Research Article: 2020 Vol: 24 Issue: 1

An Examination of Customer Relationship Value in high vs low Technology Industries

Abstract

The paper examines supplier’s perspective of relationship value and investigates if, how and to what extent relationship value and its impact on relationship quality vary according to the technological level of the product. Two types of relationship value are identified through qualitative research, direct value and indirect value and assessed using confirmatory factor analysis. A two aspect conceptualisation of each type of value is developed- a benefit-cost discrepancy regarding value drivers e.g., payment, risk, collaboration, and the relative importance of each driver to the firm. Employing a sample of 67 firms manufacturing high technology product and 65 firms manufacturing low technology product, the relative-value instrument was assessed. Using structural path modelling the effect of product technology on the links of relationship value to the two aspects of relationship quality- trust and satisfaction was examined. The survey results provide support for the relative-value based measurement instrument, a positive effect of direct and indirect value on both aspects of relationship quality, and a significant variation in value due to the technological level of the product. There are limitations related to the sampling procedure: qualitative research; selected large-sized organizations. Further research is needed to test the relationship value in different contexts. Firms may find the relative-value instrument useful in assessing what kind of value is the most cherished by the high technology (low technology) product supplier, and how the relationship value perceptions of the supplier could be improved.

Keywords

Customer-Supplier relationships, Supplier perceived value, High technology product and relationship value, Relationship quality, Trust; Satisfaction.

Introduction

What makes a business relationship valuable is an important question for developing and maintaining long term exchange partnerships. Relationship value is highlighted as the prime purpose for any firm in engaging in a continuous business relationship because value cannot be realized in arm’s length relationships and purely transactional exchange processes (Amine & Alaoui, 2018; Anderson & Narus, 1999; Biong et al., 1997; Chicksand & Rehme, 2018; Daugherty et al., 2006; Ganesan, 1994; Gao, 2017; Gronroos, & Helle, 2012; Park & Lee, 2018; Wilson & Jantrania, 1995). Value is linked to numerous relational factors e.g., relationship quality; customer loyalty (Ho et al., 2014; Lai, 2014). Numerous studies in the literature of business and industrial marketing explored the nature of relationship value e.g., (Lai et al., 2015; Ryssel et al., 2004; Ulaga, 2003; Walter & Ritter, 2003). However due to the differing conceptualizations, which in turn lead to differing approaches to measure relationship value, there is still a lack of understanding of the nature of this construct and what method is appropriate for its measurement. There has been a considerable discussion of customer perspective of value however only a few authors discuss supplier’s perspective of value. There has not been adequate conceptual and empirical effort toward examining the impact of product technology on relationship value. The purpose of this paper is to fill the above gaps. Specifically, this paper seeks to answer the following questions to contribute to both theory and practice:

1. What is relationship value from a supplier’s perspective?

2. What measures are appropriate for assessing relationship value?

3. How does the nature and role of relationship value vary by the technological level of the product?

Theoretical Background

Conceptualisation of Value

Authors propose differing conceptualizations e.g., Anderson (1995) and Wilson & Jantrania (1995) conceptualize relationship value as a function of relationship benefits (economic, strategic and behavioral benefits) received by a trading partner. This view of relationship value is supported in other studies of business and industrial marketing that various economic benefits arise value i.e., increased revenues, higher profitability due to reduced transaction costs in long-term buyer-seller relationships (Anderson & Narus, 1990; Anderson & Weitz, 1982; Dwyer et al., 1987; Ford, 1990; Hakansson, 1982; Hardwick & Ford, 1986; Kim & Frazier, 1997; Morgan & Hunt, 1994; Ritter & Walter, 2012; Ryssel et al., 2004; Sun et al., 2014; Ulaga, 2003; Walter & Ritter, 2003). However, this approach is criticized by other authors e.g., Cui & Coenen (2014) and Holm et al. (1999) and Lapierre (2000) in their studies focusing on buyer that there are a variety of costs like poor service standard; risk of opportunism; opportunity cost of alternative supplier relationships and suggest that relationship value can be better assessed by comparing benefits and costs of the business relationship. The benefit-cost tradeoff approach is consistent to the value studies in consumer marketing literature e.g., (Ravald, & Gronroos, 1996).

Amongst the studies that propose benefit-cost tradeoff approach, no consensus can be reached on which attributes to be considered to measure benefits and costs. Holm et al. (1999) and Walter et al. (2001) consider only revenue as benefit whilst some authors e.g., Eggert & Ulaga (2002) consider quality as the only benefit factor and price as the only cost factor. Lapierre (2000) consider ten types of benefits and three types of costs. Ulaga & Eggert (2006) use six relationship benefits (product quality, delivery performance, service support, personal interaction, know-how and time to market) and three costs (direct product costs, acquisition costs and operations costs). Consistent to this, Corsaro & Snehota (2010) report six benefits and three costs. Blocker’s (2011) study of five different cultures identified four benefits (offer quality, personal interaction, service support and know-how) and three costs (direct product costs, acquisition costs and operations costs).

Supplier’s Perspective of Value

There are only a few studies that investigate the supplier’s perspective of relationship value e.g., Gadde, & Snehota (2000); Walter et al., (2001); Lai et al. (2015). No consensus found in these studies about the nature of relationship value. Walter et al. (2001) use direct and indirect functions for value creation. Direct functions comprise cost reduction, quality, volume and safeguard. Indirect functions comprise innovation, marketing, scouting and social support. Gadde & Snehota (2000) use two types of benefits (cost saving and revenue). Various studies indicate that in addition to revenue, suppliers can gain other benefits e.g., product ideas, technologies and/or market access from their customers (Wilson, 1995). Partners also receive various kinds of social value e.g., friendship developed with the partner; cooperative sentiments and a trusting environment which makes the relationship enjoyable for the parties (Lapierre, 2000; Wilson & Jantrania, 1995). Lai et al. (2015) developed and tested a scale comprising six benefits of “customer service”, “relationship interaction”, “cost lowering”, “promotion assistance”, “product sales” and “information offering” to capture a supplier’s perception of relationship value. Earlier studies e.g., Anderson et al., 1994 and Hakansson & Snehota 1989 and Van Bruggen et al. (2005) discuss many benefits that suppliers obtain from customers such as product ideas, experience, technology and entry into markets. Lai et al. 2010 examined supplier’s perspective of relationship value in cross-border relationships and reported benefits and sacrifices including information offering, market expansion, product innovation, network interaction and marketing cost.

However, there has not been an adequate effort to consider costs/problems/sacrifices in driving the value perceptions. Recently, Chicksand & Rehme’s (2018) research highlights direct benefits and sacrifices as well as indirect benefits and sacrifices from a supplier’s perspective. Direct benefits include revenue improving, operational and risk reduction whereas direct sacrifices include the cost of learning and adapting processes and keeping inventory. Indirect benefit include access to new markets and indirect sacrifices/costs associated with investing in developing and managing the relationship with the customer, as well as becoming dependent on the customer for fear of losing revenue.

Nature of the B2B Market-High or Low Technology Product

There is a limited discussion of how the technological level of the product affects value perceptions of the firm. This is a legitimate topic of inquiry as earlier studies e.g., Gardner et al. (2000) discuss that significant differences exist between high technology and low technology products and alternative strategies are required to market them. Despite the significance of technology aspect, its impact on customer-supplier relationships has not been extensively studied. Recent qualitative study of Park & Lee (2018) in Taiwanese semiconductor industry highlight the importance of value research in high-technology Industry context. High technology products e.g., telecommunication devices; electronic instruments, microprocessors are innovation focused and their manufacturing involves turbulent technology. Acceptance and usage pattern of high-technology products is unpredictable (Gardner, 2000). Manufacturing these highly sophisticated products requires a considerable involvement of the customer. This close collaboration of the customer and supplier has also been referred as value co-creation (Frow et al., 2015). Low-technology products employ familiar and accepted technology, their usage pattern is not unpredictable (Gardner, 2000) and low-technology products do not require close collaboration between customer and supplier.

Conceptualizing Direct and Indirect Relationship Value

Two types of relationship value emerge from the discussion above- direct value and indirect value. Direct value from a supplier’s perspective mainly involves monetary benefit/loss e.g., revenue, operational cost and inventory cost and this type of value is relevant and important in all relationships irrespective of the product technology. Indirect value component involves nonmonetary benefit/sacrifices associated with customer-supplier relationships e.g., technical collaboration opportunities; learning benefit; access to new markets and this type of value may be more important in relationships involving high technology product.

