Research Article: 2025 Vol: 29 Issue: 1

An Approach to Measure Price Stability and Unemployment using an Endogenous Monetary Model in a Country of West Asia

Bikramjit Pal, Management Development Institute Murshidabad

Abhijit Pandit, Management Development Institute Murshidabad

Citation Information: Pal, B., & Pandit, A. (2025). An approach to measure price stability and unemployment using an endogenous monetary model in a country of West Asia. Academy of Marketing Studies Journal, 29(1), 1-17.

Abstract

Reviewing the progress of the macroeconomy is something that ought to be done now that the global crisis has been overcome. On the other hand, Saudi Arabia is becoming a wealthy and newly developed nation, which means that it is experiencing an increase in its workforce. The purpose of this essay is to investigate the factors that are contributing to the high rate of unemployment in Saudi Arabia as well as the increasingly stringent monetary policies that are being implemented. Several other methods, such as the theory of the common market, are required to confirm the results in situations when Okun's law cannot be put into practice. It is not only necessary but also enjoyable to remodel or refine something. When it comes to the economy, it is of the utmost importance to maintain a comprehensive understanding of the macroeconomic approach, as well as to recognise the monetary and social indicators. The goal of the macroeconomic system, which is to facilitate the placement of jobs and to encourage self-reliance on consumer protection, is imperative. According to ideological and political borders, those who make decisions based on their interests, philosophy, politics, or economic orthodoxy disregard the possibility of profits resulting from future inquiry. The current situation calls for the examination of fiscal and monetary alternatives that address imbalances as well. The pragmatic approach will be maintained, but it will not completely resolve these issues. A collection of graphic novels investigates the way Saudi Arabia's economy is structured. In addition to that, this article would investigate the issues that the state will face in the future about unemployment.

Keywords

Macroeconomic Progress, Global Crisis, Saudi Arabia Economy, Workforce Increase, Unemployment Factors, Monetary Policies, Common Market Theory, Okun's Law.

Introduction

The study of macroeconomics is a subfield of economics that was initially developed in countries that have experienced economic expansion. During the process of achieving specific goals, adjustments were made to the fiscal and monetary systems, as well as the monetary system. It was in this circumstance that the term "balance of payments imbalance" was coined to describe a situation in which external transactions payables and receivables occur at roughly the same time. When monetarism was eradicated in the middle of the 1970s, it marked a significant departure from the Keynesian way of thinking. Without any regard for the company's current financial situation, the concept of balance inside the organisation has come to be regarded primarily in terms of expenses. As a component of his ideology, the President centred his attention on the idea that if the government were to achieve a certain level of balance, the sector would be authorised to revert to this course of action, which would also result in the establishment of financial stability. The theory of macroeconomics tries to assess and formulate policies with reference to the consequences that these various situations will have over the long term. The difference between the two versions is not to be found in principle but rather in the design of the product. Emerging markets are distinguished from developed markets by two major systemic differences: the structures of their economies and the economies of their structures. These factors include (1) demand caps, (i.e., costs the government is unable to pay to raise or enact), (2) wage-price regulation, growth sources, and (i.e., increased taxpayer spending), (3) business events (i.e., movements in market prices) and (4) the tools that are at their disposal (structural and monetary) or the governments' abilities to respond to policies (such as unemployment insurance) and maintain stability in the market or in the event of crises, financial capability, debt and other.

At the end of the 1970s, it was generally accepted that the primary purpose of macroeconomic policy was to maximise employment and economic growth. However, by the 1990s, the focus had significantly shifted to challenges such as maintaining a balance of payments and retaining inflation under control. Stability on both the domestic and international levels is typically considered to be the most essential strategic long-term targets for emerging countries. The management of inflation and current account balances was responsible for keeping the most common challenge, which was the possibility of future acceleration, under control. Because many developing countries' long-world countries experienced debt problems in the 1980s, policymakers shifted their attention to micro-level management for a period. According to the notion, the government has the potential to accomplish everything else, including growth, until it reaches a state of market stability. A state of financial and pricing self-stability that is conducive to growth is what is supposed to be referred to as inherent balance. Because of this, the concept of preserving an external equilibrium inside the free market, which holds that all markets ought to self-regulate, has gradually lost its significance over the course of time. There is a disagreement between the two prominent perspectives on the notion that the economy and money are intimately linked to perform financial transactions.

Because of this, it became transparent that our viewpoints converged around the same common viewpoints. As a result of the fact that this was developed for use in markets where it is anticipated that they will change relatively slowly, the results were edited very little for this purpose. These kinds of relationships are influenced by the environment as well as a wide variety of elements (all of which determine variables) (what causes what). Furthermore, in every given macroeconomic analysis, it is necessary to differentiate between influences that originate from the outside (endogenous) and those that originate from within the economy (autonomous). It is generally accepted that some economies are industrial, while others are developing or to be in the process of expanding. If there is a collection of economic laws, they are effective in relation to a variety of situations. Considering this, rather than denying the existence of such inequities, sound theory and sound policy development ought to deal with them in an honest and fully committed manner. In the meantime, the concept of Orthodox philosophy endeavoured to incorporate all these inconsistencies, ultimately gaining precedence over the conflicting beliefs of other people. Plans of economic growth were undertaken in developing countries up to the early 1980s, with most of these plans being meant to promote prosperity in the near term.

The Orthodoxy was called into question by critics who were heretical. There were several different perspectives that were held, and there were several different degrees of divergence between them. In none of the examples was there anything that was deemed to be superior. In the meantime, the idea of time is being criticised for never becoming creative because of the recent economic crisis. There are a growing number of market participants who are of the opinion that markets are not sovereign. While markets are sovereign, the market itself does not appear to be sovereign. Markets are indeed capable servants, but they may not be good masters. The global recession and currency crisis both indicate that monetary policies need to be re-examined to address the situation.

This was accomplished by the implementation of a macroeconomic strategy with the intention of achieving cost equilibrium. When seen from the point of view of an analyst, short-term stability started to be regarded as a significant foundation for future prosperity. There is a theory that the International Monetary Fund (IMF) established a distinct strategy to deal with nations that were experiencing financial difficulties, and the global capital markets provided their backing for this strategy.

