Research Article: 2021 Vol: 25 Issue: 3

An Empirical Analysis of Explaining Pricing Mechanism and Long Term Performance of Ipos: Evidence From National Stock Exchange

Dr. Mani Jindal, Mangalmay Institute of Management and Technology Greater Noida

Dr. Anju Bala, Mangalmay Institute of Management and Technology, Greater Noida

Dr. Pooja Goel, Mangalmay Institute of Management and Technology, Greater Noida

Abstract

The initial public offering refers to the shares offered for sale to the general public for the first time through stock exchanges. For pricing the IPOs NSE using two anomalies as fixed price issue and Book building issue. This research paper seeks to analyze these two issues listed under NSE and analyze the IPO pricing performance from issue price to last trading price of the IPOs conducted during 2015 to 2020. The selected sample during this period is of 126 IPOs. This study aims to analyses that the IPOs are underpriced or overpriced. After the return calculations of the 126 IPOs, it has found that the sixty eight IPOs has still performed well after their issue day and remaining IPOs falls in declining side.

Keywords

National Stock Exchange, Initial Public Offering, Fixed price issue, Book building issue, Issue Price, Last Trading Price, Underpricing, Overpricing and Investors Behavior.

JEL Classifications

G1, G4, G11, G110, G12, G120.

Introduction

The primary market is the market where shares are issued to the general public for the first time. It is the channel which uses to sell the new securities in the market. Madan, (2003) described in the study that before 1992, the primary market was controlled by the Controller of the Capital Issues appointed under the Capital Issues Control Act 1947. During that time, all the share price issues were controlled by the CCI. Securities and Exchange Board of India was formed for the administrative tasks in 1988 after the abolishment of CCI. And the SEBI came in existence in 1992 to protect the interests of investors in the stock market. After 1992, all the rules, regulations and guidelines are issued by the SEBI. All the companies have listed under the two national stock exchanges which are Bombay Stock Exchange and National Stock Exchange in India regulated by SEBI.

Kumar & Anees (2012) discussed the two mechanisms for the determination of IPO pricing as Fixed price method and second is the Book-building method. In the fixed price method, the issuer of the company allows to freely price the issue. The securities offer the subscription to the public at the fixed price. But in the book building method, the IPO issues the price at which the securities are offered and allotted, the investors do not know the IPO price in advance, only the indicative price range is known by the investors. For this method, SEBI divides the allocation amount to the investors like 35% to the retail individual investors (RIIs), 15% to the non-institutional investors (NIIs) and 50% to the qualified institutional buyers (QIBs). In this method, price of the IPOs are discovered by the bidding process.

There are two anomalies as underpricing and over-pricing. The IPO pricing is underpriced when issue price is less than the listing price and over-priced when issue price is more than the listing price. In this study, the IPOs are under-performed when the issue price is more than the last traded price and when the issue price is less than the last traded price then it is considered as the IPOs are over-performed. The issue price is the price on which shares are offered for sale to the public for the first time as issue day price. After this price, the IPOs are traded in stock market at stock exchanges. But the last trading price is the closing price of a day on which share is traded in the market as closing price of the day.

Investor’s behavior is affected by their different behavioral biases as herding, overconfidence, cognitive bias, overly thinking on technical and fundaments of stock market and their investments, investors hindsight effect, mental disposition, aggressive behavior, pessimistic behavior likewise which impacted on their investment decision making. When the market is moving upside then investors behave exuberantly and on the downside of market behave pessimistically which leads them into losses. So, it is important to study all the technical and fundaments of stock market before investing into it.

Literature Review

Adams et al. (2008) explained that IPO prices were over-performed by 10 to 15 percent consistently after the listing day. The issuing companies lose money on table when the IPOs are over-performed. In this study, mean of the IPOs return shown lower than the median of IPOs return. When the IPO over-performed, the investors demand more shares. Thus, the IPOs were heavily subscribed. Islam et al., (2010) described the over-performance of the IPOs. The one hundred ninety one IPOs recorded during the study period under Chittagong stock exchange. And it recorded that on the listing day, majority of IPOs over-performed with good returns gained by the investors. The investors behaved optimistically on the listing day to get more returns.

