Research Article: 2021 Vol: 20 Issue: 1

An Empirical Investigation of the Impact of Ownership and Board Structure on Capital Structure of Listed Firms in Sub-Sahara African Countries

Benjamin Ighodalo Ehikioya, Covenant University

Alexander Ehimare Omankhanlen, Covenant University

Ofe Iwiyisi Inua, National Open University of Nigeria

Lawrence Uchenna Okoye, Covenant University

T. C. Okafor, Covenant University

Abstract

Corporate governance and capital structure are two compelling factors that affect the performance and value of the firm. The two concepts are important areas in financial management for firms to achieve high value and growth rate. This paper examines the impact of ownership and board structures on the capital structure of firms listed on the stock exchanges of selected sub-Saharan African countries for the period 2010 to 20019. The study analyses whether ownership and board structure plays any significant role in the capital structure of the firm. The result of the panel data regression analysis reveals that concentrated ownership structure negatively impacts on debt ratio in sub-Saharan African firms. The study shows that managerial ownership and board structure explains the capital structure of firms in sub-Saharan Africa. The study demonstrates evidence of a significant negative influence of managerial shareholding and CEO’s tenure on the debt ratio of listed firms in sub-Sahara Africa. The result of the study suggests that the outside directors and board size positively influence the debt ratio of listed firms in sub-Sahara African countries. Given the results of this study, it is imperative for stakeholders in the region to continually improve the ownership and board structures of the firm to avoid the negative effect of debt on performance and the value of shareholders’ wealth.

Keywords

Ownership; Capital Structure; Agency Theory; Performance.

JEL Classification

G32; G34, G38

Introduction

The level of economic activities since the global financial crises and the need to ensure shareholders' wealth maximisation has again brought corporate governance and financial structure of the firm into the spotlight of an interesting debate with implications. Corporate governance and the capital structure of the firm are two important mechanisms to enhance the market value of the firm. The literature on corporate governance has established that a good corporate governance structure can function as an instrument to reduce the agency costs arising from agency problems while improving the performance of the firm (Ararat et al., 2016; Ehikioya, 2019; Mohammed, 2018). Moreover, corporate governance can serve as an instrument to influence the financing decisions for the overall well-being of the firm (Bokpin & Arko, 2009; Lioa et al., 2015). To enhance public confidence, create access to the capital markets and increase value creation, among other compelling benefits, the need for sound corporate governance is now a matter of necessity for firms in emerging countries. Indeed, investors and other stakeholders of the firm feel that organisations with the right governance structure will take measures to protect their interest. In turn, this would help such an organisation to obtain funds with less stress and at a reduced cost (AlNodel & Hussainey, 2010; Hassan, 2017).

In the present economic environment, the significance of corporate capital structure to increase the worth of the organisation has been emphasised (Afolabi et al., 2019). The capital structure of a firm, which is a blend of debt and equity capital for a firm to fund its assets, is one of the strategic tools available for the managers to improve the performance and worth of the company (Abubakar, 2015). The management of capital structure aimed to lessen the cost of funds and increase the shareholders’ wealth. The capital structure of a firm according to the agency theory is determined by agency costs ensuing from the clashes of interest arising from the relationship between the owners and the managers of the firm (Jensen & Meckling, 1976; Fama, 1980; Abobakr, 2017 and Ehikioya, 2019). In modern organisations, the debt policy can be deployed as a control mechanism to alleviate the agency conflicts between the managers and the owners of the firm (Jensen & Meckling, 1976). Grossman & Hart (1980) state that debt financing can serve as a disciplinary measure to alleviate the agency costs of free cash flow accessible by the managers. However, Myers (1977) argued that debt could as well restrict competent managers from taking up opportunities capable of adding value to the firm. In the application of debt policy as a control measure, one important measure for consideration is how to avoid future financial distress, especially where there are no adequate assets for the firm to generate the required inflows.

In developing countries, agency problems persist due to weak corporate governance structure, institutional structure and other factors that continued to impact the value and performance of the firm. Firms in the sub-Saharan African countries have an ownership structure that is mainly in the hands of individuals and corporate organisations (Afolabi et al., 2019; Orumo, 2018). In the absence of other quality control mechanisms, the ownership structure of a firm may be available to monitor and control the actions of the managers directly, especially when firms are continuously inundated with debt portfolio that impacts on the value and performance of the firm. This scenario is somewhat different from what obtains in some other developing countries like China, where the ownership of the firm is concentrated in the hands of the institutions and state government with the capacity to manage and monitor the activities of the manager (Wen et al., 2002; Zou et al., 2017). Sub-Saharan African countries need sound corporate governance and institutional structures that would ensure the well-being of the firms and return value to the shareholders.