An investigation has revealed that the issue of inflation has been resolved, and the banking industry is making progress towards getting back on track. On the other hand, this had very little impact on her development; rather, it merely accelerated her decline. Furthermore, an overwhelming majority of the time, it led to the implementation of macro-stabilization measures that either restricted or impeded both monetary and fiscal policies.

The development of these policies was predicated on the assumption that they would be implemented with a long-term perspective in mind when they were first implemented. Nevertheless, it has resulted in two big benefits, which is a positive development. When was the first time when industrialised countries experienced issues and instability in their macroeconomic systems affecting their economies. As a further point of interest, there was a shift away from Keynesian monetary agreements and towards counter-inflationary demand management. The most important factor that led to the lack of external imbalances was the regulation of overall inflation, which was the most crucial factor. In addition, it was a widely held Orthodox idea that a macroeconomic system that is well-controlled is essential for the development of economic creativity.

The first step in this restructuring will be to reframe the goals that have been set. It is generally accepted that the process of stabilisation must come first, and that after that, economic priorities would be able to naturally take care of themselves. One of the most essential goals of macroeconomic policies, both in the short term and in the long term, is to ensure that economic growth and employment opportunities are not threatened by any of the various imbalances that already exist. To foster professional advancement, you ought to give expansion and aid to the economy the same level of importance, if not a higher level of importance. According to the opinion of an economist, we should rethink the utilisation of measures such as GDP and price as a component of the continuous evaluations. One does not regard the process of re-establishing macroeconomic equilibrium to be a component of economic policy planning. It is not possible to control inflation using interest rates, even though there is no method to regulate inflation using the money supply. When money and credit are of equal significance, an open strategy will yield the most favourable outcomes.

It is important for monetary and fiscal policy to collaborate to achieve long-term stability through the implementation of counter-cyclical measures. It would be beneficial if those in the financial sector would step aside so that we could refocus our attention on the real economy and make room for growth over the long run. At the same time as, macroeconomic policies should be employed to solve short-term situations; they should also address the overall economic fundamentals. When it comes to developing economies, different macro-level policies and objectives may be implemented depending on the level of institutional stability and macroeconomic maturity.

It is not necessary for the government to be the one to initiate the construction of new infrastructure in most countries; rather, the private sector is the one that is responsible for doing so. In the industrialised world, the government's primary duty is to provide aid rather than to create development.

For demonstrating that this theory is accurate, it would be necessary to investigate the state's understanding of its current financial situation. At long last, Saudi Arabia is confronted with the first of the most significant challenges of the century, which includes an alarmingly high rate of youth unemployment. The objective of this article is to determine the reasons behind the consistent level of unemployment in Saudi Arabia during this period.

Saudi Arabia, which is a wealthy and young country, has recently experienced a significant increase in the number of people without jobs. One of the key objectives of this research is to gain an understanding of the factors that contribute to the unstable job market and currency regimes in Saudi Arabia. This approach takes a pragmatic approach to addressing existing concerns, rather than causing new problems for the globe. The Saudi Arabian economic paradigm is exemplified by this case. The causes of the nation's unemployment over the long term are taken into consideration. In addition to this, it makes projections on the significant social and economic costs associated with unemployment by utilising Okun's law and a panel econometrics methodology that was just recently developed. If Okun's Rule cannot be implemented, other alternatives offer the responses that are often associated with the product. Through this study, an investigation on the effects of long-term unemployment on the state's well-being would be carried out.

There are a lot of people in Saudi Arabia who are ignorant of how much money influences the availability of job, which is why this study investigates the possibilities of implementing a holistic employment strategy as well as the costs associated with doing so. On the other hand, whether the government's own revenue (taxes) or expenditure creates new money (assets), the country can, or government-issued bank-created reserves (deposits) may be considered as the country's source of capital. This is because the government can create new funds. In addition to suggestions for accomplishing the overarching objectives of that research report, the report additionally supplied straightforward methods for fostering and realising financial condition.

Finally, the most significant discovery made in this study is that 1,687,313 Saudis have lost their jobs, which has led to a loss of real GDP of $95 billion and a loss of non-oil real GDP of $ 52 billion. In the first place, the purpose of the study is to devise a strategy for preserving financial stability, which would ultimately lead to significant economic gains for the entire population. Saudi Arabia is transforming its economy into a knowledge-based economy (KBE) to present policy solutions to the country's unemployment crisis. This is being accomplished using an endogenous money approach. A significant number of the KBE foundations are up to date, apart from creativity, which ought to be improved considering the enormous number of trained individuals who are currently without jobs in Saudi Arabia. Therefore, because of this, and as earlier attempts at finding answers by Saudi officials have demonstrated, this method may be advantageous to the state while posing no established risks of damage.

Literature Review

During their research on the Gulf Cooperation Council (GCC), Kandil and Morsy (2009) found that inflation in other countries had a favourable impact on the costs of living in four of the GCC countries, including Saudi Arabia. The depreciation of the home currency has been determined to be the cause of inflation by the end of the day in four different countries, including Saudi Arabia. The expenditures of the state have had a variety of effects, but they are not significant in Saudi Arabia. Similarly, the cash supply in Saudi Arabia has only had a marginal impact on the situation. In the short term, it was discovered that the costs of food and inflation in other countries were significant in Saudi Arabia (Hasan et al, 2010).

Phillips is credited with developing the well-known Phillips curve, which is the primary foundation for comprehending inflation (1958). In Nice, England, he conducted research on the connection between increases in money pay and unemployment, and he discovered that the two factors were connected in a manner that was not direct. As a result of this, they came to an agreement to modify the curve so that it would accurately reflect the relationship between the fluctuation in demand and the rate of unemployment. Therefore, policymakers that are striving to find a balance between inflation and unemployment have migrated to this curve because of this.

