Research Article: 2018 Vol: 22 Issue: 6

Agent's Competency to Work Engagement on Branchless Banking Implementation

Shelfi Malinda, Universitas Padjadjaran & Universitas Sriwijaya

Dian Masyita, Universitas Padjadjaran

Sulaeman R. Nidar, Universitas Padjadjaran

Mokhamad Anwar, Universitas Padjadjaran

Abstract

The purpose of this study was to analyze the influence of agent’s competencies as bank partners on their work engagement on branchless banking implementation which is one of the banking innovations. This study uses a survey method with the collection of primary data sources. The sample of this study was 85 bank agents in Palembang, Indonesia. Data were analyzed using descriptive statistics and regression analysis with Partial Least Square (PLS) - SEM technique. The results of this study indicate that agent’s competency has a significant positive effect on agency work engagement. In other words, the higher the competency of the agent, the higher the work engagement with the partner bank. This study contributes to branchless banking studies that have never discussed the work engagement of agent. Subsequent studies are suggested to explore other factors besides competencies that can influence the agent's work engagements. In addition, it is also recommended to analyze the effect on the performance of agents both directly and through their work engagement to the bank. For the banking world, practically synergy between the government and the bank implementing branchless banking is recommended to periodically analyze the competency and work engagement of agents in an effort to sustain branchless banking.

Keywords

Branchless Banking, Competency, Work Engagement.

Introduction

Work engagement is an interesting topic related to improving business performance because by maintaining work engagement will increase employee's performance (Markos & Sridevi, 2010) that also affected company's performance through business outcomes (Harter, et al, 2002). Employee's performance in analyzing credit provision can also affected banking performance (Wiryono & Effendi, 2018). This study then develops based on various perspectives such as a marketing perspective that discusses consumer engagement and the perspective of Human Resource Management (HRM) which discusses employee's engagements and work engagements. Based on the perspective of Human Resources, engagement is a condition of individual presence in a psychological form that involves two important components of attention and absorption (Rothbard, 2001). Meanwhile Schaufeli et al. (2002) define engagement as a positive thinking state characterized by strength, dedication and commitment and the difficulty of escaping from work (absorption). Work engagement shows a strong relationship with productivity, profitability, employee retention, and customer satisfaction (Ekpete and Iwedi, 2017; Adusei, 2018). While the element of work engagement can be seen based on three factors, namely psychological significance, security and feelings that are present positively (May, Gilson, & Harter, 2004).

Previous studies have discussed about employee's work engagement and the impact to performance (Markos & Sridevi (2010), Xanthopoulou, et al. (2009), Harter, et al. (2002)), but there has not been studies that discuss about company's partner as an object of the study. It is interesting and need to discuss more if it is a partner that has a role and function as a company's employee. In banking cases, there are bank's partner that has the same role and function with bank's operator when they implement branchless banking. As we know that branchless banking implementation is one of banking strategy to reduce operational cost and increase profitability (Abedin & Dawan (2016) and Javaid & Alalawi (2018)). Beside that, it also aims to manage credit risk of commercial banks (Abiola & Olausi, 2014). Because of this background, this study will examine further the agency's work engagement when it is associated to the implementation of branchless banking.

Branchless banking is the metamorphosis result of innovation efforts in the banking world which is defined as a theory where the bank does not have a physical branch location (Prendergast & Marr, 1994), but offers services only through the internet, mobile banking, ATMs and third party agents for deposit or withdrawal of funds (Sayar & Wolfe, 2007) Branchless banking implementation requires several basic elements, namely: technology, third party agents, storage and withdrawal services, and additional payment services. This is in line with the process of innovation diffusion which is explained in the diffusion theory of innovation according to Hsing, (2014), where the continuity of diffusion of innovation is possible because it is influenced by supporting elements, namely innovation, communication channels, time and social systems.