Since the ground-breaking work of Modigliani & Miller in 1958 on the irrelevance of capital structure, debates on firms' choices of finance have continued to resonate among the stakeholders of the firm. Several theoretical and empirical studies have been developed to explain further the concepts of corporate governance and financing decisions, and their impact on the worth of the firm (Ararat et al., 2016; Jensen & Meckling, 1976). A lot of these studies with conflicting results have been carried out in advanced countries with few recent studies in developing countries (Abor, 2007; AlNodel & Hussainey, 2010; Granado?Peiró, N., & López?Gracia,, 2017; Aguilera et al., 2018). Also, several of these studies have been done based on individual country settings and using different techniques for analysis and measurement of variables (Kiuri, 2013; Lioa et al., 2015; Mohammed, 2018). Furthermore, studies such as Uwuigbe (2014), focused on board structure without the consideration of the influence of ownership structure and control measure for industry effects on the capital structure and performance of the firms.

Motivated by the agency theory and the need to address some of the limitations in studies such as Uwuigbe (2014), this study seeks to investigate the connection between corporate governance and the capital structure of firms listed on the stock exchanges in sub-Saharan African nations. The study attempts to shed further insights into the nature and level of connection between corporate governance and the capital structure of firms listed on the stock exchanges in sub-Saharan African nations. This study expects, among other things, a significant negative impact of concentrated ownership structure and managerial shareholding on the capital structure of listed firms in sub-Saharan Africa. We further consider the impact of board independence and board size on debt ratio and approach the study from developing economies perspective using data for the period 2010 to 2019 from sub-Saharan African countries.

The investigation of the influence of corporate governance on the financing policies of listed firms in sub-Saharan African countries is essential considering the need for a superior firm performance capable of making the most of shareholders' wealth along with adding value to the economic growth of the region. This study employs the panel data regression model that controls explicitly for firms’ heterogeneity known with cross-sectional analysis. Specifically, the study used the fixed effects and the Two-Stage Least Squares to estimate the variables in the sample. This approach of using different models is important to increase the robustness of the study. Furthermore, the results of the study show that debt is negatively related to the concentrated ownership structure. Consistent with entrenched managers pursuing less debt, the study finds a negative connection between managerial shareholding, CEO tenure and the debt ratio of firms listed in sub-Saharan African countries. The result of this study has implications not only for investors and policymakers but also for other stakeholders of the sub-Saharan Africa economies.

The remaining part of this paper is structured as follows. The second section is the literature review and the development of hypotheses. In section three, the study describes the data source and the methodology employed. Section four presents the empirical results and discussion, while the final section concludes with recommendations and tips for further research work.

Literature Review

Over time, there have been studies aimed to resolve the agency problems and align the managers’ interests with that of the owners of the firms in both advanced and emerging countries (Fama, 1980; Jensen & Meckling, 1976; Lioa et al., 2015; Abobakr, 2017). The corporate governance structure is concerned with the determination of how organisations can minimise the costs of operations arising from agency conflicts. Essentially, good governance helps the organisation to manage information effectively, have better access to funds, win the trust of investors as well as reduce the overall cost of debt (Agyei & Owusu, 2014; Anderson et al., 2004; Wen et al., 2002).

The agency theory posits that the separation of firm’s ownership and control, as well as the separation of Chairman’s roles from that of the CEO, will help to eliminate the concentration of power in one hand, ensure board independence and effectiveness as well as enhance checks and balances (Fama, 1980; Jensen & Meckling, 1976; Kiuri, 2013). The agency theory argued that the agent if left alone is most likely to advance interests that are different from that of the principal due to conflicts of interest and the presence of information asymmetry (Granado?Peiró & López?Gracia, 2017). The agency theory suggests that an organisation’s ownership structure can support to reduce the agency conflicts between the managers and the owners of the firm. Furthermore, the theory advances that debt can serve as an instrument to alleviate agency conflicts since it can commit the organisation to disburse cash and reduce the free cash flow that is available for managers to engage in opportunistic behaviour (AlNodel & Hussainey, 2010; Sheikh & Wang, 2012). Accordingly, managers will only adopt a capital structure with debt only when pressured to do so. However, the proponent of the agency theory, who assumed managerial discipline by pressure, failed to acknowledge the power and influence of an entrenched manager to protect himself from external pressure.