A Relative-Value Based Concept of the Value Types

Drawing on the existing studies of value in the business and industrial marketing literature and the findings of the qualitative research this paper proposes a relative-value based conceptualization of the direct and indirect value, and develops the measures of the two types of value. A relative-value conceptualization means value determination is a subjective phenomenon. It is based not only on the presence of some relationship attributes like purchase volume or payment, but also on the relative importance of the attributes in the eyes of the supplier. This implies that value of relationship with a particular customer might be different from the point of view of different suppliers as the importance of the attributes may vary from supplier to supplier. Based on this conceptualization, a measure is developed consisting of the degree of availability of a range of attributes and the importance/weighting of the attributes. As this paper tends to investigate the supplier’s perspective of relationship value, the measure is tested using 67 high technology product manufacturers and 65 low technology product manufacturers.

Earlier studies separate value drivers depending upon whether they generate a benefit and cost for the trading firm (Lapierre, 2000; Eggert & Ulaga, 2002). However, this is arguable. Benefits and costs are perceptions of the firm regarding a relationship issue and same issue may arise a benefit for one exchange partner and a problem/cost for the other partner. For example, risk of failure is taken as a sacrifice (Ravald & Gronroos, 1996). Absence of risk implies safe and secure relationship and denotes a benefit. The same driver i.e., risk generates a benefit or cost depending upon the extent to which it is present or absent in the relationship. Thus value drivers cannot be divided into categories like benefits and costs; rather the benefit and/or cost that is generated from the drivers are to be used for value assessment. In consumer marketing literature (Ravald & Gronroos, 1996) purchase price is indicated as a benefit as well as a cost to the buyer.

Qualitative Research for Relationship Value

Thirty in-depth interviews of about two hours each were conducted by the author in that the informants were given opportunity to speak freely about any relationship. A variety of different ways in which value is perceived are reflected in the respondents’ comments stated below e.g., order consistency, customer assistance for new product development; price, payment pattern, reduced risk, which generate ‘benefit’ and ‘cost’ elements leading to value.

“The customer has been regularly ordering and has a consistent purchase pattern. These are the main attributes we value in the relationship. In past years we have dealt with numerous customers, most of them are unpredictable in their purchases, sometimes they order only one unit and at other times they ask for a sizable quantity at a short notice. This creates problems for our firm. So far this customer has been consistent in ordering and we don’t mind that they even asked for a 10 percent drop in the price this year.”

“The main factors that motivates us to keep sticking to this customer is their innovative approach and collaborative attitude. This consumer electronics manufacturer targets rural population and develops new products that are affordably priced for a low income segment. They bring new ideas for developing electronic components and we work on the projects in a collaborative manner. There is a good potential in this market. In this way, we are receiving a good value from this relationship.”

“This customer consistently purchases and never delays payments. They provide a stable stream of revenue to our firm.”

“I have stopped supplying to this buyer because there is no consistency of business. Consistency is important to remain competitive in the market.”

“This customer is a joy to work with. They exactly know how we work. It saves a lot of time and energy.”

The qualitative interviews led to identify eight drivers of value that are listed below. Payment, volume of purchase, order consistency, and cost reduction are monetary in nature driving direct value. Information and learning; Collaboration for technical advancement, ease of negotiating, coordinating and decision making, and adaptation are identified as drivers of indirect value.

Direct Value Drivers

1. Payment (timely payment)

2. Volume of purchase (order size)

3. Order consistency

4. Cost reduction (less hassles due to working with the same customer, not having to search for new customers etc.)

Indirect Value Drivers

1. Information provision and Learning benefit (information about market Intelligence, knowledge about new products/processes)

2. Collaboration for technical advancement

3. Ease of negotiating, coordinating and making decisions on relationship issues

4. Adaptation

Drawing upon the past studies of value in business-to-business marketing, the findings of qualitative interviews, and insights from the literature of organisation psychology and personal relationships, the following section discusses the conceptualization of relationship value that is developed in this study.

Relative-Value Conceptualisation of Relationship Value

In personal relationships literature, numerous authors e.g., Rusbult (1980;1983) conceptualise as well as empirically report, a two component structure of relationship value- an estimate of the relationship attributes and the importance attached to the attributes. People look for attributes in a particular relationship to satisfy their individual needs e.g., humor or liking for a particular sport. The relationship value would vary from person to person depending upon the attributes that are desired and those that are not desired. Farrell & Rusbult (1981) and Rusbult & Farrell (1983) empirically report a two-component relationship value in employee-organisational relationships also. The qualitative interviews of managers also confirmed that relationship value is evaluated by ‘benefit-cost discrepancy’ and ‘relative importance’ of specific attributes like volume; consistent ordering. Thus, using a multiattribute model approach, a measure of relationship value is developed as it requires the estimate of the relative importance of each attribute and the estimate of benefit or cost on each attribute. Multiattribute models have been applied in the past in consumer behaviour research (Mazis et al., 1975; Wilson & Lichtenthal, 1985); in industrial buying behaviour (Moller, 1981; Moller, 1985; Wilson, 1975; Wilson & Mummalaneni, 1986); in services marketing area (Parasuraman et al., 1985).

The relationship attributes are likely to vary in terms of importance to the suppliers. The relative importance of attributes is obtained by asking the respondents to complete a constant sum importance scale (refer to Appendix A). The respondents allocated 100 points over the four attribute categories so as to reflect how important they are in providing value in a long lasting relationship with the focal trading partner. Accordingly weighted, the importance of attributes is used in the subsequent analysis (that is, weight*degree of presence or absence of attribute).

Mathematically:

Direct (indirect) value for the trading partner = (percentage importance of attribute I)* (benefit from I - cost incurred of problem faced on I) where I varied from 1 to 4 (refer to the previous section for value attributes).

Relationship Quality

The present study seeks to investigate the role of relationship value in strengthening the relationship. In buyer-seller relationships literature, authors e.g., Smith (1998) view relationship quality as an important construct reflecting strength of a particular business relationship. Relationship quality is viewed as a higher order construct composed of trust and satisfaction (Crosby et al., 1990; Cui & Coenen, 2014). Existing studies of value and satisfaction differ in their view of these constructs. In services marketing, McDougall & Levesque (2000) discuss difficulty of distinguishing perceived value and satisfaction due to common characteristics these constructs possess. Spreng & Mackoy (1996) reported that customers subjectively evaluate performance attributes based on a set of standards they observe when developing judgments on quality. Similar to this, Powers & Dawn (2008) evaluate the perceived value of various alternatives relative to a multi-attribute reference point. However, numerous authors view relationship value and quality as distinct constructs (Cui & Coenen, 2014; Iacobucci et al., 1995; Ostrom & Iacobucci, 1995). According to the empirical research in this field, relationship value can be considered as an antecedent of relationship quality (Ulaga & Eggert, 2006a).

Trust

Trust is said to be a vital component of business relationships (Anderson & Narus, 1990; Doney & Canon, 1997; Dertouzous et al., 1989; Eriksson & Hallen, 1995; Ferro et al., 2016; Hau & Ngo, 2012; Jiang et al., 2011; Jukka et al., 2017; Morgan & Hunt, 1994; Mpinganjira et al., 2017; Young, 2006). Anderson & Narus (1990) refer trust as the firm’s belief that another company will perform actions that will result in positive outcomes for the firm, as well as not take unexpected actions that would result in negative outcomes for the firm. A similar view is adopted by Moorman et al. (1993) that trust is a willingness to rely on an exchange partner in whom one has confidence (based on “a belief, sentiment or an expectation about an exchange partner that results from the partner's expertise, reliability, and intentionality.”

Satisfaction

Satisfaction is an important construct in Business marketing literature. Numerous authors define satisfaction as an affective state developed based on the evaluation of the relationship with a particular exchange partner or the degree of fulfilment of the expectations of each partner in an exchange relationship (Anderson & Narus, 1990; Frazier & Summers, 1986; Han et al., 1993). Various studies of satisfaction link this construct to other relationship factors. Eggert & Ulaga, 2002; Ravald & Gronroos, 1996 discuss the positive effect of satisfaction on repeat purchase or loyalty. According to Yi (1990), satisfaction can be defined as the customer’s response to the evaluation of the perceived discrepancy between some comparison standard and the perceived performance. Following Crosby et al. (1990), Cui & Coenen (2014), and Wray et al. (1994), relationship quality construct in the present study is composed of trust and satisfaction.

