Review Article: 2023 Vol: 27 Issue: 5

An Empirical Study on Consideration of Technical and Fundamental Analysis by Retail Investors

Dileep Kumar Singh, Narsee Monjee Institute of Management Studies (NMIMS), Hyderabad

Shailesh Kediya, Symbiosis Skills and Professional University, Pune

Shyam Shukla, Bharati Vidyapeeth (Deemed to be University) Institute of Management and Entrepreneurship Development, Pune

Shrikrishna Dhale, S. B. Jain Institute of Technology, Management and Research, Nagpur

Citation Information: Kumar Singh, D., Kediya, S., Shukla, S., & Dhale, S. (2023). A comparative analysis of financial service development strategies of indian and australian firms. Academy of Marketing Studies Journal, 27(5), 1-7.

Abstract

Money is the one thing that people take more seriously than their health. Retail investors' decisions on how to invest/trade their money are influenced by their behaviour and emotions. The goal of this research is to learn more about the factors that impact retail investors' decision to invest in capital markets. Researchers can eventually give personalized and normative recommendations to investors as well as the financial planning sector in successfully and efficiently dealing with clients by better understanding what leads retail investors to adopt a specific investing style.

Keywords

Capital Market, Investors, Retailers, Technical analysis & Fundamental analysis, Risk and Return.

Introduction

Every investor should be fully aware of how the stock market operates before making any investment selections. Most capital theorists put about as much trust in charts as astronomers do in astrology due to the amount of doubt that empirical research has placed in chart readers set out to find the appropriate degrees of diversity for investors that build portfolios based on advice from brokerage houses, research services, and other sources of financial information (Gordon et al., 2000); Geetha & Ramesh (2012) start out by demonstrating how expenditures and arbitrage may result in a tenable discount of roughly 13% in the UK. The first investigation of the interacting connections between the elements using the methodology of the Decision Making Trial and Evaluation Laboratory (DEMATEL) and Analytic Network Process is provided by (Lee et al., 201; Abuhamad et al., 2013) provide an event-driven business intelligence method to generate trading signals based on several assessments in order to react instantly to any change in the market state investigate the interactions between investors and locals in western Ethiopia when it comes to commercial land sales Rodríguez et al. (2012); Singh et al. (2021). Survey information from the low-lying Benishangul-Gumuz area of Ethiopia is used in the empirical study Singh & Kediya (2020). The purpose of is to investigate entrepreneurial leadership and identify the entrepreneurial leadership competencies necessary for success in a context of a growing economy. The purpose of is to provide investors and potential investors a summary and something to think about before choosing to purchase CTRA shares. Extended Summary analyses the effectiveness of buy and sell recommendations given on the Indian stock market by technical and fundamental specialists. A customer behaviour research is used to evaluate department stores' competitiveness to that of other retail company categories. Consumers perceptions of department shops and the criteria shoppers use to assess this category are revealed through an online poll Lin (2018); Marasović et al. (2018); Marshall & Cahan (2005); Marshall et al. (2008).

The foundation of technical analysis (TA) is the notion that trends in the past prices of instruments traded on asset markets may be used to predict future values. By understanding how price indicators for the portfolio's assets interact over time, it is hoped to increase return on an investment portfolio. TA is a technique for identifying asset price trends that is predicated on the idea that price series changes in line with investor expectations (Stankovic et al. 2015).

The economic as well as financial characteristics of stocks and markets are the subject of fundamental analysis (FA). To rationalize previous movements and forecast variations, FA looks to the microeconomic elements of enterprises as well as the macroeconomic fundamentals of sectors and nations known as market fundamentals (Lui & Mole 1998, Allen & Taylor 1990).

Literature Review

In a study, explored the association amid stock returns and fundamental factors. The market value of equity shows a negative association with stock return, although the book-to-market, sales price, and debt-to-equity ratio all have a significant positive relationship. Their research indicates that, out of all the variables included, the book to market ratio is the best stock predictor also examined the relationship between profit forecasts and fundamental analysis for 33 countries between 1990 and 2000. In addition to demonstrating that macroeconomic factors, business news, industry, and nation context have a significant influence on stock return prediction, fundamental analysis has also been demonstrated to estimate stock returns differently in the short and long term came to the conclusion that using fundamental analysis to predict future stock returns and comprehend the momentum phenomenon in stock prices is helpful examined how both technical and fundamental analysis affected the market-adjusted returns of European government bonds. Liquidity, international risk, and the state of the economy right now are examples of basic factors, showing how combining fundamental and technical study might result in significant future returns on European Government bonds Branch (1976).