Mauskar & Sivasubramaniam, (2011) investigated IPO return performance through t- test method. It concluded that the hot IPOs and IPOs issue price listed at higher price band were more underpriced than the cold IPOs and IPOs issue price listed at lower price band; the investors were more reluctant to enter the market in underpriced situation. Sadaqat et al., (2011) studied three different states of economy as normal, boom, and recession. The investors got reward on the sale of IPO shares in the boom state of the economy. When the IPO market was in recession stage, the investors failed to sell their shares on the listing day and behaved pessimistically.

Jindal & Chander (2015) described the investors’ overreaction and underreaction behavior for IPOs investment in this study. The IPOs often underpriced or overpriced due to investors’ behavioral contours while making investment decisions whether to invest or not in IPO shares for make profits. The investors were invested their investment when security prices were under-performed to avoid the risk of loss and sold their security investment due to over- performance of stock and earned gain.

Pande & Vaidyanathan, (2015) explained in study the underpricing of IPOs and investors behavior on IPOs. The IPOs issuers fixed the issue price of the IPO on the higher end of the price band due to the investors’ high demand in market for the IPOs investment. This situation created the underpricing or over-performance of the IPOs. If the investors behaved pessimistic on the IPO issue then the IPO issuers fixed the offer price at the lower side of price band. It has observed that majority of studies found that the IPOs are over performed on the listing day or in the short run and after that IPOs negatively returns recorded in the long run or the IPOs performance fallen down. The investors withdraw their investments, due to this lack of interest the company’s shares decreased their value and recorded negative returns.

Ambily et al. (2016) described the IPOs price performance by comparing issue price with last traded price and analyzed the positive and negative return IPOs. This result was analyzed by calculation of IPOs return in different years. And concluded in study that the investors were invested their investments by analyzing the image of a company rather than based on fundamental analysis. Jindal (2016) described the risk and return performance of IPOs listed on NSE. This study recorded the over and under performance of IPOs and analyzed the risk by using three different measures as Sharpe’s, Treynor’s and Jensen’s Alpha. From these three models found that the IPOs were superiorly performed than the market index performance.

Chhapra et al., (2018) described in the study that the investor’s behavioral biases on financial decision making. This study found that the investors biases as overconfidence, overthinking, cognitive biases and hindsight effect influence the investment decision. The hindsight bias was affected positively to the investors investing decision and other biases affect negatively on their investment decision. The only way was to get more training and education to reduce these biases influence on their investing behavior.

Research Methodology

Objectives of the Study

1. To analyze the IPOs magnitude of underpricing and overpricing listed under fixed price issue and book building issue.

2. To analyze the IPOs price performance whether it is overpriced or underpriced from issue price to last traded price

Hypothesis of the Study

H1: There is no significant difference between the magnitude of pricing listed under book building issue and fixed price issue.

H2: There is no significant difference of pricing as underpriced or overpriced of IPOs. All the IPOs are fairly priced neither underpriced or nor overpriced.

Data Collection

This study is empirical in nature. For these objectives, secondary data has been collected to analyze the IPOs price performance. The analysis of sample data is based on those IPOs which satisfied the criteria as IPOs are listed on NSE and selected only those IPOs which have issue price and last traded price.

The issue price and last traded price data is collected from online databases including http://www.nseindia.com. The total of 145 IPOs has selected only which are listed on NSE from Jan. 2015 to Dec. 2020. Out of 145 IPOs, nineteen IPOs are excluded from sample due to non- availability of issue price or last traded price. After the rejection of these IPOs, the 126 IPOs are taken as a sample for further analysis purpose. For this analysis, the issue price of IPOs and last traded price has collected on 10th March 2021 from NSE website. The study was mainly analytical and descriptive in nature.

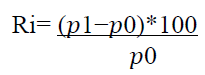

Kumar (2008) studied in the case of short run and long run analysis of IPOs that the initial return of IPO is calculated as the difference between the closing price of the first day for every stock and the offering price, divided by the offering price. In this study, the IPOs price performance is measured by using return calculation formula as given below.

