Research Article: 2022 Vol: 26 Issue: 6

An Empirical Analysis of Hedging and Price Discovery in Indian Commodity Futures Market

Syeda Rukhsana Khalid, Amjad Ali Khan College of Business Administration Asif Hasan, Malla Reddy University

Citation Information: Khalid, S.R., & Hasan, A. (2022). An empirical analysis of hedging and price discovery in indian commodity futures market. Academy of Accounting and Financial Studies Journal, 26(6), 1-10.

Abstract

In the present study attempt has been made to examine the price discovery in the commodity futures market of India. Scholastic research investigating price discovery and Market efficiency can be seen mainly in developed economies concentrating on financial securities, derivatives and commodities. In emerging economies for agri-commodities the evidence on “price discovery” is limited. There are very few studies which have investigated it in developing economies like India or China where the commodity futures market is still in a nascent stage. Even more most of the studies in India were carried out for commodities with fewer observations of data or for commodities traded on regional exchanges. This research gap motivated the author to examine the price discovery and Hedging Effectiveness of highly traded agricultural and plantation commodities. The present study reports price discovery, hedge ratios and hedging effectiveness of future contracts in agricultural commodities like turmeric, cotton and rubber. The lead lag relationship is examined between the future and spot prices using the ARDL Bound Test. For the short run dynamics Wald Test was used and Granger causality was applied to ascertain the direction of flow of information. For the present study all the commodities’ future and spot prices are co-integrated and there is bi-directional Granger long and short run causality between them. In the short run, when the commodities series were in disequilibrium the results indicated that greater adjustment was made by the spot price to re-establish the equilibrium except rubber near month and distant month where the speed of adjustment for the future series was more. The present research estimated the hedge ratios and investigated the hedging effectiveness provided by the turmeric, cotton and rubber futures market. The hedge ratios are high for all the commodities and are near to one (naïve hedge ratio). The hedging effectiveness is more than fifty percent (56% to 99%) for all commodities except turmeric (25%). The hedging effectiveness for rubber maturity month contracts (99.04%) and rubber near month contracts (97.55%) are high when compared to rubber distant month contracts (55.99%). This study will help the farmers and traders to transfer their risk from spot to futures market of the specific commodities and protect themselves from the adversities of high price fluctuations in agri-commodities, and will also help the farmers and traders in increasing their bargaining power as they can take cues from the price signals of the futures market.

Keywords

Price Discovery, Hedging, Granger Causality, Indian Commodity Futures Market.

Introduction

Scholastic research investigating price discovery and market efficiency can be seen mainly in developed economies concentrating on financial securities, derivatives and commodities. In emerging economies for agri-commodities the evidence on “price discovery” is limited. There are very few studies which have investigated it in developing economies like India or China where the commodity futures market is still in a nascent stage. Even more most of the studies in India were carried out for commodities with fewer observations of data or for commodities traded on regional exchanges. This research gap motivated the author to examine the price discovery and Hedging Effectiveness of highly traded agricultural and plantation commodities.

The present study considering the research gap and high price volatility of agricultural commodities motivated the researcher to address, first, inadequate research, second, price discovery and market efficiency of Indian agri-commodities and third, to determine hedge ratio and hedging effectiveness in these Indian agri commodities and fourth to help the Indian Small farmers from the findings of this research (Chaihetphon & Pavabutr, 2010).

Indian economy is an agrarian economy, the farmers are predominantly marginal and small and their only source of income is trading in agri-commodities. Indian Commodity Futures Market was established for the farmers to hedge and discover the spot price. The farmers condition in India is deplorable. This also prompted the researcher to examine hedging, price discovery and market efficiency of majorly traded Indian agri and plantation commodities and to augment the existing literature with new observation and fresh insights besides contributing to the policy dimension of price risk management to facilitate Indian market participant.

There is tumultuous growth in recent years in Indian Commodity Futures Market but at the same time it has undergone vicissitudes and has been blamed for speculative activities from time to time and even had witnessed banning of certain agri-commodities from future trading. The present study intends to find out whether the futures market is matured enough in the commodities of turmeric, cotton and rubber to discover the price. There also exists a spate of literature which analyses the merits of hedging. The theoretical rationale on the significance of hedging is fortified with a lot of analytical investigation. The present study felt the need to examine the effectiveness of Indian Commodity Futures in mitigating and managing the price risk through hedging as it has not been extensively researched for hedging effectiveness of the future contracts and in estimating the hedge ratio specifically using ARDL approach.