Hypotheses Development

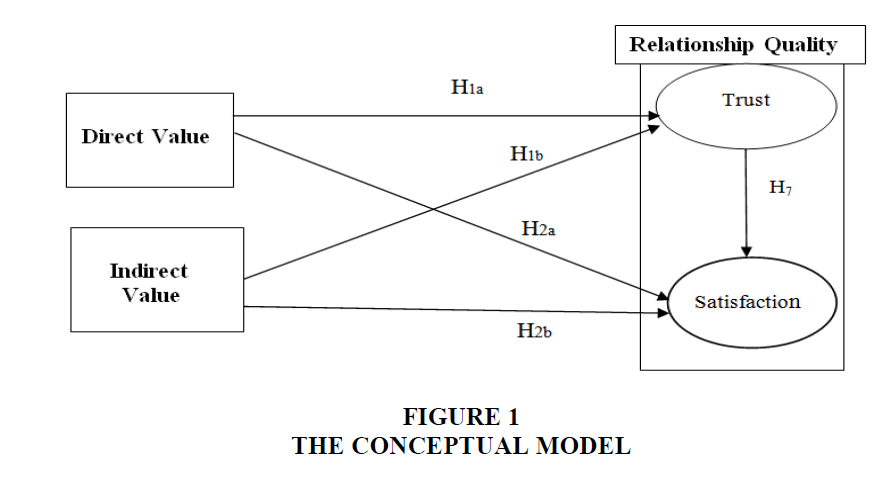

Figure 1 presents the hypothesised linkages.

An exchange partner does some evaluation of integrity and reliability to ensure that a potential partner's word is taken as credible before trust is established (Doney & Cannon, 1997). Williamson’s (1993) view of calculativeness associated with relationship continuation reflects that there is a value assessment underlying relationship development. A positive link exists between relationship value and trust because when firms realize that it is beneficial to maintain the exchange relationship, feeling of risk in dealing with the partner decreases and a confidence develops in the capabilities and motivation of the partner (Young, 2006). Economic gain is seen as a form of value in B2B relationships literature. Trusting parties do not have to engage extensively in activities such as monitoring the partner or building safeguards (through contracts) in the relationship. The reduction of such costs increases the value of the relationship (Walter et al., 2000). Indirect value arising from the relationship such as information; referrals; resource access (Walter et al., 2003; Walter et al., 2001; Wiley et al., 2005). Partners look for opportunities for relationship enhancement by exchanging strategic information, joint product development projects, or by integrating some of the business functions (Selnes, 1998). A positive link between value co-creation and relationship quality is also reported in recent studies (e.g., Chang et al., 2017; Day & Chuang, 2016; He et al., 2018, Sánchez & Santos-Vijande, 2015; Tsai, 2015). Hence hypothesis 1a and hypothesis 1b:

H1a. Supplier’s perception of direct value will positively impact upon trust in the customer.

H1b. Supplier’s perception of indirect value will positively impact upon trust in the customer.

In customer-supplier relationships, various studies have reported a positive link between the value perceived by the customer and satisfaction experienced within a particular customer-supplier relationship (Blocker, 2011; Eggert & Ulaga, 2002; Ruiz-Molina et al., 2015; Gil-Saura et al., 2018; Ulaga & Eggert, 2006a; Woodruff, 1997). Some authors report adding value to the basic market offer may improve customer satisfaction (Walter et al., 2003). Grönroos (1997) suggests that the success of a relationship that is mutually profitable for the supplier and buyer depends on the ability to continuously provide episode value and relationship value. Episode value is improved by increasing the benefits and/or reducing the sacrifice for the buyer. This will improve satisfaction of the buyer and stimulate repurchasing. Grounded in the conceptualisation of relationship marketing, this study supposes that supplier’s higher perception of value in a particular exchange relationship leads to higher degree of satisfaction. Hence:

H2a: Supplier’s perception of direct value will positively impact upon satisfaction with the relationship.

H2b: Supplier’s perception of indirect value will positively impact upon satisfaction with the relationship.

Low technology products e.g., stationery; office furniture; industrial supplies; tools and accessories; packaging equipment; sports goods do not require much customer involvement and collaboration in manufacturing. These goods are purchased by straight rebuy approach and the supplier’s perceived value is mostly driven by the quantity ordered, and order and payment consistency. Indirect value e.g., ease of working with the customer may also play some role in developing trust and satisfaction, however as compared to direct value their impact would be much less. Hence:

H3: For a supplier of low technology product, direct value will have a stronger impact on trust than indirect value.

H4: For a supplier of low technology product, direct value will have a stronger impact on satisfaction than indirect value.

The role of indirect value varies according to the technology of the product. High technology industries e.g., semiconductors; information technology; medical instruments; robotic equipment rely a lot on the information received from the customer in regards to designing and customising the products to meet their expectation. This arises opportunities for joint research and development for innovating products and technologies, and the participation in these projects demonstrates customer’s interest. Resources of time; technical expertise and infrastructure are invested by both sides for realizing rewards in future years. Supplier’s trust in customer grows stronger due to the commitments demonstrated by the customer. In low technology industries there is a limited opportunity for developing new products and processes. Products are generally standardized and the value is mostly driven by units sold and payments. Therefore, in low technology product, indirect value is limited and its effect on developing trust and satisfaction will be relatively lesser than that in a high technology product. Hence:

H5: The effect of indirect value on trust is greater in high technology product rather than a low-technology product.

H6: The effect of indirect value will be greater on satisfaction in a high technology product rather than a low-technology product.

There is no consensus regarding the link between trust and satisfaction. There are studies that position satisfaction as an outcome of trust (Ruekert & Churchill, 1984; Svensson et al., 2010). Whereas other authors view that satisfaction precedes trust (Geyskens et al., 1999; Moliner et al., 2007). Ferro et al. (2016) found a positive impact of trust on satisfaction in manufacturer-supplier relationships. Following Ferro et al. (2016) a positive effect of trust on satisfaction is hypothesised.

H7: Trust will have a positive impact on satisfaction.

Research Methodology

Item Generation, Sample and Data Collection

Table 1 presents the fourteen industries identified for the study: seven in the low technology category and seven in the high-technology category. The low technology industries were office furniture, stationery, building materials, textiles, industrial supplies, food and beverage, and sport goods, and the high-technology industries selected were electronic components, robotic equipment, medical devices, information technology products, telecommunication equipment, industrial machinery, and automobile components. Past studies e.g., Lucas (1986) assessing innovative effort in high vs. low technology used a similar approach in categorizing industries.

| Table 1: Sample Characteristics | |

| Product traded | High technology product suppliers |

|---|---|

| Automobiles components | 18% |

| Electronic components | 13% |

| Telecommunications equipment | 15% |

| Robotic equipment | 12% |

| Information technology | 18% |

| Medical devices | 13% |

| Industrial engineering | 11% |

| Total | 100% |

| Low technology product suppliers | |

| Sports goods | 14% |

| Textiles and fabrics | 15% |

| Food and beverage | 17% |

| Furniture | 13% |

| Building construction | 12% |

| Stationery | 18% |

| Industrial supplies | 11% |

| Total | 100% |

Appendix a presents the study measures. The measures of direct and indirect relationship value are listed based on the method described in the qualitative research section. Trust measures were adapted from (Svensson et al., 2006; The IMP project Group, 1982). Satisfaction measures adapted from (Andaleeb, 1996; Ferro et al., 2016). The field work was conducted in India. The selection of firms for data collection started by contacting various industrial organizations in India e.g., Chambers of Commerce, Industrial Development Banks and Corporations, Industrial Credit Corporations and Business councils and Indian importers and exporters association which provided a list of members 100 firms based in the metropolitan cities were selected from each category. The respondents were told that they should focus the interview on a particular business relationship which they considered important for their firm and they would not disclose the name of the other firm they were describing. It was ensured that the informant was the person in the firm who most frequently interacted with the customer firm and consequently the most knowledgeable about the relationship. When contacted, 25 of these refused to participate further in the study. Out of the 175 firms left, 67 high technology suppliers and 65 low technology supplier were finally selected as the volume of purchase was large and/or the product traded was significant to the production process of the customer business. As would be expected in preferred customer relationships, a majority of the respondent firms (67%) are selling a substantial portion of (60-100%) of the business to their customers. The questionnaire was pretested and amended as per the suggestions received from pre-test respondents and experts in business-to-business marketing. The questionnaire was largely self-completed but in the presence of a field staff so that any queries of the respondent could be answered. Five field staff with high levels of marketing expertise including academics and experienced marketing professionals were recruited and trained to assist in the data collection. The author organized and supervised the fieldwork as well as participated in the data collection. Senior marketing executives were asked to self-select a current relationship with a particular buyer the company had for a period of at least 5 years. The informant was generally a senior marketing manager who possessed a university degree, significantly involved in the selling and was a direct participant in the relationship with the trading partner. The respondents were also asked to report profitability, criticality and volume of product traded, and some demographic questions about themselves, their company, and their trading partner. The range of the respondent’s age was 34 to 48 years and the mean experience in purchasing was 16 years.