Where in,

Ri = initial return

p1 = last traded price p0 = issue price

If the return is positive, it is indicated as the IPOs are over-performed and if the return is negative then it is offered as the overpricing or under-performance of the IPOs.

Analysis and Interpretation

This Table 1 has recorded total number of IPOs during the period of 2015 to 2020. The 126 IPOs are recorded during this sample period listed under NSE book building issue. There is no IPO during this period listed under the Fixed Price issue. Hence, it is proved that there is significant difference between the magnitude of pricing listed under book building issue and fixed price issue. All the IPOs are issued under book building mechanism.

| Table 1 IPOS Return Performance During Study Period January 2015 to December 2020 | |||||||

| Year | Total NSE Issue | Number of IPOs | Book Building Issue | Fixed Price Issue | Number of IPOs under BB Underpricing Issue Return (%) | Number of IPOs under BB Overpricing Issue Return (%) | Average % return of IPOs under BB Issue |

| 2015 | 21 | 16 | 16 | 00 | 7 | 9 | 27.44 |

| 2016 | 29 | 26 | 26 | 00 | 13 | 13 | 67.05 |

| 2017 | 36 | 33 | 33 | 00 | 15 | 18 | 71.44 |

| 2018 | 25 | 22 | 22 | 00 | 8 | 14 | 11.19 |

| 2019 | 16 | 14 | 14 | 00 | 11 | 3 | 188.38 |

| 2020 | 18 | 15 | 15 | 00 | 14 | 1 | 92.09 |

| Total | 145 | 126 | 126 | 00 | 68 | 58 | 69.88 |

This study has recorded IPOs return performance calculated from issue price to last traded price. The below table has shown the IPOs return performance with positive and negative returns during the study period January 2015 to December 2020. The IPOs return performance has affected by the market momentum and this is affected to the investors’ behavior whether to invest or not in the IPOs.

This table has recorded that sixty eight IPOs are performed positively and fifty eight IPOs are negatively performed out of one hundred twenty six IPOs during the study period. The IPO Dixo Technologies (India) Limited has over-performed due to investors exuberantly behavior Annexure.

This IPO has issued in 2017, the issue price is Rs. 1766 and last traded price is Rs. 19540 highest return performance has recorded during the study period. From this table, this is clear that underpricing IPOs are less in 2015, 2016, 2017 and 2018 year but increased in 2019 and 2020 year. This means IPOs are performed well during the period of one and two year, as the time passes the IPOs performance is showing declining in long run of 5 years. Similarly, in the year 2015, 2016, 2017 and 2018 number of IPOs are more than 2019 and 2020 year. This means IPOs are under-performed in 2015 to 2018 years after this performance of IPOs are improved in 2019 and 2020 year. As seen in the table, the average percentage return of IPOs is increasing from 2015 to 2020. In 2015, the average return has recorded 27.44 % of sixteen IPOs then this return is risen by 67.05% of twenty six IPOs in year 2016. Afterwards, the average return earned during the period as 71.44% in 2017, 11.19% in 2018, 188.38% in 2019 and 92.09% in 2020. This means investors are investing their investments by collecting all available information and earned huge profits.

From the above Table 2, it is recorded that the sixteen IPOs are issued on issue day and out of these, seven are positively performed and remaining nine are negatively performed. It is also observed that the majority of IPOs are fall under the frequency above ±50. In this 2015 year, the maximum return is recorded by IPO Dr. Lal PathLabs with 329.09 percent and the minimum return has recorded by IPO UFO Moviez India Limited with -86.46 percent from issue price to last traded price. With this result, it is noted that seven IPOs in this year IPOs has given positive return and six IPOs are earned more than fifty percent return. This means market is positively performed and the investors are consistently got money from their investments.