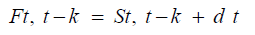

Price discovery and Risk management are the two vital functions of any derivative market. Risk Management is achieved through the process of hedging whereas Price discovery is the efficiency of the futures market to absorb all the information and reflect it through the future price. Price discovery, according to Schreiber & Schwartz (1986), is the process in which markets attempt to reach equilibrium prices. Fama, in Efficient Market Hypothesis describes market as efficient that absorbs and reflects all the information. To eliminate supernormal profit from arbitraging on price differences, an efficient futures market should send price signals to the spot market immediately, except for some transaction costs, the future prices become equivalent to spot prices. Indian agricultural futures market efficiency with cost-of-carry (stochastic convenience yield) and no-arbitrage profit expectation can be represented as:

Where Ft, t-k is the futures price at time t for delivery at time t-k, d t is the cost-of-carry, and S t-k is the expected spot price at the maturity of the contract, i.e. time t-k. If the cost-of-carry is zero or stationary, arbitrage model implies that the futures price is co-integrated with spot price. To ensure long-term efficiency of Indian commodity futures markets, two critical criteria must be met i.e. F and S must be integrated to the same order and they must also be co-integrated, otherwise F and S will tend to drift apart over time (Iyer & Pillai, 2010).

Futures are one of the most commonly traded derivatives and are more liquid when compare to the spot or cash market because of high leverage, ease of shorting, low transaction cost and high transparency. This results in greater participation from traders and investors which in turn helps in quick absorption of information and aids the spot market in attainment of the equilibrium price. Futures market should be an unbiased estimator of spot market and it should lead the spot market but in reality sometimes because of the lesser participation from investors and traders or immature futures market the price discovery tends to happen in spot market. The crux of the price discovery function hinges on whether the latest information is reflected first in changed spot (cash) or in changed future prices. Working, Black argues that in reaction to new information futures markets react quicker than their underlying spot markets due to advantages such as, more transparency, lower transaction costs and higher liquidity (Perron, 1997).

Risk arises in every aspect of human endeavour as it is inherent in human nature. Management of risk and risk itself both are inseparable and stakeholders exposed to risks have learnt to manage the impact of economic risk through a host of means which have grown manifold with the growing world economy. Commodity price volatility is one of such growing economic risk whose effect encompasses virtually everyone. The major risk faced by the participants of the commodity market is the price fluctuations or volatility. One of the most vital and practical applications of Commodity Futures Trading is to manage price risk through “”Hedging”. By the mechanism of hedging, the risk of price volatility or variability of a commodity can be managed (Lumsdaine & Papell, 1997).

Review of Empirical Studies

Kumar (2004) used Johansen co-integration, vector error correction model, Granger causality and regression with dummy variables to understand a day of the week effect in high-value agri-commodity of cardamom e-auction prices. The presence of price discovery and spill over effects was explored by Manogna and Mishra in select agri commodities. Dash studied the price discovery for twelve commodities in the Indian Spot and Futures markets and its effect on macroeconomic variables. The result from his study indicated that “inflation had a significant effect on price volatility”. Adammer and Bohl examined the price discovery in wheat, canola and corn futures contract traded in European agri-commodity markets. Kumar et al. (2008) investigated the price discovery in Indian commodity futures and spot market for nine commodities using daily price for the period 2009 to 2014 and found that there is “strong causation extending from futures to spot prices”. The result suggested that future prices could aid farmers in making wiser decisions. It could also enable them to augment their earnings as they could decide whether to store or sell their produce based on futures’ price of the crops. Inani (2017) found that “future markets are more efficient and confines information more rapidly than the spot market”. Ayalew research results were evidence of the effect of access to price information at Ethiopian commodity exchange on agri-commodities that augmented output share and inspired small farmers to augment supply. Arnade and Hoffman examined price discovery in futures of soyabean, corn and sugar and they found futures market to be relatively efficient in price discovery. Gupta et al. (2017), they have examined hedge ratio and hedging effectiveness in some agricultural and non-agricultural NCDEX and MCX traded commodities. Constant and dynamic hedge ratios are estimated by using OLS, VAR, VECM and VAR-MGARCH. The results of constant as well as dynamic hedge ratios reveal that the Indian futures market provides higher hedging effectiveness in case of precious metal (65-75%) compared to industrial metal and energy commodities (less than 50 per cent) (Garbade & Silber, 1983).