Data Analysis

The distribution properties for each item were assessed using histograms and normal probability plots. No item appeared to have a serious departure from the normal distribution. Convergent validity of direct and indirect value was examined by assessing the benefit and cost experienced over the four attributes identified for each type of value. A strong correlation was found in the ratings representing perceived benefit experienced over the four attributes for each type of value. Similarly, the ratings representing the cost incurred/problem experienced were also strongly correlated. Together the benefit and the cost ensured convergent validity of direct value and indirect value. For trust and satisfaction, first a principal components factor analysis with verimax rotation was performed on the measures and the items were examined following (Hair et al., 1998 & Churchill, 1979). Using Nunnally (1978) a minimum lower threshold of 0.7 for Cronbach Alpha was set. The factor loadings in the principal components factor analysis are high (ranging from 0.82 to 0.84) showing only one factor to be present in the items measuring one construct. Table 2 and Table 3 present the results of confirmatory factor analysis of trust and satisfaction in high technology and low technology sample respectively. High factor loadings (0.81 to 0.85) demonstrate unidimensional nature of the scales of trust and satisfaction. The composite reliability (CR) was high (ranging from 0.82 to 0.84), and the average variance extracted (AVE) (ranging from 0.70 to 0.72) confirmed good association between the items measuring a particular construct (Fornell & Larcker, 1981).

| Table 2:

Confirmatory Factor Analysis Of Trust And Satisfaction (High Technology) |

|||

| Construct | Indicators | Standardized Loading | Reliability measures |

|---|---|---|---|

| Trust | CT1 | 0.82 | CR = 0.82 |

| Mean= 4.75 | CT2 | 0.83 | AVE = 0.70 |

| SD =0.53 | CT3 | 0.81 | Cronbach Alpha = 0.86 |

| CT4 | 0.82 | ||

| Satisfaction | ST1 | 0.84 | CR = 0.84 |

| Mean = 4.33 | ST2 | 0.83 | AVE = 0.72 |

| SD = 0.51 | ST3 | 0.80 | Cronbach Alpha = 0.82 |

| ST4 | 0.81 | ||

CR= composite reliability AVE = average variance extracted

| Table 3: Confirmatory Factor Analysis Of Trust And Satisfaction (Lowtechnology) | |||

| Construct | Indicators | Standardized Loading | Reliability measures |

|---|---|---|---|

| Trust | CT1 | 0.85 | CR = 0.84 |

| Mean= 4.73 | CT2 | 0.84 | AVE = 0.72 |

| SD =0.52 | CT3 | 0.83 | Cronbach Alpha = 0.83 |

| CT4 | 0.81 | ||

| Satisfaction | ST1 | 0.84 | CR = 0.83 |

| Mean = 4.35 | ST2 | 0.81 | AVE = 0.70 |

| SD = 0.52 | ST3 | 0.83 | Cronbach Alpha = 0.83 |

| ST4 | 0.82 | ||

CR= composite reliability AVE = average variance extracted.

For examining discriminant validity, using the guidelines suggested by Anderson & Gerbing (1988), the study first assessed measurement model using AMOS version 24.0 (IBM SPSS AMOS) before testing hypothesised linkages presented in the Figure 2. The model fit indices provided evidence of solid and reliable measures of all study constructs. For low technology sample, Chi square was (42.24) at degrees of freedom 36 (chi sq./df=1.17), goodness of fit index (GFI)=0.95, comparative fit index (CFI)=0.95, incremental fit index (IFI)=0.96, Tucker Lewis index (TLI)=0.93, root mean square residual (RMR)=0.05 and root mean square error of approximation (RMSEA) =0.06. For high technology sample, Chi square was (38.56) at degrees of freedom 36 (chi sq./df=1.07), goodness of fit index (GFI)=0.95, comparative fit index (CFI)=0.93, incremental fit index (IFI)=0.95, Tucker Lewis index (TLI)=0.92, root mean square residual (RMR)= 0.05 and root mean square error of approximation (RMSEA)=0.05. To further test the discriminant validity and unidimensionality, the value of the correlation between pairs of constructs was equated to unity by presuming that the two latent constructs were alike (Bagozzi & Philips, 1982). The measurement model was re-estimated after so constraining each pair of constructs. Following the sequential chi square differential method (Anderson & Gerbing, 1988). The chi square differential was obtained to ensure that the constructs are unique. The discrimination of all constructs is supported as in all cases, the chi square statistic of the constrained model was significantly higher than the unconstrained model indicating a poorer fit for the constrained model. The lower goodness of fit index and a greater root mean square of approximation of the constrained models further support the discriminant validity of the constructs. Following Gaski (1984), to even further test discriminant validity, the alpha coefficient of the scales was compared with their correlation coefficients with the other constructs (refer to Table 10 and Table 11 for correlation coefficients in the high and low technology samples). Cronbach alpha was found to be always higher than inter-construct correlation coefficients. As the size of both samples was less than 200, structural equation modeling was not considered suitable for hypotheses testing (Garver & Mentzer, 1999; Hoelter, 1983).

Results

Table 4 presents mean ratings (out of a possible 100 points) of the four relationship attributes for each value type and the differences in mean importance of attributes in high technology and low technology segments, the first part of value. The results indicate that on an average, the greatest importance is attached to payment in the direct value with an average of 45.38 out of 100 points assigned to it in the low technology sample and 38.21 in the high technology sample. The second most important attribute of direct value is volume that has an average of 22.46 out of 100 points in the low technology sample and 24.48 in the high technology sample. Order consistency and cost reduction have a similar averages in both samples. There are no significant differences in the averages in the two samples as shown by the results of analysis of variance.

High technology and low technology samples show a significant difference in the importance of all of the four attributes of indirect value. Technical advancement has the greatest importance for the high technology sample 38.91 out of 100 points whereas only 15.64 in the low technology sample. Ease of negotiation is similar in weighting to information and learning in the high technology sample but there is a significant difference in these two attributes in the low technology sample. While information and learning benefit shows low importance in the two samples (an average of 16.10 out of 100 in the high technology sample and 8.62 in the low technology sample), the two weightings are significantly different. Overall, these results are line with expectations as high technology suppliers and low technology suppliers associate different importance to relationship attributes. Table 5 presents a comparative view of the most and the least important attribute in both the two samples.

The second component of relationship value is benefit and/or cost ratings assigned to each relationship attribute. The respondents were asked to consider the amount of benefit delivered by their trading partner on each relationship attribute. Table 6 presents the average benefit ratings given by all respondents. It is interesting to note that all the attributes are rated above the mid-point of the scale i.e. 2.5 for the scale anchored at 1 (no benefit at all) and 5 (large benefit) by both high technology and low technology samples.

A comparison of Table 6 with Table 4 provides some useful insights to the trading relationships surveyed. Payment is the most important attribute re Table 4 and it is delivering the maximum benefit (4.04). However in high technology sample, technical advancement is the most important attribute of indirect value (38.91/100 re Table 4) the benefit delivered on this attribute is not the maximum (4.43 compared to 4.50 for information benefit). Adaptation was the second most important in the high technology sample (29.85) but it is delivering the least benefit (4.22). Overall these results indicate that supplier’s expectations in regards to the most important attributes are not met by the customer. Several differences emerged between the high technology and low technology segments as the benefit received on the indirect value attributes is significantly different.

| Table 4: Mean Importance (Relative Weighting) Associated With Value Drivers | |||

| Attribute | Mean importance (High technology suppliers 67) |

Mean importance (Low technology suppliers 65) |

Anova sig. |

|---|---|---|---|

| Payment | 38.21 | 37.38 | 0.95 |

| Volume of purchase | 24.48 | 22.46 | 0.67 |

| Order consistency | 19.09 | 20.11 | 0.56 |

| Cost reduction | 18.22 | 20.05 | 0.34 |

| Information | 16.10 | 8.62 | 0.00 |

| Tech. advancement | 38.91 | 15.64 | 0.00 |

| Ease of nego | 15.14 | 38.82 | 0.00 |

| Adaptation | 29.85 | 36.92 | 0.00 |

To measure the second component of relationship value i.e. problems faced by the respondent firm in dealing with the exchange partner, the respondents were asked to rate the problem faced or the amount of cost incurred on the relationship issues on a scale ranging from 1 to 5, with 1 being no problem or cost incurred and 5 being large problem or heavy cost incurred. The differences of mean problem ratings in the high technology and low technology segments were also tested. Table 7 reproduces the results of relationship problems. None of the attributes were rated high on the problem scale with the highest rating for the sample as a whole being 1.59 for order consistency. This reflects the nature of the sample. Good quality, important relationships have led to evaluations of relationships high in benefit and low in cost.

| Table 5: The Most And The Least Important Relationship Attribute In High And Low Technology Industry | ||

| Technology/attribute | Most important attribute | Least important attribute |

|---|---|---|

| High technology | Technical advancement | Information |

| Low technology | Ease of negotiation | Information |

| Table 6 : Mean Relationship Benefit Rating By The Product Technology | |||||

| Attribute | Overall Mean benefit(N 132) | Std. Dev. | Mean Benefit rating High tech. (67) |

Mean Benefit Rating Low tech. (65) |

Anova Sig. |

|---|---|---|---|---|---|

| Payment | 4.04 | 0.74 | 4.06 | 4.02 | 0.70 |

| Volume | 3.66 | 1.14 | 3.82 | 3.40 | 0.67 |

| Order consistency | 3.89 | 0.82 | 3.94 | 3.83 | 0.23 |

| Cost reduc. | 3.74 | 0.84 | 3.76 | 3.70 | 0.65 |

| Information | 4.27 | 0.71 | 4.50 | 4.12 | 0.00 |

| Tech. adv. | 4.23 | 0.84 | 4.43 | 3.85 | 0.00 |

| Ease of nego. | 3.82 | 1.15 | 4.33 | 3.24 | 0.00 |

| Adaptation | 4.20 | 0.76 | 4.24 | 4.17 | 0.01 |

Scale: 5=large benefit, 1=no benefit at all.