The ownership structure of a firm varies across countries due to country specific characteristics and the dynamics in the institutional structure, legal systems and other distinctive factors. Compared to the developing countries with weak institutional and legal system, the developed countries have governance structure rooted in a robust legal system that helps to focus the organisations’ activities on its objectives and commitment to the stakeholders. In the opinion of Friend & Lang (1988), outside block holders have the incentives to monitor and influence the management to take actions that would help to safeguard the interest of the shareholders. Fosberg (2004) argued that the percentage of shareholding by the block holders in a firm has a direct influence on the total sum of debt in the financial structure. In a similar study, Magdalena (2012) assessed the connection between corporate governance on financial structure decisions in Indonesian firms. She reported a positive but insignificant association between institutional ownership and the capital structure of the firm. Similarly, Céspedes et al. (2010) documented evidence of a favourable relationship between the level of leverage and ownership structure of the firm. However, in a study conducted in UAE, Aljifri & Husseiney (2012) evaluated the connection between the corporate governance in place and the financial structure decisions of 71 listed firms. They documented that there is a substantial adverse connection between institutional shareholding and debt ratio. Also, Lioa et al., (2015) found institutional ownership to have an adverse connection with debt levels, which supports the agency theory.

The power of executive share ownership to deal with the agency problem and align the interests of the agent with the principal have been documented (Bokpin & Arko, 2009; Taljaard et al., 2015). Jensen & Meckling (1976) documented that directors’ share ownership can serve as an instrument to minimise managerial incentives to consume perquisites and engagement in other activities that are not capable of maximising shareholders' value. Fosberg (2004) examined the connection between agency problem and debt financing. Fosberg documented a negative impact of management ownership on firms’ debt ratio. In a study done in Saudi Arabia, AlNodel & Hussainey (2010) established a significant negative connection between managerial share ownership and long-term debt ratio. Sheikh & Wang (2012) assessed the impact of managerial share ownership on debt in Pakistan and documented a negative relationship between variables. Conversely, Bokpin & Arko (2009) investigated the relationship between corporate governance and capital structure decisions of firms in Ghana. In that study, they reported that managerial shareholding substantially and positively influence the long-term debt ratio. Magdalena (2012) submitted that managerial shareholding has an insignificant but positive connection with the debt structure of the firm.

The significance of outside (independent) executives on the board as an effective monitoring mechanism has been highlighted in the governance literature. Also, outside directors are perceived to increase the ability of the firm to monitor and supervise the managers' activities. They also support the firm to raise funds externally. According to Abubakar (2015), the composition of the board may influence the capital structure of the firm. Prior studies by Berger et al. (1997) and Bulathsinhalage & Pathirawasam (2017) acknowledged the significant positive relationship between leverage and outside directors. Also, Abor (2007) argued that the composition of outside directors could improve the capacity of the firm to engage only in value maximising activities. Furthermore, he reported a significant favourable relationship between the numbers of non-executive directors and leverage. Whereas Bokpin & Arko (2009) conveyed a statistically insignificant positive influence of board independence on the debt ratio, AlNodel & Hussainey (2010) reported a significant positive relationship among outside directors and the debt ratios. In contrast, Anderson et al. (2004) documented a negative correlation between board independent and capital structure. Also, the study of Wen et al. (2002) and Magdalena (2012) revealed a substantially adverse connection between board composition and firm’s capital structure decisions.

Extant studies demonstrated that there is a link between the capital structure of a firm and its board size (Bokpin & Arko, 2009; Bulathsinhalage & Pathirawasam, 2017; Orumo, 2018). Firms with larger board members tend to adopt a lower debt ratio in their capital structure due to the ability of the board to pressure the managers to pursue reduced leverage and increase firm performance (Uwuigbe, 2014). On the contrary, Jensen & Meckling (1976) argued that organisations with larger boards rather have a high leverage ratio in their capital structure due to the ineffectiveness of the board in decision making and to exercise adequate checks on the activities of the executive. The work of Abor (2007) and Bokpin & Arko (2009) in Ghana reported a positive and statistically significant association between leverage and board size. Similarly, AlNodel & Hussainey (2010) in a study of Saudi Arabian listed firms, found a statistically significant and favourable connection between board size and the total and long-term debt ratios. Also, Sheik and Wang (2012) examined this issue in 436 firms quoted on the Karachi stock exchange during the period 2004-2008 and documented a positive correlation between board size and level of debt. However, Berger et al. (1997), Anderson et al. (2004) and Magdalena (2012) reported a significantly and negative link between board size and financial structure.

In modern organisations, entrenched managers tend to go for lower debt to ease the pressure and risks connected with the use of higher debt (Berger et al., 1997; Taljaard et al., 2015). Managerial tenure is the number of years an executive remains in a position to carry out the assigned responsibilities, which can easily lead to entrenchment. In the opinion of Wen et al. (2002), entrenched managers would prefer to employ lesser levels of debt to avert the consequences of debt on business activities. In a cross-sectional analysis, Berger et al. (1997) argued an adverse connection between leverage and the degree of managerial entrenchment. On the contrary, Harris & Raviv (1988) argued that entrenched managers might not adopt lower leverage since it would reduce their voting power and control, which in turn would lead to monitoring pressure and dismissal.