Dey & Maitra (2016), examined whether commodity futures markets in India helped rationalize farmers’ price expectation or not. They studied efficiency, causality and divergence/convergence of futures markets of pepper, coffee, and natural rubber (NR) by employing error correction, co-integrations, and causality models. Their analysis showed that pepper futures market is efficient in price discovery, while NR and coffee spot markets did the process faster. Coffee and pepper spot and futures prices exhibit the convergence; NR showed sign of divergence. Unidirectional causality was observed in pepper futures to spot while, bidirectional causality was observed in coffee and rubber (Glynn et al., 2007).

Narsimhulu & Satyanarayana (2016) examined the efficiency of Indian agri-commodity futures in price discovery and risk management in India, using Johansen's test of co-integration (VECM), Wald chi-square test, and Granger causality test. The risk-management function was investigated using OLS and VECM to determine optimal hedge ratio and hedge effectiveness. Daily closing spot and future prices of Chana, Chilli, and Turmeric were analysed and was found that there was a long-run relationship between commodity spot and futures prices of the three commodities. The VECM results revealed that there is a long-run causality running from futures prices to spot prices, which enable the spot market to adjust its short-run deviations from long-run equilibrium path with nearly 2.17%, 2.78%, and 4.41% speed of adjustments in Chana, Chilli, and Turmeric, respectively. The Granger causality test results revealed that there is only a unidirectional causality from futures returns to spot returns of commodities - Chilli and Turmeric (Ederington, 1979). However, in the case of Chana, there is a bi-directional causality between futures and spot returns. According to hedge ratios of OLS and VECM results, it was found that the commodity futures provide 50%, 56%, and 55% variance reduction in their spot prices of Chana, Chilli, and Turmeric, respectively. It was observed that the commodity futures were more effective in hedging, and the near month futures contracts are suitable for hedging.

Nambiar & Balasubramanian (2016) analysed and compared price behaviour in Indian Rubber Spot and Future prices during pre- recession and post-recession. They used VAR method for assessing the short run causality between the two-price series of Rubber. Their results revealed that during the post-recession period the Rubber futures had played its inherent function of price discovery. Murugananthi et al. (2013) confirmed the price discovery in turmeric futures market in India using Johansen’s co-integration and Granger Causality. This paper investigated the relationship between turmeric spot price prevailed in Erode market and futures price traded on NCDEX for over a period of eight years (2004 -2012). It was found that futures price of turmeric led the spot market and unidirectional causality was confirmed from futures market to spot market. In the short run, when the turmeric series was in disequilibrium the results of VECM indicated that greater adjustment was made by the spot price to re-establish the equilibrium. The result of the study confirmed that the turmeric futures market is efficient, since it played a fair role in price discovery and there is price transfer from futures to spot market.

Jain & Biswal examines the price discovery and information sharing relationships between the S&P CNX NIFTY index and its futures using An Autoregressive Distributed Lag (ARDL) Bounds Test for co-integration and found that the spot index and its futures are co-integrated and used augmented VAR approach of Toda & Yamamoto to test for direction of causality in prices. Results indicated higher efficiency in the spot market i.e. unidirectional causality from spot to futures market was confirmed. Dinica & Armeanu (2014), estimated the optimal hedging ratio of the non-ferrous metals traded on the London Metals Exchange using three methods: the error-correction model, the ordinary least squares regression, and the auto regressive distributed lag model (Lokare, 2007; MacCallum & Austin, 2000).

The results showed that the optimal hedge ratio and hedging effectiveness had increased with the hedging horizon, converging to one for long tenors. Their findings also showed greater in-sample hedging effectiveness for more complex models, but the increase in performance was not significant for the out-of-sample analysis. Sehgal et al. (2012) examined price discovery in ten agricultural commodities i.e. Chana, guar seeds, soya bean, Potato Agra, Kapas, Turmeric, Black Pepper, Barley, Maize and Castor seeds, and they confirmed price discovery in futures for all commodities except Turmeric. They used Johansen’s Co-integration and Granger causality for the analysis of ten agricultural commodities, and found bi-directional Granger lead relationships between futures and spot in all agricultural commodities except Turmeric in which there is no co-integration and hence no causality and is informational inefficient.