Combining the above components to represent relationship value, the weighted values of the four issues were computed for direct value in the high technology and low technology samples, and then average weighted value was also computed for each issue for both samples. Weightings of relationship attributes were computed by dividing the assigned points (Refer Table 4) by 100 and taking the average across all respondents in the high technology sample and the low technology sample. The difference between the benefit and cost ratings was obtained for each value attribute and was multiplied by the importance to compute mean weighted value of that attribute. Table 8 indicates that the weighted value associated with payment was greater than the other three issues (1.06 and 1.10 in the high technology sample and the low technology sample respectively) implying that payment delivers more direct value than any other relationship attribute. It is noteworthy that in the high technology sample, the weighted value associated with technical advancement (1.17) was greater than all the issues of direct value and the other three issues of indirect value. It was also significantly greater than the technical advancement (0.37) in the low technology sample. This means technical advancement is delivering more value to a high technology product supplier than to a low technology product supplier. A comparison of the results in Table 8 with Table 4 indicates that the same attribute- payment is influential in generating benefit (4.06 and 4.02 in high technology sample and low technology respectively) and weighted value (1.06 and 1.10 in high technology and low technology respectively). Probably this is due to the fact that the cost incurred in the relationship (1.29 and 1.56 as per Table 3) are quite low and do not provide much discrimination. The benefit on information and learning attribute is rated the highest (4.50) in the high technology sample. Interestingly the cost/problem on this attribute is low (1.36) yet the weighted value is low (0.50). The reason for the low weighted value is low importance associated with this attribute (16.10).

| Table 7: Mean Relationship Problem Rating By The Role Of The Product Technology | |||||

| Attribute | Overall problem(N132) | Std. dev. | Mean Problem rating High technology (67) |

Mean Problem rating Low technology (65) |

Anova sig. |

|---|---|---|---|---|---|

| Payment | 1.39 | 0.64 | 1.29 | 1.56 | 0.01 |

| Volume | 1.37 | 0.73 | 1.22 | 1.64 | 0.00 |

| Order consistency | 1.59 | 0.74 | 1.58 | 1.59 | 0.98 |

| Cost reduction | 1.42 | 0.65 | 1.34 | 1.55 | 0.05 |

| Information | 1.35 | 0.54 | 1.36 | 1.32 | 0.66 |

| Technical advancement | 1.45 | 0.65 | 1.42 | 1.52 | 0.51 |

| Ease of negotiation | 1.41 | 0.62 | 1.35 | 1.49 | 0.15 |

| Adaptation | 1.38 | 0.59 | 1.35 | 1.43 | 0.46 |

| Table 8: Mean Weighted Value Of Relationship Attributes By Product Technology | |||||

| Attribute | Mean weighted value (N 132) | Std. dev. | High technology (67) | Low technology (65) | Anova sig. |

|---|---|---|---|---|---|

| Payment | 1.08 | 0.44 | 1.06 | 1.10 | 0.01 |

| Volume | 0.57 | 0.87 | 0.65 | 0.39 | 0.00 |

| Order consistency | 0.46 | 0.24 | 0.45 | 0.47 | 0.00 |

| Cost of reduction | 0.34 | 0.46 | 0.44 | 0.24 | 0.01 |

| Information | 0.37 | 0.23 | 0.50 | 0.24 | 0.00 |

| Technical advancement | 1.27 | 0.15 | 1.17 | 0.37 | 0.00 |

| Ease of negotiation | 0.55 | 0.34 | 0.43 | 0.68 | 0.00 |

| Adaptation | 0.94 | 0.27 | 0.86 | 1.01 | 0.00 |

Direct value was computed by summing the four weighted values of payment, volume, order consistency and cost reduction in the two samples. Mean direct value is 2.61 for the high technology product sample and 2.20 for the low technology product sample. An analysis of variance test revealed that direct value was greater for the high technology product sample than for the low technology product sample at 0.01 level of significance. Similarly the indirect value was computed by summing the weighted values of information and learning benefit, technical advancement, ease of negotiation and coordination, and adaptation in each sample. Indirect value for the high technology sample is 2.96 and the low technology sample is 2.30. There is a significant difference in the indirect value in the two samples at 0.01 level of significance. It is noteworthy that the high technology product suppliers are receiving a higher indirect value as compared to direct value (2.96 and 2.61 respectively). For the low technology suppliers, the indirect value and direct value are approximately equal (2.3 and 2.2 respectively).

Test of Hypotheses

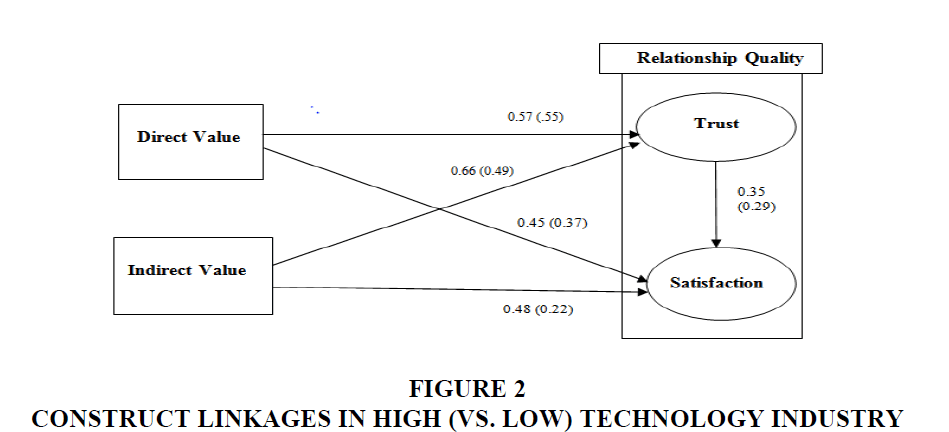

Hypotheses were tested by analysing the structural model shown in Figure 1 for the high technology sample and low technology sample. The model fit indices of the path model suggested a reasonable fit of data in the high technology sample (chi square=26.38 at 22 df; chi sq/df=0.96), GFI=0.94, CFI=0.96, NFI=0.96, IFI=0.95, TLI=0.92, standardized root mean square residual (SRMR)=0.06, and RMSEA=0.05. The model fit indices of the path model in the low technology sample (chi square=29.56 at 21 df; chi sq/df=0.91), GFI=0.95, CFI=0.95, NFI=0.95, IFI=0.94, TLI=0.93, standardized root mean square residual (SRMR)=0.05, and RMSEA=0.05. Based on the standardized coefficients (refer to Table 9), it is possible to accept hypothesis 1a that the higher the direct value, the higher the trust in the customer (standardized coefficient 0.57 and 0.55 in the high technology sample and the low technology sample respectively, p <.01). Hypothesis 1b is also supported as the standardized coefficient for the effect of indirect value on trust is positive and significant in both samples (0.66 and 0.49 for the high technology sample and low technology sample respectively, p<0.01 for both). Results also support hypotheses 2a that the higher the direct value, the higher the satisfaction (standardized coefficient 0.45 and 0.37 in the high technology sample and low technology sample respectively, p<0.01). There is adequate support for hypothesis 2b that the higher the indirect value, the higher the satisfaction (standardized coefficient 0.48 and 0.22 in the high technology sample and low technology sample respectively, p<0.01). As stated above, for the low technology sample, the standardized coefficient for direct value on trust (0.55) is higher than that of indirect value (0.49) supporting hypothesis 3. Consistent to this, the standardized coefficient of direct value on satisfaction is higher (.37) than that of indirect value (0.22), supporting hypothesis 4. Hypothesis 5 is supported by comparing the standardized beta coefficients of indirect value on trust in the two samples. As expected, for the high technology sample, the standardized coefficient is higher (0.66) than that in the low technology sample (0.49). The results also supports Hypothesis 6 as the effect of indirect value on satisfaction is stronger in the high technology sample (0.48) than that in the low technology sample (0.22). Hypothesis 7 is supported as trust has positive standardized coefficient for satisfaction in both samples (0.35 and 0.29 for the high technology sample and the low technology sample respectively, p<0.01).