An investor should do both a fundamental and a technical examination of the market before making any stock investments. The effectiveness of investors' investment choices is influenced by the rate of return that is produced when fundamental research is used, which is higher than the average market return (Abarbanell & Bushee, 1998); Bask & Fidrmuc (2009); Bülow (2017).

The effectiveness of investment decisions for investors is influenced by the usage of technical analysis since the use of buy and sells signals that come through the moving average as one of the technical analysis tools results in a higher rate of return than the market average (Vasiliou et al., 2006).

Significance of the Study

Investors, the public, traders, brokers, and others must be benefited from this research by making smarter investments and more correct estimates of forthcoming returns Harrison et al. (2018). It will likewise allow for a better understanding of financial measures' predictive capacity and their function in projecting stock returns for theoretical reasons. Fundamental scrutiny at the corporate level will give a thorough grasp of the company's financial characteristics, as well as a forecast of future profitability. Investment decisions made without considering the fundamental as well as technical research are more likely to be mistaken and perilous, as well as encouraging further notional activity in the market, creating a insistent obstruction to its growth Teklemariam et al. (2017). The key relevance of this study is to undertake detailed analysis for a safe investment through a favourable predicted return Chatterjee et al. (2020). The relevance of the article is to enable investors to undertake exhaustive analysis to secure investment with a good expected return.

The goal of our research is to investigate use of Technical analysis & Fundamental Analysis by retail investors to avoid risk in investment return.

Research Methodology

The sample size finalized for the study is 400 and the respondents are from central India. Hence the universe for the study is central India. (Singh, D., & Kediya, S. 2020) and Kediya, S. O., Singh, D. K., Shukla, J., & Nagdive, A. S. (2021, November). The sampling technique used is Purposive sampling. Statistical tools used are Descriptive analysis -Mean and standard deviation. T test and regression has also been used for testing of hypothesis.(Singh, D. K., Kediya, S., Mahajan, R., & Asthana, P. K. 2021, November) and Dhale, S., & Singh, D. K. (2022)

H01: Technical analysis & Fundamental Analysis are two major factors that are being considered by retail investors to avoid risk in investment return.

H02. The efficacy of traders' investment decisions is not significantly impacted by the usage of fundamental analysis and technical analysis tools.

Conceptual model

Due to the distinctive nature of capital market instruments, fundamental considerations have a significant influence on investing decisions. In the real world, investors rely on fundamental research, broker advice, newspaper articles, or business channels to make investment and trading decisions, as well as sound technical analysis with an emphasis on trade management. It reduces risk and aids in its management. Fundamental analysis is focused on evaluating the issuer's revenue, market position, volume of sales, asset structure, and liability obligations. The demand and supply of securities, as well as the dynamics of rates and volumes of activities connected to their purchase and sale, are the primary focus of technical analysis. It entails keeping track of and evaluating the history of changes in price and volume indicators that describe market processes. Before executing a security transaction, the investor must assess the security's trustworthiness and prospective profitability, which are based on the market and true price of the security, among other factors. By using basic analysis, it is feasible to assess the true price of securities.

Extended Elucidation

As with ordinary investors, every stock market investment seeks to maximise profit while limiting associated risk. Fundamental analysis has been more popular recently among professionals in the stock markets. It uses political and economic data, as well as recent and historical financial records, to determine a company's intrinsic worth and help spot mispriced assets.

In order to assess the market's present worth and their feelings on anticipated changes in market prices, investors find technical analysis to be more alluring when making short-term investment decisions (Allen and Taylor 1990; Lui and Mole 1998). With the intention of making market investments, fundamental and technical analysis is both employed to anticipate stock returns.

Perception of Retail Investors on Technical as well as Fundamental Analysis in Investment Decisions

Investors should protect themselves against all plausible challenges in the stock markets as investment decisions have turn into increasingly complex and precarious. Investors’ must be well-informed on the performance of all other investment groups in the capital markets.

With an objective to understand the perspective of retail investor, the researcher has collected the data through structures questionnaires.

HO1 – Technical analysis & Fundamental Analysis are two major factors which is being considered by retail investors to avoid risk in investment return.

To test the above hypothesis, student t test has been applied.

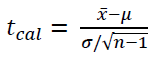

Considering the mean μ = 3, the each item mean  , n=5 (5 point likert item) and standard deviation σ

, n=5 (5 point likert item) and standard deviation σ

For n-1 d.f.

ttab = 2.76 for two tail at 5% level of signification.