Methodology

Objectives

1. To investigate the price discovery in select commodities of NCDEX.

2. To find out the hedge ratio and hedging effectiveness of the select commodities.

Data

The secondary data used in this study was collected from the official website of National Commodities &Derivatives Exchange Ltd (NCDEX). The daily closing prices of future contracts for selected commodities (rubber, cotton, and turmeric) and their respective spot closing prices were collected. The future contracts have been categorized into Maturity Month Contract (Maturing in the same month), Near Month Contract (Has only one month to maturity), Far Month Contract (Has two months to maturity) and Distant Month Contract (More than two months to maturity). Roll over methodology was used to construct the pooled series of daily data. The first day of a contract was considered as the first day of the second month from maturity month and it ends with the last day of the second month. Similarly, the contracts were rolled over to the next contracts. So that the data did not overlap and methodological problems associated with overlapping of the data were avoided (Johnson, 1976).

The commodity ‘Rubber’ had been chosen from the Plantation category of NCDEX commodities. The daily closing prices of RBBRS4KOC and spot RBBRS4KOC were collected. For commodity rubber, four types of contracts have been identified: Maturity Month Contracts, Near Month Contracts, and Distant Month Contracts. The commodity ‘Cotton’ had been chosen from the ‘Fibre’ category of NCDEX. There are a total seventeen future contracts available. All the contracts belong to the Distant Month category. There are a total of 284 observations. The commodity ‘Turmeric’ had been chosen from the Spices category of NCDEX commodities. There is only one Turmeric contract available on NCDEX and hence was chosen for the study. There are a total 87 distant month contracts available for this contract, there are a total 1176 observations collected from 87 contracts (Strazicich & Lee, 2003).

For the present study, there are large gaps in dates of future prices because of the difference in the launching months of futures contracts, and also as fluctuations in the prices of commodity futures are more; there is high probability that such data may have one or more structural break (Kroner & Sultan, 1993).

A structural break occurs when there is a sudden shift in time series, and occurrence of structural breaks in time series data may cause analytical errors. Presence of structural breaks also reduces the power of unit root tests (Keynes, 1939).

As the present study is based on commodity futures data which is a pooled series constructed from various contracts which were launched in different months, it was suspected that there would be one or more structural breaks. Hence, the need was felt to use a unit root test which gives accurate results on data with structural breaks. The study used Breakpoint Unit Root Test of Eviews 9.5 to test the stationarity of data as shown in Table 1.

| Table 1 Descriptive Statistics |

||||||

|---|---|---|---|---|---|---|

| Name of the Commodity | Series | Skewness & Kurtosis | Inference | Jarque Bera | Standard Deviation | Stationarity |

| FP | 0.97 & 3.27 | Positively Skewed | 189.99 | 3365.16 | FP is stationary at 1% | |

| Turmeric | & Leptokurtic | (0.00) | ||||

| SP | 1.04 & 3.37 | Positively Skewed | 9.27 | 3541.162 | SP is stationary at first | |

| & Leptokurtic | (0.00) | difference | ||||

| FP | 1.64 & 4.49 | Positively Skewed | 154.78 | 2337.09 | FP is stationary at 1% | |

| Cotton | & Leptokurtic | (0.00) | ||||

| SP | 1.56 & 4.32 | Positively Skewed | 136.91 | 2314.33 | SP is stationary at 1% | |

| & Leptokurtic | (0.00) | |||||

| FP | 0.30 & 1.76 | Positively Skewed | 12.99 | 1534.41 | FP is stationary at first | |

| & Platykurtic | (0.00) | difference | ||||

| Chilli | SP | 0.003 & 1.86 | Slightly, Positively Skewed & Platykurtic | 8.9 (0.011) |