Christensen (2001) asserts that the cash availability and the inflation rate have an immediate or hopeful association in the future. As a result, a rise in funds during a market would consequently lead to an increase in demand for items and services. The pursuit of fewer goods and services by a greater amount of capital would result in inflation. According to Alvarez et al.'s (2001) findings, there is a positive correlation between the cash supply and the rate of inflation. The reason for this is because whenever a financial institution makes the decision to raise the amount of cash available in the economy, it almost always results in a reduction in the interest rate. Because of this, inflation would take place if the funds of the economy multiplied at an endless rate.

After several decades of yearly inflation rates that were lower than one percent, Based on his findings, Ramady (2009). Asserts that Saudi Arabia has been experiencing significant inflation over the past few years, particularly in the years 2007 and 2008. According to the findings of an analysis, the most significant contributors to inflation in Saudi Arabia are money, interest rates, and therefore the devaluation of the riyal. This is in addition to the depreciation of the United States dollar in comparison to other major currencies. Nevertheless, the peg of the riyal is intrinsically related to each one of these elements. To put it another way, Saudi Arabia had to deal with inflation that was imported.

According to Alhamad (2014), the crisis of inflation in Saudi Arabia is multidimensional, with no obvious underlying cause but several important variables contributing to the problem. There is no indication that Saudi Arabia is experiencing inflation, according to the average estimates of the buyer price level (CPI) index. The question arises while discussing the various classes and subgroups that influence people's life, such as the availability of food, loans, and housing in general. When compared to several crucial classes and subcategories, such as housing and rent, which account for a significantly bigger percentage of an individual's profits, the average index is significantly lower. One further odd aspect of the Saudi CPI index is that, except for the final day of the year, it is incompatible with the significantly higher GDP Deflator. This is not the situation in most industrialised economies. Finally, we agree that the Consumer Price Index (CPI) for Saudi Arabia ought to be revised so that it accurately reflects the actual changes in the cost of living. It is possible that this may become a hub for research that will assist the government and other organisations in addressing the issue of inflation.

It was claimed by Al Khathla (2011) in his study that prices in the Saudi Arabian dominion had increased over the course of the past few years. In this work, the process of co-integration developed by Pesaran et al. (2001) is utilised to investigate the factors that determine inflation in both the long run and the short run. The findings indicate that global inflation, deflation of the home currency, and production constraints are the primary factors that influence inflation at the end of the day. In the short run, it has been determined that the most significant factors that influence inflation in the nation is supply bottlenecks and funds shortages.

Using both theoretical and empirical data, Akinsola and Odhiamb (2017) investigate the existing body of literature concerning the connection between inflation and the economic process in both industrialised and developing nations. The analysis found that the impact of inflation on economic processes varies not only from country to country but also across time. According to the article, the conclusions of these analyses are also influenced by characteristics that are unique to the country, the data collection that was utilised, and consequently, the methodology that was utilised. According to the findings of the study, there is undeniable evidence that a negative correlation exists between inflation and development, particularly in economies that have already been established. Despite this, there is still a great deal of debate on the level of inflation that is suitable for economic expansion. Earlier research on this topic assumed that inflation and the economic mechanism were connected in a causal relationship that was only one-way. In our knowledge, this is the first study of its kind to conduct a complete examination of the existing literature on the relationship between inflation and economic processes in industrialised and developing nations. This is the first study of its kind.

In his 2016 study, Nazer investigates the influence that cash production, oil prices, import prices, the interest rate in the United States, and Saudi Real GDP have on the Consumer Price Index (CPI) in Saudi Arabia. To get started, we utilised the method of determining the dependability of our variables. According to the Unit Root Measure, every level variable is non-stationary, but on the other hand, every variable is stationary and integrated to order one in accordance with the basic distinction. Then, to determine whether our variables were co-integrated, we utilised Johansen's co-integration test. As a direct result of this, the degree variables would be incorporated into our equations. Using a multiple association model, we discovered that there is a positive statistical correlation between the Consumer Price Index (CPI) and funds, import prices, and real GDP in Saudi Arabia. However, we also discovered that there is a negative correlation between the CPI and real GDP. Before we started our inquiry and study, we first validated the process causality by conducting a causality test. According to the findings of the causality tests, the Consumer Price Index (CPI) of Saudi Arabia is affected by cash demand, import speeds, and oil prices, but not the other way around.