| Table 2 IPOS Return Performance from Issue Price to last Traded Price in 2015 | |||||

| Number of IPOs | |||||

| IPOs Return (%) | Below ± 10 | 10 ± 20 | 20 ± 50 | Above ± 50 | Total IPOs |

| Positive return | 0 | 0 | 1 | 6 | 7 |

| Negative Return | 0 | 1 | 3 | 5 | 9 |

| Table 3 IPOS return Performance from Issue Price to last Traded Price in 2016 | |||||

| Number of IPOs | |||||

| IPOs Return (%) | Below ± 10 | 10 ± 20 | 20 ± 50 | Above ± 50 | Total IPOs |

| Positive return | 1 | 1 | 0 | 11 | 13 |

| Negative Return | 2 | 2 | 3 | 6 | 13 |

From the above table, it is noted that the twenty six IPOs are issued on listed day in year 2016. Out of twenty six IPOs, thirteen IPOs are over-performed by earn positive return and remaining thirteen IPOs are under-performed with negative return. The highest positive return has recorded by Larsen & Toubro Infotech Limited IPO with 450.73 percent return earned from issue price to last traded price. The lowest negative return has recorded by IPO Infibeam Incorporation Limited with -78.03 percent return from issue price to last traded price in long run.

From the above Table 4, in 2017 thirty three IPOs are recorded. Out of these, fifteen IPOs are underpriced and eighteen IPOs are overpriced. The maximum return from fifteen IPOs has over-performed by IPO Dixo Technologies (India) Limited with 1006.46 percent return. But the minimum return has recorded by IPO Future Supply Chain Solutions Limited with -86.30 percent from issue price to last traded price.

| Table 4 IPOS Return Performance from Issue Price to last Traded Price In 2017 | |||||

| Number of IPOs | |||||

| IPOs Return (%) | Below ± 10 | 10 ± 20 | 20 ± 50 | Above ± 50 | Total IPOs |

| Positive return | 3 | 0 | 3 | 9 | 15 |

| Negative Return | 1 | 2 | 5 | 10 | 18 |

In this Table 5, only eight IPOs are performed positively and fourteen IPOs are negatively performed. Out of eight IPOs, six IPOs performed very well and earning more than 50% return during this period of study. In these IPOs, investors performed exuberantly and make a huge profit.

| Table 5 IPOS Return Performance from Issue Price to last Traded Price in 2018 | |||||

| Number of IPOs | |||||

| IPOs Return (%) | Below ± 10 | 10 ± 20 | 20 ± 50 | Above ± 50 | Total IPOs |

| Positive return | 0 | 1 | 1 | 6 | 8 |

| Negative Return | 1 | 2 | 7 | 4 | 14 |

In this Table 6, eleven IPOs are underpriced and only three are overpriced. Out of eleven IPOs ten are performing well and earning more than 50% return during the period 2019 to 2020. The highest return (766.50%) earned by India Mart inter Mesh Limited. The three IPOs are Spandana Sphoorty Financial Limited, Ujjivan Small Finance Bank Limited and Chalet Hotels Limited performed worst in this period. The investors are behaved conservatively in these three IPOs.

| Table 6 IPOS Return Performance from Issue Price to last Traded Price in 2019 | |||||

| Number of IPOs | |||||

| IPOs Return (%) | Below ± 10 | 10 ± 20 | 20 ± 50 | Above ± 50 | Total IPOs |

| Positive return | 0 | 0 | 1 | 10 | 11 |

| Negative Return | 1 | 0 | 2 | 0 | 3 |

This Table 7 shows that IPOs are improving their performance by earning profits in this period. The fourteen IPOs are recorded positive return and only one IPO (Antony Waste Handling Cell with - 5.87%) is recorded negative return. The highest return earned by Route Mobile IPO with 359.37% which means investors are optimistically behaved in this IPO.

| Table 7 IPOS return Performance from Issue Price to last Traded Price in 2020 | |||||

| Number of IPOs | |||||

| IPOs Return (%) | Below ± 10 | 10 ± 20 | 20 ± 50 | Above ± 50 | Total IPOs |

| Positive return | 2 | 0 | 4 | 8 | 14 |

| Negative Return | 1 | 0 | 0 | 0 | 1 |

Conclusion

This study evaluated that NSE listed IPOs pricing mechanism followed in India and found that there was significant difference between magnitude of underpricing and overpricing IPOs listed under Fixed Price Issue and book building issue. This study provided insights that all the IPOs during this period were listed under book building issue. The present study evaluates the pricing performance of initial public offerings to find out whether the IPOs are under- performed or over-performed from issue price to last traded price. From this study, it concluded that majority of IPOs are over-performed from issue price to last traded price during the study period. That means most of the investors are rationally invested their investment and earned positive return. The investors always try to purchase their securities on lower rate and sell their shares at high rate by earn positive return.