All the 24 items are statistically accepted as the entire item show that tcal < ttab value at 5% level of significance. So the overall effect of all the items can also be accepted. i.e. Technical analysis & Fundamental Analysis are two major factors causing volatile behavior of retail investors of stock market is true. The study based on retail investor’s responses suggests that Technical analysis & Fundamental Analysis is the two major factors causing volatile behavior of retail investors of stock market is true Gemmill & Thomas (2000); Lynch & Rothchild (2000).

A mix of fundamental as well as technical analysis appears to be more intriguing. Technical analysis, because certain of the methodologies utilized (for example, trend-following indicators and chart-pattern analysis) can provide reliable predicting predictions concerning the trend of a company's or industry's competitive position.

H02. The efficacy of traders' investment decisions is not significantly impacted by the usage of fundamental analysis and technical analysis tools.

Results of the Significance Test of the Multiple Regression Coefficients

It can be evident from table 1 that the significance of the beta regression coefficient of investors' use of technical and fundamental analysis tools is clear as the value of P is less than the level of significance used, which is 5%, showing that H02 is rejected. It can be concluded that investors' use of fundamental as well as technical analysis tools has a significant effect on the effectiveness of their investment decisions.

| Table 1 Value: Calculated by Authors Using SPSS | |||||||

| Anova | F | Sig. | |||||

| 64.856 | .000b | ||||||

| Coefficient Analyses | |||||||

| Model | Unstandardized Coefficients | t | Sig. | ||||

| B | Std. Error | ||||||

| 1 | (Constant) | 1.870 | .184 | 10.185 | .000 | ||

| Fundamental Analysis | .247 | .041 | 5.970 | .000 | |||

| Technical Analysis | .267 | .037 | 7.118 | .000 | |||

| a. Dependent Variable: Investment decision efficacy | |||||||

Conclusion

In today's world, the capital market is crucial for mobilizing and channeling resources into productive investments for the growth of the economy, including commerce and industry. The capital market also aids in capital generation and the country's economic progress. Individuals and financial intermediaries provide funds to the capital market, which are absorbed by all the major players. As a result, it promotes the flow of capital and allows it to be employed more productively and profitably, so increasing the nation's revenue and economy. It can be inferred that each parameter in fundamental and technical analysis has its own set of benefits and drawbacks. Fundamental analysis focuses on liabilities, assets, company loans, debt, and so on, whereas technical analysis focuses on previous trends. The investor may forecast their stock using these characteristics, but no strategy can guarantee a return, and there is always a danger in investing in the stock market, no matter how much study the investor does.

Future Scope of Study

Future research on the empirical examination of how retail investors use technical and fundamental analysis is quite likely. Here are a few suggested research areas:

Analysis in comparison: The research can be expanded to compare the merits of technical and fundamental analysis. Researchers can establish whether methodology is better at influencing investment choices by comparing the returns produced using each strategy.

Risk assessment: A future research may examine the dangers of retail investors using technical and fundamental analysis. This might point up any possible disadvantages of using these techniques and recommend measures to reduce risk.

The study might be expanded to investigate the behavioural elements that affect retail investors' choices between using technical and fundamental analysis. This could offer information on the psychological aspects that influence investors' judgements.

Effect of technology: With the growing use of technology in the investment industry, a future research may concentrate on how technology helps retail investors employ technical and fundamental analysis. Analyzing how trading platforms and robo-advisors affect investing choices may fall under this category.

Overall, the study on retail investors' use of technical and fundamental analysis lays a solid groundwork for further investigation in the area of finance and investing. By building on this research, researchers may obtain a greater knowledge of how retail investors make investment decisions and give insights into the most effective ways for optimizing investment returns.

References

Abarbanell, J.S., & Bushee, B.J. (1998). Abnormal returns to a fundamental analysis strategy. Accounting Review, 19-45.

Indexed at, Google Scholar, Cross Ref

AbuHamad, M., Mohd, M., & Salim, J. (2013). Event-driven business intelligence approach for real-time integration of technical and fundamental analysis in forex market. Journal of Computer Science, 9(4), 488.

Indexed at, Google Scholar, Cross Ref

Allen, H., & Taylor, M. P. (1990). Charts, noise and fundamentals in the London foreign exchange market. The Economic Journal, 100(400), 49-59.

Indexed at, Google Scholar, Cross Ref

Al-Tamimi, H. A. H. (2006). Factors influencing individual investor behavior: an empirical study of the UAE financial markets. The Business Review, 5(2), 225-233.

Bask, M., & Fidrmuc, J. (2009). Fundamentals and technical trading: behavior of exchange rates in the CEECs. Open economies review, 20, 589-605.

Indexed at, Google Scholar, Cross Ref

Branch, B. (1976). The predictive power of stock market indicators. Journal of Financial and Quantitative Analysis, 11(2), 269-285.