1415.06 | SP is stationary at first difference |

| Rubber | ||||||

| FP | 0.36 &2.06 | Positively Skewed | 5.51 | 4561.27 | FP is stationary at 1% | |

| Maturity | & Platykurtic | (0.063) | ||||

| Month | SP | 0.38 & 2.09 | Positively Skewed | 5.54 | 4568.96 | SP is stationary at 1% |

| & Platykurtic | (0.062) | |||||

| Negatively | 5.56 | FP is stationary at 1% | ||||

| FP | -0.10 & 2.27 | Skewed & | (0.06) | 4880.80 | ||

| Near Month | Platykurtic | |||||

| Negatively | 6.66 | SP is stationary at 1% | ||||

| SP | -0.12 & 2.21 | Skewed & | (0.035) | 4878.66 | ||

| Platykurtic | ||||||

| Negatively | 8.43 | FP is stationary at 1% | ||||

| FP | -0.20 & 1.75 | Skewed & | (0.014) | 1137.36 | ||

| Distant | Platykurtic | |||||

| Month | Negatively | 12.15 | SP is stationary at 1% | |||

| SP | -0.31 & 1.55 | Skewed & | (0.002) | 1049.10 | ||

| Platykurtic | ||||||

The present study had chosen innovational outliers “assumes that the break occurs gradually, with the breaks following the same dynamic path as the innovations”, and chosen trending the data with intercept and trend break.

Result

The ARDL model was estimated for log values of FP and SP variables of the select commodities. It was pertinent to check the residuals of the select models for serial independence, as the parameter estimates would not be consistent because of the lagged values of the variable SP and FP that appeared as regressors in the respective models.

The estimated models were checked for serial correlation and stability. To check for the presence of serial correlation in residuals, Breusch-Godfrey Serial Correlation LM Test was used and Cusum test (Table 1) had been used to test the stability of the models. The next step was to check for cointegration between the two variables FP and SP and vice versa. The ARDL Bound Test had been used for this study, to test the co-integration between the variables. The F-Statistic values are given below in the Table 2.

| Table 2 Result Of “Bound Test” |

||

|---|---|---|

| Commodity | F- statistic |

Hypothesis "No Long- Run Relationship" |

| Turmeric | ||

| ARDL (3, 2) (Dependent Variable SP) |

17.99 | The hypothesis can be rejected for both the models at 2.5% and 1% respectively |

| ARDL (2, 1) (Dependent Variable FP) | 7.17 | |

| Rubber(Maturity Month) | ||

| ARDL (1,8) | 11.68 | The hypothesis can be rejected for both the models at 2.5% and 1% respectively |

| ARDL (8,1) | 11.11 | |

| Rubber (Near Month) | ||

| ARDL (2,2) | 5.67 | The hypothesis can be rejected for both the models at 2.5% and 1% respectively |

| ARDL (2,2) | 6.17 | |

| Rubber(Distant Month) | ||

| ARDL (2,2) | 7.69 | The hypothesis can be rejected for both the models at 1% and 5% respectively. |

| ARDL (2,1) | 4.38 | |

| Cotton 29 | ||

| ARDL (1,2) | 7.71 | The hypothesis can be rejected for both the models at 1% and 2.5% respectively. |

| ARDL (2,2) | 5.94 | |

There exists a long run relationship and co-integration between the future prices and spot prices of all the select commodities, indicating Granger Causality at least in one direction. To determine the direction of Granger (1969) Causality F-statistic should be significant and lagged error term should be negative and significant. The ARDL co integrating and long run form for the models are given in Table 2. The speed of adjustment towards long run equilibrium for a single period (for the present study it is daily i.e., one day) had been determined. The long-run coefficients from the co integrating equations are also reported with their respective standard errors and they are significant (Pesaran et al., 2001).

As the long run relationship between the variable FP and variable SP had been established, the short run dynamics can also be investigated. The study had used Wald Test for the same. The output of the WALD test is displayed in the Table 3.

| Table 3 Summary Table (Co-Integration And Granger Causality) |

||||||

|---|---|---|---|---|---|---|

| Commodity | Dependent Variable | Speed of Adjustment | tECT(-1) | F- Statistic |