The results are suggested to the new investors that invest in those IPOs which are recorded highest positive return in this study with the hope of get positive return in future. As the share market fluctuates the investing behavior of investors also fluctuates. If the share price moves upward then the investors invest their investments exuberantly with the expectation of gain but if the share prices move downward then the investors react conservatively to avoid losses (ANNEXUR).

Future Scope of Study

This study will be useful for the book building runners, underwriters, and price makers in deciding the issue price of IPOs in momentum period.

This study will be helpful in understanding the IPO issuers and making their decision when to go public first time. The IPO issuers always try to go public when the market i in the boom period. Otherwise, the IPO issuers postpone their decision to go public due to fear of failure of an issue. This research will also be helpful for SEBI while issuing guidelines in near future and will also be helpful for researchers for future research in this area

Annexure

| Year | S.No. | Name of the Issue (IPO) | Book Building | Issue Price | Last | Return of IPOs (%) |

| Issue/ Fixed Price Issue | Traded Price | |||||

| 2015 | 1 | Narayana Hrudayalaya Limited | BB | 250 | 409.45 | 63.78 |

| 2 | Alkem Laboratories Limited | BB | 1050 | 2768.9 | 163.7 | |

| 3 | Dr. Lal PathLabs Limited | BB | 550 | 2360 | 329.09 | |

| 4 | S H Kelkar and Company Limited | BB | 180 | 122.85 | -31.75 | |

| 5 | InterGlobe Aviation Limited | BB | 765 | 1683.6 | 120.08 | |

| 6 | Prabhat Dairy Limited | BB | 115 | 86.4 | -24.87 | |

| 7 | Sadbhav Infrastructure Project Limited | BB | 103 | 22.55 | -78.11 | |

| 8 | Shree Pushkar Chemicals and Fertilisers Limited | BB | 65 | 136.75 | 110.38 | |

| 9 | Navkar Corporation | BB | 155 | 42.55 | -72.55 | |

| 10 | Power Mech Projects Limited | BB | 640 | 537 | -16.09 | |

| 11 | Syngene International Limited | BB | 250 | 537.65 | 115.06 | |

| 12 | PNC Infratech Limited | BB | 378 | 260 | -31.22 | |

| 13 | UFO Moviez India Limited | BB | 625 | 84.65 | -86.46 | |

| 14 | MEP Infrastructure Developers Limited | BB | 63 | 19.35 | -69.29 | |

| 15 | VRL Logistics Limited | BB | 205 | 257.8 | 25.76 | |

| 16 | Inox Wind Limited | BB | 325 | 69.9 | -78.49 | |

| 2016 | 17 | Reliance Home Finance Limited | BB | 10 | 2.45 | -75.5 |

| 18 | Laurus Labs Limited | BB | 428 | 352.2 | -17.71 | |

| 19 | Sheela Foam Limited | BB | 730 | 2026.95 | 177.66 | |

| 20 | Varun Beverages Limited | BB | 445 | 993 | 123.15 | |

| 21 | PNB Housing Finance Limited | BB | 775 | 420.15 | -45.79 | |

| 22 | Endurance Technologies Limited | BB | 472 | 1390 | 194.49 | |

| 23 | ICICI Prudential Life Insurance Company Limited | BB | 334 | 487 | 45.81 | |