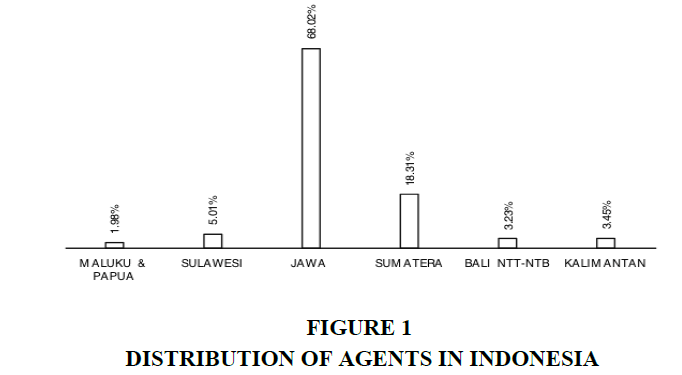

Empirically, based on data from the Financial Services Authority (OJK) shows that agent "Laku Pandai" as a distribution channel from branchless banking grew rapidly in Indonesia. Nevertheless, the problem faced today is the distribution of inequality of agents that are still concentrated in Java Island 68.02%. While Sumatra is only 18.31% and the rest is spread in Eastern Indonesia (Financial Services Authority, 2017). The following figure shows the distribution diagram of agents in Indonesia:

Another problem based on preliminary research (LPEM FEB UI 2017) shows that one of the obstacles to the implementation of branchless banking in Indonesia is the non-engagement of agents to their partner banks, where the results of this study found an agent who acts as a Laku Pandai agent as well as a Basic Financial Service Agent. It means that there is problem in agent work engagement. In other side, another previous study explained about agent competencies to give qualified customer service and convenience (Ndungu & Njeru, 2014). It also gives an advice for future study about agency banking to discuss another factor that can increase agent's performance.

Dermish, et al. (2011) identified that the main factor that hinder the decision to transact through branchless banking in Kwale County, Kenya are about the competence of agents. Competence is expressed as the ability to organize work and provide values where competencies can include great communication, engagement and commitment to work along organizational requirements (Prahalad & Hamel, 1990) and (Kogut & Zander 1992). While research on the influence of competencies and work engagements have been examined before in the political field. The results of this study explain that the influence of competence on the political engagement of students in America (Beaumont, et al., 2006). Beside that, Chidoko and Mashavira, (2014), Lorente, et al. (2014), Xanthopoulou, et al. (2009) and Hobfoll (2002) also decide that competencies significantly influence on work engagement.

Based on the previous research, it can be concluded that research on the work engagement of branchless banking agents in Indonesia which is influenced by their competency is important to be further analysis. Therefore, the purpose of this study to analysis the influence of agent competencies to its work engagement to the bank.

Methods

This research model is an explorative research with a quantitative approach. The purpose of using this method is to measure and analyze the influence of competencies on agency work engagements. Agents are bank distribution channels that have roles and functions to replace bank employees in the implementation of branchless banking.

Based on previous researches, it explained that competency has positive influence on work engagement (Beaumont, et al. (2006), Lorente, et al. (2014), Xanthopoulou, et al. (2009) and Hobfoll (2002)), the research hypothesis is formulated as follows:

H1: Competency positively influences the agent's work engagement.

The definition of work engagement consists of activation and energy which are influenced by behavioral factors so that it can be concluded that the dimensions of certain behavioral characteristics reflect the tendency to be bound. The dimensions of work engagement itself are by definition consisting of vigor, dedication and absorption (Schaufeli, et al., 2002). It explained that work engagement was measured using nine items, but this study adapted five items which was customized by observation unit of this study. It is caused of agent's role which is not an employee but only a partner of bank that replace employee's role. Therefore, Vigor (enthusiasm) consists of the desire to increase the number of customers (Y1) and the desire to increase transactions (Y2), dedication is measured based on the feeling of wanting to carry out its role as an agent at one partner bank (Y3), while absorption is measured based on the unwillingness of agents to break away from its role (Y4) and carry out its role as a bank service information provider (Y5).

If it is associated with branchless banking issues, the behavioral factors in the definition of work engagement are influenced by the problem of the agent's ability to carry out his role, which in this case is called competence (Unlukaplan and Canikalp, 2017; Omodero and Ogbonnaya, 2018). The previous study has been explained the influence of agent competency through providing convenience, customer service and agent's quality to agent's performance (Ndungu & Njeru, 2014; Ghosh., Khatun and Tarafdar, 2018). Competency in this study is measured using 9 items adapted from it. The convenience is measured by the waiting time (X1), the length of business process (X2), and physical appearance (X3), while customer service is measured by reliability of service (X4), knowledge of agents (X5) and agent attention (X6). Agent quality itself is measured by the willingness of the agent's cash balance (X7), ability of technology (X8) and agent's core business (X9).

