Review Article: 2024 Vol: 28 Issue: 2

AI Applications in Personalized Marketing and Customer Engagement in the Retail Banking Industry

Suhas Sushant Das, Institute of Management Studies, DAVV, Indore

Ashish Manohar, KLEF, Vijaywada, AP

Rajesh P. Jawajala, World Peace University (MIT-WPU), Kothrud Campus, Pune

Dhanalakshmi K, Acharya Institute of Graduate Studies Bangalore

Mayadevi Jadhav, Lexicon Management Institute of Leadership & Excellence, Pune

Dharini Raje Sisodia, Army Institute of Management and Technology, Greater Noida

Citation Information: Sushant Das, S., Manohar, A., Jawajala, R.P., Dhanalakshmi, K., Jadhav, M., & Raje Sisodia, D. (2024). AI applications in personalized marketing and customer engagement in the retail banking industry. Academy of Marketing Studies Journal, 28(2), 1-10.

Abstract

The retail banking sector is currently seeing a significant transformation as it incorporates artificial intelligence (AI) technologies to improve client interaction and implement tailored marketing strategies. This abstract presents a comprehensive review of the principal artificial intelligence (AI) applications that are now transforming the retail banking sector. The practice of personalized marketing in the retail banking sector has undergone a transformation from conventional demographic segmentation to a more advanced approach driven by artificial intelligence. This new approach involves segmenting customers based on a wide range of data sources, such as transaction history, online behavior, and individual preferences. Artificial intelligence (AI) algorithms facilitate the development of customized marketing campaigns by banks, which effectively cater to the specific demands and preferences of individual customers. As a result, the utilization of AI algorithms enhances the efficacy of client acquisition and retention endeavors. The utilization of AI-powered recommendation engines is of great significance in the provision of pertinent financial goods and services to consumers. Through the examination of past data and the analysis of real-time interactions, these engines provide customized recommendations, thereby enhancing the banking experience by making it more frictionless and captivating. In addition, chatbots and virtual assistants, which include natural language processing skills, offer continuous customer service by addressing enquiries, facilitating transactions, and providing financial advice. AI-driven virtual agents have the capacity to not only boost client engagement, but also to improve operational efficiency.

Keywords

Applications, Artificial Intelligence, Customer Engagement, Personalised Marketing, Retail Banking.