Data and Methodology

The study used data collected from ten sub-Saharan African countries based on available data and the necessity to maintain uniformity and balanced observations. The countries included in the study are South Africa, Nigeria, Namibia, Ghana, Kenya, Botswana, Mauritius, Zambia, Zimbabue and Cote de’Ivoire. The initial study sample comprises of 445 randomly selected listed firms on the stock exchanges in selected sub-Saharan African nations for the period 2010 to 2019. However, as a result of the differences in debt and corporate governance structures, firms in the financial service sector were excluded from the initial sample. Also, firms without data for the variables under consideration for the study period were omitted from the sample study. The final sample comprises of 164 firms with 1640 firm-year observations. The study employed data sourced from the annual reports of firms in the sample. Furthermore, we used data obtained from the yearly reports and publications of Stock Exchanges from the different countries in the study.

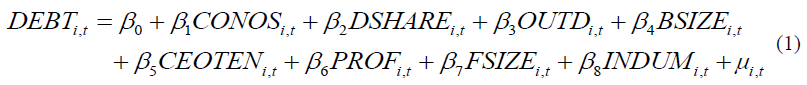

This study focused on listed firms because of the confidence that such firms operate economic activities as defined in corporate governance standards and regulations stipulated by the regulatory authorities. The study used panel data analyse to account for firm-specific heterogeneity of possible explanatory variables. The panel data regression model is stipulated as follows:

Where it is the ith firm in time t and μ is the random error term. The capital structure of the firm is proxied by debt, and it is calculated as the book value of total debt over total assets (Abubakar, 2015; Bulathsinhalage & Pathirawasam, 2017). The corporate governance variables such as concentrated ownership structure (CONOS), directors’ shareholding (DSHARE), board size (BSIZE), outside director (OUTD) and CEO tenure (CEOTEN) serves as the explanatory variables. The concentrated ownership structure is calculated as the total shares held by the top three shareholders over the firm’s total number of shares. Directors’ shareholding is measured as the proportion of director’s shareholdings over the number of outstanding shares. Board size and outside directors on the board were measured as the total number of board members and the number of non-executive directors on the board, respectively. Further, the study measure the CEO tenure as the period the CEO has been in the position of running the business. The measurement of explanatory variables follows Uwuigbe (2014); Bulathsinhalage & Pathirawasam (2017) and Mohammed (2018).

The study includes control variables like firm size (FSIZE) and profitability (PROF) perceived to have influence on capital structure. The study measure firm’s size as the natural logarithm of total assets. Profitability is proxied by return on assets (ROA), which is measured as a percentage of net profit over the total assets (Abubakar, 2015). To control for industry effects, the study introduced the industry dummy (INDUM) variable, measured to take the value of 1 if the firm is in a particular industry sector, 0 otherwise.

Empirical Results and Discussion

Descriptive Statistics

The descriptive statistical analysis of the variables in the sample is presented in Table 1. The result reveals that listed firms in sub-Saharan African countries have an average of 55.3 percent of total debt to total assets ratio with a standard deviation and median value of 37.4 percent and 53.2 percent, respectively. This result suggests the assets financing structure and the tendency for listed firms to use debt more than equity to finance investment, which, therefore, may expose the firm to future financial distress. The average (median) level of the largest shareholder’s share is 22.201 (20.104) with a minimum and maximum value of 8.440 and 33.895, respectively. This result implies that a few shareholders hold 22 percent of the shares.

| Table 1 Descriptive Statistics of the Sample | |||||

| Variables | Mean | Std. dev. | Minimum | Median | Maximum |

| DEBT | 0.553 | 0.374 | 0.006 | 0.532 | 8.301 |

| CONOS | 22.201 | 13.513 | 8.440 | 20.104 | 33.895 |

| DSHARE | 0.153 | 0.117 | 0.032 | 0.251 | 0.259 |

| OUTD | 8.820 | 4.294 | 6.000 | 3.000 | 12.000 |

| BSIZE | 8.165 | 2.445 | 7.000 | 11.000 | 19.000 |

| CEOTEN | 6.046 | 4.363 | 2.000 | 5.000 | 11.000 |

| ROA | 0.042 | 0.263 | -1.601 | 0.060 | 0.320 |

| ROE | 0.065 | 0.023 | -0.956 | 0.174 | 0.431 |

| FSIZE | 14.369 | 1.835 | 9.038 | 14.390 | 18.365 |

| INDDUM | 0.046 | 0.072 | 0 | 0.025 | 1 |

The directors’ shareholding average (median) 15.3 percent (25.1) and ranges from 3.2 percent minimum to a maximum of 25.9 percent. Outside directors have a minimum of 6 and a maximum of 12 respectively. The board size is an average of 8.16 with the lower and higher value of 7 and 19, respectively. While the CEO’s tenure has a mean value of 6.046 with a standard deviation of 4.363, firm size is an average of 14.369 percent.