The method used in this study is a survey method with primary data sources. Data collection techniques use questionnaires and interviews. Questionnaires use closed questions to bank agents. The interviews were addressed to OJK, bank employees in the branchless banking division as additional information and also the bank's agent itself. The observation unit was the "Laku Pandai" agent in Palembang, South Sumatra, Indonesia which was registered in the OJK in the third quarter, 2017. Population of this research 962 individual bank agents. The sample used purposive sampling technique with criteria:

1. Bank which agent being a partner has been ready to serve micro credit services through agent banking.

2. The agent is being active.

3. The agent serve bank transactions in the last months.

Based on the technique, sample consisted of 85 individual agents. Therefore, sample of this research is 85 respondents.

The analysis technique uses Partial Least Square (PLS) - SEM with the Smart PLS V. 3.0 application which is divided into two parts, namely evaluation of measurement results (outer model) and structural model (inner model). This analytical technique is used to analyze competency factors that influence the agency's work engagements, which have never been studied before. Another reason is because the research data is not normally distributed and less than 200 respondents (<200).

Result And Discussion

Evaluation of Measurement Results (Outer Model)

Validity test

The measurement result (outer model) shows the Outer Loading value of all indicators more than 0.7 (> 0.7) and the AVE value is greater than 0.5 (> 0.5). This means that the nine indicators of competency variables are divided into three dimensions: the convenience that is measured by the waiting time (X1), the length of business process (X2), and physical appearance (X3), while customer service is measured by reliability of service (X4), knowledge of agents (X5) and agent attention (X6). Agent quality itself is measured by the willingness of the agent's cash balance (X7), ability of technology (X8) and agent's core business (X9). be used in this research measurement model.

This is in line with the results of previous studies by Ndungu & Njeru (2014) who researched in Kenya. This equation is due to the demographic area of Indonesia which is the same as the location of the study, where the two countries are developing countries whose agents are spread in urban areas and rural areas. So, that the behavior of agents in carrying out their roles shown through competence as agents in these two countries is also the same.

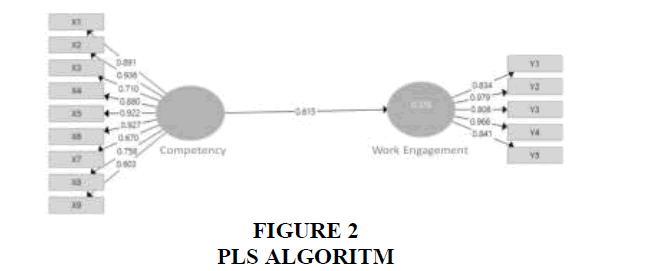

While the five indicators of the work engagement variable consist of three dimensions, namely: vigor as measured by the desire to increase the number of customers (Y1) and the desire to increase transactions (Y2), the dedication that is measured based on the feeling of wanting to carry out its role as an agent in one partner bank only (Y3), and the absorption measured based on the unwillingness of the agent to break away from its role (Y4) and carry out its role as a bank service information provider (Y5), the Outer Loading value is also more than 0.7 (> 0.7). This means that all indicators meet the requirements (valid) and can be used in this research model. It is summarized by the figure below:

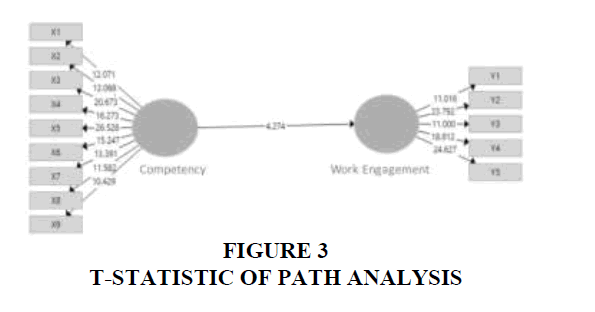

Based on bootstrapping data processing above, T-Statistic value is 4.274 (greater than 1.96). It means that the influence of the two variables is significant, in other words the hypothesis is accepted. So it can be concluded that competency has a positive and significant influence on work engagement. The figure below summarizes the results of bootstrapping process:

Reliability Test

Based on the results of the data reliability test, the Cronbach alpha value and composite reliability for all constructs were greater than 0.7. That is, the research data is reliable for further use in the calculation and analysis of research results. This value is shown in the table below:

| Table 1 Construct Reliability |

||

| Cronbach alfa | Composite Reliability | |

| Competency | 0.950 | 0.949 |

| Work Engagement | 0.951 | 0.947 |

Evaluation of Structural Models (Inner Model)

The data processing results for the inner model shown in the path coefficient indicate the original value of the sample is 0.615 and the average sample (R Adjusted) is 0.356. This means that the competency variable has a positive effect on the agent's work engagement.

