority of researchers have not seen combine effects of internal and external factors in one research study. Few researchers talked about combined effect of banks specific and macroeconomic factors to measure a singular variable either banks efficiency or financial performance or risk management but did not measure all the variables in one study (Alharthi, 2016). A wholesome study on sustainable banks performance by combining impact of all variables such as Banks efficiency, Profitability, and banks risk management through independent variables of banks specific internal factors and macroeconomic factors are scarce and have rarely been conducted in the Pakistan’s context.

This paper fills in the literature gap related to the sustainable performance of Pakistani banks by extending the literature work of Khan et al. (2015); Alharthi, (2016); Al-Homaidi et al. (2018), and Al-Homaidi et al., (2018) who ignored a major banks specific, macroeconomic and external factors that effects sustainable performance of banks. Alharthi, (2016) explored impact of macroeconomic factors and banks specific internal factors on banks efficiency, profitability, and stability, however, besides ignoring Financial Action Task Force (FATF), interest rates, exchanges rates, and the author could not construct a framework that measures sustainable performance of banks.

Conceptual Framework for Sustainable Performance of Banks

Based on prior literature, many banks specific variables have been found that impact efficiency.

This paper analyses the most relevant factors which are capital ratio, bank size, loan intensity, financial leverage, credit risk, bank age, returns on assets (ROA), and listing, ownerships (foreign, public and domestic). Similarly, in the past literature the macro-economic factors also have significant relation with the efficiency. Therefore, the most relevant variables studies in this paper are inflation, gross domestic product (GDP), the global financial crisis, market capitalization, FATF, exchange rates, interest rates and control on corruption.

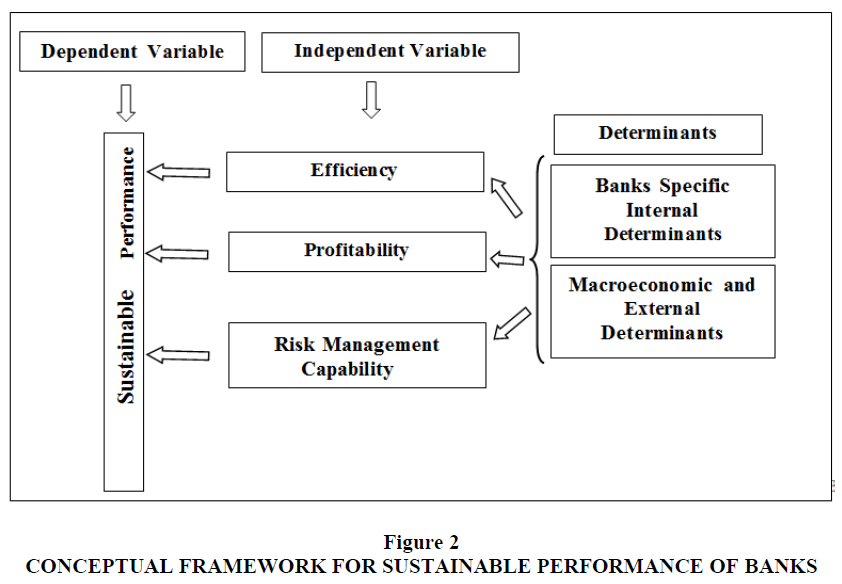

As far as profitability is concerned, the most helpful internal variables are capital ratio, bank size, credit risk, loan intensity, age, deposit ratio, ownerships (foreign, public and domestic), z-score, and listing. Whereas, inflation, GDP, the global financial crisis, market capitalization, FATF, exchange rates, interest rates and control on corruption are studied as macro-economic variables. Lastly, the Risk management capability is examined through internal factors, like capitalization z-score, loan intensity, credit risk, ROA, bank size, bank age, operating leverage listing, and ownerships (foreign, public and, domestic). Whereas inflation, GDP, market capitalization, FATF, exchange rates, interest rates and GFC can represent risk management effectively as macro-economic variables.

