Research Article: 2024 Vol: 28 Issue: 4

An Empirical Investigation to Study the Adoption of Online Banking Channels by Retail Customers

Divya Mathur, Marwadi University, Rajkot (Gujrat)

Srijib Shankar Jha, Marwadi University, Rajkot, Gujrat

Citation Information: Mathur, D., & Jha, S.S. (2024). An empirical investigation to study the adoption of online banking channels by retail customers. Academy of Marketing Studies Journal, 28(4), 1-11.

Abstract

‘Banks can save a lot of money with digital banking, and it also helps them build stronger ties with customers and provide them a unique product from the competition. Internet banking has been an option for Indian bank customers for over a decade, but adoption has been slow. In this analysis, we'll take a look at what factors Indian consumers consider when deciding whether or not to utilize an online bank. Because of developments and innovations in the financial sector, new and more efficient means of delivering and preparing financial products and services have become available. The banking industry is highly competitive, with stiff opposition from non-bank financial intermediaries and alternative financing options. The ever-increasing demands and expectations of consumers, which have grown along with their salaries and education levels, are another pressing problem for today's banking institutions. Consumers are becoming increasingly engaged and knowledgeable about their personal finance management. This research aimed to learn how Indian consumers felt about doing financial transactions using web banking services.

Keywords

Online banking, Adoption, Retail Customers.

Introduction

The banking industry is the cornerstone of every developed and developing economy. It coordinates and enforces monetary changes. How a country handles transitions in this area has a significant impact on its economic growth. Financial institutions are always on the lookout for new and creative ways to give back to the communities they serve. Customers, whether they be businesses or individuals, no longer have to go through the hassle of standing in line or searching for a phone number to get in touch with their bank. There has been a worldwide sea change in the previous two decades as a result of the proliferation of information technology, affecting both individuals and organizations. Consumers that rely on the Internet for everyday tasks like talking, shopping, banking, etc. is a constantly expanding market. Internet technology has undeniably altered the production, advertising, and distribution of goods and services.

The Internet has opened up a world of possibilities for marketers to hone in on their demographic and offer services that stand out from the crowd. To give just one example, most businesses have benefited enormously from the Internet's ability to help them save money through the use of email and other forms of individualized communication and the online delivery of their goods and services (Bhasin & Rajesh, 2021). Customers can save time, money, and hassle by handling their banking needs digitally rather than traveling to a branch. The bank's website allows you to perform many of the functions typically performed in a physical branch, such as viewing your account balance, making transfers, requesting statements, and more.

Online banking services are helpful for both banks and their consumers (Tiwari,2019). In addition, consumers no longer need to physically visit a bank in order to do the vast majority of their financial activities. Services for online banking in India can be broken down into two major groups: domestic and foreign. Customers have access to more advanced features, such as transferring money and paying bills online, on international sites, but are limited to the basics, such as viewing their account balance and transaction history, on informational sites. In response to the increasing prevalence of electronic payment methods and the launch of innovative goods in the payments industry, the Bank has also prioritized bolstering the underlying infrastructure and maintaining the security of electronic transactions. When banks decide to implement increasingly complex arrangements across the board, it can have serious repercussions on their financial soundness. (Tobbin, 2012).

The country is currently experiencing a basic issue in successfully conveying the administrations as a result of the Covid-19 event. There has been a nationwide lockdown since the incident to stop the spread of the Coronavirus. The Reserve Bank of India (RBI), India's central bank, and the government acted quickly to alleviate the crisis. The Indian Bankers Association has decided to restrict the number of workers at each branch and alter the hours that banks are open during the shutdown. Deposits, withdrawals, overdraft protections, payments, and government-to-government transfers are all services they've opted to keep up. At this time, electronic appropriation channels are regarded as a convenient, customer-centric financial service. Completely automated appropriation channels that emphasize ease and a focus on customers' financial needs will soon be a must for any financial institution (Chavan,2013). The benefits of providing superior customer service are quantifiable. The banking industry in India is attempting to improve its electronic banking channels by identifying effective strategies for fostering customer loyalty.