Introduction

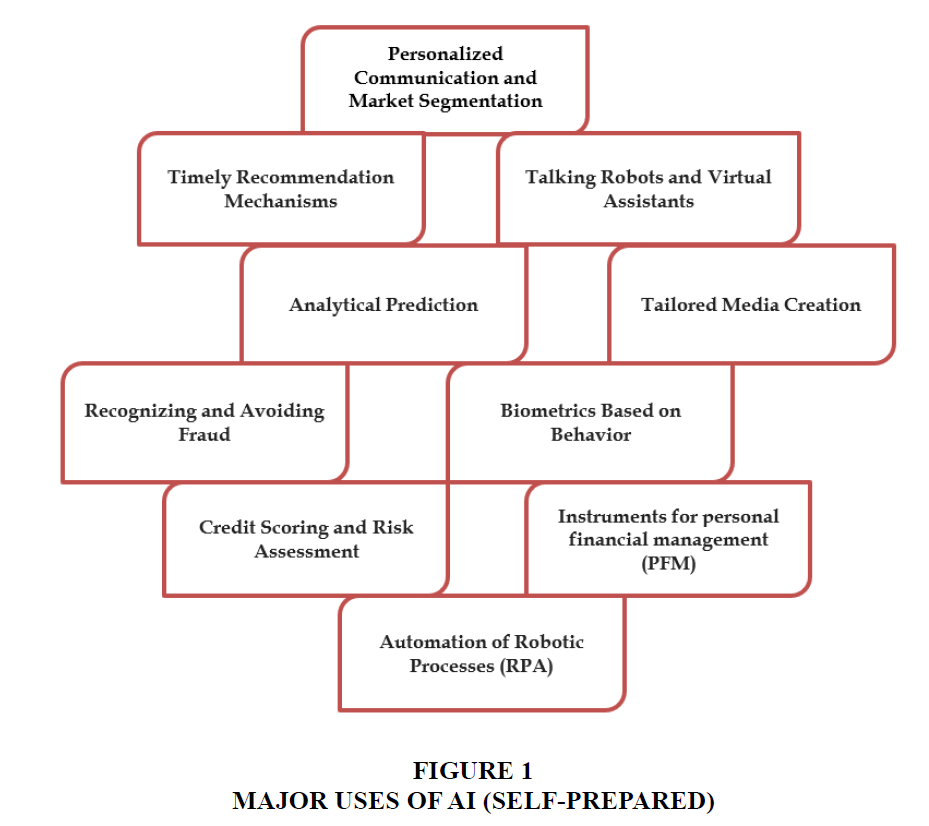

Artificial intelligence (AI) has significantly impacted the retail banking sector by facilitating customized marketing strategies and enhancing consumer engagement. In order to adapt to evolving consumer expectations, distinguish themselves from competitors, and expand their operations, retail banks must include artificial intelligence (AI) applications into customized marketing strategies and customer interactions. Artificial intelligence (AI) has demonstrated its capacity to enhance various aspects of retail banking, encompassing consumer experiences, cost reductions, risk management, and operational efficiency Figure 1.

The Following are some of the Most Important uses of AI in this Study

1. Market Segmentation and Personalized Communication:

The huge volumes of client data that can be analysed by AI algorithms include things like purchase history, demographics, and internet activity (Palanivelu, et al. 2020).

Based on these groups, personalised marketing strategies may be developed to address the wants and requirements of the target audience.

2. Prompt Recommendation Systems:

Recommendation engines powered by artificial intelligence may tailor product and service recommendations to each individual consumer based on their banking history and current needs (Bontridder, N., & Poullet, Y. , 2021).

Someone who does a lot of shopping at a certain retailer can benefit from being recommended a credit card that offers cash back benefits (Neupane, 2018).

3. Conversational Robots and Digital Helpers:

With the use of natural language processing (NLP), chatbots and virtual assistants may offer round-the-clock service to consumers by responding to their questions, processing their requests, and even giving them sound financial advice.

By providing prompt service, chatbots powered by AI may boost client loyalty.

4. Predictive Analytics:

Through the use of machine learning, businesses are able to anticipate their customers' financial requirements, such as bill payments or savings account concerns.

When consumers have issues, banks may be proactive by providing solutions or advise.

5. Customized Media Production:

Emails, newsletters, and reports may all be tailored to each individual consumer with the help of AI.

Providing each individual consumer with information and updates that are specific to their need’s increases engagement.

6. Preventing and Identifying Fraud:

Artificial intelligence systems can identify fraud in real time by constantly monitoring transactions for unusual behaviour.

Customers feel safer banking with the bank thanks to AI's security features.

7. Scoring and Risk Evaluation for Credit:

Credit risk assessments performed by AI are more precise since they take into account additional data sources.

This may improve interactions with borrowers and result in more tailored loan offers.

8. Behavioural Biometrics:

Biometrics based on a person's behaviour may be used for authentication by AI.

Passwords and other antiquated forms of authentication become superfluous, boosting security and enhancing the user experience.

9. Robotics Process Automation (RPA):

Robotic process automation (RPA) is a kind of artificial intelligence that can automate mundane back-office chores, freeing up bank workers to concentrate on more fulfilling work like fostering connections with clients.

10. Personal Financial Management (PFM) tools:

Customers may get valuable insights into their spending patterns, potential savings areas, and investment ideas with the use of PFM products enabled by AI.

Customers are more actively involved in managing their money with the help of these technologies.

In an increasingly competitive market, retail banks may benefit from using AI into customised marketing and customer interaction initiatives to better fulfil the demands of their customers. However, in order to keep customers' confidence while using these tools, financial institutions must also make data privacy and security top priorities Garbuio & Lin, (2018).

Review of Literature

Converging technologies and rising client demands are driving a sea change in the retail banking sector. Artificial intelligence (AI) is being used by retail banks as a means to reinvent marketing techniques and boost client engagement in response to rising demand for individualised services and products (Roundy, 2022). This introductory material prepares the ground for a subsequent discussion of how artificial intelligence (AI) is fundamentally altering the character of retail banking Chawla & Gupta (2017).