The conceptual framework model of this research is illustrated in Figure 2. All the three variables of Banks efficiency, Banks profitability, and banks risk management capability has been measured independently through banks specific internal factors, and macroeconomic and external factors to summarize overall performance of Pakistani banking sector.

Research Hypothesis of Performance of Banks

H1: There is a significant association between banks efficiency and sustainable performance of banks.

H2: There is a significant association between banks profitability and sustainable performance of banks.

H3: There is a significant association between banks risk management capability and sustainable performance of banks.

H4: Banks specific internal determinants, and macroeconomic and external determinants contribute positively or negatively towards banks efficiency, profitability and risk management capability.

Results and Discussion

Banks sustainable performance as dependent variables and banks efficiency, banks profitability, and banks risk management capability have been defined in the literature review in the light of previous literature. Similarly banks specific, macroeconomic, and external determinants that impact banks efficiency, profitability, and banks risk management capability has been explained in the literature review. However, methodology of each variable and determinants recommended in this paper has been explained in this section.

Banks Efficiency Results

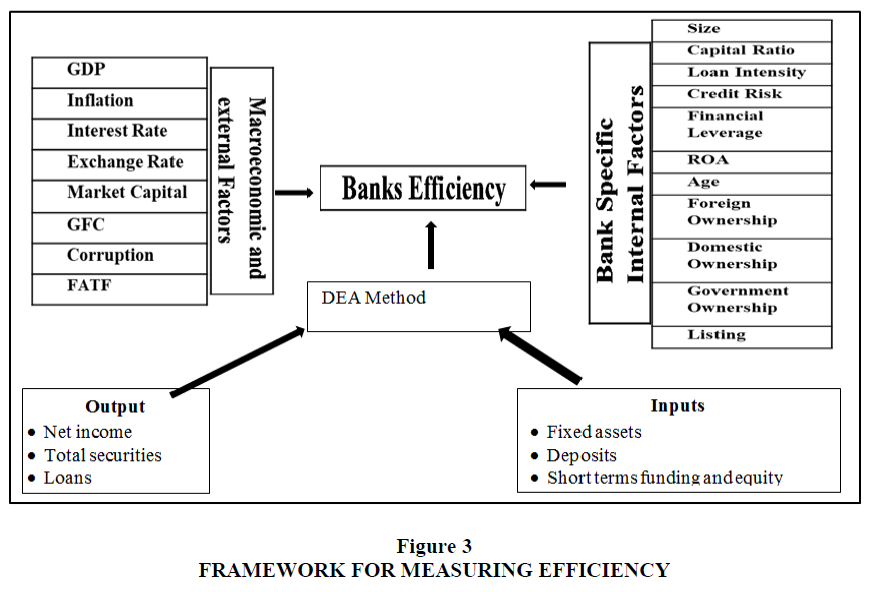

Based on the literature, in the first step the efficiency can be measured through data envelopment analysis (DEA) techniques and in the second step efficiency can be measured through determinants of efficiency. Figure 2 represents the framework of measuring banks efficiency through DEA, banks specific internal and macroeconomic and external determinants.

Step one - data envelopment analysis (dea): In the first step, the research compares efficiencies amongst public, commercial, and foreign banks by using non-parametric data envelopment analysis (DEA) encompassing scale, technical efficiency (TE), pure technical efficiency (PTE). In the banking sector different approaches are being used to measure efficiency and the most common is DEA encompassing technical, pure technical, and scale efficiencies (Rosman et al., 2014; Wanke & Barros, 2014). There are certain studies that used parametric approach like SFA including cost profit, and revenue efficiencies (Hasan & Marton, 2003). The DEA represents non parametric linear program approach using input and output to calculate efficiency (Sturm & Williams, 2004). Deposits short terms funding, Fixed assets, and equity can be taken as input, whiles loans, net income, and total securities as out puts (Majed Alharthi, 2016).