| 24 | GNA Axies Limited | BB | 207 | 394 | 90.34 | |

| 25 | L & T Technology Services Limited | BB | 860 | 2759 | 220.81 | |

| 26 | RBL Bank Limited | BB | 225 | 245 | 8.89 | |

| 27 | Dilip Buildcon Limited | BB | 219 | 647.95 | 195.87 | |

| 28 | Advanced Enzyme Technologies Limited | BB | 896 | 350.15 | -60.92 | |

| 29 | Larsen & Toubro Infotech Limited | BB | 710 | 3910.15 | 450.73 | |

| 30 | Quess Corp Limited | BB | 317 | 718.5 | 126.66 | |

| 31 | Mahanagar Gas Limited | BB | 421 | 1180 | 180.29 | |

| 32 | Parag Milk Foods Limited | BB | 215 | 107.1 | -50.19 | |

| 33 | Ujjivan Financial Services Limited | BB | 210 | 243.05 | 15.74 | |

| 34 | Thyrocare Technologies Limited | BB | 446 | 903 | 102.47 | |

| 35 | Equitas Holdings Limited | BB | 110 | 90 | -18.18 | |

| 36 | Infibeam Incorporation Limited | BB | 432 | 94.9 | -78.03 | |

| 37 | Bharat Wire Ropes Limited | BB | 45 | 40.85 | -9.22 | |

| 38 | HealthCare Global Enterprises Limited | BB | 218 | 172 | -21.1 | |

| 39 | Indian Railway Finance Corporation Limited | BB | 26 | 25 | -3.85 | |

| 40 | Quick Heal Technologies Limited | BB | 321 | 183 | -42.99 | |

| 41 | Team Lease Services Limited | BB | 850 | 3497 | 311.41 | |

| 42 | Precision Camshafts Limited | BB | 186 | 41.65 | -77.61 | |

| 2017 | 43 | Future Supply Chain Solutions Limited | BB | 664 | 91 | -86.3 |

| 44 | Shalby Limited | BB | 248 | 106.45 | -57.08 | |

| 45 | HDFC Standard Life Insurance Company Limited | BB | 290 | 740 | 155.17 | |

| 46 | Khadim India Limited | BB | 750 | 174.55 | -76.73 | |

| 47 | The New India Assurance Company Limited | BB | 800 | 152.65 | -80.92 | |

| 48 | Mahindra Logistics Limited | BB | 429 | 538.1 | 25.43 | |

| 49 | General Insurance Corporation of India | BB | 912 | 200.2 | -78.05 | |

| 50 | Indian Energy Exchange Limited | BB | 1650 | 302.45 | -81.67 | |

| 51 | MAS Financial Services Limited | BB | 459 | 878 | 91.29 | |

| 52 | Godrej Agrovet Limited | BB | 460 | 487 | 5.87 | |

| 53 | Prataap Snacks Limited | BB | 938 | 653 | -30.38 | |

| 54 | SBI Life Insurance Company Limited | BB | 700 | 969.8 | 38.54 | |

| 55 | ICICI Lombard General Insurance Company Limited | BB | 661 | 1466 | 121.79 | |