India's Digital Banking Acceptance Status

‘Technological progress has radically altered the international financial system. Innovation has facilitated monetary administrations, but the pace varies among countries (Takieddine and Sun 2015). Almost every bank in India provides some form of electronic banking to better serve its customers (Safeena et al. 2014). There has been a recent uptick in interest in cutting-edge innovations among India's financial service providers; as a result, it's essential that they take into account their clients' viewpoints while formulating new policies and procedures (Roy et al. 2017). The challenge in India is not simply in converting customers from traditional to digital financial channels, but also in incorporating the unbanked population. The challenge in India is not only to get people to switch from traditional banks to digital ones, but also to use digital currency to pull the unbanked masses into the fold of conventional banking. Since the use of electronic methods for banking exchanges is less widespread than might be expected, more in-depth and fundamental research is required to define the processes and practices that will successfully migrate customers to innovation-enabled financial channels based on the criteria that matter most to customers.”.

Boom of E-Banking

Customers are drawn to online banking mostly owing to its low pricing, 24/7 availability, and ease of use (Banu et al., 2019). It acknowledges that customer satisfaction with web banking services is associated with the simplicity with which those services can be utilized. Customers believe that online banking, automated teller machine banking, and telephone banking are all essentially the same thing, and that the most significant future barriers to the widespread adoption of online banking are Internet security, online banking regulations, consumer safeguards, and banks' reputations. When asked about their top future worries for banks, potential customers repeatedly mentioned web security and customer protection. People's trust in doing financial transactions online is significantly impacted by the amount of protection provided by websites. (Bashir & Madhavaiah, 2015) .

Threat

Invention and development are like getting two gifts for the price of one. They offer benefits analogous to those seen with postural disorders. That is to say, there are no carve-outs for IT development in this rule. The biggest problem that has arisen as a result of these advancements is the concept of safety, the reputation of the specialist organization, the loss of security, and fears about hazards associated with the constant quality of Internet Banking. Risk is all about taking chances, but it's also about feeling secure and trusted. The cornerstone of any successful partnership is trust. Consistent trust in a bank's capacity to deliver on its promises is one definition of client loyalty (Karjaluoto, 2019). Customers' trust in their online purchases is crucial to the success of the framework. In situations where there is a large gap between the bank and the client, when the future is unpredictable, and when interpersonal ties cannot be easily checked, the client's trust becomes a significant component in establishing the level of risk involved.

Customer Acceptance of Mobile Banking

“The phrase "versatile trade" can be found in various iterations in scholarly writing. Different departments, such as MIS, the board, and marketing, have different ideas on what makes a company adaptable. To put it simply, mobile commerce is the selling and buying of products and services over the internet using mobile devices. Additionally, it can be viewed as the most recent iteration of internet-based commercial transactions, with the help of telecoms satellites and other wired internet-based advances, taking place entirely on mobile phones (Kaur, 2012). Ebb and flow" Internet apps provide users with access to many services, such as surfing the web for information. The term "mobile commerce" (or "m-trade") is used to describe the exchange of products and services through mobile phones and other wireless handheld devices. There are four main aspects that determine the success of mobile commerce: portability, usability, availability, and trust in the business. While these services are accessible from everywhere, the portable trade application has strict time and place requirements (Montazemi,2015). Organizational, framework, data set, and security advancements all contribute to making mobile businesses more powerful. Flexible hardware, flexible software, and remote advancements provide mobile commerce apps that enable real-time data transmission, customer location discovery, and company management over geographic distances. Multifaceted trade and its applications rely greatly on the availability of safety and security measures to be successful. Everyone agrees that, right now, mobile banking is the most useful and consequential of the many available mobile business applications.

Challenges in the Online Banking Sector

Security

One of the most difficult things about marketing finances online is keeping your customers' information safe. This is because, in the past, thieves would have to break into a bank vault and then make a tricky run with an individual's bank investment cash. That was a horrifying thought, full of danger and risk. Anyone with a victim's name, address, and SSN can access their online bank account and take their money. The risks are far lower and it's typically done undercover.