Step Two – Measuring the impact of determinants on banks efficiency: In the second step, fixed effects regression and ordinary least squares (OLS) are used to determine effects of banks specific internal factors, macroeconomic and external factors on banks efficiency. Expected Impact of banks specific internal factors, macroeconomic factors and external determinants on Banks Efficiency. Fixed effects models and OLS are used in this paper to measure impact of determinants on banks efficiency. The regression equation is as follow (Majed Alharthi, 2016):

Effit = α + β1 LTAit + β2 EQTAit + β3 LOANSTAit + β4 LOANSDEPOit + β5 TAEQit + β6 ROAit + β7 LAGEt + β8 FOREi + β9 DOMi + β10 PUBi + β11 LGDPt + β12 INFLATIONt + β13 MCAPt + β14 GFCt + β14 LGFATFt+ ɛit

i = 1….n; t = 1….n

The efficiency scores are dependent variables, as taken from DEA which is Effit as PTE (or VRS), TE (or CRS), and SE Figure 3. Whereas, t is time, i is observations, α is the constant, ɛit is the error term, and β denotes the coefficient of variables. He independent variables include size, capital ratio, loans intensity, credit risk, financial leverage, ROA, age, ownership, GDP, inflation, market capitalisation, financial crisis (GFC), FATF (Majed Alharthi, 2016).

Banks Profitability Results

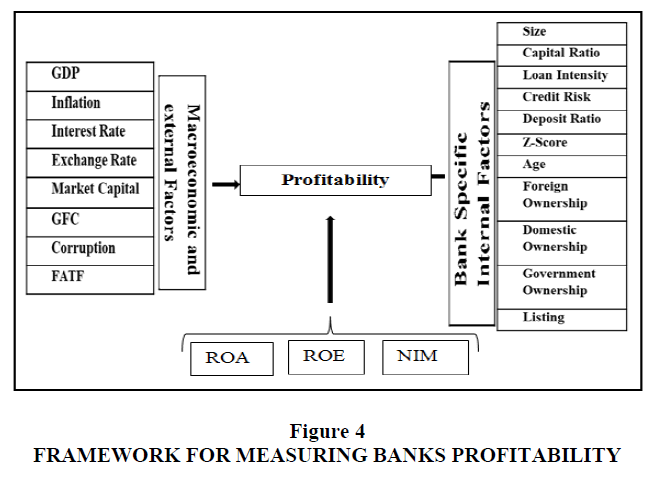

Majority of previous profitability studies frequently applied two main factors to measure profitability that are ROE and ROA, however, very rare studies used ROE, ROA, and NIM as main factors for profitability (Majed Alharthi, 2016). This paper also uses all the three factors to measure profitability. Figure 4 represents the framework of measuring banks profitability through ROA, ROE and NIM, and banks specific internal and macroeconomic and external determinants.

Step One – Calculation through ROA, ROE, and NIM: In the first step, the research compares profitability amongst public, commercial, and foreign banks by using results of ROA, ROE, and NIM. ROA is calculated by NIM divided by total assets (TA), which indicates how management is efficient in using TA to generate maximum profit (Short, 1979). Higher ROA the more efficient is the banks (Guillén et al., 2014). ROE is calculated by dividing NIM with total shareholder equity (Guillén et al., 2014). ROE denotes the management efficiency to utilize shareholder equity very efficiently. NIM is the value of NIM to total earning assets. The profits gained from lending investment is calculated by NIM. NIM= net interest income / total earning assets.

Step Two – Methodology of determinants impact on profitability: In the second step, fixed effects regression and ordinary least squares (OLS) are used to determine effects of banks specific internal factors, macroeconomic and external factors on banks profitability. Fixed effects models and OLS have been used in this paper to measure impact of determinants on banks profitability and regression equation is as follow (Majed Alharthi, 2016):

FinPerfit = α + β1 LTAit + β2 EQTAit + β3LOANSTAit + β4 LOANSDEPOit + β5 DEPOSITSTAit + β6 LAGEt + β7 LOGZit + β8 FOREi + β9 DOMi + β10 GOVi + β11 LGDPt + β12 INFLATIONt + β13MCAPt + β14 GFCt + β14 LGFATFt ɛi

t = 1.n; i = 1….n

The profitability ratios such as ROE, ROA, and NIM) are dependant variables, t is time, i is the observations, α is the constant, ɛit is the error term, and β denotes the coefficient of variables. While the independent variables are size, capital ratio, loans intensity, credit risk, deposit ratio, age, z-score, ownership, GDP, inflation, financial crisis (GFC), FATF (Majed Alharthi, 2016).