Granger Causality | |

| Long Run | Short Run | |||||

| Turmeric (Distant Month) | SP | 6.8% | -7.353 (0.000) |

88.973 (0.000) |

FP Granger causing SP |

FP- SP |

| FP | 5.2% | -4.642 (0.000) |

245.532 (0.000) |

SP Granger causing FP | SP-FP | |

| Cotton (Distant Month) | SP | 10.23% | -3.934 (0.000) |

125.266 (0.000) |

FP Granger causing SP |

FP- SP |

| FP | 9.98% | -3.454 (0.000) |

141.881 (0.000) |

SP Granger causing FP |

SP-FP | |

| Rubber (Maturity Month) | SP | 60.48% | -6.000 (0.000) |

4.654 (0.000) |

FP Granger causing SP |

FP- SP |

| FP | 57.64% | -5.851 (0.000) |

15.389 (0.000) |

SP Granger causing FP |

SP-FP | |

| Rubber (Near Month) | SP | 10.12% | -3.376 (0.000) |

361.9 (0.000) |

FP Granger causing SP |

FP -SP |

| FP | 11.13% | -3.522 (0.000) |

368.14 (0.000) |

SP Granger causing FP |

SP-FP | |

| Rubber (Distant Month) | SP | 10.14% | -3.941 (0.000) |

22.62657 (0.000) |

FP Granger causing SP |

FP -SP |

| FP | 16.6% | -2.974 (0.003) |

85.57447 (0.000) |

SP Granger causing FP |

SP-FP | |

Long run hedge ratio (-αF(-1)/αS(-1)) and short run hedge ratio (β) are calculated. Hedging effectiveness (Adj. R square) is also calculated for the select commodities in Table 4.

| Table 4 Hedge Ratios And Hedging Effectiveness |

|||

|---|---|---|---|

| Commodities | Short Run | Long Run | Hedging Effectiveness |

| Turmeric(Distant Month) | 1.03 | 1.00 | 24.86% |

| Cotton(Distant Month) | 0.99 | 1.00 | 66.06% |

| Rubber(Maturity Month) | 1 | 1 | 99.04% |

| Rubber(Near Month) | 0.99 | 1 | 97.55% |

| Rubber(Distant Month) | 0.99 | 0.99 | 55.99% |

Conclusion

The present study reports price discovery, hedge ratios and hedging effectiveness of future contracts in agricultural commodities like turmeric, cotton, and rubber. If “futures price leads spot price”, future market is said to be efficient and it implies that futures market is the first, in absorbing and reflecting the new information than the spot market and if farmers are provided with future price information they will benefit from future price signals. But, if the futures market is not mature enough i.e., the participants are less resulting in low volume of transactions and less liquidity then, the futures market will not be efficient, and the “spot price leads futures price”, and the farmers will not benefit from the futures market. There can also be bidirectional information flow between futures and spot markets; it implies that both the markets are efficient, and helps in price discovery, signifying developed agricultural commodity markets.

For the present study all the commodities’ future and spot prices are co-integrated and there is bi-directional Granger long and short run causality exists between them. In the short run, for the present study, when the commodities series were in disequilibrium the results indicated that greater adjustment was made by the spot price to re-establish the equilibrium except rubber near month and distant month where the speed of adjustment for the future series were more.

The present research estimated the hedge ratios and investigated the hedging effectiveness provided by the turmeric, cotton and rubber futures market. It is one of the important elements of success of futures contracts. The hedge ratios are high for all the commodities and are near to one (naïve hedge ratio). The hedging effectiveness is more than fifty percent (56% to 99%) for all commodities except turmeric (25%). The hedging effectiveness for rubber maturity month contracts (99.04%) and rubber near month contracts (97.55%) are high when compared to rubber distant month contracts (55.99%).

References

Chaihetphon, P., & Pavabutr, P. (2010). Price discovery in Indian gold futures market.Journal of Economics and Finance,34(4), 455-467.

Indexed at, Google Scholar, Cross Ref

Dey, K., & Maitra, D. (2012). Price discovery in Indian commodity futures market: an empirical exercise.International Journal of Trade and Global Markets,5(1), 68-87.

Indexed at, Google Scholar, Cross Ref

Dinica, M.C., & Armeanu, D. (2014). The optimal hedging ratio for non-ferrous metals.Romanian Journal of Economic Forecasting,17(1), 105-122.

Ederington, L.H. (1979). The hedging performance of the new futures markets.The Journal of Finance,34(1), 157-170.

Indexed at, Google Scholar, Cross Ref

Garbade, K.D., & Silber, W.L. (1983). Price movements and price discovery in futures and cash markets.The Review of Economics and Statistics, 289-297.