Difficulty in Transaction

Time and effort spent managing your finances in an online bank may increase. As a rule, online banks have fewer ATMs and slower processing and deposit times than their traditional branch-based competitors. To give one example, it typically takes three to five days for a store to show up in a PayPal account, the most widely used online banking system. This will continue to be a problem for online banking and finance promotions until currency rates are more competitive (Patel & Patel, 2018).

Technical Issues

Online banks stand to lose a significant amount of money in the event of a website outage or code breach because of their dependency on their websites. If a bank has to close for the day because of an uncommon problem, it could lose millions. It's possible that if a bank's website is down, consumers won't be able to make payments or complete transactions. Fifty-four percent of clients today utilize a mobile banking app financial institution must ensure the availability of their web and mobile applications for this strategy to work (Rawashdeh, 2015).

Opinions on the Efficiency of Online Banking Services throughout the Covid-19 Blackout

The banking industry is spending huge sums of money on cutting-edge technological efforts to keep their competitive edge and to give the best possible services to its consumers. Financial institutions that have fully embraced digitalization may now provide their clients more individualized types of help that can be accessed from any location and at any time. Due to the rapid spread of COVID 19, most banks in the affected nations have decreased their branch hours and encouraged consumers to use online banking services instead. Since the success of electronic banking hinges on customers' satisfaction, it's becoming increasingly important to comprehend and fulfill their wants and expectations.

Based on this premise, we analyze customers' attitudes regarding using electronic banking and preferences for alternative financial channels throughout the Covid outrage.

Objectives of the Study

1. To find the factors that contributes to Indian consumers' acceptability to online banking.

2. To ascertain the significance of the factors influencing Indian customers' willingness to adopt digital banking methods.

Research Hypothesis

H1: The Service (S) provided by online Banking positively influences use of Online Banking

H2: The Ease of use (EU) positively influences use of Online Banking.

H3: Customer trust (TU) towards online services positively influences their use of Online Banking.

Methodology

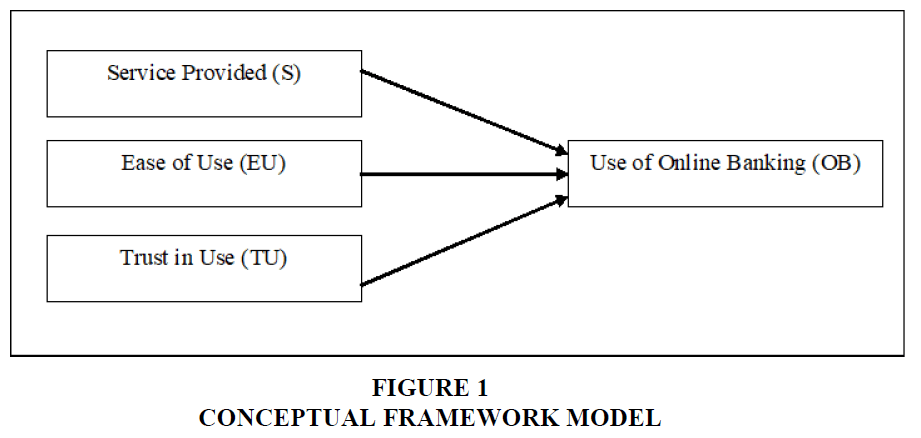

The purpose of this descriptive study is to examine the factors that have contributed to the growth in digital banking in India. A total of 150 people served as study participants. To collect and analyze the data, we employed a five-point scale questionnaire (using mean values and t test, respectively) Figure 1.