Correlation Matrix

As presented in Table 2, the result indicates that there is no concern about multicollinearity with the variables in this study. The result indicates that concentrated ownership structure and director’s shareholding have a negative correlation with the levels of debt. This finding implies that these explanatory variables can serve as mechanisms to control the use of debt of sub-Saharan African listed firms. While outside directors and board size exerts a positive correlation with debt, CEO tenure revealed a negative association with debt. This result suggests that outside directors can use their influence to help listed firms in sub-Saharan African countries to acquire more debt. It implies that optimal board size with experienced and competent board members would lead to debt financing that would pressure the managers to carry out activities in line with the objectives of the shareholders. Also, the result shows that firms with entrenched CEO would use less debt in their operations to reduce the risks of bankruptcy and loss of interest.

| Table 2 Correlation Matrix of the Sample Variables | ||||||||||

| Variables | DEBT | CONS | DSHA | OUTD | BSIZE | CEOT | ROA | ROE | FSIZE | INDD |

| DEBT | 1 | |||||||||

| CONOS | -0.371 | 1 | ||||||||

| DSHA | -0.03 | 0.334 | 1 | |||||||

| OUTD | 0.341 | 0.414 | 0.332 | 1 | ||||||

| BSIZE | 0.409 | 0.012 | 0.382 | 0.303 | 1 | |||||

| CEOTEN | -0.357 | 0.372 | 0.234 | 0.413 | 0.403 | 1 | ||||

| ROA | -0.39 | 0.034 | 0.413 | 0.303 | 0.436 | 0.64 | 1 | |||

| ROE | -0.462 | 0.273 | 0.343 | 0.443 | 0.415 | 0.342 | 0.334 | 1 | ||

| FSIZE | 0.145 | 0.033 | 0.032 | 0.283 | 0.374 | 0.534 | 0.311 | 0.433 | 1 | |

| INDD | 0.032 | 0.434 | 0.033 | 0.333 | 0.014 | 0.025 | 0.033 | 0.023 | 0.074 | 1 |

Regression Results

This study employs the fixed effects regression model to investigate the link between corporate governance and the capital structure of listed firms in sub-Saharan African countries. The choice to use the fixed effects method followed the outcome of the Hausman specification test reported in Table 3. Specifically, the result of the analysis reveals a p-value of 0.0030, which supports the fixed effects model to explain the connection between the corporate governance variables and the capital structure of firms listed on the Stock Exchanges in sub-Saharan African countries. Besides, the fixed effects technique is significant to analyse the panel data since it can account for issues relating to autocorrelation. The result demonstrates that ownership concentration reflects a substantial negative relationship with the capital structure of firms in sub-Sahara Africa. The managerial shareholding has an adverse and significant association with capital structure, as higher managerial share ownership means lower debt in the capital structure. This finding is consistent with earlier studies like Agyei & Owusu (2014); Sheikh & Wang (2012) and Taljaard et al. (2015).