Banks Risk Management Capability Results

In this section, the capital ratio and Z-score is calculated to measure the stability of banks i.e the higher the capitalization and z-score the more is the stability. In the second step the variables are determined through statistical models that decrease or increase the stability. The banks risk can lead to heavy losses resultantly leading to bankruptcy. The framework of banks risk management capability is shown in figure 5.

Step One - Calculations through Z-Score and Capital Ratio: In the first step, the research compares financial risk management capability amongst public, commercial, and foreign banks by using results of Capital Ratio and Z-Score. Z-score is the sum of average capital and average ROA divided with range volatility of ROA (Williams, 2014). To describe stability, the z-score has been used in this paper as an explained variable. Higher z-score indicates less bankruptcy (default) risks, and more financial stability. Ihe z-score formula proposed by Boyd et al., (1993) is as under:

1. ROA = return on assets

2. E/TA = equity to total assets (or capital) ratio

3. S.D. ROA = standard deviation of return on assets

The capital ratio is calculated by dividing equity with total assets. The capital ratio has been employed by Horváth, Seidler, & Weill (2014) as under:

Capital ratio = Equity / Total Assets

Step Two - Methodology of determinants on banks risk management capability: In the second step, fixed effects regression and ordinary least squares (OLS) are used to determine effects of banks specific internal factors, macroeconomic and external factors on banks risk management capability. To represents stability, the capital ratio and z-score has been used dependent variable in this paper. Fixed effect and OLS has been used as regression model to determine the relationship between independent variable and the stability (capital ratio and z-score) as under:

RiskMgmgtit = α + β1 LTAit + β2 LOGZit/EQTAit + β3 LOANSTAit + β4 LOANSDEPOit + β5 ROAit + β6 FATAit + β7 LAGEt + β8 FOREi + β9 DOMi + β10 GOVi + β11 LGDPt + β12 INFLATIONt + β13 MCAPt + β14 GFCt + β14 LGFATFt + ɛit

t = 1….n; i = 1….n

Riskmgmtit is the dependent variable that represent capital ratio or z-score as an indicator of stability. Whereas, t is time, i is the observations, β denotes the coefficient of variables, α is the constant, and ɛit is the error term. The independent variables are size, z-score/capital ratio, loans intensity, credit risk, ROA, operating leverage, age, ownership, GDP, inflation, market capitalisation, financial crisis (GFC) (Majed Alharthi, 2016).

Conclusion and Recommendations

Constructing a Framework for Sustainable Performance

Sustainable performance of banks will be measured by creating index through combining the results of banks efficiency, banks profitability, and banks risk management capability.

Banks performance framework: Mean efficiency measured through DEA (TE, SE&PTE), mean profitability measured through ROA, ROE, and NIM, and mean risk management capability measured through Z-Score and capital ratio is combined for every year and every banking group. This results into sustainable performance of banks. Thereafter banks performance index (BPI) is created to gauge the efficiency of banks relative a base year. Proposed equation is as under:

1. Constructing Banks Performance Framework (BPF) = Mean Banks efficiency + Mean banks profitability + Mean banks risk management capability

2. Creating Banks Performance Index (BPI) = (Banking Group /Base Banking Group) x 100.

Proposed summary of banks efficiency, banks profitability, and banks risk management capability are shown in Table 1 and 2.

| Table 1 Summary of Banks Efficiency, Banks Financial Performance, and Banks Risk Management Capability | ||||||||||||

| Indicator | Efficiency (Eff) | Profitability (P) | Risk Management Capability (RMC) | |||||||||

| Year | Measure | TTE | PPTE | SSE | Mean Eff | ROA | ROE | NIM | Mean P | z-score | capital | Mean RMC |

| PubBanKs | - | |||||||||||

| Pvt Banks | ||||||||||||

| Foreign Banks | ||||||||||||

| All Bank | ||||||||||||

Proposed Banks Performance Framework (BPF) and Banks performance index (BPI) is shown in Table 2.