Keeping client’s happy and coming back is crucial in retail banking. In the past, marketers would throw a broad net in the hopes of reeling in new clients, but this tactic is no longer effective. In the modern day, customers want a financial service that is tailored to their own needs and preferences (Anute, et al. 2021; Mishra & Tripathi, 2021). They count on their banks to be there for them whenever they need them and in whatever way is most convenient for them. As a result of these changes, AI has emerged as a crucial component of successful retail banking strategy Gautam (2018).

With the use of artificial intelligence tools like machine learning, NLP, and predictive analytics, financial institutions can now sift through previously unimaginable quantities of client data. Banks may now precisely categorise their clientele based on factors like spending habits, digital footprints, and individual preferences (Enholm, et al. 2022). By breaking the market into smaller, more manageable pieces, businesses may more easily develop personalised marketing strategies for each consumer.

The recommendation engine is essential to AI-driven personalisation in banking. These engines learn from clients' activities and interactions to provide recommendations about banking goods and services that are more likely to meet their needs. The results AI can bring include things like credit card offers tailored to your spending patterns or savings account suggestions that work in tandem with your financial objectives.

In addition, AI is making itself known via sophisticated chatbots and virtual helpers. These digital employees work round-the-clock to help customers with everything from basic inquiries to complex financial planning. The quick, easy, and conversational nature of these encounters not only increases consumer involvement, but also enhances the customer experience (Chalmers, et al. 2021).

AI's sphere of impact broadens beyond commercial and support functions to include predictive analytics (Prasad, et al. 2014). Banks may now better serve their clients by anticipating their future financial demands and taking measures to head off any problems before they ever arise (Sadiku, et al. 2020). Customized emails and reports are only two examples of how AI is improving content personalisation. Adding these little touches shows patrons they matter and that they are comprehended.

AI is also useful for managing risks and ensuring safety. Artificial intelligence (AI)-enabled fraud detection systems keep a close eye on all financial dealings, quickly flagging any suspicious activity and reassuring clients that their money is safe with the bank. Credit scoring algorithms powered by AI also take into account a greater variety of data sources, which leads to better lending choices and more customer satisfaction.

Research Gap

As the research delves further into this topic, it will reveal the particular ways in which these technologies are being exploited to create a banking experience that is not just more efficient and safer, but also more customer-centric and engaging. Artificial intelligence (AI) is the driving force behind retail banks' success in the era of customization and customer-centricity, when data is plentiful and client expectations are high.

Objectives of the Study

1. To explore Artificial Intelligence applications in personalized marketing and customer engagement in the retail banking industry.

2. To quantitatively assess Artificial Intelligence applications in personalized marketing and customer engagement in the retail banking industry.

Hypothesis of the Study

H01: There is no significance difference in Artificial Intelligence applications in personalized marketing in the retail banking industry.

Ha1: There is significance difference in Artificial Intelligence applications in personalized marketing in the retail banking industry.

H02: There is no significance difference in Artificial Intelligence applications in customer engagement in the retail banking industry.

Ha2: There is significance difference in Artificial Intelligence applications in customer engagement in the retail banking industry.

Research Methodology

In a market that is becoming increasingly competitive, retail banks may benefit from incorporating AI into customized marketing and customer interaction initiatives to better meet consumer demands. Current research aims to develop AI-based retail banking solutions, particularly in the areas of customized marketing and client interaction. The sample size for the investigation is 256 respondents who are customers. Five-point Likert scale responses retrieved from a structured questionnaire. Artificial Intelligence applications discussed in the study are as follows Renz & Hilbig (2020).