| 56 | Capacité Infraprojects Limited | BB | 250 | 201 | -19.6 | |

| 57 | Matrimony.com Limited | BB | 985 | 1048 | 6.4 | |

| 58 | Dixo Technologies (India) Limited | BB | 1766 | 19540 | 1006.46 | |

| 59 | Bharat Road Network Limited | BB | 205 | 33.25 | -83.78 | |

| 60 | Apex Frozen Foods Limited | BB | 175 | 246.5 | 40.86 | |

| 61 | Cochin Shipyard Limited | BB | 432 | 385.7 | -10.72 | |

| 62 | Security and Intelligence Service Limited | BB | 815 | 423.5 | -48.04 | |

| 63 | Salasar Techno Engineering Limited | BB | 108 | 374.1 | 246.39 | |

| 64 | AU Small Finance Bank Limited | BB | 358 | 1236 | 245.25 | |

| 65 | GTPL Hathway Limited | BB | 170 | 126 | -25.88 | |

| 66 | Central Depository Services (India) Limited | BB | 149 | 588 | 294.63 | |

| 67 | Eris Lifesciences Limited | BB | 603 | 584.9 | -3 | |

| 68 | Tejas Networks Limited | BB | 257 | 182.5 | -28.99 | |

| 69 | PSP Projects Limited | BB | 210 | 481.9 | 129.48 | |

| 70 | S Chand and Company Limited | BB | 670 | 104.5 | -84.4 | |

| 71 | Shankara Building Products Limited | BB | 460 | 460.8 | 0.17 | |

| 72 | CL Educate Limited | BB | 502 | 66.75 | -86.7 | |

| 73 | Avenue Supermarts Limited | BB | 299 | 3144.9 | 951.81 | |

| 74 | Music Broadcast Limited | BB | 333 | 24.6 | -92.61 | |

| 75 | BSE Limited | BB | 806 | 586.1 | -27.28 | |

| 2018 | 76 | Aavas Financiers Limited | BB | 821 | 2206 | 168.7 |

| 77 | Garden Reach Shipbuilders & Engineers Limited | BB | 118 | 204.2 | 73.05 | |

| 78 | Ircon International Limited | BB | 475 | 88.2 | -81.43 | |

| 79 | CreditAccess Grameen Limited | BB | 422 | 702 | 66.35 | |

| 80 | TCNS Clothing Co. Limited | BB | 716 | 508.5 | -28.98 | |

| 81 | Varroc Engineering Limited | BB | 967 | 404 | -58.22 | |

| 82 | Fine Organic Industries Limited | BB | 783 | 2417 | 208.68 | |

| 83 | RITES Limited | BB | 185 | 260 | 40.54 | |

| 84 | IndoStar Capital Finance Limited | BB | 572 | 326.9 | -42.85 | |

| 85 | Lemon Tree Hotels Limited | BB | 56 | 42.05 | -24.91 | |

| 86 | ICICI Securities Limited | BB | 520 | 407.3 | -21.67 | |

| 87 | Mishra Dhatu Nigam Limited | BB | 90 | 195.8 | 117.56 | |

| 88 | Sandhar Technologies Limited | BB | 332 | 220.8 | -33.49 | |

| 89 | Karda Constructions Limited | BB | 180 | 116.5 | -35.28 | |

| 90 | Hindustan Aeronautics Limited | BB | 1215 | 1061 | -12.67 | |

| 91 | Bandhan Bank Limited | BB | 375 | 348.95 | -6.95 | |

| 92 | Bharat Dynamics Limited | BB | 428 | 360.5 | -15.77 | |

| 93 | Aster DM Healthcare Limited | BB | 190 | 142.5 | -25 | |

| 94 | Galaxy Surfactants Limited | BB | 1480 | 2364.9 | 59.79 | |

| 95 | Amber Enterprises India Limited | BB | 859 | 340.95 | -60.31 | |

| 96 | Newgen Software Technologies Limited | BB | 245 | 290.05 | 18.39 | |

| 97 | Apollo Micro Systems Limited | BB | 275 | 111.55 | -59.44 | |

| 2019 | 98 | Prince Pipes and Fittings Limited | BB | 178 | 448 | 151.69 |

| 99 | Ujjivan Small Finance Bank Limited | BB | 37 | 34.6 | -6.49 | |

| 100 | CSB Bank Limited | BB | 195 | 259.8 | 33.23 | |

| 101 | Vishwaraj Sugar Industries Limited | BB | 60 | 129 | 115 | |

| 102 | indian Railway Catering and Tourism Corporation Limited | BB | 320 | 2017.9 | 530.59 | |