Results and Analysis

Tabulated in Table 1 below are the percentages of Indian customers, broken down by age and gender, who are interested in using digital banking methods. It's been estimated that 43% of the participants are female and 57% are male. Seventy-one percent of respondents utilise internet banking, while 29 percent don't. Four in ten respondents (43%) said they like online banking due to its quickness, while 36 percent cited its ease, 17 percent its security, and 4 percent its sophistication. Seventy-three percent of respondents during COVID saw positive effects from using online banking, while just 27 percent saw negative effects.

| Table1 Demographic Profile | ||

| Variables | Number of respondents | % |

| Gender | ||

| Male | 86 | 57 |

| Female | 64 | 43 |

| Using internet banking services | ||

| Yes | 106 | 71 |

| No | 44 | 29 |

| Reasons why people use online banking | ||

| It is very fast | 65 | 43 |

| It is more convenient | 54 | 36 |

| It is very safe | 25 | 17 |

| It is advanced and innovative | 6 | 4 |

| In the time of COVID, online banking has been a great help. | ||

| Yes | 109 | 73 |

| No | 41 | 27 |

Factor Analysis

To get a sense of how customers felt about Fintech, a preliminary factor analysis was run. If the sample size is large enough, as measured by the Kaiser-Meyer-Olkin (KMO) statistic, then more research can be conducted. A KMO value between 0.7 and 0.8 is acceptable for factor analysis, and a value greater than 0.8 is excellent. A KMO value between 0.7 and 0.8 is acceptable for factor analysis, and a value between 0.8 and 1.0 is excellent. The provided data is adequate for factor analysis because the KMO value is 0.869 and the significance level of Bartlett's test is less than 0.05.

Factor Extraction: Nine questions are factor analyzed using Principal Component Analysis with Varimax rotation. These questions were extracted into three factors explaining a total variance of 71.172 %, with eigenvalues above 1 Table 2.

| Table 2 Factor Loadings of Variables | ||

| Factor | Items | Item loadings |

| Service (S) | All services are available on website | .804 |

| Customers are able to complete the task satisfactorily. | .803 | |

| Customers save a lot of time when using online services. | .849 | |

| Ease of use (EU) | The operations performed in online banking are quite simple for customers. | .851 |

| Online banking provides lots of utility services | .869 | |

| Customers can access data of account anywhere | .878 | |

| Trust (TU) | Online banking has good information security ability. | .845 |

| Customers fine online banking service very productive | .811 | |

| Customers feel confident when using online banking services. | .816 | |

The mean value for services is highest (M=3.523), as shown in the descriptive statistics table. Mean Ease of use is 3.132 and the standard deviation is 0.750. Respondents' trust in services is above average (3.21). When a greater proportion of factors have mean values close to the degree of agreement, it indicates that customers have a more positive impression of online banking.

Independent variables' correlation with one another and with the dependent variables are also displayed in the table above. It is clear from the positive and statistically significant correlation coefficients between the variables that an uptick in positive attitudes toward online banking correlates with a corresponding rise in satisfied customers.

Cronbach's alpha, a measure of internal consistency, is also included in table 3 to complete the picture. The data are trustworthy because all three factors have an alpha value greater than 0.7, the cutoff for significance.

| Table 3 Cronbach’s Alpha, Mean, STD. Deviation and Correlation of the Variables | |||