Research Methodology

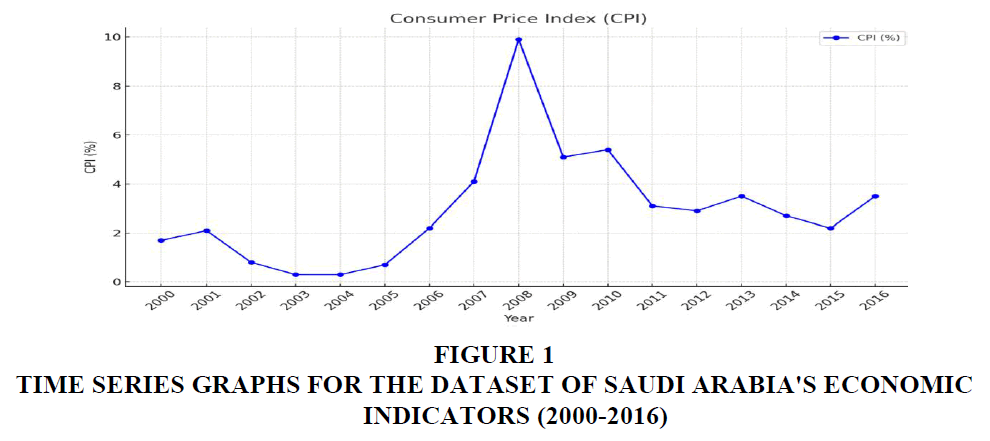

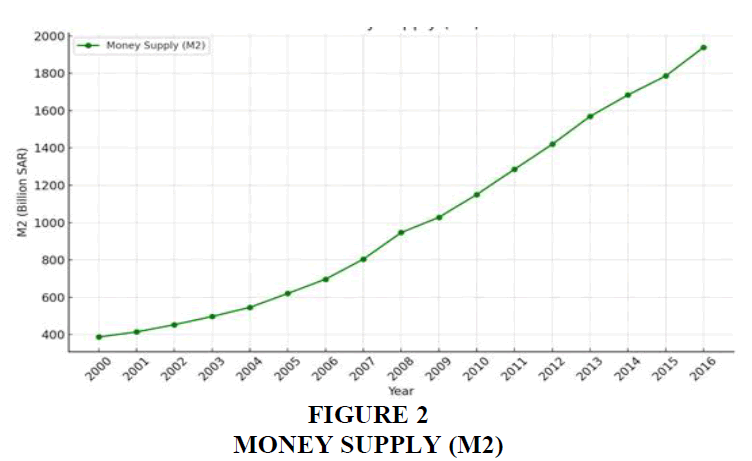

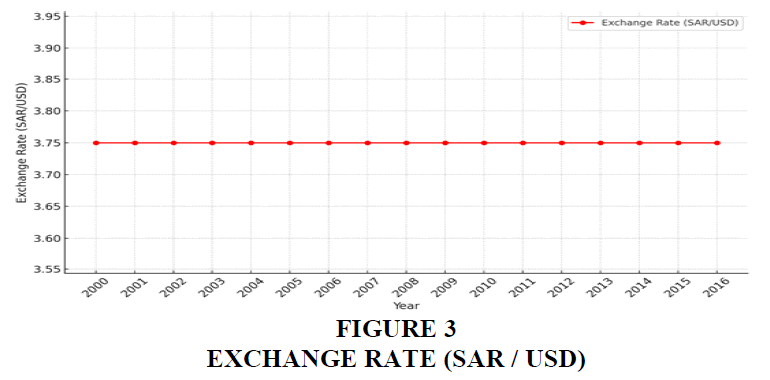

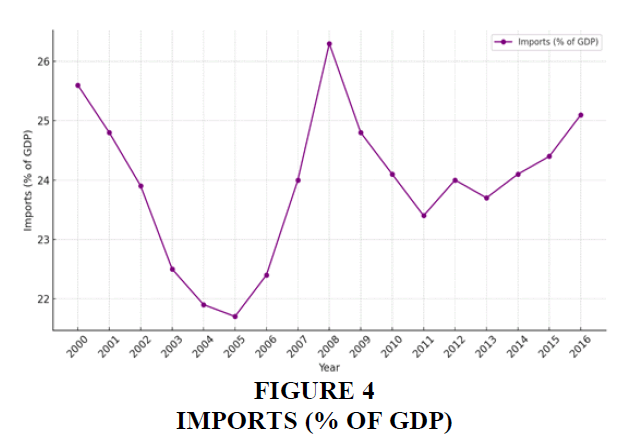

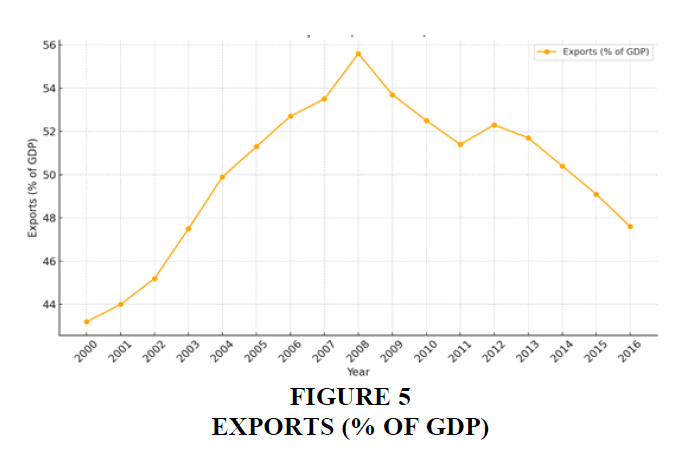

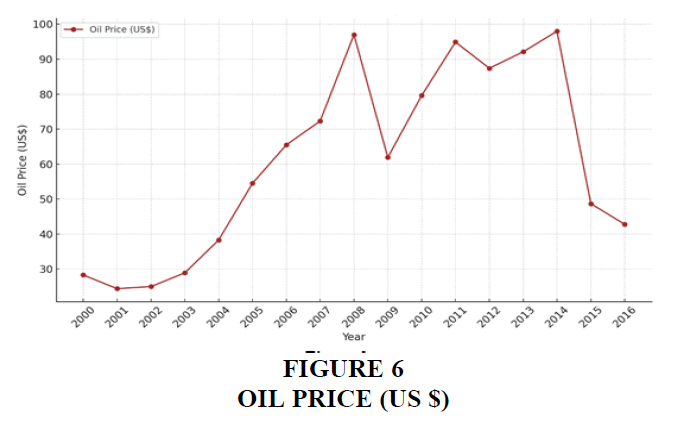

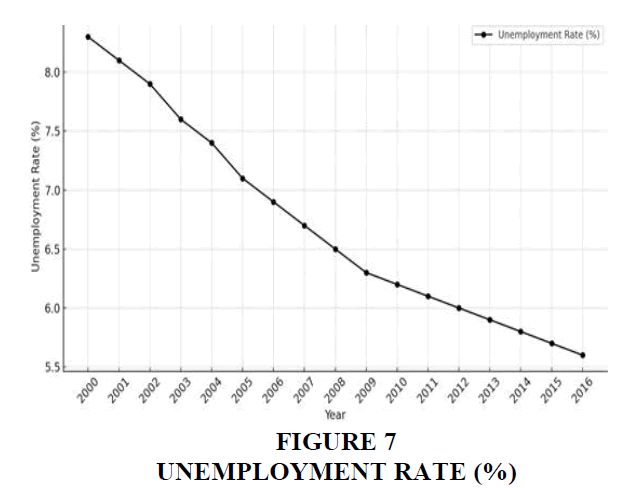

The study relies entirely on secondary sources of data. We used the Saudi Arabia Monetary Agency (SAMA) Annual Report, Different Issues; World Bank Report; and International Monetary Fund (IMF), Journals and Papers to gather relevant details. The researcher used regression analysis with inflation, or CPI, as the dependent factor in this report, which lasted 16 years from 2000 to 2016. (%) Inflation is described as a change in the prices of a basket of goods and services that are usually bought by particular types of households, as calculated by the Consumer Price Index (CPI). There are six separate variables: (1) money supply (M2), (2) set exchange rate against the US dollar, (3) goods and services imports (percentage of GDP), (4) goods and services exports (percentage of GDP), (5) average oil price (US$), and (6) unemployment rate.