Table 1 analysed the demographic statistics and stated that majority of respondents are male having age of less than 18 years, having married status, having graduation qualification and earning Rs.15000-Rs.19000.

| Table 1 Demographic Analysis | |||

| Gender | Frequency | Percent | |

| Male | 137 | 53.51% | |

| Female | 119 | 46.48% | |

| Age | Less than 18 | 123 | 48.04% |

| 18-25 | 49 | 19.14% | |

| 25-30 | 35 | 13.67% | |

| 30-35 | 22 | 8.59% | |

| 35 and above | 27 | 10.54% | |

| Marital Status | Married | 138 | 53.90% |

| Unmarried | 118 | 46.09% | |

| Education Level | Matriculation | 20 | 7.81% |

| Intermediate | 16 | 6.25% | |

| Graduation | 135 | 52.73% | |

| Post-Graduation | 48 | 18.75% | |

| Others | 37 | 14.45% | |

| Income Level | Less than Rs. 14000 | 34 | 13.28% |

| Rs. 15000- Rs. 19000 | 146 | 57.03% | |

| Rs. 20000- Rs. 24000 | 24 | 9.37% | |

| Rs. 25000 and above | 52 | 20.31% | |

Table 2 analysed the internal consistency among the variables understudy and documented that estimated value of Cronbach Alpha is 0.758 (N=10) which is greater than the acceptable threshold limit of .60. Therefore, internal consistency among the variables is present and hence further statistical test can be performed.

| Table 2 Reliability Statistics | |

| Cronbach's Alpha | N of Items |

| 0.758 | 10 |

Table 3 analysed the descriptive statistics of the study and analysed the Artificial Applications in retail banking industry. The findings of descriptive statistics stated that “Robotics Process Automation (RPA)” (Mean=4.52 and Standard deviation=0.709) is the most used AI applications in retail banking followed by “Prompt Recommendation Systems” (Mean=4.36 and standard deviation=0.740). The “Behavioural Biometrics” (Mean=3.22 and standard deviation= 1.161) is used the least in the study.

| Table 3 Descriptive Statistics | |||||

| N | Minimum | Maximum | Mean | Std. Deviation | |

| Market Segmentation and Personalized Communication | 256 | 1 | 5 | 4.27 | .921 |

| Prompt Recommendation Systems | 256 | 1 | 5 | 4.36 | .740 |

| Conversational Robots and Digital Helpers | 256 | 1 | 5 | 4.14 | .846 |

| Predictive Analytics | 256 | 1 | 5 | 4.12 | .900 |

| Customized Media Production | 256 | 1 | 5 | 4.35 | .806 |

| Preventing and Identifying Fraud | 256 | 1 | 5 | 4.16 | .827 |

| Scoring and Risk Evaluation for Credit | 256 | 1 | 5 | 3.80 | .977 |

| Behavioural Biometrics | 256 | 1 | 5 | 3.22 | 1.161 |

| Robotics Process Automation (RPA) | 256 | 1 | 5 | 4.52 | .709 |

| Personal Financial Management (PFM) tools | 256 | 1 | 5 | 3.83 | 1.001 |

| Valid N (listwise) | 256 | ||||

Table 4 analysed the one sample statistics of the study and analysed the Artificial Applications in retail banking industry. The findings of descriptive statistics stated that “Robotics Process Automation (RPA)” (Mean=4.52 and Standard deviation= .709 and standard error =0.032) is the most used AI applications in retail banking followed by “Prompt Recommendation Systems” (Mean=4.36 and standard deviation= .740 and standard error= 0.033). The “Behavioural Biometrics” (Mean=3.22 and standard deviation=1.161 and standard error=0.052) is used the least in the study De Keyser & Kunz, (2022).

| Table 4 One-Sample Statistics | ||||

| N | Mean | Std. Deviation | Std. Error Mean | |

| Market Segmentation and Personalized Communication | 256 | 4.27 | .921 | .041 |

| Prompt Recommendation Systems | 256 | 4.36 | .740 | .033 |

| Conversational Robots and Digital Helpers | 256 | 4.14 | .846 | .038 |

| Predictive Analytics | 256 | 4.12 | .900 | .040 |

| Customized Media Production | 256 | 4.35 | .806 | .036 |

| Preventing and Identifying Fraud | 256 | 4.16 | .827 | .037 |

| Scoring and Risk Evaluation for Credit | 256 | 3.80 | .977 | .044 |

| Behavioural Biometrics | 256 | 3.22 | 1.161 | .052 |

| Robotics Process Automation (RPA) | 256 | 4.52 | .709 | .032 |

| Personal Financial Management (PFM) tools | 256 | 3.83 | 1.001 | .045 |

Table 5 analysed the t test statistics of the study and analysed the Artificial Applications in retail banking industry. The findings of descriptive statistics stated that “Robotics Process Automation (RPA)” (t=142.240) is the most used AI applications in retail banking followed by “Prompt Recommendation Systems” (t=131.337). The “Behavioural Biometrics” (t=62.080) is used the least in the study.