| S | EU | TU | |

| Reliability (Alpha value) | 0.869 | 0.889 | 0.847 |

| Mean | 3.523 | 3.132 | 3.211 |

| Standard deviation | .73178 | .75005 | .70789 |

| Service (S) | 1 | .452** | .339** |

| Ease of use (EU) | .449** | 1 | .370** |

| Trust (TU) | .339** | .368** | 1 |

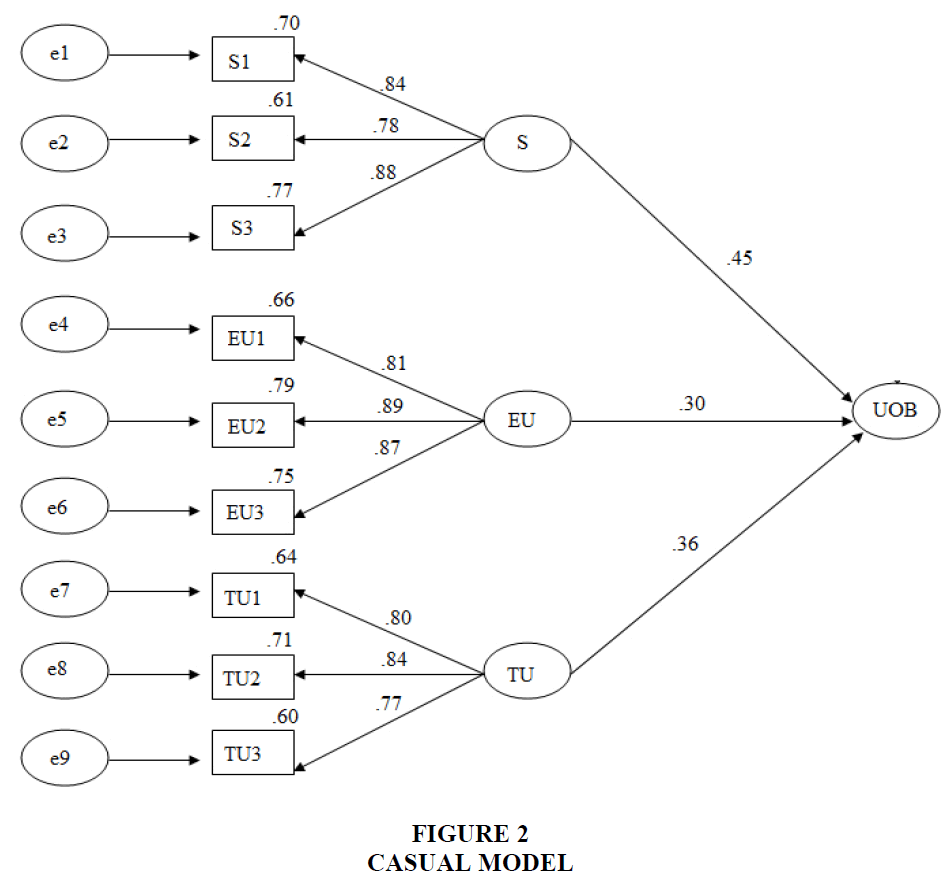

Hypothesis Testing using Structural Equation Modeling

In order to assess the significance relevance of the structural model relationship the maximum likelihood estimation method was used. The results in Table 3 depicts path coefficient of respective constructs with its level of significance. The criteria for acceptance of hypothesis are based on path having p value less than 0.05 at 5% level of significance.

By referring to Tables 3 & 4 and figure 2, it is concluded that all three variables have a significant impact on use of online Banking. The standardizedpath coefficient (β) of Service is 0.454 with p=0.000. Since, the p value is less than 0.05, indicating a positive influence on online banking usage, thus proving hypothesis H1.

| Table 4 Path Coefficients of the Structural Model | |||||||

| Hypo-theses | Outcome variables | Causal Variables | SE. | CR. | P | Path coefficient | Result |

| H1 | Use of Online Banking | Service | .060 | 6.354 | *** | .454 | Accepted |

| H2 | Use of Online Banking | Ease of use | .059 | 4.379 | *** | .296 | Accepted |

| H3 | Use of Online Banking | Trust | .072 | 5.039 | *** | .364 | Accepted |

The standardized path coefficient of ease of use to online banking usage is 0.296 (p<0.05), inferring a positive effect on Use of online banking and hypothesis H2 is also proved. Finally, the customer trust in online banking services positively influences their usage with a standardized path coefficient of 0.364 (p<0.05), indicating a positive impact; hence hypothesis H3 is supported.

The values of the goodness of fit indices shown in table 5 are consistent with the data being a good representation of the research model.

| Table 5 Overall Model Fit | ||

| Indices | Recommended criteria | Model values |

| Chi square (χ2) | pval>0.05 | 137.756 |

| Normed chi square (χ2/DF) DF=51 | 1<χ2/df<3 | 2.710 |

| Goodness-of-fit index (GFI) | >0.90 | 0.901 |

| Adjusted GFI (AGFI) | >0.80 | 0.849 |

| Comparative fit index (CFI) | >0.95 | 0.942 |

| Root mean square error of approximation (RMSEA) | <0.05 good fit <0.08 acceptable fit | 0.068 |

| Tucker-Lewis index (TLI) | 0<TLI<1 | 0.925 |

Discussion

The Research addresses a critical area in the realm of modern banking. The discussion section of this research paper interprets the findings, places them in context, and offers insights into their implications for both academia and the banking industry.