INF (CPI) = B0 + B1 (M2) +B2 (EXCR against US $) + B3 (IMP)+ B4 (EXP) + B5 (OP) + B6 (U-Rate) + ui

where, B0 is Intercept, INF (CPI) is Inflation (CPI) M2 is Money Supply, EXCR exchange rate, IMP is import value, EXP is export value, OP is oil price, U-Rate is Unemployment rate, ui is an error term obtained from the data.

Python Code for Obtaining Time Series Graphs

import pandas as pd

import matplotlib.pyplot as plt

# Step 1: Load the dataset

data = pd.read_csv('saudi_economic_data.csv')

# Display the first few rows and inspect the data

print(data.head())

# Step 2: Prepare the data (if necessary)

# Convert Year column to categorical (if necessary)

data['Year'] = data['Year'].astype(str)

# Step 3: Create Time Series Line Plots

# Plot CPI (%) over time

plt.figure(figsize=(10, 6))

plt.plot(data['Year'], data['CPI (%)'], marker='o', color='blue', label='CPI (%)')

plt.title('Consumer Price Index (CPI)')

plt.xlabel('Year')

plt.ylabel('CPI (%)')

plt.xticks(rotation=45)

plt.legend()

plt.grid(True)

plt.tight_layout()

plt.show()

# Plot Money Supply (M2) over time

plt.figure(figsize=(10, 6))

plt.plot(data['Year'], data['M2 (Billion SAR)'], marker='o', color='green', label='Money Supply (M2)')

plt.title('Money Supply (M2)')

plt.xlabel('Year')

plt.ylabel('M2 (Billion SAR)')

plt.xticks(rotation=45)

plt.legend()

plt.grid(True)

plt.tight_layout()

plt.show()

# Plot Exchange Rate (SAR/USD) over time

plt.figure(figsize=(10, 6))

plt.plot(data['Year'], data['Exchange Rate (SAR/USD)'], marker='o', color='red', label='Exchange Rate (SAR/USD)')

plt.title('Exchange Rate (SAR/USD)')

plt.xlabel('Year')

plt.ylabel('Exchange Rate (SAR/USD)')

plt.xticks(rotation=45)

plt.legend()

plt.grid(True)

plt.tight_layout()

plt.show()

# Plot Imports (% of GDP) over time

plt.figure(figsize=(10, 6))

plt.plot(data['Year'], data['Imports (% of GDP)'], marker='o', color='purple', label='Imports (% of GDP)')

plt.title('Imports (% of GDP)')

plt.xlabel('Year')

plt.ylabel('Imports (% of GDP)')

plt.xticks(rotation=45)

plt.legend()

plt.grid(True)

plt.tight_layout()

plt.show()

# Plot Exports (% of GDP) over time

plt.figure(figsize=(10, 6))

plt.plot(data['Year'], data['Exports (% of GDP)'], marker='o', color='orange', label='Exports (% of GDP)')

plt.title('Exports (% of GDP)')

plt.xlabel('Year')

plt.ylabel('Exports (% of GDP)')

plt.xticks(rotation=45)

plt.legend()

plt.grid(True)

plt.tight_layout()

plt.show()

# Plot Oil Price (US$) over time

plt.figure(figsize=(10, 6))

plt.plot(data['Year'], data['Oil Price (US$)'], marker='o', color='brown', label='Oil Price (US$)')

plt.title('Oil Price (US$)')

plt.xlabel('Year')

plt.ylabel('Oil Price (US$)')

plt.xticks(rotation=45)

plt.legend()

plt.grid(True)

plt.tight_layout()

plt.show()

# Plot Unemployment Rate (%) over time

plt.figure(figsize=(10, 6))

plt.plot(data['Year'], data['Unemployment Rate (%)'], marker='o', color='black', label='Unemployment Rate (%)')

plt.title('Unemployment Rate (%)')

plt.xlabel('Year')

plt.ylabel('Unemployment Rate (%)')

plt.xticks(rotation=45)

plt.legend()

plt.grid(True)

plt.tight_layout()

plt.show()

The code executes the subsequent operations:

Imports required libraries. Imports the dataset from a CSV file and presents a preview of the initial rows for examination. Cast the 'Year' column into a string data type to consider it as a categorical variable. Generates time series line graphs depicting the trends of different economic indicators over a period, including Consumer Price Index (CPI), Money Supply, Exchange Rate, Imports, Exports, Oil Price, and Unemployment Rate. Improves the plots by adding titles, labels, legends, grid lines, and making appropriate layout tweaks to enhance visualisation and readability.

Analysis of Results

The dataset presented in Table 1 offers a comprehensive summary of Saudi Arabia's economic indicators over duration of 16 years, from 2000 to 2016. The variables included are as follows:

| Table 1 Dataset of Saudi Arabia's Economic Indicators (2000-2016) | |||||||

| Year | CPI (%) | M2 (Billion SAR) | Exchange Rate (SAR/USD) | Imports (% of GDP) | Exports (% of GDP) | Oil Price (US$/barrel) | Unemployment Rate (%) |