| Table 5 One-Sample Test | ||||||

| Test Value = 0 | ||||||

| T | Df | Sig. (2-tailed) | Mean Difference | 95% Confidence Interval of the Difference | ||

| Lower | Upper | |||||

| Market Segmentation and Personalized Communication | 103.581 | 255 | 0.000 | 4.269 | 4.19 | 4.35 |

| Prompt Recommendation Systems | 131.337 | 255 | 0.000 | 4.348 | 4.28 | 4.41 |

| Conversational Robots and Digital Helpers | 109.170 | 255 | 0.000 | 4.136 | 4.06 | 4.21 |

| Predictive Analytics | 102.332 | 255 | 0.000 | 4.118 | 4.04 | 4.20 |

| Customized Media Production | 120.759 | 255 | 0.000 | 4.352 | 4.28 | 4.42 |

| Preventing and Identifying Fraud | 112.493 | 255 | 0.000 | 4.160 | 4.09 | 4.23 |

| Scoring and Risk Evaluation for Credit | 86.899 | 255 | 0.000 | 3.798 | 3.71 | 3.88 |

| Behavioural Biometrics | 62.080 | 255 | 0.000 | 3.224 | 3.12 | 3.33 |

| Robotics Process Automation (RPA) | 142.240 | 255 | 0.000 | 4.517 | 4.45 | 4.58 |

| Personal Financial Management (PFM) tools | 85.610 | 255 | 0.000 | 3.832 | 3.74 | 3.92 |

Table 6 analysed the KMO and Bartlett's Test and documented that the estimated value of KMO is close to 1 (N=.821) which is near to the acceptable threshold limit. Estimated value of Bartlett's Test of Sphericity is .000 which is less that the acceptable threshold limit of .005. Hence, existing sample is large enough to perform factor analysis (Exploratory factor analysis).

| Table 6 KMO and Bartlett's Test | ||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | 0.821 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 898.794 |

| df | 45 | |

| Sig. | 0.000 | |

The analysis of Communalities in Table 7 revealed that for all selected components, the estimated values exceeded the threshold limit of 0.40, indicating a satisfactory level of communal variance explained by these factors. Hence, it is possible to conduct further tests to determine the extent to which the overall variation is explained.

| Table 7 Communalities | ||

| Initial | Extraction | |

| Market Segmentation and Personalized Communication | 1.000 | 0.587 |

| Prompt Recommendation Systems | 1.000 | 0.491 |

| Conversational Robots and Digital Helpers | 1.000 | 0.461 |

| Predictive Analytics | 1.000 | 0.448 |

| Customized Media Production | 1.000 | 0.636 |

| Preventing and Identifying Fraud | 1.000 | 0.468 |

| Scoring and Risk Evaluation for Credit | 1.000 | 0.424 |

| Behavioural Biometrics | 1.000 | 0.401 |

| Robotics Process Automation (RPA) | 1.000 | 0.492 |

| Personal Financial Management (PFM) tools | 1.000 | 0.506 |

Table 8 analysed the total variance explained and documented those 10 variables reduced to manageable two factors and cumulative percentage is also 66.548 which is greater than 60%. Therefore, further rotated component matrix can be performed Raval (2015).

| Table 8 Total Variance- Explained | |||||||||

| Component | Initial- Eigenvalues | Extraction- Sums of Squared Loadings | Rotation -Sums of Squared Loadings | ||||||