| Table 2 Constructing Banks Performance Framework (BPF) and Banks Performance Index (BPI) | ||||||

| YYear | Banks | Eff= DEA = (TE+SE+PTE)÷3 | P=(ROA+ROE+NIM) ÷3 | RMC= (Z-score + capital ratio) ÷2 | BPF (Eff+FP+RMC) | BPI |

| Public Banks | ||||||

| Commercial Banks | ||||||

| Foreign Banks | ||||||

| All Banks of Pakistan | ||||||

Limitation of Study: The proposed conceptual framework in this study has be derived by reviewing prior literature available from different strands and have not been tested empirically yet. That is why it is suggested that in future further empirical research may be designed in order to draw the conclusions regarding the practical implementation of said framework.

Finally, the framework derived in this paper contributes to the existing literature on sustainability performance and risk management in general and on different profitability and efficiency determinants of the banking sector in particular. It provides new directions for further empirical research in this area.

References

Ahmad, N.H., & Noor, M.A.N.M. (2010). The Determinants Efficiency and Profitability of World Islamic Banks. International Conference on E-Business, Management and Economics, 3, 228–233.

Ali, M. (2020). FATF ‘grey list’ poses credit risks to Pakistani banks: Moody’s. PtProfit,

Ali, R. (2012). Financial Sector Performance and Economic Growth in Pakistan. Deoartment of Econoimics. Gomal University Dera Ismail Khan, Pakistan.

Ariff, M., & Can, L. (2008). Cost and profit efficiency of Chinese banks: A non-parametric analysis. China Economic Review, 19(2), 260-273.

Beck, T., Cull, R., & Jerome, A. (2005). Bank privatization and performance: Empirical evidence from Nigeria. Journal of Banking and Finance, 29(8), 2355-2379.

Betts, S.C. (2011). Contingency Theory: Science Or Technology? Journal of Business & Economics Research (JBER), 1(8).

Boyd, J.H., Graham, S.L., & Hewitt, R.S. (1993). Bank holding company mergers with nonbank financial firms: Effects on the risk of failure. Journal of Banking and Finance, 17(1), 43-63.

Brundtland, G.H., & Khalid, M. (1987). Our common future. Oxford University Press, Oxford, GB.

Choudhury, S.R. (2019). Pakistan’s prime minister visits Trump, but that’s not likely to help his country’s struggling economy. CNBC.

Curak, M., Poposki, K., & Pepur, S. (2012). Profitability determinants of the Macedonian banking sector in changing environment. Procedia-Social and Behavioral Sciences, 44, 406-416.

Dedu, V., & Chitan, G. (2013). The influence of internal corporate governance on bank performance-an empirical analysis for Romania. Procedia-Social and Behavioral Sciences, 99, 1114-1123.

Duygun, M., Shaban, M., Sickles, R.C., & Weyman-Jones, T. (2015). How a regulatory capital requirement affects banks’ productivity: an application to emerging economies. Journal of Productivity Analysis, 44(3), 237-248.

Garza-Garcia, J.G. (2012). Determinants of banks efficiency in Maxico: a two-stage analysis. Centre for Global Finance, Working Pa.

Grigorian, D.A., & Manole, V. (2002). Determinants of Commercial Bank Performance in Transition: An Application of Data Envelopment Analysis. IMF Working Papers, 02(146), 1.

Hassan, M.K. (2006). The X-efficiency in Islamic banks. Islamic Economic Studies, 13(2).

Horváth, R., Seidler, J., & Weill, L. (2014). Bank capital and liquidity creation: Granger-causality evidence. Journal of Financial Services Research, 45(3), 341-361.

Idowu, A., & Obasan, K.A. (2012). Anti-money laundering policy and its effects on bank performance in Nigeria. Business Intelligence Journal, 6(3), 367-373.