1. Service Quality and Adoption: The study found that service quality plays a significant role in the adoption of online banking channels. This suggests that customers are not only seeking convenience but also expect a seamless and responsive online banking experience. Banks should focus on enhancing their digital platforms' functionality, responsiveness, and user-friendliness to attract and retain customers.

2. Trust as a Foundation: The positive correlation between trust and online banking adoption highlights the critical role of trust in fostering customer confidence in digital banking. As online transactions involve personal and financial information, building trust through robust security measures, transparent policies, and effective communication is crucial for banks. This also implies that any breach of trust could have a substantial negative impact on adoption rates.

3. Ease of Use and Accessibility: The ease of use was identified as another significant factor promoting online banking adoption. This underscores the importance of designing user interfaces that are intuitive, user-friendly, and accessible across various devices and platforms. Banks need to invest in user experience (UX) design and conduct regular usability tests to ensure a smooth interaction for users of all demographics.

4. Segmentation of Customers: The study could have implications for segmenting customers based on their preferences and behaviors. For instance, some customers might prioritize service quality, while others might focus on ease of use. Banks can tailor their marketing strategies and offerings based on these segments, catering to specific needs and preferences.

5. Educational Initiatives: Since trust and ease of use are critical factors, banks could invest in educational initiatives to enhance customers' understanding of online security measures and the features of their digital platforms. Empowering customers with knowledge can help mitigate concerns and boost their confidence in adopting online banking channels.

Implications

1. Strategic Banking Decisions: The findings suggest that banks should prioritize investments in technological infrastructure, security protocols, and customer service to promote the adoption of online banking channels. This may involve collaborating with technology partners and third-party service providers to ensure a seamless experience.

2. Security and Privacy: The study's emphasis on trust underscores the need for banks to continually strengthen their cybersecurity measures. Any breach or compromise of customer data could erode trust and impede online banking adoption. Institutions should employ encryption, multi-factor authentication, and regular security audits to safeguard user information.

3. User-Centered Design: The implication of ease of use underscores the importance of user-centered design principles. Banks should collaborate with UX experts to create interfaces that cater to diverse user groups, including the elderly and those with limited technological familiarity.

4. Marketing Strategies: The study's insights can guide banks in crafting marketing messages that highlight not only the convenience of online banking but also the quality of service and the security measures in place. Such strategies can address potential barriers and misconceptions about online banking.

5. Regulatory Considerations: As online banking continues to evolve, regulatory bodies may need to adapt to ensure the protection of consumers' interests. Policymakers might consider establishing standards for digital banking platforms' security features and service quality.

Conclusion

The realm of financial and monetary systems has historically maintained a rigid and formal structure. Even if intended humorously, the ancient saying that "money makes the world go round" holds true for the majority of businesses. However, in the contemporary world, changes are swift and constant. Both financial institutions and their clients need to uphold their reputability in order to thrive. The evident catalyst behind the integration of financial operations with technological advancements is convenience. The majority of individuals today are accustomed to innovation to the extent that it influences their daily lives. Consequently, it is imperative for businesses operating in the present digital market to offer products and services that distinguish them from the rest. While security remains of utmost importance, it is in the best interest of banks to create user interfaces that are intuitive. People of all age groups, especially millennials, are becoming proficient in the use of mobile apps and websites. Amid these factors, there is a clear potential that can be harnessed through streamlined channels. Nonetheless, a few stages need to be completed before the advantages of digitization can be fully realized.