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 3.278 | 32.78 | 32.783 | 3.278 | 32.783 | 32.783 | 2.377 | 23.77 | 45.177 |

| 2 | 1.236 | 12.36 | 45.141 | 1.236 | 12.358 | 45.141 | 2.137 | 21.371 | 66.548 |

| 3 | 0.948 | 9.476 | 54.617 | ||||||

| 4 | 0.865 | 8.646 | 63.264 | ||||||

| 5 | 0.788 | 7.883 | 71.147 | ||||||

| 6 | 0.674 | 6.744 | 77.891 | ||||||

| 7 | 0.637 | 6.366 | 84.257 | ||||||

| 8 | 0.569 | 5.685 | 89.942 | ||||||

| 9 | 0.536 | 5.36 | 95.302 | ||||||

| 10 | 0.47 | 4.698 | 100 | ||||||

Table 9 analysed the total variance explained and documented those 10 variables reduced to manageable two factors and rotated component matrix is greater than .040 in all cases.

| Table 9 Rotated Component Matrixa | ||

| Component | ||

| 1 | 2 | |

| Market Segmentation and Personalized Communication | 0.764 | |

| Prompt Recommendation Systems | 0.591 | |

| Conversational Robots and Digital Helpers | 0.415 | |

| Predictive Analytics | 0.419 | |

| Customized Media Production | 0.796 | |

| Preventing and Identifying Fraud | 0.506 | |

| Scoring and Risk Evaluation for Credit | 0.629 | |

| Behavioural Biometrics | 0.633 | |

| Robotics Process Automation (RPA) | 0.452 | |

| Personal Financial Management (PFM) tools | 0.711 | |

Hypothesis Testing

By applying t test and Exploratory Factor analysis (EFA), the findings of the study stated that null hypothesis which are there is no significance difference in Artificial Intelligence applications in personalized marketing in the retail banking industry and there is no significance difference in Artificial Intelligence applications in customer engagement in the retail banking industry are rejected and alternative hypothesis which are there is significance difference in Artificial Intelligence applications in personalized marketing in the retail banking industry and there is significance difference in Artificial Intelligence applications in customer engagement in the retail banking industry are accepted Sharma (2018).

Conclusion

Concluding, it is imperative for retail banking institutions to develop a strategic framework that integrates the utilization of artificial applications in order to effectively implement personalized marketing strategies and enhance client engagement. The revolutionary process of artificial intelligence (AI) has been influenced by various factors, including shifts in consumer tastes, the need to differentiate oneself from competitors, and the rapid expansion of AI technology. The retail banking sector has recognized that employing a standardized approach is no longer feasible in a contemporary landscape where clients seek personalized, seamless, and convenient services. Artificial intelligence (AI) technologies, such as machine learning, natural language processing (NLP), and predictive analytics, have emerged as effective tools for achieving these objectives. The implementation of artificial intelligence in retail banks has initiated a trajectory towards hyper-personalization, wherein each interaction is tailored to the unique preferences and requirements of individual consumers. The advent of artificial intelligence (AI) has brought about significant transformations in the realm of customer service, impacting several aspects of the overall experience. The utilization of recommendation engines powered by artificial intelligence has become indispensable in the realm of individualised marketing. These engines offer significant value by furnishing buyers with pertinent recommendations that align with their unique tastes and purchase patterns. The emergence of interactive, empathetic, and always accessible virtual assistants and chatbots has profoundly changed the customer service sector. Furthermore, the integration of artificial intelligence (AI) has facilitated the advancement of predictive analytics, enabling financial institutions to proactively address the needs of their clients even before they become evident. Consequently, this has resulted in heightened customer retention rates and enhanced confidence in the services provided by these institutions. The ability to anticipate future events is also valuable in the evaluation of potential dangers and the identification of fraudulent activities, hence enhancing safety measures and enhancing consumer satisfaction. The study has the potential to forecast a greater degree of innovation in the application of artificial intelligence inside the retail banking sector. The significance of speech and immersive technologies in consumer interaction is expected to increase, while hyper-personalization is anticipated to reach unprecedented levels. Additionally, there will be advancements in conversational AI. The assurance of responsible utilization of AI will be upheld through the ongoing prioritization of ethical considerations and safeguarding of data privacy. In summary, retail banks have emerged as leaders in innovation by leveraging artificial intelligence technologies in customized marketing and customer engagement. This enables them to effectively meet the evolving demands of customers in a more digital and competitive market environment. In order to remain competitive within the fast expanding financial services industry, retail banks are expected to employ artificial intelligence (AI) technologies to deliver customized and noteworthy services to their clientele.