Figure 2 presents a comparative view of the strength of links between the constructs. The coefficient inside the parentheses are for the low technology sample and outside the parentheses are for the high technology sample.

| Table 9: Standardized Coefficients Of Structural Model | ||

| Hypothesis | High technology Sample | Low technology sample |

|---|---|---|

| H1a: Direct value trust→ | 0.57* | 0.55* |

| H1b: Indirect value trust→ | 0.66* | 0.49* |

| H2a: Direct value Satisfaction→ | 0.45* | 0.37* |

| H2b: Indirect value Satisfaction→ | 0.48* | 0.22* |

| H7: Trust Satisfaction→ | 0.35* | 0.29* |

*p <0.01 level.

| Table 10: Correlation Matrix (High Technology) | |||||

| Construct | 1 | 2 | 3 | 4 | |

|---|---|---|---|---|---|

| Trust | 1.00 | ||||

| Satisfaction | 0.49** | 1.00 | |||

| Direct value | 0.38** | 0.28** | 1.00 | ||

| Indirect value | 0.41** | 0.32** | 0.25** | 1.00 | |

Significant at ** 0.01 levels

| Table 11: Correlation Matrix (Low Technology) | |||||

| Construct | 1 | 2 | 3 | 4 | |

|---|---|---|---|---|---|

| Trust | 1.00 | ||||

| Satisfaction | 0.48** | 1.00 | |||

| Direct value | 0.47** | 0.39** | 1.00 | ||

| Indirect value | 0.36** | 0.31** | 0.26** | 1.00 | |

Significant at ** 0.01 levels

Discussion

Despite a continuous research to explore the nature and role of relationship value for the past two decades there are issues requiring attention. Past research of relationship value in the literature of business and industrial marketing uses differing approaches and conceptualisations of this construct, and the nature of its association with relationship quality is disputed. This study is a step forward in understanding the concept as two types of relationship value are conceptualised based on the monetary benefits/costs (direct value) and nonmonetary benefits/costs (or indirect value). While the extant research has identified numerous values creating attributes there has been a lack of the knowledge of how the attributes form perceptions of relationship value. Drawing on the work that considers the nature and role of value (in the literatures of interpersonal psychology, organisational psychology and behaviour, economics, consumer marketing, and business and industrial marketing) and integrating this with the findings of the qualitative research, a relative-value based conceptualisation of each type of relationship value is developed. The evaluation of relative-value involves two aspects: a benefit-cost discrepancy regarding relationship issues e.g., payment, cost reduction etc. and the relative importance of each relationship issue to the supplier for maintaining an effective relationship with the customer (Norris & Mcneilly, 1995).

An important contribution of this study is that perceived relationship value varies according to the nature of the product traded. Suppliers of high technology products are more concerned about receiving ideas from their customers regarding new products and technologies; information about market; collaborative projects for innovating products; and adaptations made by customer to accommodate their products. This finding is consistent to the study of Covin et al. (1990) that firms in high-technology industries, relative to those in low-technology industries, place more emphasis on new product development. This study found that suppliers of low technology products are more concerned about payment; volume of sales; regularity of order. The sum-total of relative-values for the relationship issues is equivalent to relationship value. The results of direct value and indirect value using the relative-values support the conceptualisation developed in this paper. The results show that payment delivers more value than the other three attributes driving the direct value for a low technology supplier, and technical advancement delivers more value than any of the issues for a high technology supplier.

In this way this research has produced useful insights by explaining how a particular attribute of value generates a relationship benefit or a relationship sacrifice and thus it is a unique contribution of this research. The literature of business marketing reports the benefit-cost discrepancy as a constituent of value (Cui & Conen, 2014; Eggert & Ulaga, 2002). The previous work, however, has not considered necessary to weight different attributes. The analysis presented in this paper shows that relationship value involves more than just a trade-off of benefits and cost/sacrifices, as relative weighting assigned by respondents to various attributes emerged as a significant component of the direct as well as indirect type of relationship value. Recent studies e.g., Cui & Conen (2014) found positive association between price and relationship value. This is contrary to the conceptualisations of previous studies that recognise price as a relationship cost. The present study can explain the positive association of price (payment) and value as the relative-value of price could be positively contributing if the firm perceives a benefit on this attribute. Using the relative-value framework it could be explained how an attribute could generate a benefit in one relationship context and a sacrifice in another relationship. This is because relationship value is differently evaluated by different firms as per the importance attached to a range of relationship attributes. This proves that presence of some attributes could be preferred to a greater extent to the others. The present study constructs a reliable and valid measurement instrument focusing on the mechanism of creation of value from the perspective of suppliers.

The findings contribute to the existing knowledge regarding the role of relationship value in developing trust and satisfaction perceptions of the supplier as the nature of linkages between the constructs are considered more explicitly in this study. Direct value and indirect value play a crucial role in driving relationship quality due to having a strong impact on trust as well as satisfaction. This study is the first to investigate the effect of product technology on the link between relationship value, and the two aspects of relationship quality-trust and satisfaction. Interestingly, for a high technology product supplier, indirect value is more effective for generating supplier’s trust and satisfaction than direct value. The nature of the link between value and quality reverses for a low technology supplier as direct value is found to be more effective than indirect value for developing trust and satisfaction. The findings also further the existing knowledge of relationship quality as direct and indirect value showed a stronger impact on trust than satisfaction. Trust showed a positive impact on satisfaction in both segments consistent with the earlier studies (e.g., Ferro et al., 2016).

Implications

In contrast to much of the past research, this research has a wider scope as it considers suppliers in a variety of industries including automobiles, medical devices, robotic equipment, electronics, telecommunications, engineering, textiles, food & beverages, building material, stationery etc. The findings suggest that relationship value is a major driving force in developing trust and satisfaction of a supplier in the business relationship. Therefore, the aim of those managing the trading relationship must be to enquire what values are the most cherished by the supplier. The nature and structure of relationship value depends upon the presence/absence of specific attributes and their relative importance for the supplier, as mentioned in the previous section. Attributes are not generalizable and care must be taken in including them in value calculation. The usefulness of the proposed conceptualisation of relationship value depends on the firm’s ability to identify the relevant attributes for analysis of relationship value. The attributes used in this study can serve as a guide but there may be other relationship issues that are important to exchange partners. Firms should consider using such research techniques as vendor surveys to identify the relevant attributes.

The relationship value tool makes it simple to assess value from a supplier’s perspective. This is possible as an important aspect of the tool is relative importance of value attributes. Customers of high technology products as well as low technology products can give relative importance ranking to the attributes appropriate to their situation. The direct value and indirect value scales showed good reliability and construct validity. The scale could be considerably useful in the future research of customer-supplier relationships.

The establishment of trust is of paramount importance as trust increases satisfaction with the existing customer through more open communication, higher quality decision making, risk taking, and cooperation. Managers must assess supplier’s perceptions of trust and ensure that a high degree of trust exists.

Conclusion

Limitations and Future Research

This study suggests several important research avenues. As the respondents were given freedom to nominate any trading relation for the purpose of this study, this may have affected the results to some extent as firms are inclined to pick good quality relationships (as stated in Young & Wilkinson, 1997). Additional investigation of the study constructs should employ samples involving different type of relationships e.g., good, poor and average.

The number of firms in the high technology and low technology segment was not sufficient to separately perform sophisticated structural modelling. A larger sample can be employed in future to facilitate structural models separately for high technology suppliers and low technology suppliers to investigate the inter-construct linkages. Future research is advised to use random sampling to increase the sample size and to expand generalization. There is also a need to conduct longitudinal studies to provide useful information about whether a change in the level of relationship value precedes or follows a change in the level of relationship quality.

The generalisability of the findings was constrained by the nature of the sample. The sample was drawn from one country alone. Additional investigation of the study constructs is required by employing samples of different countries. This study is unilateral as it explored only one side of the relationship. In future researchers may investigate relationship value generated in cross border relationships from a bilateral perspective.

This research considered only eight attributes to evaluate relationship value. However, more attributes may be influential in generating/diluting relationship value. Additional research could be conducted to investigate the nature and importance of other attributes in determining relationship value.

Additional constructs could also be added to the conceptual model to enrich the present findings. The sample size did not allow the application of sophisticated modelling techniques to analyse various rival models of the present conceptual model e.g., model in which relationship value could be solely composed of benefit-cost discrepancy, the model in which relationship value could be solely composed of benefits. Testing rival models would tell which model explains the nature of customer-supplier relationships in industrial exchanges the best.