Indexed at, Google Scholar, Cross Ref

Glynn, J., Perera, N., & Verma, R. (2007). Unit root tests and structural breaks: A survey with applications.

Granger, C.W. (1969). Investigating causal relations by econometric models and cross-spectral methods.Econometrica: Journal of the Econometric Society, 424-438.

Gupta, S., Choudhary, H., & Agarwal, D.R. (2017). Hedging efficiency of Indian commodity futures: An empirical analysis.Paradigm,21(1), 1-20.

Indexed at, Google Scholar, Cross Ref

Iyer, V., & Pillai, A. (2010). Price discovery and convergence in the Indian commodities market. Indian Growth and Development Review.

Indexed at, Google Scholar, Cross Ref

Johnson, L.L. (1976). The theory of hedging and speculation in commodity futures. The Economics of Futures Trading. 83-99.

Indexed at, Google Scholar, Cross Ref

Keynes, J.M. (1939). Relative movements of real wages and output.The Economic Journal,49(193), 34-51.

Indexed at, Google Scholar, Cross Ref

Kroner, K.F., & Sultan, J. (1993). Time-varying distributions and dynamic hedging with foreign currency futures.Journal of Financial and Quantitative Analysis,28(4), 535-551.

Indexed at, Google Scholar, Cross Ref

Kumar, B., Singh, P., & Pandey, A. (2008). Hedging effectiveness of constant and time varying hedge ratio in Indian stock and commodity futures markets.

Indexed at, Google Scholar, Cross Ref

Kumar, S. (2004). Price discovery and market efficiency: Evidence from agricultural commodities futures markets.South Asian Journal of Management,11(2), 32.

Lokare, S.M. (2007).Commodity derivatives and price risk management: An empirical anecdote from India. Reserve Bank of India.

Lumsdaine, R.L., & Papell, D.H. (1997). Multiple trend breaks and the unit-root hypothesis.Review of Economics and Statistics,79(2), 212-218.

Indexed at, Google Scholar, Cross Ref

MacCallum, R.C., & Austin, J.T. (2000). Applications of structural equation modeling in psychological research.Annual Review of Psychology,51.

Indexed at, Google Scholar, Cross Ref

Murugananthi, D., Shivkumar, K.M., Ajjan, N., & Sivakumar, S.D. (2013). Price discovery of Indian turmeric in futures market.International Journal of Commerce and Business Management,6(2), 166-170.

Nambiar, R.S., & Balasubramanian, P. (2016). Price discovery in commodity future market: a case study of rubber.International Journal of Scientific Research,5(4), 439-442.

Narsimhulu, S., & Satyanarayana, S.V. (2016). Efficiency of commodity futures in price discovery and risk management: An empirical study of agricultural commodities in India.Indian Journal of Finance,10(10), 7-26.

Perron, P. (1997). Further evidence on breaking trend functions in macroeconomic variables. Journal of Econometrics,80(2), 355-385.

Indexed at, Google Scholar, Cross Ref

Pesaran, M.H., Shin, Y., & Smith, R.J. (2001). Bounds testing approaches to the analysis of level relationships.Journal of Applied Econometrics,16(3), 289-326.

Indexed at, Google Scholar, Cross Ref

Schreiber, P.S., & Schwartz, R.A. (1986). Price discovery in securities markets.The Journal of Portfolio Management,12(4), 43-48.

Indexed at, Google Scholar, Cross Ref

Sehgal, S., Rajput, N., & Dua, R.K. (2012). Price discovery in Indian agricultural commodity markets.International Journal of Accounting and Financial Reporting,2(2), 34.

Indexed at, Google Scholar, Cross Ref

Strazicich, M., & Lee, J. (2003). Minimum LM unit root test with two structural breaks.Review of Economics and Statistics,85(4), 1082-1089.

Received: 26-Jun-2022, Manuscript No. AAFSJ-22-12256; Editor assigned: 28-Jun-2022, PreQC No. AAFSJ-22-12256(PQ); Reviewed: 12- Jul-2022, QC No. AAFSJ-22-12256; Revised: 28-Jul-2022, Manuscript No. AAFSJ-22-12256(R); Published: 04-Aug-2022