| 2000 | 1.7 | 290.5 | 3.75 | 24.3 | 37.8 | 27.7 | 8.3 |

| 2001 | 1.2 | 302.8 | 3.75 | 25.1 | 36.6 | 23.1 | 8.4 |

| 2002 | 0.8 | 316.4 | 3.75 | 25.7 | 34.5 | 24.3 | 8.5 |

| 2003 | 0.6 | 330.9 | 3.75 | 26.3 | 36.7 | 28.9 | 8.4 |

| 2004 | 0.3 | 348.2 | 3.75 | 26.9 | 38.1 | 37.7 | 8.3 |

| 2005 | 0.4 | 370.5 | 3.75 | 27.4 | 40.2 | 50.6 | 8.1 |

| 2006 | 1.3 | 396.2 | 3.75 | 27.9 | 43.1 | 61.0 | 8.0 |

| 2007 | 4.1 | 429.8 | 3.75 | 28.5 | 47.3 | 69.0 | 7.9 |

| 2008 | 9.9 | 465.7 | 3.75 | 29.3 | 51.5 | 94.1 | 7.8 |

| 2009 | 5.1 | 491.0 | 3.75 | 30.0 | 44.2 | 61.1 | 7.9 |

| 2010 | 5.3 | 513.3 | 3.75 | 30.7 | 48.0 | 79.0 | 7.8 |

| 2011 | 3.9 | 546.2 | 3.75 | 31.4 | 52.6 | 111.3 | 7.6 |

| 2012 | 2.9 | 582.9 | 3.75 | 31.9 | 54.2 | 111.7 | 7.5 |

| 2013 | 2.7 | 620.3 | 3.75 | 32.3 | 53.0 | 108.8 | 7.5 |

| 2014 | 2.2 | 650.2 | 3.75 | 32.8 | 52.7 | 98.9 | 7.6 |

| 2015 | 2.3 | 674.8 | 3.75 | 33.2 | 48.1 | 52.4 | 7.7 |

| 2016 | 3.5 | 690.1 | 3.75 | 33.7 | 41.8 | 43.4 | 7.7 |

The CPI (%), or Consumer Price Index, is a measure of the yearly inflation rate. It tracks changes in the prices of a certain set of products and services.M2 (Billion SAR): This represents the aggregate money supply in Saudi Arabia, measured in billions of Saudi Riyals (SAR). It encompasses the entire quantity of money in circulation, comprising physical currency, checking account deposits, and other highly liquid assets that can be readily converted into cash.

The currency rate between the Saudi Riyal (SAR) and the US Dollar (USD) remained stable at 3.75 SAR/USD throughout the entire period. Imports as a percentage of GDP refers to the value of products and services that a country brings in from other countries, relative to its Gross Domestic Product (GDP). This metric indicates the degree to which the economy depends on imports.

Exports as a percentage of GDP refers to the value of products and services that a country sells to other countries, expressed as a proportion of its Gross Domestic Product (GDP). This metric reflects the country's performance in terms of its exports. The oil price, measured in US dollars per barrel, represents the yearly average cost of oil. This value is of utmost importance to Saudi Arabia's economy due to its heavy reliance on oil exports. The unemployment rate is a measure of the percentage of the labour force that is currently without a job. It is used to gain an understanding of the job market and the overall economic well-being. Dataset was utilised for conducting regression analysis to investigate the correlations between inflation (CPI) and several economic parameters like money supply, exchange rate, import and export values, oil prices, and unemployment rate. The results of this investigation can provide insights into the intricacies of inflation and the influence of different economic factors on it (Figures 1-7).

These graphs depict the economic factors in Saudi Arabia from 2000 to 2016, providing a visual representation of the trends and fluctuations seen throughout this period.

Inflation (CPI) and Money Supply (M2)

H0: There is no significant difference between CPI and M2 at 5% level of significance.

Ha: There is a significant difference between CPI and M2 at 5% level of significance.

There is recognition of the alternative explanation (0.05), even though the p value (0.007299) is lower than 5%. The amount of money that is now in circulation is sometimes seen as one of the most significant immediate factors that determine inflation. According to Lipsey (1999), when there is a greater circulation of capital through the market, there is a greater purchase of commodities, which leads to an increase in overall consumption and, consequently, an increase in costs. As a result of the growth in money, the average price index has also become higher. As a direct result of the crisis, the rates in the kingdom have all increased. It is consistent with monetarist thought that inflation and funds have a mutually beneficial relationship. When there is an increase in the cost of funds, there is also an increase in the rate of inflation, and vice versa.

Inflation (CPI) and Exchange Rate

H0: There is no significant difference between CPI and exchange rate at 5% level of significance.

Ha: There is a significant difference between CPI and exchange rate at 5% level of significance.

Since the p value (0.002032) is lower than the threshold of 5% (0.05), the alternative hypothesis [Table 2] is accepted. For the fixed exchange rate to be successful in reducing inflation over time, the nation must refrain from devaluing its currency. When a financial organisation's balance of payments deficit persists and the institution is on the verge of exhausting its foreign exchange reserves, devaluations are a natural consequence. If the country's currency were to be depreciated, the government would be able to maintain a significantly higher level of cash reserves, which would result in a reduction in inflation (Suranovic, 1996).

| Table 2 Result of Regression Analysis | ||||

| Variables | Coefficient | Standard Error | t-Statistics | p-values |

| M2 | 0.294732 | 0.092805 | 3.175831 | 0.007299 |

| Exchange rate | 66.93185 | 16.19213 | 4.133603 | 0.002032 |

| Export | 0.180594 | 0.053334 | 3.386107 | 0.004871 |

| Import | 0.354989 | 0.083895 | 4.23134 | 0.000981 |

| Oil-Price | 0.067949 | 0.018122 | 3.749539 | 0.00243 |

| U-Rate | -0.37209 | 1.285767 | -0.28939 | 0.776845 |

Since 1986, the Saudi riyal (SAR) has been fixed against the dollar at a rate of 3.75 SAR for every US dollar. During the period of 2006 to 2008, when the dollar had a significant decline in comparison to most of the world's currencies, the Saudi riyal, which is indexed to the dollar one hundred percent, experienced a decline in value. The depreciation of a nation's currency, which results in an increase in the cost of buying commodities from other nations, has the potential to lead to inflation. As a result of the Saudi Arabian Monetary Authority's (SAMA) strategy, which was designed to maintain the stability of the Saudi riyal to serve the interests of the Saudi economy, the rate of exchange for the Saudi riyal remained maintained at SAR 3.75 per one US dollar inside the commodity exchange in the year 2015. Certain fluctuations in the riyal's forward rate against the dollar were noticed during a limited number of transactions (Ramady et al, 2015). These variations were observed because of speculators' anticipation that falling oil prices would have an impact on the Saudi economy

Inflation (CPI) and Import Value (% of GDP)

H0: There is no significant difference between CPI and import value at 5% level of significance.