The significance level of this study is set at 0.05 and the hypothesis proposed is a hypothesis that has a positive direction. Therefore, one-tailed test was then carried out. While it is known that the number of study respondents is 85, so that the ttable value is obtained = 1.96. The result of bootstrapping process shows that T-Statistic value is 4.274 (>1.96), greater than ttable. It means that it is significant.

The conclusion of research result is shown by the table below:

| Table 2 Conclusion Of Research Result |

||||

| Hyphothesis | Original Sample | TStatistic | Description | Conclusion |

| Competency to Work Engagement | 0.587 | 4.274 | Positive Influence, Significant | Accepted |

The result of this study shows that the hyphothesis is accepted. Whereas competency positive significant affects work engagement. In other words, the higher the competency of the agent the greater the engagement of the agent to the bank. It is in line with the previous study of Beaumont, et al. (2006) which explains how political competency has a positive influence on student's political engagement. It also in line with Elkhayat and ElBannan, (2018) where as competency positively significant influence work engagement of employees in Smal Medium Enterprises (SMEs), context of Malaysia. Similarly, another previous studies also show significant positive relationship between competency and work engagement (Lorente, et al. (2014), Xanthopoulou, et al. (2009) and Hobfoll (2002)). Therefore, result of this study in line with all previous studies that research about effect of competency to work engagement, but there was no study that research in bank agent as observation unit. Whereas the agent is a substitute for the bank's employee role in carrying out branchless banking, while his competency is the ability to carry out the bank's employee role. His high ability will have an impact on the agent's positive behavior through feeling engage to the bank which being his partner. Further, it will influence business performance of bank to.

The result of this study also shows that the resources possessed through the competency of agents in carrying out their roles will also be a predictor of work engagements. As shown by the results of previous studies which concluded that lack of resources is a predictor of no engagement in doing work (Bakker, et al. (2008) and Bedarkar & Pandita (2014)).

Agents in branchless banking play several roles as facilitative roles, educational roles, representational roles and technical roles. Therefore, the competency of agents must be demonstrated in their role to facilitate and educate people who are not touched by bank services to be bankable. The banking system can regulate individuals as agents so that they can be planned, regulated, supervised and controlled as an integrated system in service governance. This is in line with the main goal of branchless banking, namely to improve the economy, empower the community and provide protection from financial aspects, especially financing for small micro businesses.

Contribution

This result study corroborates previous studies about work engagement that is influenced by competency where the competency significantly influences the work engagement. Practically, for the banking sector, the result of this study contributes to solving the problem of the sustainability of branchless banking implementation. The main things that need to be considered and assessed are the improvement of agent competency and his work engagement to the bank. The Indonesian government must concentrate on the growth of agents outside Java, for example by training and facilitating to improve agent competency. Increasing agent competency will increase the agency's work engagement that also give positive influence to bank performance.

Conclusion

Work engagement is one of factor that influence business performance. There were most studies that discussed about it, but paid less attention that discussed the role of competencies in enhancing work engagement. Therefore, this research aims to analyze influence of competency to work engagement, especially on agent branchless banking. It is a bank's partner that replace role and function of bank's employee.

This research use 85 respondents that consist of 85 active agents in Palembang, South Sumatera, Indonesia. It uses Partial Least Square (PLS) - SEM with the Smart PLS V. 3.0 application to data processing.

The results of this study explain that competency has a significant positive affect on the agency's work engagement to the bank on implementing branchless banking. In other words, the higher the agent's competency, the higher the agent's work engagement to the bank. The agent's work engagement can be measured through enthusiasm (vigor) to increase the number of customers and commissions through the number of transactions, the dedication of the agent in carrying out his role and the feeling of being tied to the bank as measured by his unwillingness to break away from the bank and his role as an unbankable information provider.