There is also a need to consider non-linearity in business relationships. It is likely that many aspects of relationships are not linear in nature. Recent research e.g., Thompson & Young (2012) considers ways that the inevitable non-linearity in business relationships can be better explored. There is a need more quantitative and qualitative longitudinal studies of relations that show how relationship value is realized over time and how this is linked to trust and satisfaction. In this way, a greater knowledge of the causal sequences could be developed.

Appendix a

Study Measures

Trust (Svensson et al., 2006; International Marketing and Purchasing Group, 1982)

1. We feel we can trust this customer completely.

2. We have full confidence in the information provided to us by this customer.

3. We can rely on this customer to keep promises made to us.

4. We are not hesitant to do business with this customer even when the situation is vague.

Satisfaction (Andaleeb, 1996; Ferro et al., 2016)

1. The relationship between this customer and us is satisfying.

2. Our company regrets the decision to work with this customer. (reverse coded item)

3. The relationship between this customer and us is positive.

4. Our firm is content about its relationship with this customer.

Relationship Values

Indicate how important you think each issue is to your firm in ensuring or impeding an effective and valuable relationship with the customer being discussed here. Please allocate 100 points between the four issues in Part a and another 100 points between the four issues in Part b, giving a larger amount of points to more important issues and smaller amount of points to less important issues. If an issue is not important at all, write n/a for it and/or assign 0 points to it.

Part a

Issue points (/100)

1. Payment (how quickly the payment is made, terms of payment)

2. Volume of purchase

3. Order consistency

4. Cost reduction (due to working with the same customer, not having to search for new customers etc.)

Part b

Issue points (/100)

1. Information provision and Learning benefit (information about market intelligence, knowledge about new products/processes).

2. Collaboration for technical advancement.

3. Ease of negotiating, coordinating and making decisions on relationship issues.

4. Adaptation.

For each of the issues, consider how much benefit your customer provides to your firm. Payment large benefit 5 4 3 2 1 No benefit at all does not apply Considering these issues again, tell me the extent to which your firm faces problems or incurs costs. Payment large problem (costs) 5 4 3 2 1 No problem at all does not apply.

References

- Amine, N., Alaoui M.S. (2018). Relational quality, power and impact on value creation and appropriation in the customer-supplier relationship: Modeling test [Qualité relationnelle, Pouvoir et impact sur la création-appropriation de la valeur dans la relation client-fournisseur: Essai de modélisation]. Proceedings of the 32nd International Business Information Management Association Conference, IBIMA 2018 - Vision 2020: Sustainable Economic Development and Application of Innovation Management from Regional expansion to Global Growth, 1187-1209.

- Anderson, E.W. (1995). An economic approach to understanding how customer satisfaction affects buyer perceptions of value. In Proceedings of the AMA Winter Conference, 102-6.

- Anderson, E., & Barton, W. (1992). The use of pledges to build and sustain commitment in distribution channels, Journal of Marketing Research, 29, 18-34.

- Anderson, J.C. & Narus, J. (1990). A model of distributor firm and manufacturer firm working relationships. Journal of Marketing, 54(1), 42-58.

- Biong, H., Wathne, K., & Parvatiyar, A. (1997). Why do Some Companies Not Want to Engage in Partnering Relationships. In Relationships and Networks in International Business Markets, H.G. Gemunden, T. Ritter & A. Walter, eds., Elsevier Science, New York, 91-107.

- Blocker, C.P. (2011). Modeling customer value perceptions in cross-cultural business markets. Journal of Business Research, 64(5), 533-540.

- Chang, Y., Xu, X.H., Wu, Z.X. (2017). The influence of interdependence and value co-creation on relationship quality. International Conference on Management Science and Engineering - Annual Conference Proceedings, August,

- Chicksand, D. & Rehme, J. (2018). Total value in business relationships: exploring the link between power and value appropriation. Journal of Business & Industrial Marketing, 33(2), 174-182

- Corsaro, D. & Snehota, I. (2010). Searching for relationship value in business markets: are we missing something. Industrial Marketing Management, 39(6), 986-995.

- Covin, J.G., Slevin, D.P., & Covin, T.J. (1990). Content and performance of growth-seeking strategies: A comparison of small firms in high- and low technology industries. Journal of Business Venturing, 5(6), 391-412.

- Crosby, L.A., Evans, K.A. & Cowles, D. (1990). Relationship quality in services selling: an interpersonal influence perspective. Journal of Marketing, 54(3), 68-81.

- Cui, Y. & Coenen, C. (2014). Relationship value in outsourced FM services-Value dimensions and drivers. Facilities, 34(½), 43-68.

- Day, M.Y., & Chuang, W.C. (2016). The effect of customer perceived value on relationship quality between illustrator and fans to recommendation on facebook. Proceedings of the 2016 IEEE/ACM International Conference on Advances in Social Networks Analysis and Mining, ASONAM 2016

- Dertouzous, M.L., Lester, R.K. & Solow, R.M (1989). Made in America: Regaining the Productive Edge. Cambridge, MA: The MIT Press.

- Doney, P. & Cannon, J.P. (1997). An examination of the nature of trust in buyer-seller relationships. Journal of Marketing, 61(April), 35-51.

- Dwyer, F.R., Schurr, P.H. & Sejo O. (1987). Developing Buyer-Seller Relationships. Journal of Marketing, 51(April), 11-27.

- Eggert, A. & Ulaga, W. (2002). Customer Perceived Value: A Substitute for Satisfaction in Business Markets? The Journal of Business and Industrial Marketing, 17(2/3), 107-118.

- Eriksson, K. & Hallen, L. (1995). Trust and distrust in business relationships. 11th IMP Conference, Manchester, September.

- Farrell, D. & Rusbult, C.E. (1981). Exchange Variables as Predictors of Job Satisfaction, Job Commitment, and Turnover: the Impact of Rewards, Costs, Alternatives, and Investments. Organizational Behaviour and Human Performance, 28, 78-95.

- Ferro, C., Podin, C., Svensson, G. & Payan, J. (2016). Trust and commitment as mediators between economic and non-economic satisfaction in manufacturer-supplier relationships. The Journal of Business and Industrial Marketing, 31(1), 13-23.

- Ford, D. (1980). The Development of Buyer-Seller Relationships in Industrial Markets. European Journal of Marketing, 14, 339-53

- Ford, D. (1990). Understanding Business Markets: Interaction, Relationships and Networks. Academic Press, London.

- Fornell, C. & Larcker, D. (1981). Structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39-50.

- Frazier, G.L. & Summers, J.O. (1986). Perceptions of interfirm power and its use within a franchise channel of distribution. Journal of Marketing Research, 23(2), 169-176.

- Frow, P., Nenonen, J., Payne, A., & Storbacka, K. (2015). Managing co-creation design: a strategic approach to innovation, British Journal of Management, 26(3), 347-568.

- Gadde, L.E. & Snehota, I. (2000). Making the most of supplier relationships. Industrial Marketing Management, 29(4), 305-316.

- Gao, T. (2017). A Relationship Governance Perspective of Organizational Buyers' Supplier Choice Decisions. Journal of Relationship Marketing, 16(4), 328-342

- Gardner, D.M., Johnson, F., Lee, M., & Wilkinson, I. (2000), A contingency approach to marketing high technology products. European Journal of Marketing, 34(9/10), 1053-1077.

- Garver, M.S. & Mentzer, J.T. (1999). Logistics research methods: employing structural equation modeling to test for construct validity. Journal of Business Logistics, 20(1), 33-57.

- Geyskens, I., Steenkamp, J.E.M. & Kumar, N. (1999). A meta-analysis of satisfaction in marketing channel relationships. Journal of Marketing Research, 36(2), 223-239.

- Gil-Saura, I., Berenguer-Contri, G., Ruiz-Molina, M.E. (2018). Satisfaction and loyalty in B2B relationships in the freight forwarding industry: Adding perceived value and service quality into equation, Transport, 33(5), 1184-1195.

- Gronroos, C. & Helle, P. (2012). Return on relationships: Conceptual understanding and measurement of mutual gains from relational business engagements. Journal of Business & Industrial Marketing, 27(5),344-359.

- Gronroos, C. (1992). Facing the Challenge of Service Consumption: the Economics of Service. In Quality Management in Services. Eds. P. Kunst & Van Gorcum Lemmink. Assen. Maastricht, 129-40

- Hakansson, H. (1982). International Marketing and Purchasing of Industrial Goods -An Interaction Approach, John Wiley and Sons, New York.