| Table 3 Coefficient Estimates of the Sample with Fixed Effects | |||

| Explanatory variables | Coefficient | Strd error | Prob. |

| CONOS | -0.2310** | -0.4215 | 0.0263 |

| DSHARE | -0.32143 | -0.2834 | 0.0021 |

| OUTD | 0.3207* | 0.5174 | 0.0054 |

| BSIZE | 0.1463* | 1.4707 | 0.0419 |

| CEOTEN | -0.21972* | -0.287 | 0.003 |

| ROA | -0.19058 | -2.3572 | 0.0043 |

| FSIZE | 0.34444 | 0.0432 | 0.0183 |

| INDDUM | 0.01218 | 0.14342 | 0.4279 |

| Intercept | 5.6449* | 3.4372 | 0.3072 |

| Obs. | 1640 | ||

| R2 | 0.8664 | ||

| Adj. R2 | 0.7811 | ||

| F-statistic | 17.3544 | ||

| Prob(F-Stat) | 0 | ||

| Durbin-Watson Stat | 2.1534 | ||

| Huasman Spec Test | 6.1308 (0.0030) | ||

The measure of board independence and effectiveness using outside director and board size exhibits a positive connection with the capital structure of listed firms in sub-Saharan Africa. This result implies that as more competent and experienced outside directors are engaged in the board, the use of debt to finance investment increases as a strategy to supervise better, monitor and support the executives to act in the utmost interest of the investors. This result is in tandem with the literature, and findings by Bokpin & Arko (2009) and Garba & Abubakar (2014). The result implies that managers in a firm with an established corporate governance structure tend to seek debt to finance their operations. The result, however, contradicts the findings of Anderson et al. (2004) and Uwuigbe, (2014). The importance of the CEO’s entrenchment is measured using CEO tenure. The idea here is that the CEO that stays long in a position is more entrenched into the system. As expected, the result shows that CEO tenure has a significant negative connection with the capital structure of firms in sub-Saharan Africa. A substantial reason for this relationship is that the entrenched CEO could potentially take fewer debts to discourage pressure and potential bankruptcy. This result suggests that CEO tenure due to entrenchment can induce a considerable influence on the executive in such a manner that would make them act differently from the interest of the shareholders.

The result of the control variable, profitability indicates a negative and significant connection with the debt. This result is in term with the empirical outcomes of Friend & Lang (1988) and Orumo (2018), and suggests that listed firms in sub-Saharan Africa with superior performance tend to have a lower level of debt in their financing arrangement. Expectedly, the result of the study reveals a significant favourable influence of size on the debt ratio of firms listed in sub-Saharan Africa. This result implies that larger firms usually have a higher debt ratio due to their activities and the ability to raise funds from the debt markets. This result is in tandem with Sheikh & Wang (2012). The analysis shows that industry dummies are significant to explain the debt ratio of firms listed in sub-Sahara Africa. Also, it reveals that ownership concentration, directors’ shareholding, board size and outside directors’ variables plays the same significant role across industries.

The results show in Table 3 that the overall analysis using the fixed effects technique is statistically significant at the 5% level. The F- test statistics of 17.3544 with a p-value <0.0000 means that the explanatory variables have substantial effects on the capital structure of firms in sub-Saharan Africa. The estimation reveals that the variables in the study explained 87% of the variation in the capital structure of firms in the sub-Saharan Africa (R2=0.87). This result implies that variables outside of this study influence 13% of the capital structure. The result of the Durbin-Watson test statistics value of 2.1534 indicates that there is no problem with autocorrelation. Importantly, it can be observed that the variables model is essential for this study.

Robustness Check of the Results

The study employs the Two-Stage Least Square (TSLS) method to assess the robustness of the results obtained with the fixed effects model and deal with the problem of endogeneity where it exists. The study employs the Hausman specification test to check for endogeneity among the variables. As reported in Table 4, the result which shows a p-value of 0.0420 suggests evidence to support the existence of endogeneity in the sample. The study employed the internal instruments to replace the endogenous variables by its own two period lag for a good instrument as built in the software. The results of the TSLS estimate, as presented in Table 4, indicate that there is no significant difference with the results obtained using the fixed effects model. State differently, the results of the TSLS estimate of the variables appeared to be consistent with the fixed effects model. Although with improved coefficient values, the result reveals that there is a substantial negative connection between concentrated ownership structure and capital structure. Furthermore, the study shows a positive influence of outside directors and board size on the capital structure of firms listed in sub-Saharan Africa. This result suggests that board composition and board size can provide the monitoring and control mechanism on the manager.

| Table 4 Results of Two-Stage Least Squares | |||

| Explanatory variables | Coefficient | Std error | Prob. |

| CONOS | -2.0811 | -1.0111 | 0.0361 |

| DSHARE | -0.2454** | -4.0363 | 0.0001 |

| OUTD | 0.2555 | 2.9659 | 0.03061 |

| BSIZE | 0.2302* | 1.2865 | 0.00704 |

| CEOTEN | -0.2054 | -3.0071 | 0.0051 |

| ROA | -1.2332 | -0.4011 | 0.0003 |

| ROE | -2.9659** | -0.6402 | 0.0020 |

| FSIZE | 0.2865** | 0.4444 | 0.0434 |

| INDDUM | 0.4011* | 3.0071 | 0.8346 |

| Intercept | 4.6402** | 3.0071 | 0.6109 |

| Obs. | 1640 | ||

| R2 | 0.8211 | ||

| Adj. R2 | 0.7426 | ||

| F-statistic | 14.0322 | ||

| Prob(F-Stat) | 0.0002 | ||

| Durbin-Watson Stat | 1.9026 | ||

| Huasman Spec Test | 4.4739 (0.0420) | ||

Again, the direction and effect of the coefficient of managerial shareholding and CEO tenure remain the same as the prior result obtained with the fixed effects model. This finding suggests that there is a negative relationship between managerial shareholding, CEO tenure and the debt ratio of firms listed in sub-Saharan Africa. Although the result is inconsistent with Bokpin & Arko (2009); Harris & Raviv (1988) and Magdalena (2012), it, however, confirms the strong influence of these variables on the capital structure of the firms. This result is consistent with entrenched managers using less debt to reduce pressure and the risks of bankruptcy. The result affirms the importance of managerial share ownership to align the interest of the managers and the owners of the firm.