On the other hand, the main objective of branchless banking is to encourage the economy by reducing the number of people who are not touched by banking services. The success of applying branchless banking through agents is related to its competence as a bank distribution channel. Agent competency is not only very strategic in the implementation of branchless banking, but also positively influences the agency's work engagements which ultimately are expected to improve agent performance.

This result study corroborates previous studies about work engagement that is influenced by competency where the competency is positive significant effect to the work engagement. It also contributes to the study of branchless banking that has never discussed the engagement of agency work to banks before. In addition, the results of this study are expected to be used as a model of the factors forming the agency's work engagements. It proves that competency in different research subjects can affect work engagement.

Practically, it is advisable for the government and banks to implement branchless banking services to periodically assess and analyze agent competencies and agency work engagements so that they can improve branchless banking performance.

Limitations and Recommendations for Future Research

There are several limitations of this research. First, the data were collected only from active agent of bank in city level. Therefore, this study must be replicated in the country level. Second, this study is cross-sectional in nature, and cross-sectional studies limit causal inferences. Given that the demand for new competency increases along with the development of technology, conducting a longitudinal study in different time frame may generate different results. Third, this study only analyzed the influence of competency to work engagement, while work engagement give impact to performance individual (agent) and business (bank) to. Therefore, suggestions for further research are to analyze the influence of competence on the performance of agents both directly and through work engagement. It aims to see whether work engagements will strengthen the agent's performance or not. In addition, research can also be conducted to explore other factors that can influence the engagement of agency work to competence.

Appendices

| Appendix 1 Instrument Of Work Engagement |

||||||||

| S/No | Items | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

| 1. | At my job I feel strong and vigorous. | |||||||

| 2. | When I get up in the morning, I feel like going to work. | |||||||

| 3. | I am enthusiastic about my job. | |||||||

| 4. | I get carried away when I’m working. | |||||||

| 5. | I feel happy when I am working intensely. | |||||||

| 0. Never, 1. Almost Never, 2. Rarely, 3. Sometimes, 4. Often, 5. Very Often, 6. Always. | ||||||||

| Appendix 2 Instrument Of Competency |

||||||||

| S/No | Items | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

| 1. | I could serve banking transaction fast. | |||||||

| 2. | I could handle length of transaction based on bank's standardization. | |||||||

| 3. | The physical appearance as agent is always available. | |||||||

| 4. | I demonstrate sensitivity to the needs and feelings of when serve the customer. | |||||||

| 5. | The ability to transfer knowledge about bank transaction. | |||||||

| 6. | Awareness to share knowledge about bank transaction. | |||||||

| 7. | I don't need others to manage the cash balance. | |||||||

| 8. | I demonstrates a practical understanding of technology trends. | |||||||

| 9. | My core business makes activity as agent effectively. | |||||||

| 0. Never, 1. Almost Never, 2. Rarely, 3. Sometimes, 4. Often, 5. Very Often, 6. Always. | ||||||||

References

- Abedin, M.T., & Dawan, M.M. (2016). A panel data analysis for evaluating the profitability of the banking sector in bangladesh. Asian Journal of Economics and Empirical Research, 3(2), 163-171.

- Abiola, I., & Olausi, A.S. (2014). The impact of credit risk management on the commercial banks performance in Nigeria. International Journal of Management and Sustainability, 3(5), 295-306.

- Adusei, C. (2018). Determinants of Non-Performing Loans in the Banking Sector of Ghana between 1998 and 2013. Asian Development Policy Review, 6(3), 142-154.

- Bakker, A.B., Schaufeli, W.B., Leiter, Toon, M.P., & Taris, W.W. (2008). Work engagement: An emerging concept in occupational health psychology, work & stress. An International Journal of Work, 22(3), 187-200.

- Beaumont, E., Colby, A., Ehrlich, T., & Torney-Purta, J. (2006). Promoting political competence and engagement in college students: an empirical study. Journal of Political Science Education, 2(3), 249-270.

- Bedarkar, M., & Deepika, P. (2014). A study on the drivers of employee engagement impacting employee Performance. Procedia- Social and Behavioral Sciences, 133, 106-115.

- Chidoko, C., & Mashavira, N. (2014). An analysis of corporate governance in the banking sector of Zimbabwe. Humanities and Social Sciences Letters, 2(3), 174-180.