Ha: There is a significant difference between CPI and import value at 5% level of significance.

Because the p value (0.000981) is lower than the threshold of 5% (0.05), the alternative hypothesis [Table 2] has been accepted. There is a correlation between Saudi Arabia's inflation rate and the importation of goods and consumer goods. An extensive quantity of produced goods can be found in the shopping baskets of Saudi consumers. It is almost clear that domestic inflation would be affected by global inflation consequently. To a lesser extent than the United States and the Eurozone, approximately forty percent of Saudi Arabia's goods come from Asia and other developing economies (Khan, 2012). A major impact on the prices of several commodities would be caused by fluctuations in the exchange rate of the Saudi riyal in comparison to other currencies, except for goods that are purchased from the United States, where the Saudi riyal is tied to the dollar. As a result of needing to pay additional riyals to purchase the same number of goods, importers were forced to pass on the increased domestic costs to their clients.

Inflation (CPI) and Value of Export and Oil Prices

H0: There is no significant difference between CPI and export & oil prices at 5% level of significance.

Ha: There is a significant difference between CPI and export & oil prices at 5% level of significance.

Since the p values for export (0.004871) and oil prices (0.00243) are still less than 5%, alternative hypotheses are accepted in both situations (0.05). Oil prices have stayed relatively strong, increasing by an average of 91.94 percent from 2008 to 2016. Oil is the most significant element in Saudi Arabia's development since its economy is dependent on it. Refined oil rates, petrochemical industry costs, and electricity fuel costs both rise as gasoline prices rise. All of which has resulted in domestic inflation in Saudi Arabia. Oil price swings have a major effect on export prices.

Inflation and U-Rate

H0: There is no significant difference between CPI and u-rate at 5% level of significance.

Ha: There is a significant difference between CPI and u-rate at 5% level of significance.

We can accept the null hypothesis as the p value (0.68) is greater than the accepted (5%) level of significance. There is no important relationship between the u-rate and inflation. Unemployment and inflation have an opposite relationship: as found in the Philips curve. Decreasing unemployment is one of the ways that the Saudi Arabian government has tried to tackle the job-creation problem. The most important action was the Saudization of the workforce in June of 2011, when the Saudi Minister of Labor attempted to put Saudis in private sector employment. There will be a considerable amount of money loss to both for companies and the Saudi population, Al-Omari concurred, stating that these spurious high-wage rates had swelled the Saudi incomes by tens of billions of Riyal. Other people contend that it will put their money at risk. A popular explanation is that companies spend a monthly total of SR585 million on salaries, said Dr. Mohammed bin Dulaim Al-Qanani. This will help explains why in the next few years, Middle Eastern businesses will be at risk of failure due to a lack of liquidity and weak competition, according to the Arab News (2015). King Abdullah had introduced a minimum salary of $800 per month in September of 2012 for all Saudis in the public sector. The third step was a public policy that resulted in the rounding up and the deportation of 20% of foreign jobs. The staffs were given higher pay due to the supply shock, making the wages much more difficult to calculate (Alhamad, 2014).

Findings, Conclusion and Recommendations

There is no question in anyone's mind that policymakers in developing nations select indirect taxation less frequently because they have less political control over the amount of money they spend and the amount of cash they get. Because the tax base is insufficient, the revenues would be insufficient. Tax avoidance is made more difficult by the fact that it is straightforward and does not involve any avoidance. Additionally, it is not possible for legislators to acquire revenue by increasing taxes. However, contrary to what some people may believe, the problem that the Orthodox policy is experiencing is not with attracting people to it; rather, it is with attracting them away from it. It is extremely uncommon for a reduction in the tax rate to be compensated for by increases in compliance. It is difficult for policymakers to limit expenditures in such a way that social consumption takes the impact. This, in turn, reduces inflation and, at the same time, benefits those who are vulnerable. It is equally important to make use of the policy space, but creative thinkers nevertheless require space in which to flourish. When action and reaction are combined, a wide variety of circumstances can be observed as a result. The fact of the matter is that public money is used to enhance infrastructure, and social support will further increase the productivity of a company. The expenditures that are incurred by the government have a multiplier effect, which results in further taxes being levied. Richer organisations are in a better position to provide long-term care for their patients.

Since the government does not exert any control over the products and properties that are available on the market, Saudi Arabia sees lower levels of inflation. This study's ultimate objective is to evaluate price increases across the Saudi economy. For achieving this objective, regression analysis was utilised. Numerous studies have shown that the existence of Asian currency flows, the exchange rate between the United States dollar and other currencies, the need for money in the country, and the price of oil all have statistical relevance about inflation in Saudi Arabia and other countries like this one. The Saudi market has been controlled by Saudi internal factors ever since the early 2000s, even though Saudi Arabia has become increasingly globalised since the 1990s.

In conclusion, it is important to keep in mind that in a globalised economic environment that is always shifting, it is challenging for nations to maintain steady production and employment by independent demand management. The monetary and fiscal policy is now less typical than it was before the expansionary economic measures that were used by governments. These measures included deficit spending to stimulate aggregate demand and interest rate reduction to stimulate the economy. These fears are a result of the widespread fears of speculative capital flight. The phrase that follows demonstrates how matter may be utilised in virtually any form of environment: is significantly more harmful, yet it occurs much less frequently in countries that are still in the process of developing.

In the long run, the effects of fiscal policy and monetary policy are rather distinct from one another. As a result of the fact that a significant portion of fiscal deficits are financed by credit and equity, the monetary impact on the economy would be bigger in emerging countries. Even though a bear market does not favour choice and does not have any value, these securities have very few options that are either in the money or out of the money. Borrowing the most money possible from financial markets is the primary factor that drives the expansion of capital in developing countries. Even though this is uncommon in economies that are still emerging, the bulk of Latin American countries are dependent on creative economies. In addition, monetary policy is more likely to have a direct impact on the fiscal health of developing countries. This is since a relatively minor increase in interest rates can have a substantial impact in situations when the overall debt-to-GDP ratio is high, and the amount of money spent by the government on loans is higher than the total revenue.