Diagnostic Test

To further validate the results obtained with the OLS regressions as presented in Table 3, we perform the diagnostic test. The result of the diagnostic test is reported in Table 5. The result of the serial correlation test using the Breusch-Godffrey test shows F-statistic of 1.14278 and a probability value of 0.10376, which means there is no indication to support the presence of serial correlation. The result of the heteroskedastic residuals using the Breusch-Pagan-Godffrey test indicates F-value of 1.503261 and a probability value of 0.15924. This result implies that the alternative hypothesis of homoskedastic residuals is accepted. The result shows that the residuals are normally distributed with an F-statistic of 83.02966 and a probability value of 0.04047. The variables were significant at the 5% level.

| Table 5 Results of the Diagnostics Test | |||

| Diagnostic Test | Test type | F-Value (probability) | Remarks |

| Serial correlation | Breusch- Godffrey | 1.14278 (0.10376) | Serially correlated |

| Heteroskedasticity | Breusch-Pagan-Godffrey | 1.50326 (0.15924) | Homoskedasticity |

| Normality | Jarque–Bera | 83.0296 (0.04047) | Normally distributed |

Concluding Remarks

This study extends the agency framework and examines the impact of ownership and board structures on the capital structure of firms listed on the Stock Exchanges of sub-Saharan African countries. The study employs the ordinary least squares regression model to analyse panel data during the period 2010 - 2019. The result of the study provides supportive evidence to demonstrate that concentrated ownership structure negatively influences the debt ratio of listed firms in sub-Saharan Africa. This result suggests the incentives of block shareholders to monitor and control the activities of the management and persuades the managers to use lower debt in financing economic activities. Consistent with entrenched managers pursuing less debt, the results indicate a significant adverse connection between director shareholding, CEO tenure and debt ratio. This finding demonstrates the ability of outside directors to monitor and check the activities of the executive to ensure that the debt ratio is low to avert future financial distress. The undesirable impact of CEO tenure on debt ratio suggests that the entrenched CEO is likely to deploy less debt to finance investments, thereby mitigating the costs of future financial distress. The findings of this study reinforce the need to align the managers' interests with the owners of the firm.

Further, the results provide evidence to show that board size and outside directors have a significant positive connection with debt ratio. This result indicates the ability of the board members to use their influence in society to raise the required funds from the debt market to finance any positive investment. The study demonstrates that larger firms are likely to have a desirable link with the debt ratio. This study has contributed to the understanding of corporate governance and capital structure concepts, and the connection between corporate governance structure and capital structure. There is absolutely no doubt that corporate governance is also vital to firms not listed at the stock exchange. Thus, further research work is essential to extend this study to firms in the financial sector and the ones not listed, taking into account additional variables, regional analysis, industry and other firm-specific effects.

Acknowledgements

We would like to thank the Editor and anonymous referees for useful comments. We acknowledge and thank Covenant University, Ota, Nigeria for financial support.

References

- Abobakr, M.G. (2017). Corporate governance and banks performance: Evidence from Egypt. Asian Economic and Financial Review, 7(12), 1326-1343.

- Abor, J. (2007). Corporate governance and financing decisions of Ghanaian listed firms. Corporate governance: International Journal of Business in Society, 7(1), 83-92.

- Abubakar, A. (2015). Relationship between financial leverage and financial performance of deposit money banks in Nigeria. International Journal of Economics, Commerce and Management, 3(10), 123-132.

- Afolabi, A., Olabisi, J., Kajola, S.O., & Asaolu, T.O. (2019). Does leverage affect the financial performance of Nigerian firms? Journal of Economics & Management, 37(3), 5-22.

- Aguilera, R.V., Judge, W.Q., & Terjesen, S.A. (2018). Corporate governance deviance. Academy of Management Review, 43(1), 87-109.

- Agyei, A., & Owusu, A.R. (2014). The effect of ownership structure and corporate governance on capital structure of Ghanaian listed manufacturing companies. International Journal of Academic Research in Accounting Finance and Management Sciences, 4(1), 109-118.

- Aljifri, k. & Hussainey, K. (2012). Corporate governance mechanisms and capital structure in UAE. Journal of Applied Accounting Research, 13(2), 145-160.

- AlNodel, A., & Hussainey, K. (2010). Corporate governance and financing decisions by Saudi companies. Journal of Modern Accounting and Auditing, 6(8), 1- 14.