References

Anute, N., Paliwal, M., Patel, M., & Kandale, N. (2021). Impact of artificial intelligence and machine learning on business operations. Journal of Management Research and Analysis, 8(2), 69–74.

Bontridder, N., & Poullet, Y. (2021). The role of artificial intelligence in disinformation. Data & Policy, 3, E32.

Indexed at, Google Scholar, Cross Ref

Chawla, V., & Gupta, M. (2017). Reference Management Softwares: A Study of Endnote, Mendeley, Refwork, Zotero. Kaav International Journal of Science, Engineering & Technology, 4(3), 8-12.

Chalmers, D., MacKenzie, N. G., & Carter, S. (2021). Artificial Intelligence and Entrepreneurship: Implications for Venture Creation in the Fourth Industrial Revolution. Entrepreneurship: Theory and Practice, 45(5), 1028–1053.

Indexed at, Google Scholar, Cross Ref

De Keyser, A., & Kunz, W.H. (2022), "Living and working with service robots: a TCCM analysis and considerations for future research", Journal of Service Management, Vol. 33 No. 2, pp. 165-196.

Enholm, I. M., Papagiannidis, E., Mikalef, P., & Krogstie, J. (2022). Artificial intelligence and glaucoma: A literature review. Journal Francais d’Ophtalmologie, 45(2), 216–232.

Gautam, R. (2018). Impacts of Non-Performing Loans on Profitability of Nepalese Commercial Banks. National Journal of Arts, Commerce & Scientific Research Review, 5(1), 59-64.

Garbuio, M., & Lin, N. (2018). Artificial intelligence as a growth engine for health care startups: Emerging business models. California Management Review, 61(2), 59–83.

Indexed at, Google Scholar, Cross Ref

Mishra, S., & Tripathi, A. R. (2021). AI business model: an integrative business approach. Journal of Innovation and Entrepreneurship, 10(1).

Neupane, S. (2018). The Impacts of Brand Awareness and Brand Association on the Customer Based Brand Equity. National Journal of Arts, Commerce & Scientific Research Review, 5(1), 92-97.

Palanivelu, V. R., & Vasanthi, B. (2020). Role of artificial intelligence in business transformation. International Journal of Advanced Science and Technology, 29(4S), 392–400.

Prasad, R. S., & Agarwal, K. (2014). Talent Relationship Management- Effective Tool for Talent Acquisition and Retention. Kaav International Journal of Economics, Commerce & Business Management, 1(4), 70-83.

Renz, A., & Hilbig, R. (2020). Prerequisites for artificial intelligence in further education: identification of drivers, barriers, and business models of educational technology companies. International Journal of Educational Technology in Higher Education, 17(1).

Indexed at, Google Scholar, Cross Ref

Roundy, P. T. (2022). Artificial intelligence and entrepreneurial ecosystems: understanding the implications of algorithmic decision-making for startup communities. Journal of Ethics in Entrepreneurship and Technology, 2(1), 23–38.

Raval, M. (2015). A Conceptual Paper on Importance of Hris in Human Resource Management. Kaav International Journal of Economics, Commerce & Business Management, 2(1), 134-140.

Sadiku, M. N. O., Fagbohungbe, O., & Musa, S. M. (2020). Artificial Intelligence in Business. International Journal of Engineering Research and Advanced Technology, 06(07), 62–70.

Sharma, K. P. (2018). Effect of Banks’ Merger and Acquisition in Nepal: Study of Selected Banks. Kaav International Journal of Law, Finance & Industrial Relations, 5(1), 41-52.

Received: 22-Sep-2023, Manuscript No. AMSJ-23-14032; Editor assigned: 25-Sep-2023, PreQC No. AMSJ-23-14032(PQ); Reviewed: 30-Oct-2023, QC No. AMSJ-23-14032; Revised: 29-Dec-2023, Manuscript No. AMSJ-23-14032(R); Published: 23-Jan-2024