- Dermish, A., Kneiding, C., Leishman, P., & Mas, I. (2011). Branchless and mobile banking solutions for the poor: A Survey. Innovation, 6(4), 81-98.

- Ekpete, M. S., & Iwedi, M. (2017). Financial Intermediation Functions of Microfinance Banks in Nigeria: A Vector Autoregressive and Multivariate Approach. International Journal of Economics and Financial Modelling, 2(1), 7-24.

- Elkhayat, N., & ElBannan, M. A. (2018). State Divestitures and Bank Performance: Empirical Evidence from the Middle East and North Africa Region. Asian Economic and Financial Review, 8(2), 145-171.

- Froiland, J.M., & Oros, E. (2014.) Psychology intrinsic motivation, perceived competence and classroom engagement as longitudinal predictors of adolescent reading achievement. Educational Psychology, 34(2), 119-132.

- Ghosh, P. K., Khatun, M., & Tarafdar, P. (2018). Bankruptcy Via Earning Volatility: Does it Integrate in Financial Institutions?. Asian Economic and Financial Review, 8(1), 52-62.

- Harter, K.J., Schmidt, L.F., Hayes, L.T. (2002). Business-unit-level relationship between employee satisfaction, employee engagement, and business outcomes: A meta-analysis. Journal of Applied Psychology, 87(2): 268-279.

- Hobfoll, S.E. (2002). Social and psychological resources and adaptation. American Psychologist, 44(3): 513-524.

- Hsing, Y. (2014). The Role of Bank Loans in Monetary Policy Transmission in Malaysia. The Economics and Finance Letters, 1(4), 70-75.

- Javaid, S., & Alalawi, S. (2018). Performance and profitability of Islamic banks in Saudi Arabia: An empirical analysis. Asian Economic and Financial Review, 8(1), 38-51.

- Kogut, B., & Zander. U. (1992). Knowledge of the firm, combinative capabilities, and the replication of technology. Organization Science, 3(3), 383-397.

- Lorente, L., Salanova, M., Martinez, I.M., & Vera, M. (2014). How personal resources predict work engagement and self-rated performance among construction workers: A social cognitive perspective. Internasional Journal of Psychology, 49(3), 1-9.

- Markos, S., & Sridevi, M.S. (2010). Employee engagement: The key to improving performance. International Journal of Business and Management, 5(12), 89-96.

- Ndungu, C.G., & Njeru, A. (2014). Assessment of factors influencing adoption of agency banking in Kenya: The case of Kajiado north sub county. International Journal of Business and Commerce, 3(8), 91-111.

- Omodero, C. O., & Ogbonnaya, A. K. (2018). Corporate Tax and Profitability of Deposit Money Banks in Nigeria. Journal of Accounting, Business and Finance Research, 3(2), 47-55.

- Prahalad, C.K., & Hamel, G. (2007). Strategy as a field of study: Why search for a new paradigm. Strategic Management Journal, 15(S2): 5-16.

- Prendergast, G., & Marr, N. (1994). Towards a branchless banking society? International Journal of Retail & Distribution Management, 22(2): 18-26.

- Rothbard, N.P. (2001). Enriching or depleting? The dynamics of engagement in work and family roles. Administrative Science Quarterly, 46(4), 655-684.

- Sayar, C., & Wolfe, S. (2007). Internet banking market performance: Turkey versus the UK. International Journal of Bank Marketing, 25(3), 122-141.

- Schaufeli, W.B., Salanova, M., Gonzalez-Roma, V., & Bakker, A.B. (2002). The measurement of engagement and burnout: A two sample confirmatory factor analytic approach. Journal of Happiness Studies, 3(1), 71-92.

- Unlukaplan, I., & Canikalp, E. (2017). Specifying Quality of Governance in Transition Economies with Cluster Analysis. Journal of Social Economics Research, 4(1), 1-8.

- Wiryono, K.A., & Effendi, K.A (2018). Islamic bank credit risk: Macroeconomic and banking specific factor. European Research Studies Journal, 21(3), 53-62.

- Xanthopoulou, D., Bakker, A.B., Demerouti, E., & Schafeli, W.B. (2007). Reciprocal relationships between job resources, personal resources, and work engagement. Journal of Vocational Behavior, 74, 235-244.