The experiences that have supplied helpful lessons concerning the futility of monetary and capital account deregulation can be contrasted. These experiences have been provided in both industrialised countries and emerging countries. That the regulatory process does not consider distinctions between non-financial intermediaries, such as the type of company, is a very difficult task to accomplish. Since it is quite probable that it intends to enter the international financial markets, it is likely to proceed with caution. The principal application of portfolio investing is in nations where the capital and currency markets are interwoven and are among the most unpredictable. As a result, portfolio investment presents both significant opportunities and significant hazards. On the other hand, relying on the profits from portfolio investments to pay off debts can result in bankruptcy. When countries move in the direction of liberalising their financial systems, it is imperative that limits be maintained. There are problems in nations that have economies that have reached the point of complete industrialization as well. Consider it in this way: marketplaces for capital are always divided into different segments.

Currently, the monetary effects are not as pervasive. According to the consensus, it does not possess the same level of power as it currently has. In the later stages of a recession, a solution that is based on free market principles may only be inventive. A higher interest rate, on the other hand, does not restrict the growth of investments in the same way that low interest rates do. This is a financial instrument that guides the utilisation of limited capital. However, contrary to the widespread notion, according to quantity theory, a ratio of credits to liabilities can be more significant to monetary policy than the total number of credits. Both the domestic bank-reform and capital-account liberalisation policies have resulted in a significant reduction in the amount of room available for monetary expansion. If things continue to be the way they are, this organisation will never be able to survive.

Many of the debates that take place on the effectiveness of monetary policy, both in the past and in the present, centre on the question of whether the objective of monetary policy should be to control inflation or to manage it (simply interest rates). It is imperative that the primary purpose of monetary policy be development, rather than price stability. All three of these modifications contribute to the enhancement of the design of monetary policy, and they are a component of the development of the financial markets. Additionally, they bring new instruments to the table.

It is impossible to develop or carry out macroeconomic policies without first implementing changes in the overall monetary and fiscal policies. In the absence of this, it, politics will be a game of zero-sum competition. The intricate and nuanced realm of politics has an impact on the macroeconomic policies that can be reduced to a single rule and those that cannot be reduced to a single rule. The combination of ideologies and systems, as well as the existence of such agendas, leads to individuals reinforcing the conventional thinking and the methods that have been used for a long time.

During the prior conversation, it resulted in several conclusions that were incongruous. To encourage economic activity, it is recommended that a stochastic approach to all stabilisations be utilised rather than a normed one. Putting it another way, it is essential to reevaluate policies that do not solely concentrate on lowering inflation and, as a result, have the potential to fulfil the twin objective of bolstering economic growth and combating economic disparity. When it comes to the matters of deregulating the domestic capital markets, the appropriate policy is to proceed with caution. It is usually more advantageous to gradually reduce limitations on funds rather than to endeavour to retain such systems at any point in time. Many countries continue to keep their rules on the movement of cash across their banking systems. For counter-economic policies to be effective, they need to be accompanied with microeconomic restraint. To accomplish this, it is necessary to break free from the constraints of traditional economic theory and to go beyond the influence of politics.

The supply of money can be reduced if the SAMA makes strategic moves and reduces expenditures as and when they are required. The government should keep an eye on the import business of private organisations to curb global inflation. The SAMA may rethink the implementation of a fixed exchange rate system regarding the United States Dollar.

References

Akinsola, F.A, & Odhiambo, N.M. (2017). Inflation and economic growth: A review of the international literature. Comparative Economic Research, 20(3), 41-56.

Indexed at, Google Scholar, Cross Ref

Al Khathla, K. (2011). Inflation in the Kingdom of Saudi Arabia: The bound test analysis. African Journal of Business Management, 5(24), 10156.

Indexed at, Google Scholar, Cross Ref

Alhamad, H. S. (2014). The high cost of living in Saudi Arabia: Growth and inflation in a macroeconomic perspective. Inquiries Journal Student Pulse, 6(9).

Alvarez, F., Robert, E. L., & Weber, W. (2001). Interest rates and inflation. American Economic Review, 91(2), 219-225.

Indexed at, Google Scholar, Cross Ref

Arab News. (2015). Unemployment, inflation rise due to faulty policies.

Hasan, M., & Alogeel, H. (2010). Understanding the inflationary process in the GCC region. In Money in the Middle East and North Africa: Monetary Policy Frameworks and Strategies.

Kandil, M., & Morsy, H. (2009). Determinants of inflation in GCC. IMF Working Paper, 9/82.

Indexed at, Google Scholar, Cross Ref

Khan, M. R. (2012). Globalized Saudi inflation. Economic Research Thematic Report, Al Rajhi Capital.

Lipsey, R. (1999). Economics. USA: Addison-Wesley.

Nazer, Y. (2016). Causes of inflation in Saudi Arabia. The Business and Management Review, 7(3), 147-154.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bound testing approaches to the analysis of level relationships. Journal of Applied Economics, 16(3), 289-326.

Phillips, A. W. (1958). The relationship between unemployment and the rate of change of money wage rates in the United Kingdom, 1861-1957. Economica, 24(2), 283-299.

Indexed at, Google Scholar, Cross Ref

Ramady, A. M. (2009). External and internal determinants of inflation: A case study of Saudi Arabia. Middle East Journal of Economics and Finance, 2(1-2), 25-38.

Indexed at, Google Scholar, Cross Ref

Ramady, M., & Mahdi, W. (2015). OPEC in a shale oil world. In Springer Books.

Indexed at, Google Scholar, Cross Ref

Suranovic, M. S. (1996). Inflationary consequences of exchange rate systems. International Trade Theory and Policy, by The International Economics Study Centre.

Received: 03-Jul-2024, Manuscript No. AMSJ-24-14997; Editor assigned: 04-Jul-2024, PreQC No. AMSJ-24-14997(PQ); Reviewed: 26- Jul-2024, QC No. AMSJ-24-14997; Revised: 26-Oct-2024, Manuscript No. AMSJ-24-14997(R); Published: 13-Nov-2024