In the current technologically advanced and digitally-oriented landscape, customers exhibit heightened receptiveness towards conducting banking activities through digital channels. The convenience and security offered by digital banking channels are driving their growing popularity among individuals of all generations. These digital banking channels prove advantageous for both customers and the financial sector, enabling business operations to continue uninterrupted even in the face of disruptions such as a pandemic.

References

Bhasin, N. K., & Rajesh, A. (2021). Study of Increasing Adoption Trends of Digital Banking and FinTech Products in Indian Payment Systems and Improvement in Customer Services. In Collaborative Convergence And Virtual Teamwork For Organizational Transformation. 229-255.

Indexed at, Google scholar, Cross Ref

Banu, A. M., Mohamed, N. S., & Parayitam, S. (2019). Online banking and customer satisfaction: evidence from India. Asia-Pacific Journal of Management Research and Innovation, 15(1-2), 68-80.

Indexed at, Google scholar, Cross Ref

Bashir, I., & Madhavaiah, C. (2015). Trust, social influence, self‐efficacy, perceived risk and internet banking acceptance: An extension of technology acceptance model in Indian context. Metamorphosis, 14(1), 25-38.

Indexed at, Google scholar, Cross Ref

Chavan, J. (2013). Internet banking-benefits and challenges in an emerging economy. International Journal of Research in Business Management, 1(1), 19-26.

Harris, L., & Spence, L. J. (2002). The ethics of ebanking. J. Electron. Commer. Res., 3(2), 59-66.

Karjaluoto, H., Shaikh, A. A., Leppäniemi, M., & Luomala, R. (2020). Examining consumers’ usage intention of contactless payment systems. International Journal of Bank Marketing, 38(2), 332-351.

Indexed at, Google scholar, Cross Ref

Kaur, G., Sharma, R. D., & Mahajan, N. (2012). Exploring customer switching intentions through relationship marketing paradigm. International Journal of Bank Marketing, 30(4), 280-302.

Indexed at, Google scholar, Cross Ref

Montazemi, A. R., & Qahri-Saremi, H. (2015). Factors affecting adoption of online banking: A meta-analytic structural equation modeling study. Information & management, 52(2), 210-226..

Indexed at, Google scholar, Cross Ref

Patel, K. J., & Patel, H. J. (2018). Adoption of internet banking services in Gujarat: An extension of TAM with perceived security and social influence. International Journal of Bank Marketing, 36(1), 147-169.

Indexed at, Google scholar, Cross Ref

Rawashdeh, A. (2015). Factors affecting adoption of internet banking in Jordan: Chartered accountant’s perspective. International Journal of Bank Marketing, 33(4), 510-529.

Indexed at, Google scholar, Cross Ref

Roy, S. K., Balaji, M. S., Kesharwani, A., & Sekhon, H. (2017). Predicting Internet banking adoption in India: A perceived risk perspective. Journal of Strategic Marketing, 25(5-6), 418-438.

Indexed at, Google scholar, Cross Ref

Safeena, R., Kammani, A., & Date, H. (2014). Assessment of internet banking adoption: An empirical analysis. Arabian Journal for Science and Engineering, 39, 837-849.

Indexed at, Google scholar, Cross Ref

Tiwari, R. (2019). Contribution of Cyber Banking towards Digital India: AWay Forward. Khoj: An International Peer Reviewed Journal of Geography, 6(1), 46-52.

Indexed at, Google scholar, Cross Ref

Tobbin, P. (2012). Towards a model of adoption in mobile banking by the unbanked: a qualitative study. info, 14(5), 74-88.

Indexed at, Google scholar, Cross Ref

Takieddine, S., & Sun, J. (2015). Internet banking diffusion: A country-level analysis. Electronic Commerce Research and Applications, 14(5), 361-371.

Indexed at, Google scholar, Cross Ref

Received: 03-Jan-2024, Manuscript No. AMSJ-23-14316; Editor assigned: 05-Jan-2024, PreQC No. AMSJ-23-14316(PQ); Reviewed: 29-Jan-2024, QC No. AMSJ-23-14316; Revised: 26-Apr-2024, Manuscript No. AMSJ-23-14316(R); Published: 06-May-2024