Indexed at, Google Scholar, Cross Ref

Bülow, S. (2017). The effectiveness of fundamental analysis on value stocks–an analysis of piotroski’s f-score.

Chatterjee, D., Kumar, S., & Chatterjee, P. (2020). Time to payoff: efficacy of analyst recommendations in the Indian stock market. IIMB Management Review, 32(2), 153-165.

Indexed at, Google Scholar, Cross Ref

Dhale, S., & Singh, D. K. (2022). e-Pharmacy in India: An Exponential Growth Opportunity. International Journal, 10(11).

Geetha, N., & Ramesh, M. (2012). A study on relevance of demographic factors in investment decisions (No. 1231-2016-100817, pp. 14-27).

Indexed at, Google Scholar, Cross Ref

Gemmill, G., & Thomas, D. C. (2000). Sentiment, Expenses and Arbitrage in Explaining the Discount on Closed-End Funds. Cass Business School Research Paper.

Indexed at, Google Scholar, Cross Ref

Harrison, C., Burnard, K., & Paul, S. (2018). Entrepreneurial leadership in a developing economy: a skill-based analysis. Journal of Small Business and Enterprise Development, 25(3), 521-548.

Indexed at, Google Scholar, Cross Ref

Kediya, S. O., Singh, D. K., Shukla, J., & Nagdive, A. S. (2021, November). Analytical Study of Factors Affecting IoT in SCM. In 2021 International Conference on Computational Intelligence and Computing Applications (ICCICA) (pp. 1-4). IEEE.

Indexed at, Google Scholar, Cross Ref

Lin, Q. (2018). Technical analysis and stock return predictability: An aligned approach. Journal of financial markets, 38, 103-123.

Indexed at, Google Scholar, Cross Ref

Lui, Y. H., & Mole, D. (1998). The use of fundamental and technical analyses by foreign exchange dealers: Hong Kong evidence. Journal of International money and Finance, 17(3), 535-545.

Indexed at, Google Scholar, Cross Ref

Lynch, P., & Rothchild, J. (2000). One up on Wall Street: how to use what you already know to make money in the market. Simon and Schuster.

Marasović, B., Poklepović, T., & Aljinović, Z. (2011). Markowitz'model With Fundamental And Technical Analysis–Complementary Methods Or Not. Croatian Operational Research Review, 2(1), 122-132.

Marshall, B. R., & Cahan, R. H. (2005). Is technical analysis profitable on a stock market which has characteristics that suggest it may be inefficient?. Research in International Business and Finance, 19(3), 384-398.

Indexed at, Google Scholar, Cross Ref

Marshall, B. R., Cahan, R. H., & Cahan, J. M. (2008). Does intraday technical analysis in the US equity market have value?. Journal of Empirical Finance, 15(2), 199-210.

Indexed at, Google Scholar, Cross Ref

Rodríguez-González, A., Colomo-Palacios, R., Guldris-Iglesias, F., Gómez-Berbís, J. M., & García-Crespo, A. (2012). FAST: Fundamental analysis support for financial statements. Using semantics for trading recommendations. Information Systems Frontiers, 14, 999-1017.

Indexed at, Google Scholar, Cross Ref

Singh, D. K., Kediya, S., Mahajan, R., & Asthana, P. K. (2021). Management Information System in context of Food grains: An Empirical Study at Eastern Maharashtra. In 2021 International Conference on Computational Intelligence and Computing Applications (ICCICA) (pp. 1-5). IEEE.

Indexed at, Google Scholar, Cross Ref

Singh, D., & Kediya, S. (2020). Influence of Social Media Marketing on School Branding. Test Engineering and Management, 82.

Teklemariam, D., Nyssen, J., Azadi, H., Haile, M., Lanckriet, S., Taheri, F., & Witlox, F. (2017). Commercial land deals and the interactions between investors and local people: Evidence from western Ethiopia. Land use policy, 63, 312-323.

Indexed at, Google Scholar, Cross Ref

Vasiliou, D., Eriotis, N., & Papathanasiou, S. (2006). How rewarding is technical analysis? Evidence from Athens Stock Exchange. Operational Research, 6, 85-102.

Indexed at, Google Scholar, Cross Ref

Received: 17-Mar-2023, Manuscript No. AMSJ-23-13350; Editor assigned: 20-Mar-2023, PreQC No. AMSJ-23-13350(PQ); Reviewed: 22-Apr-2023, QC No. AMSJ-23-13350; Revised: 21-Jun-2023, Manuscript No. AMSJ-23-13350(R); Published: 11-Jul-2023