- Anderson, R.C., Mansi, S.A., & Reeb, D.M. (2004). Board characteristics, accounting report integrity and the cost of debt’, Journal of Accounting and Economics, 37, 315-42.

- Ararat, M., Black, B.S., & Yurtoglu, B.B. (2016). The effect of corporate governance on firm market value and profitability: time-series evidence from turkey. Emerging Markets Review, 30, 113-132. Berger, P.G., Ofek, E., & Yermack, D.L. (1997). Managerial entrenchment and capital structure decisions, Journal of Finance, 52(4), 1411-1438.

- Bokpin, A.G., & Arko A.C. (2009). Corporate governance and capital structure decisions of firms: Empirical evidence from Ghana. Studies in Economies and Finance, 26(4), 246-256.

- Bulathsinhalage, S., & Pathirawasam, C. (2017). The effect of corporate governance on firms’ capital structure of listed companies in Sri Lanka. Journal of Competitiveness, 9(2), 19-33.

- Céspedes, J., González, M., & Molina, C.A. (2010). Ownership and capital structure in Latin America. Journal of business research, 63(3), 248-254.

- Ehikioya, B.I. (2019). Does board structure affect firm performance in developing economies? Evidence from the Nigerian listed firms. African Journal of Management, 4(1), 1 - 16.

- Fama, E.F. (1980). Agency problems and the theory of the firm. Journal of Political Economy, 88(2), 288-307.

- Fosberg, R.H. (2004). Agency problems and debt financing: Leadership structure effects, corporate governance,’ International Journal of Business in Society, 4(1), 31-38

- Friend, I., & Lang, L.H.P. (1988). An empirical test of the impact of managerial self-interest on corporate capital structure, Journal of Finance, 47, 271-281.

- Garba, T., & Abubakar, B.A. (2014). Corporate board diversity and financial performance of insurance companies in Nigeria: An application of panel data approach. Asian Economic and Financial Review, 4(2), 257-277.

- Granado?Peiró, N., & López?Gracia,, J. (2017). Corporate governance and capital structure: A Spanish study. European Management Review, 14(1), 33-45.

- Grossman, S. & Hart, O. (1980). Takeover bids, the free-rider problem and the theory of the corporation, Bell Journal of Economics, 11(1), 42-64.

- Harris, M., & Raviv, A. (1988). Corporate control contests and capital structure. Journal of financial Economics, 20, 55-86.

- Hassan, M.H. (2017). Corporate governance practices and firm’s capital structure decisions: An empirical evidence of an emerging economy. Accounting and Finance Research, 6(4), 115-129.

- Jensen, M.C. & Meckling, W.H. (1976). Theory of the firm: Managerial behaviour, agency costs and capital structures, Journal of Financial Economics, 3, 305-360.

- Kiuri, R.M. (2013). The effects of ownership structure on bank profitability in Kenya. European Journal of Management Sciences and Economics, 1(2), 116-127. Lioa, L., Mukherjee, T., & Wang, W. (2015). Corporate governance and capital structure dynamics: An empirical study. Journal of Financial Research, 38(2), 169-191.

- Magdalena, R. (2012). Influence of corporate governance on capital structure decision: Evidence from Indonesian. Capital Market World Review of Business Research, 2(4), 37-49.

- Modigliani, F., & Miller, M. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261-97.

- Mohammed, A.M. (2018). The impact of ownership structure on firm performance: evidence from Jordan. Academy of Accounting and Financial Studies Journal, 22 (5), 1-9.

- Myers, S. (1977). Determinants of corporate borrowing,’ Journal of Financial Economics, 5(2), 147- 175.

- Orumo, J.I. (2018). Ownership structure and return on assets of commercial bank in Nigeria. American Finance & Banking Review, 2(2), 20-33.

- Sheikh, N.A., & Wang, Z. (2012). Effects of corporate governance on capital structure: Empirical evidence from Pakistan, Corporate Governance: International Journal of Business in Society, 12(5), 629-641.

- Taljaard, C.C.H., Ward, M.J.D., & Muller, C.J. (2015). Board diversity and financial performance: A graphical time-series approach. South African Journal of Economic and Management Sciences, 18(3), 425-448.

- Uwuigbe, U. (2014). Corporate governance and capital structure: evidence from listed firms in Nigeria stock exchange. Journal of Accounting and Management, 4(1), 5-14.

- Wen, Y., Rwegasira, K. & Bilderbeek, J. (2002). Corporate governance and capital structure Decisions of the Chinese listed firms. Corporate Governance: An International Review, 10(2), 75-83.

- Zou, L., Wilson, W., & Jia, S. (2017). Do qualified foreign institutional investors improve information efficiency: A Test of stock price synchronicity in china? Asian Economic and Financial Review, 7(5), 456-469.