Johnes, J., Izzeldin, M., & Pappas, V. (2014). A comparison of performance of Islamic and conventional banks 2004-2009. Journal of Economic Behavior and Organization, 103, 1-15.

Khan, Q.M., Kauser, R., & Abbas, U. (2015). Impact of bank specific and macroeconomic factors on banks profitability: A study on banking sector of Pakistan. Journal of Accounting and Finance in Emerging Economies, 1(2), 99-110.

Majed Alharthi. (2016). The Determinants of Efficiency, Profitability and Stability in the Banking Sector: A Comparative Study of Islamic, Conventional and Socially Responsible Banks. Journal of Chemical Information and Modeling, 53(9), 1689-1699.

Mamatzakis, C., & Obeid, H. (2011). Evaluating the productive efficiency of Islamic banking in GCC: A non-parametric approach. International Management Review, 7(1), 10.

Neves, M.E.D., Gouveia, M.D.C., & Proença, C.A.N. (2020). European bank’s performance and efficiency. Journal of Risk and Financial Management, 13(4), 67.

Noor, M.A.N.M., & Ahmad, N.H.B. (2011). Relationship between Islamic banking profitability and determinants of efficiency. IUP Journal of Managerial Economics, 9(3), 43.

Pasiouras, F., & Kosmidou, K. (2007). Factors influencing the profitability of domestic and foreign commercial banks in the European Union. Research in International Business and Finance, 21(2), 222-237.

Rosman, R., Abd Wahab, N., & Zainol, Z. (2014). Efficiency of Islamic banks during the financial crisis: An analysis of Middle Eastern and Asian countries. Pacific-Basin Finance Journal, 28, 76-90.

Saiful, S. (2017). Contingency Factors, Risk Management, and Performance of Indonesian Banks. Asian Journal of Finance & Accounting, 9(1), 35.

Schaeck, K. Cih ́k, M. (2014). Competition, Efficiency and Stability in Banking”. Financial Management, 215-241.

Smaoui, H., & Salah, I.B. (2012). Profitability of Islamic banks in the GCC region. Global Economy and Finance Journal, 5(1), 85-102.

Sufian, F. (2007). The efficiency of Islamic banking industry in Malaysia: Foreign vs domestic banks. Humanomics, 23(3), 174-192.

Sufian, F. (2011). Benchmarking the efficiency of the Korean banking sector: A DEA approach. Benchmarking, 18(1), 107-127.

Tan, Y., & Floros, C. (2013). Risk, capital and efficiency in Chinese banking. Journal of international financial Markets, Institutions and Money, 26, 378-393.

Vu, H., & Nahm, D. (2013). The determinants of profit efficiency of banks in Vietnam. Journal of the Asia Pacific Economy, 18(4), 615-631.

Wanke, P., & Barros, C. (2014). Two-stage DEA: An application to major Brazilian banks. Expert Systems with Applications, 41(5), 2337-2344.

Werner, R.A. (2016). A lost century in economics: Three theories of banking and the conclusive evidence. International Review of Financial Analysis, 46, 361-379.

Williams, B. (2014). Bank risk and national governance in Asia. Journal of Banking & Finance, 49, 10-26.

Yeh, T.L. (2011). Capital structure and cost efficiency in the Taiwanese banking industry. The Service Industries Journal, 31(2), 237-249.

Yu, Z. (2017). Efficiency and competition analysis in nine Asian banking industries (Doctoral dissertation, Loughborough University).

Zhang, J., Wang, P., & Qu, B. (2012). Bank risk taking, efficiency, and law enforcement: Evidence from Chinese city commercial banks. China Economic Review, 23(2), 284-295.

Alharthi, K. (2016). An introduction to research paradigms. International Journal of Educational Investigations, 3(8), 51-59.

Habib Bank. (n.d.). Analysis on loan processing and credit appraisal system of Habib Bank Limited, Bangladesh.

Bergen, P. (2010). The year of the drone. New America Foundation, 24.