- Han, S.L., Wilson, D.T. & Dant, S.P. (1993). Buyer-Supplier Relationship Today. Industrial Marketing Management, 22, 331-38.

- Hardwick, B. & Ford, D. (1986). Industrial Buyer Resources and Responsibilities and the Buyer-seller Relationships. Industrial Marketing and Purchasing, 1, 3-25.

- Hau, L.N. & Ngo, L.V. (2012). Relational marketing in Vietnam: an empirical study. Asia Pacific Journal of Marketing and Logistics, 24(2), 222-235.

- He, J., Huang, H., & Wu, W. (2018). Influence of interfirm brand values congruence on relationship qualities in B2B contexts. Industrial Marketing Management, 72, 161-173.

- Helm, S. (2005). Customer Valuation as a Driver of Relationship Dissolution. Sabrina Helm Heinrich-Heine-Universitaet, Germany, Journal of Relationship Marketing, 3(4), 77-91

- Ho, Y.C., Hsieh, M.J., & Yu, A.P. (2014). Effects of customer-value perception and anticipation on relationship quality and customer loyalty in medical tourism services industry. Information Technology Journal, 13(4), 652-660.

- Hoelter, D.R. (1983). The analysis of covariance structures: goodness-of-fit indices. Sociological Methods and Research, 11(3), 325-344.

- Holm, D.B., Eriksson, K. & Johanson, J. (1999). Creating Value Through Mutual Commitment to Business Network Relationships. Strategic Management Journal, 20(5), 467-486.

- Iacobucci, D., Ostrom, A. & Grayson, K. (1995). Distinguishing service quality and customer satisfaction: the voice of the consumer. Journal of Consumer Psychology, 4(3), 277-303.

- Jiang, C.X., Chua, R.Y., Kotabe, M., & Murray, J.Y. (2011). Effects of cultural ethnicity, firm size, and firm age on senior executives’ trust in their overseas business partners: evidence from China. Journal of International Business Studies, 42, 1150-73.

- Jukka, M., Blomquist, K., Li, P. & Gan, C. (2017). Trust-distrust balance: trust ambivalencein sino-western b2b relationships. Cross Cultural Strategic Management, Bingley, 24(3), 482-507.

- Kim, K. & Frazier, G.L. (1997). On Distributor Commitment in Industrial Channels of Distribution: A Multicomponent Approach. Psychology and Marketing, 14(8), December, 847-77.

- Lai, C., Chan, D., Yang, C. & Hsu, D. (2015). The value creation scale of supplier-distributor relationships in international markets. Journal of Business & Industrial Marketing, 30(2), 171-181.

- Lai, I.K.W. (2014). The Role of Service Quality, Perceived Value, and Relationship Quality in Enhancing Customer Loyalty in the Travel Agency Sector. Journal of Travel and Tourism Marketing, 31(3), 417-442.

- Lapierre, J. (2000). Customer-perceived Value in Industrial contexts. The Journal of Business and Industrial Marketing, 15(2/3), 122-145.

- Lucas, R.G. (1986). High vs. Low Technology: Assessing Innovative Effort in Canadian Industry. Canadian Journal of Administrative Sciences / Revue Canadienne des Sciences de l'Administration, 3(1), 131-145.

- Mazis, M.B., Ahtola, O.T., & Eugene, R.K. (1975). A Comparison of Four Multi-Attribute Models in the Prediction of Consumer Attitudes. Journal of Consumer Research, 2(1), 38-52.

- McDougall, G.H. & Levesque, T. (2000). Customer satisfaction with service: putting perceived value into the equation. Journal of Services Marketing, 14(5), 392-410.

- Moliner, M.A., Sánchez, J., Rodrìguez, R.M. & Callerisa, L. (2007). Perceived relationship quality and post-purchase perceived value: an integrative framework. European Journal of Marketing, 41(11/12), 1392-1422.

- Moller, K. (1985). Research Strategies in Analyzing the Organizational Buying Process. Journal of Business Research, 13, 3-17.

- Moller, K. (1981). Business Suppliers’ Value Creation Potential: A Capability-based Analysis. Industrial Marketing Management, 32(2003), 109-118.

- Moorman, C., Deshpande, R. & Zaltman, G. (1993). Factors affecting trust in marketing research relationships. Journal of Marketing, 57(January), 81-101.

- Morgan, R. & Hunt, S. (1994). The commitment-trust theory of relationship marketing. Journal of Marketing, 58, 20-38.

- Mpinganjira, M., Roberts-Lombard, H. & Svensson, G. (2017). Validating the relationship between trust, commitment, economic and non-economic satisfaction in South African buyer-supplier relationships. The Journal of Business and Industrial Marketing, 32(3), 421-31.

- Norris, D.G. & Mcneilly, K.M. (1995). The Impact of Environmental Uncertainty and Asset Specificity on the Degree of buyer-Supplier Commitment. Journal of Business-to-Business Marketing, 2(2), 59-85.

- Ostrom, A. & Iacobucci, D. (1995). Consumer trade-offs and the evaluation of services. Journal of Marketing, 59(1), 17-28.

- Parasuraman, A., Zeithaml, A. & Berry, L.L. (1985). A Conceptual Model of Service Quality and Its Implications for Future Research. Journal of Marketing, 64(1), 12-37.

- Park, C. & Lee, H. (2018). Early stage value co-creation network – business relationships connecting high-tech B2B actors and resources: Taiwan semiconductor business network case. Journal of Business & Industrial Marketing, 33(4), 478-494,

- Powers, T.L. & Dawn, V. (2008). A review of the role of satisfaction, quality, and value on firm performance. Journal of Consumer Satisfaction, Dissatisfaction and Complaining Behavior, 21(1), 80-101.

- Ravald, A. & Gronroos, C. (1996). The Value Concept and Relationship Marketing. European Journal of Marketing, 30(2), 19-30.

- Ritter, T. & Walter, A. (2012). More is not always better: The impact of relationship functions on customer-perceived relationship value. Industrial Marketing Management, 41, 136-44.

- Ruekert, R. & Churchill, G.Jr. (1984). Reliability and validity of alternative measures of channel member satisfaction. Journal of Marketing Research, 21(2), 226-233.

- Ruiz-Molina, M., Gil-Saura, I. & Moliner-Velázquez, B. (2015). Relational Benefits, Value, and Satisfaction in the Relationships Between Service Companies. Journal of Relationship Marketing, 14(1), 1-15

- Rusbult, C.E. & Farrell, D. (1983). A Longitudinal Test of the Investment Model: the Impact of Job Satisfaction, Job Commitment, and Turnover of Variations in Rewards, Costs, Alternatives and Investments. Journal of Applied Psychology, 68(August), 429-438.

- Rusbult, C.E. (1980). Commitment and Satisfaction in Romantic Associations: A Test of the Investment Model. Journal of Experimental Social Psychology, 16, 172-86

- Rusbult, C.E. (1983). A Longitudinal Test of the Investment Model: The Development (and Deterioration) of Satisfaction and Commitment in Heterosexual Involvements. Journal of Personality and Social Psychology, 45(1), 101-117.

- Ryssel, R., Ritter, T. & Gemunden, H.G. (2004). The Impact of Information Technology Deployment on Trust, Commitment and Value Creation in Business Relationships. Journal of Business and Industrial Marketing, 19(3), 197-207.

- Sánchez, J.Á.L., & Santos-Vijande, M.L. (2015). How Value Creation and Relationship Quality Coalignment Affects a Firm’s Performance: An Empirical Analysis. Journal of Marketing Channels, 22(3), 214-230.

- Selnes, F. (1998). Antecedents and consequences of trust and satisfaction in buyer-seller relationships. European Journal of Marketing, 32(3), 305-322.

- Smith, J.B. (1998). Buyer-seller relationships: similarity, relationship management, and quality. Psychology & Marketing, 15(1), 3-21.

- Spreng, R. & Mackoy, R.D. (1996). An empirical examination of a model of perceived service quality and satisfaction. Journal of Retailing, 72(2), 201-214.

- Sun, P., Pan, F., Wu, Pi. & Kuo, C. (2014). An empirical study of B2B relationship value offering type as a moderator. Journal of Business Studies Quarterly, 6(1), 79-97.

- Svensson, G., Mysen, T. & Payan, J. (2010). Balancing the sequential logic of quality constructs in manufacturing supplier relationships – causes and outcomes. Journal of Business Research, 63(11), 1209-1214.

- Thompson, M. & Young, L. (2012). The complexities of measuring complexity, special session on agent based modelling in business markets. IMP 2012 Conference, Rome, available at: www.impgroup.org

- Tsai, C.F. (2015). The Relationships among Theatrical Components, Experiential Value, Relationship Quality, and Relationship Marketing Outcomes. Asia Pacific Journal of Tourism Research, 20(8), 897-919.