| 103 | Spandana Sphoorty Financial Limited | BB | 856 | 620 | -27.57 | |

| 104 | IndiaMART InterMESH Limited | BB | 973 | 8431 | 766.5 | |

| 105 | Neogen Chemicals Limited | BB | 215 | 841.85 | 291.56 | |

| 106 | Polycab India Limited | BB | 538 | 1361.05 | 152.98 | |

| 107 | Metropolis Healthcare Limited | BB | 880 | 1920 | 118.18 | |

| 108 | Rail Vikas Nigam Limited | BB | 19 | 31.8 | 67.37 | |

| 109 | MSTC Limited | BB | 120 | 326.5 | 172.08 | |

| 110 | Chalet Hotels Limited | BB | 280 | 176.5 | -36.96 | |

| 111 | Xelpmoc Design and Tech Limited | BB | 66 | 270 | 309.09 | |

| 2020 | 112 | Antony Waste Handling Cell Limited | BB | 315 | 296.5 | -5.87 |

| 113 | Mrs. Bectors Food Specialities Limited | BB | 288 | 386.1 | 34.06 | |

| 114 | Burger King India Limited | BB | 60 | 140.15 | 133.58 | |

| 115 | Gland Pharma Limited | BB | 1500 | 2491.75 | 66.12 | |

| 116 | Equitas Small Finance Bank Limited | BB | 33 | 60.75 | 84.09 | |

| 117 | Mazagon Dock Shipbuilders Limited | BB | 145 | 226.5 | 56.21 | |

| 118 | Likhitha Infrastructure Limited | BB | 120 | 317.6 | 164.67 | |

| 119 | UTI Asset Management Company Limited | BB | 554 | 606 | 9.39 | |

| 120 | Angel Broking Limited | BB | 306 | 328.9 | 7.48 | |

| 121 | Chemcon Speciality Chemicals Limited | BB | 340 | 437.9 | 28.79 | |

| 122 | Computer Age Management Services Limited | BB | 1240 | 1845 | 48.79 | |

| 123 | Route Mobile Limited | BB | 350 | 1607.8 | 359.37 | |

| 124 | Happiest Minds Technologies Limited | BB | 166 | 540.5 | 225.6 | |

| 125 | Rossari Biotech Limited | BB | 425 | 990 | 132.94 | |

| 126 | SBI Cards and Payment Services Limited | BB | 755 | 1028 | 36.16 |

References

- Adams, M., Thornton, B., & Hall, G. (2008). IPO pricing phenomena: Empirical evidence of behavioral biases. Journal of Business & Economics Research (JBER), 6(4).

- Ali, R., & Ahmad, Z. (2010). An Empirical Investigation of the Underpricing of Initial Public Offerings in the Chittagong Stock Exchange.

- Ambily, D., Krishna, G., Aswathy, K., & Balakrishnan, D. (2016). A study on performance of IPO’s under NSE from issue price to last trading price in the year 2013–2015. Global Journal of Finance and Management, 8(1), 43-48.

- Chhapra, I.U., Kashif, M., Rehan, R., & Bai, A. (2018). An empirical investigation of investors behavioral biases on financial decision making. Asian Journal of Empirical Research, 8(3), 99-109.

- Jindal, M. (2017). Risk and return performance of IPOs: An analysis. Indian Journal of Research in Capital Markets, 4(2), 61-70.

- Jindal, M., & Chander, R. (2015). Investors Rationality for IPOs Using Meta Analysis and Forest Plots in Neyeloff et al. (2012) Framework: An Investigation. Asia-Pacific Journal of Management Research and Innovation, 11(1), 9-15.

- Kumar, P., & Anees, M. (2012). A Study on Popularity of Book Building over Fixed Price Option. Shiv Shakti International Journal in Multidisciplinary and Academic Research, 3(3), 76- 83.

- Kumar, S.S.S. (2007). Short and long-run performance of bookbuilt IPOs in India.. International Journal of Management Practices and Contemporary Thoughts, pp. 19-29, Retrieved on 27 October 2017, http://dspace.iimk.ac.in/bitstream/2259/523/1/sssk.pdf.

- Madan, A.A. (2003). Investments in IPOs in the Indian capital market. Bimaquest, 3(1), 24-34.

- Mauskar, V., & Sivasubramaniam, T.A. (2011). Initial public offerings (IPO) & the under-pricing phenomena. AMET Journal of Management, 2(1), 61-69.

- Pande, A., & R., Vaidyanathan. (2015). A Study of Initial Public Offerings on the National Stock Exchange of India. http://www.researchgate.net/profile/Alok_Pande/publications, last modified on October 30, 2016.

- Sadaqat, S., Akhtar, M.F., & Ali, K. (2011). An Analysis on the Performance of IPO - A Study on the Karachi Stock Exchange of Pakistan. International Journal of Business and Social Science, 2(6), 275-285.